1. Introduction

The principal purpose of this paper is to provide a review of the Fractal Market Hypothesis (FMH) which is a hypothesis for analysing financial time series based on the principles of fractal geometry, specifically the self-affine properties of stochastic fields. However, this paper has also been composed for readers who have no or little prior knowledge of fractal geometry or the principles of financial time series modelling, risk assessment analysis and future price prediction. For this reason, this paper provides a short introduction to fractal geometry and an overview on the mathematical modelling of financial signals. These elements are then combined to explain the principles of the FMH and how and why it can be used to model financial times series data. The FMH is part of the continuing evolution of ‘technical’ market theory, and, in this section, we provide a contextual overview of some of the basic concepts relating to the study of market risk, presenting the ideas that lie behind the developments in the field that have led to the FMH and its applications.

Following a brief introduction on how probability theory was first introduced to the study of market movements and the analysis that went before, we introduce some of the major theoretical developments in the modelling of financial times series. It is these underlying theories that have proved to be the driving force for the development of the various market analysis methods over the past 100 years, starting with Louis Bachelier’s ‘Théorie de la Spéculation’ [

1]. In the following sections, a review is provided without recourse to any mathematical details associated with the concepts. The foundations for the mathematical models associated with these concepts are considered later on in the paper.

1.1. On the Study of Risk

There are many ways of trying to predict and manage market risk. In financial markets, the oldest and perhaps the simplest approach is termed ‘fundamental analysis’ [

2]. This involves an investigative analysis of a company, industry, or market, and/or the economy, around a proposed investment or trade, which can reveal the cause of stock price changes. The results are then used to try and predict a stock’s next move. This type of fundamental analysis assumes an underlying cause. The price, bond, derivative or commodity is taken to move because of some event or fact, which, more often than not, comes from another external event. The implicit assumption in this approach, is that if one can understand the underlying cause early enough, then one can forecast the event and take the appropriate action to manage the risk or investment. In the real world, however, causes are often obscure or imperceptible. Critical information is often unknown, indeterminable, concealed or even misrepresented (such as in the Enron or Parmalat corporate scandals, for example [

3]). In addition to this, information can simply be misunderstood by some or even all of the market participants.

Major trading houses still employ large numbers of fundamental analysts to find discernible patterns [

4] which are, at times, quite accurate. For example, certain exchange rates can approach a level as described by a fundamental view, before falling back, or trending upwards. However, on an open market, this type of analysis can be severely limited. The precise sentiment, or mechanism, that links news to price is often inconsistent, and is open to individual interpretation. In hindsight, fundamental analysis can often be reconstituted so as to reveal exact predictions of events. However, before the fact, two diametrically opposed outcomes may have seemed equally likely. Thus, although validity may be perceived from time to time, it is not necessarily the best foundation to build a risk management system. In response to this, the financial industry has and continues to develop other forms of data analysis using more quantitative tools.

The second oldest form of analysis is termed ‘technical analysis’ [

5]. This concerns the recognition of patterns (real or perceived), and the study of price, volume and indicator charts, in search of clues as to whether to buy or sell. After falling out of favour in the 1980s, the discipline expanded again in the 1990s as the public took to the internet to trade stocks and shares online. It is from this evolution in communications technology that ‘modern finance theory’ was born, involving analysis methods that emerged from the mathematics of chance, probability theory, statistical analysis, and stochastic field modelling. The basic concept is that while it is not possible to predict the exact value of a future price, the (short term) fluctuations of such future values can be assessed, provided that the statistical characteristics of the fluctuations do not change in time. In this context, risk may be considered to be a measurable quantity, and is therefore manageable. It is upon this assumption that modern day market analysis has been developed. The FMH is arguably an inevitable consequence of the fact that financial time series are non-Ergodic, i.e., they are statistically non-stationary stochastic fields.

1.2. Basic Technical Issues in Financial Analysis

The majority of specific trading strategies rarely appear in the academic literature or are publicly available [

6]. Some research suggests, however, that traders today rely on technical analysis more so than fundamental analysis, in particular, for short-term forecasting, [

7,

8]. Within the realm of technical trading, there are several basic approaches that can be categorised [

9]. These include:

The Price Filter Approach where the strategy is to buy or sell after some price increases or decreases by some pre-defined percentage.

Moving Average Approach, where a buy or sell is generated after the price moves above or below a longer-term rolling average.

Support and Resistance Approach, which is based upon the principle that most trends begin when a price of a commodity breaks out from a fixed price range. This type of strategy seeks to buy or sell when the price rises above or below a local maximum.

Channel Breakout Approach, which is defined as a region within which a high price (taken over a number of periods) is within a pre-defined percentage of the corresponding low price (over the periods considered).

Many of the above approaches originated from stock trading, and not commodities, where much less research is available. This is mainly due to the fact that, historically, commodities were more ‘specialist’ than stocks. With the expansion of electronic and algorithmic-trading, and the way in which this has changed investments, the ways in which commodity and stock-market assets are traded have become more and more similar. Thus, many of the financial principles developed relating to stock markets can also be considered in terms of commodities (at least at a basic theoretical level).

Published articles outlining technical trading approaches date back to the 1960s, where a trading strategy was proposed for Copper futures, for example [

10]. In 1988, a study was undertaken to apply technical trading rules to twelve futures markets which obtained returns of up to 5.6% over a period of six years [

11]. In 2007, an extensive review of technical trading strategies applied to options and futures markets was carried out [

12]. It was found that the average annual profit for almost 100 different approaches was between 4% and 6%.

In 2008, Marshall et al. [

13] posed the question as to whether a basic-rules-type approach could successfully be applied to commodities and determined that, while some traders could make attractive returns using these principles, the strategies did not improve the average market returns when assessed across 15 different sets of commodities. Thus, based on publicly available strategies, it can be concluded that a basic rule-based approach to future trading may not be able to ‘beat the market’, and we can assume circa 4–6% as a benchmark for returns on ‘commercial’ trading strategies. This is especially attractive in the era of low interest rates, as broadly experienced since the financial crisis of 2008.

1.3. Financial Time Series Analysis

A financial time series is essentially a digital signal that, most commonly, consists of a uniformly sampled set of discrete values for the price of a commodity. The time intervals between the sequential price values can vary significantly, from seconds and minutes to days and months. For this reason, many applications developed for processing signals in general can be applied. Financial signal processing relies on the application of numerous algorithms that compute a range of statistical measures, for example, in an attempt to quantify various aspects of the price movements as data are streamed into a trading centre, for example.

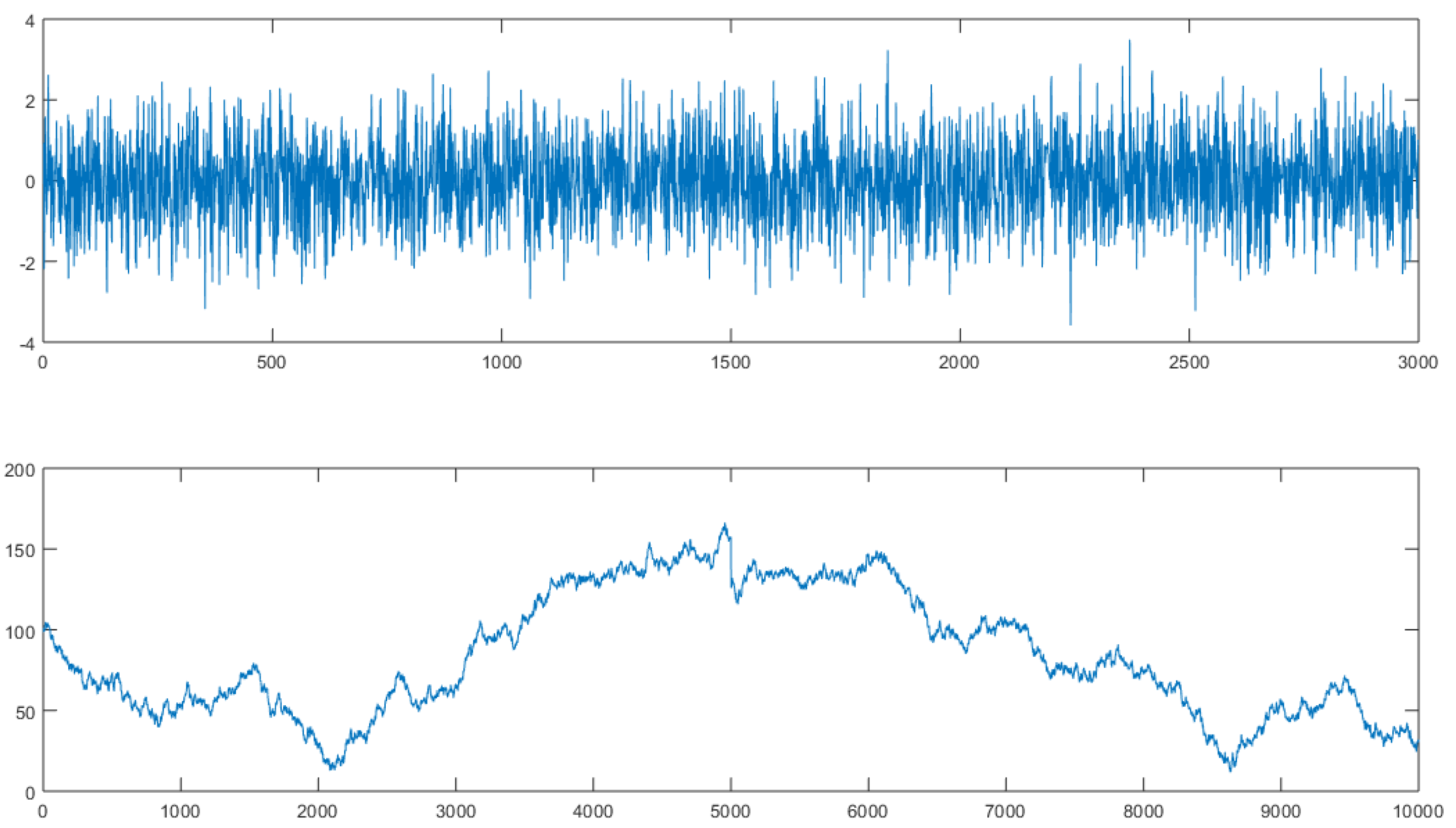

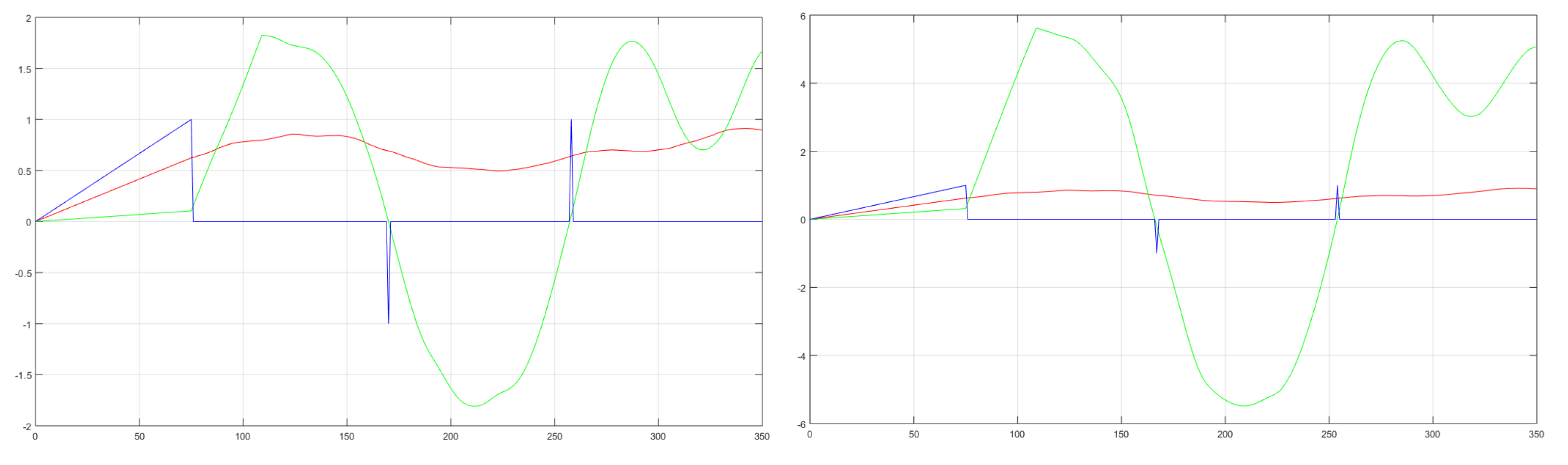

The focus of of such signal processing algorithms is based on outcomes that are specific to issues in economics and market analysis. Consequently, such algorithms focus on processing financial signals that yield metrics that are of specific interest to the financial traders. The principal goal of such algorithms is to provide a quantitative analysis that allows a best estimation of movements in financial markets, such as stock prices, options prices, or other types of derivatives. These are typically applied on a moving window basis to produce ‘metric signals’, i.e., signals that are a sequential time series of specific metrics computed from a sample of the original data. Examples of such metrics include the Volatility and the Lyapunov Exponent, which are considered later in this paper. For a series of

N (positive only) price values

, these metrics are given by [

14]

Further, such metrics can be combined into parameters such as the Lyapunov-to-Volatility Ratio (LVR) given by . Metrics such as these are relatively easy to compute (they do not involve regression, for example) and are representative of the time evolution of a financial signal when computed on a moving window basis. In this case, the metrics are related, given that they both include the log difference between two price values (i.e., ) but where, unlike the Lyapunov Exponent , the Volatility is a positive only quantity, i.e., . In addition to developing different ad hoc algorithms to assess the characteristics of a financial signal, it is often desirable to attempt to produce a more physically relevant model which unifies the known properties of the signal, subject to a specific application. This is a desire that is equally applicable to the development of models for financial signals.

An underlying model for a signal

(as a function time

t) is compounded in the equation

where ⊗ denotes the convolution integral,

is the ‘Impulse Response Function’,

is the ‘Information Function’ and

is a random viable of time, i.e., a stochastic function of time that is often referred to as the system ‘Noise’ [

15]. This is a linear stationary model for a signal where the noise is taken to be additive, and where we can define a Signal-to-Noise Ratio (SNR) given by

An underlying problem in signal processing is as follows: given

, and, with knowledge of the deterministic function

and the statistical characteristics of the stochastic function

, solve Equation (

3) for

. This is the deconvolution problem which is usually an ill-conditioned problem and sometimes an ill-posed problem. Either way, it is concerned with the extraction of information from noise for which only an estimation for the information function

is usually possible.

Financial signal processing is, in a sense, also concerned with the extraction of information from noise. However, it often attempts to achieve the impossible, at least in a deterministic sense. This is to extrapolate the signal into the future, to estimate the actual short-term future price of an investment and/or the longer-term trends of that price. Moreover, it is often of importance to predict future changes in the SNR that may occur. This is required to estimate the extent of future price variation in an investment—the future volatility of the signal.

In the field of cryptography, Equation (

3) can be used as a basic model in which

is replaced with

. The ciphertext signal is then given by [

16]

where

c is a measure of the ‘Ciphertext-to-Cipher Ratio’. This form of encrypting a plaintext signal

using a cipher

is predicated on convolutional encoding in which decryption requires the deconvolution problem to be solved exactly. However, unlike signal processing in general, including financial signal processing, in cryptography, the computation of

is under the control of the cryptographer through the application of a cryptographically strong pseudo-random number generator, for example.

In signal processing,

is a naturally occurring noise field and it is usually only possible to determine the statistical characteristics of the background noise by recording a signal when

. This is consistent with the processing of financial signals in which the level of noise (usually attributed to market volatility) is a naturally occurring feature of the signal and needs to be quantified through the computation of the volatility. Moreover, financial signals are intrinsically non-stationary and so Equation (

3) can only be applied to a segment of data over which stationary behaviour can be assumed. It is then of value to obtain suitable models for the stochastic behaviour of these (short-time) financial signals. In this context, and, as will be discussed later, the Fractal Market Hypothesis is based on considering a model for a financial signal given by Equation (

4) for

and where

In this case, the function represents a price for some commodity or stock. On a theoretical level, it is taken to be the ‘density function’ associated with a canonical ensemble of random-walk interactions, relating to the financial transactions that take place in a free market. In the sections that follow, a short history on the rationale for developing fundamental physical models to describe the stochastic behaviour of a financial signal is addressed.

1.4. Structure of the Paper

The structure of this extended work reflects its focus to serve primarily as a review paper which is inclusive of an extensive list of references. The basic aim of this paper is to provide an overview on the history of the development of financial time series modelling and to review the literature associated with the development of such models.

Section 2 and

Section 3 introduces the reader, through a review of the relevant literature, to the Random Walk and the Efficient Market Hypotheses (inclusive of the Black–Scholes model), respectively. The reason for this, is to set the scene and provide a historical background to the evolution of the FMH.

Section 4 introduce the reader to the basic principles of fractal geometry, which is then followed by an introduction, and and review, of the FMH, as given in

Section 5.

Section 6 provides a mathematical model that unifies all the hypotheses considered under the FMH, focusing on the basic differential equations and associated scaling laws associated with the models. In

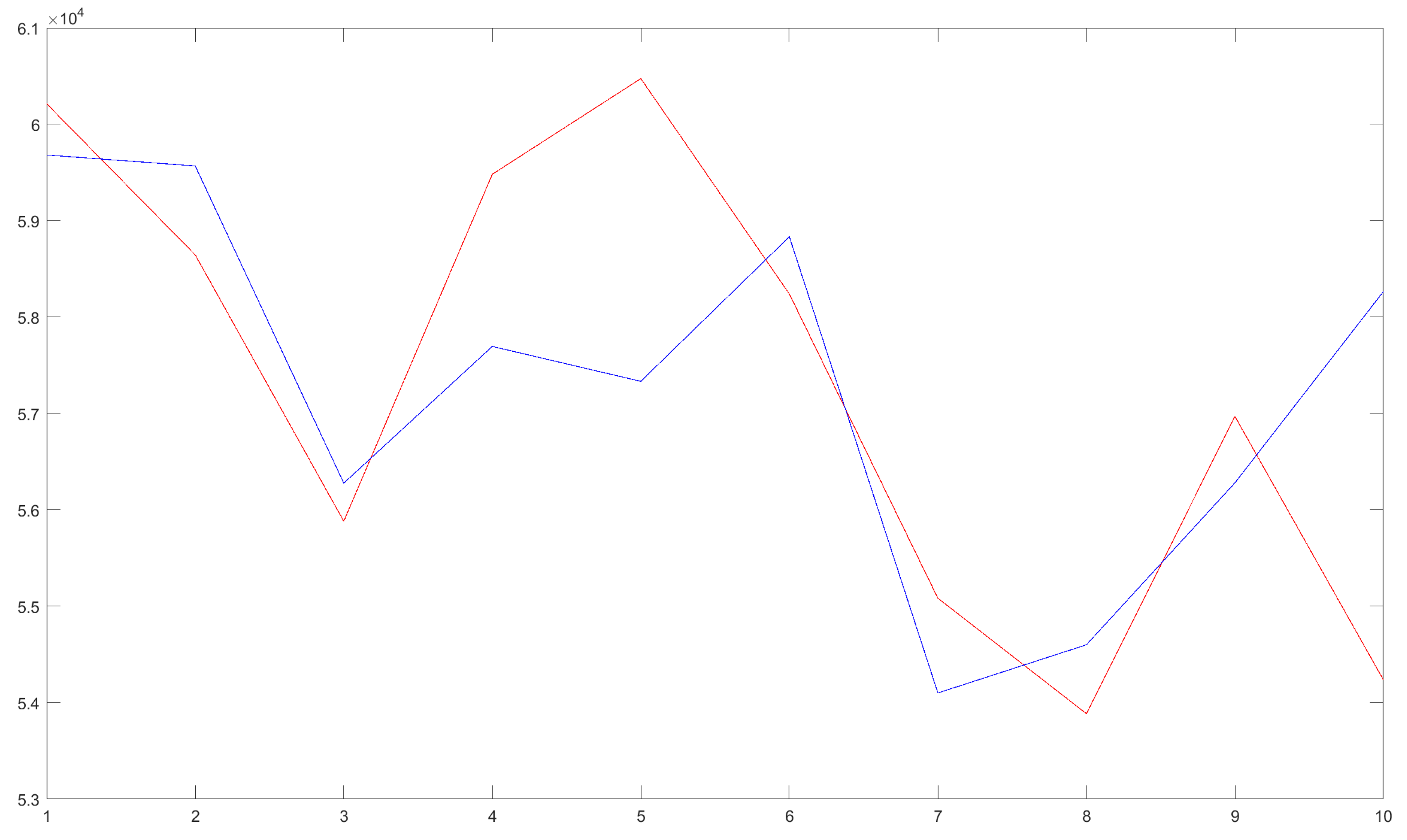

Section 7, a case study is given which explains (with reference to prior research published by the authors) how the FMH can be used to provide long-term market price predictions using the ‘Lyapunov-to-Volatility Ratio’ and/or the ‘Beta-to-Volatility Ratio’. The purpose of these long-term predictions is to provide a risk assessment on short-term price predictions obtained using a technique in machine learning known as Evolutionary Computing. The ‘TuringBot Symbolic Regression Software’ is used for this purpose, working with cryptocurrency data, specifically Bitcoin (BTC–USD exchange) market prices by way of an example. The work reported in

Section 7 represents the principal original contributions to the field, predicated on a review of the FMH that is provided.

2. The Random Walk Hypothesis

In 1654, Blaise Pascal and Pierre de Fermat first conceived the notion of probability to assist aristocrats gambling on the throw of a dice [

17]. This work helped lay the groundwork for the development of the theory of probability. There was, however, a prevailing perception during the time that ‘real’ mathematicians did not touch money. As a result, work in the field of market analysis and risk did not progress significantly further until the early 1900s when, in France, Louis Bachelier began to study French government bonds [

1].

Bachelier recognised that trying to understand the causes and effects of market movements was futile. He passed over the conventional ‘fundamental’ and ‘charting’ type analysis that had gone before, and instead, attempted to estimate the ‘odds’ that prices would move. This was a unique approach at the time. He undertook this approach by observing the ‘strange and unexpected’ analogy between the diffusion of heat through a substance and market price trends [

1]. He observed that in both cases, it is not possible to make a precise forecast. Whether it be the diffusion of particles in matter, or the activities of individuals in a free market, the dynamics of their behaviour are so complicated, that one can never analyse every factor, and how they interrelate, before any result is itself superseded. However, in both fields, it is possible to observe the broad pattern of probabilities that describes the whole system. Bachelier, therefore, adapted the principles of one field (thermodynamics) to the problems of another (market dynamics).

The Bachelier model starts by looking at the markets in terms of what Bachelier called a ‘fair game’. This is analogous to a simple coin toss: it is as likely to come up heads as it is tails. Moreover, each time you toss a coin, the odds remain 50–50 regardless of what happened in the prior toss. In other words, Bachelier assumed that there was no market memory. While it is possible to see extended runs of heads or tails, with each toss of the coin, the trend is as likely to end as it is to continue. In effect, what Bachelier referred to was what we today know as a ‘random walk’. This term was first introduced by Karl Pearson in 1905 [

18] and can be defined as a ‘mathematical formalisation of a path that consists of a succession of random steps’.

In the context of financial markets, the concept was later developed into what can be termed the Random Walk Hypothesis (RWH), e.g., [

19,

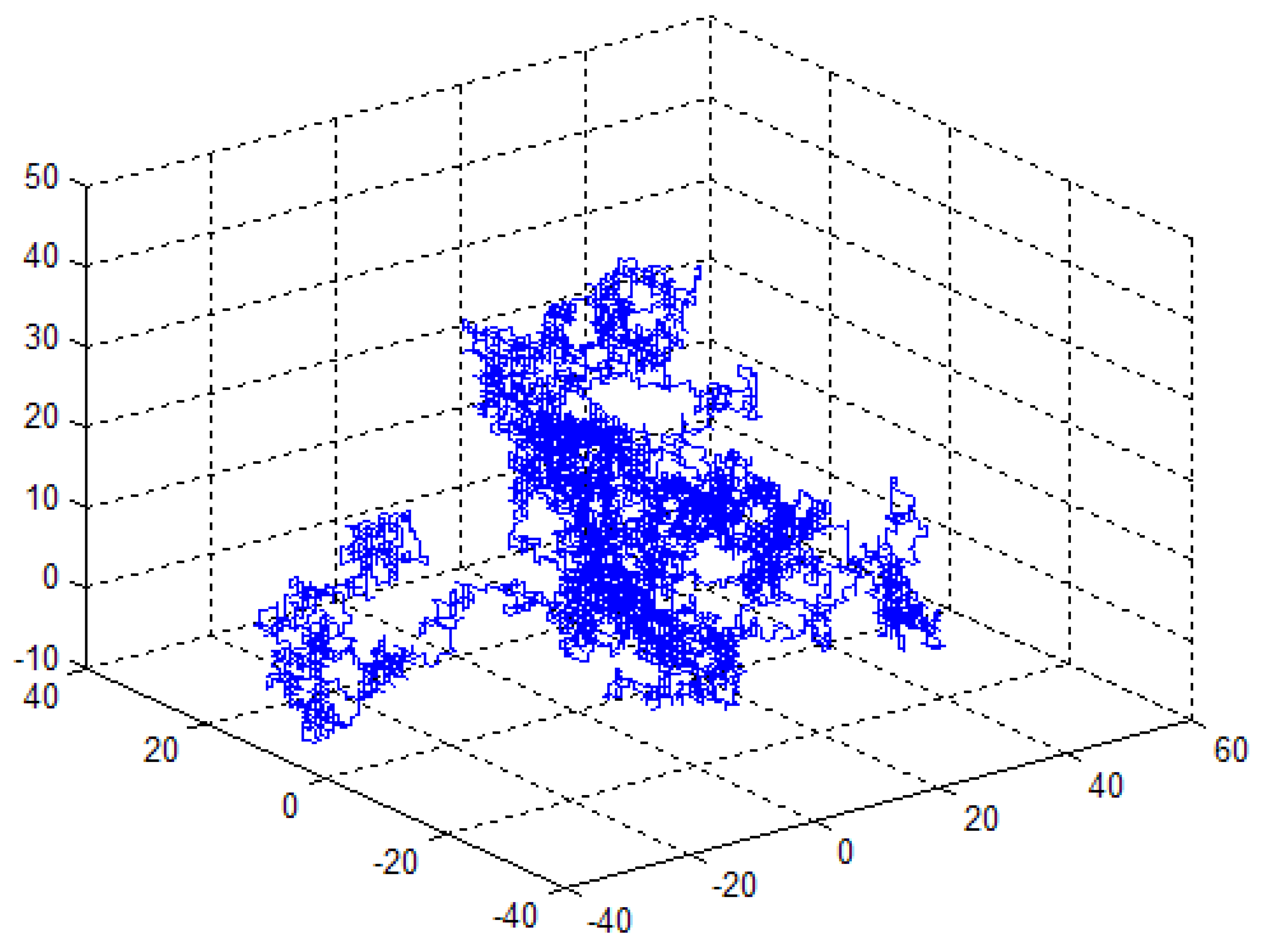

20]. An example of a three-dimensional random walk is given in

Figure 1 [

21]. Models of this type are used in many applications where they help to explain the observable characteristics of fields that are known to be the result of stochastic processes, i.e., where the spatial and temporal characteristics of a physical system are non-deterministic.

Before Bachelier, Jean Claude Fourier had devised the heat equation to describe the way heat (specifically, the temperature) spreads through a material [

22]. Bachelier adopted this equation to calculate the probability of government bond prices rising up and down, in a technique that he called the ‘Radiation of Probability’. Because the Scottish botanist Robert Brown [

23] was the first to comment on the erratic way in which tiny pollen grains moved in water, random walks are often referred to as Brownian motion, a phenomenon that was first investigated theoretically by Albert Einstein in 1905 [

24]. This led to the development of a field equation—the ‘Evolution Equation’—which was similar to that used by Bachelier to explain the characteristics of random motion. Einstein’s evolution equation is an equation for the density function (a function of space and time) which represents the number of particles per unit dimension undergoing random walks. In doing so, Einstein was able to use his evolution equation to derive the diffusion equation, which has the same basic properties as Fourier’s heat equation, when the density function is taken to describe temperature.

Using the rationale associated with a random walk, Bachelier argued that the best estimate of tomorrow’s price is the price of today. In other words, market prices behaved as a ‘martingale’ (i.e., today’s price seems to be yesterday’s price plus some random component). Moreover, he argued that each and every price variation is unrelated to the previous one (or the next one), a result that occurs through the same unchanging processes that drive the markets. In other words, he proposed that market changes were a sequence of independent and identically distributed variables. In this context, Bachelier’s opening lines in his ‘Théorie de la Spéculation’ are as follows [

1]: ‘The factors that determine activity on the Exchange are innumerable, with events, current or expected, often bearing no apparent relation to price variation. In addition to the somewhat natural causes for variation, come artificial causes: the Exchange reacts to itself, and the current trading is a function, not only of prior trading, but also of its relationship to the rest of the market. The determination of this activity depends on an innumerable number of factors: it is thus to hope for mathematical forecasting. Contradictory opinions about these variations are so evenly divided that at the same instant buyers expect a rise, a sellers expect a fall’. Bachelier later added [

1]: ‘The calculus of probability can doubtless never be applied to market activity, and the dynamics of the Exchange will never be an exact science. But it is possible to study mathematically the state of the market at a given instant; that is to say, to establish the laws of probability for price variation which the market at that instant dictates’.

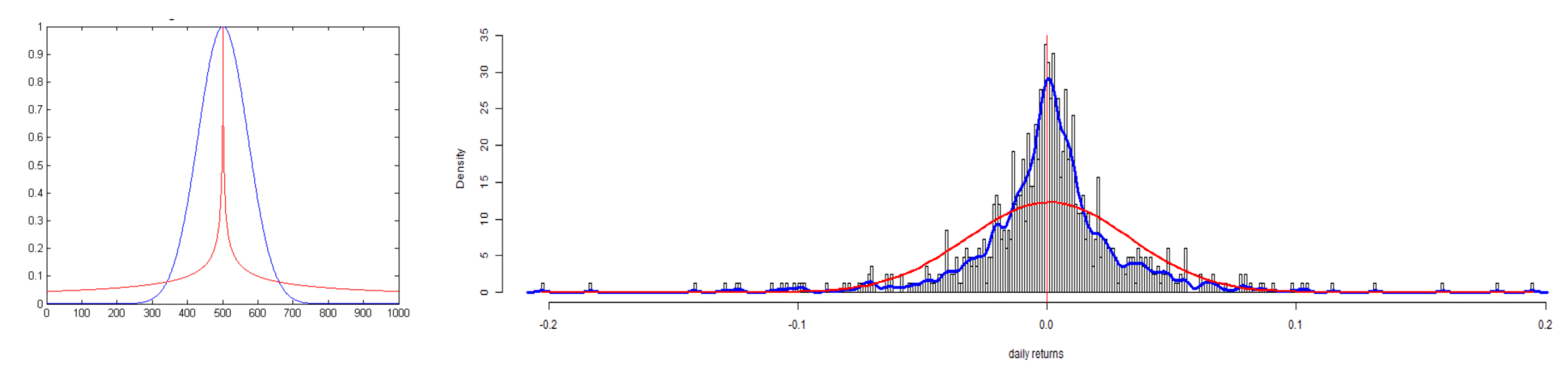

Bachelier’s proposal suggested that if all of the price changes of French government bonds were plotted as a time series, then they will spread out across the paper in a familiar bell-type-shape curve (a normal or Gaussian distribution) with many small changes clustered in the centre, and fewer large changes in the tails. An original approach at the time, this idea conveniently paved a way for using the statistical methods that had been developed earlier by Carl Fredrick Gauss for the description and analysis of normal or ‘Gaussian’ distributions coupled with the Central Limit Theorem, i.e., that the continued addition of different and independent stochastic fields with different characteristic statistical distributions will produce a stochastic field that is normally distributed. In the context of this theorem (the combination of stochastic systems tend to reduce to one that is Gaussian distributed), Gauss’s famous distribution came to be applied to the analysis of financial and commodity markets. This distribution is taken to describe the price differences (and not the price) of a financial time series, a distribution with a mean of zero. Moreover, in financial time series analysis, it is the underlying statistical model that forms the basis for the so-called Efficient Market Hypothesis, as shall be discussed in the following section.

3. The Efficient Market Hypothesis

Bachelier’s economic insight went unnoticed for many years; indeed, he was roundly criticised by his peers at the time [

25]. However, after the 1929 Wall Street crash, more economists and mathematicians began trying to understand financial markets and the stigma that had previously existed in regard to Bachelier’s ideas began to disappear. In 1956, the work of Bachelier was acknowledged by Paul A. Samuelson and the idea of ‘fair game’ and ‘random walks’ caught on. Economists began to recognise the advantages of describing markets based on the principles of Brownian motion. In the 1960s and 1970s, these concepts were developed further into a broader framework through the work of Eugene Fama, for example, who studied market dynamics and developed Bachelier’s ideas beyond the model of independent increments. He subsequently formed the basis of a financial model that would later come to be known as the Efficient Market Hypothesis (EMH) [

26].

The EMH asserts that financial markets are efficient, specifically, ‘informationally efficient’. In this sense, it is not possible to consistently achieve any returns that are in excess of the average market returns, at least, on a risk-adjusted basis, given the information that is available at the time the investment is made. In other words, an efficient financial market is a market where the price always fully reflects the information that is available.

The idea that all market information is instantaneously available is not physically reasonable and is as philosophically irrational as the principle of instantaneous action at a distance, which underpins Newtonian mechanics, for example. The reality is that, as with the propagation of any physical field which occurs at a finite speed, market information is not obtained instantaneously, but takes a finite period of time to percolate through the global financial system, even though that system is constructed from an increasingly efficient information network and communications infrastructure.

Eugene Fama went on to detail two crucial concepts that effectively define the nature of efficient markets. He proposed three types of efficient markets; strong, semi-strong and weak forms. Each of these forms is related to what information is factored into the market—the price of a specific commodity. Weak-form efficiency reflects all publicly available information on the price of a commodity. Semi-strong efficiency requires that the markets react quickly to new public information, whether it relates to trading activity or new market information. Finally, strong-form efficiency assumes that all knowable information about a company or stock is already embedded in the price of the security, both public and private. However, since new information enters the market randomly, asset price movements must also therefore be random [

27]. Thus, the more efficient the market is, the more random the sequence of price changes becomes. This eliminates any potential opportunities for price prediction (i.e., with returns over and above the ‘random walk’ model) as no investment pattern should be discernible [

28].

The EMH demonstrates that the notion of market efficiency can, in principle, be rejected, unless the accompanying model of market equilibrium is also rejected, i.e., the price setting mechanism. This concept is known as the ‘Joint Hypothesis Problem’, which states that when a theoretical model yields returns that are significantly different from the actual return, then it is not possible to be fully certain if there exists an imperfection in the model, or if the market is inefficient. In this context, traders are only able to modify their models by introducing different factors in order to eliminate any anomalies. This is justified in terms of explaining, as completely as possible, the actual returns associated with a financial model. The anomalies then function as flags to the model maker in terms of whether it can predict returns from the factors that have been introduced into the model. However, as long as there exists an anomaly, then neither the conclusions relating to a flawed model or the issue of market inefficiency can be fully rationalised.

In the 1970s and 1980s, Fama’s hypothesis came to be the guiding principle for many standard tools of modern finance, especially on how to value securities. Critics, however, subsequently blamed Fama’s belief in rational markets for the dot-com crash between 1999 and 2001 [

29]. In response to this criticism, in 2012, Fama, along with other proponents of the EMH, stated that market efficiency does not mean that there is no uncertainty in regard to the future, and that market efficiency is but a simplification of the financial system, which may not always be the case [

30]. This is certainly true, and, moreover, scientifically prudent. It is within this context that the Fractal Market Hypothesis becomes a natural successor of the EMH.

3.1. The Modern Portfolio Theory

In 1952, Markowitz introduced ‘Modern Portfolio Theory’ (MPT) [

31], which would later simply became known as ‘Portfolio Theory’. This is a model for the inclusion of diversification in investment, with the aim of determining a grouping of investment assets that collectively has a lower risk than any individual asset. Markowitz’s hypothesis grew out of earlier work by John Williams in the late 1930s, where Williams argued that to estimate a stock’s value, one should start by forecasting how much in dividends it will pay; then, one should adjust the prediction for inflation, foregoing interest, and other factors which make the forecast uncertain. In considering Williams’ earlier work, Markowitz noted that investors do not only look at their potential profit, but also look for diversification. They think about risks as well as reward, fear as well as greed. They buy many stocks, not just one and thereby build portfolios. This is a form of ‘spread betting’.

Markowitz pondered on how to translate these two concepts (i.e., risk and reward), into models that market practitioners could work with. Risk, Markowitz thought, depends on how much the stock price swings up or down around a mean—in other words, the odds that you guessed wrongly in regard to the final price. Markowitz was, in effect, proposing that the prospects for every stock can be described by just two numbers, the reward and risk. These numbers are related to the mean and the variance, the variance being the average squared deviations from the mean, which in turn, is related to the ‘Volatility’ of a stock price over time. Each possible combination of stocks will give a different return and a different overall risk profile. In addition, stock prices have a tendency to move up and down together, which Markowitz likened to the simple coin tossing game that had gone before. If the market was uncorrelated, it was a ‘fair’ game and one could expect to come out even. However, if correlated, there would be a biased tendency. Markowitz’s theory, therefore, was to mix stocks so that one could lower the overall risk profile of the portfolio. If this was achieved efficiently, Markowitz argued, one would not sacrifice too much profit.

As a result of this hypothesis, Markowitz and his contemporaries became credited with transforming investment from a game of stock tips and hunches to the engineering of means, variances, and ‘risk aversion’ indices. Indeed, the term ‘financial engineering’ first became popular on Wall Street, with the introduction of Markowitz’s Modern Portfolio Theory. There was, however, and still are, problems with this theory. As Markowitz points out in [

32], ‘it is not certain that assuming a normal distribution is necessarily suitable for the measurement of market risk’.

To build an efficient portfolio, one need accurate forecasts of earnings, share prices, and the volatility associated with thousands of stocks; otherwise, the predictive results may become wildly inaccurate. Further, for any stock, it is necessary to calculate its ‘covariance’ (a measure of the joint variability of two random variables) for every other stock and/or how it fluctuates against all other stocks. For any major market, this amounts to millions of calculations. Moreover, because of constant price changes, this exercise needs continual repetition to up-date the result in time. It was this very need that became the primary driving force behind the development of the mainframe computer on Wall Street in the 1960s.

MPT is essentially concerned with a trade-off between risk and return, where investment advisers focus on returns with the occasional caveat ‘subject to risk’. Most modern portfolio theories assumes that the exists a risk-free investment, that there will be a return from depositing funds in a sound financial institute or investing in equities. In order to increase the profit, the investor must accept greater risk. Why should this be so?

Suppose there exits an opportunity to have a guaranteed return greater than that from a conventional bank deposit. In this case, no (rational) investor will invest any money with a bank. Moreover, if the investor could borrow money at less than the return on an alternative investment, then they would borrow as much money as possible to invest in an opportunity with a higher yield. In this case, and, in response to the pressure of supply and demand, the banks would raise their interest rates. This would attract money for investment with the bank, and reduce the profit made by investors who have borrowed money from the bank. And if such opportunities did arise, the banks would probably be the first to invest our savings in them. This argument exhibits elasticity because of various ‘friction factors’ such as transaction costs, differences in borrowing and lending rates, liquidity laws and so on. However, in general, the principle is sound, because the market is saturated with arbitrageurs whose purpose is to seek out and exploit irregularities or miss-pricing.

Problems arise with MPT due to the fact that the market is considered to be ‘rational’. In other words, all investors are assumed to aim to maximise economic efficiency alone (i.e., to make as much money as possible, regardless of any and all other personal, environmental, strategic, or even social considerations) [

31,

32]. It simply attempts to maximise risk-adjusted returns, without regard to other consequences or thought.

Since being proposed, there has been widespread criticisms in regard to both the theoretical concepts and practical applications of MPT. These include the observations that:

financial returns do not follow Gaussian distributions;

correlations between asset classes are not fixed, but instead, vary depending on external events, especially in times of crises.

Moreover, there is growing evidence that investors are not rational and that the markets are not efficient [

33].

In MPT, no attempt is made to explain the underlying structure of price changes. Various outcomes are simply given in terms of probabilities. Thus, if a history exists of a particular system-level event, such as the liquidity crisis experienced following the crash of 2008, then there is no way to compute the odds of it occurring. In this respect, the reliance of MPT on asset prices means that it is vulnerable to all the typical and past modes of market failure. It can therefore be argued that MPT will break down, precisely when investors are most in need of protection from risk [

34].

3.2. The Black–Scholes Model

The Black–Scholes model considers a financial market which contains certain derivative investment instruments. The model was first articulated by Fischer Black and Myron Scholes in their 1973 paper,

‘The Pricing of Options and Corporate Liabilities’ [

35]. They derived a (nonlinear) partial differential equation, now known as the Black–Scholes equation. This equation governs the price of an option

as a function of stock price

S over time

t and is given by

where

r is the risk-free interest rate, and

is the volatility of the stock. Solutions to this equation require that

r and

are known, for which only estimates are possible, as gauged at some future point in time. In practice, it is this issue that can lead to solutions of the Black-Scholes equation becoming inaccurate.

The principal idea associated with the derivation of this equation is that one can hedge an option perfectly by buying and selling the underlying asset in just the right way. Consequently, this eliminates risk. However, the principal assumption is that the options markets are ‘frictionless’ (efficient). Robert Merton would later be the first to publish material expanding on the mathematical understanding and basis of the options pricing model. This type of hedge is now commonly referred to as ‘delta hedging’. Since its introduction, it has became the basis of many of the hedging strategies used on Wall Street and other major investment companies around the world. The acceptance of the model led to a rapid increase in options trading worldwide and legitimised the options markets. The model still remains widely used today, although often with bespoke adjustments and market correction factors.

The original model incorporates constant price variations of a stock, the time value of money, the option’s strike price, and the time for the option to expire. In order for the model to be applicable in practice, it also has to ‘assume away all kinds of complications’ [

36]. For example, Black and Scholes, like Bachelier and Markowitz before them, assumed that a stock’s risk (i.e., its volatility or ‘Vol’) can be gauged by a normal distribution. From these underlying assumptions, they showed that ‘it is possible to create a hedged position, consisting of a long position in the stock and a short position in the option, whose value will not depend on the price of the stock’ [

36]. Within just a few years, traders had incorporated the Black–Scholes terminology of ‘Vol’s’ (estimates of the Volatility at a point in time), for example, into their daily language. An entire industry grew up, and with the help of the Black–Scholes model (and its many subsequent variations), corporate financiers bought insurance, debt portfolios, and hedged against unwanted market problems more than ever before [

37].

The Black–Scholes model permitted an entirely new type of trading; not just in the actual stocks or currencies themselves, but in their volatility. Traders could construct elaborate combinations of options, so that they could cash in; not at a specific price, but when the price swung more wildly up or down than normal. Alternatively, they could design option packages that paid off only if prices were steady.

The conceptual leap associated with the development of the Black–Scholes model is that traders are not estimating the price of an asset in the future. Rather, they are gambling on how risky the market will be at some point in that future. In other words, they are considering how volatile the markets will be at a later date. This, of course, requires a good estimate of the future volatility and it is in this respect that Black–Scholes analysis is based on a ‘random walk’ model, in which price changes are taken to be independent and conform to a normal or Gaussian distribution.

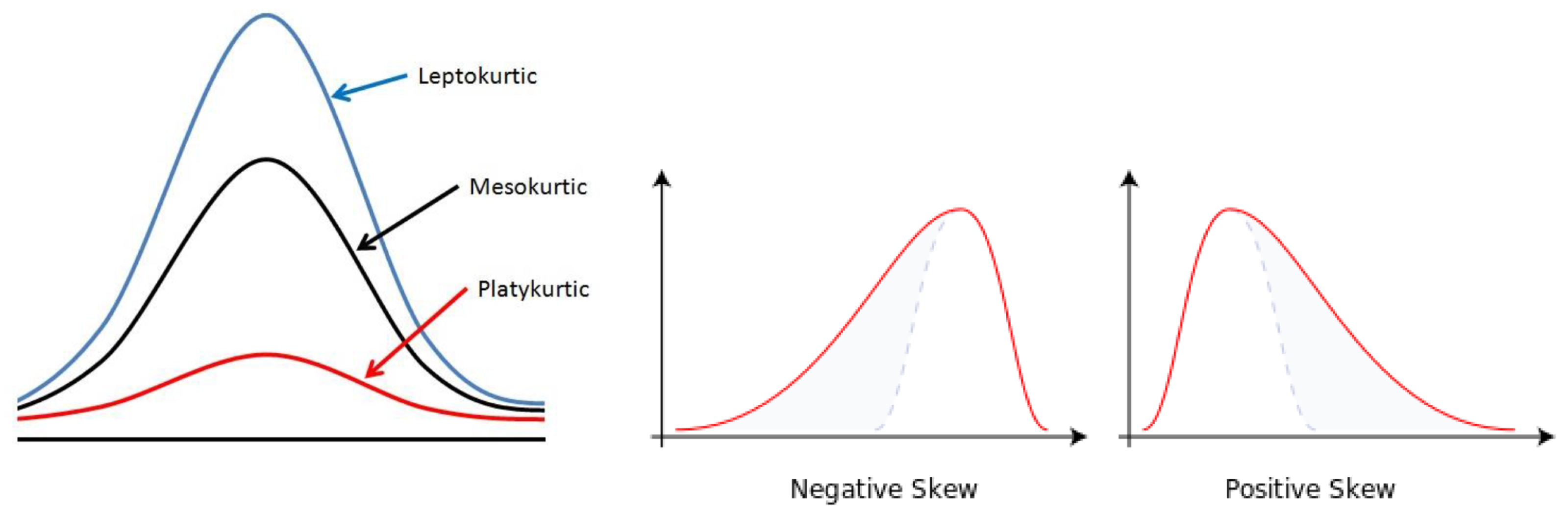

As a result of this key underlying assumption, the Black–Scholes model has shown a fundamental inability to explain the proven characteristics of financial markets, such as Kurtosis (long tails), skewness, clustering, flights, the volatility smile (i.e., where graphing implied volatilities against strike prices for a given expiry, yields a curved ‘smile’ instead of the expected straight line) [

38], or to explain major market crashes in the past that have led to recession. In fact, the widespread use and heavy reliance on the Black–Scholes model is now considered as a significant contributor to the 2008 global economic crash [

39].

3.3. Value and Limitations of the Efficient Market Hypothesis

Aside from the schools of thought on financial market behaviour already discussed, there are a variety of significant articles that also advocate an ‘efficient market’ approach. Other publications have tried to summarise the history of the EMH and categorise the spectrum of views on it, for example, [

40,

41].

In 1959, Osborne [

42] showed that the logarithm of stock prices follows Brownian motion. This is the basis for the so-called ‘log normal model’, where price variations in time denoted by the function

is given by the equation

where

reflects the average rate of growth of an asset, and

is taken to be a normally distributed stochastic field. In regard to this equation, the relative log-price change of an asset at a point in time

t is taken to be determined by some random value

whose amplitude is determined by the volatility

with the sum of an underlying trend component determined by the value of

. Thus, when

, the price value may exhibit long-term trends characterised by an exponential growth or exponential decay, depending upon whether

is positive or negative, respectively. This model is an example of a (continuous) log-normal random walk and includes the following properties:

- (i)

price increments exhibit statistical stationarity in which samples of data taken over equal time increments can be superimposed onto each other in a statistical sense;

- (ii)

the scaling of prices can be suitably re-scaled such that they too, can be superimposed onto each other in a statistical sense;

- (iii)

price changes are statistically time independent.

In 1961, Muth introduced a hypothesis that makes the case that current expectations strongly influence future performance [

43]. In other words, a trader may make a prediction based on available information and past experience, and because this prediction is based on rational reasons, and the market does not waste useful information, the prediction is likely to come true, save for a random error. In this context, Malkiel [

44] published

‘A Random Walk Down Wall Street’ in 1973, a book which has proven to be one of the most popular publications on the theory of random walks, and is subsequently cited by many in support of an efficient market assumption.

In 1978, Ball collected what was regarded as ‘scattered pieces of anomalous evidence regarding market efficiency’ in an attempt to review the acceptance of the EMH [

45]. He believed that ‘there is no other proposition in economics which has more solid empirical evidence supporting it, than the Efficient Market Hypothesis’. Despite drawing this conclusion, he also referred to a number of papers that found anomalies with the hypothesis. In summary, he stated that: ‘the studies provide a powerful stimulus and serve to highlight the fact that there are inadequacies in our current state of knowledge’.

Eun and Shim, in 1989 [

46], used auto-regressive analysis (i.e., a stochastic process model used to capture the linear inter-dependencies among multiple time series) to study nine international stock markets. They found interdependence amongst national stock markets, and noted that this was consistent with informationally efficient markets. In 1991, Jackson [

47] wrote a paper that considered a detailed model of the price formation process, assuming that agents are not price takers and concluded that it is possible to have an efficient market.

In 1990, Lo [

48] wrote a paper entitled

‘Long Term Memory in Stock Market Prices’. He used a modification of Mandelbrot’s Re-Scaled Range Analysis (to be discussed later on in this work) that accounted for short-term dependence to find that there is ‘little evidence of long-term memory in historical US stock market prices’. He further edited two volumes that combined the most influential articles on the EMH at the time [

49]. However, in 1999 Lo and MacKinlay [

50] published

‘A Non-Random Walk Down Wall Street’, in which the authors put the EMH to the test, and concluded that ‘markets are not completely random after all, and that predictable components do exist in recent stock and bond returns’.

Metcalf and Malkiel [

51] studied a number of Wall Street Journal contests, and found that experts failed to consistently beat the market. In 2001, Rubinstein [

52] re-examined some of the significant claims made in the literature against the EMH, and concluded that markets are rational. Similarly, Malkiel [

29] continued the defence of the EMH by examining some of its criticisms. He concluded that markets are far more efficient but less predictable than many academic papers have reported on, arguing that when anomalies have been noted and published, practitioners tend to implement strategies in such a way that the anomalies subsequently weaken or disappear, thereby evolving market efficiency.

In 2004, Timmermann [

53] published a paper entitled

‘Efficient Market Hypothesis and Forecasting’ in which non-stationary behaviour in a financial time series is considered that arise due to the number of investors who discover a technique that has been trading/forecasting successfully, and subsequently utilise the technique themselves. The end result is that the success of the strategy is short lived as it is eventually incorporated into all market prices. In 2005, Malkiel [

54] analysed the performance of professional investment managers and concluded that in general, there is no out-performance of index benchmarks. The paper also provided evidence that large market prices tend to reflect all information. In this context, Toth and Kertesz, in 2006 [

55], produced evidence of growing efficiency on the New York Stock Exchange and Yen and Lee [

56] produced a survey paper in 2008, concluding that ‘the EMH is here to stay’.

In 2009, Ball [

57] addressed the global financial crisis and argued that the collapse of large institutions such as Lehman Brothers reflects a failure to heed the teaching of efficient markets. He responds to a number of criticisms that were levelled at the EMH around the time of the crisis, such as the view that the EMH should have predicted the crisis, or predicted the stock price bubble. Ball lays the blame at the feet of actors in financial institutions for the stock price bubble, claiming that not enough empirical calculations were carried out on the stock prices to identify that a bubble had been created. Further, he offers the random walk argument in response to the EMH predicting the crash. If indeed a crash was predictable, then the very essence of the EMH would be untrue, stating that: ‘if anything, the hypothesis predicts that we should not be able to predict crises... if we could predict a market crash, current market prices would be inefficient because they would not reflect the information embodied in the prediction’. This statement reflects the intrinsic limitations of the EMH and is indicative of the way in which financial models based on the FMH have evolved since the crash of 2008. This is in keeping with the psychology of judgment and decision-making, as well as behavioural economics in regard to prospect theory, for example, as considered by Daniel Kahneman [

58]. In order to appreciate the FMH, it is useful to first review the underlying principles of fractal geometry. For this reason, a short overview of the subject is given in the following section.

4. An Overview of Fractal Geometry

The term fractal geometry was first coined by Benoit Mandelbrot [

33]. The term

fractal is derived from the Latin adjective

fractus. The corresponding Latin verb

frangere means ‘to break’, to create irregular fragments. Moreover, in addition to the term ‘fragmented’,

fractus also means ‘irregular’. Both meanings are preserved in the term

fragment. Thus, the term ‘fractal’ is well suited to describing the study of geometric objects that exhibit scale invariance or self-similarity.

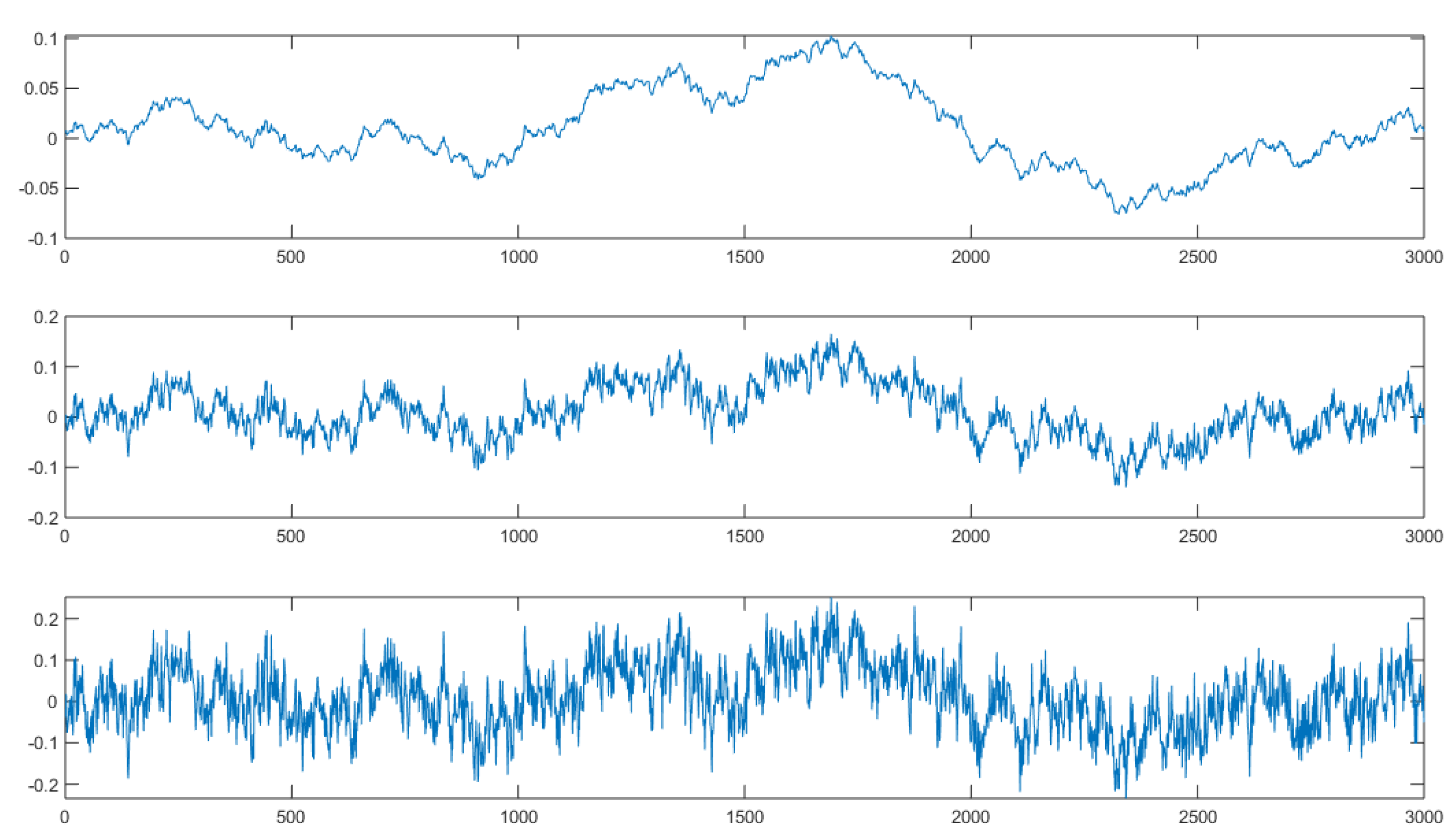

Self-similar objects are an intrinsic feature of the geometry of nature, where natural objects have a fundamental and universal geometric feature. This feature is that they tend to look the same at different scales, a property known as ‘self-similarity’. Otherwise, they tend to at least have an affinity at different scales; they are self-affine. However, it is not just the shape or geometry of natural objects that exhibit self-affinity, but the time evolution of such objects. Financial time series are examples of the latter case, i.e., the time evolution of a self-affine stochastic field. The Fractal Market Hypothesis is a result of noting that a financial time series looks the same over different time scales, at least in a statistical sense, i.e., the distribution of price values over a day, for example, is similar to the distribution for a month, which is similar to the distribution for a year and so on (assuming that there are enough data over each time scale to make the distribution—the computed histogram—statistically significant).

The mathematical roots of fractal geometry can be traced back to published works starting in the 17th Century with notions of recursion—the process of repeating things in a self-similar way. This discovery was complemented with studies undertaken primarily in the 19th Century, on classes of continuous functions that were not differentiable functions in the usual sense [

59].

In 1904, Helge von Koch, extending the ideas of Poincaré (the first to discover a chaotic deterministic system) gave a definition for a self-similar function [

60]. The principles of self-similarity were considered further by Paul Lévy. In his 1938 paper

‘Plane or Space Curves and Surfaces Consisting of Parts Similar to the Whole’, new self-similar curves were described such as the ‘Lévy C Curve’ [

61].

In the 1960s, Benoit Mandelbrot considered the basis for a self-similar geometry in papers such as

‘How Long Is the Coast of Britain? Statistical Self-Similarity and Fractional Dimension’ [

62]. In 1975, he consolidated the ideas and results of hundreds of years of mathematical development by coining the word ‘fractal’. By 1982, he had expanded these ideas in his book

‘The Fractal Geometry of Nature’ [

33], a work which introduced fractal geometry into the mainstream of professional and popular mathematics.

4.1. Self-Similar Functions

For a one-dimensional function

, say, the property called self-similarity is compounded in the result

where

is the scale length (for all dilations) and

is some exponent which determines the amplitude over which the function exhibits self-similar properties. If, for example,

, then the function is exactly self-similar.

The term self-affinity is used to describe objects that have a distorted self-similarity. An object is self-similar if is scales by the same amount in all directions. In terms of Equation (

5), this would mean the

is a constant for all values of

x. A self-affine object does not necessarily scale identically in all directions; in terms of Equation (

5),

may vary with

x so that

becomes a non-stationary self-similar function. Thus, the term self-affinity is a more general description of the fractal geometry of nature as it is rare for natural objects to exhibit scale invariance in all directions, i.e., the Fractal Geometry of nature is a non-stationary phenomenon.

From the scaling theorem (or similarity theorem) of the Fourier transform, the spectrum

of a function defined by Equation (

5) is given by

where

is the Fourier transform, defined by

This relationship is important in the (spectral) analysis of stochastic functions that are statistically self-affine, financial time series being examples of statistically self-affine (digital) signals.

4.2. Self-Affine Structures

Self-affine structures generate objects which we often perceive in terms of ‘texture’. As Manelbrot states, ‘texture is an elusive notion which mathematicians and scientists tend to avoid because they can not grasp it... and... much of fractal geometry could pass as an implicit study of texture’ [

33]. In addition to the fractal geometry of (time-invariant) objects or fields, the time evolution of such fields also exhibits a self-affine behaviour. This includes the ‘complexity’ associated with dynamical systems that are nonlinear for which there is a definable connectivity between the nonlinearity of the system undergoing feedback (iteration) and the self-affine characteristics that the system exhibits.

Quantifying this ‘connectivity’ is compounded in the Feigenbaum diagram [

63] which is used to graph the chaotic properties of a nonlinear feedback system, specifically, an iteration applied to a nonlinear function

. The Feigenbaum diagram is a display of the values obtained or approached asymptotically for fixed points, periodic orbits or chaotic attractors, as a function of the ‘bifurcation parameter’

a, say. A standard example of this, is the Logistic Map, which is based on the iteration

. All chaotic systems of this type bifurcate at the same rate, a discovery first made by Mitchell Feigenbaum in 1975 and published in 1978 [

64]. For a single-parameter map based on the iteration

, the bifurcation rate is quantified by the Feigenbaum constant which is the limiting ratio of each bifurcation interval to the next and is given by 4.669201609... Although it is believed that this number is transcendental, there is, to date, no known proof of this or whether the Feigenbaum constant is irrational.

Most fractals are scale invariant entities relating to a discrete set of scaling values

L where a sequence of translations and/or rotations are applied in order to match the fractal with itself at different (discrete) scales. Deterministic fractals are typically of this, and are based on a sequence of systematic iterations that produces consecutive repetitions of an original object (its initial shape). This process produces a number of scaled-down copies of the object. For each iteration, if the scale length is reduced by a factor

L, and

N copies of the object are generated (being re-assembled in a coordinated way that is the same at each iteration), then, the resulting pattern can be taken to adhere to the equation

, where

D is the fractal dimension. This dimension is then determined by the equation

Figure 2 provides a simple example of such an iterative process to produce a so-called ‘Cantor Set’ [

59]. Starting at the top of the graphic, a line of length 1 unit is cut into three lines of equal length, one of which is discarded. In the case of

Figure 2, the line that is discarded is the central component, but it could also be the line to the left or right hand side. Repeating this process again and again (as illustrated in

Figure 2 for six iterations), at each iteration,

and

from which it follows that

. Thus, in the case of this iteration, the fractal dimension is less than 1, i.e.,

. A Cantor set of this type is an example of so called ‘Fractal Dust’ (a distribution of points, at least, for a large number of iterations). This is because it has a fractal dimension that is less than the topological dimension

n, that, for a line is

. In this respect, if the line at each iteration is retained instead of deleted, then at each iteration

and the original topological dimension is recovered. It is for this reason that fractals are considered to be space-filling objects when

for topological dimensions

.

Having introduced the exponent

in Equation (

5) and dimensions

n and

D, it is of value to consider the relationship between them. This is given by [

59]

The range of values of is then determined by the value of the topological dimension n and the corresponding range in values of D, i.e., and ; and For the applications of fractal geometry in financial analysis (the Fractal Market Hypothesis), we are typically interested in a time series, specifically a digital signal of time, which has a topological dimension of . In this case, , and the relationship between the fractal dimension and the scaling exponent is .

4.3. The Mandelbrot Set

In addition to the Cantor set considered in the previous section, there are numerous examples of fractal objects that can be used to further introduce the principles associated with the study of fractal geometry. It is arguable that the most iconic of these is the Mandelbrot set [

65]. This a fractal that emerges from an analysis of the iteration of nonlinear functions in the complex plane. It is a structure that arises from an iteration of the type

where

f is a nonlinear function but where we consider the iteration to take place in the complex plane. In this case, we consider a complex function

where

is the independent complex variable with real and imaginary components

x and

y, respectively. Complex plane analysis then involves the iteration

for some initial condition

. This iteration represents the application of a map which is denoted by

.

The behaviour of for increasing values of n provides a trajectory or ‘orbit’ (in the complex plane). This is given by the sequence of complex values that are produced by an iteration which depends on the function and the initial condition . If is a linear function, then the iteration may or may not converge depending upon the characteristics of the function. However, if the function is nonlinear, then the iteration may produce a range of different orbits in the complex plane. Such orbits may be characterised by divergence, convergence, periodicity or chaos.

The Mandelbrot set is a set which is specifically concerned with a study of the orbits produced when is a quadratic, i.e., when where c is a complex constant for some initial condition . There are two approaches that can be considered in this respect. We can analyse the iteration for a fixed value of c and different values of the initial condition . Alternatively, we can analyse the iteration for different values of c for the same initial condition . The Mandelbrot set is based on considering an iteration for different values of c for the initial condition . Hence, we can formally define the Mandelbrot set as that set of complex numbers c for which the complex function does not diverge when iterated from alone.

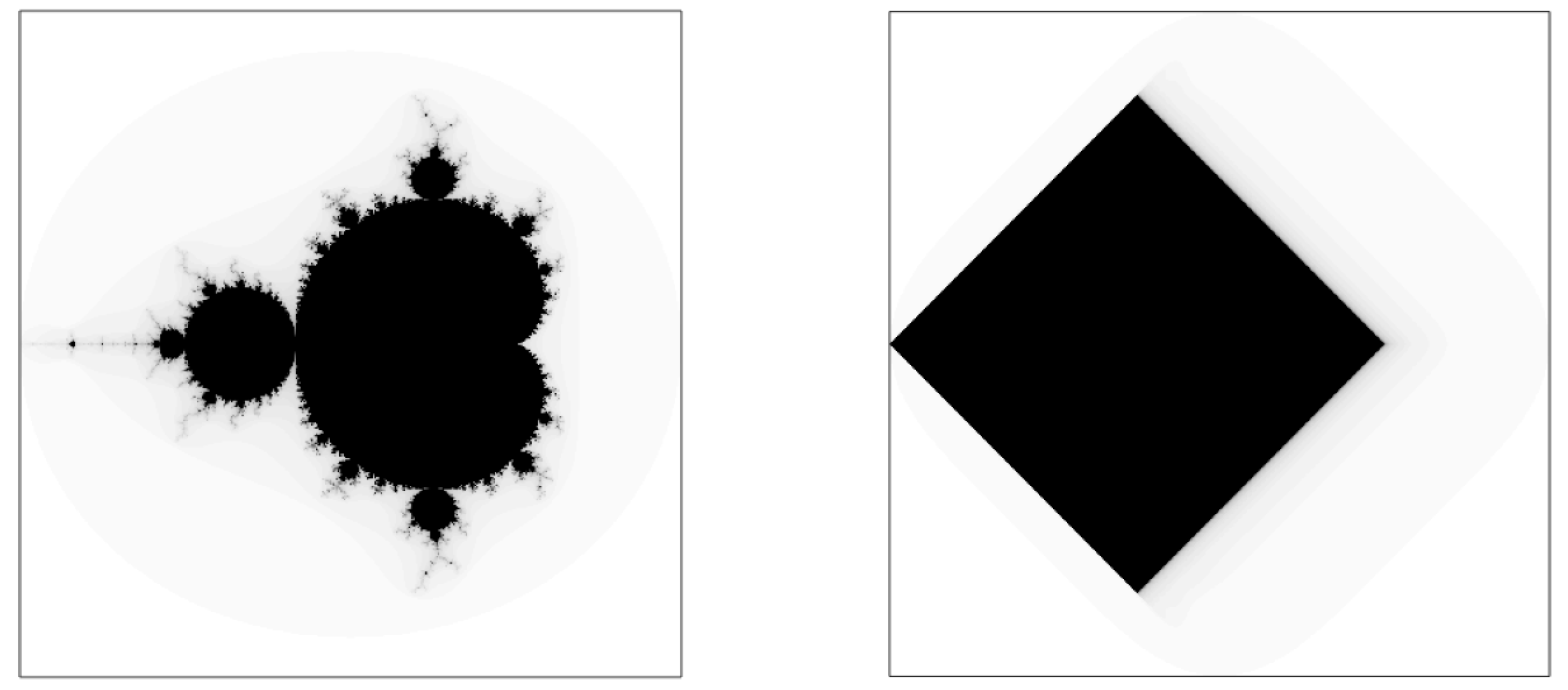

Figure 3 shows a (standard) Mandelbrot set for

and

, a

grid and

iterations [

66]. The central region of the image (the black area) represents those regions in the complex plane when the obits converge. The grey level components of the image (through to white components) are those regions in the complex plane where the orbits ‘escape to infinity’ (diverge) as the iterations proceed. The rate at which this happens determines the grey levels that are displayed. In the practice of computing a set of this type, the numerical floating point values obtained after a finite number of iterations are normalised, quantised and then presented on an grey 8-bit level scale (as given in

Figure 3) or using a specific pseudo-colour map.

While the Mandelbrot set is an icon of Fractal Geometry, it is only one of many such nonlinear complex function iterations that can be considered. In each case, by default,

. A study of the non-standard Mandelbrot set for case when

is given in [

66], a publication that includes the prototype Matlab functions used to conduct the study.

Figure 3 shows the difference between the Mandelbrot sets for

, illustrating that there is a radical difference between a self-similar object (the Mandelbrot set for

) and a Euclidean object (a square for

) in the complex plane.

As illustrated in

Figure 3, unlike the Mandelbrot set, the Euclidean square is symmetric with respect to both the imaginary axis and the real axis shifted to the left of

, a quantification of this result being given in [

66]. Just as the topological dimension of this Euclidean object (a nonstandard Mandelbrot set) is 2, the fractal dimension (specifically, the Hausdorff Dimension) of the boundary of the (standard) Mandelbrot set is also 2. Clearly, this is a case where the fractal dimension is the same for two very different complex plane sets. It is an extreme example of the fact that the fractal dimension alone can not necessarily be used to differentiate between two different fractals (or a fractal and non-fractal set). In other words, two different fractals can have exactly the same fractal dimension. In order to make such a differentiation, it is necessary to use multi-fractals as briefly addressed in the following section.

4.4. Multi-Fractals

There are a wide variety of deterministic and stochastic fractals for all topological dimensions. However, the fractal dimension alone, is not always sufficient to characterise a fractal, and, the fractal dimension is only one of a number of generalised dimensions that can be defined. These dimensions are derived via a measure theoretic analysis in ‘real space’. By way of an example, consider a fractal curve C with a fractal dimension to be the sum of two fractal curves and , with fractal dimensions and , respectively. In this case, , i.e., C is characterised by the larger of the fractal dimensions for the two curves. Thus, if the same value of fractal dimension is found for the merged curve C and .

The need for multi-fractal measures can be appreciated by considering a point-set with a large but finite number of points

N embedded in fractal dimensional space which is then covered a uniform grid of hypercubes of size

and then counting the number

of nonempty boxes. This provides an approach to computing the Fractal Dimension of an arbitrary self-affine object—specifically the ‘Box Dimension’ [

59].

A computational strategy of this type, does not include information concerning the distribution of the number of points in the nonempty boxes. To quantify this issue, suppose there are

points in the

hypercube and let

. The similarity (box-counting) dimension (which only takes account of the total number of nonempty boxes

and not

) is then given by

However, we can also define another metrics such as the the information dimension given by

Similarly, other dimensions can also be considered, leading to a hierarchy of generalised dimensions given by (for

) [

59]

These dimensions have a synergy with the statistical moments for a stochastic field (self-affine or otherwise). Along with other metrics, they form the basis of multi-fractal financial analysis and can be used to develop fuzzy inference systems based on generating a feature vector (whose elements are the values of the elements of the vector) from which a multi-parametric probability space is evolved using training data from which financially significant events are known to occur. In this way, a decision is made based on a fuzzy inference, on the likelihood of a event occurring based on the financial time series. However, as with other techniques in Artificial Intelligence, the key to this approach is the quality and quantity of relevant data which may not always available, especially in a field of study when future events can not necessarily be fully categorised [

67]. Another issue is the number of elements (multi-fractal parameters or otherwise) used to construct the feature vector. Such elements might, for example, include information entropy based metrics, designed to differentiate between order and disorder in a financial signal, when represented as a binary string [

68].

4.5. Self-Affine Functions and Fractional Calculus

Although the concept of a fractional calculus (the calculus of noninteger derivatives and integrals) has been known about for some time (dating back to the work of Niels Abel in the 1820s, which led to the birth of the subject, [

69]), it has only relatively recently experienced a rapid increase in the number of mathematicians who are now contributing to its development and the applications thereof, e.g., [

70,

71]. Even so, the connectivity between fractal geometry and fractional calculus is not always made clear and is therefore worthy of quantification. As this issue will be discussed later in regard to developing a model for a financial signal that is based on the use of fractional calculus under the FMH, we briefly consider a simple quantification of this connectivity.

Let

be a random function of time with a white noise spectrum

where we introduce the notation

, indicating that

and

are Fourier transform pairs, i.e., using the non-unitary definitions,

where

k is the (spatial) frequency. The term ‘white noise spectrum’ used here implies that

has an amplitude spectrum

and thereby a power spectrum

that is uniformly distributed across all frequencies

k.

Suppose we consider filtering

with the function

giving the spectrum

What is the effect of doing this on the scaling properties of the inverse Fourier transform

? The key to answering this question is based on noting that

where

is the Gamma function. Then, using the convolution theorem, we can write the inverse Fourier transform of

as

where ⊗ denotes the convolution integral as given. This expression for

is a model for a linear stationary process, where the sum of

is subject to an inverse scaling by

.

The convolution integral given in Equation (

9) has an important and relevant scaling relationship which is obtained by considering the convolution of the kernel

with the function

when we can write (with

)

The result illustrates that this particular convolution integral exhibits the scaling characteristics defined by Equation (

5).

So what is the relationship between this result and fractional calculus? It is a consequence of noting the generalisation of

to

Thus, if we consider the fractional differential equation (for

)

then upon Fourier transformation, we obtain Equation (

7), which, in turn, can be written as Equation (

9) and has the scaling properties compounded in Equation (

5). Moreover, assuming that

is a dimensionless function, and, given that

x has dimensions of length, then by induction

, in Equation (

10), must have a dimension of

- a fractional dimension. In this context, we can consider the solution to a fractional differential equation to be a solution that describes a self-affine function. The function

is given by the anti-derivative of

which can be written as

Note that, from Equation (

9), if

, then, given that

, we obtain

thereby retaining the standard relationship between a first-order derivative and the anti-derivative or integral of the function

. Further, given that

, to obtain higher-order fractional derivatives, we can first fractionally integrate the function

, say, and then differentiate the result. Thus, for example,

Unlike a standard differential, which defines the gradient of a function at some value

x that is independent of previous values less than

x, a fractional differential of the same function at the same value of

x is dependent on the history of the function due to the convolution of the function with the kernel

. Hence, unlike an integer derivative, a fractional derivative has ‘memory’. This is an important aspect in the approach to analysing financial signals under the FMH because financial signals should be assumed to be influenced by the memory of past financial conditions and decisions. Thus, it may be said that unlike other financial hypotheses such as the EMH as discussed in

Section 3, which do not consider financial systems to have memory, the FMH is intrinsically memory associative. This issue is explored later in

Section 6.3.1 in terms of the form of a memory function that is a characteristic of the Generalised Kolmogorov–Feller Equation.

The analysis considered above is predicated on Equation (

7) which, strictly for a white noise spectrum

, implies that the amplitude spectrum

of a self-affine function

is characterised by the scaling relationship

This is a fundamental ‘signature’ for all self-affine functions, albeit being limited to the one-dimension case. Thus, the exponent is a fundamental parameter for characterising the fractal properties of a financial signal. The analysis of a financial signal in terms of changes in (on a moving window basis) is therefore a primary issue in the characterisation of a financial signal under the FMH.

Equation (

9) is a common example of a fractional integral of order

, the anti-derivative of a fractional differential of the same order. However, there are numerous other definitions for a fractional integral, and, consequently, a fractional differential. Some example of this are presented in [

72], which develops a generic definition of a fractional differo-integral given by

where

Using different Sigmoid-type functions to approximate the sign function , it is then possible to derive a number of different definitions for a fractional derivative. It is also conjectured (with a justification) that there is no limit to the number of self-consistent definitions that can be derived for a fractional differo-integral. Thus, one of the interesting issues in the applications of fractional calculus is the apparent lack of any definition for a fractional differo-integral that can be said to be unique. This has implications for both analytical and numerical procedures that are applicable when modelling a system in terms of a fractional differential equation, for example.

5. The Fractal Market Hypothesis

The Fractal Market Hypothesis emerged in the 1990s with the work of Edgar Peters [

73] (an asset manager) and Benoit Mandelbrot [

33] (a mathematician), for example. This was a natural consequence of the work of mathematicians and others to develop the subject of fractal geometry, an icon of which is Mandelbrot’s famous book

‘The Fractal Geometry of Nature’ first published in 1982 [

33]. The hypothesis states that financial time series exhibit stochastic self-affine structures. This means that variations in prices are still taken to be random walks, but crucially, random walks whose statistical distribution is similar over different scales in time. This principle was actually first conceived by Ralph Elliott who was a professional accountant and reported on the apparent self-affine properties of financial time series data in 1938 [

74]. He was the first to observe that different sized windows of financial time series data could be scaled in such a way that they were statistically similar, i.e., the histogram of the data was (approximately) the same shape. This discovery led to the idea that financial signals were characterised be so called ‘Elliot Waves’ [

75].

The principle of Elliott waves developed in the 1930s and the Fractal Market Hypothesis that evolved in the late 1990s provides a self-consistent financial time series model for the interpretation and analysis of financial signals and investment theory. The key to this is that fractal time series have an inherent memory and thus, the price of a commodity tomorrow is determined in some way by the characteristics of the past. The importance of this observation in financial analysis is self-evident and has been the subject of research over the past few decades. This has, more recently, included the connectivity between memory, self-similarity and fractional calculus, when the fractional derivative of a function depends on the ‘history’ of that function.

One of the reasons that financial time series, and other financial data have emerged to have self-affine properties is due to the innate complexity of the world economic system. This includes the (in)stabilities that have become evident in more recent times. The dynamics of market prices have become a reflection of the multitude of interactions between agents with different investment horizons and different views on the interpretation of information, leading to disruptions, and to crashes when these interactions are broken. In this sense, the sophistication and complexity of the global financial systems that have evolved in recent times, within the context of a genuinely free global market, has led to the development of a self-organised system and self-organised systems tend to exhibit self-affine properties. This property has led to a new approach to modelling financial times series for trading and investment and for the evaluation of financial (in)stability [

76].

5.1. Nonlinear Dynamics and Chaos Theory

Chaos theory is a field of applied mathematics which has found numerous applications in many diverse disciplines including, control engineering, biology and economics, for example. It considers the behaviour of dynamical systems that are highly sensitive to initial conditions (e.g., nonlinear differential equations) and explores the transitions between order and disorder. This is where small and seemingly insignificant differences in initial conditions (due to rounding errors in numerical computations, for example), produce significantly different outcomes, rendering the idea of producing reliable deterministic long-term predictions an impossibility [

77].

It is important to note that this can happen even when dynamical systems are considered to be deterministic. This means that their dynamic behaviour is taken to be fully determined, subject to the initial conditions that are applied, and that there are no random elements or functions involved such as a stochastic source function, for example [

78]. In other words, the determinism associated with these systems does not necessarily make them predictable. This includes simple rule-based trajectories such as the ‘

algorithm’ [

79] which leads to the ‘Collatz’ Conjecture’. In this case an irregular sequence of numbers is generated subject to an initial value (a positive integer). The conjecture is concerned with whether every sequence will always reaches 1 when starting from any positive integer; a conjecture for which there is currently no proof [

80]. In terms of the seemingly irregular stream of numbers that the

algorithm can produce, the stream is an example of ‘Geometric Brownian Motion’.

Systems often become chaotic when there is feedback present, such as in the case of financial and commodity markets. For example, as the value of a commodity rises or falls, traders are inclined to buy or sell. This, in turn, further impacts the asset price, causing it to rise or fall irregularly - ‘chaotically’. Whilst there remains some controversy over the existence of chaotic dynamics in economics, this behaviour has been verified in a variety of systems including fluid dynamics and mechanics, for example. One of the more generic aspects of chaotic systems is that they tend to be the result of a feedback in regard to a nonlinear function and that they are characterised by self-affine structures, as briefly discussed in

Section 4.2.

A study of chaotic stochastic fields was initially carried out by Andrey Kolmogorov [

81,

82,

83,

84], amongst many others. Kolmogorov published his book

‘Foundations of the Theory of Probability’ in 1933, which provided the basis for a modern axiomatic approach to probability theory [

85]. In 1938, he also established the basic theorems for ‘smoothing’ and predicting stationary stochastic processes. Kolmogorov’s work also focused on turbulence, where his publications significantly influenced the field. He also developed, and is considered a founder of the field of algorithmic complexity theory, which is now commonly referred to as Kolmogorov complexity theory and has application in the developments and assessment of encryption algorithms, for example. From this work, Kolmogorov found that there are two kinds of continuous time Markov processes (i.e., stochastic processes with no memory), depending on the assumed behaviour over small intervals of time [

82]. If you assume that ‘in a small time interval there is an overwhelming probability that the state will remain unchanged, then, if it changes, the change may be radical’. This leads to what is called the phenomenon of ‘jump processes’. The other case, Kolmogorov surmised, leads to processes such as those ‘represented by classical diffusion and by Brownian motion’.

In addition to Kolmogorov, William Feller studied the relationship between Markov chains and differential equations. His theory on generators of stochastic processes, gave rise to the theory of ‘Feller Operators’ (i.e., a Markov process with a Feller transition function). As a result of these relationships, the diffusion and jump type properties associated with the Kolmogorov, Fokker–Planck [

86] and Kolmogorov–Feller [

87] equations makes such equations appropriate for modelling stochastic functions, and, in particular, nonstationary dynamic behaviour. In this context, the Generalised Kolmogorov–Feller Equation is introduced later on in this work in regard to developing a rate equation for a financial signal which incurs a so-called ‘memory function’.

Despite initial insights in the early part of the 20th Century, chaos theory only really became formalised after the 1950s, when it started to become evident that linear systems theory (the prevailing systems theory of the time), could not explain the observed behaviour of many dynamic systems. The most widely known research of this time was that of Edward Lorenz in 1961, which was concerned with the behaviour of weather systems [

88]. It was in this study that he first coined the term the ‘butterfly effect’. In a similar fashion to Modern Portfolio Theory, the main catalyst for the wider development and acceptance of chaos theory was the digital computer which allowed repeated iterations of mathematical formulae to be carried out in more detail and to a greater accuracy than ever before.

Another important development (and one of particular relevance), was the introduction of the ‘Lyaponuv exponent’, e.g., [

89,

90,

91]. The Lyapunov exponent of a dynamical system, characterises a property of the system that is concerned with the rate of separation of infinitesimally close trajectories [