Abstract

Tax avoidance is one of the most frequent reasons for which companies tend to resort to creative accounting techniques. The purpose of the study is to identify which of the eight-variables from the Beneish influences the most or least the outcome of the final score, as a percent, by developing a statistical model. The sample was selected from the Bucharest Stock Exchange and consists of 66 companies traded on the main market, for the years 2015–2019. The results show that from the total of the eight variables, GMI (Gross Margin Index), AQI (Asset Quality Index), DEPI (Depreciation Index) and TATA (Total Accruals to Total Assets) are significantly influencing the probability to commit fraud. The developed model is validated with only 10% of the non-fraud companies being mistakenly considered as fraud based on our model and vice versa.

1. Introduction

The act of fraud has been practiced since ancient times, when it was expressed in various ways. The first definition of it was stated in Hammurabi’s Code, about 1800 years before the new era (Halilbegovic et al. 2020). In the literature it is specified that between corporate taxpayers and the taxing authorities is a continuous “war”, and that tax avoidance might be as old as the taxes itself (Ibrahim et al. 2013). Nowadays, the actions taken by companies to manipulate the financial statement continues, and the managers and accountants have gotten more and more creative in order to resort to different methods. The fraudulent action is considered to either be detected, or undetected (Mohammad et al. 2020). For this, specialists have developed and are constantly improving the models that can help identify the presence of financial fraud.

Financial fraud is present and can occur in different sectors of activity. Thus, the responsibility of raising red flags is distributed to the management of the company, and to the staff who are in charge of corporate governance (Bilgin et al. 2017). Externally, the auditors should apply sufficient audit tests to be assured that financial statements are free of errors or financial manipulation. Therefore, the responsibility is not attributed only to the management or to the auditor, it is equitable distributed (Johnes 2010).

The purpose of this paper is to identify which of the eight Beneish variabiles (Days Sales in Receivables Index (DSRI), Gross Margin Index (GMI), Asset Quality Index (AQI), Sales Growth Index (SGI), Depreciation Index (DEPI), Sales General and Administrative Expenses Index (SGAI), Leverage Index (LVGI), Total Accruals to Total Assets (TATA)) have a positive/negative influence on the final score for the Romanian companies traded on the main market. A similar study was conducted for companies listed on Tehran Stock Exchange and the researchers concluded that DSRI, GMI, AQI, SGI, DEPI and TATA variables have a direct significant effect on fraudulent reporting, and on the other hand SGAI and LEVI have a significant inverse effect (Mohammad et al. 2020).

In order to conduct the study, the companies traded on the main market from the BVB (Bucharest Stock Exchange) were divided in two categories as follows: “FRAUD” and “NON-FRAUD”. To obtain the final number of the companies analyzed, from the total of 81 businesses, the financial institutions and companies not based in Romania were eliminated. Thus, for the remaining 66 companies, the Beneish score was applied for the period 2015–2019. An average score was made for each company. The resulting values were reported at the reference level of “−2.22”. The scores higher than the reference point were included in the “FRAUD” area, and those with a lower score “NON-FRAUD”. Of the companies, 44 belong to the “FRAUD” area and 22 “NON-FRAUD”. Further, to obtain the statistical model, an intermediary step was applied. The Mann-Whitney test was applied to emphasize which of the quantitative variables is significantly different from one group to the other. Then, the progressive approach was used by estimating the binary logistic regression in the sample, in univariate form, along with the ROC curve. The binary logistic regression estimates the probability of finding a fraud company, based on the factors considered. The ROC curve has a similar approach. The results show that the variables which significantly influence the probability to commit fraud are: GMI (Gross Margin Index), AQI (Asset Quality Index), DEPI (Depreciation Index) and TATA (Total Accruals to Total Assets). The developed model is validated with only 10% error.

In the literature there are several models for identifying the presence of financial fraud: Beneish Model (Beneish 1999), Dechow-Dichev (Dechow and Dichev 2002), Piotroski model (Piotroski 2002), Lev-Thiagarajan model (Lev and Thiagarajan 1993), Vladu model (Vladu et al. 2016), Robu and Robu (2013), Hasan score (Hasan et al. 2017). In the current study the Beneish Model was applied, since it is the most known mathematical model for detecting earning management and financial fraud.

The research question of the paper is:

Research question: “What are the financial indicators that most strongly discriminate the two states: fraudulent financial statements and non-fraudulent financial statements?”

Through the conducted study, we contribute to the literature, by validating the Beneish model for Romanian companies. It is important to mention that the results may vary if the sample size is larger or smaller.

The outline of the paper is as follows; in Section 1 we present a brief literature review regarding the financial fraud and the methods used in the literature for detecting it. For the next section we detailed the objectives and the methodology applied in order to achieve them. Section 3 is dedicated to presenting the results obtained. The last part of the paper presents the main conclusion of the study and highlights the added value that was made.

2. Literature Review

For a better understanding of the topic, a brief definition of the concept of financial fraud will be made, followed by the presentation of the models used in the literature, to detect fraudulent actions.

Financial fraud is committed as a result of a series of intentional acts, for the purpose of gain or unjust, illegal advantage. It is an act undertaken with the intention of deceiving others, often ending in significant financial losses (Achim and Borlea 2020). Using fraudulent techniques, companies’ financial statements show discrepancies between the actual and created reality. All this creates an imbalance that should be noticed and marked with “red flags” (MacCarthy 2017). Among the many reasons for resorting to fraud, the literature also presents the situation in which a company is on the verge of bankruptcy. Thus, to present a positive image, pressure is put on managers to cosmeticize the results in order to remain attractive to stakeholders (MacCarthy 2017).

The motives that grounds fraudulent actions are varied, but the most common action is to avoid paying taxes. Tax expense is an incentive for companies in accounting manipulation since income tax is perceived as an unproductive outflow of capital sources (Svabova et al. 2020). The concept of tax-fraud consists of the non-payment of the taxes, and therefore violating the law. It is an intentional act, made to reduce the tax obligation. A means by which a business can restore to tax avoidance is underreporting sales or income and overstating deductions. In order to reduce taxation, companies cross the line of what is allowed by the tax system, by using illegal actions to reduce the amount of taxes (Hbaieb and Omri 2019).

In the literature, fraudulent actions are interpreted through the “Fraud Triangle” to outline various categories of action, to prevent the occurrence of financial fraud. The concept consists of three approaches; opportunity, which refers to the circumstance that allowed the occurrence of fraudulent action, incentives, which is also referred to as some pressure that affects the mentality of the employee and rationalization that addresses the justification of those who resort to accounting manipulation techniques (Schuchter and Levi 2013).

Goldmann (2009) underlines the fact that sometimes management often lives under the impression that their organizations are immune to fraud. A series of five myths were illustrated as follows:

- Ethics and Compliance Training “Has Us Covered”

It assumes that employees are trained to detect the red flags. However, most of the time, the word “fraud” is not even included in the code of ethics. A major difference must be made in the sense that “all fraud is unethical, but not all unethical conduct is fraudulent”.

- 2.

- Our Finance Staff are Qualified to Protect Us Against Fraud

In most of the companies it could be the case that “internal auditors, financial managers, accountants, treasurers, and other professionals” are not properly trained to detect the presence of financial fraud.

- 3.

- We Have Very Little Fraud Here

The reality is that in most of the cases, “no organization is immune to fraud”. Some have less, some have more.

- 4.

- Fraud is a Necessary Cost of Doing Business

If the organization has no policy for investigating and punishing financial fraud, then the “small” fraudulent actions can soon turn into major losses. When this happens, the outcome can do great damage to the organization and interested parties.

- 5.

- Implementing Controls and Training is Costly

The most effective anti-fraud techniques include “financial controls, operational controls, physical security of inventory, employee training, audits”. (Goldmann 2009). Prevention is the key to a healthy development of a company. It comes with a cost, but the costs are lower, rather than the case when financial fraud occurs.

Identifying the presence/absence of financial fraud is a topic of high importance. Therefore, we chose to approach a few of the present models in the literature as follows: the Piotroski model (F-Score), Dechow-Dichev, Lev-Thiagarajan, Hasan score, Robu&Robu, Vladu model and M-Beneish.

The first model, developed by Joseph Piotroski in 2002, had as ground point assessing the financial strength of a stock to maximize an investor’s profit. The basis of Piotroski’s research allows the application of a simple, nine-step analysis that indicates scores that can reveal a possible manipulation of financial statements by defining the company’s overall financial position as “weak”/“strong”. The model can be applied to both private and state-owned companies.

The calculation of the score is composed of three stages. The first stage includes profitability indicators (ROA, CFO, ACCRUAL). For the next stage, the following indicators are included: LEVER, LIQUID and EQ_OFFER. The last part includes the operational efficiency scores: MARGIN and TURN (Gimeno et al. 2019).

On the same note, Dechow and Dichev (2002), in their paper, measured the level of quality of accumulations based on the cash flow from commitments and the result of earnings which influences the financial statements. At the same time, it is highlighted that companies with a low quality of accumulations have a higher degree of commitments that are not related to cash flows (Dechow and Dichev 2002).

Another approach on measuring the level of financial manipulation was developed by Lev and Thiagarajan (1993). In the conducted study they have identified a set of 12 signals in order to measure the quality of gains and future increases. The fundamental signals analyzed are: Inventory, Accounts Receivable, Capital Expenditure, R&D (Research&Developmente), Gross Margin, Sales and Administrative Expenses (S&A), Provision for Doubtful Receivables, Effective Tax, Order Backlog, Labor Force, LIFO earnings, Audit Qualification (Lev and Thiagarajan 1993).

The value of higher total positive fundamental scores suggests a high quality of earnings, while total negative fundamental scores imply a low quality of earnings. The developed score is very useful when comparing different sectors of economic activity.

A relative new approach in identifying the presence of financial statement manipulation was developed by Hasan in 2017. The author established as a sample seven Asian countries (Indonesia, Thailand, Malaysia, Hong Kong, Singapore, China and Japan), with companies listed on the Malaysian Stock Exchange. In total, 4200 companies were analyzed, and the financial statements from 2008–2013 were analyzed (Hasan et al. 2017). The author addresses the concept of “gray area”, which is defined as an “area” that has susceptibilities or elements in those financial statements with an index value higher than the benchmark of the Beneish index. To develop the model, four steps were followed as detailed: “The first stage deals with developing the indices, the second stage deals with the detection of manipulators, the third stage deals with the developing of overall manipulation index (OMI), and the fourth and final stage deals with the level of manipulation of each index” (Hasan et al. 2017).

In the same vein, Vladu (Vladu et al. 2016) has developed a score applied for the Spanish companies, in the period of 2005–2012. Companies were selected which were following the rules, “good companies”, in addition to businesses which were not complying with the law. Twelve variables were developed, and the “t” symbol is used for the year in which the financial fraud has occurred. The variables developed are: Receivable index (RI), Inventories index (II), Gross margin index (GMI), Sales growth (SG), Depreciation index (DI), Discretionary expenses index (DEI), Leverage index 1 (LI1), Leverage index 2 (LI2), Asset quality (AQ), CFO index 1 (CFO1), CFO index 2 (CFO2), Sales index (SI) (Vladu et al. 2016).

A model developed and applied for Romania companies was elaborated by Robu and Robu, in 2013. A series of indicators based on the Beneish model were computed. Sixty-four companies were included in the sample, for the years 2011–2012. After computing several values, the model was established, and it is as follows: “M-FraudRisk-Beneish = −0.383IICC + 0.039IMB − 0.325ICA + 0.448IVV + 0.273ID + 0.915IVCA + 0.478IGI − 0.153IAA”. For the developed function, three intervals were obtained:

- The interval [−2.841; −0.355]—results with a value contained in the interval is free of risk, so it is considered to be a safe zone;

- The interval (−0.355; 0.313)—scores contained in this interval are part of the “grey zone”, uncertainty. In this case, additional audit procedures are expected;

- The interval [0.313; 2.453]—any value contained in this interval, are considered to be in a zone with risk of financial fraud. (Robu and Robu 2013).

Beneish Model was developed in 1999, by professor Messoud Beneish. The score measures the level of earning management of the financial situations. To compute the score, the data available from the financial statements published by the companies, are needed. The model is formed by eight variables: Days Sales in Receivables Index (DSRI), Gross Margin Index (GMI), Asset Quality Index (AQI), Sales Growth Index (SGI), Depreciation Index (DEPI), Sales General and Administrative Expenses Index (SGAI), Leverage Index (LVGI), Total Accruals to Total Assets (TATA).

Any value of the final score higher than “−2.22” indicates the presence of financial fraud (Beneish 1999). In the literature, the Beneish Model is considered to be one of the most accurate and well-known models of detecting financial fraud. (Svabova et al. 2020).

Halilbegovic et al. (2020), divides the Beneish variables, in two categories “manipulation signals” and “motivation signals”. In the manipulation signals are included: “Day Sales in Receivables Index (DSRI) for revenue inflation; Asset Quality Index (AQI) for expenditure capitalization; Depreciation Index (DEPI) for declining rate; and Total Accruals to Total Assets (TATA) for accounting not supported by cash”, and in the motivation signals: Gross Margin Index (GMI) for deteriorating margins; Sales Growth Index (SGI) for sustainability concerns; Selling, General, and Administrative Index (SGAI) for decreasing efficiency; and Leverage Index (LEVI) for tighter debt constraints” (Halilbegovic et al. 2020).

In the literature, the way that the variables show the actual state of the company have had several approaches. Researchers have argued the probability of manipulation increases when the company’s financial statements show significant changes in accounts receivable, deteriorating gross margins, decreasing asset quality, sales growth and increasing accruals (Goldmann 2009).

Beside the mathematical models presented above (and other stated in the literature), other general methods that can help detecting financial fraud are: “surprise audits, surveillance, regular internal audits, ratio analysis of the organization ’s key financial records, physical review of organization—owned supplies and asset inventory, manual review of T & E (travel&expenses) claims, manual assessment of payroll information, manual review of all vendors, have all bank reconciliations conducted by a manager outside of the accounts payable or procurement area” (Goldmann 2009).

Another approach in detecting the presence of financial fraud is data mining. It is broadly approached in the literature for detecting the presence of financial statement manipulation. A series of authors—Koh and Low, 2004; Kotsiantis, 2006; Kirkos, 2007, Hoogs, 2007; Belinna, 2009, Ravishankar, 2011 and so on applied or analyzed data mining methods to identify the presence of financial fraud (Gupta and Gill 2012). It assumes the extraction of structured data, from unstructured texts. In the process of identifying the presence of financial fraud, words or clusters of words can be used to identify the relationship with other variables (Gupta and Gill 2012).

For the present case study, the application of the Beneish model was chosen to identify the degree of accounting manipulation, and the presence/absence of financial fraud, since it is the best-known model in this regard. Also, the variables developed by professor Messoud Beneish were the basis for the elaboration of numerous mathematical models to identify the risk of not complying with the law. Romania (Robu and Robu 2013), Spain (Vladu et al. 2016), Asian countries (Malaysia, Indonesia, Thailand, Hong Kong, Singapore, China, and Japan) (Sabau et al. 2020). The effectiveness of the Beneish model in detecting and preventing financial fraud was identified by Herawati (2015) and Ramírez-Orellana et al. (2017).

In the approach literature, the authors did not found studies applied on the econometric model selected for the conducted study. Computing and analyzing the obtain results from the selected indexes the impact on economic environment was observed. Also, it was intended to update the results, for the computed indexes.

In the following, the materials and methods will be presented, and in the end, the results and conclusion will be approached.

3. Materials and Methods

To achieve the objectives, 81 companies, that trade on the main market from the Bucharest Stock Exchange (BVB) were selected. The sample was constructed from two perspectives. From the first, we have took into consideration the type of the company. Financial institutions and companies that were not based in Romania have been eliminated. The second aspect referred to the financial statement, meaning that we selected the businesses which had publish without interruption in the analyzed period, more precisely they were not delisted in a certain year. After applying the filters mentioned above, 66 companies for the period 2015–2019 were analyzed.

Next, for the selected sample, the Beneish score was calculated. An average of the score for each company was calculated, and then reported at the reference value of “−2.22” so the selected sample can be divided in the two categories: FRAUD and NON-FRAUD. The two categories are as follows:

- -

- 44 of the companies are restoring to illegal techniques: FRAUD

- -

- 22 present a good financial situation, do not resort to techniques that distort the current state of society: NON-FRAUD.

The steps that were followed to carry out the study are:

- -

- Centralizing the data from the reports downloaded from the Bucharest Stock Exchange (BVB);

- -

- Calculation of the eight variables and finally of the Beneish score;

- -

- Calculation of the average Beneish scores for the period 2015–2019 and segmentation of companies into those of the type “FRAUD”, respectively “NON-FRAUD”;

- -

- The application of the statistical model.

The detailed version of the variables that compose the Beneish score are as follows:

1. Days Sales in Receivables Index (DSRI) represents the ratio between the period of collecting receivables from one financial year to the previous one. If there are no extreme changes of the crediting policy, it is expected that this indicator has a linear structure. A value higher than 1 can be interpreted to mean that the accounts receivable is higher in the year t than in the t − 1. It could signal the presence of inflated revenues (Mahama 2015).

DSRI = (Net Receivablest/Salest)/(Net Receivablest−1/Salest−1)

2. Gross Margin Index (GMI) is constructed to detect irregularities of financial statements by measuring the ratio of a company’s previous year’s gross margin to the present year’s gross margin (Beneish 1999). A signal that a company is engaged in result manipulation can be observed from the reduction of Gross Margi ratio in the current year, compared with the previous. A score greater than 1 indicates the deterioration of the GMI index, due to the fact that the management team was motivated to manipulate the numbers to look better than they might be otherwise. A GMI score greater than 1 is an important red flag for any auditors and accountants to show the degree of manipulation financial data (Robu and Robu 2013). An unbalanced raise in the accounts receivable compared to the revenues may indicate the presence of fictitious sales.

where COGS is cost of goods sold (COGS) and it refers to the direct costs of producing the goods sold by a company.

GMI = [(Salest−1 − COGSt−1)/Salest−1]/[(Salest − COGSt)/Salest]

3. Asset Quality Index (AQI) For measuring the quality of the company (AQI) in a given year, computing the ratio of non-current assets (except property, plants and equipment) will show the company’s actual condition (Beneish 1999). A greater value than 1 of the AQI variable can signal the presence of financial fraud. The cases in which the AQI has a higher value is when the accountant professional resort to revaluation techniques of assets/fixed assets, the research and development and advertising costs are capitalized as intangible assets (Ibadin and Ehigie 2019). The outcome of the last techniques might be to increase the assets while the profitability of the company is preserved by using the manipulation techniques (Ibadin and Ehigie 2019). Shortly, a high value of the variable indicates the presence of creative accounting/fraud by using excessive capitalization of expenditure (Ibadin and Ehigie 2019).

where PP&Erepresents property plant and equipment (PPE).

AQI = [1 − (Current Assetst + PP&Et + Securitiest)/Total Assetst]/[1 − ((Current Assetst−1 + PP&Et−1 + Securitiest−1)/Total Assetst−1)]

4. Sales Growth Index (SGI) measures the probability in manipulating the financial statement through the ratio of current sales to previous sales. If it is a case of a high value of the index, then it may be a case of manipulation of financial statements (Mahama 2015).

SGI = Salest/Salest−1

5. Depreciation Index (DEPI) Depreciation index represents the ratio of depreciation expenses and gross value (Mahama 2015). The tendency of this index is to manipulate the revenues for the current year (Mahama 2015). A value greater than 1 shows that the rate at which assets are depreciated has slowed down (Beneish 1999). DEPI measures the depreciation expenses of tangible assets and equipment. So, the red flags could be raised when the revenues are increasing and the expenses with depreciation are decreasing (Ibadin and Ehigie 2019). Another case in which the DEPI index has a higher value than 1 could be when the accountants, together with the management, hide the receivables resulting from fictitious sales; this fact can be observed by changing the value of the depreciation.

DEPI = (Depreciationt−1/(PP&Et−1 + Depreciationt−1))/(Depreciationt/(PP&Et + Depreciationt))

6. Sales General and Administrative Expenses Index (SGAI) compares the ratio of a company’s sales, general and administrative expenses to sales (Ibadin and Ehigie 2019). The index could include a series of incentives or bonuses for the managers. A correlation is expected between SGAI and sales. So, a disproportionate increase of the sales in relation to general and administrative expenses could signal the presence of red flags.

SGAI = (SG&A Expenset/Salest)/(SG&A Expenset−1/Salest−1)

7. Leverage Index (LVGI) measures the ratio between the total debt of an enterprise and the total assets. A value higher than 1 may suggest the possibility of the company being involved in financial fraud (Ibadin and Ehigie 2019).

LVGI = [(Current Liabilitiest + Total Long Term Debtt)/Total Assetst]/[(Current Liabilitiest−1 + Total Long Term Debtt−1)/Total Assetst−1]

8. Total Accruals to Total Assets (TATA) is a qualitative indicator of cash flows for the company. It shows the extent to which cash sales are made. The red flags in case of this index can be raised if the degree of accruals as part of the total assets increases. Also, an increase in revenue or decrease in expenses, within the framework of accruals, indicate the presence of manipulation of financial information (Aghghaleh et al. 2016).

TATA = (Income from Continuing Operationst − Cash Flows from Operationst)/Total Assets

The M-Beneish equation is as follows:

M = −4.84 + 0.92 × DSRI + 0.528 × GMI + 0.404 × AQI + 0.892 × SGI + 0.115 × DEPI − 0.172 × SGAI + 4.679 × TATA − 0.327 × LVGI (Beneish 1999).

The first step in the research was the descriptive analysis of the variables—mean, median, standard deviation, minimum and maximum were computed and interpreted.

As the goal is to discriminate between fraudulent and non-fraudulent companies, the next step was to apply comparison tests for this—we have used the non-parametric approach given by the Mann-Whitney test. This choice is based on two reasons: (1) we have evaluated normality of the distributions of the variables on the two groups and in most cases, they turned out not to be normal; (2) the previous result was expected as we have relatively small samples.

The Mann-Whitney test was an intermediary step intended to emphasize which of the quantitative variables is significantly different from one group to the other. By using a progressive approach, we have then estimated the binary logistic regression in the sample, univariate form, along with the ROC curve. The binary logistic regression estimates the probability to find a fraud company, based on the factors considered. The ROC curve has a similar approach. The AUROC and p-value are presented in the results part.

The construction of the final estimation model is based on previous results, in the sense that dimensions that turned out to be significant in the univariate estimations were included in a multiple binary logistic regression model. The function returns a score (z), which is then transformed in the probability (using the exponential function—exp) based on the following formula:

that can be reduced at:

A series of estimation and post-estimation tests were applied to evaluate the model’s quality. They all validate the model.

One of these procedures is given by the classification scheme which compares the real group with the one estimated through the model. Another such procedure is, again, related to the ROC curve. Probabilities computed based on the model were used in the construction of the ROC curve and, once again, the goodness-of-fit was assessed based on the AUROC and the probability attached. Additionally, this method allows for evaluating different thresholds and the sensitivity and specificity related to the model.

4. Results and Discussions

In the following, the results of the applied method are presented.

The descriptive analysis (Table 1) conducted on the groups of fraud (fraud and non-fraud) clearly emphasize that the non-fraud group has lower scores for all eight dimensions that are considered in the Beneish score. This is valid for both the average and the median value. In the mentioned above table, GMI index for the companies committing fraud has the minimum value of 0.574, the maximum 34.535, the average 3.627 and the standard deviation 6.164. While the non-fraud companies have the minimum value of −26.727, and the maximum 1.865, the average −1.274 and standard deviation 6.368. In case of the companies who commit fraud, the minimum for AQI is 0.750, while the maximum is 39.623. The average has the value of 2.704 and the standard deviation 6.053. For the non-fraud companies the minimum is 0.608, the maximum 1.846, the average 1.059 and the standard deviation 0.269. DEPI, for the fraud companies has a minimum 0.844, maximum 32.262, average 3.639 and standard deviation 5.310. The non-fraud companies have minimum for DEPI 0.905, maximum 4.782, average 1.437 and standard deviation 0.839. For TATA variable the minimum for fraud companies is −0.663, the maximum 0.195, average −0.009 and standard deviation 0.129. The non-fraud businesses have the minimum −0.485, the maximum 0.227, the average −0.085 and standard deviation 0.136. The results clearly underline the differences between the fraud companies, compared to the non-fraud. For all the components of the test (mean, median, std. deviation, minimum, maximum) in the case of the fraud category the values are higher than in the case of non-fraud, where the results are lower. So, it is very clear that in the case of the mean, just as stated above, the average and the median scores for all these variables are significantly lower for the non-fraud companies.

Table 1.

Descriptive statistics of the Beneish score components on the fraud groups.

The GMI index signals the irregularities of financial statements by measuring the ratio of a company’s previous year’s gross margin to the present year’s gross margin (Beneish 1999). The reduction of the Gross Margin Index in the current year, compared with the previous, is a signal for the presence of the result manipulation. The managers who are under pressure to attain a certain budget can also manipulate earnings. For the AQI index in a given year, the ratio of non-current assets will reveal the company’s condition. To obtain the DEPI index, the ratio of depreciation expenses and gross value will be computed.

For TATA the manipulation can be observed when the total accruals as part of the total assets increase. It is considered a qualitative indicator of the cash flows for a business. It analyses the extent to which cash sales are made. It is important to take into con-sideration the increase in revenue or decrease in expenses, within the framework of accruals. They can indicate the presence of manipulation of financial information.

Additionally, the high variation in the scores of some of the dimensions, highlighted by both the standard deviation and the minimum and maximum values have led to non-normal distributions. That is why, a first comparison between the fraud and non-fraud group was conducted using nonparametric tests. Results of the Mann-Whitney test for independent groups (Table 2) show that there are significant differences in the distributions of fraud and non-fraud companies based on GMI, AQI, DEPI and TATA.

Table 2.

Independent group comparison of the Beneish score components—results of the Mann-Whitney test.

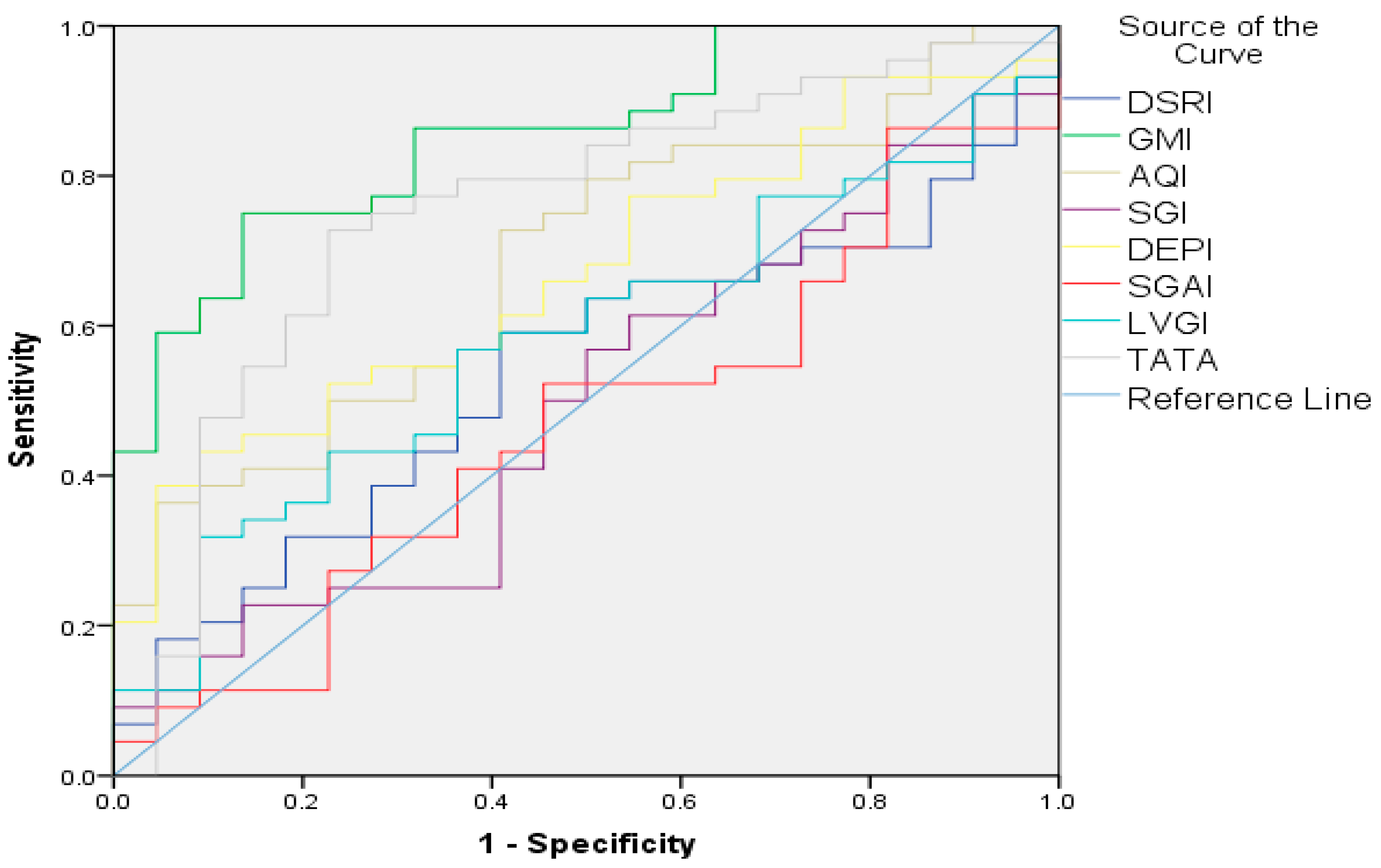

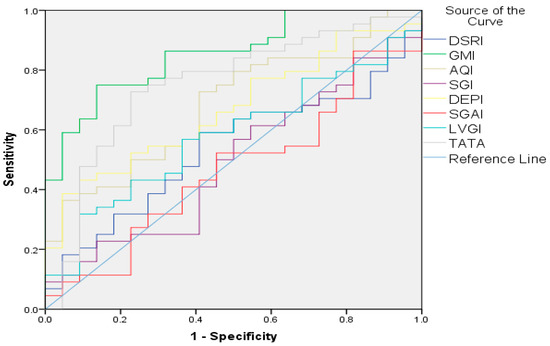

However, the final goal of our research is not only to assess differences between the two groups of companies, but, actually, to evaluate how the eight dimensions of the global Beneish score individually influence the probability of the Romanian companies to commit fraud. Consequently, we have applied the binary logistic regression, as described in the methodological part, along with the construction of the ROC curve. Both confirm the results of the Mann-Whitney test: only GMI, AQI, DEPI and TATA are significantly influencing the probability to commit fraud (Table 3). However, DEPI and TATA are only significant at the 10% critical level when assessed through the regression procedure. In respect to the relationship between fraud and the dimensions, the exponent of the binary regression coefficient is higher than 1 in all cases, showing an increasing probability to commit fraud for companies that have higher scores. For example, the odds of committing a fraud increases 8.316 times with any one point increase in the GMI score. The highest impact in terms of odds ratios belongs to TATA. A company which has a score one point higher than another has a probability 89.8 times higher to commit fraud. When the area under the ROC curve is evaluated, the highest impact is found for GMI (0.854), followed by TATA (0.752), AQI (0.686) and DEPI (0.670). The results can be visualized in Figure 1.

Table 3.

Univariate binary logistic regression.

Figure 1.

Roc curve analysis for the univariate situation. Source: authors’ construction in SPSS 24.

In case of GMI index, the presence of financial fraud could be signaled when the accountants, managers restore to fictitious sales. For the AQI variable the presence of earning manipulation appears when the management changes the reevaluation techniques of the assets/fixed assets. This could also be the case when capitalizing as intangible assets the costs for research and development and advertising. The outcome of restoring this technique is shown in the excess of capitalization of expenditures. Applying this manipulating technique can increase the assets, while the profitability of the company is preserved.

The purpose for the DEPI index is to measure the revenues of the current year. The manipulation of the accounts could appear for this variable when the revenues increase and the expenses with the depreciation decrease. So, the red flags can be raised when the current index shows a higher value, correlated with the decrease of the depreciation value. For TATA the manipulation can be observed when the total accruals as part of the total assets increase.

Considering all this, we have eliminated the insignificant variables from the analysis and, in the final stage of our research, we have only introduced the significant dimensions in the final multivariate binary logistic regression.

When the multivariate binary logistic regression is applied, DEPI and AQI lose their significance, both p-values being higher than 0.1. GMI and TATA have a significant positive impact upon the probability to commit fraud—every 1-point increase in the score increases the probability 4.234 times and 23.862 times, respectively (Table 4).

Table 4.

Multivariate logistic regression.

Quality control procedures show the validity of the final model. This is also emphasized by the very good fit of the data based on the estimated probability. Table 5 presents the classification scheme. Based on the estimations, only two of the fraud companies and two of the non-fraud ones were incorrectly classified in the other group. For the fraud companies the model has returned a correct percentage of 95.5, while 90.9% of the non-fraud companies were correctly classified as such.

Table 5.

Classification Table for the multivariate binary regression.

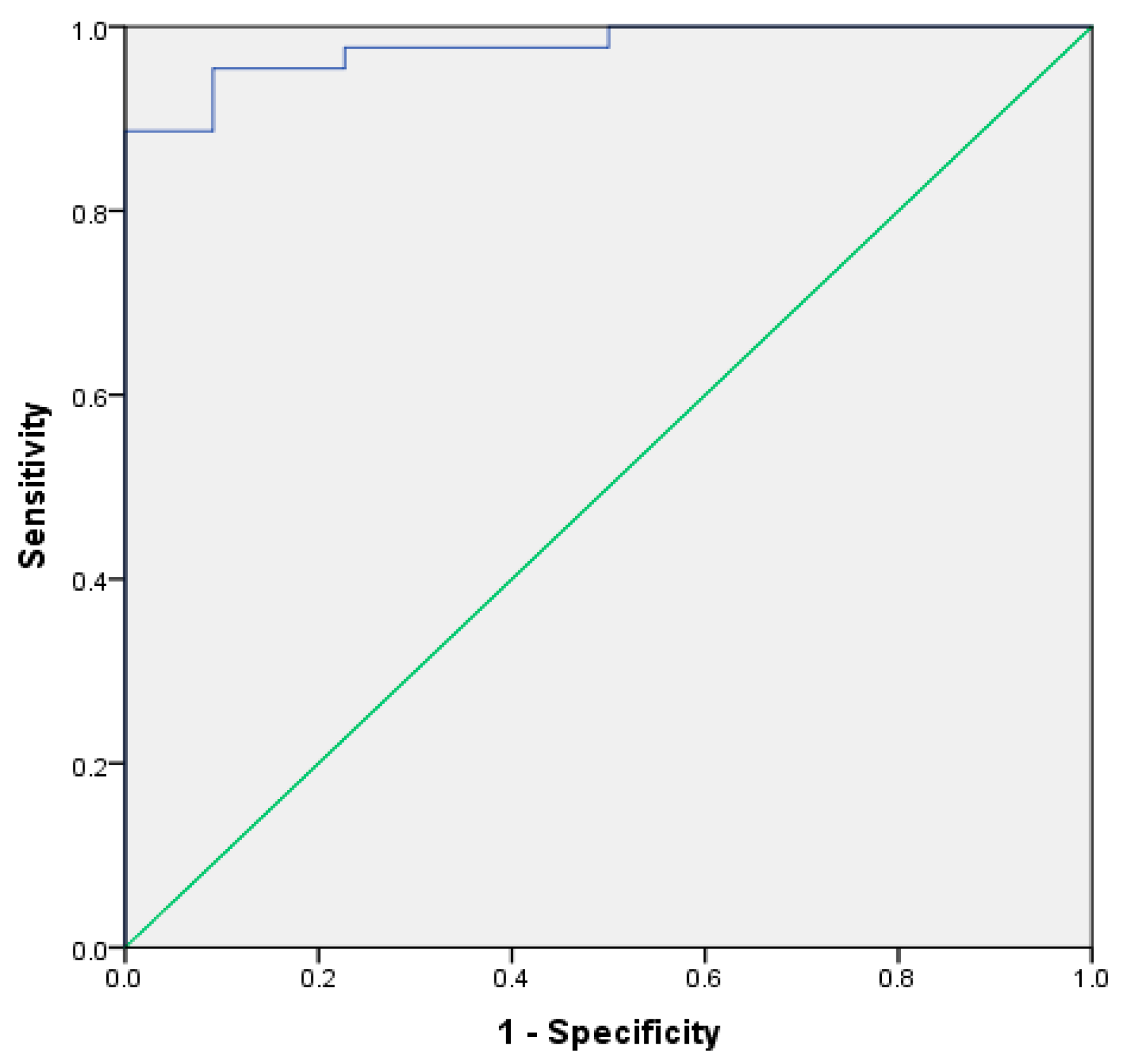

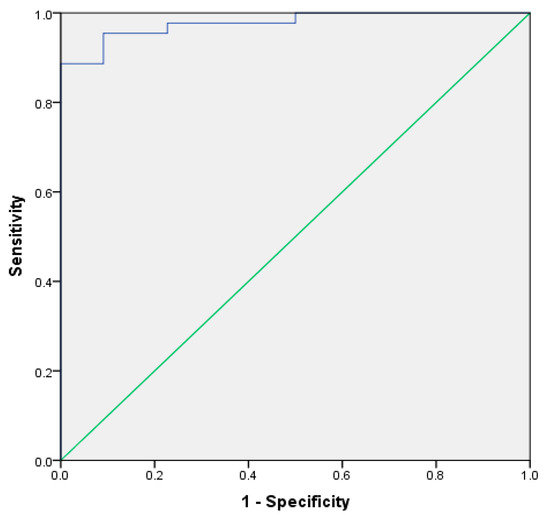

As a final validation procedure, we have constructed the ROC curve for the probabilities estimated through the regression model (Figure 2). The AUROC = 0.977 (p-value = 0.000) confirms the efficiency of the model obtained. Coordinates of the ROC curve show that a value of 50% for the estimated probability ensures 95.5% accuracy in predicting companies that would commit frauds, with a false-positive share below 10%. This means that less than 10% of the non-fraud companies could be mistakenly considered as fraud based on our model.

Figure 2.

ROC curve for multivariate binary logistic regression. Source: authors’ construction in SPSS 24.

Our findings align with the results of other studies in the literature. Mohammad et al. (2020) in the conducted research had also confirmed that indexes GMI, AQI, DEPI and TATA have a direct influence on identifying the presence of financial fraud. In the study conducted by Herawati (2015) for the indexes GMI, DEPI and TATA the runed tests also showed that they have a significant influence in detecting financial fraud. Repousis (2016) also confirms that AQI index can signal the presence of financial fraud. Another confirmation of significant influence in detecting financial fraud by Beneish indexes was obtained by Fhiqi and Ni (2019)—DEPI, AQI. Buljubasic and Halilbegovic (2017) confirms that there is a significant relationship between GMI and AQI and financial statement fraud. Another interesting study, conducted on the manufacturing businesses from Ghana, revealed that the ”profitability, liquidity, financial leverage, change of audit firm and the overall economic condition (Z-score)” are considered to be red flags which can predict the possibility of financial fraud occurrence (Anning and Adusei 2020). A study, developed on the Borsa Istanbul companies, also outlined the relationship between the indexes AQI and SGAI and the probability of identifying the presence of financial fraud (Erdoğan and Erdoğan 2020).

So, the results obtained in our study are validated by other studies in the literature, showing that the indexes obtained in our study have a direct influence on the fraud risk detection.

5. Conclusions

In the conducted study the research question was answered. For the Research Question: “What are the financial indicators that most strongly discriminate the two states: fraudulent financial statements and non-fraudulent financial statements” were established and validated by the applied tests. Firstly, by applying the descriptive statistics, we saw the differences between the “fraud” and “non-fraud” companies. Analyzing the different values for the mean, median, std. deviation, minimum and maximum showed us the differences between the two categories clearly. Then, the high variation in the scores led to non-normal distributions. Thus, in order to make the first comparison between the fraud and non-fraud a nonparametric test was conducted. Mann-Whitney test confirmed us that the variables which most influence the probability of fraud occurrence are: GMI (Gross Margin Index), AQI (Asset Quality Index), DEPI (Depreciation Index) and TATA (Total Accruals to Total Assets). In addition, we find that the statistical model is validated by the conducted tests. Thus, the AUROC test is 0.977 (p-value = 0.000). So, the developed statistical model was validated with a 95.5% accuracy for identifying the companies which commit frauds. From the revealed indexes, a company can restore to financial fraud by creating fictious sales, changes in the reevaluation techniques and increases in revenues, correlated with a decrease of depreciation.

The indexes analyzed tell us the way in which a company can resort to manipulation techniques. Before calculating the Beneish score, each variable that compose it can show the current state of a business. Each index refers to a certain aspect and indicate us what element from the financial statements should be overviewed. Having a closer look over the scores, one may make certain conclusions about a company. The means by which a business manipulates the accounts can be a case of creating fictious sales, and decreasing the depreciation value, correlated with an increase in revenues, changing the reevaluation techniques.

Even if we talk about financial fraud and creative accounting, we cannot say that there will be a time when everything will function according to regulations. Technology laws are developing, but at the same time there appear breaches that will always be observed by the ones who resort to illegal actions. It is important for those who analyze the financial statements to use all the data and information available, and use their professional judgment and do their best in identifying the ones who are breaking the law.

The conducted study is in the use of the stakeholders and the government. Investors can follow the indicators, see the actual state of a certain business, and then decide if it is worth buying shares or continuing to invest, depending on the case. The banks, in the case of future loans, or different analysis, can reveal by computing the indexes whether a business is following the right conduct on reporting the financial statements. This can also be the case for the employees. With the interest for the business to grow and be more notorious and of course to keep their jobs, they could present the interest in analyzing the indexes and conclude whether the company is on the “right path”.

For a while now, the changes in the economic sector were not that steep. In the pandemic times that we are living, companies need to adapt to a different context, which has led to new changes in business and opportunistic behavior. The challenge here was detecting the financial fraud, but since the most companies have shifted their activity in the online environment, new loopholes in the law may appear. In this case, the internal control, internal audit, managers, external auditors and regulators should be more cautious when evaluating the activity of a company. The times are changing, so all the involved parties need to keep the rhythm and maybe be one step ahead.

6. Limitations

In terms of the limitations, we can say that the sample size is small, but this is also an outline for the improvement in future studies, in the sense of analyzing all the companies listed on the Bucharest Stock Exchange. Another limitation can be seen in the inconsistency in terms of the activity field. The analyzed businesses are from varied sectors. This could be the second improvement for the next article, selecting all the listed companies, and computing the indexes for each sector of activity. Improvement is a constant, and for each study conducted, another research opportunity may arise.

Author Contributions

All authors had an equal contribution. All authors have read and agreed to the published version of the manuscript.

Funding

This work was supported by a grant of the Romanian Ministry of Education and Research, CNCS—project number PN-III-P4-ID-PCE-2020-2174, within PNCDI III This work was also possible with the financial support of the Operational Programme Human Capital 2014–2020 under the project number POCU 123793 with the title “Researcher, future entrepreneur—New Generation”.

Data Availability Statement

The data presented in this study are contained and available in the framework articles and in the Web of Science database.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Achim, Monica Violeta, and Nicolae Sorin Borlea. 2020. Economic and Financial Crime. Corruption, Shadow Economy, and Money Laun-Dering. Cham: Springer. [Google Scholar] [CrossRef]

- Aghghaleh, Shabnam Fazli, Zakiah Muhammaddun Mohamed, and Mohd Mohid Rahmat. 2016. Detecting Financial Statement Frauds in Malaysia: Comparing the Abilities of Beneish and Dechow Models. Asian Journal of Accounting and Governance 7: 57–65. [Google Scholar] [CrossRef]

- Anning, Asafo Adjei, and Michael Adusei. 2020. An Analysis of Financial Statement Manipulation among Listed Manufacturing and Trading Firms in Ghana. Journal of African Business, 1–15. [Google Scholar] [CrossRef]

- Beneish, Messod D. 1999. The Detection of Earnings Manipulation. Financial Analysts Journal 55: 24–36. [Google Scholar] [CrossRef]

- Bilgin, Mehmet Huseyin, Giray Gozgor, and Chi Keung Marco Lau. 2017. Institutions and gravity model: The role of political economy and corporate governance. Eurasian Business Review, 421–36. [Google Scholar] [CrossRef]

- Buljubasic, Elvisa, and Sanel Halilbegovic. 2017. Detection of Financial Statement Fraud Using Beneish Model. International Conference on Economic and Social Studies, 252–62. [Google Scholar] [CrossRef]

- Dechow, Patricia M., and Ilia D. Dichev. 2002. The quality of accruals and earnings: The role of accruals estimation errors. The Accounting Review 77: 35–59. [Google Scholar] [CrossRef]

- Erdoğan, Murat, and Eda Oruç Erdoğan. 2020. Financial Statement Manipulation: A Beneish Model Ap plication. Contemporary Issues in Audit Management and Forensic Accounting, 173–88. [Google Scholar] [CrossRef]

- Fhiqi, Alfian, and Nyoman Alit Triani Ni. 2019. Fraudulent Financial Reporting Detection Using Beneish M-Score Model in Public Companies in 2012–2016. Asia Pacific Fraud Journal 4. [Google Scholar] [CrossRef]

- Gimeno, Ruth, Loban Lidia, and Vincente Luis. 2019. A neural approach to the value investing tool F-score. Finance Research Letters 37: 101367. [Google Scholar] [CrossRef]

- Goldmann, Peter. 2009. Anti-Fraud Risk and Control Worbook. Hoboken: John Wiley & Sons, Inc., pp. 3–125. [Google Scholar] [CrossRef]

- Gupta, Rajan, and Singh Nasib Gill. 2012. Financial Statement Fraud Detection using Text Mining. International Journal of Advanced Computer Science and Applications 3: 189–91. [Google Scholar] [CrossRef]

- Halilbegovic, Sanel, Celebic Nedim, Cero Ermin, Buljubasic Elvisa, and Mekic Anida. 2020. Application of Beneish M-score model on small and medium enterprises in Federation of Bosnia and Herzegovina. Eastern Journal of European Studies 11: 146–63. [Google Scholar]

- Hasan, Md, Shamimul Omar, Binti Normah, Barnes Paul, and Handley-Schachler Morrison. 2017. A cross-country study on manipulations in financial statements of listed companies. Journal of Financial Crime 24: 656–77. [Google Scholar] [CrossRef]

- Hbaieb, Ines Hakim, and Mohamed Ali Brahim Omri. 2019. Tax management and tax fraud: Evidence from Tunisian companies. Internationa Journal of Managerial and Financial Accounting 11: 132–44. [Google Scholar] [CrossRef]

- Herawati, Nurul. 2015. Application of Beneish M-Score Models and Data Mining to Detect Financial Fraud. In 2nd Global Conference on Business and Social Science. Amsterdam: Elsevier B.V., vol. 211, pp. 924–30. [Google Scholar]

- Ibadin, Peter Okoeguale, and Aimienrovbiye Humphrey Ehigie. 2019. Beneish Model, Corporate Governance and Financial Statements Manipulation. Asian Journal of Accounting and Governance 12: 51–64. [Google Scholar]

- Ibrahim, Aramide Salihu, Siti Normala Sheikh Obid, and Hairul Azlan Annuar. 2013. Measures of Corporate Tax Avoidance: Empirical evidence from an emerging economy. International Journal of Business and Society 14: 412–27. [Google Scholar]

- Johnes, Martyn. 2010. Auditors and Fraud—And the end of Watchdogs and Bloodhounds, The Magazine Financial Auditor. Bucharest: CAFR, vol. 8, pp. 46–49. [Google Scholar]

- Lev, Baruch, and S. Ramu Thiagarajan. 1993. Fundamental Information Analysis. Accounting Research Center, Booth School of Business, University of Chicago 31: 190–215. [Google Scholar] [CrossRef]

- MacCarthy, John. 2017. Using Altman Z-score and Beneish M-score Models to Detect Financial Fraud and Corporate Failure: A Case Study of Enron Corporation. International Journal of Finance and Accounting 6: 159–66. [Google Scholar] [CrossRef]

- Mahama, Muntari. 2015. Detecting Corporate Fraud and Financial Distress Using the Altman and Beneish Models. International Journal of Economics, Commerce and Management III. Available online: https://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.681.8022&rep=rep1&type=pdf (accessed on 27 February 2021).

- Mohammad, Mahdi Shakouria, AliAsghar Taherabadib, Mehrdad Ghanbaric, and Babak Jamshidinavidd. 2020. Explaining the Beneish model and providing a comprehensive model of fraudulent financial reporting (FFR). International Journal of Nonlinear Analysis and Applications 12: 39–48. [Google Scholar] [CrossRef]

- Piotroski, Joseph D. 2002. Value Investing: The Use of Historical Financial Statement Information to Separate Winners from Losers. Journal of Accounting Research 38: 1–41. [Google Scholar] [CrossRef]

- Ramírez-Orellana, Alicia, María J. Martínez-Romero, and Teresa Mariño-Garrido. 2017. Measuring fraud and earnings management by a case of study: Evidence from an international family business. European Journal of Family Business 7: 41–45. [Google Scholar] [CrossRef]

- Repousis, Spyridon. 2016. Using Beneish model to detect corporate financial statement fraud in Greece. Journal of Financial Crime 23: 1063–73. [Google Scholar] [CrossRef]

- Robu, Ioan Bogdan, and Mihaela Alina Robu. 2013. Proceduri de Audit Pentru Estimarea Riscului de Fraudă Bazate pe Indici de Detectare a Manipulărilor Contabile. Audit Financiar 106: 4–16. Available online: https://www.researchgate.net/publication/258238495_Proceduri_de_audit_pentru_estimarea_riscului_de_frauda_bazate_pe_indici_de_detectare_a_manipularilor_contabileAudit_Procedures_for_Estimating_the_Fraud_Risk_Based_on_Indexes_for_Detection_of_Accountin (accessed on 19 March 2021).

- Sabau, Andrada Ioana, Ioana Lavinia Safta, Gabriela Monica Miron, and Monica Violeta Achim. 2020. Manipulation of Financial Information through Creative Accounting: Case Study at Companies listed on the Romanian Stock Exchange. Paper presented at the 18th RSEP International Economics, Finance & Business Conference, Istanbul, Turkey, August 26–27; pp. 64–80. Available online: https://www.researchgate.net/publication/346927731_Manipulation_of_Financial_Information_through_Creative_Accounting_Case_Study_at_Companies_listed_on_the_Romanian_Stock_Exchange (accessed on 20 March 2021).

- Schuchter, Alexander, and Michael Levi. 2013. The Fraud Triangle revisited. Security Journal 29: 107–21. [Google Scholar] [CrossRef]

- Svabova, Lucia, Katarina Kramarova, Jan Chutka, and Lenka Strakova. 2020. Detecting earnings manipulation and fraudulent financial reporting in Slovakia. Oeconomia Copernicana 11: 485–508. [Google Scholar] [CrossRef]

- Vladu, Alina Beattrice, Oriol Amat, and Dan Dacian Cuzdriorean. 2016. Truthfulness in Accounting: How to Discriminate Accounting Manipulators from Non-manipulators. Journal of Business Ethics 140: 633–48. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).