Evaluating the Optimal External Equity Financing Strategy and Critical Factors for the Startup of Lending Company in Taiwan: An Application of Expert Network Decision Model

Abstract

1. Introduction

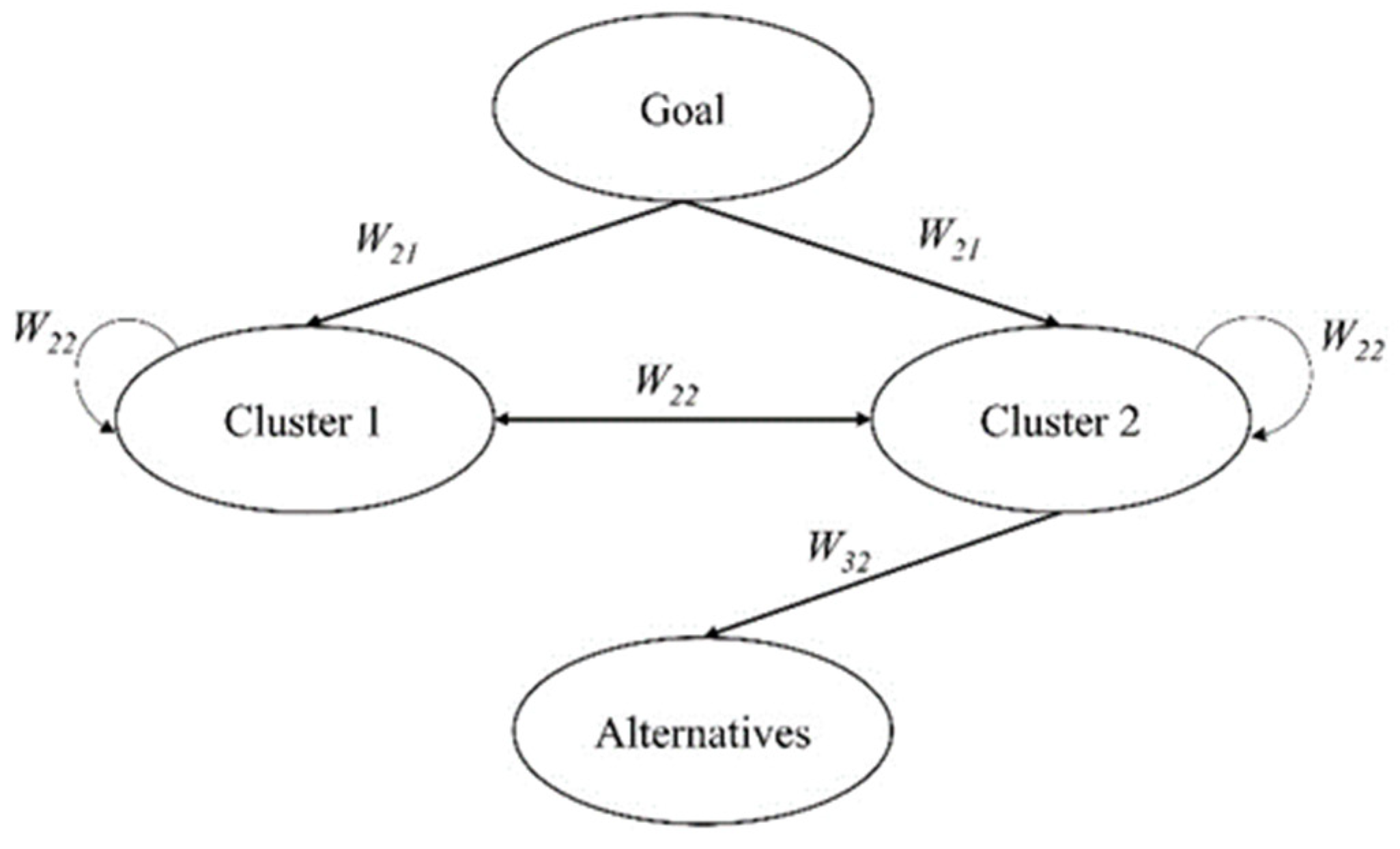

2. Expert Network Decision Model

2.1. Delphi Method

- Select the anonymous experts.

- Conduct the first round of the survey.

- Conduct the second round of the questionnaire survey.

- Conduct the third round of the questionnaire survey.

- Integrate expert opinions and reach a consensus.

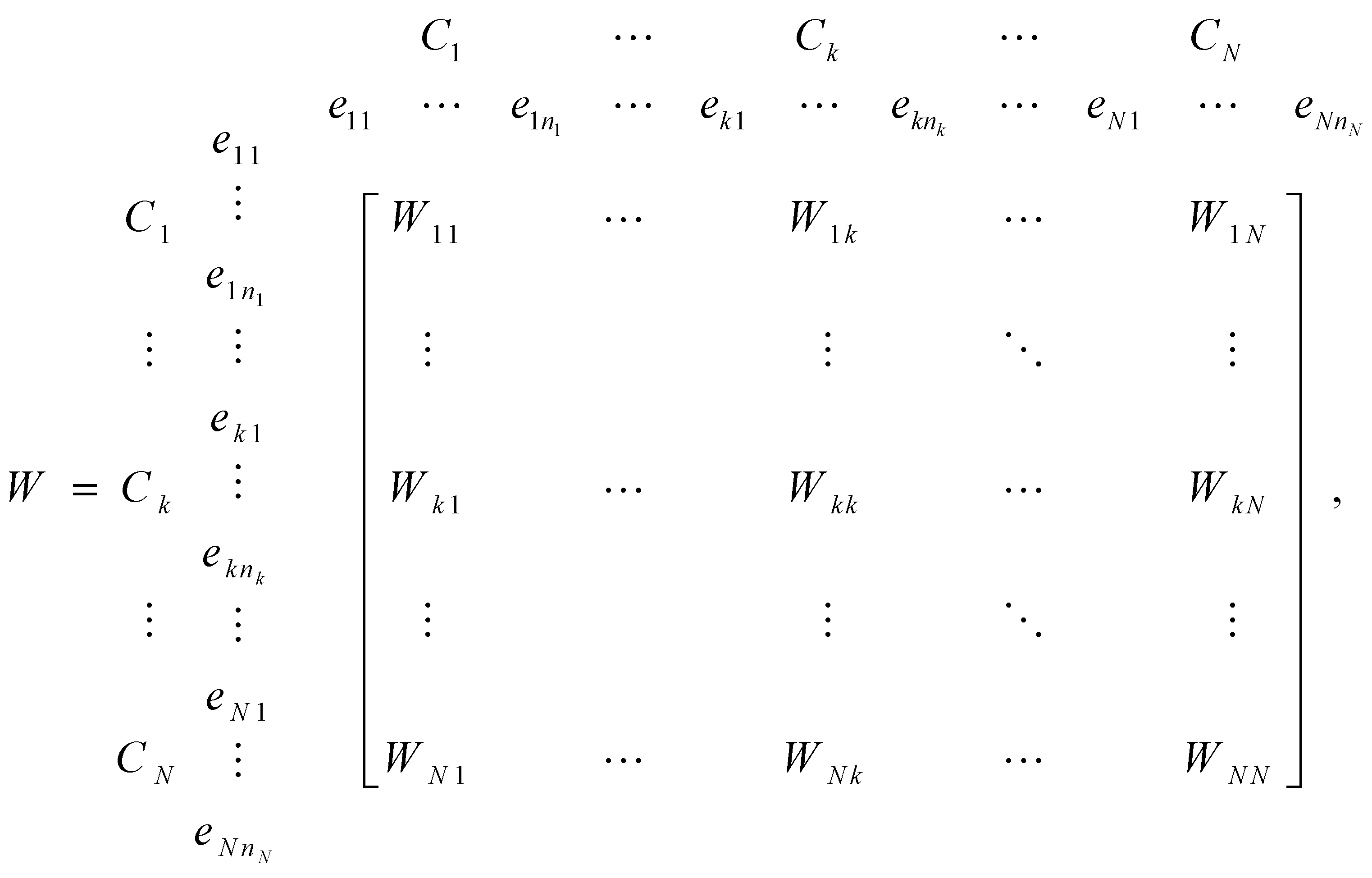

2.2. Analytic Network Process

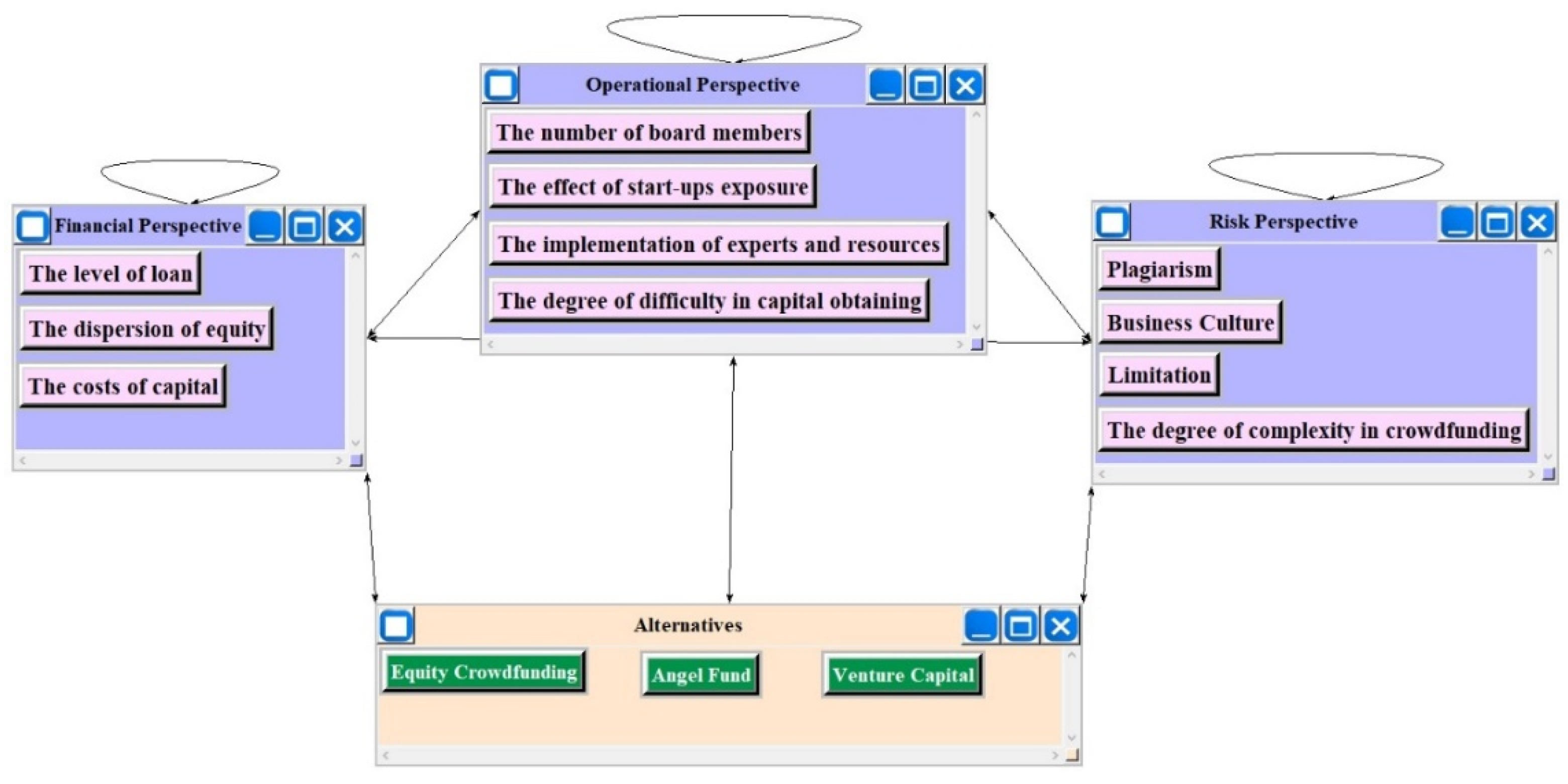

3. Empirical Study

- Financial Perspective:

- 1.1.

- Level of Loan (LL): can be obtained from different external equity crowdfunding plans by start-ups, such as EC, AF, and VC.

- 1.2.

- Dispersion of Equity (DE): the degree of equity dispersion after start-ups are subscribed by investors.

- 1.3.

- Cost of Capital (CC): the costs needed for financing under different external equity crowdfunding plans, such as platform commissions, interests, labor costs, advertising expenses, and administrative charges.

- Operation Perspective:

- 2.1.

- Number of Board Members (MBM): the investors’ involvement in the management of start-ups after subscription.

- 2.2.

- Effect of Stat-ups Exposure (ESE): the effects on start-ups when financing is conducted through external equity crowdfunding.

- 2.3.

- Implementation of Experts and Resources (IER): the differences in professionals and resources introduced after start-ups have obtained finance through different external equity financing plans.

- 2.4.

- The Degree of Difficulty in Capital Obtaining (DCO): the different difficulties in finance through different external equity financing plans of start-ups.

- Risks Perspective:

- 3.1.

- Plagiarism (PLA): when start-ups finance through external equity crowdfunding platforms, their know-hows or ideas may be plagiarized or counterfeited.

- 3.2.

- Business Culture (BUC): start-ups obtain capital, and investors control the equity and intervene in the corporate business, causing conflict in the management cultures between investors and start-ups.

- 3.3.

- Limitation (LIT): investors may have restrictions, such as board seats, control rights, and liquidation preferences, placed on the start-ups after investment.

- 3.4.

- Degree of Complexity in Crowdfunding (DCC): different fundraising plans have varying fundraising complexity, which has a great impact on the start-ups’ fundraising activities in the earlier stage.

- External equity financing plans:

- 4.1.

- Equity Crowdfunding (EC): fundraisers may raise capital through equity-crowdfunding channels, which denotes that fundraisers may offer equities of the target companies in exchange for capital and investors obtain the corresponding equities to obtain subsequent profits or dividends.

- 4.2.

- Angel Fund (AF): fundraisers may raise capital by using angel fund platforms and provide part of the equities in the target companies to obtain injections from an angel fund. Angel investors mainly invest in the start-ups before going public to enable them to operate effectively.

- 4.3.

- Venture Capital (VC): fundraisers may raise capital through venture capital channels. Venture capitals are the equity holders who participate in the boards of directors of the invested companies in most cases and who introduce professionals and resources to improve the business performances of start-ups.

4. Discussion

5. Conclusions

- Uncertainty of humans: This study implements the modified Delphi method and the ANP for determining the optimal financing plan. However, the proposed expert network decision support models are not concerned about the ambiguous nature of humans. Therefore, future works are able to combine the fuzzy concepts in the evaluation model construction.

- Investors’ view: This study was implemented by expert opinions for evaluating the optimal external financing strategy. Hence, future studies can apply the investors’ view to assess the optimal start-up based on the results of this study.

- Samples of survey: To reduce the complex evaluation procedures, this study was based on the experts view to determine the optimal solution. Thus, future studies can carry out with the larger sample to identify the optimal solution in this field.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| CC | DE | LL | DCO | ESE | IER | MBM | BUC | DCC | LIT | PLA | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CC | 0.000 | 0.367 | 0.419 | 0.417 | 0.388 | 0.356 | 0.413 | 0.362 | 0.413 | 0.483 | 0.393 |

| DE | 0.392 | 0.000 | 0.581 | 0.254 | 0.207 | 0.239 | 0.176 | 0.302 | 0.196 | 0.202 | 0.236 |

| LL | 0.608 | 0.633 | 0.000 | 0.329 | 0.405 | 0.405 | 0.411 | 0.336 | 0.391 | 0.315 | 0.371 |

| DCO | 0.373 | 0.403 | 0.511 | 0.000 | 0.409 | 0.498 | 0.573 | 0.492 | 0.506 | 0.386 | 0.473 |

| ESE | 0.197 | 0.152 | 0.112 | 0.312 | 0.000 | 0.211 | 0.255 | 0.184 | 0.198 | 0.184 | 0.162 |

| IER | 0.082 | 0.106 | 0.096 | 0.266 | 0.176 | 0.000 | 0.172 | 0.093 | 0.093 | 0.082 | 0.101 |

| MBM | 0.348 | 0.339 | 0.281 | 0.422 | 0.415 | 0.291 | 0.000 | 0.231 | 0.203 | 0.348 | 0.264 |

| BUC | 0.061 | 0.079 | 0.107 | 0.071 | 0.084 | 0.103 | 0.091 | 0.000 | 0.157 | 0.386 | 0.266 |

| DCC | 0.368 | 0.418 | 0.411 | 0.396 | 0.407 | 0.364 | 0.378 | 0.355 | 0.000 | 0.281 | 0.283 |

| LIT | 0.409 | 0.471 | 0.398 | 0.419 | 0.451 | 0.389 | 0.367 | 0.383 | 0.432 | 0.000 | 0.451 |

| PLA | 0.162 | 0.032 | 0.084 | 0.114 | 0.058 | 0.144 | 0.164 | 0.262 | 0.411 | 0.333 | 0.000 |

| AF | EC | VC | CC | DE | LL | DCO | ESE | IER | MBM | BUC | DCC | LIT | PLA | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| AF | 0.000 | 0.000 | 0.000 | 0.447 | 0.403 | 0.389 | 0.397 | 0.413 | 0.422 | 0.383 | 0.421 | 0.365 | 0.313 | 0.388 |

| EC | 0.000 | 0.000 | 0.000 | 0.462 | 0.398 | 0.413 | 0.408 | 0.386 | 0.366 | 0.398 | 0.366 | 0.399 | 0.438 | 0.353 |

| VC | 0.000 | 0.000 | 0.000 | 0.091 | 0.199 | 0.198 | 0.195 | 0.201 | 0.212 | 0.219 | 0.213 | 0.236 | 0.249 | 0.259 |

| CC | 0.353 | 0.447 | 0.377 | 0.000 | 0.367 | 0.419 | 0.417 | 0.388 | 0.356 | 0.413 | 0.362 | 0.413 | 0.483 | 0.393 |

| DE | 0.281 | 0.105 | 0.189 | 0.392 | 0.000 | 0.581 | 0.254 | 0.207 | 0.239 | 0.176 | 0.302 | 0.196 | 0.202 | 0.236 |

| LL | 0.366 | 0.449 | 0.434 | 0.608 | 0.633 | 0.000 | 0.329 | 0.405 | 0.405 | 0.411 | 0.336 | 0.391 | 0.315 | 0.371 |

| DCO | 0.337 | 0.487 | 0.406 | 0.373 | 0.403 | 0.511 | 0.000 | 0.409 | 0.498 | 0.573 | 0.492 | 0.506 | 0.386 | 0.473 |

| ESE | 0.255 | 0.103 | 0.214 | 0.197 | 0.152 | 0.112 | 0.312 | 0.000 | 0.211 | 0.255 | 0.184 | 0.198 | 0.184 | 0.162 |

| IER | 0.112 | 0.088 | 0.101 | 0.082 | 0.106 | 0.096 | 0.266 | 0.176 | 0.000 | 0.172 | 0.093 | 0.093 | 0.082 | 0.101 |

| MBM | 0.296 | 0.322 | 0.279 | 0.348 | 0.339 | 0.281 | 0.422 | 0.415 | 0.291 | 0.000 | 0.231 | 0.203 | 0.348 | 0.264 |

| BUC | 0.098 | 0.114 | 0.072 | 0.061 | 0.079 | 0.107 | 0.071 | 0.084 | 0.103 | 0.091 | 0.000 | 0.157 | 0.386 | 0.266 |

| DCC | 0.367 | 0.301 | 0.388 | 0.368 | 0.418 | 0.411 | 0.396 | 0.407 | 0.364 | 0.378 | 0.355 | 0.000 | 0.281 | 0.283 |

| LIT | 0.412 | 0.396 | 0.431 | 0.409 | 0.471 | 0.398 | 0.419 | 0.451 | 0.389 | 0.367 | 0.383 | 0.432 | 0.000 | 0.451 |

| PLA | 0.123 | 0.189 | 0.109 | 0.162 | 0.032 | 0.084 | 0.114 | 0.058 | 0.144 | 0.164 | 0.262 | 0.411 | 0.333 | 0.000 |

| AF | EC | VC | CC | DE | LL | DCO | ESE | IER | MBM | BUC | DCC | LIT | PLA | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| AF | 0.000 | 0.000 | 0.000 | 0.112 | 0.101 | 0.097 | 0.099 | 0.103 | 0.106 | 0.096 | 0.105 | 0.091 | 0.078 | 0.097 |

| EC | 0.000 | 0.000 | 0.000 | 0.116 | 0.100 | 0.103 | 0.102 | 0.097 | 0.092 | 0.100 | 0.092 | 0.100 | 0.110 | 0.088 |

| VC | 0.000 | 0.000 | 0.000 | 0.023 | 0.050 | 0.050 | 0.049 | 0.050 | 0.053 | 0.055 | 0.053 | 0.059 | 0.062 | 0.065 |

| CC | 0.142 | 0.180 | 0.152 | 0.000 | 0.092 | 0.105 | 0.104 | 0.097 | 0.089 | 0.103 | 0.091 | 0.103 | 0.121 | 0.098 |

| DE | 0.113 | 0.042 | 0.076 | 0.098 | 0.000 | 0.145 | 0.064 | 0.052 | 0.060 | 0.044 | 0.076 | 0.049 | 0.051 | 0.059 |

| LL | 0.147 | 0.181 | 0.175 | 0.152 | 0.158 | 0.000 | 0.082 | 0.101 | 0.101 | 0.103 | 0.084 | 0.098 | 0.079 | 0.093 |

| DCO | 0.109 | 0.157 | 0.131 | 0.093 | 0.101 | 0.128 | 0.000 | 0.102 | 0.125 | 0.143 | 0.123 | 0.127 | 0.097 | 0.118 |

| ESE | 0.082 | 0.033 | 0.069 | 0.049 | 0.038 | 0.028 | 0.078 | 0.000 | 0.053 | 0.064 | 0.046 | 0.050 | 0.046 | 0.041 |

| IER | 0.036 | 0.028 | 0.033 | 0.021 | 0.027 | 0.024 | 0.067 | 0.044 | 0.000 | 0.043 | 0.023 | 0.023 | 0.021 | 0.025 |

| MBM | 0.095 | 0.104 | 0.090 | 0.087 | 0.085 | 0.070 | 0.106 | 0.104 | 0.073 | 0.000 | 0.058 | 0.051 | 0.087 | 0.066 |

| BUC | 0.027 | 0.031 | 0.020 | 0.015 | 0.020 | 0.027 | 0.018 | 0.021 | 0.026 | 0.023 | 0.000 | 0.039 | 0.097 | 0.067 |

| DCC | 0.101 | 0.083 | 0.107 | 0.092 | 0.105 | 0.103 | 0.099 | 0.102 | 0.091 | 0.095 | 0.089 | 0.000 | 0.070 | 0.071 |

| LIT | 0.113 | 0.109 | 0.119 | 0.102 | 0.118 | 0.100 | 0.105 | 0.113 | 0.097 | 0.092 | 0.096 | 0.108 | 0.000 | 0.113 |

| PLA | 0.034 | 0.052 | 0.030 | 0.041 | 0.008 | 0.021 | 0.029 | 0.015 | 0.036 | 0.041 | 0.066 | 0.103 | 0.083 | 0.000 |

| AF | EC | VC | CC | DE | LL | DCO | ESE | IER | MBM | BUC | DCC | LIT | PLA | |

| AF | 0.078 | 0.078 | 0.078 | 0.078 | 0.078 | 0.078 | 0.078 | 0.078 | 0.078 | 0.078 | 0.078 | 0.078 | 0.078 | 0.078 |

| EC | 0.082 | 0.082 | 0.082 | 0.082 | 0.082 | 0.082 | 0.082 | 0.082 | 0.082 | 0.082 | 0.082 | 0.082 | 0.082 | 0.082 |

| VC | 0.040 | 0.040 | 0.040 | 0.040 | 0.040 | 0.040 | 0.040 | 0.040 | 0.040 | 0.040 | 0.040 | 0.040 | 0.040 | 0.040 |

| CC | 0.104 | 0.104 | 0.104 | 0.104 | 0.104 | 0.104 | 0.104 | 0.104 | 0.104 | 0.104 | 0.104 | 0.104 | 0.104 | 0.104 |

| DE | 0.070 | 0.070 | 0.070 | 0.070 | 0.070 | 0.070 | 0.070 | 0.070 | 0.070 | 0.070 | 0.070 | 0.070 | 0.070 | 0.070 |

| LL | 0.107 | 0.107 | 0.107 | 0.107 | 0.107 | 0.107 | 0.107 | 0.107 | 0.107 | 0.107 | 0.107 | 0.107 | 0.107 | 0.107 |

| DCO | 0.106 | 0.106 | 0.106 | 0.106 | 0.106 | 0.106 | 0.106 | 0.106 | 0.106 | 0.106 | 0.106 | 0.106 | 0.106 | 0.106 |

| ESE | 0.049 | 0.049 | 0.049 | 0.049 | 0.049 | 0.049 | 0.049 | 0.049 | 0.049 | 0.049 | 0.049 | 0.049 | 0.049 | 0.049 |

| IER | 0.031 | 0.031 | 0.031 | 0.031 | 0.031 | 0.031 | 0.031 | 0.031 | 0.031 | 0.031 | 0.031 | 0.031 | 0.031 | 0.031 |

| MBM | 0.078 | 0.078 | 0.078 | 0.078 | 0.078 | 0.078 | 0.078 | 0.078 | 0.078 | 0.078 | 0.078 | 0.078 | 0.078 | 0.078 |

| BUC | 0.032 | 0.032 | 0.032 | 0.032 | 0.032 | 0.032 | 0.032 | 0.032 | 0.032 | 0.032 | 0.032 | 0.032 | 0.032 | 0.032 |

| DCC | 0.085 | 0.085 | 0.085 | 0.085 | 0.085 | 0.085 | 0.085 | 0.085 | 0.085 | 0.085 | 0.085 | 0.085 | 0.085 | 0.085 |

| LIT | 0.096 | 0.096 | 0.096 | 0.096 | 0.096 | 0.096 | 0.096 | 0.096 | 0.096 | 0.096 | 0.096 | 0.096 | 0.096 | 0.096 |

| PLA | 0.042 | 0.042 | 0.042 | 0.042 | 0.042 | 0.042 | 0.042 | 0.042 | 0.042 | 0.042 | 0.042 | 0.042 | 0.042 | 0.042 |

References

- Cole, R.; Cumming, D.; Li, D. Do banks or VCs spur small firm growth? J. Int. Financ. Mark. Inst. Money 2016, 41, 60–72. [Google Scholar] [CrossRef]

- Vaznyte, E.; Andries, P. Entrepreneurial orientation and start-ups’ external financing. J. Bus. Ventur. 2019, 34, 439–458. [Google Scholar] [CrossRef]

- Myers, S.C. The capital structure puzzle. J. Financ. 1984, 39, 574–592. [Google Scholar] [CrossRef]

- Mina, A.; Lahr, H.; Hughes, A. The demand and supply of external finance for innovative firms. Ind. Corp. Chang. 2013, 22, 869–901. [Google Scholar] [CrossRef]

- Robb, A.M.; Robinson, D.T. The capital structure decisions of new firms. Rev. Financ. Stud. 2014, 27, 153–179. [Google Scholar] [CrossRef]

- Casamatta, C.; Haritchabalet, C. Dealing with venture capitalists: Shopping around or exclusive negotiation. Rev. Financ. 2013, 18, 1743–1773. [Google Scholar] [CrossRef][Green Version]

- Chen, X.P.; Yao, X.; Kotha, S. Entrepreneur passion and preparedness in business plan presentations: A persuasion analysis of venture capitalists’ funding decisions. Acad. Manag. J. 2009, 52, 199–214. [Google Scholar] [CrossRef]

- Carpenter, R.E.; Petersen, B.C. Capital market imperfections, high-tech investment, and new equity financing. Econ. J. 2002, 112, F54–F72. [Google Scholar] [CrossRef]

- Paul, S.; Whittam, G.; Wyper, J. The pecking order hypothesis: Does it apply to start-up firms? J. Small Bus. Enterp. Dev. 2007, 14, 8–21. [Google Scholar] [CrossRef]

- Aghion, P.; Fally, T.; Scarpetta, S. Credit constraints as a barrier to the entry and post-entry growth of firms. Econ. Policy 2007, 22, 732–779. [Google Scholar] [CrossRef]

- Guiso, L.; Sapienza, P.; Zingales, L. The role of social capital in financial development. Am. Econ. Rev. 2004, 94, 526–556. [Google Scholar] [CrossRef]

- Dogru, T.; Sirakaya-Turk, E. The value of cash holdings in hotel firms. Int. J. Hosp. Manag. 2017, 65, 20–28. [Google Scholar] [CrossRef]

- Park, J. Financial constraints and the cash flow sensitivities of external financing: Evidence from Korea. Res. Int. Bus. Financ. 2019, 49, 241–250. [Google Scholar] [CrossRef]

- Khémiri, W.; Noubbigh, H. Determinants of capital structure: Evidence from sub-Saharan African firms. Q. Rev. Econ. Financ. 2018, 70, 150–159. [Google Scholar] [CrossRef]

- Yildirim, R.; Masih, M.; Bacha, O.I. Determinants of capital structure: Evidence from Shari’ah compliant and non-compliant firms. Pacific-Basin Financ. J. 2018, 51, 198–219. [Google Scholar] [CrossRef]

- Walthoff-Borm, X.; Schwienbacher, A.; Vanacker, T. Equity crowdfunding: First resort or last resort? J. Bus. Ventur. 2018, 33, 513–533. [Google Scholar] [CrossRef]

- Ivanov, V.; Knyazeva, A. US securities-based crowdfunding under Title III of the JOBS Act. DERA White Paper 2017. Available online: https://www.sec.gov/dera/staff-papers/white-papers/28feb17_ivanov-knyazeva_crowdfunding-under-titleiii-jobs-act.html (accessed on 15 July 2019).

- Rossi, M. The new ways to raise capital: An exploratory study of crowdfunding. Int. J. Financ. Res. 2014, 5, 8–18. [Google Scholar] [CrossRef]

- Massolution, C.F. The Crowdfunding Industry Report. 2015. Available online: http://www.smv.gob.pe/Biblioteca/temp/catalogacion/C8789.pdf (accessed on 9 July 2019).

- Statista. Inc. Alternative Financing Report 2019. Available online: https://www.statista.com/outlook/297/100/alternative-financing/worldwide (accessed on 9 July 2019).

- Belleflamme, P.; Lambert, T.; Schwienbacher, A. Crowdfunding: Tapping the right crowd. J. Bus. Ventur. 2014, 29, 585–609. [Google Scholar] [CrossRef]

- Cholakova, M.; Clarysse, B. Does the Possibility to Make Equity Investments in Crowdfunding Projects Crowd Out Reward–Based Investments? Entrep. Theory Pract. 2015, 39, 145–172. [Google Scholar] [CrossRef]

- Lu, Y.; Chang, R.; Lim, S. Crowdfunding for solar photovoltaics development: A review and forecast. Renew. Sustain. Energy Rev. 2018, 93, 439–450. [Google Scholar] [CrossRef]

- Mollick, E. The dynamics of crowdfunding: An exploratory study. J. Bus. Ventur. 2014, 29, 1–16. [Google Scholar] [CrossRef]

- Drover, W.; Wood, M.S.; Zacharakis, A. Attributes of angel and crowdfunded investments as determinants of VC screening decisions. Entrep. Theory Pract. 2017, 41, 323–347. [Google Scholar] [CrossRef]

- Short, J.C.; Ketchen Jr, D.J.; McKenny, A.F.; Allison, T.H.; Ireland, R.D. Research on crowdfunding: Reviewing the (very recent) past and celebrating the present. Entrep. Theory Pract. 2017, 41, 149–160. [Google Scholar] [CrossRef]

- Vismara, S. Equity retention and social network theory in equity crowdfunding. Small Bus. Econ. 2016, 46, 579–590. [Google Scholar] [CrossRef]

- Estrin, S.; Gozman, D.; Khavul, S. Case study of the equity crowdfunding landscape in London: An entrepreneurial and regulatory perspective. FIRES Case Study 2016, 5, 1–62. [Google Scholar]

- Agrawal, A.; Catalini, C.; Goldfarb, A. The Geography of Crowdfunding; National Bureau of Economic Research: Cambridge, MA, USA, 2011; Available online: https://www.nber.org/system/files/working_papers/w16820/w16820.pdf (accessed on 10 July 2019).

- Fenwick, M.; McCahery, J.A.; Vermeulen, E.P. Fintech and the financing of entrepreneurs: From crowdfunding to marketplace lending. 2017. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2967891. (accessed on 13 July 2019).

- Mollick, E.; Robb, A. Democratizing innovation and capital access: The role of crowdfunding. Calif. Manag. Rev. 2016, 58, 72–87. [Google Scholar] [CrossRef]

- Cox, K.C.; Lortie, J.; Stewart, S.A. When to pray to the angels for funding: The seasonality of angel investing in new ventures. J. Bus. Ventur. Insights 2017, 7, 68–76. [Google Scholar] [CrossRef]

- Mason, C.M.; Harrison, R.T. The size of the informal venture capital market in the United Kingdom. Small Bus. Econ. 2000, 15, 137–148. [Google Scholar] [CrossRef]

- Becker-Blease, J.R.; Sohl, J.E. New venture legitimacy: The conditions for angel investors. Small Bus. Econ. 2015, 45, 735–749. [Google Scholar] [CrossRef]

- Kerr, W.R.; Lerner, J.; Schoar, A. The consequences of entrepreneurial finance: Evidence from angel financings. Rev. Financ. Stud. 2011, 27, 20–55. [Google Scholar] [CrossRef]

- Teker, S.; Teker, D. Venture capital and business angels: Turkish case. Procedia-Soc. Behav. Sci. 2016, 235, 630–637. [Google Scholar] [CrossRef]

- Dibrova, A. Business angel investments: Risks and opportunities. Procedia-Soc. Behav. Sci. 2015, 207, 280–289. [Google Scholar] [CrossRef]

- Puri, M.; Zarutskie, R. On the life cycle dynamics of venture-capital-and non-venture-capital-financed firms. J. Financ. 2012, 67, 2247–2293. [Google Scholar] [CrossRef]

- Buchner, A.; Mohamed, A.; Wagner, N. Are venture capital and buyout backed IPOs any different? J. Int. Financ. Mark. Inst. Money 2019, 60, 39–49. [Google Scholar] [CrossRef]

- Fernhaber, S.A.; McDougall-Covin, P.P. Venture capitalists as catalysts to new venture internationalization: The impact of their knowledge and reputation resources. Entrep. Theory Pract. 2009, 33, 277–295. [Google Scholar] [CrossRef]

- Mäkelä, M.M.; Maula, M.V. Cross-border venture capital and new venture internationalization: An isomorphism perspective. Ventur. Cap. 2005, 7, 227–257. [Google Scholar] [CrossRef]

- Bertoni, F.; Colombo, M.G.; Grilli, L. Venture capital financing and the growth of high-tech start-ups: Disentangling treatment from selection effects. Res. Policy 2011, 40, 1028–1043. [Google Scholar] [CrossRef]

- Davila, A.; Foster, G.; Gupta, M. Venture capital financing and the growth of startup firms. J. Bus. Ventur. 2003, 18, 689–708. [Google Scholar] [CrossRef]

- Guo, D.; Jiang, K. Venture capital investment and the performance of entrepreneurial firms: Evidence from China. J. Corp. Financ. 2013, 22, 375–395. [Google Scholar] [CrossRef]

- Jain, B.A.; Kini, O. Venture capitalist participation and the post-issue operating performance of IPO firms. Manag. Decis. Econ. 1995, 16, 593–606. [Google Scholar] [CrossRef]

- Cosh, A.; Cumming, D.; Hughes, A. Outside enterpreneurial capital. Econ. J. 2009, 119, 1494–1533. [Google Scholar] [CrossRef]

- Vanacker, T.R.; Manigart, S. Pecking order and debt capacity considerations for high-growth companies seeking financing. Small Bus. Econ. 2010, 35, 53–69. [Google Scholar] [CrossRef]

- Tsai, H.Y.; Chang, C.W.; Lin, H.L. “Fuzzy hierarchy sensitive with Delphi method to evaluate hospital organization performance”. Expert Syst. Appl. 2010, 37, 5533–5541. [Google Scholar] [CrossRef]

- Chen, H.C.; Yang, C.H. Applying a multiple criteria decision-making approach to establishing green marketing audit criteria. J. Clean. Prod. 2019, 210, 256–265. [Google Scholar] [CrossRef]

- Lai, Y.L.; Ishizaka, A. The application of multi-criteria decision analysis methods into talent identification process: A social psychological perspective. J. Bus. Res. 2020, 109, 637–647. [Google Scholar] [CrossRef]

- Mejías, A.M.; Bellas, R.; Pardo, J.E.; Paz, E. Traceability management systems and capacity building as new approaches for improving sustainability in the fashion multi-tier supply chain. Int. J. Prod. Econ. 2019, 217, 143–158. [Google Scholar] [CrossRef]

- Van Le, H.; Suh, M.H. Changing trends in internet startup value propositions, from the perspective of the customer. Technol. Forecast. Soc. Chang. 2019, 146, 853–864. [Google Scholar]

- Hsueh, J.T.; Lin, C.Y. Constructing a network model to rank the optimal strategy for implementing the sorting process in reverse logistics: Case study of photovoltaic industry. Clean Technol. Environ. Policy 2015, 17, 155–174. [Google Scholar] [CrossRef]

- Kheybari, S.; Rezaie, F.M.; Farazmand, H. Analytic network process: An overview of applications. Appl. Math. Comput. 2020, 367, 124780. [Google Scholar] [CrossRef]

- Lin, C.S.; Lin, C.Y. Constructing a network evaluation framework for improving the financial ecosystem in small-medium size firms. Technol. Econ. Dev. Econ. 2018, 24, 893–913. [Google Scholar] [CrossRef]

- Saaty, T.L. Decision Making with Dependence and Feedback: The Analytic Network Process; RWS Publications: online publisher, 1996; Volume 4922. [Google Scholar]

- Rowe, G.; Wright, G. The Delphi technique as a forecasting tool: Issues and analysis. Int. J. Forecast. 1999, 15, 353–375. [Google Scholar] [CrossRef]

- Saaty, T.L.; Takizawa, M. Dependence and independence: From linear hierarchies to nonlinear networks. Eur. J. Oper. Res. 1986, 26, 229–237. [Google Scholar] [CrossRef]

- Dubey, N.; Tanksale, A. A study of barriers for adoption and growth of food banks in India using hybrid DEMATEL and Analytic Network Process. Socio-Econ. Plan. Sci. 2021, 101124. (In press) [CrossRef]

- Keyvanfar, A.; Shafaghat, A.; Ismail, N.; Mohamad, S.; Ahmad, H. Multifunctional retention pond for stormwater management: A decision-support model using Analytical Network Process (ANP) and Global Sensitivity Analysis (GSA). Ecol. Indic. 2021, 124, 107317. [Google Scholar] [CrossRef]

- Kordrostami, F.; Attarod, P.; Abbaspour, K.C.; Ludwig, R.; Etemad, V.; Alilou, H.; Bozorg-Haddad, O. Identification of optimum afforestation areas considering sustainable management of natural resources, using geo-environmental criteria. Ecol. Eng. 2021, 168, 106259. [Google Scholar] [CrossRef]

- Wu, C.R.; Lin, C.T.; Chen, H.C. Evaluating competitive advantage of the location for Taiwanese hospitals. J. Inf. Optim. Sci. 2007, 28, 841–868. [Google Scholar] [CrossRef]

- Sung, W.C. Application of Delphi Method, a Qualitative and Quantitative Analysis, to the Healthcare Management. J. Healthc. Manag. 2001, 2, 11–19. [Google Scholar]

- Hasson, F.; Keeney, S. Enhancing rigour in the Delphi technique research. Technol. Forecast. Soc. Chang. 2011, 78, 1695–1704. [Google Scholar] [CrossRef]

- Atmaca, E.; Basar, H.B. Evaluation of power plants in Turkey using Analytic Network Process (ANP). Energy 2012, 44, 555–563. [Google Scholar] [CrossRef]

- Keramati, A.; Salehi, M. Website success comparison in the context of e-recruitment: An analytic network process (ANP) approach. Appl. Soft Comput. 2013, 13, 173–180. [Google Scholar] [CrossRef]

- Ali-Yrkko, J.; Rouvinen, P.; Seppala, T.; Yla-Anttila, P. “Who Captures Value in Global Supply Chains? Case Nokia N95 Smartphone”. J. Ind. Compet. Trade 2011, 11, 263–278. [Google Scholar] [CrossRef]

- Linden, G.; Kraemer, K.L.; Dedrick, J. “Who Captures Value in a Global Innovation Network? The Case of Apple’s iPod”. Commun. ACM 2009, 52, 140–144. [Google Scholar] [CrossRef]

- Mahmood, A.; Luffarelli, J.; Mukesh, M. What’s in a logo? The impact of complex visual cues in equity crowdfunding. J. Bus. Ventur. 2019, 34, 41–62. [Google Scholar] [CrossRef]

- Piva, E.; Rossi-Lamastra, C. Human capital signals and entrepreneurs’ success in equity crowdfunding. Small Bus. Econ. 2018, 51, 667–686. [Google Scholar] [CrossRef]

- Bapna, S. Complementarity of signals in early-stage equity investment decisions: Evidence from a randomized field experiment. Manag. Sci. 2019, 65, 933–952. [Google Scholar] [CrossRef]

- Butticè, V.; Di Pietro, F.; Tenca, F. Is equity crowdfunding always good? Deal structure and the attraction of venture capital investors. J. Corp. Financ. 2020, 65, 101773. [Google Scholar] [CrossRef]

- Hornuf, L.; Schmitt, M.; Stenzhorn, E. Equity crowdfunding in Germany and the United Kingdom: Follow-up funding and firm failure. Corp. Gov. An. Int. Rev. 2018, 26, 331–354. [Google Scholar] [CrossRef]

- Signori, A.; Vismara, S. Does success bring success? The post-offering lives of equity-crowdfunded firms. J. Corp. Financ. 2018, 50, 575–591. [Google Scholar] [CrossRef]

| Goal | Perspectives | Sub-Criteria | Ref. |

|---|---|---|---|

| Optimal Alternative | Financial Perspective | The level of loan | Ahlers et al., (2015); Bessière et al., (2018) |

| The dispersion of equity | Ahlers et al., (2015); Signori, & Vismara (2018); Rogan & Sarfati (2018) | ||

| The costs of capital | Expert suggestion | ||

| Operational Perspective | The number of board members | Signori, & Vismara (2018); Turan (2015) | |

| The effect of start-ups exposure | Hauge, & Chimahusky (2016); Presenza et al., (2019) | ||

| The degree of difficulty in capital obtaining | Bessière et al., (2018) | ||

| The implementation of experts and resources | Baum, & Silverman (2004); Knockaert et al., (2010) | ||

| Risk Perspective | Plagiarism | Pazowski & Czudec (2014) | |

| Business culture | Dai & Nahata (2016); Nahata et al., (2014) | ||

| Limitation | Kaplan & Stromberg (2001); Da Rin et al., (2013); Rogan & Sarfati (2018) | ||

| The degree of complexity in crowdfunding | Bessière et al., (2018) |

| Financial Perspective | Operational Perspective | Risk Perspective | |

|---|---|---|---|

| Financial Perspective | 1.000 | 1.248 | 1.462 |

| Operational Perspective | 0.801 | 1.000 | 1.171 |

| Risk Perspective | 0.684 | 0.854 | 1.000 |

| Eigenvectors (weights) | 0.402 | 0.322 | 0.275 |

| Angel Fund | Equity Crowdfunding | Venture Capital | |

|---|---|---|---|

| CC | 0.447 | 0.462 | 0.091 |

| DE | 0.403 | 0.398 | 0.199 |

| LL | 0.389 | 0.413 | 0.198 |

| DCO | 0.397 | 0.408 | 0.195 |

| ESE | 0.413 | 0.386 | 0.201 |

| IER | 0.422 | 0.366 | 0.212 |

| MBM | 0.383 | 0.398 | 0.219 |

| BUC | 0.421 | 0.366 | 0.213 |

| DCC | 0.365 | 0.399 | 0.236 |

| LIT | 0.313 | 0.438 | 0.249 |

| PLA | 0.388 | 0.353 | 0.259 |

| Normalized by Cluster | Limiting | Rank | |

|---|---|---|---|

| Angel Fund | 0.391 | 0.078 | 2 |

| Equity Crowdfunding | 0.409 | 0.082 | 1 |

| Venture Capital | 0.201 | 0.040 | 3 |

| CC | 0.369 | 0.104 | 3 |

| DE | 0.248 | 0.070 | 7 |

| LL | 0.383 | 0.107 | 1 |

| DCO | 0.401 | 0.106 | 2 |

| ESE | 0.187 | 0.049 | 8 |

| IER | 0.118 | 0.031 | 11 |

| MBM | 0.294 | 0.078 | 6 |

| BUC | 0.126 | 0.032 | 10 |

| DCC | 0.333 | 0.085 | 5 |

| LIT | 0.376 | 0.096 | 4 |

| PLA | 0.165 | 0.042 | 9 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lin, C.-Y.; Wang, Y.-H. Evaluating the Optimal External Equity Financing Strategy and Critical Factors for the Startup of Lending Company in Taiwan: An Application of Expert Network Decision Model. Mathematics 2021, 9, 2239. https://doi.org/10.3390/math9182239

Lin C-Y, Wang Y-H. Evaluating the Optimal External Equity Financing Strategy and Critical Factors for the Startup of Lending Company in Taiwan: An Application of Expert Network Decision Model. Mathematics. 2021; 9(18):2239. https://doi.org/10.3390/math9182239

Chicago/Turabian StyleLin, Chun-Yueh, and Yi-Hsien Wang. 2021. "Evaluating the Optimal External Equity Financing Strategy and Critical Factors for the Startup of Lending Company in Taiwan: An Application of Expert Network Decision Model" Mathematics 9, no. 18: 2239. https://doi.org/10.3390/math9182239

APA StyleLin, C.-Y., & Wang, Y.-H. (2021). Evaluating the Optimal External Equity Financing Strategy and Critical Factors for the Startup of Lending Company in Taiwan: An Application of Expert Network Decision Model. Mathematics, 9(18), 2239. https://doi.org/10.3390/math9182239