Exploring the Transition from Petroleum to Natural Gas in Tanzania’s Road Transport Sector: A Perspective on Energy, Economy, and Environmental Assessment

Abstract

:1. Introduction

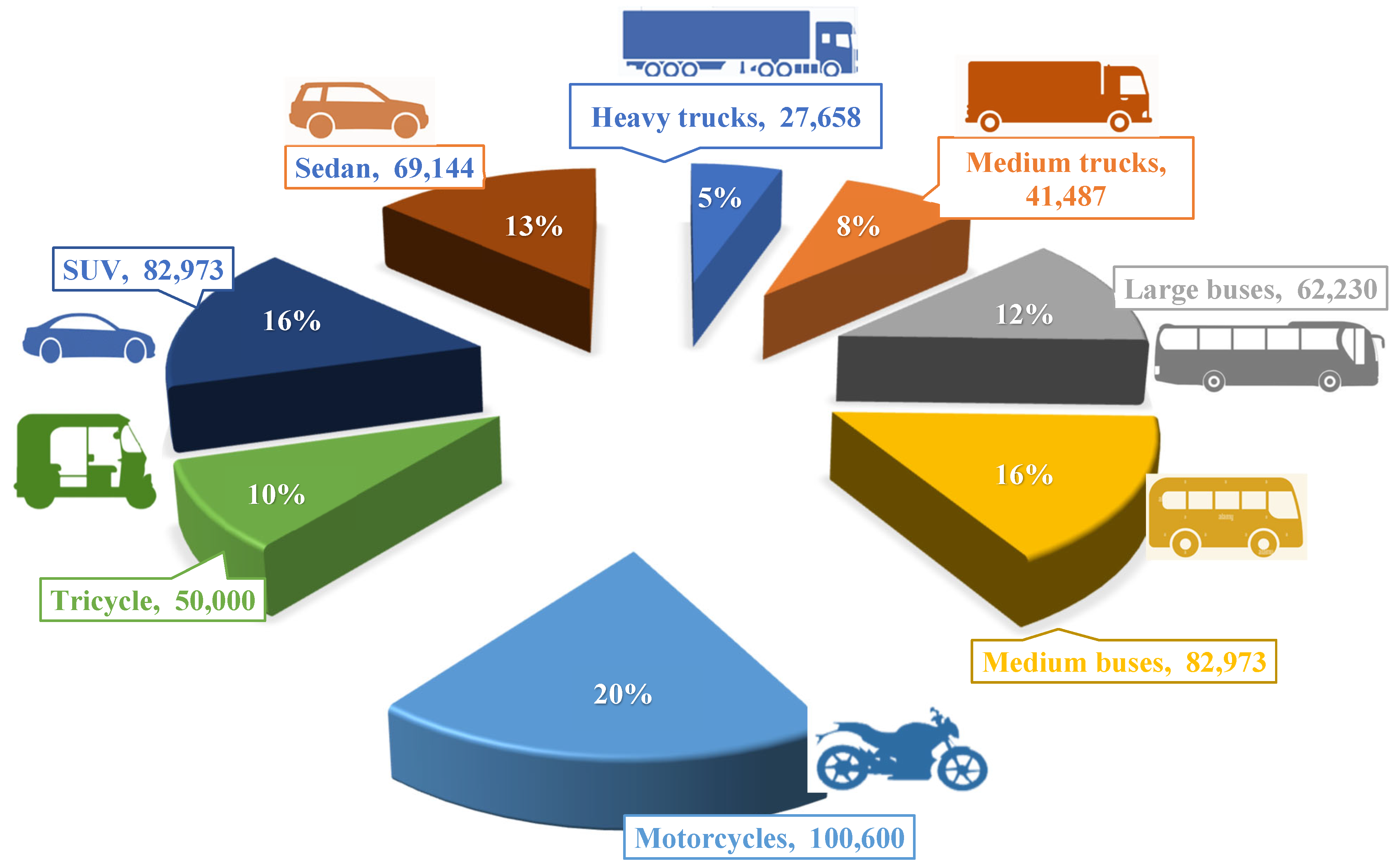

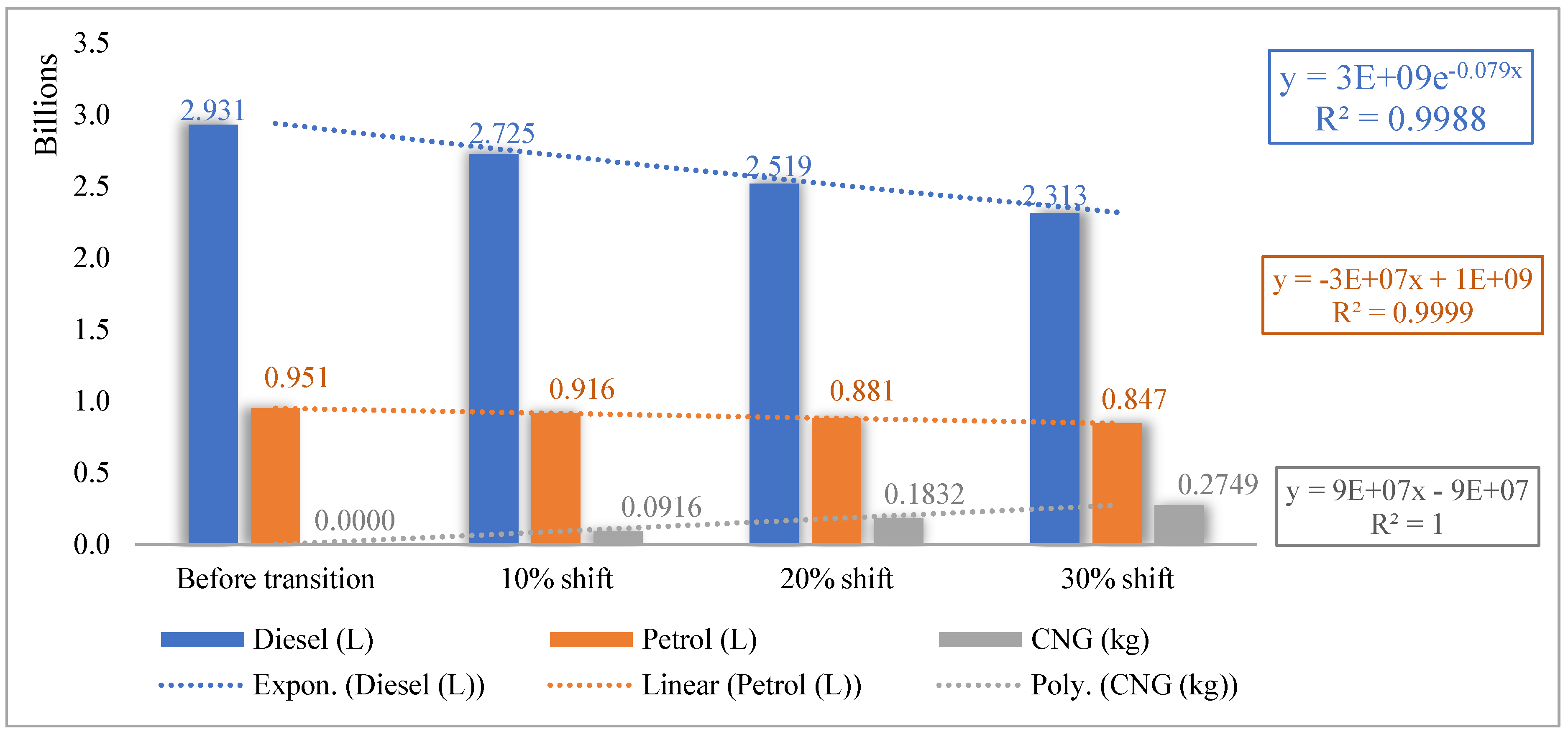

- The number of road vehicles and their related fuel consumption are evaluated. The main target is to quantify the annual fuel demand, which includes petroleum fuel (diesel and petrol) demand for road vehicles prior to transition, natural gas demand during transition, and reduction in petroleum fuel demand post-transition.

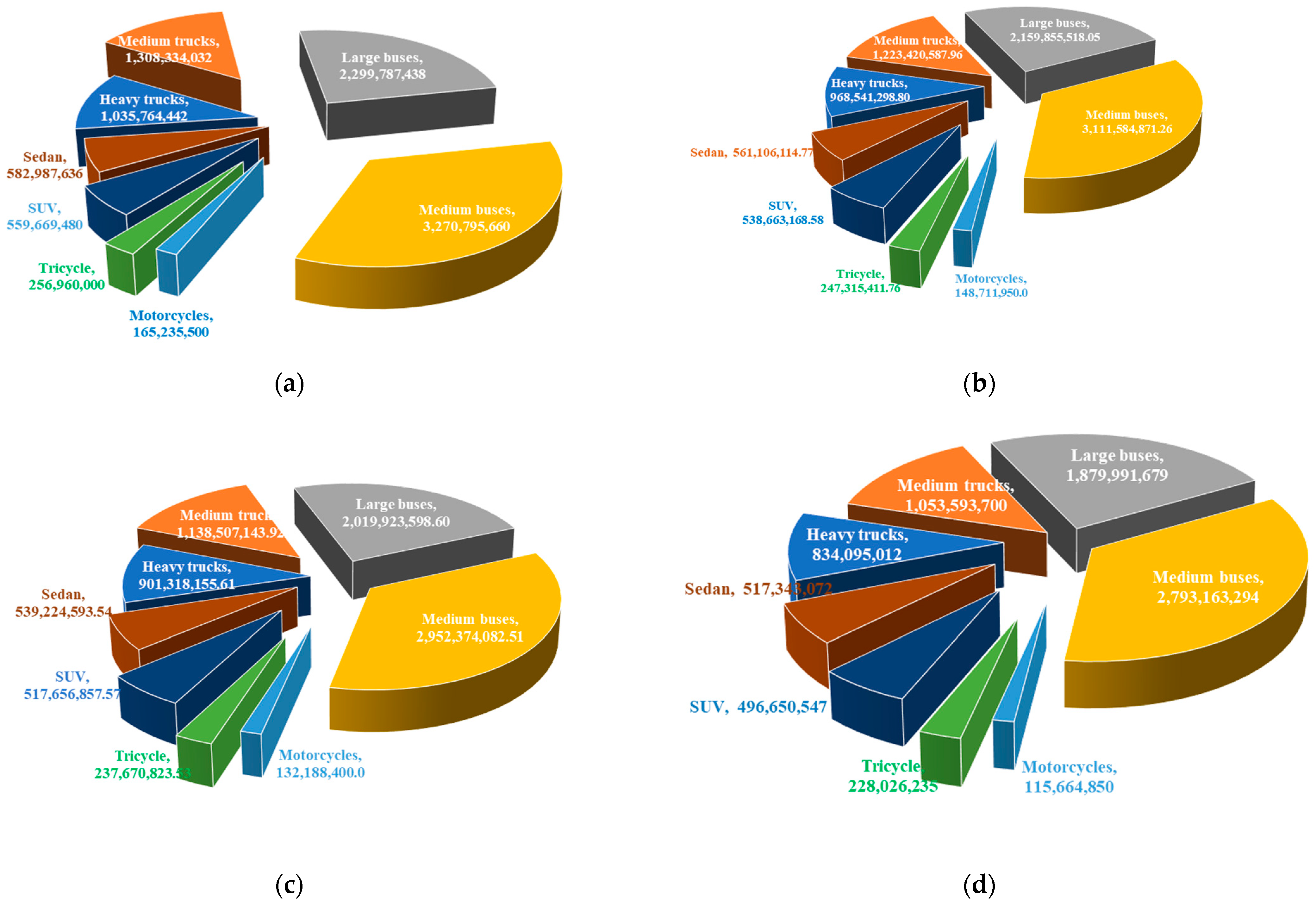

- The government revenue from petroleum fuel usage in an annual basis is assessed. The foregone revenue is estimated at a 10, 20, and 30% shift of vehicles from petroleum to natural gas. The percent shift of vehicles is for both diesel and petrol vehicles. The foregone revenue is computed to assess the percentage loss in government revenue post-transition.

- The environmental benefits of the transition to natural gas in road sector are assessed.

2. Materials and Methods

2.1. Overview of Tanzania’s Road Transport Sector

2.2. Trends in Vehicle Growth and Oil Imports

3. Data Analysis

3.1. Estimation of Annual Fuel Demand

Assumptions

- In bi-fuel engine, the fuel is 100% petrol or 100% natural gas.

- Fuel prices: TZS 1550/kg of natural gas, TZS 3190/L of petrol, TZS 3112/L of diesel,

- Natural gas is a non-taxed fuel.

- Transition rates: 10, 20, and 30% of vehicle population considered in this study.

- Fuel conversion factors: 10 kWh/1 L of diesel, 8.9 kWh/1 L of petrol, 13.6 kWh/1 kg of natural gas.

- Government revenue from petroleum fuel sales is considered to be 30%.

- The emission factors are 2.7 kgCO2e/L of diesel, 2.31 kgCO2e/L of petrol, and 2.25 kgCO2e/kg of natural gas [42].

- The carbon tax is considered as 8.0 US$/tCO2e [32].

- The exchange rate regarded in the study is 2710 TZS/US$ as of August 2024 [45].

- The percentages of active road vehicles for heavy trucks, medium trucks, large buses, medium buses, motorcycles, tricycles, SUVs, and sedans are 20, 20, 25, 40, 90, 80, 70, and 70% respectively.

- It assumed that natural gas infrastructure is available at a sufficient level.

- The investment and maintenance costs of natural gas infrastructure are not considered in the calculations.

3.2. Estimation of Government Revenue

3.3. Environmental Benefits

4. Results and Discussions

4.1. Annual Fuel Demand Pre− and Post−Transition

4.2. Analysis of Government Revenue

4.3. Environmental Benefits

5. Conclusions and Policy Implication

- In the post-transition, a 10, 20, and 30% shift to natural gas dropped diesel and petrol demand by 7 and 3.68%, 7 and 3.8%, and 15 and 7.5%, respectively. In natural gas, the demand started at 0.0916 billion kg and grew substantially by 200% and later by 300%. This indicates that petroleum products will not largely be affected instead natural gas demand rises exponentially.

- The transition has consequences in government revenue, which takes the form of taxes on petroleum products. The shift from 10 to 30% could lead to foregone taxes amounting to TZS 0.09, 0.31, and 0.54 trillion, indicating a tax loss of about 3, 9, and 15%. However, these losses could be advantageous to the government for reducing the forex required in oil importation.

- The 10, 20, and 30% shift could offset approximately 8959.19, 8438.86, and 7918.53 MtCO2e, equivalent to 5.4, 10.97 and 16.47% of the road emissions.

- The post-transition road emissions might result in a carbon tax revenue of about US$ 71,673,591.37, 67,510,909.24, and 63,348,227.11 per year. On the other side, the post-transition carbon credit revenue of about US$ 20,813,410.64, 41,626,821.27, and 62,440,231.91 is expected annually.

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- IEA. Oil Demand Growing at a Slower Pace as Post-Covid Rebound Runs Its Course. 2024. Available online: https://www.iea.org/commentaries/oil-demand-growing-at-a-slower-pace-as-post-covid-rebound-runs-its-course (accessed on 29 September 2024).

- Weber, S.; Hans, W. Environmental awareness: The case of climate change. Russ. J. Econ. 2018, 4, 328–345. [Google Scholar] [CrossRef]

- Othman, M.F.; Adam, A.; Najafi, G.; Mamat, R. Green fuel as alternative fuel for diesel engine: A review. Renew. Sustain. Energy Rev. 2017, 80, 694–709. [Google Scholar] [CrossRef]

- Bishoge, O.K.; Zhang, L.; Mushi, W.G. Challenges facing the implementation of the national natural gas policy in Tanzania. Int. J. Energy Sect. Manag. 2020, 13, 500–517. [Google Scholar] [CrossRef]

- Makala, D.; Zongmin, L. Natural Gas Consumption and Economic Growth in Tanzania. Eur. J. Sustain. Dev. Res. 2020, 4, em0113. [Google Scholar] [CrossRef]

- Gerald, J.K. Natural Gas Consumption in Power Generation and Economic Growth in Tanzania. Tengeru Comm. Dev. J. 2021, 8, 16–36. [Google Scholar]

- OPEC. Natural Gas Data-Annual Statistical Bulletin 2024. 2024. Available online: https://asb.opec.org/ASB_Charts.html?chapter=1572 (accessed on 29 September 2024).

- Statista. Leading Countries by Proved Natural Gas Reserves Worldwide in 1960 and 2022. 2024. Available online: https://www.statista.com/statistics/265329/countries-with-the-largest-natural-gas-reserves/ (accessed on 29 September 2024).

- Africa Energy Chamber. Natural Gas Is Key to Africa’s Industrialisation Process and to Ending the Region’s Massive Energy Poverty. 2023. Available online: https://energychamber.org/natural-gas-is-key-to-africas-industrialisation-process-and-to-ending-the-regions-massive-energy-poverty/#:~:text=Across%20the%20region%2C%20natural%20gas,(32%25)%2C%20in%20particular (accessed on 29 September 2024).

- Tanzania Investment Centre. Oil and Gas. 2024. Available online: https://www.tic.go.tz/pages/oil-and-gas (accessed on 29 September 2024).

- Energy and Water Utilities Authorities. General Information. 2024. Available online: https://www.ewura.go.tz/natural-gas/ (accessed on 29 September 2024).

- Ministry of Works and Transport. Transport and Meteorology Sector Statistics-2021. 2021. Available online: https://www.mow.go.tz/uploads/documents/sw-1633366677-TRANSPORT%20AND%20METEOROLOGY%20SECTOR%20STATISTICS%20-%202019.pdf (accessed on 29 September 2024).

- Tanzania Ports Authority. Internal Data Acquired from the Internal Import Department. 2024; Internal data. [Google Scholar]

- Ministry of Finance. Revenue Estimates: For the Year from 1st July, 2022 to 30th June 2023, pp. 20. 2024. Available online: https://www.mof.go.tz/uploads/documents/en-1658231440-Revenue_estimates_22_23%20(1).pdf (accessed on 10 August 2024).

- Roychowdhury, A. CNG Programme in India: The Future Challenges. Center for Science and Environment (CSE). 2010. Available online: http://www.indiaenvironmentportal.org.in/files/CNG%20programme%20in%20India.pdf (accessed on 10 August 2024).

- Ministry of Petroleum and Natural Gas. Natural gas Pipelines. 2024. Available online: https://mopng.gov.in/en/pdc/investible-projects/oil-amp-gas-infrastructure/natural-gas-pipelines (accessed on 10 August 2024).

- Zacharias, L.G.L.; de Andrade, A.C.A.C.; Guichet, X.; Mouette, D.; Peyerl, D. Natural gas as a vehicular fuel in Brazil: Barriers and lessons to learn. Energy Policy 2022, 167, 113056. [Google Scholar] [CrossRef]

- Aelex. A Quick Overview of the New National Gas Policy. 2024. Available online: https://www.aelex.com/a-quick-overview-of-the-new-national-gas-policy/ (accessed on 10 August 2024).

- Ani, G.O.; Ikiensikimama, S.S. Natural Gas Development Trend in Nigeria: The Investor’s Road Map. J. Energy Res. Rev. 2020, 5, 39–48. [Google Scholar] [CrossRef]

- Roychowdhury, A.; Chandola, P.; Chattopadhyaya, V. Opportunities for CNG-Based Transportation Programme in Nigeria: Policy Brief Report. 2022. Available online: https://www.cseindia.org/policy-brief-opportunities-for-cng-based-transportation-programme-in-nigeria-11681 (accessed on 10 August 2024).

- Zhou, Y.; Fang, W.; Li, M.; Liu, W. Exploring the impacts of a low-carbon policy instrument: A case of carbon tax on transportation in China. Resour. Conserv. Recycl. 2018, 139, 307–314. [Google Scholar] [CrossRef]

- Solaymani, S.; Kardooni, R.; Yusoff, S.B.; Kari, F. The impacts of climate change policies on the transportation sector. Energy 2015, 81, 719–728. [Google Scholar] [CrossRef]

- Kim, Y.D.; Han, H.O.; Moon, Y.S. The empirical effects of a gasoline tax on CO2 emissions reductions from transportation sector in Korea. Energy Policy 2011, 39, 981–989. [Google Scholar] [CrossRef]

- Zhang, Y.; Abbas, M.; Iqbal, W. Analyzing sentiments and attitudes toward carbon taxation in Europe, USA, South Africa, Canada and Australia. Sustain. Prod. Consum. 2021, 28, 241–253. [Google Scholar] [CrossRef]

- Davis, L.W.; Kilian, L. Estimating the Effect of a Gasoline Tax on Carbon Emissions; Working Paper; Department of Economics, University of Michigan: Ann Arbor, MI, USA, 2009. [Google Scholar]

- Gupta, M.; Bandyopadhyay, K.R.; Singh, S.K. Measuring effectiveness of carbon tax on Indian road passenger transport: A system dynamics approach. Energy Econ. 2019, 81, 341–354. [Google Scholar] [CrossRef]

- Chatterjee, S.; Dhavala, K.K.; Murty, M.N. Estimating cost of air pollution abatement for road transport in India: Case studies of Andhra Pradesh and Himachal Pradesh. Econ. Polit. Wky. 2007, 42, 3662–3668. [Google Scholar]

- Wu, Q.; Cheng, W.; Zheng, Z.; Zhang, G.; Xiao, H.; Wen, C. Research on the carbon credit exchange strategy for scrap vehicles based on evolutionary game theory. Int. J. Environ. Res. Public Health 2023, 20, 2686. [Google Scholar] [CrossRef]

- Gupta, H.; Rakshit, D. Assessing the demand for carbon credits from the most polluting and hard-to-abate sectors in India. J. Clean. Prod. 2023, 425, 138825. [Google Scholar] [CrossRef]

- Tangvitoontham, N.; Chaiwat, P. Carbon Credit Estimation: A Case Study of Shifting Freighting Mode to Railway from ICD Lat Krabang, Bangkok to Laem Chabang Port, Chonburi. J. Bus. Econ. 2015, 3, 145–149. [Google Scholar] [CrossRef]

- Yu, L.; Ding, Y.; Jian, S. Managing carbon emissions in urban mobility system: A credit-based reservation scheme. Transp. Res. D Transp. Environ. 2024, 130, 104197. [Google Scholar] [CrossRef]

- Greyson, K.A.; Gerutu, G.B.; Bobi, S.; Chombo, P.V. Exploring the potential of compressed natural gas as a sustainable fuel for rickshaw: A case study of Dar es Salaam. J. Nat. Gas Sci. Eng. 2021, 96, 104273. [Google Scholar] [CrossRef]

- Gerutu, G.B.; Greyson, K.A.; Chombo, P.V. Compressed Natural Gas as an Alternative Vehicular Fuel in Tanzania: Implementation, Barriers, and Prospects. Methane 2023, 2, 66–85. [Google Scholar] [CrossRef]

- National Transport Policy. 2011. Available online: http://www.tzonline.org/pdf/nationaltransportpolicy1.pdf (accessed on 10 August 2024).

- JICA Report. Comprehensive Transport and Trade System Development Master Plan in the United Republic of Tanzania. Volume 2 Chapter 6; 2021. Available online: https://openjicareport.jica.go.jp/pdf/12150512_02.pdf (accessed on 10 August 2024).

- TANROADs. Tanzania Transport Integration Project. 2023. Available online: https://www.tanroads.go.tz/common/uploads/tor/q2f9c4ae6973e6f04a2a73b1a4fe4583.pdf (accessed on 10 August 2024).

- Tanzania Invest. Tanzania Oil. 2024. Available online: https://www.tanzaniainvest.com/oil (accessed on 10 August 2024).

- Energy and Water Utilities Authorities. Petroleum Infrastructure. 2024. Available online: https://www.ewura.go.tz/pages/petroleum-infrastructure (accessed on 10 August 2024).

- OEC World. Refined petroleum in Tanzania. Available online: https://oec.world/en/profile/bilateral-product/refined-petroleum/reporter/tza (accessed on 10 August 2024).

- Nithyanandan, K.; Zhang, J.; Li, Y.; Meng, X.; Donahue, R.; Lee, C.F.; Dou, H. Diesel-like efficiency using compressed natural gas/diesel dual-fuel combustion. J. Energy Resour. Technol. 2016, 138, 052201. [Google Scholar] [CrossRef]

- Ismail, M.; Fawzi, M.; Zulkifli, F.; Osman, S. Effects of Fuel Ratio on Performance and Emission of Diesel-Compressed Natural Gas (CNG) Dual Fuel Engine. JSAEM 2021, 2, 157–165. [Google Scholar] [CrossRef]

- Aosaf, M.R.; Wang, Y.; Du, K. Comparison of the emission factors of air pollutants from gasoline, CNG, LPG and diesel fueled vehicles at idle speed. Environ. Pollut. 2022, 305, 119296. [Google Scholar] [CrossRef] [PubMed]

- Dao, I.; Roncalli, T.; Semet, R. An Introduction to Carbon Pricing: Carbon Tax, Cap & Trade, ETS and Internal Carbon Price. Cap & Trade, ETS and Internal Carbon Price (August 29, 2024). 2024. Available online: http://www.thierry-roncalli.com/download/Carbon_Pricing_Primer.pdf (accessed on 10 October 2024).

- Terrapass. Creating Carbon Credits: Is It Profitable? 2024. Available online: https://terrapass.com/blog/creating-carbon-credits-is-it-profitable/ (accessed on 10 August 2024).

- Bank of Tanzania. Exchange Rates. 2024. Available online: https://www.bot.go.tz/exchangerate/excrates (accessed on 10 August 2024).

- World Bank Blogs. What a Carbon Tax Can Do and Why It Cannot Do It All. 2022. Available online: https://blogs.worldbank.org/en/energy/what-carbon-tax-can-do-and-why-it-cannot-do-it-all#:~:text=A%20carbon%20tax%20reflecting%20the,discussions%20are%20ongoing%20in%20others (accessed on 10 August 2024).

- International Monetary Fund. What Is Carbon Taxation? 2019. Available online: https://www.imf.org/en/Publications/fandd/issues/2019/06/what-is-carbon-taxation-basics (accessed on 10 August 2024).

- De Bruin, K.; Yakut, A.M. The Impacts of Removing Fossil Fuel Subsidies and Increasing Carbon Taxation in Ireland. Environ. Resour. Econ. 2023, 85, 741–782. [Google Scholar] [CrossRef]

- Calignano, G.; Vaaland, T.I. Local content in Tanzania: Are local suppliers motivated to improve? Extr. Ind. Soc. 2018, 5, 104–113. [Google Scholar] [CrossRef]

- Li, J.; Du, Q.; Lu, C.; Huang, Y.; Wang, X. Simulations for double dividend of carbon tax and improved energy efficiency in the transportation industry. Environ. Sci. Pollut. Res. 2023, 30, 19083–19096. [Google Scholar] [CrossRef]

- Nong, D.; Simshauser, P.; Nguyen, D.B. Greenhouse gas emissions vs. CO2 emissions: Comparative analysis of a global carbon tax. Appl. Energy 2021, 298, 117223. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gerutu, G.B.; Nyari, E.A.; Lujaji, F.; Khilamile, M.; Greyson, K.A.; Zongo, O.A.; Chombo, P.V. Exploring the Transition from Petroleum to Natural Gas in Tanzania’s Road Transport Sector: A Perspective on Energy, Economy, and Environmental Assessment. Methane 2025, 4, 12. https://doi.org/10.3390/methane4020012

Gerutu GB, Nyari EA, Lujaji F, Khilamile M, Greyson KA, Zongo OA, Chombo PV. Exploring the Transition from Petroleum to Natural Gas in Tanzania’s Road Transport Sector: A Perspective on Energy, Economy, and Environmental Assessment. Methane. 2025; 4(2):12. https://doi.org/10.3390/methane4020012

Chicago/Turabian StyleGerutu, Gerutu Bosinge, Esebi Alois Nyari, Frank Lujaji, Mathew Khilamile, Kenedy Aliila Greyson, Oscar Andrew Zongo, and Pius Victor Chombo. 2025. "Exploring the Transition from Petroleum to Natural Gas in Tanzania’s Road Transport Sector: A Perspective on Energy, Economy, and Environmental Assessment" Methane 4, no. 2: 12. https://doi.org/10.3390/methane4020012

APA StyleGerutu, G. B., Nyari, E. A., Lujaji, F., Khilamile, M., Greyson, K. A., Zongo, O. A., & Chombo, P. V. (2025). Exploring the Transition from Petroleum to Natural Gas in Tanzania’s Road Transport Sector: A Perspective on Energy, Economy, and Environmental Assessment. Methane, 4(2), 12. https://doi.org/10.3390/methane4020012