Decision Analysis on the Financial Performance of Companies Using Integrated Entropy-Fuzzy TOPSIS Model

Abstract

1. Introduction

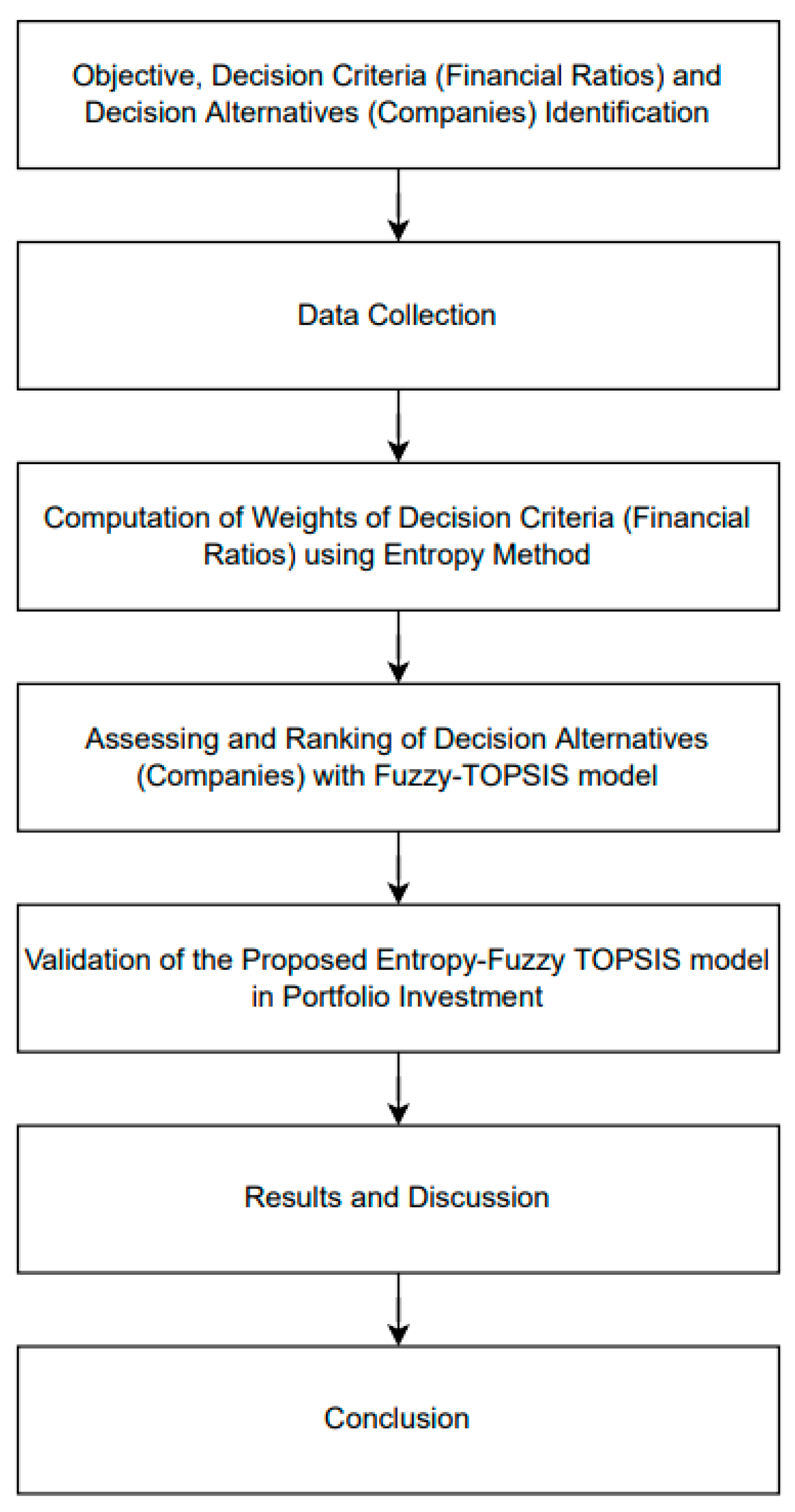

2. Materials and Methods

2.1. Proposed Entropy-Fuzzy TOPSIS Model

2.2. Validation of the Proposed Model in Portfolio Investment

- denotes a parameter representing the target rate of return required by an investor,

- denotes the weight invested in asset j,

- denotes covariance between assets i and j,

- denotes the expected return of asset j per period,

- n denotes the number of assets,

- denotes weight invested in asset i.

- denotes the expected return of asset j per period,

- denotes the weight invested in asset j,

- denotes the portfolio’s mean return.

3. Empirical Results

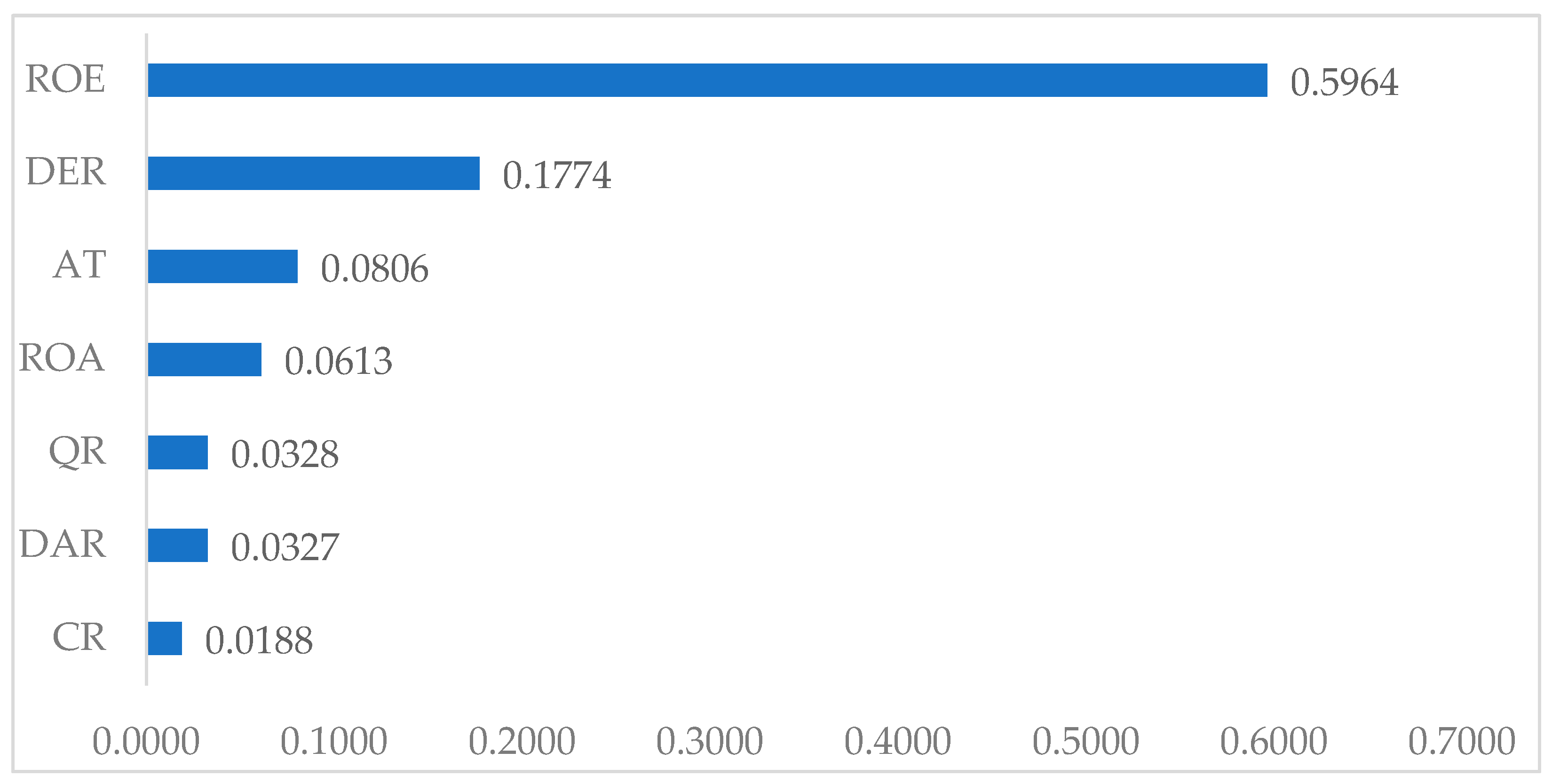

3.1. Priorities of Financial Ratios with Entropy Weight Method

3.2. Financial Performance Evaluation and Ranking of Companies with the Proposed Entropy-Fuzzy TOPSIS Model

3.3. Validation of the Proposed Entropy-Fuzzy TOPSIS Model in Portfolio Investment

4. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Barcellos-Paula, L.; la Vega, I.D.; Gil-Lafuente, A.M. The quintuple helix of innovation model and the SDGs: Latin-American countries’ case and its forgotten effects. Mathematics 2021, 9, 416. [Google Scholar] [CrossRef]

- Lafuente-Lechuga, M.; Cifuentes-Faura, J.; Faura-Martínez, U. Sustainability, Big Data and Mathematical Techniques: A Bibliometric Review. Mathematics 2021, 9, 2557. [Google Scholar] [CrossRef]

- Safitri, Y.; Ningsih, R.D.; Agustianingsih, D.P.; Sukhwani, V.; Kato, A.; Shaw, R. COVID-19 Impact on SDGs and the Fiscal Measures: Case of Indonesia. Int. J. Environ. Res. Public Health 2021, 18, 2911. [Google Scholar] [CrossRef] [PubMed]

- Suriyankietkaew, S.; Nimsai, S. COVID-19 impacts and sustainability strategies for regional recovery in Southeast Asia: Challenges and opportunities. Sustainability 2021, 13, 8907. [Google Scholar] [CrossRef]

- International Monetary Fund. Fiscal Monitor: Policy for the Recovery. Washington, WA, USA, 2020. Available online: https://www.imf.org/en/Publications/FM/Issues/2020/09/30/october-2020-fiscal-monitor (accessed on 25 December 2021).

- Sachs, J.; Schmidt-Traub, G.; Kroll, C.; Lafortune, G.; Fuller, G.; Woelm, F. The Sustainable Development Goals and COVID-19. In Sustainable Development Report 2020; Cambridge University Press: Cambridge, UK, 2020; Available online: https://s3.amazonaws.com/sustainabledevelopment.report/2020/2020_sustainable_development_report.pdf (accessed on 25 December 2021).

- Donthu, N.; Gustafsson, A. Effects of COVID-19 on business and research. J. Bus. Res. 2020, 117, 284–289. [Google Scholar] [CrossRef]

- Nikkei Asia. Dow Closes Down 430 Points on Omicron Fears. 2021. Available online: https://asia.nikkei.com/Business/Markets/Dow-closes-down-430-points-on-omicron-fears (accessed on 25 December 2021).

- Bachman, D. United States Economic Forecast. 2021. Available online: https://www2.deloitte.com/us/en/insights/economy/us-economic-forecast/united-states-outlook-analysis.html (accessed on 25 December 2021).

- Batrancea, L.M. An Econometric Approach on Performance, Assets, and Liabilities in a Sample of Banks from Europe, Israel, United States of America, and Canada. Mathematics 2021, 9, 3178. [Google Scholar] [CrossRef]

- Batrancea, L. The Nexus between Financial Performance and Equilibrium: Empirical Evidence on Publicly Traded Companies from the Global Financial Crisis Up to the COVID-19 Pandemic. J. Risk. Finance. 2021, 14, 218. [Google Scholar] [CrossRef]

- Achim, M.V.; Safta, I.L.; Văidean, V.L.; Mureșan, G.M.; Borlea, N.S. The impact of covid-19 on financial management: Evidence from Romania. Econ. Res.-Ekon. Istraz. 2022, 35, 1807–1832. [Google Scholar] [CrossRef]

- Karim, M.R.; Shetu, S.A.; Razia, S. COVID-19, liquidity and financial health: Empirical evidence from South Asian economy. Asian J. Econ. Bank. 2021, 5, 307–323. [Google Scholar] [CrossRef]

- Mirza, N.; Rahat, B.; Naqvi, B.; Rizvi, S.K.A. Impact of COVID-19 on corporate solvency and possible policy responses in the EU. Q. Rev. Econ. Finance. 2020. [Google Scholar] [CrossRef]

- Zheng, F.; Zhao, Z.; Sun, Y.; Khan, Y.A. Financial performance of China’s listed firms in presence of coronavirus: Evidence from corporate culture and corporate social responsibility. Curr. Psychol. 2021. [Google Scholar] [CrossRef] [PubMed]

- Vito, A.D.; Gómez, J. Estimating the COVID-19 cash crunch: Global evidence and policy. J. Account. Public Policy 2020, 39, 106741. [Google Scholar] [CrossRef]

- Rababah, A.; Al-Haddad, L.; Sial, M.S.; Chunmei, Z.; Cherian, J. Analyzing the effects of COVID-19 pandemic on the financial performance of Chinese listed companies. J. Public Affairs 2020, 20, e2440. [Google Scholar]

- Ali, S.; Talha, N. During COVID-19, impact of subjective and objective financialknowledge and economic insecurity on financial managementbehavior: Mediating role of financial wellbeing. J. Public Affairs 2021, 22, e2789. [Google Scholar]

- Stojić, G.; Stević, Z.; Antuchevićienė, J.; Pamučar, D.; Vasiljević, M. A novel rough WASPAS approach for supplier selection in a company manufacturing PVC carpentry products. Information 2018, 9, 121. [Google Scholar] [CrossRef]

- Shaverdi, M.; Ramezani, I.; Tahmasebi, R.; Rostamy, A.A.A. Combining fuzzy AHP and fuzzy TOPSIS with financial ratios to design a novel performance evaluation model. Int. J. Fuzzy Syst. 2016, 18, 248–262. [Google Scholar] [CrossRef]

- Shaverdi, M.; Heshmati, M.R.; Ramezani, I. Application of fuzzy AHP approach for financial performance evaluation of Iranian petrochemical sector. Procedia Comput. Sci. 2014, 31, 995–1004. [Google Scholar] [CrossRef]

- Monga, R.; Aggrawal, D.; Singh, J. Application of AHP in evaluating the financial performance of industries. In Advances in Mathematics for Industry 4.0, 1st ed.; Ram, M., Ed.; Academic Press: London, UK, 2020; pp. 319–333. [Google Scholar]

- İç, Y.T.; Yurdakul, M.; Pehlivan, E. Development of a hybrid financial performance measurement model using AHP and DOE methods for Turkish commercial banks. Soft Comput. 2021, 26, 2959–2979. [Google Scholar] [CrossRef]

- Chiang, J.; Chiou, C.; Doong, S.; Chang, I. Research on construction of performance indicators for the marketing alliance of catering industry and credit card issuing banks by using the Balanced Scorecard and fuzzy AHP. Sustainability 2020, 12, 9005. [Google Scholar] [CrossRef]

- Bulgurcu, B.K. Application of TOPSIS technique for financial performance evaluation of technology firms in Istanbul Stock Exchange Market. Procedia Soc. Behav. Sci. 2012, 62, 1033–1040. [Google Scholar] [CrossRef]

- Gayathri, C.; Kamala, V.; Gajanand, M.S.; Yamini, S. Analysis of operational and financial performance of ports: An integrated fuzzy DEMATEL-TOPSIS approach. Benchmarking Int. J. 2021, 29, 1046–1066. [Google Scholar] [CrossRef]

- Shannon, C.E. A mathematical theory of communication. Bell Syst. Tech. 1948, 27, 379–423. [Google Scholar] [CrossRef]

- Saraswat, S.K.; Digalwar, A.K. Evaluation of energy alternatives for sustainable development of energy sector in India: An integrated Shannon’s entropy fuzzy multicriteria decision approach. Renew. Energy 2021, 171, 58–74. [Google Scholar] [CrossRef]

- Chodha, V.; Dubey, R.; Kumar, R.; Singh, S.; Kaur, S. Selection of industrial arc welding robot with TOPSIS and Entropy MCDM techniques. Mater. Today Proc. 2022, 50, 709–715. [Google Scholar] [CrossRef]

- Li, J.; Chen, Y.; Yao, X.; Chen, A. Risk management priority assessment of heritage sites in China based on entropy weight and TOPSIS. J. Cult. Herit. 2021, 49, 10–18. [Google Scholar] [CrossRef]

- Yang, W.; Xu, K.; Lian, J.; Ma, C.; Bin, L. Integrated flood vulnerability assessment approach based on TOPSIS and Shannon entropy methods. Ecol. Indic. 2018, 89, 269–280. [Google Scholar] [CrossRef]

- Huang, W.; Shuai, B.; Sun, Y.; Wang, Y.; Antwi, E. Using entropy-TOPSIS method to evaluate urban rail transit system operation performance: The China case. Transp. Res. A 2018, 111, 292–303. [Google Scholar] [CrossRef]

- Zadeh, L.A. Fuzzy sets. Inf. Control. 1965, 8, 338–353. [Google Scholar] [CrossRef]

- Hwang, B. Chapter 3—Methodology. In Performance and Improvement of Green Construction Projects: Management Strategies and Innovations; Butterworth-Heinemann: Oxford, UK, 2018; pp. 15–22. [Google Scholar]

- Nădăban, S.; Dzitac, S.; Dzitac, I. Fuzzy TOPSIS: A general view. Procedia Comput. Sci. 2016, 91, 823–831. [Google Scholar] [CrossRef]

- Sokolović, J.; Stanujkić, D.; Śtirbanović, Z. Selection of process for aluminium separation from waste cables by TOPSIS and WASPAS methods. Miner. Eng. 2021, 173, 107186. [Google Scholar] [CrossRef]

- Shamsuzzoha, A.; Piya, S.; Shamsuzzaman, M. Application of fuzzy TOPSIS framework for selecting complex project in a case company. J. Glob. Oper. Strateg. Sourc. 2021, 14, 528–566. [Google Scholar] [CrossRef]

- Palczewski, K.; Sałabun, W. The fuzzy TOPSIS applications in the last decade. Procedia Comput. Sci. 2019, 159, 2294–2303. [Google Scholar] [CrossRef]

- Sahin, B.; Yip, T.L.; Tseng, P.; Kabak, M.; Soylu, A. An application of a fuzzy TOPSIS multi-criteria decision analysis algorithm for dry bulk carrier selection. Information 2020, 11, 251. [Google Scholar] [CrossRef]

- Kabassi, K.; Botonis, A.; Karydis, C. Evaluating websites of specialized cultural content using fuzzy multi-criteria decision making theories. Informatica 2020, 44, 45–54. [Google Scholar] [CrossRef]

- Sharma, N.K.; Kumar, V.; Verma, P.; Luthra, S. Sustainable reverse logistics practices and performance evaluation with fuzzy TOPSIS: A study on Indian retailers. Clean. Logist. Supply Chain 2021, 1, 100007. [Google Scholar] [CrossRef]

- Korol, T. The implementation of fuzzy logic in forecasting financial ratios. Contemp. Econ. 2017, 12, 165–188. [Google Scholar]

- Leal, M.; Ponce, D.; Puerto, J. Portfolio problems with two levels decision-makers: Optimal portfolio selection with pricing decisions on transaction costs. Eur. J. Oper. Res. 2020, 284, 712–727. [Google Scholar] [CrossRef]

- Lahmiri, S.; Bekiros, S. Nonlinear analysis of Casablanca Stock Exchange, Dow Jones and S&P500 industrial sectors with a comparison. Physica A 2020, 539, 122923. [Google Scholar]

- Kamaludin, K.; Sundarasen, S.; Ibrahim, I. Covid-19, Dow Jones and equity market movement in ASEAN-5 countries: Evidence from wavelet analyses. Heliyon 2021, 7, e05851. [Google Scholar] [CrossRef] [PubMed]

- Plastun, A.; Sibande, X.; Gupta, R.; Wohar, M.E. Evolution of price effects after one-day abnormal returns in the US stock market. N. Am. J. Econ. Finance 2021, 57, 101405. [Google Scholar] [CrossRef]

- González, F.F.; Webb, J.; Sharmina, M.; Hannon, M.; Braunholtz-Speight, T.; Pappas, D. Local energy businesses in the United Kingdom: Clusters and localism determinants based on financial ratios. Energy 2022, 239, 122119. [Google Scholar] [CrossRef]

- Messer, R. Common financial ratios. In Financial Modeling for Decision Making: Using MS-Excel in Accounting and Finance; Emerald Publishing Limited: Bingley, UK, 2020; p. 325. [Google Scholar]

- Batrancea, L. The influence of liquidity and solvency on performance within the healthcare industry: Evidence from publicly listed companies. Mathematics 2021, 9, 2231. [Google Scholar] [CrossRef]

- Horta, I.M.; Camanho, A.S.; da Costa, J.M. Performance assessment of construction companies: A study of factors promoting financial soundness and innovation in the industry. Int. J. Prod. Econ. 2012, 137, 84–93. [Google Scholar] [CrossRef]

- Huang, J.; Wang, H. A data analytics framework for key financial factors. J. Model. Manag. 2016, 12, 178–189. [Google Scholar] [CrossRef]

- Nguyen, L.T.M.; Dinh, P.H. Ex-ante risk management and financial stability during the COVID-19 pandemic: A study of Vietnamese firms. China Finance Rev. Int. 2021, 11, 349–371. [Google Scholar] [CrossRef]

- Wieprow, J.; Gawlik, A. The Use of Discriminant Analysis to Assess the Risk of Bankruptcy of Enterprises in Crisis Conditions Using the Example of the Tourism Sector in Poland. Risks 2021, 9, 78. [Google Scholar] [CrossRef]

- Zorn, A.; Esteves, M.; Baur, I.; Lips, M. Financial Ratios as Indicators of Economic Sustainability: A Quantitative Analysis for Swiss Dairy Farms. Sustainability 2018, 10, 2942. [Google Scholar] [CrossRef]

- Lee, P.T.; Lin, C.; Shin, S. Financial performance evaluation of shipping companies using entropy and grey relation analysis. In Multi-Criteria Decision Making in Maritime Studies and Logistics; Lee, P., Yang, Z., Eds.; Springer International Publishing: New York, NY, USA, 2018; pp. 219–247. [Google Scholar]

- Yadav, S.K.; Dharani, M. Prioritizing of banking firms in India using entropy-TOPSIS method. Int. J. Bus. Innov. Res. 2019, 20, 554–570. [Google Scholar] [CrossRef]

- Li, Z.; Luo, Z.; Wang, Y.; Fan, G.; Zhang, J. Suitability evaluation system for the shallow geothermal energy implementation in region by Entropy Weight Method and TOPSIS method. Renew. Energy 2022, 184, 564–576. [Google Scholar] [CrossRef]

- Chen, P. Effects of the entropy weight on TOPSIS. Expert Syst. Appl. 2021, 168, 114186. [Google Scholar] [CrossRef]

- Mavi, R.K.; Goh, M.; Mavi, N.K. Supplier selection with Shannon entropy and fuzzy TOPSIS in the context of supply chain risk management. Procedia Soc. Behav. Sci. 2016, 235, 216–225. [Google Scholar] [CrossRef]

- Chen, C.T. Extensions of the TOPSIS for group decision-making under fuzzy environment. Fuzzy Sets Syst. 2000, 114, 1–9. [Google Scholar] [CrossRef]

- Solangi, Y.A.; Cheng, L.; Shah, S.A.A. Assessing and overcoming the renewable energy barriers for sustainable development in Pakistan: An integrated AHP and fuzzy TOPSIS approach. Renew. Energy 2021, 173, 209–222. [Google Scholar] [CrossRef]

- Emovon, I.; Aibuedefe, W.O. Fuzzy TOPSIS application in materials analysis for economic production of cashew juice extractor. Fuzzy Inf. Eng. 2020, 12, 1–18. [Google Scholar] [CrossRef]

- Mathangi, S.; Maran, J.P. Sensory evaluation of apple ber using fuzzy TOPSIS. Mater. Today Proc. 2021, 45, 2982–2986. [Google Scholar] [CrossRef]

- Liu, P. An extended TOPSIS method for multiple attribute group decision making based on generalized interval-valued trapezoidal fuzzy numbers. Informatica 2011, 35, 185–196. [Google Scholar]

- Markowitz, H. Mean–variance approximations to expected utility. Eur. J. Oper. Res. 2014, 234, 346–355. [Google Scholar] [CrossRef]

- Tayali, H.A.; Tolun, S. Dimension reduction in mean-variance portfolio optimization. Expert Syst. Appl. 2018, 92, 161–169. [Google Scholar] [CrossRef]

- Huang, X. Mean–variance models for portfolio selection subject to experts’ estimations. Expert Syst. Appl. 2012, 39, 5887–5893. [Google Scholar] [CrossRef]

- Pinasthika, N.; Surya, B.A. Optimal portfolio analysis with risk-free assets using index-tracking and Markowitz mean-variance portfolio optimization model. J. Bus. Manag. 2014, 3, 737–751. [Google Scholar]

- Spaseski, N. Portfolio management: Mean-variance analysis in the US asset market. Eur. J. Bus. Soc. Sci. 2014, 3, 242–248. [Google Scholar]

- Markowitz, H.M. Foundations of portfolio theory. J. Financ. 1991, 46, 469–477. [Google Scholar] [CrossRef]

- Markowitz, H. Portfolio selection. J. Financ. 1952, 7, 77–91. [Google Scholar]

- Xiao, H.; Ren, T.; Zhou, Z. Time-consistent strategies for the generalized multiperiod mean-variance portfolio optimization considering benchmark orientation. Mathematics 2019, 7, 723. [Google Scholar] [CrossRef]

- Lefebvre, W.; Loeper, G.; Pham, H. Mean-variance portfolio selection with tracking error penalization. Mathematics 2020, 8, 1915–1937. [Google Scholar] [CrossRef]

- Aljinović, Z.; Marasović, B.; Šestanović, T. Cryptocurrency portfolio selection—A multicriteria approach. Mathematics 2021, 9, 1677–1697. [Google Scholar] [CrossRef]

- Fernandez-Navarro, F.; Martinez-Nieto, L.; Carbonero-Ruz, M.; Montero-Romero, T. Mean squared variance portfolio: A mixed-integer linear programming formulation. Mathematics 2021, 9, 223. [Google Scholar] [CrossRef]

- Park, H. Modified mean-variance risk measures for long-term portfolios. Mathematics 2021, 9, 111. [Google Scholar] [CrossRef]

- Corsaro, S.; De Simone, V.; Marino, Z.; Scognamiglio, S. l1-Regularization in portfolio selection with machine learning. Mathematics 2022, 10, 540. [Google Scholar] [CrossRef]

- Novais, R.G.; Wanke, P.; Antunes, J.; Tan, Y. Portfolio optimization with a mean-entropy-mutual information model. Entropy 2022, 24, 369. [Google Scholar] [CrossRef]

- Bodie, Z.; Kane, A.; Marcus, A. Investments, 12th ed.; McGraw-Hill: New York, NY, USA, 2021. [Google Scholar]

| Hierarchy | Description | ||

|---|---|---|---|

| Objective | Assessment and Ranking of the Financial Performances of Companies under DJIA | ||

| Decision Criteria | Current Ratio (CR) Quick Ratio (QR) Debt-to-Equity Ratio (DER) Debt-to-Assets Ratio (DAR) Asset Turnover (AT) Return on Asset (ROA) Return on Equity (ROE) | ||

| Decision Alternatives | AXP AMGN AAPL BA CAT CSCO CVX GS HD HON | IBM INTC JNJ KO JPM MCD MMM MRK MSFT NKE | PG TRV UNH CRM VZ V WBA WMT DIS DOW |

| Linguistic Terms | TFNs |

|---|---|

| Very low | 1, 1, 3 |

| Low | 1, 3, 5 |

| Medium | 3, 5, 7 |

| High | 5, 7, 9 |

| Very high | 7, 9, 9 |

| Companies | CR | QR | DER | DAR | AT | ROA | ROE |

|---|---|---|---|---|---|---|---|

| MMM | 1.7400 | 1.2100 | 134.4386 | 38.3543 | 0.8386 | 13.8314 | 46.3529 |

| AXP | 1.1347 | 1.1347 | 257.5771 | 30.3486 | 0.1673 | 3.2200 | 26.5114 |

| AMGN | 3.0971 | 2.8086 | 256.5757 | 48.6843 | 0.3471 | 10.8200 | 49.4629 |

| AAPL | 1.2629 | 1.2271 | 115.2043 | 30.5629 | 0.8043 | 18.1143 | 63.9543 |

| BA | 1.2271 | 0.3586 | 1329.2100 | 21.0657 | 0.7671 | 2.1971 | 459.5800 |

| CAT | 1.3829 | 0.9800 | 253.5143 | 47.2471 | 0.6043 | 4.8886 | 26.2443 |

| CVX | 1.1529 | 0.9314 | 25.5686 | 14.8700 | 0.5257 | 2.2371 | 3.8286 |

| CSCO | 2.3329 | 2.2757 | 48.2171 | 21.1129 | 0.4557 | 9.7943 | 22.5071 |

| KO | 1.1343 | 1.0000 | 203.8743 | 50.3757 | 0.4314 | 8.4271 | 35.9286 |

| DOW | 1.8500 | 1.3250 | 97.3975 | 25.7400 | 0.7033 | 3.3433 | 14.1867 |

| GS | 1.1002 | 1.1002 | 435.3043 | 39.2800 | 0.0474 | 1.0057 | 11.8657 |

| HD | 1.2171 | 0.3671 | 810.5420 | 55.6857 | 2.2414 | 20.1857 | 2932.2020 |

| HON | 1.3257 | 1.0786 | 93.5800 | 29.1529 | 0.6686 | 9.3443 | 29.0271 |

| IBM | 1.1357 | 1.0929 | 272.6314 | 38.0429 | 0.5557 | 7.3100 | 54.6171 |

| INTC | 1.8657 | 1.5014 | 38.5686 | 22.0929 | 0.5400 | 13.3329 | 23.1929 |

| JNJ | 1.6200 | 1.3543 | 45.9986 | 18.8486 | 0.5200 | 10.2650 | 25.0067 |

| JPM | 1.1050 | 1.1050 | 195.3814 | 18.5686 | 0.0396 | 1.1443 | 12.7429 |

| MCD | 1.6629 | 1.6443 | 340.3300 | 76.9371 | 0.5857 | 14.4514 | 118.6800 |

| MRK | 1.3371 | 1.0800 | 85.3800 | 29.6357 | 0.4529 | 6.5629 | 18.8200 |

| MSFT | 2.5386 | 2.5000 | 72.3214 | 26.8100 | 0.4843 | 12.9114 | 34.0871 |

| NKE | 2.5714 | 1.7586 | 48.5114 | 17.7286 | 1.5000 | 16.1900 | 36.4957 |

| PG | 0.8729 | 0.7043 | 60.3671 | 25.9871 | 0.5614 | 8.1900 | 18.8129 |

| CRM | 0.9786 | 0.9792 | 27.0286 | 11.7143 | 0.4929 | 1.8514 | 3.1914 |

| TRV | 1.3065 | 1.3065 | 26.2729 | 6.1457 | 0.2838 | 2.6986 | 11.3929 |

| UNH | 1.5156 | 1.5156 | 72.0386 | 24.2114 | 1.5049 | 7.6743 | 22.6257 |

| VZ | 0.9100 | 0.8650 | 271.4600 | 42.2200 | 0.4786 | 6.3843 | 50.7843 |

| V | 1.7543 | 1.7551 | 46.2486 | 21.9929 | 0.3029 | 14.1786 | 30.5643 |

| WBA | 0.9600 | 0.5214 | 61.7471 | 22.5371 | 1.7414 | 5.0429 | 12.5686 |

| WMT | 0.8686 | 0.2686 | 59.2043 | 22.7214 | 2.3871 | 6.2714 | 16.4629 |

| DIS | 1.0129 | 0.9414 | 49.9386 | 24.2100 | 0.5100 | 7.1771 | 14.2443 |

| Companies | CR | QR | DER | DAR | AT | ROA | ROE |

|---|---|---|---|---|---|---|---|

| MMM | 0.0396 | 0.0330 | 0.0230 | 0.0425 | 0.0389 | 0.0555 | 0.0110 |

| AXP | 0.0258 | 0.0309 | 0.0441 | 0.0336 | 0.0078 | 0.0129 | 0.0063 |

| AMGN | 0.0704 | 0.0765 | 0.0440 | 0.0539 | 0.0161 | 0.0434 | 0.0117 |

| AAPL | 0.0287 | 0.0334 | 0.0197 | 0.0339 | 0.0373 | 0.0727 | 0.0151 |

| BA | 0.0279 | 0.0098 | 0.2278 | 0.0233 | 0.0356 | 0.0088 | 0.1088 |

| CAT | 0.0314 | 0.0267 | 0.0435 | 0.0523 | 0.0280 | 0.0196 | 0.0062 |

| CVX | 0.0262 | 0.0254 | 0.0044 | 0.0165 | 0.0244 | 0.0090 | 0.0009 |

| CSCO | 0.0531 | 0.0620 | 0.0083 | 0.0234 | 0.0212 | 0.0393 | 0.0053 |

| KO | 0.0258 | 0.0273 | 0.0349 | 0.0558 | 0.0200 | 0.0338 | 0.0085 |

| DOW | 0.0421 | 0.0361 | 0.0167 | 0.0285 | 0.0326 | 0.0134 | 0.0034 |

| GS | 0.0250 | 0.0300 | 0.0746 | 0.0435 | 0.0022 | 0.0040 | 0.0028 |

| HD | 0.0277 | 0.0100 | 0.1389 | 0.0617 | 0.1040 | 0.0811 | 0.6939 |

| HON | 0.0301 | 0.0294 | 0.0160 | 0.0323 | 0.0310 | 0.0375 | 0.0069 |

| IBM | 0.0258 | 0.0298 | 0.0467 | 0.0421 | 0.0258 | 0.0294 | 0.0129 |

| INTC | 0.0424 | 0.0409 | 0.0066 | 0.0245 | 0.0251 | 0.0535 | 0.0055 |

| JNJ | 0.0368 | 0.0369 | 0.0079 | 0.0209 | 0.0241 | 0.0412 | 0.0059 |

| JPM | 0.0251 | 0.0301 | 0.0335 | 0.0206 | 0.0018 | 0.0046 | 0.0030 |

| MCD | 0.0378 | 0.0448 | 0.0583 | 0.0852 | 0.0272 | 0.0580 | 0.0281 |

| MRK | 0.0304 | 0.0294 | 0.0146 | 0.0328 | 0.0210 | 0.0264 | 0.0045 |

| MSFT | 0.0577 | 0.0681 | 0.0124 | 0.0297 | 0.0225 | 0.0518 | 0.0081 |

| NKE | 0.0585 | 0.0479 | 0.0083 | 0.0196 | 0.0696 | 0.0650 | 0.0086 |

| PG | 0.0198 | 0.0192 | 0.0103 | 0.0288 | 0.0261 | 0.0329 | 0.0045 |

| CRM | 0.0223 | 0.0267 | 0.0046 | 0.0130 | 0.0229 | 0.0074 | 0.0008 |

| TRV | 0.0297 | 0.0356 | 0.0045 | 0.0068 | 0.0132 | 0.0108 | 0.0027 |

| UNH | 0.0345 | 0.0413 | 0.0123 | 0.0268 | 0.0699 | 0.0308 | 0.0054 |

| VZ | 0.0207 | 0.0236 | 0.0465 | 0.0468 | 0.0222 | 0.0256 | 0.0120 |

| V | 0.0399 | 0.0478 | 0.0079 | 0.0244 | 0.0141 | 0.0569 | 0.0072 |

| WBA | 0.0218 | 0.0142 | 0.0106 | 0.0250 | 0.0808 | 0.0202 | 0.0030 |

| WMT | 0.0198 | 0.0073 | 0.0101 | 0.0252 | 0.1108 | 0.0252 | 0.0039 |

| DIS | 0.0230 | 0.0257 | 0.0086 | 0.0268 | 0.0237 | 0.0288 | 0.0034 |

| Financial Ratio | CR | QR | DER | DAR | AT | ROA | ROE |

|---|---|---|---|---|---|---|---|

| ej | 0.9816 | 0.9681 | 0.8271 | 0.9681 | 0.9215 | 0.9403 | 0.4190 |

| wj | 0.0188 | 0.0328 | 0.1774 | 0.0327 | 0.0806 | 0.0613 | 0.5964 |

| Companies | CR | QR | DER | DAR | AT | ROA | ROE |

|---|---|---|---|---|---|---|---|

| MMM | (1, 3, 5) | (1, 3, 5) | (1, 1, 3) | (3, 5, 7) | (1, 3, 5) | (5, 7, 9) | (1, 1, 3) |

| AXP | (1, 1, 3) | (1, 3, 5) | (1, 1, 3) | (1, 3, 5) | (1, 1, 3) | (1, 1, 3) | (1, 1, 3) |

| AMGN | (7, 9, 9) | (7, 9, 9) | (1, 1, 3) | (5, 7, 9) | (1, 1, 3) | (3, 5, 7) | (1, 1, 3) |

| AAPL | (1, 1, 3) | (1, 3, 5) | (1, 1, 3) | (1, 3, 5) | (1, 3, 5) | (7, 9, 9) | (1, 1, 3) |

| BA | (1, 1, 3) | (1, 1, 3) | (7, 9, 9) | (1, 3, 5) | (1, 3, 5) | (1, 1, 3) | (1, 1, 3) |

| CAT | (1, 3, 5) | (1, 3, 5) | (1, 1, 3) | (3, 5, 7) | (1, 3, 5) | (1, 3, 5) | (1, 1, 3) |

| CVX | (1, 1, 3) | (1, 3, 5) | (1, 1, 3) | (1, 1, 3) | (1, 3, 5) | (1, 1, 3) | (1, 1, 3) |

| CSCO | (5, 7, 9) | (5, 7, 9) | (1, 1, 3) | (1, 3, 5) | (1, 1, 3) | (3, 5, 7) | (1, 1, 3) |

| KO | (1, 1, 3) | (1, 3, 5) | (1, 1, 3) | (5, 7, 9) | (1, 1, 3) | (1, 3, 5) | (1, 1, 3) |

| DOW | (3, 5, 7) | (3, 5, 7) | (1, 1, 3) | (1, 3, 5) | (1, 3, 5) | (1, 1, 3) | (1, 1, 3) |

| GS | (1, 1, 3) | (1, 3, 5) | (1, 3, 5) | (3, 5, 7) | (1, 1, 3) | (1, 1, 3) | (1, 1, 3) |

| HD | (1, 1, 3) | (1, 1, 3) | (5, 7, 9) | (5, 7, 9) | (7, 9, 9) | (7, 9, 9) | (7, 9, 9) |

| HON | (1, 3, 5) | (1, 3, 5) | (1, 1, 3) | (1, 3, 5) | (1, 3, 5) | (3, 5, 7) | (1, 1, 3) |

| IBM | (1, 1, 3) | (1, 3, 5) | (1, 1, 3) | (3, 5, 7) | (1, 3, 5) | (1, 3, 5) | (1, 1, 3) |

| INTC | (3, 5, 7) | (3, 5, 7) | (1, 1, 3) | (1, 3, 5) | (1, 3, 5) | (5, 7, 9) | (1, 1, 3) |

| JNJ | (1, 3, 5) | (3, 5, 7) | (1, 1, 3) | (1, 1, 3) | (1, 3, 5) | (3, 5, 7) | (1, 1, 3) |

| JPM | (1, 1, 3) | (1, 3, 5) | (1, 1, 3) | (1, 1, 3) | (1, 1, 3) | (1, 1, 3) | (1, 1, 3) |

| MCD | (1, 3, 5) | (3, 5, 7) | (1, 3, 5) | (7, 9, 9) | (1, 3, 5) | (5, 7, 9) | (1, 1, 3) |

| MRK | (1, 3, 5) | (1, 3, 5) | (1, 1, 3) | (1, 3, 5) | (1, 1, 3) | (1, 3, 5) | (1, 1, 3) |

| MSFT | (5, 7, 9) | (7, 9, 9) | (1, 1, 3) | (1, 3, 5) | (1, 1, 3) | (5, 7, 9) | (1, 1, 3) |

| NKE | (5, 7, 9) | (3, 5, 7) | (1, 1, 3) | (1, 1, 3) | (5, 7, 9) | (5, 7, 9) | (1, 1, 3) |

| PG | (1, 1, 3) | (1, 1, 3) | (1, 1, 3) | (1, 3, 5) | (1, 3, 5) | (1, 3, 5) | (1, 1, 3) |

| CRM | (1, 1, 3) | (1, 3, 5) | (1, 1, 3) | (1, 1, 3) | (1, 1, 3) | (1, 1, 3) | (1, 1, 3) |

| TRV | (1, 1, 3) | (3, 5, 7) | (1, 1, 3) | (1, 1, 3) | (1, 1, 3) | (1, 1, 3) | (1, 1, 3) |

| UNH | (1, 3, 5) | (3, 5, 7) | (1, 1, 3) | (1, 3, 5) | (5, 7, 9) | (1, 3, 5) | (1, 1, 3) |

| VZ | (1, 1, 3) | (1, 3, 5) | (1, 1, 3) | (3, 5, 7) | (1, 1, 3) | (1, 3, 5) | (1, 1, 3) |

| V | (1, 3, 5) | (3, 5, 7) | (1, 1, 3) | (1, 3, 5) | (1, 1, 3) | (5, 7, 9) | (1, 1, 3) |

| WBA | (1, 1, 3) | (1, 1, 3) | (1, 1, 3) | (1, 3, 5) | (5, 7, 9) | (1, 3, 5) | (1, 1, 3) |

| WMT | (1, 1, 3) | (1, 1, 3) | (1, 1, 3) | (1, 3, 5) | (7, 9, 9) | (1, 3, 5) | (1, 1, 3) |

| DIS | (1, 1, 3) | (1, 3, 5) | (1, 1, 3) | (1, 3, 5) | (1, 3, 5) | (1, 3, 5) | (1, 1, 3) |

| Companies | CR | QR | DER | DAR | AT | ROA | ROE |

|---|---|---|---|---|---|---|---|

| MMM | (0.002, 0.006, 0.010) | (0.004, 0.011, 0.018) | (0.059, 0.177, 0.177) | (0.005, 0.007, 0.011) | (0.009, 0.027, 0.045) | (0.034, 0.048, 0.061) | (0.066, 0.066, 0.199) |

| AXP | (0.002, 0.002, 0.006) | (0.004, 0.011, 0.018) | (0.059, 0.177, 0.177) | (0.007, 0.011, 0.033) | (0.009, 0.009, 0.027) | (0.007, 0.007, 0.020) | (0.066, 0.066, 0.199) |

| AMGN | (0.015, 0.019, 0.019) | (0.025, 0.033, 0.033) | (0.059, 0.177, 0.177) | (0.004, 0.005, 0.007) | (0.009, 0.009, 0.027) | (0.020, 0.034, 0.048) | (0.066, 0.066, 0.199) |

| AAPL | (0.002, 0.002, 0.006) | (0.004, 0.011, 0.018) | (0.059, 0.177, 0.177) | (0.007, 0.011, 0.033) | (0.009, 0.027, 0.045) | (0.048, 0.061, 0.061) | (0.066, 0.066, 0.199) |

| BA | (0.002, 0.002, 0.006) | (0.004, 0.004, 0.011) | (0.020, 0.020, 0.025) | (0.007, 0.011, 0.033) | (0.009, 0.027, 0.045) | (0.007, 0.007, 0.020) | (0.066, 0.066, 0.199) |

| CAT | (0.002, 0.006, 0.010) | (0.004, 0.011, 0.018) | (0.059, 0.177, 0.177) | (0.005, 0.007, 0.011) | (0.009, 0.027, 0.045) | (0.007, 0.020, 0.034) | (0.066, 0.066, 0.199) |

| CVX | (0.002, 0.002, 0.006) | (0.004, 0.011, 0.018) | (0.059, 0.177, 0.177) | (0.011, 0.033, 0.033) | (0.009, 0.027, 0.045) | (0.007, 0.007, 0.020) | (0.066, 0.066, 0.199) |

| CSCO | (0.010, 0.015, 0.019) | (0.018, 0.025, 0.033) | (0.059, 0.177, 0.177) | (0.007, 0.011, 0.033) | (0.009, 0.009, 0.027) | (0.020, 0.034, 0.048) | (0.066, 0.066, 0.199) |

| KO | (0.002, 0.002, 0.006) | (0.004, 0.011, 0.018) | (0.059, 0.177, 0.177) | (0.004, 0.005, 0.007) | (0.009, 0.009, 0.027) | (0.007, 0.020, 0.034) | (0.066, 0.066, 0.199) |

| DOW | (0.006, 0.010, 0.015) | (0.011, 0.018, 0.025) | (0.059, 0.177, 0.177) | (0.007, 0.011, 0.033) | (0.009, 0.027, 0.045) | (0.007, 0.007, 0.020) | (0.066, 0.066, 0.199) |

| GS | (0.002, 0.002, 0.006) | (0.004, 0.011, 0.018) | (0.035, 0.059, 0.177) | (0.005, 0.007, 0.011) | (0.009, 0.009, 0.027) | (0.007, 0.007, 0.020) | (0.066, 0.066, 0.199) |

| HD | (0.002, 0.002, 0.006) | (0.004, 0.004, 0.011) | (0.020, 0.025, 0.035) | (0.004, 0.005, 0.007) | (0.063, 0.081, 0.081) | (0.048, 0.061, 0.061) | (0.464, 0.596, 0.596) |

| HON | (0.002, 0.006, 0.010) | (0.004, 0.011, 0.018) | (0.059, 0.177, 0.177) | (0.007, 0.011, 0.033) | (0.009, 0.027, 0.045) | (0.020, 0.034, 0.048) | (0.066, 0.066, 0.199) |

| IBM | (0.002, 0.002, 0.006) | (0.004, 0.011, 0.018) | (0.059, 0.177, 0.177) | (0.005, 0.007, 0.011) | (0.009, 0.027, 0.045) | (0.007, 0.020, 0.034) | (0.066, 0.066, 0.199) |

| INTC | (0.006, 0.010, 0.015) | (0.011, 0.018, 0.025) | (0.059, 0.177, 0.177) | (0.007, 0.011, 0.033) | (0.009, 0.027, 0.045) | (0.034, 0.048, 0.061) | (0.066, 0.066, 0.199) |

| JNJ | (0.002, 0.006, 0.010) | (0.011, 0.018, 0.025) | (0.059, 0.177, 0.177) | (0.011, 0.033, 0.033) | (0.009, 0.027, 0.045) | (0.020, 0.034, 0.048) | (0.066, 0.066, 0.199) |

| JPM | (0.002, 0.002, 0.006) | (0.004, 0.011, 0.018) | (0.059, 0.177, 0.177) | (0.011, 0.033, 0.033) | (0.009, 0.009, 0.027) | (0.007, 0.007, 0.020) | (0.066, 0.066, 0.199) |

| MCD | (0.002, 0.006, 0.010) | (0.011, 0.018, 0.025) | (0.035, 0.059, 0.177) | (0.004, 0.004, 0.005) | (0.009, 0.027, 0.045) | (0.034, 0.048, 0.061) | (0.066, 0.066, 0.199) |

| MRK | (0.002, 0.006, 0.010) | (0.004, 0.011, 0.018) | (0.059, 0.177, 0.177) | (0.007, 0.011, 0.033) | (0.009, 0.009, 0.027) | (0.007, 0.020, 0.034) | (0.066, 0.066, 0.199) |

| MSFT | (0.010, 0.015, 0.019) | (0.025, 0.033, 0.033) | (0.059, 0.177, 0.177) | (0.007, 0.011, 0.033) | (0.009, 0.009, 0.027) | (0.034, 0.048, 0.061) | (0.066, 0.066, 0.199) |

| NKE | (0.010, 0.015, 0.019) | (0.011, 0.018, 0.025) | (0.059, 0.177, 0.177) | (0.011, 0.033, 0.033) | (0.045, 0.063, 0.081) | (0.034, 0.048, 0.061) | (0.066, 0.066, 0.199) |

| PG | (0.002, 0.002, 0.006) | (0.004, 0.004, 0.011) | (0.059, 0.177, 0.177) | (0.007, 0.011, 0.033) | (0.009, 0.027, 0.045) | (0.007, 0.020, 0.034) | (0.066, 0.066, 0.199) |

| CRM | (0.002, 0.002, 0.006) | (0.004, 0.011, 0.018) | (0.059, 0.177, 0.177) | (0.011, 0.033, 0.033) | (0.009, 0.009, 0.027) | (0.007, 0.007, 0.020) | (0.066, 0.066, 0.199) |

| TRV | (0.002, 0.002, 0.006) | (0.011, 0.018, 0.025) | (0.059, 0.177, 0.177) | (0.011, 0.033, 0.033) | (0.009, 0.009, 0.027) | (0.007, 0.007, 0.020) | (0.066, 0.066, 0.199) |

| UNH | (0.002, 0.006, 0.010) | (0.011, 0.018, 0.025) | (0.059, 0.177, 0.177) | (0.007, 0.011, 0.033) | (0.045, 0.063, 0.081) | (0.007, 0.020, 0.034) | (0.066, 0.066, 0.199) |

| VZ | (0.002, 0.002, 0.006) | (0.004, 0.011, 0.018) | (0.059, 0.177, 0.177) | (0.005, 0.007, 0.011) | (0.009, 0.009, 0.027) | (0.007, 0.020, 0.034) | (0.066, 0.066, 0.199) |

| V | (0.002, 0.006, 0.010) | (0.011, 0.018, 0.025) | (0.059, 0.177, 0.177) | (0.007, 0.011, 0.033) | (0.009, 0.009, 0.027) | (0.034, 0.048, 0.061) | (0.066, 0.066, 0.199) |

| WBA | (0.002, 0.002, 0.006) | (0.004, 0.004, 0.011) | (0.059, 0.177, 0.177) | (0.007, 0.011, 0.033) | (0.045, 0.063, 0.081) | (0.007, 0.020, 0.034) | (0.066, 0.066, 0.199) |

| WMT | (0.002, 0.002, 0.006) | (0.004, 0.004, 0.011) | (0.059, 0.177, 0.177) | (0.007, 0.011, 0.033) | (0.063, 0.081, 0.081) | (0.007, 0.020, 0.034) | (0.066, 0.066, 0.199) |

| DIS | (0.002, 0.002, 0.006) | (0.004, 0.011, 0.018) | (0.059, 0.177, 0.177) | (0.007, 0.011, 0.033) | (0.009, 0.027, 0.045) | (0.007, 0.020, 0.034) | (0.066, 0.066, 0.199) |

| Financial Ratio | CR | QR | DER | DAR | AT | ROA | ROE |

|---|---|---|---|---|---|---|---|

| A+ | (0.015, 0.019, 0.019) | (0.025, 0.033, 0.033) | (0.059, 0.177, 0.177) | (0.011, 0.033, 0.033) | (0.063, 0.081, 0.081) | (0.048, 0.061, 0.061) | (0.464, 0.596, 0.596) |

| A− | (0.002, 0.002, 0.006) | (0.004, 0.004, 0.011) | (0.020, 0.020, 0.025) | (0.004, 0.004, 0.005) | (0.009, 0.009, 0.027) | (0.007, 0.007, 0.020) | (0.066, 0.066, 0.199) |

| Companies | Extent with Fuzzy PIS | Extent with Fuzzy NIS |

|---|---|---|

| MMM | 0.557 | 0.193 |

| AXP | 0.599 | 0.151 |

| AMGN | 0.553 | 0.192 |

| AAPL | 0.541 | 0.212 |

| BA | 0.720 | 0.031 |

| CAT | 0.583 | 0.168 |

| CVX | 0.574 | 0.173 |

| CSCO | 0.552 | 0.200 |

| KO | 0.600 | 0.147 |

| DOW | 0.573 | 0.180 |

| GS | 0.676 | 0.101 |

| HD | 0.183 | 0.560 |

| HON | 0.562 | 0.193 |

| IBM | 0.585 | 0.164 |

| INTC | 0.538 | 0.217 |

| JNJ | 0.542 | 0.206 |

| JPM | 0.586 | 0.158 |

| MCD | 0.623 | 0.159 |

| MRK | 0.587 | 0.166 |

| MSFT | 0.534 | 0.218 |

| NKE | 0.488 | 0.262 |

| PG | 0.583 | 0.171 |

| CRM | 0.586 | 0.158 |

| TRV | 0.579 | 0.165 |

| UNH | 0.534 | 0.221 |

| VZ | 0.597 | 0.150 |

| V | 0.554 | 0.198 |

| WBA | 0.549 | 0.205 |

| WMT | 0.534 | 0.217 |

| DIS | 0.578 | 0.177 |

| Companies | Entropy-Fuzzy TOPSIS Closeness Coefficients | Ranking |

|---|---|---|

| MMM | 0.2578 | 13 |

| AXP | 0.2017 | 26 |

| AMGN | 0.2578 | 12 |

| AAPL | 0.2812 | 7 |

| BA | 0.0418 | 30 |

| CAT | 0.2235 | 19 |

| CVX | 0.2313 | 17 |

| CSCO | 0.2659 | 10 |

| KO | 0.1967 | 28 |

| DOW | 0.2388 | 15 |

| GS | 0.1302 | 29 |

| HD | 0.7534 | 1 |

| HON | 0.2555 | 14 |

| IBM | 0.2191 | 22 |

| INTC | 0.2870 | 6 |

| JNJ | 0.2758 | 8 |

| JPM | 0.2125 | 23 |

| MCD | 0.2030 | 25 |

| MRK | 0.2202 | 21 |

| MSFT | 0.2900 | 4 |

| NKE | 0.3490 | 2 |

| PG | 0.2269 | 18 |

| CRM | 0.2125 | 23 |

| TRV | 0.2216 | 20 |

| UNH | 0.2925 | 3 |

| VZ | 0.2004 | 27 |

| V | 0.2634 | 11 |

| WBA | 0.2718 | 9 |

| WMT | 0.2885 | 5 |

| DIS | 0.2344 | 16 |

| Optimal Portfolio | Value |

|---|---|

| Portfolio mean return | 0.0225 |

| Portfolio risk | 0.0445 |

| Portfolio performance ratio | 0.5056 |

| DJIA index return (Benchmark) | 0.0095 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lam, W.H.; Lam, W.S.; Liew, K.F.; Lee, P.F. Decision Analysis on the Financial Performance of Companies Using Integrated Entropy-Fuzzy TOPSIS Model. Mathematics 2023, 11, 397. https://doi.org/10.3390/math11020397

Lam WH, Lam WS, Liew KF, Lee PF. Decision Analysis on the Financial Performance of Companies Using Integrated Entropy-Fuzzy TOPSIS Model. Mathematics. 2023; 11(2):397. https://doi.org/10.3390/math11020397

Chicago/Turabian StyleLam, Weng Hoe, Weng Siew Lam, Kah Fai Liew, and Pei Fun Lee. 2023. "Decision Analysis on the Financial Performance of Companies Using Integrated Entropy-Fuzzy TOPSIS Model" Mathematics 11, no. 2: 397. https://doi.org/10.3390/math11020397

APA StyleLam, W. H., Lam, W. S., Liew, K. F., & Lee, P. F. (2023). Decision Analysis on the Financial Performance of Companies Using Integrated Entropy-Fuzzy TOPSIS Model. Mathematics, 11(2), 397. https://doi.org/10.3390/math11020397