The Sustainable Supply Chain Network Competition Based on Non-Cooperative Equilibrium under Carbon Emission Permits

Abstract

:1. Introduction

1.1. Background

1.2. Practical Motivation

1.3. Research Question and Contributions

- (1)

- There is always a conflict between environmental protection goals and economic development goals. As for the government, how to properly enact policy or combine the advantage of different policies? Moreover, what are the differences between each kind of polices?

- (2)

- Carbon emission constraint incurs intense pressure on enterprises. They will face the choice of adjusting production planning passively or undertaking the social responsibility initiatively. Then, how should enterprises make operation decisions under different policies?

- (3)

- What is the benefit of reverse logistics? Does it affect enterprise strategy? What are the related parameters that influence supply chain performance such as consumers’ environmental awareness or recovery ratio?

- (1)

- We incorporate carbon trade regulations into the equilibrium model of a CLSCN to analyze the impacts of carbon trade behaviors of the two types of manufacturers on equilibrium decisions.

- (2)

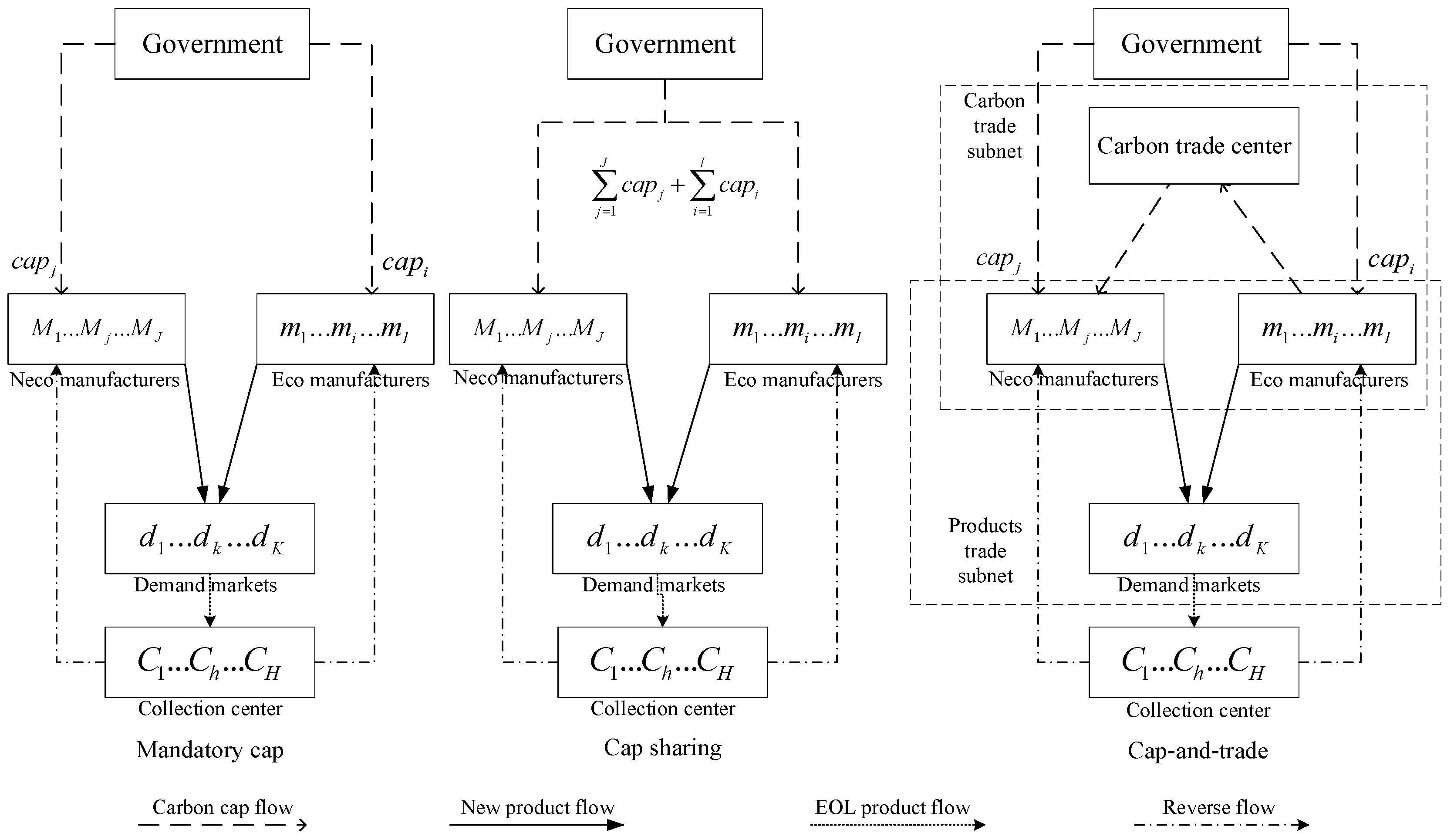

- We first propose the carbon trade subnet and the product transaction subnet in the SCN and introduce the carbon trade center as a place for carbon trading.

- (3)

- By comparing three carbon reduction regulations, we illustrate the different laws of decision and profits and emission control and identify best practices for enterprises under different regulations.

2. Literature Review

2.1. Sustainable Supply Chain

2.2. Cap-and-Trade Regulations

2.3. Supply Chain Network Based on Non-Cooperative Equilibrium

2.4. Consumers’ Environmental Awareness

2.5. Research Gap

3. Notations and Assumptions

3.1. Notations

3.2. Assumptions

4. Model

4.1. Demand Market Decisions

4.2. Collection Centers’ Decisions

4.3. The Supply Chain Network under Cap-and-Trade (CT) Policy

4.3.1. Non-Ecological Manufacturers’ Decisions

4.3.2. Ecological Manufacturers’ Decisions

4.3.3. Carbon Trade Center’s Decisions

4.3.4. The Equilibrium Conditions of Closed-Loop Supply Chain Network in the CT Model

4.4. The Supply Chain Network under Mandatory Cap Policy (MC)

4.4.1. Non-Ecological Manufacturers’ Decisions

4.4.2. Ecological Manufacturers’ Decisions

4.5. The Supply Chain Network under Cap-Sharing Scheme (CS)

Manufacturers’ Decisions

5. Discussion

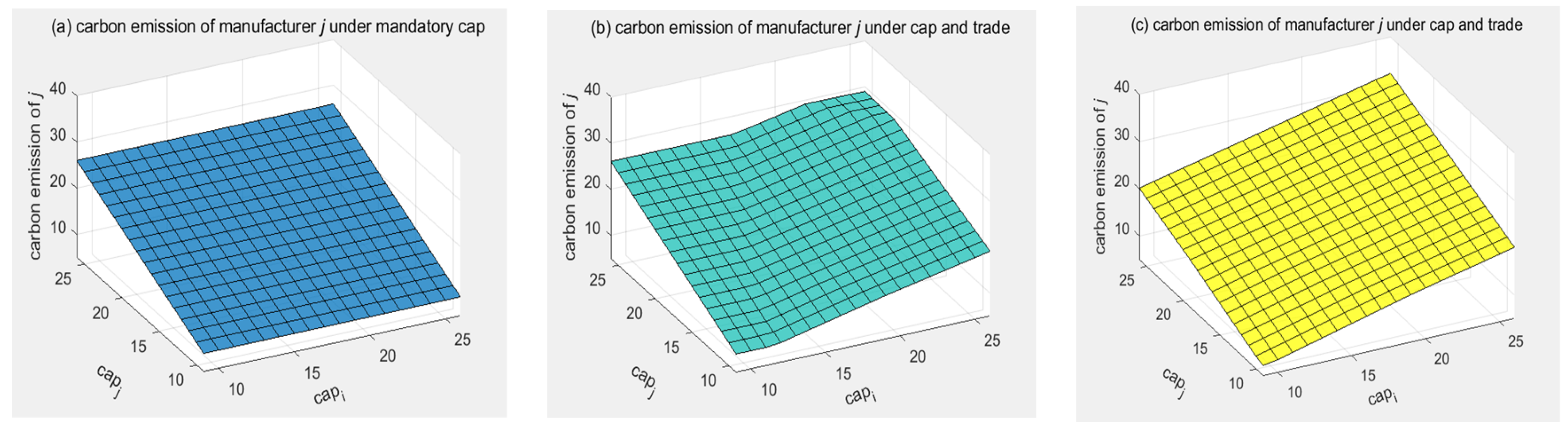

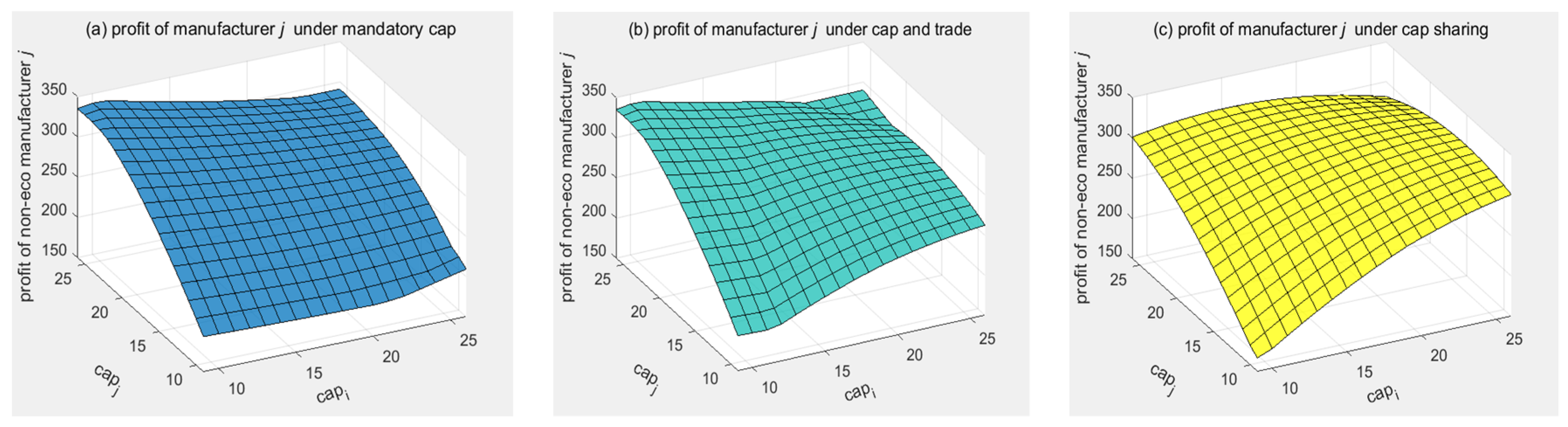

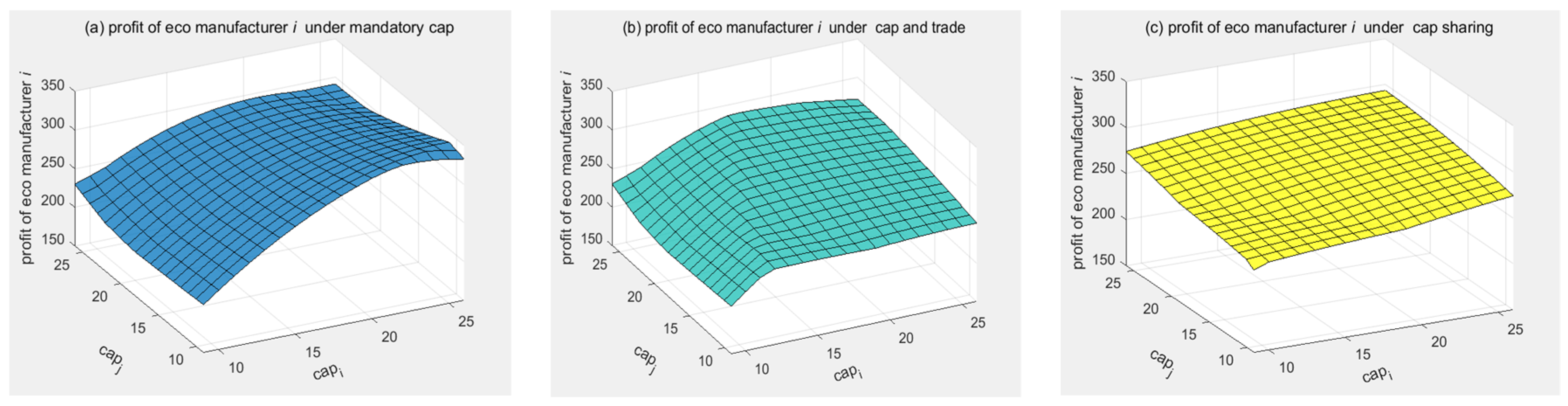

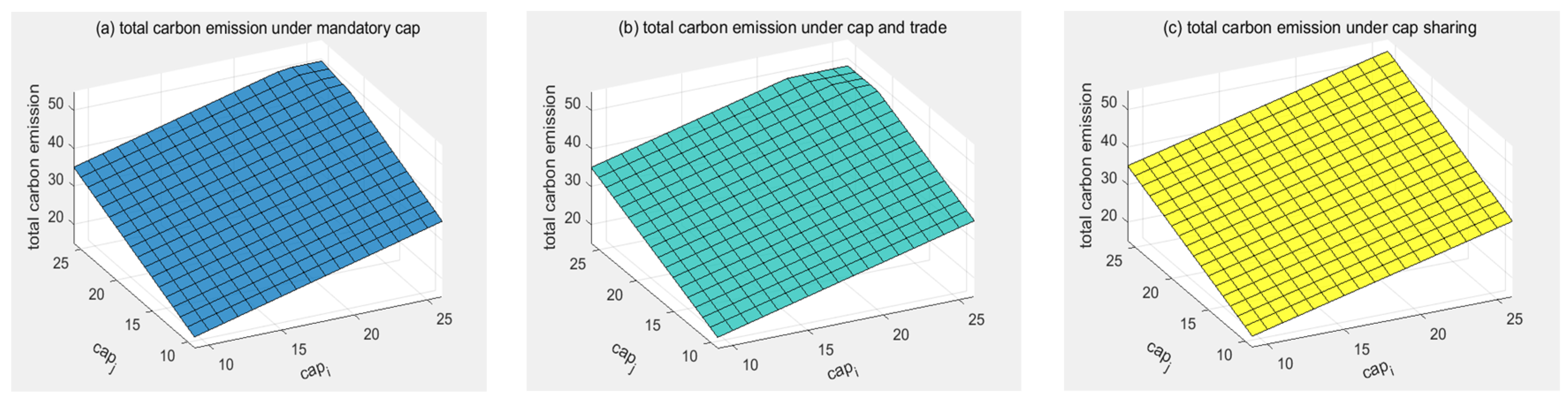

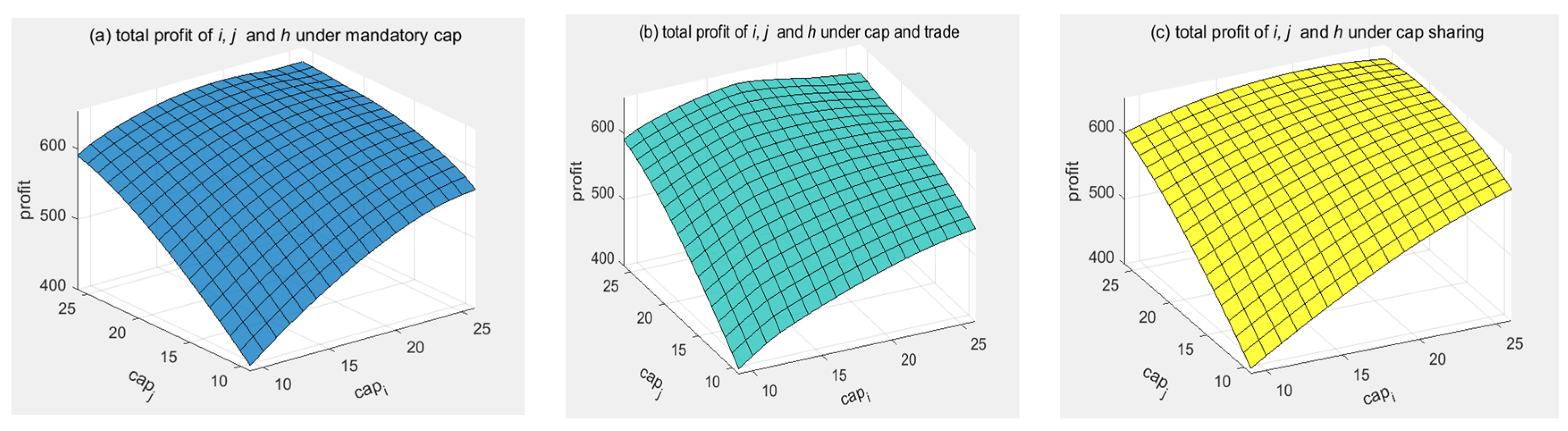

5.1. Analyzing the Effects of Cap on Optimal Decisions and Profits

5.1.1. The Effects on Non-Ecological Manufacturer

5.1.2. The Effects on Ecological Manufacturer

5.1.3. The Effects on Supply Chain Performance

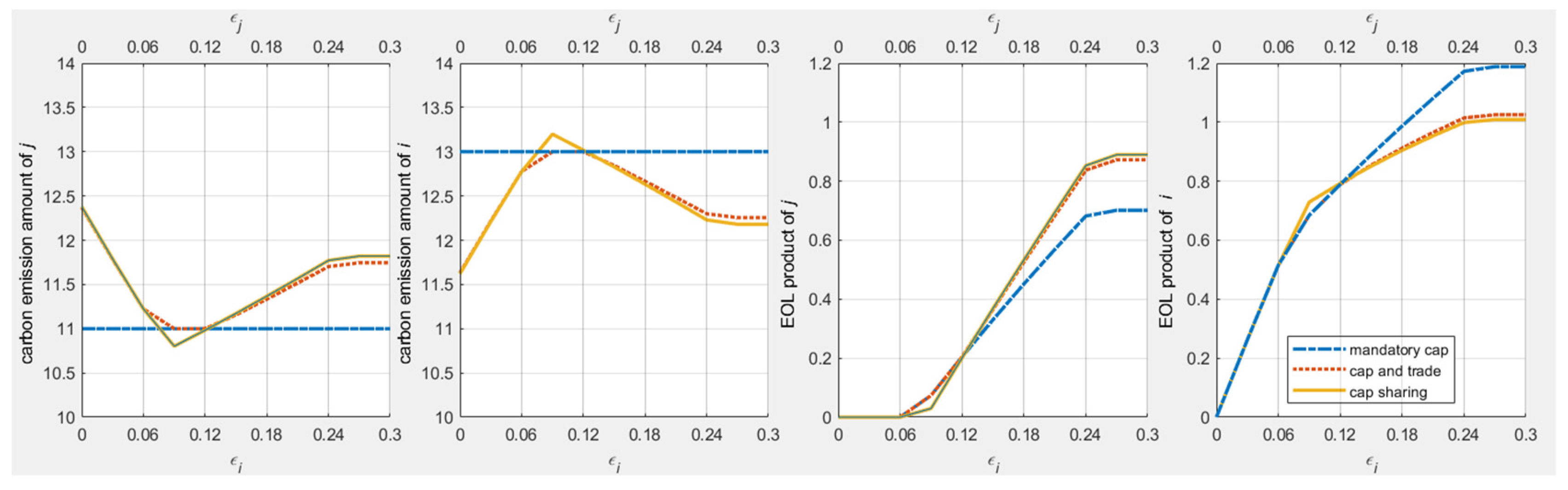

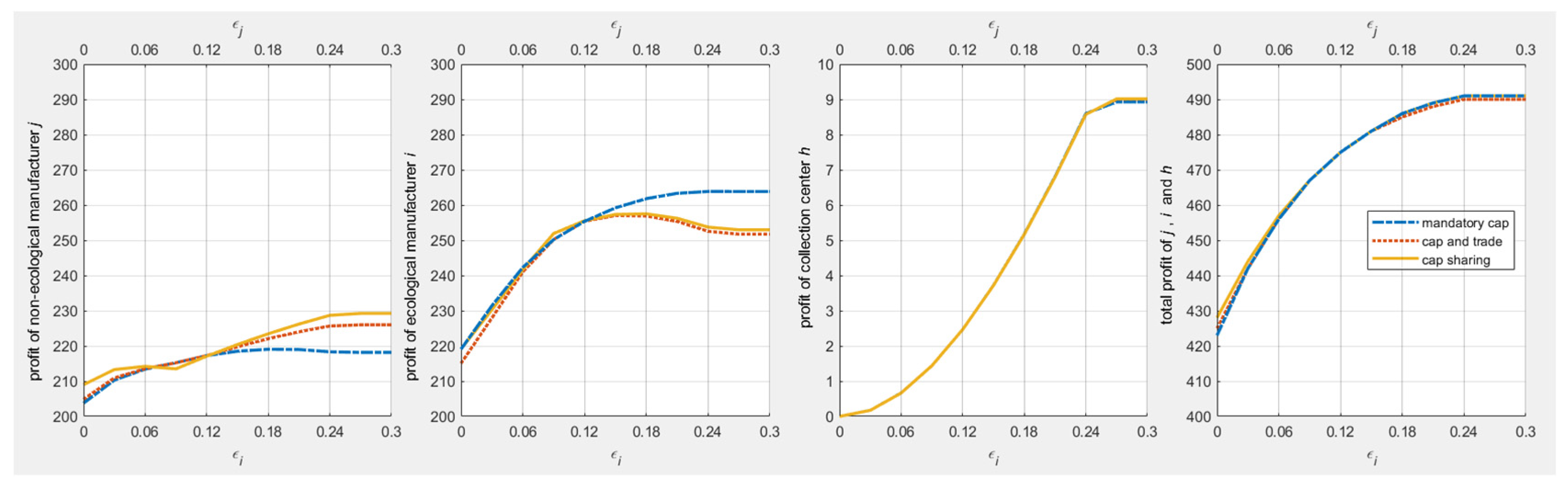

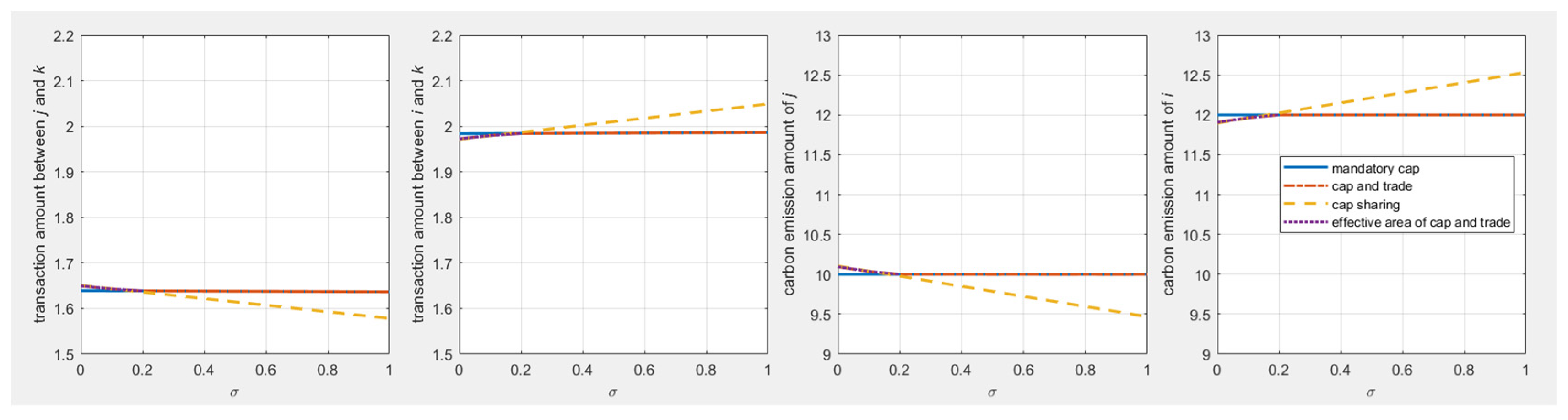

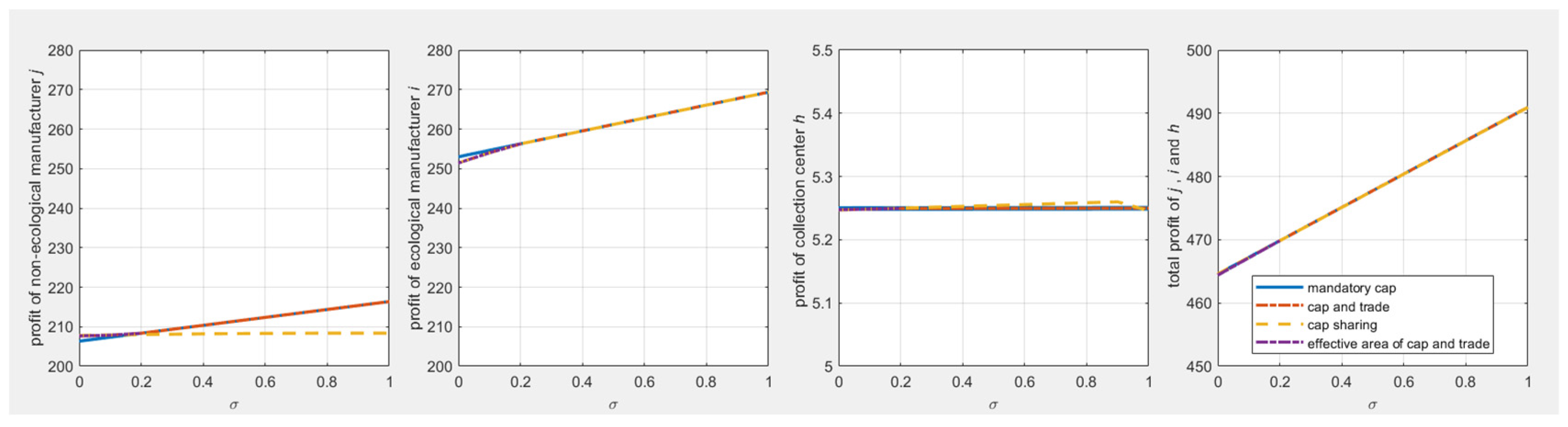

5.2. Analyzing Effects of and on Optimal Decisions and Profits

5.3. Analysis Effects of on Optimal Decisions and Profits

5.4. Managerial Insights

- Firstly, by comparing the three carbon emission policies, even though cap-and-trade regulations are more flexible than mandatory cap policy, it still loses a little efficiency than cap-sharing schemes. Both cap-and-trade regulations and cap-sharing schemes can encourage firms to adjust their production and pricing strategies. Governments should allocate caps properly and implement cap-sharing schemes in some pilot enterprises.

- Secondly, the proposed model proves that investment in green production technology helps ecological manufacturers gain lower carbon emissions and high profits. The technologies work both in forward and reverse channels. For wise enterprise leadership, correct decisions should be made on when and how to adopt cleaner production technology.

- Thirdly, the reverse supply chain should be valued at a strategic level because of its essential role in promoting a circular economy and sustainable development. Especially high-emission enterprises can complete green transformation and reduce emissions through recycling and remanufacturing processes.

- Finally, consumers are increasingly concerned about the impact of the production process on the environment. On the one hand, governments can reward manufacturers for producing more environmentally friendly products. On the other hand, the information or technology can be shared between enterprises.

6. Conclusions

- (1)

- Policy CS is effective in coordinating the relationship between economic development and environmental protection. In practice, the government may permit carbon cap sharing among enterprises, especially within a large enterprise to achieve a win-win situation. In other situations, CS policy may act as the ideal goal to measure the performance of MC and CT regulations.

- (2)

- Policy MC is easy to implement for governments, and the carbon reduction goal can be reached either. However, the carbon quotas cannot be converted to revenue, even if there are excess quotas for manufacturers.

- (3)

- Additionally, policy CT may lose a little efficiency compared with cap-sharing schemes, but it benefits government regulations. If governments can adjust cap transaction costs or relax carbon quotas, policy CT may show better performance. Moreover, policy CT can promote manufacturers adopting green technology to reduce carbon emissions, and the carbon emission rights have the nature of assets and create extra revenue.

- (4)

- It should be noted that in all scenarios, ecological manufacturers always show better performances, which means the green technology innovation can benefit firms both in sustainable development and economic development.

- (5)

- Consumers’ environmental protection awareness has a positive effect on ecological manufacturers but hurts non-eco manufacturers, especially in cap-sharing schemes. Moreover, when the recycling rate is at a relatively high level, it effectively helps eco manufacturers to use more reusable materials and reduce carbon emissions, whereas when it exceeds a certain value, the change has almost no influence on equilibrium results.

- (1)

- Information sharing can be considered, especially the production cost for different manufacturers.

- (2)

- The model can include irrational behavior factors of decision-makers, such as free-riding behavior.

- (3)

- The online transaction fashion can be incorporated into the model, especially in the post-COVID-19 era.

- (4)

- Some practical constraints, such as financial constraints and capacity constraints, can be considered in the model in future research.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

- The equilibrium conditions of the closed-loop supply chain network in the MC model

Appendix B

- The equilibrium conditions of closed-loop supply chain network in CS model

Appendix C

- Qualitative Properties

Appendix D

References

- Liu, P.T.; Liu, L.Y.; Xu, X. Carbon footprint and carbon emission intensity of grassland wind farms in Inner Mongolia. J. Clean. Prod. 2021, 313, 127878. [Google Scholar] [CrossRef]

- Liu, M.L.; Li, Z.H.; Anwar, S. Supply chain carbon emission reductions and coordination when consumers have a strong preference for low-carbon products. Environ. Sci. Pollut. Res. 2021, 28, 19969–19983. [Google Scholar] [CrossRef] [PubMed]

- Cheng, P.Y.; Ji, G.X.; Zhang, G.T. A closed-loop supply chain network considering consumer’s low carbon preference and carbon tax under the cap-and-trade regulation. Sustain. Prod. Consum. 2022, 29, 614–635. [Google Scholar] [CrossRef]

- Zhang, G.T.; Cheng, P.Y.; Sun, H. Carbon reduction decisions under progressive carbon tax regulations: A new dual-channel supply chain network equilibrium model. Sustain. Prod. Consum. 2021, 27, 1077–1092. [Google Scholar] [CrossRef]

- Yu, M.; Cruz, J.M.; Li, M.D. The sustainable supply chain network competition with environmental tax policies. Int. J. Prod. Econ. 2019, 217, 218–231. [Google Scholar] [CrossRef]

- Guchhait, R.; Sakar, B. Economic and environmental assessment of an unreliable supply chain management. RAIRO-Oper. Res. 2021, 55, 3153–3170. [Google Scholar] [CrossRef]

- Xu, X.F.; He, Y.Y. Blockchain application in modern logistics information sharing: A review and case study analysis. Prod. Plan. Control 2022, 1–15. [Google Scholar] [CrossRef]

- Zhang, W.; Yan, S.; Li, J. Credit risk prediction of SMEs in supply chain finance by fusing demographic and behavioral data. Transport. Res. E Logist. Transport. Rev. 2022, 158, 102611. [Google Scholar] [CrossRef]

- Guchhait, R.; Pareek, S.; Sakar, B. How Does a Radio Frequency Identification Optimize the Profit in an Unreliable Supply Chain Management? Mathematics 2019, 7, 490. [Google Scholar] [CrossRef] [Green Version]

- Wu, Y.S.; Lu, R.H.; Yang, J. Government-led low carbon incentive model of the online shopping supply chain considering the O2O model. J. Clean. Prod. 2021, 279, 123271. [Google Scholar] [CrossRef]

- He, L.; Hu, C.; Zhao, D. Carbon emission mitigation through regulatory policies and operations adaptation in supply chains: Theoretic developments and extensions. Nat. Hazards 2016, 84, 179–207. [Google Scholar] [CrossRef]

- Dinan, T. Policy Options for Reducing CO2 Emissions; Congress of the U.S. Congressional Budget Office: Washington, DC, USA, 2008.

- Yu, Y.G.; Zhou, S.J.; Shi, Y. Information sharing or not across the supply chain: The role of carbon emission reduction. Transport. Res. E Logist. Transport. Rev. 2020, 137, 101915. [Google Scholar] [CrossRef]

- Xu, X.F.; Wang, C.L.; Zhou, P. GVRP considered oil-gas recovery in refined oil distribution: From an environmental perspective. Int. J. Prod. Econ. 2021, 235, 108078. [Google Scholar] [CrossRef]

- Cao, J.; Chen, X.H.; Zhang, X.M. Overview of remanufacturing industry in China: Government policies, enterprise, and public awareness. J. Clean. Prod. 2020, 242, 1–17. [Google Scholar] [CrossRef]

- Cai, J.Y.; Cai, Z. Renewable resource industry’s international experience and enlightenment. Econ. Geogr. 2010, 30, 2044–2049. [Google Scholar]

- Xing, E.F.; Shi, C.D.; Zhang, J.X. Double third-party recycling closed-loop supply chain decision under the perspective of carbon trading. J. Clean. Prod. 2020, 259, 1–11. [Google Scholar] [CrossRef]

- Patel, G.S. A Stochastic Production Cost Model for Remanufacturing Systems. Master’s Thesis, The University of Texas-Pan American, Edinburg, TX, USA, 2006. [Google Scholar]

- Gregorio, R.S.; Sofía, E.M.; Carlos, R.A. Multivariable Supplier Segmentation in Sustainable Supply Chain Management. Sustainability 2020, 12, 4556. [Google Scholar]

- Zhang, X.X.; Ji, Y.N.; Shen, C.L. Manufacturers’ green investment in a competitive market with a common retailer. J. Clean. Prod. 2020, 276, 123164. [Google Scholar] [CrossRef]

- Guo, S.; Choi, T.M.; Shen, B. Green product development under competition: A study of the fashion apparel industry. Eur. J. Oper. Res. 2020, 280, 523–538. [Google Scholar] [CrossRef]

- Savaskan, R.C.; Bhattacharya, S.; Van Wassenhove, L.N. Closed-loop supply chain models with product remanufacturing. Manag. Sci. 2004, 50, 239–252. [Google Scholar] [CrossRef] [Green Version]

- Chen, C.K.; Ulya, M.A. Analyses of the reward-penalty mechanism in green closed-loop supply chains with product remanufacturing. Int. J. Prod. Econ. 2019, 210, 211–223. [Google Scholar] [CrossRef]

- Taleizadeh, A.A.; Alizadeh-Basban, N.; Niaki, S.T.A. A closed-loop supply chain considering carbon reduction, quality improvement effort, and return policy under two remanufacturing scenarios. J. Clean. Prod. 2019, 232, 1230–1250. [Google Scholar] [CrossRef]

- Yang, Y.; Xu, X. A differential game model for closed-loop supply chain participants under carbon emission permits. Comput. Ind. Eng. 2019, 135, 1077–1090. [Google Scholar] [CrossRef]

- Taleizadeh, A.A.; Moshtagh, M.S.; Moon, I. Optimal decisions of price, quality, effort level and return policy in a three-level closed-loop supply chain based on different game theory approaches. Eur. J. Int. Eng. 2017, 11, 486–525. [Google Scholar] [CrossRef] [Green Version]

- Zerang, E.S.; Taleizadeh, A.A.; Razmj, J. Analytical comparisons in a three-echelon closed-loop supply chain with price and marketing effort-dependent demand: Game theory approaches. Environ. Dev. Sustain. 2018, 20, 451–478. [Google Scholar] [CrossRef]

- Chu, J.F.; Shao, C.F.; Ali, E. Performance evaluation of organizations considering economic incentives for emission reduction: A carbon emission permit trading approach. Energy Econ. 2021, 101, 105398. [Google Scholar] [CrossRef]

- Wang, Y.J.; Chen, W.D.; Liu, B.Y. Manufacturing/remanufacturing decisions for a capital-constrained manufacturer considering carbon emission cap and trade. J. Prod. Clean. 2017, 140, 1118–1128. [Google Scholar] [CrossRef]

- Xu, L.; Wang, C. Sustainable manufacturing in a closed-loop supply chain considering emission reduction and remanufacturing. Resour. Conserv. Recycl. 2018, 131, 297–304. [Google Scholar] [CrossRef]

- Wang, C.; Miao, Z.; Chen, X. Factors affecting changes of greenhouse gas emissions in belt and road countries. Renew. Sust. Energ. Rev. 2021, 147, 111220. [Google Scholar] [CrossRef]

- Zhu, Q.; Li, X.; Li, F. Analyzing the sustainability of China’s industrial sectors: A data-driven approach with total energy consumption constraint. Ecol. Indic. 2021, 122, 107235. [Google Scholar] [CrossRef]

- Chai, Q.F.; Xiao, Z.D.; Lai, K.H. Can carbon cap and trade mechanism be beneficial for remanufacturing? Int. J. Prod. Econ. 2018, 203, 311–321. [Google Scholar] [CrossRef]

- Si, M.X.; Bai, L.; Du, K. Fuel consumption analysis and cap and trade system evaluation for Canadian in situ oil sands extraction. Renew. Sustain. Energy Rev. 2021, 146, 111145. [Google Scholar] [CrossRef]

- Ji, J.N.; Zhang, Z.Y.; Yang, L. Comparisons of initial carbon allowance allocation rules in an O2O retail supply chain with the cap-and-trade regulation. Int. J. Prod. Econ. 2017, 187, 68–84. [Google Scholar] [CrossRef]

- Zhang, B.; Xu, L. Multi-item production planning with carbon cap and trade mechanism. Int. J. Prod. Econ. 2013, 144, 118–127. [Google Scholar] [CrossRef]

- Du, S.; Ma, F.; Fu, Z. Game-theoretic analysis for an emission-dependent supply chain in a ‘cap-and-trade’ system. Ann. Oper. Res. 2015, 228, 135–149. [Google Scholar] [CrossRef]

- Yang, G.F.; Wang, Z.P.; Li, X.Q. The optimization of the closed-loop supply chain network. Transport. Res. E Logist. Transport. Rev. 2008, 45, 16–28. [Google Scholar] [CrossRef]

- Xu, X.F.; He, J.; Zheng, Y. Multi-objective artificial bee colony algorithm for multi-stage resource leveling problem in sharing logistics network. Comput. Ind. Eng. 2020, 142, 106338. [Google Scholar] [CrossRef]

- Nagurney, A.; Dong, J.; Zhang, D. A supply chain network equilibrium model. Transp. Res. Part E Logist. Transp. Rev. 2002, 38, 281–303. [Google Scholar] [CrossRef]

- Nagurney, A.; Daniele, P.; Shukla, S. A supply chain network game theory model of cybersecurity investments with nonlinear budget constraints. Ann. Oper. Res. 2017, 248, 405–427. [Google Scholar] [CrossRef]

- Nagurney, A.; Yu, M. Sustainable fashion supply chain management under oligopolistic competition and brand differentiation. Int. J. Prod. Econ. 2012, 135, 532–540. [Google Scholar] [CrossRef]

- He, L.F.; Xu, Z.G.; Niu, Z.W. Joint optimal production planning for complex supply chains constrained by carbon emission abatement policies. Discrete Dyn. Nat. Soc. 2014, 2014, 361923. [Google Scholar] [CrossRef]

- Tao, Z.G.; Zhong, Y.G.; Sun, H. Multi-period closed-loop supply chain network equilibrium with carbon emission constrains. Resour. Conserv. Recycl. 2015, 104, 354–365. [Google Scholar] [CrossRef]

- He, L.F.; Mao, J.; Hu, C.L. Carbon emission regulation and operations in the supply chain network under stringent carbon policy. J. Clean. Prod. 2019, 238, 1–18. [Google Scholar] [CrossRef]

- Li, Q.; Long, R.; Chen, H. Empirical study of the willingness of consumers to purchase low-carbon products by considering carbon labels: A case study. J. Clean. Prod. 2017, 161, 1237–1250. [Google Scholar] [CrossRef]

- Hong, Z.; Wang, H.; Yu, Y. Green product pricing with non-green product reference. Transp. Res. Part E Logist. Transp. Rev. 2018, 115, 1–15. [Google Scholar] [CrossRef]

- Ma, S.G.; He, Y.; Gu, R.; Li, S.S. Sustainable supply chain management considering technology investments and government intervention. Transp. Res. Part E Logist. Transp. Rev. 2021, 149, 102290. [Google Scholar] [CrossRef]

- Tong, W.; Mu, D.; Zhao, F. The impact of cap-and-trade mechanism and consumers’ environmental preferences on a retailer-led supply chain. Resour. Conserv. Recycl. 2019, 142, 88–100. [Google Scholar] [CrossRef]

- Allevi, E.; Gnudi, A.; Konnov, I.V. Evaluating the effect of environmental regulations on a closed-loop supply chain network: A variational inequality approach. Ecol. Environ. Conserv. 2018, 261, 1–43. [Google Scholar] [CrossRef]

- Gao, J.; Han, H.; Hou, L. Pricing and effort decisions in a closed-loop supply chain under different channel power structures. J. Clean. Prod. 2016, 112, 2043–2205. [Google Scholar] [CrossRef]

- Hong, X.; Govindan, K.; Xu, L. Quantity and collection decisions in a closed-loop supply chain with technology licensing. Eur. J. Oper. Res. 2017, 3, 820–829. [Google Scholar] [CrossRef]

- Huang, Y.; Wang, Z. Values of information sharing: A comparison of supplier-remanufacturing and manufacturer-remanufacturing scenarios. Transport. Res. Part E 2017, 106, 20–44. [Google Scholar] [CrossRef]

- Huang, Y.; Wang, Z. Closed-loop supply chain models with product take-back and hybrid remanufacturing under technology licensing. J. Clean. Prod. 2017, 142, 3917–3927. [Google Scholar] [CrossRef]

- Liao, Z.; Zhu, X.; Shi, J. Case study on initial allocation of Shanghai carbon emission trading based on Shapley value. J. Clean. Prod. 2015, 103, 338–344. [Google Scholar] [CrossRef]

- Ray, S.; Jewkes, E.M. Customer lead time management when both demand and price are lead time sensitive. Eur. J. Oper. Res. 2004, 153, 769–781. [Google Scholar] [CrossRef]

- Liu, Z.G.; Anderson, T.D.; Cruz, J.M. Consumer environmental awareness and competition in two-stage supply chains. Eur. J. Oper. Res. 2012, 218, 602–613. [Google Scholar] [CrossRef]

- Hammond, D.; Beullens, P. Closed-loop supply chain network equilibrium under legislation. Eur. J. Oper. Res. 2007, 183, 895–908. [Google Scholar] [CrossRef]

- Paksoy, T.; Özceylan, E.; Weber, G.W. A multi objective model for optimization of a green supply chain network. Glob. J. Technol. Optim. 2011, 2, 84–96. [Google Scholar] [CrossRef]

- Cheng, F.L.; Sue, J.L.; Charles, L. Analysis of the impacts of combining carbon taxation and emission trading on different industry sectors. Energy Policy 2008, 36, 722–729. [Google Scholar]

- Kinderlehrer, D.; Stampacchia, G. An Introduction to Variational Inequalities and their Applications; Society for Industrial Mathematics: Philadelphia, PA, USA, 1987. [Google Scholar]

| Literature | Consumer’s Green Awareness | Low-Carbon Policy | Supply Chain Structure | Research Method | |||

|---|---|---|---|---|---|---|---|

| Carbon Tax | Cap-and-Trade | SC | Network | Empirical Analysis | Modeling Analysis | ||

| 1. [1] | √ | ||||||

| 2. [2] | √ | √ | √ | √ | |||

| 3. [3] | √ | √ | √ | √ | √ | ||

| 4. [4] | √ | √ | √ | √ | |||

| 5. [5] | √ | √ | √ | √ | |||

| 6. [7] | √ | √ | √ | ||||

| 7. [17] | √ | √ | √ | √ | |||

| 8. [20] | √ | √ | √ | ||||

| 9. [21] | √ | √ | √ | ||||

| 10. [28] | √ | √ | √ | ||||

| 11. [31] | √ | ||||||

| 12. [32] | √ | ||||||

| 13. [35] | √ | √ | √ | √ | |||

| 14. [39] | √ | √ | |||||

| 15. [48] | √ | √ | √ | ||||

| 16. [49] | √ | √ | √ | √ | |||

| This paper | √ | Cap-and-trade, mandatory cap, cap sharing | √ | √ | |||

| Parameters | Definition |

|---|---|

| . | |

| . | |

| . | |

| . | |

| Unit carbon trading commission charged by carbon trading center. | |

| Unit carbon trading price between non-eco manufacturers and eco manufacturers. | |

| . | |

| The proportion of reusable materials extracted from recycled products when collection centers dispose EOL products from demand markets. | |

| denotes the reusable material conversion ratio. | |

| Consumer environmental awareness level. | |

| . | |

| . | |

| Carbon emission factor of a truck. | |

| . | |

| denotes the number of trucks between eco manufacturers and collection centers. | |

| The total transport costs of unit product. |

| Decision Variables | Notations |

|---|---|

| . | |

| . | |

| The amount of products that a non-ecological manufacturer j sells and transfers to demand market k, . | |

| The amount of reusable material from collection center h to non-ecological manufacturer j, . | |

| The amount of product that ecological manufacturer i sells and transfers to demand market k, . | |

| The amount of reusable material from collection center h to ecological manufacturer i, . | |

| The amount of recycling EOL (end of life) product from demand market k to collection center h, . | |

| The carbon cap amount of non-ecological manufacturer j buying from carbon trade center, . | |

| The carbon cap amount of ecological manufacturer i selling to carbon trade center, . | |

| The price consumers paid for non-ecological products in demand market k, and . | |

| The price consumers paid for ecological products in demand market k, and . |

| Endogenous Variables | Notations |

|---|---|

| The product price between manufacturers and demand market k, . | |

| The EOL product recycling price paid by collection center h to consumers in demand market k. | |

| The reusable material price paid by non-ecological manufacturer j to collection center h. | |

| The reusable material price paid by ecological manufacturer i to collection center h. |

| Functions | Notations |

|---|---|

| . | |

| . | |

| . | |

| The transportation cost burden assumed by consumers to obtain the product. | |

| . | |

| . | |

| The disposal cost function of collection center h. | |

| The transaction cost from demand market k to collection center h. | |

| Disutility to consumers due to collection of EOL product. | |

| The demand function of ecological product. | |

| The demand function of non-ecological product. |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Cheng, P.; Zhang, G.; Sun, H. The Sustainable Supply Chain Network Competition Based on Non-Cooperative Equilibrium under Carbon Emission Permits. Mathematics 2022, 10, 1364. https://doi.org/10.3390/math10091364

Cheng P, Zhang G, Sun H. The Sustainable Supply Chain Network Competition Based on Non-Cooperative Equilibrium under Carbon Emission Permits. Mathematics. 2022; 10(9):1364. https://doi.org/10.3390/math10091364

Chicago/Turabian StyleCheng, Peiyue, Guitao Zhang, and Hao Sun. 2022. "The Sustainable Supply Chain Network Competition Based on Non-Cooperative Equilibrium under Carbon Emission Permits" Mathematics 10, no. 9: 1364. https://doi.org/10.3390/math10091364

APA StyleCheng, P., Zhang, G., & Sun, H. (2022). The Sustainable Supply Chain Network Competition Based on Non-Cooperative Equilibrium under Carbon Emission Permits. Mathematics, 10(9), 1364. https://doi.org/10.3390/math10091364