Empowering Consumers within Energy Communities to Acquire PV Assets through Self-Consumption

Abstract

1. Introduction

RQ1: How can a technical solution for the simple, fast and verifiable acquisition of shared PV systems within an energy community be designed?

RQ2: What are the financial benefits for the involved stakeholders (consumers, energy providers, etc.)?

2. Literature Review

2.1. Energy Communities

2.2. Novel Energy Business Models and Co-Ownership of PV Assets

2.3. Blockchain in Energy Communities and Use of Tokens

2.4. Research Contribution

3. Materials and Methods

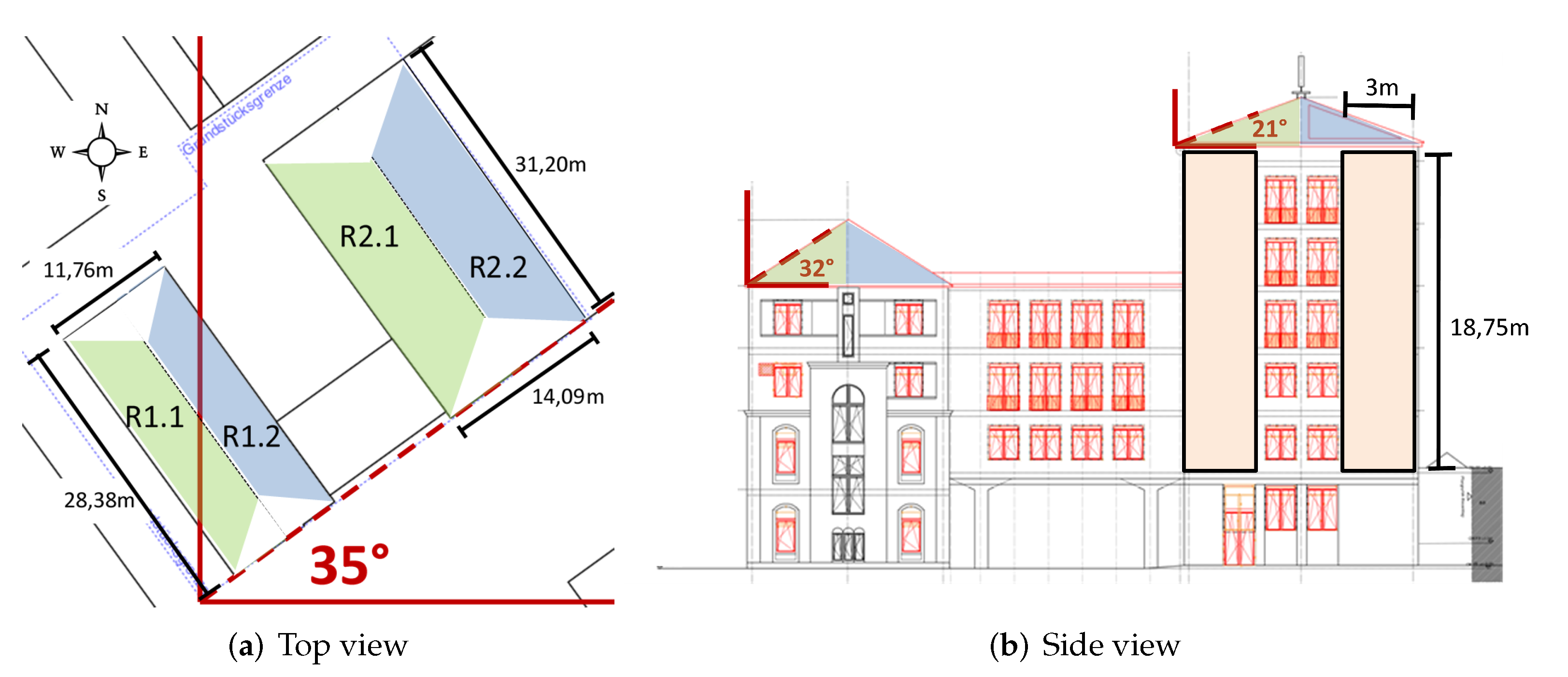

3.1. Selected Renewable Energy Community

3.2. Case Study Characteristics

3.3. Definition of Key Performance Indicators

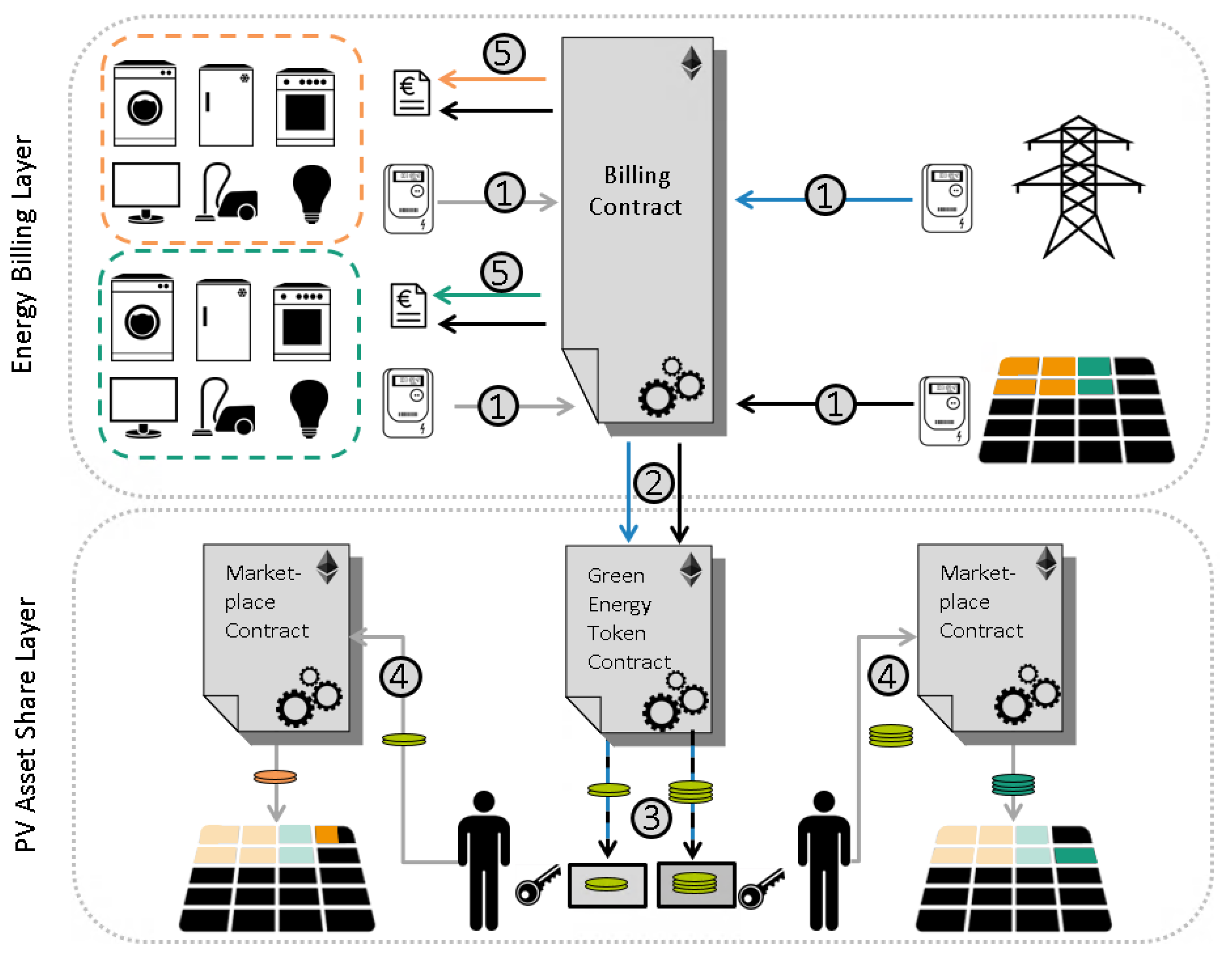

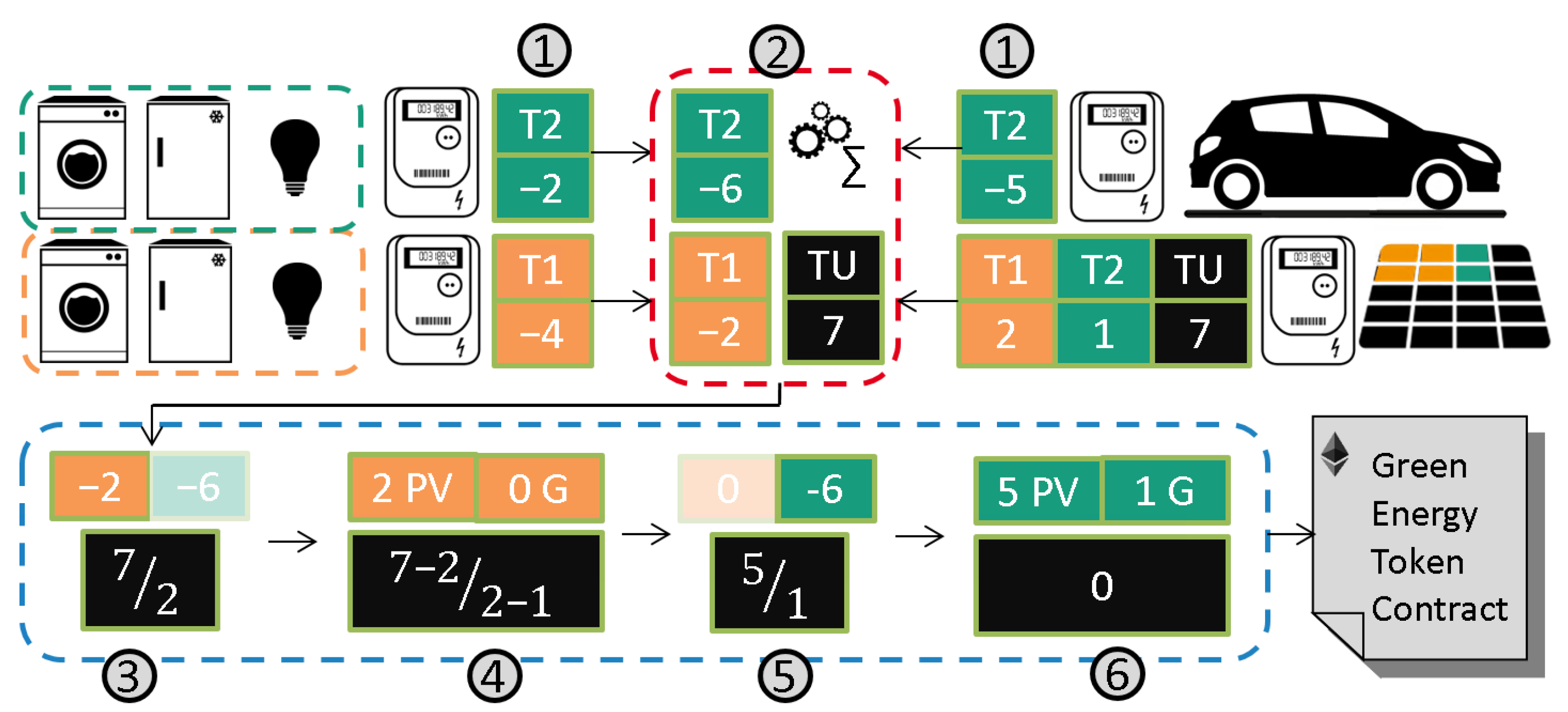

4. Prosumer Asset Ownership System (PAOS)

4.1. Stakeholder

4.2. Layer Structure and Token Transmission

4.3. Layer Components and Token Design

4.3.1. Billing Contract

4.3.2. Green Energy Token

4.3.3. Marketplace Contract

4.3.4. Token Design of GET and Marketplace Contract

4.4. Shifts in Community Structure

4.5. Additional Use Cases for GET

5. Results and Discussion

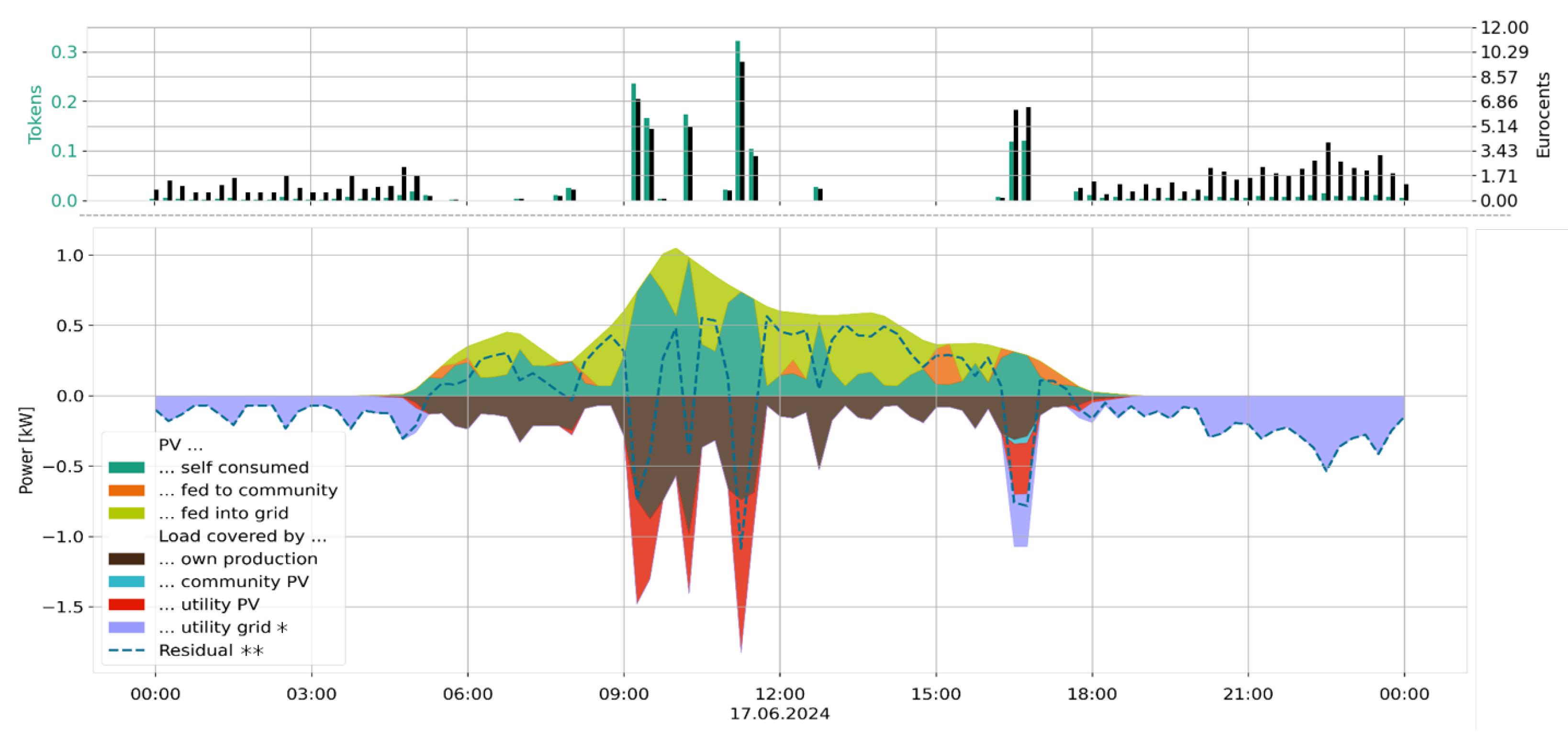

5.1. Selected Member Perspective

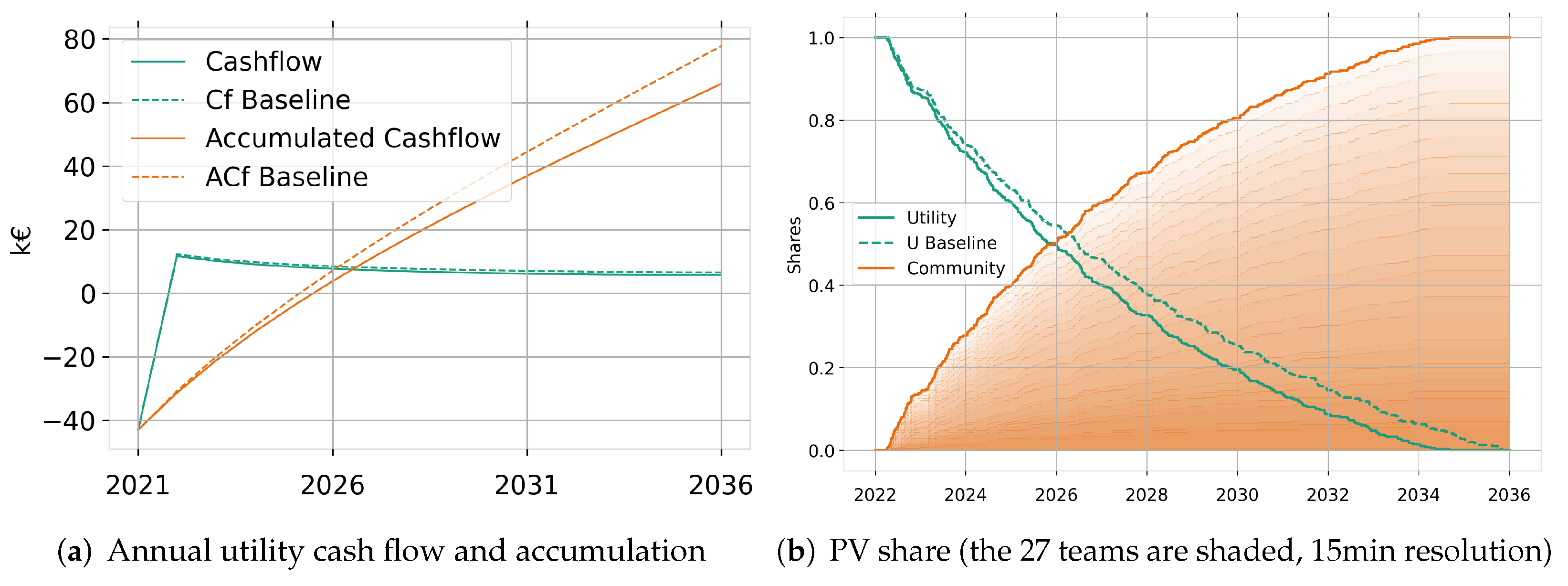

5.2. Utility Perspective

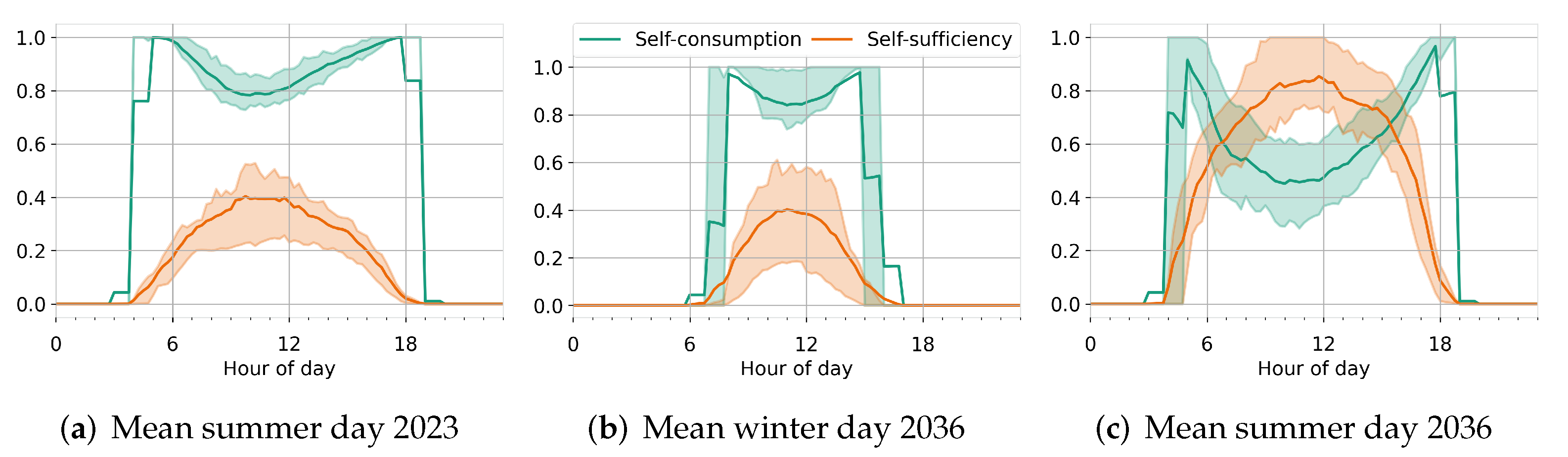

5.3. Community Perspective

6. Conclusions

7. Outlook

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A. Detailed Simulation Setup

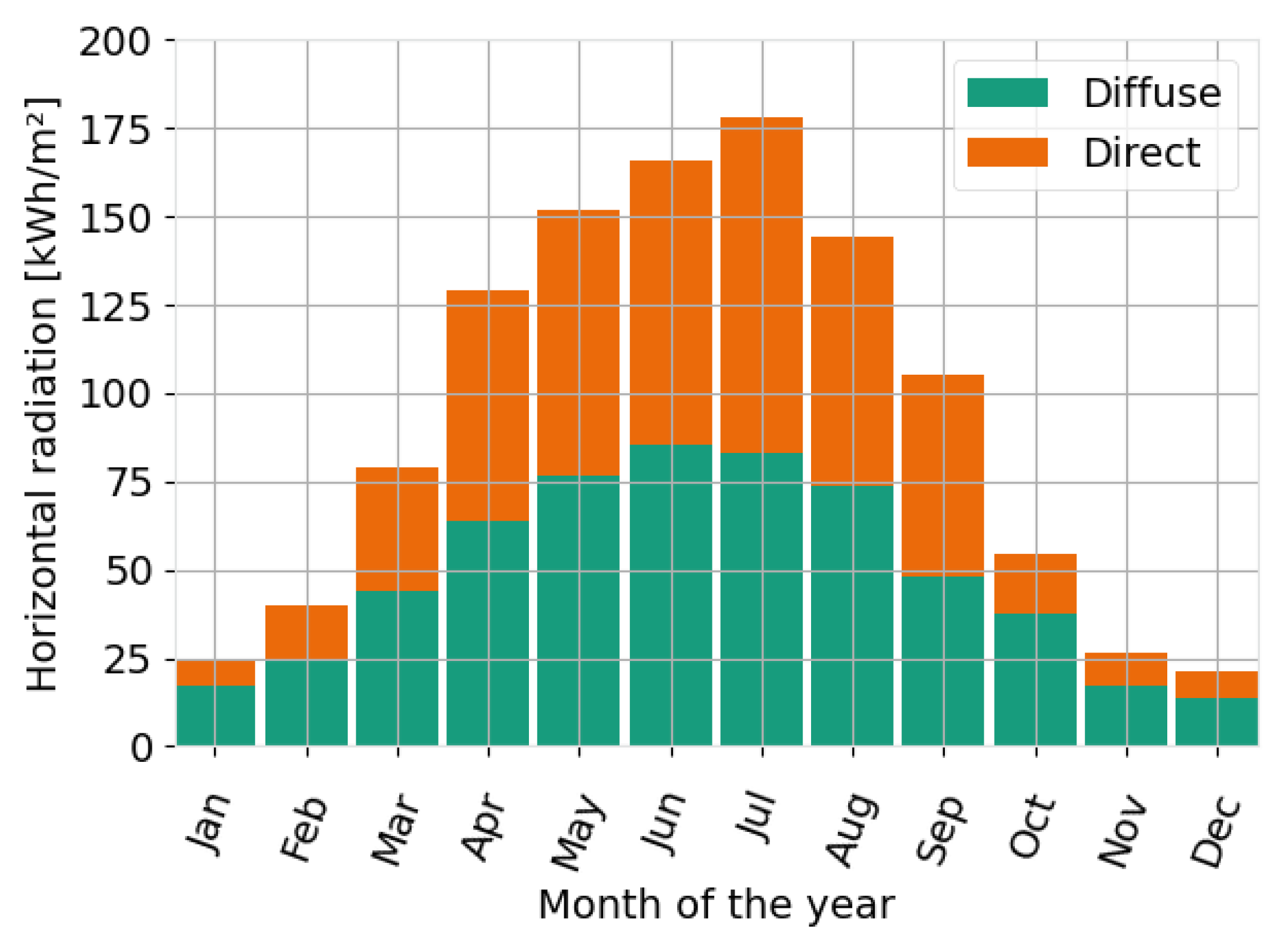

Appendix A.1. Location

Appendix A.2. Electric Vehicle Time Series Generation and Control Schemes

Appendix A.3. PV Time Series Generation

| Roof/Facade | R1.1 | R1.2 | R2.1 | R2.2 | Facade | Total |

|---|---|---|---|---|---|---|

| Max. available area [] | 182 | 182 | 275 | 275 | 112 | 1026 |

| Number of modules | 20 | 10 | 36 | 15 | 24 | 105 |

| Capacity installed [kWp] | 7.6 | 3.8 | 13.7 | 5.7 | 9.1 | 39.9 |

| Attribute | Length | Width | Power | Efficiency | Type |

|---|---|---|---|---|---|

| Value | 1763 mm | 1040 mm | 380 W | 21% * | Monocrystalline SI |

Appendix A.4. Business, Commerce and Service Units

| Team | 17 | 18 | 19 | 20 | 21 | 22 |

|---|---|---|---|---|---|---|

| Type | Office | Office | Office | Office | Office | Office |

| Annual demand [kWh] | 2620 | 3554 | 4086 | 3051 | 2183 | 3297 |

| Team | 23 | 24 | 25 | 26 | 27 | 17-27 |

| Type | Office | Office | Coffee shop | Office | Office | Sum |

| Annual demand [kWh] | 4797 | 3242 | 5234 | 4994 | 2273 | 39331 |

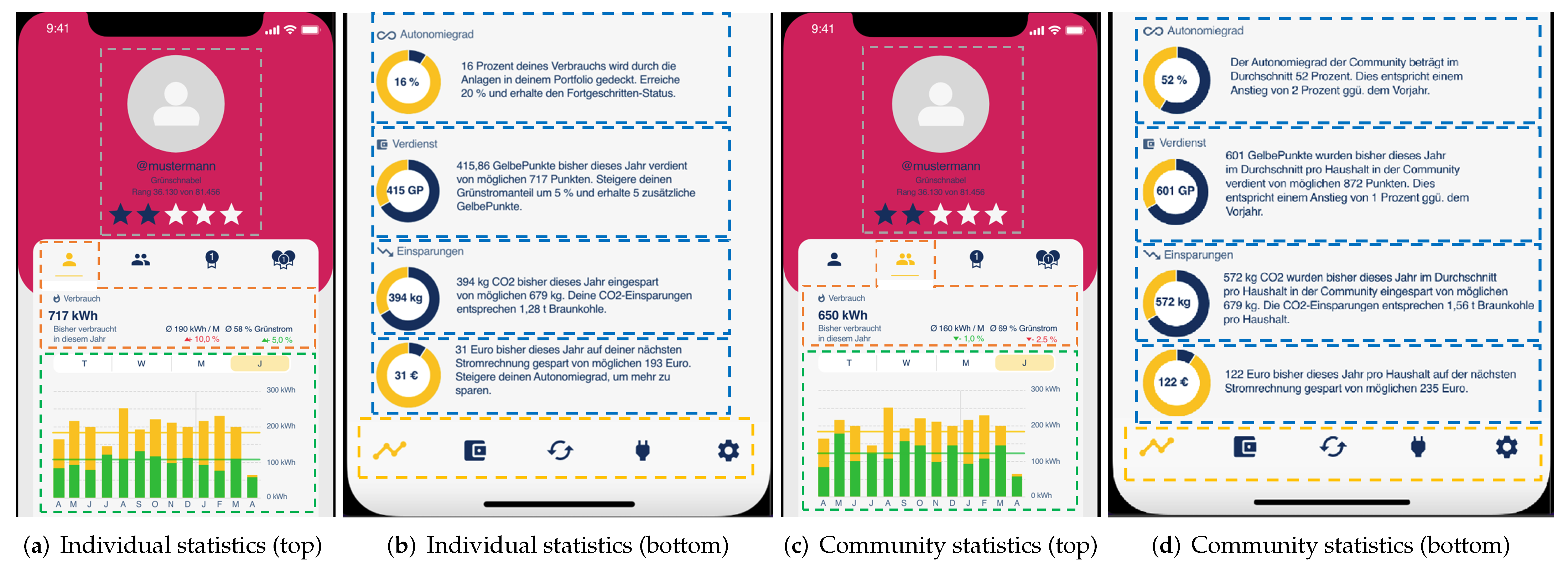

Appendix B. Details on the User Interface

- Self-sufficiency (for the individual view: together with the next target to reach a higher rank)

- Earned tokens as a share of the maximum possible tokens (when consumption and production match perfectly)

- saved compared to the maximum savings possible when consuming 100% of the local solar production. (Note that this is a theoretical value calculated for the area of the community. In fact it does not matter where the PV energy is consumed as long as PV energy replaces a fossil energy source, so feeding into the grid is still saving )

- Cost savings on the electricity bill

References

- Henni, S.; Staudt, P.; Weinhardt, C. A sharing economy for residential communities with PV-coupled battery storage: Benefits, pricing and participant matching. Appl. Energy 2021, 301, 117351. [Google Scholar] [CrossRef]

- Norbu, S.; Couraud, B.; Robu, V.; Andoni, M.; Flynn, D. Modeling economic sharing of joint assets in community energy projects under LV network constraints. IEEE Access 2021, 9, 112019–112042. [Google Scholar] [CrossRef]

- BMWi. Mieterstrom: Energiewende im eigenen Haus. 2017. Available online: https://www.bmwi.de/Redaktion/DE/Artikel/Energie/mieterstrom.html (accessed on 16 February 2022).

- Lowitzsch, J.; Hoicka, C.E.; van Tulder, F.J. Renewable energy communities under the 2019 European Clean Energy Package—Governance model for the energy clusters of the future? Renew. Sustain. Energy Rev. 2020, 122, 109489. [Google Scholar] [CrossRef]

- Davidson, C.; Steinberg, D.; Margolis, R. Exploring the market for third-party-owned residential photovoltaic systems: Insights from lease and power-purchase agreement contract structures and costs in California. Environ. Res. Lett. 2015, 10, 024006. [Google Scholar] [CrossRef]

- Bruck, M.; Sandborn, P.; Goudarzi, N. A Levelized Cost of Energy (LCOE) model for wind farms that include Power Purchase Agreements (PPAs). Renew. Energy 2018, 122, 131–139. [Google Scholar] [CrossRef]

- Gjorgievski, V.Z.; Cundeva, S.; Georghiou, G.E. Social arrangements, technical designs and impacts of energy communities: A review. Renew. Energy 2021, 169, 1138–1156. [Google Scholar] [CrossRef]

- Radl, J.; Fleischhacker, A.; Revheim, F.H.; Lettner, G.; Auer, H. Comparison of profitability of PV electricity sharing in renewable energy communities in selected European countries. Energies 2020, 13, 5007. [Google Scholar] [CrossRef]

- Roberts, M.B.; Bruce, A.; MacGill, I. A comparison of arrangements for increasing self-consumption and maximising the value of distributed photovoltaics on apartment buildings. Sol. Energy 2019, 193, 372–386. [Google Scholar] [CrossRef]

- Tervo, E.; Agbim, K.; DeAngelis, F.; Hernandez, J.; Kim, H.K.; Odukomaiya, A. An economic analysis of residential photovoltaic systems with lithium ion battery storage in the United States. Renew. Sustain. Energy Rev. 2018, 94, 1057–1066. [Google Scholar] [CrossRef]

- Wang, Z.; Gu, C.; Li, F. Flexible operation of shared energy storage at households to facilitate PV penetration. Renew. Energy 2018, 116, 438–446. [Google Scholar] [CrossRef]

- Yazdanie, M.; Orehounig, K. Advancing urban energy system planning and modeling approaches: Gaps and solutions in perspective. Renew. Sustain. Energy Rev. 2021, 137, 110607. [Google Scholar] [CrossRef]

- Li, S.; Pan, Y.; Xu, P.; Zhang, N. A decentralized peer-to-peer control scheme for heating and cooling trading in distributed energy systems. J. Clean. Prod. 2021, 285, 124817. [Google Scholar] [CrossRef]

- Fernandez, E.; Hossain, M.; Mahmud, K.; Nizami, M.S.H.; Kashif, M. A Bi-level optimization-based community energy management system for optimal energy sharing and trading among peers. J. Clean. Prod. 2021, 279, 123254. [Google Scholar] [CrossRef]

- Das, L.; Munikoti, S.; Natarajan, B.; Srinivasan, B. Measuring smart grid resilience: Methods, challenges and opportunities. Renew. Sustain. Energy Rev. 2020, 130, 109918. [Google Scholar] [CrossRef]

- Warneryd, M.; Håkansson, M.; Karltorp, K. Unpacking the complexity of community microgrids: A review of institutions’ roles for development of microgrids. Renew. Sustain. Energy Rev. 2020, 121, 109690. [Google Scholar] [CrossRef]

- Heaslip, E.; Costello, G.J.; Lohan, J. Assessing Good-Practice Frameworks for the Development of Sustainable Energy Communities in Europe: Lessons from Denmark and Ireland. J. Sustain. Dev. Energy Water Environ. Syst. 2016, 4, 307–319. [Google Scholar] [CrossRef]

- Reijnders, V.M.; Laan, M.D.V.D.; Dijkstra, R. Energy communities: A Dutch case study. Behind Beyond Meter. 2020, 137–155. [Google Scholar] [CrossRef]

- Kobashi, T.; Yoshida, T.; Yamagata, Y.; Naito, K.; Pfenninger, S.; Say, K.; Takeda, Y.; Ahl, A.; Yarime, M.; Hara, K. On the potential of “Photovoltaics+ Electric vehicles” for deep decarbonization of Kyoto’s power systems: Techno-economic-social considerations. Appl. Energy 2020, 275, 115419. [Google Scholar] [CrossRef]

- Directive (EU) 2019/944 of the European Parliament and of the Council of 5 June 2019 on Common Rules for the Internal Market for Electricity. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A32019L0944 (accessed on 16 February 2022).

- Karystinos, C.; Vasilakis, A.; Kotsampopoulos, P.; Hatziargyriou, N. Local Energy Exchange Market for Community Off-Grid Microgrids: Case Study Los Molinos del Rio Aguas. Energies 2022, 15, 703. [Google Scholar] [CrossRef]

- Wolsink, M. Distributed energy systems as common goods: Socio-political acceptance of renewables in intelligent microgrids. Renew. Sustain. Energy Rev. 2020, 127, 109841. [Google Scholar] [CrossRef]

- Bandeiras, F.; Pinheiro, E.; Gomes, M.; Coelho, P.; Fernandes, J. Review of the cooperation and operation of microgrid clusters. Renew. Sustain. Energy Rev. 2020, 133, 110311. [Google Scholar] [CrossRef]

- Milchram, C.; Künneke, R.; Doorn, N.; van de Kaa, G.; Hillerbrand, R. Designing for justice in electricity systems: A comparison of smart grid experiments in the Netherlands. Energy Policy 2020, 147, 111720. [Google Scholar] [CrossRef]

- Jiang, Y.; Zhou, K.; Lu, X.; Yang, S. Electricity trading pricing among prosumers with game theory-based model in energy blockchain environment. Appl. Energy 2020, 271, 115239. [Google Scholar] [CrossRef]

- Su, W. The Role of Customers in the U.S. Electricity Market: Past, Present and Future. Electr. J. 2014, 27, 112–125. [Google Scholar] [CrossRef]

- Richter, M. Utilities’ business models for renewable energy: A review. Renew. Sustain. Energy Rev. 2012, 16, 2483–2493. [Google Scholar] [CrossRef]

- Guajardo, J.A. Third-party ownership business models and the operational performance of solar energy systems. Manuf. Serv. Oper. Manag. 2018, 20, 788–800. [Google Scholar] [CrossRef]

- Chronis, A.G.; Palaiogiannis, F.; Kouveliotis-Lysikatos, I.; Kotsampopoulos, P.; Hatziargyriou, N. Photovoltaics Enabling Sustainable Energy Communities: Technological Drivers and Emerging Markets. Energies 2021, 14, 1862. [Google Scholar] [CrossRef]

- Andoni, M.; Robu, V.; Flynn, D.; Abram, S.; Geach, D.; Jenkins, D.; McCallum, P.; Peacock, A. Blockchain technology in the energy sector: A systematic review of challenges and opportunities. Renew. Sustain. Energy Rev. 2019, 100, 143–174. [Google Scholar] [CrossRef]

- Di Silvestre, M.L.; Gallo, P.; Guerrero, J.M.; Musca, R.; Sanseverino, E.R.; Sciumè, G.; Vásquez, J.C.; Zizzo, G. Blockchain for power systems: Current trends and future applications. Renew. Sustain. Energy Rev. 2020, 119, 109585. [Google Scholar] [CrossRef]

- Lüth, A.; Zepter, J.M.; del Granado, P.C.; Egging, R. Local electricity market designs for peer-to-peer trading: The role of battery flexibility. Appl. Energy 2018, 229, 1233–1243. [Google Scholar] [CrossRef]

- Tsao, Y.C.; Thanh, V.V. Toward sustainable microgrids with blockchain technology-based peer-to-peer energy trading mechanism: A fuzzy meta-heuristic approach. Renew. Sustain. Energy Rev. 2021, 136, 110452. [Google Scholar] [CrossRef]

- Wang, S.; Xu, Z.; Ha, J. Secure and decentralized framework for energy management of hybrid AC/DC microgrids using blockchain for randomized data. Sustain. Cities Soc. 2022, 76, 103419. [Google Scholar] [CrossRef]

- Antonopolous, A.M.; Wood, G. Mastering Ethereum: Building Smart Contracts and DApps, 1st ed.; O’Reilly UK Ltd.: Farnham, UK, 2018. [Google Scholar]

- Heckelmann, M. Zulässigkeit und Handhabung von Smart Contracts; Neue Juristische Wochenschrift (NJW), Verlag C.H.BECK oHG: München, Germany, 2018; p. 504. [Google Scholar]

- Kaulartz, M. Rechtliche Grenzen bei der Gestaltung von Smart Contracts; DSRI-Tagungsband, Verlag C.H.BECK oHG: München, Germany, 2016; p. 504. [Google Scholar]

- Köhler, M.; Arndt, H.W.; Fetzer, T. Recht des Internet, 7th ed.; C.F. Müller: Heidelberg, Germany, 2016. [Google Scholar]

- Lo, Y.C.; Medda, F. Assets on the blockchain: An empirical study of Tokenomics. Inf. Econ. Policy 2020, 53, 100881. [Google Scholar] [CrossRef]

- Esmaeilian, B.; Sarkis, J.; Lewis, K.; Behdad, S. Blockchain for the future of sustainable supply chain management in Industry 4.0. Resour. Conserv. Recycl. 2020, 163, 105064. [Google Scholar] [CrossRef]

- Nakamoto, S. Bitcoin: A Peer-to-Peer Electronic Cash System. 2017. Available online: https://bitcoin.org/bitcoin.pdf (accessed on 16 February 2022).

- Westerkamp, M.; Victor, F.; Küpper, A. Tracing manufacturing processes using blockchain-based token compositions. Digit. Commun. Networks 2020, 6, 167–176. [Google Scholar] [CrossRef]

- Mihaylo, M.; Jurado, S.; Avellana, N.; Van Moffaert, K.; de Abril, I.; Nowe, A. NRGcoin: Virtual currency for trading of renewable energy in smart grids. In Proceedings of the 11th International Conference on the European Energy Market, Krakow, Poland, 28–30 May 2014; pp. 1–6. [Google Scholar] [CrossRef]

- Aitzhan, N.; Svetinovic, D. Security and privacy in decentralized energy trading through multi-signatures, blockchain and anonymous messaging streams. Trans. Dependable Secur. Comput. 2018, 15, 840–852. [Google Scholar] [CrossRef]

- Sikorski, J.; Haughton, J.; Kraft, M. Blockchain technology in the chemical industry: Machine-to-machine electricity market. Appl. Energy 2017, 195, 234–246. [Google Scholar] [CrossRef]

- Al Kawasmi, E.; Arnautovic, E.; Svetinovic, D. Bitcoin-based decentralized carbon emissions trading infrastructure model. Syst. Eng. 2015, 18, 115–130. [Google Scholar] [CrossRef]

- EnStadt:Pfaff: Innovatives Energie- und Mobilitätskonzept mit Bundesweiter Strahlkraft. 2020. Available online: https://www.kaiserslautern.de/buerger_rathaus_politik/medienportal/pressemitteilungen/057464/index.html.de (accessed on 16 February 2022).

- Pfaff Reallabor. 2022. Available online: https://pfaff-reallabor.de/ (accessed on 16 February 2022).

- Fischer, D.; Harbrecht, A.; Surmann, A.; McKenna, R. Electric vehicles’ impacts on residential electric local profiles—A stochastic modelling approach considering socio-economic, behavioural and spatial factors. Appl. Energy 2019, 233-234, 644–658. [Google Scholar] [CrossRef]

- Fischer, D.; Härtl, A.; Wille-Haussmann, B. Model for electric load profiles with high time resolution for German households. Energy Build. 2015, 92, 170–179. [Google Scholar] [CrossRef]

- Wittwer, C.; Wille-Haussmann, B.; Fischer, D.; Köpfer, B.; Bercher, S.; Engelmann, P.; Ohr, F. synGHD-Synthetische Lastprofile für eine Effiziente Versorgungsplanung für nicht-Wohngebäude; Technical Report; Fraunhofer ISE: Freiburg, Germany, 2020. [Google Scholar] [CrossRef]

- Huld, T.; Gottschalg, R.; Beyer, H.G.; Topič, M. Mapping the performance of PV modules, effects of module type and data averaging. Sol. Energy 2010. [Google Scholar] [CrossRef]

- King, D.L.; Kratochvil, J.a.; Boyson, W.E. Photovoltaic array performance model. Online 2004, 8, 1–19. [Google Scholar] [CrossRef]

- Surmann, A.; Chantrel, S.P.M.; Fischer, D.; Kohrs, R.; Wittwer, C. Stochastic Bottom-Up Framework for Load and Flexibility for Agent Based Controls of Energy Communities; CIRED 2019: Liège, Belgium, 2019. [Google Scholar]

- Surmann, A.; Walia, R.; Kohrs, R. Agent-based bidirectional charging algorithms for battery electric vehicles in renewable energy communities. Energy Inform. 2020, 3, 19. [Google Scholar] [CrossRef]

- Kost, C.; Shammugam, S.; Fluri, V.; Peper, D.; Davoodi Memar, A.; Schlegel, T. Stromgestehungskosten Erneuerbare Energien. 2021. Available online: https://www.ise.fraunhofer.de/content/dam/ise/de/documents/publications/studies/DE2021_ISE_Studie_Stromgestehungskosten_Erneuerbare_Energien.pdf (accessed on 16 February 2022).

- Fraunhofer Institute for Solar Energy Systems ISE. Energy Charts: Annual Electricity Spot Market Prices in Germany. 2020. Available online: https://energy-charts.info (accessed on 16 February 2022).

- Renewable Power Generation Costs in 2019. 2020. Available online: https://www.irena.org/publications/2020/Jun/Renewable-Power-Costs-in-2019 (accessed on 16 February 2022).

- Sterchele, P.; Brandes, J.; Heilig, J.; Wrede, D.; Kost, C.; Schlegl, T.; Bett, A.; Henning, H.M. Paths to a Climate-Neutral Energy System. The German Energy Transition in Its Social Context; Fraunhofer Institute for Solar Energy Systems ISE: Freiburg, Germany, 2020. [Google Scholar]

- Chantrel, S.P.M.; Surmann, A.; Kohrs, R.; Utz, M.; Albrecht, S. Agenten- und Blockchainbasiertes Energiemanagementsystem für Mieterstromobjekte. In Internationaler ETG-Kongress 2019, 08.–09.05.2019 in Esslingen am Neckar; VDE VERLAG GMBH: Esslingen am Neckar, Germany, 2019; pp. 465–470. [Google Scholar]

- Koirala, B.P.; van Oost, E.; van der Windt, H. Community energy storage: A responsible innovation towards a sustainable energy system? Appl. Energy 2018, 231, 570–585. [Google Scholar] [CrossRef]

- Aikaterini, B.; Jeremy, P.; Sylvester, A. Enabling collective awareness of energy use via a social serious game. EAI Endorsed Trans. Serious Games 2017, 4. [Google Scholar] [CrossRef]

- Bundesamt für Bauwesen und Raumordnung, Deutscher Wetterdienst. Ortsgenaue Testreferenzjahre von Deutschland für Mittlere, Extreme und Zukünftige Witterungsverhältnisse. 2017. Available online: https://www.bbsr.bund.de/BBSR/DE/forschung/programme/zb/Auftragsforschung/5EnergieKlimaBauen/2013/testreferenzjahre/01-start.html;jsessionid=5D9912D230EB887C1F831671303A8A0F.live21304?nn=2544408&pos=2 (accessed on 16 February 2022).

| Description | Native Token | Application Token |

|---|---|---|

| Token transmission | linear or circular | linear or circular |

| Available Quantity | unlimited or limited | limited |

| Fungibility | fungible | fungible or non-fungible |

| Duration of Validity | unrestricted | restricted |

| Transferability | transferable | transferable or non-transferable |

| Team | Apartment/Commercial Unit | Battery Electric Vehicle (BEV) | ||||

|---|---|---|---|---|---|---|

| Type * | Occupancy | Annual | Nominal | Battery | Annual | |

| Demand | Power | Size | Demand | |||

| [-] | [-] | [kWh] | [kW] | [kWh] | [kWh] | |

| 1 | Student | 1 | 550 | - | - | - |

| 2 | Student | 1 | 838 | 22 | 85 | 2397 |

| 3 | Student | 1 | 1095 | - | - | - |

| 4 | Apprentice | 1 | 958 | - | - | - |

| 5 | Apprentice | 1 | 1422 | 11 | 51 | 1354 |

| 6 | Single parent | 2 | 1665 | - | - | - |

| 7 | Retired | 2 | 1749 | 3.7 | 6.8 | 479 |

| 8 | Retired | 2 | 1576 | - | - | - |

| 9 | Part time worker | 2 | 2233 | - | - | - |

| 10 | Full time worker | 2 | 1592 | 11 | 51 | 882 |

| 11 | Full time worker | 2 | 1717 | - | - | |

| 12 | Family | 4 | 3764 | 22 | 22.95 | 1409 |

| 13 | Family | 4 | 3523 | - | - | |

| 14 | Family | 4 | 3150 | 22 | 13.6 | 1663 |

| 15 | Family | 4 | 3400 | - | - | |

| 16 | Family | 4 | 3646 | 22 | 15.5 | 1472 |

| 17–27 | Offices | - | 2183 ... 5234 | - | - | - |

| Overall | Building & BEVs | - | 113,531 | 113.8 | 245.85 | 9656 |

| Utility | PV | - | 46,112 ** | 40 ** | - | - |

| Parameter | Value | Source * |

|---|---|---|

| Utility costs… | ||

| for PV installation | 1075 €/kWp | average balance of system costs [56] page 11 |

| for PV O&M | 860 €/a | = 21.5 €/(kW * a) * 40 kW [56] page 13 |

| gifting PV energy | 7.735 ct/kWh | 6.5 ct EEG levy + 19% vat |

| selling PV energy | 11.25 ct/kWh | 6.5 ct EEG levy + 19% vat on end user el. price |

| buying from EPEX | 3.05 ct/kWh | Day ahead average 2020 [57] |

| selling grid energy | 23.43 ct/kWh | Considering taxes, surcharges, and EPEX ** |

| Utility profit from… | ||

| feed in tariff | 6.88 ct/kWh | = (0.0703 €/kW * 10 kW + 0.0683 €/kW |

| * 30 kW)/40 kW [Bundesnetzagentur] | ||

| selling PV energy | 18.49 ct/kWh | = 29.74 ct/kWh − 11.25 ct/kWh |

| End user… | ||

| electricity price | 29.74 ct/kWh | Local utility base tariff |

| monthly fee | 11.72 €/month | Local utility base tariff |

| Building (Co-)Owner | Utility Company | Com. Members | |

|---|---|---|---|

| Role | Allows the installation of building integrated PV systems | Finances, builds, owns and operates the PV plants and the REC | Incorporate the REC by being customers of the utility |

| Motivation & Benefit | • Fulfills legal requirements to dedicate a fraction of the roof to solar systems | • Becomes a REC service provider | • Become prosumers |

| • Improves rating of the buildings energy performance certificate | • Incites prosumers to activate flexibility when needed | • Comprehend the fluctuation of renewables and adjust their behavior | |

| • No capital needed | • Improves image | • Save costs | |

| • Apartments become more attractive | • Encourages customers for long term cooperation | • Consume local and renewable | |

| • Participates in the energy transition | • Scales up its RE production capacity | • Participate in the energy transition |

| Description | Green Energy Token | PV Asset Token |

|---|---|---|

| Type of use | Native Token—reward | Application Token— |

| for desired behavior | represents PV plant shares | |

| Token Transmission | linear | circular |

| Available Quantity | unlimited | limited |

| Fungibility | fungible | fungible |

| Duration of Validity | unrestricted | restricted to PV plant lifetime |

| Transferability | transferable | non-transferable |

| ROI | Community el. | Self-consumption share (SCS) | |||

| Utility | bill reduction | Building | ∑ individual shares | ||

| Scenario | [month] | 2036 | All years | 2021 | 2036 |

| controlled | 57 | 24% | 69% | 5% | 54% |

| baseline | 51 | 23% | 61% | 5% | 52% |

| Time [month] to reach | Self-sufficiency share (SSS) | ||||

| community PV share of | Building | ∑ individual shares | |||

| 50% | 100% | All years | 2021 | 2036 | |

| controlled | 48 | 153 | 38% | 3% | 30% |

| baseline | 66 | 167 | 33% | 3% | 29% |

| Team | Mode | 1 | 2 * | 10 * | 11 | 13 | 14 * | 27 | Overall |

|---|---|---|---|---|---|---|---|---|---|

| 2022 | controlled | 304 | 1098 | 870 | 650 | 1165 | 1533 | 1023 | 28,101 |

| baseline | 304 | 1092 | 868 | 650 | 1165 | 1537 | 1023 | 28,092 | |

| 2027 | controlled | 279 | 976 | 754 | 573 | 1017 | 1293 | 790 | 23,061 |

| baseline | 279 | 1029 | 791 | 573 | 1014 | 1356 | 785 | 23,320 | |

| 2036+** | controlled | 271 | 921 | 710 | 555 | 966 | 1205 | 726 | 21,441 |

| baseline | 267 | 1009 | 768 | 555 | 953 | 1289 | 705 | 21,678 | |

| controlled | –11% | –16% | –18% | –15% | –17% | –21% | –29% | –24% | |

| baseline | –12% | –8% | –12% | –15% | –18% | –16% | –31% | –23% |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Surmann, A.; Chantrel, S.P.M.; Utz, M.; Kohrs, R.; Strüker, J. Empowering Consumers within Energy Communities to Acquire PV Assets through Self-Consumption. Electricity 2022, 3, 108-130. https://doi.org/10.3390/electricity3010007

Surmann A, Chantrel SPM, Utz M, Kohrs R, Strüker J. Empowering Consumers within Energy Communities to Acquire PV Assets through Self-Consumption. Electricity. 2022; 3(1):108-130. https://doi.org/10.3390/electricity3010007

Chicago/Turabian StyleSurmann, Arne, Stefan P. M. Chantrel, Manuel Utz, Robert Kohrs, and Jens Strüker. 2022. "Empowering Consumers within Energy Communities to Acquire PV Assets through Self-Consumption" Electricity 3, no. 1: 108-130. https://doi.org/10.3390/electricity3010007

APA StyleSurmann, A., Chantrel, S. P. M., Utz, M., Kohrs, R., & Strüker, J. (2022). Empowering Consumers within Energy Communities to Acquire PV Assets through Self-Consumption. Electricity, 3(1), 108-130. https://doi.org/10.3390/electricity3010007