Consumer Acceptance in Measuring Greece’s Readiness for Transport Automation

Abstract

:1. Introduction

2. Materials and Methods

3. Results

- Consumer opinions of AVs;

- Percentage of the population living near AV test areas;

- KPMG Change Readiness people and civil society technology use sub indicator;

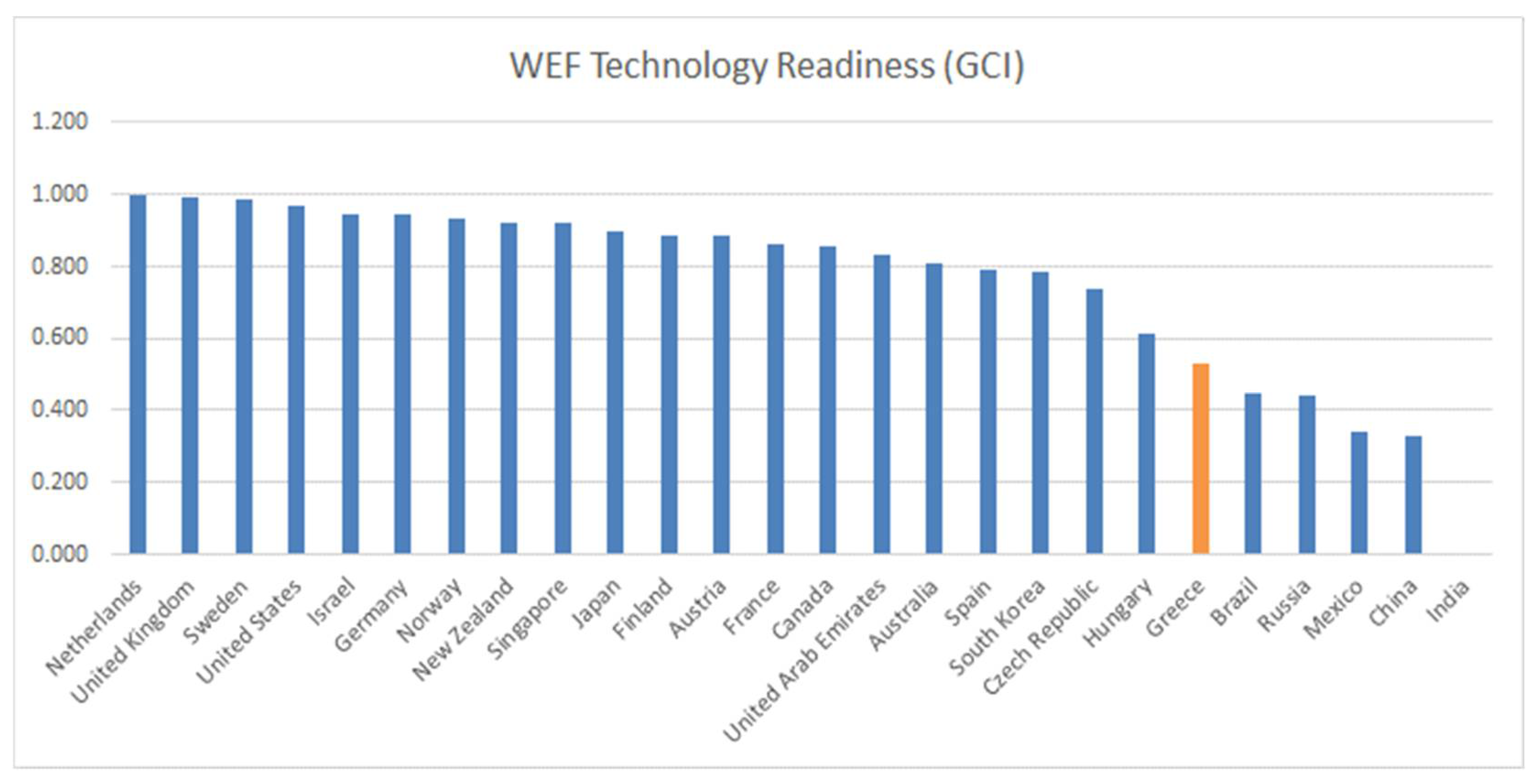

- GCI technology readiness score;

- Ridesharing Market Penetration.

3.1. Consumer Opinions of AVs

3.2. Percentage of the Population Living near AV Test Areas

3.3. KPMG Change Readiness People and Civil Society Technology Use Sub Indicator

3.4. GCI Technology Readiness Score

3.5. Ridesharing Market Penetration

3.6. Pillars I, II and III

- AV Regulations: The variable for AV regulations is determined by the activities of each country in the field of AV operation and testing. In Greece, legislation exists since December 2014, allowing pilot trials to be carried out for research purposes up to a level of autonomy 5 (according to SAE [35]). As there is no specific experimental framework that would include relevant restrictions (the relevant legislation is under review), the restrictions are considered small-scale. In order to determine the score, a comparative review of the legislative frameworks of other countries included in the 25 KPMG reference countries was performed, in terms of consistency. The value assigned to Greece is 6.5/7.

- AV Department within Government Transportation Department: This variable reflects whether a country has a specific government body responsible for coordinating AV activities and initiatives. Assessment was made on a scale of 0–7 on the basis of a media research. In Greece, the relevant responsibility falls within an existing agency of the Ministry of Transport, so it is one body but that body is not dedicated to AVs nor was it been established for this purpose. In this context, the score awarded is 5/7.

- Change Readiness Government Capability: The Change Readiness Index (CRI) as defined by KPMG [32] identifies the ability of a country—its government, private and public enterprises, citizens and society—to prepare, manage and respond to a wide range of changes, such as those arising by AVs. With regard to policy and legislation, the most relevant aspect is that of the preparedness of the government. The index value for state readiness for Greece is 0.48/1.0

- Effectiveness of Law-Making Bodies: This variable is determined on the basis of the Networked Readiness Index (NRI) of the World Economic Forum of 2018 [36], which is compiled after consultation with business executives in each country, about the efficiency of the legislative process in their country. This variable was included to measure a country’s ability to pass arrangements on the development of AVs. From the index values, Greece receives a score of 3.48/7.0.

- Efficiency of the Legal System in Challenging Regulations: In measuring the above NRI index, business executives were also asked about the extent to which both citizens and businesses can ensure justice through the judicial system against state decisions. This variable was included in order to measure the ability of AV manufacturers and others to challenge any state regulations against them. From the index values Greece receives a score of 3.12/7.0.

- Number of government-funded AV pilots: Like the degree of funding for AV infrastructure, the number of government-sponsored pilot trials provides an indication of a country’s commitment to AVs. In Greece the only pilot tests with AV that have been carried out (by the time of the calculations) were within the framework of the EC funded CityMobil2 project in the city of Trikala [37]. This pilot was only indirectly funded by the government, thus, taking also into account the scores of countries with similar status, the score assigned to this variable for Greece was 3.5/7.

- Assessment of the Data-Sharing Environment: Sharing data and open data ensure greater cooperation between state and private enterprises to encourage the development of AVs. For the values of the countries in the relevant variable, the Open Data Barometer [38] was used, in which, Greece has a score of 38.94/100

- Industry Partnerships: To foster the deployment of AV technology, partnerships are necessary between equipment manufacturers and technology providers. The calculation of this variable was based on review of local and international media, consulting firms and blogs by AV industry leaders, from which information on relevant business partnerships was collected. Each country was rated on the 0–7 scale (highest score in the countries with more partnerships). No relevant partnership was found in Greece, so the resulting grade is 0.

- Number of Investments in AV Related Firms: Along with the development and upcoming broad deployment of AVs, investment in this sector by equipment manufacturers and technology companies has increased significantly in recent years. For each investment, the country in which the company or body has its head office was determined and the result was normalized with regard to the population of the country. As identified in the 2nd Pillar II variable, there are no relevant companies based in Greece, in which case this variable will be set to 0.

- Availability of the Latest Technology: From the Networking Readiness Index (NRI) [36] to the question of the extent to which the latest technology is available in each country, the business executives surveyed scored on a scale of 1 (not at all)–7 (largely). This variable is included to measure whether businesses and consumers in each country have access to the latest technological breakthroughs. For Greece, the corresponding NRI value is 5.18/7.

- Capacity for innovation: Looking again at the Networking Readiness Index (NRI), one of the questions asked to business executives concerns the extent to which companies located in each country have the potential to innovate. The values are given on the scale 1 (not at all)–7 (largely). The continued development of AVs will require continuous innovation, so this variable is included to determine whether companies in each country have the potential for innovation. For Greece, the corresponding NRI value is 2.54/7.

- Market Share of Electric Cars: For most countries the data was available from the International Energy Agency’s Global EV Outlook 2018 [44]. For Greece, the corresponding data were obtained from the European Alternative Fuel Observatory [45], according to which the market share held by Electric Vehicles for 2018 in Greece was 0.2%.

- Number of Electric Vehicle Charging Stations: Most AVs will probably also be electric, so large-scale adoption of AVs will also require availability of electric vehicle charging stations. Data from the International Energy Agency (IEA) were used for the scores of this variable. To eliminate differences in numbers due to the different size of each country, the number of charging stations was normalized based on the size of each country’s road network [46]. For Greece we used data from the European Alternative Fuel Observatory [45] according to which in 2019 there were 52 charging stations in our country, while the total length of the road network amounts to 117,000 km. Thus, the value for Greece is 0.000444.

- GSMA Global Connectivity Index Infrastructure Score: It is estimated that AVs will generate approximately 4000 gigabytes of data each day; some of this data will remain in the vehicle but a significant amount will be shared to be used for vehicle diagnostics, constantly updated maps, in-vehicle entertainment and other uses. Data for this factor were retrieved from the GSMA Mobile Connectivity Index [47], which measures availability in high-performance mobile data coverage. For Greece the value of the index is 70/100.

- 4G Coverage: The size of the data generated by autonomous vehicles and needing to be shared outside the vehicle will require extensive coverage of a high-speed wireless network. While all of the countries included in the AVRI are in the process of developing 5G networks, for most, the extensive use of these networks is several years away. OpenSignal [48] data were used for the values of this coefficient. For Greece the corresponding value is 76.04%.

- CGI Road Quality Score: The use of AVs requires high quality road network for their adoption. As part of the World Economic Forum’s Global Competitiveness Index (CGI), business executives in each country were asked about the quality of road infrastructure in terms of their size and condition and were asked to rate them on a scale of 1 (extremely poor quality)–7 (excellent quality) [33]. Based on these data, Greece receives a score of 4.7/7.

- LPI Infrastructure Score: When determining the World Bank’s Logistic Performance Index (LPI), survey participants were asked to rate the quality of infrastructure in general and road infrastructure in particular on a scale of 1 (very low)–5 (very high). The indicator targets the quality of road infrastructure in terms of supply chain and freight transport, as opposed to the GCI index which targets the overall quality of road infrastructure. For Greece, the value of LPI [49] for infrastructure is 3.17/5.

- Change Readiness Technology Infrastructure Score: The KPMG Technology Infrastructure Readiness Index measures the quality of each country’s technological infrastructure. Based on the values of the Index [32], Greece receives a score of 0.6.

4. Discussion

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- KPMG International. 2018 Autonomous Vehicles Readiness Index; KPMG: Zug, Switzerland, 2018. [Google Scholar]

- KPMG International. 2019 Autonomous Vehicles Readiness Index; KPMG: Zug, Switzerland, 2019. [Google Scholar]

- KPMG International. 2020 Autonomous Vehicles Readiness Index; KPMG: Zug, Switzerland, 2020. [Google Scholar]

- OECD. Handbook on Constructing Composite Indicators; OECD: Paris, France, 2008. [Google Scholar]

- Edmonds, E. AAA Newsroom. 2017. Available online: http://go.nature.com/2i296OW (accessed on 20 April 2022).

- Cartenì, A. The acceptability value of autonomous vehicles: A quantitative analysis of the willingness to pay for shared autonomous vehicles (SAVs) mobility services. Transp. Res. Interdiscip. Perspect. 2020, 8, 100224. [Google Scholar] [CrossRef]

- Bansal, P.; Kockelman, K.M. Are we ready to embrace connected and self-driving vehicles? A case study of Texans. Transportation 2016, 45, 641–675. [Google Scholar] [CrossRef]

- Bansal, P.; Kockelman, K.M.; Singh, A. Assessing public opinions of and interest in new vehicle technologies: An Austin perspective. Transp. Res. Part C: Emerg. Technol. 2016, 67, 1–14. [Google Scholar] [CrossRef]

- Bakalos, N.; Papadakis, N.; Litke, A. Public Perception of Autonomous Mobility Using ML-Based Sentiment Analysis over Social Media Data. Logistics 2020, 4, 12. [Google Scholar] [CrossRef]

- Nastjuk, I.; Herrenkind, B.; Marrone, M.; Brendel, A.B.; Kolbe, L.M. What drives the acceptance of autonomous driving? An investigation of acceptance factors from an end-user’s perspective. Technol. Forecast. Soc. Chang. 2020, 161, 120319. [Google Scholar] [CrossRef]

- Mathis, L.-A.; Diedrichs, F.; Widlroither, H.; Ruscio, D.; Napoletano, L.; Zofka, M.R.; Viehl, A.; Frohlich, P.; Friedrich, J.; Lindstrom, A.; et al. Creating informed public acceptance by a user-centered human-machine interface for all automated transport modes. In Proceedings of the Rethinking Transport 8th Transport Research Arena TRA 2020, Helsingfors, Finland, 27–30 April 2020. (Conference canceled). [Google Scholar]

- Lillis, Y.; Zidianakis, E.; Partarakis, N.; Ntoa, S.; Stephanidis, C. A Framework for Personalised HMI Interaction in ADAS Systems. In Proceedings of the 5th International Conference on Vehicle Technology and Intelligent Transport Systems (VEHITS 2019), Heraklion, Greece, 3–5 May 2019. [Google Scholar]

- Xu, W. From automation to autonomy and autonomous vehicles: Challenges and opportunities for human-computer interaction. Interactions 2021, 28, 48–53. [Google Scholar] [CrossRef]

- Faas, S.M.; Mathis, L.-A.; Baumann, M. External HMI for self-driving vehicles: Which information shall be displayed? Transp. Res. Part F Traffic Psychol. Behav. 2020, 68, 171–186. [Google Scholar] [CrossRef]

- Forke, J.; Fröhlich, P.; Suette, S.; Gafert, M.; Puthenkalam, J.; Diamond, L.; Zeilinger, M.; Tscheligi, M. Understanding the Headless Rider: Display-Based Awareness and Intent-Communication in Automated Vehicle-Pedestrian Interaction in Mixed Traffic. Multimodal Technol. Interact. 2021, 5, 51. [Google Scholar] [CrossRef]

- Mirnig, A.G.; Gartner, M.; Wallner, V.; Gafert, M.; Braun, H.; Frohlich, P.; Suette, S.; Sypniewski, J.; Meschtsherjakov, A.; Tscheligi, M. “Stop or Go? Let me Know! A Field Study on Visual External Communication for Automated Shuttles”. In Proceedings of the AutomotiveUI 21: 13th International Conference on Automotive User Interfaces and Interactive Vehicular Applications, Leeds, UK, 9–14 September 2021. [Google Scholar]

- Lakhan, A.; Dootio, M.A.; Groenli, T.M.; Sodhro, A.H.; Khokhar, M.S. Multi-Layer Latency Aware Workload Assignment of E-Transport IoT Applications in Mobile Sensors Cloudlet Cloud Networks. Electronics 2021, 10, 1719. [Google Scholar] [CrossRef]

- Pomoni, M.; Laiou, A.; Yannis, G.; Loukea, M.; Bekiaris, E. Future trends in transport workforce based on demographic, behavioural, cultural and socioeconomic factors. Transp. Res. Procedia 2020, 48, 2811–2820. [Google Scholar] [CrossRef]

- Orfanou, F.; Vlahogianni, E.; Yannis, G. A Taxonomy of Skills and Knowledge for Efficient Autonomous Vehicle Operation. In Advances in Mobility-as-a-Service Systems. CSUM 2020—Advances in Intelligent Systems and Computing; Nathanail, E., Adamos, G., Karakikes, I., Eds.; Springer Nature: Cham, Switzerland, 2020; Volume 1278, pp. 305–315. [Google Scholar]

- Bastiaan, J.M.; Peters, D.L.; Pimentel, J.R.; Zadeh, M. The AutoDrive Challenge: Autonomous Vehicles Education and Training Issues. In Proceedings of the 2019 ASEE Annual Conference & Exposition, Tampa, FL, USA, 16–19 June 2019. [Google Scholar]

- Austroads. Education and Training for Drivers of Assisted and Automated Vehicles; Austroads: Sydney, Australia, 2020. [Google Scholar]

- Noble, A.M.; Klauer, S.G.; Doerzaph, Z.R.; Manser, M.P. Driver Training for Automated Vehicle Technology—Knowledge, Behaviors, and Perceived Familiarity. In Proceedings of the Human Factors and Ergonomics Society Annual Meeting, Seattle, DC, USA, 28 October–1 November 2019. [Google Scholar]

- Mohammadian, S.; Zheng, Z.; Haque, M.M.; Bhaskar, A. Continuum Modelling of Freeway Traffic Flows in the Era of Connected and Automated Vehicles: A Critical Perspective and Research Needs. arXiv 2021, arXiv:2111.04955. [Google Scholar]

- Orfanou, F.P.; Vlahogianni, E.I.; Yannis, G.; Mitsakis, E. Humanizing autonomous vehicle driving: Understanding, modeling and impact assessment. Transp. Res. Part F: Traffic Psychol. Behav. 2022, 87, 477–504. [Google Scholar] [CrossRef]

- Straub, E.R.; Schaefer, K.E. It takes two to Tango: Automated vehicles and human beings do the dance of driving—Four social considerations for policy. Transp. Res. Part A Policy Pr. 2019, 122, 173–183. [Google Scholar] [CrossRef]

- Milakis, D.; Thomopoulos, N.; van Wee, B. Advances in Transport Policy and Planning—Policy Implications of Autonomous Vehicles; Academic Press, Elsevier: Cambridge, MA, USA, 2020; Volume 5. [Google Scholar]

- Mylonas, C.; Mitsakis, E.; Dolianitis, A.; Chalkiadakis, C. Is Greece Ready for Autonomous Vehicles? A Methodological Approach. In Proceedings of the IEEE 23rd International Conference on Intelligent Transportation Systems (ITSC), Online, 20–23 September 2020. [Google Scholar]

- Souris, C.; Theofilatos, A.; Yannis, G. Attitudes of Greek Drivers Towards Autonomous Vehicles—A preliminary analysis using stated preference approach. Adv. Transp. Stud. 2019, 48, 105–116. [Google Scholar]

- Markvica, K.; Rosenkranz, P.; Loukea, M.; Gaitanidou, E.; Bekiaris, E.; Giro, C.; Orfanou, F.; Vlahogianni, E.; Yannis, G.; Fassina, F.; et al. D1.1: User clusters, opinion, research hypotheses and use cases towards future autonomous vehicle acceptance. Drive2 Future 2020. [Google Scholar]

- Demiridi, E.; Kopelias, P.; Nathanail, E.; Skabardonis, A. Connected and Autonomous Vehicles—Legal Issues in Greece, Europe and USA. In Data Analytics: Paving the Way to Sustainable Urban Mobility. CSUM 2018; Advances in Intelligent Systems and Computing: Skiathos, Greece, 2019. [Google Scholar]

- Codecademy, Normalisation. 2020. Available online: https://www.codecademy.com/articles/normalization (accessed on 12 May 2020).

- KPMG International. Change Readiness Index. Assessing Countries’ Ability to Manage Change and Cultivate Opportunity; KPMG: Zug, Switzerland, 2019. [Google Scholar]

- WEF. World Economic Forum—Global Competitiveness Index—Greece. 2020. Available online: https://tradingeconomics.com/greece/competitiveness-index (accessed on 23 April 2022).

- Statista. “Ride Hailing Taxi”. 2020. Available online: https://www.statista.com/outlook/368/138/ride-hailing-taxi/greece (accessed on 23 April 2022).

- SAE. Taxonomy and Definitions for Terms Related to Driving Automation Systems for On-Road Motor Vehicles; SAE: Warrendale, PA, USA, 2018. [Google Scholar]

- World Economic Forum. Network Readiness Index; WEF: Cologny, Switzerland, 2018. [Google Scholar]

- e-Trikala. CityMobil2. 2020. Available online: http://www.e-trikala.gr/portfolio/citymobil2/ (accessed on 25 April 2022).

- World Wide Web Foundation. Open Data Barometer 4th Edition—Global Report; World Wide Web Foundation: Geneva, Switzerland, 2017. [Google Scholar]

- Crunch Base, P. Crunchbase. 2020. Available online: www.crunchbase.com (accessed on 20 April 2020).

- Vision System, “www.prweb.com”. 2016. Available online: http://www.prweb.com/releases/vsi/segmentsautonomousvehicle/prweb13472308.htm (accessed on 20 April 2022).

- Cometlabs, “263 Self-Driving Car Startups to Watch”. 2017. Available online: https://blog.cometlabs.io/263-self-driving-car-startups-to-watch-8a9976dc62b0 (accessed on 20 April 2020).

- PatSeer. “PatSeer”. 2020. Available online: www.patseer.com (accessed on 20 April 2020).

- Patent iNSIGHT Pro. Autonomous Car-Control Mechanism; Gridlogics: Pune, India, 2016. [Google Scholar]

- IEA International Energy Agency. Global EV Outlook 2018. Towards Cross-Modal Electrification. Available online: https://iea.blob.core.windows.net/assets/387e4191-acab-4665-9742-073499e3fa9d/Global_EV_Outlook_2018.pdf (accessed on 20 April 2020).

- EAFO. European Alternative Fuels Observatory, “Greece”. 2020. Available online: https://www.eafo.eu/countries/greece/1735/summary (accessed on 25 April 2020).

- CIA. The World Factbook/Greece. 2020. Available online: https://www.cia.gov/the-world-factbook/countries/greece (accessed on 25 April 2020).

- GSMA. GSMA Mobile Connectivity Index. 2020. Available online: https://www.mobileconnectivityindex.com/ (accessed on 25 April 2020).

- OpenSignal. The State of LTE; OpenSignal: London, UK, 2018. [Google Scholar]

- The World Bank. Logistics Performance Index. 2018. Available online: https://lpi.worldbank.org/ (accessed on 25 April 2020).

- Cascetta, E.; Cartenì, A.; Di Francesco, L. Do autonomous vehicles drive like humans? A Turing approach and an application to SAE automation Level 2 cars. Transp. Res. Part C Emerg. Technol. 2021, 134, 103499. [Google Scholar] [CrossRef]

- European Commission. New 5G Cross-Border Corridor for Connected and Automated Mobility Announced at the Digital Assembly 2018. Available online: https://digital-strategy.ec.europa.eu/en/news/new-5g-cross-border-corridor-connected-and-automated-mobility-announced-digital-assembly-2018 (accessed on 20 April 2020).

- Connected and Automated Driving. Connected and Automated Driving—Test Sites. Available online: https://www.connectedautomateddriving.eu/test-sites/ (accessed on 27 April 2022).

- Sondro, A.H.; Obaidat, M.S.; Abbasi, Q.H.; Pace, P.; Pribhulal, S.; Yasar, A.-U.-H.; Fortino, G.; Imran, M.A.; Qaraqe, M. “Quality of Service Optimization in an IoT-Driven Intelligent Transportation System. IEEE Wirel. Commun. 2019, 26, 10–17. [Google Scholar]

- Autovista Group. Greece Announces National Electricity Transfer Plan to Promote Electromobility, 9 June 2020. Available online: https://autovistagroup.com/news-and-insights/greece-announces-national-electricity-transfer-plan-promote-electromobility (accessed on 20 April 2022).

- Brewer, M. “The Electric Future of Autonomous Vehicles”, Carnegy Mellon, July 2020. Available online: https://www.cmu.edu/news/stories/archives/2020/july/electric-autonomous-vehicles.html (accessed on 17 April 2022).

- Motors, G. “Path to Autonomous—Why All AVs Should Be EVs”, General Motors. Available online: https://www.gm.com/stories/all-avs-should-be-evs (accessed on 17 April 2022).

- McCauley, R. Why Autonomous and Electric Vehicles Are Inextricably Linked, Government Technology. Available online: https://www.govtech.com/fs/why-autonomous-and-electric-vehicles-are-inextricably-linked.html (accessed on 17 April 2022).

- EuroRAP. The Centre for Research and Technology-Hellas (CERTH), Hellastron and the Greek Ministry of Infrastructure and Transport Prepare a EuroRAP National Licence Scheme to Move Close to Zero Fatalities—Press Release, 27 January 2020. Available online: https://eurorap.org/the-centre-for-research-and-technology-hellas-certh-hellastron-and-the-greek-ministry-of-infrastructure-and-transport-prepare-a-eurorap-national-licence-scheme-to-move-close-to-zero-fatalities/ (accessed on 20 April 2020).

- EuroRAP. EuroRAP Announces the Official Launch of 20 National Programmes to Support the Implementation of the National Road Safety Action Plan, 21 January 2021. Available online: https://eurorap.org/press-release-eurorap-announces-the-official-launch-of-19-national-programmes-to-strengthen-road-infrastructure-safety/ (accessed on 23 March 2022).

- European Commission. 2030 Climate & Energy Framework. 2020. Available online: https://ec.europa.eu/clima/policies/strategies/2030_en (accessed on 25 April 2020).

| Pillar | Number of Variables | Maximum Value | Adjustment Factor |

|---|---|---|---|

| Pillar 1 | 7 | 9 | 1.29 |

| Pillar 2 | 7 | 9 | 1.29 |

| Pillar 3 | 6 | 9 | 1.5 |

| Pillar 4 | 5 | 9 | 1.8 |

| Variable | Score |

|---|---|

| Consumer opinion of AVs | 0.701 |

| Percentage of the population living near AV test areas | 0 |

| KPMG Change Readiness people and civil society technology use sub indicator | 0.173 |

| GCI technology readiness score | 0.531 |

| Ridesharing Market Penetration | 0.268 |

| Pillar | Ι | ΙΙ | ΙΙΙ | ΙV | Total |

|---|---|---|---|---|---|

| Value | 3.61 | 0.553 | 3.340 | 3.022 | 10.52 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gaitanidou, E.; Bekiaris, E. Consumer Acceptance in Measuring Greece’s Readiness for Transport Automation. Future Transp. 2022, 2, 644-658. https://doi.org/10.3390/futuretransp2030035

Gaitanidou E, Bekiaris E. Consumer Acceptance in Measuring Greece’s Readiness for Transport Automation. Future Transportation. 2022; 2(3):644-658. https://doi.org/10.3390/futuretransp2030035

Chicago/Turabian StyleGaitanidou, Evangelia, and Evangelos Bekiaris. 2022. "Consumer Acceptance in Measuring Greece’s Readiness for Transport Automation" Future Transportation 2, no. 3: 644-658. https://doi.org/10.3390/futuretransp2030035

APA StyleGaitanidou, E., & Bekiaris, E. (2022). Consumer Acceptance in Measuring Greece’s Readiness for Transport Automation. Future Transportation, 2(3), 644-658. https://doi.org/10.3390/futuretransp2030035