Intangible ICT and Their Importance within Global Value Chains: An Empirical Analysis Based on Longitudinal Data Regression

Abstract

:1. Introduction

- The investment in total ICT (tangible and intangibles) increases the participation in global value chains.

- The effect of total ICT investments differs depending on the form of participation (Backward and Forward). Total ICT investments have a higher impact on backward than on forward participation.

- The effect of intangible ICT (software) differs; it is higher than the effect of tangible ICT (hardware) on global value chains participation.

- ICT assets in TBS have a stronger impact on participation in the GVC than in the manufacturing sector.

- Intangibles ICT assets in the manufacturing sector have a stronger impact on participation in the GVC than in the TBS.

2. Materials and Methods

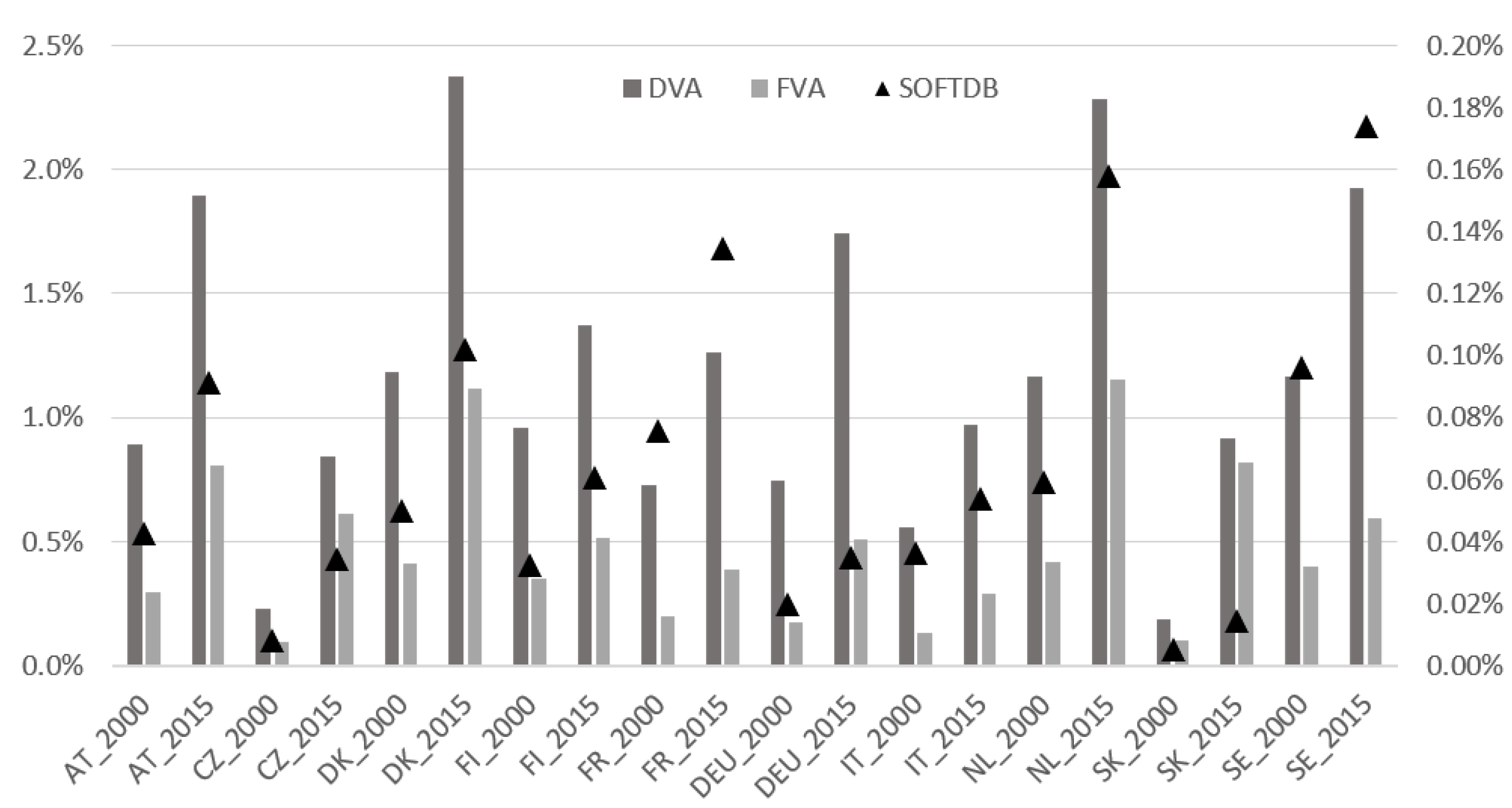

3. Results

4. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Jona-Lasinio, C.; Manzocchi, S.; Meliciani, V. Knowledge based capital and value creation in global supply chains. Technol. Forecast. Soc. Chang. 2019, 148, 119709. [Google Scholar] [CrossRef]

- Thum-Thysen, A.; Voigt, P.; Bilbao-Osorio, B.; Maier, C.H.; Ognyanova, D. Unlocking investment in intangible assets. Eur. Econ. Discuss. Pap. 2017, 16, 23–35. Available online: https://ideas.repec.org/p/euf/dispap/047.html (accessed on 22 January 2022).

- Tsakanikas, A.; Roth, F.; Calio, S.; Calighirou, Y.; Dimas, P. The Contribution of Intangible Inputs and Participation in Global Value Chains to Productivity Performance—Evidence from Eu-28, 2000–2014. Globaltino 2020, 5, 1–30. Available online: https://EconPapers.repec.org/RePEc:zbw:uhhhdp:5 (accessed on 10 January 2022).

- Koopman, R.; Powers, W.; Wang, Z.; Wei, S. Give credit where credit is due: Tracing value added in global production chains. National Bureau of Economic Research, Cambridge. Working Papers. 2010. No. 16426. Available online: https://www.nber.org/papers/w16426 (accessed on 10 January 2022).

- Miroudot, S.; Cadestin, C. Services in global value chains: From inputs to value—Creating activities. In OECD Trade Policy Papers; No. 197; OECD Publishing: Paris, France, 2017; pp. 1–58. [Google Scholar]

- Timmer, M.; Los, B.; Stehrer, R.; de Vries, G. Fragmentation, income and jobs: An analysis of European competitiveness. Econ. Policy 2014, 28, 613–661. [Google Scholar] [CrossRef]

- Baldwin, R. Global supply chains: Why they matter and where they are going. In Global Value Chains in a Changing World; Elms, D.K., Low, P., Eds.; WTO: Geneva, Switzerland, 2013; pp. 13–59. [Google Scholar]

- Jona-Lasinio, C.; Meliciani, V. Productivity Growth and International Competitiveness: Does Intangible Capital Matter? Intereconomics Rev. Eur. Econ. Policy 2018, 53, 58–62. Available online: https://ideas.repec.org/a/spr/intere/v53y2018i2d10.1007_s10272-018-0722-y.html (accessed on 10 January 2022). [CrossRef] [Green Version]

- Glova, J.; Mrazkova, S.; Dancakova, D. Measurement of Intangibles and Knowledge: An Empirical Evidence. AD ALTA—J. Interdiscip. Res. 2018, 8, 76–80. [Google Scholar]

- Glova, J.; Dancakova, D.; Suleimenova, S. Managerial Aspect of Intangibles: Own Development or External Purchased Intangible Assets—What Does Really Count? Pol. J. Manag. Stud. 2018, 18, 84–93. [Google Scholar] [CrossRef]

- Pan, H.; Kwak, Y.; Deal, B. Participatory Development of Planning Support Systems to Improve Empowerment and Localization. J. Urban Technol. 2022, 28, 1–12. [Google Scholar] [CrossRef]

- Abusaada, H.; Elshater, A. Competitiveness, distinctiveness and singularity in urban design: A systematic review and framework for smart cities. Sustain. Cities Soc. 2021, 68, 102782. [Google Scholar] [CrossRef]

- Appio, F.P.; Lima, M.; Paroutis, S. Understanding Smart Cities: Innovation ecosystems, technological advancements, and societal challenges. Technol. Forecast. Soc. Chang. 2019, 142, 1–14. [Google Scholar] [CrossRef]

- Pan, H.; Geertman, S.; Deal, B. What does urban informatics add to planning support technology? Environ. Plan. B Urban Anal. City Sci. 2020, 47, 1317–1325. [Google Scholar] [CrossRef]

- Chung, N.; Lee, H.; Ham, J.; Koo, C. Smart Tourism Cities’ Competitiveness Index: A Conceptual Model. In Information and Communication Technologies in Tourism 2021; Wörndl, W., Koo, C., Stienmetz, J.L., Eds.; Springer: Cham, Switzerland, 2021. [Google Scholar] [CrossRef]

- OECD. New Sources of Growth: Knowledge-Based Capital. Key Analyses and Policy Conclusions. 2013. SYNTHESIS REPORT. Available online: https://www.oecd.org/sti/inno/newsourcesofgrowthknowledge-basedcapital.htm (accessed on 10 January 2022).

- OECD. ICT Investment in OECD countries and partner economies. OECD Digital Economy Paper 2019, No. 280, 1–65. [Google Scholar] [CrossRef]

- Sampath, G.P.; Vallejo, B. Trade, global value chains and upgrading: What, when and how? J. Dev. Res. 2018, 30, 482–504. [Google Scholar] [CrossRef]

- Choi, H.; Kim, S.; Jung, T. The role of innovation in upgrading in global value chains. Glob. Econ. Rev. 2019, 48, 273–283. [Google Scholar] [CrossRef]

- Roth, F.; Thum, A.E. Does Intangible Capital Affect Economic Growth. Ceps Work. Doc. 2010, 335, 1–33. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1672706 (accessed on 10 January 2022).

- Niebel, T. ICT and Economic Growth: Comparing Developing, Emerging and Developed Countries. World Dev. 2018, 104, 197–211. [Google Scholar] [CrossRef] [Green Version]

- Marrocu, E.; Paci, R.; Pontis, M. Intangible capital and firm’s productivity. Ind. Corp. Chang. 2012, 21, 377–402. [Google Scholar] [CrossRef]

- Vrh, N. What drives the differences in domestic value added in exports between old and new EU member states? Econ. Res.-Ekon. Istraživanja 2018, 31, 645–663. [Google Scholar] [CrossRef] [Green Version]

- Vlčková, J.; De Castro, T.; Antal, J. Upgrading in the global value chains: The case of the Czech Republic. In Global Value Chains; Upgrading in the V4 Countries: Prague, Czech Republic, 2015. [Google Scholar]

- Pekarčík, M.; Ďurčová, J. Industry 4.0: The position of E.U. Member States in the Mains Indicators. In Proceedings of the IAI Academic Conference Proceedings, Skopie, North Macedonia, 20 May 2019; Available online: https://ia-institute.com/wp-content/uploads/2021/04/IAI-Proceedings-28.1-17.2.2021.pdf (accessed on 10 January 2022).

- Fagerberg, J.; Lundvall, B.; Srholec, M. Global value chains, National innovation system and economic development. Eur. J. Dev. Res. 2018, 30, 533–556. [Google Scholar] [CrossRef]

- Constantinescu, C.; Mattoo, A.; Ruta, M. Does vertical specialisation increase productivity? World Econ. 2019, 42, 2385–2402. [Google Scholar] [CrossRef] [Green Version]

- Durand, C.; Milberg, W. Intellectual monopoly in global value chains. Rev. Int. Political Econ. 2019, 27, 404–429. [Google Scholar] [CrossRef] [Green Version]

- Sollow, R.M. We’d Better Watch Out. New York Times Book Review, USA. 1987. Available online: http://www.standupeconomist.com/pdf/misc/solow-computer-productivity.pdf (accessed on 10 January 2022).

- Brynjolfsson, E. The productivity paradox of information technology: Review and assessment. Commun. ACM 1993, 36, 66–77. [Google Scholar] [CrossRef]

- Corrado, C.; Hulten, C.; Sichel, D. Measuring capital and technology: An expanded framework. In Measuring Capital in New Economy; Corrado, C., Haltiwanger, J., Sichel, D., Eds.; University of Chicago Press: Chicago, IL, USA, 2005; pp. 11–46. [Google Scholar]

- Corrado, C.; Hulten, C.; Sichel, D. Intangible capital and US economic growth. Rev. Income Wealth 2009, 55, 661–685. [Google Scholar] [CrossRef]

- Brynjolfsson, E.; Rock, D.; Syverson, C. Artifical Intelligence and the Moder Productivity Paradox: A clash of Expectations and Statistics. National Bureau of Economics Research Working Papers 24001. 2017. Available online: http://www.nber.org/papers/w24001 (accessed on 10 January 2022).

- Kim, K.; Bounfour, A.; Nonnis, A.; Özaygen, A. Measuring ICT externalities and their contribution to productivity: A bilateral trade based approach. Telecommun. Policy 2021, 45, 102085. [Google Scholar] [CrossRef]

- Corrado, C.; Haskel, J.; Jona-Lasinio, C.; Iommi, M. Innovation and Intangible Investment in Europe, Japan and United States. Oxf. Rev. Econ. Policy 2013, 29, 261–286. Available online: https://www.jstor.org/stable/23607143 (accessed on 10 January 2022). [CrossRef]

- Pieri, F.; Vecchi, M.; Venturini, F. Modeling the joint impact of R&D and ICT on productivity: A frontier analysis approach. Res. Policy 2018, 47, 1842–1852. [Google Scholar] [CrossRef] [Green Version]

- Vu, K. Measuring the Impact of ICT Investment on Economic Growth. J. Econ. Growth. 2005, pp. 1–41, Cordpus ID:10663932. Available online: https://www.semanticscholar.org/paper/1-Measuring-the-Impact-of-ICT-Investments-on-Growth-Vu/bc0f46f772594fbd19a85593304115e86c3a9fbc (accessed on 10 January 2022).

- Dal Borgo, M.; Goodridge, P.; Haskel, J.; Pesole, A. Productivity and growth in UK Industries: An intangible investment approach. Oxf. Bull. Econ. Stat. 2012, 75, 806–834. [Google Scholar] [CrossRef] [Green Version]

- Bajgar, M.; Criscuolo, C.H.; Timmis, J. Intangible and industry concentration: Supersize me. OECD Sci. Technol. Ind. Work. Pap. No. 12. 2021, pp. 1–39. Available online: https://dx.doi.org/10.1787/ce813aa5-en (accessed on 10 January 2022).

- Corrado, C.; Haskel, J.; Jona-Lasinio, C. Knowledge Spillovers, ICT and productivity growth. Oxf. Bull. Econ. Stat. 2017, 79, 592–618. [Google Scholar] [CrossRef] [Green Version]

- Gerefi, G.; Humphrey, J.; Sturgeon, T. The Governance of Global Value Chains. Rev. Int. Political Econ. 2005, 12, 78–104. Available online: http://www.jstor.org/stable/25124009 (accessed on 10 January 2022). [CrossRef]

- Adarov, A.; Stehrer, R. Tangible and Intangible Assets in the Growth Performance of the EU, Japan, and the US. In wiiw Research Report No. 442; The Vienna Institute for International Economic Studies (wiiw): Vienna, Austria, 2019; pp. 1–44. Available online: http://hdl.handle.net/10419/223092 (accessed on 10 January 2022).

- Adarov, A.; Stehrer, R. Capital Dynamics, Global Value Chains, Competitiveness and Barriers to FDI and Capital Accumulation in the EU. Res. Rep. 2020, No. 446, pp. 1–63. Available online: https://data.europa.eu/doi/10.2760/74061 (accessed on 10 January 2022).

- Stehrer, R.; Bykova, A.; Jäger, K.; Reiter, O.; Schwarzhappel, M. Industry Level Growth and Productivity Data with Special Focus on Intangible Assets. WIIW Stat. Rep. 2019, 8, 1–44. Available online: https://euklems.eu/wp-content/uploads/2019/10/Methodology.pdf (accessed on 10 January 2022).

- Andrejovska, A. Effective Tax Rate in the Context of the Economic Determinants. Montenegrin J. Econ. 2019, 15, 31–40. [Google Scholar] [CrossRef]

- Mihokova, L.; Andrejovska, A.; Martinkova, S. Tax Competitiveness of the EU Member States in the Context of Corporate Taxation. Politicka Ekon. 2018, 66, 588–608. [Google Scholar] [CrossRef] [Green Version]

- O’Mahony, M.; Timmer, P.M. Output, input and productivity measures at the industry level: The EU KLEMS database. Econ. J. 2009, 119, 374–403. [Google Scholar] [CrossRef]

- Corrado, C.; Haskel, J.; Jona-Lasinio, C.; Iommi, M. Intangible investment in the EU and US before and since the great recession and its contribution to productivity growth. J. Infrastruct. Policy Dev. 2018, 2, 11–36. [Google Scholar] [CrossRef] [Green Version]

- Thangavelu, S.; Wang, W.; Oum, S. Servicification in global value chains: Comparative analysis of selected Asian countries with OECD. World Econ. 2018, 41, 3045–3070. [Google Scholar] [CrossRef] [Green Version]

- Adarov, A.; Stehrer, R. Implications of Foreign Direct Investment, Capital Formation and Structure for Global Value Chains. WIIW Res. Rep. 2019, 44, 3246–3299. Available online: http://hdl.handle.net/10419/223075 (accessed on 10 January 2022). [CrossRef]

- Brynjolfsson, E.; Hitt, L.M.; Yang, S. Intangible Assets: Computers and Organisational Capital. Brook. Pap. Econ. Act. 2002, 1, 137–181. Available online: https://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.714.7004&rep=rep1&type=pdf (accessed on 10 January 2022). [CrossRef] [Green Version]

- Corrado, C.; Haskel, J.; Jona-Lasinio, C.; Iommi, M. Intangible capital and growth in advanced economies: Measurement method and comparative results. In IZA DP Working Paper No. 6733; Forschungsinstitut zur Zukunft der Arbeit: Bonn, Germany, 2012. [Google Scholar]

| Name of the Variable | Definition | Source |

|---|---|---|

| Dependent variable based on export | ||

| DVAFEX_TH_ln | Domestic value added embodied in foreign exports/Total hours worked (natural logarithm) | OECD TIVA |

| FVADEX_TH_ln | Foreign value added embodied in domestic exports/Total hours worked (natural logarithm) | OECD TIVA |

| ΔICT_ln | Tangible and intangible ICT assets | EU_KLEMS |

| ΔNon_ICT_ln | Tangible and intangible non-ICT assets | EU_KLEMS |

| ΔSOFTDB_ln | Intangible ICT assets | EU_KLEMS |

| ΔHARDWARE_ln | Tangible ICT assets | EU_KLEMS |

| ΔIntermed_ln | Intermediates inputs | EU_KLEMS |

| ΔLAB_SERV_ln | Labour services | EU_KLEMS |

| CIT | Corporate income tax rate | OECD |

| ROBUSTNESS check—variable based on final demand | ||

| DVAFFD_TH_ln | Domestic value added embodied in foreign final demand/Total hours worked (natural logarithm) | OECD TIVA |

| FVAFFD_TH_ln | Foreign value added embodied in domestic final demand/Total hours worked (natural logarithm) | OECD TIVA |

| Variable | Mean | St. Error | Median | St. Dev. | Minimum | Maximum | Count |

|---|---|---|---|---|---|---|---|

| DVA_FEX_TH | 0.0560 | 0.0023 | 0.0207 | 0.1355 | 0.0002 | 2.1890 | 3520 |

| FVA_DEX | 0.0437 | 0.0031 | 0.0063 | 0.181 | 0.0001 | 2.8561 | 3520 |

| GVC | 0.0997 | 0.0048 | 0.0273 | 0.2856 | 0.0003 | 3.7431 | 3520 |

| FFD_DVA_TH | 0.042 | 0.0017 | 0.0214 | 0.0984 | 0.0004 | 1.8056 | 3520 |

| DFD_FVA_TH | 0.0724 | 0.0035 | 0.0198 | 0.2059 | 0.0007 | 2.5851 | 3520 |

| GVC_FD | 0.1144 | 0.0046 | 0.0433 | 0.274 | 0.0013 | 3.5237 | 3520 |

| ICT | 98.94 | 0.88 | 98.82 | 52.29 | 1.24 | 1434.89 | 3520 |

| Non_ICT | 97.58 | 0.24 | 98.99 | 14.11 | 23.37 | 220.33 | 3520 |

| SoftDB | 104.76 | 1.77 | 97.24 | 104.87 | 0 | 2800.00 | 3520 |

| HARDWARE | 146.58 | 3.81 | 107.39 | 226.22 | 0.9 | 5300.00 | 3520 |

| LAB_SERV | 104.51 | 0.3 | 100.66 | 17.93 | 24.89 | 239.42 | 3520 |

| Intermed | 95.76 | 0.2 | 97.89 | 11.98 | 34.02 | 193.48 | 3520 |

| CIT | 0.269 | 0.001 | 0.258 | 0.056 | 0.16 | 0.420 | 3520 |

| Total GVC Participation | DVAFEX_TH+FFVADEX_TH | DVAFEX_TH+FVADEX_TH | DVAFEX_TH+FVADEX_TH | DVAFEX_TH+FVADEX_TH | DVAFEX_TH+FVADEX_TH | DVAFEX_TH+FVADEX_TH |

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (5) | (6) | (7) | |

| ΔICT_ln | 0.336 *** | 0.188 *** | 0.071 *** | |||

| (0.022) | (0.019) | (0.017) | ||||

| ΔNon_ICT_ln | 0.639 *** | 0.922 *** | 0.784 *** | |||

| (0.057) | (0.044) | (0.039) | ||||

| ΔSoftDB_ln | 0.117 *** | 0.076 *** | ||||

| (0.013) | −0.012 | |||||

| ΔHARDWARE_ln | −0.057 *** | −0.046 *** | ||||

| (0.012) | (0.01) | |||||

| 0.211 *** | 0.187 *** | 0.071 *** | ||||

| (0.018) | (0.019) | (0.018) | ||||

| 0.851 *** | 0.816 *** | 0.707 *** | ||||

| (0.047) | (0.046) | (0.041) | ||||

| 0.105 *** | 0.075 *** | |||||

| (0.013) | (0.011) | |||||

| −0.059 ** | −0.045 ** | |||||

| (0.012) | (0.01) | |||||

| ΔINTERMED_ln | 1.374 *** | 1.347 *** | ||||

| (0.045) | (0.047) | |||||

| ΔLAB_SERV_ln | −0.981 *** | −1.016 *** | −0.672 *** | −1.017 *** | −0.975 *** | −0.620 *** |

| (0.062) | (0.049) | (0.045) | (0.05) | (0.05) | (0.046) | |

| CIT | −1.583 *** | −1.478 *** | −1.066 *** | −1.540 *** | −1.432 *** | −1.010 *** |

| (0.037) | (0.038) | (0.041) | (0.041) | (0.042) | (0.04) | |

| Balanced | YES | YES | YES | YES | YES | YES |

| Random | YES | YES | YES | YES | YES | YES |

| Observation | 3520 | 3520 | 3520 | 3300 | 3300 | 3300 |

| R2 | 0.542 | 0.556 | 0.651 | 0.503 | 0.518 | 0.619 |

| F_stat | *** | *** | *** | *** | *** | *** |

| Hausman | 0.2795 | 0.1371 | 0.4793 | 0.2574 | 0.1778 | 0.4369 |

| FL | DVAFEX/TH | DVAFEX/TH | DVAFEX/TH | DVAFEX/TH | DVAFEX/TH | DVAFEX/TH |

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (5) | (6) | (7) | |

| ΔICT_ln | 0.208 *** | 0.184 *** | 0.090 *** | |||

| (0.016) | (0.047) | (0.017) | ||||

| ΔNon_ICT_ln | 0.882 *** | 0.842 *** | 0.730 *** | |||

| (0.042) | (0.042) | (0.039) | ||||

| ΔSoftDB_ln | 0.111 *** | 0.078 *** | ||||

| (0.012) | (0.011) | |||||

| ΔHARDWARE_ln | −0.063 *** | −0.053 *** | ||||

| (0.011) | (0.010) | |||||

| 0.202 *** | 0.180 **** | 0.088 ** | ||||

| (0.017) | (0.019) | (0.018) | ||||

| 0.777 *** | 0.745 *** | 0.658 *** | ||||

| (0.045) | (0.044) | (0.041) | ||||

| 0.099 *** | 0.074 *** | |||||

| (0.012) | (0.011) | |||||

| −0.057 *** | −0.046 *** | |||||

| (0.011) | (0.010) | |||||

| ΔINTERMED_ln | 1.107 *** | 1.071 *** | ||||

| (0.045) | (0.046) | |||||

| ΔLAB_SERV_ln | −0.967 *** | −0.922 *** | −0.644 *** | −0.916 *** | −0.875 *** | −0.592 *** |

| (0.047) | (0.047) | (0.044) | (0.048) | (0.048) | (0.046) | |

| CIT | −1.459 *** | −1.356 *** | −1.024 *** | −1.408 *** | −1.305 *** | −0.971 *** |

| (0.035) | (0.036) | (0.036) | (0.039) | (0.040) | (0.040) | |

| Balanced | YES | YES | YES | YES | YES | YES |

| Random | YES | YES | YES | YES | YES | YES |

| Observation | 3520 | 3520 | 3520 | 3300 | 3300 | 3300 |

| R2 | 0.527 | 0.542 | 0.613 | 0.484 | 0.599 | 0.572 |

| F_stat | *** | *** | *** | *** | *** | *** |

| Hausman | 0.1173 | 0.0746 | 0.2257 | 0.0511 | 0.06878 | 0.1379 |

| BL | FVADEX/TH | FVADEX/TH | FVADEX/TH | FVADEX/TH | FVADEX/TH | FVADEX/TH |

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (5) | (6) | (7) | |

| ΔICT_ln | 0.345 ** | 0.295 ** | 0.164 ** | |||

| (0.022) | (0.024) | (0.022) | ||||

| ΔNon_ICT_ln | 0.642 ** | 0.684 ** | 0.448 ** | |||

| (0.056) | (0.056) | (0.051) | ||||

| ΔSoftDB_ln | 0.120 ** | 0.074 ** | ||||

| (0.016) | (0.015) | |||||

| ΔHARDWARE_ln | −0.017 | −0.004 * | ||||

| (0.015) | (0.014) | |||||

| 0.323 ** | 0.285 ** | 0.152 ** | ||||

| (0.023) | (0.065) | (0.024) | ||||

| 0.488 ** | 0.454 ** | 0.329 ** | ||||

| (0.060) | (0.060) | (0.055) | ||||

| 0.111 ** | 0.075 ** | |||||

| (0.017) | (0.015) | |||||

| −0.034 ** | −0.018 * | |||||

| (0.015) | (0.014) | |||||

| ΔINTERMED_ln | 1.550 ** | 1.544 ** | ||||

| (0.059) | (0.062) | |||||

| ΔLAB_SERV_ln | −1.002 ** | −0.989 ** | −0.600 ** | −0.964 ** | −0.939 ** | −0.533 ** |

| (0.061) | (0.062) | (0.058) | (0.065) | (0.065) | (0.062) | |

| CIT | −1.921 ** | −1.826 ** | −1.361 ** | −1.941 ** | −1.837 ** | −1.353 ** |

| (0.047) | (0.048) | (0.047) | (0.053) | (0.054) | (0.053) | |

| Balanced | YES | YES | YES | YES | YES | YES |

| Random | YES | YES | YES | YES | YES | YES |

| Observation | 3520 | 3520 | 3520 | 3300 | 3300 | 3300 |

| R2 | 0.485 | 0.493 | 0.579 | 0.441 | 0.450 | 0.540 |

| F_stat | ** | ** | ** | ** | ** | ** |

| Hausman | 0.2148 | 0.0746 | 0.396 | 0.2344 | 0.1038 | 0.4141 |

| Total GVC Participation | DVAFEX_TH+FVADEX_TH | DVAFEX_TH+FVADEX_TH | DVAFEX_TH+FVADEX_TH |

|---|---|---|---|

| (1) | (2) | (3) | |

| C | 0.063 ** | 0.017 | −0.034 |

| (0.022) | (0.025) | (0.021) | |

| TBS | 0.265 *** | 0.249 *** | 0.167 *** |

| (0.031) | (0.034) | (0.034) | |

| C | 1.014 *** | 0.977 *** | 0.892 *** |

| (0.054) | (0.053) | (0.045) | |

| TBS | 0.108 | 0.080* | −0.129 |

| (0.088) | (0.088) | (0.086) | |

| C | 0.157 *** | 0.124 *** | |

| (0.019) | (0.016) | ||

| TBS | 0.070 *** | 0.040 * | |

| (0.023) | (0.022) | ||

| C | −0.051 ** | −0.052 ** | |

| (0.014) | (0.012) | ||

| TBS | −0.059 *** | −0.035 * | |

| (0.022) | (0.021) | ||

| ΔINTERMED_ln C | 1.296 *** | ||

| (0.050) | |||

| ΔINTERMED_ln TBS | 1.123 *** | ||

| (0.107) | |||

| ΔLAB_SERV_ln C | −1.228 *** | −1.163 *** | −0.664 *** |

| (0.060) | (0.060) | (0.055) | |

| ΔLAB_SERV_ln TBS | 0.740 *** | 0.721 *** | 0.598 *** |

| (0.118) | (0.118) | (0.113) | |

| CIT_C | −1.460 *** | −1.322 *** | −0.977 *** |

| (0.053) | (0.054) | (0.048) | |

| CIT_TBS | −1.083 *** | −1.007 *** | −0.818 *** |

| (0.063) | (0.066) | (0.065) | |

| Balanced | YES | YES | YES |

| Random | YES | YES | YES |

| Observation_C | 1800 | 1800 | 1800 |

| Observation_TBS | 1065 | 1065 | 1065 |

| R2 C | 0.563 | 0.584 | 0.697 |

| R2 TBS | 0.503 | 0.511 | 0.557 |

| F_stat | *** | *** | *** |

| Hausman_C | 0.4943 | 0.6908 | 0.0736 |

| Hausman_TBS | 0.2548 | 0.3273 | 0.1172 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Pekarčík, M.; Ďurčová, J.; Glova, J. Intangible ICT and Their Importance within Global Value Chains: An Empirical Analysis Based on Longitudinal Data Regression. Mathematics 2022, 10, 1198. https://doi.org/10.3390/math10071198

Pekarčík M, Ďurčová J, Glova J. Intangible ICT and Their Importance within Global Value Chains: An Empirical Analysis Based on Longitudinal Data Regression. Mathematics. 2022; 10(7):1198. https://doi.org/10.3390/math10071198

Chicago/Turabian StylePekarčík, Marek, Júlia Ďurčová, and Jozef Glova. 2022. "Intangible ICT and Their Importance within Global Value Chains: An Empirical Analysis Based on Longitudinal Data Regression" Mathematics 10, no. 7: 1198. https://doi.org/10.3390/math10071198

APA StylePekarčík, M., Ďurčová, J., & Glova, J. (2022). Intangible ICT and Their Importance within Global Value Chains: An Empirical Analysis Based on Longitudinal Data Regression. Mathematics, 10(7), 1198. https://doi.org/10.3390/math10071198