Business Model Development for a High-Temperature (Co-)Electrolyser System

Abstract

:1. Introduction

2. Description of the Technology

2.1. Fundamentals of Water Electrolysis

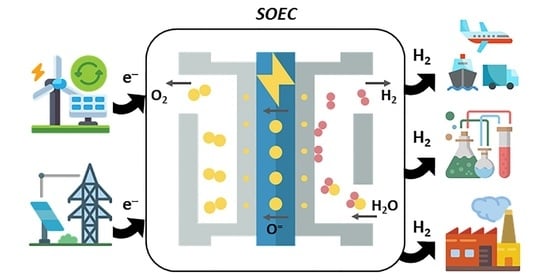

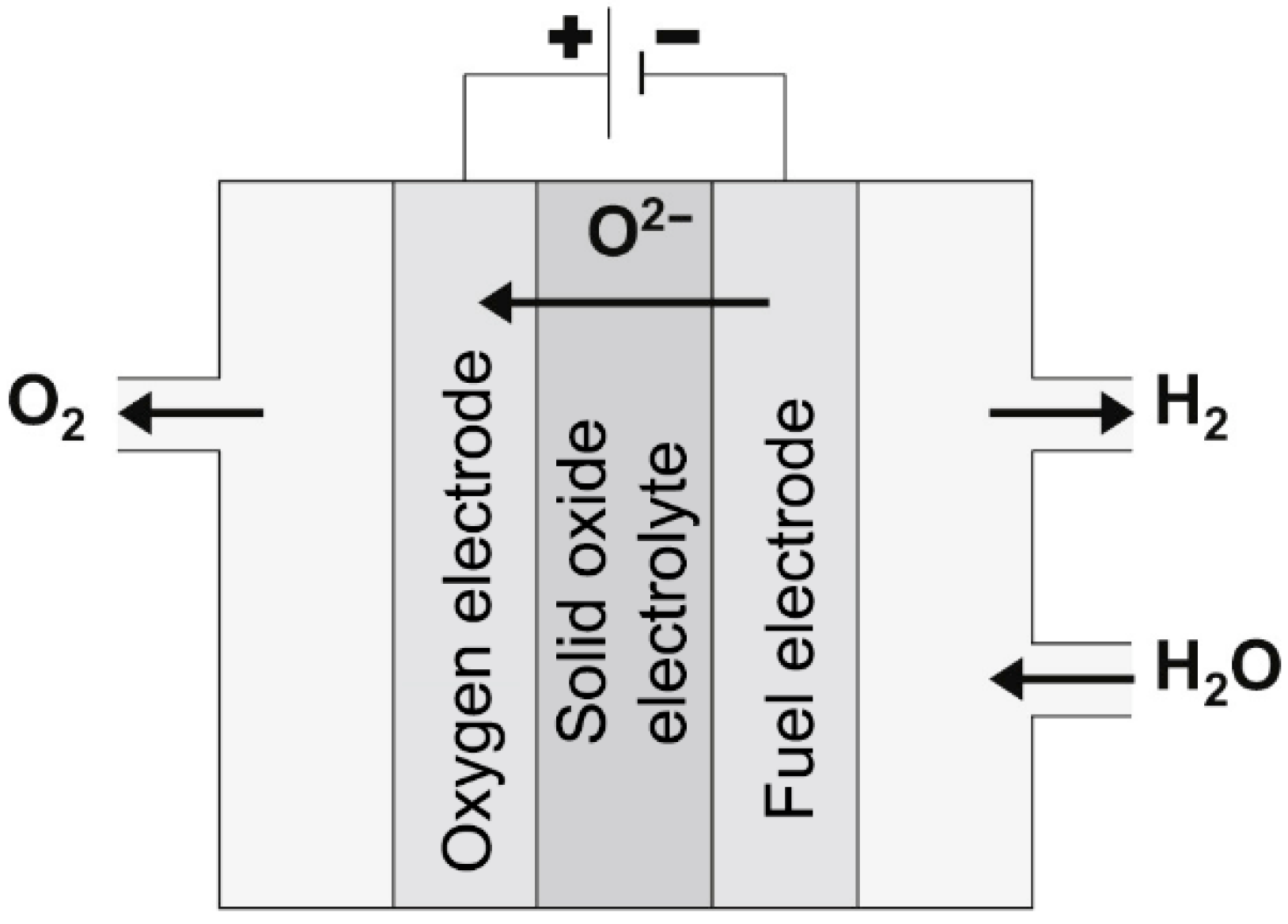

2.2. Solid Oxide Electrolysis

3. Market Analysis

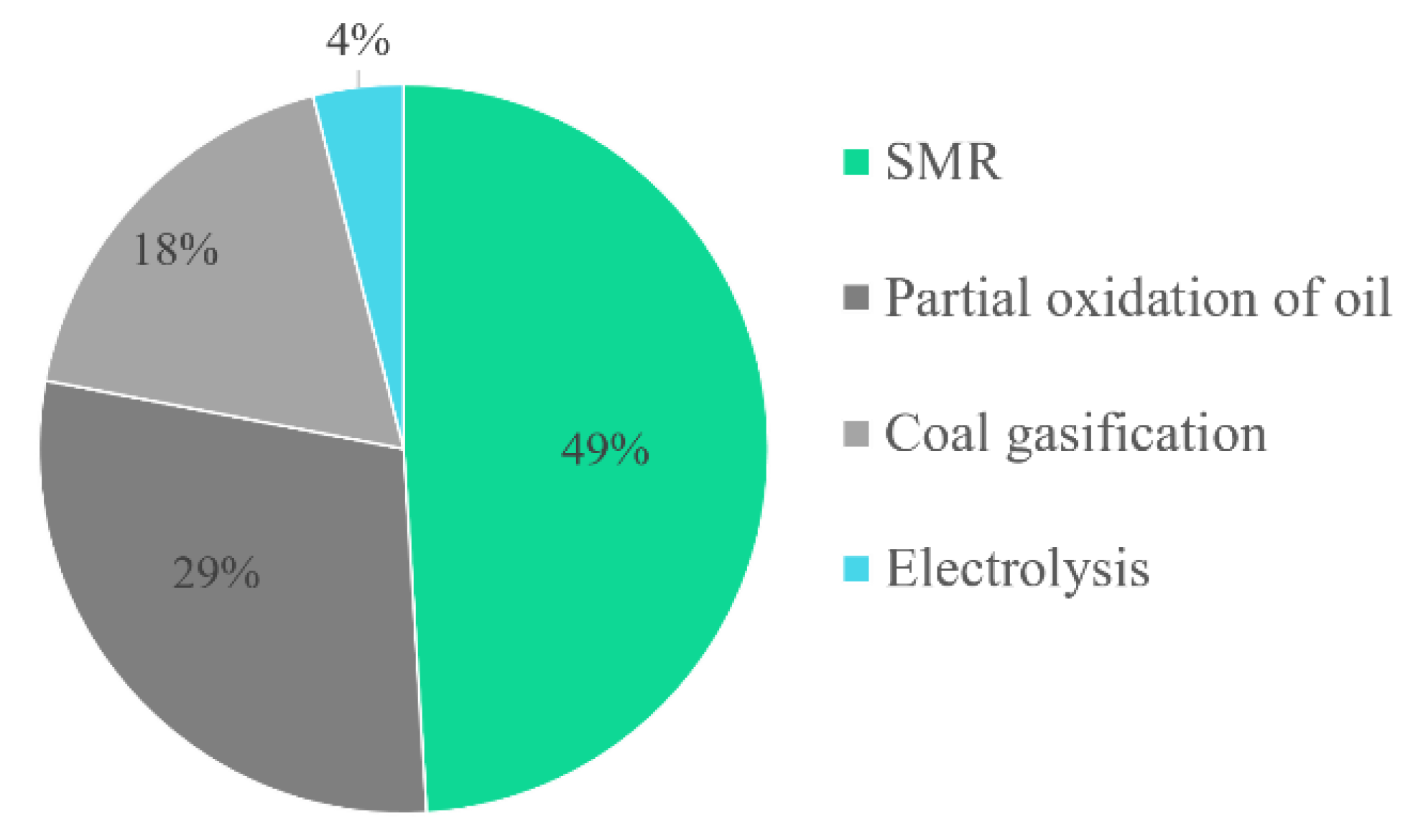

3.1. Hydrogen Production Overview

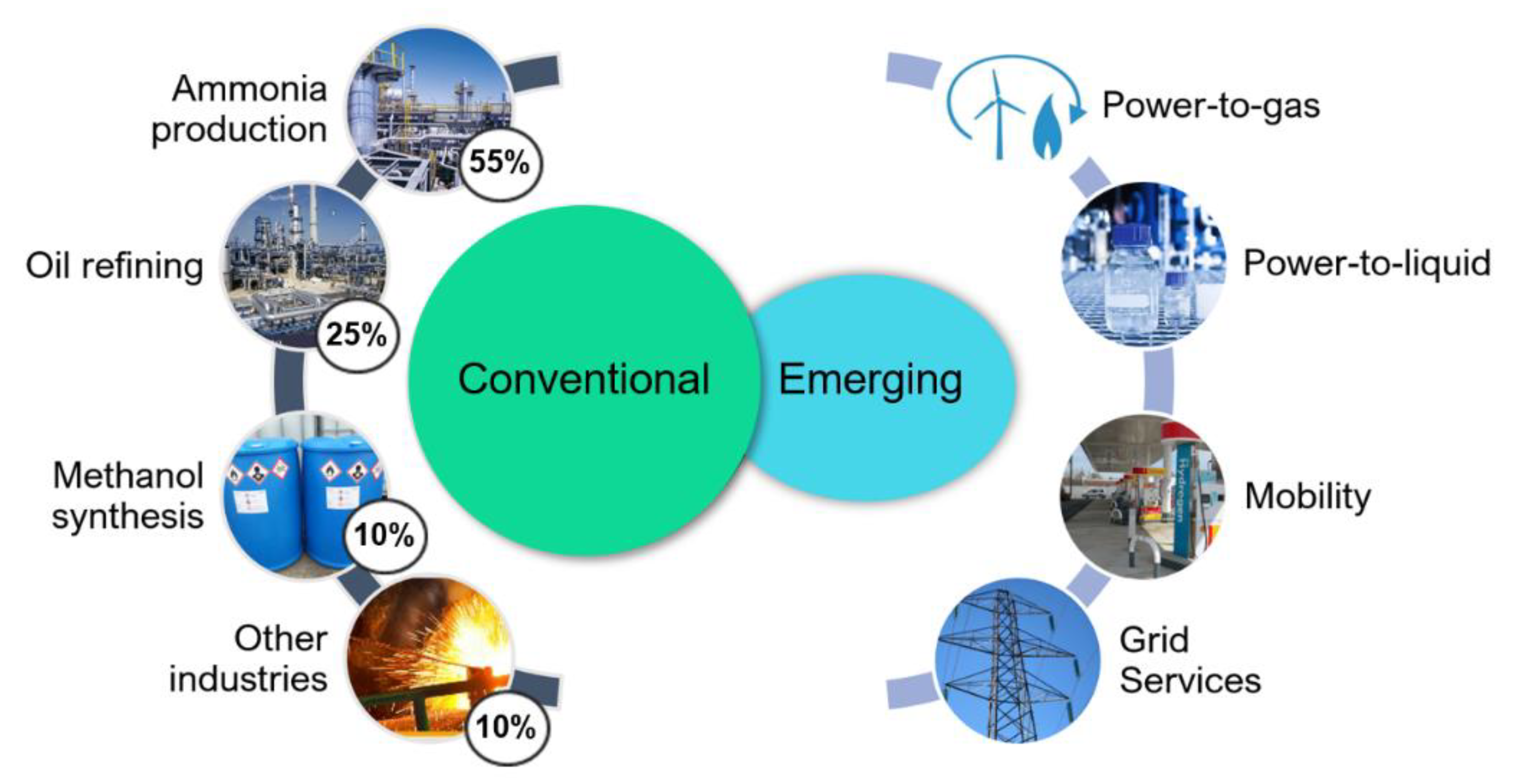

3.2. Market Segmentation

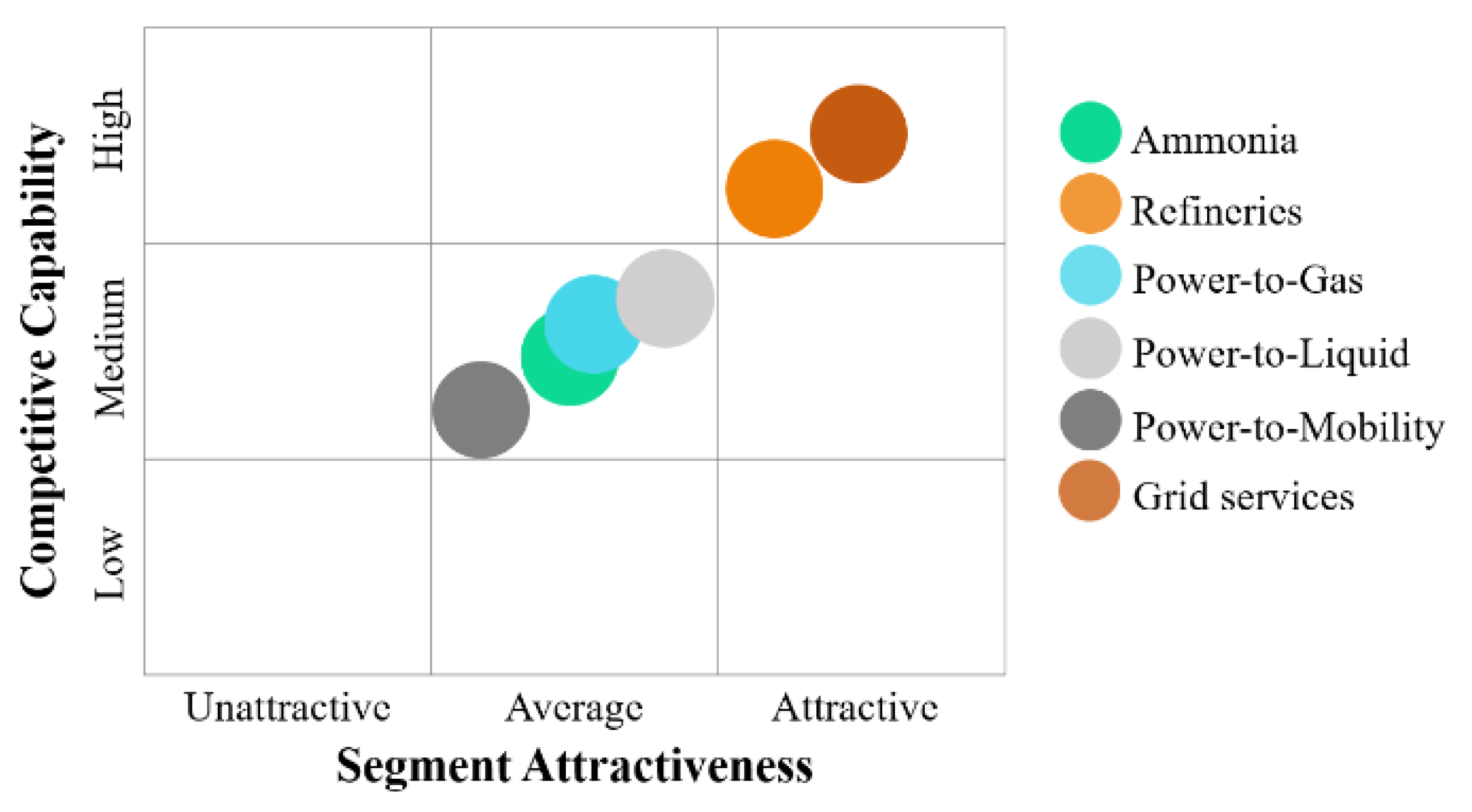

3.3. Opportunity Analysis

3.3.1. Refineries

3.3.2. Power-to-Gas

3.3.3. Power-to-Mobility

3.3.4. Power-to-Liquid

3.3.5. Grid Services

4. Industry and Competitor Analysis

4.1. Electrolyser Industry Overview

4.2. Competitor Profiling

4.3. Business Trends

5. Business Model Development

5.1. Challenges for Electrolyser-Based Businesses

5.2. Opportunities for Electrolyser-Based Business

5.3. Business Case Selection

5.4. Business Model Proposal

6. Summary and Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Parra, D.; Zhang, X.; Bauer, C.; Patel, M.K. An integrated techno-economic and life cycle environmental assessment of power-to-gas systems. Appl. Energy 2017, 193, 440–454. [Google Scholar] [CrossRef]

- International Energy Agency (IEA). World Energy Outlook 2012; IEA: Paris, France, 2012. [Google Scholar]

- Cooper, J.; Stamford, L.; Azapagic, A. Shale Gas: A review of the economic, environmental, and social sustainability. Energy Technol. 2016, 4, 772. [Google Scholar] [CrossRef]

- IPCC. Foreword, Preface, Dedication and In Memoriam. In Climate Change 2014: Mitigation of Climate Change; Contribution of Working Group III to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change; Edenhofer, O., Pichs-Madruga, R., Sokona, Y., Minx, J.C., Farahani, E., Kadner, S., Seyboth, K., Adler, A., Baum, I., Brunner, S., Eds.; Cambridge University Press: Cambridge, UK; New York, NY, USA, 2014; p. 1454. [Google Scholar] [CrossRef] [Green Version]

- The German Ministry of the Environment. Klimaschutzplan 2050; The German Ministry of the Environment: Berlin, Germany, 2016. [Google Scholar] [CrossRef]

- Herstellerübersicht, E. H2 -Erzeugung Durch Wasserelektrolyse; HZwei: Oberkrämer, Germany, 2017; pp. 2–5. [Google Scholar]

- P2X Kopernikus Project. Available online: https://www.kopernikus-projekte.de/en/projects/p2x (accessed on 17 March 2022).

- European Commission. COM(2020) 301 Final: A Hydrogen Strategy for a Climate-Neutral Europe; European Commission: Brussels, Belgium, 2020. [Google Scholar]

- European Commission. The European Green Deal; European Commission: Brussels, Belgium, 2019; Volume 53, p. 24. [Google Scholar] [CrossRef]

- Yodwong, B.; Guilbert, D.; Phattanasak, M.; Kaewmanee, W.; Hinaje, M.; Vitale, G. Proton Exchange Membrane Electrolyzer Modeling for Power Electronics Control: A Short Review. C J. Carbon Res. 2020, 6, 29. [Google Scholar] [CrossRef]

- Tarancón, A.; Fàbrega, A.; Morata, A.; Torrell, M.; Andreu, T. Power-to-Fuel and Artificial Photosynthesis for Chemical Energy Storage. In Materials for Sustainable Energy Applications: Conversion, Storage, Transmission, and Consumption; Munoz-Rojas, D., Moya, X., Eds.; Pan Stanford Publishing: Redwood City, CA, USA, 2016; pp. 493–566. [Google Scholar]

- Hauch, A.; Küngas, R.; Blennow, P.; Hansen, A.B.; Hansen, J.B.; Mathiesen, B.V.; Mogensen, M.B. Recent advances in solid oxide cell technology for electrolysis. Science 2020, 370, eaba6118. [Google Scholar] [CrossRef] [PubMed]

- Wulf, C.; Zapp, P.; Schreiber, A. Review of Power-to-X Demonstration Projects in Europe. Front. Energy Res. 2020, 8, 191. [Google Scholar] [CrossRef]

- Breakthrough for Power-To-X: Sunfire Puts First Co-Electrolysis into Operation and Starts Scaling. 2019. Available online: https://www.sunfire.de/en/news/detail/breakthrough-for-power-to-x-sunfire-puts-first-co-electrolysis-into-operation-and-starts-scaling (accessed on 15 December 2019).

- GrInHy2.0 Officially Started. 2019. Available online: https://www.green-industrial-hydrogen.com/project/news/grinhy20-officially-started (accessed on 11 January 2020).

- Multimegawatt High-Temperature Electrolyser to Generate Green Hydrogen for Production of High-Quality Biofuels. 2020. Available online: https://cordis.europa.eu/project/id/875123 (accessed on 22 September 2021).

- Zheng, Y.; Chen, Z.; Zhang, J. Solid Oxide Electrolysis of H2O and CO2 to Produce Hydrogen and Low-Carbon Fuels. Electrochem. Energy Rev. 2021, 4, 508–517. [Google Scholar] [CrossRef]

- El-Nagar, R.A.; Ghanem, A.A. Syngas Production, Properties, and Its Importance. In Sustainable Alternative Syngas Fuel; Ghenai, C., Inayat, A., Eds.; IntechOpen: London, UK, 2019. [Google Scholar] [CrossRef]

- Andersson, M.; Jan, F. Technology Review—Solid Oxide Cells 2019; Energiforsk AB: Stockholm, Sweden, 2019. [Google Scholar]

- Pandiyan, A.; Uthayakumar, A.; Subrayan, R.; Cha, S.W.; Moorthy, S.B.K. Review of solid oxide electrolysis cells: A clean energy strategy for hydrogen generation. Nanomater. Energy 2019, 8, 2–22. [Google Scholar] [CrossRef]

- Fuel Cells and Hydrogen 2 Joint Undertaking (FCH JU). Addendum to the Multi-Annual Work Plan 2014–2020; FCH 2 JU: Brussels, Belgium, 2018; Available online: https://www.fch.europa.eu/sites/default/files/MAWP%20final%20version_endorsed%20GB%2015062018%20%28ID%203712421%29.pdf (accessed on 12 January 2020).

- Böhm, H.; Zauner, A.; Goers, S.; Tichler, R.; Kroon, P. Store&Go—D7.5: Report on Experience Curves and Economies of Scale. Store GO Proj. 2018, 131, 691797. [Google Scholar]

- Smolinka, T.; Günther, M.; Garche, J. Stand und Entwicklungspotenzial der Wasserelektrolyse zur Herstellung von Wasserstoff aus regenerativen Energien. NOW-Studie 2010, 2011. Available online: https://www.google.com/url?sa=t&rct=j&q=&esrc=s&source=web&cd=&cad=rja&uact=8&ved=2ahUKEwi457HhgdP4AhVWuKQKHZkVCI8QFnoECAgQAQ&url=https%3A%2F%2Fwww.now-gmbh.de%2Fwp-content%2Fuploads%2F2020%2F09%2Fnow-studie-wasserelektrolyse-2011.pdf&usg=AOvVaw0FErz4sC3FRw3EAFMgFrGc (accessed on 10 June 2018).

- Ding, H.; Wu, W.; Jiang, C.; Ding, Y.; Bian, W.; Hu, B.; Singh, P.; Orme, C.J.; Wang, L.; Zhang, Y.; et al. Self-sustainable protonic ceramic electrochemical cells using a triple conducting electrode for hydrogen and power production. Nat. Commun. 2020, 11, 1907. [Google Scholar] [CrossRef]

- Wendt, H.; Vogel, G. Die Bedeutung der Wasserelektrolyse in Zeiten der Energiewende. Chem. Eng. Today 2014, 86, 144–148. [Google Scholar] [CrossRef]

- Schmidt, O.; Gambhir, A.; Staffell, I.; Hawkes, A.; Nelson, J.; Few, S. Future cost and performance of water electrolysis: An expert elicitation study. Int. J. Hydrogen Energy 2017, 42, 30470–30492. [Google Scholar] [CrossRef]

- Santhanam, K.; Press, R.J. Introduction to Hydrogen Technology, 2nd ed.; Wiley: Hoboken, NJ, USA, 2017. [Google Scholar]

- Ball, M.; Wietschel, M. (Eds.) The Hydrogen Economy—Opportunity and Challenges; Cambridge University Press: Cambridge, UK, 2010. [Google Scholar] [CrossRef]

- Frois, B. Balancing the Grid with hydrogen technologies. In Proceedings of the 13th European SOFC & SOE Forum, Lucerne, Switzerland, 3–6 July 2018. [Google Scholar]

- The Essential Chemical Industry—Online. Hydrogen; Department of Chemistry, University of York: New York, NY, USA, 2016; Available online: http://www.essentialchemicalindustry.org/chemicals/hydrogen.html (accessed on 2 December 2019).

- Thomas, D. Renewable Hydrogen Solutions; Hydrogenics: Brussels, Belgium, 2017. [Google Scholar]

- Adelung, S.; Kurkela, E.; Habermeyer, F.; Kurkela, M. Review of Electrolysis Technologies and Their Integration Alternatives; VTT Technical Research Centre of Finland Ltd.: Otaniemi, Finland, 2018. [Google Scholar]

- European Commission. Innovative Solid Oxide Electrolyser Stacks for Efficient and Reliable Hydrogen Production; RelHy Final Report (FP7-ENERGY- 213009); European Commission: Brussels, Belgium, 2013. [Google Scholar]

- Friend, G.; Zehle, S. Guide to business planning. Choice Rev. Online 2004, 46, 6899. [Google Scholar] [CrossRef] [Green Version]

- Riester, C.M. Business Model Development for a High-Temperature Co-Electrolyzer System. Master’s Thesis, Instituto Superior Técnico, Universidade de Lisboa, Lisboan, Portugal, 2018. [Google Scholar]

- Gupta, S.A.A. Hydrogen Generation Market Forecasts 2026. Global Report. 2020. Available online: https://www.gminsights.com/industry-analysis/hydrogen-generation-market (accessed on 22 September 2021).

- Burton, N.A.; Padilla, R.V.; Rose, A.; Habibullah, H. Increasing the efficiency of hydrogen production from solar powered water electrolysis. Renew. Sustain. Energy Rev. 2020, 135, 110255. [Google Scholar] [CrossRef]

- Hydrogen Council. Path to Hydrogen Competitiveness. A Cost Perspective; Hydrogen Council: Brussels, Belgium, 2020. [Google Scholar]

- Staffell, I.; Scamman, D.; Velazquez Abad, A.; Balcombe, P.; Dodds, P.E.; Ekins, P.; Shah, N.; Ward, K.R. The role of hydrogen and fuel cells in the global energy system. Energy Environ. Sci. 2019, 12, 463–491. [Google Scholar] [CrossRef] [Green Version]

- Hydrogen Roadmap Europe; Fuel Cells and Hydrogen Joint Undertaking (FCH): Brussels, Belgium, 2019; Available online: https://fch.europa.eu/sites/default/files/Hydrogen%20Roadmap%20Europe_Report.pdf (accessed on 23 September 2020).

- Industrial Efficiency Technology Database—Ammonia Production. Available online: http://www.iipinetwork.org/wp-content/Ietd/content/ammonia.html (accessed on 11 November 2020).

- Jaggai, C.; Imkaraaz, Z.; Samm, K.; Pounder, A.; Koylass, N.; Chakrabarti, D.P.; Guo, M.; Ward, K. Towards greater sustainable development within current Mega-Methanol (MM) production. Green Chem. 2020, 22, 4279–4294. [Google Scholar] [CrossRef]

- MarketsAndMarkets. Green Ammonia Market by Technology. 2020. Available online: https://www.marketsandmarkets.com/Market-Reports/green-ammonia-market-118396942.html (accessed on 12 November 2020).

- Fuel Cells and Hydrogen Joint Undertaking. Study on Early Business Cases for H2 in Energy Storage and More Broadly Power to H2 Applications, Final Report, P2H-BC/4NT/0550274/000/03, 2017; Fuel Cells and Hydrogen Joint Undertaking: Brussels, Belgium, 2017; Available online: https://www.fch.europa.eu/sites/default/files/P2H_Full_Study_FCHJU.pdf (accessed on 20 September 2021).

- MarketWatch. Water Electrolysis Market Size—Global Industry Analysis, Market Share, Growth. 2020. Available online: https://www.marketwatch.com/press-release/water-electrolysis-market-size---global-industry-analysis-market-share-growth-trends-top-countries-analysis-top-manufacturers-segmentation-and-forecast-2026-2020-09-15 (accessed on 12 November 2020).

- Tiwari, H. Hydrogen Electrolyzer Market: Global Industry Analysis 2012–2016 and Opportunity Assessment, 2017–2027; Future Market Insights (FMI): London, UK, 2017. [Google Scholar]

- Global Solid Oxide Fuel Cell (SOFC) Market 2019 by Manufacturers, Regions, Type and Application, Forecast To 2024. 2019. Available online: https://www.industryresearch.biz/global-solid-oxide-fuel-cell-sofc-market-13813359 (accessed on 20 September 2021).

- Nel ASA. Annual Report 2017; Nel ASA: Oslo, Norway, 2018; Available online: https://nelhydrogen.com/press-release/nel-asa-annual-report-2017 (accessed on 20 September 2019).

- McPhy Energy. McPhy Energy: Strong Revenue Increase in 2017 for McPhy: +34%. 2018. Available online: https://www.globenewswire.com/news-release/2018/01/23/1299342/0/en/McPhy-Energy-Strong-revenue-increase-in-2017-for-McPhy-34.html (accessed on 22 November 2019).

- Hydrogenics Corporation. 2017 Annual Report; Hydrogenics Corporation: Mississauga, ON, Canada, 2018. [Google Scholar]

- ITM Power. 2017 Annual Report and Financial Statements; ITM Power: Sheffield, UK, 2018. [Google Scholar]

- Hannover Messe. Group Exhibit Hydrogen + Fuel Cells + Batteries at HANNOVER MESSE. 2018. Available online: https://www.h2fc-fair.com/hm18/index.html (accessed on 27 April 2018).

- Motz, B. Hydrogenics Signs Development Agreement with Chinese Partner. GlobeNewswire, 2016. Available online: https://www.globenewswire.com/news-release/2016/06/08/846936/13854/en/Hydrogenics-Signs-Development-Agreement-with-Chinese-Partner.html (accessed on 8 June 2018).

- Gilroy, R.; Nikola awards Nel hydrogen contract to support 30 fueling stations. Transport Topics. Available online: https://www.ttnews.com/articles/nikola-awards-nel-hydrogen-contract-support-30-fueling-stations (accessed on 29 June 2018).

- Healy, R.; Nel Acquires Proton Onsite to Create World’s Largest Electrolyser Company. Gasworld Magazine. Available online: https://www.gasworld.com/nel-acquires-proton-onsite/2012338.article (accessed on 28 February 2017).

- Decourt, B.; Lajoie, B.; Debarre, R.; Soupa., O. FactBook—Hydrogen based energy-conversion, A.T. Kearney Energy Transition Institute, February, 2014. Available online: https://www.energy-transition-institute.com/documents/17779499/17781876/Hydrogen+Based+Energy+Conversion_FactBook.pdf/ab80d85b-faa3-9c7b-b12f-27d8bad0353e?t=1590787502000 (accessed on 26 April 2018).

- Chang, H. Evaluation indicators for energy-chemical systems with multi-feed and multi-product. Energy 2012, 43, 344–354. [Google Scholar]

- Widera, B. Renewable hydrogen implementations for combined energy storage, transportation and stationary applications. Therm. Sci. Eng. Prog. 2020, 16, 100460. [Google Scholar] [CrossRef]

- IEA. The Future of Hydrogen: Seizing Today’s Opportunities; OECD: Paris, France, 2019. [Google Scholar] [CrossRef]

- Ferrero, D.; Gamba, M.; Lanzini, A.; Santarelli, M. Power-to-Gas Hydrogen: Techno-economic assessment of processes towards a multi-purpose energy carrier. Energy Procedia 2016, 101, 50–57. [Google Scholar] [CrossRef] [Green Version]

- European Commission. Advanced Electrolyser for Hydrogen Production with Renewable Energy Sources; ADEL Final Report (FP7-FCH JU #256755); European Commission: Brussels, Belgium, 2018. [Google Scholar]

- Sun, Y.; Zheng, W.; Ji, S.; Sun, A.; Shuai, W.; Zheng, N.; Han, Y.; Xiao, G.; Ni, M.; Xu, H. Dynamic behavior of high-temperature CO2/H2O co-electrolysis coupled with real fluctuating renewable power. Sustain. Energy Technol. Assess. 2022, 52, 102344. [Google Scholar] [CrossRef]

| Parameters | AEL | PEM | SOEC/(CoSOEC) |

|---|---|---|---|

| Temperature range | 40–90 °C | 20–100 °C | 700–1000 °C |

| Electrolyte | Aqueous alkaline | Solid polymer | Solid oxide (ZrO2/Y2O3) |

| Charge carrier | OH− | H+ | O2− |

| Cathode reaction | 2H2O + 2e− → H2 + 2OH− | 2H+ + 2e− → H2 | H2O + 2e− → H2 + O2− (2CO2 + 4e− → 2CO + 2O2−) |

| Anode reaction | 2OH− → ½O2 + H2O + 2e− | H2O → ½O2 + 2H+ + 2e− | O2− → ½O2 + 2e− |

| System efficiency (LHV) | 51–60% | 46–60% | 76–81% |

| Degradation rate | 0.03–0.17%/1000 h | 0.06–0.3%/1000 h | 0.6%/1000 h |

| Key Players | Nel Hydrogen | McPhy Energy | Hydrogenics Corporation | Giner ELX | ITM Power Plc | Tianjin Mainland Hydrogen Equipment | Sunfire |

|---|---|---|---|---|---|---|---|

| Headquarters | Oslo, Norway | La Motte-Fanjas, France | Mississauga, Canada | Newton, MA, US | Sheffield, UK | Tianjin, China | Dresden, Germany |

| Total revenue * (2016) | EUR 12.0 M [48] | EUR 7.5 M [49] | EUR 24.7 M [50] | N/A | EUR 2.15 M [51] | N/A | N/A |

| Total revenue * (2017) | EUR 31.2 M ** [48] | EUR 10.1 M [49] | EUR 40.9 M [50] | N/A | EUR 2.70 M [51] | N/A | N/A |

| Estimated Market Share (2017) | 45% | 12% | 10% | 2% | 10% | 12% | <1% |

| Prominent regions | Europe; MEA | Western Europe; Asia Pacific; MEA | Europe; North America; Asia | North America | Europe; North America | China; Europe (as “Hydrogen Pro”) | Europe |

| Electrolyser Product type | PEM (Proton Onsite); Alkaline (Nel Hydrogen) | Alkaline | PEM; Alkaline | PEM | PEM | Alkaline | SOEC |

| Business Strategy | Mergers and Acquisitions; Product Launch; Collaborations | Collaborations; Expansion | Product Launch; Collaborations | Product Launch; Collaborations | Product Launch; Collaborations | Collaborations | Product Launch; Expansion; Collaborations |

| Key Partnerships | Key Activities | Value Propositions | Customer Relationships | Customer Segments |

|---|---|---|---|---|

Suppliers of process equipment and services

|

|

| Get: Industry exhibitions, fairs, direct contact Keep: Follow-up meetings/calls Grow: Brand awareness, country expansion, referrals | Ammonia/methanol-consuming industries

|

| Key Resources | Channels | |||

| Owned (direct)

| |||

| Cost Streams | Revenue Streams | |||

Variable costs

| Fixed costs

|

| ||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Riester, C.M.; García, G.; Alayo, N.; Tarancón, A.; Santos, D.M.F.; Torrell, M. Business Model Development for a High-Temperature (Co-)Electrolyser System. Fuels 2022, 3, 392-407. https://doi.org/10.3390/fuels3030025

Riester CM, García G, Alayo N, Tarancón A, Santos DMF, Torrell M. Business Model Development for a High-Temperature (Co-)Electrolyser System. Fuels. 2022; 3(3):392-407. https://doi.org/10.3390/fuels3030025

Chicago/Turabian StyleRiester, Christian Michael, Gotzon García, Nerea Alayo, Albert Tarancón, Diogo M. F. Santos, and Marc Torrell. 2022. "Business Model Development for a High-Temperature (Co-)Electrolyser System" Fuels 3, no. 3: 392-407. https://doi.org/10.3390/fuels3030025

APA StyleRiester, C. M., García, G., Alayo, N., Tarancón, A., Santos, D. M. F., & Torrell, M. (2022). Business Model Development for a High-Temperature (Co-)Electrolyser System. Fuels, 3(3), 392-407. https://doi.org/10.3390/fuels3030025