1. Introduction

The COVID-19 pandemic is an unpredictable threat to all of humanity, having a catastrophic effect on all spheres of the economy (

Eckert and Mikosch 2022). For a relatively stable and growing world economy, the COVID-19 crisis, caused by the pandemic, became a shock—a bifurcation point that forced the world economic system from the stationary (equilibrium) state (

Li et al. 2021;

Sukaesih et al. 2022). The establishment of a new attractor (a new trajectory for the development of the world economic system in the post-COVID-19 period and a new balance in world markets) is the priority of the modern world economy, and the key role in achieving this priority is entrepreneurship (

Meyer et al. 2022;

Torkkeli et al. 2022). The development of business (through using its entire production capacity, turnover of assets, and receipt of revenue and profit) is the driver of economic growth, creating jobs and ensuring value-added (

Jebran and Chen 2022;

Kumar and Zbib 2022;

Matsilele et al. 2022).

To be able to compile the scientifically substantiated forecasts of the end of the COVID-19 pandemic and crisis, it is necessary to study—thoroughly and in detail—the experience and specifics of the influence of this crisis on entrepreneurship. The essence of this influence consists in increasing the entrepreneurial risks (

Akhtaruzzaman et al. 2022;

Vagin et al. 2022;

Yankovskaya et al. 2022;

Zhilkina et al. 2022). The advantage of consideration of the negative influence of the crisis on entrepreneurship from the position of risk is the systemic accounting of the negative consequences of the crisis on entrepreneurship and the probability of their appearance. Due to its systemic character, risk allows for measuring and characterising—in the most precise and correct manner—the influence of the crisis on entrepreneurship. Risk is treated as the scale (volume of losses) of the negative change in the parameters of entrepreneurship and the dependence (probability) of this change on the COVID-19 crisis.

In the works of

Engidaw (

2022),

Li et al. (

2022),

Meyer et al. (

2021),

Peñarroya-Farell and Miralles (

2022), and

Xie et al. (

2022), significant attention is paid to the analysis of the negative dynamics and difficulties of the development of entrepreneurship amid the COVID-19 crisis. However, these works somewhat ignore the main peculiarity of the current crisis, t that it was caused by a pandemic. Unlike other crises (for example, the global financial and economic crisis of 2008), for the first time in recent decades, the COVID-19 crisis has become not the main, but a secondary threat (while the pandemic is the primary threat).

Because of this, the possibilities of economic crisis management are limited and complicated by the need to deal with the pandemic as a priority (

Arora et al. 2022). Measures to overcome the virus threat, including social distancing and restrictions on international transportation, in 2020 during the acute phase of the COVID-19 economic crisis did not allow economic crisis management to be carried out by stimulating the development of entrepreneurship (for example, through the increasing volume of production and international trade). This feature (the contradiction between pandemic control measures and economic crisis management measures) determines the specifics of the COVID-19 crisis and is not fully disclosed in the existing literature.

The modern history of humanity—from the second half of the 20th century up to now—has undergone many crises of different coverage and depth, but the COVID-19 crisis became the first economic depression caused by natural reasons. As noted in

Afonso and Blanco-Arana (

2022) and

Yu et al. (

2022), most crises have a socio-economic nature, i.e., are caused by the violation of balance (sharp change in demand and/or offer and their critical imbalance) in the commodity markets or the stock market.

The COVID-19 crisis stands out because it is not connected to a socio-economic underrun and thus requires a special approach to its research and management. The increased complexity of the crisis management of COVID-19 consists of the following: unlike a regular crisis (which resolution envisages the restoration of balance in the commodity/stock market (

Bolgova 2017), in the case of the COVID-19 crisis, there is a need for a more complex set of well-coordinated actions. First (the first stage), it is necessary to overcome the viral threat. Recently, outstanding results were achieved in this direction—due to mass vaccination around the world and the collective immunity achieved to COVID-19. Then (in the second stage), after stabilization of the situation in the sphere of healthcare, it is necessary to ensure the post-crisis restoration of the economy with the help of the accelerated growth and development of entrepreneurship.

The problem is that the connection between the pandemic and the entrepreneurial risks is unknown. There are many proofs that the indicators of entrepreneurship dropped down amid the COVID-19 crisis (

Fasth et al. 2022), but it is unclear to which extent they are caused by the pandemic itself. Due to the uncertainty of the entrepreneurial risks of the COVID-19 crisis, the perspectives of overcoming the crisis are still unclear. The standard approach (popular in the existing literature) to evaluate the crisis through the prism of entrepreneurship is not sufficiently informative regarding the COVID-19 crisis because the crisis was caused not by the market but by the pandemic.

The decline in entrepreneurial activity and the aggravation of the factors of entrepreneurship against the background of the COVID-19 crisis are caused not only by the pandemic but by many other factors. To discover the perspectives on ending the COVID-19 crisis, it is important to study the direct influence of the pandemic on entrepreneurial risks. This led to the research question (RQ) of this paper: how high are the entrepreneurial risks and how did the COVID-19 pandemic influence them? The answer to this question will help understand at which stage (of the two) of ending the COVID-19 crisis the modern world economy is in now.

As the answer to the research question, this paper offers the following hypothesis: the entrepreneurial risks increased amid the COVID-19 crisis, but the increase was caused not so much by the pandemic (as the initial cause of the crisis) as by the general uncertain (unpredictable) socio-economic context which is susceptible to negative changes. The hypothesis is based on the works of

Bertogg and Koos (

2021),

Fatouh et al. (

2021),

Han and Hart (

2021),

Weeks (

2021), and

Armantier et al. (

2021).

The goal of this paper is to study the risks of entrepreneurship amid the COVID-19 pandemic and crisis and is reached with the help of the following research tasks:

This paper’s originality consists in specifying the influence of the COVID-19 pandemic on entrepreneurial risks, explaining—thoroughly and in detail—the essence of these risks, and opening possibilities for highly-effective risk management.

The core of the scientific novelty of this research is a clear differentiation between the crisis and the COVID-19 pandemic. This has allowed for a better explanation of the nature of entrepreneurial risks, which, on the one hand, are predetermined by the general, wider context of the COVID-19 crisis in which current entrepreneurship finds itself, and a larger list of factors—social, financial, market, and regulatory. Though the economic crisis has a clear quantitative measure—a decrease in GDP—this manifestation is rather a result of entrepreneurial risks, not their factor.

On the other hand, there is a focused factor—the pandemic—which has a precise quantitative measurement due to reliable factors such as the COVID-19 case rate and mortality. Due to their differentiation, this paper proves that the COVID-19 crisis began against the background of the pandemic but then acquired a more vivid socio-economic nature—the management of the entrepreneurial risks requiring systemic and coordinated efforts in the sphere of the fight against the viral threat, and socio-economic crisis management in the form of a decline in GDP and a slowdown in economic growth. Thus, the pandemic nature of the COVID-19 crisis, which is its feature for managing business risks, requires systemic and coordinated efforts in the field of combating the virus threat on the one hand, and socio-economic crisis management on the other hand.

2. Literature Review

The theoretical basis of this study is the existing literature that highlights entrepreneurial projects in the context of crisis as a special contextual structure, such as scholars

Castelblanco et al. (

2022),

Díaz et al. (

2022), and

Hoang et al. (

2022). The conducted research is also based on the latest literature on entrepreneurial projects in the COVID-19 crisis by authors such as

Apostolopoulos et al. (

2022),

Belitski et al. (

2022),

Crupi et al. (

2022),

Gavriluță et al. (

2022),

Ge et al. (

2022),

Harima (

2022),

Ibáñez et al. (

2022),

Liñán and Jaén (

2022), and

Sadiq et al. (

2022).

This research uses the scientific provisions of the theory of entrepreneurial risks, according to which, risks are losses. The following entrepreneurial risks are distinguished:

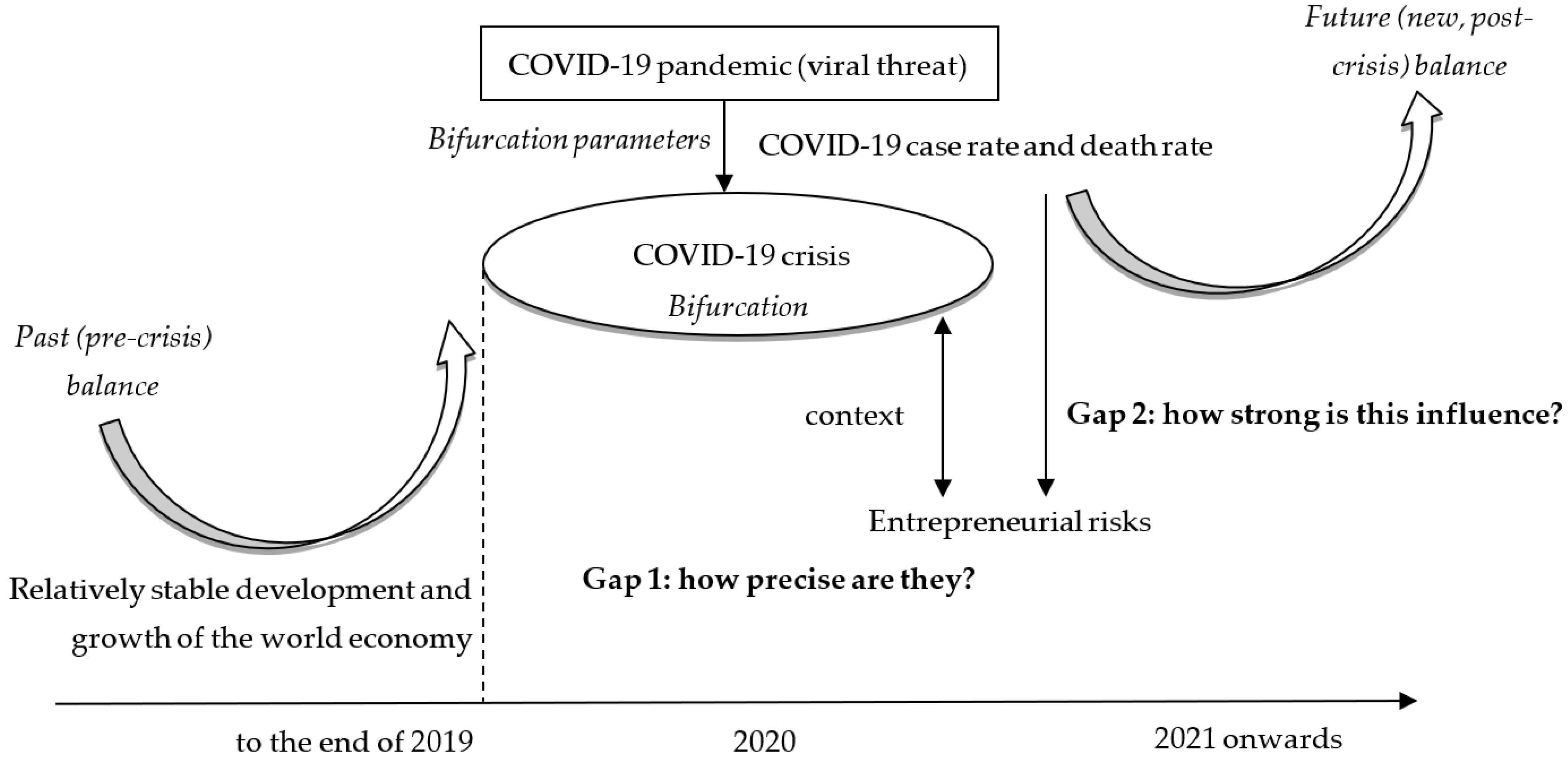

The overview and content analysis of the existing literature sources show the considerable attention of the global academic community to the issues of entrepreneurial risks amid the COVID-19 pandemic and crisis. At the same time, there is a research gap that is connected to the lack of thorough elaboration, preserving uncertainty regarding the cause-and-effect links between the entrepreneurial risks amid the COVID-19 pandemic and crisis. The described aggravation of the factors of entrepreneurship in 2020 has not yet been measured quantitatively and precisely, which leads to ambiguity regarding the volume of entrepreneurial risks—which is the first research gap.

The influence of the COVID-19 pandemic on entrepreneurship in 2020 was studied only fragmentarily and is based on an insufficient empirical framework. Thus, there is no scientific proof of the fact that entrepreneurial risks are caused by the pandemic itself—fully or in part (and it is unclear which part exactly). This is the second research gap. The concept of the research, literature gaps, and the research question are shown in

Figure 1.

This paper uses the systems theory. From its position, the bifurcation parameters (parameters causing bifurcation) of the COVID-19 crisis are the case rate and mortality of the new coronavirus infection (

Figure 1). The COVID-19 crisis is treated as a new context that formed under the influence of the pandemic. In this new context, the entrepreneurial risks grew, but it is unclear to which extent (gap # 1) and what influence the factors of the pandemic—the COVID-19 case rate and mortality—had on them (gap # 2). These gaps cause uncertainty and hinder the establishment of the future (new, post-crisis) balance of the world economy. Thus, they must be filled in.

These gaps are to be filled in here through the systematic analysis of the international experience, which allows for precise quantitative measuring of the volume of entrepreneurial risks (change in the characteristics of companies in 2020 compared to 2019); it also allows proving or disproving the dependence of entrepreneurial risks on the influence of the pandemic’s factors: case rate and death of COVID-19.

3. Materials and Method

3.1. Research Sample

This paper’s sample consists of the top ten countries in the world with the leading COVID-19 case rates, starting 22 October 2020 up to 22 February 2022 (based on the materials of the

World Health Organization (

2022)), given in the order of reduction in the position in the ranking, i.e., reduction of the acuteness of the viral threat: the USA, India, Brazil, Russia, Spain, France, Mexico, Germany, Turkey, and Italy. To measure the entrepreneurial risks, as the empirical framework of the research, the rankings Global 500 for 2019 and 2020 are used (

Fortune 2022). The

Fortune (

2022) database was chosen as the empirical base for this study since it is a reliable source of data on the performance of companies from various countries and contains highly detailed and comparable statistics for different years and for different companies. The advantage of relying on

Fortune (

2022) statistics is the opportunity to conduct applied international research and to study specific rather than generalised characteristics of enterprises.

From the

Fortune (

2022) Global 500 rankings for 2019 and 2020, the basic characteristics of enterprises are taken:Position in the ranking (global competitiveness), Revenue, Profit, Asset value, and Number of employees. The arithmetic means (aggregated, generalised) of the values of these factors for all countries of the sample are calculated. They characterise the situation in international entrepreneurship on the whole before the pandemic (in 2019) and amid the COVID-19 crisis (in 2020).

A range of equal criteria that are mandatory for use was utilised during the formation of the sample of data for the dataset. First, the data must be reliable and true, have precise quantitative measuring, and be topical as of 2020. Second, for the selected countries, there must be accessible statistics on the susceptibility to the COVID-19 pandemic and statistics on entrepreneurship, which are compatible with other countries (from the same respectable global ranking). Third, the data on entrepreneurship must be available (and compatible in dynamics) for 2019–2020, to discover the influence of the pandemic. A maximum of ten companies were selected from each country. The empirical data for all indicators and the detailed authors’ calculations for each country are presented in

Table A1,

Table A2,

Table A3,

Table A4,

Table A5,

Table A6,

Table A7,

Table A8,

Table A9 and

Table A10.

3.2. Concept of the Research

The logic, structure, and methodology of this research are reflected by its concept (

Table 1).

According to the concept of this research (

Table 1), the first task is to determine the level (quantitative measuring of the change in the characteristics of companies in 2020 compared to 2019) of the entrepreneurial risks amid the COVID-19 pandemic and crisis in 2020. To do this, the trend analysis method is used to perform dynamic modelling of the change (growth rate, TG) in the characteristics of entrepreneurship in 2020 compared to 2019:

The empirical framework is the data from

Table A1,

Table A2,

Table A3,

Table A4,

Table A5,

Table A6,

Table A7,

Table A8,

Table A9 and

Table A10. Firstly, calculations for each country in isolation are performed. Then, the data are enlarged, and a general table of data is formed which reflects the situation in international entrepreneurship amid the COVID-19 pandemic and crisis. The result of this task is the determination of the entrepreneurial risks: characteristics that were aggravated in 2020 compared to 2019 (for which TG < 0).

The second task of this research is to analyse the influence of the COVID-19 pandemic on the level of entrepreneurial risks in 2020. For this, the correlation and regression method of analysis is used to perform a systemic analysis of the influence of case rate per 1000 people (cas) and mortality (mrt) from COVID-19 on the entrepreneurial risks in the regression function (research model):

For model (1), multiple correlation (R) is calculated and t-Stat is provided. The empirical framework is the data from

Table 2.

Table 2 contains statistics on the number of cases, those recovered, and deaths from COVID-19 in the countries of the sample, according to the

World Health Organization (

2022). To obtain the compatible (regardless of the population) data, the death rate per 1000 people was calculated. For this, the ratio of the integral death rate (accrued total) to the population in 2020 from the materials of the

World Bank (

2022) was calculated. Additionally, the percent of mortality as a ratio of deaths to total cases (accrued total) was calculated. This research was based on the statistics on COVID-19 as of 22 October 2020 (year-end 2020) to evaluate, in the most precise way, the situation in 2020 when the influence of the pandemic on the economy and entrepreneurship was the strongest, and when the COVID-19 vaccines were not yet registered—i.e., when the risks of the pandemic were the highest.

The purpose of this task was to determine the level of the dependence of entrepreneurial risks (TG) on the factors of the pandemic (cas and mrt). The proposed hypothesis (H) is deemed proven if there are two or more entrepreneurial risks (TG < 0), and if there are a lot of bcas < 0 bmrt < 0 at a moderate correlation (R < 70) in the research model (1).

Thus, the research and the chosen research methodology are representative of determining the impact of the pandemic on entrepreneurship. While the relationship between the pandemic and the general difficulty of entrepreneurship is obvious, and noted in the literature, the new point of view on their relationship, proposed in this article, allows us to rethink their relationship from the standpoint of entrepreneurial risk. Through the study of the highly detailed experience of specific companies from various countries, this research allows us to quantify the change in the characteristics of enterprises in 2020 compared to 2019 and, from the standpoint of this change, characterise the level of entrepreneurial risks in the context of the COVID-19 pandemic and crisis in 2020.

Due to subsequent aggregation, that is, a generalisation of the characteristics of entrepreneurship by country and an analysis of the impact of morbidity and mortality from COVID-19 on them, we can clearly define and quantify the impact of the pandemic on the level of entrepreneurial risks in 2020. This allows us to give an unambiguous, objective, and reliable, at the scale of the world economic system, answer to the research question (RQ) posed about the volume of the entrepreneurial risks and the impact of the COVID-19 pandemic on them.

4. Results

4.1. Evaluation of the Level of Entrepreneurial Risks Amid the COVID-19 Pandemic and Crisis in 2020

Within the first task of this research, trend analysis is used to find the level (quantitative measuring of the change in the characteristics of companies in 2020 compared to 2019) of the entrepreneurial risks amid the COVID-19 pandemic and crisis in 2020. Based on the data from

Table A1,

Table A2,

Table A3,

Table A4,

Table A5,

Table A6,

Table A7,

Table A8,

Table A9 and

Table A10, the dynamic modelling of the change (growth rate, TG) in the characteristics of entrepreneurship in 2020 compared to 2019 was performed. Its generalised results for the evaluated countries are given in

Table 3.

The indicators in

Table 3 refer to large businesses, that is, to the largest companies included in the Global 500 rating of

Fortune (

2022). Considering that in most economies of the selected countries, the large companies’ sector has a significant share—from 40 to 55% (in terms of asset turnover, profit, value-added, and number of employees), this allows us to quite fully and reliably characterise entrepreneurship in general in the countries under study.

The results of the evaluation from

Table 3 showed that the risk of a decrease in competitiveness (reputational losses) is almost absent. On average, the position of companies from countries of the sample in the ranking by

Fortune (

2022) improved in 2020 (compared to 2019) by 11%. The only country with a negative growth rate was the USA (−1.09%), i.e., the probability of losses was 0.1 (very small).

The risks of a decrease in revenue and profit (financial losses) are moderate. The growth rate of revenue of companies from countries of the sample in the ranking by

Fortune (

2022) improved in 2020 (compared to 2019), equalling −3.1% on average (the volume of losses was moderate). Losses were observed in most countries; the probability of losses was 0.7 (high). The growth rate of the profit of companies from countries of the sample in the ranking by

Fortune (

2022) improved in 2020 (compared to 2019), equalling −3.4% on average (the volume of losses was moderate). The losses were peculiar for most countries; the probability of losses was 0.4 (moderate).

The risk of a decrease in asset value (financial and non-financial losses) was low. On average, the asset value of companies from countries of the sample in the ranking by

Fortune (

2022) grew in 2020 (compared to 2019) by 3.4%. A negative growth rate was observed only in certain countries (the USA, India, and Germany), so the probability of losses was 0.3 (low).

The risk of a decrease in the number of employees (losses of human resources and corporate knowledge) was moderate. The growth rate of the number of employees of companies from countries of the sample in the ranking by

Fortune (

2022) reduced in 2020 (compared to 2019) by 0.5%. The losses were observed in most of the countries; the probability of losses was 0.6 (high).

Thus, the targeted outcome of solving the set task was achieved: the entrepreneurial risks (characteristics that aggravated in 2020 compared to 2019, for which TG < 0) were determined: the risks of decrease in revenue and profit (financial losses) and the risk of decrease in the number of employees (losses of human resources and corporate knowledge). All these risks were moderate.

4.2. Analysis of the Influence of the COVID-19 Pandemic on the Level of Entrepreneurial Risks in 2020

Regarding the second task of this research, to find the influence of the COVID-19 pandemic on the level of entrepreneurial risks in 2020, the method of correlation and regression analysis was used to perform a systemic analysis of the influence of the case rate per 1000 people (cas) and mortality (mrt) from COVID-19 on the entrepreneurial risks, based on the data from

Table 2 and

Table 3 and the research model (1). The results of the analysis are provided in

Table 4.

A pre-validation of model data revealed the economic sense of studying the relationship of variables and consists of the following: the increase in the level of morbidity and mortality from COVID-19 causes a natural increase in voluntary self-restrictive measures of enterprises as a manifestation of their corporate social responsibility, as well as mandatory government measures restricting entrepreneurial activity. Although the measures of public and corporate governance in the fight against the virus threat vary in severity and composition, they are limited to social distancing and improved sanitation.

From the point of view of entrepreneurial risks, the implementation of these measures means an increase in costs if it is impossible to receive additional income due to a decrease in the degree of utilisation of production capacities and a decrease in the solvency of demand. Business expenses can also increase in relation to income if a decision is made to preserve jobs and wages if it is impossible to use the full-scale of human resources when in self-isolation and, at best, working remotely. For most professions, especially those involving working with clients, remote work is associated with significantly lower labour productivity and the inability to perform a number of essential work functions. This also means the risk of a reduction in the number of employees (loss of human resources and corporate knowledge) if the company decides to reduce staff and/or reduce wages during the period of forced business downtime.

The results of the analysis from

Table 4 demonstrated that almost all coefficients of regression are negative. Therefore, factors of the pandemic—the COVID-19 case rate and mortality—had a negative influence on the entrepreneurial risks in 2020. However, the influence of these factors is weak. The risk of a decrease in competitiveness (reputational losses), which was almost absent in 2020, is 44.16% explained by factors of the pandemic. The risks of a decrease in revenue and profit (financial losses), which were moderate in 2020, are 50.63% and 20.76%, accordingly, explained by the influence of factors of the pandemic.

The risk of a decrease in asset value (financial and non-financial losses), which is almost absent in 2020, is 29.05% explained by factors of the pandemic. The risk of a decrease in the number of employees (losses of human resources and corporate knowledge), which is moderate in 2020, is 51.70% explained by factors of the pandemic. The provided t-Statistics demonstrate a weak connection between the variables.

Thus, the targeted outcome of solving the set task was achieved—the level of dependence of the entrepreneurial risks (TG) on factors of the pandemic (cas and mrt) was determined to be low. Since the moderate entrepreneurial risks (TGRev < 0, TGPrf < 0, and TGEmp < 0) and their susceptibility to the negative influence of the factors of the COVID-19 pandemic (most of bcas < 0 and bmrt < 0 in

Table 4) were determined to have a moderate correlation (all R < 70 in

Table 4), the proposed hypothesis (H) is deemed proved.

5. Discussion

The conducted research contributes to the development of the theory of entrepreneurial risks by specifying the influence of the COVID-19 pandemic on entrepreneurship from the position of risks. The achieved growth of scientific knowledge in the dialogue with the existing literature is noted in

Table 5.

As shown in

Figure 2, the decline of GDP in countries of the sample equalled 5.6% on average, while according to

Table 3, the entrepreneurial risks did not achieve this level and were as follows:

Risks of a decrease in revenue and profit (financial losses): the value of the losses of revenue: −3.1%, profit: 3.4%; probability of the losses of revenue: 0.7, profit: 0.4;

Risk of a decrease in the number of employees (losses of human resources and corporate knowledge): the value of losses: 0.5%, probability of losses: 0.6.

This opened a new view of the COVID-19 crisis, which, unlike most other economic crises, is closely connected to entrepreneurial risks and is very dependent on other factors (which are beyond entrepreneurship).

Unlike

Miao et al. (

2020),

Polinkevych et al. (

2021), and

Thomson et al. (

2022), it was determined that factors of healthcare factors—the COVID-19 case rate and mortality—are not the key reasons for high entrepreneurial risks in 2020. The level of dependence of the entrepreneurial risks on factors of the pandemic was low:

Risks of a decrease in revenue and profit (financial losses): are explained by 50.63% and 20.76%, accordingly, from the influence of factors of the pandemic;

Risk of a decrease in the number of employees (losses of human resources and corporate knowledge): is explained by 51.70%, of the factors of the pandemic.

This demonstrates that the entrepreneurial risks are largely determined by the context of the crisis than by the COVID-19 pandemic. Even if the factors of the pandemic initially (early 2020) caused and then became the drivers of entrepreneurial risks, the influence of the pandemic was limited. Thus, one should not expect that overcoming the viral threat (due to vaccination) will automatically (all by itself) ensure the reduction in entrepreneurial risks and end the COVID-19 crisis. There is a need for additional, special measures of the risk management of entrepreneurship that lie beyond healthcare.

The results obtained provided the answer to the research question (RQ): the entrepreneurial risks in 2020 were moderate and susceptible to a weak negative influence of the COVID-19 pandemic. The contribution of the obtained results to the literature consists of a specific and accurate quantitative measurement of the patterns of entrepreneurial response to the pandemic. While it is obvious and noted in the available literature that any business project is prone to limited income, increasing losses, etc., in a pandemic (after all, the lack of an inclination for entrepreneurship among the population in a global pandemic is natural and undeniable), it was still unclear to what extent the decline in entrepreneurship was in the context of the pandemic. The value of the quantitative measurements taken, and the results obtained from them, lies in the fact that they provide an opportunity to predict the subsequent change in entrepreneurial activity in the context of the ongoing (as of mid-2022) COVID-19 pandemic.

This article also contributed to the growth of scientific knowledge by rethinking the impact of the pandemic on entrepreneurship from a risk perspective. The results obtained clearly identified specific entrepreneurial risks arising or intensifying in the context of a pandemic—these are the risks of reducing returns and profitability and the risk of reducing the number of employees. It has also been proven that the risk of a decrease in the value of assets is not typical for a pandemic. This made it possible to delineate the boundaries of entrepreneurial risks that are aggravated in the context of a pandemic and opens opportunities for more targeted (focused on increased risks during a pandemic) and more effective risk management of entrepreneurship, thus making it possible to increase its resilience to a pandemic.

The scientific novelty of this article lies in the fact that for the first time the impact of the economic crisis and the pandemic on entrepreneurship is distinguished. The pre-existing literature has only broadly pointed to an overall unfavourable market context. The highly detailed study conducted in the article made it possible to clarify cause-and-effect relationships and reveal the direct impact of the COVID-19 pandemic on entrepreneurial risks.

While there are many, perhaps more significant, factors affecting the level of entrepreneurship during a pandemic, such as restrictions applied by various governments, the collapse of non-essential activities, assistance expressed in terms of funding received, etc., these factors have an economic nature and have been studied in detail in the available literature. In contrast, this article revealed the impact of previously unknown factors of morbidity and mortality from the virus threat that first emerged in the context of the COVID-19 pandemic on entrepreneurial risks which makes it possible to more accurately predict the consequences of the implementation of economic crisis management measures and measures to combat the pandemic separately for business risks, select the most appropriate measures, and maximise the effectiveness of business risk management.

6. Conclusions

Solving the first task ensured the precise quantitative measuring of the influence of the manifestations of the pandemic (case rate and mortality) on the characteristics of international entrepreneurship, which ensured the achievement of this article’s set goal. The following entrepreneurial risks in 2020 were revealed: risks of a decrease in revenue and profit (financial losses): volume of the losses of revenue: −3.1%, profit: 3.4%; probability of the losses of revenue: 0.7, profit: 0.4; and the risk of a decrease in the number of employees (losses of human resources and corporate knowledge): volume of losses: 0.5%, probability of losses: 0.6.

Solving the second task showed that healthcare factors—the COVID-19 case rate and mortality—were not the key reasons for high entrepreneurial risks in 2020. The level of dependence of the entrepreneurial risks on factors of the pandemic was low: the risks of a decrease in revenue and profit (financial losses) were 50.63% and 20.76%, accordingly, explained by the influence of pandemic factors; the risk of a decrease in the number of employees (losses of human resources and corporate knowledge) was 51.70%, explained by factors of the pandemic.

This paper’s contribution to the literature consists in specifying the cause-and-effect links between the COVID-19 pandemic and crisis and entrepreneurial risks. It was substantiated that the entrepreneurial risks have an important, but not central, place in the system of the factors of the COVID-19 crisis. In their turn, the entrepreneurial risks were caused not so much by the pandemic as by other reasons, which lie beyond the limits of this research. This revealed a specific feature of the COVID-19 crisis (its difference from other, preceding crises), which is a weaker connection between the crisis (and its reasons—in this case, factors of the pandemic) and the entrepreneurial risks. Thus, the standard approach to economic crisis management which envisages the management of the entrepreneurial risks through influencing the causes of the crisis (in this case, factors of the pandemic) will have (and has) a limited effect.

The theoretical significance of the results obtained consists in their proving the uniqueness of the COVID-19 crisis from the position of entrepreneurial risks. The anomaly of the COVID-19 crisis is caused by the fact that, despite its causing the deepest depression in the world economy in recent decades, it is the first time that an economic crisis, or even the pandemic that led to it, is not the main factor of entrepreneurial risks, which are largely determined by the general context and, perhaps, internal factors. Therefore, the entrepreneurial risk is not so much of the economy as of the social nature and thus requires new methodological approaches to its measuring and management. Entrepreneurial risk should be measured by combining quantitative and qualitative evaluations. The management of entrepreneurial risk should be based on the whole complex of available tools—not only in the sphere of the economy (crisis management), and, in the case of COVID-19, in the sphere of healthcare (fighting the viral threat as the cause of the crisis)—and also on the social sphere which is more diverse and complex and requires more flexible solutions.

The practical significance of the results obtained, and conclusions made, consists in opening a more complex understanding of the COVID-19 crisis—not only as a decline in GDP but also as a complex of mutually connected (determined by the pandemic) socio-economic processes. Unlike the traditional components (entrepreneurial and economic), the COVID-19 crisis has four relatively isolated components: (1) economic (decrease in GDP); (2) entrepreneurial (entrepreneurial risks); (3) healthcare (pandemic), and (4) social (social distancing). Crisis management requires the systemic management of all the distinguished components. Differentiation of these components forms a more comprehensive vision and opens a possibility for the growth of efficiency of the COVID-19 crisis management, in particular, management of the entrepreneurial risks that emerged during the crisis.

Nevertheless, it should be noted that the results obtained reflect the experience of only the leading companies (large entrepreneurship). At the level of small and medium entrepreneurship, the ties between the COVID-19 pandemic and crisis and the entrepreneurial risks might be different and thus require isolated research which should be conducted in further scientific works.