5.1. Overall Accident Years Estimate

In order to get to a formula that allows for estimating the one-year volatility—i.e., the standard deviation from the CDR random variable as illustrated in Equation (

6)—we have used the error propagation technique, as suggested by

Röhr (

2016), a technique which allows for calculating at the same time the uncertainty both about the parameters estimate and about the random process underlying the data. As we have already described in

Section 2.3, the CDR is the technical result of the claims reserve development in a one-year time-framework. Given Equation (

6) and the link ratios illustrated in

Section 2.2, in the chain ladder framework, the

is written in the following way:

It is therefore necessary to estimate the ultimate cost

at the

time, but, as we have obtained the observations up to the

t time, we can use the

estimates made on the basis of the observations in

t. To this purpose, the best approach is to write (

42) in the following way:

In a priori absence of data, the ratio between two link ratios linked to the same

j development year and estimated in a two-years-in-a-raw balance sheet can be calculated through the credibility factor (see

Merz and Wüthrich 2015):

where

is the credibility coefficient.

By using (

44) for the link ratios, the CDR estimate (

43) can be also written in the following way:

As shown by

Renshaw and Verrall (

1998), between the link ratios, we have calculated through the chain ladder method and the parameters calculated through the GLM method there is the following ratio:

on the (

46) basis, as for the link ratios product, we have

, thus the ultimate cost estimate can be defined as:

If we make reference to the cumulative payment

instead—that in

t is a r.v.—we have:

In calculating the last derivative, we have taken into account that

. By adding and subtracting the hypothetical value

to (

48), we get:

The cumulative paid sums

of the following year can be broken up—as suggested in

Röhr (

2016)—through the

residual linked to the process variance and the

residual linked to the parameter variance.

Keeping in mind (

46), (

47) and (

49), it is possible to get the following ratio:

Therefore, the ultimate cost in

for the

i accident year—that is the second addend of Equation (

45)—can also be written in the following way:

As a consequence, the cost of the total of all generations, can be calculated by adding the cost of all the accident years:

Therefore, it is possible to consider the ultimate cost prediction in

as a fluctuation of the prediction in the

t time, where the

and

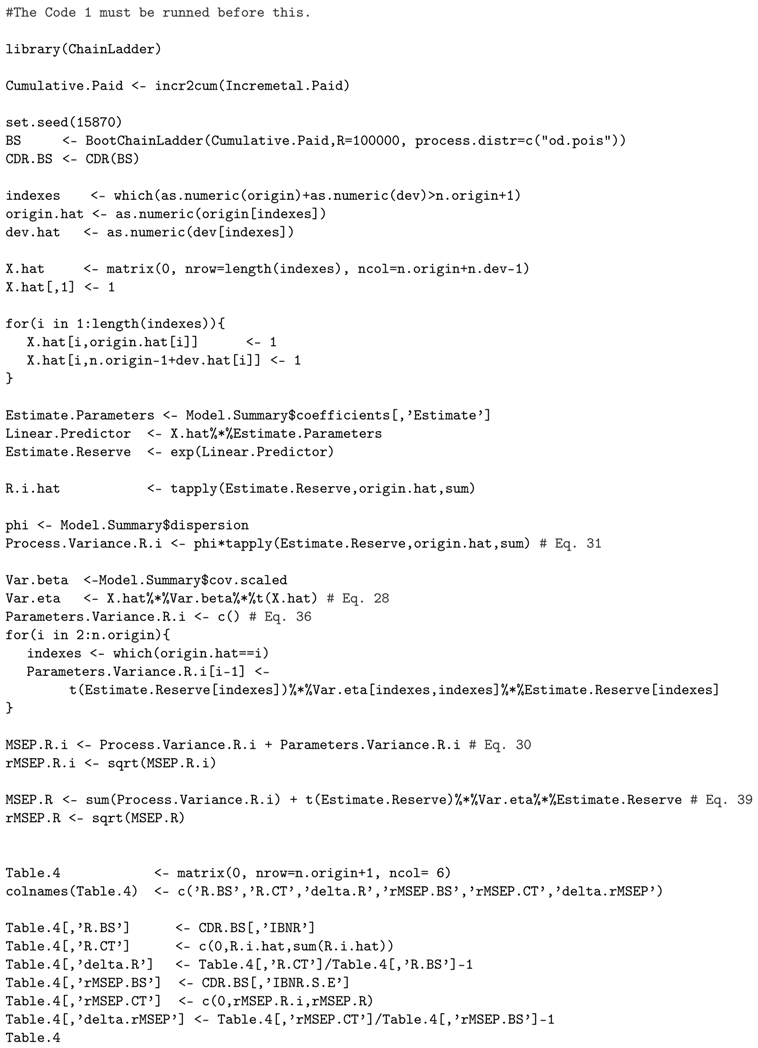

residuals represent the process innovation. A simulation approach would demand the

simulation and the

estimate through the bootstrap method.

Notice that the two residuals are independent as to the model basic assumptions. To determine a closed tool, we will use a different approach by taking into account Taylor’s expansion of such a fluctuation. As Step 1, we consider the fluctuation linked to the process variance, we calculate the derivatives

3—making reference to the first residual—and we estimate them in 0—for every

and

—thus getting the following weights:

To make this calculation easier, we initially consider the first addend of the numerator of Equation (

53) derivative development:

and

By applying the same calculation also to the other addends, we get:

In calculating this derivative, we have kept in mind that .

Considering that

instead, it is possible to write:

As for the

reminder, linked to the parameter error, we initially consider the derivative in relation to the estimate of the intercept parameter

c:

Thus, deriving the ultimate cost

with reference to

, and estimating the derivative in 0—for each

and

, for the latter, we also consider the equality for every parameter (component-wise equality)—similarly to what we had already done to calculate Equations (

53) and (

57), we get:

and, in a very similar way, we get the derivative in comparison with the parameters

and

:

By using the above-written derivatives, as to the ratio between the ultimate cost estimated in

—which in t is random—and, in

t, we get to the Taylor’s first-order approximation, which is:

Through using Formulae (

45) and (

61), taking the denominator—after changing its sign—from the first to the second member and by exploiting the assumption of independence among the incremental payments, for the square sum of the CDR, we get to the following first-order approximation:

In Equation (

62), we have omitted the products between the

and

residuals because, as they are independent, they will cancel out in Equation (

63).

By replacing the parameters estimates with the corresponding unknown values, we can get the MSEP of the the CDR—i.e., of the one-year loss—for the total of generations:

where

—hat matrix—is the matrix that codes the accident and development years linked to the incremental payments of

year through the dummy variables, while

is the vector of the

weights estimate calculated in (

56) and better specified by using the GLM language:

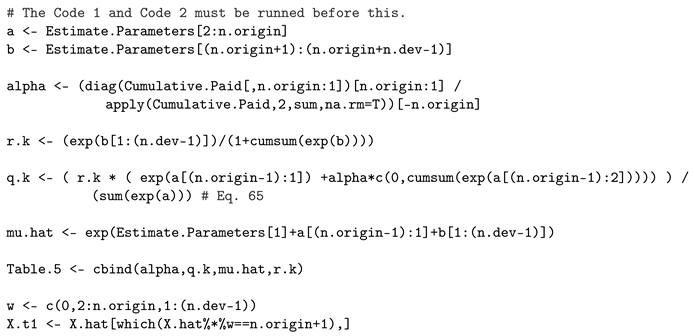

Notice that, for

, we have

; under this circumstance, the summation is null. Simplifying, (

64) can also be written in an easier way, as explained in (

65):

5.2. One-Year Volatility for Accident Year

In this section, we will illustrate the calculation of the one-year volatility for an

fixed accident year. Starting from Equation (

51), that we write again just for convenience,

and we proceed to get an approximation through a Taylor residuals expansion in series. Similarly to what we have done in the previous section, we calculate the partial derivative, at the point

, of the ultimate cost estimated in

:

by considering first of all the case

, we get:

while, for

:

therefore, in the particular case

, we have that

, while for

the logarithmic (

67) becomes:

and we have

. In the particular case of the GLM estimate model, with logarithmic link function and ODP distribution, we get the following simplified form for the

ratio:

similarly to (

57), keeping in mind that

, we get:

equally, by taking the partial derivatives of the

residuals in comparison with the GLM model parameters written in Equations (

58) and (

59), we get the partial derivatives—at the

point—of the ultimate cost

, for example in comparison with

:

By using previous results, for the

generation, we get the following Taylor approximation for the ratio between the ultimate cost estimate done in

and the one done in

t:

Therefore, in a way very similar to Equation (

62), for the square claims’ development ratio, we get the following Taylor’s first-order expansion:

Finally, as for the MSEP estimate, we have the following expression:

where

is a length

vector whose elements are:

while

is the projection matrix —hat matrix— that encodes the incremental payments of the

following year for the

generations and the previous ones.