1. Introduction

Dynamic term structure models play an important role in fixed-income asset pricing and strategic asset allocation. However, the connection between dynamic factor models and portfolio optimization has been explored only in recent years. The literature is mainly focused on the construction and performance of equity portfolios under the mean variance (MV) approach (see for example [

1,

2]). Ref. [

3] examined the the validity of the expectation hypothesis (EH) of the term structure of U.S. repo rates and the profitability of portfolios of bonds that exploit deviations from the EH. Ref. [

4] investigated the MV analysis immunization to real yield curve fluctuations under the Vasicek term structure model. Ref. [

5] using the Vasicek term structure model examined the optimal portfolio choice under inflation risk. Refs. [

6,

7,

8] constructed optimal portfolios generated from various Nelson–Siegel term structure models. Ref. [

9] mentioned that if we can estimate expected bond returns and their variance–covariance matrix, the portfolio optimization procedure is similar to that of equity portfolios.

The majority of the literature about dynamic factor models and bond portfolios is focused on the dynamic Nelson–Siegel model. In addition, the application of control chart procedures is referred mainly to stock portfolios. Our research deals with a different class of factor models, the Gaussian affine term structure model (ATSM) with the minimum chi square estimator, and extends the application of control chart procedures to government bond portfolios. Minimum chi-square estimation (MCSE) avoids many of the numerical problems associated with the maximum likelihood estimation (MLE) for the affine term structure models and ensures the finding of global maximum solutions ([

10].) Following the work of [

8], we obtain closed-form solutions for the expected bond returns and the covariance matrix of bond returns but for a different class of dynamic factor models. The purpose of this work is, firstly, the construction of an MV and global minimum variance (GMV) portfolio that consists of government bonds via a no-arbitrage ATSM and secondly to apply exponentially weighted moving average (EWMA) control charts for monitoring the optimal portfolio weights. For the covariance of the proposed control statistics, we propose an iterative procedure.

We mention that in our case, the asset returns, which are the bond expected returns, due to their structure exhibit autocorrelation, and appropriate control charts are constructed. The expected return and variance of bond yields are estimated from the distribution of a dynamic term structure model. The results indicate that the proposed technique for obtaining bond portfolios could be a good alternative to other existing methods, and we determine the appropriate monitoring procedure for the fixed-income portfolio.

Government bonds issued by national governments are generally considered low-risk investments in comparison with stocks. Bonds are usually less volatile than stocks, and many investors include bonds in their portfolio as a source of diversification so as to reduce potential losses and overall portfolio risk. Investing in sovereign bonds, especially in times of economic turmoil, could be a safer choice for individual and institutional investors such as pension funds. The investor at every time is interested in the optimal portfolio weights, and structural breaks may cause changes that may have economic effects. The portfolio investor needs to detect these breaks as soon as possible, since they may alter the optimal portfolio composition. The presence of structural breaks can influence the estimation of the portfolio parameters and affects the forecasting procedures. The investor decides every time period about the optimal wealth allocation. As a result, he needs to know whether the optimal portfolio allocation in the previous time period can be still considered now as the optimal. If the current portfolio position is not the optimal, then the investor could face wealth losses. The new information about bond expected returns arrives sequentially, and the optimal portfolio weights should be monitored in a sequential manner. In order to do this, we apply statistical process control (SPC) methods, specially control charts, for deciding whether the optimal portfolio weights of the last period are still optimal in the current period.

In

Section 2, we present the related literature, and in

Section 3, we describe our data set. Next, in

Section 4, we estimate the term structure model, the one-period ahead expected returns and the variance of the bond yields for a specified out-of-sample period. In

Section 5, we present the framework and the results for the fixed-income portfolio optimization.

Section 6 deals with the application of control charts to optimal weights of a global minimum variance portfolio (GMVP).

Section 7 and

Section 8 present the results of a simulation study and an empirical example, respectively. Finally, in

Section 9, we present the conclusion of this work and our contribution.

2. Related Literature

According to [

11], since the processes that affect both bond price and bond return are non-ergodic, the traditional statistical techniques cannot be used to directly model the expected return and volatility of bond yields. Refs. [

12,

13] proposed the use of the one-factor [

14] model for the yield curve for the mean variance bond portfolios optimization. In contrast, our analysis refers to the category of multifactor dynamic term structure model exploiting the forecasting benefits they have in comparison to one-factor models. Ref. [

8] are focused on Nelson–Siegel models, the Gaussian dynamic term structure model of [

15] and the no-arbitrage representation of a dynamic Nelson–Siegel model of [

16]. However, in our work, we use the term structure model of [

10] that combines macroeconomic and latent factors for a small set of bond yield maturities. This class of ATSMs using the MCSE approach has many estimation advantages in contrast to models that use MLE such as that of [

15], especially when applied to highly persistent data. The Nelson–Siegel model is mainly focused on the bond yields under the empirical measure. The no-arbitrage affine models specify via appropriate restrictions the dynamic evolution of yields under a risk-neutral measure and provide through the market price of risk a connection between these two measures [

17].

Another difference is that [

8] proposed a dynamic rule to switch each time among alternative bond strategies. In contrast, our work is focused on extending the affine model of [

10] by constructing optimal bond portfolios and finding techniques for portfolio monitoring so as to detect changes in the vector of optimal weights. In addition, in our portfolio optimization framework, we examine the cases of including or not the short selling constraint. Ref. [

15] cannot incorporate most auxiliary restrictions on the model dynamics under the historical probability measure. One important issue is that the representation that [

15] proposed becomes unidentified in the presence of a unit root. There is another identification issue, which has separately been recognized by [

15] using a very different approach from ours: not all matrices of the factor loadings under the risk-neutral measure can be transformed into a lower triangular form. The model of [

16] requires certain restrictions on the ATSM. For example, they impose over-identifying parameter restrictions on parameters under the

measure. Furthermore, there is no constant in the equation for the instantaneous risk-free rate process, and the first factor must be a unit-root process. In addition, the mean-reversion rates of the second and third factors must be identical. According to [

18], the restrictions imposed are not motivated by beliefs about risk compensation. The monitoring of optimal portfolio weights is restricted to the case of GMV portfolios.The main reason is that the GMV portfolio has only the estimation risk concerning the variance matrix of asset returns. The literature of control charts in portfolio monitoring is mainly focused in risk assets.

Ref. [

7] used Markowitz’s approach to optimize bond portfolios of constant maturity future contracts based on heteroskedastic dynamic factor models applied to the term structure of interest rates. The factor models considered here are the dynamic Nelson–Siegel model proposed by [

19] and the extension proposed by [

20]. From the factor models, they estimated expected bond returns and the conditional covariance matrix of bonds returns. For the estimation of the conditional covariance matrix of bonds returns, they proposed a multivariate generalized autoregressive conditional heteroskedasticity (GARCH) specification suitable for the estimation and forecast of conditional covariance matrices for high-dimensional problems. The empirical results confirm the better out-of-sample performance of the proposed method with respect to a benchmark index.

Ref. [

6] estimated the value at risk (VaR) of fixed-income bond portfolios. For the construction of these bond portfolios, they used the dynamic version of the Nelson–Siegel three-factor model of [

19]. Ref. [

21] developed a new factor-augmented model for calculating the VaR risk of bond portfolios based on the Nelson–Siegel structural framework. In addition, they tested if the information contained in macroeconomic variables and financial stress shocks can improve the accuracy of VaR prediction. Ref. [

8] constructed duration-constrained optimal portfolios from various Nelson–Siegel term structure models having only yield factors. They used two datasets of bond yields: the first where the out-of-sample yields have a downward trend and a second with an upward trend. The expected return and variance of bond yields are estimated from the distribution of the dynamic term structure model. In addition, [

8] proposed a dynamic rule to switch among all the alternative bond investment strategies.

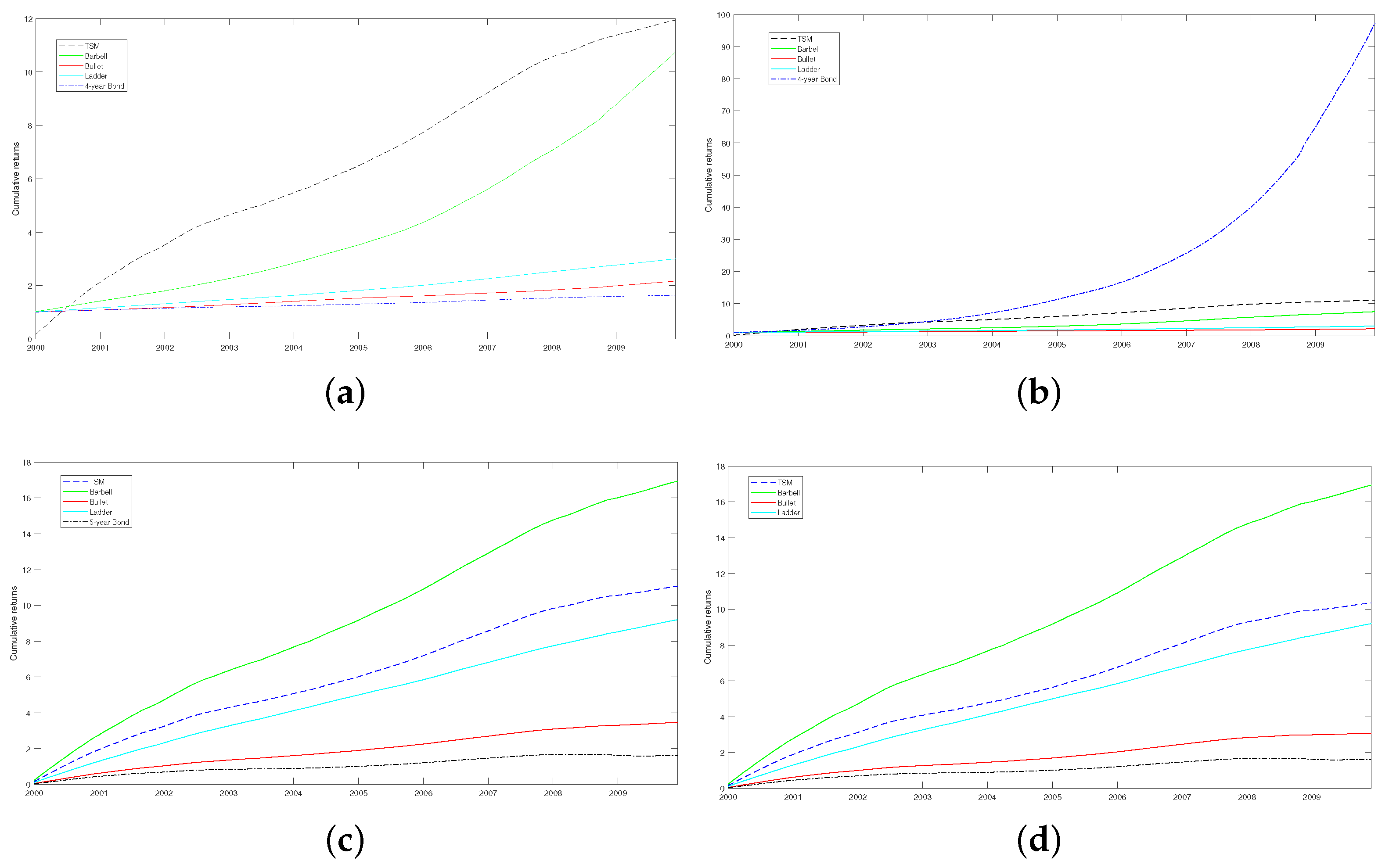

The main difference in our work is the choice of the class of term structure models. Instead of the Nelson–Siegel, we use the Gaussian ATSMs with the MCSE method proposed by [

10]. Following the estimation of the yield curve model, we generate forecasts of bond returns, which subsequently are used for the mean-variance optimization problem. We mention that an important element of this procedure is the ability to obtain good forecast results from the term structure model. In our analysis, we perform forecasts of one-period ahead estimates of fixed-income returns. The distribution of bond returns follows that of the ATSM, which is the multivariate normal distribution. The estimated MV bond portfolios are compared with traditional bond portfolio strategies, and we show that it can be a reasonable alternative to them.

In recent years, SPC techniques, especially control charts, have been applied to non-industrial fields such as the surveillance of optimal portfolio weights (see for example [

22]). A control chart should provide to the investor a signal that there is a possible change in the monitoring process, which is the portfolio weights [

23]. The control chart procedure consists of the control statistic and a rejection area [

24]. If the value of the control statistic lies in the rejection area, then the control chart gives a signal that the monitoring process is out-of-control. A main characteristic of a control chart procedure is the average run length (

ARL) that represents the average number of subgroups before a signal is given that the monitoring process is out-of-control. We assume that

is the control chart statistic and

c is a control limit that defines when the process is out-of-control. The run length, which is the number of samples before a signal is given, is

and

ARL is equal to

. When the process is in-control, the

ARL (

) should be large and in the out-of-control-state (

), it should be the opposite. Another measure of the performance of a control chart is the median run length (

), which is the median number of sample points before the first out-of-control signal is given. Since the work of [

25], various charts procedures have been proposed. Ref. [

26] introduced the EWMA control chart and [

27] introduced the multivariate case.

Ref. [

28] derived the exact and asymptotic distribution of the optimal portfolio weights for various portfolio strategies. The asset returns is assumed to follow a stationary normal distribution. The estimation of optimal portfolio weights depends on two components: the mean and the variance of asset returns. Assuming

k uncorrelated risky asset returns for

n time periods, the vector of the first

optimal weights in the GMV portfolio follows a multivariate t-distribution. However, since government bonds are estimated from a set of common factors, bond yields are correlated, we do not make any assumptions about the distribution of optimal weights and estimate the necessary quantities from a simulation study.

The literature regarding monitoring portfolio weights with control charts assumes independent asset returns. [

29] showed that linear combinations of the components of the GMVP weights follow a multivariate

t-distribution. Structural breaks in the covariance matrix of asset returns have as a consequence changes in the mean and the covariance of optimal weights. If a change in the covariance matrix occurs, then the optimal portfolio allocation changes, and a new one is estimated with known mean and covariance.

Ref. [

30] monitored optimal weights of a GMV portfolio using the distribution of the estimator of the covariance matrix of asset returns so as to construct multivariate and simultaneous control charts. These control chart procedures are independent of the covariance matrix of asset returns. Ref. [

31] used the local constant volatility approach for the surveillance of the unconditional covariance matrix of the

k assets returns so as to monitor changes in the optimal GMVP weights. The result of this method is the decrease of the variance of the GMVP for the out-of-sample period.

Ref. [

23] proposed various EWMA control charts for monitoring the optimal weights of the GMV portfolio. The estimated weights are highly autocorrelated, and they proposed modified EWMA and control charts based on the first differences of the sample weights. The authors examined changes in the covariance matrix of asset returns that either affect only the mean of the optimal portfolio weights or changes that are designed so as to display the transition from a bull market to a bear market. [

31] investigated the distributional properties of the expected returns and the variance of various portfolio strategies.

Ref. [

32] proposed some new characteristics for monitoring optimal portfolio weights in a global minimum variance process. They suggest alternative processes to the optimal weights process and to the difference process. Control charts for these alternative characteristic processes are constructed for both univariate and multivariate EWMA recursion. Ref. [

33] developed directionally invariant cumulative sum (CUSUM) control charts for monitoring the GMVP estimated optimal weights and the characteristic process. Changes in the GMVP composition are attributed to changes in the covariance matrix of asset returns. The MCUSUM1 and MCUSUM2 charts of [

34] and the projection pursuit (PPCUSUM) scheme of [

35] are applied for monitoring these processes. The results support the simultaneous use of both the control charts for the optimal weights and the characteristic process.

Ref. [

36] estimated the optimal GMVP weights with the sample volatility estimators. The realized GMVP weights are evaluated using the realized volatility measures from intraday data. According to the authors, the advantage of this method for the estimation of the covariance matrix of asset returns is that it leads to an improvement in incorporating new daily market news. Ref. [

36] suggested statistical tests in order to check on a daily basis whether a target portfolio deviates from the GMVP. Ref. [

37] used EWMA procedures for the surveillance of the rebalancing process of index tracking (IT) portfolios. When a signal is given, the optimal portfolio allocation is changed, and the portfolio needs to be redesigned via a rebalancing strategy. The proposed EWMA control charts are employed on a portfolio’s daily returns and daily volatility. The empirical study on stock data compares the portfolio rebalancing approach using SPC methods with portfolios using the traditional fixed rebalancing windows. The findings showed that in markets with large volatility, using SPC methods is more stable than using the approach with fixed rebalancing windows.

Ref. [

38] used the CUSUM control chart to regulate the rebalancing dynamic of index-tracking portfolios. The proposed methodology is applied to stock market data, and a comparison is made between the estimated CUSUM-based portfolios with portfolios using fixed rebalancing time windows and EMWA-based portfolios. Portfolios with a fixed rebalancing window perform better that CUSUM-based portfolios when the control limits are more sensitive to deviations of the tracking portfolio from the benchmark portfolio. The opposite happens when control limits are less sensitive to changes. The comparison between CUSUM and EWMA-based tracking portfolios did not favor clearly any of these two methods.

The main questions of this paper are the following:

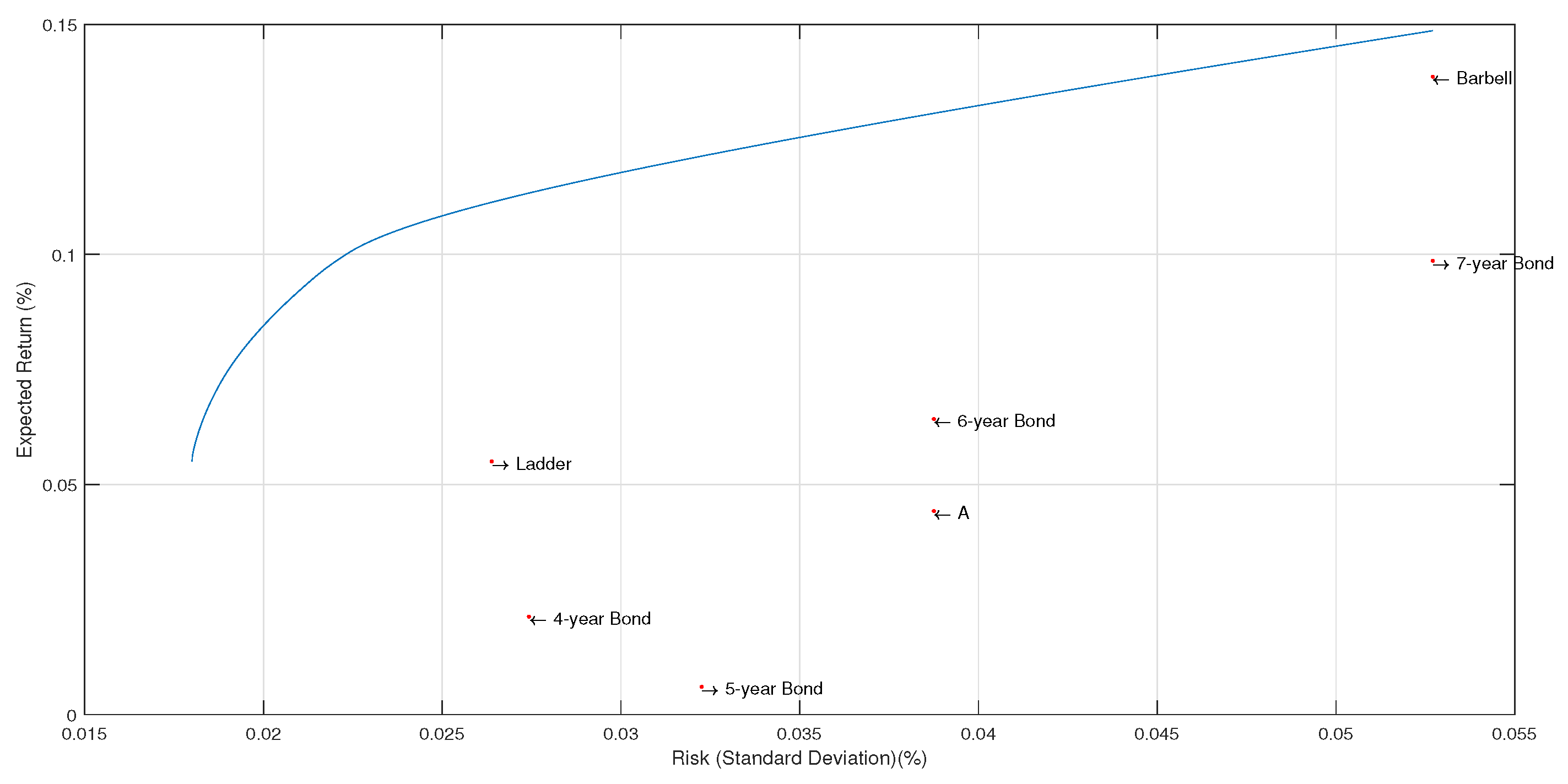

If we can perform an MV portfolio strategy with or not allowing short selling that can be an alternative strategy to existing traditional methods.

If control chart procedures can be helpful in monitoring fixed-income portfolios.

3. Data

Our data set consists of fixed-maturity, end-of-month continuously compounded yields on U.S. zero-coupon bonds from January 1981 to December 2009, totaling 348 monthly observations. This data set of monthly time series of yields was constructed from [

39] from the Center for Research in Security Prices (CRSP) unsmoothed Fama and Bliss [

40] forward rates and is publicly available in the

Journal of Applied Econometrics Data Archive (these data, denoted here as JKV data set, can be downloaded from the following link:

http://qed.econ.queensu.ca/jae/datasets/jungbacker001/ (accessed on 10 October 2022)). For our work, we have chosen yields with maturities 3,48,60,72,84 and 120 months for the time period from January 1981 to December 2009. The class of Gaussian ATSMs we use in our analysis provides a good fit jointly to macroeconomic factors and bond yields. However, it has the shortcoming when some interest rates are near their zero lower bound (ZLB), placing positive probabilities on negative interest rates [

41]. This condition may be problematic for the prediction of future bond yields when interest rates are very close to the ZLB: for example, in U.S. Treasury yields after the financial crisis of 2008–2009. Ref. [

41] found that the standard Gaussian ATSM model performed well until the end of 2008 but underperformed since then until 2014. As a result, we choose the period until the end of 2009 in order to perform our analysis.

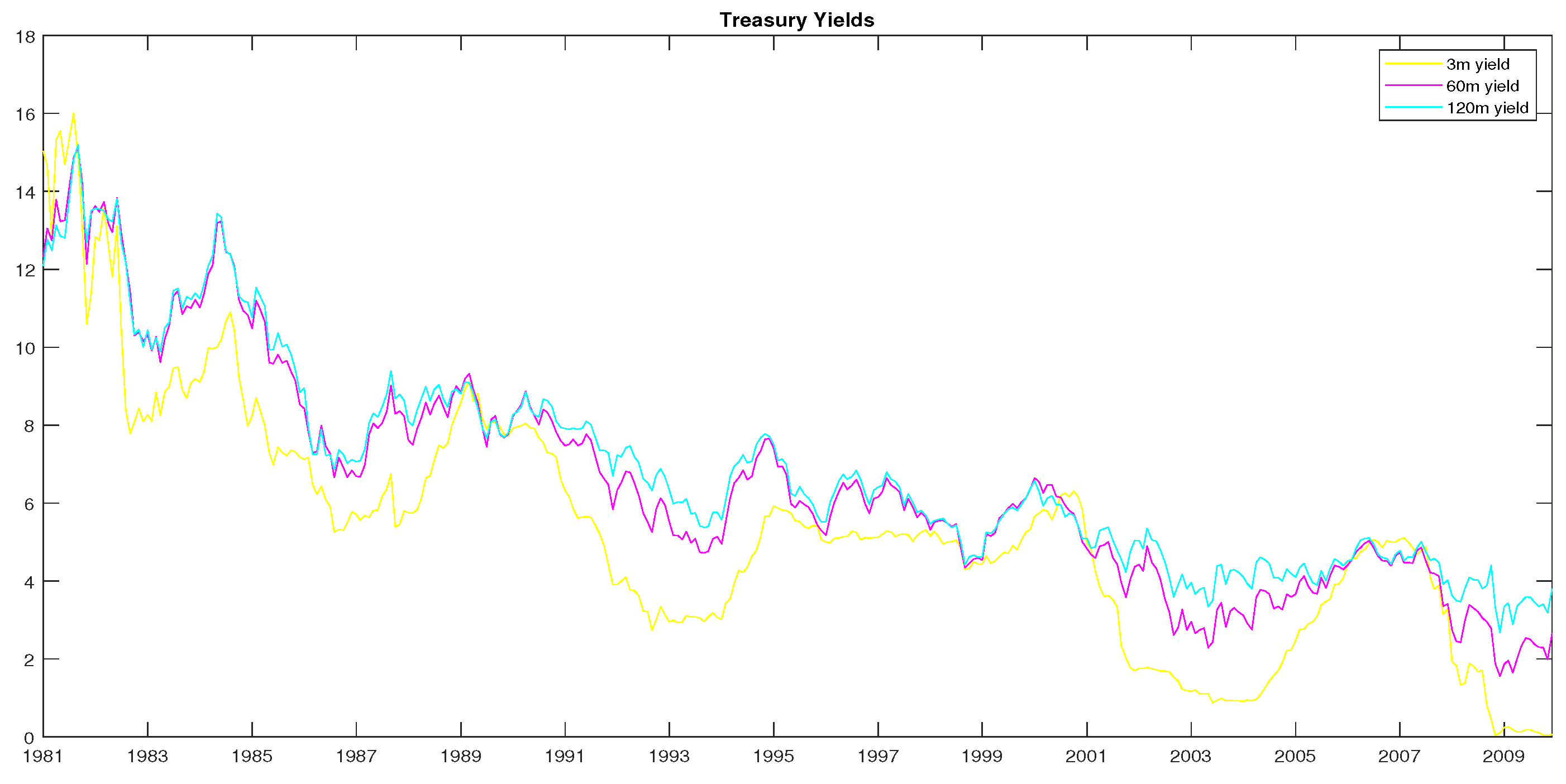

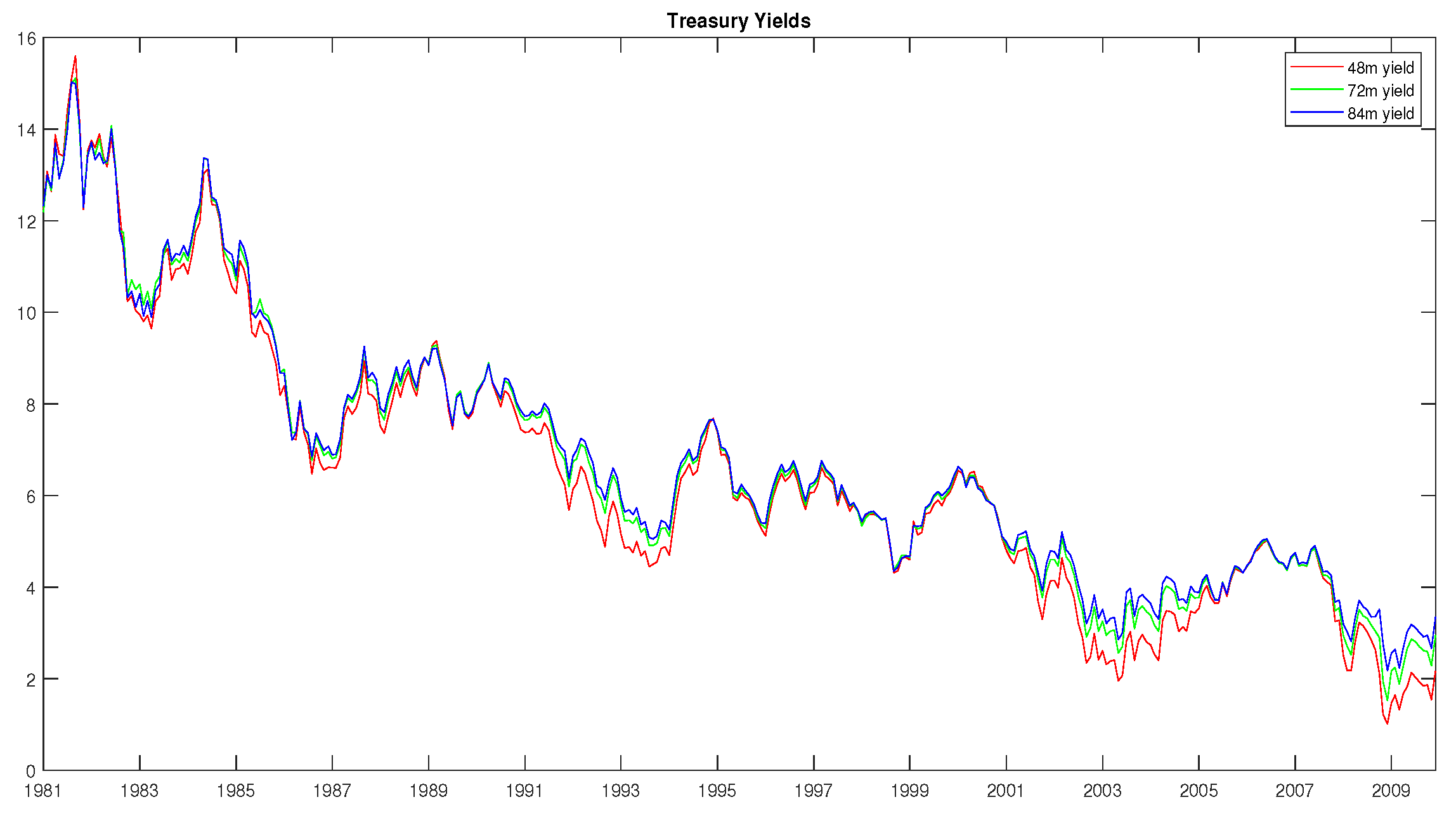

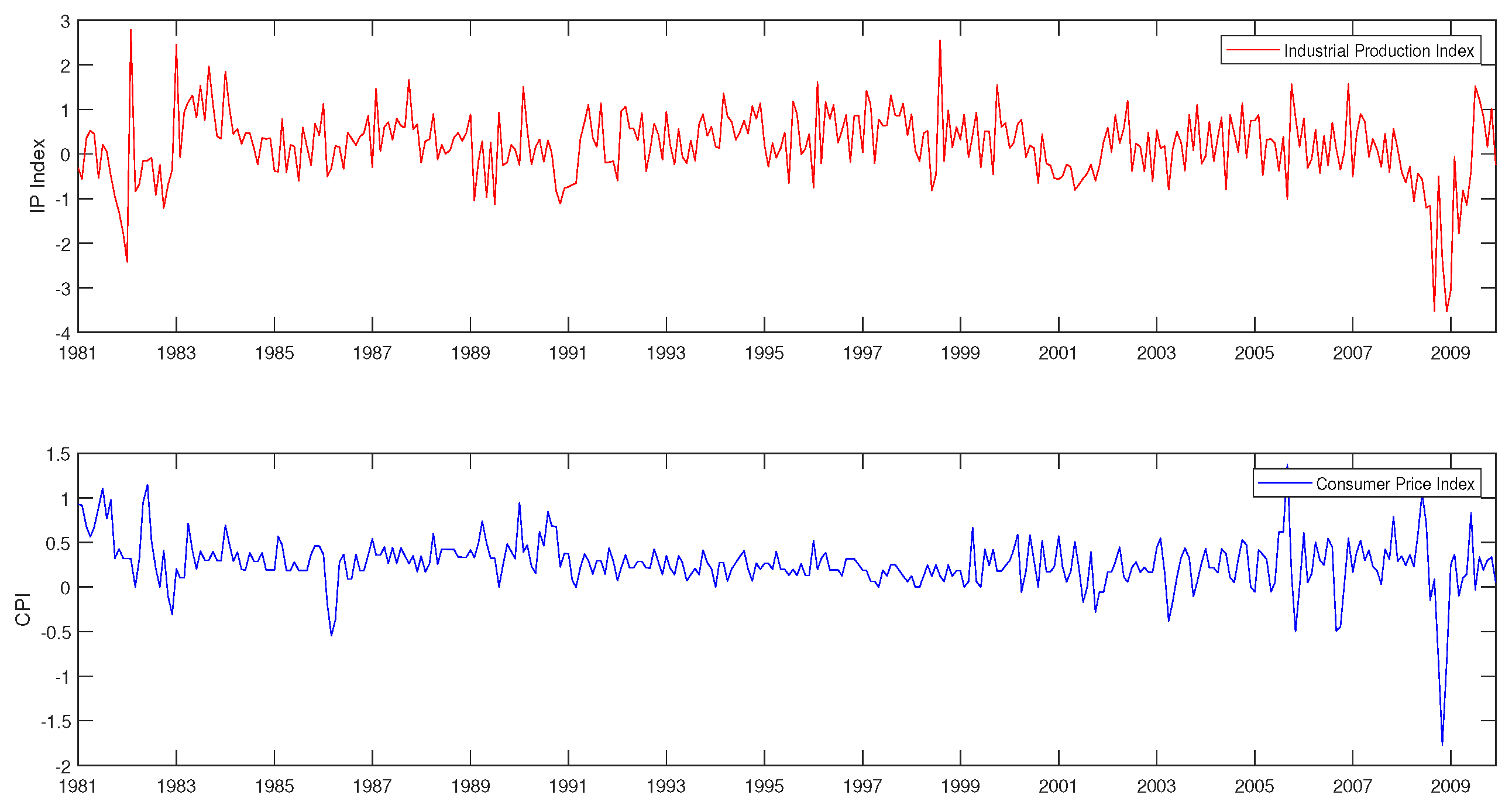

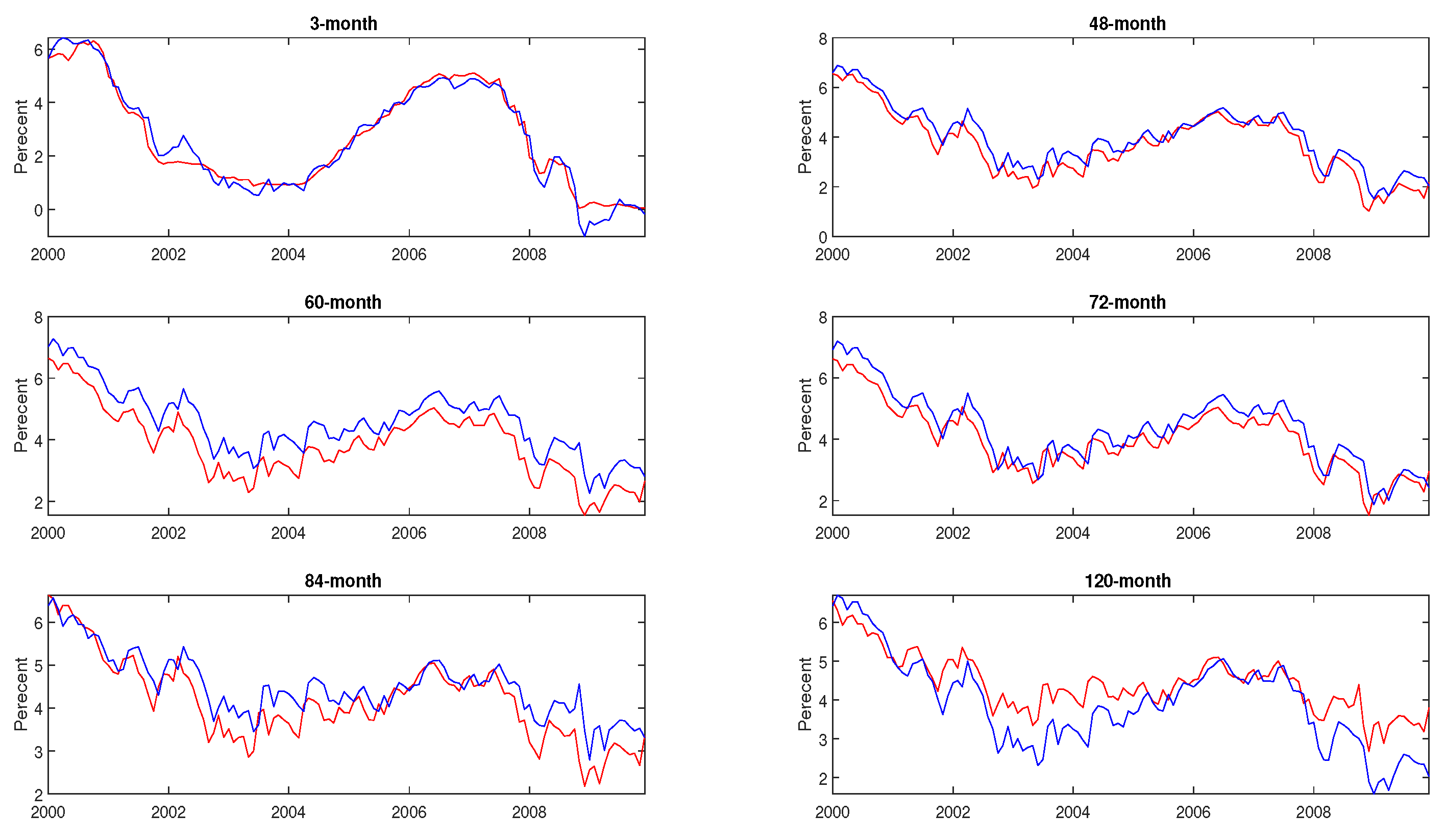

Figure 1 and

Figure 2 plot the time series of U.S. Treasury yields. The average yield curve is downward sloping. Usually, in periods where the yield curve level displays a downward trend, bond returns exhibit good performance [

8].

Following the recent literature, in the term structure models, we use both macroeconomic and latent factors. Since the seminal work of [

42], there has been growing literature for incorporating macroeconomic factors in the term structure models (e.g., [

43,

44,

45]). These studies exploit small macroeconomic information sets, and some authors consider the dynamics of the term structure augmented with additional factors such as information on exchange rates or survey data (e.g., [

46,

47,

48]). Refs. [

49,

50] modeled yield curve dynamics by adding to standard macroeconomic factors three additional financial factors: credit risk, liquidity risk and risk premium factors ([

51]). The incorporation of macroeconomic factors contributes to the improvement of yield curve forecasting. Good yield curve predictions are important in order to achieve better results in terms of fixed-income portfolio performance. We use two macroeconomic factors: Consumer Price Index (CPI) monthly time series seasonally adjusted and, as a proxy for the monthly gross domestic product growth (GDP), the monthly Industrial Production (IP) growth. The CPI measures the average changes in the price level of a basket of goods. The IP growth measures the growth rate of the production of goods. The IP growth rates and the CPI time series are obtained from the Federal Reserve St. Luis database. The data series are displayed in

Figure 3. The CPI factor peaks in early 1981 and in average falls during the recession of 1981–1982. In the subsequent period, an upward trend follows before the fall in the fourth quarter of 1990. Next, the CPI stays mainly at the same level until an upward trend during the period from the end of 1999 until March 2008. For the period from the third quarter of 2008 until middle of 2009, we have a period of economic downturn due to the global financial crisis of 2008–2009. The IP index growth rate is seasonally adjusted. Most of the movements of the IP index growth rate follow that of the business cycles. However, the time series of CPI has more smooth fluctuations.

Table A1 and

Table A2 present some descriptive statistics for the bond yields and the macroeconomic observable factors, respectively. The yield levels show mild excess kurtosis at short maturities, which decreases with maturity, and positive skewness at all maturities. In

Table A3 and

Table A4, we present the autocorrelations of these time series for lags 1, 5, 12, 20 and 24. An important fact is that the time series of all bond yields are highly autocorrelated, showing strong persistence. For lags 1 and 5, IP growth rates exhibit a low level of autocorrelation, and for lag 1, the CPI exhibits a medium level of autocorrelation. For lags greater than 5, both factors exhibit no autocorrealtion. In

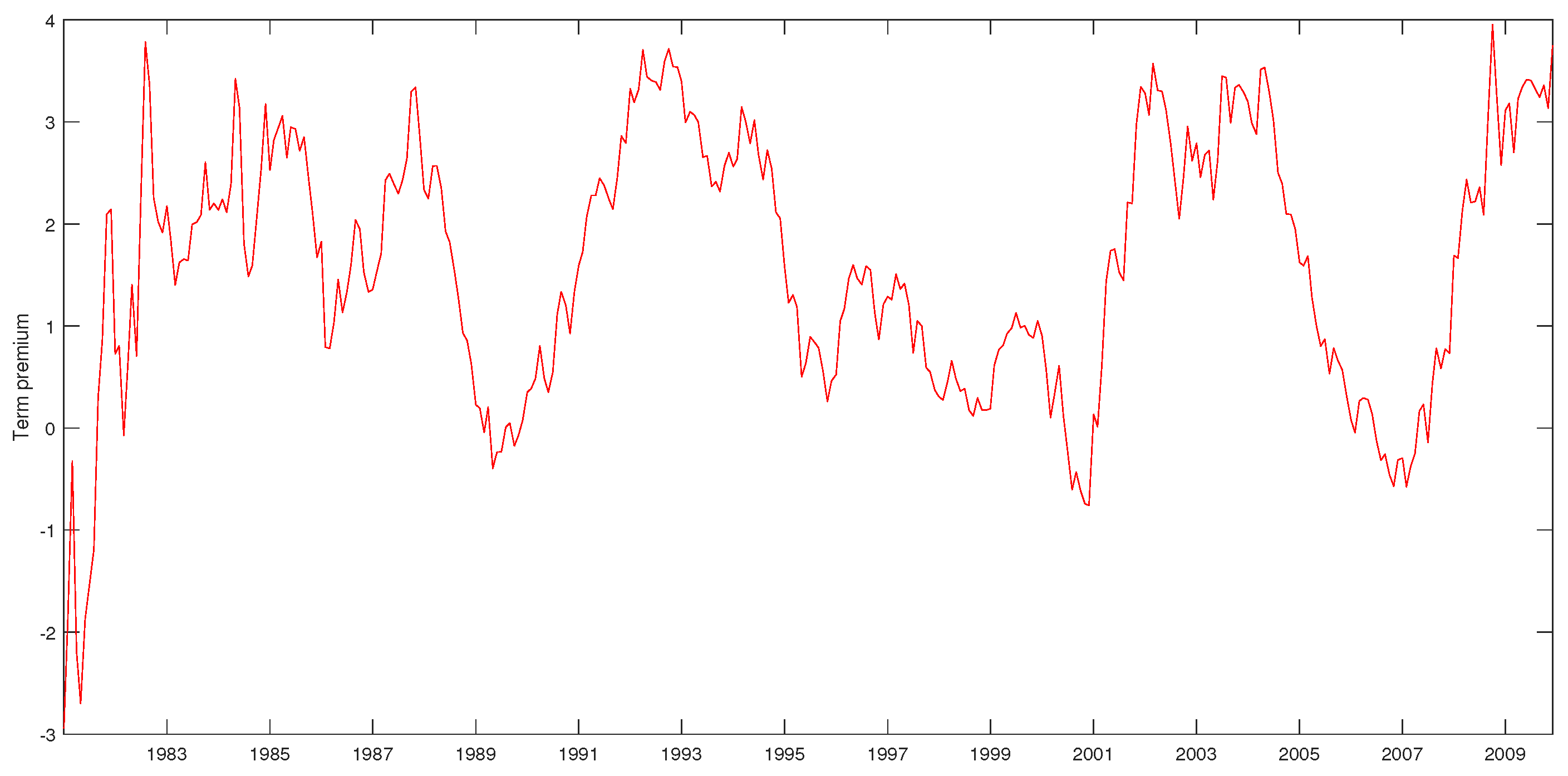

Figure 4, we have plotted the yields term premia, the difference between the 10-year yield and the 3-month yield. The term premia at the beginning of our sample period starts from a negative position and continuously increases from 1981:09 to 2009:12 and remains at positive levels with the exception of time periods 1989:05 to 1989:07, 1989:10 to 1989:11, 2000:07 to 2000:12 and 2006:07 to 2007:04. During the recession periods, the term premia exhibits an upward trend. The estimation procedure is performed for the in-sample period from 1981:01 to 1999:12, while the out-of-sample period is from 2000:01 to 2009:12.

8. Empirical Example

The control charts based on the first differences of optimal portfolio weights are applied in the out-of-sample period from January 2000 to December 2009 for a total of 120 months. We assume an investor holds a portfolio consisting of U.S. Treasury bonds. Before we construct the control charts, it is necessary to determine the target process or else the in-control process. This may be quite challenging for real data in financial applications, especially in our example, where we have less frequent data than daily or monthly. When the monitoring process is in-control, it is assumed there is no change point and the target process is estimated.

We choose the period from September 1996 to December 1999, for a total of 40 months, as the prerun period where the process is in-control. In this period, the U.S. Treasury bond returns are assumed to be in the in-control state.This period is before the recession at March 2001 according to the National Bureau of Economic Research (NBER) (see

https://www.nber.org/cycles/main.html (accessed on 10 October 2022)). Using the observations from this period, we estimate the in-control one-period ahead log-realized returns, the one-period ahead expected returns, the covariance matrix of bond returns and the target optimal GMV portfolio weights. The control charts are constructed for the out-of-sample period, and there is no-reestimation of the target process in case of a change point. After the control chart gives a signal and is confirmed from the financial analyst that this is a structural break, normally, the target process should be reevaluated (see, for example [

23,

33]). Since, in our case, we have less frequent data, a possible solution to this problem may be via simulation. The control limits are chosen for a prespecified value

h of the

, which is equal to 6 months: this means that on average, each control chart should give the first false alarm after six months. The control charts are estimated for the following set of smoothing parameters:

Ref. [

23] mentioned that a benefit of the first difference control charts is that they give an alarm almost immediately with high probability if the change in the parameters we monitor is large. The estimation algorithm is presented in

Appendix B.

Ref. [

63] is in favor of lower values for the smoothing parameter and found that the optimal value of

is time varying and clusters in high and low periods. In contrast, [

64] support the choice of large values of the smoothing parameters in the EWMA model in financial applications. In our empirical example, we find that in the case of control schemes based on the Mahalanobis distance, constrained and unconstrained GMVP values equal or lower than 0.15 and 0.3, respectively, are appropriate. In addition, for control schemes based on multivariate EWMA recursion for both cases, smoothing parameter values equal or lower than 0.3 are preferred.

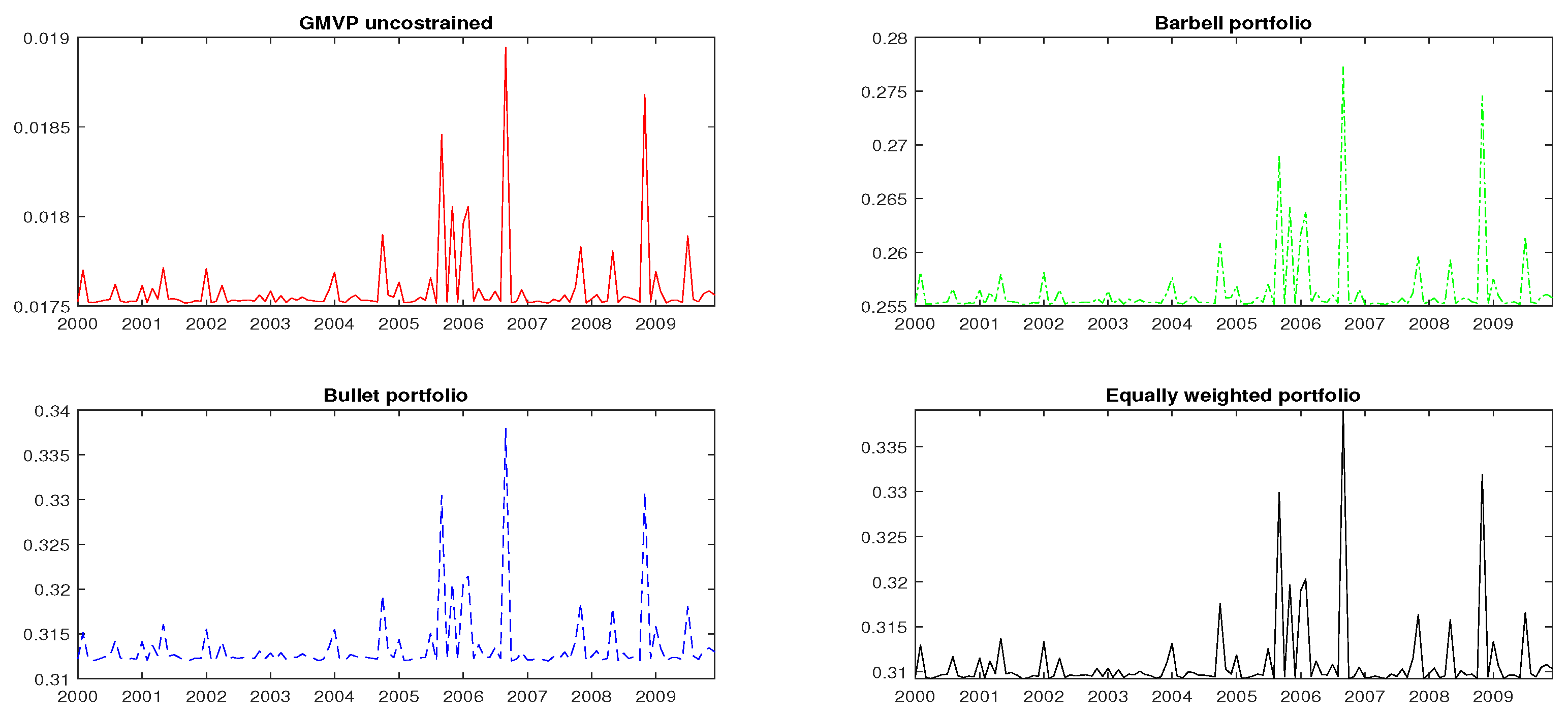

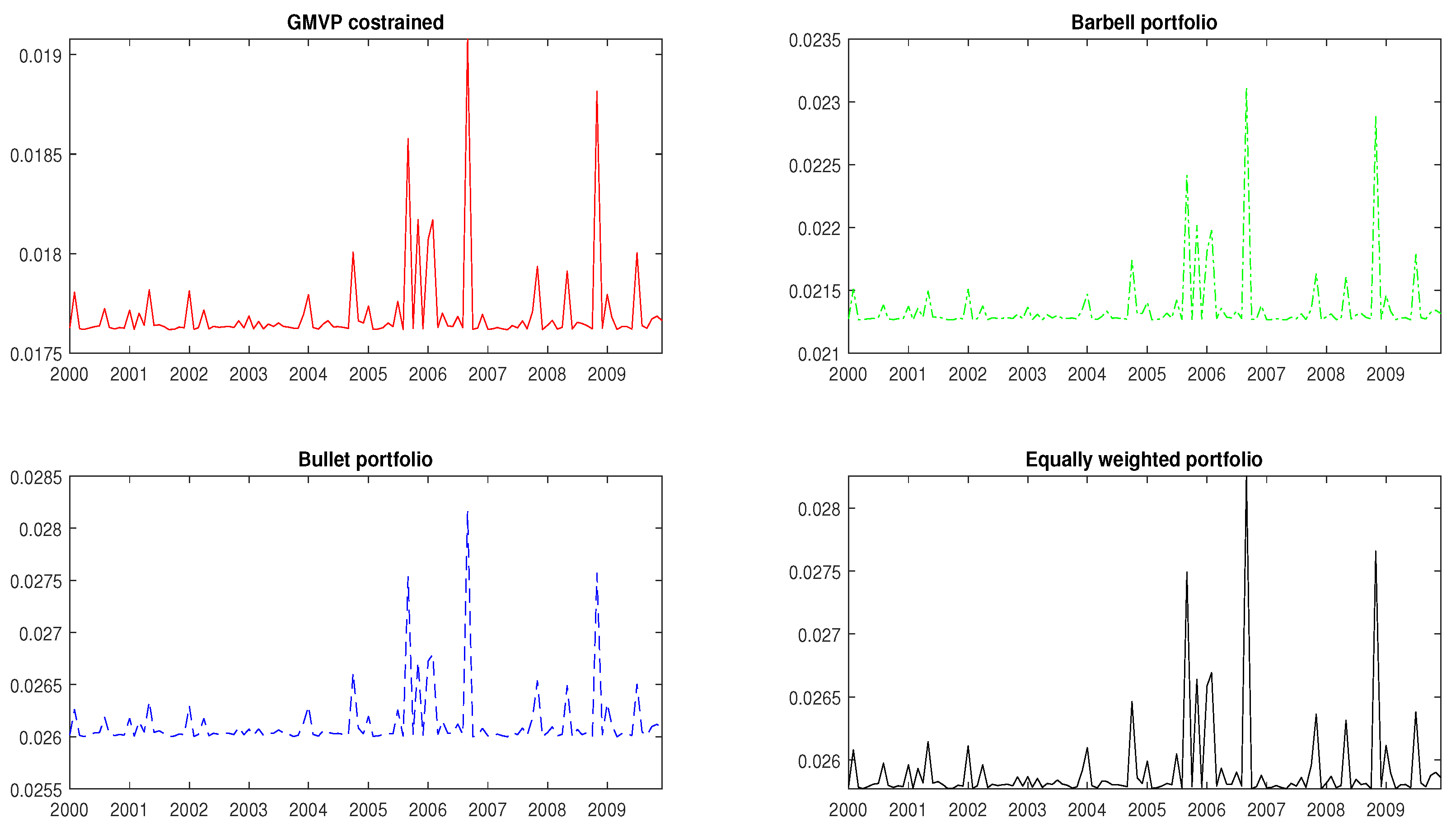

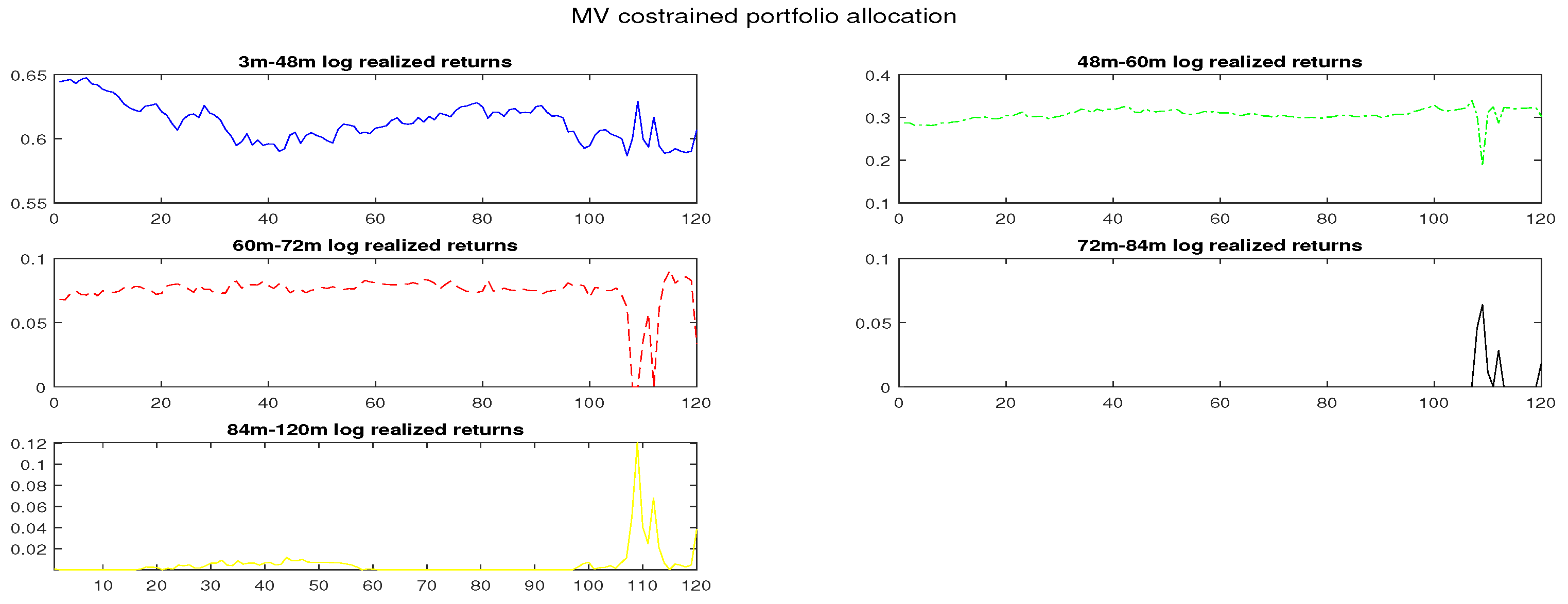

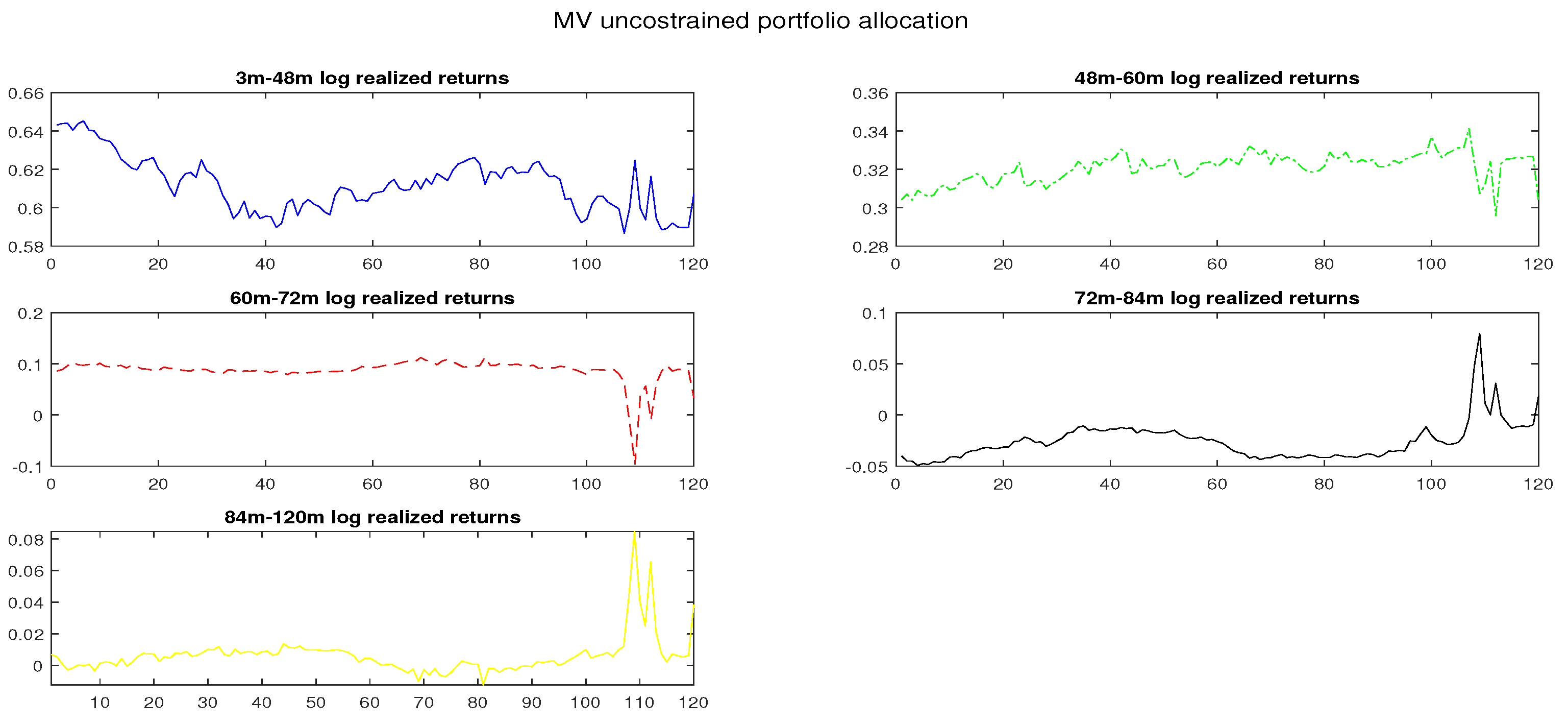

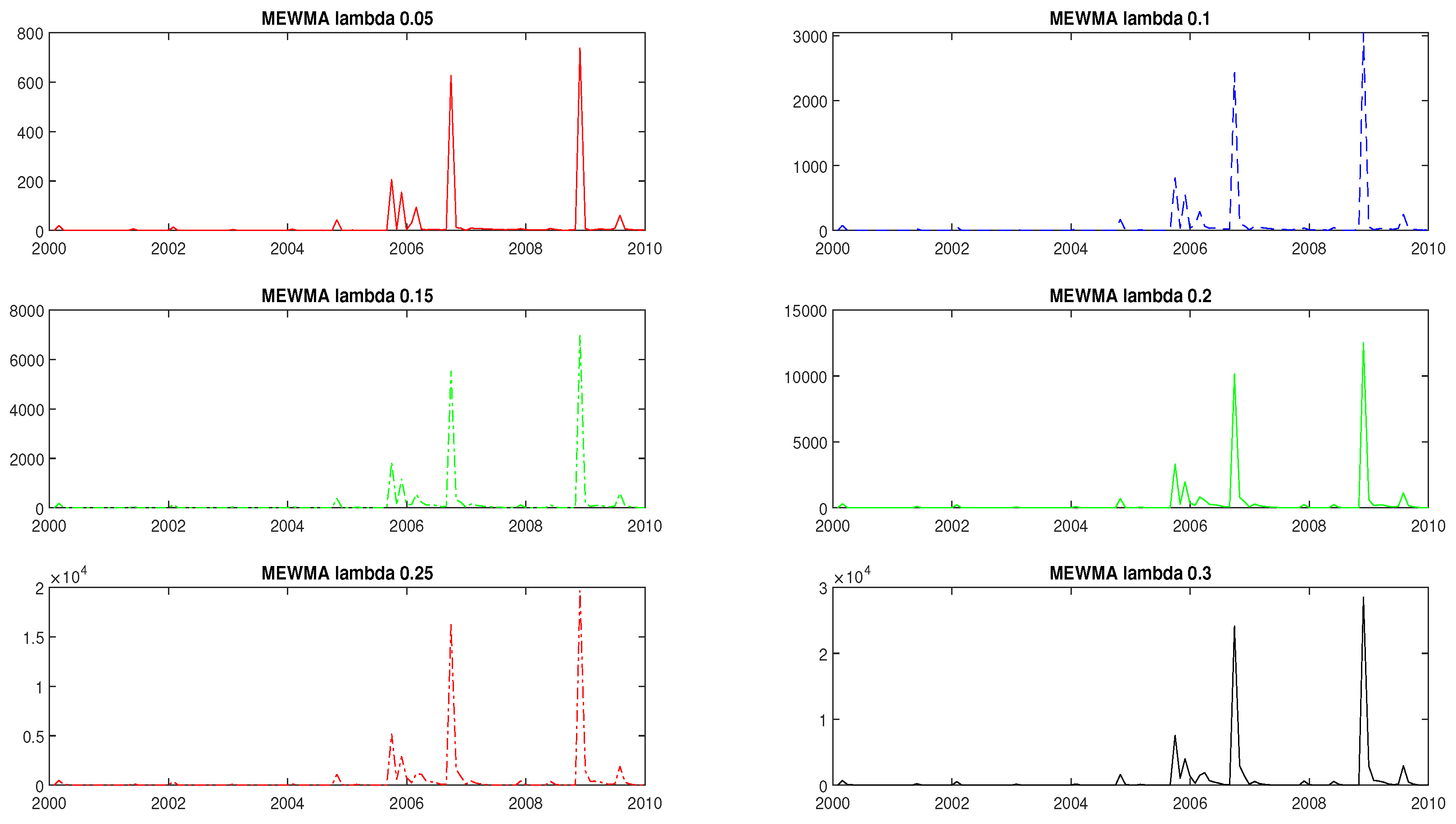

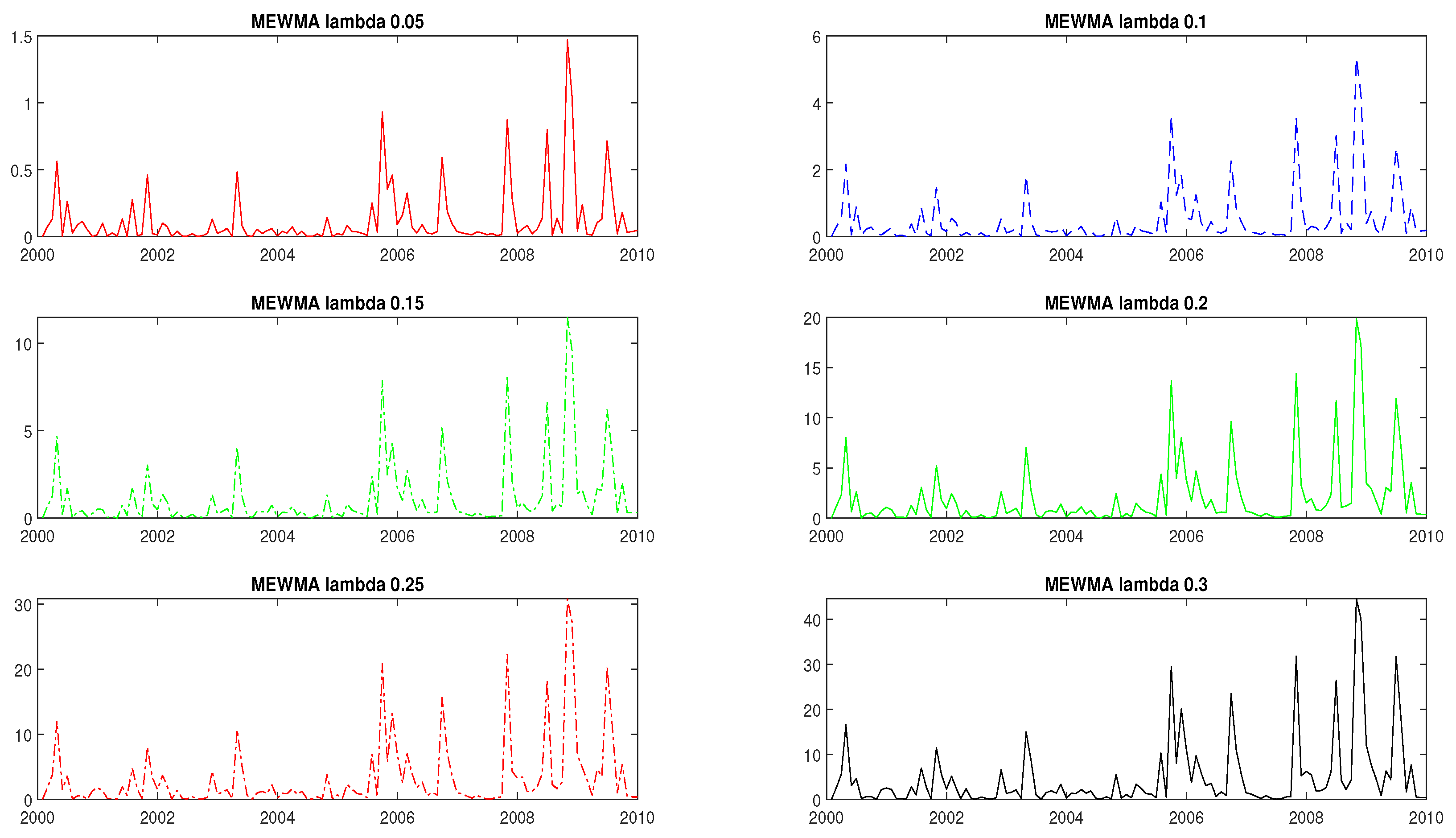

Figure 7 and

Figure 8 present analogously the control statistics based on the MEWMA recursion. We remind that for the MEWMA charts, the smoothing matrix is taken as a diagonal matrix with diagonal elements equal to

,

. In the control schemes, based on the Mahalanobis distance, the control statistics show large oscillations in contrast with those of MEWMA recursion that exhibit a very smoother behavior. As a consequence, control statistics based on Mahalanobis distance are more often lying above the control limit from those based on MEWMA recursion.

The main purpose of an investor is to minimize the one-period-ahead out-of-sample portfolio variance. The proposed control charts give a signal when a structural break in the optimal portfolio weights is likely to happen.

Table 4 presents for the two control chart procedures, constrained and unconstrained portfolio optimization, the control limits and the corresponding smoothing parameters. The smoothing parameters for the procedures based on the Mahalanobis distance are set equal to 0.15, and for the MEWMA statistics, both optimization cases are equal to 0.2. Additional results for other values of the smoothing parameter are available upon request.

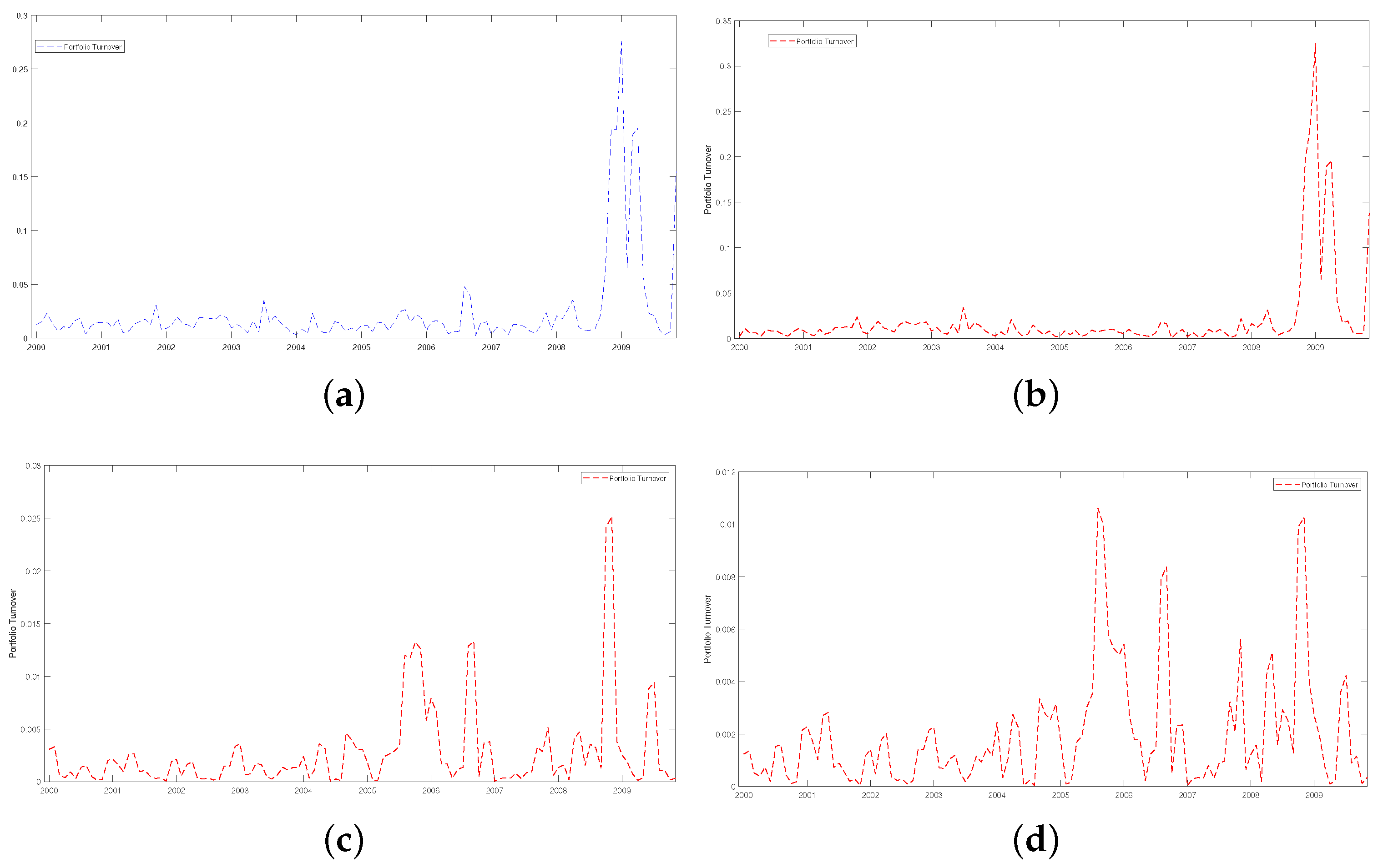

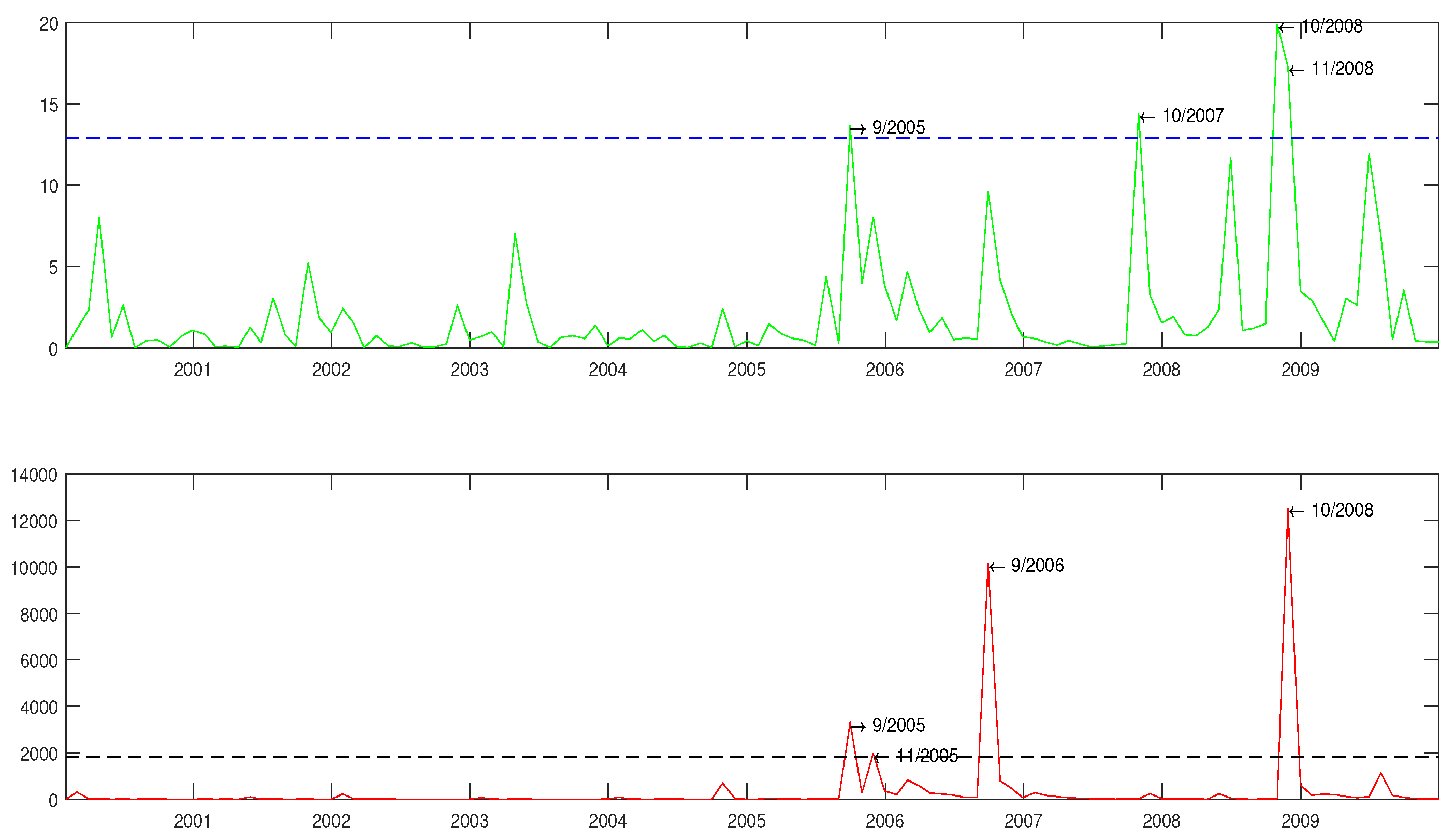

Figure 9 illustrates the change points for the control schemes based on the MEWMA. We remind that when a signal is given and a change point is identified, the process should be re-estimated, as [

23] mentioned.

Figure 9 presents the control charts for the two portfolio strategies based on the multivariate EWMA recursion. The difference control charts using the Mahalanobis distance for both constrained and unconstrained portfolios give more signals than the charts using the MEWMA statistic. The latter control schemes behave better, which is in contradiction with the results for risk assets and daily data that [

23] found. A possible explanation could be the difference in the risk characteristics of the data, since here, we have less risky assets than stocks: government bonds. A possible advantage of using less frequently than daily data could be the reduction of a large number of signals especially in terms of structure models. A distinction between real and false alarm, is difficult and each signal obtained should be evaluated for further actions by a financial analyst. In our work, we attempt to give, if it is possible, an economic interpretation of the signals obtained from the control charts. The use of a difference MEWMA control chart for an unconstrained portfolio gives in the out-of-sample period four signals (without reestimation). The dates of the signals are 2005:09, 2007:10, 2008:10 and 2008:11. The difference MEWMA control chart for a constrained portfolio gives signals at the following dates: 2005:09, 2005:11, 2007:09 and 2008:10. The economic evaluation of all given signals is of great importance in finance. In December 2007, the global financial crisis started, which led to the Great Recession until June 2009 according to the NBER. Both control schemes detect the structural break due to the financial crisis of 2007. However, the MEWMA chart for the constrained portfolio gives a signal a month earlier than the chart in an unconstrained case. The signals that both charts give in September 2005 could be associated with the housing market correction during the period 2005–2006 that started in June 2005.

If we estimate the Sharpe ratios for the constrained and unconstrained GMV portfolio for the time periods before and after the change point at September 2005, we see a decline in the values (see

Table 5). This is an extra indication that the financial analyst should examine the composition of the optimal portfolio. Specifically, from the results in

Table 5, we see that ignoring a structural break may have important economic consequences for the investor, since the performance of the investment has deteriorated, and the optimal portfolio allocation has changed. From

Figure A1 and

Figure A2, for the unconstrained and constrained GMV portfolio, respectively, we see fluctuations and a rise in the portfolio standard deviation from September 2005 until the end of the out-of-sample period.

The number of signals that detect previous works about monitoring stock portfolios with control charts (e.g., [

23,

33]) is quite large, especially in comparison with our analysis about term structure-based portfolios. This can make the work of an analyst more difficult so as to explore the causes and the results of each detected change from the control chart.

9. Concluding Remarks

In this work, we first apply the mean variance portfolio approach introduced by Markowitz ([

57]) to obtain optimal portfolios composed of government bonds. The portfolio optimization is based on an affine term structure model estimated using the minimum chi square approach. The research is restricted to the class of Gaussian VAR affine term structure models using both latent and macro factors. For the state evolution process, we assume homoscedasticity. This portfolio optimization strategy is compared with other benchmark strategies and outperforms most of them for both allowing short selling or not. In addition, the results confirm the finding of previous works (e.g., [

7,

8]) that portfolio optimization based on dynamic factor models could be an alternative to traditional bond strategies. Second, we propose control charts for the surveillance of optimal portfolio weights based on the differences between two successive estimated global minimum variance portfolio (GMVP) weights. We apply these control schemes in two portfolio optimization cases, allowing short selling or not. The difference control charts are based on the univariate EWMA recursion using the Mahalanobis distance and the multivariate EWMA recursion.

The estimation of the control charts requires the knowledge of the moments of the estimated optimal weights and especially their autocovariance. For the estimation of the covariance, we use a simulation approach, since our asset returns are correlated. The proposed control schemes are constructed so as to have the same in-control average run length (

ARL) or media run length (

MRL). Next, they are compared using as a performance measure the out-of-control

ARL and

MRL. For the out-of-sample period, only changes in the variance of bond returns are considered. The MEWMA difference control chart performs better than the the Mahalanobis difference chart, and for every control scheme, the results for a constrained portfolio outperform those for an unconstrained. The smoothing parameter values should be chosen from the interval 0.1 to 0.3. In addition, an empirical study is performed with the results for the out-of-sample period favoring the MEWMA difference control chart and the Malananobis difference charts giving a larger number of signals. Previous works for stock portfolios that use EWMA control charts, such as those of [

23], support the use of difference control chart procedures with values for the smoothing parameter within the interval [0.1,0.25]. An important issue is the economic interpretation of the signals and the identification as structural breaks or not.

Finally, further research should be focused on techniques for the estimation of the moments of optimal portfolio weights when the asset returns are identical and data-dependent under the normality assumption. In addition, further analysis should be extended to non-Gaussian affine models or models that allows heteroscedasticity.