1. Introduction

The maritime industry has undergone significant transformations in recent years due to increased market competition, local political conflicts, and traffic congestion, which have significantly impacted the profits of maritime supply chain stakeholders [

1]. In particular, COVID-19 has disrupted global shipping activities in the past few years as countries imposed stringent navigational policies. During this period, the disruption of the maritime supply chain has caused heavy losses to the global economy and trade [

2]. Although the import and export trade has resumed, surging demand and cargo flow imbalance still place enormous pressure on ports and shipping companies [

3]. The impact of shipping disruptions on the global economy highlights the need to enhance decision-making flexibility among maritime supply chain members, which has also become a common concern for policymakers, stakeholders, and researchers. Ports, an essential member of the maritime supply chain, are not only points of transit but also key facilitators of trade efficiency [

4,

5]. They handle cargo loading and unloading while providing the infrastructure support for the shipping lines to operate efficiently [

3]. Recently, governments have adopted ports as a policy tool to promote growth in related maritime sectors to avoid the risks caused by unbalanced and uncertain market demand [

6].

Facing an increasingly complex world and diverse market demands, shipping companies prefer to select ports with high efficiency, large capacity, and advanced infrastructure as hubs to ensure high service quality and minimize risks. Shanghai Port has become one of the busiest container ports in the world based on its world-class infrastructure and automated loading and unloading systems [

4]. Traditional shipping clusters that focus only on cargo handling will gradually decline, such as Naples and Liverpool. Thus, the inevitable trend for port development is to adopt more advanced maritime technologies to provide more comprehensive logistics and high value-added services and satisfy growing marine demands while maintaining competitiveness [

4]. More and more port operators upgraded facilities to improve cargo handling efficiency and attract services beyond traditional businesses, such as legal services and insurance, to add more value to the maritime services industry and enhance risk resistance capabilities [

7]. For example, artificial intelligence (AI) technology has powerful predictive analysis capabilities. If port operators adopt AI technology, it can reduce the impact of environmental uncertainty on ports, help them quickly respond to various potential risks, effectively improve the quality of port services in the maritime supply chain, and generate more revenue.

Differing from port operators who face the problems of port upgrading and transformation, shipping companies feel the increasing pressure from backhaul issues in two-way transportation as trade demands and port operations evolve. Backhaul arises from asymmetric demand between inbound and outbound shipping volumes. It is often observed that outbound demand surpasses inbound demand and even faces the issue of empty return voyages for shipping companies [

5,

8,

9]. Therefore, the problem of backhaul shipping considerably escalates operational expenses and poses significant logistical challenges for shipping companies [

9]. To mitigate costs and better meet customer needs, shipping companies must make appropriate ship route decisions to balance the cost of loading and unloading containers on long-distance liner service routes while avoiding risks [

9]. Facing a significant cost imbalance or other natural or artificial risks, shipping companies must consider the advantages of one-way transportation. In contrast to two-way logistics, this approach focuses solely on the shipping demand from the departure port to the destination port without taking the demand for backhaul shipping into account, which can eliminate the inefficiency of returning empty containers [

10]. Recently, the topic of strategic decision-making processes of port operators and shipping companies within complex markets has become increasingly popular.

Several studies [

11,

12,

13] have shown that vertical integration is beneficial for optimizing port operations and enhancing the efficiency of the maritime supply chain. Zhao and Sun [

13] developed a two-stage game model to examine how port investment decisions and cooperation mechanisms benefit ports and shipping liners. However, it remains to be determined how the port operator facility upgrade decisions and shipping company route selection decisions interact and how they affect the efficiency of the maritime supply chain. Few studies have explored the interaction between the two.

To bridge this gap, we developed a three-stage game model consisting of a port operator and a shipping company to analyze their interactions. We used the game theory modeling approach inspired by Adler et al. [

14] and the foundational work of Zhao and Sun [

13]. Following this model, we can investigate the influence of port facility upgrades and shipping company logistics decisions on port vertical integration. We aim to answer the following questions: What impact does the port operator with advanced technology in its facilities have on its own and downstream shipping companies’ profits? What is the interaction between the upgrade decision of port operators’ facilities and shipping companies’ choice of one-way or two-way logistics? How can we coordinate the strategic decisions of port operators and shipping companies to achieve Pareto improvement?

Based on the derived equilibrium results, we first found that shipping companies prefer two-way logistics when the potential market size is moderate but shift towards one-way logistics when the market size is very large or very small. Second, our analysis reveals three potential equilibria depending on the fixed costs of port facility upgrades and two-way logistics. If these costs are moderate, the shipping company and port operator may reach one of two pure strategy equilibria—either both opting for upgrades and two-way logistics or neither investing in upgrades and the shipping company choosing one-way logistics. Otherwise, they may converge to a mixed strategy equilibrium where each party probabilistically decides whether to upgrade or adopt two-way logistics. The optimal decision to upgrade facilities depends on fixed costs and whether the shipping company chooses two-way logistics. Last, our results suggest that collaboration between the two parties can lead to mutually beneficial outcomes under the right financial terms.

This study contributes in several ways. Specifically, although several studies [

15,

16] have discussed the role of upgrading port facilities in the maritime supply chain through empirical research, we constructed a game model to study how port facility upgrades affect the decisions and profit of shipping companies and the maritime supply chain. The model highlights the interaction between port infrastructure upgrades and shipping companies’ route optimization strategies. Secondly, the imbalance of transportation volume in sea freight has always been a problem that troubles shipping companies and scholars [

17,

18,

19]. We analyze the optimal decisions for shipping companies regarding one-way or two-way logistics in different market sizes. Based on existing literature [

20,

21,

22], we further explore port cooperation and the coordinating role of revenue-sharing contracts in the maritime supply chain. We find that revenue-sharing contracts could be beneficial for both parties under certain circumstances. Cooperation, facility upgrades, and route selection in different market sizes are all beneficial for improving the maritime supply chain to withstand risks.

The remainder of the paper is organized as follows.

Section 2 reviews the most related work in the literature.

Section 3 presents the three-stage game model.

Section 4 examines the decentralized equilibrium results for port and shipping companies. The centralized equilibrium results are derived in

Section 5.

Section 6 is a case study. In

Section 7, conclusions are drawn from the results. For the sake of clarity, all proofs are provided in the

Appendix A.

3. Model Description

We consider a port operator (she) and a liner container shipping company (he) in the context of port upgrades. Port upgrading in this study refers to port operators introducing advanced technology to existing infrastructure to improve operational efficiency and analytical capabilities. The upgraded port can attract and induce additional business as a result, and we set the proportion of business brought about by the port upgrade as b, . To simplify the analysis, the shipping company in the model can be viewed as an aggregate of all associated shipping companies. During midterm strategic planning, the port operator needs to determine whether to upgrade the port to attract additional demand, and the shipping company needs to determine whether the logistics should be carried out one way or two ways within a single round trip; as part of their short-term tactical decision making, the port operator ought to determine her handling charge per 20-foot equivalent unit (TEU), and the shipping company has to decide on their freight rate per TEU.

To understand their implications for both parties involved, a three-stage game-theoretic model is developed to examine the interplay between midterm and short-term decision-making processes. And, the decision-making processes of both parties satisfied profit maximization in all scenarios. Specifically, in the first stage, the port operator decides whether to upgrade her facilities, while the shipping company simultaneously decides whether to engage in one-way or two-way logistics in a single round-trip. In the paper, one-way logistics refers to shipping companies not considering the backhaul shipping demand, while two-way logistics represent the shipping company considering both the demand from the departure port to the destination port and the shipping demand from the destination port back to the departure port. According to what was previously stated, she has two decision options about facilities upgrade (upgrade or not), and he also has two choices about backhaul shipping (one-way or two-way logistics). We obtain a 2 × 2 framework with four possible game scenarios in the decision-making process between shipping companies and terminal operators:

Port upgrade with two-way logistics (UT): The port operator upgrades facilities, that is, introduces artificial intelligence technology to existing infrastructure, and the shipping company makes two port calls, ensuring backhaul cargo transport.

No upgrade with two-way logistics (NT): The port operator does not upgrade facilities, and the shipping company makes two port calls, ensuring backhaul cargo transport.

Port upgrade with one-way logistics (UO): The port operator upgrades facilities, that is, introduces artificial intelligence technology to existing infrastructure, but the shipping company opts for only a single port call, not taking backhaul cargo.

No upgrade with one-way logistics (NO): The port operator does not upgrade facilities, and the shipping company makes one port call without backhauling.

In the second stage, the port operator determines her unit handling charge (

w) to maximize her total profit. In the third stage, the shipping company decides on the freight rate (

p) to maximize profit. The sequence of events in this three-stage game is illustrated in

Figure 1. The notations used in this paper are summarized in

Table A1.

3.1. Upgrade with Two-Way Logistics (UT)

In the UT scenario, during midterm strategic planning, the port operator decides to introduce advanced technology to upgrade existing facilities, and the shipping company uses the port for both outbound and inbound backhaul cargo. After that, during short-term decision-making, the port operator sets her handling charge w per TEU, followed by the shipping company deciding on their freight rate p per TEU. Both parties aim to maximize their profits.

Assuming a linear demand function, the quantity of outbound freight in TEUs is determined by and the quantity of backhaul freight in TEUs is calculated as , where a represents the baseline market size for freight in TEUs, denotes the incremental freight demand attributed to the port’s facility upgrade, and signifies the load factor for backhaul freight.

Accordingly, the shipping company’s gross profit is calculated as follows, where

is the fixed cost associated with backhauling for the shipping company.

The port operator’s revenue from handling outbound freight is

, and its revenue from handling backhaul freight is

. In addition to handling charges, the port is able to secure additional business through her value-added services, such as customs clearance. The proportion of cargo associated with the port’s value-added service is denoted by

b and the price of this service is denoted by

. Therefore, the port’s additional revenue from this service is calculated as

. In addition,

is the cost of upgrading the port facility. As a result, the total profit of the port operator is

Subsequently, the port sets her handling charge, followed by the shipping company pricing their freight rate. The equilibrium outcomes of this subgame in the scenario UT are derived and summarized in Proposition 1.

Proposition 1. Under scenario UT, the equilibrium freight rate is and the equilibrium port handling charge is . The corresponding profit of the shipping company isand the corresponding profit of the port operator is Proposition 1 indicates that both the equilibrium freight rate and the equilibrium port handling charge increase in a, and , while decreasing in b and . As the values of a, , or go up, the overall market size expands, allowing the shipping company to levy higher rates on their customers and enabling the port operator to impose higher service charge on the shipping company. Conversely, as b or increases, which reflects the proportion and price of value-added logistics services, the port operator’s revenue from these additional services goes up. In response to this, the port operator reduces the handling charge , thereby reducing , making her service more attractive to a larger customer base and potentially increasing its total revenue.

3.2. No Upgrade with Two-Way Logistics (NT)

In the NT scenario, during midterm strategic planning, the port operator decides not to upgrade facilities, and the shipping company uses the port for both outbound and inbound backhaul cargo.

Given a specific freight rate

p, the quantity of outbound freight in TEUs is

, and the quantity of backhaul freight in TEUs

. The gross profit of the shipping company is then calculated as

The port operator’s revenue from the outbound shipping is

, and her revenue from the inbound shipping is

. Furthermore, by facilitating trade with the shipping company, the port operator is able to attract additional value-added services, leading to extra revenue streams, which is

. Therefore, the total profit for the port operator is then determined by

Afterward, in the phase of short-term decision-making within the NT scenario, the port operator sets the terminal handling charge w to maximize her profit first. Then, the shipping company determines the freight rate p to maximize their profit. The equilibrium results that stem from this subgame in the scenario NT are derived and summarized in Proposition 2.

Proposition 2. Under scenario NT, the equilibrium freight rate is and the equilibrium port handling charge is . The corresponding profit of the shipping company isand the corresponding profit of the port operator is Proposition 2 suggests that both the equilibrium freight rate and the equilibrium port handling charge increase in a and but decrease in b and . An increase in a or leads to an expansion of the market size, enabling the shipping company to elevate its rate charged to customers and allowing the port operator to impose a higher service charge on the shipping company. On the other hand, when b or increases, indicating a higher proportion of cargo using value-added logistics services and a higher price for those services, the port operator sees an increase in revenue from these additional services. To capitalize on this opportunity and attract more customers, the port operator chooses to lower the terminal handling fee , which in turn reduces the freight rate , thereby increasing the port’s revenue streams through value-added services and boosting her total profit.

3.3. Upgrade with One-Way Logistics (UO)

In the UO scenario, during midterm strategic planning, the port operator upgrades her facilities, and the shipping company makes one port call without backhauling.

Given a specific freight rate

p, the quantity of outbound freight in TEUs is

, and the shipping company’s gross profit is

The port operator’s revenue derived from the handling charge is

. And her revenue from the value-added service is

. Therefore, the total profit of the port operator is

Following this, in the short-term decision-making phase within the UO scenario, the port operator sets the terminal handling charge w to maximize her profit first. Afterwards, the shipping company determines the freight rate p to maximize their profit. Proposition 3 summarizes the equilibrium results for this subgame in scenario UO.

Proposition 3. Under UO scenario, the equilibrium freight rate is and the equilibrium port handling charge is . The corresponding profit of the shipping company isand the corresponding profit of the port operator is Proposition 3 states that, in the subgame equilibrium of scenario NT, both the freight rate and the port handling charge increase in a and but decrease in b and . An increase in a or results in an expansion of the market, thereby enabling the shipping company to impose higher rates on customers. Concurrently, the port operator can request an increase in handling charge from the shipping company. On the other hand, when b or increase, it signifies an increase in the revenue stream generated from the value-added service for the port operator. To entice a broader customer base and thus augment its total revenue, the port operator decides to reduce her terminal handling charge , leading to a lower freight rate .

3.4. No Upgrade with One-Way Logistics (NO)

In the NO scenario, during midterm strategic planning, the port operator does not upgrade her facilities, and the shipping company makes one port call without backhauling.

Given a specific freight rate

p, the quantity of outbound freight in TEUs is

, and the shipping company’s profit is

The port operator’s revenue from the handling charge is

, and her revenue from the value-added service is

. Therefore, the total profit of the port operator is

Thereafter, the port operator decides the terminal handling charge w, followed by the shipping company determining the freight rate p. Proposition 4 summarizes the equilibrium results obtained from this subgame within scenario NO.

Proposition 4. Under scenario NO, the equilibrium freight rate is and the equilibrium port handling charge is . The corresponding profit of the shipping company isand the corresponding profit of the port operator is Proposition 4 implies that both the freight rate and the equilibrium port handling charge increase in a but decrease in b and .

An increase in parameter a results in the expansion of the market. Consequently, the shipping company raises prices for his customers, and the port operator also increases her handling fee charged to the shipping company. When b or increases, the additional revenue generated from the value-added service for the port operator increases. To attract more customers and boost revenue, the port operator decreases her handling charge , thereby lowering the freight rate, denoted as . This strategic adjustment enables the port operator to attract a larger customer base and increase her overall revenue.

The profits at equilibrium for both the port operator and the liner container shipping company in all four possible scenarios are further summarized in

Table 2.

We obtain

Table 3 by solving the first-order partial derivatives of the parameters contained in it using the equilibrium price and profit above. The “+” in this table represents positive correlation, the “−” represents negative.

4. Upgrade and Logistics Strategies

In this section, in the framework of backward induction, we examine the strategic choices made by the port operator in terms of upgrading facilities or maintaining existing facilities, and by the shipping company in terms of one-way or two-way logistics. These decisions are made simultaneously by both parties. The Nash equilibrium will be determined by examining the optimal responses from both parties.

4.1. Best Responses for the Shipping Company

We first examine the optimal response for the shipping company. Based on the profits presented in

Table 2, we present Proposition 5.

Proposition 5. Let and .

- A.

When , ; when , .

- B.

When , ; when , .

Proposition 5 states that, when the port facility is upgraded (when the port facility is not upgraded), if the associated fixed cost for the two-way logistics is sufficiently low, i.e., (), the optimal response of the shipping company is to adopt two-way logistics. Moreover, the cost thresholds and increase in b, , and . This indicates that, as the market size increases due to two-way logistics, the demand for value-added services increases, or the price of the value-added service increase, the shipping company may switch from one-way logistics to two-way logistics. As the market size expands due to the adoption of two-way logistics, shipping companies may transition from one-way to two-way logistics to capitalize on the growing market opportunities. This shift is further driven by an increasing demand for value-added services, indicating that customers seek more comprehensive and sophisticated logistics solutions. Additionally, if value-added service prices rise, companies may find optimizing their operations through two-way logistics more profitable. The effects of a and on the cost thresholds () are further discussed in Proposition 6.

Proposition 6. When , increases in a and ξ, and increases in a; when , increases and then decreases in , and increases and then decreases in a.

Proposition 6 points out that, when

, the market size growth due to two-way logistics is sufficiently large (

), as the market potential—driven by increases in

a or

—rises, the shipping company switches from one-way to two-way logistics. On the other hand, when

is low (

), the shipping company prefers two-way logistics if the market potential is moderate, and prefers one-way logistics if the market potential is either high or low. This finding is further illustrated in

Figure 2.

Figure 2 describes the impact of

a and

on the fixed cost thresholds associated with two-way logistics

and the optimal decision of the shipping company in different scenarios. Obviously, the fixed cost related to two-way logistics for the shipping company increases and then decreases in laden container demand in TEU, regardless of whether the port operator updates facilities if the load factor for backhaul freight is low (see Proposition 6). Where

Figure 2a describes when the port operator upgrading the facility, the best optimal backhaul shipping decision for the shipping company. When the port operator does not upgrade the facilities, the shipping company’s decision is shown in

Figure 2b.

4.2. Best Response for the Port Operator

We then examine the best response for the port operator. Based on the results summarized in

Table 2, we present Proposition 7.

Proposition 7. Let and .

- A.

When , ; when , .

- B.

When , ; when , .

Proposition 7 suggests that, when the shipping company chooses two-way (one-way) logistics, it is better for the port operator to upgrade her facilities if the associated upgrading costs are below a certain threshold, i.e., (). Cost thresholds and increase as b, , , or a increases. This indicates that, when there is growth in the market size for shipping goods, or an increase in demand resulting from facility upgrades, or an increase in the demand for the port operator’s value-added services, or an increase in the price for the value-added services, shipping companies that have not upgraded their facilities may consider reconsidering and initiating an upgrade. Facility upgrades in response to several key market dynamics will be helpful for the port operator. Growth in the market size for shipping, increased demand stemming from facility upgrades, or an increase in the price of these services all serve as compelling reasons for the port operator to upgrade their infrastructure. Facilities upgrading can lead to improved operational efficiency, better service offerings, and the ability to capitalize on higher revenue opportunities.

4.3. Nash Equilibrium

By combining the best responses of the shipping company and the port operator, we are able to derive Nash equilibrium. After comparing the cost thresholds derived above, we arrive at the following conclusion, which is summarized in Proposition 8.

Proposition 8. Let solve

- A.

When , and ;

- B.

When , and .

The equilibrium results are further summarized in Table 4 and Table 5. According to Proportion 8, in the presence of significant growth in the market size of shipping goods due to two-way logistics, the upgrade cost threshold rises with a higher fixed cost threshold for two-way logistics; similarly, the fixed cost threshold for adopting two-way logistics increases with a higher facility upgrade cost threshold.

Moreover, there is at least one equilibrium between the port operator and the shipping company. In particular, when the incremental increase in the market size due to two-way logistics is substantial (), if and , there exists an equilibrium in which the shipping company adopts two-way logistics and the port operator upgrades its facility. Interestingly, when and , there exist three equilibria. Two of them are pure strategy equilibrium: UT and NO, and one is the mixed equilibrium. In UT equilibrium, the shipping company adopts two-way logistics and the port operator upgrades its facility; in NO equilibrium, the shipping company adopts one-way logistics and the port operator does not upgrade its facility; in the mixed equilibrium, the shipping company has a probability of adopting two-way logistics and the port operator also has a probability of upgrading her facilities.

6. Case Study

Through the game-theoretic model developed above, we can obtain all analytical solutions to the problem we are focused on, all of which have closed-form. Based on this, parameters in the model can basically cover all actual variations, which enables us to analyze almost all possible scenarios in reality. In this section, we extracted empirical values about some parameters in the paper from existing research to validate our analysis results.

Wu et al. [

54] adopted the Baowu Group as a case study to analyze how the shipping company plans backhaul shipping to improve operational efficiency. In the research of Wu et al. [

54], the Baowu Group needs to import 1.5 million tons of steel through the Shanghai Port in each production cycle, which is a stable demand. In order to achieve business needs more economically, the Baowu Group regularly leases a fleet of bulk carriers and pays USD 6.17 per ton to the shipping company. Therefore, the shipping company that carries the Baowu Group’s cargo has a fixed shipping demand that is 1.5 million tons, and it is one-way logistics. Although there are differences between bulk carriers transporting steel and container ships in TEU units in the model, these two only differ in terms of carrying units in our research. As mentioned above, the shipping company in the model can be viewed as an aggregate of all associated shipping companies. Therefore, we take the value above as a reference value and convert it into TEU units, that is, we set

in the model. Then, we adopt the data from [

55] and set w = 1.7. Meanwhile,

represents the increase in demand brought about by port upgrades, which is an exogenous variable we can set to any value greater than 0. In this section, we set it to 5000. Similarly, we set

.

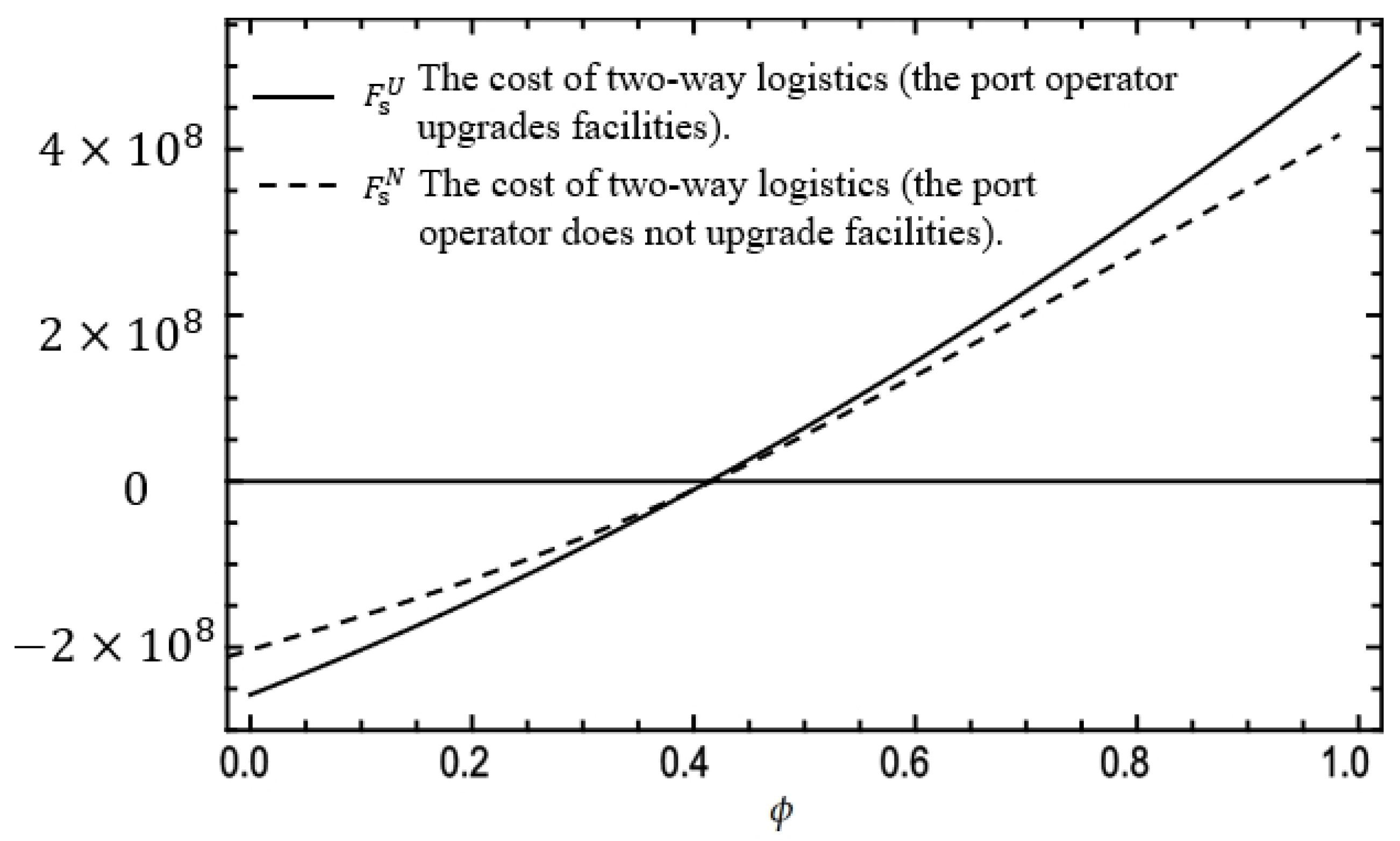

According to the profit functions of the shipping company in the four game scenarios constructed in the previous, we can obtain the relationship between the profit difference caused by two-way logistics in backhaul shipping (i.e., the fixed cost associated with two-way logistics for the shipping company) and the load factor of backhaul for the shipping company when the port operator upgrades facilities and the relationship between the two when not upgrading the port. We reached a conclusion consistent with the derivation of the model. As shown in

Figure 3, with the increasing shipping demand for backhaul shipping, the shipping company switches from one-way to two-way logistics. In addition, when the port operator upgrades facilities, which means that demand for value-added services increases or the price of the value-added service increases, the shipping company will switch from one-way logistics to two-way logistics.

7. Conclusions

In this section, we first discuss the policies’ impact and then briefly summarize our study’s main findings. Based on that, we develop the limitations and conduct future research.

7.1. Policy Implications in Practice

There is a multi-tier relationship between policies and port upgrades. Policy often plays a role as the catalyst for port modernization and expansion. China’s Belt and Road Initiative (BRI) aims to enhance global trade connectivity. Under the BRI, several countries, such as Pakistan, Greece, and Sri Lanka, have invested significantly in upgrading their ports. Governments have adopted ports as a policy tool to promote growth in related maritime sectors and avoid the risks caused by unbalanced and uncertain market demand. Similarly, Europe has pushed ports like Rotterdam in the Netherlands to invest in eco-friendly upgrades, such as shore power systems and renewable energy integration, to reduce carbon emissions. In conclusion, policies provide the financial support needed for port modernization.

We focus on the interaction between the port upgrades and the shipping company’s backhaul shipping decisions. Although we did not specifically discuss the role of policies, the research is based on the current policy. This means that the policy provides subsidies to the port operator. It can also be viewed as a cost discount coefficient. To a certain extent, this reduces the cost of upgrading port facilities, thereby promoting the port operator to be more willing to upgrade facilities. With policy support, the upgraded facilities can provide higher value-added services at higher prices and lower costs. In research conclusions, the impact of policies on the main conclusions of the model will be similar to that of the profit-sharing coefficient (s).

7.2. Major Findings

As markets become more complex and diverse and technological advancements develop rapidly, the maritime supply chain must enhance its resilience while ensuring greater efficiency and stability. This is essential for reducing the risks of supply chain disruptions that can impact stakeholders. We construct a three-stage game model to explore the interactions between the port operator and the shipping company under various scenarios. The first stage involves a strategic choice by the port operator on whether to upgrade her facilities that use artificial intelligence on existing facilities to help improve operational efficiency. While the shipping company chooses between one-way or two-way logistics. This leads to four possible scenarios: (1) upgrading with two-way logistics, (2) upgrading with one-way logistics, (3) no upgrade with two-way logistics, and (4) no upgrade with one-way logistics. In each scenario, the sequence of decisions begins with the port operator setting the terminal handling charge to maximize her profit at the second stage. Following this, at the third stage, the shipping company determines the freight rate to optimize their own profit.

We first derive equilibrium outcomes under both decentralized and centralized decision-making processes. Equilibria under decentralized decision making, where the port operator and the shipping company optimize their own objectives independently, and centralized decision making, where a unified authority coordinates decisions to maximize collective outcomes, are derived. Then, we examine the impact of main factors on these equilibrium outcomes, including the potential market size, the incremental demand generated by two-way logistics and facility upgrades, the additional service demand faced by the port operator, the price of the port’s value-added service, and the fixed costs associated with implementing two-way logistics and upgrading the facility. One interesting finding is that shipping companies tend to choose two-way logistics when the potential market size is moderate, whereas they opt for one-way logistics when the market size is either large or small. Moreover, when fixed costs for port facility upgrades and two-way logistics are moderate, there exists three equilibria: two pure strategy equilibrium (UT and NO) and one mixed-strategy equilibrium. In UT equilibrium, the shipping company adopts two-way logistics and the port operator upgrades her facilities; in NO equilibrium, the shipping company adopts one-way logistics and the port operator does not invest in upgrade; in the mixed equilibrium, the shipping company has a probability of adopting two-way logistics and the port operator also has a probability of upgrading her facilities. Whether the operator introduces AI technology into the existing facilities depends on fixed costs and whether the shipping company chooses a two-way route.

Furthermore, we constructed a cooperative model involving the port operator and the shipping company, demonstrating that an appropriately designed revenue-sharing contract could benefit both parties under certain circumstances. We find that the cooperation between ports and shipping companies, upgrade facilities, and shipping routes will all affect the risk tolerance, operational efficiency, and customer satisfaction of the maritime supply chain in different market sizes.

7.3. Limitations and Future Research

Considering that the model highlights the interaction between port infrastructure upgrades and shipping company route optimization strategies. To explore port cooperation and vertical integration, we constructed a cooperation model involving a port operator and a shipping company and obtained the conditions under which the revenue-sharing contract benefits both parties. The research has several limitations that warrant further exploration. Firstly, the coordination mechanisms employed in this study are simplistic. Future research could expand on this by conducting the comparative analyses of various coordination mechanisms in the maritime supply chain. Secondly, the model does not account for the impact of inter-port competition on port–shipping company cooperation. Incorporating port selection probabilities for shipping companies would introduce additional complexity that may detract from our current research focus. in the future, we will examine port competition dynamics and their influence on vertical integration in the maritime supply chain. Finally, while we have discussed policy implications, our study lacks a quantitative assessment of policy impacts. Additionally, our policy analysis has primarily focused on subsidy support. Future could include comparative studies examining the differential effects of regulatory control vs. incentive-based policies on terminal operations and shipping companies’ performance.