1. Introduction

Financial derivatives are important hedging instruments that allow for the management of risks associated with high volatility and uncertainty, as they derive their current value from an underlying commodity or asset (

Islam and Chakraborti 2015). An option is a financial contract allowing the holder to buy (call option) or sell (put option) an underlying asset, such as a stock, at a predetermined strike price before a specified expiration date. European options can only be exercised at expiration, while American options can be exercised anytime up to the expiration date. Perpetual options, unlike standard options, can be exercised at any time indefinitely, as they never expire (

Gapeev and Al Motairi 2018). The literature contains numerous studies on perpetual American options (

Rodrigo 2022).

Following this research direction, in this study we deal with the problem of pricing perpetual American put options with a generalized standard put payoff , where is the underlying asset price at time t, and is the payoff function. The payoff function G is assumed to be a continuously decreasing function such that for all , and for all , where K is the contracted strike price.

It is well known (see

Karatzas 1988;

Karatzas and Shreve 1998;

MacKean 1965;

Merton 1973;

Samuelson 1965) that the price of a perpetual American put option with the standard payoff function

can be found by solving an associated free-boundary problem. In this formulation, using the Black–Scholes model, we seek a critical price

and a pricing function

such that

in the exercise region

, and, in the case of no dividends, the linear ordinary differential equation

holds in the continuation region

. The critical price

separates the exercise region, where it is optimal to exercise the option, from the continuation region, where it is best to hold the option. Note that

is not known a priori and is thus referred to as a free boundary, determined using the value-matching and smooth-pasting conditions

and

, which are required to avoid arbitrage opportunities. These conditions ensure that the price and its first derivative are both continuous. Moreover, the inequality

must hold in the exercise region

, to ensure the construction of a strategy that super-replicates the option payoff (for details, see the proof of Theorem A1 in

Appendix A, Equation (

A10)). We observe that for the standard payoff function

, the previous inequality holds because in the exercise region, it gives

, and thus,

since

. However, for an option with a general non-concave payoff function, the above inequality is not guaranteed to be satisfied.

In this paper, we establish sufficient conditions on the payoff function to ensure both that the above inequality holds within the exercise region and that the free-boundary problem associated with the pricing of a perpetual American put option admits a unique solution. To achieve this, we provide a novel expression for the Black–Scholes operator in terms of elasticity (see Proposition 1). To the best of our knowledge, this result has not yet appeared in the literature. Using this new formulation, we will show that for payoff functions with strictly decreasing elasticity, the associated free-boundary problem admits a unique solution. This also enables the derivation of closed-form solutions for the option price.

A notable contribution in this area is the work by

Rodrigo (

2022), who derives pricing formulas for perpetual American options with general payoffs, primarily focusing on piecewise linear functions. In that contribution, the analysis is oriented toward the structural properties and support of the payoff function and includes various types of options, such as calls and straddles. In contrast, the present study focuses on perpetual American put options with a class of generalized standard put payoffs, which includes non-linear forms such as power and polynomial options—extending beyond the piecewise linear framework considered in Rodrigo’s work. Moreover, our approach is inspired by the methodology introduced in

Karatzas and Shreve (

1998), where the pricing problem for standard payoffs is shown to be equivalent to a free-boundary problem. We adopt this perspective and develop a novel analytical framework based on the concept of elasticity, a key economic indicator that captures the responsiveness of the payoff to changes in the underlying asset. By expressing the Black–Scholes operator in terms of elasticity, we derive sufficient conditions under which the associated free-boundary problem admits a unique solution.

The remainder of the paper is organized as follows. The mathematical formulation of the pricing problem is developed and the main results are given in

Section 2. In

Section 3, we apply our findings to some classes of perpetual American put options with non-linear payoffs. Conclusions are drawn in

Section 5. Additionally, in

Appendix A we show that the formulation of the pricing problem as a free-boundary problem is still valid in the case of generalized standard put payoffs.

2. Pricing of Perpetual American Put Options with Generalized Standard Put Payoff

In this section we formulate the free-boundary problem associated with option pricing and state our main results.

We consider a perpetual American put option with payoff at time

t given by

. The payoff function

is assumed to be a non-negative decreasing continuous function on

such that

for all

, and

for all

, with

. We also assume that

. Note in particular that these assumptions are satisfied by the standard payoff

of a vanilla put option, where

K is the contracted strike price. We assume that the underlying asset price process

satisfies the standard Black–Scholes model

where

r is the risk-free interest rate,

is the dividend yield,

is the volatility of the stock, and

is a Wiener process with respect to the risk-neutral probability measure. Here, the parameters

,

, and

are assumed to be constants.

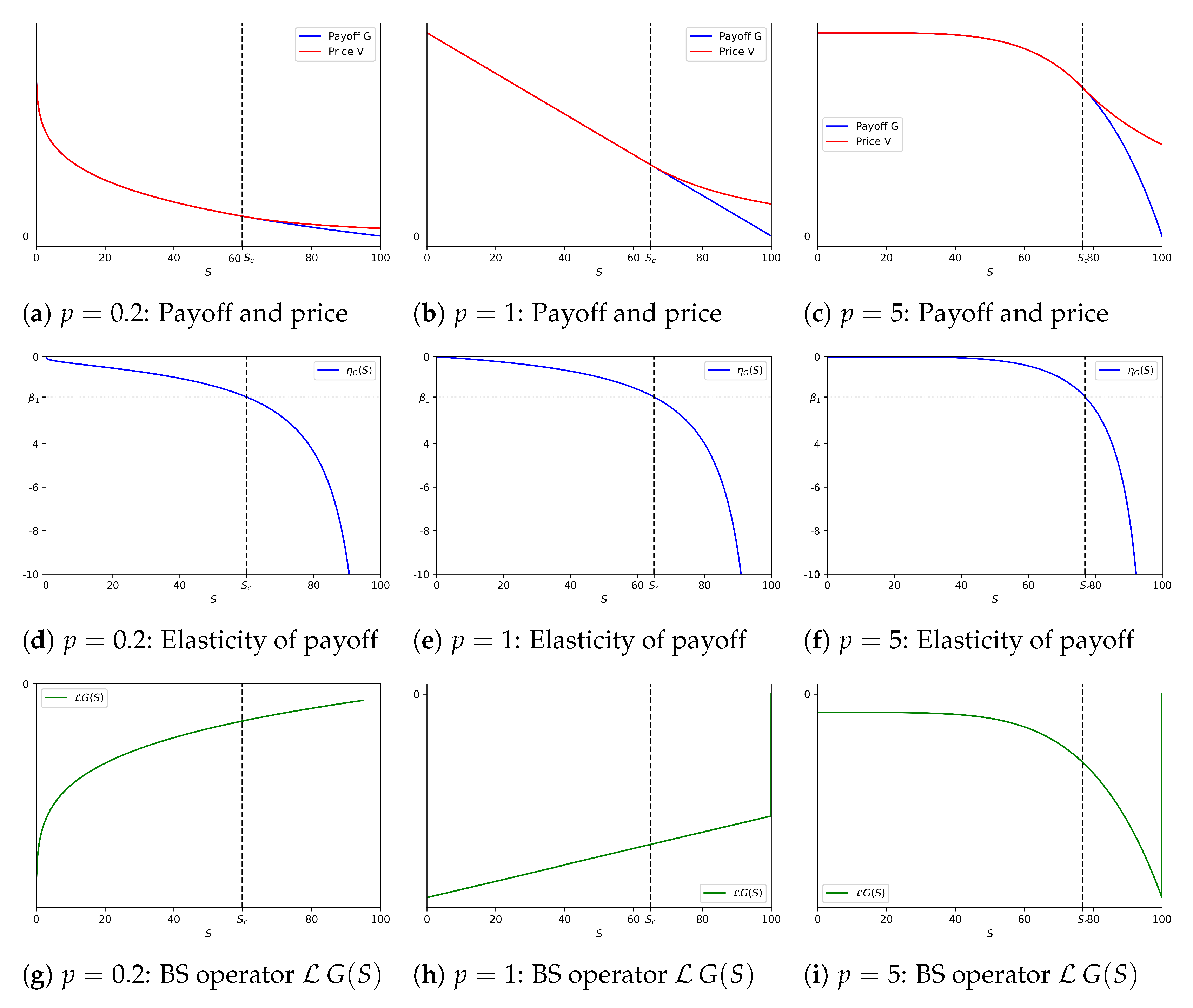

The free-boundary problem associated with a perpetual American put option with payoff function can be expressed as follows.

Problem 1. Find a free boundary and a decreasing function in the space such thatfor some constant . The solution

V is usually referred to as the value function or option pricing function, and the free boundary

is known as the optimal exercise price or critical stock price. Moreover, by considering the Black–Scholes operator given by

in the exercise region

, it is optimal to exercise the option, since

, and therefore, the option value is

. In the continuation region

it is not optimal to exercise the option, and thus, the option value satisfies

.

By inspecting the proof of Theorem A1 (see

Appendix A), we observe that the condition (3) of Problem 1, specifically

for

, enables us to achieve (

A10) and thus allows us to construct a strategy that super-replicates the payoff of the option. As we have shown in Remark 1, in the case of standard payoff, this condition can be directly derived by computation.

Remark 1. For a perpetual American put option with standard payoff , the solution to Problem 1 is given by (see Karatzas and Shreve 1998)andwhere is the negative solution to (13) given by (14). The proof of this result proceeds using analogous arguments to those in the initial part of the demonstration of Theorem 1, which will be presented subsequently. Specifically, we emphasize that, in this case, condition (3) can be established by demonstrating thatThe equalityis derived directly by computation, noting that for we have . Furthermore, for , the inequalityholds because and , sincewhere the last equality follows from the fact that is a solution to Equation (13). Our aim is to provide sufficient conditions on a generalized standard put payoff function

G of a perpetual American put option such that both the inequality (3) holds within the exercise region and Problem 1 admits a unique solution. We start with noting that if

is a solution to Problem 1 the following boundary conditions, known as the value-matching and smooth-pasting conditions,

must be satisfied to ensure the continuity of both the price and its first derivative. We first observe that, due to the boundary conditions (

8), it is evident that at critical price

, the elasticity of the payoff function aligns with the elasticity of the option value function, namely

where the elasticity function

of

G is defined for

by (note that

for

)

and the elasticity

of

V is

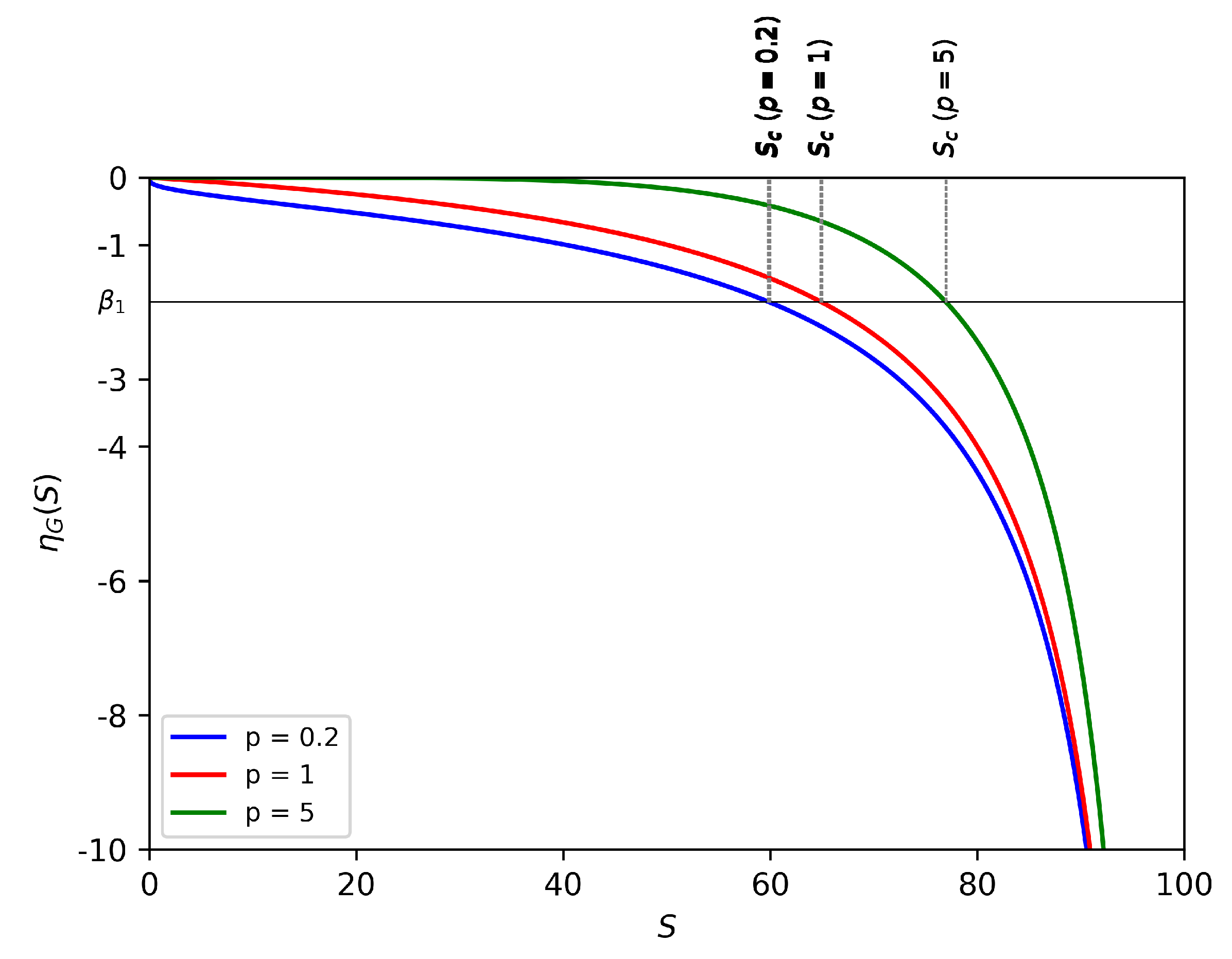

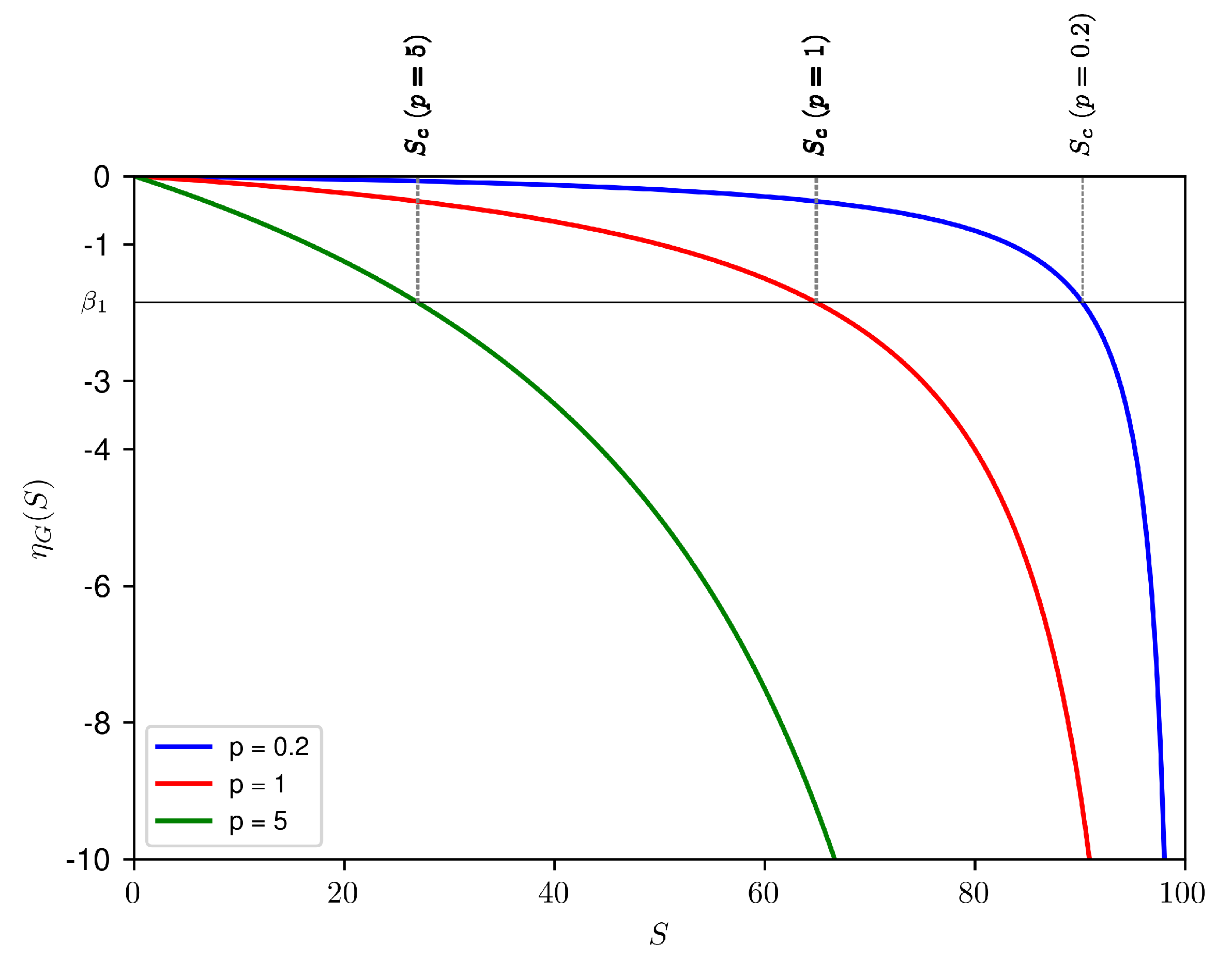

Note that, in the case of put options, the elasticity is negative.

Inspired by (

9), we focused on the elasticity of the payoff function

G to identify sufficient conditions to ensure that Problem 1 admits a solution. To this end, in the next Proposition we provide a novel expression for the Black–Scholes operator in terms of the elasticity of the payoff.

Proposition 1. Let D be an open subset of the real line , and a function , such that for all . Then the operator defined bycan be expressed, for , aswhere is the elasticity function of F, and and are the solutions to the algebraic equationgiven by Proof. From the expression of elasticity

, it follows that

Furthermore, through computation, we obtain

Substituting (

16) and (

17) in (

11), we obtain

Since

are the solutions to Equation (

13), we can write

Using the last equality in (

18), we obtain (

12). □

Remark 2. In the absence of dividends, that is, when , we find from (14) and (15) that and . Therefore, from (12), we obtain the following expression: The result established in Proposition 1 provides a valuable expression for the Black–Scholes operator and enables the reformulation of condition (3) (i.e., for ) in terms of the elasticity . This formulation is useful for establishing the next theorem, our main result, which provides sufficient conditions for the existence of a unique solution to Problem 1.

For clarity and consistency of notation, we specify that, throughout this manuscript and in the Appendix, the symbols

and

refer exclusively to the solutions to Equation (

13), defined in (

14) and (

15), respectively.

Theorem 1. Consider a perpetual American put options with payoff , where the payoff function is a non-negative decreasing continuous function on such that for all , and for all , where is a suitable real constant. We also assume that and, furthermore, that the elasticity function of G is strictly decreasing. Then Problem 1 admits a unique solution , where the boundary is the unique solution to the equationin the interval , with given by (14), that is,and the value function is Proof. First, we observe that the linear ordinary differential equation

, i.e.,

has solutions to the type

, where

and

are the solutions to (

13) given in (

14) and (

15), and

. Since we are looking for a decreasing function

V, it follows that

, and so,

. Furthermore, the boundary condition

, with

, implies that

. Therefore, the function

is a decreasing function satisfying conditions (

2) and (5). The value function

V solution to Problem 1 is required to be

, and so, in order to ensure the regularity of

V at boundary

, the smooth-pasting condition

must be satisfied. Since, from (

21), we have

for

, and

for

, the condition

is verified if

, that is, if

.

Thus we may conclude that Problem 1 admits a unique solution if the following conditions are satisfied:

- (i)

There exists a unique solution to equation in the interval ;

- (ii)

Properties (3), (4) and (6) hold.

We will show that the assumption of strictly decreasing elasticity payoff function is sufficient to ensure that (i) and (ii) are verified.

First, we will prove (i). For this, we consider the function

f, defined as

. Observing that

f is of class

, and

, by applying Rolle’s Theorem it follows that there exists

such that

. Through computation, we have

from which, since

for

, we deduce that

implies that

, and thus,

. The uniqueness of the solution

follows from the assumption of the strict monotonicity of elasticity function

. So, we have proven (i).

We now prove (ii). Using (

12) with

and

, we have, for

,

We observe that for all

, it follows that

and

. Furthermore, if

then

, because

, and

G is decreasing, and thus,

, since

. Moreover, from (i) we know that

, and thus, by using the strictly decreasing property of

, it gives

for all

. Thus, from (

23) we get

for all

, that is, the condition (3).

Let us prove inequality (4), that is,

for all

. Since

for all

, we only have to prove that the inequality holds in

. Thus, from (

20), we have to show that for all

,

To this end, we consider again the function

,

. Since

, and

is strictly decreasing, from (

22) we obtain for

from which, observing that

, it follows that

f is strictly decreasing in

. Therefore, for all

, we can write

and thus, from (

20),

that is, the condition (4).

We must now prove (6). For this, we will prove that for all

,

from which (6) follows by letting

. First, we consider the case

. Since

is strictly decreasing we have

, and thus,

from which, taking into account that

G is decreasing and positive, we obtain

Observing that

for

, we get (

24). We now consider the case

. Since the function

V given in (

20) is convex in

, we can write

from which, observing that

V is decreasing and positive, it follows that

and thus, (

24). The proof is therefore completed. □

Remark 3. We observe that if is the solution to Problem 1 given by (19) and (20), it follows that Remark 4. We note that the conditions established in Theorem 1 are sufficient to ensure the existence and uniqueness of the solution to the associated free-boundary problem, and its consistency with the pricing problem. The question of whether these conditions are also necessary remains open and will be explored in future research.

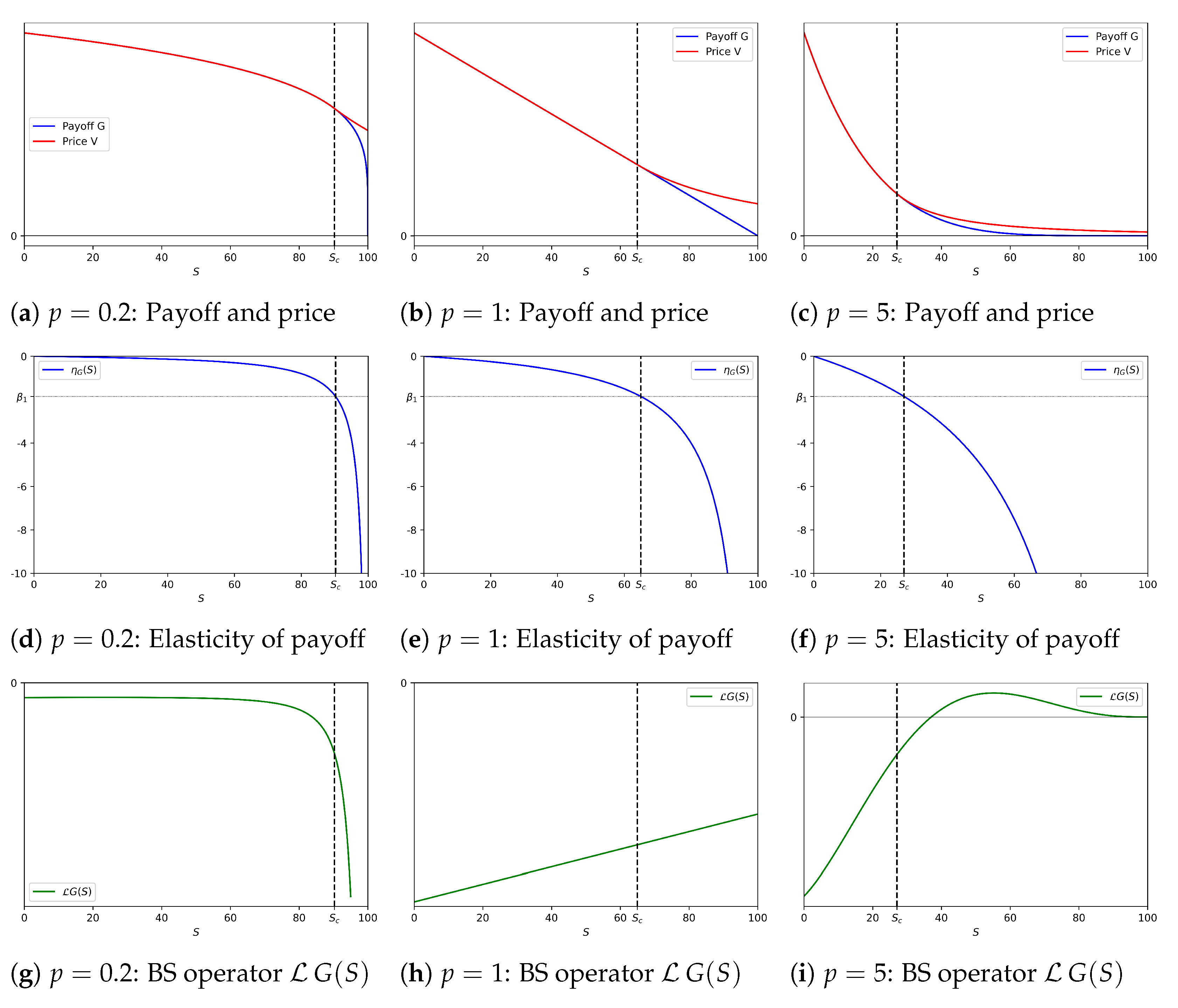

4. Toward an Extension of Our Methodology to Perpetual American Call Options: Some Preliminary Results

To illustrate the broader applicability of the methodology developed in the preceding sections, we briefly explore its potential extension to the case of perpetual American call options. While a comprehensive analysis of this setting lies beyond the scope of the present work, the discussion below outlines how the framework—based on the concept of strictly decreasing elasticity of the payoff function—can be adapted to this context. A more detailed investigation will be pursued in future research.

It is important to note that the case of call options differs significantly from the put option case previously analyzed. As established in

Karatzas and Shreve (

1998), for the standard payoff function

, when the underlying stock pays no dividends (i.e.,

), the value of the perpetual American call option equals the current stock price, i.e.,

. In this scenario, the optimal exercise price

becomes infinite. Conversely (see

Karatzas and Shreve 1998), when the conditions

hold, the associate free-boundary problem admits the solution

given by

where

is the positive solution to equation (

13), as defined in (

15), and

Note that for the standard call payoff

, the elasticity

is strictly decreasing for

. Moreover, it results in

for

, since

This inequality follows from the fact that, under the assumption

, and using the bound

(see, e.g.,

Karatzas and Shreve 1998), we obtain

Building on these considerations, and in analogy with Theorem 1, we now provide sufficient conditions on a generalized standard call payoff function to allow for the resolution to the associated free-boundary problem. Unlike the put option payoff, which is bounded, the call option payoff is unbounded. Therefore, we require an appropriate growth condition on the payoff function.

Theorem 2. Consider a perpetual American call option with payoff , where the payoff function is a non-negative, continuous, and increasing function on satisfying for all , and for all , where is a suitable real constant. Assume further that and that its elasticity function for G is strictly decreasing. Moreover, suppose the growth conditionis satisfied, where is the positive root of Equation (13), as defined in (15). Let be the unique solution to the equationand define the value function asThen the pair is the unique solution to the following free-boundary problem: Proof. The general solution to the differential equation

is of the form

, where

are the roots of Equation (

13). Since we seek an increasing solution, we set

, yielding

. Imposing the boundary condition

, we obtain

and thus the expression in (

33). Therefore, the increasing function defined in (

33) satisfies conditions (

34) and (37). Since we have

for

, and

for

, the smooth-pasting condition

is verified if

, that is, if

.

Following an argument analogous to that used in the proof of Theorem 1, we prove that

is the unique solution to the free-boundary problem by showing the following: (i) there exists a unique solution

to equation

in the interval

; (ii) properties (35) and (36) hold. For this, we consider the function

f of class

defined by

. From the growth condition, we have

, and thus, there exists

such that

. From this, since

and

for

, we deduce that

. The uniqueness of the solution

follows from the assumption that

is strictly decreasing. So, we have proven (i). We now prove (ii). Using (

12) with

and

, we have, for

,

We observe that for

, we have

,

, and

, since

and

, because

G is increasing. Moreover,

for all

, since

, and

is strictly decreasing. Thus, from (

38), we get

for all

, that is, (35).

We now prove (36). Since

for all

, we only have to prove that

in

. We observe that function

is strictly increasing in

, since

and

, because

, and

is strictly decreasing. Therefore, for all

, we can write

and thus, from (

33),

This completes the proof. □

5. Conclusions and Future Perspectives

In this paper, we considered the problem of pricing perpetual American put options, allowing for a broader class of generalized standard put payoff functions. By establishing sufficient conditions on the payoff function, we ensured that the associated free-boundary problem admits a unique solution. To achieve this, we derived a novel expression for the Black–Scholes operator in terms of elasticity. Our main result demonstrates that for payoff functions with strictly decreasing elasticity, the pricing problem admits a unique solution.

Our findings extend the existing literature by investigating the relationship between payoff elasticity and the value of financial options. Additionally, the proposed approach enables the derivation of closed-form solutions for option prices in the case of non-linear payoffs, such as power options and powered options.

Future research could explore the application of this methodology to the hedging of the considered derivatives using elasticity, which measures the percentage change in the option price for a given percentage change in the asset price. Elasticity is always negative for put options, as noted by

Sick and Gamba (

2010), and its absolute value can be less than or greater than one, indicating that a put option may or may not be riskier than the underlying asset. These considerations could also be applied to barrier options of the American type with general payoff. Additionally, our results have potential applications in energy markets, as advances in energy storage technologies have enhanced the long-term storability of energy commodities, making them suitable as underlying assets for perpetual options, as discussed by

Johnson et al. (

2024);

Rahman et al. (

2020).

We also underline that although our analysis has been conducted within the classical Black–Scholes framework, it is important to acknowledge its inherent limitations. In particular, the assumptions of constant volatility and continuous asset paths may not hold in real markets. Incorporating stochastic volatility, such as the Heston model (see, e.g.,

Ha et al. 2025;

Heston 1993;

Lee 2019), or jump processes introduces significant mathematical challenges, such as the loss of closed-form solutions, the need for more sophisticated numerical methods, and the potential non-uniqueness of the free boundary. Investigating these extensions would require a deeper analysis of the interplay between payoff elasticity and the dynamics of the underlying asset, and represents a promising direction for future research.