Climate Risks: Business Scenarios and Financial Implications

A special issue of Risks (ISSN 2227-9091).

Deadline for manuscript submissions: closed (31 December 2024) | Viewed by 9686

Special Issue Editors

Interests: accounting; circular economy; european taxonomy; sustainable business models

Special Issues, Collections and Topics in MDPI journals

Interests: accounting; corporate finance; international trade; sustainability

Special Issues, Collections and Topics in MDPI journals

Special Issue Information

Dear Colleagues,

This Special Issue is devoted to the dissemination of research on the modeling and management of climate risks in business. The most influential reporting standards at the global level, namely the IFRS Sustainability Disclosure Standards and the European Sustainability Reporting Standards, have included climate-related risks as a prominent topic of corporate sustainability disclosure. First, companies should identify whether they are subject to climate-related physical risks or transition risks. Second, companies should describe the resilience of their strategy and business models in relation to climate change. Finally, companies should evaluate and disclose the anticipated financial effects from material physical and transition risks, specifically for future cash flows, expenses and liabilities, and assets at risk.

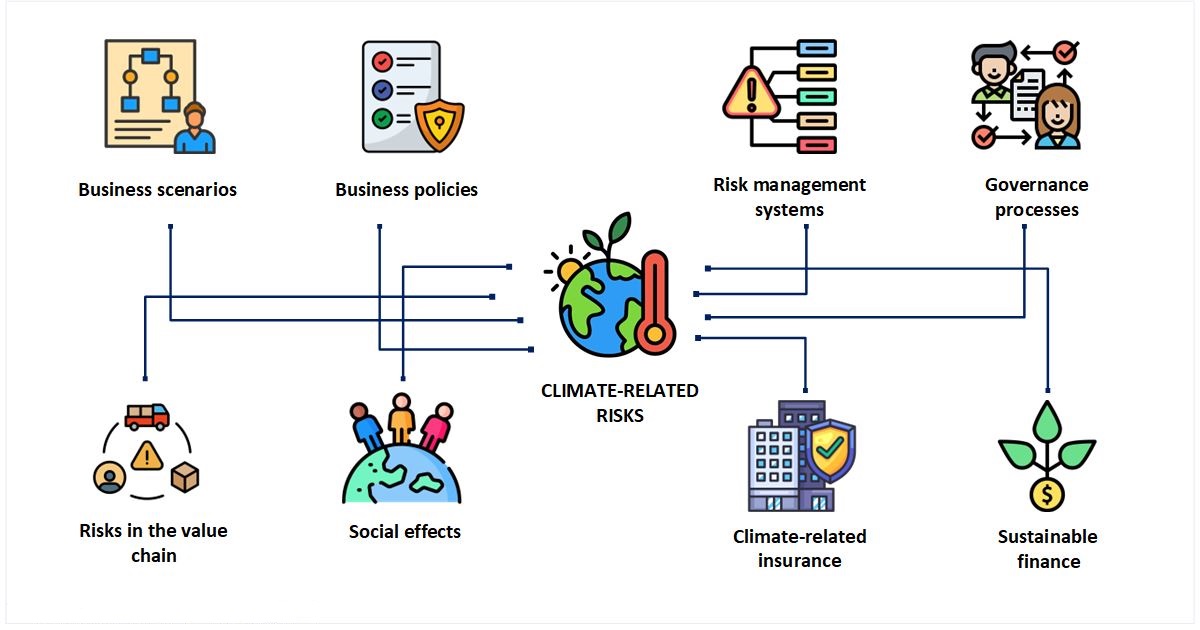

The Special Issue will include high-quality, original research papers discussing theoretical modeling and applied solutions for tackling climate-related risks, with a focus on economic and business impacts. Research topics should address but are not limited to any of the following aspects:

- Climate-related scenario analysis and alignment with state-of-the-art science in the domain.

- Key forces and drivers to take into consideration in each scenario at the company and sector level.

- Business policies related to climate change mitigation, climate change adaptation, energy efficiency and renewable energy deployment.

- Business adaptability to climate change, e.g., the entity’s ability to redeploy, repurpose, upgrade, or decommission existing assets.

- Design of risk management systems and strategies with a focus on climate-related risks.

- Governance processes and stakeholder participation to identify, assess, prioritize, and monitor climate-related risks.

- Modeling and quantifying climate-related risks in own operations and along the upstream and downstream value chain.

- Acute and chronic physical risks arising from water and ocean-related hazards.

- Biodiversity loss and ecosystem degradation caused by climate change in conjunction with business activities.

- Social effects of climate-related risks (displacement, relocation, migration) and how companies can reduce the negative externalities of their business activities.

- The link between climate-related risks and food security: applications for farming systems and technologies.

- Flood risk, crop insurance and the impact of extreme weather events on business activities and survival, especially for small and medium-sized enterprises (SMEs).

- Sustainable finance and the criteria for assessing climate-related risks within investment portfolios.

- The importance of carbon assurance and verification for increasing public confidence in corporate efforts towards decarbonization.

- Fintech and blockchain applications for addressing climate-related risks.

Prof. Dr. Voicu-Dan Dragomir

Dr. Irena Jindřichovská

Prof. Dr. Madalina Dumitru

Guest Editors

Manuscript Submission Information

Manuscripts should be submitted online at www.mdpi.com by registering and logging in to this website. Once you are registered, click here to go to the submission form. Manuscripts can be submitted until the deadline. All submissions that pass pre-check are peer-reviewed. Accepted papers will be published continuously in the journal (as soon as accepted) and will be listed together on the special issue website. Research articles, review articles as well as short communications are invited. For planned papers, a title and short abstract (about 250 words) can be sent to the Editorial Office for assessment.

Submitted manuscripts should not have been published previously, nor be under consideration for publication elsewhere (except conference proceedings papers). All manuscripts are thoroughly refereed through a single-blind peer-review process. A guide for authors and other relevant information for submission of manuscripts is available on the Instructions for Authors page. Risks is an international peer-reviewed open access monthly journal published by MDPI.

Please visit the Instructions for Authors page before submitting a manuscript. The Article Processing Charge (APC) for publication in this open access journal is 1800 CHF (Swiss Francs). Submitted papers should be well formatted and use good English. Authors may use MDPI's English editing service prior to publication or during author revisions.

Keywords

- climate-related risks

- climate change mitigation

- business scenarios

- renewable energy deployment

- biodiversity losses

- water stress

Benefits of Publishing in a Special Issue

- Ease of navigation: Grouping papers by topic helps scholars navigate broad scope journals more efficiently.

- Greater discoverability: Special Issues support the reach and impact of scientific research. Articles in Special Issues are more discoverable and cited more frequently.

- Expansion of research network: Special Issues facilitate connections among authors, fostering scientific collaborations.

- External promotion: Articles in Special Issues are often promoted through the journal's social media, increasing their visibility.

- Reprint: MDPI Books provides the opportunity to republish successful Special Issues in book format, both online and in print.

Further information on MDPI's Special Issue policies can be found here.