1. Introduction

Globalization and information and communication technologies (ICTs) are continuously transforming the relationship between geographical locations, spaces and economic activities [

1], shaping urban and regional geographies [

2]. Within this general trend, the rise of sharing/collaborative forms of the economy is now accompanied by a debate regarding the range of their potential benefits in terms of economic growth [

3] and sustainable development [

4,

5].

The technological innovation driven by ICTs matches important changes in urban areas and the labour market. Traditional productive areas are being abandoned and traditional businesses (manufacturing) are relocating to other areas. High skilled workers—in terms of internet and digital skills—find their own way to enter the market, given the fact that their new competencies are not covered by traditional enterprises and the shrinking traditional sectors. These choices happen in a situation of individual scarcity of financial and banking capital, and necessitates innovative solutions for these new enterprises, made up mostly by individual freelancers, start-ups and micro-enterprises. Within this framework, work and workplaces are being radically modified [

6], giving rise to collaborative workplaces, such as hacker spaces, maker spaces, fabrication laboratories (Fab Labs) and coworking spaces.

Coworking is often regarded as the “new model of work”, a typical case of the sharing and collaborative economy [

7]. Its appearance and diffusion have been related to the more general growth of the so-called “creative class” [

8] in the knowledge and creative industries. The rationale for coworking is found in the need of knowledge workers and freelancers to work in a community, sharing not only know-how and skills, but also a physical space. Coworking spaces (CSs) are shared workplaces made up by open space desks and other facilities and services offered and organized by coworking businesses (CBs), run by coworking managers, providers or proprietors.

CSs exhibit both access to a shared physical space and the sharing of intangible assets [

9]. CBs create advantages for the working community by boosting knowledge transfer, opening new job opportunities and offering shared physical assets.

The diffusion of coworking is the result of the interest from CS utilizers (CUs) toward the services supplied by CBs. In fact, CBs offer an array of innovative services that differ from traditional enterprises, targeting the needs of both “lone eagles” [

6] (i.e., individual freelance workers) and new kinds of enterprises, most notably start-ups. To do so, CBs are required to meet the new market demands of highly-skilled workers and knowledge-intensive activities.

It has been claimed that new collaborative workspaces are largely located in a few creative cities that are acting as “coworking hotspots” [

6] (p. 11). Coworking is thus an urban phenomenon that shows its potential in terms of the regeneration and revitalization of urban environments. It contributes to job creation [

10,

11], to the reuse of former industrial buildings turned into vacant spaces [

12,

13], to the development of creative districts by enhancing the “innovation ecosystem” of cities [

14], to the transformation of public spaces [

15], and to the attraction of other types of activities inside the urban area [

11].

Ponzini and Rossi [

16] argue that the growth of the urban creative class and Florida’s creative city theory, whereby the competitiveness of cities depends on the emergence of creative activities, fueled a variety of interventions and urban policies targeting both the urban physical fabric and the economic fabric. Among them, the opening of new spaces for the creative class, such as CSs, is viewed by some authors as a sort of “urban panacea”, promoting successful urban regeneration policies. However, against this widespread idea of considering coworking as a positive phenomenon, some authors have suggested the presence of a “coworking bubble” [

6,

17,

18], casting a shadow on the sustainability of the coworking model.

In 2017, we conducted research in Porto Marghera (Venice, Italy), a former chemical industrial site and now one of the largest Italian brownfields, which is undergoing a slow process of urban regeneration, especially in the northern part.

In this context, the search for new business opportunities as well as the challenges posed by the reuse of vacant spaces located on the former industrial site, led some local entrepreneurs to consider coworking as a possible alternative for the relaunch of their underused areas and vacant buildings.

Given the lack of data on the economic viability and operating conditions of Italian CBs, required by Venetian entrepreneurs to evaluate different investment possibilities for their area, we wanted to answer to the following research questions: (1) where are Italian CBs located? (2) Are CBs economically viable? (3) Is the intensity of use of CS the key to their economic viability? (4) What are the internal factors and operational conditions ensuring the efficiency and the success of a CB? (5) Are CSs cheaper than traditional office spaces?

The aim of this paper is twofold: on the one hand, it wants to contribute to situating coworking in the urban debate, deepening its potential for the renewal of urban areas; on the other hand, it seeks to understand whether coworking represents an effective response to the needs of new enterprises, and to what extent coworking promoters are capable of supplying solutions to such needs.

In the first desk research phase, we produced a national coworking census, mapping Italian CBs to explore their location. Secondly, to find evidence regarding the economic viability of coworking, we conducted a national survey of CBs. The survey was carried out in spring 2017, submitting a questionnaire to the coworking managers of Italian CBs. Finally, we compared the prices for access to CSs to those for the rent of traditional office spaces. We argue that the economic viability of CBs—and therefore their ability to produce positive effects on urban fabrics and more generally on cities—is highly dependent on internal factors, strictly related to the choices of coworking promoters and managers. We highlight the important role of the coworking promoter/manager, whose organizational and marketing choices can determine the success of the CB, and secondarily trigger spillover effects for the urban and economic fabrics.

The paper is organized as follow: in the

Section 2 we situate coworking in the broader sharing economy debate. In the

Section 3, we explore the possible impacts of this phenomenon on the city, with reference to the relevant literature. In the fourth

Section 4 we introduce the scope, the methodology and the description of our survey. The main results and key findings of our survey are presented in the

Section 5. A discussion (

Section 6) and conclusion (

Section 7) follow.

2. Coworking in the Sharing Economy Debate

The sharing economy is emerging as a global trend now diffused in different economic activities, such as retail, logistics, transportation, tourism, and in various spheres such as the labour market organization, finance, and office spaces [

19]. Their common feature is that they facilitate access to goods and services, on the demand and supply side, through digital platforms [

20]. Being a widespread phenomenon, the sharing economy is affecting the entire economy. The increasing number of activities involving sharing practices is shaping cities [

21], and rural areas are also now experiencing some of the transformative effects of the sharing economy [

22].

The spread of sharing practices has been facilitated by the advent of ICTs and digitisation, enabling both the creation of digital sharing platforms and the possibility of working from different locations. However, the sharing economy, in contrast to Friedman’s idea of a globalized world becoming flat [

23], has proved to be affected by the spatial dimension, and represents an urban phenomenon that “directly affects the urban economy at both the neighbourhood and city-wide levels” [

21] (p. 259). In the same way, the emergence of ICTs and digitisation also changed the idea of work, transforming communities and workplaces [

2] and leading to what has been called the “third wave of virtual work” [

24]. The first wave was characterized by the increased use of personal computers and emails, creating the possibility to work as self-employed freelancers; the second wave occurred when companies started to take the cost advantages related to virtual work, despite the disadvantages related to their inferior commitment to one employee. These workers started to feel the need to be part of a community and to “renew social contacts” [

25] (p. 576) between them. This demand is producing the “third wave of virtual work”, whereby virtual workers “physically reunite and retether to specific spaces” [

24], giving rise to a new kind of “localized spaces for collaborative innovation” [

14] (p. 1), such as CSs. Within this process, sharing economy platforms are facilitating the participation of individuals in communities, offering new possibilities for virtual workers not only to physically gather, but also to cooperate easily and to take advantage of less expensive online services, such as e-commerce, e-marketing, e-procurement, e-assistance.

CSs can be generally defined as “shared workplaces utilised by different sorts of knowledge professionals, mostly freelancers, working in various degree of specialisation in the vast domain of the knowledge industry” [

18] (p. 194). In practical terms, CSs are open space offices furnished with desks and internet connections—and often also meeting rooms, private office spaces and other equipped rooms—that are rented to freelancers, professionals, start-ups or micro-businesses.

Since the opening of the first CS in 2005 in San Francisco [

18,

26], CSs have been increasing worldwide at an impressive pace. As reported in 2012, their number doubled each year since 2006 [

27], and is still growing; the same happened to the number of coworking members worldwide [

28,

29,

30,

31,

32].

The phenomenon of coworking is generally analysed within the sharing economy debate [

9,

18,

20,

22], as it involves both “the access of shared physical assets (office, infrastructure, cafeteria, etc.) and the sharing of intangible assets, such as (information, knowledge, etc.)” [

9] (p. 6). Some authors say that CSs reflect “the collective-driven, networked approach of the open-source-idea translated into physical space” [

33] (p. 202). Others claim that coworking can be associated with the sharing economy, as the latter is also characterized by the possibility to access under-utilized resources and physical assets [

34,

35], for the purpose of maximizing the utilization of “‘surplus’ or ‘idle’ capacity” of those assets [

36]. Even if the boundaries of the sharing economy are difficult to define precisely and in the relevant literature “there is no ‘shared’ consensus on what activities comprise the ‘sharing economy’” [

19] (p. 6), some authors tried to produce a classification of sharing economy activities and platforms. According to Richardson, the phenomenon can be better understood “as a series of performances, rather than a coherent set of economic practices” [

20] (p. 127). The performances identified are: the enactment of a community, the access to common resources, and the collaboration between participants [

20]. From our perspective, coworking is characterised by all these performances. Following another approach, Codagnone and Martens divide the existing sharing platforms into three categories: “(a) recirculation of goods (second-hand and surplus goods markets); (b) increased asset utilization (production factors markets); and (c) service and labour exchanges” [

19] (p. 10). According to these authors, coworking can be associated with initiatives falling inside the second and third categories, as CSs facilitate respectively the recirculation of idle assets, vacant or underused spaces, and the creation of new job opportunities through networking.

3. Coworking and Urban Area Renewal

While many authors have written about the definition of coworking and CS [

6,

14,

18,

26,

37], few have discussed the effects of shared work practices on the evolution of cities and the potential of CSs to transform the urban fabric. Only recently, the potential role of CSs in stimulating urban regeneration processes and “micro-scale physical transformations” [

15] (p. 3) has been discussed, viewing coworking as a means of providing an effective alternative for the reuse of former industrial or under-utilised buildings [

38].

According to this view, the urban regeneration potential of CSs is twofold. Firstly, the reuse of vacant or underused buildings is contributing to the recycling of idle urban assets, thus contributing to the realization of a circular economy, centred on the reuse of assets that have completed their life cycle, giving them new life and minimising energy and material waste. CSs, seen as the answer to the new organizational needs of knowledge workers, fit into the challenges posed by the re-cycling of the urban fabric [

39], moving from deindustrialization to a new phase of economic growth. It is worth noting that CSs, in order to differentiate themselves from traditional office spaces, “tend to emphasize their idiosyncratic, bespoke ‘Post-Fordist’ design aesthetics” [

32] (p. 10) and their location in former industrial buildings responds to such desires. Many CSs have already opened inside industrial era buildings [

32]. There are indeed several examples of this trend: Betahaus in Berlin’s Kreuzberg, a space of 3000 sqm now converted into a hub for creative start-ups; Ponyride in Detroit, a formerly derelict building now home of a business incubator and collaborative workspaces [

40]; the 311 coworking space in Verona (Italy), opened in 2015 on formerly industrial land close to the city centre, a collaborative open space of 2000 sqm [

41]. These examples show the potential of CBs—and in general of shared service accommodation—in “reusing and revaluing decaying properties” [

12] (p. 118). Furthermore, the opening of CBs is also impacting positively on the quality of the surrounding neighbourhood, increasing the attractiveness of the area by occasionally improving public spaces and generating socio-economic and micro-regeneration effects [

15]. Secondly, according to other authors, coworking is capable of producing some “soft” impacts on the city. The emergence of new forms of creative production has favoured the concentration of creative activities in some places [

42], benefitting from urban density and the generation of proximity spill-overs [

43]. Some authors study “the creative city” or the “knowledge-based city” [

44,

45] and the appearance of innovation districts [

46] shaping the urban economy. This phenomenon is seen as very positive, and politicians are looking with more and more interest to the potential of creative activities to foster the competitiveness of cities, by leveraging the “urban creative class” [

16] (p. 1052). In line with this, CBs represent a strategic model, acting “as interfaces with the creative milieu in the city and beyond” [

47] (p. 133), and boosting innovation processes in the city at the individuals and community levels [

48]. Kojo and Nenonen, studying the evolution of CBs, identified regional development as one driver for the evolution of coworking [

49], while Buksh and Mouat say that the presence of knowledge workers has “wider economic and social benefits across the city fringes and regional centres” [

2] (p. 22).

Of course, the effects of CBs on the urban environment arising from the two approaches described above are deeply intertwined, as the concentration of creative activities is “the result of both material and immaterial transformations” [

42] (p. 63).

Despite coworking being celebrated as a positive urban phenomenon, able to enhance competitiveness, foster innovation and contribute to urban regeneration, some authors have evoked the presence of a “coworking bubble”. Back in 2012, Cashman observed that Spain, despite the economic crisis and the high level of unemployment, exhibited the most pronounced growth of CSs [

17]. According to other authors, the bubble could be explained by both the precariousness of the knowledge workers, “pushed to become freelancers” and “to seek asylum in CS” [

6] (p. 17), and the low profitability of CBs, frequently forced to seek public subsidies [

50]. In the debate on urban regeneration policies, coworking is considered by some authors as a sort of “urban panacea”. From our perspective, coworking is an entrepreneurial activity that could also represent an innovative way to reuse vacant buildings and regenerate urban areas. As we have described, while some authors explored the influence of CSs on the urban environment, their contributions focus more on the effects of creative activities, rather than exploring the preconditions for the appearance of “urban creative concentrations” [

42]. More particularly, in the case of CSs, there is little or no evidence of the role played by internal factors and operational conditions in contributing to the sustainability of the coworking model. To fill this gap, we decided to investigate these aspects, submitting a questionnaire to Italian coworking managers/promoters.

4. Materials and Methods

The purpose of the research into Italian CBs, conducted in early 2017, was to collect data about the ongoing experiences in Italy to understand their conditions of operability, economic sustainability, space uses and organization in different urban contexts.

This research was set up to answer to the questions posed by some entrepreneurs, who are looking at coworking as a possible business to relaunch vacant or underused areas located in the Venice mainland, inside Porto Marghera, a former chemical industrial hub and now one of the biggest Italian brownfields, also included in the Italian National Priority List [

51]. In this context, coworking might offer a possible innovative solution to facilitate an urban regeneration process and the reuse of vacant buildings, as suggested by Ginelli for the Milan case [

52], considering also the track record of successful experiences of reuse and soft regeneration associated with collaborative workspaces and coworking [

40,

53].

Investors are looking at the possibility to start a coworking business in the area, and our work was aimed at responding to their need to evaluate the advantages and disadvantages of the coworking model, looking at ongoing experiences to evaluate the economic viability of coworking, in order to develop different investment scenarios for their area. In order to offer precise indications to local entrepreneurs, given the lack of meaningful data about the Italian operational context of CBs, we investigated the internal and external factors conducive to the growth of such businesses, the importance of entrepreneurial actions and the contractual forms of successful initiatives, setting up a national survey of CBs.

The survey was designed to understand the conditions for the success of a CB. On the one hand, the economic viability and sustainability of a CB is dependent on external factors: its location, the activities and amenities in the surrounding area, the accessibility of the structure. These are all preconditions for the occurrence of “urban creative concentrations” [

42], and hence factors affecting the success and the outcomes of a CB. On the other hand, the viability of a CB is related to internal factors, such as the availability of enough space to meet the demand, the differentiation of the working environment into different ambiances suitable for different purposes, the quality of the services provided, which is then reflected in the physical layout of the space; but also organisational factors, such as the types of contracts offered, the price paid to rent a desk, the flexibility of the opening hours and days, and more generally the atmosphere perceived by the CUs.

Our research aimed to explore some relevant factors of the success of CBs, looking at their location, internal factors and operational conditions.

The research was carried out in three different phases. The first phase was the creation of a coworking census at the national level, and the mapping of Italian CBs, aimed at evaluating the dimensions of the Italian coworking phenomenon and at exploring the location of CBs. CBs were mapped using the results from Google Maps search engine with the keyword “coworking”.

The second phase aimed at understanding the operational conditions of CBs already in business. In this phase, an online questionnaire was sent to Italian coworking managers and providers. The research questions guiding the preparation of the questionnaire were: (1) how important is entrepreneurial action for the success of the CB? (2) Are there any specific distinctive features of successful CBs? (3) What kind of contracts and services do CBs offer to their CUs?

The preparation of the questionnaire was anticipated by two site visits to CSs in Italy, one in Mestre (Venice mainland) and one in Verona. The first location was chosen because it is part of the biggest network of affiliated CBs in Italy; the second location was 311 in Verona, which—as already mentioned in the introduction—represents a relevant case study, considering that it opened in a former industrial building and contributed to the revitalization of the surrounding area. Along with the site visits, we carried out desk research into the websites of coworking providers (both single and affiliated CBs), to understand how they are organised and to provide a taxonomy of the different supplementary rooms and services offered by CBs. The taxonomy was useful to better tailor the questionnaire.

The questionnaire was made up of 37 questions—comprising multiple choice questions, dichotomous questions and semantic differential questions—covering the most important organizational and economical aspects of CBs. The questionnaire was sent by email to the coworking managers of 413 coworking spaces of the 495 that were recorded during the first phase of the research; a total of 82 coworking managers did not provide a valid email address.

We collected 128 complete questionnaires with a response rate of 31%.

CS, the shared working environment, is what characterizes a CB. Therefore, we grouped the respondents according to the rate of occupation of the open space desks. This variable may be a proxy for the economic sustainability and is the principal internal factor and operational condition affecting the viability of CBs. This choice is in line with the survey carried out by Deskmag, an online magazine about coworking, that shows that most of the revenue of a coworking space comes from the rent of open space desks [

54]. Open space desk occupation is directly connected to the economic viability of the CB, as each user pays to rent a desk first and this allows CUs to use the other possible facilities. CBs were grouped in three categories based on the reported rate of occupancy of the offered open space desks during the previous six months. The three categories were: low performance, comprising CBs where the percentage of occupancy was less than 50%; medium performance, with a level of occupancy between 50% and 75%; and high performance, with occupancy of more than 75%. We analysed these three groups of CBs in relation to the other variables that we investigated in the questionnaire, such as the dimensions of their coworking space, the length of their period of activity, the number of open space desks, the types of the contracts offered to users, the profitability and the level of cost associated with each type of contract, the presence of individual office rooms and the level of saturation associated, the possibility to use meeting rooms, the different kinds of services provided, and the opening times.

In the third phase, we focused on the rental expenses for the use of a coworking spaces. As coworking spaces are often regarded as a cheap way for freelancers to rent a work space that they could not otherwise afford in a traditional office, we collected information about the price per square meter of different Italian CSs. Then, we compared them with the data on office spaces rental values provided by the Italian Revenue Agency. The purpose was to test whether Italian CSs are cheaper than traditional offices.

5. Results

The results are presented in three separate sections. In the

Section 1, we provide some insights based on our national census of CSs. In the

Section 2, we present the key findings regarding the questionnaire survey, focusing on the physical arrangement of CSs (i.e., the factors which characterise the layout of a coworking space) and on the organizational and managerial aspects. In the

Section 7 we compare the rent prices of CSs with rent prices of traditional office spaces.

5.1. Mapping Italian Coworking Businesses

The census of Italian CBs registered the presence of 495 CBs. In

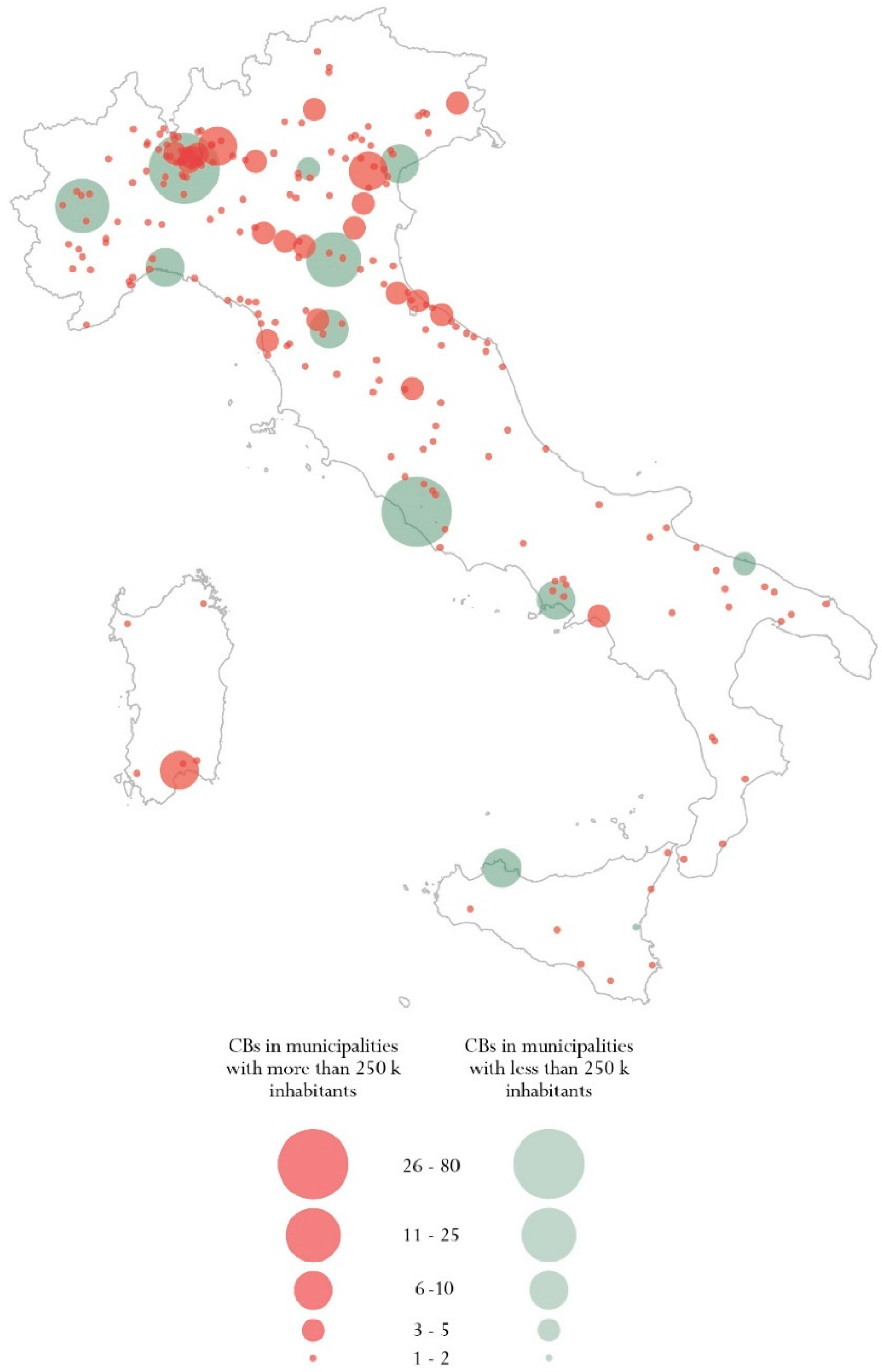

Figure 1, Italian CBs are aggregated by municipality and displayed in relation to the inhabitants of each municipality, distinguishing CBs located in municipalities with more than 250,000 inhabitants. The map shows that CBs are located predominantly in the north of Italy. Despite coworking being a phenomenon generally associated with big cities, Italian CBs are also located in small cities and towns. In fact, cities with more than 250,000 inhabitants account for the 37% of the mapped CBs, while the 46% are situated in municipalities with less than 100,000 inhabitants. The biggest concentration of CBs is in Milan and its metropolitan area, accounting for the 20% of total Italian CBs.

5.2. Results of the National Survey on Coworking Businesses

The indicator according to which we chose to evaluate the performance of CBs was the occupancy rate of open space desks. Based on this variable, we grouped the CBs into three performance categories. This resulted in 76 CBs associated with low performance, 24 with medium performance, and 28 with high performance (see the percentages in

Figure 2).

These results were then cross-referenced with the information regarding the other variables investigated, highlighting some differences between high performance, medium performance and low performance CBs.

5.2.1. Longevity and Dimension

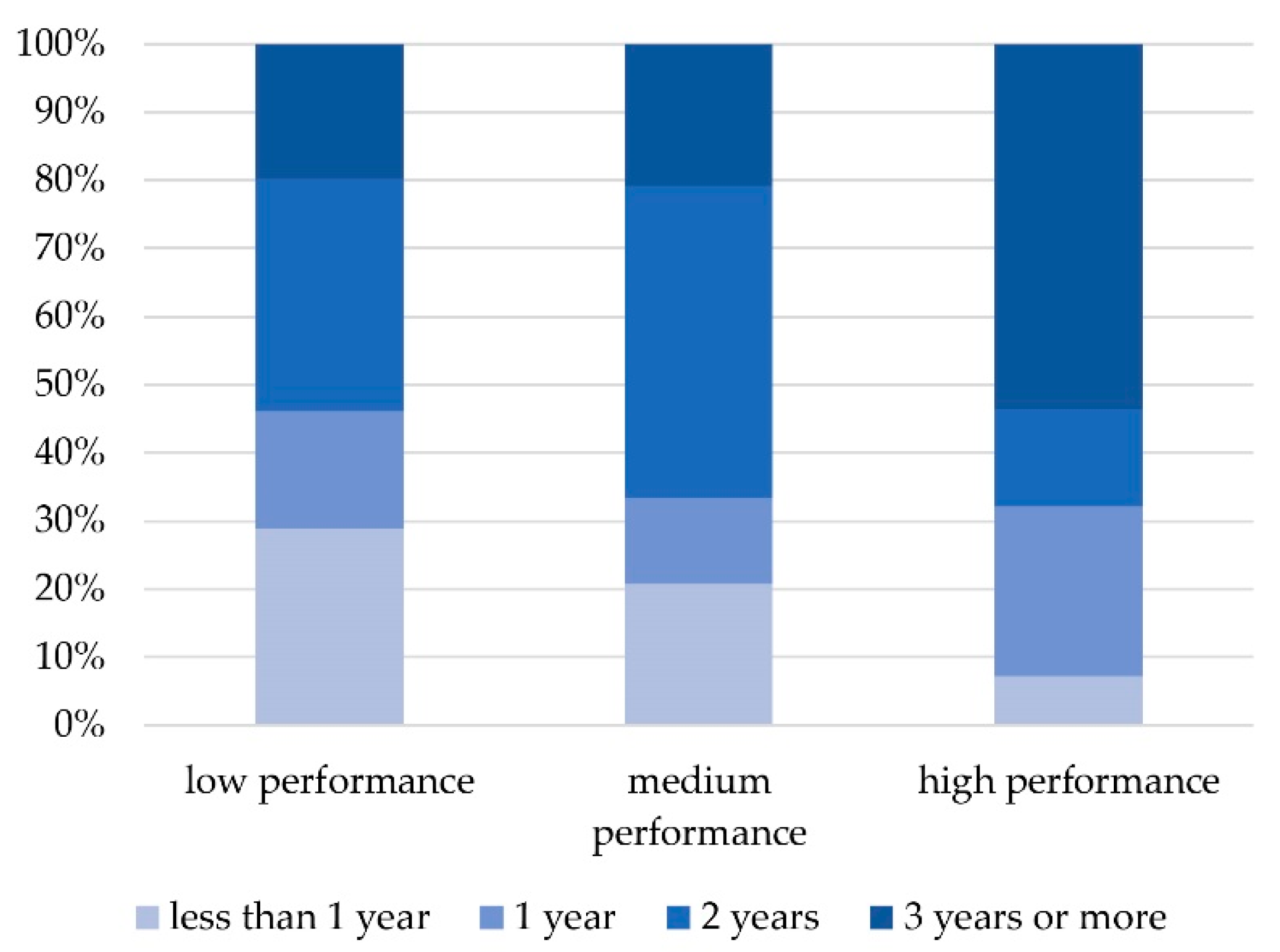

The first variable we investigated was the timespan the CB had been in activity. As shown in

Figure 3, a significantly wider share of high-performance CBs had been in business for three years or more than the low-performance CBs. The low-performance CBs were characterised by a shorter time-span of activity than high-performance CBs. The data showed that the share of CBs that opened less than one year before the survey was 28% for low-performance CBs and 7% for high-performance CBs.

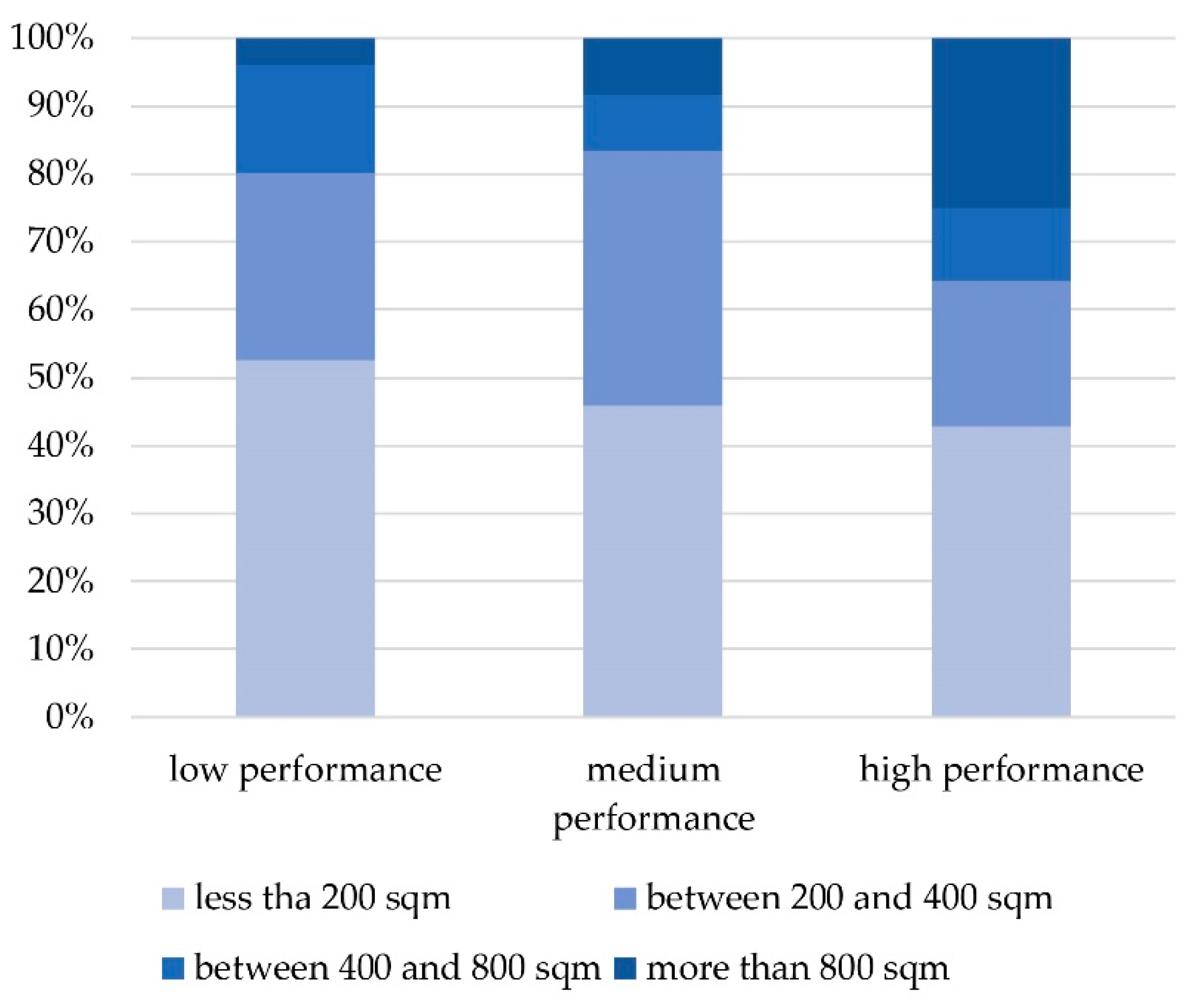

The second aspect we considered in relation to performance was the dimension of the CS provided in each CB. As summarized in

Figure 4, a considerable share of high-performance CBs are characterised by a large CS: one in four high-performance CBs is bigger than 800 sqm, while only 4% of low-performance CBs are bigger than 800 sqm. Beside this, it is worth noting that almost half of the Italian CBs (49%) were found to be small.

As shown in

Table 1, the average floor space occupied by open space desks also reflected this difference, even considering the trimmed mean and discarding outlier values, which resulted mainly from the presence of very large CSs affecting the average values. The standard deviation of the dimensions of the CS of high-performance CBs was also higher than that of the medium-performance CBs and low-performance CBs, underlining the fact that the floor space occupied by open space desks in high-performance CBs is also more variable.

According to the results for the dimension of the CSs, high-performance CBs turned out to have on average a higher number of open space desks (see

Table 2).

5.2.2. Flexibility and Profitability of Contracts

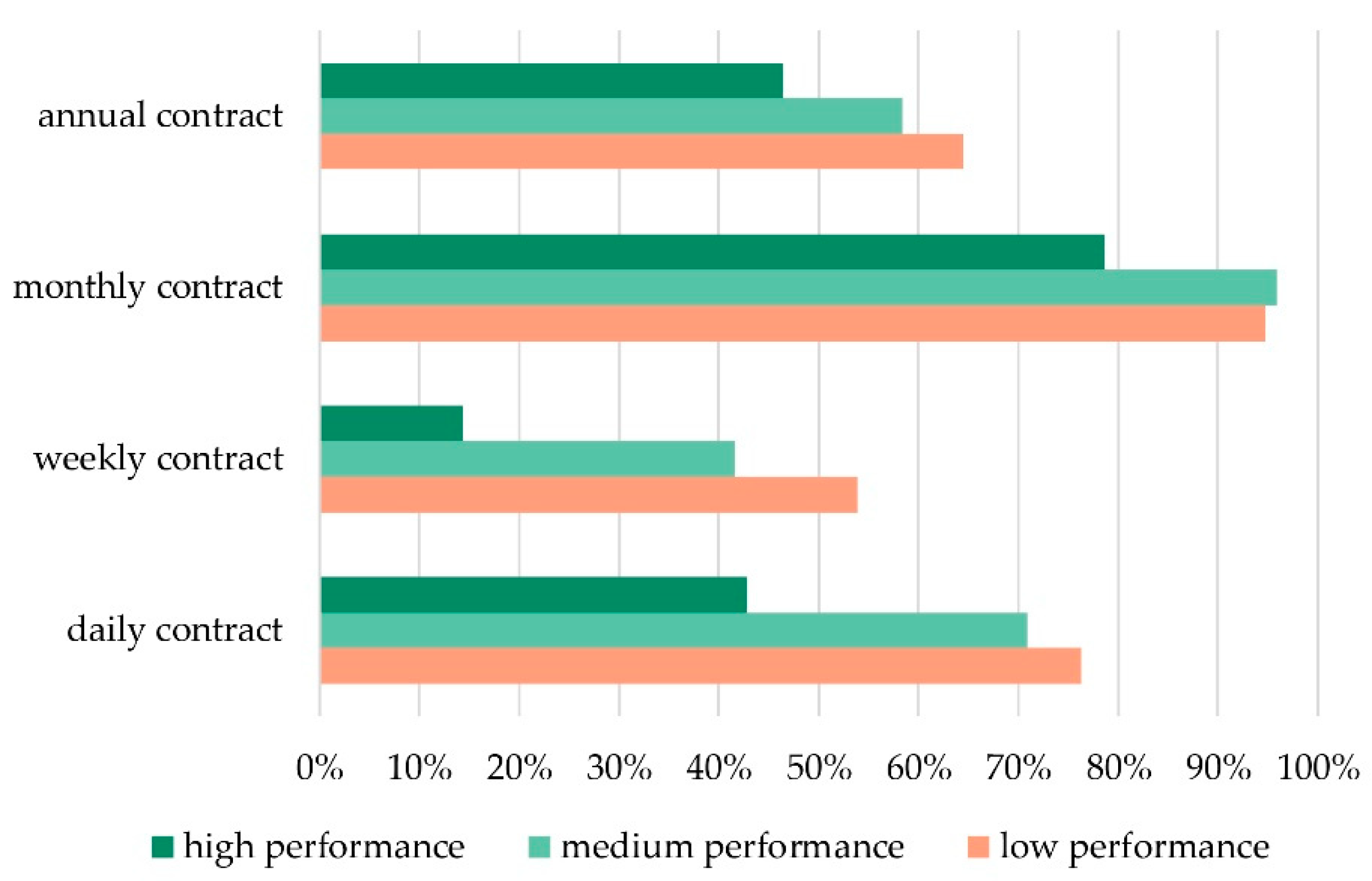

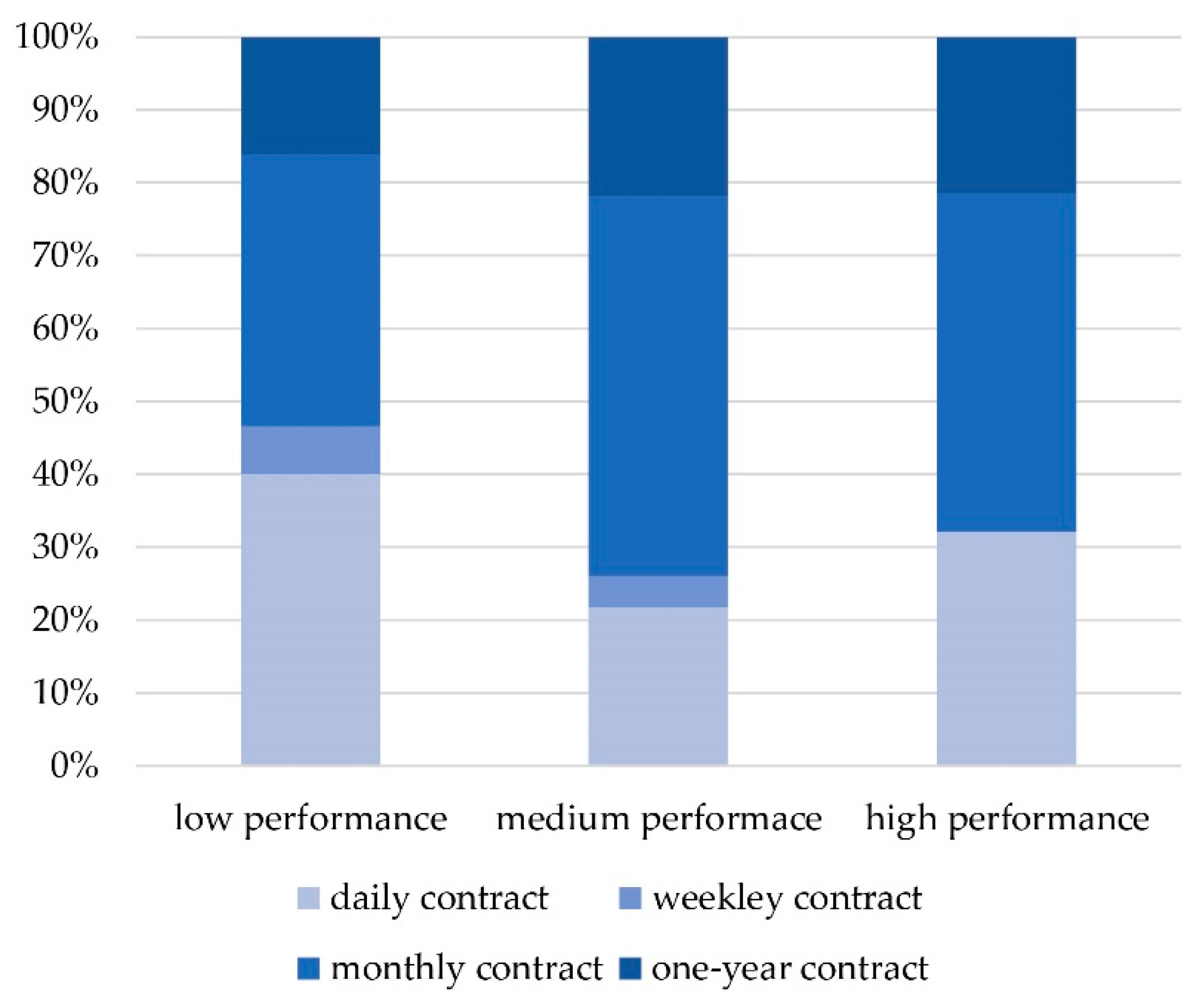

A third aspect investigated was the flexibility of the contracts offered to the users of the open space, represented by the different types of contracts (daily, weekly, monthly or annual) offered by each CB. As shown in

Figure 5, the share of high-performance CBs offering four kinds of contract was substantially lower than the contracts offered by low-performance CBs: more than a half of the CBs turned out to offer only one kind of contract. Regarding the types of contracts offered (see

Figure 6), the main differences between high-performance and low-performance CBs was the proportion of CBs offering daily contracts and weekly contracts, while the difference in proportion offering monthly contracts and annual contracts was much smaller.

We investigated the profitability associated with the renting contracts. It was measured by asking coworking managers to indicate a percentage range of profit associated with each type of contract in the previous six months.

The profitability of daily contracts was generally low, and only a few low-performance CBs presented a high share of profitability (

Figure 7).

Weekly contracts turned out to be the worst contract in terms of profitability for every performance category. Also, 30% of low-performance CBs and up to the 57% of high-performance CBs did not even offer weekly contracts.

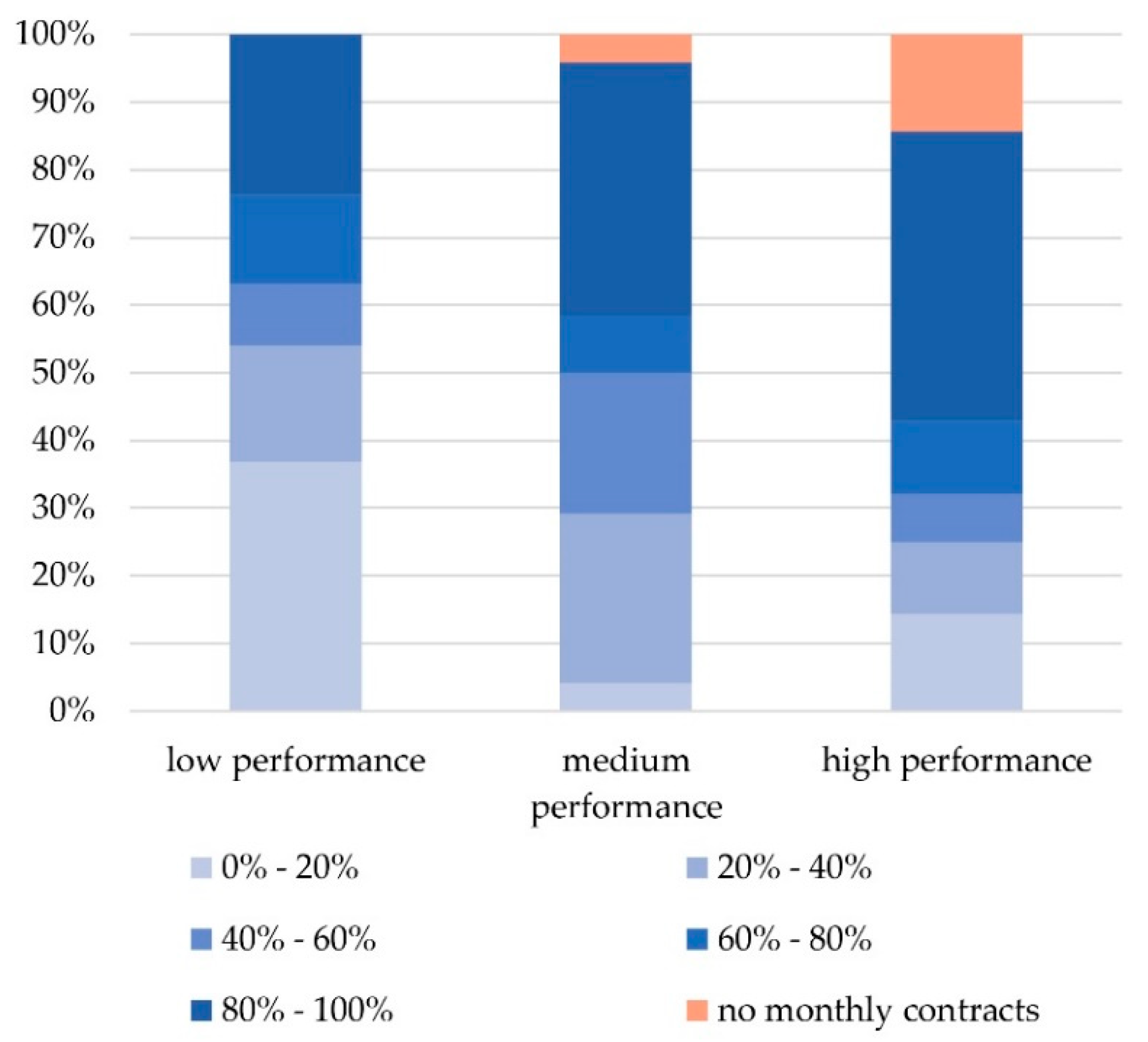

Monthly contracts (

Figure 8) was the most profitable in each category of CBs. High profitability (80–100%) was obviously more frequent for high-performance and medium-performance CBs. In coherence with this data, a low level of profitability (0–20%) appeared more recurrently for low-performance CBs.

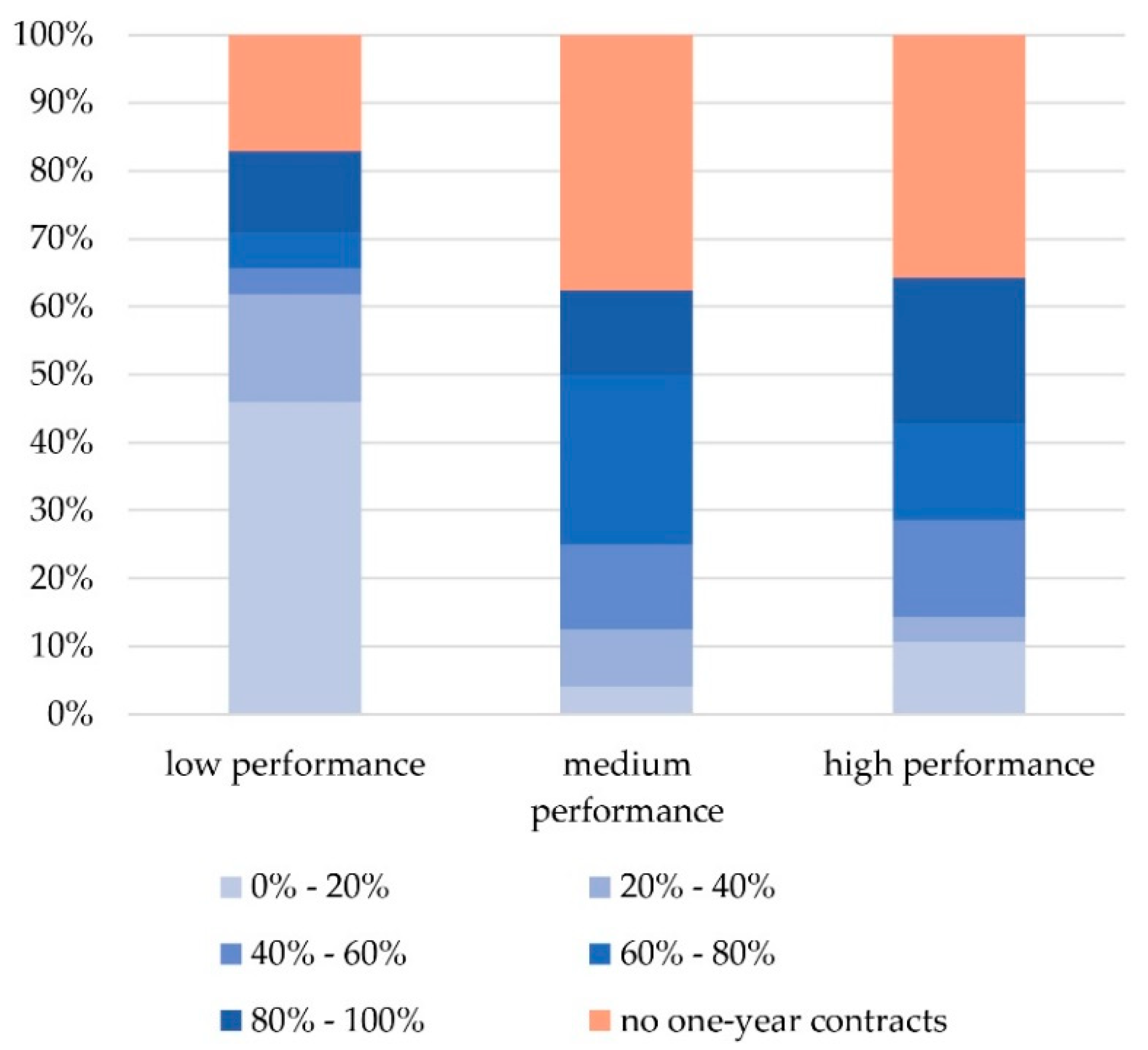

The situation with regard to annual contracts (see

Figure 9) was similar.

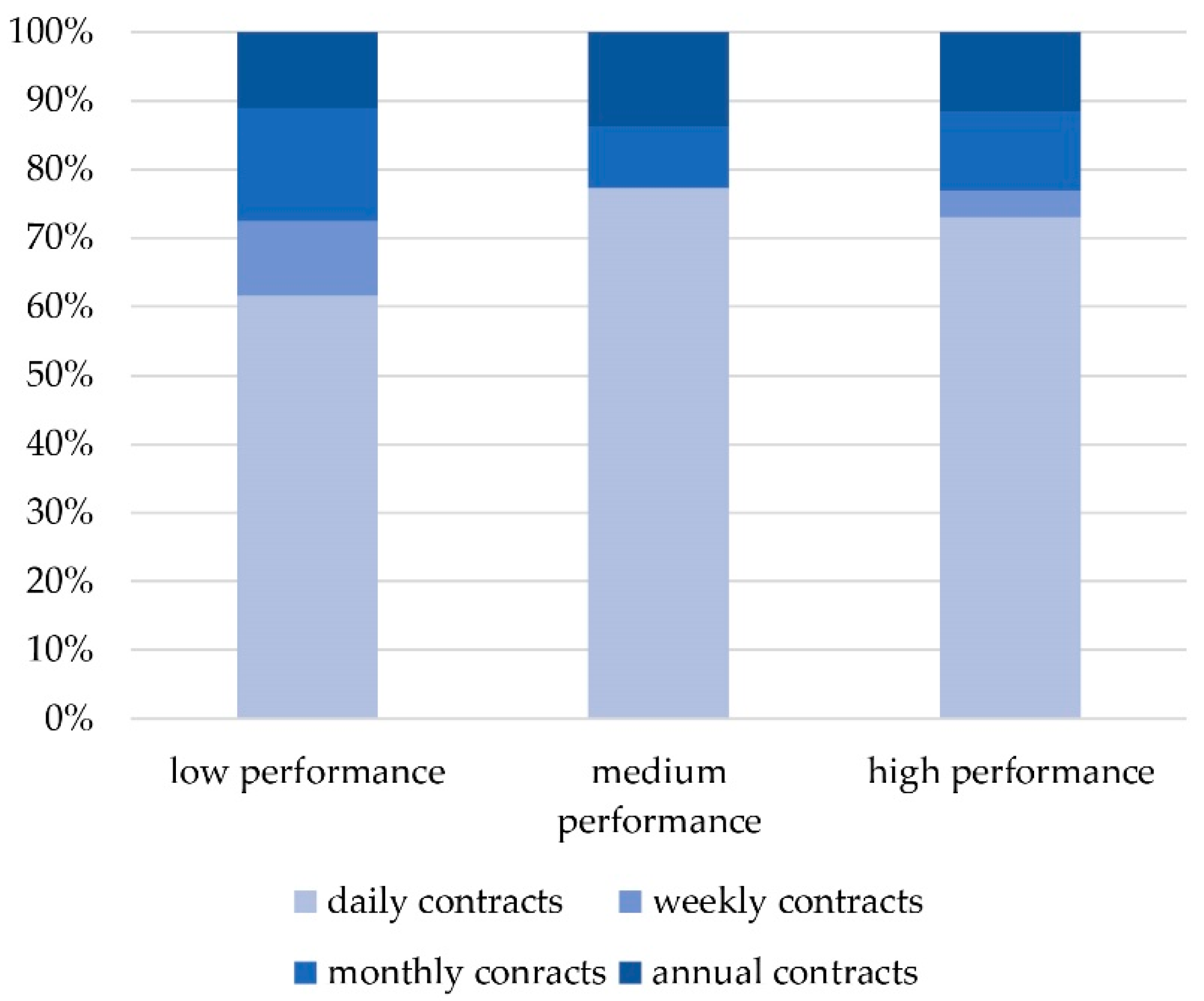

We then asked coworking managers which kind of contract is the most profitable. Monthly contracts turned out to be the most profitable for medium-performance and high-performance CBs, followed by daily contracts. For low performance CBs, daily contracts were reported to be the most profitable (

Figure 10).

In terms of administrative costs, some contracts were costlier than others. The respondents reported that the costliest contract is the daily contract (see

Figure 11), and this was found to be a common result in all three performance categories.

5.2.3. Occupancy and Services Provided

As discovered during the visit to CSs and using the information found on coworking providers’ websites, a common feature of CBs is the presence of individual office spaces.

This trend was confirmed by the data collected during the survey, as 69% of the respondents declared that their CSs were equipped with individual office spaces.

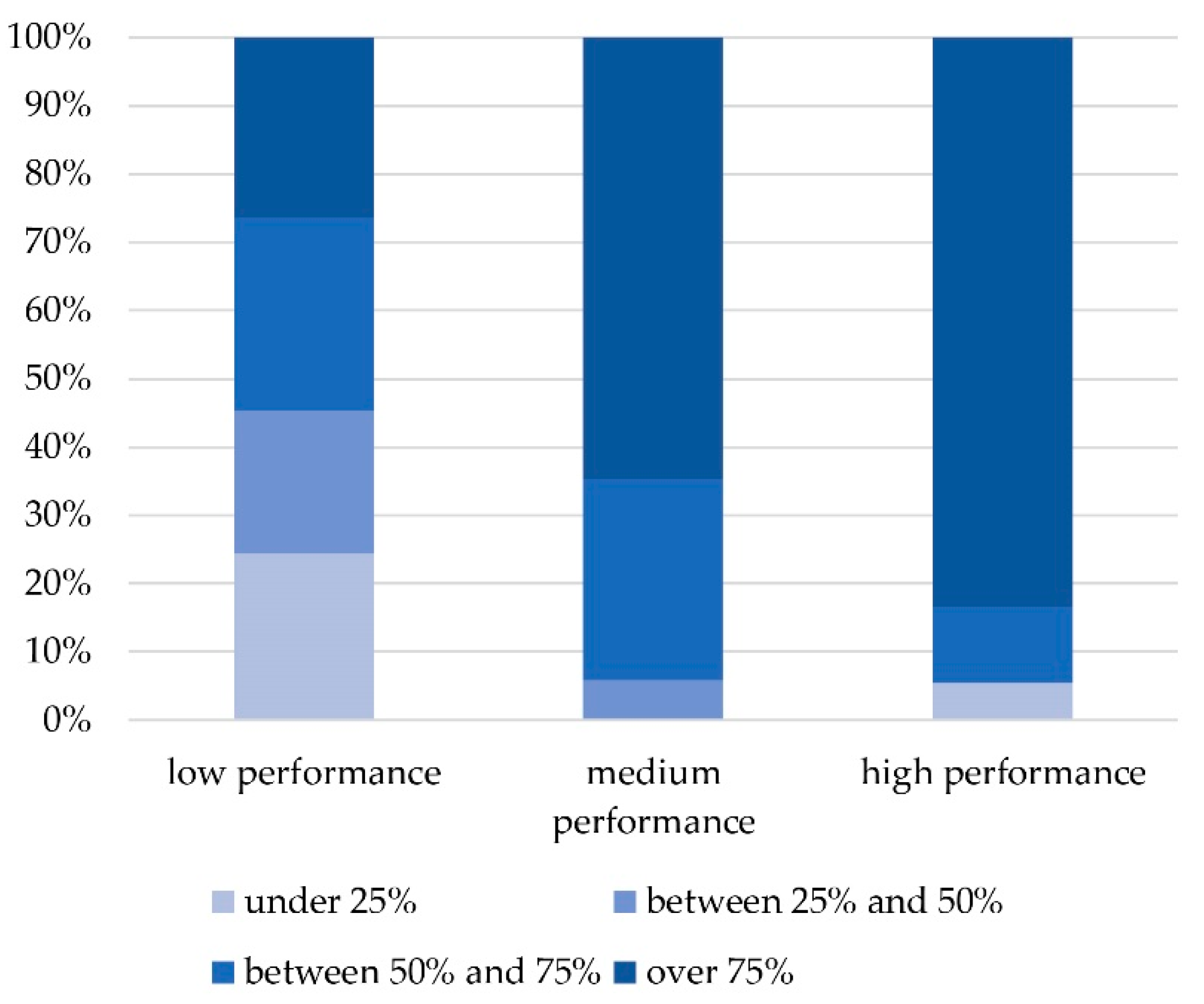

By comparing the occupancy of individual office spaces in the six months immediately prior to the survey (see

Figure 12), high-performance CBs were found to have a better level of occupancy, followed by medium-performance CBs, while low-performance CBs showed significantly lower percentages of occupancy.

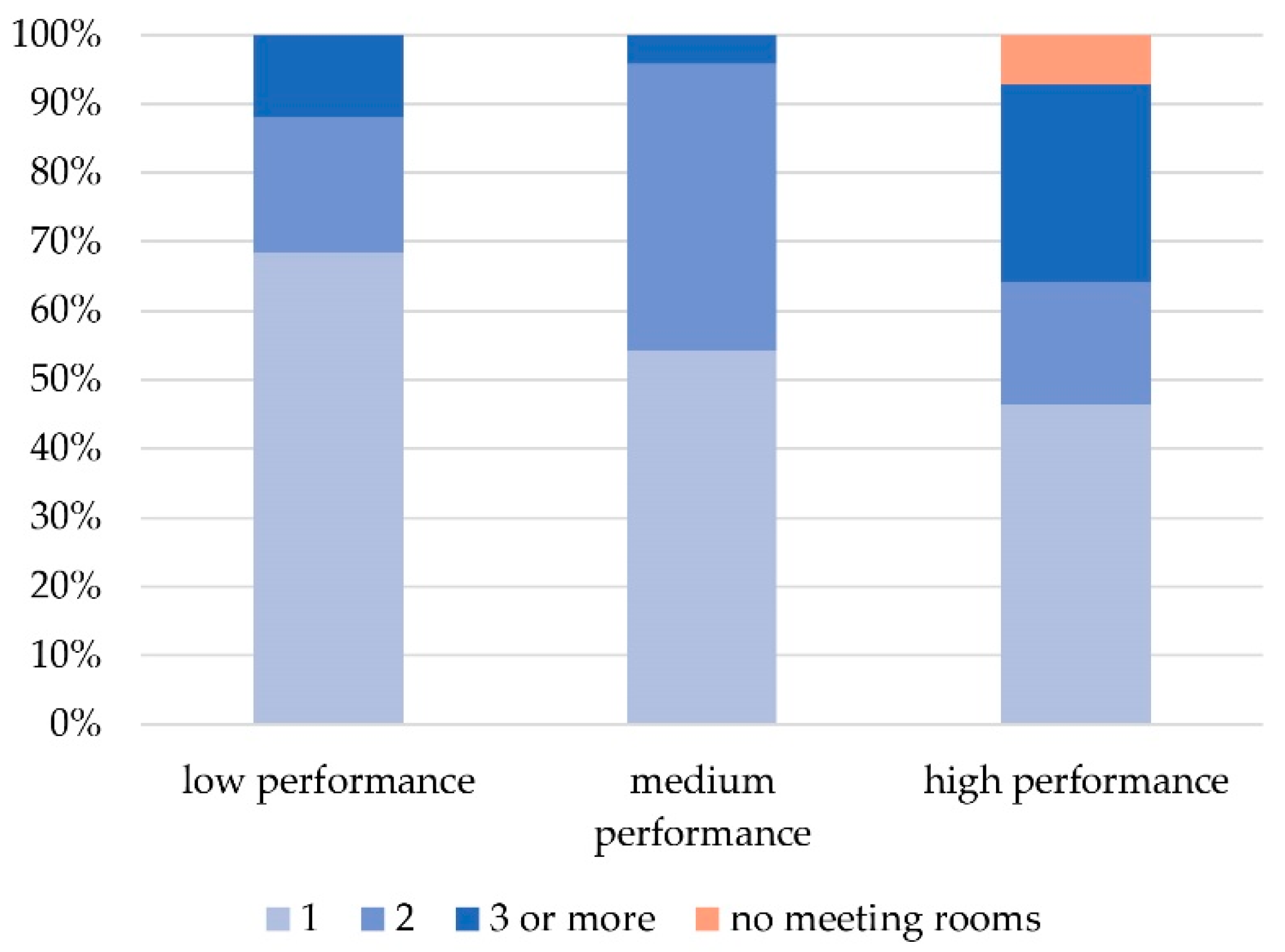

The presence of meeting rooms is another key element of CSs. High-performance CBs were found to have the highest number of meeting rooms (

Figure 13). In fact, 29% of high-performance CB managers reported that their space is equipped with three or more meeting rooms, while only 12% of low-performance CBs arranged their spaces in the same way, as most of them were generally equipped with only one meeting room.

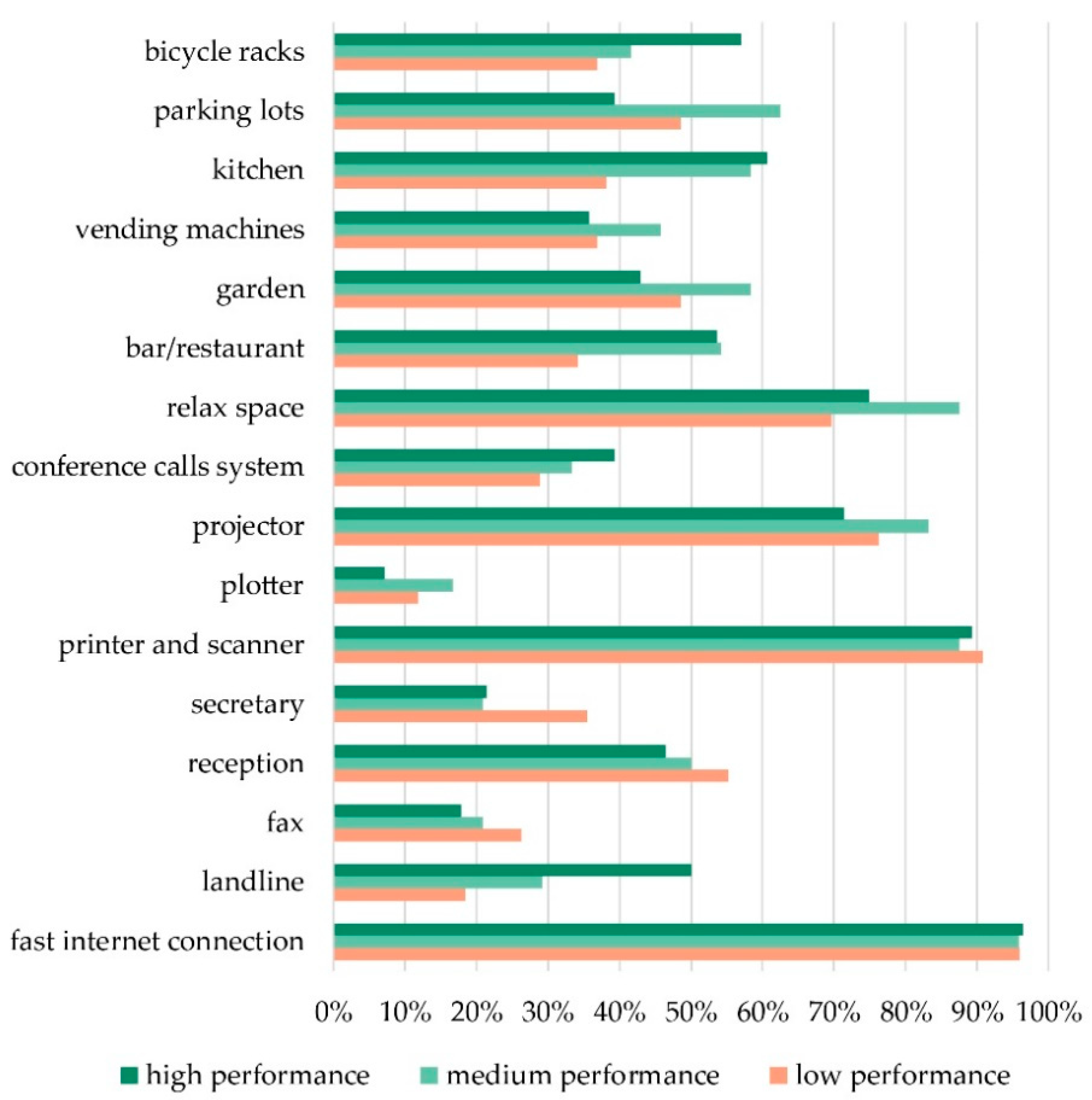

Some services, such as a fast internet connection and printers were found to be provided by almost every CB (

Figure 14). For other services the analysis highlighted some differences between high-performance, medium-performance and low-performance CBs: the presence of a bar/restaurant and a kitchen could be observed more in high-performance and medium-performance CBs; the presence of a relaxation space, parking lots, a garden and vending machines was more frequent in medium-performance CBs; bicycle racks and landlines were services offered more commonly by high-performance CBs.

5.2.4. Timetable

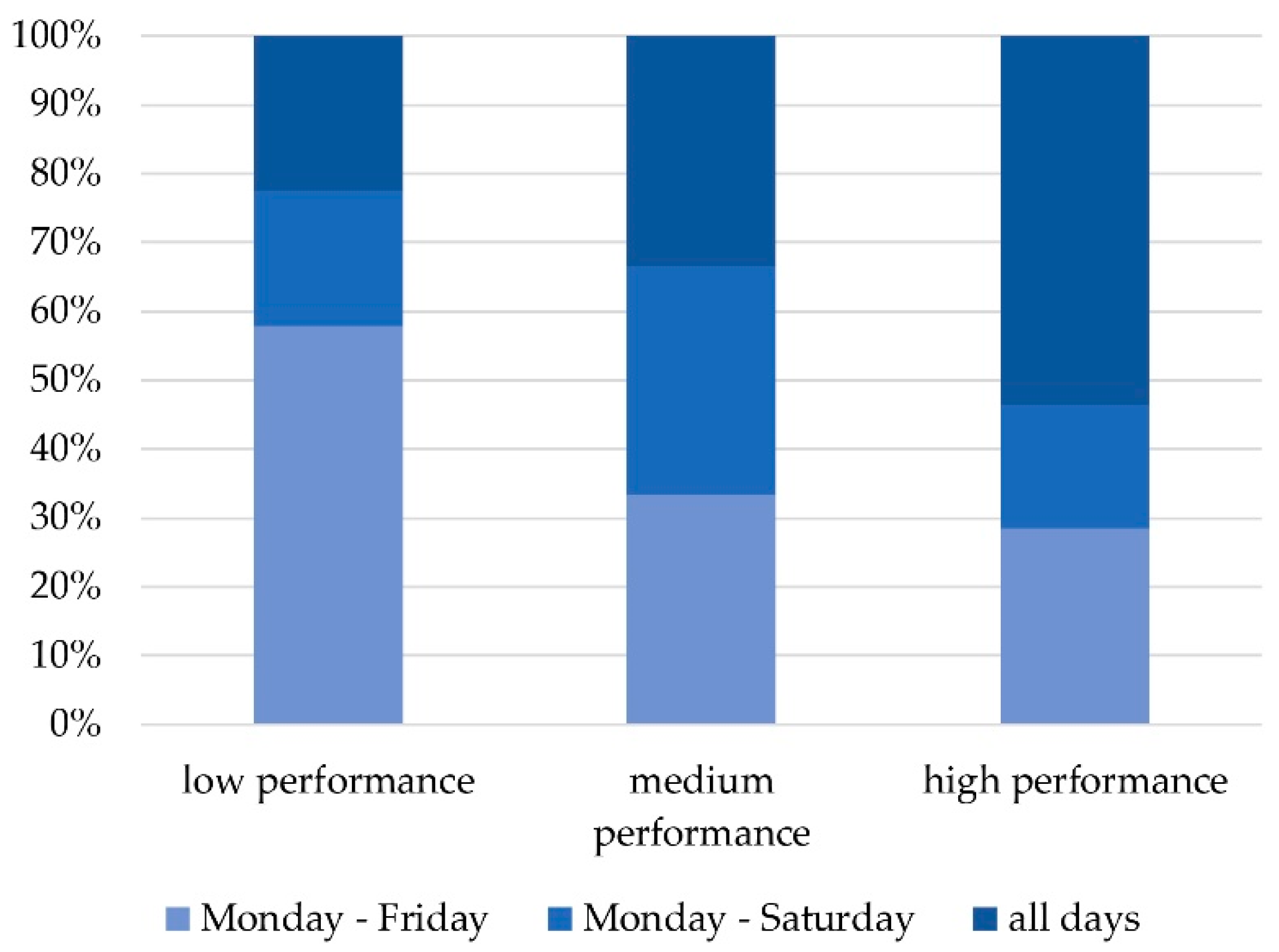

The coworking managers were asked to indicate the opening hours and days of their CSs.

A significant number of high-performance CBs reported being open every day, while low-performance CBs tend to offer fewer opening days (

Figure 15). The same situation was observed for the opening hours (

Figure 16).

5.3. Comparison of Coworking and Traditional Office Rent Prices

We now turn to the comparison of rental prices between traditional offices and coworking spaces, since in the literature the success and the diffusion of these new types of workplaces is related not only to better services, but also to their being a cheaper alternative to the traditional office. By looking at some of the coworking providers’ websites, we collected data on the open space surface and the relative monthly fees, considering the minimum monthly fee for renting a desk in an open space. Using this information, we then calculated the price per square meter, and we compared this value to that for traditional offices in the same area. The monthly rental price per square meter for offices can be found at the Italian Revenue Agency (Agenzia delle Entrate) webGIS, offering minimum and maximum prices for different areas [

55]. We used the latest data available (year 2016, I semester), considering the mean between the maximum and minimum values. Other related useful information pertained to the quality of available spaces, as in some areas there are different prices according to the state of maintenance of the office spaces.

Figure 17 below shows that the price per square meter of CSs were much higher than those associated with traditional offices in every location we considered.

6. Discussion

In this paragraph, we discuss the results of the national survey, and we compare them with data from a selection of surveys and forecasts conducted by Deskmag. These are global surveys aimed at exploring the general trends of coworking worldwide, and the only studies on coworking also providing some data about the organization of CSs and the profitability of CBs, which are useful for coworking promoters starting a new business or that are already in business.

In line with the survey carried out by Deskmag in 2012 [

27], which registered a relevant increase in CBs located in rural areas, our mapping of Italian CBs shows that there is a significant share of CBs located outside big municipalities, even though coworking maintains its urban character in large “hotspot” cities, as suggested by Moriset [

6]. The spread of CBs to many small municipalities or medium-sized towns reflects the distribution of the population in Italy, where only few municipalities have more than 250,000 inhabitants [

56]. Agglomerations at different scales, among smaller municipalities, around medium-sized cities and in large urban areas create opportunities for creative activities in many different locations, and the territorial distribution and concentration of CBs reflect those opportunities.

The main result of our survey is that the success of any CB, in terms of the intensity of occupancy of the provided desks, which is directly related to the profitability of the CB, is highly dependent on internal factors. These are physical factors: the high level of occupation of open space desks that characterises high-performance CBs is associated with the dimensions of the CS, showing that large CSs are the most attractive. This result is also in line with the latest coworking forecast provided by Deskmag [

30], which shows that CSs are becoming bigger, and the increasing size is associated with higher profitability, as also reported in a previous survey by Deskmag [

27]. High-performance CBs also show a higher level of occupancy of individual offices. The presence of these spaces, according to Deskmag’s latest survey [

29], is one of the new elements in a CS, as CBs are expected to show a higher share of individual offices [

30]. In our survey, CBs with a medium and high level of performance are those offering more services to coworking users. The factors contributing to the attractiveness of CSs are also organisational: the success of any CB appears to be related to the opening times and to the variety of contractual forms. High-performance CBs offer a lower number of contractual forms, mainly monthly and annual contracts, lowering the turnover of CUs and consequently increasing the intensity of use in time. Of course, these contracts are more profitable exactly because they guarantee a higher occupancy rate, leading to a selection of coworking members through time.

The second important result of the survey is to show the role of coworking managers and coworking promoters, confirming the relevance of strategic choices and investments, which might be related to the mission of the proprietors of CSs, and to the interaction with proactive users. As observed by the investigation of Spinuzzi [

26], CBs differentiate themselves from the others by arranging the CS in different ways, according to their location, design, flexibility and professionalism. These differentiators are highly reliant on the choices of the coworking managers “who structure, design, furnish, and run their sites based on their understanding and model of coworking” [

26] (p. 418). According to Parrino, the choice of coworking manager could also facilitate the exchange of knowledge between CUs, by providing online platforms, networking events and coaching [

57].

Another important factor affecting the success of a CB turned out to be its longevity, as high-performance CBs turned out to have been in the business for three or more years. Again, this finding confirms the results of Deskmag’s second global survey, which showed that “72% of all coworking spaces become profitable after more than two years in operation” [

54]. The rationale of this finding could be that, provided the high risks distinctive of this type of business, the fact that highly-skilled digital workers and new enterprises require innovative services and solutions, and the scarcity of financial capital associated with these activities, the oldest cohort of CBs are the most effective and the most able to overcome risk and obstacles to their successful operation.

A third result pertains to the comparison of the price paid in traditional and CB spaces: although coworking is often considered a cheap alternative to traditional offices, our data show that CUs spend more to rent a desk in a CS. This result indicates that CUs might prefer to pay for the “liquidity” of their choices and short-term perspectives in their own personal business. They are willing to pay more to have flexibility, to have more services, and to have fewer constraints, especially avoiding the length of office lease agreements, which according to Italian law last for at least six years.

7. Conclusions

Coworking is considered by many authors to be an activity falling under the umbrella of the sharing economy. It is characterized by the tendency of highly-skilled workers to physically gather in some locations to take advantage of proximity and knowledge exchange, a process facilitated by digital platforms. In this way, coworking involves sharing both physical assets (office, common spaces) and intangible assets (knowledge, skills). Coworking is also generally regarded as a positive urban phenomenon, fuelling regeneration processes and enhancing competitiveness, even if some authors evoke the presence of a “coworking bubble”.

Following the interest of some local entrepreneurs in the coworking model as a possible innovative way to relaunch their vacant properties located in the former industrial site of Porto Marghera (Venice, Italy), our study investigated coworking as an entrepreneurial activity, which opens up the possibility to offer new market opportunities enabled by digitization and urban regeneration. We claimed that the lack of data on the dimensions of the coworking phenomenon in Italy, on the one hand, and about the organizational and economic aspects of CBs on the other hand, made any generalization about the sustainability of coworking untenable. Sharing the concerns regarding a “coworking bubble” and of the low sustainability of CBs, we decided to investigate the economic viability of Italian CBs, looking at the role of internal factors and exploring how those factors can contribute to the sustainability of the coworking model. In fact, although in the last few years a lot of literature has been produced around the concept of coworking, the factors contributing to the success of CBs seem to be overlooked. This is why we collected data on various determinants, physical and intangible, that might enhance the success and the viability of coworking as an innovative model of regeneration, creating value for decaying properties and vacant buildings.

A national survey was carried out in three phases: firstly, we conducted a national census of Italian CBs, mapping the results at the municipal scale; then we submitted an online questionnaire to coworking managers and providers, investigating the arrangement of the space, the services provided and their profitability; finally, we compared the rent prices of CSs and traditional offices, to understand whether the preferences of CUs are related to the greater affordability of CSs.

The major contribution of our work is that we recognized that coworking is an entrepreneurial activity, emerging to answer to the needs of highly-skilled workers and new kinds of enterprises, such as start-ups. These new enterprises are different from traditional enterprises as they are characterised by high level human capital and scarce financial resources, and thus they need different kinds of services. We found that CUs are willing to pay more to get access to CSs precisely because of the opportunities and services inside CSs. These opportunities are the result of the entrepreneurial action of coworking promoters, in their attempt to respond to the necessities of flexible jobs.

The other contribution of this paper is the proposal of a rough ranking of efficiency in Italian coworking initiatives. Based on our findings, the largest businesses, by practicing simpler contractual schemes, reach higher utilization and, after a few years of operation, better financial performance. The role of the coworking manager is emphasized and it is strictly related to the success of the CB: the entrepreneurial ability of coworking promoters in attracting CUs and in making the right investment choices is the enabling condition for CBs to become viable, strengthening the affiliation between CUs and the CB, and sustaining a working community. Following Richardson [

20], we consider coworking as being characterised by a series of performances—the enactment of a community, the access to common resources and the collaboration between participants—and we believe that the occurrence of these performances is deeply affected by the choices of coworking managers.

We suggest that further research should look at the characteristics of CUs, to investigate whether the success of CBs is also related to the typology, structure and operating conditions of start-ups or other businesses using their CS. In fact, CUs might differ not only in the type of business they are undertaking, but they could also have access to different financial resources, changing the way they are building their business and thus also the services they expect to find inside a CS. Therefore, it would be interesting to set up a survey of CUs, and to match the results to those from the survey of CBs.

The alleged presence of a “coworking bubble” and the fact that CBs were found to be often unprofitable [

54] or to rely on public subsidies [

50], suggests a move away from the emphasis on the creative class acting as an “urban panacea” for urban regeneration and competitiveness. Instead, we shed light on the role of the “coworking entrepreneur”, whose choices create the operational conditions for the economic viability of CBs and the attractiveness of CSs, consequently producing some positive urban effects. In fact, coworking can produce a positive effect on the urban environment and for the people involved only if they become more stable forms of work organization in the city, lasting in time and surviving as business activities capable of interacting with the socio-economic urban fabric. At a broader scale, the emerging forms of sharing activities and collaborative workplaces are leading to a “spatial reconfiguration of jobs in cities” [

58], creating new networks of microbusinesses that are replacing the traditional industrial clusters and in which coworking spaces are acting as physical platforms [

18]. It is also changing “the way cities generate jobs through entrepreneurship” [

59], and in this sense the “coworking entrepreneur” should be regarded as an urban innovator, whose choices are capable of producing urban concentrations of creative activity and consequently shape the urban and socio-economic fabric of our cities.