1. Introduction

De Finetti introduced in 1957 the expected net present value (NPV) of dividends paid by an insurance company as a criterion for assessing its stability. According to this model, the maximum of the expected NPVs, if it exists, can be a proxy for the insurance company’s value. In some cases (e.g., due to regulatory issues), the insurance company has to ensure the negative balance protection and therefore must be rescued by injecting capital. Hence, the company aims to maximize the total amount of expected dividend payments minus the total expected cost of capital injection while permanently keeping the surplus process non-negative.

Usually, spectrally negative Lévy processes (Lévy processes with only downward jumps) are used to model the underlying surplus process of an insurance company, which increases with premium payments and decreases with insurance payouts. The optimization problem for this model was studied by

Avram et al. (

2007), who proved that it is optimal to inject capital when the process is below zero and pay dividends when the process is above a suitably chosen threshold.

In this paper, we focus on the case when the insurance company pays a fixed transaction cost each time a dividend payment is made. The fixed transaction cost makes the continuous payment of dividends no longer feasible, which implies that only lump sum dividend payments are possible. In this case, a strategy is assumed to have the form of impulse control; whenever dividends are accrued, a constant transaction cost

is incurred. Unlike the barrier strategies described above, which are typically optimal for the case without transaction cost, we pursue the optimality of the reflected

-policies. In these strategies, the surplus process is brought down to

whenever it exceeds the level

for some

, and pushes the surplus to 0 whenever it goes below 0. Previously, the version of the de Finetti’s optimal dividend problem with fixed transaction cost and without bail-outs was solved for the spectrally negative case by

Loeffen (

2009) and for the dual model (i.e., spectrally positive Lévy processes) by

Bayraktar et al. (

2014b).

In this paper, we also propose a model to maximize the value of the insurance company by means of the dividend payments while keeping the expected present value of the capital injection bounded. The idea of introducing this constraint is to bound the budget needed for the company to survive and therefore to reduce the risk faced (e.g., operational risk).

Specifically, we solve the following two problems:

We find the solution to the optimal bail-out dividend problem with fixed transaction cost for the case of spectrally negative Lévy processes. We show that a reflected -policy is optimal (see Theorem 1). We use scale functions to characterize the optimal thresholds as well as the value function. We prove the optimality of the proposed policy by means of a verification theorem.

We solve the constrained dividend maximization problem with capital injection on the set of strategies such that the expected net present value of injected capital must be bounded by a given constant. This is an offshoot of

Hernández et al. (

2018) for the bail-out case. Using the previous results, in Theorems 2 and 3, we present the solution when the surplus of the company is modeled by a spectrally negative Lévy process.

This paper is organized as follows. In

Section 2, we introduce the problem. In

Section 3, we provide a review of scale functions and some fluctuation identities of spectrally negative Lévy processes as well as their reflected versions. In

Section 4, we solve the optimal bail-out dividend problem with fixed transaction cost for the case of a spectrally negative Lévy process. In

Section 5, we present the solution for the constrained bail-out dividend problem. In

Section 6, we illustrate our main results by giving some numerical examples.

2. Formulation of the Problem

Let be a Lévy process defined on a probability space , and let be the completed and right-continuous filtration generated by X. Recall that a Lévy process is a process that has càdlàg paths and stationary and independent increments. For , we denote by the law of X, where . For convenience, we take , when . The expectation operator associated with is denoted by We take , where is the expectation operator associated with .

We henceforth assume that the insurance company’s surplus X is modeled by a spectrally negative process, i.e., a Lévy process that only has negative jumps. We omit the case when X has monotone trajectories to avoid trivial cases.

The Laplace exponent of

X is given by

where

,

, and the Lévy measure of

X,

, is a measure defined on

satisfying

As is well-known, the process

X has bounded variation paths if and only if

and

. In this case,

X can be written as

where

and

is a drift-less subordinator. Since we omit the case when

X has monotone paths, it is necessary that the constant

c is greater than zero. Note that the Laplace exponent of

X, with

X as in Equation (

1), is given as follows,

De Finetti’s Problem with Fixed Transaction Cost and Capital Injection

Let

be a strategy, where

is left-continuous

-a.s., and

is right-continuous

-a.s. Additionally, we assume that

and

are non-negative, and non-decreasing

-a.s., start at zero and are adapted to the filtration

. Then, the controlled process,

, associated with the strategy

, is the following

For each , the quantities and represent the cumulative amounts that the insurance company has paid to its shareholders and has injected, respectively.

The set of admissible policies

consists of those policies

for which

is non-negative and for

,

When there is a fixed transaction cost

, we only consider the class of admissible strategies

such that

where

. We denote this class by

and in the case

, we take

.

Given an initial capital

and a policy

, with

, we define the expected NPV as follows,

where

,

, and

is the unit cost per capital injected.

Remark 1. Note that in the case of proportional transaction cost the expected NPV changes towhere , so by changing δ and Λ

appropriately we can recover Equation (

2).

Hence, the value function we aim to find is

Remark 2. Since we want to avoid this function taking the value , we assume that . We also assume that , otherwise the value function will go to infinity since large amounts of dividends will be paid, given that the company will inject capital at a cheaper cost to bail out.

Note that the problem in Equation (

3) was studied by

Avram et al. (

2007) under the assumption

(see

Section 3.2). Therefore, we focus on the optimal control problem when

(see

Section 4).

3. Preliminaries

In this section, we revise the scale functions of spectrally negative Lévy processes and their properties (see, e.g.,

Kuznetsov et al. (

2013);

Kyprianou (

2014)). We also recall well known results regarding optimal dividend strategies with capital injection for spectrally one-sided Lévy processes when the transaction cost is equal to 0 (i.e.,

).

For each

, there exists a map

, called

q-scale function, satisfying

for

, and strictly increasing on

, which is defined by its Laplace transform:

where

We also define, for

,

Since

is equal to zero on

, we have

Remark 3. - 1.

By Equation (8.26) of Kyprianou (2014), the left- and right-hand derivatives of always exist on . In addition, as in, e.g., (Chan et al. 2011, Theorem 3), if X is of unbounded variation or the Lévy measure is atomless, we have . - 2.

- 3.

From Lemma 3.3 of Kuznetsov et al. (2013), , as .

Due to Remark 3, we make the following assumption throughout the paper.

Assumption 1. We assume that either X has unbounded variation or Π is absolutely continuous with respect to the Lebesgue measure. Under this assumption, it holds that is in .

We give the following properties related to and for later use.

Remark 4. - (i)

By Proposition 5.5 in Hernández et al. (2018), we have that is a strictly log-convex function on , for . - (ii)

From Lemma 1 in Avram et al. (2007), it is known that is a log-concave function on .

We define the stopping times

and

, respectively, as follows,

here and further on, let

. By Theorem 8.1 in

Kyprianou (

2014), we have that

3.1. Reflected Lévy Processes

Let

and

be defined, respectively, as

We denote

and

, which are strong Markov processes. Observe that the process

pushes

X upwards whenever it attempts to down-cross the level 0; as a result the process

Y only takes values on

. An introduction to the theory of Lévy processes and their reflected processes can be encountered in

Bertoin (

1998);

Kyprianou (

2014).

Let

be defined as

, with

. Then, by Proposition 2 in

Pistorius (

2004),

Remark 5. Note that, by definition, the function H is strictly positive, strictly decreasing and satisfies Therefore, the function H has an inverse from onto when and , and from onto otherwise.

Similarly, taking

, with

, we know from Proposition 2 in

Pistorius (

2004) that

3.2. Optimal Dividends without Transaction Cost and with Capital Injection

When

, Equation (

2) becomes

for any initial capital

and admissible policy

. Consider the strategy

, which consists in setting reflecting barriers at

a and 0, respectively. The controlled risk process

is a doubly reflected spectrally negative Lévy process and was studied by

Avram et al. (

2007). Intuitively, the process behaves similar to a Lévy process when it is inside

, but when it tries to cross above the level

a or below the level 0 it is forced to stay inside

. Using Theorem 1 from

Avram et al. (

2007), we have that for

and

,

Note that the expression in Equation (

12) is finite under our assumption that

. Using the expressions above, we can see that, for

,

where

Equation (

13) suggests that, to find the best barrier strategy we should maximize the function

. Thus, we can define the candidate for the optimal barrier by

Remark 6. Note that and satisfiesHere, in case that X is of unbounded variation, the first equality is understood to be . The barrier level , given in Equation (

15)

, corresponds with the level defined in Avram et al. (2007). Using the definition of the function H, we have that Since H is strictly decreasing, has a unique maximum at that is either a critical point, which is a solution of , or 0 if the right-hand derivative of is negative at 0. Therefore, by Remark 5, In addition, note that is strictly increasing on and strictly decreasing on .

Hence, from

Avram et al. (

2007), we know that the value function in Equation (

3) and the optimal strategy are given by

and

, where

and

are as in Equations (

13) and (

16), respectively.

Remark 7. Note that the optimal barrier as .

4. Capital Injection and Fixed Transaction Cost

In this section, we solve the problem in Equation (

3) in the presence of a fixed transaction cost

. We consider strategies where the capital injection policy is

, given in Equation (

6), and the dividend strategy is the so-called reflected

-policy, defined below.

4.1. Value Function of Reflected -Policies

Let

be a pair such that

. In this subsection, we define the reflected

-policy, denoted by

, and under which we construct the controlled process. Let

be the Lévy process reflected from below 0, so we set

where

. The process then jumps downward by

so that

. Now, for

,

is the reflected process from below at 0 of

), and

. By repeating this procedure, we can construct the process inductively. The process

clearly admits the decomposition

where

and

are the cumulative amounts of dividend payments and capital injection, respectively.

Let us compute the expected NPV of dividends with transaction costs for this strategy. For this purpose, we denote

If

, by the Strong Markov Property and Equation (

8), we obtain that

When

, an amount

is paid as dividends and a transaction cost

is incurred immediately, so by using Equation (

17) we obtain

Hence, taking

, and solving for

we get

Using the aforementioned expression in Equation (

17), we have for

,

Now, let us calculate the expected NPV of the injected capital denoted by

Again, by the Strong Markov Property, noting that

and Equations (

8)–(

9), we have for

Thus, setting

and solving for

, we obtain

Putting the pieces together, we obtain

Hence, we have the following result.

Lemma 1. The expected NPV associated with a reflected -policy is given bywhere Remark 8. Note that is on , and 4.2. Choice of Optimal Thresholds

To choose the optimal thresholds among reflected policies, we maximize the function .

Proposition 1. The function , defined in Equation (

19)

, attains its maximum on . Proof. Let

be fixed. The first derivative of

with respect to

is given by

where

On the other hand, taking

in Equation (

12), we see

Then, using Equation (

10), we have

Therefore, since

(see Remark 3), the right-hand side of the aforementioned inequality goes to

as

goes to

∞, which implies

From here and Remark 8, we obtain that there exists

(that depends on

) such that

Taking

, with

, we see

for each

, since Equation (

23) holds. From Equation (

20) and the fact that

, it follows that

for

. Then, by the definitions of

and

—see Equations (

21) and (

14), respectively—we get

Now, let us take

(where

is defined in Equation (

14)). Then, using the fact that

is strictly decreasing in

(see Remark 6), we have that for any

it holds that

and

This implies that the maximum of the function

has to be achieved on the set

Finally, from Equation (

22), we obtain

Hence, for any

, we can find

such that

Therefore, the function

attains its maximum on the set

☐

Note that by Proposition 1 the set

defined as

is not empty. Moreover, since

and using Equation (

14), it follows that

with equality if

, and

Proposition 2. There exists a unique pair in . Furthermore, , with defined in Equation (

16)

, and the value function associated with the -policy is Proof. Let

M be the maximum value of

in

; therefore, for any

, we have that

by Equation (

25). From Remark 6, we know that

is strictly increasing on

and strictly decreasing on

. If

,

attains

M at a unique

and therefore

is the only point that satisfies Equation (

24). On the other hand, if

,

can only attain the value

M at a unique

and a unique

. Hence,

is the only point that satisfies Equations (

24) and (

25), that is, the only existing point in

. Now, from Lemma 1 and using that

, we obtain the first part of Equation (

26). For the second part, let

, then

☐

The following properties of are used below in the verification theorem.

Remark 9. From Equations (

10)

and (

26)

, we note Remark 10 (Continuity/smoothness at zero)

. Note that for , . Therefore,

- (i)

is continuous at zero.

- (ii)

For the case of unbounded variation, we have that

4.3. Verification

Let us denote by

the function given in Equation (

26), which is the optimal value function among reflected policies. We now prove some properties of this function.

Lemma 2. The function is and .

Proof. By Assumption A1, we have that, for each

, the function

is continuously differentiable on

. This implies, by Equation (

26), that

is

. On the other hand, using Equation (

28), we have that for

,

This implies that

. For

, we obtain by Equation (

26) that

which implies the result. ☐

Let

be the operator defined as follows,

where

and

F is a function on

such that

is well defined.

Proposition 3. - 1.

for .

- 2.

for .

Proof. This implies that for

,

We note that

for all

, where

is the barrier strategy at the level

a for the dividend problem with capital injection given by Equation (

13). Therefore,

- (i)

If we take

, and

, we obtain

Recall the functions

and

H are as in Equations (

7) and (

14), respectively. Then,

By Proposition 2, we know that . Then, , since by Remark 6.

- (ii)

We have for

,

which comes from the fact that for

, then

by Remark 2. On the other hand, for

, we have, using the fact that

,

- (iii)

This and Point (ii) imply that .

- (iv)

Thus, by similar arguments to those in the proof of Theorem 2 in

Loeffen (

2008), we obtain the result. ☐

Lemma 3. - 1.

For , we have that .

- 2.

For , we have that .

Proof. 1. By Equation (

5) together with Equation (

26), we note that for

,

On the other hand, for .

2. Let us consider

. We note that

Now, suppose that

, then using Equation (

26) we obtain

Finally, for the case

, by Equation (

27), we have

☐

Now, we proceed to the verification theorem that proves the optimality of the -policy.

Theorem 1 (Verification Theorem)

. Let , be as in Equations (3) and (26), respectively. Then, for all . Hence, the -policy is optimal. Proof. By the definition of

,

for all

. Let us verify that

for all admissible

and for all

. Recall that

is defined in Equation (

2). Take

fixed and let

be the sequence of stopping times where

. Since

, with

X being a spectrally negative Lévy process, it is a semi-martingale and

is sufficiently smooth on

by Lemma 2, and continuous (respectively, continuously differentiable) at zero for the case of bounded variation (respectively, unbounded variation) by Remark 10, we can use the change of variables/Meyer-Itô’s formula (cf. Theorems II.31 and II.32 of

Protter (

2005)) on the stopped process

to deduce under

that

where

M is a local martingale with

,

is the continuous part of

, and

J is a jump process, which is given by

On the other hand, by Part (1) of Lemma 3, we obtain that

Similarly, by Part (2) of Lemma 3,

Hence, from Equation (

28), we derive that

Using Proposition 3 along with Point 3 in the proof of Lemma 6 in

Loeffen (

2009), and that

a.s. for

, we observe that

where the last inequality follows from Remark 9. In addition, by the compensation formula (see, e.g., Corollary 4.6 of

Kyprianou (

2014)),

is a zero-mean

-martingale. Now, taking expected value in Equation (

29) and letting (

-a.s., the monotone convergence theorem, applied separately for

and

, gives

This completes the proof. ☐

5. Optimal Dividends with Capital Injection Constraint

In this section, we are interested in maximizing the expected NPV of the dividend strategy subject to a constraint in the expected present value of the injected capital. Specifically, we aim to solve

for any

and

. Strategies

that do not satisfy the capital injection constraint are called infeasible. Recall that the insurance company has to inject capital to ensure the non-negativity of the risk process. Therefore, small values of

K require very low dividend payments to keep the risk process non-negative, or would even make the problem infeasible. In the latter case, we define the value function as

.

To solve this problem, we use the solution of the optimal dividend problem with capital injection found in the section above. Thus, for

, we define the function

with

as in Equation (

2). It is easy to check that

since for infeasible strategies

. By interchanging the sup with the inf we obtain an upper bound for

, the so-called weak duality. Hence, the dual problem of Equation (

32) is defined as

with

given in Equation (

3). The last equality in Equation (

31) is true, since

is infinite for any

; see Remark 2. The main goal is to prove that

.

5.1. No Transaction Cost

In this subsection, we consider the problem in Equation (

30) without transaction cost, i.e.,

. For this case, we denote

and

. From

Section 3.2, recall that for each

, the optimal strategy is a barrier strategy, which is determined by

defined in Equation (

16), and its NPV satisfies

, where

is as in Equation (

13). Given a barrier strategy at

and

, the expected NPV of the injected capital is given by the function

with

as in Equation (

10). Clearly, if

, then

. We also define

Using Equation (

12) and the properties of scale functions (see Remark 3 (3)),

Note that

is the expected present value of the injected capital for the pay-nothing strategy

. Therefore, letting

in Equation (

13), it can be verified

Hence, if

, then for any

,

Conversely, if

, the problem in Equation (

30) is infeasible, which is verified below.

Lemma 4. If , then .

Proof. First, by Remark 7 and Equation (

11), it is easy to verify that

Now, since for any , , we have the result. ☐

The next lemma allows us to prove that, when

, Equation (

34) holds with equality, and it is used to prove the main result of this subsection.

Lemma 5. Let be fixed. The function is strictly decreasing on .

Proof. First, consider the case when

. Then, by Remark 4 (i), we have that

is strictly increasing and the lemma is obtained. Now, when

, a simple calculation shows that

which is strictly negative, by Remarks 3 and 5. From here, we conclude the assertion of the lemma. ☐

Lemma 6. If , then and the optimal strategy is the pay-nothing strategy .

Proof. By Equation (

34), we know that

. On the other hand, from Lemma 5 and Equation (

33), we have that

for all

. Then, using Equations (

33) and (

35)

☐

Using Equation (

12), we have that

when the risk process has unbounded variation. Otherwise, by Remark 3 (2),

and

corresponds to the expected NPV of the injected capital for the strategy

(see Equation (4.5) in

Avram et al. (

2007)).

Lemma 7. Assume that the risk process X has bounded variation. If , then , with .

Proof. If the Lévy measure is finite, by Equation (

16), we have that

. The same is true for the infinite Lévy measure case since

by Remark 5. Using Equation (

13) and Remark 6, we obtain

Now, by Equations (

31), (

36) and (

37) and the weak duality, we get

Since

,

is a feasible strategy. Then, using Equation (

11), it yields,

Therefore, ☐

We are now ready for the main result of this subsection.

Theorem 2. Assume and let V and as in Equation (

30)

and Equation (

31)

, respectively, then . Furthermore, if x and K are such that , thenwhere , and . Proof. Lemmas 4, 6 and 7 show imply that Equation (

38) holds when

x and

K are such that

. Assume now that

, then by Lemma 5 the function

is injective, so there exists a unique

such that

. Note that from Equation (

16), we have that there exists a unique

such that

. Then,

Meanwhile, since the strategy

is feasible, we see

This implies that

. Finally, the weak duality gives Equation (

46). ☐

5.2. With Transaction Cost

Now, we consider the problem given in Equation (

30) with transaction cost

. From the previous section, we know that optimal strategies are

-reflected strategies with

given in Proposition 2.

Proposition 4. The curve is continuous and unbounded, for .

Proof. From Remark 7 and the fact that

(by Proposition 2), we know that

as

, so the curve is unbounded. To show the continuity of the curve, we consider two cases and use the implicit function theorem. To this end, suppose first

. Defining

, we have

. Then,

since

. From here, we see that the conditions of the implicit function theorem are satisfied. Now, if

, define the function

by

Then, . Again, simple calculations show that the Jacobian determinant of this system of equations is , since . Therefore, the curve is continuous, for . ☐

Next, we analyze the level curves of the constraint. Let

be the expected present value of the injected capital under a

-reflected policy. Then, the calculations given in the proof of Lemma 1 show that

Remark 11. Note that , where is as in Equation (

32).

The next lemmas describe some properties of .

Lemma 8. Let be fixed.

- 1.

If is fixed, then the function , given in Equation (

39)

, is strictly decreasing for all , andwhere is defined in Equation (

33).

- 2.

If is fixed, is strictly decreasing for all .

Proof. Let

be fixed. First, assume that

. To show that

is strictly decreasing, it is sufficient to verify that

is strictly decreasing, which is true if

Since

is a strictly log-convex function on

by Remark 4 (i),

Taking

in the inequality above and integrating between

and

, it follows that

Then, Equation (

43) yields Equation (

42) and hence Equation (

41) is strictly decreasing. For the case

, it can be verified that

Then, using Equations (

43) and (

44), we obtain that

is strictly decreasing for all

. Similarly, we obtain Point 2 of the lemma. Now, by L’Hôpital’s rule together with Exercise 8.5 (i) in

Kyprianou (

2014), it is not difficult to see that Equation (

40) holds for any

. ☐

Note that Equation (

34) still holds if

. On the other hand, using that

as

together with Equation (

18) we have that

by Remark 3 (3).

Remark 12. Using the same arguments as in Lemma 7, we have that for bounded and unbounded variation processes. Similarly, if x and K are such that , then . Note also that .

Lemma 9. Let be fixed. Then, for each , there exist such that the level curve is continuous, contained in the set and contains the points and .

Proof. The continuity of the level curve is obtained as an immediate consequence of the continuity of . Observe that, by Lemma 5, we know the existence of such that . Meanwhile, from Lemma 8, we have that there exists such that . Now, the fact that the level curve is contained in is a consequence of Remark 11 and Lemma 8. ☐

Remark 13. Lemmas 4 and 9 yield that the parametric curve and the level curve must intersect, i.e., there exists such that , for .

By similar arguments as in the proof of Theorem 2, by Remarks 12 and 13, and using Equation (

45), we get the following result, whose proof is omitted.

Theorem 3. Assume and let and as in Equations (

30)

and (

31)

, respectively, then . Furthermore, if are such that - 1.

, then ;

- 2.

, then ;

- 3.

, then ; and

- 4.

, then there exists such that

6. Numerical Examples

In this section, we confirm the obtained results by a sequence of numerical examples. Here, we assume that

X is of the form

where

,

, and

are a standard Brownian motion, a Poisson process with arrival rate

, and an i.i.d. sequence of random variables with distribution Gamma (1,2), respectively, which are assumed mutually independent. Since there is no closed form for the scale function

associated with

X, we use a numerical algorithm presented in

Surya (

2008) in order to approximate the inverse Laplace transform of Equation (

4). Similarly, we approximate the derivatives of the scale functions and use the trapezoidal rule to calculate its integrals.

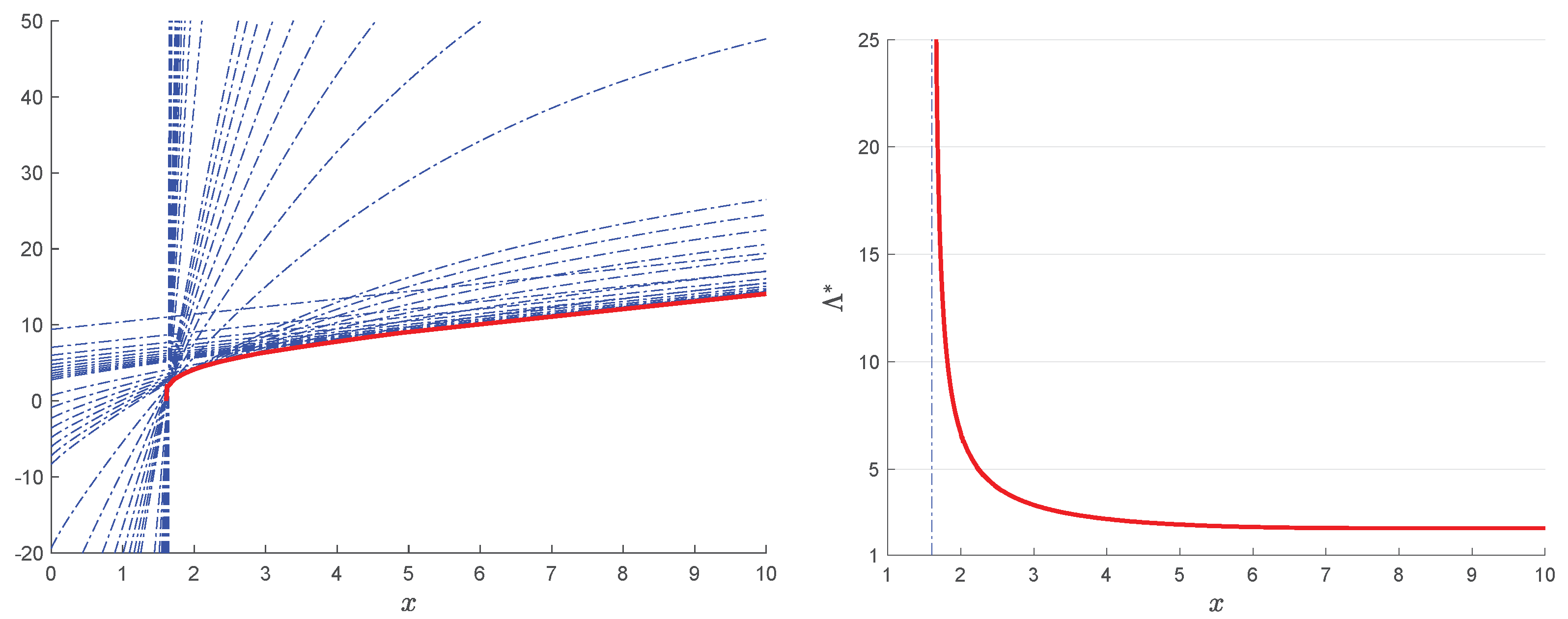

We first consider the case without transaction cost presented in

Section 3.2. In

Figure 1 (left), we plot the function

for various values of

and a fixed value of

K. For

, where

is such that

, its minimum over the considered values of

provides (an approximation of)

, indicated by the solid red line in the plot. Since the process has unbounded variation, then

. In

Figure 1 (right), we plot, for

, the Lagrange multiplier

given in Theorem 2. We observe that

goes to infinity as

and remains always above 1.

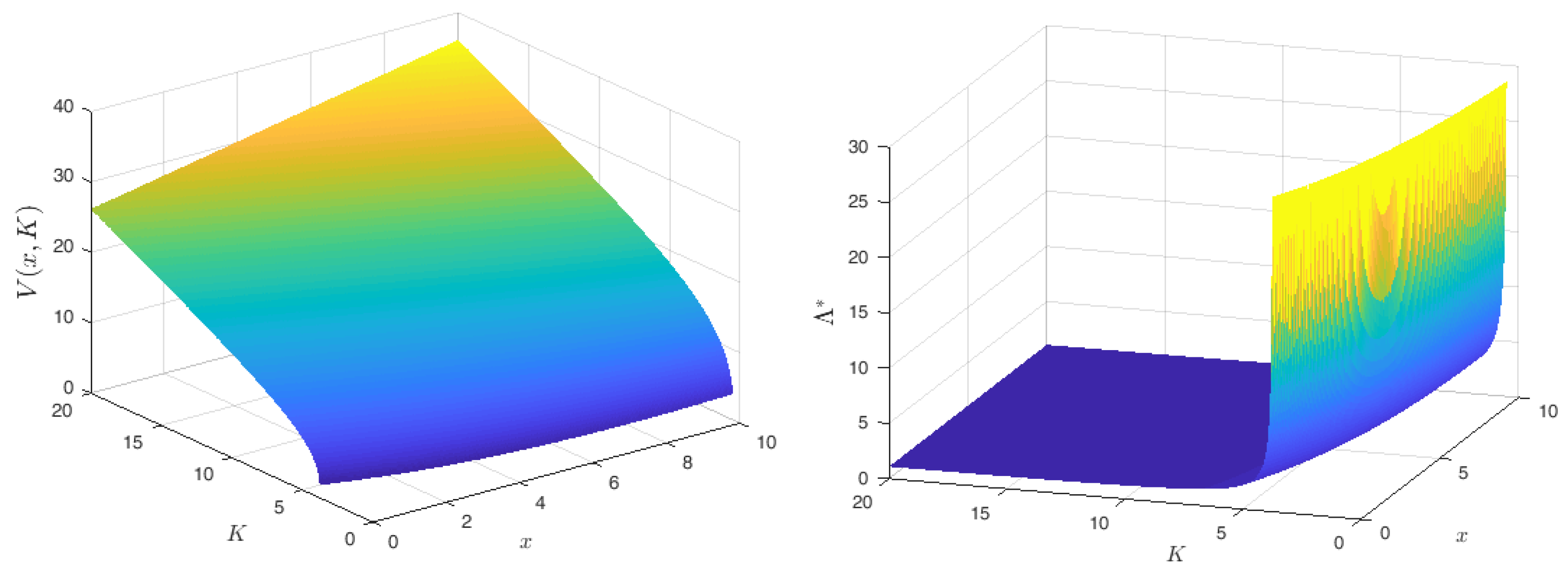

In

Figure 2, we show the values of

and Lagrange multiplier

as functions of

. It is confirmed that

increases as

x and

K increase, while

increases as

x and

K decrease.

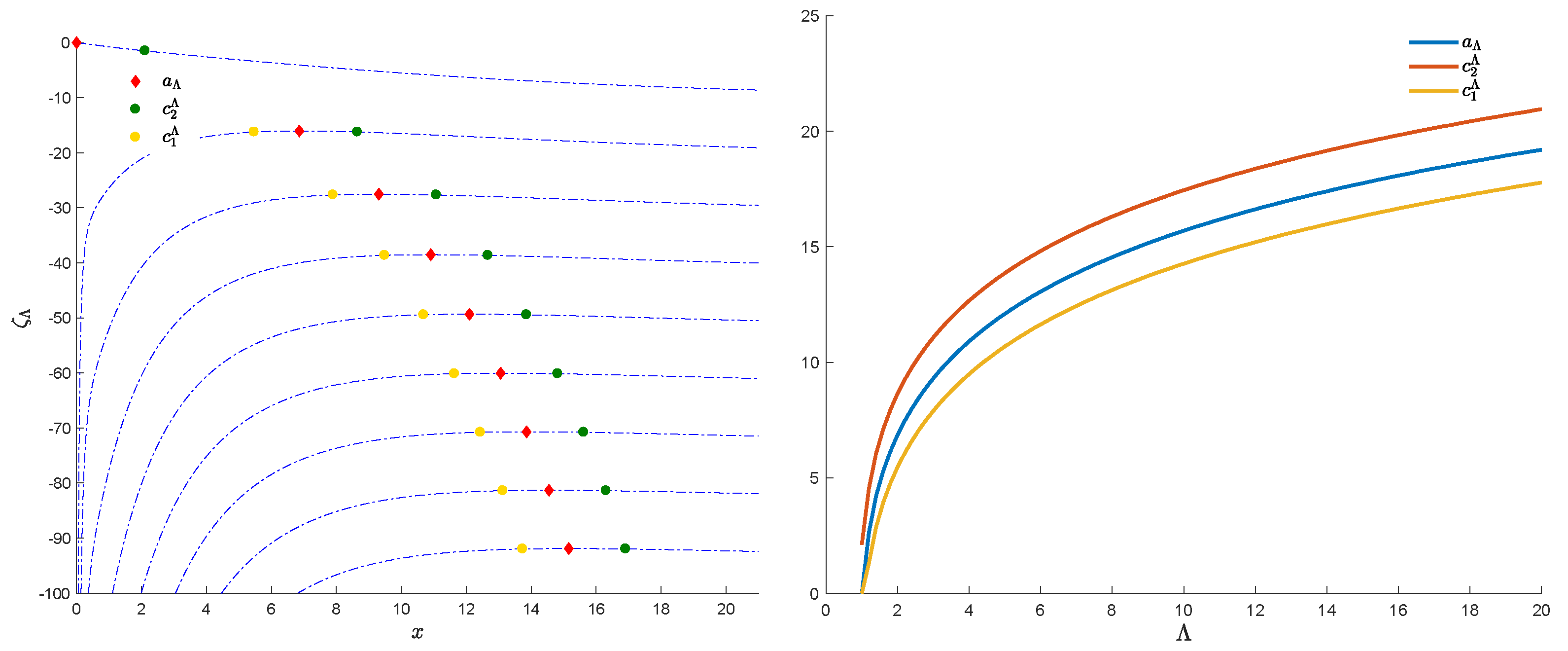

We now move to the case with transaction cost. First, we illustrate the results shown in

Section 4. In

Figure 3 (left), we plot the function

for the values of

. We also plot its maximum value attained at

and the value attained at the corresponding optimal values

with transaction cost

. Note that, when

,

and for the other values of

,

. In

Figure 3 (right), we plot the optimal thresholds

and

as function of

.

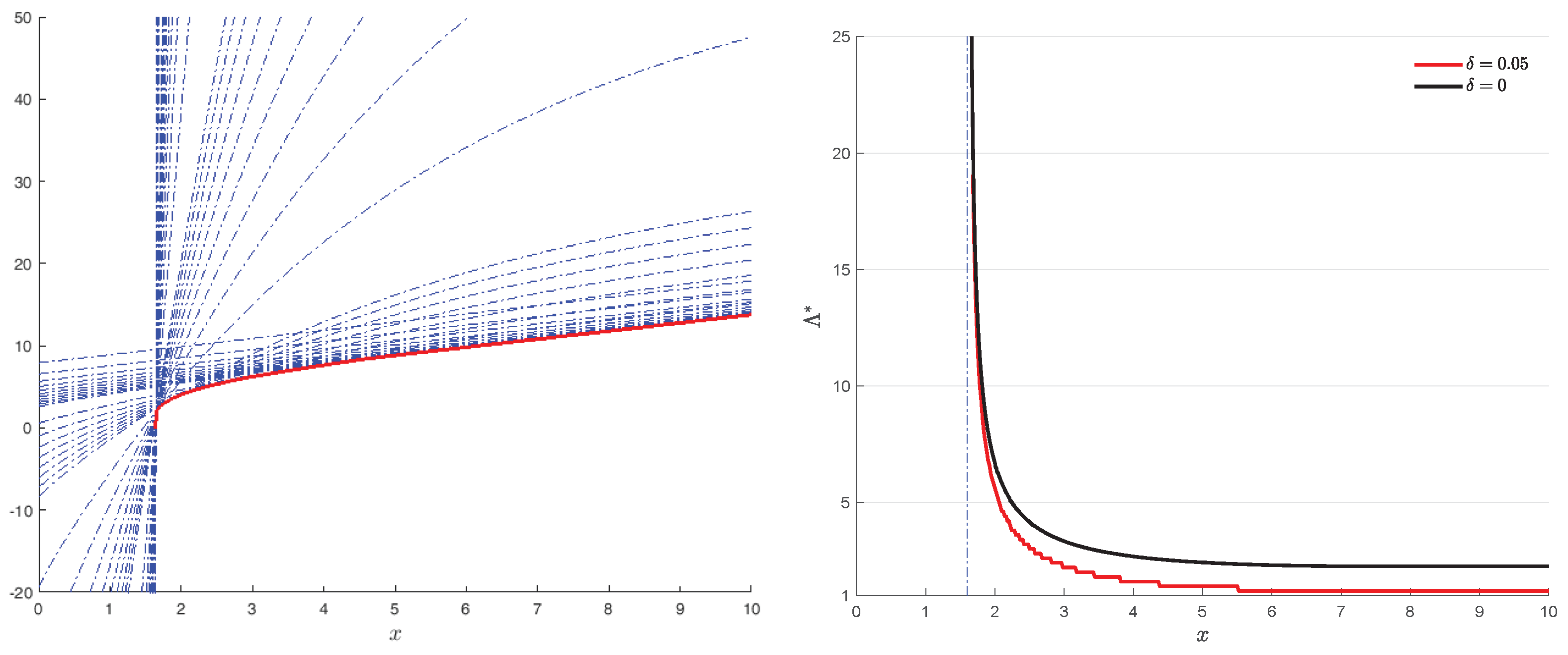

In

Figure 4, we illustrate the findings of

Section 5.2. This figure is analogous to

Figure 1 but with transaction cost

as above. It can be seen that the change in the function

is relatively very small, but the change in the optimal Lagrange multiplier

is significant, being smaller in the case of transaction cost. A similar figure as

Figure 2 in the case of transaction cost is omitted since both have the same shape.

7. Concluding Remarks

In this study, we proved that the optimal strategy for the bail-out dividend problem with fixed transaction costs is given by a reflected -policy. We also characterized the optimal thresholds and gave a semi-explicit form for the value function in terms of the scale functions. In addition, we used the previous results to solve the constrained dividend maximization problem with the restriction that the expected present value of the capital injected is bounded by a given constant. The solution of the constrained problem can provide the insurance company with a guideline to maximize the profits of the shareholders taking into account the risk of bail-out losses.

It is a legitimate and interesting question whether the optimal strategy and the associated value function with transaction costs (i.e., ) converge to the corresponding optimal strategy and its value function without transaction cost as . Although we conjecture that indeed this is the case, further investigation is needed.

Another interesting generalization would involve considering fixed and proportional costs for the capital injection as well. We conjecture that in this case the optimal strategy would consist in a double band strategy, that is, a band strategy similar to the dividend payment strategy given in this paper, and a band strategy for the capital injection, which consists in pushing the process to a positive level each time the surplus process tries to cross below 0. We leave this problem as an opportunity for future research.