Time Restrictions on Life Annuity Benefits: Portfolio Risk Profiles

Abstract

:1. Introduction

2. Literature Review

3. Time Frames for the Policy and the Benefit Payment

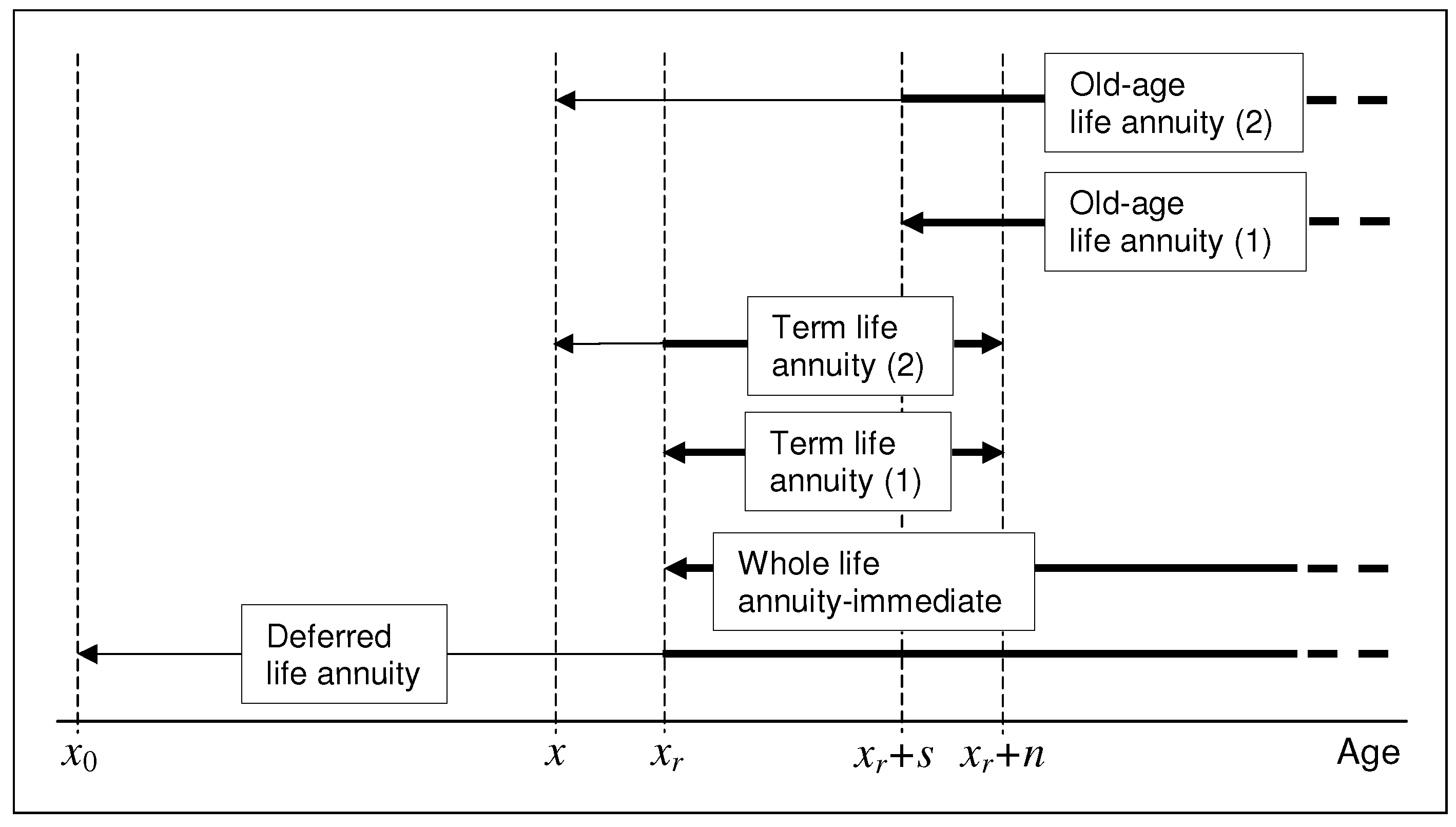

3.1. Traditional Alternative Post-Retirement Income Solutions

- the immediate whole life annuity, purchased at the retirement time against a single premium (that is, the SPIA);

- the deferred life annuity, purchased during the working period, usually financed by a sequence of premiums (which constitute the so called “accumulation annuity”), with benefit payment commencing at the retirement time;

- the income drawdown, that is, a sequence of withdrawals from a fund, starting at the retirement time.

3.2. A Reference Scheme including Additional Alternatives

- an age within the working period (e.g., at the beginning of the accumulation period);

- the age at retirement;

- an age before retirement time (; e.g., the age at which the annuity rate is stated);

- the number of years of term annuity payments;

- the length in years of the delay period (e.g., in old-age life annuities).

3.2.1. Deferred Life Annuities

3.2.2. Immediate Whole Life Annuity

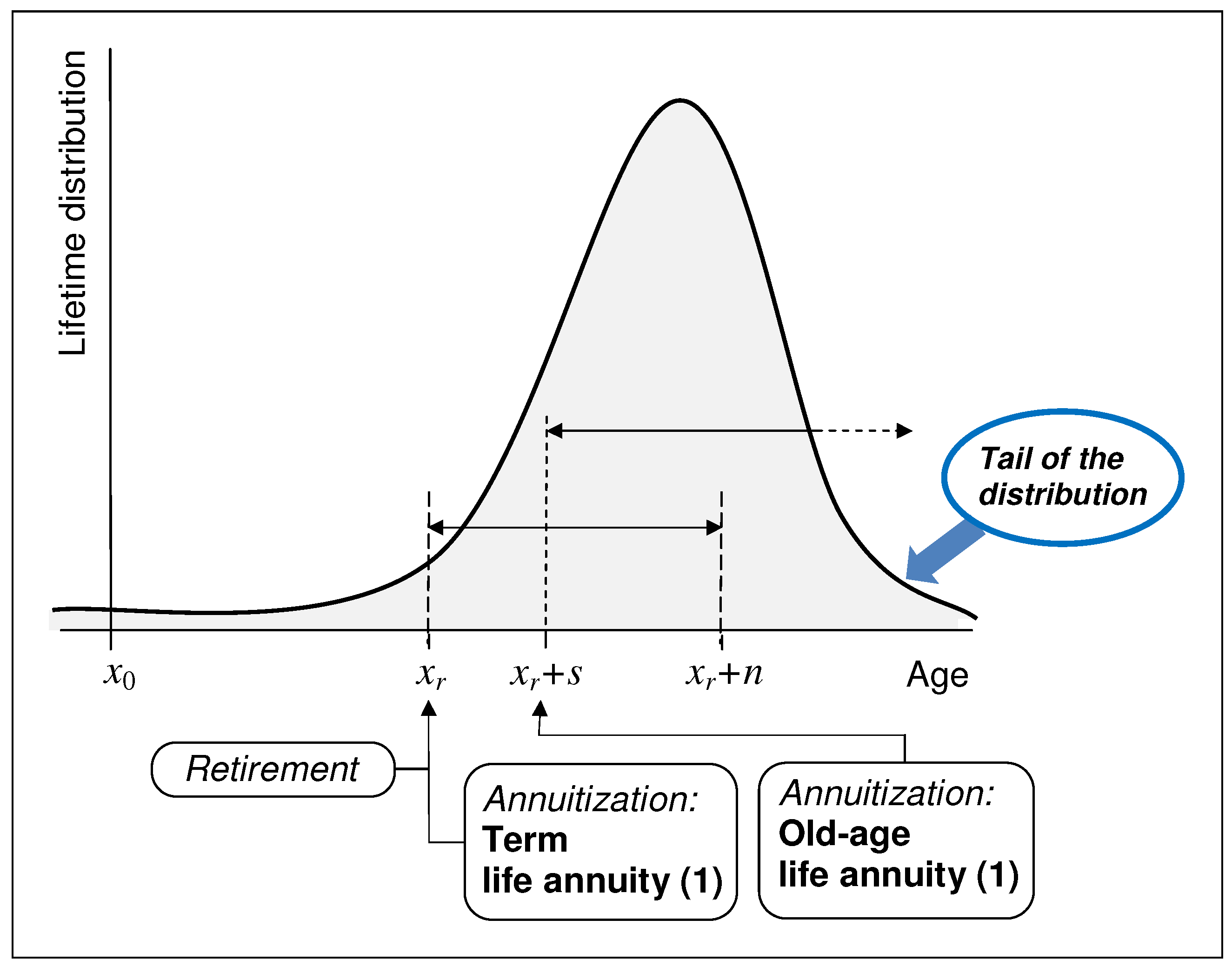

3.2.3. Term Life Annuities

3.2.4. Old-Age Life Annuities

3.3. Longevity Risk Transfers

4. Valuation Framework

4.1. Present Value of Future Benefits

4.2. Mortality Model

4.3. Financial Model

5. Portfolio Risk Profiles: Numerical Results

5.1. Arrangements

5.2. Parameters

5.3. Results and Discussion: Longevity Risk Only

5.4. Results and Discussion: Longevity and Financial Risk

5.5. Results and Discussion: Stress Test

6. Concluding Remarks

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- ANIA. 2014. Le Basi Demografiche per Rendite Vitalizie A 1900–2020 e A62. Relazione Tecnico-Metodologica. Available online: https://www.ordineattuari.it/media/246594/relazione_tecnica_a62_final.pdf (accessed on 29 March 2022).

- Bacinello, Anna Rita, An Chen, Thorsten Sehner, and Pietro Millossovich. 2021. On the market-consistent valuation of participating life insurance heterogeneous contracts under longevity risk. Risks 9: 20. [Google Scholar] [CrossRef]

- Biffis, Enrico. 2005. Affine processes for dynamic mortality and actuarial valuations. Insurance: Mathematics and Economics 37: 443–68. [Google Scholar] [CrossRef]

- Blackburn, Craig, and Michael Sherris. 2013. Consistent dynamic affine mortality models for longevity risk applications. Insurance: Mathematics and Economics 53: 64–73. [Google Scholar] [CrossRef]

- Blackburn, Craig, Katja Hanewald, Annamaria Olivieri, and Michael Sherris. 2017. Longevity risk management and shareholder value for a life annuity business. ASTIN Bulletin 47: 43–77. [Google Scholar] [CrossRef]

- Bowers, Newton L., Hans U. Gerber, James C. Hickman, Donald A. Jones, and Cecil J. Nesbitt. 1997. Actuarial Mathematics. Schaumburg: The Society of Actuaries. [Google Scholar]

- Boyle, Phelim, and Mary Hardy. 2003. Guaranteed annuity options. ASTIN Bulletin 33: 125–52. [Google Scholar] [CrossRef]

- Brouhns, Natacha, Michel Denuit, and Jeroen K. Vermunt. 2002. A Poisson log-bilinear regression approach to the construction of projected lifetables. Insurance: Mathematics and Economics 31: 373–93. [Google Scholar] [CrossRef]

- Cairns, Andrew J. G., David P. Blake, and Kevin Dowd. 2006. A two-factor model for stochastic mortality with parameter uncertainty: Theory and calibration. Journal of Risk and Insurance 73: 687–718. [Google Scholar] [CrossRef]

- Dickson, David C. M., Mary R. Hardy, and Howard R. Waters. 2020. Actuarial Mathematics for Life Contingent Risks, 3rd ed. Cambridge: Cambridge University Press. [Google Scholar]

- Gerber, Hans U. 1995. Life Insurance Mathematics. Berlin and Heidelberg: Springer. [Google Scholar]

- Ghalehjooghi, Ahmad Salahnejhad, and Antoon Pelsser. 2021. Time-consistent and market-consistent actuarial valuation of the participating pension contract. Scandinavian Actuarial Journal 2021: 266–94. [Google Scholar] [CrossRef]

- Gong, Guan, and Anthony Webb. 2010. Evaluating the advanced life deferred annuity—An annuity people might actually buy. Insurance: Mathematics & Economics 46: 210–21. [Google Scholar]

- Hieber, Peter, Jan Natolski, and Ralf Werner. 2019. Fair valuation of cliquet-style return guarantees in (homogeneous and) heterogeneous life insurance portfolios. Scandinavian Actuarial Journal 2019: 478–507. [Google Scholar] [CrossRef]

- Huang, Huaxiong, Moshe A. Milevsky, and Thomas S. Salisbury. 2009. A different perspective on retirement income sustainability: The blueprint for a ruin contingent life annuity (RCLA). Journal of Wealth Management 11: 89–96. [Google Scholar] [CrossRef]

- Hunt, Andrew, and David Blake. 2021. On the structure and classification of mortality models. North American Actuarial Journal 25: S215–S234. [Google Scholar] [CrossRef]

- Lee, Ronald D., and Lawrence R. Carter. 1992. Modeling and forecasting U.S. mortality. Journal of the American Statistical Association 87: 659–71. [Google Scholar]

- Macdonald, Angus S. 2004. Annuities. In Encyclopedia of Actuarial Science. Edited by Josez L. Teugels and Bjørn Sundt. Hoboken: John Wiley & Sons. [Google Scholar]

- Milevsky, Moshe A. 2005. Real longevity insurance with a deductible: Introduction to advanced-life delayed annuities (ALDA). North American Actuarial Journal 9: 109–22. [Google Scholar] [CrossRef]

- Olivieri, Annamaria, and Ermanno Pitacco. 2009. Stochastic mortality: The impact on target capital. ASTIN Bulletin 39: 541–63. [Google Scholar] [CrossRef]

- Olivieri, Annamaria, and Ermanno Pitacco. 2015. Introduction to Insurance Mathematics. Technical and Financial Features of Risk Transfers, 2nd ed. EAA Series; Berlin and Heidelberg: Springer. [Google Scholar]

- Orozco-Garcia, Carolina, and Hato Schmeiser. 2019. Is fair pricing possible? An analysis of participating life insurance portfolios. Journal of Risk and Insurance 86: 521–60. [Google Scholar] [CrossRef]

- Pitacco, Ermanno. 2021. Life Annuities. From Basic Actuarial Models to Innovative Designs. London: Risk Books. [Google Scholar]

- Renshaw, Arthur E., and Steven Haberman. 2003. Lee–Carter mortality forecasting with age-specific enhancement. Insurance: Mathematics and Economics 33: 255–72. [Google Scholar] [CrossRef]

- Renshaw, Arthur E., and Steven Haberman. 2006. A cohort-based extension to the Lee–Carter model for mortality reduction factors. Insurance: Mathematics and Economics 38: 556–70. [Google Scholar] [CrossRef]

- Rocha, Roberto, Dimitri Vittas, and Heinz P. Rudolph. 2011. Annuities and Other Retirement Products. Designing the Payout Phase. Washington, DC: The World Bank. [Google Scholar]

- Schrager, David F. 2006. Affine stochastic mortality. Insurance: Mathematics and Economics 38: 81–97. [Google Scholar] [CrossRef]

- Stephenson, James B. 1978. The high-protection annuity. The Journal of Risk and Insurance 45: 593–610. [Google Scholar] [CrossRef]

| Annuity Type | Year of Birth | Entry Age | Deferment | Maximum Duration |

|---|---|---|---|---|

| Immediate whole life annuity | 1957 | 65 | 0 | ∞ |

| Deferred life annuity | 1972 | 50 | 15 | ∞ |

| Term life annuity (1) | 1957 | 65 | 0 | 25 |

| Term life annuity (2) | 1972 | 50 | 15 | 25 |

| Old-age life annuity (1) | 1942 | 80 | 0 | ∞ |

| Old-age life annuity (2) | 1957 | 65 | 15 | ∞ |

| Annuity Type | Benefit Payment Age Frames | |

|---|---|---|

| Immediate whole life annuity | 21.20 | |

| Deferred life annuity | 21.54 | |

| Term life annuity (1) | 19.23 | |

| Term life annuity (2) | 18.95 | |

| Old-age life annuity (1) | 9.47 | |

| Old-age life annuity (2) | 7.72 |

| Annuity Type | |||

|---|---|---|---|

| Immediate whole life annuity | 101.60% | 102.06% | 103.24% |

| Deferred life annuity | 101.76% | 102.26% | 103.55% |

| Term life annuity (1) | 100.96% | 101.24% | 101.92% |

| Term life annuity (2) | 101.06% | 101.35% | 102.10% |

| Old-age life annuity (1) | 102.65% | 103.38% | 105.40% |

| Old-age life annuity (2) | 103.65% | 106.66% | 107.42% |

| Annuity Type | |||

|---|---|---|---|

| Immediate whole life annuity | 105.28% | 106.83% | 110.71% |

| Deferred life annuity | 105.77% | 107.44% | 111.85% |

| Term life annuity (1) | 103.07% | 103.91% | 105.89% |

| Term life annuity (2) | 103.34% | 104.25% | 106.51% |

| Old-age life annuity (1) | 108.69% | 111.33% | 118.22% |

| Old-age life annuity (2) | 112.17% | 115.80% | 124.98% |

| Annuity Type | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Immediate whole life annuity | 103.24% (Age 65) | 104.14% (Age 70) | 105.43% (Age 75) | 107.42% (Age 80) | 110.64% (Age 85) | 116.13% (Age 90) | 124.69% (Age 95) | … (Age 100) | … (Age 105) | … (Age 110) |

| Deferred life annuity | 103.55% (Age 50) | 103.55% (Age 55) | 103.55% (Age 60) | 103.55% (Age 65) | 104.33% (Age 70) | 105.43% (Age 75) | 107.09% (Age 80) | 109.72% (Age 85) | 114.16% (Age 90) | 121.40% (Age 95) |

| Term life annuity (1) | 101.92% (Age 65) | 102.49% (Age 70) | 103.29% (Age 75) | 104.44% (Age 80) | 106.14% (Age 85) | - | - | - | - | - |

| Term life annuity (2) | 102.10% (Age 50) | 102.10% (Age 55) | 102.10% (Age 60) | 102.10% (Age 65) | 102.56% (Age 70) | 103.18% (Age 75) | 104.06% (Age 80) | 105.34% (Age 85) | - | - |

| Old-age life annuity (1) | 105.40% (Age 80) | 108.96% (Age 85) | 114.96% (Age 90) | 124.19% (Age 95) | … (Age 100) | … (Age 105) | … (Age 110) | … (Age 115) | … (Age 120) | |

| Old-age life annuity (2) | 107.42% (Age 65) | 107.42% (Age 70) | 107.42% (Age 75) | 107.42% (Age 80) | 110.64% (Age 85) | 116.13% (Age 90) | 124.69% (Age 95) | … (Age 100) | … (Age 105) | … (Age 110) |

| Annuity Type | Annuity Age Frames | Annuity Maximum Duration | Benefit Payment Age Frames | Maximum Number of Payments |

|---|---|---|---|---|

| Immediate whole life annuity | (65,121] | 56 | (65,121] | 56 |

| Deferred life annuity | (50,121] | 71 | (65,121] | 56 |

| Term life annuity (1) | (65,90] | 25 | (65,90] | 25 |

| Term life annuity (2) | (50,90] | 40 | (65,90] | 25 |

| Old-age life annuity (1) | (80,121] | 41 | (80,121] | 41 |

| Old-age life annuity (2) | (65,121] | 56 | (80,121] | 41 |

| Moderate Deviations in Mortality | Major Deviations in Mortality | ||||||

|---|---|---|---|---|---|---|---|

| Annuity Type | BE | ||||||

| Immediate whole life annuity | 16.60 | 102.24% | 102.87% | 104.45% | 104.64% | 105.98% | 109.86% |

| Deferred life annuity | 12.34 | 103.57% | 104.53% | 107.00% | 105.97% | 107.60% | 111.68% |

| Term life annuity (1) | 15.50 | 101.92% | 102.47% | 103.88% | 103.25% | 104.14% | 106.54% |

| Term life annuity (2) | 11.28 | 103.31% | 104.19% | 106.46% | 104.51% | 105.72% | 108.77% |

| Old-age life annuity (1) | 8.26 | 102.77% | 103.57% | 105.61% | 107.69% | 110.08% | 115.32% |

| Old-age life annuity (2) | 4.98 | 104.53% | 105.82% | 109.10% | 111.55% | 114.98% | 125.44% |

| Moderate Deviations in Mortality | Major Deviations in Mortality | ||||||

|---|---|---|---|---|---|---|---|

| Annuity Type | BE | ||||||

| Immediate whole life annuity | 14.85 | 103.72% | 104.75% | 107.36% | 105.26% | 106.78% | 111.02% |

| Deferred life annuity | 9.48 | 106.63% | 108.37% | 113.01% | 108.00% | 110.18% | 115.85% |

| Term life annuity (1) | 14.03 | 103.48% | 104.52% | 107.03% | 104.29% | 105.45% | 108.60% |

| Term life annuity (2) | 8.80 | 106.42% | 108.09% | 112.73% | 107.10% | 108.99% | 113.87% |

| Old-age life annuity (1) | 7.75 | 103.54% | 104.54% | 107.11% | 107.72% | 110.00% | 115.38% |

| Old-age life annuity (2) | 4.02 | 106.82% | 108.73% | 113.52% | 112.42% | 116.14% | 126.86% |

| Mortality Shock after 0 Years | Mortality Shock after 10 Years | |||

|---|---|---|---|---|

| Annuity Type | ||||

| Immediate whole life annuity | 109.41% | 111.75% | 107.38% | 109.93% |

| Deferred life annuity | 111.40% | 114.98% | 110.88% | 114.83% |

| Term life annuity (1) | 106.20% | 107.96% | 104.36% | 106.34% |

| Term life annuity (2) | 108.10% | 111.29% | 107.61% | 111.11% |

| Old-age life annuity (1) | 115.94% | 119.23% | 106.83% | 109.89% |

| Old-age life annuity (2) | 123.75% | 128.90% | 120.89% | 126.25% |

| Financial Shock after 0 Years | Financial Shock after 10 Years | |||

|---|---|---|---|---|

| Annuity Type | ||||

| Immediate whole life annuity | 107.10% | 109.47% | 103.96% | 106.17% |

| Deferred life annuity | 115.53% | 119.67% | 110.83% | 115.08% |

| Term life annuity (1) | 106.17% | 108.08% | 103.12% | 105.12% |

| Term life annuity (2) | 114.48% | 118.37% | 109.99% | 113.30% |

| Old-age life annuity (1) | 105.52% | 108.50% | 103.15% | 106.02% |

| Old-age life annuity (2) | 113.92% | 119.08% | 109.55% | 114.44% |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Olivieri, A.; Pitacco, E. Time Restrictions on Life Annuity Benefits: Portfolio Risk Profiles. Risks 2022, 10, 164. https://doi.org/10.3390/risks10080164

Olivieri A, Pitacco E. Time Restrictions on Life Annuity Benefits: Portfolio Risk Profiles. Risks. 2022; 10(8):164. https://doi.org/10.3390/risks10080164

Chicago/Turabian StyleOlivieri, Annamaria, and Ermanno Pitacco. 2022. "Time Restrictions on Life Annuity Benefits: Portfolio Risk Profiles" Risks 10, no. 8: 164. https://doi.org/10.3390/risks10080164

APA StyleOlivieri, A., & Pitacco, E. (2022). Time Restrictions on Life Annuity Benefits: Portfolio Risk Profiles. Risks, 10(8), 164. https://doi.org/10.3390/risks10080164