Global Supply of Secondary Lithium from Lithium-Ion Battery Recycling

Abstract

1. Introduction

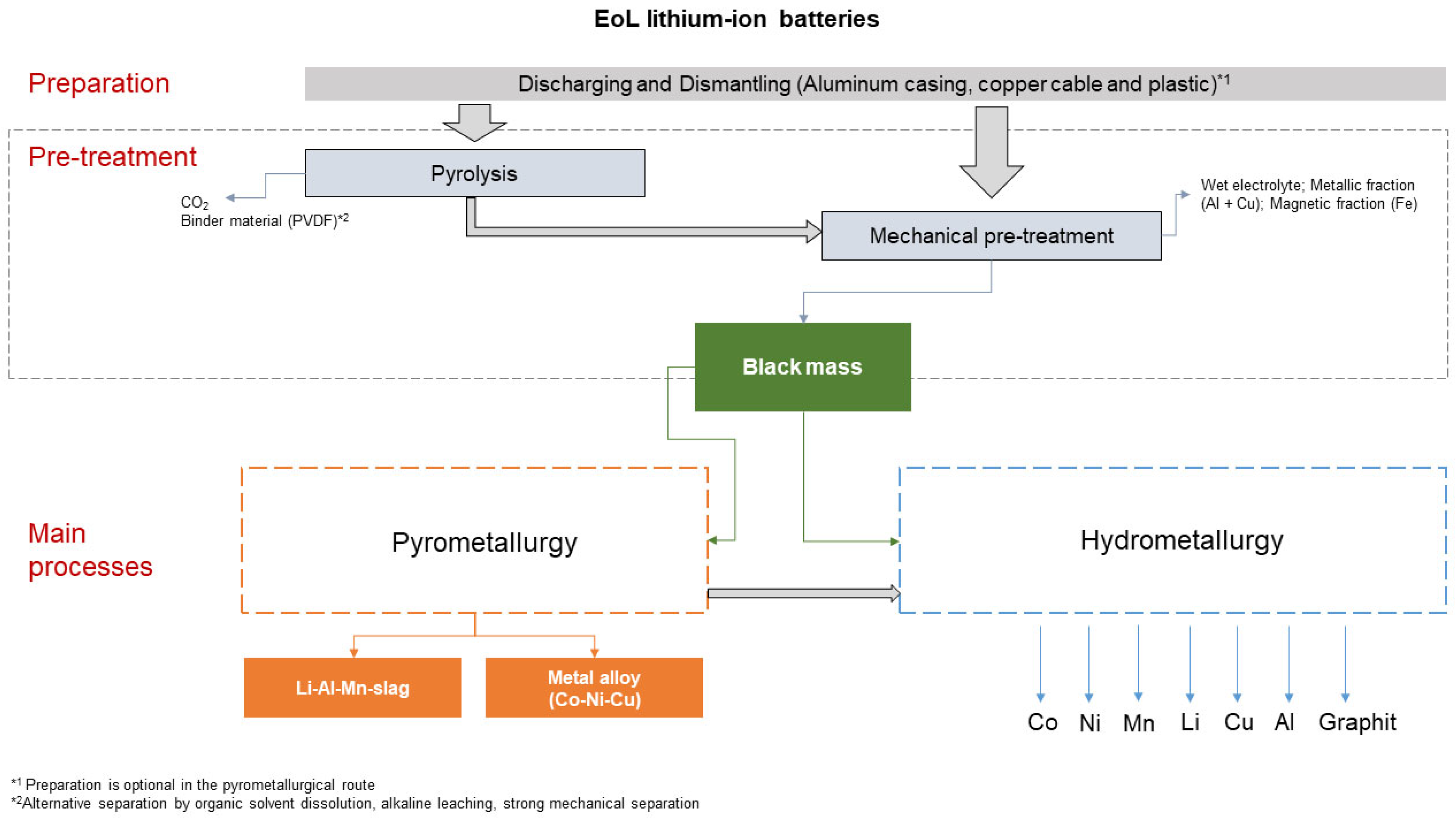

2. Current Recycling Routes

- Preparation: sorting, disassembly, discharging (optional)

- Thermal and/or mechanical pre-treatment (optional)

- Main processes: pyro- and/or hydrometallurgy; direct recycling

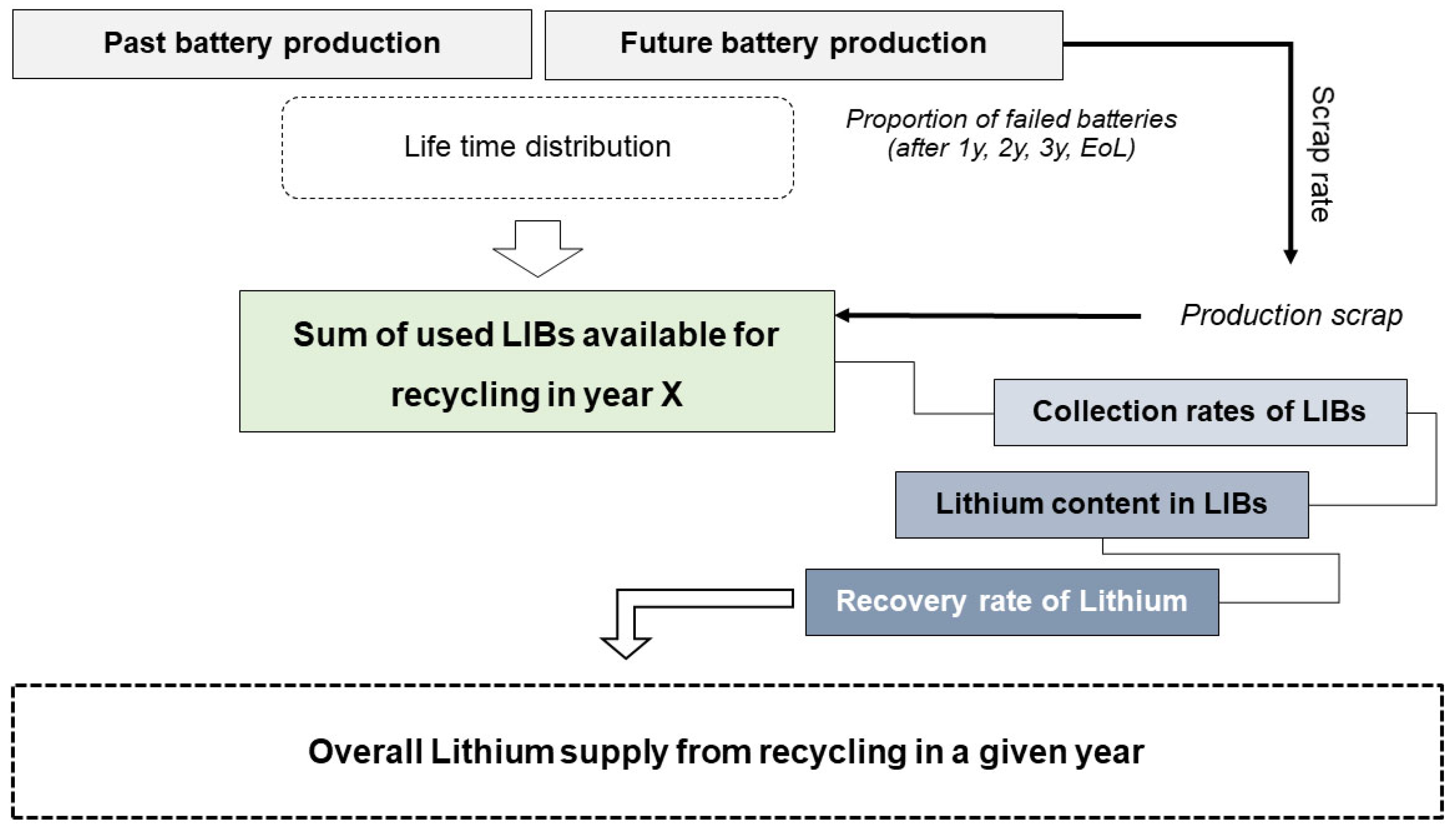

3. Materials and Methods

3.1. General Approach

3.2. Past and Future Battery Production

| Data Source | 2016 | 2020 | 2022 | 2023 | 2025 | 2027 | 2029 | 2030 | 2035 | 2040 | 2050 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Rho Motion (EVs) [31] | - | 154 | 473 | 698 | 1132 | 1601 | 2236 | 2651 | 4568 | 6786 | - |

| S. Moores [30] | - | 501 | - | - | 2492 | - | - | 3010 | - | 3900 | 5000 |

| Benchmark Minerals [8] | - | 501 | - | - | 2492 | - | - | 6700 (NET Zero Pathway) | 11,800 (NET Zero Pathway) | 20,000 (Net Zero Pathway) | |

| S&P Global Mobility (EVs) [32,33] | - | 455 | 966 | 1246 | 2800 | - | - | 5900 | - | - | - |

| Avicenne Energy [29] | 94 | 232 | 350 | - | 609 | - | - | 1300 | - | - | - |

| IEA, Global EV Outlook (EVs) [34] | - | - | - | 1500 | - | - | - | 5500 | - | 6500 | - |

| Öko Institut (B2DS Szenario-“Unter 2 Grad Szenario”) (EVs) [28] | >100 | - | - | - | - | - | - | 1500 | - | - | 6600 |

| Circular Energy Storage [7] | 120 | 265 | 588 | 721 | 1059 | 1558 | 2333 | 2900 | - | - | - |

3.3. Lithium Contents in Batteries

3.4. Battery Lifetimes

3.5. Production Scrap Rate

3.6. Collection Rates

3.7. Recovery Rate

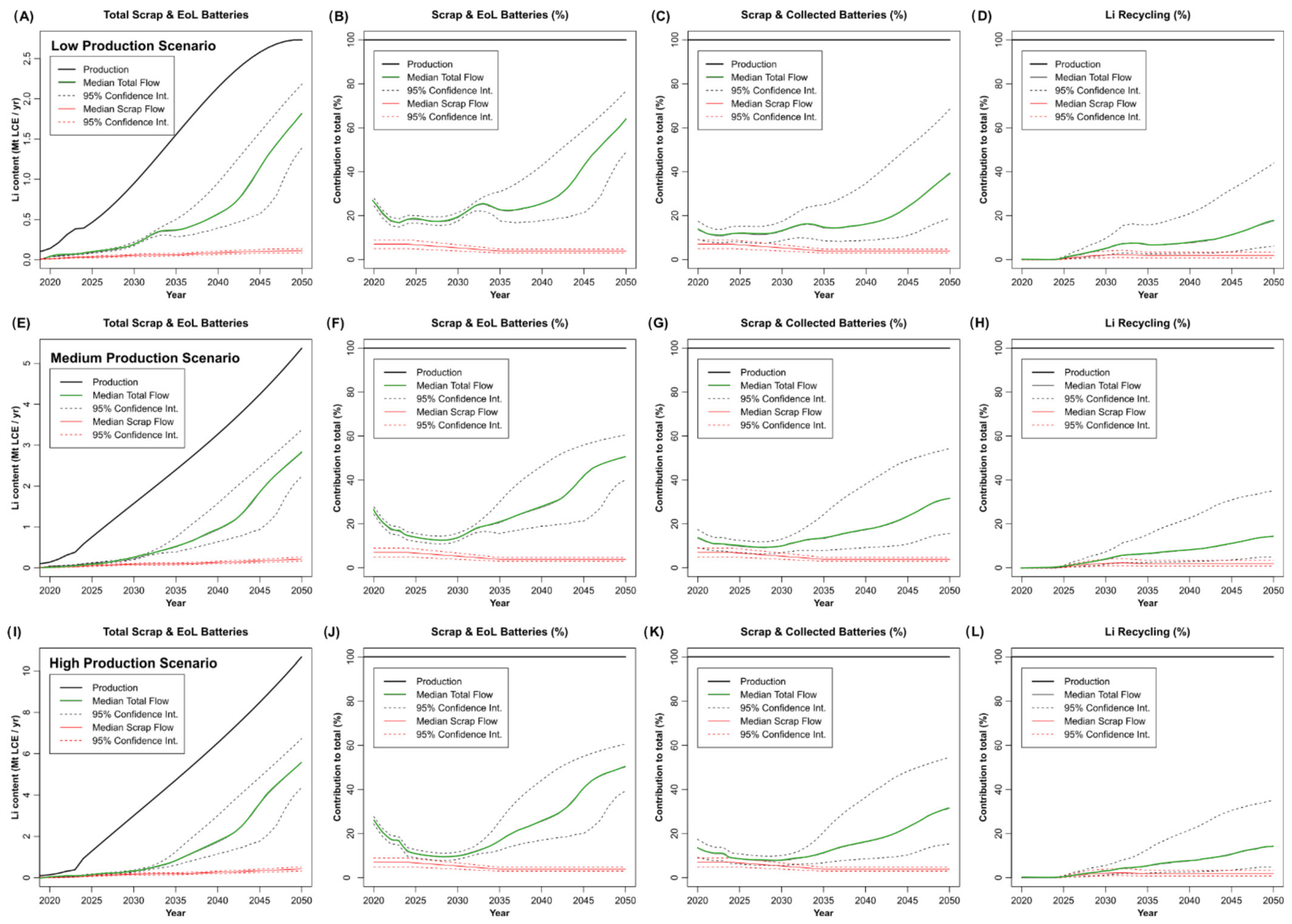

4. Global Results

4.1. Low Production Scenario

4.2. Medium Production Scenario

4.3. High Production Scenario

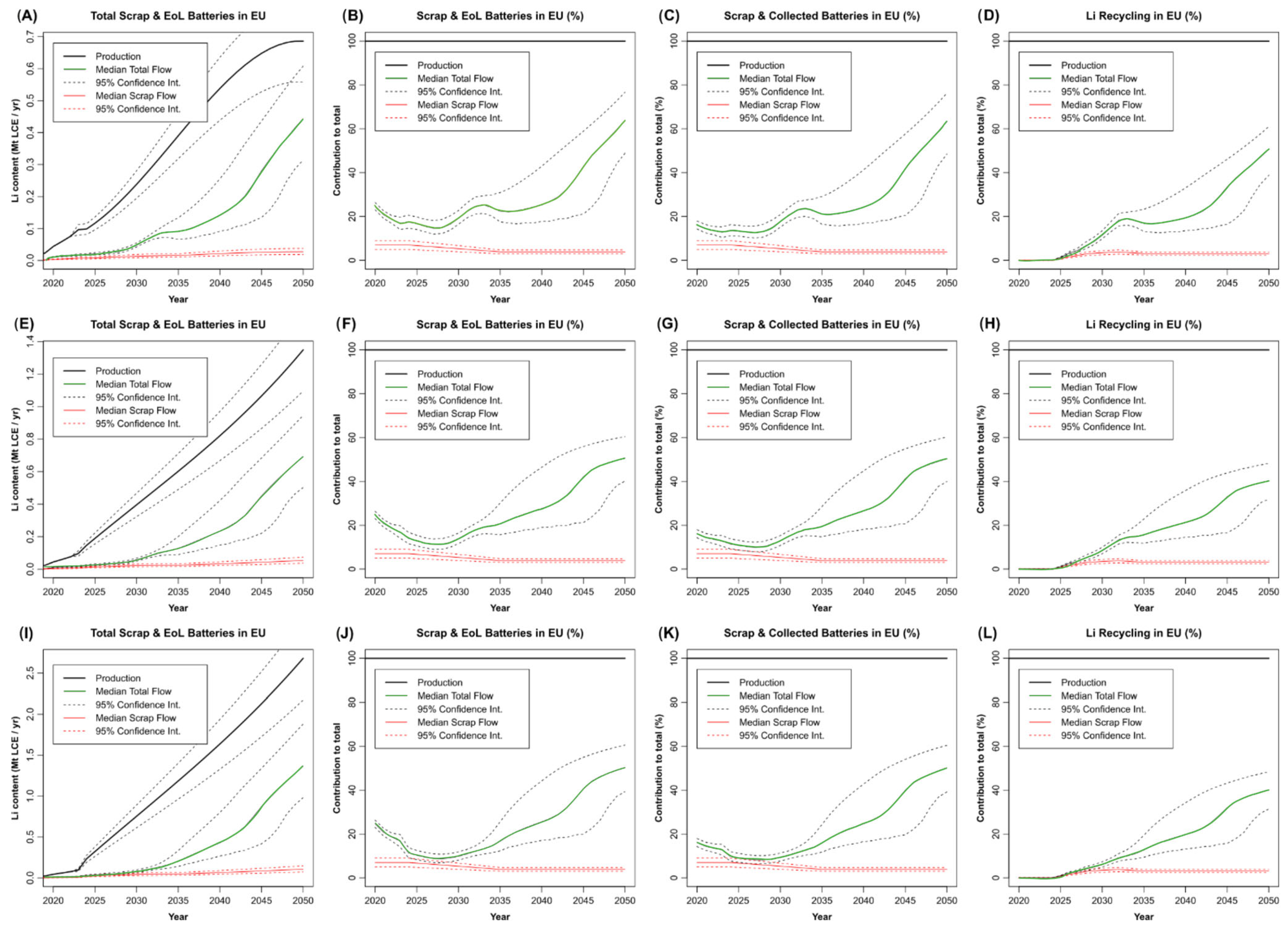

5. EU Results

5.1. Low Production Scenario

5.2. Medium Production Scenario

5.3. High Production Scenario

6. Discussion

6.1. Major Sources of Uncertainty

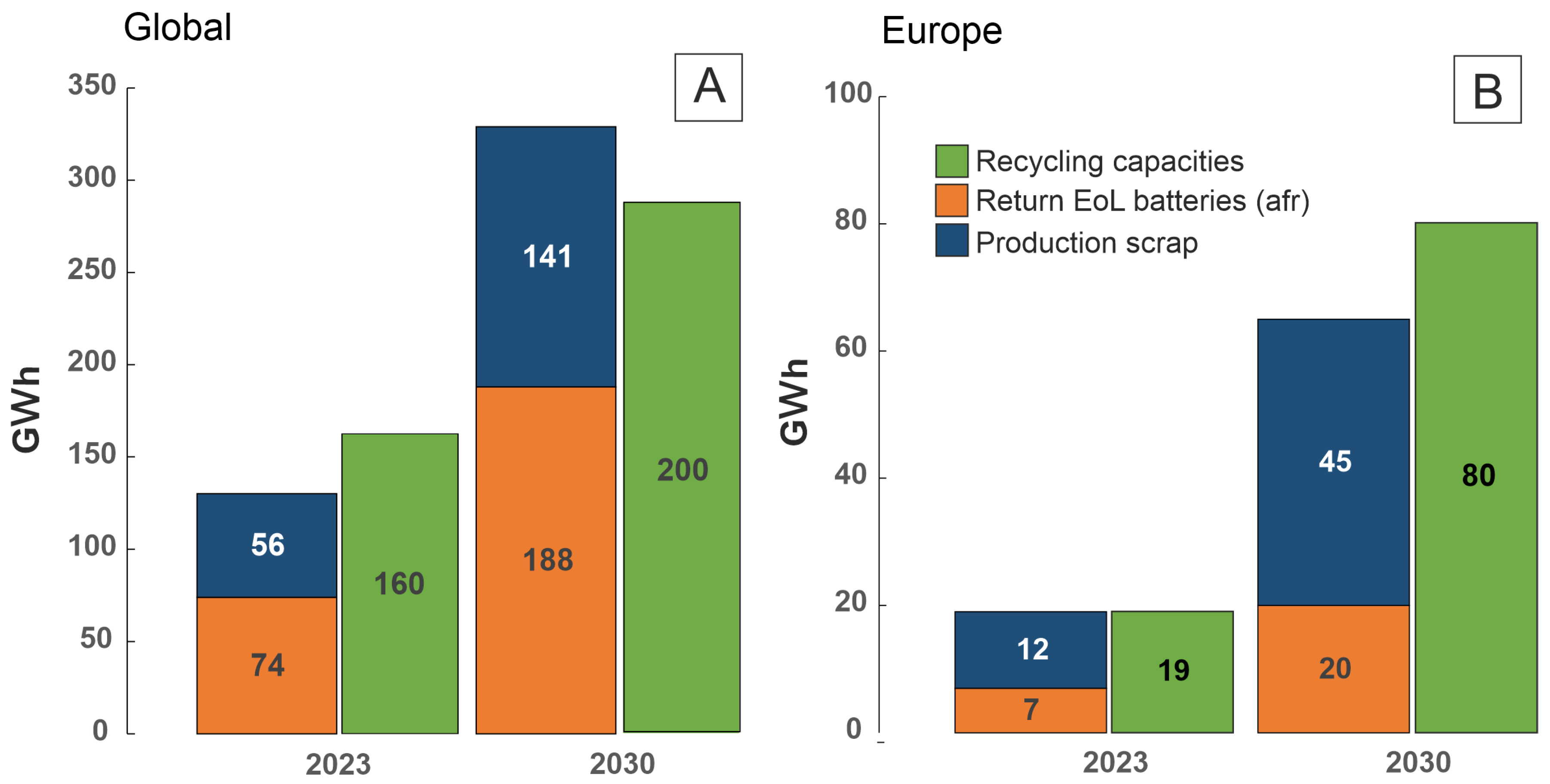

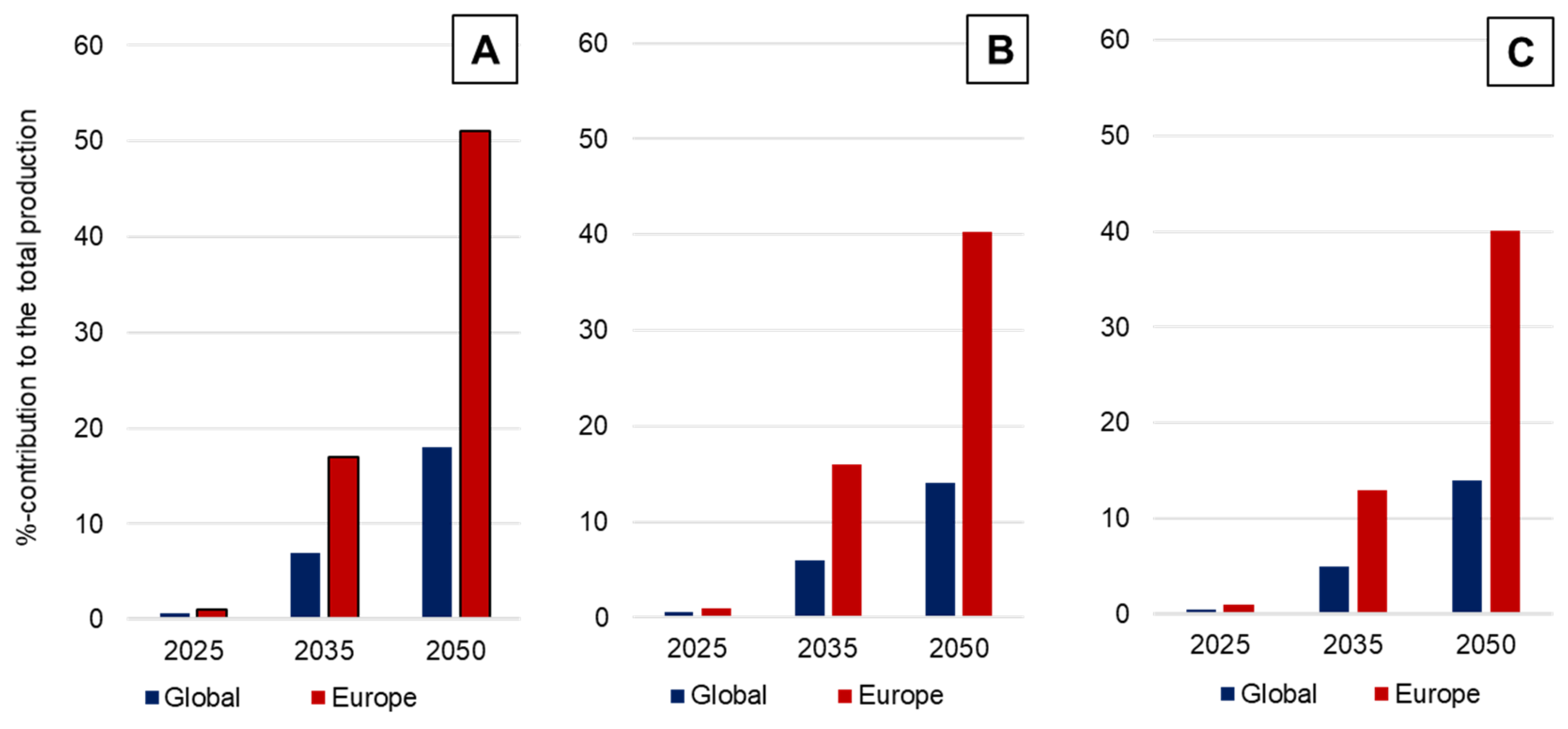

- Battery production: Future battery production scenarios are highly uncertain. This is why we used three cases in this study, without specifying the relative probabilities of each of these cases. Globally, battery cell production capacities for LIBs have been between 700 and 800 GWh for the EV sector in 2024 [48]. Current battery cell production for the EV sector in Europe amounts to around 190 GWh/a [48]. Both figures, global and EU, approximately correspond to the production capacities in the low production scenario (Figure 7 and Figure 8). Comparing actual tracked capacities in the literature with simulated production capacities in each scenario globally and on the EU level, the low production scenario is probably most realistic to happen in the short- to mid-term future. Especially the recent slowdown in EV sales and cancellations of battery cell factories in the EU underpin this assumption [49,50]. The uncertainty in the production scenarios naturally increases the further projections are made into the future. However, we note that the final results of expected recycling rates by 2050 do not differ substantially between scenarios and are only slightly higher in the low-production scenario compared to the medium- and high-production scenarios. Therefore, the substantial uncertainty in future production growth does not translate to similar uncertainties for expected recycling rates.

- Battery lifetime: Uncertainties in the distributions of battery lifetimes are much more important as a source of uncertainty in our estimates. An increasing lifetime of a maximum 15-year warranty-relevant period in 2030 was assumed, remaining constant afterwards. The current development and rapid dynamics in battery research indicate that the average lifespan of batteries tends to lengthen. However, it is not clear whether this trend will continue indefinitely. It is not clear at what level further improvements will not be economic. Either way, improvements in battery lifetimes beyond those assumed in our simulations would imply that the return flows of EoL batteries would be smaller in the future than we estimated. Furthermore, batteries may remain in use beyond their currently expected lifetime distributions, depending on customer needs or their repurposing for secondary purposes. These factors greatly influence the available EoL material that should ultimately be available for recycling. Assuming lifespans of over 20 years [51] with a subsequent secondary use phase of 5–30 years [52,53], the availability of substantial amounts of EoL material, and consequently its contribution to new battery production as recycled lithium, could be delayed well beyond 2050.

- Collection rates: the rates for globally collected batteries plus scrap volumes available for recycling, range approximately between 20% and 60 to 70% of battery production in the medium and high production scenario. The median is below 40% in all the scenarios. The lower limits of these estimates result from the assumed range of collection rates between 0% and EU rates in non-EU countries, where only production scrap is collected and contributes to recycling. The general increasing trend of collected batteries and scrap volumes results mostly from regulated increases in the EU (see methods) and increasing return flows relative to production volumes over time, which are in turn due to the expected slowdown in the relative growth rates of battery production by 2050 (Figure 4). The contribution to the total amounts to maximum values between 60 to 70% in each of the scenarios, which results from the assumed global collection rate of EoL batteries of 100% by 2050, is the ideal case. However, this final rate is highly uncertain. Comparing global and EU results, it is noticeable that the collection rates are higher in the EU due to implemented targets set on a national level and in the EU battery regulation (cf. methods). The significant increase at the end is most probably due to the high volumes of EoL batteries. The little bump between the years 2030 and 2035 (for the proportion of collected EoL batteries plus scrap) is mostly due to the little kink at the beginning of the production time series (2023–2024), where we go from real data to interpolated future production. For collected batteries plus scrap as a proportion of total production, we note an actual decrease in proportion from 2020 to 2022. This is due to the transition from portable to EV batteries being the dominant EoL battery type (longer average battery lifetimes decrease return rates initially). Overall, we believe that our assumptions for global (non-EU) collection rates, which we took to be 45–50% on average, provide a reasonable intermediate scenario. The raw materials contained in LIBs already make their recycling economically attractive, which may incentivize higher rates in the future. However, this may change if battery compositions become dominated by low-value components such as in LFP batteries.

- Recovery rates: The contribution of recycled lithium to battery production also depends greatly on the recovery rates of lithium in recycling processes. Effective recovery rates for lithium on the global and European scales are currently unknown. Lithium is currently only recovered by hydrometallurgical processes. In our simulations, the expected contribution of recycled lithium in 2050 ranges between ~40 and 50% in Europe, across all scenarios (Figure 8). These large quantities are a result of the high recovery rates that the EU sets in the EU battery regulation. In case these rates should be revised due to the uneconomic conditions they may induce for the recycling industry, recovery rates could be reduced and recycled lithium would not be available in the estimated amounts. On a global scale, the median recycled lithium contribution to the total production does not exceed 20% by 2050 in any of the scenarios (Figure 8), even though expected total return flows (medians) generally reach around 50–60% by 2050. However, the ranges are quite narrow in the beginning and will get wider in the future years. Besides, the second use of EV LIBs is gaining traction, with numerous real-world projects e.g., Nissan [54], Vattenfall [55] and Mercedes Benz [56], and projects indicating a significant role for repurposed batteries especially in energy storage systems. The parameters of the second life were not taken into account in this study, mainly because there is a lack of reliable and publicly available data. However, it is certain that in case of a large-scale implementation of second-use applications, the return volume of EoL batteries will be delayed by several years and therefore less recycled lithium will be available.

6.2. Factors Not Considered in This Study

6.3. Policy Implications

6.4. Future Work

Supplementary Materials

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Buchert, M.; Dolega, P.; Degreif, S. Gigafactories für Lithium-Ionen-Zellen–Rohstoffbedarfe für Die globale Elektromobilität bis 2050; Oeko-Inst. eV: Darmstadt, Germany, 2019. [Google Scholar]

- Clean Energy Institute. Lithium-Ion Battery. University of Washington. 2020. Available online: https://www.cei.washington.edu/research/energy-storage/lithium-ion-battery/ (accessed on 14 December 2023).

- European Commission. Regulation of the European Parliament and of the Council Concerning Batteries and Waste Batteries, Amending Directive 2008/98/EC and Regulation (EU) 2019/1020 and repealing Directive 2006/66/EC 2023. 2023. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32023R1542 (accessed on 16 June 2025).

- Agora Verkehrswende.Klimabilanz von Elektroautos. Einflussfaktoren und Verbesserungspotenzial. 2019. Available online: https://www.agora-verkehrswende.de/fileadmin/Projekte/2018/Klimabilanz_von_Elektroautos/Agora-Verkehrswende_22_Klimabilanz-von-Elektroautos_WEB.pdf (accessed on 16 June 2025).

- World Economic Forum. A Vision for a Sustainable Battery Value Chain in 2030: Unlocking the Full Potential to Power Sustainable Development and Climate Change Mitigation. 2019. Available online: https://www3.weforum.org/docs/WEF_A_Vision_for_a_Sustainable_Battery_Value_Chain_in_2030_Report.pdf (accessed on 16 June 2025).

- PEM Chair at RWTH and Roland Berger GmbH. Battery Monitor 2023. The Value Chain Between Economy and Ecology. 2023. Available online: https://content.rolandberger.com/hubfs/07_presse/Batteriemonitor_2023_digital_final.pdf (accessed on 16 June 2025).

- Circular Energy Storage. CES Online Database. 2023. Available online: https://www.circularenergystorage-online.com/ (accessed on 16 June 2025).

- Benchmark Minerals. Lithium Has to Scale Twenty Times by 2050 as Automakers Face Generational Challenge. 2022. Available online: https://source.benchmarkminerals.com/article/lithium-has-to-scale-twenty-times-by-2050-as-automakers-face-generational-challenge (accessed on 3 July 2024).

- Castro, F.D.; Cutaia, L.; Vaccari, M. End-of-life automotive lithium-ion batteries (LIBs) in Brazil: Prediction of flows and revenues by 2030. Resour. Conserv. Recycl. 2021, 169, 105522. [Google Scholar] [CrossRef]

- Gaines, L.; Zhang, J.; He, X.; Bouchard, J.; Melin, H.E. Tracking Flows of End-of-Life Battery Materials and Manufacturing Scrap. Batteries 2023, 9, 360. [Google Scholar] [CrossRef]

- Sattar, A.; Greenwood, D.; Dowson, M.; Unadkat, P. Automotive Lithium-ion Battery Recycling in the UK. Warwick University (The British Advance). 2020. Available online: https://hvm.catapult.org.uk/wp-content/uploads/2022/06/22350m-WMG-Battery-Recycling-report-v7.pdf (accessed on 16 June 2025).

- Weyhe, R.; Yang, X. Investigation about Lithium-Ion Battery Market Evolution and future Potential of Secondary Raw Material from Recycling. 2019. Available online: https://accurec.de/wp-content/uploads/2018/04/0-2Market-Research_YXF_3.0.pdf (accessed on 16 June 2025).

- Kastanaki, E.; Giannis, A. Dynamic estimation of end-of-life electric vehicle batteries in the EU-27 considering reuse, remanufacturing and recycling options. J. Clean. Prod. 2023, 393, 136349. [Google Scholar] [CrossRef]

- Shafique, M.; Rafiq, M.; Azam, A.; Luo, X. Material flow analysis for end-of-life lithium-ion batteries from battery electric vehicles in the USA and China. Resour. Conserv. Recycl. 2022, 178, 106061. [Google Scholar] [CrossRef]

- Brückner, L.; Frank, J.; Elwert, T. Industrial Recycling of Lithium-Ion Batteries—A Critical Review of Metallurgical Process Routes. Metals 2020, 10, 1107. [Google Scholar] [CrossRef]

- Ciez, R.E.; Whitacre, J.F. Examining different recycling processes for lithium-ion batteries. Nat. Sustain. Nat. 2019, 2, 148–156. [Google Scholar] [CrossRef]

- Hanisch, C.; Diekmann, J.; Stieger, A.; Haselrieder, W.; Kwade, A. Recycling of Lithium-Ion Batteries. In Handbook of Clean Energy Systems; Yan, J., Ed.; John Wiley & Sons, Ltd.: Chichester, UK, 2015; pp. 1–24. [Google Scholar]

- Harper, G.; Sommerville, R.; Kendrick, E.; Driscoll, L.; Slater, P.; Stolkin, R. Recycling lithium-ion batteries from electric vehicles. Nature 2019, 575, 75–86. [Google Scholar] [CrossRef]

- IEA Recycling of Critical Minerals-Strategies to Scale Up Recycling and Urban Mining. 2024. Available online: https://iea.blob.core.windows.net/assets/3af7fda6-8fd9-46b7-bede-395f7f8f9943/RecyclingofCriticalMinerals.pdf (accessed on 16 June 2025).

- Mayyas, A.; Steward, D.; Mann, M. The case for recycling: Overview and challenges in the material supply chain for automotive li-ion batteries. Sustain. Mater. Technol. 2019, 19, e00087. [Google Scholar] [CrossRef]

- Sojka, R.; Pan, Q.; Billmann, L. Comparative Study of LIB Recycling Processes. 2020. Available online: https://accurec.de/wp-content/uploads/2021/04/Accurec-Comparative-study.pdf (accessed on 16 June 2025).

- Zhou, L.F.; Yang, D.; Du, T.; Gong, H.; Luo, W.B. The Current Process for the Recycling of Spent Lithium Ion Batteries. Front. Chem. 2020, 8, 578044. [Google Scholar] [CrossRef]

- Windisch-Kern, S.; Holzer, A.; Ponak, C.; Raupenstrauch, H. Pyrometallurgical Lithium-Ion-Battery Recycling: Approach to Limiting Lithium Slagging with the InduRed Reactor Concept. Processes 2021, 9, 84. [Google Scholar] [CrossRef]

- Olutogun, M.; Vanderbruggen, A.; Frey, C.; Rudolph, M.; Bresser, D.; Passerini, S. Recycled graphite for more sustainable lithium-ion batteries. Carbon Energy 2024, 6, e483. [Google Scholar] [CrossRef]

- Vanderbruggen, A.; Hayagan, N.; Bachmann, K.; Ferreira, A.; Werner, D.; Horn, D.; Peuker, U.; Serna-Guerrero, R.; Rudolph, M. Lithium-Ion Battery Recycling─Influence of Recycling Processes on Component Liberation and Flotation Separation Efficiency. ACS EST Eng. 2022, 2, 2130–2141. [Google Scholar] [CrossRef]

- Frenzel, M.; Mikolajczak, C.; Gutzmer, J.; Reuter, M.A. Quantifying the relative availability of high-tech by-product metals–The cases of gallium, germanium and indium. Resour. Policy 2017, 52, 327–335. [Google Scholar] [CrossRef]

- Nassar, N.T.; Kim, H.; Frenzel, M.; Moats, M.S.; Hayes, S.M. Global tellurium supply potential from electrolytic copper refining. Resour. Conserv. Recycl. 2022, 184, 106434. [Google Scholar] [CrossRef]

- Öko Institut. B2DS Szenario-“Unter 2 Grad Szenario”. 2019. Available online: https://www.now-gmbh.de/wp-content/uploads/2020/10/now-factsheet_elektrobomilitaet-und-rohstoffe.pdf (accessed on 16 June 2025).

- Avicenne Energy. Commercial Data. 2021. Available online: https://www.avicenne.com/pdf/Presentation_Avicenne_Energy_June_2022.pdf (accessed on 16 June 2025).

- Moores, S. The Global Battery Arms Race: Lithium-Ion Battery Gigafactories and Their Supply Chain. Oxford Institute for Energy Studies. 2021. Available online: https://www.oxfordenergy.org/wpcms/wp-content/uploads/2021/02/THE-GLOBAL-BATTERY-ARMS-RACE-LITHIUM-ION-BATTERY-GIGAFACTORIES-AND-THEIR-SUPPLY-CHAIN.pdf (accessed on 16 June 2025).

- Rho Motion. EV Battery Outlook. 2022. Available online: https://rhomotion.com/research/ev-battery-forecast/ (accessed on 16 June 2025).

- S&P Global Mobility (EVs). Press Release. 2022. Available online: https://www.spglobal.com/market-intelligence/en/news-insights/research/investment-in-lithium-ion-batteries-could-deliver-5-point-9-twh-capacity-by-2030 (accessed on 16 June 2025).

- S&P Global Mobility (EVs). Press Release. 2021. Available online: https://www.spglobal.com/market-intelligence/en/news-insights/research/top-electric-vehicle-markets-dominate-lithium-ion-battery-capacity-growth (accessed on 16 June 2025).

- IEA. Global EV Outlook 2023. 2023. Available online: https://iea.blob.core.windows.net/assets/dacf14d2-eabc-498a-8263-9f97fd5dc327/GEVO2023.pdf (accessed on 16 June 2025).

- Marscheider-Weidemann, F.; Langkau, S.; Baur, S.J.; Billaud, M.; Deubzer, O.; Eberling, E.; Erdmann, L.; Haendel, M.; Krail, M.; Loibl, A.; et al. Raw materials for emerging technologies 2021. DERA Rohst. 2021, 50, 348. [Google Scholar]

- Anderson, B.A.; Råde, I. Metal resource constraints for electric-vehicle batteries. Transp. Res. Part D Transp. Environ. 2001, 6, 297–324. [Google Scholar] [CrossRef]

- Gerssen-Gondelach, S.; Faaij, A.P.C. Performance of batteries for electric vehicles on short and longer term. J. Power Sources 2012, 212, 111–129. [Google Scholar] [CrossRef]

- BYD. Warranty Policy. 2025. Available online: https://www.byd.com/eu/service-maintenance/warranty-policy (accessed on 16 June 2025).

- Hyundai. Warranty Policy. 2025. Available online: https://www.hyundai.com/eu/driving-hyundai/owning-a-hyundai/why-hyundai-services/warranty.html (accessed on 16 June 2025).

- KIA. Warranty Policy. 2025. Available online: https://www.kia.com/uk/about/news/electric-car-battery-warranty/ (accessed on 16 June 2025).

- Tesla. Warranty Policy. 2025. Available online: https://www.tesla.com/support/vehicle-warranty (accessed on 16 June 2025).

- Volkswagen. Warranty Policy. 2025. Available online: https://www.volkswagen.co.uk/en/electric-and-hybrid/living-electric/looking-after-your-ev/vehicle-and-battery-warranties.html (accessed on 16 June 2025).

- EU. Consumer Guarantees. 2024. Available online: https://europa.eu/youreurope/business/dealing-with-customers/consumer-contracts-guarantees/consumer-guarantees/index_en.htm (accessed on 5 August 2024).

- Gattiglio, F. The Batteries Directive Review. In Proceedings of the 24th International Congress for Battery Recycling ICBR 2019, Lyon, France, 18–20 September 2019. Panel discussion. [Google Scholar]

- EPBA The Collection of Waste Portable Batteries in Europe in View of the Achievability of the Collection Targets Set by Batteries Directive 2006/66/EC. Short Update Covering 2018 Data. 2020. Available online: https://www.epbaeurope.net/assets/resources/Report-on-the-portable-battery-collection-rates-Short-Update-Mar-20-final-1.1.pdf (accessed on 16 June 2025).

- DOE Energy Department Announces Battery Recycling Prize and Battery Recycling R&D Center. 2019. Available online: https://www.energy.gov/articles/energy-department-announces-battery-recycling-prize-and-battery-recycling-rd-center#:~:text=Currently%2C%20lithium%2Dion%20batteries%20are,ion%20batteries%20for%20eventual%20recycling.%20 (accessed on 5 August 2024).

- Ziemann, S.; Müller, D.B.; Schebek, L.; Weil, M. Modeling the potential impact of lithium recycling from EV batteries on lithium demand: A dynamic MFA approach. Resour. Conserv. Recycl. 2018, 133, 76–85. [Google Scholar] [CrossRef]

- VDI/VDE Innovation + Technik GmbH. Battery Cell Production in Europe: Status Quo and Outlook, Market Analysis Update Q2 2024. 2024. Available online: https://www.ipcei-batteries.eu/accompanying-research/market-updates (accessed on 16 June 2025).

- EY. How to Retake the Momentum in the EV Transition. Press Release. 2024. Available online: https://www.ey.com/en_gl/insights/automotive/how-to-retake-the-momentum-in-ev-transition#:~:text=Consequently%2C%20overall%20EV%20market%20growth,2025%20up%20to%20approximately%2023%25 (accessed on 8 October 2024).

- Transport & Environment. How not to Lose It All: Two-Thirds of Europe’s Battery Gigafactories at Risk Without Further Action. 2023. Available online: https://www.transportenvironment.org/uploads/files/TE-Battery-risk-report.pdf (accessed on 16 June 2025).

- Fastmarkets. EV Battery Lifespans: Unlocking the Secrets to Battery Lifetimes and Battery Recycling. Press Release. 2024. Available online: https://www.fastmarkets.com/insights/ev-battery-lifespans-unlocking-the-secrets-to-battery-lifetimes-and-battery-recycling/#:~:text=The%20longevity%20of%20lithium%2Dion,to%20extend%20beyond%2015%20years (accessed on 18 December 2024).

- Bobba, S.; Mathieux, F.; Blengini, G.A. How will second-use of batteries affect stocks and flows in the EU? A model for traction Li-ion batteries. Resour. Conserv. Recycl. 2019, 145, 279–291. [Google Scholar] [CrossRef]

- Casals, L.C.; García, B.A.; Canal, C. Second life batteries lifespan: Rest of useful life and environmental analysis. J. Environ. Manag. 2019, 232, 354–363. [Google Scholar] [CrossRef]

- Nissan. Nissan and Ecobat to Give Used EV Batteries a Second Life Beyond the Car. 2024. Available online: https://uk.nissannews.com/en-GB/releases/nissan-and-ecobat-to-give-used-ev-batteries-a-second-life-beyond-the-car (accessed on 13 January 2025).

- Vattenfall. Autobatterien Entsorgen und Recyceln. 2023. Available online: https://www.vattenfall.de/infowelt-energie/e-mobility/elektroauto-batterie-recycling (accessed on 13 January 2025).

- Mercedes-Benz Energy Storage. 2025. Available online: https://www.mercedes-benz.com/en/mercedes-benz-energy/ (accessed on 13 January 2025).

- Rho Motion. Press Release “Record Number EVs Sold in November” 2024. Available online: https://rhomotion.com/news/record-number-evs-sold-in-november/ (accessed on 16 December 2024).

- DERA. Preistrendmonitor. 2025. Available online: https://www.deutsche-rohstoffagentur.de/DERA/DE/Aktuelles/Monitore/2025/01-25/2025-01-preistrendmonitor.pdf?__blob=publicationFile&v=2 (accessed on 16 June 2025).

- Wood, D.L.; Li, J.; Daniel, C. Prospects for reducing the processing cost of lithium ion batteries. Power Sources 2015, 275, 234–242. [Google Scholar] [CrossRef]

- Duffner, F.; Mauler, L.; Wentker, M.; Leker, J.; Winter, M. Large-scale automotive battery cell manufacturing: Analyzing strategic and operational effects on manufacturing costs. J. Clean. Prod. 2021, 232, 107982. [Google Scholar] [CrossRef]

- Mauler, L.; Duffner, F.; Leker, J. Economies of scale in battery cell manufacturing: The impact of material and process innovations. Appl. Energy 2021, 286, 116499. [Google Scholar] [CrossRef]

- European Commission. Waste Treatment–Amendment to the European List of Waste to Address Waste Batteries and Wastes from Treating Them. Published Initiative. 2024. Available online: https://ec.europa.eu/info/law/better-regulation/have-your-say/initiatives/14016-Waste-treatment-Amendment-to-the-European-List-of-Waste-to-address-waste-batteries-and-wastes-from-treating-them_en (accessed on 19 December 2024).

- European Commission. Critical Raw Materials Act. 2024. Available online: https://single-market-economy.ec.europa.eu/sectors/raw-materials/areas-specific-interest/critical-raw-materials/critical-raw-materials-act_en (accessed on 19 December 2024).

- Yole Développement. Solid-State Battery 2021, Market & Technology Report. 2021. Available online: https://medias.yolegroup.com/uploads/2021/04/YINTR21187_Solid-State_Battery_2021_Flyer.pdf (accessed on 16 June 2025).

- Fraunhofer Institute for Systems and Innovation Research ISI. Solid-State Batteries for Electric Vehicles: Still in R&D or on the Verge of Commercialization? Blog Battery Update. 2024. Available online: https://www.isi.fraunhofer.de/en/blog/themen/batterie-update/feststoffbatterien-elektro-autos-kommerzialisierung-stand-forschung-entwicklung.html (accessed on 19 December 2024).

| Cathode Material | Lithium Content |

|---|---|

| NMC | 0.096–0.123 |

| NCA | 0.095–0.098 |

| LFP | 0.084 |

| LMO | 0.080 |

| LMNO | 0.065 |

| LMFP | 0.082 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kresse, C.; Bookhagen, B.; Buarque Andrade, L.; Frenzel, M. Global Supply of Secondary Lithium from Lithium-Ion Battery Recycling. Recycling 2025, 10, 122. https://doi.org/10.3390/recycling10040122

Kresse C, Bookhagen B, Buarque Andrade L, Frenzel M. Global Supply of Secondary Lithium from Lithium-Ion Battery Recycling. Recycling. 2025; 10(4):122. https://doi.org/10.3390/recycling10040122

Chicago/Turabian StyleKresse, Carolin, Britta Bookhagen, Laura Buarque Andrade, and Max Frenzel. 2025. "Global Supply of Secondary Lithium from Lithium-Ion Battery Recycling" Recycling 10, no. 4: 122. https://doi.org/10.3390/recycling10040122

APA StyleKresse, C., Bookhagen, B., Buarque Andrade, L., & Frenzel, M. (2025). Global Supply of Secondary Lithium from Lithium-Ion Battery Recycling. Recycling, 10(4), 122. https://doi.org/10.3390/recycling10040122