Global Research Trends in Financial Transactions

Abstract

1. Introduction

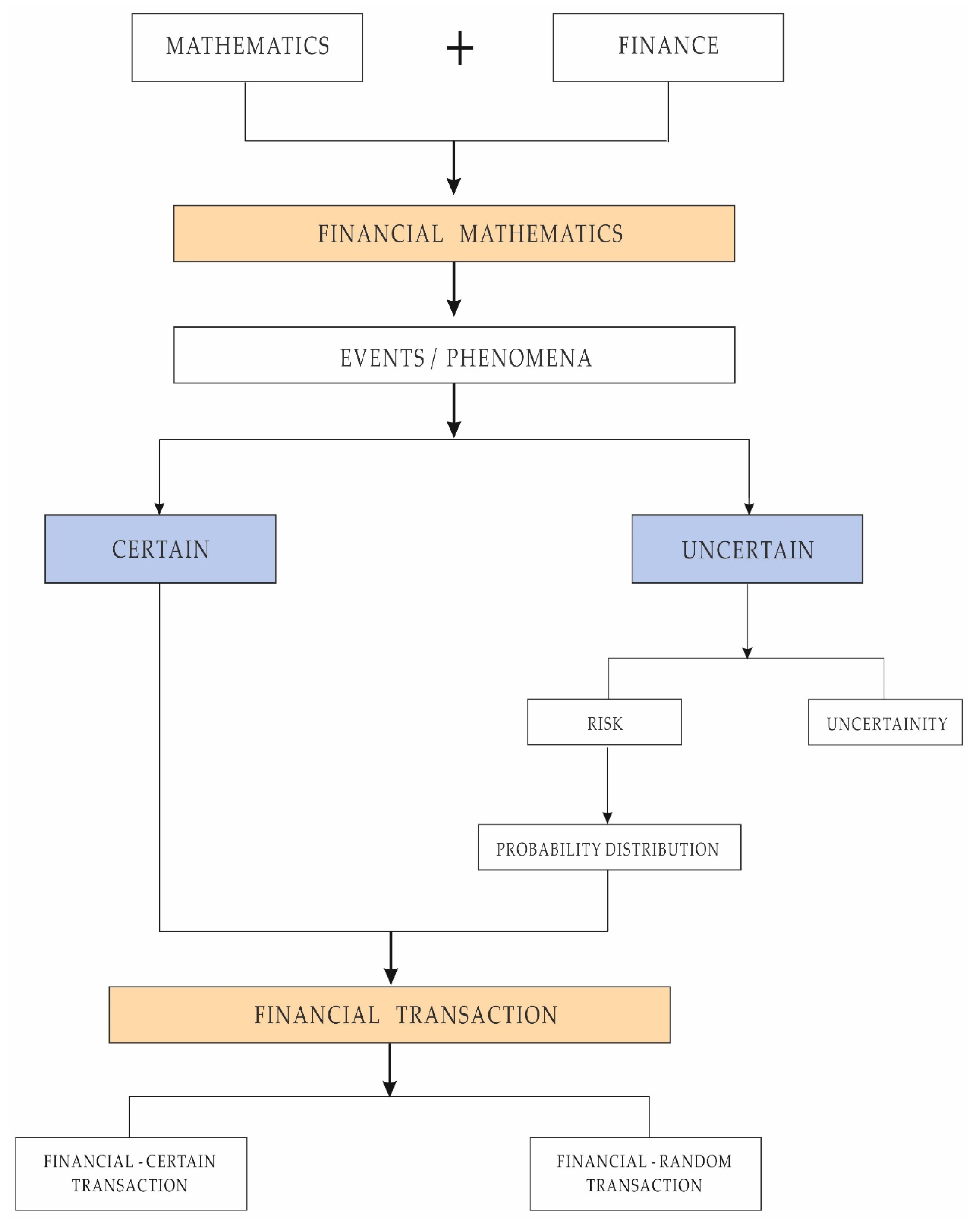

2. Research Scope

2.1. Financial Mathematics

2.2. Financial Transactions

2.2.1. Certain Financial Transactions

- The borrowed capital is repaid with the interest accumulated at a certain instant.

- The loaned capital is reimbursed through an income that covers capital and interest at the instant indicated in the contract.

2.2.2. Random Financial Transactions

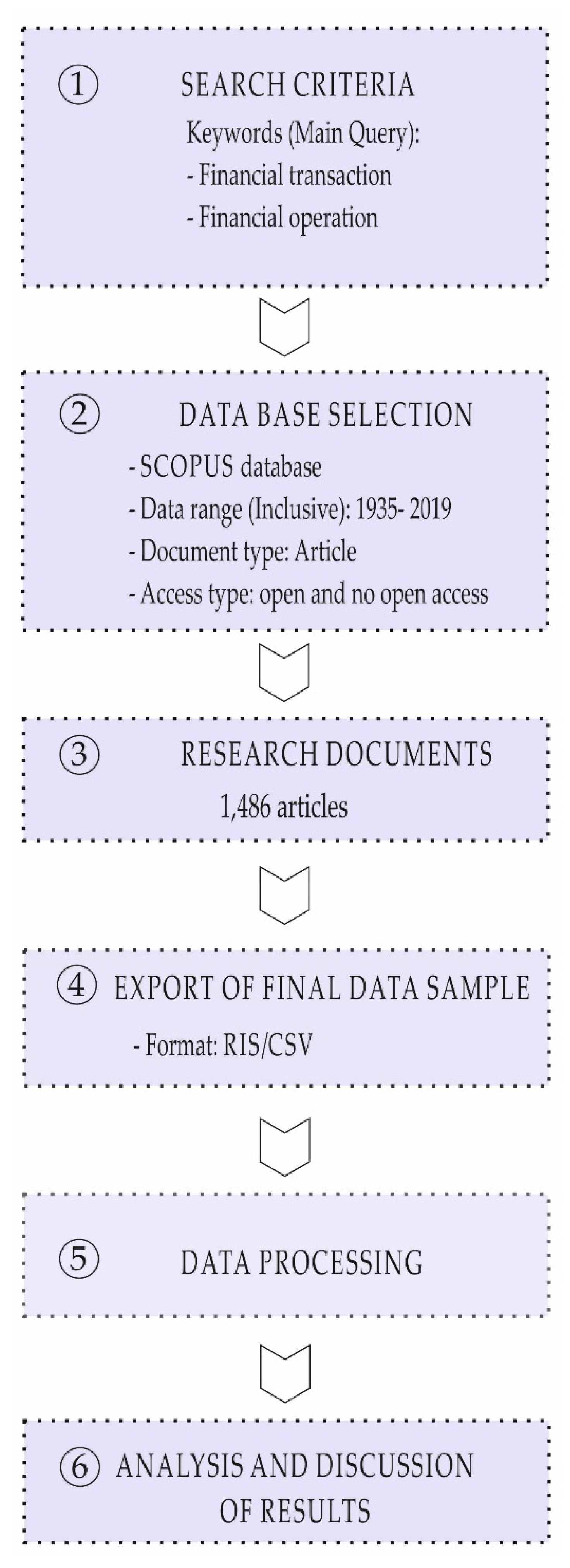

3. Materials and Methods

4. Results and Discussion

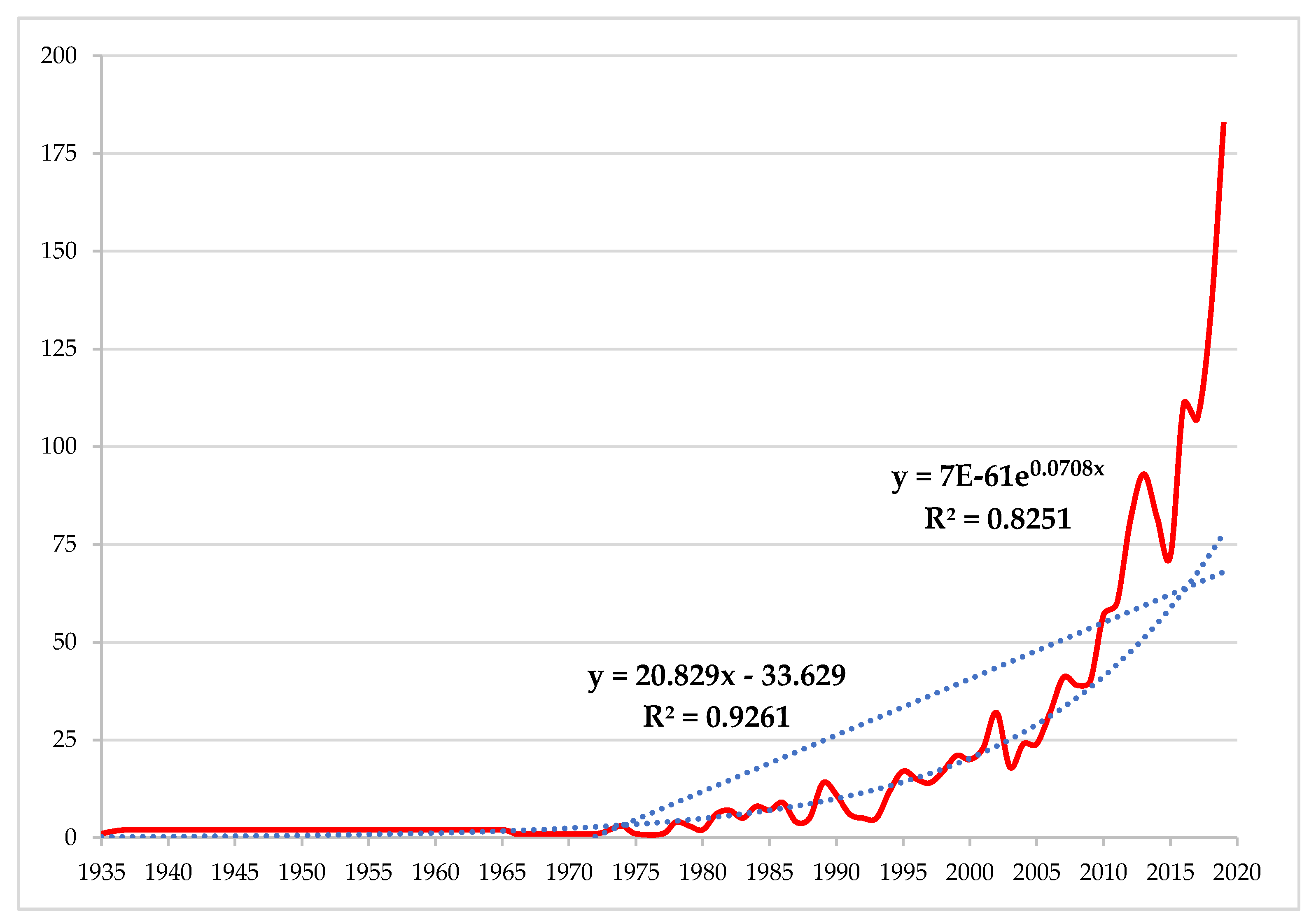

4.1. Evolution of Scientific Research, Thematic Areas, and Journals

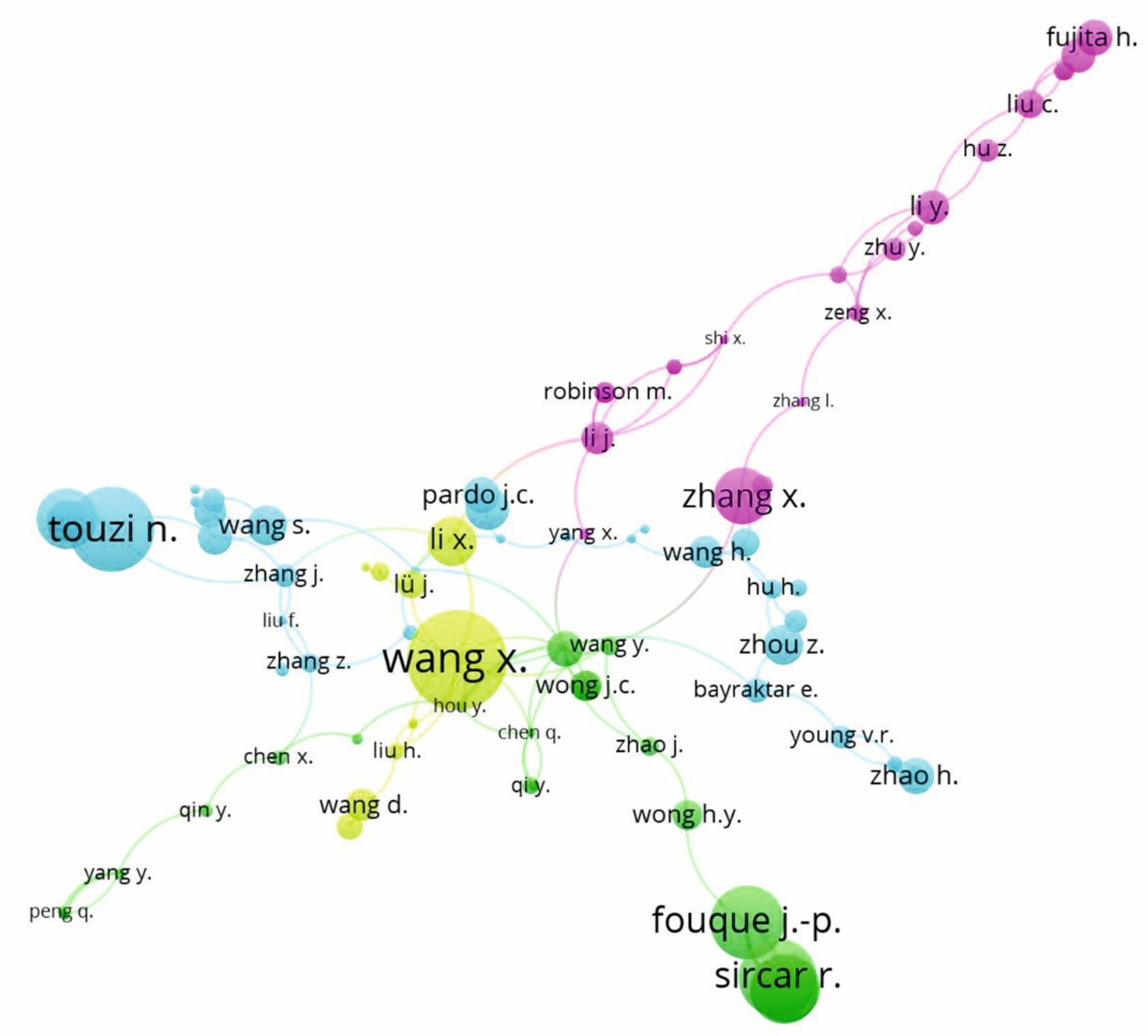

4.2. Publications by Author, Institution, and Country

4.3. Keyword Analysis

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Anderson, G.; Kercheval, A.N. Lectures on Financial Mathematics: Discrete Asset Pricing. Synth. Lect. Math. Stat. 2010, 3, 1–63. [Google Scholar] [CrossRef]

- Godlewski, C.J.; Sanditov, B. Financial Institutions Network and the Certification Value of Bank Loans. Financ. Manag. 2017, 47, 253–283. [Google Scholar] [CrossRef]

- Patterson, B.I. Studies in the Operation of Financial Intermediaries. J. Financ. 1963, 18, 79–80. [Google Scholar] [CrossRef]

- Constantinides, G.M. Transaction Costs and the Pricing of Financial Assets. Multinatl. Financ. J. 1997, 1, 93–99. [Google Scholar] [CrossRef][Green Version]

- Gallien, F.; Kassibrakis, S.; Malamud, S. Managing inventory with proportional transaction costs. Math. Financ. Econ. 2019, 14, 121–138. [Google Scholar] [CrossRef]

- Butt, N. On Discrete Probability Approximations for Transaction Cost Problems. Asia-Pac. Financ. Mark. 2019, 26, 365–389. [Google Scholar] [CrossRef]

- Nwogugu, M. Some game theory and financial contracting issues in corporate transactions. Appl. Math. Comput. 2007, 186, 1018–1030. [Google Scholar] [CrossRef]

- Baaquie, B.E. Financial modeling and quantum mathematics. Comput. Math. Appl. 2013, 65, 1665–1673. [Google Scholar] [CrossRef]

- Kamleitner, B.; Hoelzl, E.; Kirchler, E. Experiencing costs and benefits of a loan transaction: The role of cost–benefit associations. J. Econ. Psychol. 2010, 31, 1047–1056. [Google Scholar] [CrossRef]

- Morrison, R.J. Investment (Savings) Elaborated—With Special Reference to Japan. Financ. Anal. J. 1982, 38, 45–48. [Google Scholar] [CrossRef]

- Pina, G. Macro and micro financial liberalizations, savings and growth. J. Financ. Econ. Policy 2018, 10, 290–309. [Google Scholar] [CrossRef]

- Woodward, D.B. Investment. Financ. Anal. J. 1951, 7, 40. [Google Scholar] [CrossRef]

- Shalit, S.S. The Mathematics of Financial Leverage. Financ. Manag. 1975, 4, 57–66. [Google Scholar] [CrossRef]

- Haslem, J.A.; Bell, F.W.; Murphy, N.B. Costs in Commercial Banking: A Quantitative Analysis of Bank Behavior and Its Relation to Bank Regulation. J. Financ. 1969, 24, 144. [Google Scholar] [CrossRef]

- Lockwood, L.J.; Taggart, R.A. Quantitative Analysis for Investment Management. J. Financ. 1997, 52, 910. [Google Scholar] [CrossRef]

- Ensor, K.B.; Koev, G.M. Computational finance: Correlation, volatility, and markets. Wiley Interdiscip. Rev. Comput. Stat. 2014, 6, 326–340. [Google Scholar] [CrossRef]

- Finnerty, J.D. Financial Engineering in Corporate Finance: An Overview. Financ. Manag. 1988, 17, 14. [Google Scholar] [CrossRef]

- Smith, K. The Financial Economic Risk in Financial Engineering Models. Wilmott 2015, 2015, 50–55. [Google Scholar] [CrossRef]

- Leonidov, A. Systemic risks in financial markets. Glob. Mark. Financ. Eng. 2015, 2, 5–12. [Google Scholar] [CrossRef]

- Walter, J.E. Investment Planning under Variable Price Change. Financ. Manag. 1972, 1, 36–50. [Google Scholar] [CrossRef]

- Charoenwong, C.; Chong, B.S.; Yang, Y.C. Asset Liquidity and Stock Liquidity: International Evidence. J. Bus. Financ. Account. 2013, 41, 435–468. [Google Scholar] [CrossRef]

- Subrahmanyam, A. The implications of liquidity and order flows for neoclassical finance. Pac. Basin Financ. J. 2009, 17, 527–532. [Google Scholar] [CrossRef]

- Kurlat, P. Liquidity as Social Expertise. J. Financ. 2018, 73, 619–656. [Google Scholar] [CrossRef]

- Whited, T.M. Investment and financial asset accumulation. J. Financ. Intermediation 1991, 1, 307–334. [Google Scholar] [CrossRef]

- Bodnaruk, A.; Simonov, A. Do financial experts make better investment decisions? J. Financ. Intermediation 2015, 24, 514–536. [Google Scholar] [CrossRef]

- Ekeland, I.; Pirvu, T.A. Investment and consumption without commitment. Math. Financ. Econ. 2008, 2, 57–86. [Google Scholar] [CrossRef]

- Backer, M. Financial Reporting and Security Investment Decisions. Financ. Anal. J. 1971, 27, 67–72. [Google Scholar] [CrossRef]

- Bierman, H.; Rao, V.R. Investment Decisions with Sampling. Financ. Manag. 1978, 7, 19. [Google Scholar] [CrossRef]

- Abad Segura, E. Análisis Matemático-Financiero de Nuevas Operaciones Aleatorias de Amortización y Ahorro; Universidad Almería: Almería, Spain, 2017; Volume 356. [Google Scholar]

- Gebhardt, G.; Gerke, W.; Steiner, M. Handbook for financial management. Insur. Math. Econ. 1993, 13, 175. [Google Scholar] [CrossRef]

- Balasubramanyan, L.; Berger, A.N.; Koepke, M.M. How do lead banks use their private information about loan quality in the syndicated loan market? J. Financ. Stab. 2019, 43, 53–78. [Google Scholar] [CrossRef]

- Li, F.; Chow, T.-M.; Pickard, A.; Garg, Y. Transaction Costs of Factor-Investing Strategies. Financ. Anal. J. 2019, 75, 62–78. [Google Scholar] [CrossRef]

- Huang, D.; Mu, D.; Yang, L.; Cai, X. CoDetect: Financial Fraud Detection with Anomaly Feature Detection. IEEE Access 2018, 6, 19161–19174. [Google Scholar] [CrossRef]

- Pollin, R.; Heintz, J.; Herndon, T. The revenue potential of a financial transaction tax for US financial markets. Int. Rev. Appl. Econ. 2018, 32, 772–806. [Google Scholar] [CrossRef]

- Tian, M.-W.; Yan, S.-R. Influence of risk preference change on the investment and consumption decision of financial assets. J. Interdiscip. Math. 2018, 21, 1139–1144. [Google Scholar] [CrossRef]

- Ferrara, M.; Pansera, B.; Strati, F. On the Inception of Financial Representative Bubbles. Mathematics 2017, 5, 64. [Google Scholar] [CrossRef]

- Russell, J.R.; Engle, R.F. A Discrete-State Continuous-Time Model of Financial Transactions Prices and Times. J. Bus. Econ. Stat. 2005, 23, 166–180. [Google Scholar] [CrossRef]

- Garmaise, M.J. Borrower Misreporting and Loan Performance. J. Financ. 2015, 70, 449–484. [Google Scholar] [CrossRef]

- Huber, J.; Kleinlercher, D.; Kirchler, M. The impact of a financial transaction tax on stylized facts of price returns—Evidence from the lab. J. Econ. Dyn. Control 2012, 36, 1248–1266. [Google Scholar] [CrossRef]

- Liesenfeld, R.; Nolte, I.; Pohlmeier, W. Modelling financial transaction price movements: A dynamic integer count data model. Empir. Econ. 2005, 30, 795–825. [Google Scholar] [CrossRef]

- Shen, C.-H. Credit rationing for bad companies in bad years: Evidence from bank loan transaction data. Int. J. Financ. Econ. 2002, 7, 261–278. [Google Scholar] [CrossRef]

- Zhang, M.Y.; Russell, J.R.; Tsay, R.S. A nonlinear autoregressive conditional duration model with applications to financial transaction data. J. Econom. 2001, 104, 179–207. [Google Scholar] [CrossRef]

- Saunders, R. Simple Sensitivity Analysis by Financial Modelling. Teach. Math. Appl. 1983, 2, 23–27. [Google Scholar] [CrossRef]

- Wu, H.-K. Bank examiner criticisms, bank loan defaults, and bank loan quality. J. Financ. 1969, 24, 697–705. [Google Scholar] [CrossRef]

- Robinson, H.A.; Richeson, A.W. Financial Mathematics. Natl. Math. Mag. 1935, 10, 112. [Google Scholar] [CrossRef]

- Garis, R.L.; Mead, E.S. The Business Corporation: Its Financial Organization and Operation. South. Econ. J. 1941, 8, 117. [Google Scholar] [CrossRef]

- Deyoung, R.; Gron, A.; Torna, G.; Winton, A. Risk Overhang and Loan Portfolio Decisions: Small Business Loan Supply before and during the Financial Crisis. J. Financ. 2015, 70, 2451–2488. [Google Scholar] [CrossRef]

- Conklin, J.N. Financial Literacy, Broker-Borrower Interaction and Mortgage Default. Real Estate Econ. 2016, 45, 376–414. [Google Scholar] [CrossRef]

- Gil Peláez, L. Matemática de las Operaciones Financieras; Editorial AC: Madrid, Spain, 1993. [Google Scholar]

- Gil Luezas, M.A.; Gil Peláez, L. Matemáticas de las Operaciones Financieras; Universidad Nacional de Educación a Distancia: Madrid, Spain, 1987. [Google Scholar]

- Conklin, G.H. Evaluation of Savings and Loan Stocks. Financ. Anal. J. 1967, 23, 39–42. [Google Scholar] [CrossRef]

- Gil-Peláez, J. Note on the Inversion Theorem. Biometrika 1951, 38, 481. [Google Scholar] [CrossRef]

- Singh, B.K. Loss Functions in Financial Sector: An Overview. Asian J. Math. Stat. 2015, 8, 35–45. [Google Scholar] [CrossRef][Green Version]

- Skogh, G. Insurance and the institutional economics of financial intermediation. Insur. Math. Econ. 1993, 12, 75. [Google Scholar] [CrossRef]

- Newell, G.E. Is Quarterly Financial Data Adequate for Investment Decision Making? Financ. Anal. J. 1969, 25, 37–43. [Google Scholar] [CrossRef]

- Cerqueiro, G.; Degryse, H.; Ongena, S. Rules versus discretion in loan rate setting. J. Financ. Intermediation 2011, 20, 503–529. [Google Scholar] [CrossRef]

- Sekine, J. Long-Term Optimal Investment with a Generalized Drawdown Constraint. SIAM J. Financ. Math. 2013, 4, 452–473. [Google Scholar] [CrossRef]

- Vadori, N.; Swishchuk, A. Inhomogeneous Random Evolutions: Limit Theorems and Financial Applications. Mathematics 2019, 7, 447. [Google Scholar] [CrossRef]

- Yang, H. Ruin theory in a financial corporation model with credit risk. Insur. Math. Econ. 2003, 33, 135–145. [Google Scholar] [CrossRef]

- Chen, I.; Lee, Y.; Liu, Y. Bank liquidity, macroeconomic risk, and bank risk: Evidence from the Financial Services Modernization Act. Eur. Financ. Manag. 2019, 26, 143–175. [Google Scholar] [CrossRef]

- Men, Z.; Kolkiewicz, A.W.; Wirjanto, T.S. Threshold Stochastic Conditional Duration Model for Financial Transaction Data. J. Risk Financ. Manag. 2019, 12, 88. [Google Scholar] [CrossRef]

- Frikha, N. Shortfall Risk Minimization in Discrete Time Financial Market Models. SIAM J. Financ. Math. 2014, 5, 384–414. [Google Scholar] [CrossRef][Green Version]

- Udell, G.F. Loan quality, commercial loan review and loan officer contracting. J. Bank. Financ. 1989, 13, 367–382. [Google Scholar] [CrossRef]

- Niinimaki, J.-P. Hidden loan losses, moral hazard and financial crises. J. Financ. Stab. 2012, 8, 1–14. [Google Scholar] [CrossRef]

- Epaulard, A.; Pommeret, A. Financial Integration, Growth and Volatility. Pac. Econ. Rev. 2016, 21, 330–357. [Google Scholar] [CrossRef]

- Li, K.; Wang, W. Debtor-in-possession financing, loan-to-loan, and loan-to-own. J. Corp. Financ. 2016, 39, 121–138. [Google Scholar] [CrossRef]

- Gottesman, A.A.; Roberts, G.S. Loan Rates and Collateral. Financ. Rev. 2007, 42, 401–427. [Google Scholar] [CrossRef]

- Choi, J.; Tosyali, A.; Kim, B.; Lee, H.; Jeong, M.K. A Novel Method for Identifying Competitors Using a Financial Transaction Network. IEEE Trans. Eng. Manag. 2019, 1–16. [Google Scholar] [CrossRef]

- Zarutskie, R. Competition, financial innovation and commercial bank loan portfolios. J. Financ. Intermediation 2013, 22, 373–396. [Google Scholar] [CrossRef]

- Reichert, C. Closed-end investment companies: Historic returns and investment strategies. Financ. Serv. Rev. 1998, 7, 83–93. [Google Scholar] [CrossRef]

- Garfield, E. Derek Price and the Practical World of Scientometrics. Sci. Technol. Hum. Values 1988, 13, 349–350. [Google Scholar] [CrossRef]

- Griffith, B.C. Little scientometrics, little scientometrics, little scientometrics, little scientometrics, ... and so on and so on. Scientometrics 1994, 30, 487–493. [Google Scholar] [CrossRef]

- Vlachý, J. Quotations and scientometrics. Scientometrics 1979, 1, 377–380. [Google Scholar] [CrossRef]

- Bhattacharya, S. Eugene Garfield: Brief reflections. Scientometrics 2017, 114, 401–407. [Google Scholar] [CrossRef]

- Rousseau, R.; Hu, X. Under-cited influential work by Eugene Garfield. Scientometrics 2017, 114, 651–657. [Google Scholar] [CrossRef]

- Pudovkin, A.I.; Garfield, E. Percentile Rank and Author Superiority Indexes for Evaluating Individual Journal Articles and the Author’s Overall Citation Performance. Collnet J. Scientometr. Inf. Manag. 2009, 3, 3–10. [Google Scholar] [CrossRef]

- Abad-Segura, E.; Cortés-García, F.J.; Belmonte-Ureña, L.J. The sustainable approach to corporate social responsibility: A global analysis and future trends. Sustainability 2019, 11, 5382. [Google Scholar] [CrossRef]

- Duque-Acevedo, M.; Belmonte-Ureña, L.J.; Cortés-García, F.J.; Camacho-Ferre, F. Agricultural waste: Review of the evolution, approaches and perspectives on alternative uses. Glob. Ecol. Conserv. 2020, 22, e00902. [Google Scholar] [CrossRef]

- Abad-Segura, E.; González-Zamar, M.-D.; Infante-Moro, J.C.; Ruipérez García, G. Sustainable Management of Digital Transformation in Higher Education: Global Research Trends. Sustainability 2020, 12, 2107. [Google Scholar] [CrossRef]

- Bornmann, L.; Mutz, R. Growth rates of modern science: A bibliometric analysis based on the number of publications and cited references. J. Assoc. Inf. Sci. Technol. 2015, 66, 2215–2222. [Google Scholar] [CrossRef]

- Nicolaisen, J.; Frandsen, T.F. Bibliometric evolution: Is the journal of the association for information science and technology transforming into a specialty Journal? J. Assoc. Inf. Sci. Technol. 2014, 66, 1082–1085. [Google Scholar] [CrossRef]

- Abad-Segura, E.; González-Zamar, M.D. Effects of Financial Education and Financial Literacy on Creative Entrepreneurship: A Worldwide Research. Educ. Sci. 2019, 9, 238. [Google Scholar] [CrossRef]

- Belmonte-Ureña, L.J.; Garrido-Cardenas, J.A.; Camacho-Ferre, F. Analysis of World Research on Grafting in Horticultural Plants. HortScience 2020, 55, 112–120. [Google Scholar] [CrossRef]

- González-Zamar, M.D.; Ortiz Jiménez, L.; Sánchez Ayala, A.; Abad-Segura, E. The Impact of the University Classroom on Managing the Socio-Educational Well-being: A Global Study. Int. J. Environ. Res. Public Health 2020, 17, 931. [Google Scholar] [CrossRef] [PubMed]

- Abad-Segura, E.; González-Zamar, M.D.; Luque de la Rosa, A.; Gallardo-Pérez, J. Management of the digital economy in higher education: Trends and future perspectives. Campus Virtuales 2020, 9, 57–68. [Google Scholar]

- Eto, M. Extended co-citation search: Graph-based document retrieval on a co-citation network containing citation context information. Inf. Process. Manag. 2019, 56, 102046. [Google Scholar] [CrossRef]

- Prathap, G. Quantity, quality, and consistency as bibliometric indicators. J. Assoc. Inf. Sci. Technol. 2013, 65, 214. [Google Scholar] [CrossRef]

- Hu, C.; Song, M.; Guo, F. Intellectual structure of market orientation: A citation/co-citation analysis. Mark. Intell. Plan. 2019, 37, 598–616. [Google Scholar] [CrossRef]

- Rotolo, D.; Rafols, I.; Hopkins, M.M.; Leydesdorff, L. Strategic intelligence on emerging technologies: Scientometric overlay mapping. J. Assoc. Inf. Sci. Technol. 2015, 68, 214–233. [Google Scholar] [CrossRef]

- Senthilkumar, R.; Ulaganathan, G. Mapping of Research Productivity in Lovely Professional University: A Scientometric Study. Sciexplore Int. J. Res. Sci. 2016, 3, 36–40. [Google Scholar] [CrossRef]

- Zhou, S.; Tao, Z.; Zhu, Y.; Tao, L. Mapping theme trends and recognizing hot spots in postmenopausal osteoporosis research: A bibliometric analysis. PeerJ 2019, 7, e8145. [Google Scholar] [CrossRef]

- Lee, C.I.S.; Felps, W.; Baruch, Y. Mapping Career Studies: A Bibliometric Analysis. Acad. Manag. Proc. 2014, 2014, 14214. [Google Scholar] [CrossRef]

- Fellnhofer, K. Visualised bibliometric mapping on smart specialisation: A co-citation analysis. Int. J. Knowl. Based Dev. 2018, 9, 76. [Google Scholar] [CrossRef]

- Van Eck, N.J.; Waltman, L. Citation-based clustering of publications using CitNetExplorer and VOSviewer. Scientometrics 2017, 111, 1053–1070. [Google Scholar] [CrossRef] [PubMed]

- Van Eck, N.J.; Waltman, L. Software survey: VOSviewer, a computer program for bibliometric mapping. Scientometrics 2009, 84, 523–538. [Google Scholar] [CrossRef] [PubMed]

- Albarillo, F. Language in Social Science Databases: English Versus Non-English Articles in JSTOR and Scopus. Behav. Soc. Sci. Libr. 2014, 33, 77–90. [Google Scholar] [CrossRef]

- Engle, R.F.; Russell, J.R. Autoregressive Conditional Duration: A New Model for Irregularly Spaced Transaction Data. Econometrica 1998, 66, 1127–1162. [Google Scholar] [CrossRef]

- Quinn, D. The Correlates of Change in International Financial Regulation. Am. Political Sci. Rev. 1997, 91, 531–551. [Google Scholar] [CrossRef]

- Poon, S.; Swatman, P.M. An exploratory study of small business Internet commerce issues. Inf. Manag. 1999, 35, 9–18. [Google Scholar] [CrossRef]

- Lerner, J.; Schoar, A. Does Legal Enforcement Affect Financial Transactions? The Contractual Channel in Private Equity. Q. J. Econ. 2005, 120, 223–246. [Google Scholar] [CrossRef]

- Rajan, R.G. Has Finance Made the World Riskier? Eur. Financ. Manag. 2006, 12, 499–533. [Google Scholar] [CrossRef]

- Khan, F. How “Islamic” is Islamic Banking? J. Econ. Behav. Organ. 2010, 76, 805–820. [Google Scholar] [CrossRef]

- Baptista, G.; Oliveira, T. Understanding mobile banking: The unified theory of acceptance and use of technology combined with cultural moderators. Comput. Hum. Behav. 2015, 50, 418–430. [Google Scholar] [CrossRef]

- Perera, S.; Harrison, G.; Poole, M. Customer-focused manufacturing strategy and the use of operations-based non-financial performance measures: A research note. Account. Organ. Soc. 1997, 22, 557–572. [Google Scholar] [CrossRef]

- Rotchanakitumnuai, S.; Speece, M. Barriers to Internet banking adoption: A qualitative study among corporate customers in Thailand. Int. J. Bank Mark. 2003, 21, 312–323. [Google Scholar] [CrossRef]

- Torres, L.; Pina, V.; Acerete, B. E-government developments on delivering public services among EU cities. Gov. Inf. Q. 2005, 22, 217–238. [Google Scholar] [CrossRef]

- Costanza, R.; Stern, D.; Fisher, B.; He, L.; Ma, C. Influential publications in ecological economics: A citation analysis. Ecol. Econ. 2004, 50, 261–292. [Google Scholar] [CrossRef]

- Waltman, L. A review of the literature on citation impact indicators. J. Informetr. 2016, 10, 365–391. [Google Scholar] [CrossRef]

- Mustafa, S. Tools, Techniques, and Methods of Finance and their Applications in Business. Adv. Soc. Sci. Res. J. 2018, 5. [Google Scholar] [CrossRef]

- Balbás, A.; Balbás, B.; Balbás, R. Golden options in financial mathematics. Math. Financ. Econ. 2019, 13, 637–659. [Google Scholar] [CrossRef]

- Feng, L.; Lin, X. Inverting Analytic Characteristic Functions and Financial Applications. Siam J. Financ. Math. 2013, 4, 372–398. [Google Scholar] [CrossRef]

- Gerhold, S.; Gülüm, I.C. Consistency of option prices under bid–ask spreads. Math. Financ. 2020, 30, 377–402. [Google Scholar] [CrossRef]

- Ogawa, Y.; Hosoe, N. Optimal indirect tax design in an open economy. Int. Tax Public Financ. 2020. [Google Scholar] [CrossRef]

- Gradojevic, N.; Caric, M. Predicting Systemic Risk with Entropic Indicators. J. Forecast. 2016, 36, 16–25. [Google Scholar] [CrossRef]

- Dewan, P.; Dharni, K. Herding Behaviour in Investment Decision Making: A Review. J. Econ. Manag. Trade 2019, 24, 1–12. [Google Scholar] [CrossRef][Green Version]

- Huang, T.T.; Sun, B.Q. The impact of the Internet on global industry: New evidence of Internet measurement. Res. Int. Bus. Financ. 2016, 37, 93–112. [Google Scholar] [CrossRef]

- Yu, L.; Nilsson, J. Social Capital and Financial Capital in Chinese Cooperatives. Sustainability 2019, 11, 2415. [Google Scholar] [CrossRef]

- Polyviou, A.; Velanas, P.; Soldatos, J. Blockchain Technology: Financial Sector Applications beyond Cryptocurrencies. Proceedings 2019, 28, 7. [Google Scholar] [CrossRef]

- Kassimatis, K. Financial liberalization and stock market volatility in selected developing countries. Appl. Financ. Econ. 2002, 12, 389–394. [Google Scholar] [CrossRef]

- Albekov, A.; Lakhno, Y. Building of Multilateral Cooperation of BRICS Countries in the Field of Financial Technologies. KnE Soc. Sci. 2018, 3, 68–76. [Google Scholar] [CrossRef]

- Sun, J.; Hou, J.W. Monetary and Financial Cooperation between China and the One Belt One Road Countries. Emerg. Mark. Financ. Trade 2018, 55, 2609–2627. [Google Scholar] [CrossRef]

- Asongu, S.A. Globalization, Financial Crisis and Contagion: Time—Dynamic Evidence from Financial Markets of Developing Countries. J. Adv. Stud. Financ. 2012, III, 131–139. [Google Scholar] [CrossRef][Green Version]

- Li, Z.; Liu, L. Financial globalization, domestic financial freedom and risk sharing across countries. J. Int. Financ. Mark. Inst. Money 2018, 55, 151–169. [Google Scholar] [CrossRef]

- Knight, M.D. Developing Countries and the Globalization of Financial Markets. IMF Work. Pap. 1998, 98, 1. [Google Scholar] [CrossRef]

- Gaies, B.; Goutte, S.; Guesmi, K. Does financial globalization still spur growth in emerging and developing countries? Considering exchange rates. Res. Int. Bus. Financ. 2020, 52, 101113. [Google Scholar] [CrossRef]

- Noakes, S. The Role of Political Science in China: Intellectuals and Authoritarian Resilience. Political Sci. Q. 2014, 129, 239–260. [Google Scholar] [CrossRef]

- Holden, K. The globalization of universities and science in Southern China. Science 2015. [Google Scholar] [CrossRef]

- Mervis, J. When Europeans do science in China. Science 2019. [Google Scholar] [CrossRef]

- Directive (EU) 2015/2366 of the European Parliament and of the Council of 25 November 2015 on Payment Services in the Internal Market, Amending Directives 2002/65/EC, 2009/110/EC and 2013/36/EU and Regulation (EU) No 1093/2010, and Repealing Directive 2007/64/EC. Available online: https://ec.europa.eu/info/law/payment-services-psd-2-directive-eu-2015-2366_en (accessed on 21 March 2020).

- Thakor, A.V. Fintech and banking: What do we know? J. Financ. Intermediation 2020, 41, 100833. [Google Scholar] [CrossRef]

- Maeng, S.-S.; Lee, H.-W. FinTech Development and Financial Consumer Protection Policy. Bus. Law Rev. 2017, 31, 331–365. [Google Scholar] [CrossRef]

- Chen, M.A.; Wu, Q.; Yang, B. How Valuable Is FinTech Innovation? Rev. Financ. Stud. 2019, 32, 2062–2106. [Google Scholar] [CrossRef]

- Boot, A.; Thakor, A. Post-crisis evolution of banking and financial markets: Introduction. J. Financ. Intermediation 2019, 39, 1–3. [Google Scholar] [CrossRef]

- Fetiniuc, V.; Luchian, I. Actual tendencies in the evolution of financial sciences. Geopolit. Soc. Secur. Freedom J. 2019, 2, 63–76. [Google Scholar] [CrossRef][Green Version]

| Year | Article title [Reference] | Author(s) | Journal |

|---|---|---|---|

| 2019 | How do lead banks use their private information about loan quality in the syndicated loan market? [31] | Balasubramanyan, L.; Berger, A. N.; Koepke, M. M. | Journal of Financial Stability |

| 2019 | Transaction Costs of Factor-Investing Strategies [32] | Li, F.; Chow, T.-M.; Pickard, A.; Garg, Y. | Financial Analysts Journal |

| 2018 | CoDetect: Financial Fraud Detection with Anomaly Feature Detection [33] | Huang, D.; Mu, D.; Yang, L.; Cai, X. | IEEE Access |

| 2018 | The revenue potential of a financial transaction tax for US financial markets [34] | Pollin, R.; Heintz, J.; Herndon, T. | International Review of Applied economics |

| 2018 | Influence of risk preference change on the investment and consumption decision of financial assets [35] | Tian, M.-W.; Yan, S.-R. | Journal of Interdisciplinary Mathematics |

| 2017 | On the Inception of Financial Representative Bubbles [36] | Ferrara, M.; Pansera, B.; Strati, F. | Mathematics |

| 2015 | A Discrete-State Continuous-Time Model of Financial Transactions Prices and Times [37] | Russell, J. R.; Engle, R. F. | Journal of Business & economic Statistics |

| 2015 | Borrower Misreporting and Loan Performance [38] | Garmaise, M. J. | The Journal of finance |

| 2012 | The impact of a financial transaction tax on stylized facts of price returns—Evidence from the lab [39] | Huber, J.; Kleinlercher, D.; Kirchler, M. | Journal of economic Dynamics and Control |

| 2005 | Modelling financial transaction price movements: a dynamic integer count data model [40] | Liesenfeld, R.; Nolte, I.; Pohlmeier, W. | Empirical economics |

| 2002 | Credit rationing for bad companies in bad years: evidence from bank loan transaction data [41] | Shen, C.-H. | International Journal of finance & economics |

| 2001 | A nonlinear autoregressive conditional duration model with applications to financial transaction data [42] | Zhang, M. Y.; Russell, J. R.; Tsay, R. S. | Journal of econometrics |

| 1983 | Simple Sensitivity Analysis by Financial Modelling [43] | Saunders, R. | Teaching Mathematics and Its Applications |

| 1969 | Bank examiner criticisms, bank loan defaults, and bank loan quality [44] | Wu, H.-K. | The Journal of finance |

| 1935 | Financial Mathematics [45] | Robinson, H. A.; Richeson, A. W. | National Mathematics Magazine |

| Year | Tittle [Reference] | Author(s) | Journal | Total Citations | Thematic Area | Percentage of Theamtic Areas Cited |

|---|---|---|---|---|---|---|

| 1998 | Autoregressive conditional duration: A new model for irregularly spaced transaction data [97] | Engle, R.F., Russell, J.R. | Econometrica | 768 | Economics, Econometrics and Finance | Economics, Econometrics and Finance (58%) Business, Management and Accounting (19%) Mathematics (15%) Computer Science (8%) |

| 1997 | The correlates of change in international financial regulation [98] | Quinn, D. | American Political Science Review | 546 | Social Sciences | Economics, Econometrics and Finance (50%) Social Sciences (39%) Business, Management and Accounting (10%) Nursing and Health Professions (1%) |

| 1999 | An exploratory study of small business Internet commerce issues [99] | Poon, S., Swatman, P.M.C. | Information and Management | 319 | Computer Science | Economics, Econometrics and Finance (65%) Computer Science (26%) Social Sciences (13%) Engineering (7%) |

| 2005 | Does legal enforcement affect financial transactions? The contractual channel in private equity [100] | Lerner, J., Schoar, A. | Quarterly Journal of economics | 230 | Economics, Econometrics and Finance | Economics, Econometrics and Finance (56%) Business, Management and Accounting (33%) Social Sciences (10%) Computer Science (2%) |

| 2006 | Has finance made the world Riskier? [101] | Rajan, R.G. | European Financial Management | 226 | Economics, Econometrics and Finance | Economics, Econometrics and Finance (62%) Business, Management and Accounting (26%) Social Sciences (9%) Engineering (2%) |

| 2010 | How Islamic is Islamic Banking? [102] | Khan, F. | Journal of economic Behavior and Organization | 201 | Economics, Econometrics and Finance | Business, Management and Accounting (41%) Economics, Econometrics and Finance (40%) Social Sciences (14%) Arts and Humanities (5%) |

| 2015 | Understanding mobile banking: The unified theory of acceptance and use of technology combined with cultural moderators [103] | Baptista, G., Oliveira, T. | Computers in Human Behavior | 184 | Arts and Humanities | Business, Management and Accounting (51%) Computer Science (26%) Social Sciences (12%) Economics, Econometrics and Finance (12%) |

| 1997 | Customer-focused manufacturing strategy and the use of operations-based non-financial performance measures: A research note [104] | Perera, S., Harrison, G., Poole, M. | Accounting, Organizations and Society | 179 | Social Sciences | Business, Management and Accounting (76%) Economics, Econometrics and Finance (14%) Social Sciences (6%) Engineering (4%) |

| 2003 | Barriers to Internet banking adoption: A qualitative study among corporate customers in Thailand [105] | Rotchanakitumnuai, S., Speece, M. | International Journal of Bank Marketing | 171 | Business, Management and Accounting | Business, Management and Accounting (66%) Computer Science (15%) Economics, Econometrics and Finance (12%) Social Sciences (7%) |

| 2005 | E-government developments on delivering public services among EU cities [106] | Torres, L., Pina, V., Acerete, B. | Government Information Quarterly | 166 | Social Sciences | Computer Science (39%) Business, Management and Accounting (29%) Social Sciences (28%) Economics, Econometrics and Finance (4%) |

| Journal | A | TC | TC/A | H * | CiS * | SJR * | SNIP * | 1st A | Last A | Country |

|---|---|---|---|---|---|---|---|---|---|---|

| International Journal of Innovative Technology and Exploring Engineering | 15 | 1 | 0.07 | 1 | NC | NC | NC | 2019 | 2019 | India |

| Journal of Money Laundering Control | 15 | 60 | 4.00 | 5 | 1.02 | NC | NC | 2006 | 2019 | UK |

| Journal of Theoretical and Applied Information Technology | 10 | 10 | 1.00 | 2 | 0.67 | 0.166 | 0.500 | 2010 | 2019 | Pakistan |

| Journal of Internet Banking and Commerce | 9 | 169 | 18.78 | 6 | 0.52 | 0.159 | 0.835 | 2009 | 2016 | Canada |

| Lecture Notes in Computer Science | 9 | 36 | 4.00 | 3 | 1.06 | 0.283 | 0.713 | 2003 | 2010 | Germany |

| Computers and Security | 7 | 116 | 16.57 | 3 | 4.65 | 0.667 | 2.303 | 1986 | 2019 | UK |

| International Journal of Applied Engineering Research | 7 | 5 | 0.71 | 1 | 0.13 | 0.122 | 0.354 | 2013 | 2016 | India |

| IEEE Access | 6 | 53 | 8.83 | 3 | 4.96 | 0.609 | 1.718 | 2018 | 2019 | USA |

| Intereconomics | 6 | 9 | 1.50 | 3 | 0.53 | 0.282 | 0.551 | 1992 | 2012 | Germany |

| International Journal of Engineering and Technology (UAE) | 6 | 2 | 0.33 | 1 | 0.08 | 0.113 | 0.192 | 2018 | 2018 | United Arab Emirates |

| Author | Affiliation | City, Country | First Article | Last Article | Keywords |

|---|---|---|---|---|---|

| Khare, A. | Indian Institute of Management Rohtak | Rohtak, India | 2010 | 2016 | Financial Security-Internet Banking-Online Banking |

| Nerudová, D. | Mendelova univerzita v Brne | Brno, Czech Republic | 2011 | 2019 | Financial Transaction Tax-Budget-Capital Market |

| Capelle-Blancard, G. | Universite Paris 1 Pantheon-Sorbonne | Paris, France | 2016 | 2018 | Financial Transaction Tax-Liquidity-Tobin Tax |

| Musolino, F. | Università degli Studi di Messina | Messina, Italy | 2012 | 2014 | Speculation-Currency Markets-Financial Risk |

| Russell, J.R. | The University of Chicago | Chicago, USA | 1998 | 2008 | Market Microstructure-Bid-ask Bounce-Discrete-valued Time Series |

| Thurner, S. | Complexity Science Hub Vienna | Vienna, Austria | 2009 | 2017 | Systemic Risk Banking Regulation-DebtRank |

| Yi, G. | Pukyong National University | Busan, South Korea | 2004 | 2018 | Investments-Batch-storage Network-economic Order Quantity |

| Batoš, V. | University of Dubrovnik | Dubrovnik, Croatia | 2002 | 2009 | Banking Industry-Computer Simulation-Data Acquisition |

| Benjamin, R. | Fundacao Getulio Vargas | Rio de Janeiro, Brazil | 2010 | 2010 | Deregulation-Financial Crisis-Financialization |

| Brockett, P.L. | The University of Texas at Austin | Austin, USA | 1996 | 2013 | Financial Time Series-Statistical Test-Stochastic Process Model |

| Institution | Country | First Article | Last Article | Main Keywords |

|---|---|---|---|---|

| University of Oxford | UK | 2006 | 2018 | Financial Services, Banking, Economics, Tobin Tax, Agent-based Modeling |

| New York University | USA | 1907 | 2017 | Approximation Theory, Autoregressive Conditional Duration, Balanced Budget Requirements, Bid-ask Bounce, Debt |

| International Islamic University Malaysia | Malaysia | 2012 | 2019 | Islamic Mobile Banking, Banking Product, Consumer Protection, Credit card, Credit financing |

| University of New South Wales UNSW Australia | Australia | 1990 | 2019 | Bank Capital, Close-out Netting Provision, Digital Banking, Forward contract, Financial Transaction Tax |

| International Monetary Fund | USA | 1985 | 2007 | Banking, Capital, Cash-flow Tax, Corporate Income Tax, Capital Market |

| Massachusetts Institute of Technology | USA | 1988 | 2018 | Finance, Financial Transaction, Behavioral Feature, Commercial Bank, Credit Card Data |

| Islamic Azad University | United Arab Emirates | 2012 | 2017 | Accelerated Share Repurchase (ASR), Earnings Per Share (EPS), Intellectual Capital, Bank Cost, Banking |

| Universiti Kebangsaan Malaysia | Malaysia | 2014 | 2019 | Banked Consumers, Consumer Protection, Credit Rating, Default, Data Stream Clustering |

| Göteborgs Universitet | Sweden | 2007 | 2017 | Monitoring, Average Run Length, Change Point Detection, Financial Transaction Tax, Likelihood Ratio, Fat-tailed distribution |

| University of Michigan | USA | 1988 | 2013 | Bonus Tax, Economic, Financial Activity Tax, Financial Transaction Tax, International Finance |

| Cluster Number * | Color | Cluster Name ** | % | Main Keywords |

|---|---|---|---|---|

| 1 | Red | UK | 32.00 | Financial Transaction Tax, Network Security, Financial Data Processing, Mathematical Models, Agent-based Modeling |

| 2 | Green | Canada | 22.67 | Money Laundering, Biometric, Currency Devaluation, Banks’ Accounting, Artificial Intelligence |

| 3 | Pink | USA | 18.67 | Security, Banking, Financial Services, Blockchain, Financial System |

| 4 | Yellow | Australia | 17.33 | Money Laundering, Blockchain, Bitcoin, Risk Management, Audit Risk |

| 5 | Violet | Switzerland | 5.33 | Financial System, Banking IT Innovation, Bitcoin, Blockchain, Business Ethic |

| 6 | Blue | Pakistan | 4.00 | Internet Banking, Anti-money Laundering, Financial Time Series, Banknote Verification, Barter Credit |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Abad-Segura, E.; González-Zamar, M.-D. Global Research Trends in Financial Transactions. Mathematics 2020, 8, 614. https://doi.org/10.3390/math8040614

Abad-Segura E, González-Zamar M-D. Global Research Trends in Financial Transactions. Mathematics. 2020; 8(4):614. https://doi.org/10.3390/math8040614

Chicago/Turabian StyleAbad-Segura, Emilio, and Mariana-Daniela González-Zamar. 2020. "Global Research Trends in Financial Transactions" Mathematics 8, no. 4: 614. https://doi.org/10.3390/math8040614

APA StyleAbad-Segura, E., & González-Zamar, M.-D. (2020). Global Research Trends in Financial Transactions. Mathematics, 8(4), 614. https://doi.org/10.3390/math8040614