Banking Transformation Through FinTech and the Integration of Artificial Intelligence in Payments

Abstract

1. Introduction

- ✓

- Participation in equity (risk capital) funds.

- ✓

- Guarantees to local banks lending to many final beneficiaries, for instance small and medium-sized enterprises (SMEs).

- ✓

- Risk sharing with financial institutions to boost investment in large infrastructure projects (e.g., the Europe 2020 project bonds initiative or the Connecting Europe Facility financial instruments).

- ✓

- Equity and debt.

- ✓

- Loan guarantees and venture capital.

- ✓

- Capacity building and risk-sharing facilities.

2. Literature Review

3. Materials and Methods

- -

- Identify the innovative financial instruments used in sustainable financing.

- -

- Evaluate the impact of these instruments on sustainable development goals.

- -

- Analyze the effects of digitalization on the efficiency and transparency of sustainable financing.

3.1. Quantitative Analysis

3.2. Qualitative Analysis

- -

- E = the positive environmental impact generated by the projects.

- -

- S = the positive social impact generated by the projects.

- -

- T = total investment cost.

4. Results

4.1. Digital Solutions for Crisis Management

- ✓

- Banks and financial institutions—40%;

- ✓

- Non-governmental organizations (NGOs)—30%;

- ✓

- Public sector organizations—20%;

- ✓

- Academics and researchers—10%.

- ✓

- In total, 70% of respondents had experience with projects funded by green bonds in the past three years, with many initiatives supported by the European Commission. Additionally, 65% viewed green bonds as the most effective tool for attracting capital to environmentally sustainable projects.

- ✓

- In total, 55% of participants emphasized the importance of impact funds in generating measurable social and environmental benefits, particularly in projects addressing climate change and social equity.

- ✓

- In total, 45% of respondents reported utilizing crowdfunding platforms to secure funding for sustainable projects, reflecting the increasing appeal of decentralized, community-driven financial solutions.

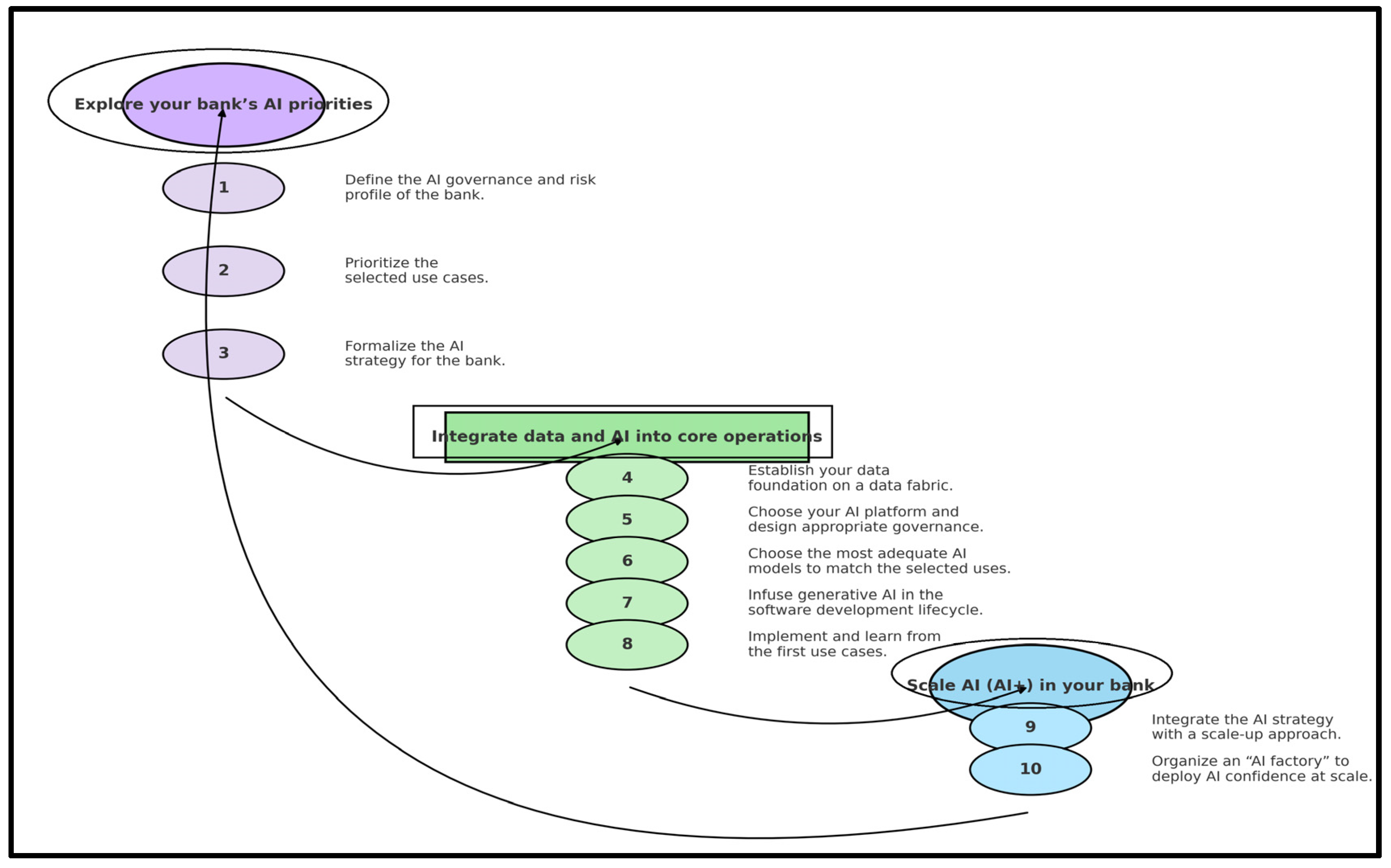

4.2. The Impact of Digitalization on Sustainable Finance

4.3. Evaluation of the Impact of Financial Instruments

- Sustainable Investment Growth Rate (RCIS):

- Social and environmental impact (ISE):

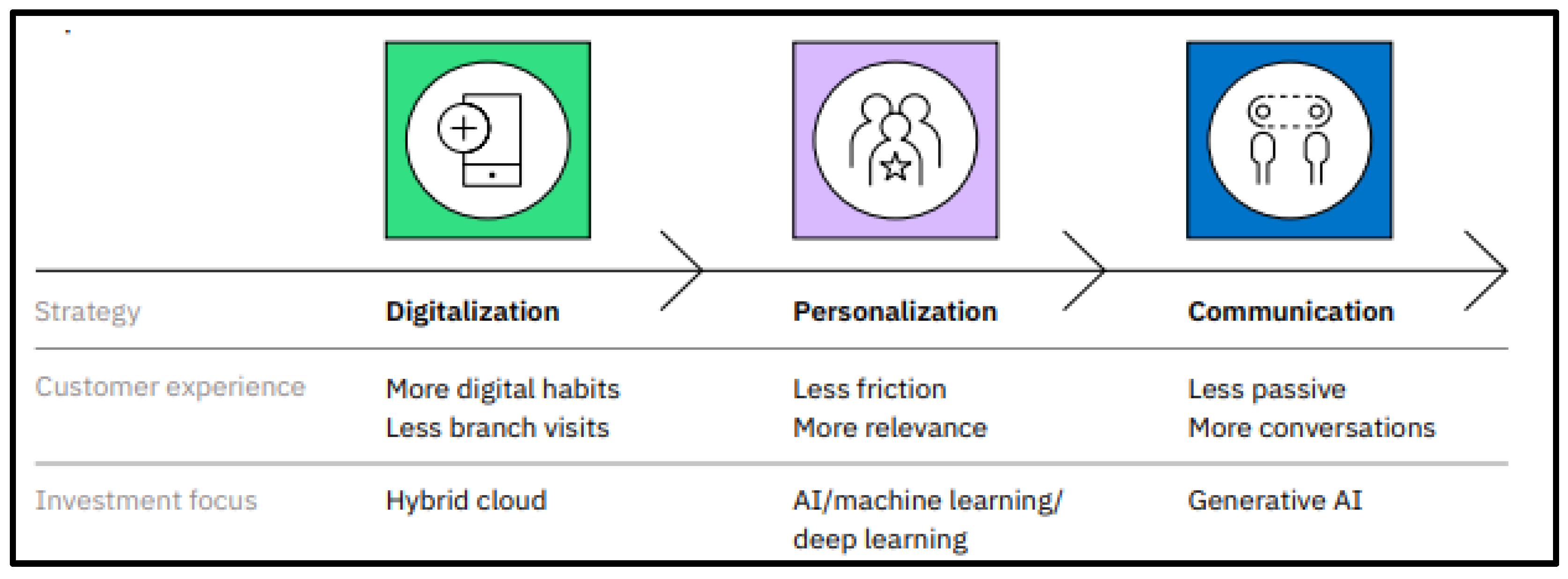

- Digitalization as a Pathway to Access

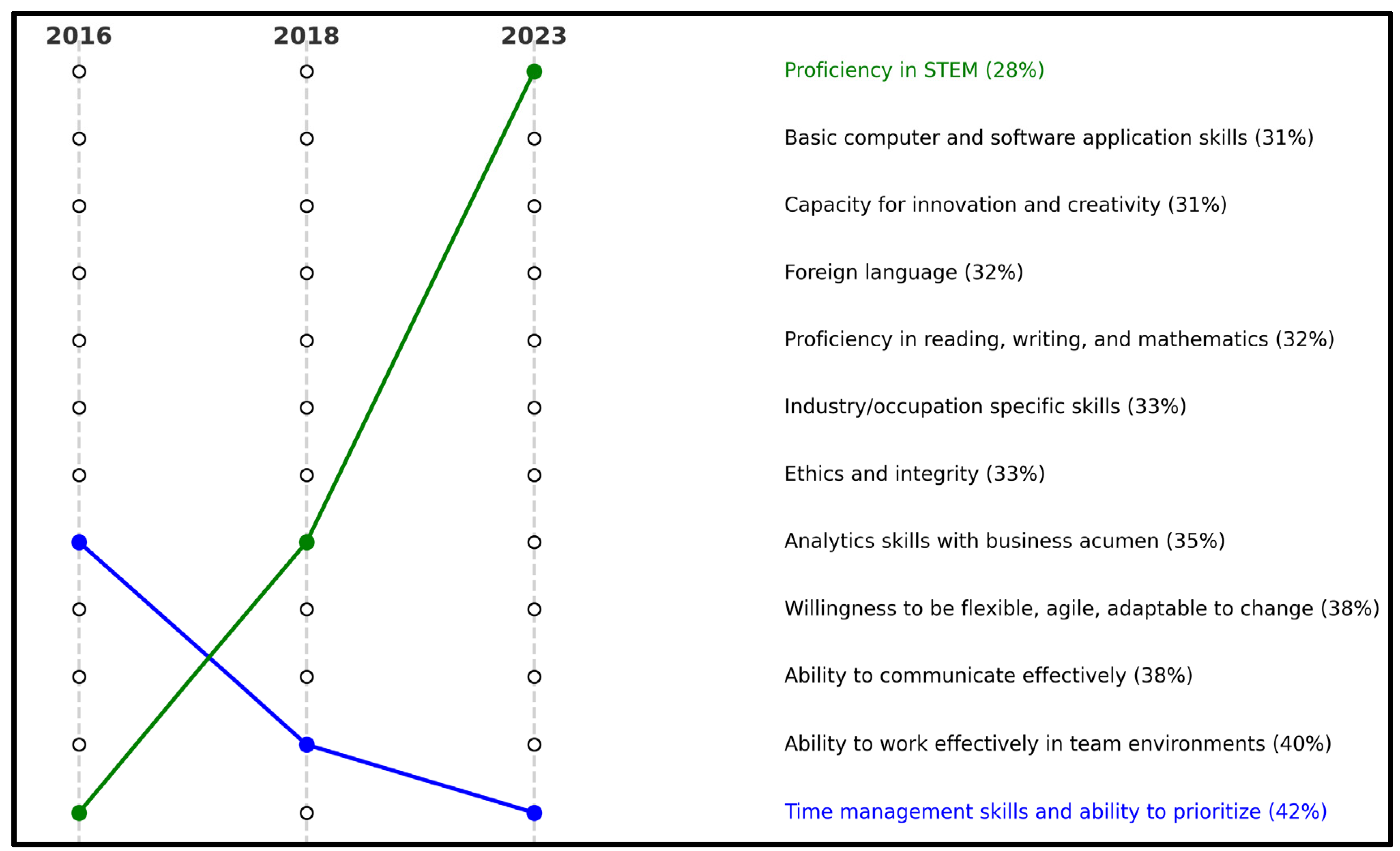

- The Influence of Generative AI on Bridging the Skill Gap

- The Role of Financial Instruments and Digitalization in Advancing Sustainable Financing

- -

- Democratized Access to Capital: SMEs can tap into a wide pool of investors, bypassing traditional banks.

- -

- Transparency and Trust: Blockchain and smart contracts ensure complete transparency in fund usage.

- -

- Liquidity: Tokens can be traded on secondary markets, providing quick exit opportunities for investors.

- -

- Automation and Efficiency: Removing intermediaries reduces costs and speeds up transactions.

- 1.

- Total Value Locked (TVL)

- 2.

- Token Price Volatility

- 3.

- Dividend Yield or Distributed Earnings

- 4.

- Market Capitalization Growth Rate of Tokens

- 5.

- Secondary Market Liquidity

- 6.

- User Adoption Rate

- 7.

- Conversion Rate of Invested Capital into Tokens

- 8.

- Return on Investment (ROI)

- 9.

- Risk Distribution Ratio

- 10.

- Transaction and Management Costs

- ➢

- Asset Tokenization: The conversion of real-world assets into digital tokens, enabling fractional ownership and improving liquidity.

- ➢

- Investor Participation: Allowing both individual and institutional investors to engage through a decentralized platform.

- ➢

- Smart Contract Execution: Automating transactions and enforcing investment agreements without intermediaries, ensuring efficiency and security.

- ➢

- Crowdfunding Process: Enabling small and medium-sized enterprises (SMEs) to raise capital efficiently through tokenized fundraising mechanisms.

- ➢

- Automated Dividend Distribution: Ensuring transparent, timely distribution of returns to investors based on predefined smart contract rules.

- ✓

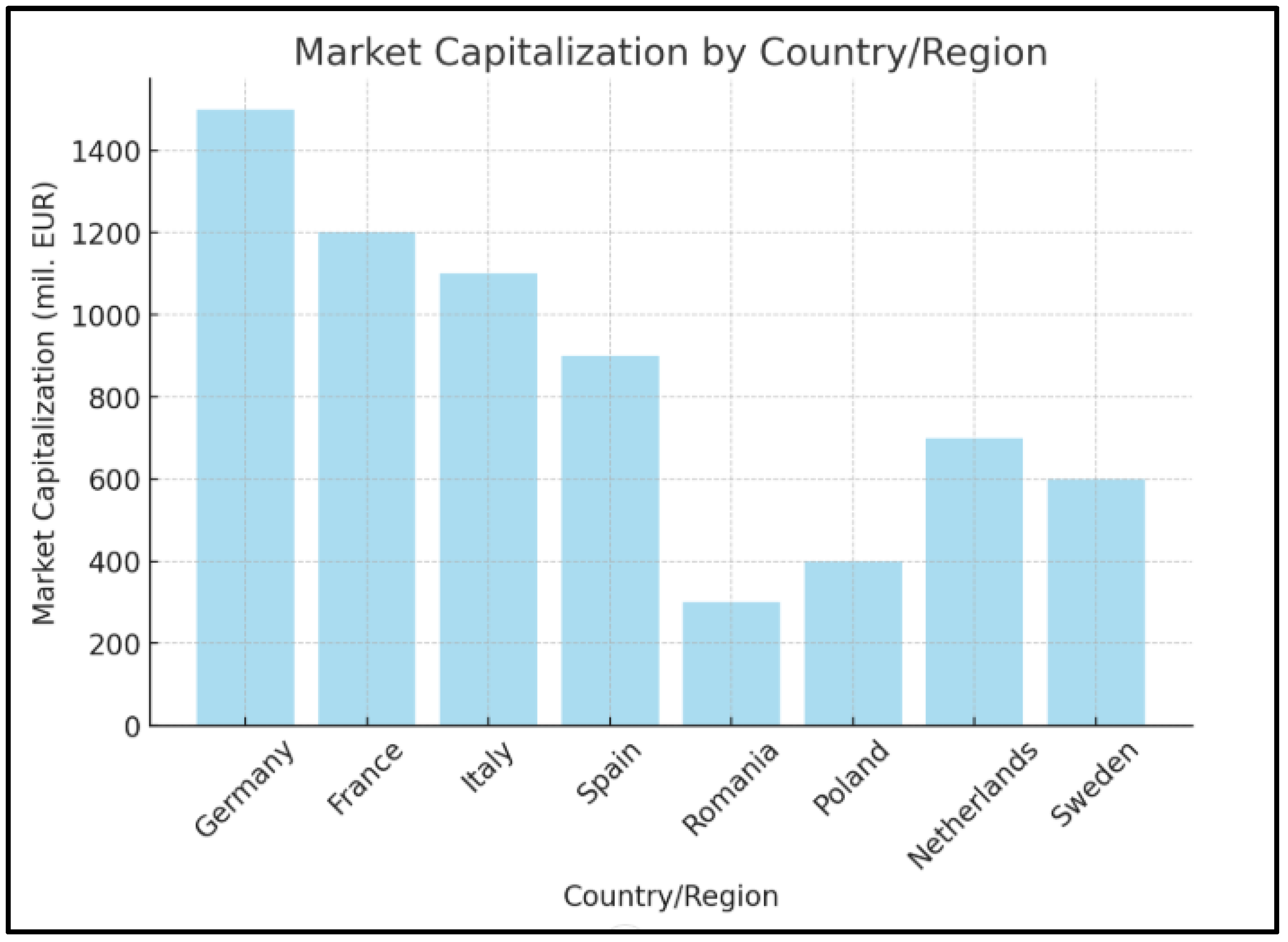

- Total Market Capitalization by Region—A breakdown of the overall market value of tokenized assets across different European regions, showcasing investment concentration and geographical distribution.

- ✓

- Return on Investment (ROI) by Sector—An analysis of profitability across various industries, indicating which sectors yield the highest financial returns within the tokenized investment ecosystem.

- ✓

- Number of Participating SMEs and Adoption Rate—A measure of market penetration, highlighting how many small and medium-sized enterprises are leveraging this financial instrument and the rate at which adoption is growing.

- ✓

- Liquidity and Volatility of Token Markets—A critical evaluation of market dynamics, assessing how easily tokens can be traded and how price fluctuations impact investment stability.

- ✓

- Regional Distribution of SMEs—Analyzing how businesses are spread across different European regions and their respective market penetration.

- ✓

- Total Market Capitalization—Estimating the combined value of tokenized assets associated with SMEs in each region, offering insight into investment concentration.

- ✓

- Return on Investment (ROI) per Sector—Evaluating profitability trends across industries, highlighting which sectors benefit the most from tokenized financing.

- ✓

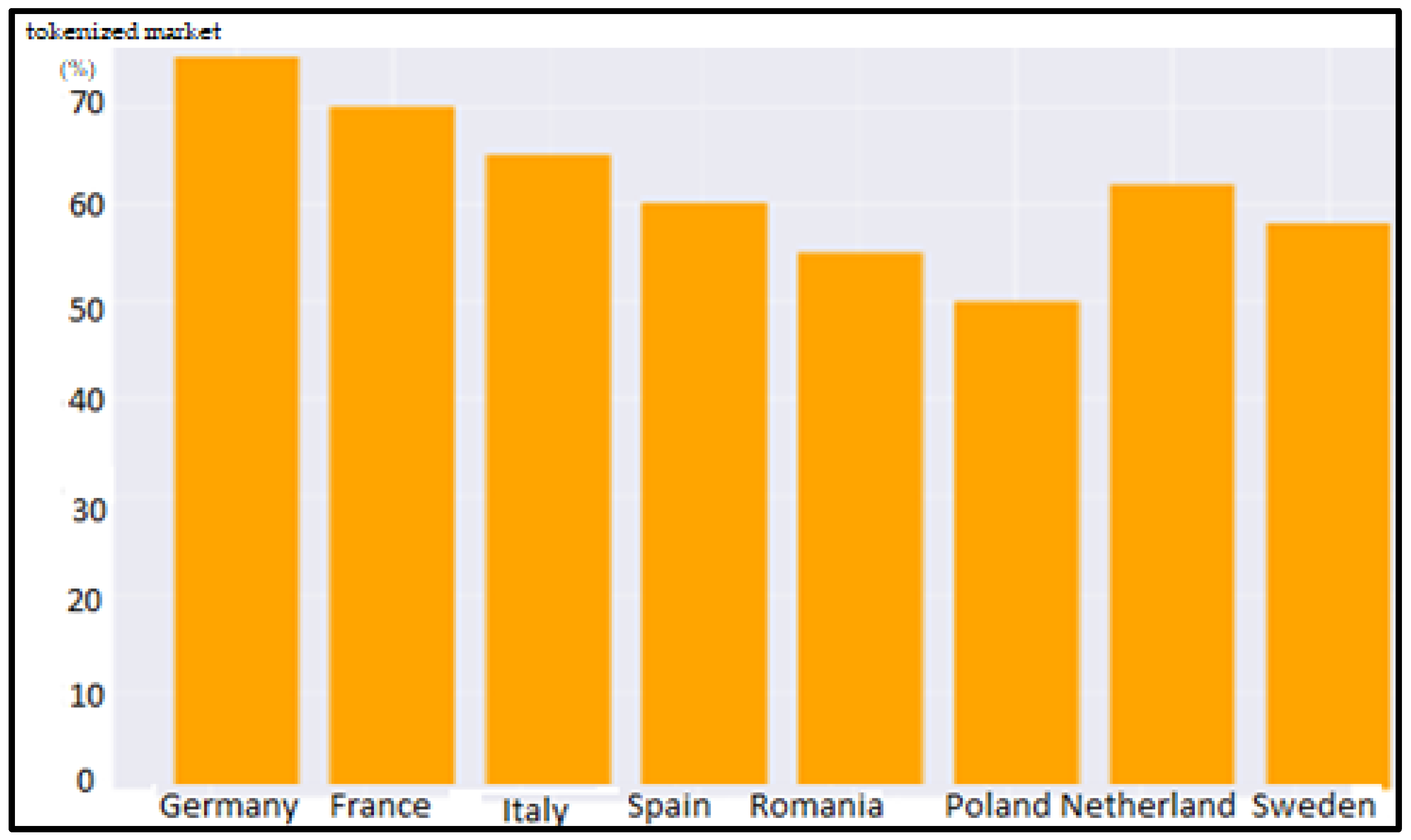

- Adoption Rate of Tokenized Investments—Measuring the percentage of SMEs integrating blockchain-based financial instruments into their capital-raising strategies.

- ✓

- Liquidity and Market Volatility—Assessing the stability and trading dynamics of tokenized assets, providing a risk assessment for potential investors.

- Overview of Key Financial Metrics:

- ✓

- Token Market Capitalization (Million EUR) by Country—This chart highlights the total value of tokenized assets in different European nations, showcasing the distribution of investments and the strength of various regional markets.

- ✓

- Average Investment Return (%)—A comparative measure of profitability across regions, illustrating the potential returns investors can expect from SME tokenization.

- ✓

- Market Liquidity (%)—This metric reflects the ease with which tokenized assets can be bought or sold, offering insights into market efficiency and trading flexibility.

- ✓

- Token Price Volatility (%)—Capturing the extent of price fluctuations in tokenized assets, this indicator helps assess investment risks and overall market stability.

5. Discussion

5.1. The Role of Innovative Financial Instruments

5.2. Digitalization as a Driving Force

5.3. Ongoing Challenges in Sustainable Finance

5.4. Positive Trends and Growth Potential

6. Conclusions and Recommendations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Abbreviations

| TLA | Three-letter acronym |

| LD | Linear dichroism |

References

- European Commission, 2020 Regulation (EU) 2020/127 of the European Parliament and of the Council of 29 January 2020. Available online: https://eur-lex.europa.eu/eli/reg/2020/127/oj/eng (accessed on 1 November 2024).

- Elkington, J. Cannibals with Forks: The Triple Bottom Line of 21st Century Business; Capstone Publishing: Oxford, UK, 1997. [Google Scholar]

- Goldstein, J.A.; Sastry, G.; Musser, M.; DiResta, R.; Gentzel, M.; Sedova, K. Generative Language Models and Automated Influence Operations: Emerging Threats and Potential Mitigations. arXiv 2023, arXiv:2301.04246v1. [Google Scholar] [CrossRef]

- Glaser, B.; Strauss, A. Discovery of Grounded Theory: Strategies for Qualitative Research, 1st ed.; Routledge: Cambridge, MA, USA, 1999. [Google Scholar] [CrossRef]

- UNEP Finance Initiative. Available online: https://www.unepfi.org/ (accessed on 1 November 2024).

- Kölbel, J.F.; Heeb, T.; Paetzold, F.; Busch, T. Sustainable finance and its role in global economic transformation. Financ. Innov. 2020, 6, 10–32. [Google Scholar]

- United Nations Environment Programme. Financing the 2030 Agenda: Sustainable Finance and the Sustainable Development Goals; UNEP: Nairobi, Kenya, 2021; Available online: https://www.unep.org/resources/report/financing-2030-agenda-sustainable-finance-and-sustainable-development-goals (accessed on 1 November 2024).

- IBM. 2023 Global Outlook for Banking and Financial Markets. Available online: https://www.ibm.com/thought-leadership/institute-business-value/en-us/report/2023-banking-financial-markets-outlook (accessed on 1 December 2024).

- Gabor, D.; Brooks, S. The digital revolution in financial inclusion: International development in the fintech era. New Political Econ. 2017, 22, 423–436. [Google Scholar] [CrossRef]

- Benedictus, H. The impact of green bonds on sustainable finance: Evidence from emerging markets. Sustain. Dev. 2018, 26, 1–12. [Google Scholar]

- Friede, G.; Busch, T.; Bassen, A. ESG and Financial Performance: Aggregated Evidence From More Than 2000 Empirical Studies. J. Sustain. Financ. Investig. 2015, 5, 210–233. Available online: https://ssrn.com/abstract=2699610 (accessed on 1 November 2024).

- Ramamurthy, A.; Bhanbhro, S.; Bruce, F.; Collier-Sewell, F. Racialised experiences of Black and Brown nurses and midwives in UK health education: A qualitative study. Nurse Educ. Today 2023, 126, 105840. [Google Scholar]

- Strauss, A.; Corbin, J. Basics of Qualitative Research: Techniques and Procedures for Developing Grounded Theory, 2nd ed.; Sage Publications, Inc.: Abingdon, UK, 1998. [Google Scholar]

- Global Sustainable Investment Alliance. Global Sustainable Investment Review 2020; GSIA: 2020. Available online: https://www.gsi-alliance.org/trends-report-2020 (accessed on 1 December 2024).

- Busch, T.; Bauer, R.; Orlitzky, M. Sustainable Development and Financial Markets: Old Paths and New Avenues. Bus. Soc. 2015, 55, 303–329. [Google Scholar]

- Hofmann, H.; Kahn, H. Sustainable finance and the role of technology. Financ. Res. Lett. 2019, 29, 99–105. [Google Scholar] [CrossRef]

- Eccles, R.G.; Ioannou, I.; Serafeim, G. The impact of corporate sustainability on organizational processes and performance. Manag. Sci. 2014, 60, 2835–2857. [Google Scholar]

- Van Duuren, E.; Plantinga, A.; Scholtens, B. ESG Integration and the Investment Management Process: Fundamental Investing Reinvented. J. Bus. Ethics 2016, 138, 525–533. [Google Scholar] [CrossRef]

- Nakamoto, S. Bitcoin: A Peer-to-Peer Electronic Cash System. 2008. Available online: https://nakamotoinstitute.org/library/bitcoin/ (accessed on 1 December 2024).

- Zeng, S.; Xie, X. Crowdfunding and sustainability: A framework for integrating decentralized finance. Sustain. Dev. 2020, 28, 234–247. [Google Scholar]

- OECD. Green Finance and Investment. In Mobilising Bond Markets for a Low-Carbon Transition; OECD Publishing: Paris, France, 2017. [Google Scholar] [CrossRef]

- Tapscott, A.; Tapscott, D. How Blockchain Is Changing Finance, Financial Markets. 2017. Available online: https://hbr.org/2017/03/how-blockchain-is-changing-finance (accessed on 1 December 2024).

- Treleaven, P.; Brown, R.; Yang, D. Blockchain technology in finance. Computer 2017, 50, 14–17. [Google Scholar]

- Cohen, J.; Fadul, J. Fintech and the Future of Sustainable Finance: Trends and Challenges. Sustain. Financ. J. 2021, 2, 24–38. [Google Scholar]

- Ding, K.; Lev, B.; Peng, X.; Sun, T.; Vasarhelyi, M.A. Machine Learning Improves Accounting Estimates: Evidence from Insurance Payments. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3253220 (accessed on 1 May 2020).

- Baker, S.; Schaltegger, S. The role of sustainability in the financial services industry: An analysis of current practices and future directions. J. Bus. Ethics 2015, 130, 841–854. [Google Scholar] [CrossRef]

- Dorfleitner, G.; Hornuf, L.; Schmitt, M.; Weber, M. The Fintech Market in Germany. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2885931 (accessed on 17 October 2016).

- Fatemi, A.; Fooladi, I. Sustainable finance: A review of the literature. Int. J. Bus. Soc. Sci. 2013, 4, 1–16. [Google Scholar]

- Xu, J.; Wang, L.; Zhao, Y. Digital finance and ESG investment. Emerg. Mark. Rev. 2021, 48, 100777. [Google Scholar]

- United Nations Environment Program. Annual Overview 2021, Sustainable Finance and ESG Investment Trends. Available online: https://www.unepfi.org/industries/banking/annual-overview-2021/ (accessed on 1 November 2024).

- Flammer, C. Corporate Green Bonds. J. Financ. Econ. 2021, 142, 499–516. [Google Scholar]

- Hahn, T.; Pinkse, J. The influence of environmental management practices on environmental performance: A stakeholder perspective. Bus. Soc. 2014, 53, 232–264. [Google Scholar]

- Amel-Zadeh, A.; Serafeim, G. Why and How Investors Use ESG Information: Evidence from a Global Survey. Financ. Anal. J. 2018, 74, 87–103. [Google Scholar] [CrossRef]

- Cohen, L.; Fadul, M. Sustainable finance: From theory to practice. J. Financ. Regul. Compliance 2021, 29, 150–165. [Google Scholar]

- G20 Green Finance Study Group. G20 Green Finance Synthesis Report; G20: 2016. Available online: https://collaboration.worldbank.org/content/usergenerated/asi/cloud/attachments/sites/collaboration-for-development/en/groups/green-finance-community-of-practice/documents/jcr:content/content/primary/blog/g20_green_finances-5qSy/Synthesis_Report_Full_EN.pdf (accessed on 1 December 2024).

- Krueger, P.; Sautner, Z.; Starks, L.T. The importance of climate risks for institutional investors. Rev. Financ. Stud. 2020, 33, 1067–1111. [Google Scholar]

- Capelle-Blancard, G.; Monjon, S. The performance of socially responsible investment: A review of the literature. J. Econ. Surv. 2012, 26, 1–24. [Google Scholar]

- Leins, M. Blockchain and sustainable finance: Enhancing transparency and efficiency. J. Financ. Technol. 2020, 8, 115–132. [Google Scholar]

- Manta, O. Sustainable Finance and Innovative Financial Instruments: Challenges and Opportunities. J. Financ. Econ. 2019. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3523827 (accessed on 1 November 2024).

- Giese, G.; Lee, L.; Melas, D.; Nagy, Z.; Nishikawa, T. Foundations of ESG investing: How ESG affects equity valuation, risk, and performance. J. Portf. Manag. 2019, 46, 69–83. [Google Scholar]

- Sullivan, R.; Mackenzie, C. Responsible Investment: Guide to ESG Data and Analytics; CFA Institute: Charlottesville, Virginia, 2017; Available online: https://www.cfainstitute.org/-/media/documents/article/industry-research/responsible-investment-guide-to-esg-data-and-analytics.pdf (accessed on 1 December 2024).

- IBM Institute for Business. Value Analysis of S&P Global Data, , 2021. The Global C-Suite Study Series. Available online: https://www.ibm.com/thought-leadership/institute-business-value/en-us/ (accessed on 1 December 2024).

- Krueger, P.; Sautner, Z.; Starks, L.T. The effects of corporate social responsibility on financial performance. J. Financ. 2020, 75, 1515–1557. [Google Scholar]

- Luc, R.; ter Horst, J.; Zhang, C. Socially responsible investments: Institutional aspects, performance, and investor behavior. J. Bank. Financ. 2008, 32, 1723–1742. [Google Scholar]

- Chen, M.A.; Wu, Q.; Yang, B. How Valuable Is FinTech Innovation? Rev. Financ. Stud. 2019, 32, 2062–2106. [Google Scholar]

- Hahn, R.; Pinkse, J. Stakeholder pressure as a catalyst for sustainability reporting: Evidence from the media industry. J. Bus. Ethics 2014, 123, 1–20. [Google Scholar] [CrossRef]

- Manta, O.; Palazzo, M. Transforming Financial Systems: The Role of Time Banking in Promoting Community Collaboration and Equitable Wealth Distribution. FinTech 2024, 3, 407–423. [Google Scholar] [CrossRef]

- Manta, O.; Yue, X.G. Sustainable financing in the digital era: Evaluation and models through Innovative Financial Instruments. In Proceedings of the 11th International Conference—ESPERA 2024, Bucharest, Romania, 17–18 October 2024; Available online: https://ince.ro/ESPERA/espera.html (accessed on 1 November 2024).

- Zeng, S.; Xie, X. Financial technology and sustainable finance: A literature review. Sustainability 2020, 12, 4910. [Google Scholar] [CrossRef]

- Hofmann, S.; Kahn, R. How artificial intelligence and blockchain technology will shape sustainable finance. Sustain. Financ. J. 2019, 22, 1–12. [Google Scholar]

- Manta, O. Financial Technology and Innovation for Sustainable Development. FinTech 2024, 3, 424–426. [Google Scholar] [CrossRef]

| Country/Region | Token Market Capitalization (mil. EUR) | Number of Participating SMEs | Average Investment Return (%) | Market Liquidity (%) | Token Price Volatility (%) |

|---|---|---|---|---|---|

| Germany | 1500 | 350 | 8.5 | 75 | 12.0 |

| France | 1200 | 290 | 7.9 | 70 | 10.5 |

| Italy | 1100 | 270 | 6.8 | 65 | 11.2 |

| Spain | 900 | 220 | 6.5 | 60 | 9.8 |

| Romania | 300 | 100 | 10.2 | 55 | 14.3 |

| Poland | 400 | 120 | 9.3 | 50 | 13.1 |

| Netherlands | 600 | 150 | 8.0 | 62 | 11.0 |

| Sweden | 500 | 130 | 7.7 | 58 | 10.9 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Manta, O.; Vasile, V.; Rusu, E. Banking Transformation Through FinTech and the Integration of Artificial Intelligence in Payments. FinTech 2025, 4, 13. https://doi.org/10.3390/fintech4020013

Manta O, Vasile V, Rusu E. Banking Transformation Through FinTech and the Integration of Artificial Intelligence in Payments. FinTech. 2025; 4(2):13. https://doi.org/10.3390/fintech4020013

Chicago/Turabian StyleManta, Otilia, Valentina Vasile, and Elena Rusu. 2025. "Banking Transformation Through FinTech and the Integration of Artificial Intelligence in Payments" FinTech 4, no. 2: 13. https://doi.org/10.3390/fintech4020013

APA StyleManta, O., Vasile, V., & Rusu, E. (2025). Banking Transformation Through FinTech and the Integration of Artificial Intelligence in Payments. FinTech, 4(2), 13. https://doi.org/10.3390/fintech4020013