A Model for Assessing the Causality of Factors in the Development of Voluntary Pension Insurance in the Republic of Kazakhstan

Abstract

:1. Introduction

2. Characteristics of the Global Three-Level Pension Model

- Subsystem of state pension provision;

- Subsystem of state pension insurance;

- Subsystem of voluntary pension insurance.

3. Analysis of the Development of the Subsystem of Voluntary Pension Insurance: Models and Factors

- Low replacement rate: a brief career, which means a small density of contributions because of irregular deductions affects the replacement rate. This has a direct impact on the future adequacy of the pension income.

- Low level of declared wages: the low basic level of wages can be explained by jobs with low productivity or the result of not declaring wages. It is not uncommon for employees and employers to agree to lower their stated wages to reduce pension contributions. This corresponds to the conclusions in [12], which show that the very structure of the social insurance system can affect the frequency of contributions.

- Low income and poor working conditions in the informal sector of the economy (self-employed, small, and medium-sized businesses). This sector of the economy remains unaccounted for (undervalued), but it contributes significantly to the country’s economy. The income and permanent employment of workers in the informal sector are different and uncertain because of fairly frequent market changes they cannot control. Therefore, workers in the informal sector have to face market risks on their own [13].

- The frequency with which a person reads articles and brochures about investment or financial planning;

- The frequency of visits to financial planning websites;

- The frequency with which a person tunes in to TV and radio broadcasts about retirement planning and investing;

- Planning expenses in future periods of life;

- Discussing retirement plans with a professional in the field, with a friend or acquaintance.

- Public confidence in the pension system related to voluntary savings;

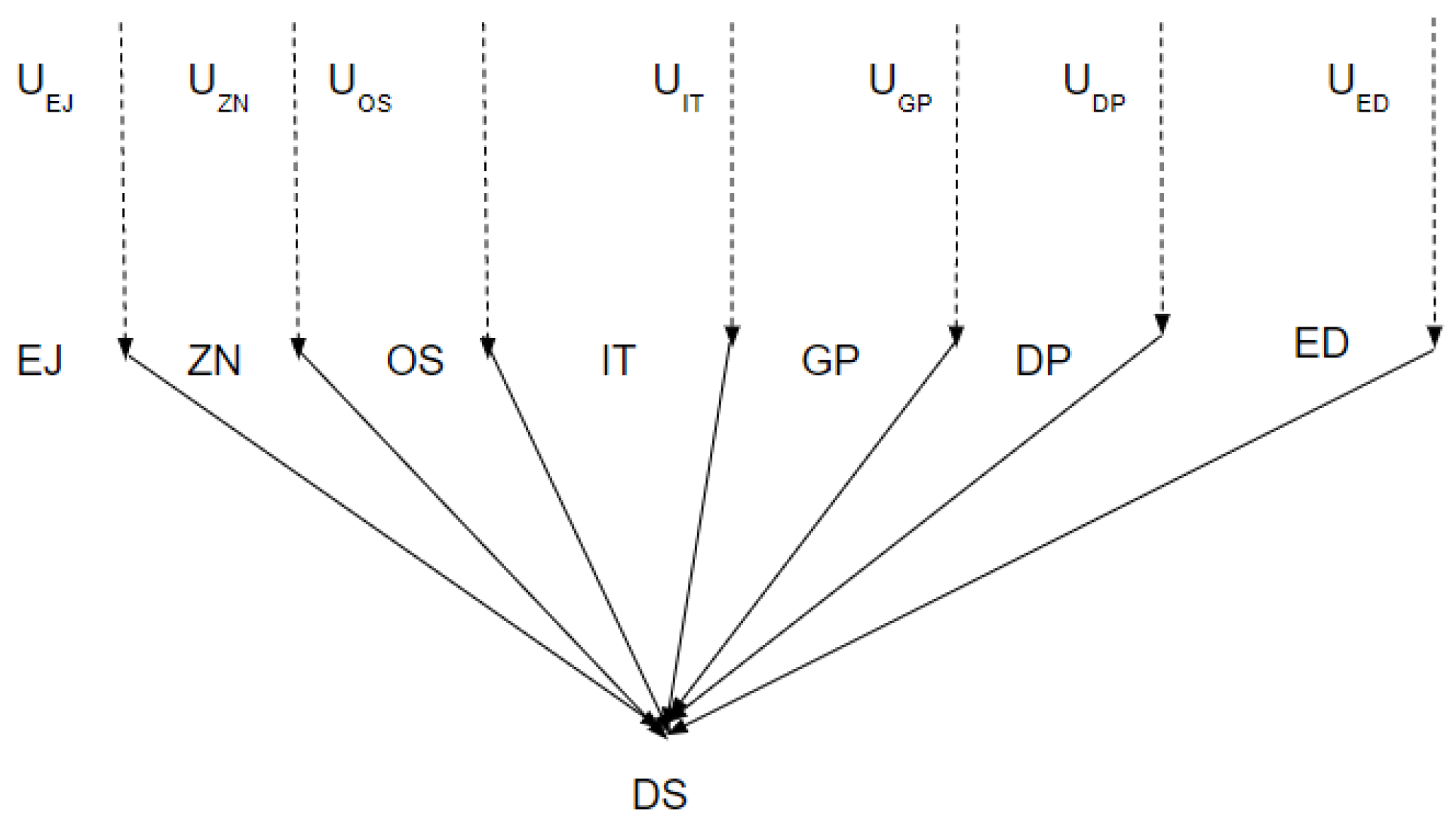

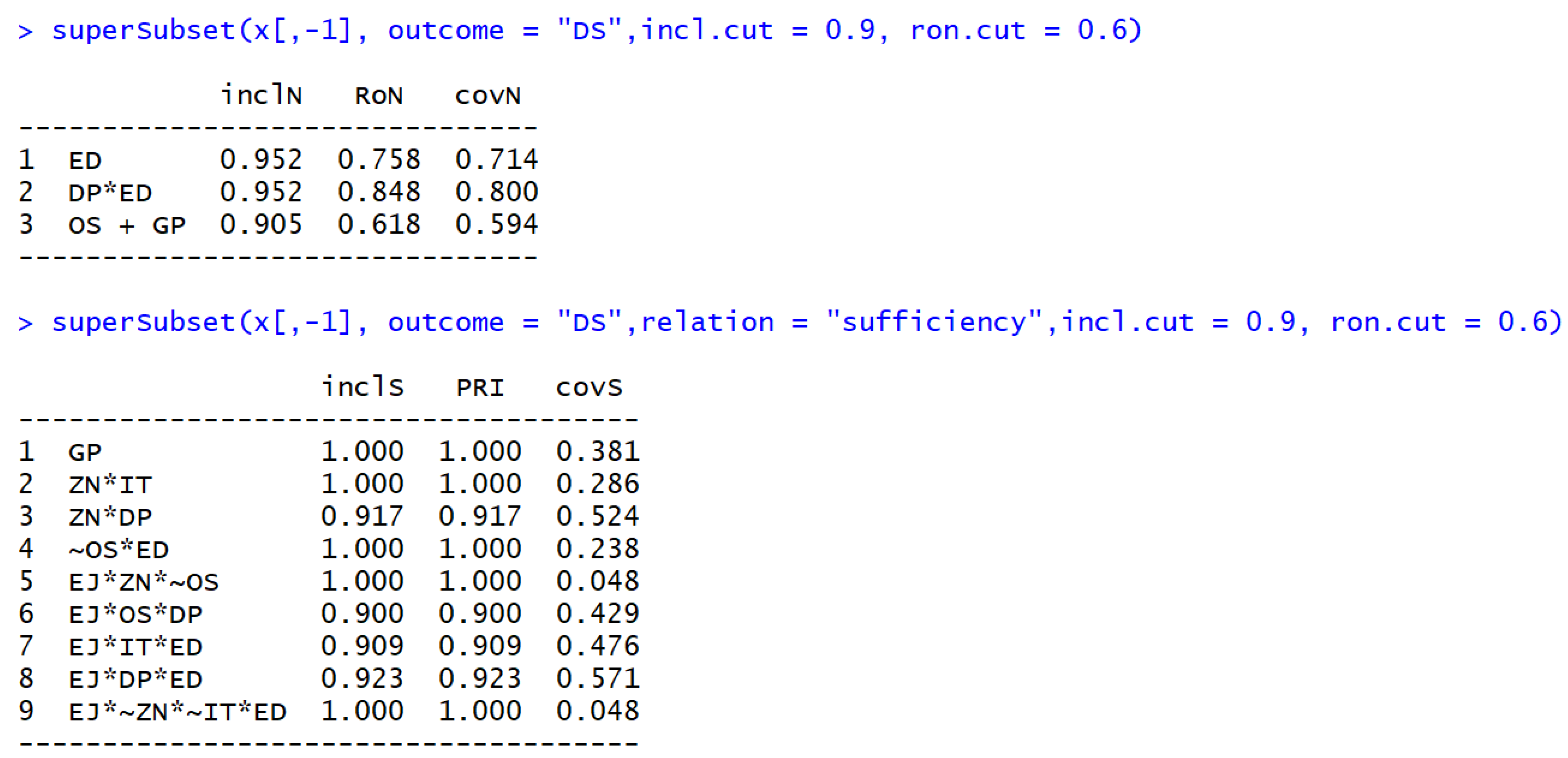

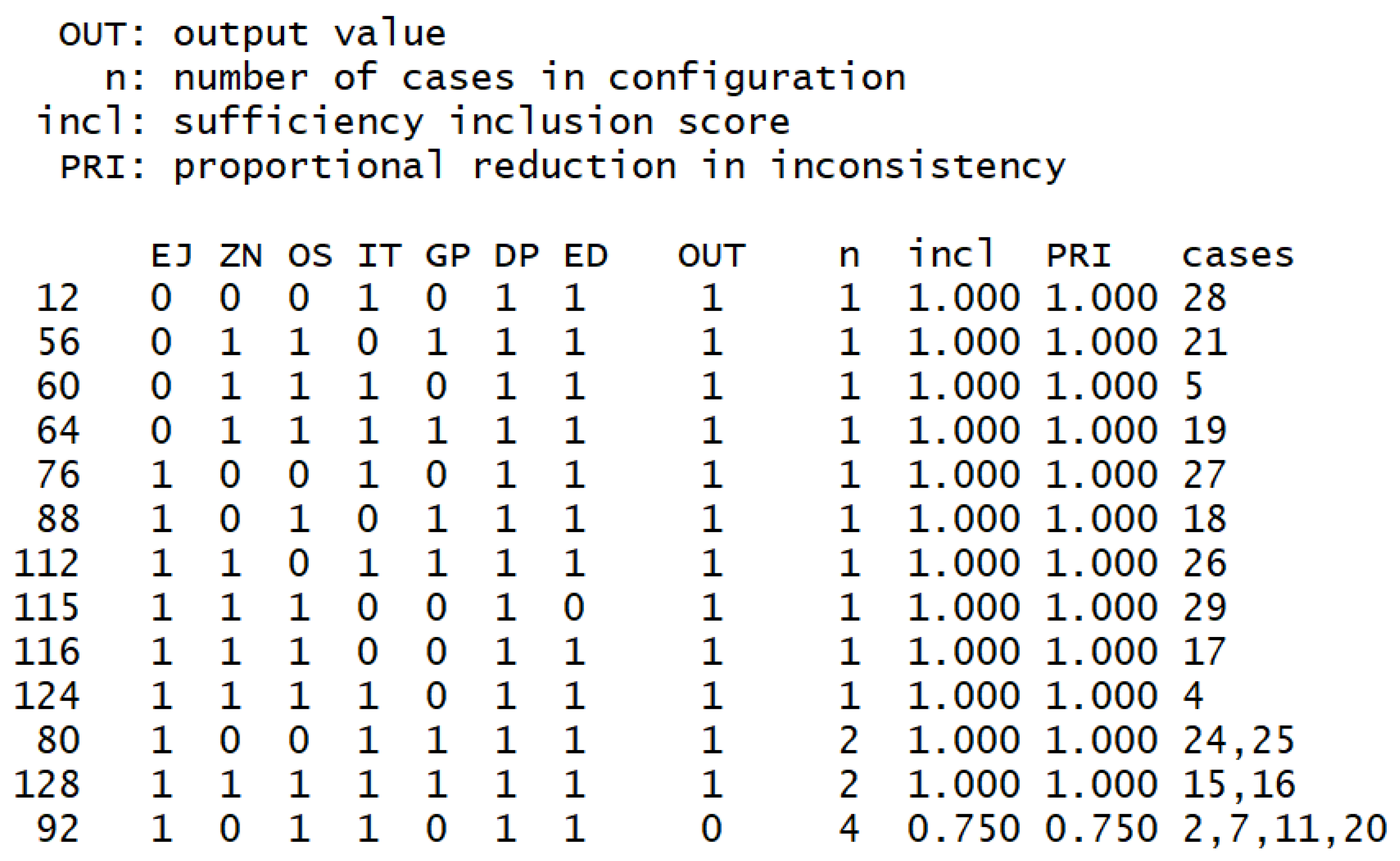

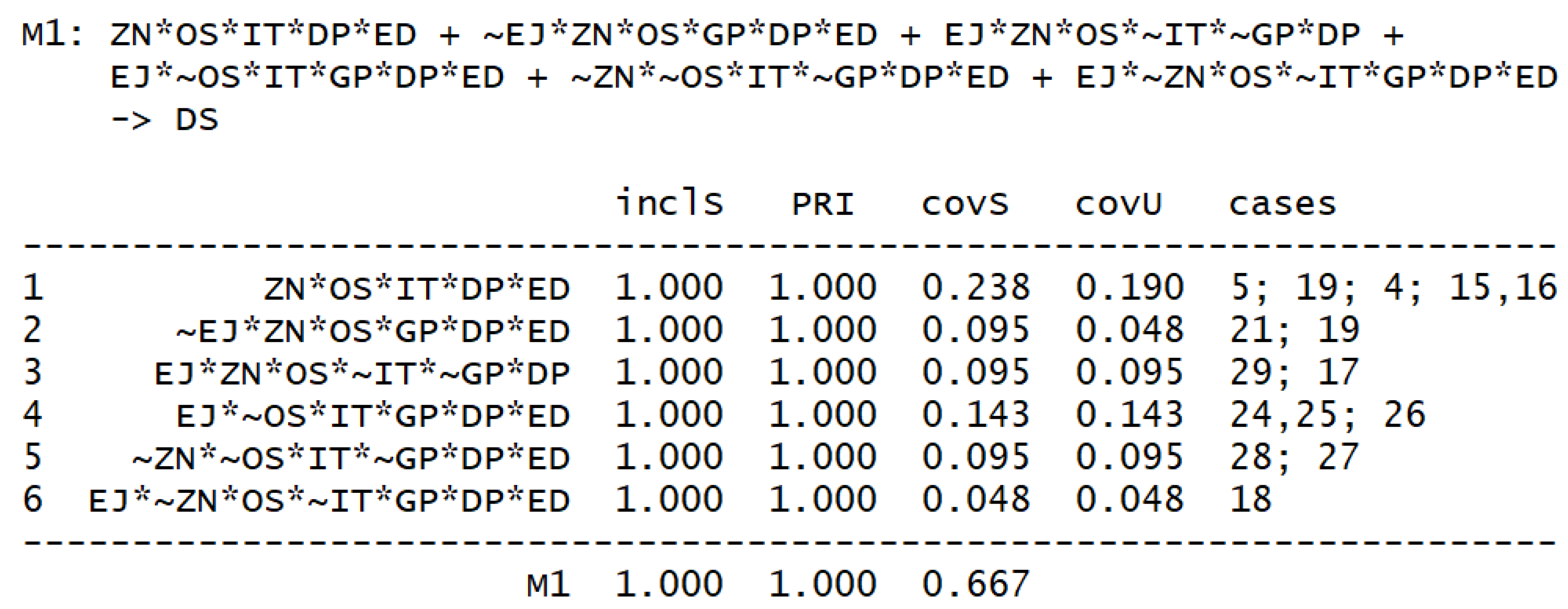

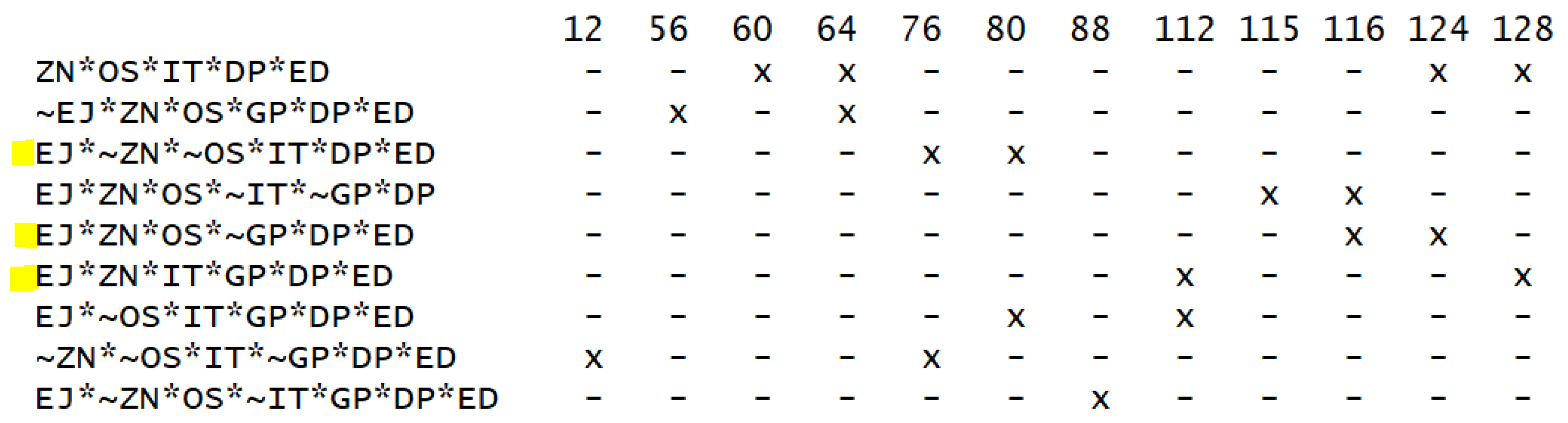

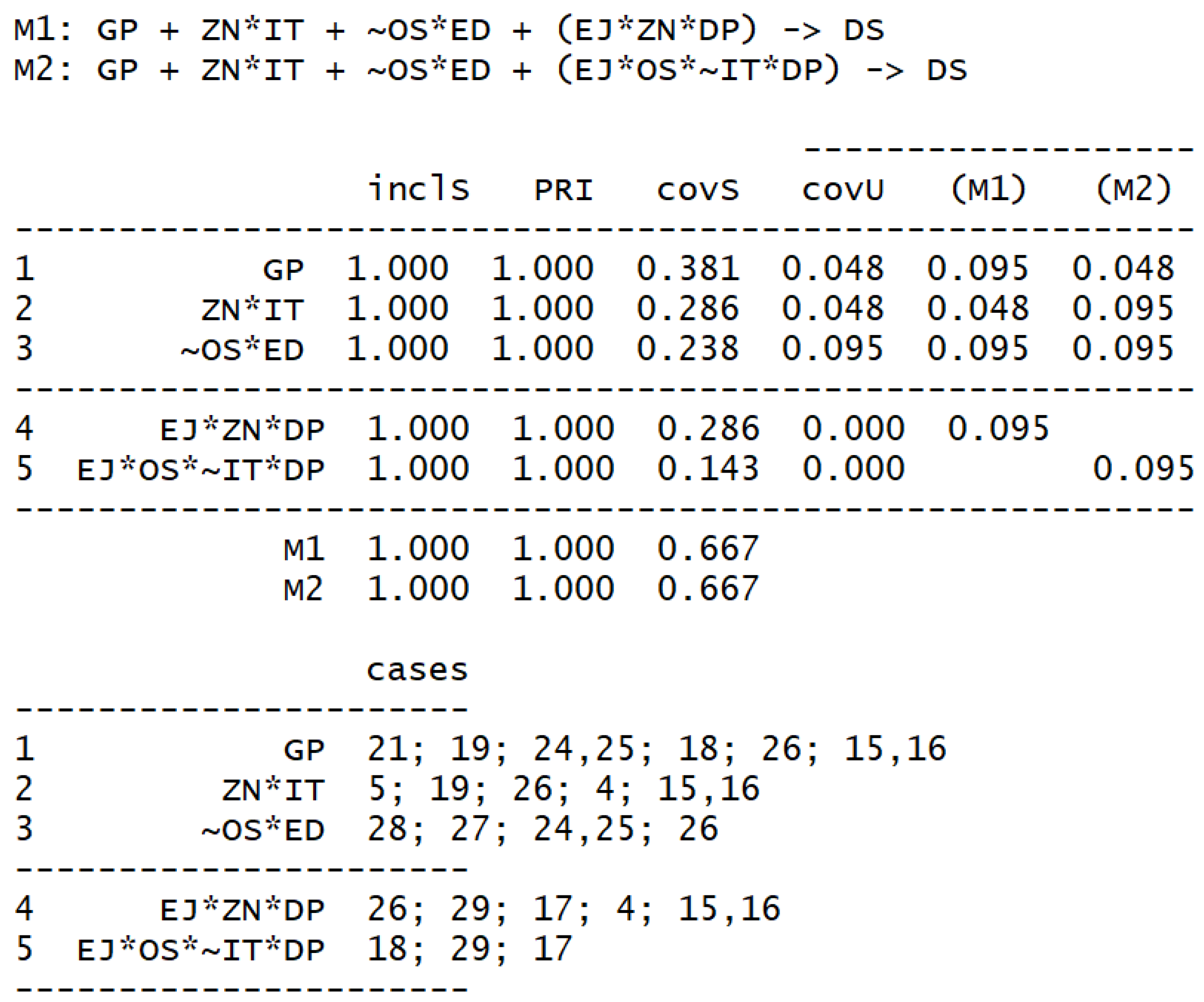

4. An economic and Mathematical Model for Assessing the Causality of Factors in the Development of Voluntary Pension Insurance in the Republic of Kazakhstan

- Conditions (causes) from the set V that ensure the fulfillment of the consequence DS. Necessary and sufficient configuration of conditions that ensure the execution of the corollary in the QCA method.

- Test the hypothesis that the variables we introduce into the model increase the logical coverage of the consequence:

5. Conclusions

- Encourage citizens to participate in the system of voluntary pension contributions due to a competent combination of mechanisms for behavioral economics. This can include awareness of citizens about pension provision, the ability to plan their expenses, and increase planning horizons.

- Actively introduce information technologies into the pension system. Create an information platform by the unified cumulative pension fund of the Republic of Kazakhstan, as an integral element for the dissemination of knowledge and information about pension provision, as well as a means of communication between the population and the pension system.

- The tools we use correctly describe the process and result of modeling. We should continue further research using fuzzy and multivalued logic and the QCA method. The iterative process of building the model showed that not all factors equally affect the result. It is necessary to increase the number of factors reasonably, without changing the design of the study, and process the results of the survey using fuzzy logic and the QCA method.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Whitehouse, E. Pensions and the Crisis. How Should Retirement-Income Systems Respond to Financial and Economic Pressures: The Geneva Papers on Risk and Insurance. Issues Pract. 2009, 34, 536–547. [Google Scholar]

- Holzmann, R.; Hinz, R. Old Age Income Support in the 21st Century: An International Perspective on Pension Systems and Reform; World Bank: Washington, DC, USA, 2005. [Google Scholar]

- Price, W.; Rudolph, H. Reversal and Reduction, Resolution and Reform: Lessons from the Financial Crisis in Europe and Central Asia to Improve Outcomes from Second Pillar Pensions; Working Paper 77779; World Bank: Washington, DC, USA, 2013; pp. 1–82. [Google Scholar]

- Schwartz, A.; Arias, O. The Inverted Pyramid: Pension Systems Facing Demographic Challenges in Europe and Central Asia; The World Bank: Washington, DC, USA, 2014; pp. 304–347. [Google Scholar]

- Organisation for Economic Co-Operation and Development, OECD Pensions Outlook. OECD ILibrary. 2012. Available online: https://www.oecd-ilibrary.org/finance-and-investment/Oecd-Pensions-Outlook-2012_9789264169401-En (accessed on 23 March 2022).

- Mrsik, J.; Lazarevski, D. Reformed Pensions Systems in Central and Eastern Europe: Challenges to Future Safe Pension Benefits. 2012. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2137029 (accessed on 29 March 2022). [CrossRef] [Green Version]

- Berk, A.; Cok, M.; Kosak, M.; Sambt, J. CEE Transition from PAYG to Private Pensions: Income Gaps and Asset Allocation. Czech J. Econ. Financ. 2013, 63, 360–381. [Google Scholar]

- European Commission. The 2015 Ageing Report: Economic and Budgetary Projections for the 28 EU Member States (2013–2060); European Economy 3; European Commission: Brussels, Belgium, 2015; p. 424. [Google Scholar]

- OECD. Pensions at a Glance; OECD: Paris, France, 2013. [Google Scholar] [CrossRef]

- Holzmann, R.; Robalino, D. Closing the Coverage Gap: The Role of Social Pensions and Other Retirement Income Transfers; World Bank: Washington, DC, USA, 2009. [Google Scholar]

- Roffman, R.; Oliveri, M. Pension Coverage in Latin America: Trends and Determinants; Social Protection Discussion Paper No. 1217; World Bank: Washington, DC, USA, 2012; p. 212. Available online: http://siteresources.worldbank.Org (accessed on 29 March 2022).

- Ribe, H.; Robalino, D. From Right to Reality: Incentives, Labor Market and the Challenge of Universal Social Protection in Latin America and Caribbean; World Bank Group, Ed.; The World Bank: Washington, DC, USA, 2012; p. 454. [Google Scholar]

- Willmore, L. Universal Pensions in Low Income Countries. 2006. Available online: https://papers.ssrn.com/sol3/papers.cfm?Abstract_id=381180 (accessed on 29 March 2022).

- Mutembei, R. Effect of Financial Literacy on Voluntary Retirement Planning Among Employees of State Corporations Under the Ministry of Health in Nairobi County, Kenya; University of Nairobi: Nairobi, Kenya, 2016; pp. 34–47. [Google Scholar]

- Holzmann, R.; Truman, P.; Cuesta, J. Extending Coverage in Multi-Pillar Systems: Constraints and Hypothesis, Preliminary Evidence and Future Research Agenda; Social Protection Discussion: Paper Series; World Bank: Washington, DC, USA, 2000; pp. 1–14. [Google Scholar]

- Thomas, R.; Sane, S. In Search of Inclusion: Informal Sector Participation in a Voluntary, Defined Contribution Pension System. 2013. Available online: http://www.igidr.ac.in/pdf/publication/WP-2013-022.pdf (accessed on 29 March 2022).

- Hinrichs, K. Recent pension reforms in Europe: More challenges, new directions. An overview. Social Policy and Administration. 2021, 55, 409–422. [Google Scholar] [CrossRef]

- Castel, P. Voluntary Defined Benefit Pension System Willingness to Participate the Case of Vietnam. Center for International Policy Exchanges. 2005. Available online: http://www.umdcipe.org/conferences/policy_exchanges/conf_papers/Papers/2381.Pdf (accessed on 29 March 2022).

- Moorthy, M.; Thamil, D.; Chiau, S. A Study on Retirement Planning Behaviour of Working Individuals in Malaysia. Int. J. Acad. Res. Econ. Manag. Sci. 2012, 2, 54–72. [Google Scholar]

- Valdes-Prieto, S. A Theory of Contribution Density and Implication for Pension Design; SP Discussion Paper 0828; World Bank: Washington, DC, USA, 2008; pp. 1–52. [Google Scholar]

- Mesa, A.; Behrman, J.; Bravo, D. Characteristics and Determinants of the Density of Contributions in a Private Social Security System; Research Paper WP 2004-077; Michigan Retirement Research Center: Ann Arbor, MI, USA, 2004; pp. 2–49. [Google Scholar]

- Medrano, P. Participación en el Sistema de PFA de Qué Depende; University of Chile: Santiago, Chile, 2007; pp. 12–17. [Google Scholar]

- Pieńkowska-Kamieniecka, S. The Role of Additional Pension Plans in Selected Countries in Central and Eastern Europe. In Proceedings of the 5th International Conference the Economies of Balkan and Eastern Europe Countries in the Changed Word, Split, Croatia, 6–8 May 2013; Kavala Institute of Technology: Kavala, Greece, 2013; pp. 143–153. [Google Scholar]

- Rutecka-Góra, J. Evolution of Supplementary Old-Age Pension Systems in Selected CEE Countries. J. Manag. Financ. 2016, 14, 149–162. [Google Scholar] [CrossRef]

- Hershey, D.; Jacob-Lawson, J.; McArdle, J. Psychological Foundations of Financial Planning for Retirement. J. Adult Dev. 2008, 14, 26–36. [Google Scholar] [CrossRef]

- Heuts, L.; Klaver, J. Evaluatie Informatiebepalingen Pensioenwetgeving: Eindrapport; Regioplan Beleidsonderzoek: Amsterdam, The Netherlands, 2011. [Google Scholar]

- Atkinson, A.; Yermo, J.; Messy, F. Lessons from National Pensions Communication Campaigns. 2012. Available online: https://www.researchgate.net/Publication/241764279 (accessed on 29 March 2022).

- Kast, F.; Meier, S.; Pomeranz, D. Under-Savers Anonymous: Evidence on Self-Help Groups and Peer Pressure as a Savings Commitment Device; NBER Working Paper 18417; National Bureau of Economic Research: Cambridge, MA, USA, 2012; pp. 79–93. [Google Scholar] [CrossRef]

- Mugerman, Y.; Sade, O.; Shayo, M. Long Term Savings Decisions: Financial Reform, Peer Effects and Ethnicity. J. Econ. Behav. Organ. 2014, 106, 235–253. [Google Scholar] [CrossRef]

- Beshears, J.; Choi, J.J.; Laibson, D.; Madrian, B.C.; Milkman, K.L. The Effect of Providing Peer Information on Retirement Savings Decisions. J. Financ. 2015, 70, 1161–1201. [Google Scholar] [CrossRef]

- Johansen, K. Information Search in Pension Plan Decisions. Appl. Econ. Lett. 2013, 20, 1648–1650. [Google Scholar] [CrossRef]

- Fang, H.; Feng, J. The Chinese Pension System. 2018. Available online: http://www.nber.org/papers/W25088 (accessed on 29 March 2022).

- Autoriteit Financiële Markten. Een Volgende Stap Naar Meer Pensioeninzicht: Pensioeninformatie Actief Gebruiken. Autoriteit Financiële Markten, Amsterdam. 2012. Available online: https://www.afm.Nl/ (accessed on 29 March 2022).

- Bernheim, B.D.; Fradkin, A.; Popov, I. The Welfare Economics of Default Options in 401(k) Plans. Am. Econ. Rev. 2015, 105, 2798–2837. [Google Scholar] [CrossRef] [Green Version]

- Brown, K.M.; Laschever, R.A. When They’re Sixty-Four: Peer Effects and the Timing of Retirement. Am. Econ. J. Appl. Econ. 2012, 4, 90–115. [Google Scholar] [CrossRef]

- Bucher-Koenen, T.; Lusardi, A.; Alessie, R. How Financially Literate Are Women? Some New Perspectives on the Gender Gap; Netspar Panel Paper; Global Financial Literacy Excellence Center: Washington, DC, USA, 2012; Volume 31, pp. 12–26. [Google Scholar]

- Camerer, C.; Weber, M. Recent Developments in Modeling Preferences: Uncertainty and Ambiguity. J. Risk Uncertain. 1992, 5, 325–370. [Google Scholar] [CrossRef]

- Kearney, M. Essays on the Determinants of Pensions Savings and Retirement Management Decisions; Working Paper 4; University of Maryland: College Park, MD, USA, 2011; pp. 4–18. Available online: https://pqdtopen.proquest.com/doc/904159541.Html?FMT=ABS (accessed on 29 March 2022).

- Melissa, A.; Knoll, M. The Role of Behavioral Economics and Behavioral Decision Making in Americans’ Retirement Savings Decisions; Society of Actuaries: Schaumburg, IL, USA, 2011; pp. 70–80. [Google Scholar]

- Meng, C.; Pfau, W. The Role of Pension Funds in Capital Market Development; GRIPS Discussion Papers; National Graduate Institute for Policy Studies: Tokyo, Japan, 2010; pp. 52–64. [Google Scholar]

- Merton, R.; Snippe, J. Dutch Not Facing up to Pension Troubles. Financial Times, 26 September 2012. [Google Scholar]

- Mitchell, O.S.; Utkus, S.P. Lessons from Behavioral Finance for Retirement Plan Design; PRC WP 2003-6. In Pension Design and Structure; Oxford University Press (OUP): Oxford, UK, 2004; pp. 3–42. [Google Scholar] [CrossRef] [Green Version]

- Nazarov, D.; Nazarov, A.; Kovtun, D. Building Technology and Predictive Analytics Models in the SAP Analytic Cloud Digital Service. In Proceedings of the 2020 IEEE 22nd Conference on Business Informatics (CBI), Antwerp, Belgium, 22–24 June 2020; Institute of Electrical and Electronics Engineers (IEEE): Piscataway, NJ, USA, 2020; Volume 2, pp. 106–110. [Google Scholar] [CrossRef]

- Nazarov, D.M.; Morozova, A.S.; Kokovikhin, A.Y. SAP Analytic Cloud: A Tool for the Formation of Professional Competencies of Business Analyst. In Proceedings of the CEUR Workshop Proceedings, St. Petersburg, Russia, 17–20 June 2020; p. 2570. [Google Scholar]

- Munnell, A.; Sunden, A.; Taylor, C. What Determines 401(k) Participation and Contributions. Soc. Secur. Bull. 2002, 64, 64–75. [Google Scholar] [CrossRef] [Green Version]

- O’Connor, K.M.; De Dreu, C.K.W.; Schroth, H.; Barry, B.; Lituchy, T.R.; Bazerman, M.H. What We Want to Do Versus What We Think We Should Do: An Empirical Investigation of Intrapersonal Conflict. J. Behav. Decis. Mak. 2002, 15, 403–418. [Google Scholar] [CrossRef]

- Olsen, A.; Whitman, K. Effective Retirement Savings Programs: Design Features and Financial Education. Soc. Secur. Bull. 2007, 67, 53–72. [Google Scholar] [PubMed]

- Papke, L.E. Participation in and Contributions to 401(k) Pension Plans: Evidence from Plan Data. J. Hum. Resour. 1995, 30, 311. [Google Scholar] [CrossRef]

- Peron, A.; John, K.M. Willingness to Participate in Micro Pension Schemes: Evidence from the Informal Sector in Ghana. J. Econ. Int. Financ. 2013, 5, 21–34. [Google Scholar]

- Popta, B.; Morency, B. Summary of the Chilean Pension System Santiago: International Centre for Pension Management; Organisation for Economic Co-operation and Development (OCDE): Paris, France, 2018; pp. 70–110. [Google Scholar]

- Prast, H. Complexe Producten: Wat Kunnen Ze Betekenen En Wie Moet Ze Begrijpen? Over financiële Educatie En De Verantwoordelijkheid Van Instituties; De Nederlandsche Bank: Amsterdam, The Netherlands, 2007; pp. 45–67. [Google Scholar]

- Raaij, F.; Huiskes, N. Individual Differences in Pension Knowledge; CASS, City University: London, UK, 2011; pp. 34–87. [Google Scholar]

- Renneboog, L.; Spaenjers, C. Religion, Economic Attitudes, and Household Finance. Oxf. Econ. Pap. 2012, 64, 103–127. [Google Scholar] [CrossRef]

- Schmidt-Hebbel, K. Does Pension Reform Really Spur Productivity, Saving and Growth? Banco Central De Chile, Gerencia De Investigacion Economica, Departamento Publicaciones: Santiago, Chile, 1998; Volume 33, pp. 1–7. [Google Scholar]

- Spruit, J. Does Pension Awareness Reduce Pension Concerns? Causal Evidence from the Netherlands. Master’s Thesis, Leiden University, Leiden, The Netherlands, 2018; pp. 32–38. [Google Scholar]

- Stelten, S. Extending Coverage of the New Pension Scheme in India; Hertie School of Governance: Berlin, Germany, 2017; pp. 1–25. [Google Scholar]

- Wang, X.; Yu, C.; Wei, Y. Social Media Peer Communication and Impacts on Purchase Intentions: A Consumer Socialization Framework. J. Interact. Mark. 2012, 26, 198–208. [Google Scholar] [CrossRef]

- Waters, R.D.; Burnett, E.; Lamm, A.; Lucas, J. Engaging Stakeholders through Social Networking: How Nonprofit Organizations Are Using Facebook. Public Relat. Rev. 2009, 35, 102–106. [Google Scholar] [CrossRef]

- Wijzer in Geldzaken. Pensioenbewustzijn, Wijzer in Geldzaken, The Hague. 2012. Available online: https://www.wijzeringeldzaken.nl/Regel-Je-pensioen/5-Vragen-over-Het-Verdelen-En-Verevenen-Van-Pensioen-Bij-Een-Scheiding/ (accessed on 29 March 2022).

- Wolf, C.A. Whether to Approve an Education Savings Account Program in Texas: Preventing Crime Does Pay; EDRE Working Paper; University of Arcansas: Fayetteville, AR, USA, 2016; p. 20. [Google Scholar]

- Shalgimbaeva, N.T. Report on the Results of Trips to the Republic of Chile to Study the Issues of the Functionality of the Funded Pension System; National Bank of the Republic of Kazakhstan: Almaty, Kazakhstan, 2011; pp. 6–9. [Google Scholar]

- Wright, S. Correlation and I Causality. J. Agric. Res. 1921, 20, 557. [Google Scholar]

- Rubin, D.B. Bayesian Inference for Causal Effects: The Role of Randomization. Ann. Stat. 1978, 6, 34–58. [Google Scholar] [CrossRef]

- Hair, J.F. A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM); Saga: Ventura County, CA, USA, 2014; p. 56. [Google Scholar]

- Jassbi, J.; Mohamadnejad, F.; Nasrollahzadeh, H.A. Fuzzy DEMATEL Framework for Modeling Cause and Effect Relationships of Strategy Map. Expert Syst. Appl. 2011, 38, 5967–5973. [Google Scholar] [CrossRef]

- Chen, F.H.; Chi, D.-J. Application of a New DEMATEL to Explore Key Factors of China’s Corporate Social Responsibility: Evidence from Accounting Experts. Qual. Quant. 2015, 49, 135–154. [Google Scholar] [CrossRef]

- Wu, H.-H.; Chang, S.-Y. A Case Study of Using DEMATEL Method to Identify Critical Factors in Green Supply Chain Management. Appl. Math. Comput. 2015, 256, 394–403. [Google Scholar] [CrossRef]

- Khanam, S.; Siddiqui, J.; Talib, F. Modelling the TQM Enablers and IT Resources in the ICT Industry: An ISM-MICMAC Approach. Int. J. Inf. Syst. Manag. 2015, 1, 195–218. [Google Scholar] [CrossRef]

- Mudgal, R.K.; Shankar, R.; Talib, P.; Raj, T. Greening the Supply Chain Practices: An Indian Perspective of enablers’ Relationships. Int. J. Adv. Oper. Manag. 2009, 1, 151. [Google Scholar] [CrossRef]

- Angrist, J.D.; Pischke, J.-S. The Credibility Revolution in Empirical Economics: How Better Research Design Is Taking the Con Out of Econometrics. J. Econ. Perspect. 2010, 24, 3–30. [Google Scholar] [CrossRef] [Green Version]

- Balke, A.; Pearl, J. Counterfactuals and Policy Analysis in Structural Models. In Uncertainty in Artificial Intelligence; Besnard, P., Hanks, S., Eds.; Morgan Kaufmann: Burlington, MA, USA, 1995; p. 11. [Google Scholar]

- Dawid, A.P. Conditional Independence in Statistical Theory. J. R. Stat. Soc. Ser. B Stat. Methodol. 1979, 41, 1–31. [Google Scholar] [CrossRef]

- Engle, R.; Hendry, D.; Richard, J. Exogeneity. Econometrica 1983, 51, 277–304. [Google Scholar] [CrossRef]

- Foygel, R.; Draisma, J.; Drton, M. Half-Trek Criterion for Generic Identifiability of Linear Structural Equation Models. Ann. Stat. 2012, 40, 1682–1713. [Google Scholar] [CrossRef]

- Galles, D.; Pearl, J. An Axiomatic Characterization of Causal Counterfactuals. Found. Sci. 1998, 3, 151–182. [Google Scholar] [CrossRef]

- Glymour, M.; Greenland, S. Causal Diagrams. In Modern Epidemiology, 3rd ed.; Rothman, K., Greenland, S., Lash, T., Eds.; Lippincott Williams & Wilkins: Philadelphia, PA, USA, 2008; pp. 183–209. [Google Scholar]

- Pearl, J. The Foundations of Causal Inference. Sociol. Methodol. 2010, 40, 75–149. [Google Scholar] [CrossRef]

- Pearl, J. An Introduction to Causal Inference. Int. J. Biostat. 2010, 6, 354. [Google Scholar] [CrossRef]

- Pearl, J. Graphical Models, Potential Outcomes and Causal Inference: Comment on Lindquist and Sobel. Stat. Med. 2011, 58, 770–771. [Google Scholar] [CrossRef]

- Ambuehl, M.; Baumgartner, M. Cna: Causal Modeling with Coincidence Analysis. R Package Version 2.0.0. 2017. Available online: https://CRAN.R-project.org/Package=cna (accessed on 29 March 2022).

- Barrenechea, R.; Mahoney, J. A Set-Theoretic Approach to Bayesian Process Tracing. Sociol. Methods Res. 2017, 48, 451–484. [Google Scholar] [CrossRef]

- Cheli, B.; Lemmi, A. A “totally” Fuzzy and Relative Approach to the Multidimensional Analysis of Poverty. Econ. Notes 1995, 1, 115–134. [Google Scholar]

- Cronqvist, L.; Berg-Schlosser, D. Multi-Value QCA (mvQCA). In Configurational Comparative Methods: Qualitative Comparative Analysis (QCA) and Related Techniques; Rihoux, B., Ragin, C., Eds.; Sage Publications: London, UK, 2009; pp. 69–86. [Google Scholar]

- Dalgaard, P. Introductory Statistics With R, 2nd ed.; Springer: New York, NY, USA, 2008. [Google Scholar]

- De Meur, G.; Rihoux, B.; Yamasaki, S. Adressing the Critiques of QCA. In Configurational Comparative Methods: Qualitative Comparative Analysis (QCA) and Related Techniques; Rihoux, B., Ragin, C., Eds.; Sage Publications: London, UK, 2009; pp. 147–165. [Google Scholar]

- Dusa, A. A Mathematical Approach to the Boolean Minimization Problem. Qual. Quant. 2008, 44, 99–113. [Google Scholar] [CrossRef]

- Ragin, C. Redesigning Social Inquiry: Fuzzy Sets and Beyond; University of Chicago Press: Chicago, IL, USA; London, UK, 2008. [Google Scholar]

- Ragin, C.C. Comment: Lucas and Szatrowski in Critical Perspective. Sociol. Methodol. 2014, 44, 80–94. [Google Scholar] [CrossRef]

- Ragin, C.; Rihoux, B. Qualitative Comparative Analysis (QCA): State of the Art and Prospects. Qual. Methods 2004, 2, 3–13. [Google Scholar]

| Predictors | Coding of Variables (Dichotomy) |

|---|---|

| Work experience (EJ) | Sufficient (over 13.5 years)—1 Insufficient (less than 13.5 years)—0 |

| Knowledge of legislation pension and social security (ZN) | Knows the basics—1 Does not know the basics—0 |

| Level of awareness of voluntary accumulation models (OS) | Aware—1 Not aware—0 |

| The level of ownership of information and communication technologies (IT) by the population | Owns—1 Does not own—0 |

| Planning horizon (GP) | High—1 Low—0 |

| Public confidence in the pension system (DP) | Trusts—1 Does not trust—0 |

| Education level (ED) | Above bachelor’s degree—1 Below bachelor’s degree—0 |

| Voluntary Pension Insurance System (DS) | Ready to pay—1 Not ready to pay—0 |

| Regression Statistics | ||||||

|---|---|---|---|---|---|---|

| Multiple R | 0.614 | |||||

| R-square | 0.377 | |||||

| Normalized R-square | 0.357 | |||||

| Standard error | 0.403 | |||||

| Observations | 97 | |||||

| ANOVA | ||||||

| df | SS | MS | F | Significance F | ||

| Regression | 3 | 9.1 | 3.0 | 18.8 | 0.000 | |

| Residual | 93 | 15.1 | 0.2 | |||

| Total | 96 | 24.2 | ||||

| Coefficients | Standard error | t-statistics | p-value | Lower 95% | Upper 95% | |

| Y-crossing | 1.870 | 0.220 | 8.486 | 0.000 | 1.432 | 2.307 |

| Awareness | 0.291 | 0.109 | 2.672 | 0.009 | 0.075 | 0.507 |

| Education level | −0.157 | 0.045 | −3.530 | 0.001 | −0.246 | −0.069 |

| Income level | −0.108 | 0.041 | −2.626 | 0.010 | −0.189 | −0.026 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Nazarov, D.; Bayakhmetova, A.; Bayakhmetova, L.; Bayakhmetova, L. A Model for Assessing the Causality of Factors in the Development of Voluntary Pension Insurance in the Republic of Kazakhstan. Mathematics 2022, 10, 1415. https://doi.org/10.3390/math10091415

Nazarov D, Bayakhmetova A, Bayakhmetova L, Bayakhmetova L. A Model for Assessing the Causality of Factors in the Development of Voluntary Pension Insurance in the Republic of Kazakhstan. Mathematics. 2022; 10(9):1415. https://doi.org/10.3390/math10091415

Chicago/Turabian StyleNazarov, Dmitry, Aliya Bayakhmetova, Lyazzat Bayakhmetova, and Leila Bayakhmetova. 2022. "A Model for Assessing the Causality of Factors in the Development of Voluntary Pension Insurance in the Republic of Kazakhstan" Mathematics 10, no. 9: 1415. https://doi.org/10.3390/math10091415

APA StyleNazarov, D., Bayakhmetova, A., Bayakhmetova, L., & Bayakhmetova, L. (2022). A Model for Assessing the Causality of Factors in the Development of Voluntary Pension Insurance in the Republic of Kazakhstan. Mathematics, 10(9), 1415. https://doi.org/10.3390/math10091415