Partnerships for Private Transit Investment—The History and Practice of Private Transit Infrastructure with a Case Study in Perth, Australia

Abstract

1. Introduction

1.1. New Investment in Urban Transit

1.2. Land Value Uplift and the Entrepreneur Rail Model

1.3. Theory, Purpose, and Structure of the Paper

- Section 2 provides a series of global historical case studies of entrepreneurial rail building. Rather than being a comprehensive history this is intended to demonstrate the breadth of this model of railway building—commercially-motivated and linked to land development.

- Section 3 examines the Western Australian case studies, being Perth Electric Tramways Ltd. and the earlier land grant railways.

- Section 4 draws conclusions on the potential for this model of railway building to be revived in contemporary western cities, potentially incorporating the more recent governance innovation of the city deal.

- Section 5 contains concluding remarks.

2. Global Entrepreneurial Rail History

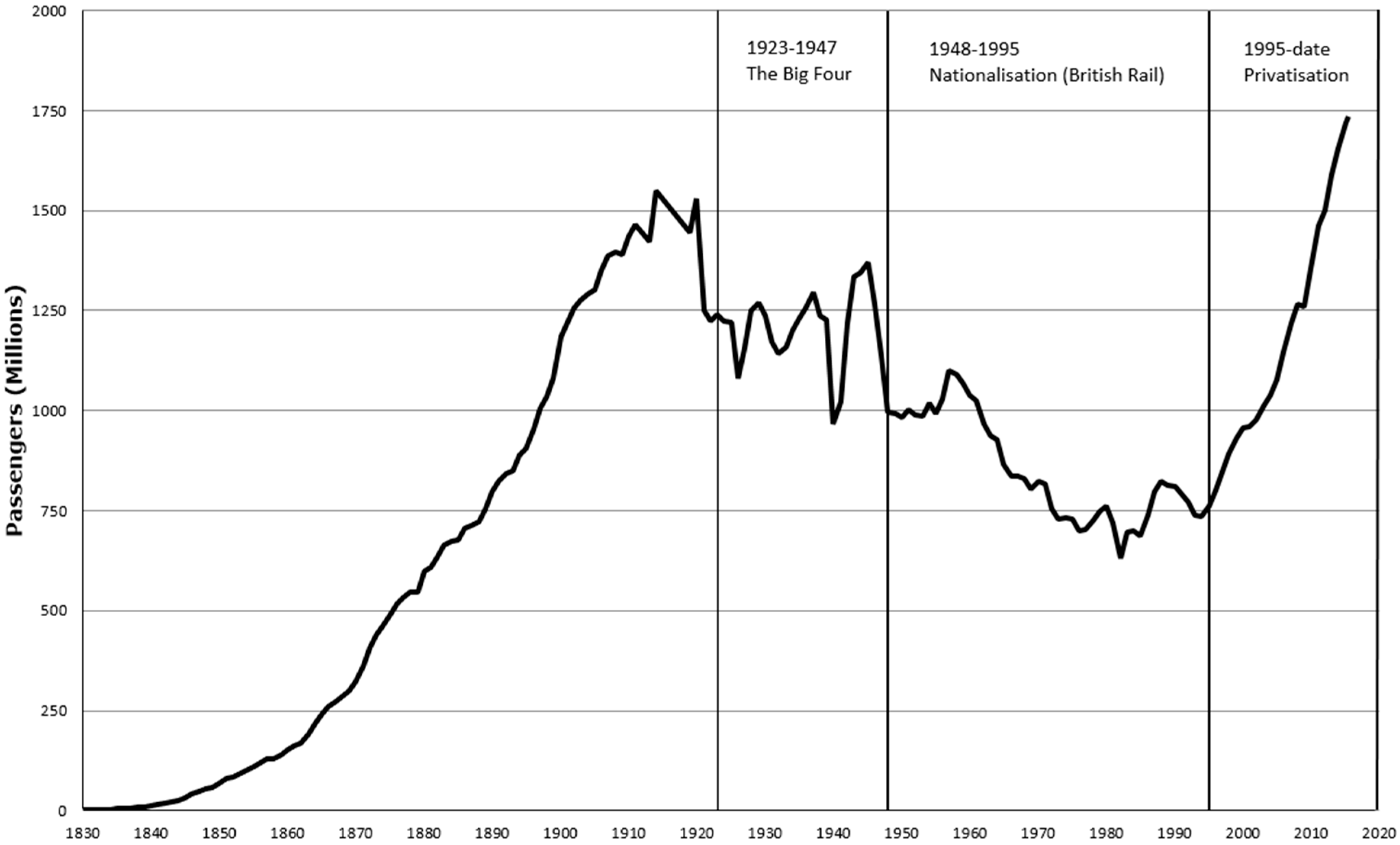

2.1. Britain

2.2. North America

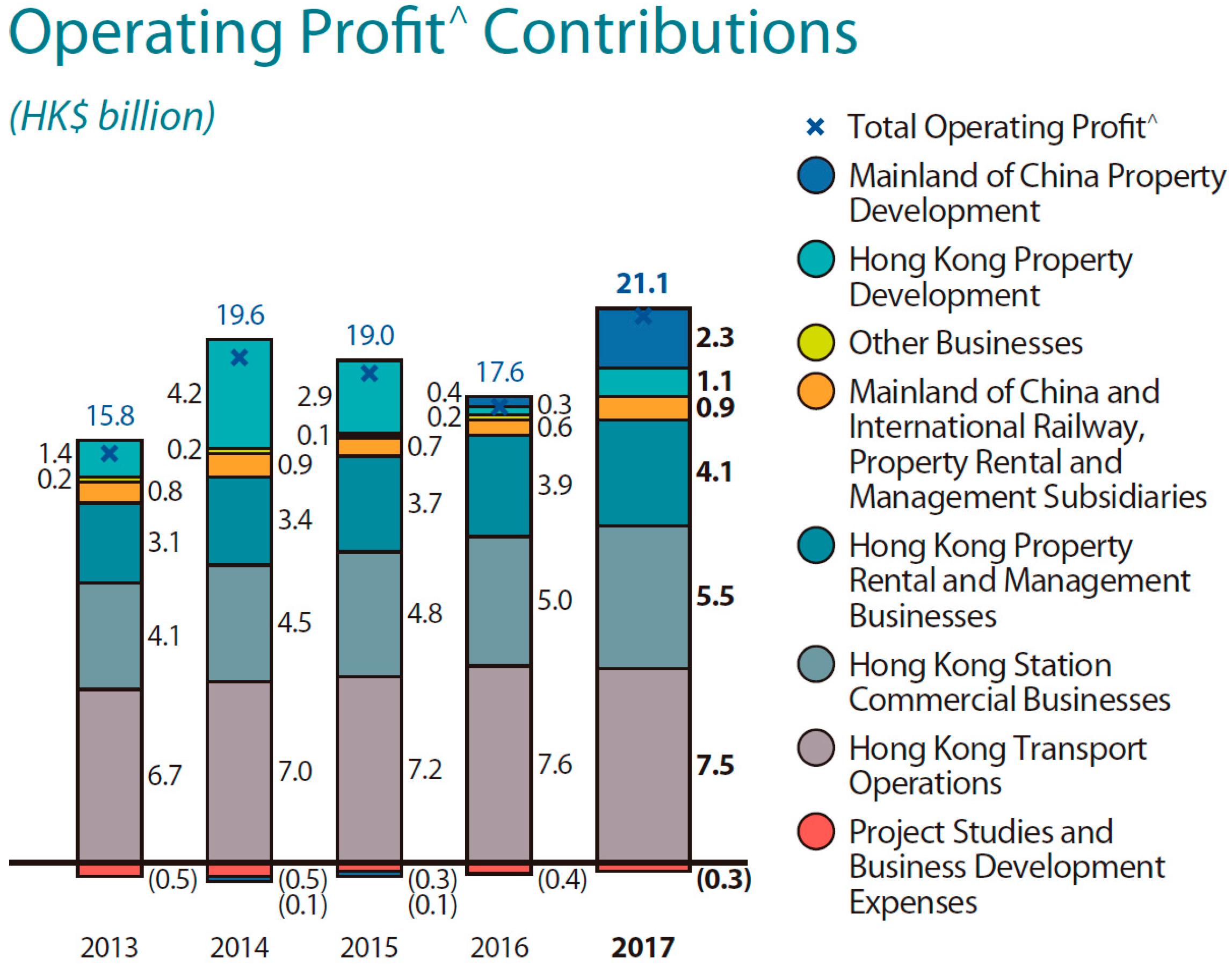

2.3. Asia

2.4. Australia

3. Historical Case Studies from Western Australia

- The Perth Electric Tramways Limited, a British company that laid down the core of the extensive tramway network in the capital city, Perth, which was later subject to state takeover.

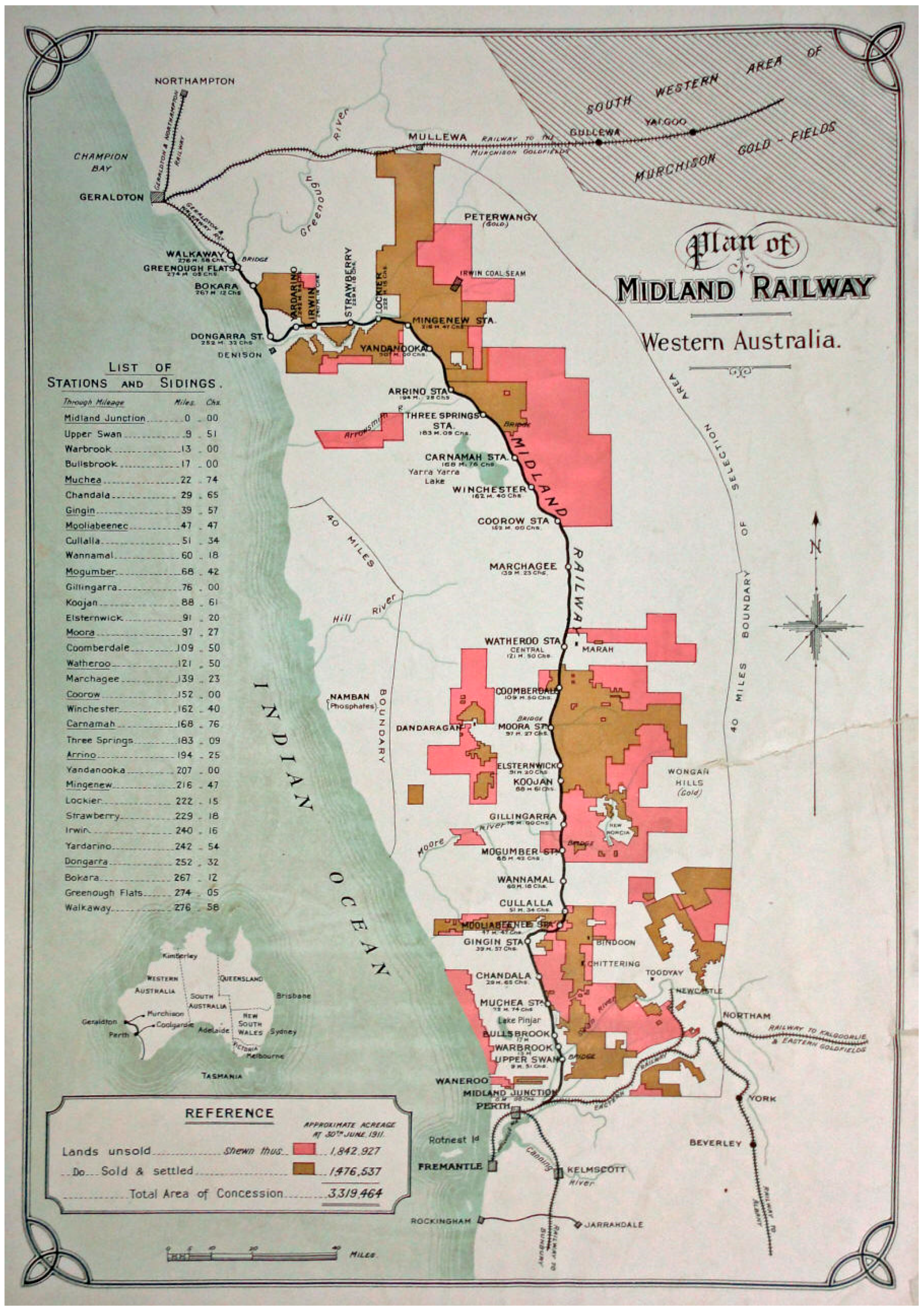

- The land grant railways—two railways were developed in Western Australia with grants of undeveloped land that the government was unable to bring under development on its own. This model was essentially the same as the American railways and the Canadian Pacific.

3.1. Perth Electric Tramways Limited

3.1.1. Tramway Regulatory Framework

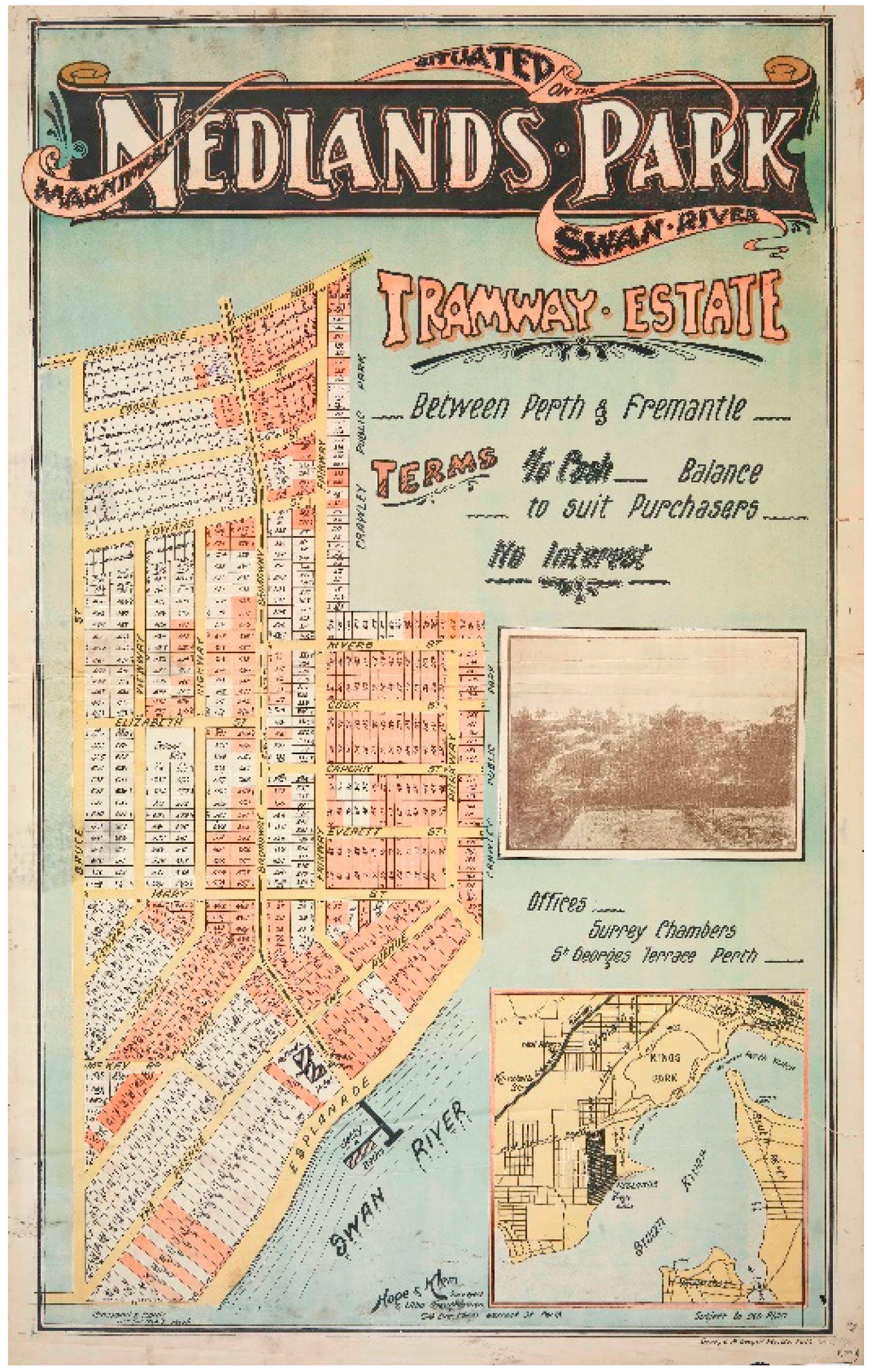

3.1.2. Nedlands Park Tramway Estate

- The two authorities would receive 3% of the gross profits of the tramway operation between them, in lieu of rates payments and in return for the right to use the roadway.

- The developers were to build a public jetty on the river foreshore at the end of the tramway, as well as public baths. The jetty was to be handed over to the one of these municipalities, who would also have the option to purchase the baths at any time. The baths were to be ceded to the municipality at the end of three years regardless.

- A substantial area of river foreshore land was ceded to the two authorities, to be maintained in perpetuity as a reserve for the local community (this foreshore reserve was used as a selling point in marketing the estate).

- The two authorities had responsibility for building and maintaining various roads, and maintaining the foreshore.

- Construction on the tramway was to commence within nine months of the bill being passed, and to be completed within nine months.

- There was to be a minimum service level of nine cars per direction per day.

- Maximum fare levels were set.

- There were certain construction standards, including the materials used and gauge of the tracks—which were the same as on the existing tramway network, 3′ 6′′.

- The promoter was required to pay a deposit of £1000 into the Colonial Treasury, a substantial sum at the time. If the promoter did not meet minimum service levels over the course of the following 10 years, or failed to complete the tramway on time, then this deposit would be forfeited [63].

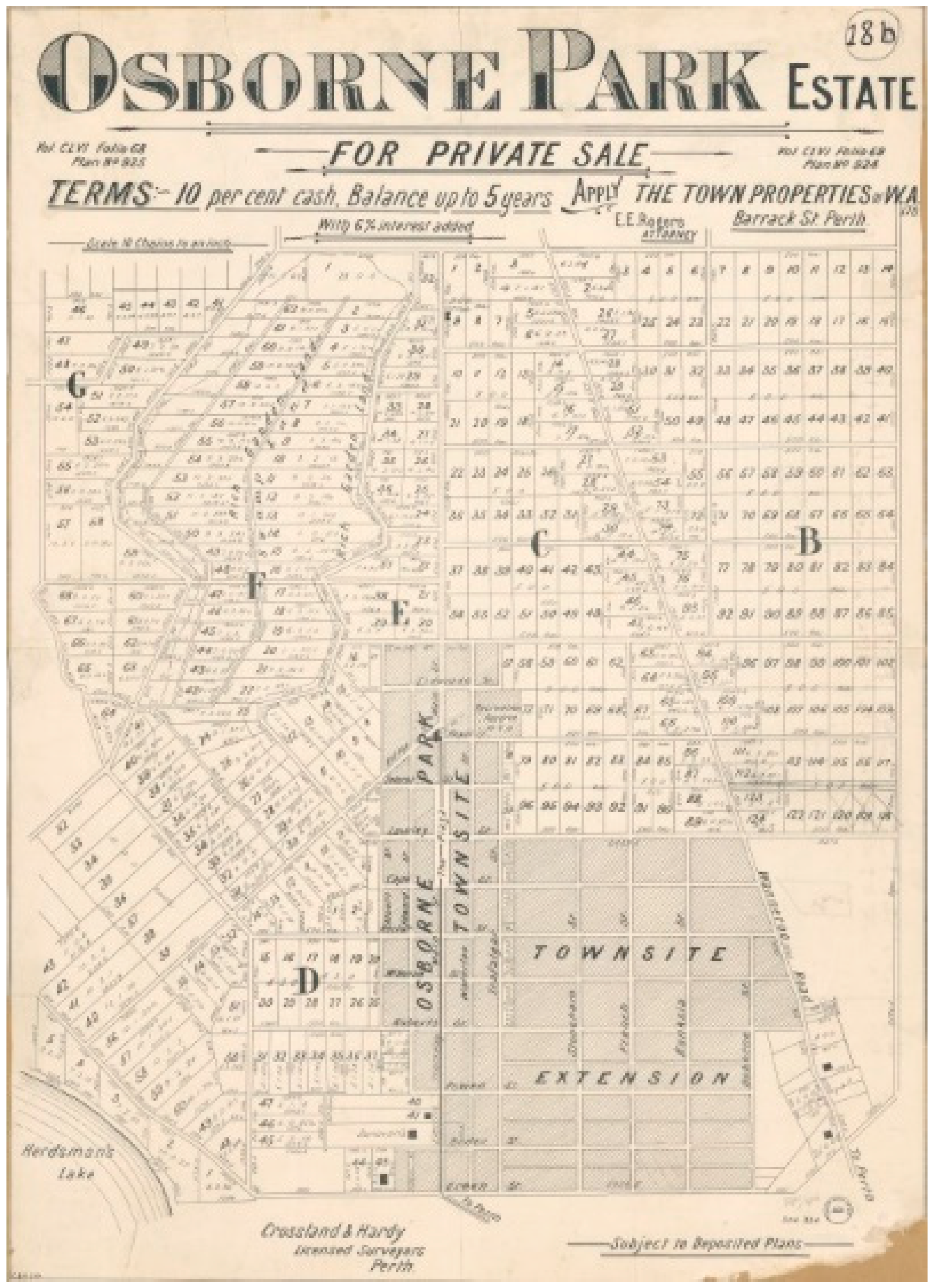

3.1.3. The Osborne Park Development

3.2. Great Southern and Midland Land Grant Railways

4. Reinventing Entrepreneurial Infrastructure

4.1. Lessons from Western Australian History

- The requirement for government approval, first through the responsible minister, and then by the legislature.

- Control of building standards and track gauges, to ensure standardisation and integration between the lines of different proponents.

- Prescribed construction timelines and a cash bond, to ensure the promoter delivers the promised infrastructure, and in a timely manner.

- Protections of the rights of adjacent property owners.

- Powers for government agencies to modify or otherwise interfere with the rail infrastructure, if required for some public purpose.

- A strong local government involvement, early on in the process.

- The increment in improved accessibility offered by the new transit.

- The rate of growth, with new transit infrastructure is more likely to affect land development in rapidly growing cities than in those where growth is slower.

- The ease or difficulty in assembling land parcels within close proximity to stations.

- The severity of zoning, or similar political or legal barriers to development.

- Transit-land use integration.

4.2. Can City Deals Mimic Historical Rail Governance?

- Demonstration of government commitment: explicit government support can give investors confidence about political and regulatory risk. This is often given as one of the explanations for rail projects’ increasing land values.

- Regulatory and compliance burden: one potential role of government is to simplify or otherwise manage its own regulatory approvals processes for a project, including land use planning approvals. In some jurisdictions, approvals can be time-consuming and can create uncertainty. This is a concern raised by the Australian property industry [79].

- Risk: A joint railway and large-scale real estate development is a large project, representing a substantial risk for a private company. In particular, this model requires a large upfront capital for development costs and to build the infrastructure. The returns come later, as the developments go to market, and final sales are uncertain. Government can provide financing guarantees to lower the cost of finance for potentially high-risk undertakings.

- Several roles suggest themselves for different tiers of government in Australian cities:

- Land assembly for redevelopment: this role could be filled by state and local government. In Western Australia, a state government mechanism already exists for acquiring land for long-term strategy infrastructure planning. This is the Metropolitan Region Improvement Fund, which uses revenues from an increment on the state’s land tax to fund land voluntary acquisition for public purposes [80].

- Concessional finance or underwriting: for large projects, this role might be filled by the national government, whose larger financial resources allow it to better absorb this risk. Concessional finance was provided to the Tsukuba Express project in Japan [81].

- Community and stakeholder engagement: this role can be undertaken by the relevant local governments, and the project proponent, as has been done by the CLARA consortium in Australia.

- Regulatory co-ordination: all tiers of government have regulatory functions. Simplifying this process can result from a partnership between different levels of government. City deals are particularly suited to this function.

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Newman, P.; Davies-Slate, S.; Jones, E. The Entrepreneur Rail Model: Funding urban rail through majority private investment in urban regeneration. Res. Transp. Econ. 2016. [Google Scholar] [CrossRef]

- Newman, P.; Kenworthy, J. The End of Automobile Dependence: How Cities Are Moving Beyond Car-Based Planning; Island Press: Washington, DC, USA, 2015. [Google Scholar]

- Clark, G.; Clark, G. Nations and the Wealth of Cities: A New Phase in Public Policy; Centre for London: London, UK, 2014. [Google Scholar]

- Clark, G.; Moonen, T. Creating Great Australian Cities: Summary Report; Property Council of Australia: Sydney, Australia, 2018. [Google Scholar]

- Department of the Prime Minister and the Cabinet. Smart Cities Plan. 2018. Available online: https://cities.infrastructure.gov.au/18190/documents/48080 (accessed on 20 July 2018).

- Glazebrook, G.; Newman, P. The City of the Future. Urban Plan. 2018, 3, 1–20. [Google Scholar] [CrossRef]

- Newman, P.; Glazebrook, G.; Kenworthy, J. Peak car and the rise of global rail: Why this is happening and what it means for large and small cities. J. Transp. Technol. 2013, 3, 272–287. [Google Scholar] [CrossRef]

- Renne, J.L. Make Rail (and Transit-Oriented Development) Great Again. Hous. Policy Debate 2017, 27, 472–475. [Google Scholar] [CrossRef]

- Scott, Rick. Gov. Scott: FDOT Begins Process for Privately Funded High-Speed Rail from Orlando to Tampa”. Media Release; 22 June 2018. Available online: https://www.flgov.com/2018/06/22/gov-scott-fdot-begins-process-for-privately-funded-high-speed-rail-from-orlando-to-tampa/ (accessed on 20 July 2018).

- Caisse de Dépôt et Placement du Québec. About Us, Frequently Asked Questions. 2017. Available online: https://www.cdpqinfra.com/en/the-model (accessed on 20 July 2018).

- Cleary, N. (Consolidated Land and Rail Australia Pty Ltd.) Personal communication, 8 June 2018.

- Crossrail Ltd. Funding. 2018. Available online: http://www.crossrail.co.uk/about-us/funding (accessed on 20 July 2018).

- Buck, M. Crossrail project: Finance, funding and value capture for London’s Elizabeth line. Proc. Inst. Civ. Eng. Civ. Eng. 2017, 170, 15–22. [Google Scholar] [CrossRef]

- Regan, M.; Smith, J.; Love, P. Financing of public private partnerships: Transactional evidence from Australian toll roads. Case Stud. Transp. Policy 2017, 5, 267–278. [Google Scholar] [CrossRef]

- Goldberg, J. The Brisconnections Airport Link: The Inevitable Collapse of a 5 Billion Dollar Megaproject. In Proceedings of the 35th ARTF Conference, Perth, Australia, 26–28 September 2012. [Google Scholar]

- Roukouni, A.; Medda, F. Evaluation of Value Capture Mechanisms as a Funding Source for Urban Transport: The Case of London’s Crossrail. Procedia Soc. Behav. Sci. 2012, 48, 2393–2404. [Google Scholar] [CrossRef]

- Medda, F.; Cocconcelli, L. To Tax or Not to Tax: The case of London Crossrail. 2013. Available online: https://www.ucl.ac.uk/qaser/pdf/publications/starebei5 (accessed on 20 July 2018).

- Vadali, S. Value Capture State-of-the Practice Examples (United States): Highways. In Proceedings of the TRB 5th International Summer Finance Conference. 2014. Available online: http://onlinepubs.trb.org/onlinepubs/conferences/2014/Finance/11.Vadali,Sharada.pdf (accessed on 31 August 2018).

- SGS Economics and Planning. Innovative Funding Models for Public Transport in Australia; SGS Economics and Planning: Canberra, Australia, 2015. [Google Scholar]

- Mathur, S.; Smith, A. A Decision-Support Framework for Using Value Capture to Fund Public Transit: Lessons from Project-Specific Analyses; Faculty Publications, Urban and Regional Planning; San Jose State University: San Jose, CA, USA, 2012; Available online: Scholarworks.sjsu.edu/cgi/viewcontent.cgi?article=1014&context=urban_plan_pub (accessed on 31 August 2018).

- Matan, A.; Newman, P. People Cities: The Life and Legacy of Jan Gehl; Island Press: Washington, DC, USA, 2016. [Google Scholar]

- City of New York. Business Improvement Districts. 2016. Available online: www1.nyc.gov/site/sbs/neighborhoods/bids.page (accessed on 20 July 2018).

- Cervero, R. Rail Transit and Joint Development: Land Market Impacts in Washington, D.C. and Atlanta. J. Am. Plan. Assoc. 1994, 60, 83–94. [Google Scholar] [CrossRef]

- Cervero, R.; Murakami, J. Rail and Property Development in Hong Kong: Experiences and Extensions. Urban Stud. 2009, 46, 2019–2043. [Google Scholar] [CrossRef]

- Mathur, S.; Smith, A. Land value capture to fund public transportation infrastructure: Examination of joint development projects’ revenue yield and stability. Transp. Policy 2013, 30, 327–335. [Google Scholar] [CrossRef]

- Levinson, D. Density and dispersion: The co-development of land use and rail in London. J. Econ. Geogr. 2008, 8, 55–77. [Google Scholar] [CrossRef]

- Perth Airport. Shareholders. 2017. Available online: https://www.perthairport.com.au/Home/corporate/about-us/corporate-structure/shareholders (accessed on 20 July 2018).

- Sharma, R.; Newman, P.; Matan, A. Urban Rail—India’s great opportunity for sustainable urban development. In Proceedings of the European Transport Conference, Frankfurt, Germany, 28–30 September 2015. [Google Scholar]

- Ubbels, B.; Nijkamp, P.; Verhoef, E.; Potter, S.; Enoch, M. Alternative ways of funding public transport. EJTIR 2001, 1, 73–89. Available online: http://www.ejtir.tudelft.nl/issues/2001_01/pdf/2001_01_05.pdf (accessed on 31 August 2018).

- Salon, D.; Shewmake, S. Opportunities for Value Capture to Fund Public Transport: A Comprehensive Review of the Literature with a Focus on East Asia; Institute for Transportation and Development Policy: Chennai, India, 2011; Available online: http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1753302 (accessed on 31 August 2018).

- Rosen, S. Hedonic prices and implicit markets: Product differentiation in pure competition. J. Political Econ. 1974, 82, 601–630. [Google Scholar] [CrossRef]

- McIntosh, J.; Trubka, R.; Newman, P. Can Value Capture Work in a Car Dependent City? Willingness to Pay for Transit Access in Perth, Western Australia. Transp. Res. Part A 2014, 67, 320–339. Available online: http://www.sciencedirect.com/science/journal/09658564/67 (accessed on 31 August 2018). [CrossRef]

- Zhao, Z.; Larson, K. Special assessments as a value capture strategy for public transit finance. Public Works Manag. Policy 2011, 16, 320–340. [Google Scholar] [CrossRef]

- Cervero, R. The Transit Metropolis—A Global Inquiry; Island Press: Washington, DC, USA, 1998. [Google Scholar]

- Newman, P.W.G.; Kenworthy, J.R. Sustainability and Cities: Overcoming Automobile Dependence; Island Press: Washington, DC, USA, 1999. [Google Scholar]

- Newman, P.; Kosonen, L.; Kenworthy, J. Theory of urban fabrics: Planning the walking, transit/public transport and automobile/motor car cities for reduced car dependency. Town Plan. Rev. 2016, 87, 429–458. [Google Scholar] [CrossRef]

- Campbell, G.; Turner, J.D. Dispelling the Myth of the Naive Investor during the British Railway Mania, 1845–1846. Bus. Hist. Rev. 2012, 86, 3–41. [Google Scholar] [CrossRef]

- Odlyzko, A. The Railway Mania: Fraud, disappointed expectations, and the modern economy. J. Railway Canal Hist. Soc. 2012, 215, 1–16. [Google Scholar]

- Odlyzko, A. The forgotten discovery of gravity models and the inefficiency of early railway networks. OEconomia 2015, 5, 157–192. [Google Scholar] [CrossRef]

- Wolmar, C. The Subterranean Railway: How the London Underground Was Built and How It Changed the City Forever; Atlantic Books: London, UK, 2004. [Google Scholar]

- Harter, J. World Railways of the Nineteenth Century: A Pictorial History in Victorian Engravings; JHU Press: Baltimore, MD, USA, 2005; p. 52. [Google Scholar]

- Warner, S.B., Jr. Streetcar Suburbs, The Process of Growth in Boston, 1870–1900; Colonial Society of Massachusetts and the New England Quarterly, etc. 36: 397; Harvard University Press; MIT Press: Cambridge, MA, USA, 1963. [Google Scholar]

- Canadian Pacific (Undated) Our History. Available online: https://cpconnectingcanada.ca/our-history/ (accessed on 20 July 2018).

- Canadian Pacific (Undated) Immigration and Settlement. Available online: https://cpconnectingcanada.ca/#immigration-settlements (accessed on 20 July 2018).

- Hanna, J. Colonist Cars Helped Build the West. Momentum, Fall. 2008. Available online: http://www.okthepk.ca/dataCprSiding/cprNews/cpNews90/08090100.html (accessed on 20 July 2018).

- Canadian Pacific. Real Estate Opportunities. 2018. Available online: http://www.cpr.ca/en/about-cp/real-estate (accessed on 20 July 2018).

- MTR Corporation. FAQ, 2. What Is the Company’s Relationship with the Hong Kong SAR Government? 2014. Available online: https://www.mtr.com.hk/en/corporate/investor/investor_faq.html#02 (accessed on 20 July 2018).

- MTR Corporation. Operating Profit Contributions. 2018. Available online: http://www.mtr.com.hk/archive/corporate/en/investor/profit_en.pdf (accessed on 20 July 2018).

- Government of Singapore. 6 Things You Need to Know about the New Rail Financing Framework. 2018. Available online: https://www.gov.sg/factually/content/6-things-you-need-to-know-about-the-new-rail-financing-framework (accessed on 20 July 2018).

- Land Transport Authority. Train Operators. 2015. Available online: https://www.lta.gov.sg/content/ltaweb/en/public-transport/mrt-and-lrt-trains/train-operators.html (accessed on 20 July 2018).

- Land Transport Authority (Singapore). Bus Industry to Complete Transition to Bus Contracting Model on 1 September 2016. News Release; 11 August 2016. Available online: https://www.lta.gov.sg/apps/news/page.aspx?c=2&id=e1fbdb6d-3200-4b23-846e-bb2184ba3dcc (accessed on 20 July 2018).

- Temasek. Temasek Review 2017: Transportation & Industrials. 2017. Available online: http://www.temasekreview.com.sg/major-investments/transportation-and-industrials.html. (accessed on 20 July 2018).

- Land Transport Authority. About LTA. 2017. Available online: https://www.lta.gov.sg/content/ltaweb/en/about-lta.html (accessed on 20 July 2018).

- Cervero, R.; Murakami, J. Rail + Property Development: A Model of Sustainable Transit Finance and Urbanism; Working Paper; UC Berkeley Center for Future Urban Transport: Berkeley, CA, USA, 2008; p. 141. [Google Scholar]

- Department of Infrastructure and Regional Development (Australia). History of Rail in Australia; Department of Infrastructure and Regional Development: Canberra, Australia, 2017. Available online: https://infrastructure.gov.au/rail/trains/history.aspx (accessed on 20 July 2018).

- Public Transport Authority of Western Australia. Our History—1830 to 1900; Public Transport Authority of Western Australia: Perth, Australia, 2017. Available online: http://www.pta.wa.gov.au/about-us/our-role/our-history#1830-to-1900-28 (accessed on 20 July 2018).

- Culpeffer-Cooke, T.; Gunzburg, A.; Pleydell, I.; Brown, D. (Eds.) Tracks by the Swan: The Electric Tram and Trolley Bus Era of Perth, Western Australia; Perth Electric Tramway Society Inc.: Mount Lawley, Australia, 2010. [Google Scholar]

- Australian Bureau of Statistics. Australian Historical Population Statistics. Catalogue Number 3105.0.65.001, Table 3. 2014. Available online: http://www.abs.gov.au/AUSSTATS/abs@.nsf/DetailsPage/3105.0.65.0012014?OpenDocument (accessed on 31 August 2018).

- Government of the Western Australia. Tramways Act (Western Australia). 1885. Available online: https://www.legislation.wa.gov.au/legislation/statutes.nsf/law_a2958.html (accessed on 31 August 2018).

- Legislative Assembly (Western Australia). Parliamentary Debates; 23 September 1885, 385. Hon. J.A. Wright, Engineer-in-Chief. 1885. Available online: http://www.parliament.wa.gov.au/hansard/hansard1870to1995.nsf/vwWeb1880Main?OpenView&Start=1&Count=1000&Expand=6#6 (accessed on 31 August 2018).

- Battye Library. Enlargement of Nedlands Park Tramway Estate Booklet, Published 1908; Battye Library: Perth, Australia, 1975.

- Legislative Assembly (Western Australia). Parliamentary Debates. 1907. Available online: http://www.parliament.wa.gov.au/hansard/hansard1870to1995.nsf/vwWeb1900Main?OpenView&Start=1&Count=1000&Expand=8#8 (accessed on 31 August 2018).

- Government of the Western Australia. Nedlands Park Tramway Act (Western Australia). 1907. Available online: https://www.legislation.wa.gov.au/legislation/statutes.nsf/main_mrtitle_9526_homepage.html (accessed on 31 August 2018).

- Pellatt, S.H. Osborne Park; Dix and Little: Perth, Australia, 1913. [Google Scholar]

- Easton, L.A. Stirling City; University of Western Australia Press: Perth, Australia, 1972. [Google Scholar]

- Government of the Western Australia. North Perth and Perth Road Board Districts Tramways Act (Western Australia). 1902. Available online: https://www.legislation.wa.gov.au/legislation/prod/filestore.nsf/FileURL/mrdoc_14128.pdf/$FILE/North%20Perth%20and%20Perth%20Road%20Board%20Districts%20Tramways%20Act%201902%20-%20%5B00-00-00%5D.pdf?OpenElement (accessed on 31 August 2018).

- State Library of Western Australia. J S Battye Library of West Australian History Midland Railway Company. Private Archives—Collection Listing; M/N 0239/1, Acc. 1557A, 1558A; State Library of Western Australia: Perth, Australia, 2002.

- Legislative Assembly (Western Australia). Parliamentary Debates. 1896. Available online: http://www.parliament.wa.gov.au/hansard/hansard1870to1995.nsf/vwWeb1890Main?OpenView&Start=1&Count=1000&Expand=7#7 (accessed on 31 August 2018).

- Gatzlaff, D.H.; Smith, M.T. The impact of the Miami Metrorail on the value of residences near station locations. Land Econ. 1993, 69, 54–66. [Google Scholar] [CrossRef]

- Cervero, R. Effects of Light and Commuter Rail Transit on Land Prices: Experiences in San Diego County. J. Transp. Res. Forum 2004, 43, 121–138. [Google Scholar] [CrossRef]

- Du, H.; Mulley, C. Transport Accessibility and Land Values: A Case Study of Tyne and Wear. Rep. RICS Res. Pap. Ser. 2007, 7, 1–52. [Google Scholar]

- Australian Bureau of Statistics. Motor Vehicle Census, Australia, 31 January 2018. Catalogue Number 9309.0, Table 2. 2018. Available online: http://www.abs.gov.au/AUSSTATS/abs@.nsf/DetailsPage/9309.031%20Jan%202018?OpenDocument (accessed on 31 August 2018).

- Shoup, D. The High Cost of Free Parking. J. Plan. Educ. Res. 1997, 17, 3–20. [Google Scholar] [CrossRef]

- Guerra, E.; Cervero, R. Cost of a ride: The effects of densities on fixed-guideway transit ridership and costs. J. Am. Plan. Assoc. 2011, 77, 267–290. [Google Scholar] [CrossRef]

- Frank, L.; Pivo, G. The Impacts of Mixed Use and Density on the Utilization of Three Modes of Travel: The Single Occupant Vehicle, Transit, and Walking. Transp. Res. Rec. 1994, 1466, 44–52. [Google Scholar]

- Pushkarev, B.; Zupan, J. Public Transportation and Land Use Policy; Indiana University Press: Bloomington, IN, USA, 1977. [Google Scholar]

- Dittmar, H.; Ohland, G. The New Transit Town: Best Practices in Transit-Oriented Development; Island Press: Washington, DC, USA, 2004. [Google Scholar]

- Hirooka, H. The development of Tokyo’s rail network. Jpn. Railw. Transp. Rev. 2000, 23, 22–30. [Google Scholar]

- Property Council of Australia (Undated) Less Red Tape. Available online: https://www.propertycouncil.com.au/Web/Advocacy/Advocacy_Priorities/Red_tape/Web/Advocacy/Priority/Red_Tape.aspx?hkey=8c2ac5d1-3f23-4d5a-b9c6-0182723945cf (accessed on 20 July 2018).

- Office of State Revenue (Western Australia) (Undated) 2014–15 Land Tax. Available online: https://www.finance.wa.gov.au/cms/uploadedFiles/_State_Revenue/Land_Tax/Land_Tax_Brochure_2014-15.pdf (accessed on 20 July 2018).

- Metropolitan Intercity Railway Company. Metropolitan Intercity Railway Company (undated) Company Profile; Metropolitan Intercity Railway Company: Tokyo, Japan, 2018. [Google Scholar]

- Department of the Prime Minister and Cabinet (Australia) (Undated) Delivering City Deals. Available online: https://cities.infrastructure.gov.au/19047/documents/64949 (accessed on 10 August 2018).

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Davies-Slate, S.; Newman, P. Partnerships for Private Transit Investment—The History and Practice of Private Transit Infrastructure with a Case Study in Perth, Australia. Urban Sci. 2018, 2, 84. https://doi.org/10.3390/urbansci2030084

Davies-Slate S, Newman P. Partnerships for Private Transit Investment—The History and Practice of Private Transit Infrastructure with a Case Study in Perth, Australia. Urban Science. 2018; 2(3):84. https://doi.org/10.3390/urbansci2030084

Chicago/Turabian StyleDavies-Slate, Sebastian, and Peter Newman. 2018. "Partnerships for Private Transit Investment—The History and Practice of Private Transit Infrastructure with a Case Study in Perth, Australia" Urban Science 2, no. 3: 84. https://doi.org/10.3390/urbansci2030084

APA StyleDavies-Slate, S., & Newman, P. (2018). Partnerships for Private Transit Investment—The History and Practice of Private Transit Infrastructure with a Case Study in Perth, Australia. Urban Science, 2(3), 84. https://doi.org/10.3390/urbansci2030084