1. Introduction

Small and medium enterprises (SMEs) worldwide are increasingly struggling with the complexity of tax compliance as regulatory landscapes continue to evolve. In recent years, the rising reliance on Financial Technology (FinTech) solutions has emerged as a critical trend, presenting a transformative opportunity to simplify compliance, enhance business efficiency, and foster strategic growth. For instance, SMEs in Greece—a vital driver of the national economy—are turning to FinTech to navigate challenges such as regulatory demands and limited access to resources. This adoption is not only vital for ensuring resilience but also for boosting competitiveness and performance in an increasingly digital economy. By focusing on the interplay between FinTech solutions and entrepreneurial success, this study seeks to address urgent real-world concerns while offering valuable insights into the broader economic implications.

FinTech refers to the various financial services transformed at a rapid pace due to new technologies and various aspects of business processes, including tax compliance and entrepreneurial orientation. FinTech enables various digital solutions, including digital banking, automatic tax reports, e-invoicing, etc., which simplify financial transactions, make them more transparent, and reduce administrative costs. Fintech has the potential to revolutionize businesses, drive better tax compliance, and improve business performance.

SMEs play an essential role in the economic development of most countries, including Greece. SMEs are significant employment, innovation, and economic drivers. Notwithstanding, SMEs face some unique issues, such as poor access to money, complex regulation, and great market competition. Against the above, the use of FinTech offers a solution to some of the mentioned issues by providing efficient, less costly, and supportive decision-making money services.

Despite the growing interest in FinTech, there is limited understanding of how its adoption affects key entrepreneurial outcomes, particularly in the context of SMEs in Greece. Previous research has primarily focused on the benefits of FinTech for large enterprises, with little attention given to its impact on smaller firms. Moreover, the mechanisms through which FinTech adoption influences entrepreneurial performance remain underexplored.

This study tries to cover the research gap by examining the effect of the use of FinTech on business outcomes in the case of the Greek SMEs, through the mediating role of tax compliance and entrepreneurial orientation. Through the integration of the Technology Acceptance Model (TAM) and the Firm’s Resource-Based View (RBV), in this paper, we establish a theoretical model to test how the use of FinTech tools impacts the entrepreneurial performance through tax compliance and entrepreneurial orientation.

The use of financial technology solutions is thought to benefit tax compliance by making processes more efficient and transparent to create a business environment that encourages compliance. Research shows that incorporating fintech into processes can improve compliance results. Studies have shown that using electronic tax systems can boost tax compliance [

1,

2]. Moreover, the beneficial impact of adopting technology on adhering to tax regulations is emphasized by the idea that advancements in technology enable effective maintenance of records and reporting, which are essential aspects of complying with tax laws [

3].

In addition to influencing compliance in taxation, the use of FinTech also positively impacts entrepreneurial orientation (EO) positively. Entrepreneurial orientation refers to the company’s strategic stance in terms of the use of innovation, taking risks, and proactiveness, all of which are necessary to develop a competitive advantage and enhance performance. The use of FinTech solutions helps in empowering entrepreneurs by making them gain easier access to funds, cutting the cost of the transaction, and making the operation efficient [

3]. The above assertion also receives support in evidence in the sense that businesses making use of FinTech are most likely to record greater entrepreneurial orientation, in the sense that the use of the same helps them cope in case of market issues and capture opportunities in the market [

4].

Moreover, tax compliance should also act to mediate the impact of the use of FinTech and entrepreneurial orientation. The mediating effect suggests that the benefit derived from the use of FinTech, including compliance and efficiency in operation, could actually help boost a company’s mindset by freeing up more time for strategic planning instead of dealing with compliance issues [

5]. The connection between following tax rules and having a mindset is underscored in studies that show how businesses that comply with tax laws are more likely to be innovative and expand into markets. This underscores the importance of tax compliance in building an entrepreneurial culture [

6].

The relationship between entrepreneurial orientation and entrepreneurial performance (EP) is another core component in this research. Entrepreneurial orientation is often regarded as the foundation to entrepreneurial performance, in the sense that enterprises embracing the element of innovation and taking risks are most likely to achieve outstanding performance outcomes [

2,

7,

8]. Empirical evidence agrees that finding enterprises with high entrepreneurial orientation outperform others in market share, profitability, and growth [

7]. It follows, therefore, that the dynamics in the relationships are necessary to formulate strategies to enhance both tax compliance and entrepreneurial performance.

Finally, the hypothesized propositions also stipulate that entrepreneurial orientation acts to mediate the influence between the use of FinTech and entrepreneurial performance. The mediating effect implies that the advantage from the employment of FinTech also comes through the improvement in compliance and entrepreneurial skills [

9]. The evidence from the research says the use of FinTech in the proper manner places the businesses in a position to innovate and adapt to the needs in the market, and consequently, attain improved performance [

4]. The overall model underscores the linkage between the use of FinTech, tax compliance, entrepreneurial orientation, and the overall performance, and offers a solid foundation to further research the relationships in the current practices in businesses.

The specific research objectives of the current study are the following:

To examine the direct impact of FinTech adoption on tax compliance and entrepreneurial orientation within Greek SMEs;

To assess the impact of tax compliance on entrepreneurial orientation;

To evaluate the effect of entrepreneurial orientation on the performance of entrepreneurs;

To explore the mediating mechanisms between the use of FinTech and the association between entrepreneurial orientation and entrepreneurial performance.

Based on these objectives, specific hypotheses regarding the relationships among FinTech adoption, tax compliance, entrepreneurial orientation, and performance are developed and discussed in

Section 2.4. To test and validate the research hypotheses, this study leveraged SmartPLS 4, SmartPLS software version 4.0.9.2, a software tool for Partial Least Squares Structural Equation Modeling (PLS-SEM). By addressing these objectives, this study contributes to the existing literature on FinTech and entrepreneurship, offering valuable insights for SME owners, policymakers, and FinTech providers. The findings of this research have practical implications for enhancing the competitiveness and sustainability of SMEs through the strategic adoption of FinTech tools.

The remaining sections of this paper are organized as follows. The next section presents a comprehensive review of the literature, focusing on the role of FinTech in business operations, its relationship with tax compliance, and its influence on entrepreneurial orientation and performance. This is followed by the development of our theoretical framework and hypotheses, which are derived from the integration of the Technology Acceptance Model (TAM) and the Resource-Based View (RBV). The Methods section describes the data collection process, sampling techniques, and measures used to assess the constructs. The Results section reports findings from the Structural Equation Modeling (SEM) analysis, while the Discussion interprets these findings in light of the literature and highlights their theoretical, practical, and policy implications. Finally, the paper concludes with a summary of contributions, limitations, and directions for future research.

2. Literature Review

This research explores the interactions between Entrepreneurial Orientation, FinTech Adoption, Tax Compliance, and Entrepreneurial Performance. All these elements are crucial in determining the face of current-day entrepreneurship, most significantly the ways in which enterprises leverage the use of technology to develop businesses, cope with compliance, and ultimately succeed. Understanding the interactions between them could provide useful lessons to entrepreneurs, regulators, and researchers.

2.1. The Role of FinTech in Business Operations

Financial Technology or FinTech is the incorporation of cutting-edge technologies into services to help businesses streamline operations and enhance customer experiences while boosting efficiency as well as effectiveness in service delivery and innovation in the marketplace sector overall. The emergence of FinTech has revolutionized approaches by introducing digital payment systems, online lending platforms, and blockchain technology services that are changing the way businesses manage their finances, access funding sources, and navigate through the complexities of financial regulations in a more efficient and user-friendly manner. The realm of technology (FinTech) covers uses such as online banking services, mobile payment options, person-to-person lending platforms, automated tax filing systems, and blockchain innovations.

The applications of FinTech grew considerably in the last few years, thanks to the availability of tools in the digital world and the demand for effective financial services [

10]. The entry of FinTech greatly impacted the lives of entrepreneurs, bringing opportunities to old and new businesses. Kolokas et al. [

11] also reveal the fact that macroeconomic drivers, including GDP per capita and market size, positively influence FinTech startups, suggesting that a good economic climate stimulates entrepreneurs’ activity. This observation is also supported by Mbate et al. [

12], who posit that the use of FinTech greatly helps in the digitization of bank services, and this in turn stimulates real entrepreneurship to a greater effect than the mere desire to start a company. The findings indicate that FinTech enables access to resources and fosters an environment that supports entrepreneurial development.

Studies have indicated that embracing FinTech can offer advantages to companies. Small- and medium-sized enterprises (SMEs) utilizing FinTech solutions can simplify processes, lower transaction expenses while also boosting financial visibility and facilitating credit accessibility [

13]. For instance, digital banking services and mobile payment platforms empower SMEs to handle their finances with efficiency and conduct transactions swiftly and accurately [

14]. Automated systems offer the potential to simplify procedures and make tax responsibilities more transparent, which could result in adherence, by taxpayers and fewer mistakes linked to filings [

15]. Nonetheless, incorporating technology (FinTech) presents hurdles as medium-sized enterprises (SMEs) might encounter obstacles, like inadequate digital skills, worries about safeguarding data and privacy, and the expenses connected with integrating new technologies [

16]. To fully leverage the advantages of FinTech in improving business results, it is essential to grasp the elements that impact its adoption and effects on businesses. According to a study by Hai et al. [

1], embracing tax systems can play a role in linking people’s attitudes towards these systems with their actual compliance behavior regarding taxes, implying that favorable views on FinTech may enhance compliance rates. The results support the conclusions drawn by Yimam et al.’s [

2] study that introducing sales registration devices notably boosts tax adherence among companies and underscores how technology can aid in promoting compliance.

Studies conducted recently have pointed out the increase in FinTech usage across industries due to the COVID-19 pandemic [

17]. This growth has spurred the creation of offerings and services designed to align with the changing requirements of both businesses and customers. For example, in China, the incorporation of blockchain technology has notably cut down on transaction durations and improved transparency [

18]. In Europe, as in other places, mobile payment services such as Revolut and N26 have completely changed how individuals handle their money [

19].

Despite these advances, some issues are underexplored. The research has largely focused on the benefits of FinTech to large businesses, and less research has focused on the impact on SMEs. The channels through which the use of FinTech influences the performance of entrepreneurs are poorly understood. Empirical research into the mediating impact of tax compliance and EO on the impact of the use of FinTech and EP is also in short supply.

Although progress has been made in aspects of technological development and innovation in the business sector; there are still uncharted territories that need to be delved into further exploration and understanding. Existing research has predominantly focused its lens upon the advantages that FinTech brings to corporations with limited regard for small and medium enterprises (SMEs). The mechanisms through which FinTech adoption influences entrepreneurial performance are not well understood. There is a lack of empirical research examining the role of tax compliance and EO as mediators in the relationship between FinTech adoption and EP.

2.2. FinTech Adoption and Tax Compliance

Tax compliance refers to the extent to which businesses adhere to tax laws and regulations, including tax calculations and on-time payment, along with the submission of tax documentation. Effective tax compliance is crucial for upholding stability and sidestepping repercussions. Research has underscored the influence of technology on tax compliance by indicating that digital resources can streamline taxation procedures and enhance compliance rates [

20]. SMEs often find it tough to meet tax requirements because of their budget and the intricate nature of tax laws. FinTech tools, like automated tax reporting and electronic invoicing, can support SMEs by offering up-to-date information and easing tasks while ensuring precise tax calculations [

21]. Better tax compliance lays the groundwork for a base that lets SMEs manage resources efficiently and concentrate on strategic plans. Ensuring tax compliance is crucial for businesses within the ecosystem since it plays an essential role in their operations and success levels. Research shows that incorporating FinTech innovations can boost tax compliance by simplifying procedures and increasing transparency.

For example, Martins and Picoto [

5] emphasized that the expenses related to tax compliance play a role in determining whether companies will embrace advancements or not. Hence, businesses that prioritize adhering to tax regulations are more inclined to invest in technology that can improve their efficiency [

5]. This discovery supports the idea that embracing FinTech can have an impact on tax adherence since enhanced compliance may alleviate challenges and enable business owners to concentrate on strategic expansion efforts effectively. Moreover, comprehending the link between adhering to tax requirements and an entrepreneurial mindset is crucial in recognizing how compliance can promote a thinking and proactive atmosphere for businesses. Studies show that companies that follow tax rules well have an advantage in pursuing ventures by using resources for innovation and market research [

22]. This is especially important in the FinTech sector, where leveraging technology can help with compliance and boost a company’s mindset. The research conducted by Troise et al. [

22] indicates that the growth of technology (FinTech) can have an effect on the decision-making process of entrepreneurs, which in turn affects the decisions made by entrepreneurs and managers when starting and running new businesses [

22]. Additionally, the existing literature provides evidence that tax compliance plays a role in connecting FinTech adoption with mindset. Research has indicated that companies that make use of financial technology tools are more prepared to handle hurdles. This can boost their mindset by freeing them up to concentrate on creativity and conformity, as mentioned by Kurniasari et al. [

23]. This connection emphasizes how following tax rules can actually support endeavors and indicates that better compliance could foster an inventive business atmosphere.

2.3. Entrepreneurial Orientation and Business Performance

Entrepreneurial orientation (EO) refers to a position strategy marked by innovativeness, risk-taking, and proactiveness. The high EO of enterprises increases the likelihood of introducing new products and services, engaging in risky businesses, and accommodating market developments in advance. EO ranks among the most significant predictors of the company’s capacity to recognize and exploit new opportunities [

24]. Empirical evidence suggests EO positively correlates with many different measures of the enterprises’ performance, such as profitability, market share, and growth [

25].

A robust EO empowers companies to outshine their rivals by adjusting to market changes and fostering innovation effectively. In the realm of FinTech adoption, EO significance lies in determining how firms utilize resources to improve efficiency and reach strategic objectives effectively. Studies suggest that embracing FinTech can support entrepreneurs by granting them assistance and cutting down on transaction expenses, which in turn cultivates an entrepreneurial setting [

3]. Additionally, incorporating FinTech into business practices has proven to ease the shift from the use of the money market informally to the use of the money market officially, which is a pivotal factor in bolstering general economic stability and progress [

3]. Besides that, the influence of mindset on business achievements has been extensively explored in the existing literature.

The enterprises with high EO are likely to attain outstanding results in terms of their operation because they are in a position to innovate and adapt to the demands in the market [

26]. The use of FinTech solutions also empowers entrepreneurs to accommodate the intricate market situations. Cumming et al. [

27] posit that the employment of Fintech plays a crucial role in the entrepreneurial internationalization, determining the boost of business outcomes. The mediating influence of Fintech adoption and entrepreneurial performance establishes the linkage between the constructs. Empirical evidence indicates that the ability of businesses to use Fintech and exploit new opportunities results in the improvement of outcomes in terms of performance [

28]. This suggests the added advantage of using Fintech in terms of the overall entrepreneurial processes and performance.

Success in business can be gauged by Entrepreneurial Performance (EP), which is commonly assessed based on factors like profitability, growth and market share as customer retention, and return on investment (ROI). A strong EP signifies a company’s proficiency in executing strategies and attaining business results. The relationship between FinTech Adoption (FA), Tax Compliance (TC), and Entrepreneurial Orientation (EO) plays a role in influencing EP.

By embracing FinTech solutions in their operations and services sector businesses might witness tax compliance leading to improved well-being and overall performance levels. The incorporation of FinTech tools in activities allows companies to simplify processes, boost productivity, and elevate customer satisfaction. FinTech covers a spectrum of uses such as online banking, mobile payments, peer-to-peer lending, automated tax filings, and blockchain technology. By offering options, FinTech has the potential to boost a company’s operational effectiveness, cut down expenses, and enhance strategic decision-making capabilities. SMEs can improve their management and boost competitiveness by embracing FinTech tools [

29].

Rauch et al. [

30] suggest that EO-driven businesses attain better money- and market-based outcomes. The focus of EO on innovation not only boosts performance but also empowers organizations to navigate market shifts and capitalize on fresh prospects effectively. The increase in the use of FinTech significantly changed the entrepreneurial environment and the offered opportunities to old and new businesses. Studies indicate that adopting technology (FinTech) can make financial operations more efficient by cutting transaction costs and providing financial visibility [

13]. For example, the use of mobile banking and digital payment assists SMEs in carrying out their transactions in an efficient manner and makes money movements in a timely and secure manner [

14]. This digital improvement helps in simplifying the reporting process and leads to a transparent and accountable taxation, which is very important in enhancing tax compliance [

31].

Nevertheless, embracing FinTech comes with its hurdles for SMEs. These obstacles include a lack of digital literacy, worries regarding data protection and confidentiality as well as the financial implications linked to integrating new tech solutions [

16]. It is essential to grasp the elements that shape the adoption of FinTech and how it influences business results to leverage its advantages. Hai et al. [

1] reveal that using electronic tax systems may influence how people view these systems and impact their tax compliance behavior in a way suggesting that having an opinion of FinTech can result in better compliance results. This is in line with the study of Yimam et al. [

2], where they show how the use of sales registration devices notably boosts businesses’ adherence to tax laws, prominently showcasing the influence of technology in ensuring compliance.

In summary, the success of a business is closely tied to its Entrepreneurial Performance, which is shaped by factors such as incorporating FinTech solutions, compliance with tax regulations, and the overall entrepreneurial orientation of the organization. The implementation of FinTech tools has been shown to streamline operations, cut costs, and enhance decision-making processes, resulting in financial management and sustainable growth for small and medium enterprises (SMEs). The literature suggests that strong EO and improved TC, facilitated by FinTech, can significantly boost EP, enabling businesses to adapt to market changes, seize new opportunities, and achieve superior performance outcomes.

2.4. Theoretical Framework and Hypotheses Development

Although there is increasing fascination with FinTech nowadays, there are gaps in research that need to be filled. Firstly, most studies have primarily focused on the advantages of FinTech for corporations. Paying attention to small- and medium-sized enterprises (SMEs). The distinct challenges and opportunities that SMEs encounter when embracing FinTech solutions warrant investigation. Secondly, the ways in which the adoption of FinTech affects performance are not fully understood. There is a necessity for empirical studies to clarify how FinTech tools improve business outcomes by enhancing tax compliance and entrepreneurial mindset. There has not been research on how tax compliance and entrepreneurial orientation play a role in connecting FinTech adoption and entrepreneurial performance. Taking a look at these connections is important for coming up with strategies to make the most out of FinTech for small businesses. This study seeks to address these gaps by exploring how FinTech adoption affects results in small businesses while considering the mediating influences of tax compliance and entrepreneurial orientation. The results will offer perspectives for business owners, decision makers in government or organizations, and financial technology (FinTech) providers by giving actionable advice on improving the competitiveness and longevity of SMEs through thoughtful adoption of strategic FinTech solutions.

This study’s theoretical basis incorporates two theories. The Technology Acceptance Model and the Resource-Based View. These theories form the groundwork for exploring how the adoption of technology influences results through factors, like tax compliance and entrepreneurial orientation.

Davis’ [

32] Technology Acceptance Model (TAM), often cited as a framework for understanding and forecasting user acceptance of technology, emphasizes two factors in technology adoption: the perceived ease of use and perceived usefulness of a system or tool. Perceived ease of use relates to an individual’s belief that using a system would require effort, while perceived usefulness pertains to the extent to which one thinks that utilizing the system would improve their performance at work. In this research study setting, we use the Technology Acceptance Model (TAM) to explore how small- and medium-sized enterprises (SMEs) decide to embrace technology (FinTech) solutions, like banking, automated tax filings, and electronic invoicing. The decision-making process is influenced by how easy and beneficial SMEs perceive these technologies to be. By adopting FinTech tools, it is anticipated that tax compliance will improve while also fostering a mindset focused on entrepreneurship. These tools offer advantages such as financial data accessibility, reduced administrative tasks and support for thinking and proactive behavior. TAM is selected for its capacity to explain the factors influencing technology adoption, particularly in the rapidly evolving financial technology (FinTech) sector. The model assesses users’ perceptions of technology in terms of perceived ease of use and perceived usefulness, which are critical in determining the acceptance and utilization of tax compliance systems by entrepreneurs [

33]. Previous studies have leveraged TAM effectively to evaluate technology acceptance in various fields, highlighting its adaptability. For example, Newbert [

34] discusses how various factors influence technology adoption in firm contexts, while Shin et al. [

35] utilized an extended TAM framework to investigate digital capital acceptance during the COVID-19 pandemic, reinforcing the model’s applicability to technology-driven sectors.

The Resource-Based Theory (RBV) by Barney [

36] highlights the importance of a company’s resources and abilities in gaining and maintaining an edge in the market. According to this viewpoint resources that are valuable and rare and cannot be easily imitated or substituted play a role in giving a company its advantage. These resources can range from assets like technology and financial investments to ones such as expertise, skills, and the culture within the organization. In this research paper, we explore how small and medium enterprises (SMEs) benefit from using technology (FinTech) to improve their tax compliance and entrepreneurial mindset as outlined in the Resource-Based View (RBV) framework. By integrating FinTech solutions into their operations, SMEs can enhance efficiency and accuracy while fostering innovation. The expected outcome is a boost in performance seen through higher profits, customer loyalty, ROI and increased sales growth. The choice of RBV in this study is grounded in its theoretical foundation, which underscores the significance of leveraging unique organizational resources and capabilities to achieve competitive advantage and enhance performance [

37]. Empirical evidence has shown that the RBV framework is instrumental in understanding firm performance across various sectors, including entrepreneurship. For instance, Kellermanns et al. [

38] illustrate how insights from RBV have informed research on entrepreneurial venture performance, demonstrating its relevance in assessing the capabilities that drive success in business ventures. Furthermore, Kruesi and Bazelmans [

39] contextualize RBV as foundational for understanding resource utilization in business operations, reinforcing its applicability in entrepreneurship.

The integration between TAM and RBV offers a theoretical foundation to capture the relationships between FinTech adoption, tax compliance, entrepreneurial orientation, and performance. This dual-model approach underscores the importance of integrating multiple theoretical perspectives to holistically understand the dynamics within the FinTech sector, as illustrated in previous research [

34,

39]. This perspective allows for an evaluation of how tax compliance can be regarded as an internal resource that firms can utilize to enhance their performance in a competitive digital economy. The hypotheses are based on the theories mentioned above.

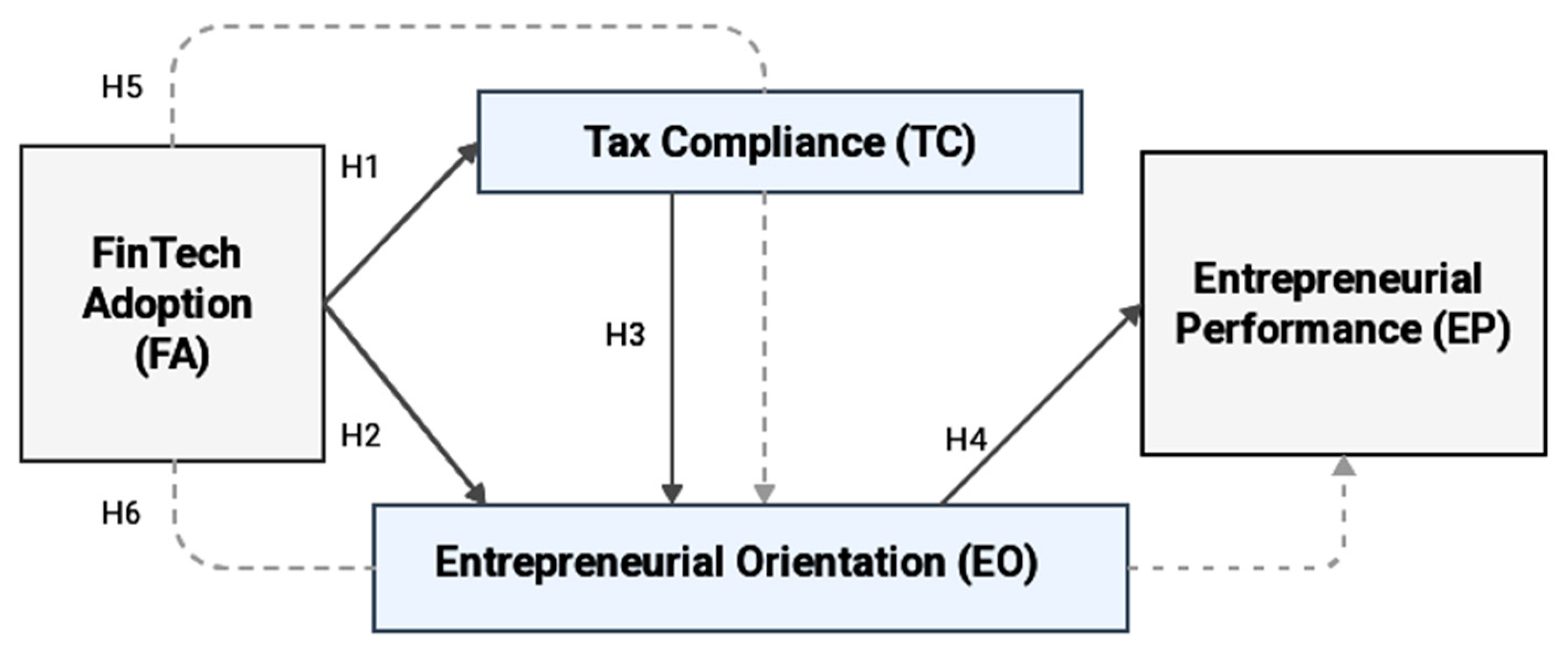

The following are the hypotheses based on the theories mentioned above:

H1: FinTech Adoption Positively Influences Tax Compliance.

H2: FinTech Adoption Positively Influences Entrepreneurial Orientation.

H3: Tax Compliance Positively Influences Entrepreneurial Orientation.

H4: Entrepreneurial Orientation (EO) Positively Influences Entrepreneurial Performance.

H5: Tax Compliance Mediates the Relationship Between FinTech Adoption and Entrepreneurial Orientation.

H6: Entrepreneurial Orientation (EO) Mediates the Relationship Between FinTech Adoption (FA) and Entrepreneurial Performance (EP).

By grounding the research in the established theories and bridging the research gaps, we provide a rigorous model to explicate how the employment of FinTech tools could impact favorable outcomes in the domain of entrepreneurship through the mediating mechanisms of compliance in taxation and entrepreneurial orientation.

3. Methods

3.1. Data and Sample

The data we used for this cross-sectional study were gathered from SMEs located in Greece over a six-month period, from October 2023 to March 2024.

Banks, financial institutions, and other finance companies were intentionally excluded from this study to maintain the focus on small and medium-sized enterprises (SMEs) outside of the financial sector. This choice was made because SMEs in non-financial industries face distinct challenges in adopting FinTech tools for tax compliance, which are the primary focus of this research. Including banks or financial institutions would have introduced a different set of variables and complexities that fall outside the scope of this study.

A stratified random sampling methodology was employed to achieve a diverse group from various industries, including manufacturing, services, retail, and the tech industries. This methodology was chosen to ensure proportional representation across key dimensions, which are critical for capturing variability in SMEs’ challenges and behaviors toward FinTech adoption. More particularly, the sample was stratified by industry sector, firm size, firm age, type of firm, and gender of owner-managers to reflect diversity and address the constructs being investigated. This provided a diverse and exhaustive sampling from various industries, ensuring that the sample reflects the diversity of SMEs in Greece and that the unique experiences and behaviors of different types of SMEs are captured.

A structured questionnaire was both electronically and face to face administered to the SME owners and managers. The questionnaire reached the final decision makers in the SMEs, who are most aware of the company’s use of FinTech tools, taxation compliance practices, and entrepreneurial activity. To minimize non-response bias, follow-up emails and phone calls were made to encourage participation from initially unresponsive businesses. Additionally, incentives such as the summarized findings of the research were provided to respondents. In total, 400 questionnaires were circulated, resulting in 307 responses received achieving a response rate of 76.75%. The significant response rate indicates participation, from the respondents, which boosts the credibility and accuracy of the gathered data. Statistical tests were conducted to ensure that early and late respondents did not differ significantly in their responses.

The sample comprised SMEs of varying sizes, with the number of employees ranging from 1 to 250, and annual revenues spanning different levels. To provide a detailed understanding of the sample, we recorded demographic characteristics of the respondents, including their age, gender, and educational background. This diverse sample allows for a robust analysis of the relationships among FinTech adoption, tax compliance, entrepreneurial orientation, and performance within Greek SMEs.

Structural Equation Modeling (SEM) was chosen as the primary analytical technique due to its ability to simultaneously evaluate multiple relationships between constructs, including both direct and indirect effects. This approach is particularly suitable for testing the hypothesized model, which includes mediating relationships, and for addressing the complexity of the interconnections between FinTech Adoption, Tax Compliance, Entrepreneurial Orientation, and Entrepreneurial Performance.

This study employed a quantitative data collection strategy by conducting structured surveys electronically and face-to-face with upper-level decision makers in the SMEs in Greece. This approach was chosen to make sure that a wide range of participants could take part and to increase the number of responses from companies spread out across locations. The survey participants were requested to assess statements concerning how their company embraces FinTech, complies with tax regulations, demonstrates an entrepreneurial mindset, and achieves entrepreneurial success using a 5-point Likert scale. The choice of this scaling technique aimed to measure viewpoints while also capturing variations in perspectives on attitudes and operational challenges during implementation.

To enhance the findings’ validity and dependability, the items in the survey were developed carefully with accurate anchors and randomized item order. A pilot test also tested item wording and determined contextual applicability. The significant participation level and active role of decision makers in the survey contribute to strengthening the trustworthiness of the acquired data.

3.2. Measures

To ensure the reliability and validity of our measurements, we employed established scales for each of the key constructs in this study (

Appendix A Table A1): FinTech Adoption (FA), Tax Compliance (TC), Entrepreneurial Orientation (EO), and Entrepreneurial Performance (EP). Multiple items assessed each construct, and the respondents marked the degree to which they agreed with each item along a 5-point Likert scale from 1 (strongly disagree) to 5 (strongly agree).

FinTech Adoption (FA) was assessed by employing a rigorous instrument developed by Balaskas et al. [

40] and comprising five items. The instrument aims at the measurement of the quality and the degree to which Fintech is used in the company’s businesses. Sample items are “Our firm intends to continue using FinTech in the future” and “We think it will be worth it for us to adopt FinTech when it is available”. The instrument was also validated as reliable, Cronbach’s alpha of 0.89.

Tax Compliance (TC) was assessed by a four-item instrument derived from research by Herman et al. [

41], concentrating on the compliance with tax law and regulation by the company, accuracy and punctuality in taxation payment. It comprised items like “Our firm understands the provisions of tax regulations” and “Our firm pays taxes on time”. The instrument also exhibited good reliability, Cronbach’s alpha of 0.86.

A five-item measurement tool to evaluate the Entrepreneurial Orientation (EO) construct by Nguyen et al. [

42], which captures the company’s proactivity, innovativeness, and risk-taking. Sample items are the phrases “Our firm frequently introduces new products and services compared to competitors” and “Our firm is proactive in forecasting changes and reshaping our business accordingly”. The instrument had good reliability, Cronbach’s alpha of 0.88.

Entrepreneurial Performance (EP) was measured by a four-item scale. The items evaluated the company’s success in achieving the company’s objectives, including profitability, customer retention, return on investment (ROI), and increase in sales, as employed by Tippins and Sohi [

43]. The scale was found to be reliable, and Cronbach’s alpha was 0.89.

To ensure the constructs’ validity, we conducted confirmatory factor analysis (CFA) and evaluated the following metrics. The detailed results of these assessments are presented in relevant tables in the subsequent sections. Composite Reliability (CR) assesses the internal consistency of the constructs. All constructs had CR values above the recommended threshold of 0.70, indicating strong internal consistency. Average Variance Extracted (AVE) measures the amount of variance captured by the constructs relative to the amount of variance due to measurement error. The AVE values for all constructs exceeded the benchmark of 0.50, confirming that each construct explains a substantial portion of the variance in its indicators. Discriminant Validity was assessed using the Heterotrait–Monotrait (HTMT) ratio, with all values below the recommended cutoff of 0.85, demonstrating that the constructs are sufficiently distinct from one another.

The number of items was different for each construct because they were either adopted or adapted from previous valid studies. Furthermore, it was not essential that the number of items in every construct be equal.

3.3. Conceptual Framework

In this section, we present the conceptual framework that underpins our study. The framework is designed to illustrate the relationships among the key constructs: FinTech Adoption (FA), Tax Compliance (TC), Entrepreneurial Orientation (EO), and Entrepreneurial Performance (EP). The model posits that FinTech Adoption influences both Tax Compliance and Entrepreneurial Orientation directly. Tax Compliance, in turn, positively impacts Entrepreneurial Orientation, which subsequently drives Entrepreneurial Performance. Additionally, Tax Compliance mediates the relationship between FinTech Adoption and Entrepreneurial Orientation, while Entrepreneurial Orientation mediates the relationship between FinTech Adoption and Entrepreneurial Performance. These hypothesized relationships are grounded in the theoretical foundations of TAM and RBV, which highlight technology acceptance and the leveraging of firm resources to improve performance. The conceptual model serves as a visual guide to understanding how these constructs interact and influence one another, forming the basis for our hypotheses and subsequent analysis.

Figure 1 provides the conceptual model displaying the hypothesized relationships among the constructs. The model implies that the effect of FinTech Adoption (FA) is to influence both Tax Compliance (TC) and Entrepreneurial Orientation (EO) in a direct fashion. It also implies the effect of Tax Compliance (TC) to influence Entrepreneurial Orientation (EO) positively. Entrepreneurial Orientation (EO) is anticipated to influence Entrepreneurial Performance (EP) in a direct fashion. In addition to that, the model suggests two impacts: Tax Compliance (TC), which acts as a mediator between FinTech Adoption (FA) and Entrepreneurial Orientation (EO), and Entrepreneurial Orientation (EO), which acts as a mediator between FinTech Adoption (FA) and Entrepreneurial Performance (EP). These mediation effects indicate that the impact of FinTech Adoption on Entrepreneurial Orientation and Performance is partially directed through enhancements in Tax Compliance and the fostering of an entrepreneurial mindset. By visually displaying the interactions between them,

Figure 1 helps to describe the theoretical channels through which the effect of the uptake in FinTech translates into terms of outcomes at the entrepreneurial level. This conceptual model offers a structured basis from which to conduct the examination of both the direct and the indirect effects in the research.

3.4. Ethical Considerations

Informed consent was sought from all participants before data collection, ensuring that they were aware of this study’s purpose and their rights, including the right to withdraw at any time. Data confidentiality was maintained by anonymizing responses and securely storing data in compliance with GDPR. No personally identifiable information was collected to protect the privacy of respondents.

4. Results

4.1. Descriptive Statistics

The sample characteristics are presented in

Table 1. The firms in the sample varied in age, with 46.90% of them operating for 0–5 years, 33.22% for 6–10 years, and 19.87% for more than 11 years. The majority of firms had between 1 and 9 employees (50.82%), followed by 10–19 employees (29.32%), 20–49 employees (17.58%), and 50–249 employees (2.28%). In terms of gender distribution among owner-managers, 68.40% were male, and 31.60% were female. The sample also included a mix of family-owned businesses (52.77%) and non-family businesses (47.23%), reflecting the diverse ownership structures of SMEs in Greece. The industry sectors represented in the sample included Technology and ICT (11.40%), Logistics and Supply Chain (6.19%), Manufacturing with a Sustainable Focus (17.26%), Retail and E-commerce (26.72%), Renewable Energy and Sustainability (7.17%), Tourism and Hospitality (27.04%), and Professional and Consulting Services (4.23%). This distribution ensures that the findings of this study are applicable across a wide range of industry contexts.

The diverse representation of sectors and firm characteristics in the sample strengthens the generalizability of this study’s findings. The employment of various industries allows the investigation into how the use of FinTech, taxation compliance, and entrepreneurial orientation influence the performance of various SME types. This study focuses on SMEs to offer insights into the hurdles and advantages they encounter in adopting FinTech solutions and staying compliant with tax laws. In essence, the thorough data collection process and the diverse characteristics of the sample allow for an examination of how FinTech adoption, tax compliance, entrepreneurial spirit, and performance are interconnected within Greek SMEs. This research adds to the body of research by offering real-world proof of how FinTech can boost the performance of SMEs and promote an effective entrepreneurial environment.

4.2. Reliability and Validity Analysis

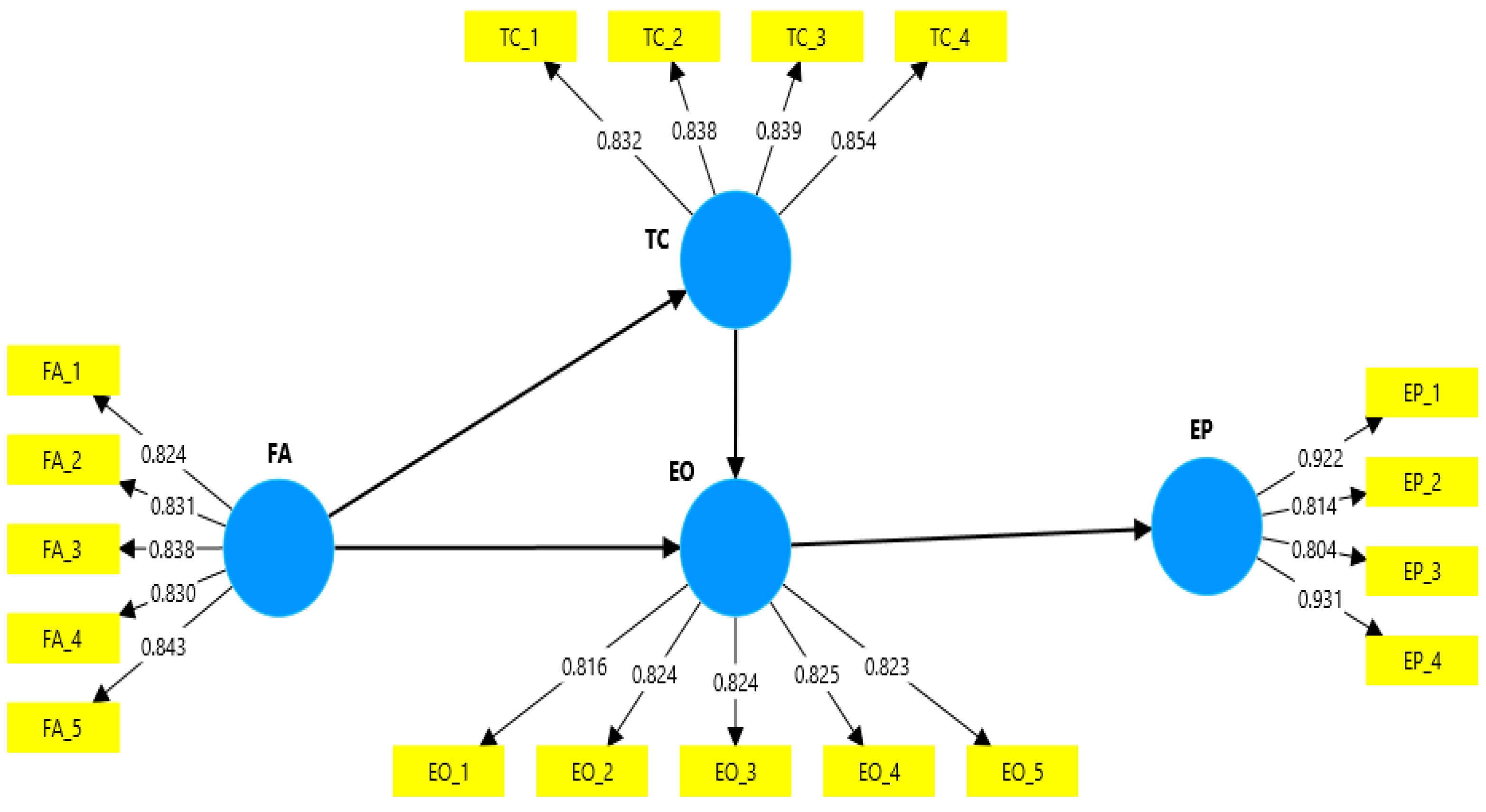

Table 2 summarizes the assessment of construct reliability and convergent validity for the constructs FinTech Adoption (FA), Tax Compliance (TC), Entrepreneurial Orientation (EO), and Entrepreneurial Performance (EP). Factor loadings represent the strength of the relationship between each item and its underlying construct. Each item in the constructs demonstrates strong factor loadings, all exceeding the threshold of 0.704, indicating that the items reliably measure their respective constructs. Thus, the confirmatory factor analysis (CFA) demonstrated strong factor loadings for all items, which confirms that each item reliably measures its associated construct.

Furthermore, the model achieved robust convergent validity, as evidenced by Average Variance Extracted (AVE) values exceeding 0.50 for all constructs. AVE measures the amount of variance captured by a construct relative to the variance due to measurement error. AVE values above 0.50 indicate that the construct explains more than half of the variance in its items, confirming strong convergent validity.

The Cronbach’s alpha (α) values for all constructs exceed the recommended threshold of 0.70, with values ranging from 0.861 to 0.891, which reflects high internal consistency. This ensures reliability in measuring FinTech Adoption, Tax Compliance, Entrepreneurial Orientation, and Entrepreneurial Performance. The Composite Reliability (CR) values for each construct—0.919 for FA, 0.906 for TC, 0.913 for EO, and 0.925 for EP—surpass the benchmark of 0.70, confirming strong reliability across all constructs. The Average Variance Extracted (AVE) values, ranging from 0.677 to 0.757, exceed the critical value of 0.50, indicating that a substantial portion of the variance is explained by the constructs. These metrics all affirm the solidity of the measurement model, verifying that the constructs are reliable and accurately reflect the theoretical concepts. This provides a good foundation for the structure analysis, verifying that the constructs represent the theoretical concepts accurately and indicating the trustworthiness and validity of the findings.

Table 3 shows the outcomes of the validity evaluation utilizing the Heterotrait–Monotrait (HTMT) ratio. Discriminant validity guarantees that concepts that are theoretically different are also distinct, in practice. The HTMT ratios for all construct pairs are well below the recommended cutoff of 0.85.

For instance, the HTMT ratio between Entrepreneurial Orientation (EO) and Entrepreneurial Performance (EP) is 0.565, indicating a moderate but acceptable level of correlation. Similarly, the HTMT ratios between FinTech Adoption (FA) and the other constructs are all below 0.85–0.578 with EO, 0.529 with EP, and 0.526 with TC, demonstrating good discriminant validity. The HTMT ratios for Tax Compliance (TC) with other constructs are also below the threshold, reinforcing the distinctiveness of each construct. These results collectively confirm that the constructs in this study are sufficiently distinct from one another, ensuring that each construct measures a unique aspect of the phenomenon under investigation. This provides a solid basis for further analysis, supporting the conclusion that the constructs are valid and not overly correlated.

Figure 2 visually presents the assessment of the measurement model, illustrating the relationships between the constructs and their respective indicators. The constructs—FinTech Adoption (FA), Tax Compliance (TC), Entrepreneurial Orientation (EO), and Entrepreneurial Performance (EP)—are depicted as latent variables, represented by oval shapes. Each construct is connected to its respective indicators (items), shown as rectangles, through arrows that represent the factor loadings. The high factor loadings, all exceeding the threshold of 0.70, indicate strong relationships between the constructs and their indicators, confirming that the items are reliable measures of their respective constructs.

Figure 2, overall, provides an overall schematic presentation of the measurement model, indicating the high reliability and validity of the constructs used in the research.

4.3. Hypothesis Testing (Direct Effects)

The results validate the theoretical model by revealing significant relationships between the constructs (

Table 4). The Beta coefficients provide meaningful business insights by highlighting the strength and direction of relationships among constructs, offering practical implications for how FinTech adoption can enhance tax compliance and entrepreneurial performance.

“H1: FinTech Adoption Positively Influences Tax Compliance”. The analysis establishes a strongly positive association between the use of FinTech tools by SMEs and compliance in taxation at 0.461 (standardized coefficient, also referred to as the Beta) and 7.692 (t-value) and 0 (p-value). The association implies that the use of FinTech tools by SMEs ensures compliance with taxation. In other words, the significant Beta value of 0.461 for the relationship between FinTech Adoption and Tax compliance suggests that SMEs actively leveraging FinTech tools (e.g., automated tax reporting) significantly enhance their compliance with tax regulations. The employment of digital banking, auto-reporting, and e-invoice reduces administrative burden and errors, making taxation compliance easier and less cumbersome. The observation is in line with studies that underscore the advantages of technology (FinTech) in simplifying tax procedures and enhancing precision in tax computations and filings. As a result of this development, SMEs using FinTech are more prepared to fulfill their tax responsibilities and diminish the chances of facing legal repercussions and financial instability. The reduction in administrative burden allows firms to mitigate penalties and focus on strategic growth.

“H2: FinTech Adoption Positively Influences Entrepreneurial Orientation”. The results show a significant positive relationship between FinTech Adoption (FA) and Entrepreneurial Orientation (EO), with a Beta value of 0.348, a t-value of 6.336, and a p-value of 0. This finding suggests that increased adoption of FinTech tools fosters a stronger entrepreneurial orientation within SMEs. By providing better financial information and innovative solutions, FinTech enables firms to be more proactive, innovative, and willing to take risks. This supports the idea that technology acceptance plays a crucial role in shaping a firm’s strategic posture towards entrepreneurship. Firms that embrace FinTech are likely to develop a culture of innovation, positioning themselves better to seize new opportunities and respond to market changes effectively.

“H3: Tax Compliance Positively Influences Entrepreneurial Orientation”. The significant positive relationship between Tax Compliance (TC) and Entrepreneurial Orientation (EO), with a Beta value of 0.357, a t-value of 5.914, and a p-value of 0, indicates that efficient tax compliance contributes to a stronger entrepreneurial orientation. Efficient tax practices provide a stable financial foundation, allowing firms to allocate resources towards strategic initiatives and innovation. By reducing uncertainties and the risk of legal penalties, firms with high tax compliance can focus on exploring new business opportunities and enhancing their competitive edge. This implies the significance of upholding tax procedures to bolster endeavors within small- and medium-sized enterprises (SMEs).

“H4: Entrepreneurial Orientation (EO) Positively Influences Entrepreneurial Performance”. The analysis confirms a significant positive relationship between Entrepreneurial Orientation (EO) and Entrepreneurial Performance (EP), with a Beta value of 0.501, a t-value of 9.171, and a p-value of 0. This strong relationship highlights the critical role of entrepreneurial orientation in driving business success. Companies having high entrepreneurial orientation, in terms of innovativeness, risk-taking, and proactiveness, are in a position to seize market opportunities, leading to improved business outcomes in terms of profitability, customer retention, return on investments (ROI), and sales. This finding resonates with studies highlighting how an entrepreneurial mindset can significantly enhance a company’s performance and underscores the importance of fostering such an approach for long-term success.

4.4. Mediation Analysis

The mediation analysis revealed significant indirect effects. For instance, the Beta value of 0.164 for FA -> TC -> EO suggests that tax compliance acts as a crucial mechanism through which FinTech adoption fosters a more proactive and innovative entrepreneurial mindset. Similarly, the Beta value of 0.174 for FA -> EO -> EP underscores the importance of cultivating an entrepreneurial orientation as an intermediary step in translating FinTech adoption into tangible performance gains, such as profitability and ROI. More specifically:

“H5: Tax Compliance Mediates the Relationship Between FinTech Adoption and Entrepreneurial Orientation”. The mediation analysis shows that the relationship between FinTech Adoption (FA) and Entrepreneurial Orientation (EO) is partially mediated by Tax Compliance (TC). The indirect effect of FA on EO through TC has a Beta value of 0.164, a standard error of 0.038, a t-value of 4.364, and a p-value of 0. This significant mediation effect indicates that improved tax compliance, resulting from increased FinTech adoption, positively influences entrepreneurial orientation. This finding suggests that FinTech tools not only directly enhance entrepreneurial orientation but also do so indirectly by fostering better tax compliance, which in turn promotes a proactive and innovative culture within SMEs. This supports Hypothesis H5, highlighting the critical role of tax compliance in the relationship between FinTech adoption and entrepreneurial orientation.

“H6: Entrepreneurial Orientation (EO) Mediates the Relationship Between FinTech Adoption (FA) and Entrepreneurial Performance (EP)”. The mediation analysis also shows that the relationship between FinTech Adoption (FA) and Entrepreneurial Performance (EP) is partially mediated by Entrepreneurial Orientation (EO). The indirect effect of FA on EP through EO has a Beta value of 0.174, a standard error of 0.038, a t-value of 4.535, and a p-value of 0. This significant mediation effect indicates that increased FinTech adoption enhances entrepreneurial performance not only directly but also indirectly by strengthening entrepreneurial orientation. Firms that adopt FinTech tools develop a more innovative, risk-taking, and proactive culture, which translates into better business outcomes such as profitability, customer retention, ROI, and sales growth. This finding supports Hypothesis H6, emphasizing the importance of entrepreneurial orientation as a mediating factor in the relationship between FinTech adoption and entrepreneurial performance.

Overall, the results in

Table 5 provide strong empirical support for the mediation hypotheses (H5 and H6). The significant indirect effects highlight the critical roles of tax compliance and entrepreneurial orientation in translating FinTech adoption into tangible business outcomes, thereby enhancing the overall effectiveness of FinTech tools in driving entrepreneurial success.

4.5. Model Fit and Predictive Relevance

Table 6 provides a comprehensive overview of the model’s explanatory power, predictive relevance, and effect sizes for the relationships among the constructs in this study. Each metric—

R2,

R2 Adjusted,

Q2, and

F2—offers unique insights into the robustness and validity of the structural model.

The R2 values represent the coefficient of determination, indicating the proportion of variance in the dependent variables explained by the independent variables in the model. For Entrepreneurial Orientation (EO), the R2 value is 0.371, meaning that 37.1% of the variance in EO is explained by the model. It represents the explanatory power, according to common thresholds. As a guideline, R2 values of 0.75, 0.50, and 0.25 can be considered substantial, moderate, and weak. The adjusted R2 value, which accounts for the number of predictors, is 0.367, providing a slightly more conservative estimate of the explanatory power. Similarly, the model explains 25.8% of the variance in Entrepreneurial Performance (EP) with an adjusted R2 value of 0.256. For Tax Compliance (TC), the R2 value is 0.219, and the adjusted R2 value is 0.217, indicating that the model explains 21.9% of the variance in TC, which is relatively weak but still meaningful in the given research context. The R2 and adjusted R2 values suggest that the model has a reasonable explanatory power for the key constructs, highlighting the importance of FinTech Adoption, Tax Compliance, and Entrepreneurial Orientation in predicting Entrepreneurial Performance.

The Q2 values, based on the Stone-Geisser Q2 criterion, assess the predictive relevance of the model. Unlike R2 values, which measure how well the model explains the variance in the data, Q2 values evaluate the model’s ability to predict new data. Values greater than zero indicate that the model has predictive relevance, but their magnitude determines its strength: EO (0.243) → Medium predictive relevance, EP (0.187) → Medium predictive relevance, TC (0.148) → Small to medium predictive relevance. These positive Q2 values confirm that the model has meaningful predictive power for all three constructs. This suggests that the model not only fits the data well but also has practical utility in predicting how FinTech adoption impacts key entrepreneurial outcomes.

The F2 scores represent the effect size, the influence each predictor holds on the dependent variable. The F2 thresholds are as follows: small (≥0.02), medium (≥0.15), and large (≥0.35). According to the findings, the F2 are as follows: EO → EP (0.336) → Moderate to large effect, FA → EO (0.15) → Small to medium effect, FA → TC (0.27) → Moderate effect, TC → EO (0.157) → Small to medium effect. The effect size implies the significant influence of Entrepreneurial Orientation in determining Entrepreneurial Performance and the contributions from FinTech Adoption and Tax Compliance to the model.

The R2, R2 Adjusted, Q2, and the F2 all provide a good test of the structural model, confirming the model’s validity and reliability. The predictive and explanatory fit, as well as the predictive relevance of the model, confirm the significant impact of FinTech Adoption, Tax Compliance, and Entrepreneurial Orientation in the determination of Entrepreneurial Performance. The effect size also captures the significant channels through which the constructs influence the outcomes.

The insights from the above metrics are useful to inform policymakers, SME entrepreneurs, and the providers of FinTech about the most powerful drivers of entrepreneurial performance. By applying the use of FinTech tools to support tax compliance and the building of an entrepreneurial orientation, the SMEs are empowered to become competitive and attain improved business outcomes. The findings also increase the theoretical explanation of the relationships between the use of FinTech, the compliance in taxation, the entrepreneurial orientation, and the entrepreneurial performance, and provide a useful platform to develop future research.

4.6. Discussion and Implications

4.6.1. Implications of the Results

The findings demonstrate that FinTech adoption significantly impacts tax compliance (β = 0.461) and entrepreneurial orientation (β = 0.348), while entrepreneurial orientation strongly drives entrepreneurial performance (β = 0.501). These results highlight the critical role of entrepreneurial orientation as both a direct driver and a mediator in translating FinTech adoption into tangible performance gains. The observed relationships confirm that FinTech tools not only streamline tax compliance but also foster an entrepreneurial mindset, enabling firms to focus on innovation and strategic growth. By reducing operational inefficiencies and increasing transparency in financial practices, SMEs that adopt FinTech are better positioned to achieve sustainable competitive advantages.

4.6.2. Justification and Implementation of the Theoretical Model

The theoretical model proposed in this study integrates TAM and RBV to capture the pathways through which FinTech adoption influences entrepreneurial performance. The findings validate this framework, showing that perceived ease of use and usefulness of FinTech tools enhance their adoption, as posited by TAM. This, in turn, directly improves tax compliance by automating processes and enhancing transparency. From an RBV perspective, tax compliance serves as a strategic resource that facilitates entrepreneurial orientation, allowing SMEs to allocate resources toward innovation and risk-taking. The strong relationship observed between entrepreneurial orientation and performance underscores how FinTech adoption enables SMEs to respond proactively to market demands, thereby driving growth and competitiveness. These results provide empirical support for the theoretical model, demonstrating its applicability to the SME context.

4.6.3. Theoretical Consequences

The findings of this study are contributive to the research body in the area of FinTech adoption, taxation compliance, and entrepreneurship. Through the integration between the Technology Acceptance Model (TAM) and the Resource-Based View (RBV), this study offers a theoretical model in the capture of how the use of FinTech impacts entrepreneurial performance through the mediating influence of tax compliance and entrepreneurial orientation. The findings confirm the idea that FinTech tools not only have an impact on tax compliance and entrepreneurial mindset but also indirectly enhance these intermediary elements. It emphasizes the significance of taking an approach that factors in technology acceptance and resource management when examining performance. Moreover, the strong correlation observed between tax compliance and entrepreneurial orientation introduces a perspective on how following regulations can stimulate an attitude. These finding questions the belief that compliance is solely administrative and proposes that effective tax strategies can lay the groundwork for strategic creativity and embracing risks. The substantial mediation effects provide support for the idea that intermediary elements are crucial in converting FinTech adoption into measurable business results.

4.6.4. Practical Applications

This study’s real-world implications are diverse and provide insights for small business owners and financial technology providers alike. For business owners and managers specifically, the findings underscore the importance of incorporating financial technology tools into their day-to-day activities. Through the utilization of banking services, automated tax filings, and electronic invoicing systems, small businesses can improve their compliance with tax regulations, streamline operations, and cultivate an environment of innovation and initiative. The notable positive impact on performance underscores the potential for technology to boost profitability, customer loyalty, return on investment (ROI), and sales expansion. Small business owners should take into account the option of investing in financial technology solutions that match their objectives and operational requirements.

For companies in the FinTech industry, the research highlights the significance of designing user-efficient products customized for medium enterprises (SMEs). Companies are encouraged to prioritize the development of resources that streamline tax obligations, improve clarity, and encourage business endeavors. By grasping the obstacles and demands faced by SMEs, FinTech companies can provide solutions that bring advantages and encourage broad acceptance.

4.6.5. Repercussions for Policies

The results indicate implications for policymakers to consider in relation to FinTech utilization for improving tax compliance and business performance by SMEs monitoring and encouraging the use of such technologies through policy support measures and incentives like tax breaks or financial assistance could foster a smoother transition to FinTech while safeguarding data privacy and security, within regulatory boundaries. In addition to the point raised earlier on the table regarding programs and workshops in regard to spreading knowledge about the advantages of FinTech and offering guidance on how to utilize it, can really empower small and medium enterprises (SMEs) to make well-informed choices about integrating technology into their operations. Such actions have the potential to boost the competitiveness and long-term viability of the SME industry, which will in turn play a role in fostering expansion and progress.

6. Conclusions

The interconnectedness among the use of FinTech, taxation compliance, entrepreneurial orientation, and the entrepreneurs’ performance implies the integration of the use of technology into the current practices. This research illuminated the impact of the use of FinTech on the business outcomes in the case of the SMEs in Greece, and the necessity to be compliant in taxation.

Our empirical findings affirm the truth that the use of FinTech significantly encourages compliance in taxation and, consequently, entrepreneurial orientation and performance. The use of FinTech solutions makes taxation processes easier, reduces errors, and ensures timely compliance. The use of FinTech tools, through the automation of taxation reporting and real-time availability of monetary facts, assists SMEs in fulfilling taxation obligations in a timely and accurate manner. This enhanced tax compliance not only lowers the risk of consequences and financial instabilities but also establishes a solid financial footing for companies.

Viewing tax compliance as a tool rather than just a legal requirement changes it into a driver for business growth and innovation in entrepreneurship. By adopting FinTech for tax processes, SMEs can allocate resources and time towards innovation, strategic plans, and market growth. Companies that adhere to regulations are more likely to earn trust from stakeholders, gain access to funding, and navigate competition successfully.

This research highlights the importance of having a system for tax compliance and utilizing FinTech to promote a thinking and creative business environment. Effective tax compliance leads to a mindset and ultimately results in improved entrepreneurial success. Entrepreneurs who combine FinTech with a focus on tax compliance are better positioned for lasting growth and success. Recognizing these connections enables stakeholders to make informed choices that support a flourishing community.

The findings also hold consequences for policymakers and small business owners, and firms in the financial technology sector (FinTech). Policymakers are advised to promote the adoption of FinTech and support tax compliance through incentives and favorable regulations, as they can work together to boost the success of entrepreneurs effectively. Small business owners are urged to incorporate FinTech tools designed specifically to enhance tax compliance to improve their operations and focus their energy on strategic business growth. In addition to this advice for SMEs is that FinTech providers should customize their solutions to meet the tax compliance requirements of businesses by offering, to use platforms that simplify meeting regulatory standards and reporting obligations.

In essence, this research underscores the impact of embracing FinTech by SMEs, showcasing how modern financial technologies can boost business success by improving adherence, to tax regulations and fostering a strong entrepreneurial mindset. By underscoring the significance of tax compliance in this context, we offer perspectives for individuals seeking to promote an inventive SME industry. Grasping these intertwined relationships is crucial for nurturing an environment where technology and compliance work together to improve business outcomes.

This research underscores the transformative potential of FinTech adoption in SMEs, highlighting its critical role in improving tax compliance, fostering entrepreneurial orientation, and enhancing overall performance. By adopting FinTech solutions, SMEs can streamline tax processes, reduce compliance costs, and channel resources toward innovation and strategic growth, ultimately achieving sustainable business success. The significant relationships observed in this study, such as the direct impact of FinTech Adoption on Tax Compliance, demonstrate the practical pathways through which technology drives business outcomes. Looking ahead, the future of FinTech holds immense promise for SMEs, contingent on collaborative efforts among entrepreneurs, policymakers, and FinTech providers. Proactive investments in accessible technologies and supportive policies will ensure SMEs remain competitive and resilient, creating an ecosystem where technological innovation and regulatory compliance together fuel economic growth and entrepreneurial success.