Tail Conditional Expectation and Tail Variance for Extended Generalized Skew-Elliptical Distributions

Abstract

1. Introduction

2. Extended Generalized Skew-Elliptical Distributions

3. The TCE and TV for Univariate EGSE Distributions

4. Expressions for the Proposed TCE and TV

4.1. Extended Generalized Skew-Normal Distribution

Extended Skew-Normal Distribution

4.2. Extended Generalized Skew-Student-t Distribution

Extended Skew-Student-t Distribution

4.3. Extended Generalized Skew-Logistic Distribution

Extended Skew-Logistic-Normal Distribution

4.4. Extended Generalized Skew-Laplace Distribution

Extended Skew-Laplace-Normal Distribution

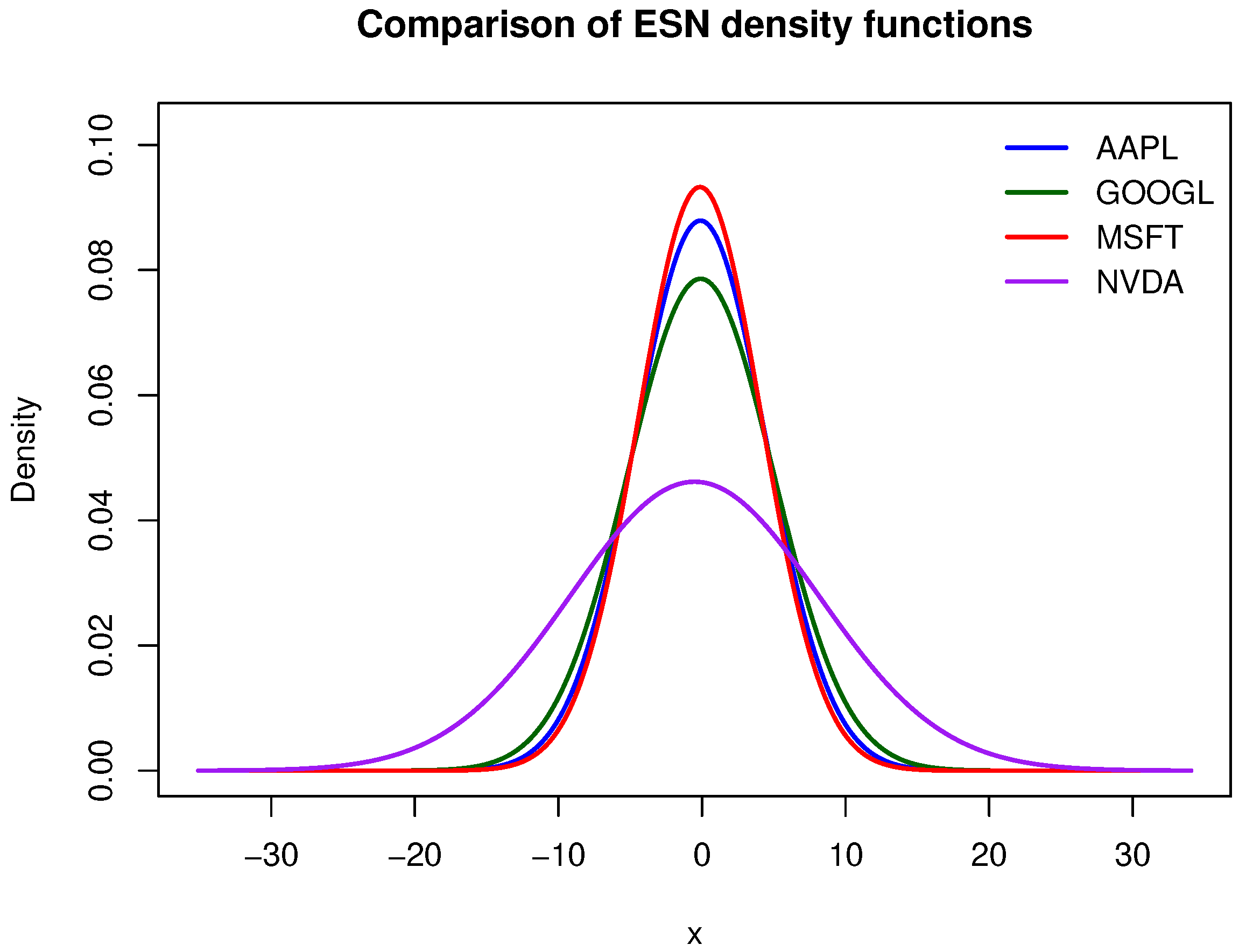

5. Numerical Illustration

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A. Proof of Lemma 1

Appendix B. Proof of Proposition 1

Appendix C. Proof of Proposition 2

References

- Morgan, J. RiskMetrics-Technical Document; Morgan Guaranty Trust Company: New York, NY, USA, 1996. [Google Scholar]

- Artzner, P.; Delbaen, F.; Eber, J.M.; Heath, D. Coherent measures of risk. Math. Financ. 1999, 9, 203–228. [Google Scholar] [CrossRef]

- Landsman, Z.; Makov, U.; Shushi, T. Tail conditional moments for elliptical and log-elliptical distributions. Insur. Math. Econ. 2016, 71, 179–188. [Google Scholar] [CrossRef]

- Li, Z.; Luo, J.; Yao, J. Convex bound approximations for sums of random variables under multivariate log-generalized hyperbolic distribution and asymptotic equivalences. J. Comput. Appl. Math. 2021, 391, 113459. [Google Scholar] [CrossRef]

- Furman, E.; Landsman, Z. Tail variance premium with applications for elliptical portfolio of risks. ASTIN Bull. J. IAA 2006, 36, 433–462. [Google Scholar] [CrossRef][Green Version]

- Eini, E.J.; Khaloozadeh, H. Tail variance for generalized skew-elliptical distributions. Commun. Stat. Theory Methods 2022, 51, 519–536. [Google Scholar] [CrossRef]

- Yang, Y.; Wang, G.; Yao, J.; Xie, H. A generalized tail mean-variance model for optimal capital allocation. Insur. Math. Econ. 2025, 122, 157–179. [Google Scholar] [CrossRef]

- Yang, Y.; Wang, G.; Yao, J. Tail moments and tail joint moments for multivariate generalized hyperbolic distribution. J. Comput. Appl. Math. 2025, 457, 116307. [Google Scholar] [CrossRef]

- Duan, J.; Landsman, Z.; Yao, J. Tail variance and confidence of using tail conditional expectation: Analytical representation, capital adequacy, and asymptotics. Adv. Appl. Probab. 2025, 57, 346–369. [Google Scholar] [CrossRef]

- McNeil, A.J.; Frey, R.; Embrechts, P. Quantitative Risk Management: Concepts, Techniques and Tools-Revised Edition; Princeton University Press: Princeton, NJ, USA, 2015. [Google Scholar]

- Ignatieva, K.; Landsman, Z. A class of generalised hyper-elliptical distributions and their applications in computing conditional tail risk measures. Insur. Math. Econ. 2021, 101, 437–465. [Google Scholar] [CrossRef]

- Ignatieva, K.; Landsman, Z. Tail variance for generalised hyper-elliptical models. ASTIN Bull. J. IAA 2025, 55, 144–167. [Google Scholar] [CrossRef]

- Neuberger, A.; Payne, R. The skewness of the stock market over long horizons. Rev. Financ. Stud. 2021, 34, 1572–1616. [Google Scholar] [CrossRef]

- Hasan, M.M.; Taylor, G.; Richardson, G. Brand capital and stock price crash risk. Manag. Sci. 2022, 68, 7221–7247. [Google Scholar] [CrossRef]

- Bauer, M.; Chernov, M. Interest rate skewness and biased beliefs. J. Financ. 2024, 79, 173–217. [Google Scholar] [CrossRef]

- Shi, Y.; Punzo, A.; Otneim, H.; Maruotti, A. Hidden semi-Markov models for rainfall-related insurance claims. Insur. Math. Econ. 2025, 120, 91–106. [Google Scholar] [CrossRef]

- Azzalini, A. A class of distributions which includes the normal ones. Scand. J. Stat. 1985, 12, 171–178. [Google Scholar] [CrossRef]

- Azzalini, A.; Dalla Valle, A. The multivariate skew-normal distribution. Biometrika 1996, 83, 715–726. [Google Scholar] [CrossRef]

- Branco, M.D.; Dey, D.K. A general class of multivariate skew-elliptical distributions. J. Multivar. Anal. 2001, 79, 99–113. [Google Scholar] [CrossRef]

- Landsman, Z.; Makov, U.; Shushi, T. Extended generalized skew-elliptical distributions and their moments. Sankhya A 2017, 79, 76–100. [Google Scholar] [CrossRef]

- Zhang, Z.; Arellano-Valle, R.B.; Genton, M.G.; Huser, R. Tractable Bayes of skew-elliptical link models for correlated binary data. Biometrics 2023, 79, 1788–1800. [Google Scholar] [CrossRef]

- Barndorff-Nielsen, O. Exponentially decreasing distributions for the logarithm of particle size. Proc. R. Soc. Lond. A Math. Phys. Sci. 1977, 353, 401–419. [Google Scholar] [CrossRef]

- Ignatieva, K.; Landsman, Z. Estimating the tails of loss severity via conditional risk measures for the family of symmetric generalised hyperbolic distributions. Insur. Math. Econ. 2015, 65, 172–186. [Google Scholar] [CrossRef]

- Wei, Z.; Zhu, X.; Wang, T. The extended skew-normal-based stochastic frontier model with a solution to ‘wrong skewness’ problem. Statistics 2021, 55, 1387–1406. [Google Scholar] [CrossRef]

- Morales, C.E.G.; Matos, L.A.; Dey, D.K.; Lachos, V.H. On moments of folded and doubly truncated multivariate extended skew-normal distributions. J. Comput. Graph. Stat. 2022, 31, 455–465. [Google Scholar] [CrossRef]

- Valeriano, K.A.; Galarza, C.E.; Matos, L.A.; Lachos, V.H. Likelihood-based inference for the multivariate skew-t regression with censored or missing responses. J. Multivar. Anal. 2023, 196, 105174. [Google Scholar] [CrossRef]

- Eini, E.J.; Khaloozadeh, H. Tail conditional moment for generalized skew-elliptical distributions. J. Appl. Stat. 2021, 48, 2285–2305. [Google Scholar] [CrossRef]

- Fang, K.; Kotz, S.; Ng, K. Symmetric Multivariate and Related Distributions; Chapman and Hall: London, UK; CRC: Boca Raton, FL, USA, 1990. [Google Scholar]

- Azzalini, A.; Capitanio, A. Statistical applications of the multivariate skew normal distribution. J. R. Stat. Soc. Ser. B (Stat. Methodol.) 1999, 61, 579–602. [Google Scholar] [CrossRef]

- Arnold, B.C.; Beaver, R.J.; Azzalini, A.; Balakrishnan, N.; Bhaumik, A.; Dey, D.; Cuadras, C.; Sarabia, J.M.; Arnold, B.C.; Beaver, R.J. Skewed multivariate models related to hidden truncation and/or selective reporting. Test 2002, 11, 7–54. [Google Scholar] [CrossRef]

- Wang, J.; Boyer, J.; Genton, M.G. A skew-symmetric representation of multivariate distributions. Stat. Sin. 2004, 14, 1259–1270. [Google Scholar]

- Arellano-Valle, R.B.; Branco, M.D.; Genton, M.G. A unified view on skewed distributions arising from selections. Can. J. Stat. 2006, 34, 581–601. [Google Scholar] [CrossRef]

- Arellano-Valle, R.B.; Genton, M.G. Multivariate unified skew-elliptical distributions. Chil. J. Stat. 2010, 1, 17–33. [Google Scholar]

- Azzalini, A. The Skew-Normal and Related Families; Cambridge University Press: Cambridge, UK, 2013; Volume 3. [Google Scholar]

- Landsman, Z.M.; Valdez, E.A. Tail conditional expectations for elliptical distributions. N. Am. Actuar. J. 2003, 7, 55–71. [Google Scholar] [CrossRef]

- Landsman, Z.; Makov, U.; Shushi, T. Tail conditional expectations for generalized skew-elliptical distributions. SSRN Electron. J. 2013. [Google Scholar] [CrossRef]

- Zuo, B.; Yin, C.; Balakrishnan, N. Expressions for joint moments of elliptical distributions. J. Comput. Appl. Math. 2021, 391, 113418. [Google Scholar] [CrossRef]

- Cheng, T.; Peng, X.; Choiruddin, A.; He, X.; Chen, K. Environmental extreme risk modeling via sub-sampling block maxima. arXiv 2025, arXiv:2506.14556. [Google Scholar] [CrossRef]

- Badwan, R.; Pakyari, R. Analyzing Competing Risks with Progressively Type-II Censored Data in Dagum Distributions. Axioms 2025, 14, 508. [Google Scholar] [CrossRef]

| Stock | Mean | Variance | Minimum | Median | Maximum | Skewness | Kurtosis |

|---|---|---|---|---|---|---|---|

| AAPL | −0.1103 | 20.6282 | −35.9396 | −0.2757 | 24.4474 | −0.2896 | 6.0404 |

| GOOGL | −0.0972 | 25.7890 | −24.5316 | −0.2871 | 25.1809 | 0.1527 | 2.9529 |

| MSFT | −0.1384 | 18.3213 | −24.3242 | −0.1709 | 20.2344 | −0.1123 | 2.9616 |

| NVDA | −0.5211 | 74.7393 | −54.9581 | −0.7576 | 46.8584 | −0.2557 | 3.5786 |

| Stock | Confidence | VaR | TCE | TV |

|---|---|---|---|---|

| AAPL | 70% | 2.2703 | 5.1509 | 5.4514 |

| 75% | 2.9516 | 5.6600 | 4.9794 | |

| 80% | 3.7103 | 6.2442 | 4.5057 | |

| 85% | 4.5947 | 6.9459 | 4.0162 | |

| 90% | 5.7074 | 7.8565 | 3.4858 | |

| GOOGL | 70% | 2.5643 | 5.7852 | 6.8155 |

| 75% | 3.3261 | 6.3544 | 6.2254 | |

| 80% | 4.1744 | 7.0076 | 5.6331 | |

| 85% | 5.1632 | 7.7922 | 5.0210 | |

| 90% | 6.4074 | 8.8103 | 4.3582 | |

| MSFT | 70% | 2.1049 | 4.8197 | 4.8419 |

| 75% | 2.7470 | 5.2994 | 4.4226 | |

| 80% | 3.4620 | 5.8500 | 4.0019 | |

| 85% | 4.2955 | 6.5114 | 3.5672 | |

| 90% | 5.3441 | 7.3695 | 3.0961 | |

| NVDA | 70% | 4.0103 | 9.4933 | 19.7490 |

| 75% | 5.3072 | 10.4622 | 18.0388 | |

| 80% | 6.7513 | 11.5742 | 16.3223 | |

| 85% | 8.4346 | 12.9099 | 14.5484 | |

| 90% | 10.5525 | 14.6431 | 12.6247 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, P.; Wang, G.; Yang, Y.; Yao, J. Tail Conditional Expectation and Tail Variance for Extended Generalized Skew-Elliptical Distributions. Mathematics 2025, 13, 2972. https://doi.org/10.3390/math13182972

Wang P, Wang G, Yang Y, Yao J. Tail Conditional Expectation and Tail Variance for Extended Generalized Skew-Elliptical Distributions. Mathematics. 2025; 13(18):2972. https://doi.org/10.3390/math13182972

Chicago/Turabian StyleWang, Pin, Guojing Wang, Yang Yang, and Jing Yao. 2025. "Tail Conditional Expectation and Tail Variance for Extended Generalized Skew-Elliptical Distributions" Mathematics 13, no. 18: 2972. https://doi.org/10.3390/math13182972

APA StyleWang, P., Wang, G., Yang, Y., & Yao, J. (2025). Tail Conditional Expectation and Tail Variance for Extended Generalized Skew-Elliptical Distributions. Mathematics, 13(18), 2972. https://doi.org/10.3390/math13182972