Performance Evaluation of the Efficiency of Logistics Companies with Data Envelopment Analysis Model

Abstract

1. Introduction

2. Literature Review

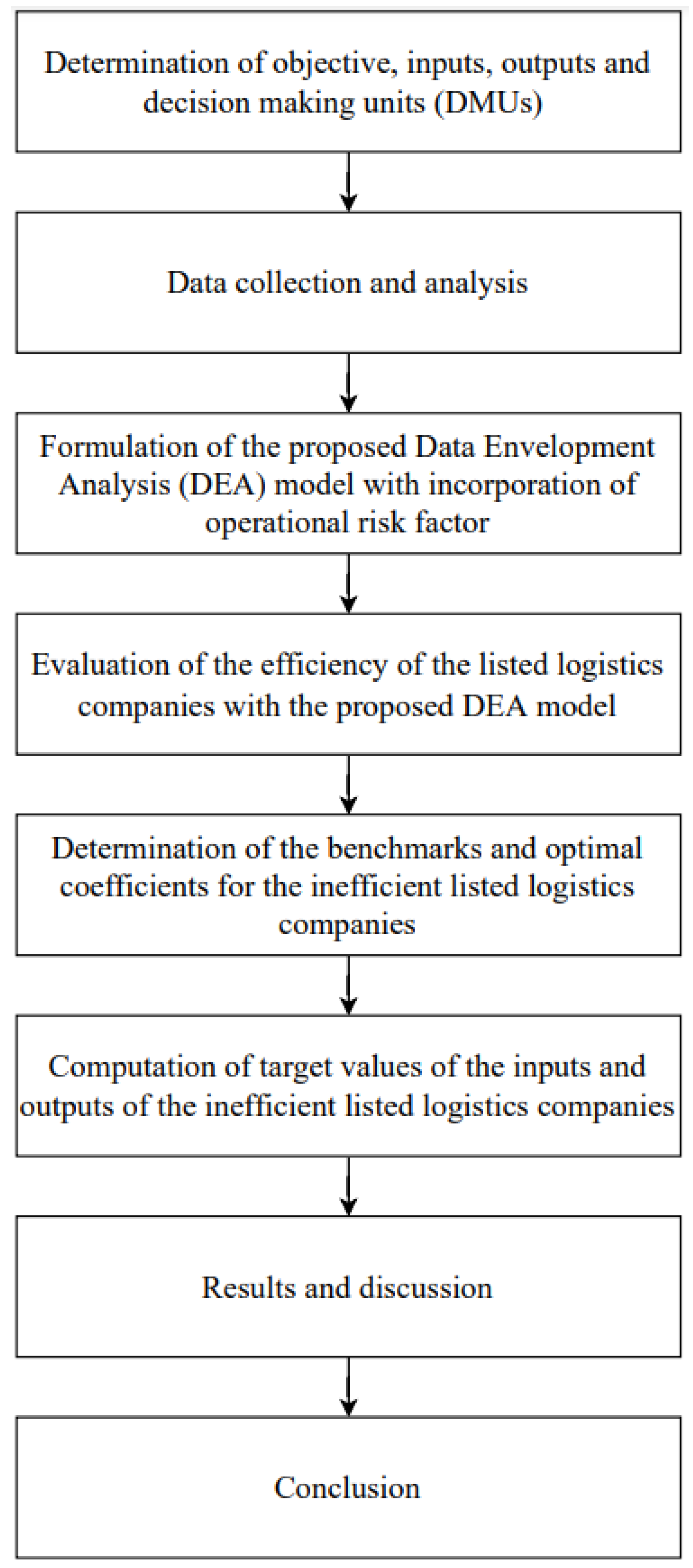

3. Materials and Methods

4. Results and Discussion

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Ramli, A.; Shakir, K.A. Current and future prospect of logistics and transportation sector in Malaysia. In Modeling Economic Growth in Contemporary Malaysia (Entrepreneurship and Global Economic Growth); Sergi, B.S., Jaafar, A.R., Eds.; Emerald Publishing Limited: Bingley, UK; pp. 279–290.

- Jeevan, J.; Othman, M.R.; Hasan, Z.R.A.; Pham, T.Q.M.; Park, G.K. Exploring the development of Malaysian seaports as a hub for tourism activities. Marit. Bus. Rev. 2019, 4, 310–327. [Google Scholar] [CrossRef]

- Rashidi, K.; Cullinane, K. Evaluating the sustainability of national logistics performance using data envelopment analysis. Transp. Policy 2019, 74, 35–46. [Google Scholar] [CrossRef]

- Khan, S.A.R.; Jian, C.; Zhang, Y.; Golpîra, H.; Kumar, A.; Sharif, A. Environmental, social and economic growth indicators spur logistics performance: From the perspective of South Asian Association for Regional Cooperation countries. J. Clean. Prod. 2019, 214, 1011–1023. [Google Scholar] [CrossRef]

- Ko, C.; Lee, P.; Anandarajan, A. The impact of operational risk incidents and moderating influence of corporate governance on credit risk and firm performance. Int. J. Account. Inf. Manag. 2019, 27, 96–110. [Google Scholar] [CrossRef]

- Xu, G.; Qiu, X.; Fang, M.; Kou, X.; Yu, Y. Data-driven operational risk analysis in E-Commerce logistics. Adv. Eng. Inform. 2019, 40, 29–35. [Google Scholar] [CrossRef]

- Ferreira, S.; Dickason-Koekemoer, Z. A conceptual model of operational risk events in the banking sector. Cogent Econ. Finance 2019, 7, 1706394. [Google Scholar] [CrossRef]

- Suki, N.M.; Suki, N.M.; Sharif, A.; Afshan, S. The role of logistics performance for sustainable development in top Asian countries: Evidence from advance panel estimations. Sustain. Dev. 2021, 29, 595–606. [Google Scholar] [CrossRef]

- Lochan, S.A.; Rozanova, T.P.; Bezpalov, V.V.; Fedyunin, D.V. Supply chain management and risk management in an environment of stochastic uncertainty (retail). Risks 2021, 9, 197. [Google Scholar] [CrossRef]

- Gurtu, A.; Johny, J. Supply chain risk management: Literature review. Risks 2021, 9, 16. [Google Scholar] [CrossRef]

- Vasiliev, I.I.; Smelov, P.A.; Klimovskih, N.V.; Shevashkevich, M.G.; Donskaya, E.N. Operational risk management in a commercial bank. Int. J. Eng. Technol. 2018, 7, 524–529. [Google Scholar] [CrossRef]

- Valová, I. Basel II approaches for the calculation of the regulatory capital for operational risk. Financial Asset. Investig. 2011, 2, 1–16. [Google Scholar]

- Hasan, M.F.; Al-Dahan, N.S.; Abdulameer, H.H. Analysis of the impact of operational risk on the banking liquidity and growth using BIA method: A comparative study. J. Xi’an Univ. Archit. Technol. 2020, 12, 1363–1374. [Google Scholar]

- Cristea, M. Operational risk management in banking activity. J. East. Eur. Res. Bus. Econ. 2021, 2021, 969612. [Google Scholar] [CrossRef]

- Siddika, A.; Haron, R. Capital adequacy regulation. In Banking and Finance; Haron, R., Husin, M.M., Murg, M., Eds.; Intech Open: London, UK, 2020. [Google Scholar]

- Chen, J.; Sohal, A.S.; Prajogo, D.I. Supply chain operational risk mitigation: A collaborative approach. Int. J. Prod. Res. 2013, 57, 2186–2199. [Google Scholar] [CrossRef]

- Hunjra, A.I. Do firm-specific risks affect bank performance? Int. J. Emerg. Mark. 2022, 17, 664–682. [Google Scholar] [CrossRef]

- Bai, X.; Cheng, L.; Iris, Ҫ. Data-driven financial and operational risk management: Empirical evidence from the global tramp shipping industry. Transp. Res. Part E Logist. Transp. Rev. 2022, 158, 102617. [Google Scholar] [CrossRef]

- Hosseinzadeh-Bandbafha, H.; Nabavi-Pelesaraei, A.; Khanali, M.; Ghahderijani, M.; Chau, K. Application of data envelopment analysis approach for optimization of energy use and reduction of greenhouse gas emission in peanut production of Iran. J. Clean. Prod. 2018, 172, 1327–1335. [Google Scholar] [CrossRef]

- Cavalcanti, J.H.; Kovács, T.; Kő, A. Production system efficiency optimization using sensor data, machine learning-based simulation and genetic algorithms. Procedia CIRP 2022, 107, 528–533. [Google Scholar] [CrossRef]

- Rahimpour, K.; Shirouyehzad, H.; Asadpour, M.; Karbasian, M. A PCA-DEA method for organizational performance evaluation based on intellectual capital and employee loyalty: A case study. J. Model. Manag. 2020, 15, 1479–1513. [Google Scholar] [CrossRef]

- Mohanta, K.K.; Sharanappa, D.S.; Aggarwal, A. Efficiency analysis in the management of COVID-19 pandemic in India based on data envelopment analysis. Curr. Res. Behav. Sci. 2021, 2, 100063. [Google Scholar] [CrossRef]

- Shabanpour, H.; Yousefi, S.; Saen, R.F. Forecasting sustainability of supply chains in the circular economy context: A dynamic network data envelopment analysis and artificial neural network approach. J. Enterp. Inf. Manag. 2021, 154, 113357. [Google Scholar] [CrossRef]

- Banker, R.D.; Charnes, A.; Cooper, W.W. Some models for estimating technical and scale inefficiencies in data envelopment analysis. Manag. Sci. 1984, 30, 1078–1092. [Google Scholar] [CrossRef]

- Cinaroglu, S. Changes in hospital efficiency and size: An integrated propensity score matching with data envelopment analysis. Socio-Econ. Plan. Sci. 2021, 76, 100960. [Google Scholar] [CrossRef]

- İlgün, G.; Sönmez, S.; Konca, M.; Yetim, B. Measuring the efficiency of Turkish maternal and child health hospitals: A two-stage data envelopment analysis. Eval. Program Plan. 2022, 91, 102023. [Google Scholar] [CrossRef] [PubMed]

- Sefeedpari, P.; Shokoohi, Z.; Pishgar-Komleh, S.H. Dynamic energy efficiency assessment of dairy farming system in Iran: Application of window data envelopment analysis. J. Clean. Prod. 2020, 275, 124178. [Google Scholar] [CrossRef]

- Bhunia, S.; Karmaker, S.; Bhattacharjee, S.; Roy, K.; Kanthal, S.; Pramanick, M.; Baishya, A.; Mandal, B. Optimization of energy consumption using data envelopment analysis (DEA) in rice-wheat-green gram cropping system under conservation tillage practices. Energy 2021, 236, 121499. [Google Scholar] [CrossRef]

- Albertini, F.; Gomes, L.P.; Grondona, A.E.B.; Caetano, M.O. Assessment of environmental performance in building construction sites: Data envelopment analysis and Tobit model approach. J. Build. Eng. 2021, 44, 102994. [Google Scholar] [CrossRef]

- Torres-Samuel, M.; Vásquez, C.L.; Luna, M.; Bucci, N.; Viloria, A.; Crissien, T.; Manosalva, J. Performance of education and research in Latin American countries through data envelopment analysis (DEA). Procedia Comput. Sci. 2020, 170, 1023–1028. [Google Scholar] [CrossRef]

- Zeng, X.; Zhou, Z.; Gong, Y.; Liu, W. A data envelopment analysis model integrated with portfolio theory for energy mix adjustment: Evidence in the power industry. Socio-Econ. Plan. Sci. 2022, 83, 101332. [Google Scholar] [CrossRef]

- Fathi, B.; Ashena, M.; Bahari, A.R. Energy, environmental, and economic efficiency in fossil fuel exporting countries: A modified data envelopment analysis approach. Sustain. Prod. Consum. 2021, 26, 588–596. [Google Scholar] [CrossRef]

- Saen, R.F.; Karimi, B.; Fathi, A. Assessing the sustainability of transport supply chains by double frontier network data envelopment analysis. J. Clean. Prod. 2022, 354, 131771. [Google Scholar] [CrossRef]

- Pascoe, S.; Cannard, T.; Dowling, N.A.; Dichmont, C.M.; Asche, F.; Little, L.R. Use of data envelopment analysis (DEA) to assess management alternatives in the presence of multiple objectives. Mar. Policy 2023, 148, 105444. [Google Scholar] [CrossRef]

- Qi, H.; Zhou, Z.; Li, N.; Zhang, C. Construction safety performance evaluation based on data envelopment analysis (DEA) from a hybrid perspective of cross-sectional and longitudinal. Saf. Sci. 2022, 146, 105532. [Google Scholar] [CrossRef]

- Čiković, K.F.; Martinčević, I.; Lozić, J. Application of data envelopment analysis (DEA) in the selection of sustainable suppliers: A review and bibliometric analysis. Sustainability 2022, 14, 6672. [Google Scholar] [CrossRef]

- Charnes, A.; Cooper, W.; Rhodes, E. Measuring the efficiency of decision-making units. Eur. J. Oper. Res. 1978, 2, 429–444. [Google Scholar] [CrossRef]

- Nong, T.N. Performance efficiency assessment of Vietnamese ports: An application of Delphi with Kamet principles and DEA model. Asian J. Shipp. Logist. 2022, in press. [CrossRef]

- Wanke, P.; Rojas, F.; Tan, Y.; Moreira, J. Temporal dependence and bank efficiency drivers in OECD: A stochastic DEA-ratio approach based on generalized auto-regressive moving averages. Expert Syst. Appl. 2023, 214, 119120. [Google Scholar] [CrossRef]

- Smętek, K.; Zawadzka, D.; Strzelecka, A. Examples of the use of data envelopment analysis (DEA) to assess the financial effectiveness of insurance companies. Procedia Comput. Sci. 2022, 207, 3924–3930. [Google Scholar] [CrossRef]

- Ning, Y.; Zhang, Y.; Wang, G. An improved DEA prospect cross-efficiency evaluation method and its application in fund performance analysis. Mathematics 2023, 11, 585. [Google Scholar] [CrossRef]

- Gardijan, M.; Lukač, Z. Measuring the relative efficiency of the food and drink industry in the chosen EU countries using the data envelopment analysis with missing data. Cent. Eur. J. Oper. Res. 2018, 26, 695–713. [Google Scholar] [CrossRef]

- Karimi, A.; Barati, M. Financial performance evaluation of companies listed on Tehran Stock Exchange. A negative data envelopment analysis approach. Int. J. Law. Manag. 2018, 60, 885–900. [Google Scholar] [CrossRef]

- Al-Mana, A.A.; Nawaz, W.; Kamal, A.; Koҫ, M. Financial and operational efficiencies of national and international oil companies: An empirical investigation. Resour. Policy 2020, 68, 101701. [Google Scholar] [CrossRef]

- Kedžo, M.G.; Lukač, Z. The financial efficiency of small food and drink producers across selected European Union countries using data envelopment analysis. Eur. J. Oper. Res. 2020, 291, 586–600. [Google Scholar] [CrossRef]

- Halkos, G.E.; Salamouris, D.S. Efficiency measurement of the Greek commercial banks with the use of financial ratios: A data envelopment analysis approach. Manag. Account. Res. 2004, 15, 201–224. [Google Scholar] [CrossRef]

- Curtis, P.G.; Hanias, M.; Kourtis, E.; Kourtis, M. Data envelopment analysis (DEA) and financial ratios: A pro-stakeholders’ view of performance measurement for sustainable value creation of the wind energy. Int. J. Econ. Bus. Admin. 2020, 8, 326–350. [Google Scholar]

- Dahooie, J.H.; Hajiagha, S.H.R.; Farazmehr, S.; Zavadskas, E.K.; Antucheviciene. A novel dynamic credit risk evaluation method using data envelopment analysis with common weights and combination of multi-attribute decision-making methods. Comput. Oper. Res. 2021, 129, 105223. [Google Scholar] [CrossRef]

- Mohtashami, A.; Ghiasvand, B.M. Z-ERM DEA integrated approach for evaluation of banks & financial institutes in stock exchange. Expert Syst. Appl. 2020, 147, 113218. [Google Scholar]

- Habib, A.M.; Shahwan, T.M. Measuring the operational and financial efficiency using a Malmquist data envelopment analysis: A case of Egyptian hospitals. Benchmarking Int. J. 2020, 27, 2521–2536. [Google Scholar] [CrossRef]

- Chen, J. A new approach to overall performance evaluation based on multiple contexts: An application to the logistics of China. Comput. Ind. Eng. 2018, 122, 170–180. [Google Scholar] [CrossRef]

- Wohlgemuth, M.; Fries, C.E.; Sant’Anna, A.M.O.; Giglio, R.; Fettermann, D.C. Assessment of the technical efficiency of Brazilian logistic operators using data envelopment analysis and one inflated beta regression. Ann. Oper. Res. 2020, 286, 703–717. [Google Scholar] [CrossRef]

- Zhang, Q.; Koutmos, D. Using operational and stock analytics to measure airline performance: A network DEA approach. Decis. Sci. 2021, 52, 720–748. [Google Scholar] [CrossRef]

- Venkadasalam, S.; Mohamad, A.; Sifat, I.M. Operational efficiency of shipping companies: Evidence from Malaysia, Singapore, the Philippines, Thailand and Vietnam. Int. J. Emerg. Mark. 2019, 15, 875–897. [Google Scholar] [CrossRef]

- Li, Z.; Wang, X.; Zheng, R.; Na, S.; Liu, C. Evaluation analysis of the operational efficiency and total factor productivity of container terminals in China. Sustainability 2022, 14, 13007. [Google Scholar] [CrossRef]

- Li, H.; Jiang, L.; Liu, J.; Su, D. Research on the evaluation of logistics efficiency in Chinese coastal ports based on the four-stage DEA model. J. Mar. Sci. Eng. 2022, 10, 1147. [Google Scholar] [CrossRef]

- Ho, N.; Nguyen, P.M.; Luu, T.; Tran, T. Selecting partners in strategic alliances: An application of the SBM DEA model in the Vietnamese logistics industry. Logistics 2022, 6, 64. [Google Scholar] [CrossRef]

- Gan, W.; Yao, W.; Huang, S. Evaluation of green logistics efficiency in Jiangxi province based on three-stage DEA from the perspective of high-quality development. Sustainability 2022, 14, 797. [Google Scholar] [CrossRef]

- Cavaignac, L.; Dumas, A.; Petiot, R. Third-party logistics efficiency: An innovative two-stage DEA analysis of the French market. Int. J. Logist. Res. 2020, 24, 581–604. [Google Scholar] [CrossRef]

- Dziwok, E. New approach to operational risk measurement in banks. Int. J. Trade Glob. Mark. 2018, 11, 259–269. [Google Scholar] [CrossRef]

- Oberholzer, M.; Mong, D.; van Romburgh, J. Towards a new model to benchmark firms’ operating efficiency: A data envelopment analysis approach. S. Afr. J. Account. Res. 2017, 31, 223–239. [Google Scholar] [CrossRef]

- Bursa Malaysia. Company Announcements. Available online: https://www.bursamalaysia.com/market_information/announcements/company_announcement (accessed on 10 August 2022).

- Bowlin, W.F. Measuring performance: An introduction to data envelopment analysis (DEA). J. Cost. Anal. 1998, 15, 3–27. [Google Scholar] [CrossRef]

- Sharif, O.; Hasan, M.Z.; Kurniasari, F.; Hermawan, A.; Gunardi, A. Productivity and efficiency analysis using DEA: Evidence from financial companies listed in Bursa Malaysia. Manag. Sci. Lett. 2019, 9, 301–312. [Google Scholar] [CrossRef]

- Koengkan, M.; Fuinhas, J.A.; Kazemzadeh, E.; Osmani, F.; Alavijeh, M.K.; Auza, A.; Teixeira, M. Measuring the economic efficiency performance in Latin America and Caribbean countries: An empirical evidence from stochastic production frontier and data envelopment analysis. Int. Econ. 2022, 169, 43–54. [Google Scholar] [CrossRef]

- Hsu, W.K.; Huang, S.S.; Huynh, N.T. An assessment of operating efficiency of container terminals in a port— an empirical study in Kaohsiung Port using data envelopment analysis. Res. Transp. Bus. Manag. 2022, in press. [CrossRef]

- Campisi, D.; Mancuso, P.; Mastrodnato, S.L.; Morea, D. Efficiency assessment of knowledge intensive business services industry in Italy: Data envelopment analysis (DEA) and financial ratio analysis. Meas. Bus. Excell. 2019, 23, 484–495. [Google Scholar] [CrossRef]

- Kamel, M.A.; Mousa, M.E.; Hamdy, R.M. Financial efficiency of commercial banks listed in Egyptian stock exchange using data envelopment analysis. Int. J. Prod. Perform. Manag. 2022, 71, 3683–3703. [Google Scholar] [CrossRef]

- Shah, S.A.A.; Masood, O. Input efficiency of financial services sector: A non-parametric analysis of banking and insurance sectors of Pakistan. Eur. J. Islamic. Finance 2017, 6, 1–12. [Google Scholar]

- Merendino, A.; Gagliardo, E.D.; Coronella, S. The efficiency of the top mega yacht builders across the world: A financial ratio-based data envelopment analysis. Int. J. Manag. Decis. Mak. 2018, 17, 125–147. [Google Scholar] [CrossRef]

- Tamatam, R.; Dutta, P.; Dutta, G.; Lessmann, S. Efficiency analysis of Indian banking industry over the period of 2008-2017 using data envelopment analysis. Benchmarking Int. J. 2019, 26, 2417–2442. [Google Scholar] [CrossRef]

- Raval, S.J.; Kant, R.; Shankar, R. Analyzing the lean six sigma enabled organizational performance to enhance operational efficiency. Benchmarking Int. J. 2020, 27, 2401–2434. [Google Scholar] [CrossRef]

- Pham, T.Q.M.; Park, G.K.; Choi, K. The efficiency analysis of world top container ports using two-stage uncertainty DEA model and FCM. Marit. Bus. Rev. 2020, 6, 2–21. [Google Scholar] [CrossRef]

- Taleb, M.; Ramli, R.; Khalid, R. Developing a two-stage approach of super efficiency slack-based measure in the presence of non-discretionary factors and mixed integer-valued data envelopment analysis. Expert Syst. Appl. 2018, 103, 14–24. [Google Scholar] [CrossRef]

- Kouaissah, N.; Hocine, A. XOR data envelopment analysis and its application to renewable energy sector. Expert Syst. Appl. 2022, 207, 118044. [Google Scholar] [CrossRef]

- Ng, C.Y.; Chuah, K.B.; King, A.P. An integrated approach for the benchmarking of production facilities’ environmental performance: Data envelopment analysis and life cycle assessment. Int. J. Sustain. Eng. 2019, 12, 108–114. [Google Scholar] [CrossRef]

- Raith, A.; Rouse, P.; Seiford, L.M. Benchmarking using data envelopment analysis: Application to stores of a post and banking business. In Multiple Criteria Decision Making and Aiding: Cases on Models and Methods with Computer Implementations (International Series in Operations Research & Management Science 274; Huber, S., Geiger, M.J., Almeida, A.T., Eds.; Springer: Cham, Switzerland, 2018. [Google Scholar]

- Güner, S. Investigating infrastructure, superstructure, operating and financial efficiency in the management of Turkish seaports using data envelopment analysis. Transp. Policy 2015, 40, 36–48. [Google Scholar] [CrossRef]

- Gandhi, A.V.; Sharma, D. Technical efficiency of private sector hospitals in India using data envelopment analysis. Benchmarking Int. J. 2018, 25, 3570–3591. [Google Scholar] [CrossRef]

- Ghondaghsaz, N.; Kordnaeij, A.; Delkhah, J. Operational efficiency of plastic producing firms in Iran: A DEA approach. Benchmarking Int. J. 2018, 25, 2126–2144. [Google Scholar] [CrossRef]

- Susanty, A.; Purwanggono, B.; Al Faruq, C. Electricity distribution efficiency analysis using data envelopment analysis (DEA) and soft system methodology. Procedia Comput. Sci. 2022, 203, 342–349. [Google Scholar] [CrossRef]

- Malhotra, R.; Malhotra, D.K.; Lermack, H. Using data envelopment analysis to analyze the performance of North American class I freight railroads. Financ. Model. Appl. Data Envel. Appl. 2009, 13, 113–131. [Google Scholar]

| Objective | To Optimize the Efficiency of the Listed Logistics Companies with Operational Risk Factor in Malaysia Using Proposed DEA Model | ||

| Inputs | Current ratios (CTR) | ||

| Debt-to-asset ratios (DAR) | |||

| Debt-to-equity ratios (DER) | |||

| Weighted average cost of capital (WACC) | |||

| Outputs | Earnings per share (EPS) | ||

| Return on asset (ROA) | |||

| Return on equity (ROE) | |||

| Basic indicator approach (BIA) | |||

| Decision Making Units (DMUs) | AIRPORT | HUBLINE | PRKCORP |

| BHIC | ILB | SEALINK | |

| BIPORT | LITRAK | SEEHUP | |

| CJCEN | MAYBULK | SURIA | |

| COMPLET | MISC | SYSCORP | |

| FREIGHT | MMCCORP | TAS | |

| GCAP | NATWIDE | TASCO | |

| GDEX | POS | TNLOGIS | |

| HARBOUR | PDZ | TOCEAN | |

| DMUs | Efficiency | Rank | Categorization |

|---|---|---|---|

| AIRPORT | 1.0000 | 1 | Efficient |

| BHIC | 0.9649 | 20 | Inefficient |

| BIPORT | 0.9737 | 18 | Inefficient |

| CJCEN | 0.8889 | 24 | Inefficient |

| COMPLET | 1.0000 | 1 | Efficient |

| FREIGHT | 0.9400 | 21 | Inefficient |

| GCAP | 0.9026 | 22 | Inefficient |

| GDEX | 1.0000 | 1 | Efficient |

| HARBOUR | 0.9860 | 17 | Inefficient |

| HUBLINE | 1.0000 | 1 | Efficient |

| ILB | 1.0000 | 1 | Efficient |

| LITRAK | 0.8875 | 25 | Inefficient |

| MAYBULK | 0.8497 | 26 | Inefficient |

| MISC | 1.0000 | 1 | Efficient |

| MMCCORP | 1.0000 | 1 | Efficient |

| NATWIDE | 1.0000 | 1 | Efficient |

| POS | 1.0000 | 1 | Efficient |

| PDZ | 1.0000 | 1 | Efficient |

| PRKCORP | 1.0000 | 1 | Efficient |

| SEALINK | 0.9906 | 16 | Inefficient |

| SEEHUP | 1.0000 | 1 | Efficient |

| SURIA | 0.9666 | 19 | Inefficient |

| SYSCORP | 1.0000 | 1 | Efficient |

| TAS | 0.6725 | 27 | Inefficient |

| TASCO | 0.8966 | 23 | Inefficient |

| TNLOGIS | 1.0000 | 1 | Efficient |

| TOCEAN | 1.0000 | 1 | Efficient |

| Efficiency | |

|---|---|

| Minimum efficiency | 0.6725 |

| Maximum efficiency | 1.0000 |

| Average efficiency | 0.9600 |

| Percentage of efficiency (%) | 55.56 |

| Percentage of inefficiency (%) | 44.44 |

| Inefficient DMUs | Benchmarks (Efficient DMUs) | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Complet | Hubline | ILB | MISC | Mmccorp | POS | Prkcorp | Seehup | Syscorp | Tnlogis | Tocean | |

| BHIC | 0.5682 | 0.1476 | 0.0001 | 0.0025 | 0.2816 | ||||||

| BIPORT | 0.1580 | 0.1239 | 0.0001 | 0.0406 | 0.1368 | 0.5405 | |||||

| CJCEN | 0.0894 | 0.5247 | 0.0012 | 0.3847 | |||||||

| FREIGHT | 0.2039 | 0.4376 | 0.0025 | 0.3560 | |||||||

| GCAP | 0.7071 | 0.0857 | 0.2072 | ||||||||

| HARBOUR | 0.1507 | 0.2119 | 0.0021 | 0.6353 | |||||||

| LITRAK | 0.1478 | 0.0039 | 0.0375 | 0.8108 | |||||||

| MAYBULK | 0.4004 | 0.1028 | 0.0032 | 0.0003 | 0.4933 | ||||||

| SEALINK | 0.1194 | 0.8806 | |||||||||

| SURIA | 0.8525 | 0.0336 | 0.0992 | 0.0147 | |||||||

| TAS | 0.0379 | 0.6720 | 0.2901 | ||||||||

| TASCO | 0.0334 | 0.3635 | 0.0022 | 0.0049 | 0.5960 | ||||||

| DMU | Output/Input | Initial Value | Target Value | Potential Improvement |

|---|---|---|---|---|

| BHIC | EPS | 0.0690 | 0.0690 | 0.0000 |

| ROA | 0.0192 | 0.0192 | 0.0000 | |

| ROE | 0.0414 | 0.0441 | 0.0027 | |

| BIA | 0.0545 | 0.0545 | 0.0000 | |

| CTR | 0.9947 | 0.9598 | −0.0349 | |

| DAR | 0.5779 | 0.5471 | −0.0308 | |

| DER | 1.8922 | 1.6809 | −0.2113 | |

| WACC | 0.0733 | 0.0707 | −0.0026 | |

| BIPORT | EPS | 0.3648 | 0.3648 | 0.0000 |

| ROA | 0.0689 | 0.0689 | 0.0000 | |

| ROE | 0.1501 | 0.1746 | 0.0245 | |

| BIA | 0.1102 | 0.1102 | 0.0000 | |

| CTR | 3.2174 | 1.2836 | −1.9338 | |

| DAR | 0.5415 | 0.5273 | −0.0142 | |

| DER | 1.2977 | 1.2638 | −0.0339 | |

| WACC | 0.0602 | 0.0586 | −0.0016 | |

| CJCEN | EPS | 0.1121 | 0.1145 | 0.0024 |

| ROA | 0.0456 | 0.0374 | −0.0082 | |

| ROE | 0.0739 | 0.0722 | −0.0017 | |

| BIA | 0.0116 | 0.1768 | 0.1652 | |

| CTR | 1.8669 | 1.6569 | −0.2100 | |

| DAR | 0.3959 | 0.5228 | 0.1268 | |

| DER | 0.6771 | 1.3977 | 0.7207 | |

| WACC | 0.0772 | 0.0612 | −0.0160 | |

| FREIGHT | EPS | 0.1018 | 0.1932 | 0.0914 |

| ROA | 0.0633 | 0.0641 | 0.0008 | |

| ROE | 0.1023 | 0.1023 | 0.0000 | |

| BIA | 0.0160 | 0.1710 | 0.1550 | |

| CTR | 2.1968 | 2.1162 | −0.0807 | |

| DAR | 0.3794 | 0.3513 | −0.0281 | |

| DER | 0.6125 | 0.5900 | −0.0225 | |

| WACC | 0.0731 | 0.0704 | −0.0027 | |

| GCAP | EPS | 0.0362 | 0.0991 | 0.0629 |

| ROA | 1.1417 | 1.1417 | 0.0000 | |

| ROE | 0.0650 | 1.8885 | 1.8235 | |

| BIA | 0.0049 | 0.0166 | 0.0117 | |

| CTR | 13.9511 | 3.8790 | −10.0721 | |

| DAR | 5.2244 | 0.3059 | −4.9185 | |

| DER | 0.5446 | 0.4934 | −0.0513 | |

| WACC | 0.0775 | 0.0702 | −0.0073 | |

| HARBOUR | EPS | 0.1041 | 0.1232 | 0.0191 |

| ROA | 0.0550 | 0.0550 | 0.0000 | |

| ROE | 0.0907 | 0.0911 | 0.0003 | |

| BIA | 0.0122 | 0.0899 | 0.0777 | |

| CTR | 1.9375 | 1.9331 | −0.0044 | |

| DAR | 0.3852 | 0.3755 | −0.0097 | |

| DER | 0.6587 | 0.6572 | −0.0015 | |

| WACC | 0.0657 | 0.0655 | −0.0001 | |

| LITRAK | EPS | 0.3192 | 0.3192 | 0.0000 |

| ROA | 0.0753 | 0.1150 | 0.0398 | |

| ROE | 0.2539 | 0.2539 | 0.0000 | |

| BIA | 0.0608 | 0.0608 | 0.0000 | |

| CTR | 3.0011 | 1.2042 | −1.7969 | |

| DAR | 0.6972 | 0.5896 | −0.1076 | |

| DER | 2.9152 | 1.5080 | −1.4072 | |

| WACC | 0.0603 | 0.0535 | −0.0068 | |

| MAYBULK | EPS | 0.0771 | 0.0771 | 0.0000 |

| ROA | 0.0668 | 0.0730 | 0.0062 | |

| ROE | 0.1121 | 0.1121 | 0.0000 | |

| BIA | 0.0425 | 0.0425 | 0.0000 | |

| CTR | 2.3389 | 1.9873 | −0.3516 | |

| DAR | 0.3433 | 0.2917 | −0.0516 | |

| DER | 0.7257 | 0.4414 | −0.2843 | |

| WACC | 0.0997 | 0.0801 | −0.0195 | |

| SEALINK | EPS | 0.0122 | 0.0286 | 0.0165 |

| ROA | 0.0067 | 0.0129 | 0.0063 | |

| ROE | 0.0136 | 0.0208 | 0.0071 | |

| BIA | 0.0034 | 0.0081 | 0.0048 | |

| CTR | 1.0091 | 1.0004 | −0.0088 | |

| DAR | 0.4391 | 0.4094 | −0.0297 | |

| DER | 0.8154 | 0.8083 | −0.0071 | |

| WACC | 0.0719 | 0.0682 | −0.0037 | |

| SURIA | EPS | 0.1925 | 0.1925 | 0.0000 |

| ROA | 0.0439 | 0.0712 | 0.0274 | |

| ROE | 0.0620 | 0.1157 | 0.0537 | |

| BIA | 0.0159 | 0.0404 | 0.0245 | |

| CTR | 2.8923 | 2.8063 | −0.0861 | |

| DAR | 0.2793 | 0.2710 | −0.0083 | |

| DER | 0.4018 | 0.3875 | −0.0143 | |

| WACC | 0.0848 | 0.0822 | −0.0025 | |

| TAS | EPS | 0.0405 | 0.2532 | 0.2127 |

| ROA | 0.0266 | 0.0303 | 0.0037 | |

| ROE | 0.0450 | 0.0477 | 0.0026 | |

| BIA | 0.0018 | 0.2577 | 0.2559 | |

| CTR | 2.1528 | 1.5306 | −0.6222 | |

| DAR | 0.5080 | 0.3612 | −0.1468 | |

| DER | 1.5783 | 0.6088 | −0.9695 | |

| WACC | 0.1028 | 0.0731 | −0.0297 | |

| TASCO | EPS | 0.1886 | 0.1886 | 0.0000 |

| ROA | 0.0597 | 0.0597 | 0.0000 | |

| ROE | 0.1032 | 0.1058 | 0.0026 | |

| BIA | 0.0160 | 0.1463 | 0.1303 | |

| CTR | 1.6644 | 1.5248 | −0.1396 | |

| DAR | 0.4191 | 0.3840 | −0.0351 | |

| DER | 0.8357 | 0.6753 | −0.1604 | |

| WACC | 0.0734 | 0.0672 | −0.0062 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lee, P.F.; Lam, W.S.; Lam, W.H. Performance Evaluation of the Efficiency of Logistics Companies with Data Envelopment Analysis Model. Mathematics 2023, 11, 718. https://doi.org/10.3390/math11030718

Lee PF, Lam WS, Lam WH. Performance Evaluation of the Efficiency of Logistics Companies with Data Envelopment Analysis Model. Mathematics. 2023; 11(3):718. https://doi.org/10.3390/math11030718

Chicago/Turabian StyleLee, Pei Fun, Weng Siew Lam, and Weng Hoe Lam. 2023. "Performance Evaluation of the Efficiency of Logistics Companies with Data Envelopment Analysis Model" Mathematics 11, no. 3: 718. https://doi.org/10.3390/math11030718

APA StyleLee, P. F., Lam, W. S., & Lam, W. H. (2023). Performance Evaluation of the Efficiency of Logistics Companies with Data Envelopment Analysis Model. Mathematics, 11(3), 718. https://doi.org/10.3390/math11030718