Time-Varying Granger Causality of COVID-19 News on Emerging Financial Markets: The Latin American Case

Abstract

1. Introduction

2. Data and Methods

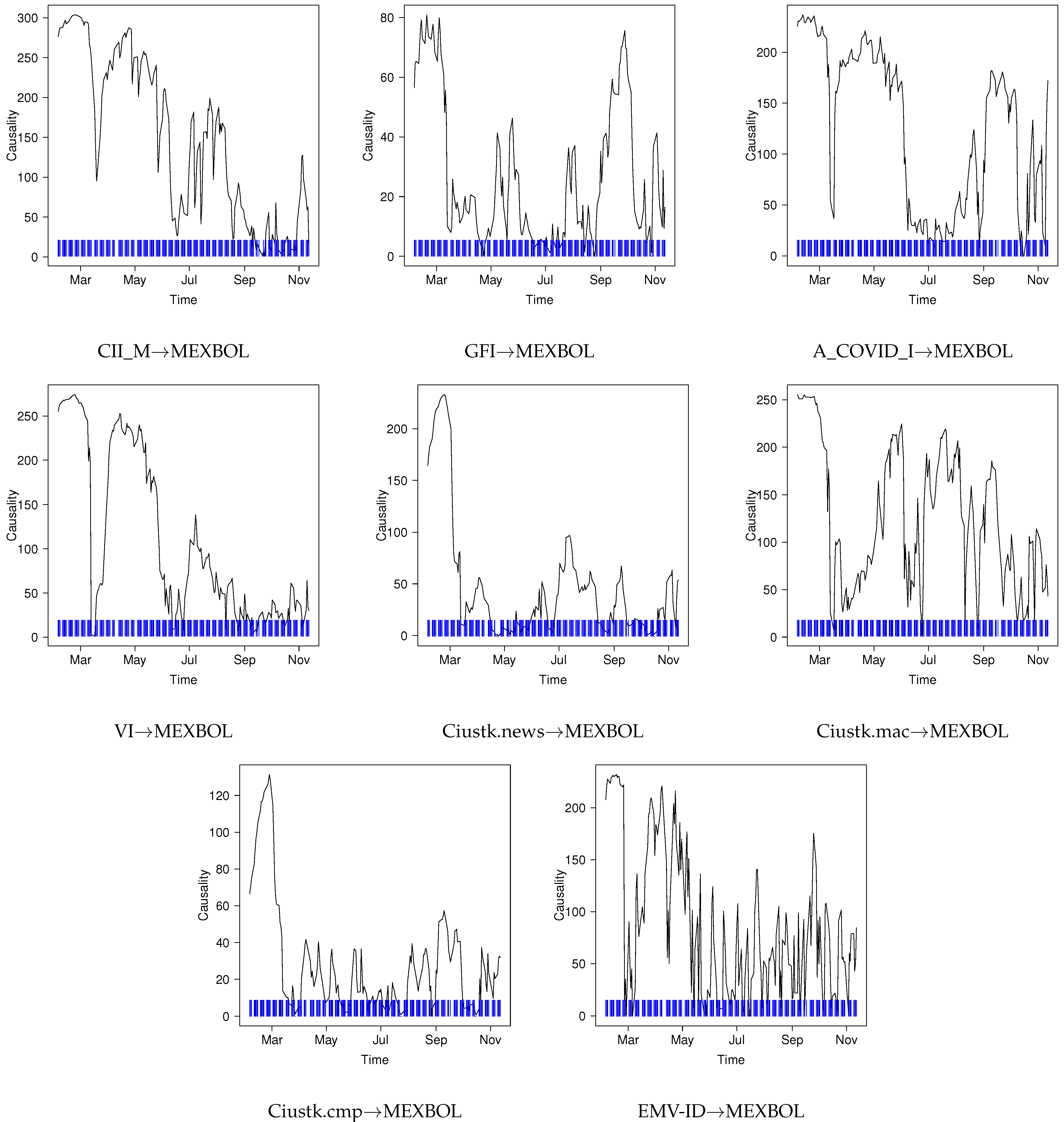

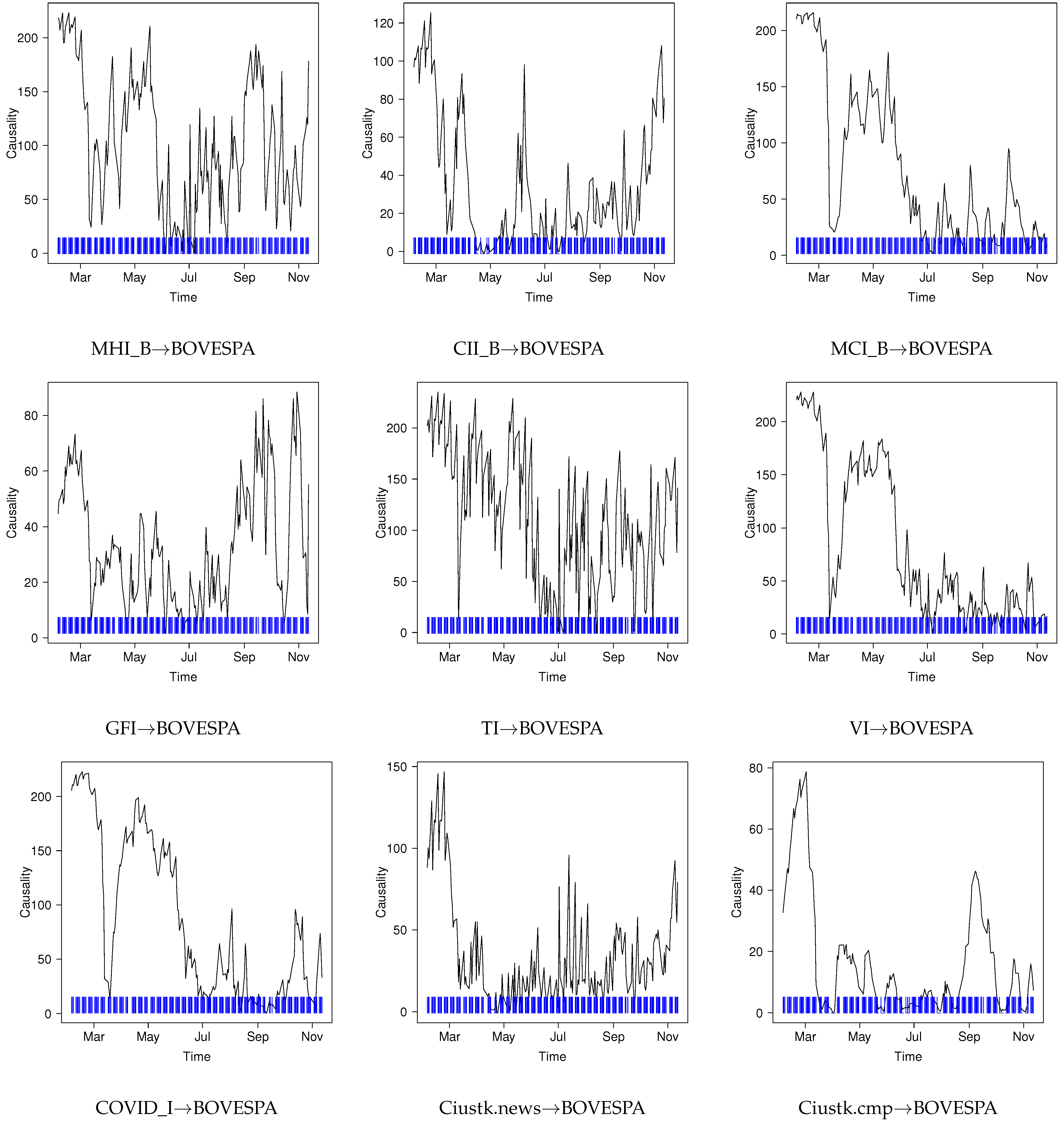

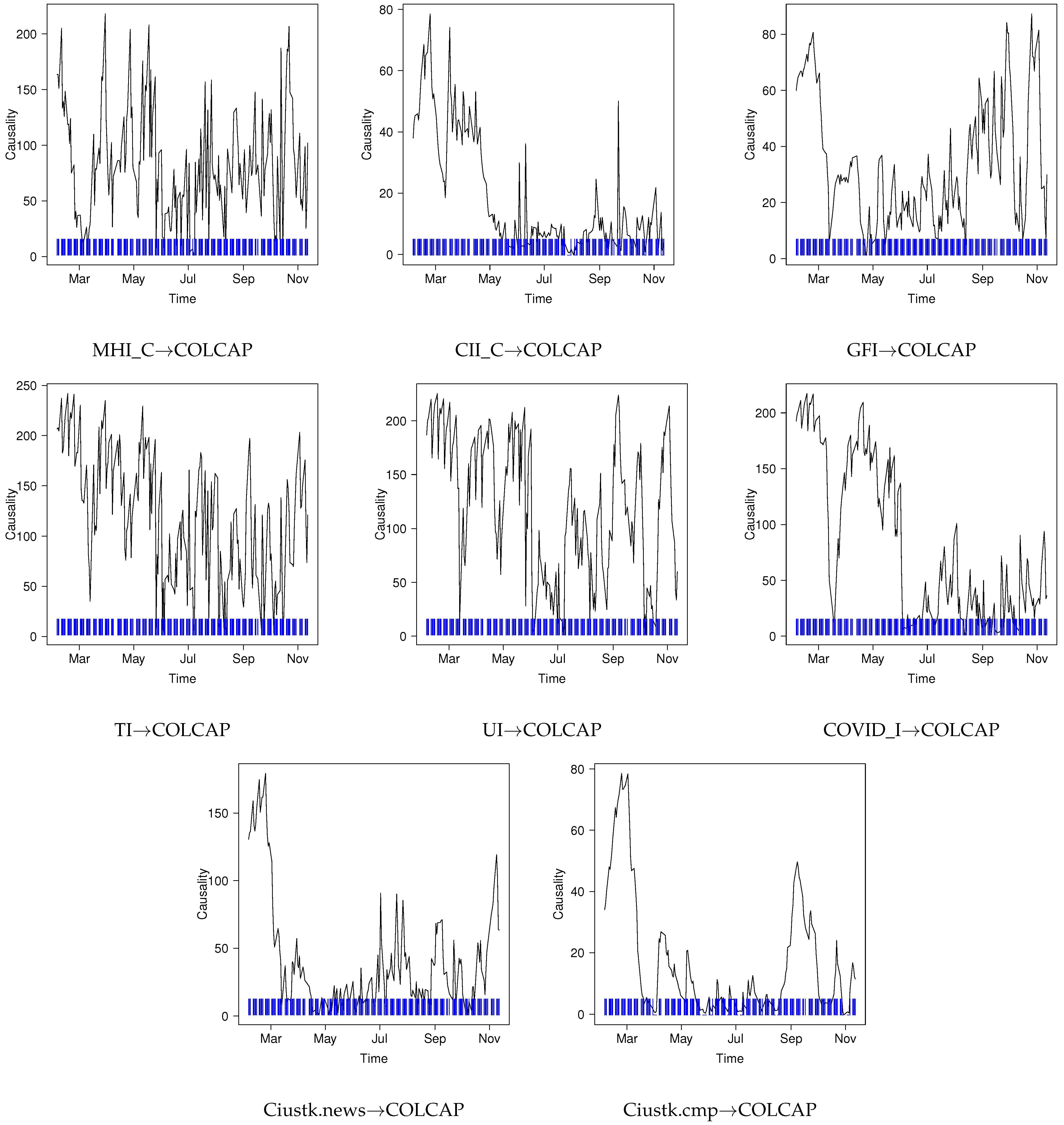

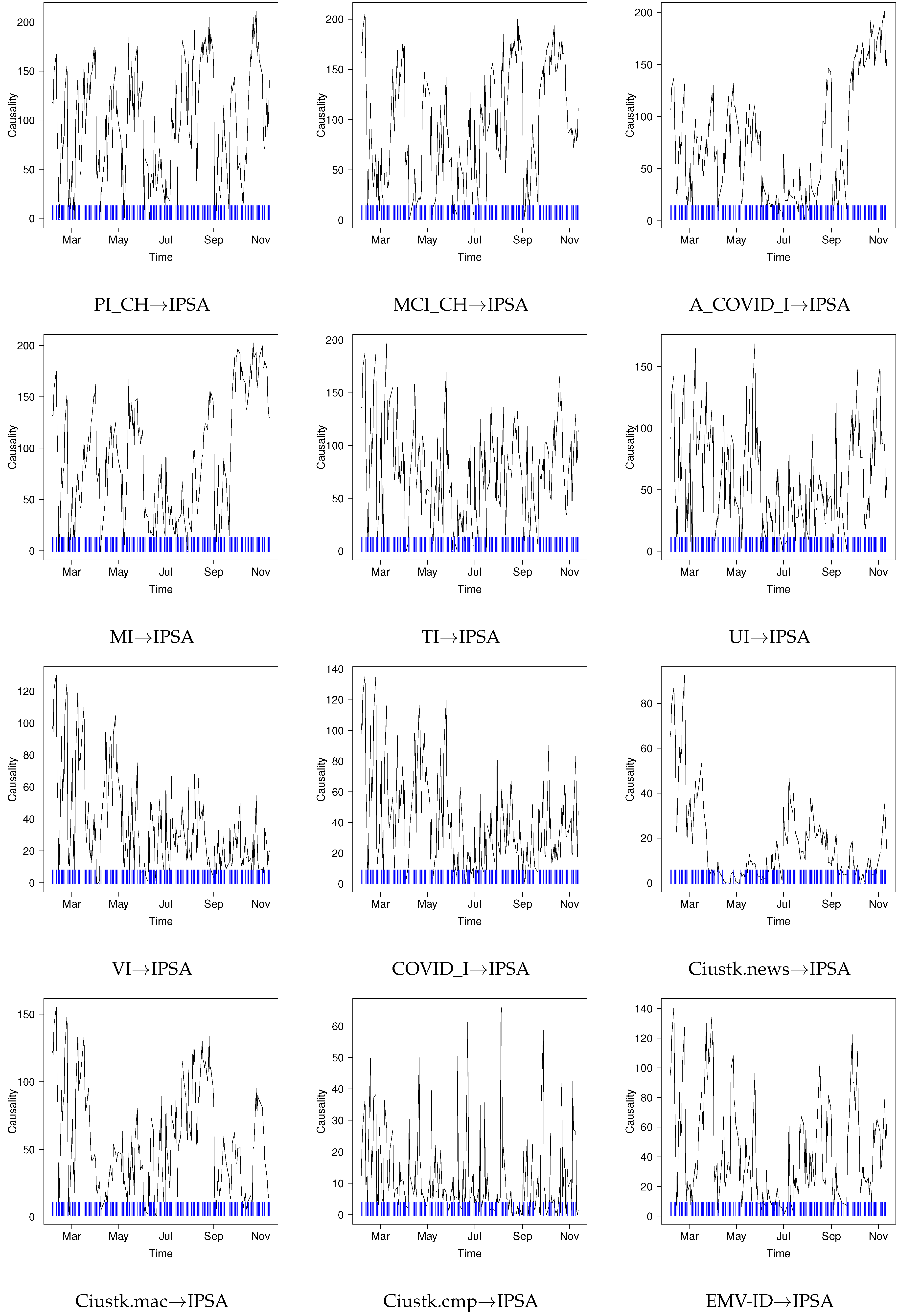

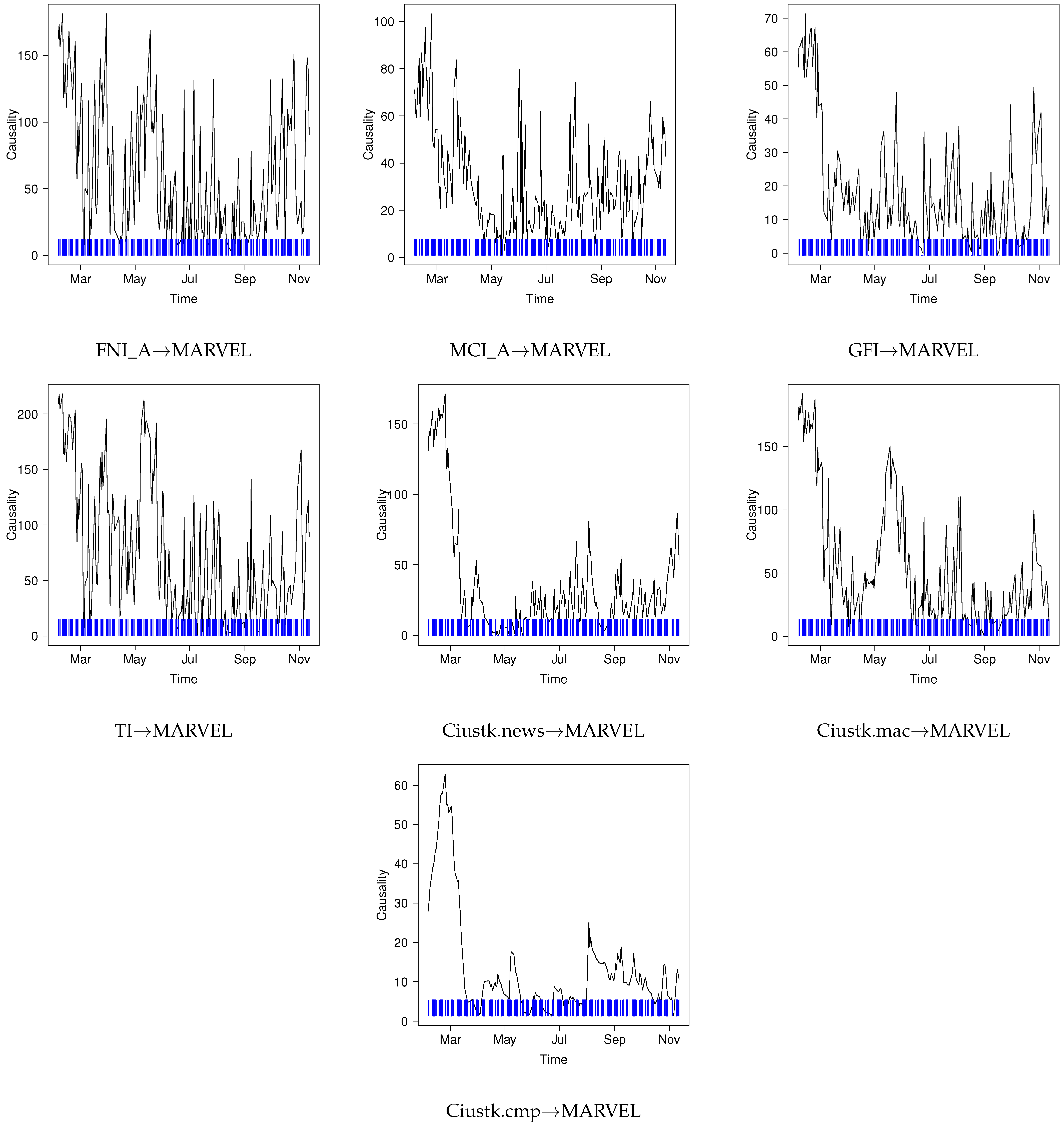

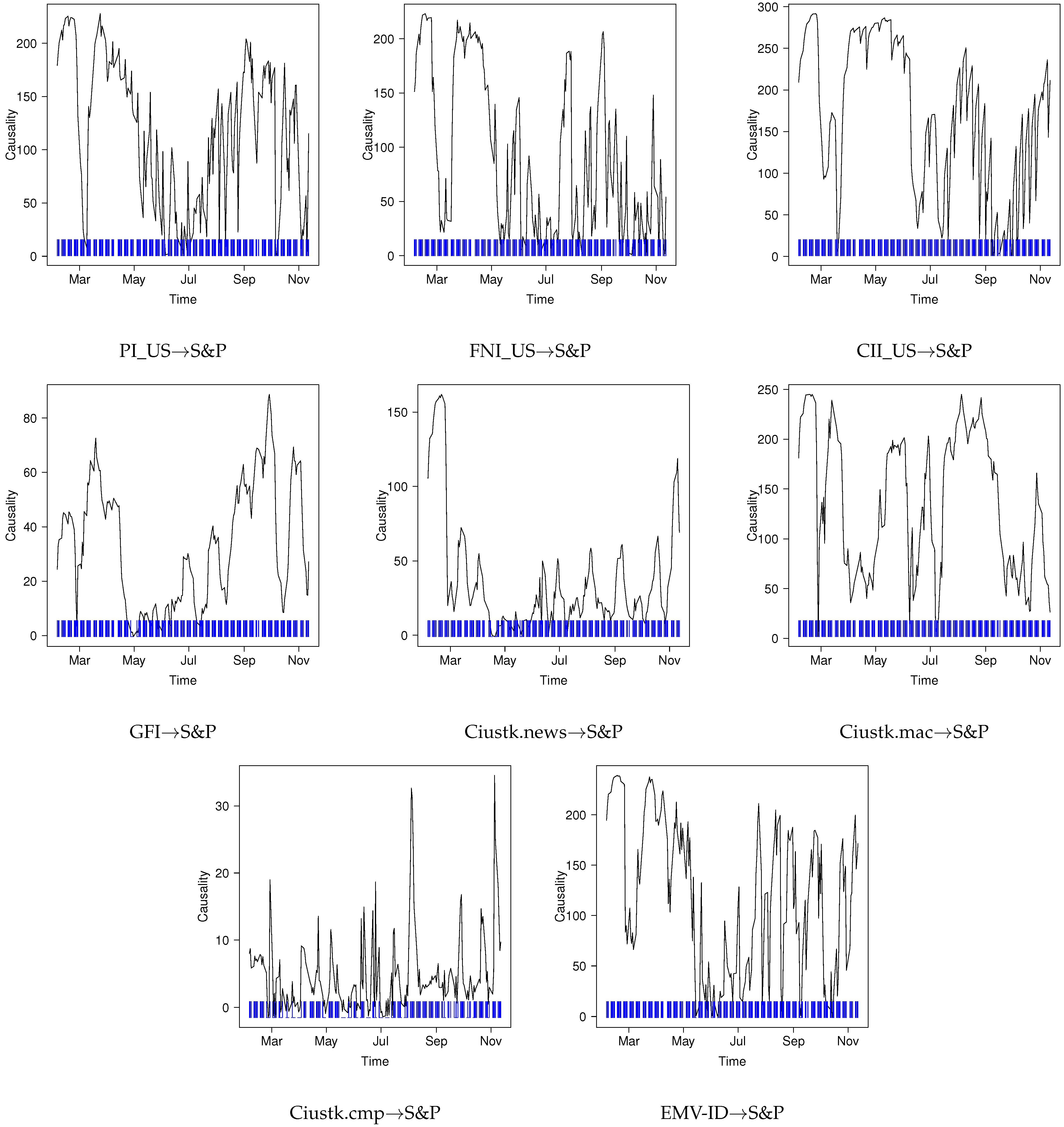

3. Results and Discussion

4. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Data Availability Statement

Conflicts of Interest

References

- World Health Organization. Rolling Updates on Coronavirus Disease (COVID-19). Available online: https://www.who.int/emergencies/diseases/novel-coronavirus-2019/events-as-they-happen (accessed on 20 November 2022).

- Economic Commission for Latin America and the Caribbean. Informe Sobre El Impacto Económico En América Latina y El Caribe de La Enfermedad Por Coronavirus (COVID-19); UNECLAC: Santiago, Chile, 2020; ISBN 9789210054140. [Google Scholar]

- Hasan, M.B.; Mahi, M.; Hassan, M.K.; Bhuiyan, A.B. Impact of COVID-19 Pandemic on Stock Markets: Conventional vs. Islamic Indices Using Wavelet-Based Multi-Timescales Analysis. N. Am. J. Econ. Financ. 2021, 58, 101504. [Google Scholar] [CrossRef]

- Yarovaya, L.; Elsayed, A.H.; Hammoudeh, S. Determinants of Spillovers between Islamic and Conventional Financial Markets: Exploring the Safe Haven Assets during the COVID-19 Pandemic. Financ. Res. Lett. 2021, 43, 101979. [Google Scholar] [CrossRef]

- Albulescu, C.T. COVID-19 and the United States Financial Markets’ Volatility. Financ. Res. Lett. 2021, 38, 101699. [Google Scholar] [CrossRef] [PubMed]

- Shehzad, K.; Xiaoxing, L.; Bilgili, F.; Koçak, E. COVID-19 and Spillover Effect of Global Economic Crisis on the United States’ Financial Stability. Front. Psychol. 2021, 12, 632175. [Google Scholar] [CrossRef] [PubMed]

- Nicola, M.; Alsafi, Z.; Sohrabi, C.; Kerwan, A.; Al-Jabir, A.; Iosifidis, C.; Agha, M.; Agha, R. The Socio-Economic Implications of the Coronavirus Pandemic (COVID-19): A Review. Int. J. Surg. 2020, 78, 185–193. [Google Scholar] [CrossRef]

- Wei, S.-J. Ten Keys to Beating Back COVID-19 and the Associated Economic Pandemic. In Mitigating the COVID Economic Crisis: Act Fast and Do Whatever It Takes; Baldwin, R., Weder di Mauro, B., Eds.; CEPR Press: London, UK, 2020; pp. 71–76. ISBN 978-1-912179-29-9. [Google Scholar]

- Sharma, S.S. A Note on the Asian Market Volatility During the COVID-19 Pandemic. Asian Econ. Lett. 2020, 1, 17661. [Google Scholar] [CrossRef]

- Hong, H.; Bian, Z.; Lee, C.C. COVID-19 and Instability of Stock Market Performance: Evidence from the U.S. Financ. Innov. 2021, 7, 12. [Google Scholar] [CrossRef]

- Topcu, M.; Gulal, O.S. The Impact of COVID-19 on Emerging Stock Markets. Financ. Res. Lett. 2020, 36, 101691. [Google Scholar] [CrossRef]

- Umar, Z.; Gubareva, M.; Teplova, T. The Impact of COVID-19 on Commodity Markets Volatility: Analyzing Time Frequency Relations between Commodity Prices and Coronavirus Panic Levels. Resour. Policy 2021, 73, 102164. [Google Scholar] [CrossRef]

- Corbet, S.; Hou, Y.; Hu, Y.; Lucey, B.; Oxley, L. Aye Corona! The Contagion Effects of Being Named Corona during the COVID-19 Pandemic. Financ. Res. Lett. 2021, 38, 101591. [Google Scholar] [CrossRef]

- Shaikh, I. On the Relation between the Crude Oil Market and Pandemic COVID-19. Eur. J. Manag. Bus. Econ. 2021, 30, 331–356. [Google Scholar] [CrossRef]

- Phan, D.H.B.; Narayan, P.K. Country Responses and the Reaction of the Stock Market to COVID-19 a Preliminary Exposition. Emerg. Mark. Financ. Trade 2021, 56, 2138–2150. [Google Scholar] [CrossRef]

- Javed, F.; Mantalos, P. Sensitivity of the Causality in Variance Test to the GARCH (1,1) Parameters. Chil. J. Stat. 2015, 6, 49–65. [Google Scholar] [CrossRef]

- Baker, S.R.; Bloom, N.; Kost, K.; Sammon, M.; Viratyosin, T. The Unprecedented Stock Market Impact of COVID-19; National Bureau of Economic Research: Cambridge, MA, USA, 2020. [Google Scholar]

- Bai, L.; Wei, Y.; Wei, G.; Li, X.; Zhang, S. Infectious Disease Pandemic and Permanent Volatility of International Stock Markets: A Long-Term Perspective. Financ. Res. Lett. 2020, 40, 101709. [Google Scholar] [CrossRef] [PubMed]

- Bouri, E.; Gkillas, K.; Gupta, R.; Pierdzioch, C. Forecasting Power of Infectious Diseases-Related Uncertainty for Gold Realized Variance. Financ. Res. Lett. 2021, 42, 101936. [Google Scholar] [CrossRef]

- Gupta, R.; Subramaniam, S.; Bouri, E.; Ji, Q. Infectious Disease-Related Uncertainty and the Safe-Haven Characteristic of US Treasury Securities. Int. Rev. Econ. Financ. 2021, 71, 289–298. [Google Scholar] [CrossRef]

- Li, Y.; Liang, C.; Ma, F.; Wang, J. The Role of the IDEMV in Predicting European Stock Market Volatility during the COVID-19 Pandemic. Financ. Res. Lett. 2020, 36, 101749. [Google Scholar] [CrossRef]

- RavenPack Coronavirus. Available online: https://coronavirus.ravenpack.com (accessed on 20 November 2022).

- Baig, A.S.; Butt, H.A.; Haroon, O.; Rizvi, S.A.R. Deaths, Panic, Lockdowns and US Equity Markets: The Case of COVID-19 Pandemic. Financ. Res. Lett. 2021, 38, 101701. [Google Scholar] [CrossRef]

- Ho, K.-Y.; Shi, Y.; Zhang, Z. News and Return Volatility of Chinese Bank Stocks. Int. Rev. Econ. Financ. 2020, 69, 1095–1105. [Google Scholar] [CrossRef]

- Akhtaruzzaman, M.; Boubaker, S.; Umar, Z. COVID-19 Media Coverage and ESG Leader Indices. Financ. Res. Lett. 2021, 45, 102170. [Google Scholar] [CrossRef]

- Cepoi, C.O. Asymmetric Dependence between Stock Market Returns and News during COVID-19 Financial Turmoil. Financ. Res. Lett. 2020, 36, 101658. [Google Scholar] [CrossRef]

- Tan, Ö. The Effect of Pandemic News on Stock Market Returns During the Covid-19 Crash: Evidence from International Markets. Connect. Istanb. Univ. J. Commun. Sci 2021, 60, 217–240. [Google Scholar] [CrossRef]

- Capelle-Blancard, G.; Desroziers, A. The Stock Market Is Not the Economy? Insights from the COVID-19 Crisis. SSRN Electron. J. 2020, 1–40. [Google Scholar] [CrossRef]

- Niu, Z.; Liu, Y.; Gao, W.; Zhang, H. The Role of Coronavirus News in the Volatility Forecasting of Crude Oil Futures Markets: Evidence from China. Resour. Policy 2021, 73, 102173. [Google Scholar] [CrossRef]

- Naseem, S.; Mohsin, M.; Hui, W.; Liyan, G.; Penglai, K. The Investor Psychology and Stock Market Behavior During the Initial Era of COVID-19: A Study of China, Japan, and the United States. Front. Psychol. 2021, 12, 626934. [Google Scholar] [CrossRef]

- Xiang, Y.-T.; Yang, Y.; Li, W.; Zhang, L.; Zhang, Q.; Cheung, T.; Ng, C.H. Timely Mental Health Care for the 2019 Novel Coronavirus Outbreak Is Urgently Needed. Lancet Psychiatry 2020, 7, 228–229. [Google Scholar] [CrossRef] [PubMed]

- Jawadi, F.; Namouri, H.; Ftiti, Z. An Analysis of the Effect of Investor Sentiment in a Heterogeneous Switching Transition Model for G7 Stock Markets. J. Econ. Dyn. Control 2018, 91, 469–484. [Google Scholar] [CrossRef]

- Huynh, T.L.D.; Foglia, M.; Nasir, M.A.; Angelini, E. Feverish Sentiment and Global Equity Markets during the COVID-19 Pandemic. J. Econ. Behav. Organ. 2021, 188, 1088–1108. [Google Scholar] [CrossRef] [PubMed]

- Haroon, O.; Rizvi, S.A.R. COVID-19: Media Coverage and Financial Markets Behavior—A Sectoral Inquiry. J. Behav. Exp. Financ. 2020, 27, 100343. [Google Scholar] [CrossRef] [PubMed]

- Dong, H.; Gil-Bazo, J.; Ratiu, R.V. Information Demand during the COVID-19 Pandemic. J. Account. Public Policy 2021, 40, 106917. [Google Scholar] [CrossRef]

- Galai, D.; Sade, O. The “Ostrich Effect” and the Relationship between the Liquidity and the Yields of Financial Assets. J. Bus. 2006, 79, 2741–2759. [Google Scholar] [CrossRef]

- Devpura, N.; Narayan, P.K.; Sharma, S.S. Is Stock Return Predictability Time-Varying? J. Int. Financ. Mark. Institutions Money 2018, 52, 152–172. [Google Scholar] [CrossRef]

- Fernandez-Perez, A.; Gilbert, A.; Indriawan, I.; Nguyen, N.H. COVID-19 Pandemic and Stock Market Response: A Culture Effect. J. Behav. Exp. Financ. 2021, 29, 100454. [Google Scholar] [CrossRef] [PubMed]

- Namouri, H.; Jawadi, F.; Ftiti, Z.; Hachicha, N. Threshold Effect in the Relationship between Investor Sentiment and Stock Market Returns: A PSTR Specification. Appl. Econ. 2018, 50, 559–573. [Google Scholar] [CrossRef]

- Lu, F.; Hong, Y.; Wang, S.; Lai, K.; Liu, J. Time-Varying Granger Causality Tests for Applications in Global Crude Oil Markets. Energy Econ. 2014, 42, 289–298. [Google Scholar] [CrossRef]

- Blitz, D.; Huisman, R.; Swinkels, L.; van Vliet, P. Media Attention and the Volatility Effect. Financ. Res. Lett. 2020, 36, 101317. [Google Scholar] [CrossRef]

- Salisu, A.A.; Akanni, L.O. Constructing a Global Fear Index for the COVID-19 Pandemic. Emerg. Mark. Financ. Trade 2020, 56, 2310–2331. [Google Scholar] [CrossRef]

- Salisu, A.A.; Ogbonna, A.E.; Oloko, T.F.; Adediran, I.A. A New Index for Measuring Uncertainty Due to the COVID-19 Pandemic. Sustainability 2021, 13, 3212. [Google Scholar] [CrossRef]

- Narayan, P.K.; Iyke, B.N.; Sharma, S.S. New Measures of the COVID-19 Pandemic: A New Time-Series Dataset. Asian Econ. Lett. 2021, 2, 1–14. [Google Scholar] [CrossRef]

- Bera, A.K.; Jarque, C.M. Efficient Tests for Normality, Homoscedasticity and Serial Independence of Regression Residuals. Econ. Lett. 1981, 7, 313–318. [Google Scholar] [CrossRef]

- Meng, M.; Lee, J.; Payne, J.E. RALS-LM Unit Root Test with Trend Breaks and Non-Normal Errors: Application to the Prebisch-Singer Hypothesis. Stud. Nonlinear Dyn. Econom. 2017, 21, 31–45. [Google Scholar] [CrossRef]

- Engle, R. Autoregressive Conditional Heteroscedasticity with Estimates of the Variance of United Kingdom Inflation. Econometrica 1982, 50, 987–1007. [Google Scholar] [CrossRef]

- Killick, R.; Fearnhead, P.; Eckley, I.A. Optimal Detection of Changepoints with a Linear Computational Cost. J. Am. Stat. Assoc. 2012, 107, 1590–1598. [Google Scholar] [CrossRef]

- Broock, W.A.; Scheinkman, J.A.; Dechert, W.D.; LeBaron, B. A Test for Independence Based on the Correlation Dimension. Econom. Rev. 1996, 15, 197–235. [Google Scholar] [CrossRef]

- Cevik, E.I.; Atukeren, E.; Korkmaz, T. Oil Prices and Global Stock Markets: A Time-Varying Causality-in-Mean and Causality-in-Variance Analysis. Energies 2018, 11, 2848. [Google Scholar] [CrossRef]

- Gupta, R.; Kanda, P.; Wohar, M.E. Predicting Stock Market Movements in the United States: The Role of Presidential Approval Ratings. Int. Rev. Financ. 2021, 21, 324–335. [Google Scholar] [CrossRef]

- Coronado, S.; Gupta, R.; Hkiri, B.; Rojas, O. Time-Varying Spillovers between Currency and Stock Markets in the USA: Historical Evidence from More than Two Centuries. Adv. Decis. Sci. 2020, 24, 1–32. [Google Scholar]

- Engle, R. Dynamic Conditional Correlation. J. Bus. Econ. Stat. 2002, 20, 339–350. [Google Scholar] [CrossRef]

- Kanda, P.; Burke, M.; Gupta, R. Time-Varying Causality between Equity and Currency Returns in the United Kingdom: Evidence from over Two Centuries of Data. Phys. A Stat. Mech. Appl. 2018, 506, 1060–1080. [Google Scholar] [CrossRef]

- Jammazi, R.; Ferrer, R.; Jareño, F.; Shahzad, S.J.H. Time-Varying Causality between Crude Oil and Stock Markets: What Can We Learn from a Multiscale Perspective? Int. Rev. Econ. Financ. 2017, 49, 453–483. [Google Scholar] [CrossRef]

- Gallotti, R.; Valle, F.; Castaldo, N.; Sacco, P.; De Domenico, M. Assessing the Risks of ‘Infodemics’ in Response to COVID-19 Epidemics. Nat. Hum. Behav. 2020, 4, 1285–1293. [Google Scholar] [CrossRef] [PubMed]

- Evans, K.P. Intraday Jumps and US Macroeconomic News Announcements. J. Bank Financ. 2011, 35, 2511–2527. [Google Scholar] [CrossRef]

- Jawadi, F.; Louhichi, W.; ben Ameur, H.; Ftiti, Z. Do Jumps and Co-Jumps Improve Volatility Forecasting of Oil and Currency Markets? Energy J. 2019, 40, 131–150. [Google Scholar] [CrossRef]

- Youssef, M.; Mokni, K.; Ajmi, A.N. Dynamic Connectedness between Stock Markets in the Presence of the COVID-19 Pandemic: Does Economic Policy Uncertainty Matter? Financ. Innov. 2021, 7, 13. [Google Scholar] [CrossRef] [PubMed]

- Azimli, A. The Impact of COVID-19 on the Degree of Dependence and Structure of Risk-Return Relationship: A Quantile Regression Approach. Financ. Res. Lett. 2020, 36, 101648. [Google Scholar] [CrossRef] [PubMed]

- Engelhardt, N.; Krause, M.; Neukirchen, D.; Posch, P.N. Trust and Stock Market Volatility during the COVID-19 Crisis. Financ. Res. Lett. 2021, 38, 101873. [Google Scholar] [CrossRef]

- Coronado, S.; Martinez, J.N.; Romero-Meza, R. Time-Varying Multivariate Causality among Infectious Disease Pandemic and Emerging Financial Markets: The Case of the Latin American Stock and Exchange Markets. Appl. Econ. 2021, 54, 3924–3932. [Google Scholar] [CrossRef]

- Romero-Meza, R.; Coronado, S.; Ibañez-Veizaga, F. COVID-19 y Causalidad En La Volatilidad Del Mercado Accionario Chileno. Estud. Gerenciales 2021, 37, 242–250. [Google Scholar] [CrossRef]

| Mexico | Brazil | Colombia | ||||||

|---|---|---|---|---|---|---|---|---|

| MEXBOL | CII_M | BOVESPA | MHI_B | CII_B | MCI_B | COLCAP | MHI_C | CII_C |

| 02/25/20 | 03/10/20 | 06/02/20 | 03/12/20 | 03/09/20 | 03/06/20 | 08/21/20 | 09/01/20 | 06/08/20 |

| 04/28/20 | 07/31/20 | 07/03/20 | 05/15/20 | 06/12/20 | 08/21/20 | 09/01/20 | 06/08/20 | |

| 06/11/20 | 09/17/20 | 09/08/20 | 09/14/20 | 10/19/20 | ||||

| 07/08/20 | 10/12/20 | 10/19/20 | ||||||

| 07/21/20 | 10/26/20 | |||||||

| 08/28/20 | ||||||||

| 10/07/20 | ||||||||

| 10/27/20 | ||||||||

| Chile | Peru | Argentina | ||||||

| IPSA | PI_CH | MCI_CH | IGBVL | SI_P | CII_P | MARVEL | MCI_A | FNI_A |

| 04/02/20 | 05/27/20 | 03/04/20 | 06/03/20 | 07/08/20 | 04/13/20 | 02/12/20 | 02/26/20 | 03/23/20 |

| 07/16/20 | 06/03/20 | 07/07/20 | 08/04/20 | 08/13/20 | 08/13/20 | 03/06/20 | 06/02/20 | 03/26/20 |

| 09/08/20 | 07/16/20 | 08/25/20 | 05/08/20 | 04/24/20 | ||||

| 07/29/20 | 06/02/20 | |||||||

| 09/21/20 | 06/10/20 | |||||||

| 09/23/20 | 07/13/20 | |||||||

| 09/15/20 | ||||||||

| 09/30/20 | ||||||||

| U.S.A | ||||||||

| S&P | PI_US | FNI_US | CII_US | EMV-ID | ||||

| 03/06/20 | 05/11/20 | 05/04/20 | 03/09/20 | 04/07/20 | ||||

| 04/07/20 | 05/21/20 | 05/29/20 | ||||||

| 05/26/20 | 08/14/20 | |||||||

| 07/31/20 | ||||||||

| Indexes | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| GFI | A_COVID_I | MI | TI | UI | VI | COVID_I | Ciustk.news | Ciustk.mac | Ciustk.cmp |

| 04/03/20 | 05/22/20 | 05/22/20 | 03/05/20 | 06/01/20 | 04/03/20 | 05/15/20 | 04/13/20 | 04/01/20 | 04/13/20 |

| 10/23/20 | 06/05/20 | 10/20/20 | 03/27/20 | 10/22/20 | 11/06/20 | 06/05/20 | 05/29/20 | 07/07/20 | 05/28/20 |

| 08/13/20 | 05/21/20 | 08/14/20 | 07/30/20 | 10/06/20 | 07/08/20 | ||||

| 05/29/20 | 08/26/20 | ||||||||

| 09/23/20 | |||||||||

| New Index | Stock Market Index | ||||||

|---|---|---|---|---|---|---|---|

| MEXBOL | BOVESPA | COLCAP | IPSA | IGBVL | MARVEL | S&P | |

| CII_M | x | ||||||

| MHI_B | x | ||||||

| CII_B | x | ||||||

| MCI_B | x | ||||||

| MHI_C | x | ||||||

| CII_C | x | ||||||

| PI_CH | x | ||||||

| MCI_CH | x | ||||||

| SI_P | x | ||||||

| CII_P | x | ||||||

| FNI_A | x | ||||||

| MCI_A | x | ||||||

| PI_US | x | ||||||

| FNI_US | x | ||||||

| CII_US | x | ||||||

| GFI | x | x | x | x | x | x | x |

| A_COVID_I | x | x | x | ||||

| MI | x | x | |||||

| TI | x | x | x | x | |||

| UI | x | x | x | ||||

| VI | x | x | x | x | |||

| COVID_I | x | x | x | x | |||

| Ciustk.news | x | x | x | x | x | x | x |

| Ciustk.mac | x | x | x | x | x | ||

| Ciustk.cmp | x | x | x | x | x | x | x |

| EMV-ID | x | x | x | x | |||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Coronado, S.; Martinez, J.N.; Gualajara, V.; Romero-Meza, R.; Rojas, O. Time-Varying Granger Causality of COVID-19 News on Emerging Financial Markets: The Latin American Case. Mathematics 2023, 11, 394. https://doi.org/10.3390/math11020394

Coronado S, Martinez JN, Gualajara V, Romero-Meza R, Rojas O. Time-Varying Granger Causality of COVID-19 News on Emerging Financial Markets: The Latin American Case. Mathematics. 2023; 11(2):394. https://doi.org/10.3390/math11020394

Chicago/Turabian StyleCoronado, Semei, Jose N. Martinez, Victor Gualajara, Rafael Romero-Meza, and Omar Rojas. 2023. "Time-Varying Granger Causality of COVID-19 News on Emerging Financial Markets: The Latin American Case" Mathematics 11, no. 2: 394. https://doi.org/10.3390/math11020394

APA StyleCoronado, S., Martinez, J. N., Gualajara, V., Romero-Meza, R., & Rojas, O. (2023). Time-Varying Granger Causality of COVID-19 News on Emerging Financial Markets: The Latin American Case. Mathematics, 11(2), 394. https://doi.org/10.3390/math11020394