Abstract

This paper examines the dynamic relationships and the volatility spillover effects among crude oil, gold, and Chinese electricity companies’ stock prices, from 2 December 2008 to 25 July 2022. By estimating the dynamic conditional correlation (DCC) model, we identify the time-varying correlation between crude oil, gold, and Chinese electricity stocks. Then, we use the time-varying parameter VAR model (TVP-VAR) to analyze the total and net volatility spillover effects. In addition, we compare the hedge ratio strategy and the portfolio weights strategy, as well as the corresponding hedging effectiveness among the crude oil, gold, and Chinese electricity companies. Considering the impact of the extreme events, we also extend the examination to the special period analysis of two crises, the Chinese stock market crash in 2015 and the COVID-19 pandemic in 2020. The results indicate that significant volatility spillover effects exist among crude oil, gold, and Chinese electricity companies’ stock volatility, and the total spillover effects show a sharp increase under the impact of the crisis. On average, gold is a much cheaper hedging tool than crude oil, whereas these two commodity assets remain net volatility receivers during the whole period and the crisis. However, it is worth noting that for specific assets, the impact of the crisis on spillover effects depends on the characteristics of crisis events and the assets analyzed. Additionally, most optimal weight strategies provide better hedging effectiveness than hedging strategies from the perspective of hedging effectiveness.

Keywords:

electricity stock market; crude oil; gold; spillover effects; hedge ratios; portfolio weights; hedging effectiveness MSC:

91B84

1. Introduction

As a critical energy carrier, electricity is an important material basis for a nation’s social and economic development and prosperity. However, over the past decades, many countries have suffered from electricity shortages due to the non-storage nature of electricity and the frequent occurrence of severe emergencies, especially extreme weather events. It means that the stability of social order is seriously threatened, and the electricity market is also full of uncertainty, resulting in greater volatility in electricity prices compared with other similar commodities [1]. More importantly, the virtual economy is inextricably linked to the real economy, and either side will inevitably be affected by the fluctuations of the other side. Therefore, these events can also affect the investment confidence of individual and institutional investors, and exacerbate the volatility of the financial market, leading to an intensified investor panic.

China’s electricity industry has experienced rapid development in recent years. So far, it is the largest country in the world’s electric supply and electric demand. To narrow the gap between the rapid growth in electricity demand and supply, and ensure the electricity sector structure fit in with China’s economic construction and social development, the government launched a series of reforms. With the steady progress of these reforms, the construction and development of China’s electricity market have made some obvious progress [2,3,4,5,6,7,8], but the remaining problems have likewise drawn widespread attention from scholars. Zheng et al. [5] find that the electricity reform in March 2015 significantly improves technical efficiency but reduces the reliability of the electricity supply. Similar findings are also reported by Gohli [9] that China is suffering from electricity shortage under the combined impact of the energy crisis and economic recovery, and electricity generators are also under considerable strain in terms of both generation costs and electricity supply. In addition, reforms to liberalize electricity prices have exacerbated electricity price volatility [10] and increased uncertainty in the electricity market. Therefore, it is necessary for investors to choose hedging commodities to offset their investment risks and protect their profits.

With the rising levels of financial integration and liberalization, strong risk contagion and huge price fluctuations have been observed frequently in financial markets, leading to lower portfolio returns but higher risks [11]. As a result, to investment risk without reducing expected returns, investors increase their research interest in commodity markets to re-examine the diversification strategy of the asset portfolio and turn to include some specific commodities in their asset allocation, most often gold and oil [12].

Gold and oil are the most actively traded commodities in the world and are often used by investors to hedge their investment risks [13]. Historically, gold has always been regarded as a flight-to-safety asset, as its inflation-proof properties have been generally accepted [14]. Furthermore, gold can also resist the risks associated with some major uncertain events or emergencies [15], especially since the performance of gold is impressive during the stock market crash. On the other hand, as an important strategic material for industrial production and economic development, oil is also one of the strong hedging instruments that can be served as a safe haven for investors. In particular, in some specific sectors or emerging markets, oil displays a superior hedging performance than gold. Basher and Sadorsky [16] find that the hedging effectiveness of oil is significantly higher than those of gold, VIX, and bonds in hedging against emerging market stock prices. Xu et al. [17] observe that oil has the largest hedging capacity on the Chinese stock market among the four economies of the United States, Japan, China, and Hong Kong. Kang et al. [18] find that even though the cost of hedging with gold is similar to that of oil in the short term, oil has stronger hedging effectiveness on sector ETFs than gold in both the short and long term. In addition, Naeem et al. [19] claim that oil is a better hedging tool than gold for industrial metals and agricultural commodities. Therefore, in this paper, we choose crude oil and gold as hedging instruments for electrical companies.

Based on the background mentioned above, this paper focuses on the research of volatility spillover effects between commodity markets and Chinese electricity stock markets. We select some stocks from the main board of China’s A-shares as representatives of the Chinese electricity industry stock market; meanwhile, oil and gold are chosen as hedging and portfolio diversification tools. To examine the time-varying correlations in the volatilities of crude oil, gold, and electricity companies’ stock prices, we approach the dynamic conditional correlation (DCC) model proposed by Engle [20], which estimators have the flexibility of univariate GARCH but not the complexity of conventional multivariate GARCH. It should be noted that we can use the DCC model to get the correlation between two return series over time, but it does not provide any information on how the volatility of one series is affected by the volatility of the other [21]. In recent years, Diebold and Yilmaz [22] proposed the measurement method of overall and directional volatility spillover under the framework of generalized vector autoregression, which has been widely used in the study of the volatility spillover effect. However, the method suffers from window loss due to the limitation of the scrolling window. In addition, short scrolling window length will stop the estimation, and too much will lead to overfitting [23]. Therefore, we use the time-varying parameter VAR model (TVP-VAR) proposed by Antonakakis et al. [24] to examine the volatility spillover effects. This model is a generalized version of the volatility spillover approach of Diebold and Yilmaz [22]. In particular, the main advantages of the TVP-VAR model are not affected by the size of the rolling window and do not lose observations [25]. Moreover, the presence of an outlier would not significantly affect our results, which provides a better adjustment to parameter changes [26]. Then, we calculate the optimal hedge ratios and portfolio weights, as well as the corresponding hedging effectiveness. More importantly, to illustrate the effects of different crises, we compare the properties of hedging and safe-haven against risk during two sub-periods.

Overall, the contributions of this study to the related literature can be summarized as follows. First, we analyze the volatility relationship between China’s electricity stock market and the commodity market. Although the development of China’s electricity market has attracted much attention recently, to our best knowledge, few papers have analyzed China’s electricity industry from the perspective of investment. Even more, the literature on the interaction between China’s stock market and commodity markets has mostly focused on aggregate analysis, which may mask the heterogeneity between different industries and is not very useful for analyzing diversified portfolio strategies. Thus, this paper fills these gaps in the literature by investigating the volatility spillover effects among oil, gold, and the stocks of major electricity companies in China. Second, we extend the literature in the area of spillovers between China’s stock market and commodity markets, particularly under different market conditions. Specifically, we examine the time-varying correlation and spillover effects in the two crisis periods, the 2015 Chinese stock market crash and COVID-19 in 2019, and illustrate that the impact of the crisis varies depending on the feature of the crisis and the characteristics of the series analyzed. Third, our research quantifies the hedge ratio, optimal weights, and the hedging effectiveness of the electricity stock-commodity portfolio, which can help portfolio managers adjust optimal hedging and portfolio diversification strategies to make more favorable decisions, especially during such crisis periods. Additionally, these main findings also provide a reference for policymakers to quickly formulate measures to deal with external emergencies in the process of China’s electricity market reform.

The remainder of this paper is organized as follows. Section 2 briefly reviews the relevant literature. Section 3 lays out the methodology employed in this paper. Section 4 consists of the dataset employed and descriptive statistics, and the most significant empirical results and discussion are reported in Section 5. Finally, in Section 6, we provide some concluding remarks.

2. Literature Review

Electricity is an indispensable part of economic growth. However, although lots of studies are related to electricity, only in recent years have scholars paid attention to the volatility spillovers of electricity markets. Souhir et al. [27] point out that electricity prices are more volatile than other commodity prices due to the liberalization of electricity markets. Interestingly, similar results are also reported by Han et al. [1]. They examine the volatility spillovers among five regional electricity markets in the NEM and conclude that the volatility of electricity markets is significantly higher than that of other comparable financial or commodity markets, and the pattern of spillover effects may be influenced by the market structures and specific events. Based on the connectedness measure originally proposed by Diebold and Yilmaz [28], Ji et al. [29] found that electricity prices are the biggest information receiver among the energy and carbon markets. Furthermore, from the perspective of the firm level, the outcomes of Ji et al. [30] show that the carbon market serves as a recipient in the information spillover among carbon price returns and European electricity returns, and large companies often contribute more information to the system compared to small companies. In addition, Naeem et al. [31] find that because of the low short-term correlation between electricity futures and other variables, it can be used as a risk-diversification tool and a safe haven asset in the portfolio, especially against the risk of oil shocks. Liu et al. [32] provide more information on the spillover effects of electricity spot and futures markets. They observe that the spillover effect of natural gas on the electricity market is the highest in the European fossil fuel market. This result is not in line with the findings of Zhang et al. [33], where the authors find that both in North America and in Europe, oil has a stronger volatility spillover on electricity utility stock indices than natural gas. Moreover, they confirm that extreme events can significantly affect the spillover effects.

With the acceleration of rapid economic growth and modernization, the Chinese government has taken a series of measures to support the fast-growing demand for electricity, which has attracted considerable attention from academics. Nevertheless, the focus of attention is either on the achievements or impacts of these measures or on the problems that still exist in the electricity market. For example, Guo et al. [34] review a series of reforms launched by the Chinese government and focus on the new round of electricity sector reform in terms of motivations, progress, and recommendations. Their investigation reveals that China’s electricity market reforms achieve some progress in reducing pollution, increasing generation efficiency, developing renewable energy, and so on. The steadily increasing marketization of China’s electricity price is also confirmed by Zhao and Hu [35], and they also observe that marketization can effectively motivate the promotion effect of electricity price on energy efficiency. Zheng et al. [5] report similar results in energy efficiency, but they also find a decrease in the supply reliability of electricity. In addition, some authors examine the impact of the development of China’s electricity sector on renewable energy [2,3,8] and carbon emission [4,6,7]. However, only a few papers specifically analyze China’s electricity market from the view of investment [36,37].

It is well acknowledged that risk is the focus of attention from investors and policymakers. Considering that the contagion effect within the stock market is increasing with financial liberalization, while the correlation between the commodity market and the stock market is relatively low, more and more investors put commodities into their portfolio strategies to hedge their risk without decreasing the expected returns. However, it is important to note that the volatility spillover effect means risk contagion, which can weaken the ability of asset portfolios to reduce or avoid risks [23]. Therefore, a large number of studies have examined and emphasized the volatility spillover effect and the portfolio diversification of commodity markets and stock markets, but most of them focus on aggregate stock market indices [24]. For example, Vardar et al. [38] find that the volatility spillover effects among ten countries’ stock market indices and the spot price of five major commodities evolve depending on the market conditions. Ali et al. [39] reveal 21 commodities’ hedge, safe haven, and diversification potential for 49 international stock markets. In addition, they corroborate that gold is the strongest haven asset, especially for some developed stock markets. Wen et al. [23] observe that there is a highly dependent relationship between the Chinese stock market and Chinese commodity markets, and the level of total volatility spillover varies in different periods. Ahmed and Huo [40] suggest that there is a significant unidirectional return spillover effect from the oil market to the Chinese stock market, while there is no return spillover between gold and these two markets. Reboredo et al. [41] investigate connectedness spillovers among six stock indices and three blocks of markets. They believe that the risk effect of stock markets needs to be hedged with other asset classes or financial derivatives.

Considering that aggregate stock market indices may hardly reflect the volatility spillover effects between various sectors and the commodity markets [24,42], some scholars have analyzed the relationship between commodity assets and stocks at the sectorial or company level in recent times. For example, Morema and Bonga-Bonga [42] simultaneously evaluate the impact of gold and oil price fluctuation on index volatility of the aggregate stock market and three component sectors. They conclude that both gold and oil are powerful hedging tools, but oil can only be used to mitigate risk in the industrial sector, rather than the risk in the aggregate stock market. Dutta et al. [15] discern that volatility indices of crude oil, gold, and silver are all effective tools to reduce the risk of clean energy stock indices. In addition, Mensi et al. [12] demonstrate that sectoral indices of the stock market react differently to the variabilities in commodity prices. For the firm level, Antonakakis et al. [24] observe that there are significant volatility spillover effects among crude oil and oil and gas companies’ stock volatility, and the spillover is usually unidirectional. Maitra et al. [43] examine the volatility co-movement and spillover between oil and liner shipping stocks and confirm the importance of oil as a hedging instrument. Further, the outcomes suggest there are persistent volatility spillovers between oil prices and 22 international transportation or logistic companies’ stock returns, and maximizing risk-adjusted gains can be achieved by adjusting the portfolio according to the economic situation.

The studies mentioned above show that most research has been dedicated to the hedging and safe-haven properties of commodity assets against the stock market. But undeniably, the results are not consistent, potentially because they focus not only on different sectorial indices but also on different periods. In particular, the spillover effects between commodity assets and stock markets are susceptible to some major crisis events, such as the financial crisis and the COVID-19 pandemic [44]. The results of Wen et al. [23] suggest that the volatility correlations between commodity markets and stock markets increase following major crisis events, and the risk-hedging ability of most commodities decreases significantly. Maitra et al. [43] evaluate how the global financial crisis in 2008 affects the spillover dynamics between oil and liner shipping markets. They elaborate on the importance of choosing appropriate strategies in different economic environments. Unlike the financial crisis, the recent outbreak of COVID-19 has not only brought enormous risks to the global financial market and economy but also has immensely impacted the social and environmental pillars of sustainability in human lives [45,46,47]. To contain this highly contagious “once-in-a-century” pandemic [48], governments around the world had to take extreme steps like lockdowns, social distancing, and suspending business operations. These measures have led to a sharp decline in electricity demand [49] and also slowed the transition to a sustainable energy world [50]. Additionally, the relationship between commodity and stock markets has also changed significantly by COVID-19 [51]. Zhang et al. [52] observe that during the trade disputes between China and the United States and the COVID-19 pandemic, the spillover effects between commodity and stock markets intensify. Dai et al. [53] confirm that the volatility spillovers among WTI crude oil, gold, and the Chinese stock markets of new energy vehicles will be affected by major events such as the oil price crisis and COVID-19.

Along with the prosperity of China’s economic construction and the rapid development of the stock market, researchers have paid more attention to analyzing the nexus between the commodity and Chinese stock markets [54]. For example, Bouri et al. [55] compare the causality-in-mean and causality-in-variance between the international oil market and the Chinese stock market before and after China’s refined oil pricing reform of 27 March 2013. They find that the causality-in-mean between the two markets strengthened after the reform, whereas the causality-in-variance almost disappeared. Dai et al. [53] confirm that crude oil and gold are cheap hedging tools, and they can also be used as diversifier assets to reduce the risk of Chinese energy vehicle stock indices. Similar results are also reported by Mensi et al. [56], who demonstrate that the inclusion of oil and gold in China’s equity portfolio can reduce the level of risk. Furthermore, they also observe that gold provides better hedging effectiveness than oil in both tranquil and turbulent periods. In addition, the results of Wang and Li [57] support that gold can serve as a good risk-hedging tool in the short term. Conversely, Peng [58] finds that gold only acts as an effective diversifier for China’s stock, and it performs well as a safe haven against stock market risk during the financial crisis. The findings of Zhang et al. [59] are consistent with those of Peng [58]. They perceive that gold is a good diversifier rather than a hedging tool for China’s stock market, and it should be preferred over oil and Chinese stocks in portfolios. However, the results of Bouri et al. [60] show that the safe-haven property of gold is not stable when they examine the short-term and long-term causality dynamics between gold and the Chinese and Indian stock markets using implied volatility indices. Additionally, Hsiao et al. [61] find that oil has a significant spillover effect on China’s renewable energy companies’ stock prices. In contrast, the research of Qu et al. [62] indicates that the volatility of oil only causes short-lived shocks to new energy stocks, indicating that it is not the dominant factor for the volatility spillover and investment risk of new energy stocks in China.

In summary, the achievements and shortcomings of China’s electricity industry development have been widely discussed in recent years, but few papers put their attention to the electricity stock market from an investment perspective. Thus, it is of great significance for policymakers and investors to analyze the volatility spillover and investment risk in the electricity stock market, especially in the extreme risk period, such as the COVID-19 crisis. In addition, lots of literature have already analyzed the correlation and volatility spillovers between commodity markets and stock markets, most of this literature focuses on aggregate or sectorial indices. However, it is difficult for aggregate and sector indices to reflect the heterogeneity at the firm level. While diversification strategies and risk management mainly involve specific companies, implying that portfolio diversification and risk management at the firm level is more useful to investors than aggregate or sectorial analysis. Based on the analysis above, our research aims to investigate the volatility spillover effects between electricity companies and two major commodities, oil and gold, to illustrate the volatility contagion and implement optimal diversification strategies, especially in turbulent times like the COVID-19 pandemic.

3. Methodology

3.1. Dynamic Conditional Correlation

By estimating the DCC model proposed by Engle [20], we can obtain the time-varying correlations in the volatilities of gold, oil prices, and electricity companies’ stock prices, thereby constructing the optimal diversification strategies. The model is estimated in two steps. In the first step, the GARCH parameters are estimated. In the second step, the conditional correlations are estimated. The form of the model is:

where rt, μt, and εt are N × 1 vectors, representing the analyzed time series, conditional mean, and the error term, respectively. Let Ft − 1 denote the information set available up to t − 1. Furthermore, Ht is the time-varying conditional variance-covariance matrix, Dt is a diagonal matrix of square root conditional variance, where hiit can be defined as any univariate GARCH-type model, and Rt indicates the matrix containing the time-varying conditional correlations.

where Qt = (qij,t) is an N × N symmetric positive definite matrix as follows:

is the N × N unconditional variance matrix of standardized residuals ut. A notable point is that the parameters θ1 and θ2 should satisfy: θ1 > 0, θ2 > 0, and θ1 + θ2 < 1.

3.2. Volatility Spillover Effects

To estimate the total and net-pairwise volatility spillover effects, we follow the TVP-VAR model proposed by Antonakakis et al. [24], which is an extension of the volatility spillover approach of Diebold and Yilmaz [22]. We built a TVP-VAR model at the beginning as follows:

where yt is a vector of endogenous variables, representing the object set of this study. Θk represents parameter matrices and τt is an error term. Then, the H-step-ahead forecast error variance in the generalized VAR framework can be decomposed as:

where Σ is the variance matrix of the error vector τt and σjj is the standard deviation of the error term of the volatility of variable j. In addition, ej is a selection vector with 1 as the jth element and zero otherwise. Then, we can get an N × N matrix Φij(H), where each entry provides the volatility contribution of variable j to the forecast error variance of variable i. Afterward, each entry of the variance decomposition matrix is normalized by the row sum to make sure the sum of each row in the variance decomposition matrix equals 1.

with and by construction.

Then, the total spillover index (TS) is computed as follows:

This approach takes into account volatility spillovers in different directions. Specifically, the directional volatility spillovers transmitted from variable i to all other variables j are defined as follows:

Similarly, the directional volatility spillovers which i receives from all other variables are defined as follows:

Thus, the net total directional volatility spillovers could be computed by subtracting Equation (10) from Equation (9) as follows:

Therefore, Equation (11) provides information on whether variable i is a net receiver or transmitter of volatility shocks. Specifically, If NSi(H) is positive, it means that the variable i is a net transmitter. Conversely, if NSi(H) is negative, it means that the variable i is a net receiver.

Moreover, the net pairwise volatility spillovers can also be derived by:

Similarly, if NPSij(H) is positive, it means that variable i has a greater effect on variable j. Conversely, if NPSij(H) is negative, it indicates that variable j has a greater effect on variable i.

3.3. Hedge Ratios and Portfolio Weights

In this section, we explore the optimal diversification strategy through two methods, including the optimal hedging ratio and the optimal portfolio weights. More specifically, the hedge ratios and portfolio weights are computed by the estimates of the conditional variance and covariance.

According to Kroner and Sultan [63], the risk-minimizing hedge ratios between assets i and j at time t can be computed by:

where βij,t indicates the optimal hedge ratio and hij,t is the conditional covariance between i and j at time t, hjj,t is the conditional variance of j. Furthermore, following Kroner and Ng [64], the optimal portfolio weights between i and j can be calculated by:

with

where wij,t denotes the weight of i in one unit portfolio of two variables i and j at time t; meanwhile, the weight of variable j in the portfolio at time t is 1 − wij,t.

Next, as suggested by Ku et al. [65] and Chang et al. [66], we compute the index of hedging effectiveness (HE) to compare these two strategies above, and it can be obtained as follows:

where varunhedged represents the variance of unhedged position, and varhedged denotes the variance of hedged variance of the two strategies aforementioned. Thus, HE measures the percentage of variance declined under the hedged portfolio. In short, the higher HE demonstrates stronger hedging effectiveness.

4. Data

In this paper, we utilize daily data on crude oil prices, gold, and Chinese electricity companies’ stock prices. It should be noted that, we use time series data, which better reflects the macro situation [67,68,69,70] and is more suitable than panel data [3,71]. Crude oil prices are measured by the continuous contract on the West Texas Intermediate (WTI) crude oil futures contract, and data are obtained from U.S. Energy Information Administration (EIA). This paper only chooses 12 representative electricity companies from China’s A-share main board due to the limited availability of data (serious missing data or too short a time for the company to be listed). In order of assets from largest to smallest, the selected corporations are the following: Huaneng Power International incorporated (HPI), Datang International Power Generation Corporation Limited (DTP), Huadian Power International Corporation Limited (HDPI), Shenergy Company Limited (SNGY), Guangzhou Development Group Incorporated (GDG), Sichuan Chuantou Energy Corporation Limited (SCTE), Changyuan Electric Power Company Limited (CYDL), Guangxi Guidong Electric Power Corporation Limited (GDEP), Chongqing Three Gorges Water Conservancy and Electric Power Company Limited (CQSXSL), Xingjiang Tianfu Energy Corporation Limited (TFNY), Guizhou Qianyyuan Power Company Limited (GZQYDL), and Hunan Chendian International Development Corporation Limited (CDGJ). It should be noted that because China has relied largely on coal and water resources to generate electricity for a long time [72], we select only seven thermal power companies and five hydropower companies, and these companies are represented in terms of generation and stock market value. For example, HPI has the largest market value and the installed capacity of power generation among thermal power generation companies, while HDPI and DTP also rank third and fourth, respectively. As for hydropower, SCTE is also in the front rank of installed capacity and market value. In addition, some small companies also have been included in this paper, such as TFNY and CDGJ have small market value, especially CDFJ, which is the smallest hydropower company in terms of market capitalization. The stock prices of the companies mentioned above and the gold price on the Shanghai Gold Exchange (GOLD) are collected from the CSMAR database.

It is important to highlight that our sample covers recent major crises attacking China. The whole sample period extends from 2 December 2008 to 25 July 2022 with 2920 observations. It should be noted that we chose to start our estimation sample from the end of 2008 because, in addition to the 2015 stock market crash, China’s stock market also experienced a crash in 2008 and stabilized at the end of 2008. The highest point of the Shanghai Stock Exchange Composite Index (SSECI) in the 2008 crash was 6124.04 on 16 October 2007 and the lowest point was 1664.92 on 28 October 2008 [73]. Furthermore, we implement analysis for two sub-periods: the stock market crash and the COVID-19 epidemic periods. The first sub-period is China’s stock market crash range from 15 June 2015 to 27 January 2016. During this period, the SSECI lost more than 49% from 5176.79 to 2638.3. The plunge did not stop until the end of the following January. Another sub-period was set from 31 December 2019 to 8 September 2020, which includes the major periods of the spread of COVID-19 in China. Concretely, the WHO China office officially announced the first infected case of pneumonia in Wuhan on 31 December 2019, while the national commendation conference for fighting COVID-19 in China was held on 8 September 2020, which marked the beginning and normalization of the COVID-19 epidemic [74], respectively.

Following Antonakakis et al. [24], the price volatility is defined by taking the absolute return of each analyzed variable, as shown in Equation (1), where Pt denotes the daily closing value of crude oil prices and stocks at the time t.

The volatility statistics for WTI, gold, and stock prices of major Chinese electricity companies are shown in Table 1 and several notable points can be obtained. Firstly, the results demonstrate that WTI is the most volatile and GOLD is the least, with a value of 3.281 and 0.729, respectively, while the standard deviation of other series is between 1.5 and 2.5. Secondly, the skewness coefficients and the kurtosis coefficients indicate that the distributions of all volatility time series are right-skewed and peaked. We examine the existence of the ARCH effect using the Lagrange multiplier test proposed by Engle [75], and the results show the obvious ARCH effect of all returns. Additionally, the results of Jarque-bera statistics suggest that each series is far from normally distributed. A final observation that is worth mentioning here is the results of the ADF test indicate that all sample series are stationary processes.

Table 1.

Descriptive statistics.

Table 2 reports the Pearson (above diagonal) and Spearman (below diagonal) correlations. It shows the unconditional correlations among volatility of the analyzed series. Both WTI and gold have obvious positive correlations with the volatility of the analyzed electricity companies and correlations are weak, but the correlation of gold is weaker than WTI. Additionally, a high correlation can be found among the electricity companies. Then, diversification is of great significance to reduce investment risk.

Table 2.

Pearson (above diagonal) and Spearman (below diagonal) correlations.

5. Empirical Results

5.1. Volatility Co-Movements

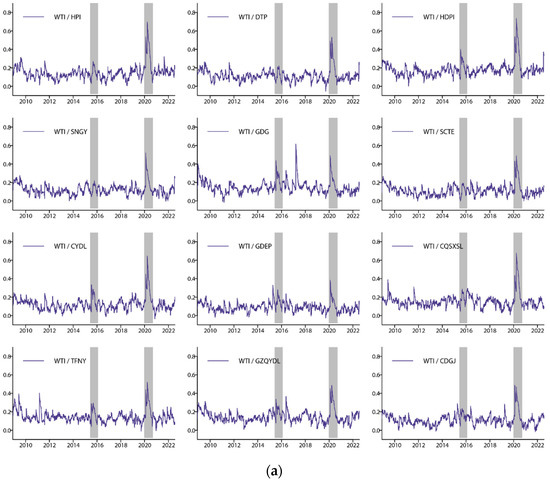

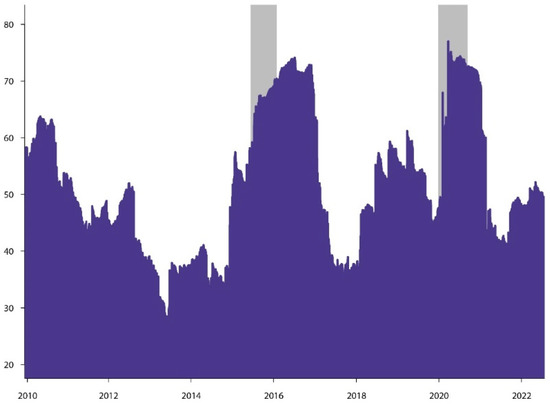

Figure 1 depicts the time-varying conditional correlations of WTI and analyzed companies, as well as gold and the analyzed companies, which are obtained from the DCC model. The correlation coefficient values between these series are not high in normal time, mostly vary from 0 to 0.3, and the correlation clustering is obvious. This is suggestive of the fact that portfolio diversification is meaningful. In other words, portfolio diversification of commodity assets and stock markets can provide investors with opportunities to reduce risk. Notably, during the Chinese stock market crash and the COVID-19 epidemic period, the correlations between WTI and electricity companies exhibit two significant peaks. It is potentially because the value of electricity companies’ stocks and oil decreased during the two crisis periods. Moreover, although a sharp increase in the volatility correlations between WTI and Chinese electricity companies’ stock prices can be observed during the two crisis periods, the highest degree of correlation during the COVID-19 pandemic reaches more than 0.7, while the peak value of the stock market crash is relatively low. It is potentially because the lockdowns and traffic control caused by COVID-19 significantly reduce the oil demand. The volatility correlations between gold and electricity companies’ stock prices are also influenced by the COVID-19 pandemic, and there are common peaks in their correlations during the crisis period. However, unlike WTI, these peaks are relatively low, and we also observe a drop in the correlation between gold and those companies’ stocks in the early stage of the stock market crash period and then restore gradually. These results show that gold is less affected by the crisis.

Figure 1.

(a) Dynamic conditional correlation between WTI volatility and electricity companies’ stock price volatility; (b) Dynamic conditional correlation between gold volatility and electricity companies’ stock price volatility. Note: The first and second shaded bars refer to two crisis periods, namely, the stock market crash period and the COVID-19 epidemic period.

In this subsection, we observe the relationship among all categories by investigating their spillover effects. Table 3 provides the results of static spillover effects under the full sample period and two sub-periods (the stock market crash and the COVID-19 pandemic), including the total, directional, and net volatility spillovers. The total volatility spillover shown in Panel A reveals that 56.08% of the volatility forecast error variance could be interpreted as the spillovers among all studied categories, due to the high interdependence among electricity companies’ stock. The final row of Panel A in Table 3 shows the net spillover effects of full sample estimation. We notice that WTI and gold are net volatility receivers, with values of −6.75% and −5.04%, respectively. For the electricity companies, we can also see that larger companies tend to be net transmitters of systemic shocks, except for HPI, with a value of −0.63%, possibly due to the decline in operating performance in recent years. This finding is similar to Ji et al. [30], who find companies with larger power generation volumes are more likely to be net transmitters, which indicates that large companies tend to provide more information to the system than small one.

Table 3.

Static volatility spillover indexes.

Next, we proceed to explore the impact of extreme events on volatility spillover. The results of Panel B and Panel C in Table 3 report the volatility spillover during two sub-periods. As is shown in the results, the total volatility spillover index increased to 74.43% and 74.49%, respectively during the sub-periods covering the Chinese stock market crash and COVID-19 outbreak, indicating that the spillover effects increased sharply under the impact of the crisis. The net volatility spillover indexes of WTI remain negative, with values of −18.40% and −22.76%, respectively. The same is true for gold, which is −4.61% and −21.26%. It means that WTI and gold are still net recipients of systemic shocks during the two crisis periods. It is worth noting that there are differences in the impact of the two crises, which can be explained by the finding of Choi [76] that the fundamental causes of the crises are diverse. Concretely, the 2015 Chinese stock market crash was caused by internal financial problems in China and had a limited impact on the world economy in a short period. In contrast, although the Chinese economy was the earliest to be affected by COVID-19, it quickly spread globally and sent strong shock waves throughout the world’s economy. Therefore, during the market crash, the impact of WTI on electricity companies has not changed significantly, while these electricity companies increase the intensity of volatility spillover transmitted to WTI. However, both parties’ contributions to the variance of volatility error have increased profoundly during the period of COVID-19. These results are suggestive of the fact that the increase of volatility spillover is bidirectional between the electricity stock market in China and WTI during the COVID-19 pandemic crisis, thus we can infer that the pandemic has an important impact on both WTI and China’s electricity stock market. In contrast, during the market crash period, the increase in volatility spillover is unidirectional from China’s stock market to oil, indicating that electricity companies’ stock has been directly impacted by the stock market collapse, and then spread to WTI. Furthermore, the volatility spillover effects between gold and electricity companies’ stocks are also deeply influenced by the pandemic. However, it is worth noting that during the stock market crash period, the spillover effects from electricity companies to gold did not increase dramatically, demonstrating that the collapse of China’s stock market did not have a tremendous impact on gold.

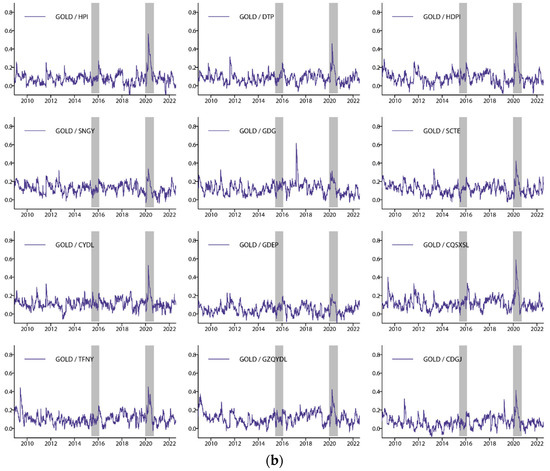

Since the static analysis only provides the average spillover effects, we examine the spillover index over time to better understand the dynamic features of the total volatility spillover, which are shown in Figure 2. It is important to point out that the time-varying total volatility spillover over the whole sample is calculated based on 200 days of rolling windows, and the forecast horizon is selected to be 30 days. Several dramatic changes can be found from it: Firstly, the most fascinating point is that two significant peaks exceed 70%, which coincide with the two crises depicted as shadow areas. More specifically, the total volatility spillover has been rising continuously since 2015, which may be caused by the oil price crash. After that, the spillover index experienced a slight decline, but it rose sharply due to the collapse of China’s stock market in mid-2015 and exceeded 70%, which is the first shadow area. Notably, it did not fade out immediately as the stock market became gradually stabilized in mid-2016 but rather continued to rise until the beginning of 2017. These findings are consistent with those of Antonakakis et al.’s [24] argument that some crises have a lasting impact on the total volatility spillover effect. Then, the total spillover trend continued with a steep nosedive until the end of 2017, whereas it rose sharply by more than 20% after a short period of stabilization, mainly as a result of the US-China trade war in 2018. Soon afterward the percentage of total spillover showed a downward trend, but increased sharply due to the outbreak of COVID-19, which is consistent with the second shaded area in Figure 2. As can be seen, the highest peak is found to exceed 75% during 2020–2021. Last but not least, unlike the stock market crash crisis, the total volatility spillover index rose suddenly when COVID-19 broke out, reached its peak rapidly, and then generally showed a downward trend rather than continuing to rise with the spread of the crisis.

Figure 2.

Total volatility spillover.

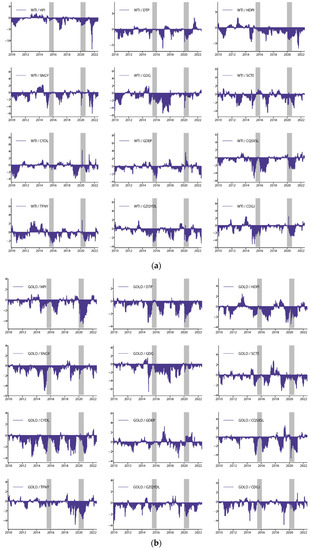

We further analyzed the time-varying net pairwise effects between commodity assets and electricity companies, and the results are shown in Figure 3. It is clear that neither WTI nor gold consistently remains the recipient or transmitter in the whole period, but the net transmission of volatility spillovers towards WTI or gold increased significantly under the influence of the COVID pandemic in 2019–2020. These results are suggestive of the fact that the fluctuation of electricity companies’ stock prices exerts great influence on the price volatility of commodities, especially during the crisis, which is in line with the results of Antonakakis et al. [24] and Dai et al. [53]. However, it is worth noting that the impact of the crisis on spillover effects varies due to the characteristics of companies. More specifically, compared with small companies, some large electricity companies transmit fewer volatility spillovers to WTI during the market crash period, such as HPI, DTP, and HDPI. On the one hand, unlike small companies that mainly use clean energy to generate electricity, most large companies in our sample this paper mainly use thermoelectricity generation. This means that they are more vulnerable to crude oil prices. On the other hand, in recent years, the Chinese government attaches great importance to the development of clean energy, and the clean energy power generation industry has experienced rapid development. It implies that electricity companies which highly focus on the development of clean energy are more likely to have an impact on WTI. Therefore, WTI is much more affected by small companies focusing on new energy during the crisis originating in China. These findings are consistent with Ferrer et al. [77], that is, the stock prices of renewable energy companies have become net transmitters of volatility spillovers to crude oil prices. As for the net pairwise spillover effects between gold and electricity companies’ stock, the response of gold to these two crises is different, though the gold serves as a net receiver of spillovers almost throughout the entire sample period. Specifically, the absolute value of the net spillover index of gold shows a downward trend at the earlier stage of the stock market crash period, rather than a rapid upward trend during the pandemic. This result confirms once again that, compared with the COVID-19 pandemic, the crash of China’s stock market does not have a severe impact on gold. On the contrary, it reduces the spillovers transmitted from Chinese companies to gold.

Figure 3.

(a) Net dynamic pairwise volatility directional spillover between WTI and electricity companies’ stock prices; (b) Net dynamic pairwise volatility directional spillover between gold and electricity companies’ stock prices.

5.2. Portfolio Strategies

From the analysis shown above, volatility spillover effects vary among China’s electrical companies, crude oil, and gold. To examine the effect on portfolio diversification and risk management, we calculate the optimal hedge ratios, as well as the hedging effectiveness. Furthermore, considering the change of volatility spillovers related to the crisis, we also extend the examination to a period-specific analysis of the two crises, including China’s stock market crash period and the period of COVID-19. Table 4 represents the average hedge ratios for each WTI-stock pair in the full period and two sub-periods, and the hedge ratios for each gold-stock pair are shown in Table 5.

Table 4.

Hedge ratios and the corresponding hedging effectiveness for WTI and electricity companies.

Table 5.

Hedge ratios and the corresponding hedging effectiveness for gold and electricity companies.

According to Table 4, we can obtain some valuable findings. Firstly, the hedge ratios vary from 0.099 to 0.267 when a long position is taken in the WTI. In contrast, the hedge costs are relatively low when WTI served as a short position to hedge stock assets during the whole period, while the hedge ratios fluctuate between 0.094 and 0.18. However, we can observe a drop in the corresponding hedging effectiveness, and most of them are negative.

Secondly, focusing on different periods, it is rather evident that the hedging ratios for a long position in WTI increase significantly during the COVID-19 period, as well as a short position in WTI during the stock market crash period. This outcome agrees with Dai [53], concluding that crisis events could lead to the increase of hedging costs, and indicates that investors should choose appropriate investment strategies depending on different market conditions, especially in turbulent times, investors need to actively rebalance their portfolios rather than adopt static methods.

Concretely, during the COVID-19 period, even though the hedge ratios for a short position in WTI volatility are still lower than these ratios for a long position in WTI, the hedging cost of these “WTI-stock” pairs increase substantially. However, all the hedging effectiveness of WTI hedging against electricity companies’ stocks fall sharply below zero, ranging from a minimum of −86.986% to a maximum of −7.925%. Hence, the “short position in WTI and a long position in electricity stock markets” portfolio strategy should not be selected during the COVID-19 crisis period.

Finally, in contrast to the results of the whole period, the hedging cost of WTI as a short position is relatively higher than that of a long position during the stock market crash period. Another finding that merits attention is that the hedging effectiveness remains negative whether investors take a long position or a short position in the volatility of some electricity companies’ stocks, such as HPI, DTP, SNGY, and SCTE, indicating these companies’ stocks are inappropriate for investors to adopt hedge portfolio strategies during the crash period.

As for the average hedging ratios between gold and electricity companies’ stock prices, as that in Table 5, the hedge ratios are generally lower when investors take a long position in the volatility of gold, whether in the whole period or the crisis periods. However, we do not observe any significant difference in hedging efficiency between these two strategies.

In addition, by comparing Table 4 and Table 5, we find that the optimal hedge ratios of gold are much lower than WTI when commodity assets adopted in our sample are served as a long position. These results highlight that gold is a much cheaper hedging tool compared with WTI. This observation is consistent with Dai et al. [53].

We further assess the optimal portfolio weights and corresponding hedging effectiveness between WTI and these electricity companies, and that between gold and the electricity companies across the whole period and two crisis periods.

Compared to the weights in the whole period, the results shown in Table 6 suggest that the average optimal weights of WTI increased during the Chinese stock market crash period and declined during the COVID-19 period. A similar situation is observed in the portfolios with gold.

Table 6.

Portfolio weights and the corresponding hedging effectiveness.

These are indicative of the fact that international investors should hold more WTI or gold as a safe haven during the collapse of China’s stock market while investing more in the electricity companies’ stocks during the COVID-19 period in their portfolios. The latter finding agrees with Zhu et al. [78] and may be attributable to the fact that the Chinese economy is the first to restore though it is also the first to be hit by COVID-19.

Regarding the two commodities selected in this paper, the average weights of gold in the optimal portfolio always exceed 50%. These findings are consistent with those of Morema and Bonga-Bonga [42], reflecting the investors’ preference for gold to stocks in an optimal portfolio.

However, from the perspective of hedging effectiveness, the results reveal that the hedging effectiveness of the WTI-stock pair is generally higher than the gold-stock pair whether in the whole period or the two sub-periods. As illustrated in Table 6, the hedging effectiveness of WTI-stock pair ranges from a minimum of 54.225% to a maximum of 77.132%, while the hedging effectiveness of gold-stock pair ranges from 4.296% to 10.758%. The same is true during the crisis in our sample period. The minimum and maximum values of the hedging effectiveness of the WTI-stock pair during the 2015 Chinese stock market crash and the COVID-19 are 3.652%, 49.211% and 79.652%, 95.311%, respectively, which are much higher than the hedging effectiveness of the gold-stock pair. In addition, we can also see the results from Table 4, Table 5 and Table 6 that most optimal weights strategies provide better hedging effectiveness than hedging strategies during our sample period. Therefore, the empirical analysis considered up to now reveals that on average during our sample period, the optimal weights strategy is relatively better and investors should invest more in WTI crude oil than gold in the portfolio of commodity and electricity company stocks.

6. Conclusions

This paper estimates the volatility spillover effects and dynamic relationship among WTI, gold, and the Chinese electricity stock market from the perspective of the firm level. We calculate the optimal hedge ratios and portfolio weights between the analyzed commodities and electricity companies’ stocks, as well as the hedging effectiveness. In particular, this paper also highlights the implications of the crisis on the volatility spillover and diversification strategies. We further analyze the spillover effects in two sub-periods, including China’s stock market crash period and the COVID-19 period.

The main findings of this paper can be concluded as follows. First of all, a time-varying correlation between the volatility of commodity assets (including crude oil and gold) and the analyzed electricity companies’ stock prices can be observed. The correlations are not high in normal circumstances, indicating portfolio diversification is feasible. In addition, unlike WTI, although the correlations between gold and the stock prices of these companies are also vulnerable to extreme events such as the COVID-19 pandemic, the correlations are relatively weak and show different trends during the crash of China’s stock market.

Secondly, by comparing the static volatility spillovers in different periods, the preliminary result suggests that the crisis tends to increase total spillover effects, which is also confirmed by the results of the dynamic time-varying spillover index. Additionally, even though WTI and gold are net volatility receivers both throughout the whole period and during the crisis, it is notable that the impact of the crisis on spillover effects varies due to the feature of the crisis and the characteristics of the analyzed series. Concretely, volatility spillovers for both commodity assets and electricity companies’ stocks increased significantly in the period of COVID-19, while in the stock market crash period, only electricity companies’ stocks increase the intensity of volatility spillover transmitted to WTI. More interestingly, we find that larger electricity companies tend to be net transmitters excepting the HPI, and some small electricity companies transmit more volatility spillover to WTI in the market crash period.

Thirdly, we calculate the optimal hedge ratios and the hedging effectiveness in different periods. The values of optimal hedge ratios are relatively low when WTI is taken as a short position, except during periods of stock market crashes. However, most values of hedging effectiveness of WTI hedging against electricity companies’ stocks are negative, especially during the COVID-19 pandemic, indicating that the strategy of WTI served as a short position would not be preferred. Gold is a much cheaper hedging tool compared with WTI, and the hedge ratios are generally lower when investors take a long position in the volatility of gold.

Finally, we assess the optimal portfolio weights and the results show that the average weights for gold in the optimal portfolio always exceed 50%, reflecting the investors’ preference for gold. In addition, compared to the whole period, the optimal weights of gold increased during the stock market crash period and declined during the COVID-19 period. Notably, the results for WTI are similar, but the hedging effectiveness of the WTI-stock pair is generally higher compared to the gold-stock pair. Furthermore, from the perspective of hedging effectiveness, most optimal weight strategies provide better hedging effectiveness compared to traditional hedging strategies.

Overall, our findings offer some recommendations for international investors and policymakers. The diversification strategy consisting of commodity assets and stocks can provide opportunities for international investors to reduce investment risk without reducing profits. It is worth emphasizing that while many investors prefer gold because of its safe-haven properties, gold is not always the best hedging tool, and other commodities such as oil may have better hedging effectiveness in certain circumstances. Moreover, although on average large companies have a greater impact on the market, it does not mean that they are suitable for inclusion in the portfolio strategy. In other words, investors need to dynamically balance their investment strategies with the characteristics of the commodity-stock portfolio and the current economic situation, especially carefully analyzing the underlying causes of market turbulence. As for policymakers, they should monitor the volatility spillover effects between commodity assets and stock markets, and be aware that such spillover effects can be exacerbated by the crisis. Therefore, they should not only guard against the impact of the crisis on the financial markets, but also formulate policies based on the characteristics of the crisis and the source (direction) of the volatility spillover, and implement the energy transition as soon as possible while meeting the country’s growing energy needs.

There are some limitations of this study. First, although this paper has tried to expand the scope of the study as much as possible, due to objective reasons such as the availability of data, some new energy generation companies could not be included in the scope of the study. Therefore, future research could focus on this aspect. Second, this paper only makes a comparative analysis of the sub-samples of China’s stock market crash in 2015 and COVID-19 in 2019. Future research can make further comparisons to more crises or landmark events. Moreover, this paper only analyzes the volatility spillover effects between China’s electricity stock market and the commodity market. In further studies, we hope to expand to other markets and analyze whether these crises have a different impact on other countries. Finally, to provide more useful information for investors with different investment horizons and different levels of risk tolerance, future research can also consider decomposing the spillover effects by frequency.

Author Contributions

Conceptualization, G.W., J.M. and B.M.; investigation, G.W. and J.M.; resources, G.W. and J.M.; writing—original draft preparation, G.W.; writing—review and editing, J.M. and B.M.; project administration, J.M. and B.M.; funding acquisition, J.M.; All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the Hunan Provincial Department of Education (21B0813) and the National Natural Science Foundation of China (72202046).

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Han, L.; Kordzakhia, N.; Trück, S. Volatility spillovers in Australian electricity markets. Energy Econ. 2020, 90, 104782. [Google Scholar] [CrossRef]

- Zhang, S.; Andrews-Speed, P.; Li, S. To what extent will China’s ongoing electricity market reforms assist the integration of renewable energy? Energy Policy 2018, 114, 165–172. [Google Scholar] [CrossRef]

- Li, Z.; Zou, F.; Mo, B. Does mandatory CSR disclosure affect enterprise total factor productivity? Ekon. Istraz. 2022, 35, 4902–4921. [Google Scholar] [CrossRef]

- Lin, J.; Kahrl, F.; Yuan, J.; Chen, Q.; Liu, X. Economic and carbon emission impacts of electricity market transition in China: A case study of Guangdong Province. Appl. Energy 2019, 238, 1093–1107. [Google Scholar] [CrossRef]

- Zheng, X.; Menezes, F.; Nepal, R. In between the state and the market: An empirical assessment of the early achievements of China’s 2015 electricity reform. Energy Econ. 2021, 93, 105003. [Google Scholar] [CrossRef]

- Mo, B.; Li, Z.; Meng, J. The dynamics of carbon on green energy equity investment: Quantile-on-quantile and quantile coherency approaches. Environ. Sci. Pollut. Res. 2022, 29, 5912–5922. [Google Scholar] [CrossRef]

- Liu, L. The Driving Force of CO2 Reduction in China’s Industries. Financ. Econ. Lett. 2022, 1, 33–39. [Google Scholar] [CrossRef]

- Zhao, X.; Zhong, Z.; Gan, C.; Yan, F.; Zhang, S. What is the appropriate pricing mechanism for China’s renewable energy in a new era? Comput. Ind. Eng. 2022, 163, 107830. [Google Scholar] [CrossRef]

- Gohli, H. High-voltage steering: China’s energy market reforms, industrial policy tools and the 2021 electricity crisis. Energy Res. Soc. Sci. 2022, 93, 102851. [Google Scholar] [CrossRef]

- Liu, H.; Zhang, Z.; Chen, Z.-M.; Dou, D. The impact of China’s electricity price deregulation on coal and power industries: Two-stage game modeling. Energy Policy 2019, 134, 110957. [Google Scholar] [CrossRef]

- Nardo, M.; Ossola, E.; Papanagiotou, E. Financial integration in the EU28 equity markets: Measures and drivers. J. Financ. Mark. 2022, 57, 100633. [Google Scholar] [CrossRef]

- Mensi, W.; Yousaf, I.; Vo, X.V.; Kang, S.H. Asymmetric spillover and network connectedness between gold, BRENT oil and EU subsector markets. J. Int. Financ. Mark. Inst. Money 2022, 76, 101487. [Google Scholar] [CrossRef]

- Jin, J.; Yu, J.; Hu, Y.; Shang, Y. Which one is more informative in determining price movements of hedging assets? Evidence from Bitcoin, gold and crude oil markets. Phys. A Stat. Mech. Its Appl. 2019, 527, 121121. [Google Scholar] [CrossRef]

- Adekoya, O.B.; Oliyide, J.A.; Oduyemi, G.O. How COVID-19 upturns the hedging potentials of gold against oil and stock markets risks: Nonlinear evidences through threshold regression and markov-regime switching models. Resour. Policy 2021, 70, 101926. [Google Scholar] [CrossRef]

- Dutta, A.; Das, D.; Jana, R.; Vo, X.V. COVID-19 and oil market crash: Revisiting the safe haven property of gold and Bitcoin. Resour. Policy 2020, 69, 101816. [Google Scholar] [CrossRef]

- Basher, S.A.; Sadorsky, P. Hedging emerging market stock prices with oil, gold, VIX, and bonds: A comparison between DCC, ADCC and GO-GARCH. Energy Econ. 2016, 54, 235–247. [Google Scholar] [CrossRef]

- Xu, S.; Du, Z.; Zhang, H. Can Crude Oil Serve as a Hedging Asset for Underlying Securities?—Research on the Heterogenous Correlation between Crude Oil and Stock Index. Energies 2020, 13, 3139. [Google Scholar] [CrossRef]

- Kang, S.; Hernandez, J.A.; Sadorsky, P.; McIver, R. Frequency spillovers, connectedness, and the hedging effectiveness of oil and gold for US sector ETFs. Energy Econ. 2021, 99, 105278. [Google Scholar] [CrossRef]

- Naeem, M.A.; Hasan, M.; Arif, M.; Suleman, M.T.; Kang, S.H. Oil and gold as a hedge and safe-haven for metals and agricultural commodities with portfolio implications. Energy Econ. 2022, 105, 105758. [Google Scholar] [CrossRef]

- Engle, R. Dynamic conditional correlation: A simple class of multivariate generalized autoregressive conditional heteroskedasticity models. J. Bus. Econ. Stat. 2002, 20, 339–350. [Google Scholar] [CrossRef]

- Hassan, K.; Hoque, A.; Gasbarro, D. Separating BRIC using Islamic stocks and crude oil: Dynamic conditional correlation and volatility spillover analysis. Energy Econ. 2019, 80, 950–969. [Google Scholar] [CrossRef]

- Diebold, F.X.; Yilmaz, K. Better to give than to receive: Predictive directional measurement of volatility spillovers. Int. J. Forecast. 2012, 28, 57–66. [Google Scholar] [CrossRef]

- Wen, F.; Cao, J.; Liu, Z.; Wang, X. Dynamic volatility spillovers and investment strategies between the Chinese stock market and commodity markets. Int. Rev. Financ. Anal. 2021, 76, 101772. [Google Scholar] [CrossRef]

- Antonakakis, N.; Cunado, J.; Filis, G.; Gabauer, D.; De Gracia, F.P. Oil volatility, oil and gas firms and portfolio diversification. Energy Econ. 2018, 70, 499–515. [Google Scholar] [CrossRef]

- Dai, Z.; Zhu, H. Time-varying spillover effects and investment strategies between WTI crude oil, natural gas and Chinese stock markets related to belt and road initiative. Energy Econ. 2022, 108, 105883. [Google Scholar] [CrossRef]

- Thanh, T.T.; Linh, V.M. An exploration of sources of volatility in the energy market: An application of a TVP-VAR extended joint connected approach. Sustain. Energy Technol. Assess. 2022, 53, 102448. [Google Scholar]

- Souhir, B.A.; Heni, B.; Lotfi, B. Price risk and hedging strategies in Nord Pool electricity market evidence with sector indexes. Energy Econ. 2019, 80, 635–655. [Google Scholar] [CrossRef]

- Diebold, F.X.; Yılmaz, K. On the network topology of variance decompositions: Measuring the connectedness of financial firms. J. Econ. 2014, 182, 119–134. [Google Scholar] [CrossRef]

- Ji, Q.; Zhang, D.; Geng, J.-B. Information linkage, dynamic spillovers in prices and volatility between the carbon and energy markets. J. Clean. Prod. 2018, 198, 972–978. [Google Scholar] [CrossRef]

- Ji, Q.; Xia, T.; Liu, F.; Xu, J.-H. The information spillover between carbon price and power sector returns: Evidence from the major European electricity companies. J. Clean. Prod. 2019, 208, 1178–1187. [Google Scholar] [CrossRef]

- Naeem, M.A.; Peng, Z.; Suleman, M.T.; Nepal, R.; Shahzad, S.J.H. Time and frequency connectedness among oil shocks, electricity and clean energy markets. Energy Econ. 2020, 91, 104914. [Google Scholar] [CrossRef]

- Liu, T.; He, X.; Nakajima, T.; Hamori, S. Influence of fluctuations in fossil fuel commodities on electricity markets: Evidence from spot and futures markets in Europe. Energies 2020, 13, 1900. [Google Scholar] [CrossRef]

- Zhang, W.; He, X.; Nakajima, T.; Hamori, S. How does the spillover among natural gas, crude oil, and electricity utility stocks change over time? Evidence from North America and Europe. Energies 2020, 13, 727. [Google Scholar] [CrossRef]

- Guo, H.; Davidson, M.R.; Chen, Q.; Zhang, D.; Jiang, N.; Xia, Q.; Kang, C.; Zhang, X. Power market reform in China: Motivations, progress, and recommendations. Energy Policy 2020, 145, 111717. [Google Scholar] [CrossRef]

- Xin-gang, Z.; Shu-ran, H. Does market-based electricity price affect China’s energy efficiency? Energy Econ. 2020, 91, 104909. [Google Scholar] [CrossRef]

- Wang, Z.; Gao, X.; An, H.; Tang, R.; Sun, Q. Identifying influential energy stocks based on spillover network. Int. Rev. Financ. Anal. 2020, 68, 101277. [Google Scholar] [CrossRef]

- Si, D.-K.; Li, X.-L.; Xu, X.; Fang, Y. The risk spillover effect of the COVID-19 pandemic on energy sector: Evidence from China. Energy Econ. 2021, 102, 105498. [Google Scholar] [CrossRef]

- Vardar, G.; Coşkun, Y.; Yelkenci, T. Shock transmission and volatility spillover in stock and commodity markets: Evidence from advanced and emerging markets. Eurasian Econ. Rev. 2018, 8, 231–288. [Google Scholar] [CrossRef]

- Ali, S.; Bouri, E.; Czudaj, R.L.; Shahzad, S.J.H. Revisiting the valuable roles of commodities for international stock markets. Resour. Policy 2020, 66, 101603. [Google Scholar] [CrossRef]

- Ahmed, A.D.; Huo, R. Volatility transmissions across international oil market, commodity futures and stock markets: Empirical evidence from China. Energy Econ. 2021, 93, 104741. [Google Scholar] [CrossRef]

- Reboredo, J.C.; Ugolini, A.; Hernandez, J.A. Dynamic spillovers and network structure among commodity, currency, and stock markets. Resour. Policy 2021, 74, 102266. [Google Scholar] [CrossRef]

- Morema, K.; Bonga-Bonga, L. The impact of oil and gold price fluctuations on the South African equity market: Volatility spillovers and financial policy implications. Resour. Policy 2020, 68, 101740. [Google Scholar] [CrossRef]

- Maitra, D.; Chandra, S.; Dash, S.R. Liner shipping industry and oil price volatility: Dynamic connectedness and portfolio diversification. Transp. Res. Part E Logist. Transp. Rev. 2020, 138, 101962. [Google Scholar] [CrossRef]

- Shahzad, S.J.H.; Naeem, M.A.; Peng, Z.; Bouri, E. Asymmetric volatility spillover among Chinese sectors during COVID-19. Int. Rev. Financ. Anal. 2021, 75, 101754. [Google Scholar] [CrossRef]

- Awan, T.M.; Khan, M.S.; Haq, I.U.; Kazmi, S. Oil and stock markets volatility during pandemic times: A review of G7 countries. Green Financ. 2021, 3, 15–27. [Google Scholar] [CrossRef]

- Wu, Y.; Ma, S. Impact of COVID-19 on energy prices and main macroeconomic indicators—evidence from China’s energy market. Green Financ. 2021, 3, 383–402. [Google Scholar] [CrossRef]

- Jareño, F.; González Pérez, M.d.l.O.; Belmonte, P. Asymmetric interdependencies between cryptocurrency and commodity markets: The COVID-19 pandemic impact. Quant. Financ. Econ. 2022, 6, 83–112. [Google Scholar] [CrossRef]

- Gates, B. Responding to COVID-19—A once-in-a-century pandemic? N. Engl. J. Med. 2020, 382, 1677–1679. [Google Scholar] [CrossRef]

- Norouzi, N.; de Rubens, G.Z.; Choupanpiesheh, S.; Enevoldsen, P. When pandemics impact economies and climate change: Exploring the impacts of COVID-19 on oil and electricity demand in China. Energy Res. Soc. Sci. 2020, 68, 101654. [Google Scholar] [CrossRef]

- Hosseini, S.E. An outlook on the global development of renewable and sustainable energy at the time of COVID-19. Energy Res. Soc. Sci. 2020, 68, 101633. [Google Scholar] [CrossRef]

- Zhang, H.; Chen, J.; Shao, L. Dynamic spillovers between energy and stock markets and their implications in the context of COVID-19. Int. Rev. Financ. Anal. 2021, 77, 101828. [Google Scholar] [CrossRef]

- Zhang, H.; Jin, C.; Bouri, E.; Gao, W.; Xu, Y. Realized higher-order moments spillovers between commodity and stock markets: Evidence from China. J. Commod. Mark. 2022, 100275. [Google Scholar] [CrossRef]

- Dai, Z.; Zhu, H.; Zhang, X. Dynamic spillover effects and portfolio strategies between crude oil, gold and Chinese stock markets related to new energy vehicle. Energy Econ. 2022, 109, 105959. [Google Scholar] [CrossRef]

- Zhu, J.; Song, Q.; Streimikiene, D. Multi-Time Scale Spillover Effect of International Oil Price Fluctuation on China’s Stock Markets. Energies 2020, 13, 4641. [Google Scholar] [CrossRef]

- Bouri, E.; Chen, Q.; Lien, D.; Lv, X. Causality between oil prices and the stock market in China: The relevance of the reformed oil product pricing mechanism. Int. Rev. Econ. Financ. 2017, 48, 34–48. [Google Scholar] [CrossRef]

- Mensi, W.; Vo, X.V.; Kang, S.H. Precious metals, oil, and ASEAN stock markets: From global financial crisis to global health crisis. Resour. Policy 2021, 73, 102221. [Google Scholar] [CrossRef]

- Wang, H.; Li, S. Asymmetric volatility spillovers between crude oil and China’s financial markets. Energy 2021, 233, 121168. [Google Scholar] [CrossRef]

- Peng, X. Do precious metals act as hedges or safe havens for China’s financial markets? Financ. Res. Lett. 2020, 37, 101353. [Google Scholar] [CrossRef]

- Zhang, Y.; Wang, M.; Xiong, X.; Zou, G. Volatility spillovers between stock, bond, oil, and gold with portfolio implications: Evidence from China. Financ. Res. Lett. 2021, 40, 101786. [Google Scholar] [CrossRef]

- Bouri, E.; Roubaud, D.; Jammazi, R.; Assaf, A. Uncovering frequency domain causality between gold and the stock markets of China and India: Evidence from implied volatility indices. Financ. Res. Lett. 2017, 23, 23–30. [Google Scholar] [CrossRef]

- Hsiao, C.Y.-L.; Lin, W.; Wei, X.; Yan, G.; Li, S.; Sheng, N. The impact of international oil prices on the stock price fluctuations of China’s renewable energy enterprises. Energies 2019, 12, 4630. [Google Scholar] [CrossRef]

- Qu, F.; Chen, Y.; Zheng, B. Is new energy driven by crude oil, high-tech sector or low-carbon notion? New evidence from high-frequency data. Energy 2021, 230, 120770. [Google Scholar] [CrossRef]

- Kroner, K.F.; Sultan, J. Time-varying distributions and dynamic hedging with foreign currency futures. J. Financ. Quant. Anal. 1993, 28, 535–551. [Google Scholar] [CrossRef]

- Kroner, K.F.; Ng, V.K. Modeling asymmetric comovements of asset returns. Rev. Financ. Stud. 1998, 11, 817–844. [Google Scholar] [CrossRef]

- Ku, Y.-H.H.; Chen, H.-C.; Chen, K.-H. On the application of the dynamic conditional correlation model in estimating optimal time-varying hedge ratios. Appl. Econ. Lett. 2007, 14, 503–509. [Google Scholar] [CrossRef]

- Chang, C.-L.; McAleer, M.; Tansuchat, R. Crude oil hedging strategies using dynamic multivariate GARCH. Energy Econ. 2011, 33, 912–923. [Google Scholar] [CrossRef]

- Li, Z.; Ao, Z.; Mo, B. Revisiting the valuable roles of global financial assets for international stock markets: Quantile coherence and causality-in-quantiles approaches. Mathematics 2021, 9, 1750. [Google Scholar] [CrossRef]

- Li, Z.; Mo, B.; Nie, H. Time and frequency dynamic connectedness between cryptocurrencies and financial assets in China. Int. Rev.Econ. Financ. 2023. [Google Scholar] [CrossRef]

- Assifuah-Nunoo, E.; Junior, P.O.; Adam, A.M.; Bossman, A. Assessing the safe haven properties of oil in African stock markets amid the COVID-19 pandemic: A quantile regression analysis. Quant. Financ. Econ. 2022, 6, 244–269. [Google Scholar] [CrossRef]

- Li, Z.; Chen, L.; Dong, H. What are bitcoin market reactions to its-related events? Int. Rev.Econ. Financ. 2021, 73, 1–10. [Google Scholar] [CrossRef]

- Li, Z.; Chen, H.; Mo, B. Can digital finance promote urban innovation? Evidence from China. Borsa Istanb. Rev. 2022. [Google Scholar] [CrossRef]

- Ming, Z.; Song, X.; Lingyun, L.; Yuejin, W.; Yang, W.; Ying, L. China’s large-scale power shortages of 2004 and 2011 after the electricity market reforms of 2002: Explanations and differences. Energy Policy 2013, 61, 610–618. [Google Scholar] [CrossRef]

- Zhao, S.; Chen, X.; Zhang, J. The systemic risk of China’s stock market during the crashes in 2008 and 2015. Phys. A Stat. Mech. Its Appl. 2019, 520, 161–177. [Google Scholar] [CrossRef]

- Li, J.; Liu, R.; Yao, Y.; Xie, Q. Time-frequency volatility spillovers across the international crude oil market and Chinese major energy futures markets: Evidence from COVID-19. Resour. Policy 2022, 77, 102646. [Google Scholar] [CrossRef]

- Engle, R.F. Autoregressive conditional heteroscedasticity with estimates of the variance of United Kingdom inflation. Econometrica 1982, 50, 987–1007. [Google Scholar] [CrossRef]

- Choi, S.-Y. Analysis of stock market efficiency during crisis periods in the US stock market: Differences between the global financial crisis and COVID-19 pandemic. Phys. A Stat. Mech. Its Appl. 2021, 574, 125988. [Google Scholar] [CrossRef]

- Ferrer, R.; Shahzad, S.J.H.; López, R.; Jareño, F. Time and frequency dynamics of connectedness between renewable energy stocks and crude oil prices. Energy Econ. 2018, 76, 1–20. [Google Scholar] [CrossRef]

- Zhu, P.; Tang, Y.; Wei, Y.; Lu, T. Multidimensional risk spillovers among crude oil, the US and Chinese stock markets: Evidence during the COVID-19 epidemic. Energy 2021, 231, 120949. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).