Abstract

This paper explores the relationship between public policy and entrepreneurial activity in EU countries by using the panel threshold model. The paper was fundamental based on and confirmed the psychological threshold theory; namely, the results showed a single threshold effect between government effectiveness and entrepreneurial activity. Government public policy boosts entrepreneurial activity at the first segment, but the promotion effect becomes relatively slow after the threshold value. When separating the EU countries into efficiency-driven and innovation-driven countries, the threshold effect only existed in innovation-driven countries. After the threshold value, governance effectiveness hindered entrepreneurial activity, because saturation and excessive regulations impeded business in these countries. In essence, it is not a matter of working harder or winding down but a matter of promoting a moderate public policy, which is indeed necessary for the government to encourage entrepreneurial activity. Ultimately, keeping economic growth stable is essential for a favorable entrepreneurial environment.

MSC:

91-10 mathematical modeling

1. Introduction

The institutional framework established by public policies directs its attention from an SME-oriented policy to one oriented towards productive and innovative entrepreneurship. Regulated entrepreneurship implies fair practices and generates added value.

Entrepreneurial activity is considered to generate economic wealth for both entrepreneurs and third parties (business partners, stakeholders, and society as a whole), promote social welfare by changing lives and improving living standards, and drive innovation by creating and developing new products and technologies conquering new markets. Therefore, entrepreneurship is essential to the national economy for furthering economic development. Entrepreneurship is affected by public policy, since government regulation stimulates business initiatives and corrects unfair practices, competition, and economic crime. Carree et al. [1] studied the impact of entrepreneurship on economic growth and emphasized four sides of the empirical studies within the literature in the field. Firstly, they found divergent results concerning the relationship between entrepreneurial activity and economic growth at the regional level.

On the one hand, they quote Audretsch et al. [2], demonstrating that regions with high start-up rates show high growth rates. On the other hand, they emphasize the effect of self-employment on growth. They quote Carree et al. [3], stating that the growth of business ownership rate harms economic growth in the medium term. Hence, there is no clear conclusion on whether entrepreneurship benefits economic growth. Comprehension of both the benefits and disadvantages of entrepreneurship allows for a prudent approach to promoting entrepreneurship with positive economic and societal impacts.

Indubitably, a firm’s success (due to the entrepreneur’s initiative) depends on the state’s support, translating into healthy public policies, proper infrastructure, and institutions. Gradually, public policies focused on entrepreneurship have become an increasingly important topic of interest for leaders, practitioners, and public decision-makers, especially in the current economic and financial crisis that affects the world. We focused our attention and our empirical research on the context of the European Union, because growth in Europe is unimaginable in the absence of small and medium enterprises. Statistics show that SMEs represent more than 90% of all European companies; therefore, they create jobs, wealth, and welfare in Europe. Carayannis et al. [4] analyzed the regional and spatial perspectives of entrepreneurship after 60 years of a shared European vision and concluded that entrepreneurship can flourish with an integrated policy mix. They believe that there is a need for more research on the impact of entrepreneurship considering multi-dimensional aspects regarding the geographical level. Arenal et al. [5] analyzed the development of an entrepreneurship policy in the EU from 1990 to 2016 and found cross-national similarities and differences between the EU level and several national approaches. We focused our approach on European countries, considering the national differences, political instabilities, economic imbalances, and public regulation to support business initiatives (i.e., quality, stability, consistency, and implementation).

Our paper explored the relationship between public policy and entrepreneurial activity in EU countries. The novelty of our research can be distinguished on three main grounds: the complexity of the current state of the research, the theory that we fundamentally based our research on, and the use of the panel threshold regression model. Previous studies did not consider nonlinear attribution; hence our methodology provides more accurate results by capturing the nonlinear relationship between public policy and entrepreneurial activity in EU countries. We determined the heterogeneity of development stages in EU countries and, therefore, we classified them into efficiency-driven and innovation-driven countries (Salman [6]). Our results indicate that the threshold effect exists in innovation-driven countries, and after the threshold value, governance effectiveness, even negatively, affects entrepreneurial activity. The results are valid for public authorities, indicating that moderate public policy is necessary concerning the threshold effect of government effectiveness on entrepreneurial activity.

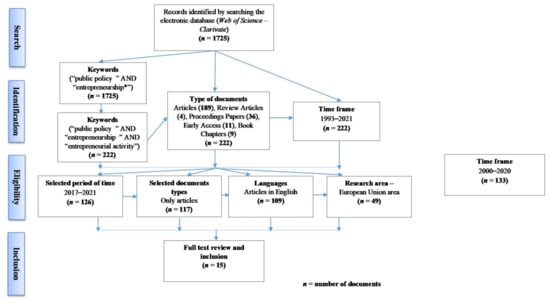

The current state of the research provides an overview of the relevant literature to emphasize the relationship between public policy and entrepreneurial activity and comprises a systematic analysis to focus on the most innovative and newest scientific research. This approach to a state-of-the-art research method is relevant, since it can provide an overview of areas where the field of research is disparate and interdisciplinary. We conducted a more complex analysis to focus on the most innovative and new scientific research by employing a systematic analysis. Data selection was performed using the Web of Science—Core Collection, involving search terms to identify types of information. The first research step included Boolean search operators and wildcards characters for the introduction of keywords: (“public policy*”) AND (“entrepreneurship*”) AND (entrepreneurial activity). To nuance the study’s novelty, the time frame for the analysis was reduced to 2017–2021. Considering the diversity of the document types offered by WOS, our study was reduced to articles. For an international audience and easy replicability of the review, only articles in the English language were selected. Furthermore, works that did not address our subject of analysis in the European Union area were excluded. Moreover, considering the summary and title of the relevant contributions, only those articles containing one or more determinants that directly or indirectly affect the purpose of our research were extracted (Figure 1).

Figure 1.

The systematic selection strategy of the studies highlights the relationship between public policy, entrepreneurship, and entrepreneurial activity. Source: authors’ own processing.

Table 1 reports data (articles) relevant to the relationship between public policy, entrepreneurship, and entrepreneurial activity.

Table 1.

Relevant articles on the relationship between public policy, entrepreneurship, and entrepreneurial activity.

Cicchiello [12] states that public policy ensures an essential role in how new funding alternatives can change entrepreneurship. In this light, the author investigated public policies that support various forms of entrepreneurial activity in Europe. The results showed that measures to reinforce entrepreneurship across Europe have been applied and aligned with national authorities’ political objectives. It was also concluded that less bureaucratic public policies that significantly influence entrepreneurial activity increase the survival of successful businesses. In addition, the public policies of public decision-makers must be those with a significant impact on entrepreneurship including competitiveness and innovation. Thus, decision-makers can influence the business environment of entrepreneurs by promoting flexible forms of financing.

Campos et al. [20] evaluated public policies and programs regarding entrepreneurship and certain aspects at the national policy-making level to observe their effects on entrepreneurship and internationalization. Therefore, the results suggest that the effectiveness of public policies is mainly associated with several different aspects such as the bureaucratic system, availability of information and infrastructure, the importance given to entrepreneurial policies by public bodies, young entrepreneurs receiving support, adequate programs, and regulatory frameworks.

Abdesselam et al. [7] conducted a study based on the determinants of entrepreneurial activity in three critical moments of a crisis: (i) pre-crisis period (1999–2008)—a period characterized by accelerated growth and development of entrepreneurship as well as an increase in entrepreneurial activity, with meagre unemployment rates and a high GDP; (ii) the crisis period (2009)—an event that marks, in the beginning, a slight break in the dynamism of entrepreneurship, the period in which a slight increase in unemployment was observed, which had increasing tendencies in the following period; (iii) post-crisis (2010–2012): the period characterized by a negative influence of the crisis, decreasing the entrepreneurial dynamism, and the entrepreneurial activity had a significant decline.

The year 2008 marks the beginning of the financial crisis that led to a decrease in tax revenues, with the public sector in some European countries facing an unsustainable budget deficit. Regarding this aspect, Bilau et al. [8] studied how business angels (BAs) can stimulate entrepreneurial activity in the country most affected by the crisis—Portugal—with one of the most significant recessions and many austerity measures. On the one hand, the results show that economic environment was severely damaged due to the existence of a multitude of austerity measures and, on the other hand, there was a decrease in economic activity. The authors also noted that BAs are becoming a significant source of funding, especially in times of crisis, and the government is launching a series of actions to support increased investment in BAs.

Policymakers have an essential role in identifying the vast array of factors that affect entrepreneurial activity, designing and applying public policies that increase sustainable economic growth and improve social prosperity. In this light, Zikou et al. [11] examined the public sector’s role in entrepreneurship and investigated the relationship between the degree of diversification of economic activity and entrepreneurship, applying data samples from all regions related to the European Union. The paper presents empirically tested hypotheses on panel data, and the period included in the analysis was 14 years (1999–2013). The results revealed that entrepreneurship, prosperity, and economic development at the regional level can be stimulated by reducing the public sector, highlighted by the negative relationship between the share of the public sector and entrepreneurship. Moreover, there was an inconclusive relationship regarding the impact of diversity on entrepreneurial activities, a fact justified by modern trends in the global economy.

The role of entrepreneurship in society is essential and based on a series of positive externalities, such as increased productivity and innovation, which determine an increased interest in this area of research. Several studies have examined the relationship between entrepreneurial activity and various determinant variables. In this light, Nicolae et al. [10] conducted a study that explored the factors that influence the dynamics of entrepreneurship, the main goal being to determine common factors that can support the flourishing of entrepreneurship. Despite the differences between countries, the results outlined common factors that can lead to the development of entrepreneurship globally; the results can support decision-makers by using them to improve entrepreneurial activity in their countries.

Urbano et al. [13] explored the influence of several existential factors on entrepreneurial activities. In this light, the results outline that the institutional environment impacts entrepreneurial activity in developing countries. Moreover, the authors noted a positive relationship between entrepreneurship and economic growth, which shows that entrepreneurship is a powerful tool with a significant influence on economic growth; therefore, policymakers should create and support public policy that increases entrepreneurial activity and, with it, fast, sustainable economic growth.

Martínez-Rodriguez et al. [18] examined economic factors (fiscal and monetary policy instruments) and socio-cultural factors (human capital and other variables) that had an impact on entrepreneurship, based on a sample of 32 countries and two time spans: (i) 2001–2008 (expansion period) and (ii) 2009–2016 (crisis and recovery period). The results revealed the need to implement policies to promote entrepreneurship with human capital being the factor with the highest efficiency in the business cycle.

Developed countries have two essential components in overcoming barriers to entrepreneurship: development and wealth. In this sense, Abdesselam et al. [14] proposed establishing the typologies of entrepreneurial countries in Europe based on variables related to entrepreneurial activity and economic development. Thus, the results emphasized that entrepreneurship has a high level in developed countries characterized by high-performance health systems, innovation, and increased well-being of citizens and whose public policy supports the establishment of new companies and supports the development of existing ones.

The intention of entrepreneurs to launch a start-up, including their behavior, can be strongly influenced by government barriers. In this light, Lecuna et al. [17] applied the theory of planned behavior to observe the influence of corruption and inefficient bureaucracy on entrepreneurship. The results conclude that political factors play a crucial role in simplifying regulations that facilitate business development. Briefly, less bureaucracy and fewer procedures when setting up a business can lead to increased involvement of individuals in entrepreneurship.

In Sweden, small- and medium-sized towns that have not been included in expanding metropolitan areas have some key characteristics: unemployment, depopulation, and industrial decline. By performing a study at the level of 100 vulnerable municipalities in Sweden with primary data and secondary register data, Naldi et al. [19] underscored, among other things, that environmental, economic, demographic, and geographic factors have a significant influence on the existence and development of entrepreneurial activity. It should also be noted that a mutual influence exists between policy entrepreneurship and social capital; therefore, the vulnerability of small- and medium-sized towns could decrease by taking decisions and actions that strengthen both policy entrepreneurship and social cohesion. This fact can be a real new challenge for national and regional policies.

Kallas et al. [16] explored the set of defining characteristics (contextual and cognitive) through which individuals acquire, or not, the quality of an entrepreneur based on data from a reported survey applied to the population of Estonia. The results of the study indicated the existence of three stages in becoming an entrepreneur as follows: (i) intention—the interest to start a business is developed by young people, unemployed, and individuals with vocational education; (ii) action—regarding the start of the entrepreneurial action (business plan or financing aspects), there was a significant presence of gender (men predominantly, fewer women), while on the other hand, middle-aged people and managers did not display a significant interest; (iii) starting up—lastly, the intention and the action is materialized in entrepreneurial activity by men.

Public decision-makers must consider the cultural context (which has multiple dimensions) specific to each country when developing public policies that stimulate entrepreneurship; changes in the culture of countries cannot be achieved quickly, and public policies should shed new light on special tools in overcoming cultural disadvantages. Crespo [9] investigated the complex causal relationships between national culture dimensions, economic development level, and male and female entrepreneurial activity. Complementarily, how the combinations of dimensions of the national culture led to increased entrepreneurial activity among both women and men were investigated, and the role that the combination of economic development and national cultural dimensions had in the increase in entrepreneurial activity in males and females. The results suggest the existence of configurations that are specific only to one sex—female or male. Furthermore, these configurations result from a combination of economic development and national cultural dimensions, existing in different configurations for only one of the sexes, leading to an increase or decrease in male or female entrepreneurial activity.

Raposo et al. [21] stated that the literature on the relationship between entrepreneurial ecosystems and sustainability could be developed through empirical evidence; in this light, a binary regression based on a logistical distribution was developed with a variety of variables on a sample of nine countries. The results involved considerations relevant to decision-makers and companies (i.e., managers and entrepreneurs), emphasizing that entrepreneurship is a systemic phenomenon that strongly influences national sustainability.

Aparicio et al. [15] comment that the economic development of vulnerable communities and the stimulation of entrepreneurial activity can be led through public policies outlined around progress-oriented social values.

Researchers commonly associated entrepreneurship with economic growth theory and, concerning public policy, with economic freedom theory (Adam Smith [22]; John Stuart Mill [23]; Ludwig von Mises [24]; Friedrich A. Hayek [25]; Milton Friedman [26]). In contrast to previous studies that fundamentally underlined their approaches towards entrepreneurship, we chose an interdisciplinary approach; namely, we grounded our study on the psychological threshold theory. Based on the psychologist Lewis Terman’s experiment in 1921, Arthur R. Jensen [27] further developed the threshold theory and stated that intelligence does not generate creativity above a certain level.

The paper is harmoniously divided into Section 1 (Introduction), Section 2 (Materials and Methods), Section 3 (Results), Section 4 (Discussion), Section 5 (Conclusions), and References. Section 1 (Introduction) places our research within the context of exploring the relationship between public policy and entrepreneurial activity in EU countries, fundamentally basing it on the psychological threshold theory. The Introduction includes a systematic analysis for revealing scientific research on the topic mentioned above. Section 2 (Materials and Methods) introduces the two main hypotheses of the article and develops the panel threshold regression model (Hansen [28]) into four equations for grounding the interaction relationship between public policy and entrepreneurial activity. We chose a panel threshold regression model to test if we could identify a threshold value after which the governance effectiveness hindered entrepreneurial activity in EU countries. The novelty of our research also refers to the nonlinear attribution. Hence, our methodology provides more accurate results by capturing the nonlinear relationship between public policy and entrepreneurial activity in EU countries as shown in Section 3 (Results). Section 4 (Discussion) is dedicated to summarizing and interpreting the results according to the field literature, the working hypotheses, and the psychological threshold theory. Ultimately, we included policy recommendations concerning governance effectiveness indicators that can improve the level of entrepreneurial activities in the Conclusions (Section 5). The list of references comprises an extensive range of published papers in leading mainstream journals on the topic.

2. Materials and Methods

2.1. Theory Assumptions

Good governance and sensible policies are preconditions to establishing a favorable business environment (Klapper et al. [29]). Entrepreneurs are reluctant to commit resources in an uncertain environment characterized by constant policy changes and severe corruption. This would reduce the investment enthusiasm and distort the allocation of resources for both nascent and mature entrepreneurial activities (Brunetti et al. [30]). Busse and Hefeker [31] state that changes in government policy or political institutions can affect entrepreneurial behavior, as the risk premium incorporated in any investment project is influenced by political risk. Favorable policies for entrepreneurship, including rules, regulations, and property rights, can reduce information asymmetries and market risk. It can be concluded that weak protection of property rights, a high level of corruption, and an inefficient judicial system can hinder information flow, impacting information costs and benefits gained from information, and, as a result, hinder entrepreneurial activity. We, therefore, propose Hypothesis 1.

Hypothesis 1 (H1).

High-quality government effectiveness can encourage people to start businesses and entrepreneurial activities overall.

The rule of law is known as one of the world governance indicators and is highly associated with government effectiveness. However, excessive government intervention may bring more barriers, such as strict approval process and regulation, which will lead to an excessive or too complex process of establishing a new business (Troilo [32]). Consequently, this stifles the initiative of entrepreneurship. In addition, this phenomenon may be universal in developed economies because of the saturated market conditions. Likewise, Aidis et al. [33], Demirguc-Kunt et al. [34], and Grilo and Thurik [35] state the nonsignificant or negative correlation between the rule of law and entrepreneurship in some of the wealthiest countries. Considering the above studies, we propose Hypothesis 2.

Hypothesis 2 (H2).

After reaching a certain level, government effectiveness may negatively affect entrepreneurial activities, especially in developed countries.

2.2. The Panel Threshold Regression Model

We considered panel data concerning the existence of control variables based on the panel threshold regression model of Hansen [28] and constructed the following single threshold model:

where is the level of public policy as the threshold variable; denotes the estimated threshold value; and are the estimated threshold coefficients of different threshold values. The distinctive coefficients infer that when the independent variable is lower than the threshold value , the dependent variable is associated with with the rate. Once the independent variable exceeds the threshold value , the dependent variable changes with unit when changes one unit; is the vector of 4 × 1, which comprises the control variables , , , and . Specifically, is the gross domestic product (GDP) growth rate used to control the effect of business cycles on entrepreneurial activity; , , and are trade volume, educational attainment, and gender gap, respectively; , , and are the estimated coefficients corresponding to the control variables , and ; is a fixed effect representing the heterogeneity of countries under different levels of trade dependency. The error term, , is a white noise process, which subjects to ; denotes the different countries in the analysis; t refers to a specific period.

The advanced threshold regression Equation (1) can also be rewritten as:

Equation (2) represents a single threshold regression model; however, there may be numerous thresholds in empirical applications. Therefore, the formula of the double threshold regression model can be organized as follows:

Equation (3) can also be simplified as follows:

where the threshold value is .

Accordingly, this can be extended to the multiple threshold model.

3. Results

This paper considered total entrepreneurial activity (TEA) to proxy the entrepreneurial activity as the dependent variable. TEA identifies the percentage of individuals in the nation, ages 18 to 64, who are actively engaged in starting or managing a new business; entrepreneurs engaged in both activities are counted only once (Bygrave et al. [36]). The threshold variable was a government policy that was measured by government effectiveness. It reflected perceptions of the quality of public services, the quality of the civil service and the degree of its independence from political pressures, the quality of policy formulation and implementation, and the credibility of the government’s commitment to such policies.

The control variables included GDP growth rate, the share of trade volume on GDP, and education. Despite the fact that entrepreneurial activity originates at the individual level and is always traceable to a single person, it relies on macroeconomic conditions and the business environment. A good performance of national economic condition would have buoyant business demand and propel entrepreneurial activity. We expected high economic growth rates to signal high investment returns and attract further people who want to start a business. Moreover, international trade is linked with the expansion of industries, which may positively affect entrepreneurial activity.

On the contrary, some scholars found that poorer countries’ entrepreneurial activity and economic growth were harmful (Acs et al. [37]). Furthermore, human capital is strongly correlated with entrepreneurial activity (Burton-Jones and Spender [38]). In particular, education plays an essential role in accumulating human capital. Hence, it is reasonable to expect that the better educated the population, the higher the level of entrepreneurial activity. General educational attainment can provide only part of the gender gap in entrepreneurial activity, because greater educational attainment does not always translate into better labor outcomes for females (Ramos-Rodriguez et al. [39]). Narrowing the gender gap in education benefits female entrepreneurial activity, because it stimulates a gender-egalitarian environment by creating role models for female entrepreneurs (Dilli and Westerhuis [40]). We thus introduced the gender parity index for the gross enrolment ratio in primary and secondary education, which is the ratio of girls to boys enrolled at primary and secondary levels in public and private schools. The sample periods ranged from 2002 to 2019. Annual data were collected from multiple independent sources; the details are reported in Table 2.

Table 2.

Index description.

We performed a panel threshold regression model to evidence the interaction relationship between public policy and entrepreneurial activity. It is well known that to avoid the spurious regression problem, all variables in the model should be stationary. Therefore, we proceeded with unit root tests before the panel threshold regression model. Since the single-equation augmented Dickey–Fuller (ADF) test presents limited power when the data are generated by a near-unit root but stationary process, to improve the reliability of the results, we adopted two-panel unit root tests proposed by Levin et al. [41] and Im et al. [42]. Table 3 highlights that the null hypothesis of unit roots was rejected within a 1% significance level. This implies that all of the variables in our analysis were stationary, which is the following panel threshold regression premise.

Table 3.

Panel unit root tests.

After repeating 10,000 times in the bootstrapping of the sample, Table 4, section (a) presents the panel threshold regression between public policy and EA in 27 EU member countries. There was a threshold effect for the single threshold model under the 5% significance level, while the double threshold effect was not significant. The single threshold value was 1.981, which means that public policy had different effects on EA before and after the threshold value. Combined with Table 4, section (b), we can infer that when public policy is lower than 1.981, the coefficient is 0.372. At this stage, public policy will be beneficial for entrepreneurial activity in a positive direction. Once the public policy exceeds the threshold value, the coefficient is 0.069. This means that when public policy is more than 1.981, the promotion effect of public policy on enterprise activities will be weakened ( < ). The reason for this is that public policy is closely related to corruption that will bring significant risk to the entrepreneur because of the relatively high levels of information asymmetries. Corruption also creates disincentives for investment in innovation and complex economic activities where payoffs are difficult or costly to monitor because they are uncertain or temporally removed. Thus, corruption increases transaction costs, further limiting the potential scope of their activities (Luhmann [43]). Improving public policy, which is measured as government effectiveness, will restrain corruption and encourage entrepreneurial activity. However, excessive government policy intervention will inhibit the innovation activities of enterprises (Klapper et al. [44]). As a result, H1 was verified. Table 4, section (c) shows that the coefficients of GDP growth rate were significantly positive. It can be inferred that rapid economic growth will provide an ideal environment for entrepreneurial activity. represents gender parity in educational attainment. Even though the gender gap is closing in education, higher levels of female education create better opportunities for wage employment and lower entrepreneurial activity levels (Verheul et al. [45]).

Table 4.

(a). Tests for threshold effects between public policy and EA in EU countries. (b). Estimated coefficients of public policy. (c). Estimated coefficients of the control variables.

Moreover, we inferred that there were heterogeneities among EU countries, which resulted in the nonsignificant regression result. Therefore, based on the study of Salman [6], we separated the whole panel into two sub-panels from the perspective of economic strategies: efficiency- and innovation-driven countries. Table 5 and Table 6, section (a) show the panel threshold regression test results in efficiency-driven countries and innovation-driven countries, respectively.

Table 5.

Tests for the threshold effects between public policy and entrepreneurial activity in EU efficiency-driven countries.

Table 6.

(a). Tests for the threshold effects between public policy and entrepreneurial activity in EU innovation-driven countries. (b). Estimated coefficients of public policy. (c). Estimated coefficients of the control variables.

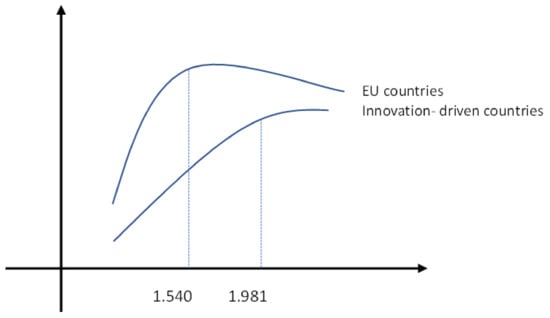

Table 5 and Table 6, section (a) show that the threshold effect was not significant in efficiency-driven countries but significant in the innovation-driven countries panel. The threshold value was 1.540 under the 1% significance level. Table 6, section (b) reports that when public policy was lower than 1.540, the coefficient was 0.702. After this stage, the coefficient was −0.028. In general, innovation-driven countries are accompanied by higher government efficiency. Our results show that countries with high governance effectiveness have less favorable attitudes towards and lower levels of entrepreneurship when compared to countries with less effective governance (efficiency-driven countries). This finding is statistically significant yet counterintuitive. One possible explanation is that developed countries may have fewer entrepreneurial opportunities because the market for new businesses in developed countries is saturated relative to developing countries. This saturation would decrease the motivation for nascent businesses and, subsequently, entrepreneurship overall.

Furthermore, some developed countries have higher barriers to entry for new businesses (Friedman [46]). Barriers to entry may include stricter regulation and more significant taxes. For instance, Finland and Denmark showed very high levels of governance effectiveness, but they have the heaviest tax burdens with ranks of 14 and 17 out of 210 countries. The tax burdens of Denmark and Finland were 55% and 51% of GDP, respectively. This inhibits entrepreneurial activity severely.

Consequently, H2 can be confirmed.

Similar to Fedushko et al. [47], we considered that the complexity of the national environment, economic structure, and diversity of data determine the heterogeneity of development stages in EU countries. Therefore, we classified them into efficiency-driven and innovation-driven countries (Salman [6]). We found that the threshold effect existed in innovation-driven countries, and after the threshold value, governance effectiveness, even negatively, affected entrepreneurial activity (Figure 2).

Figure 2.

Overall outcomes. Source: authors’ own processing.

According to Table 6, section (c), education will positively affect entrepreneurial activity. This reflects the vital contribution of a qualified education to increase the human capital investment and, consequently, increase the EA in innovative-driven regions. These results are consistent with Sánchez [48], suggesting that education drives and increases individuals’ entrepreneurial intentions towards self-employment. The outcomes are also in accordance with Lobonț et al. [49], suggesting that cultural and economic development differences impact entrepreneurial activity. However, the improvement in gender equity in education exerted the opposite influence. This finding is consistent with Kelley et al. [50], who revealed that females were more likely than men to have a high level of education, but females exhibited an early-stage entrepreneurial activity rate of less than half that of men among entrepreneurs in most innovation-driven countries in Europe.

4. Discussion

This article used the panel threshold model (Hansen [28]) to capture the nonlinear relationship between public policy and entrepreneurial activity in EU countries. The empirical results showed a single threshold effect between government effectiveness and entrepreneurial activity in the whole panel.

When the threshold was exceeded, the promotion of government public policy on entrepreneurial activity turned from a fast to a slow pace. Considering the heterogeneity of development stages in EU countries, we further classified the efficiency-driven and innovation-driven countries; the threshold effect only existed in innovation-driven countries. After the threshold value, governance effectiveness, even negatively, affected entrepreneurial activity. This may be because of saturation and barriers, including regulation and tax in developed economies (e.g., innovation-driven countries), hindering the motivation of entrepreneurial activity. Overall, H1 and H2 were also confirmed. In addition, the rapid economic growth and the improvement in education levels were conducive to entrepreneurial activities, but gender equality in education had no positive effect on entrepreneurship.

The findings are both consistent with the field literature and the psychological threshold theory; likewise, psychological theory states that above a certain level, intelligence does not generate additional creativity, and knowledgeable people are not granted success during their lives; concerning the relationship between public policy and entrepreneurial activity in EU countries, we found a threshold value above which the governance effectiveness hindered entrepreneurial activity because the saturation and excessive regulations impede the business in these countries.

5. Conclusions

Although government regulation stimulates business initiatives and corrects unfair practices, excessive policy interventions impede entrepreneurial activity. We explored the relationship between public policy and entrepreneurial activity in EU countries, fundamentally basing our research on the psychological threshold theory and using the panel threshold regression model.

The single threshold value of 1.981 exists in EU countries. When public policy is lower than 1.981, the coefficient is 0.372. At this stage, public policy will be beneficial for entrepreneurial activity in a positive direction. Once public policy exceeds the threshold value, the coefficient is 0.069, indicating that the promotion effect of public policy on enterprise activities will be weakened. Due to the heterogeneity of the development stages in EU countries, we classified them into efficiency-driven and innovation-driven countries. We found that the threshold effect was not significant for efficiency-driven countries, even under the 10% significance level. However, the single threshold value was 1.540 under the 1% significance level in innovation-driven countries, and when public policy was lower than 1.540, the coefficient was 0.702. After this stage, the coefficient was −0.028, suggesting that governance effectiveness even negatively, affects entrepreneurial activity.

Based on these findings, policy recommendations can be inferred. Firstly, since the control of corruption is a vital governance effectiveness indicator that can improve the level of entrepreneurial activities, special attention should be given to the control of corruption by policymakers for innovation and entrepreneurship to flourish. Furthermore, moderate public policy is necessary concerning the threshold effect of government effectiveness on entrepreneurial activity. Reducing barriers to entrepreneurship, including providing more financing channels and cutting down on tax burdens and regulations, is conducive to encouraging entrepreneurship and increasing employment. Moreover, improving education can boost entrepreneurial activity. Primarily, it is crucial to target eliminating gender differences in entrepreneurship, particularly in skills related to entrepreneurial activity learned through channels other than education, such as internships, and to create opportunities for females to network with other entrepreneurs. Therefore, moderate public policy is necessary concerning the threshold effect of government effectiveness on entrepreneurial activity.

Ultimately, keeping economic growth stable is essential for a favorable entrepreneurial environment for efficient- and innovation-driven countries.

Author Contributions

Conceptualization A.-C.N. and O.-R.L.; methodology, F.C., A.D. and Z.-Z.L.; software, A.D., Z.-Z.L. and A.-M.Ț.; validation, F.C., Z.-Z.L. and A.-M.Ț.; formal analysis, Z.-Z.L. and A.-M.Ț.; investigation, A.D., A.-C.N. and O.-R.L.; resources, F.C. and A.-M.Ț.; data curation, F.C., Z.-Z.L. and A.-M.Ț.; writing—original draft preparation, A.-C.N. and O.-R.L.; writing—review and editing, A.D., A.-C.N. and O.-R.L. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Publicly available datasets were analyzed in this study. This data can be found here: https://www.gemconsortium.org/; https://databank.worldbank.org/source/worldwide-governance-indicators; https://databank.worldbank.org/source/world-development-indicators (accessed on 26 March 2022).

Conflicts of Interest

The authors declare no conflict of interest.

References

- Carree, M.A.; Thurik, A.R. The Impact of Entrepreneurship on Economic Growth. In Handbook of Entrepreneurship Research; Acs, Z., Audretsch, D., Eds.; International Handbook Series on Entrepreneurship; Springer, Kluwer Academic Publishers: New York, NY, USA, 2010; Volume 5, pp. 557–594. [Google Scholar]

- Audretsch, D.B.; Fritsch, M. Growth regimes overtime and space. Reg. Stud. 2002, 36, 113–124. [Google Scholar] [CrossRef]

- Carree, M.; van Stel, A.; Thurik, R.; Wennekers, S. Economic Development and Business Ownership: An Analysis Using Data of 23 OECD Countries in the Period 1976–1996. Small Bus. Econ. 2002, 19, 271–290. [Google Scholar] [CrossRef]

- Carayannis, E.; Jones, P.; Liargovas, P.; Apostolopoulos, N. Entrepreneurship and the European Union policies after 60 years of common European vision: Regional and spatial perspectives. J. Small Bus. Entrep. 2020, 32, 517–522. [Google Scholar] [CrossRef]

- Arenal, A.; Feijoo, C.; Moreno, A.; Ramos, S.; Armuña, C. Entrepreneurship Policy Agenda in the European Union: A Text Mining Perspective. Rev. Policy Res. 2021, 38, 243–271. [Google Scholar] [CrossRef]

- Salman, D.M. What is the role of public policies to robust international entrepreneurial activities on economic growth? Evidence from cross countries study. Future Bus. J. 2016, 2, 1–14. [Google Scholar]

- Abdesselam, R.; Bonnet, J.; Renou-Maissant, P.; Aubry, M. Entrepreneurship, economic development, and institutional environment: Evidence from OECD countries. J. Int. Entrep. 2017, 16, 504–546. [Google Scholar] [CrossRef]

- Bilau, J.; Mason, C.; Botelho, T.; Sarkar, S. Angel investing in an austerity economy—The take-up of government policies in Portugal. Eur. Plan. Stud. 2017, 25, 1516–1537. [Google Scholar] [CrossRef]

- Crespo, N.F. Cross-cultural differences in the entrepreneurial activity of men and women: A fuzzy-set approach. Gend. Manag. Int. J. 2017, 32, 281–299. [Google Scholar] [CrossRef]

- Nicolae, M.; Lupu, R.; Ion, I. What Matters for Entrepreneurship? A Global View on Its Determinants. J. Econ. Forecast. 2017, 20, 135–149. [Google Scholar]

- Zikou, E.; Varsakelis, N.; Sarri, A.K. Does public sector crowd out entrepreneurship? Evidence from the EU regions. Int. J. Entrep. Behav. Res. 2017, 24, 866–881. [Google Scholar] [CrossRef]

- Cicchiello, A.F. Building an entrepreneurial ecosystem based on crowdfunding in Europe: The role of public policy. J. Entrep. Public Policy 2019, 8, 297–318. [Google Scholar] [CrossRef]

- Urbano, D.; Audretsch, D.; Aparicio, S.; Noguera, M. Does entrepreneurial activity matter for economic growth in developing countries? The role of the institutional environment. Int. Entrep. Manag. J. 2019, 16, 1065–1099. [Google Scholar] [CrossRef]

- Abdesselam, R.; Bonnet, J.; Renou-Maissant, P. What are the drivers of business demography and employment in the countries of the European Union? Appl. Econ. 2020, 52, 4018–4043. [Google Scholar] [CrossRef]

- Aparicio, S.; Audretsch, D.; Urbano, D. Does Entrepreneurship Matter for Inclusive Growth? The Role of Social Progress Orientation. Entrep. Res. J. 2020, 11, 20190308. [Google Scholar] [CrossRef]

- Kallas, E.; Parts, E. From entrepreneurial intention to enterprise creation: The case of Estonia. J. Entrep. Emerg. Econ. 2021, 13, 1192–1214. [Google Scholar] [CrossRef]

- Lecuna, A.; Cohen, B.; Mandakovic, V. Want more high-growth entrepreneurs? Then control corruption with less ineffective bureaucracy. Interdiscip. Sci. Rev. 2020, 45, 525–546. [Google Scholar]

- Martínez-Rodriguez, I.; Callejas-Albiñana, F.E.; Callejas-Albiñana, A.I. Economic and Socio-Cultural Drivers of Necessity and Opportunity Entrepreneurship Depending on the Business Cycle Phase. J. Bus. Econ. Manag. 2020, 21, 373–394. [Google Scholar] [CrossRef] [Green Version]

- Naldi, L.; Larsson, J.P.; Westlund, H. Policy entrepreneurship and entrepreneurial orientation in vulnerable Swedish municipalities. Entrep. Reg. Dev. 2020, 32, 473–491. [Google Scholar] [CrossRef]

- Campos, J.; Braga, V.; Correira, A.; Ratten, V.; Marques, C. Perceptions on effectiveness of public policies supporting entrepreneurship and internationalization. J. Entrep. Public Policy 2021, 10, 492–504. [Google Scholar] [CrossRef]

- Raposo, M.; Fernandes, C.I.; Veiga, P.M. We dreamed a dream that entrepreneurial ecosystems can promote sustainability. Manag. Environ. Qual. 2022, 33, 86–102. [Google Scholar] [CrossRef]

- Smith, A. An Inquiry into the Nature and Causes of the Wealth of Nations; Cannan, E., Ed.; University of Chicago Press: Chicago, IL, USA, 1976. [Google Scholar]

- Mill, J.S. Principles of Political Economy, with Some of Their Applications to Social Philosophy; John W. Parker: London, UK, 1848. [Google Scholar]

- Von Mises, L. The Theory of Money and Credit, 3rd ed.; Liberty Classics: Indianapolis, IN, USA, 1912; Available online: http://www.econlib.org/library/Mises/msT.html (accessed on 26 March 2022).

- Hayek, F. The Road to Serfdom; University of Chicago Press: Chicago, IL, USA, 1944. [Google Scholar]

- Friedman, M. Capitalism and Freedom; University of Chicago Press: Chicago, IL, USA, 1962. [Google Scholar]

- Jensen, A.R. Bias in Mental Testing; Free Press: New York, NY, USA, 1980. [Google Scholar]

- Hansen, B.E. Threshold effects in non-dynamic panels: Estimation, testing and inference. J. Econom. 1999, 93, 345–368. [Google Scholar] [CrossRef] [Green Version]

- Klapper, L.; Lewin, A.; Quesada, J.M. The Impact of the Business Environment on the Business Creation Process; World Bank Policy Research Working Paper No. 4937; World Bank: Washington, DC, USA, 2009. [Google Scholar]

- Brunetti, A.; Kisunko, G.; Weder, B. Credibility of rules and economic growth: Evidence from a worldwide survey of the private sector. World Bank Econ. Rev. 1998, 12, 353–384. [Google Scholar] [CrossRef] [Green Version]

- Busse, M.; Hefeker, C. Political risk, institutions and foreign direct investment. Eur. J. Political Econ. 2007, 23, 397–415. [Google Scholar] [CrossRef] [Green Version]

- Troilo, M. Legal institutions and high-growth aspiration entrepreneurship. Econ. Syst. 2011, 35, 158–175. [Google Scholar] [CrossRef]

- Aidis, R.; Estrin, S.; Mickiewicz, T.M. Size matters: Entrepreneurial entry and government. Small Bus. Econ. 2012, 39, 119–139. [Google Scholar] [CrossRef]

- Demirguc-Kunt, A.; Love, I.; Maksimovic, V. Business environment and the incorporation decision. J. Bank. Financ. 2006, 30, 2967–2993. [Google Scholar] [CrossRef] [Green Version]

- Grilo, I.; Thurik, R. Latent and actual entrepreneurship in Europe and the US: Some recent developments. Int. Entrep. Manag. J. 2005, 1, 441–459. [Google Scholar] [CrossRef] [Green Version]

- Bygrave, W.D.; Hay, M.; Ng, E.; Reynolds, P. Executive forum: A study of informal investing in 29 nations composing the global entrepreneurship monitor. Ventur. Cap. 2003, 5, 101–116. [Google Scholar] [CrossRef]

- Acs, Z.J.; O’Gorman, C.; Szerb, L.; Terjesen, S. Could the Irish miracle be repeated in Hungary? Small Bus. Econ. 2007, 28, 123–142. [Google Scholar] [CrossRef] [Green Version]

- Burton-Jones, A.; Spender, J.C. The Oxford Handbook of Human Capital; Oxford University Press: Oxford, UK, 2011. [Google Scholar]

- Ramos-Rodriguez, A.; Medina-Garrido, J.; Ruiz-Navarro, J. Determinants of hotels and restaurants entrepreneurship: A study using GEM data. Int. J. Hosp. Manag. 2012, 31, 579–587. [Google Scholar] [CrossRef]

- Dilli, S.; Westerhuis, G. How institutions and gender differences in education shape entrepreneurial activity: A cross-national perspective. Small Bus. Econ. 2018, 51, 371–392. [Google Scholar] [CrossRef] [Green Version]

- Levin, A.; Lin, C.F.; Chu, J. Unit root in panel data: Asymptotic and finite-sample properties. J. Econom. 2002, 108, 1–24. [Google Scholar] [CrossRef]

- Im, K.S.; Pesaran, M.H.; Shin, Y. Testing for unit roots in heterogeneous panels. J. Econom. 2003, 115, 53–74. [Google Scholar] [CrossRef]

- Luhmann, N. Familiarity, Confidence, Trust: Problems and Alternatives. In Trust: Making and Breaking Cooperative Relations; Gametta, D., Ed.; Basil Blackwell: Oxford, UK, 1988; pp. 94–107. [Google Scholar]

- Klapper, L.; Laeven, L.; Rajan, R. Entry regulation as a barrier to entrepreneurship. J. Financ. Econ. 2006, 82, 591–629. [Google Scholar] [CrossRef]

- Verheul, I.; Van Stel, A.; Thurik, R. Explaining female and male entrepreneurship at the country level. Entrep. Reg. Dev. 2006, 18, 151–183. [Google Scholar] [CrossRef]

- Friedman, B.A. The relationship between governance effectiveness and entrepreneurship. Int. J. Humanit. Soc. Sci. 2011, 1, 221–225. [Google Scholar]

- Fedushko, S.; Mastykash, O.; Syerov, Y.; Peracek, T. Model of User Data Analysis Complex for the Management of Diverse Web Projects during Crises. Appl. Sci. 2020, 10, 9122. [Google Scholar] [CrossRef]

- Sánchez, J.C. University training for entrepreneurial competencies: Its impact on intention of venture creation. Int. Entrep. Manag. J. 2011, 7, 239–254. [Google Scholar] [CrossRef]

- Lobonț, O.R.; Nicolescu, A.C.; Lăpugean, C.R.; Alebaite, I. Is Cultural Diversity a Determinant of the Entrepreneurial Activity? Transform. Bus. Econ. 2015, 14, 332–354. [Google Scholar]

- Kelley, D.J.; Brush, C.S.; Greene, P.G.; Herrington, M.; Ali, A.; Kew, P. Special Report: Women’s Entrepreneurship. In The Global Entrepreneurship Monitor; Global Entrepreneurship Research Association, London Business School: London, UK, 2017; Available online: https://www.gemconsortium.org/report/gem-20162017-womens-entrepreneurship-report (accessed on 26 March 2022).

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).