A Novel Method for Food Market Regulation by Emotional Tendencies Predictions from Food Reviews Based on Blockchain and SAEs

Abstract

1. Introduction

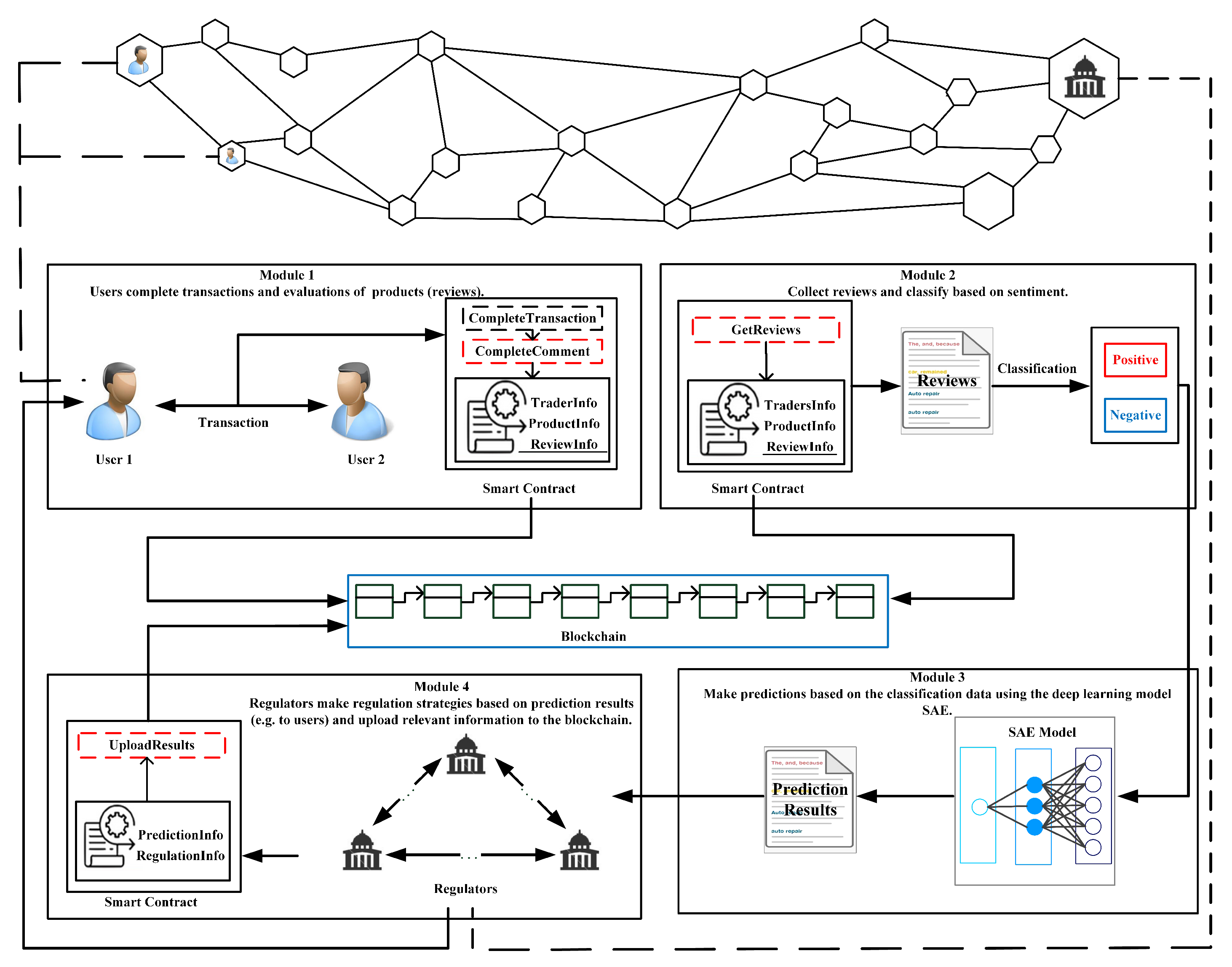

- Blockchain has been used by different entities in the food transactions process, where it also can be used as a data hosting platform to ensure the authenticity of the data;

- The number of sentiment reviews are used as the data set for feeding the deep learning model. Here, the deep learning model can be used to predict the emotional tendencies of the consumers;

- Based on the predicted results, regulators can formulate corresponding measures to prevent things that are not conducive to market development.

2. Theoretical Background

3. Empirical Framework

4. Methodology of Emotional Tendencies Predictions

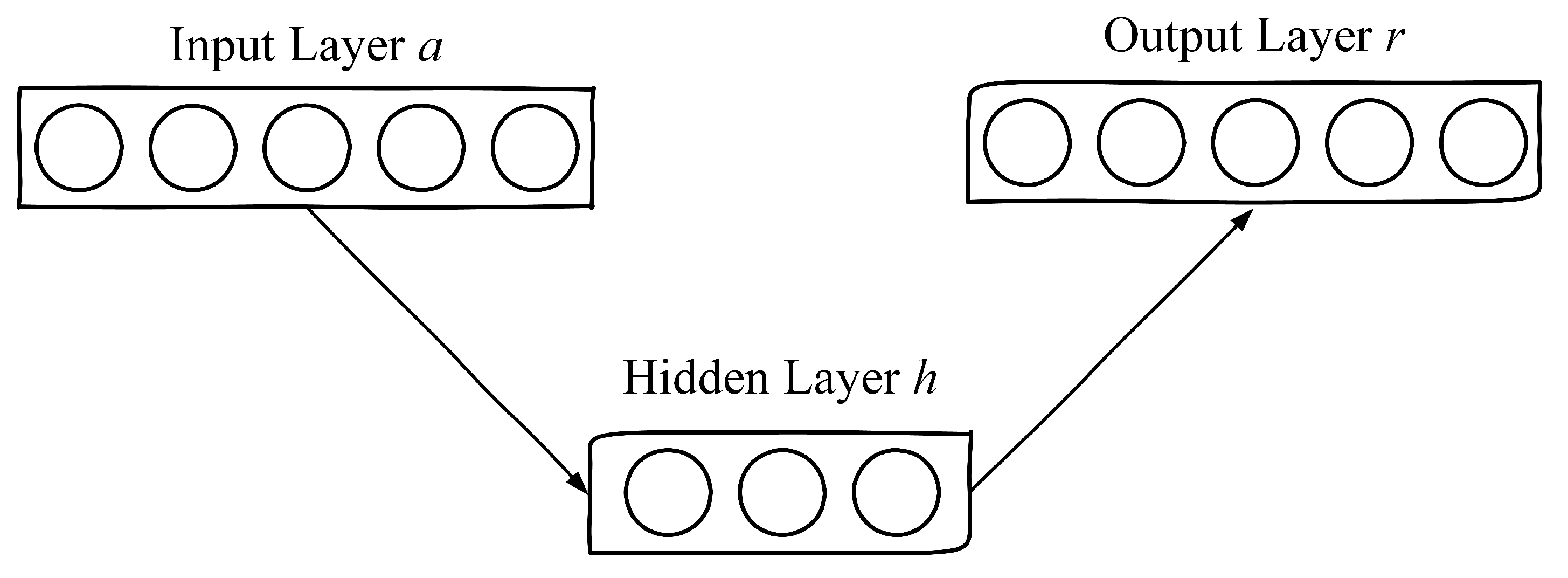

4.1. Autoencoder

| Algorithm 1 Training process of an autoencoder. |

| Input: Dataset , the number of hidden units and the number of the iterations T, initialize the matrices and biases randomly. Output: The optimization outcomes.

|

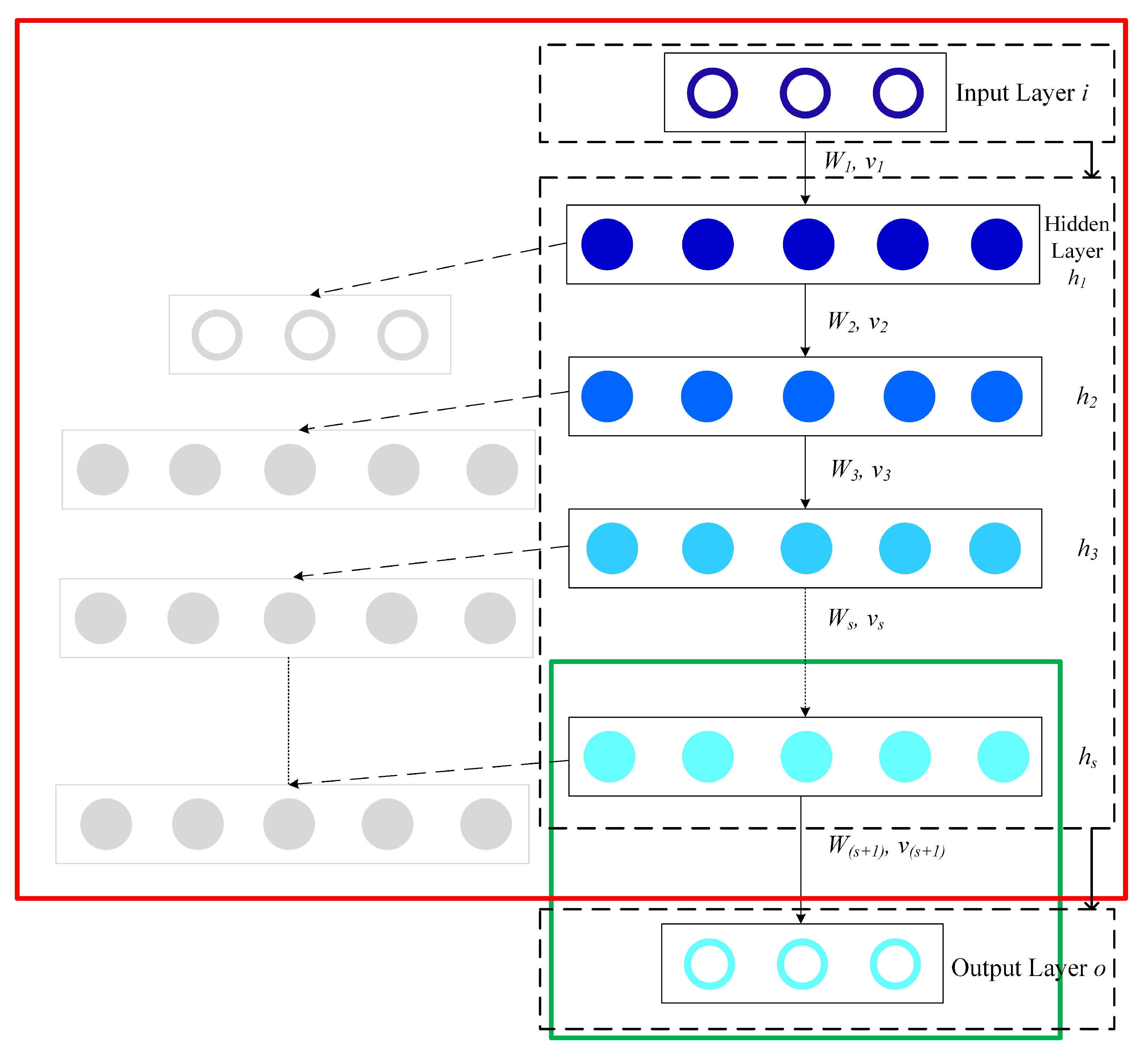

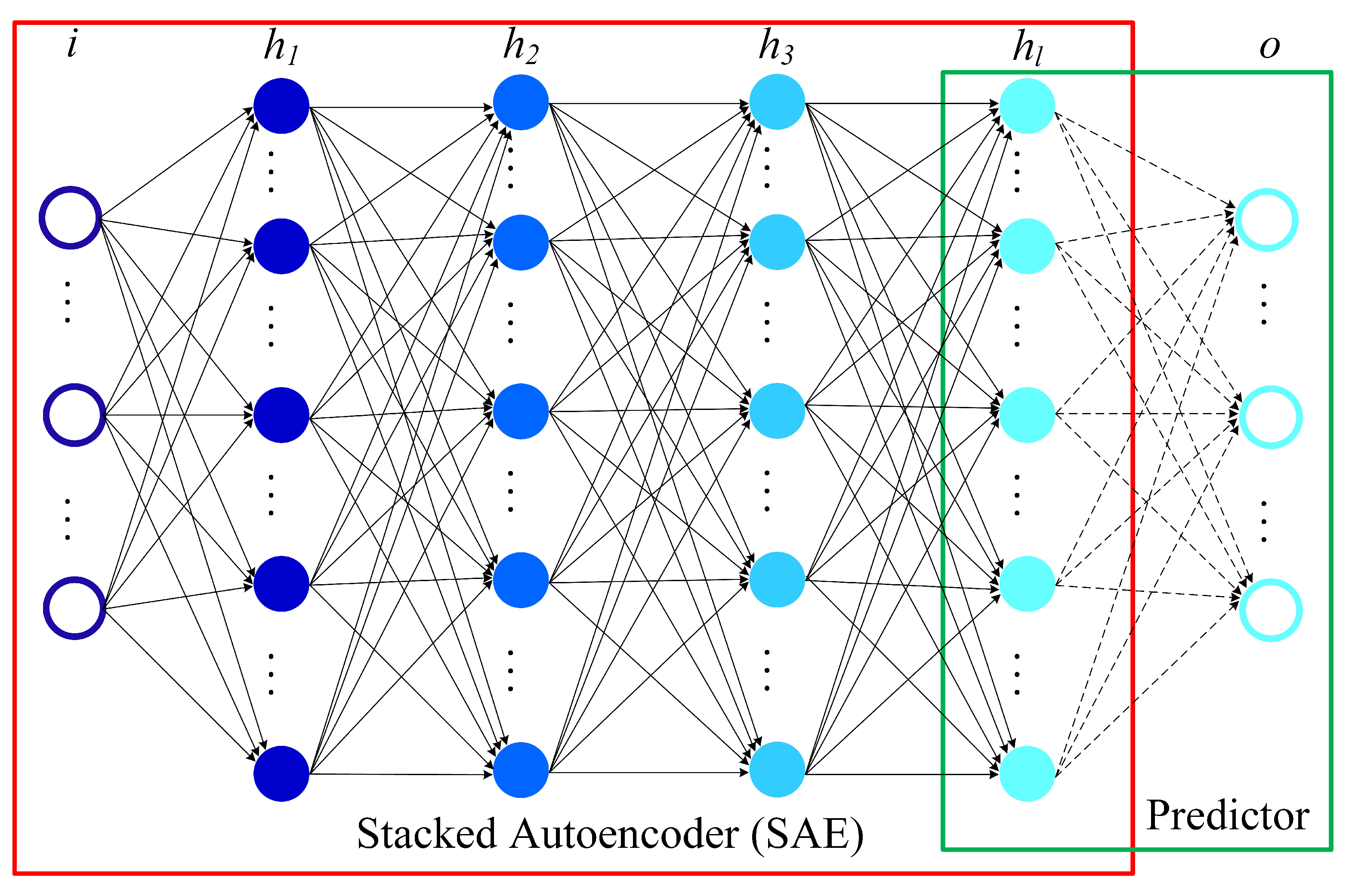

4.2. SAEs

4.3. Training Process of SAEs

4.4. Sentiment Tendency Determination

| Algorithm 2 Training process of SAEs. |

| Input: Training Dataset the expected number of hidden layers , the number of the pretraining iterations . Output: The optimization results.

|

| Algorithm 3 Process of sentiment tendency determination and regulations. |

| Input: Number of positive reviews and negative reviews collected in the previous period, total period , time interval t, identification numbers of traders , and total number of traders . Output: Prediction results , , and

|

5. Experiments and Performance Analysis

5.1. Data Source

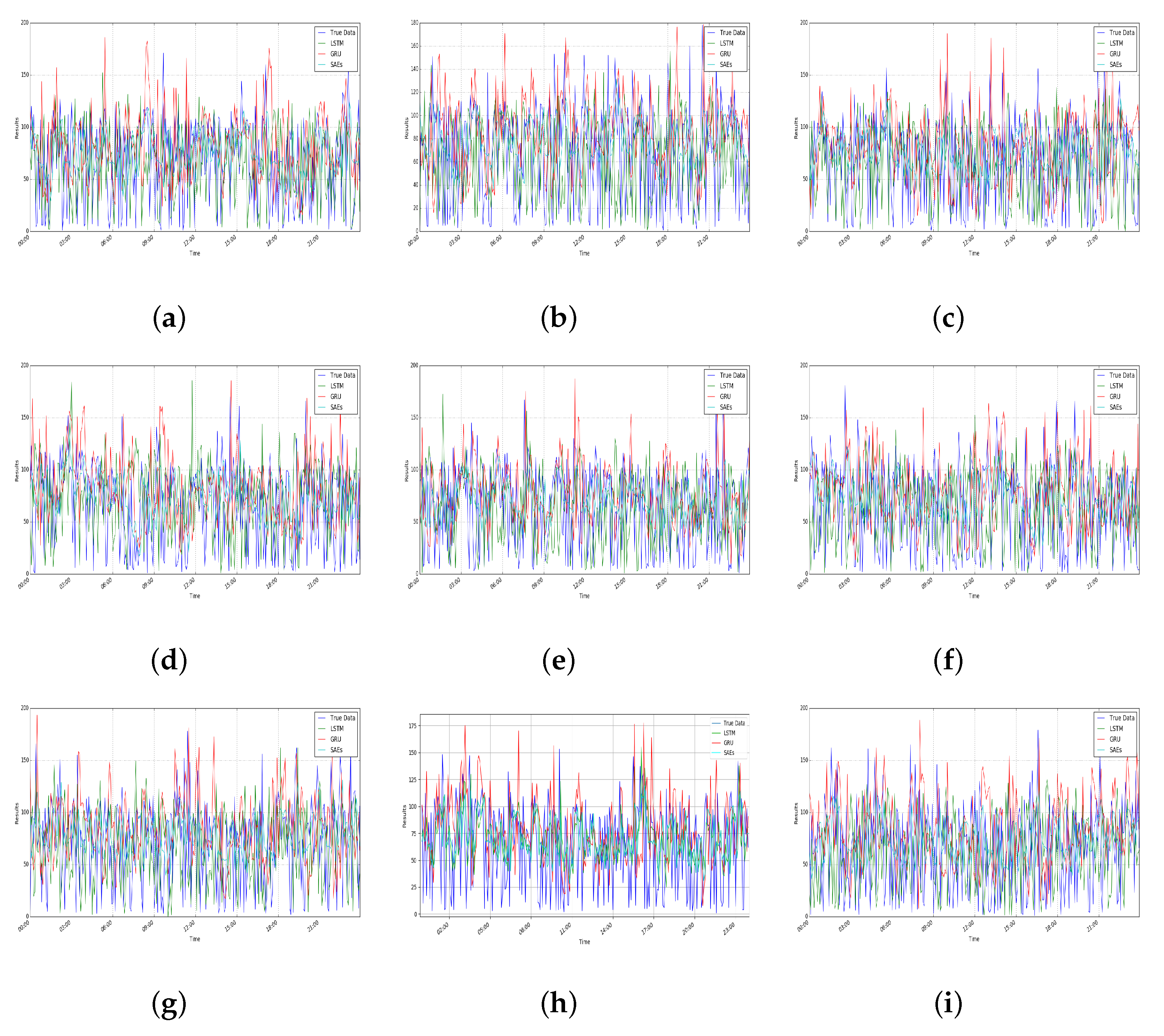

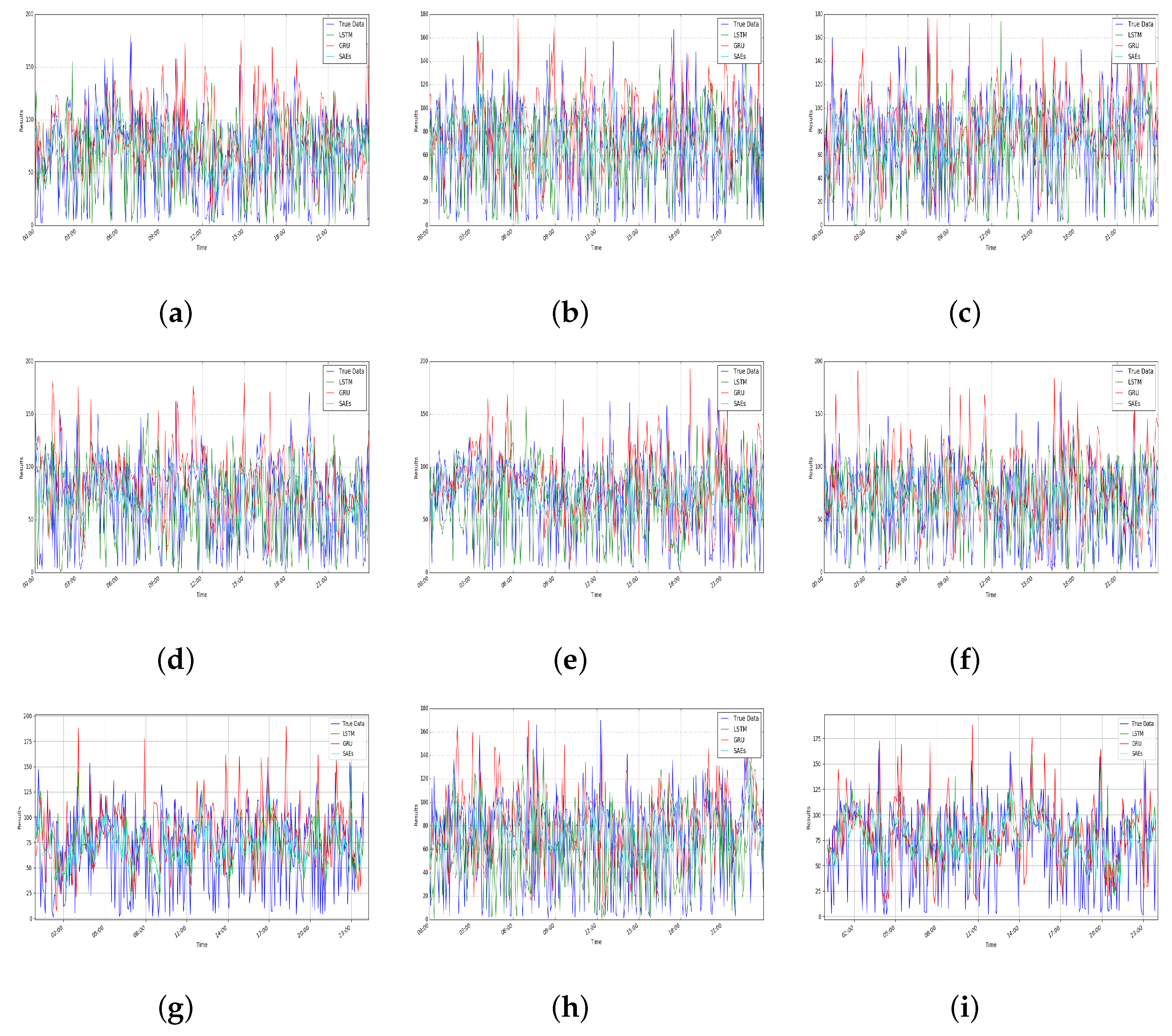

5.2. Metrics and Performance Analysis

5.3. Case Study

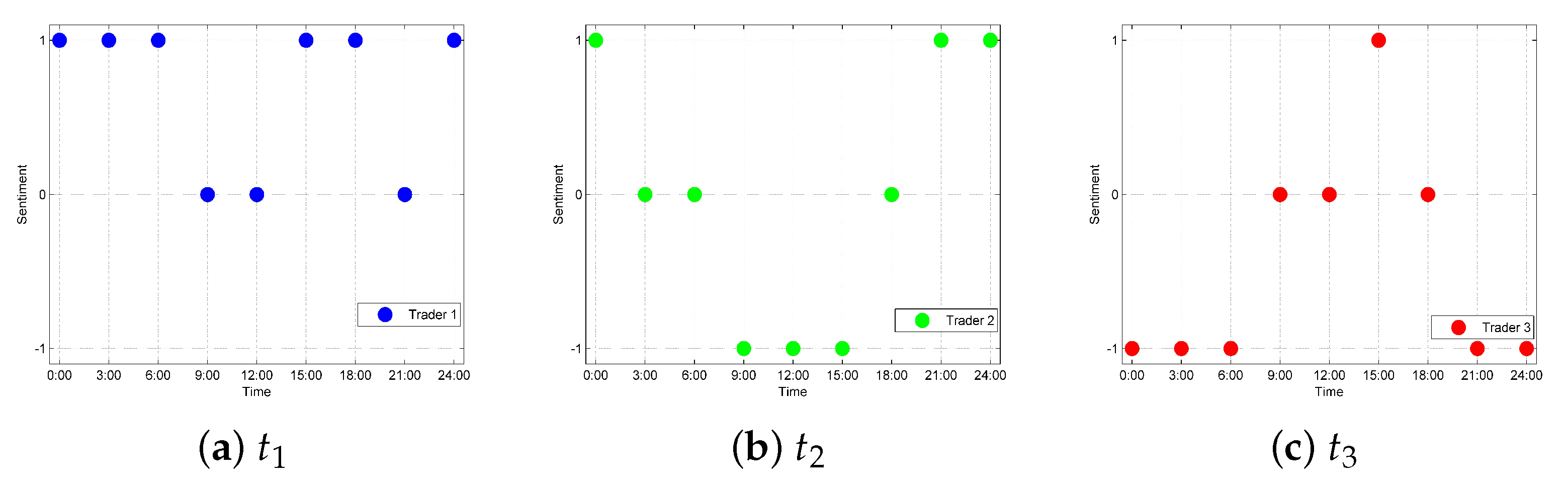

5.3.1. For Regulations of Traders

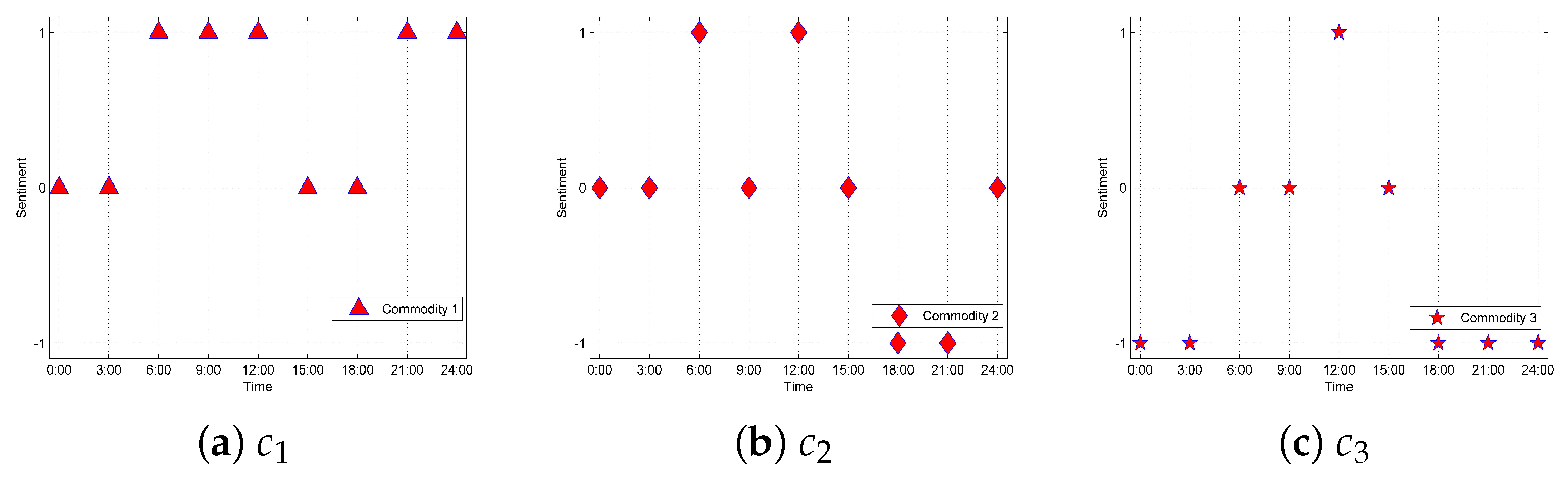

5.3.2. For Improvements of Commodities

6. Conclusions

6.1. Discussion and Theoretical Advance

6.2. Limitations and Further Researches

Author Contributions

Funding

Conflicts of Interest

References

- Bigliardi, B.; Galati, F. Innovation trends in the food industry: The case of functional foods. Trends Food Sci. Technol. 2013, 31, 118–129. [Google Scholar] [CrossRef]

- MArtino, G.; Riganelli, C.; Marchini, A.; Polenzani, B. Food safety investments factors in the Italian meat sector: Conceptual framework and empirical evidence. New Medit Mediterr. J. Econ. Agric. Environ. 2020, 19. [Google Scholar] [CrossRef]

- Lu, H.; Feng, S.; Trienekens, J.H.; Omta, S.W.F. Network strength, transaction-specific investments, inter-personal trust, and relationship satisfaction in Chinese agri-food SMEs. China Agric. Econ. Rev. 2012, 4, 363–378. [Google Scholar] [CrossRef]

- Tian, F. A supply chain traceability system for food safety based on HACCP, blockchain & Internet of things. In Proceedings of the 2017 International Conference on Service Systems and Service Management, Dalian, China, 16–18 June 2017; pp. 1–6. [Google Scholar]

- Kamble, S.S.; Gunasekaran, A.; Gawankar, S.A. Achieving sustainable performance in a data-driven agriculture supply chain: A review for research and applications. Int. J. Prod. Econ. 2020, 219, 179–194. [Google Scholar] [CrossRef]

- Govindan, K. Sustainable consumption and production in the food supply chain: A conceptual framework. Int. J. Prod. Econ. 2018, 195, 419–431. [Google Scholar] [CrossRef]

- Zhang, B.; Wu, X.; You, J.; Li, Q.; Karray, F. Detection of microaneurysms using multi-scale correlation coefficients. Pattern Recognit. 2010, 43, 2237–2248. [Google Scholar] [CrossRef]

- Abdelaziz, A.H. Comparing fusion models for dnn-based audiovisual continuous speech recognition. IEEE/ACM Trans. Audio Speech Lang. Process. 2017, 26, 475–484. [Google Scholar] [CrossRef]

- Creydt, M.; Fischer, M. Blockchain and more-algorithm driven food traceability. Food Control 2019, 105, 45–51. [Google Scholar] [CrossRef]

- Kamilaris, A.; Fonts, A.; Prenafeta-Boldύ, F.X. The rise of blockchain technology in agriculture and food supply chains. Trends Food Sci. Technol. 2019, 91, 640–652. [Google Scholar] [CrossRef]

- Stranieri, S.; Riccardi, F.; Meuwissen, M.P.; Soregaroli, C. Exploring the impact of blockchain on the performance of agri-food supply chains. Food Control 2021, 119, 107495. [Google Scholar] [CrossRef]

- Mao, D.; Hao, Z.; Wang, F.; Li, H. Novel automatic food trading system using consortium blockchain. Arab. J. Sci. Eng. 2019, 44, 3439–3455. [Google Scholar] [CrossRef]

- Mao, D.; Hao, Z.; Wang, F.; Li, H. Innovative blockchain-based approach for sustainable and credible environment in food trade: A case study in shandong province, china. Sustainability 2018, 10, 3149. [Google Scholar] [CrossRef]

- Mao, D.; Hao, Z. A novel sketch-based three-dimensional shape retrieval method using multi-view convolutional neural network. Symmetry 2019, 11, 703. [Google Scholar] [CrossRef]

- Mao, D.; Hao, Z.; Wang, Y.; Fu, S. A novel dynamic dispatching method for bicycle-sharing system. ISPRS Int. J. Geo-Inf. 2019, 8, 117. [Google Scholar] [CrossRef]

- Hao, Z.; Mao, D.; Zhang, B.; Zuo, M.; Zhao, Z. A novel visual analysis method of food safety risk traceability based on blockchain. Int. J. Environ. Res. Public Health 2020, 17, 2300. [Google Scholar] [CrossRef]

- Wen, S.; Wei, H.; Yang, Y.; Guo, Z.; Zeng, Z.; Huang, T.; Chen, Y. Memristive lstm network for sentiment analysis. IEEE Trans. Syst. Man Cybern. Syst. 2019, 51, 1794–1804. [Google Scholar] [CrossRef]

- Chen, C.; Zhuo, R.; Ren, J. Gated recurrent neural network with sentimental relations for sentiment classification. Inf. Sci. 2019, 502, 268–278. [Google Scholar] [CrossRef]

- Abid, F.; Alam, M.; Yasir, M.; Li, C. Sentiment analysis through recurrent variants latterly on convolutional neural network of twitter. Future Gener. Comput. Syst. 2019, 95, 292–308. [Google Scholar] [CrossRef]

- Wang, J.; Yu, L.-C.; Lai, K.R.; Zhang, X. Tree-structured regional cnn-lstm model for dimensional sentiment analysis. IEEE/ACM Trans. Audio Speech Lang. Process. 2019, 28, 581–591. [Google Scholar] [CrossRef]

- Fu, R.; Zhang, Z.; Li, L. Using lstm and gru neural network methods for traffic flow prediction. In Proceedings of the 2016 31st Youth Academic Annual Conference of Chinese Association of Automation (YAC), Wuhan, China, 11–13 November 2016; pp. 324–328. [Google Scholar]

- Li, J.; Gao, L.; Song, W.; Wei, L.; Shi, Y. Short term traffic flow prediction based on lstm. In Proceedings of the 2018 Ninth International Conference on Intelligent Control and Information Processing (ICICIP), Wanzhou, China, 9–11 November 2018; pp. 251–255. [Google Scholar]

- Zhang, D.; Kabuka, M.R. Combining weather condition data to predict traffic flow: A gru-based deep learning approach. IET Intell. Transp. Syst. 2018, 12, 578–585. [Google Scholar] [CrossRef]

- Duan, Y.; Lv, Y.; Wang, F.Y. Performance evaluation of the deep learning approach for traffic flow prediction at different times. In Proceedings of the 2016 IEEE International Conference on Service Operations and Logistics, and Informatics (SOLI), Beijing, China, 10–12 July 2016; pp. 223–227. [Google Scholar]

- Bengio, Y.; Lamblin, P.; Popovici, D.; Larochelle, H. Greedy layer-wise training of deep networks. Adv. Neural Inf. Process. Syst. 2007, 19, 153. [Google Scholar]

- Lv, Y.; Duan, Y.; Kang, W.; Li, Z.; Wang, F.-Y. Traffic flow prediction with big data: A deep learning approach. IEEE Trans. Intell. Transp. Syst. 2014, 16, 865–873. [Google Scholar] [CrossRef]

- Palm, R.B. Prediction as a Candidate for Learning Deep Hierarchical Models of Data; Technical University of Denmark: Kongens Lyngby, Denmark, 2012. [Google Scholar]

- Hinton, G.E.; Osindero, S.; Teh, Y.-W. A fast learning algorithm for deep belief nets. Neural Comput. 2006, 18, 1527–1554. [Google Scholar] [CrossRef] [PubMed]

- Zhou, Z.; Xu, L. Amazon Food Review Classification Using Deep Learning and Recommender System; Stanford University: Stanford, CA, USA, 2009. [Google Scholar]

- Wiriyaphanich, T.; Guinard, J.-X.; Spang, E.; Amsler Challamel, G.; Valgenti, R.T.; Sinclair, D.; Lubow, S.; Putnam-Farr, E. Food Choice and Waste in University Dining Commons—A Menus of Change University Research Collaborative Study. Foods 2021, 10, 577. [Google Scholar] [CrossRef]

- Andreassen, H.; Gjerald, O.; Hansen, K.V. “The Good, The Bad, and the Minimum Tolerable”: Exploring Expectations of Institutional Food. Foods 2021, 10, 767. [Google Scholar] [CrossRef]

- Rocha, C.; Pinto Moura, A.; Pereira, D.; Costa Lima, R.; Cunha, L.M. Consumer-Led Adaptation of the EsSense Profile® for Herbal Infusions. Foods 2021, 10, 684. [Google Scholar] [CrossRef] [PubMed]

- Marsola, C.d.M.; Cunha, L.M.; Carvalho-Ferreira, J.P.d.; da Cunha, D.T. Factors Underlying Food Choice Motives in a Brazilian Sample: The Association with Socioeconomic Factors and Risk Perceptions about Chronic Diseases. Foods 2020, 9, 1114. [Google Scholar] [CrossRef] [PubMed]

- Zhang, A.; Jakku, E. Australian Consumers’ Preferences for Food Attributes: A Latent Profile Analysis. Foods 2021, 10, 56. [Google Scholar] [CrossRef]

- Jahangir, H.; Gougheri, S.S.; Vatandoust, B.; Golkar, M.A.; Ahmadian, A.; Hajizadeh, A. Plug-in electric vehicle behavior modeling in energy market: A novel deep learning-based approach with clustering technique. IEEE Trans. Smart Grid 2020, 11, 4738–4748. [Google Scholar] [CrossRef]

- Fu, X.; Ouyang, T.; Chen, J.; Luo, X. Listening to the investors: A novel framework for online lending default prediction using deep learning neural networks. Inf. Process. Manag. 2020, 57, 102236. [Google Scholar] [CrossRef]

- Fuentes, S.; Tongson, E.; Torrico, D.D.; Gonzalez Viejo, C. Modeling pinot noir aroma profiles based on weather and water management information using machine learning algorithms: A vertical vintage analysis using artificial intelligence. Foods 2020, 9, 33. [Google Scholar] [CrossRef] [PubMed]

- Gunaratne, T.; Viejo, C.G.; Gunaratne, N.; Torrico, D.D.; Fuentes, S. Chocolate quality assessment based on chemical fingerprinting using near infra-red and machine learning modeling. Foods 2019, 8, 426. [Google Scholar] [CrossRef] [PubMed]

- Álvarez-Pato, V.M.; Sánchez, C.N.; Domínguez-Soberanes, J.; Méndoza-Pérez, D.E.; Velázquez, R. A multisensor data fusion approach for predicting consumer acceptance of food products. Foods 2020, 9, 774. [Google Scholar]

- Marín-Obispo, L.M.; Villarreal-Lara, R.; Rodríguez-Sánchez, D.G.; Follo-Martínez, D.; Espíndola Barquera, M.d.l.C.; Díaz de la Garza, R.I.; Hernández-Brenes, C. Insights into drivers of liking for avocado pulp (persea americana): Integration of descriptive variables and predictive modeling. Foods 2021, 10, 99. [Google Scholar]

- Kshetri, N. Blockchain and the economics of food safety. IT Prof. 2019, 21, 63–66. [Google Scholar] [CrossRef]

- Gorlov, S.M.; Krivorotova, N.F.; Dotdueva, Z.S.; Syromyatnikov, D.A.; Litvin, D.B. A methodology for comprehensive analysis of agricultural development management problems. Rev. Espac. 2018, 39, 17. [Google Scholar]

| LSTM | GRU | SAEs | |||||

|---|---|---|---|---|---|---|---|

| MAE | RMSE | MAE | RMSE | MAE | RMSE | ||

| Positive | (a) | 36.335451 | 46.211931 | 43.180532 | 53.695487 | 36.611738 | 44.703110 |

| (b) | 44.001377 | 54.172575 | 42.477046 | 52.547250 | 37.151156 | 45.119240 | |

| (c) | 43.429057 | 53.584650 | 42.236403 | 52.846026 | 37.062104 | 44.879368 | |

| (d) | 43.931223 | 53.855806 | 43.567233 | 54.203652 | 37.256250 | 45.128175 | |

| (e) | 43.798400 | 53.697382 | 42.014015 | 52.638279 | 36.890818 | 44.813605 | |

| (f) | 42.934769 | 52.923344 | 43.011107 | 53.428688 | 37.135335 | 45.199576 | |

| (g) | 43.019526 | 53.086045 | 42.399551 | 53.085417 | 36.812493 | 44.660683 | |

| (h) | 37.742285 | 46.050368 | 42.803237 | 53.571811 | 36.928434 | 45.036694 | |

| (i) | 43.912802 | 53.713543 | 42.077536 | 52.711389 | 37.223346 | 45.327537 | |

| AVE | 42.122766 | 51.921738 | 42.640740 | 53.192000 | 37.007964 | 44.985332 | |

| Negative | (a) | 43.184724 | 53.525993 | 42.811964 | 53.476943 | 36.864293 | 44.842421 |

| (b) | 44.018736 | 53.891109 | 42.662726 | 53.234308 | 37.159017 | 45.017255 | |

| (c) | 43.014621 | 52.914675 | 42.347422 | 52.891398 | 37.109032 | 44.888128 | |

| (d) | 43.707601 | 53.563837 | 42.786897 | 53.127477 | 37.048903 | 44.897605 | |

| (e) | 44.223738 | 54.368301 | 42.847674 | 53.379149 | 37.307459 | 45.169035 | |

| (f) | 42.831805 | 53.116795 | 42.697464 | 53.403691 | 37.135870 | 45.198482 | |

| (g) | 37.823529 | 46.089258 | 42.632475 | 53.294239 | 37.181486 | 45.212046 | |

| (h) | 43.407516 | 53.513330 | 42.295810 | 52.858094 | 36.573601 | 44.688961 | |

| (i) | 37.737973 | 45.994387 | 42.580679 | 53.198429 | 37.320087 | 45.407901 | |

| AVE | 42.216690 | 51.886410 | 42.629230 | 53.207080 | 37.077750 | 45.035760 | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hao, Z.; Wang, G.; Mao, D.; Zhang, B.; Li, H.; Zuo, M.; Zhao, Z.; Yen, J. A Novel Method for Food Market Regulation by Emotional Tendencies Predictions from Food Reviews Based on Blockchain and SAEs. Foods 2021, 10, 1398. https://doi.org/10.3390/foods10061398

Hao Z, Wang G, Mao D, Zhang B, Li H, Zuo M, Zhao Z, Yen J. A Novel Method for Food Market Regulation by Emotional Tendencies Predictions from Food Reviews Based on Blockchain and SAEs. Foods. 2021; 10(6):1398. https://doi.org/10.3390/foods10061398

Chicago/Turabian StyleHao, Zhihao, Guancheng Wang, Dianhui Mao, Bob Zhang, Haisheng Li, Min Zuo, Zhihua Zhao, and Jerome Yen. 2021. "A Novel Method for Food Market Regulation by Emotional Tendencies Predictions from Food Reviews Based on Blockchain and SAEs" Foods 10, no. 6: 1398. https://doi.org/10.3390/foods10061398

APA StyleHao, Z., Wang, G., Mao, D., Zhang, B., Li, H., Zuo, M., Zhao, Z., & Yen, J. (2021). A Novel Method for Food Market Regulation by Emotional Tendencies Predictions from Food Reviews Based on Blockchain and SAEs. Foods, 10(6), 1398. https://doi.org/10.3390/foods10061398