Entrepreneurship as a Neglected Pitfall in Future Finnish Teachers’ Readiness to Teach 21st Century Competencies and Financial Literacy: Expectancies, Values, and Capability

Abstract

1. Introduction

1.1. The Need for 21st Century Competencies

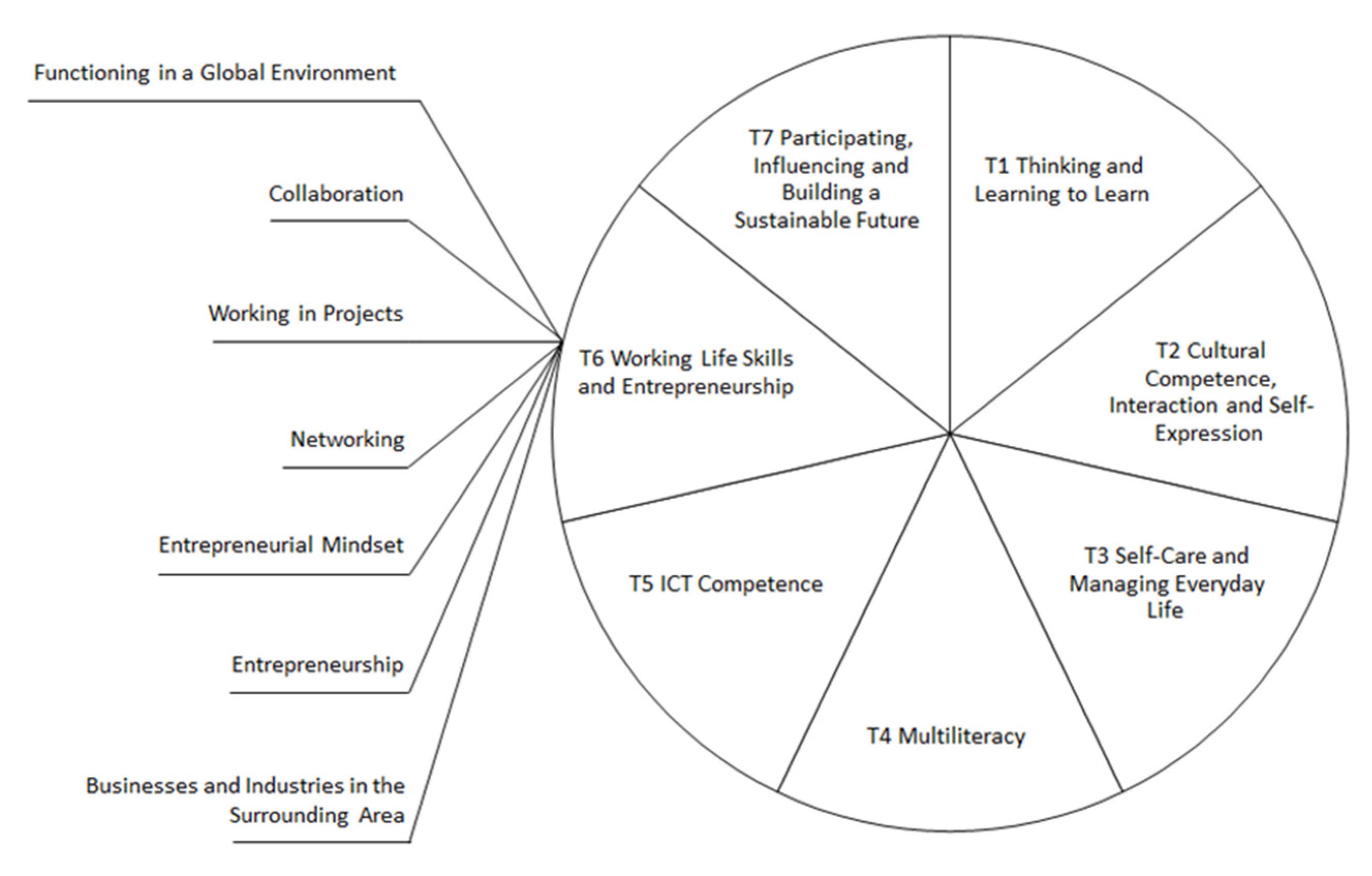

1.2. Entrepreneurship Education in the Finnish National Curricula

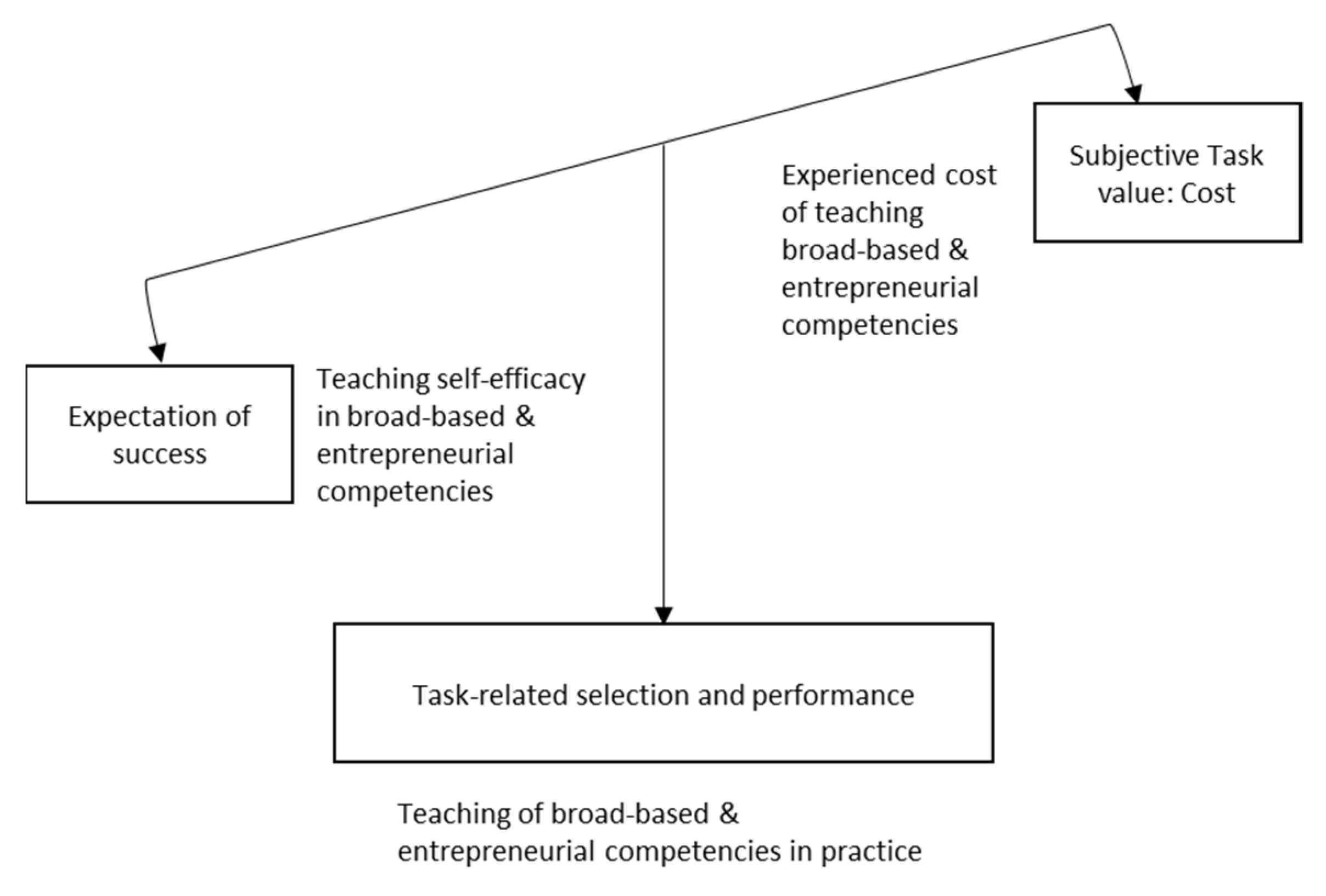

1.3. Expectancy-Value Theory and Teacher Self-Efficacy

2. Materials and Methods

2.1. Sample

2.2. Measures

2.3. Data Analysis

3. Results

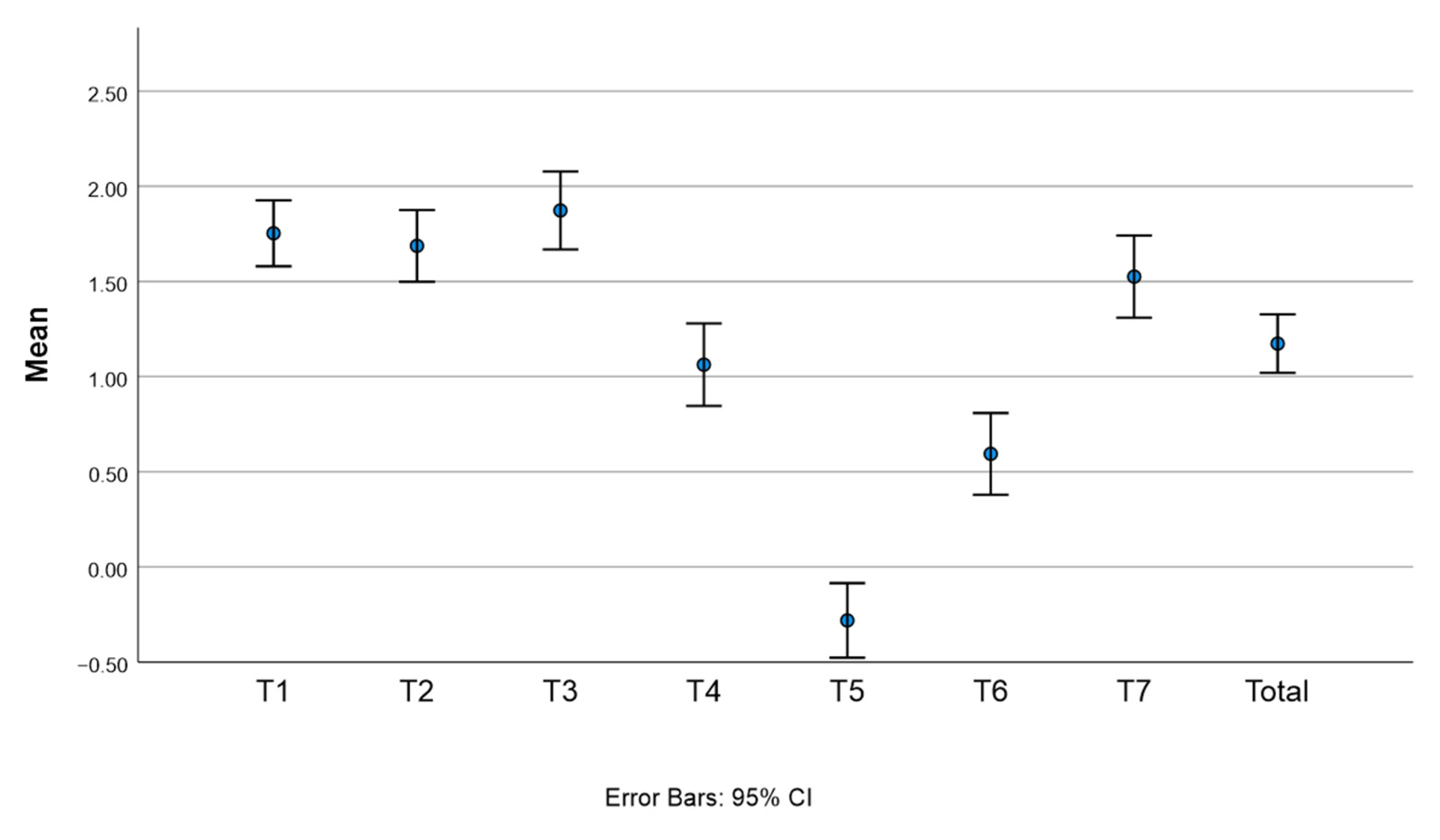

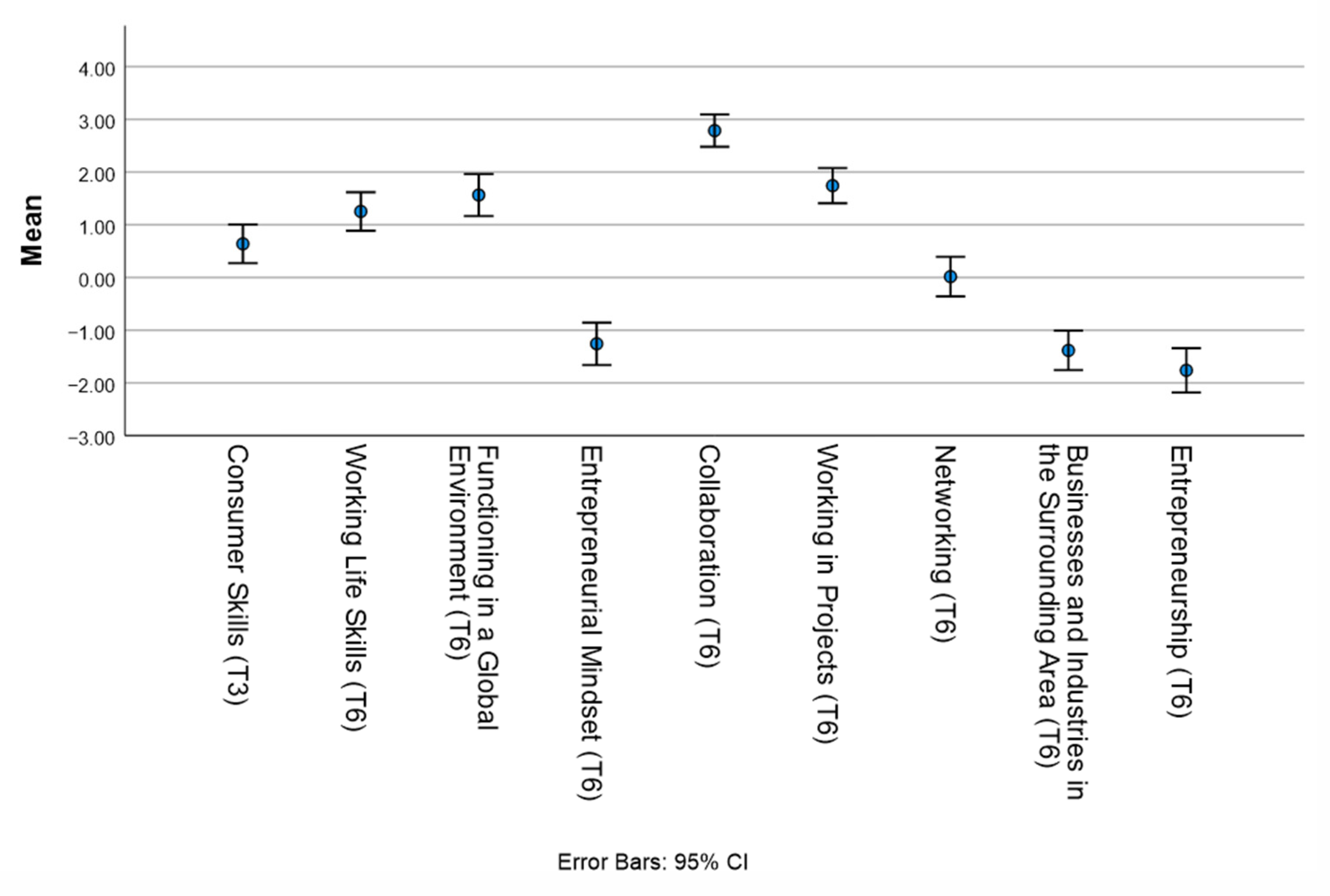

3.1. Expectancy-Values Regarding the Teaching of Broad-Based Competencies

3.2. Teaching Self-Efficacy in Entrepreneurial Competencies, Objective Financial Knowledge, Subjective Financial Capability, and the Related Teacher Background Factors

4. Discussion

4.1. Practical Implications

4.2. Methodological Limitations

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Jardim, J. Entrepreneurial Skills to Be Successful in the Global and Digital World: Proposal for a Frame of Reference for Entrepreneurial Education. Educ. Sci. 2021, 11, 356. [Google Scholar] [CrossRef]

- DigiConsumers Research Project. Available online: digiconsumers.fi/en (accessed on 28 April 2022).

- Being a 21st Century Educator. Available online: http://www.nea.org/assets/docs/A-Guide-to-Four-Cs.pdf (accessed on 28 April 2022).

- Finnish National Board of Education (FNBE). Finnish National Core Curriculum for Basic Education; Finnish National Board of Education (FNBE): Helsinki, Finland, 2014. [Google Scholar]

- Lonka, K. Phenomenal Learning from Finland; Edita Publishing: Helsinki, Finland, 2018. [Google Scholar]

- Trilling, B.; Fadel, C. 21st Century Skills. Learning for Life in Our Times; John Wiley & Sons: Hoboken, NJ, USA, 2009. [Google Scholar]

- OECD. Learning Compass 2030. Conceptual Learning Framework. OECD Future of Education and Skills 2030. 2019. Available online: https://www.oecd.org/education/2030-project/teaching-and-learning/learning/learning-compass-2030/OECD_Learning_Compass_2030_concept_note.pdf (accessed on 28 April 2022).

- Organisation for Economic Cooperation and Development. PISA 2021 Financial Literacy Analytical and Assessment Framework; Organisation for Economic Cooperation and Development: Paris, France, 2019. [Google Scholar]

- Willis, L.E. Finance-Informed Citizens, Citizen-Informed Finance: An Essay Occasioned by the International Handbook of Financial Literacy. J. Soc. Sci. Educ. 2017, 16, 16–27. [Google Scholar] [CrossRef]

- Björklund, M.; Sandahl, J. Financial Literacy as Citizenship Education—A Viable Prospect? J. Soc. Sci. Educ. 2020, 19, 4–20. [Google Scholar]

- Hastings, J.S.; Madrian, B.C.; Skimmyhorn, W.L. Financial Literacy, Financial Education, and Economic Outcomes. Annu. Rev. Econ. 2013, 5, 347–373. [Google Scholar] [CrossRef]

- Organisation for Economic Cooperation and Development. National Strategies for Financial Education; OECD/INFE Policy Handbook: Paris, France, 2015. [Google Scholar]

- Walstad, W.; Tharayil, A.; Wagner, J. Financial literacy and financial education in high school. In Handbook of Consumer Finance Research; Xiao, J.J., Ed.; Springer International Publishing: Berlin, Germany, 2016; pp. 131–139. [Google Scholar]

- Oksanen, A.; Aaltonen, M.; Rantala, K. Debt Problems and Life Transitions: A Register-Based Panel Study of Finnish Young People. J. Youth Stud. 2016, 19, 1194–1203. [Google Scholar] [CrossRef]

- Dwivedi, Y.K.; Ismagilova, E.; Hughes, D.L.; Carlson, J.; Filieri, R.; Jacobson, J.; Jain, V.; Karjaluoto, H.; Kefi, H.; Krishen, A.S.; et al. Setting the future of digital and social media marketing research: Perspectives and research propositions. Int. J. Inf. Manag. 2021, 59, 102168. [Google Scholar] [CrossRef]

- European Commission. Competence Frameworks: The European Approach to Teach. and Learn. 21st Century Skills. 2016. Available online: https://ec.europa.eu/jrc/en/news/competence-frameworks-european-approach-teach-and-learn-21st-century-skills (accessed on 28 April 2022).

- Björklund, M. Teaching Financial Literacy: Competence, Context and Strategies among Swedish Teachers. J. Soc. Sci. Educ. 2019, 18, 28–48. [Google Scholar]

- Leumann, S. Representing Swiss Vocational Education and Training Teachers’ Domain-Specific Conceptions of Financial Literacy Using Concept Maps. Citizsh. Soc. Econ. Educ. 2017, 16, 19–38. [Google Scholar] [CrossRef]

- Blue, L.; Grootenboer, P.; Brimble, M. Financial Literacy Education in the Curriculum: Making the Grade or Missing the Mark? Int. Rev. Econ. Educ. 2014, 16, 51–62. [Google Scholar] [CrossRef]

- Lee, N. Financial Literacy and Financial Literacy Education. What Might be the Components of an Effective Financial Literacy Curriculum? Ph.D. Thesis, Department of Lifelong and Comparative Education, Faculty of Policy and Society, Institute of Education, University of London, London, UK, 2010. Available online: https://core.ac.uk/download/pdf/40025499.pdf (accessed on 28 April 2022).

- Pajari, K.; Harmoinen, S. Teachers’ Perceptions of Consumer Education in Primary Schools in Finland. Discourse Commun. Sustain. Educ. 2019, 10, 72–88. [Google Scholar] [CrossRef]

- Eccles-Parsons, J.S.; Adler, T.F.; Futterman, R.; Goff, S.B.; Kaczala, C.M.; Meece, J.L.; Midgley, C. Expectancies, Values, and academic behaviors. In Achievement and Achievement Motives; Spence, J.T., Ed.; W.H. Freeman: New York, NY, USA, 1983; pp. 75–146. [Google Scholar]

- Feather, N.T. Values, Valences, and Choice: The influence of Values on the Perceived Attractiveness and Choice of Alternatives. J. Pers. Soc. Psychol. 1995, 68, 1135–1151. [Google Scholar] [CrossRef]

- Dassa, L.; Nichols, B. Self-Efficacy or Overconfidence? Comparing Preservice Teacher Self-Perceptions of Their Content Knowledge and Teaching Abilities to the Perceptions of Their Supervisors. New Educ. 2019, 15, 156–174. [Google Scholar] [CrossRef]

- Arruti, A.; Paños-Castro, J. How do Future Primary Education Student Teachers Assess their Entrepreneurship Competences? An Analysis of Their Self-Perceptions. J. Entrep. Educ. 2020, 23, 1–13. [Google Scholar]

- Grigg, R. EntreCompEdu, a professional development framework for entrepreneurial education. Educ. Train. 2020, 63, 1058–1072. [Google Scholar] [CrossRef]

- Green, S.K. Using an Expectancy-Value Approach to Examine Teachers’ Motivational Strategies. Teach. Teach. Educ. 2002, 18, 989–1005. [Google Scholar] [CrossRef]

- Kent, A.M.; Giles, R.M. Preservice Teachers’ Technology Self-Efficacy. SRATE J. 2017, 26, 9–20. [Google Scholar]

- Ranellucci, J.; Rosenberg, J.M.; Poitras, E.G. Exploring Pre-Service Teachers’ Use of Technology: The Technology Acceptance Model and Expectancy–Value Theory. J. Comput. Assist. Lear. 2020, 26, 810–824. [Google Scholar] [CrossRef]

- Leader-Janssen, E.M.; Rankin-Erickson, J.L. Preservice Teachers’ Content Knowledge and Self-Efficacy for Teaching Reading. Lit. Res. Instr. 2013, 52, 204–229. [Google Scholar] [CrossRef]

- Kola, A.J.; Sunday, O.S. A Review of Teacher Self-Efficacy, Pedagogical Content Knowledge (PCK) and Out-Of-Field Teaching: Focusing on Nigerian Teachers. Int. J. Elem. Educ. 2015, 4, 80–85. [Google Scholar]

- Lonka, K.; Makkonen, J.; Litmanen, T.; Berg, M.; Hietajärvi, L.; Kruskopf, M.; Lammassaari, H.; Maksniemi, E.; Nuorteva, M. Road to 21st Century Competence–Evaluation Framework for Transversal Skills in the Finnish Curriculum. 2017. Available online: https://kirstilonka.fi/wp-content/uploads/2018/08/evaluation_framework_microsoft_final.pdf (accessed on 29 June 2022).

- Eccles, J.S.; Wigfield, A. From Expectancy-Value Theory to Situated Expectancy-Value Theory: A Developmental, Social Cognitive, and Sociocultural Perspective on Motivation. Contemp. Educ. Psychol. 2020, 61, 101859. [Google Scholar] [CrossRef]

- Brown, V.A.; Harris, J.A.; Russell, J.Y. Tackling Wicked Problems: Through the Transdisciplinary Imagination; Routledge: London, UK, 2010. [Google Scholar]

- Weber, E.P.; Khademian, A.M. Wicked Problems, Knowledge Challenges, and Collaborative Capacity Builders in Network Settings. Public Adm. Rev. 2008, 68, 334–349. [Google Scholar] [CrossRef]

- Prensky, M. Digital Natives, Digital Immigrants. Horizon 2001, 9, 1–6. [Google Scholar] [CrossRef]

- Tynjälä, P.; Slotte, V.; Nieminen, J.; Lonka, K.; Olkinuora, E. From university to working Life: Graduates’ workplace skills in practice. In Higher Education and Working Life—Collaborations, Confrontations, and Challenges; Elsevier Earli: Amsterdam, The Netherlands, 2006; pp. 77–88. [Google Scholar]

- Ahonen, A.; Kankaanranta, M. Introducing assessment tools for 21st century skills in Finland. In Assessment and Teaching of 21st Century Skills: Methods and Approach; Griffin, P., Care, E., Eds.; Springer: Dordrecht, The Netherlands, 2015; pp. 213–225. [Google Scholar]

- Finnish National Agency for Education. Core Curriculum for General Upper Secondary Schools in a Nutshell. 2021. Available online: https://www.oph.fi/en/statistics-and-publications/publications/core-curriculum-general-upper-secondary-schools-nutshell (accessed on 28 April 2022).

- OECD. OECD Skills Outlook 2021: Why Lifelong Learning is Essential for Modern Society. Available online: https://digital-skills-jobs.europa.eu/en/latest/news/oecd-skills-outlook-2021-why-lifelong-learning-essential-modern-society (accessed on 28 April 2022).

- Autio, M.; Kortesalmi, K.; Ranta, M.; Sekki, S.; Kylkilahti, E. Finnish Home Economics Teachers Enabling Sustainability and Consumer Skills for Young People. In Proceedings of the Canadian Symposium XVI Issues and Directions for Home Economics/Family Studies/Human Ecology Education, Vancouver, BC, Canada, 27–28 February 2021. [Google Scholar]

- European Commission. Entrepreneurship Education: A Guide for Educators. Brussels. 2013. Available online: https://ec.europa.eu/docsroom/documents/7465/attachments/1/translations/en/renditions/pdf (accessed on 28 April 2022).

- Ito, M.; Gutiérrez, K.; Livingstone, S.; Penuel, W.; Rhodes, J.; Salen, K.; Schor, J.; Sefton-Green, J.; Watkins, C. Connected Learning: An Agenda for Research and Design; The Digital Media and Learning Research Hub Reports on Connected Learning: Irvine, CA, USA, 2013. [Google Scholar]

- Halinen, I. The new educational curriculum in Finland. In Improving the Quality of Childhood in Europe; Matthes, M., Pulkkinen, L., Clouder, C., Heys, B., Eds.; Alliance for Childhood European Network Foundation: Brussels, Belgium, 2018; Volume 7, pp. 75–89. [Google Scholar]

- Growing Mind: Sociodigital Participation In and Out of the School Context. Students’ Experiences. 2019. Available online: http://hdl.handle.net/10138/322143 (accessed on 25 April 2022).

- OECD. International Survey of Adult Financial Literacy. 2020. Available online: www.oecd.org/financial/education/launchoftheoecdinfeglobalfinancialliteracysurveyreport.htm (accessed on 29 April 2022).

- Hietanen, L.; Uusiautti, S.; Määttä, K. Enhancing Entrepreneurship in Learners—An Implementation and Evaluation of Entrepreneurship Education Through Music Education. Probl. Educ. 21st Century 2014, 59, 34–47. [Google Scholar] [CrossRef]

- Löfström, J. Yhteiskuntaoppi: Social Studies in Finland. A Country Report. J. Soc. Sci. Educ. 2019, 18, 88–101. [Google Scholar]

- Kortesalmi, M.; Autio, M. Talous-ja kuluttajakasvatus talousosaamisen mahdollistajana [Financial and consumer education enabling financial skills]. Kansantal. Aikakauskirja 2019, 115, 588–603. [Google Scholar]

- Koskinen, H. Domesticating Startup Culture in Finland. Eur. J. Cult. Political Sociol. 2021, 8, 175–196. [Google Scholar] [CrossRef]

- Youth and Economy TAT. TAT Yrityskylä [Me and My City]. 2022. Available online: https://yrityskyla.fi/en/ (accessed on 25 April 2022).

- Wigfield, A.; Eccles, J.S. Expectancy–Value Theory of Achievement Motivation. Contemp. Educ. Psycho. 2000, 25, 68–81. [Google Scholar] [CrossRef]

- Eccles, J.S.; Wigfield, A. Motivational Beliefs, Values, and Goals. Annu. Rev. Psychol. 2002, 53, 109–132. [Google Scholar] [CrossRef]

- Bandura, A. Social cognitive theory. In Annals of Child. Development. Six Theories of Child. Development: Revised Formulations and Current Issues; Vasta, R., Ed.; JAI Press: Greenwich, CT, USA, 1989; Volume 6, pp. 1–60. [Google Scholar]

- Bandura, A. Self-Efficacy: The Exercise of Control; W.H. Freeman: New York, NY, USA, 1997. [Google Scholar]

- Klassen, R.; Chiu, M.M. Effects on Teachers’ Self-Efficacy and Job Satisfaction: Teacher Gender, Years of Experience, and Job Stress. J. Educ. Psychol. 2010, 102, 741–756. [Google Scholar] [CrossRef]

- Çakiroglu, J.; Çakiroglu, E.; Boone, W.J. Pre-Service Teacher Self-Efficacy Beliefs Regarding Science Teaching: A Comparison of Pre-Service Teachers in Turkey and the USA. Sci. Educ. 2005, 14, 31–40. [Google Scholar] [CrossRef][Green Version]

- Sharp, A.C.; Brandt, L.; Tuft, E.A.; Jay, S. Relationship of Self-Efficacy and Teacher Knowledge for Prospective Elementary Education Teachers. Univers. J. Educ. Res. 2016, 4, 2432–2439. [Google Scholar] [CrossRef][Green Version]

- Gibson, S.; Dembo, M.H. Teacher Efficacy: A Construct Validation. J. Educ. Psych. 1984, 76, 569. [Google Scholar] [CrossRef]

- Tschannen-Moran, M.; Hoy, A.W. Teacher efficacy: Capturing an elusive construct. Teach. Teach. Educ. 2001, 17, 783–805. [Google Scholar] [CrossRef]

- Rotter, J.B. Generalized Expectancies for Internal Versus External Control of Reinforcement. Psychol. Monogr. 1996, 80, 1–28. [Google Scholar] [CrossRef]

- Malinen, O.P.; Savolainen, H.; Engelbrecht, P.; Xu, J.; Nel, M.; Nel, N.; Tlale, D. Exploring Teacher Self-Efficacy for Inclusive Practices in Three Diverse Countries. Teach. Teach. Educ. 2013, 33, 34–44. [Google Scholar] [CrossRef]

- Thomson, M.M.; Palermo, C.J. Using an Expectancy-Value Model to Understand Teaching Motivation among Nontraditional Preservice Teachers: A Phenomenological Study Approach. Action Teach. Educ. 2018, 40, 151–168. [Google Scholar] [CrossRef]

- Wilson, F.; Kickul, J.; Marlino, D. Gender, Entrepreneurial Self–Efficacy, and Entrepreneurial Career Intentions: Implications for Entrepreneurship Education. Entrep. Theory Pract. 2007, 31, 387–406. [Google Scholar] [CrossRef]

- Pihie, Z.A.; Bagheri, A. Teachers’ and Students’ Entrepreneurial Self-Efficacy: Implication for Effective Teaching Practices. Procedia Soc. Behav. Sci. 2011, 29, 1071–1080. [Google Scholar] [CrossRef]

- Salgado, D. The Relationship between Teacher Experience and the Entrepreneurial Orientation of Teachers. Ph.D Thesis, Grand Canyon University, Phoenix, AZ, USA, 2016. [Google Scholar]

- Seikkula-Leino, J.; Ruskovaara, E.; Ikavalko, M.; Mattila, J.; Rytkola, T. Promoting Entrepreneurship Education: The Role of the Teacher? Educ. Train. 2010, 52, 117–127. [Google Scholar] [CrossRef]

- Serido, J.; Shim, S.; Tang, C. A Developmental Model of Financial Capability: A Framework for Promoting a Successful Transition to Adulthood. Int. J. Behav. Dev. 2013, 37, 287–297. [Google Scholar] [CrossRef]

- Lusardi, A.; Mitchell, O.S. The Economic Importance of Financial Literacy: Theory and Evidence. J. Econ. Lit. 2014, 52, 5–44. [Google Scholar] [CrossRef] [PubMed]

- Lusardi, A.; Tufano, P. Debt Literacy, Financial Experiences, and Overindebtedness. J. Pension Econ. Finan. 2015, 14, 332–368. [Google Scholar] [CrossRef]

- Van Rooij, M.; Lusardi, A.; Alessie, R. Financial Literacy and Stock Market Participation. J. Financ. Econ. 2011, 101, 449–472. [Google Scholar] [CrossRef]

- Allgood, S.; Walstad, W.B. The Effects of Perceived and Actual Financial Literacy on Financial Behaviors. Econ. Inq. 2016, 54, 675–697. [Google Scholar] [CrossRef]

- Brown, M.; Graf, R. Financial Literacy and Retirement Planning in Switzerland. Numeracy 2013, 6, 2–23. [Google Scholar] [CrossRef]

- Amagir, A.; Groot, W.; Maassen van den Brink, H.; Wilschut, A. Financial Literacy of High School Students in the Netherlands: Knowledge, Attitudes, Self-Efficacy, and Behavior. Int. Rev. Econ. Educ. 2020, 34, 100185. [Google Scholar] [CrossRef]

- Danes, S.M.; Haberman, H. Teen Financial Knowledge, Self-Efficacy, and Behavior: A Gendered View. J. Financ. Couns. Plan. 2007, 18, 48–60. [Google Scholar]

- Obschonka, M.; Hakkarainen, K.; Lonka, K.; Salmela-Aro, K. Entrepreneurship as a twenty-first century skill: Entrepreneurial alertness and intention in the transition to adulthood. Small Bus. Econ. 2017, 48, 487–501. [Google Scholar] [CrossRef]

- Raworth, K. Doughnut Economics: Seven Ways to Think Like a 21st-Century Economist; Chelsea Green Publishing: White River Junction, VT, USA, 2017. [Google Scholar]

- Wittau, F. Consumer Education as Counselling? Teacher Beliefs about Consumption and (Social Science) Education. J. Soc. Sci. Educ. 2021, 20, 147–173. [Google Scholar] [CrossRef]

- Vedenpää, I.; Lonka, K. Teachers’ and teacher students’ conceptions of learning and creativity. Creativeness 2014, 5, 1821. [Google Scholar] [CrossRef]

- Lusardi, A.; Mitchell, O. Financial Literacy and Retirement Planning: New Evidence from the Rand American Life Panel. Mich. Retire. Res. Cent. Res. Pap. No. WP 2007, 157. [Google Scholar] [CrossRef]

- Skagerlund, K.; Lind, T.; Strömbäck, C.; Tinghög, G.; Västfjäll, D. Financial Literacy and the Role of Numeracy. How Individuals’ Attitude and Affinity with Numbers Influence Financial Literacy. J. Behav. Exp. Econ. 2018, 74, 18–25. [Google Scholar] [CrossRef]

- Wigfield, A.; Gladstone, J.R. What does expectancy-value theory have to say about motivation and achievement in times of change and uncertainty? In Motivation in Education at a Time of Global Change (Advances in Motivation and Achievement); Emerald Publishing Limited: Bingley, UK, 2019; Volume 20, pp. 15–32. [Google Scholar]

- Wilska, T.-A. Kuluttajaksi sosiaalistumisen haasteet ja kuluttajakasvatus jälkimodernissa kulutusyhteiskunnassa [The Challenges of Consumer Socialization and Consumer Education in the Postmodern Consumer Society]. Aikuiskasvatus 2014, 1, 43–48. [Google Scholar] [CrossRef]

- Löfström, J.; van den Berg, M. Making Sense of the Financial Crisis in Economic Education: An Analysis of the Upper Secondary School Studies Teaching in Finland in the 2010′s. J. Soc. Sci. Educ. 2013, 12, 53–68. [Google Scholar]

- OECD. Can behavioural economics be used to make financial education more effective? In Improving Financial Education Efficiency; OECD—Bank of Italy Symposium on Financial Literacy: Rome, Italy, 2011; pp. 65–101. [Google Scholar]

| Broad-Based Competence | Example Sub-Level Competence, n of Items a | Teaching Self-Efficacy (TSE) M|SD|Alpha | Interest M|SD|Alpha | Cost M|SD|Alpha | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| T1 Thinking and Learning to Learn | Critical Thinking | 5 | 3.89 | 0.89 | 0.811 | 5.42 | 0.71 | 0.799 | 2.07 | 1.15 | 0.885 |

| T2 Cultural Competence, Interaction, and Self-Expression | Self-Awareness and Emotional Skills | 3 | 3.85 | 1.00 | 0.671 | 5.20 | 0.81 | 0.573 | 2.12 | 1.20 | 0.805 |

| T3 Self-Care and Managing Everyday Life | Promoting Well-being and Health | 6 | 4.07 | 0.96 | 0.788 | 5.12 | 0.83 | 0.819 | 2.33 | 1.26 | 0.895 |

| T4 Multiliteracy | Self-Expression and Communication | 3 | 3.56 | 1.04 | 0.713 | 4.89 | 0.94 | 0.627 | 2.47 | 1.31 | 0.769 |

| T5 Information and Communication Technology (ICT) Competence | Computational thinking | 9 | 3.03 | 0.98 | 0.911 | 4.06 | 1.04 | 0.916 | 3.32 | 1.18 | 0.916 |

| T6 Working Life Skills and Entrepreneurship | Entrepreneurial mindset | 8 | 3.62 | 1.02 | 0.876 | 4.76 | 1.01 | 0.862 | 3.14 | 1.36 | 0.869 |

| T7 Participating, Influencing, and Building a Sustainable Future | Agency in a Democratic Society | 7 | 3.89 | 1.01 | 0.892 | 5.09 | 0.85 | 0.846 | 2.37 | 1.26 | 0.906 |

| M Total | T1–T7 | 41 | 3.70 | 0.72 | 0.863 | 4.94 | 0.64 | 0.850 | 2.55 | 0.99 | 0.903 |

| Sub-Level Competence | Teaching Self-Efficacy (TSE) M|SD | Interest M|SD | Cost M|SD | |||

|---|---|---|---|---|---|---|

| Consumer Skills (T3) | 3.78 | 1.12 | 4.89 | 1.15 | 2.95 | 1.43 |

| Working Life Skills (T6) | 3.92 | 1.17 | 5.14 | 0.97 | 2.96 | 1.54 |

| Functioning in a Global Environment (T6) | 3.93 | 1.23 | 5.07 | 1.06 | 2.44 | 1.44 |

| Entrepreneurial Mindset (T6) | 2.74 | 1.33 | 3.86 | 1.52 | 3.83 | 1.49 |

| Collaboration (T6) | 4.57 | 1.05 | 5.43 | 0.86 | 1.28 | 1.11 |

| Working in Projects (T6) | 3.99 | 1.18 | 4.63 | 1.25 | 2.38 | 1.28 |

| Networking (T6) | 3.39 | 1.28 | 4.52 | 1.28 | 3.27 | 1.34 |

| Businesses and Industries in the Surrounding Area (T6) | 2.84 | 1.30 | 3.95 | 1.39 | 3.88 | 1.41 |

| Entrepreneurship (T6) | 2.56 | 1.34 | 3.62 | 1.58 | 4.08 | 1.51 |

| Group | Objective Financial Knowledge a | Subjective Financial Capability | TSE in Entrepreneurship | TSE in Entrepreneurial Mindset | TSE in Businesses and Industries… | TSE in Consumer Skills | TSE in Entrepreneurial Competencies |

|---|---|---|---|---|---|---|---|

| Subject | |||||||

| 0.065 | <0.001 | 0.422 | 0.361 | 0.071 | 0.017 | 0.331 | |

| Financial | 4.70 (2.13) | 4.45 (0.93) | 2.50 (1.36) | 2.63 (1.32) | 2.94 (1.45) | 3.99 (1.16) | 2.69 (1.25) |

| Other | 3.97 (2.32) | 3.81 (1.02) | 2.47 (1.29) | 2.69 (1.28) | 2.70 (1.19) | 3.68 (1.12) | 2.63 (1.09) |

| Subject | |||||||

| <0.001 | 0.022 | 0.446 | 0.307 | 0.146 | 0.011 | 0.443 | |

| STEM | 5.71 (1.31) | 4.46 (1.01) | 2.47 (1.36) | 2.57 (1.38) | 2.85 (1.38) | 4.09 (1.21) | 2.62 (1.28) |

| Other | 3.91 (2.31) | 3.92 (1.02) | 2.44 (1.29) | 2.68 (1.26) | 2.63 (1.20) | 3.67 (1.10) | 2.60 (1.08) |

| Gender | |||||||

| 0.027 | 0.058 | 0.453 | 0.092 | 0.336 | 0.093 | 0.198 | |

| Female | 3.92 (2.32) | 3.91 (1.03) | 2.47 (1.32) | 2.63 (1.28) | 2.74 (1.26) | 3.70 (1.12) | 2.62 (1.12) |

| Male | 4.84 (2.07) | 4.24 (1.00) | 2.49 (1.24) | 2.84 (1.29) | 2.80 (1.21) | 3.88 (1.18) | 2.73 (1.14) |

| n | M | Med | Mod | SD | 1 | 2 | 3 | 4 | 5 | 6 | 7 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | Objective Financial Knowledge a | 104 | 4.20 | 5.00 | 5.00 | 2.27 | 1 | ||||||

| 2 | Subjective Financial Capability | 111 | 4.01 | 3.80 | 3.40 | 1.03 | 0.365 ** | 1 | |||||

| 3 | TSE in Entrepreneurship | 368 | 2.47 | 2.00 | 1.00 | 1.30 | 0.209 * | 0.377 ** | 1 | ||||

| 4 | TSE in Entrepreneurial Mindset | 370 | 2.68 | 3.00 | 2.00 | 1.29 | 0.262 ** | 0.396 ** | 0.809 ** | 1 | |||

| 5 | TSE in Businesses | 369 | 2.75 | 3.00 | 3.00 | 1.25 | 0.039 | 0.320 ** | 0.582 ** | 0.526 ** | 1 | ||

| 6 | TSE in Consumer Skills | 376 | 3.74 | 4.00 | 4.00 | 1.13 | 0.191 | 0.390 ** | 0.242 ** | 0.319 ** | 0.341 ** | 1 | |

| 7 | Age | 650 | 27.72 | 24.00 | 21.00 | 8.61 | 0.298 ** | 0.252 ** | 0.180 ** | 0.205 ** | 0.011 | 0.060 | 1 |

| Effect | Estimate | SE | 95% CI | p | |

|---|---|---|---|---|---|

| LL | UL | ||||

| Intercept | 0.041 | 0.559 | −1.070 | 1.151 | 0.942 |

| Objective Financial Knowledge a | 0.002 | 0.051 | −0.099 | 0.102 | 0.971 |

| Subjective financial capability b | 0.369 | 0.121 | 0.129 | 0.609 | 0.003 |

| Teaching financial subjects | −0.088 | 0.245 | −0.574 | 0.398 | 0.721 |

| Teaching STEM subjects | −0.308 | 0.291 | −0.886 | 0.271 | 0.293 |

| Female | −0.147 | 0.243 | −0.630 | 0.335 | 0.546 |

| Age | 0.016 | 0.012 | −0.008 | 0.040 | 0.186 |

| TSE in Consumer Skills b | 0.200 | 0.094 | 0.013 | 0.387 | 0.036 |

| Research Question | Findings |

|---|---|

| RQ1. What are the greatest pitfalls in the future teachers’ readiness to teach the 21st century competencies based on their expectancy-value beliefs (i.e., interest, teaching self-efficacy, and cost)? |

|

| Are there some aspects within the working life and entrepreneurship competencies as well as financial literacy that the future teachers find particularly difficult or burdensome to teach, as according to Figure 1? |

|

| RQ2. How are teaching self-efficacies (TSE) in the different aspects of entrepreneurial competence and teacher background factors such as taught subject, age, and gender related to the future teachers’ objective and subjective financial capability? |

|

| Most importantly, what factors predict future teachers’ TSE in entrepreneurship: financial capability, TSE in consumer skills, or the background factors of taught subject, age, and gender? |

|

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ranta, M.; Kruskopf, M.; Kortesalmi, M.; Kalmi, P.; Lonka, K. Entrepreneurship as a Neglected Pitfall in Future Finnish Teachers’ Readiness to Teach 21st Century Competencies and Financial Literacy: Expectancies, Values, and Capability. Educ. Sci. 2022, 12, 463. https://doi.org/10.3390/educsci12070463

Ranta M, Kruskopf M, Kortesalmi M, Kalmi P, Lonka K. Entrepreneurship as a Neglected Pitfall in Future Finnish Teachers’ Readiness to Teach 21st Century Competencies and Financial Literacy: Expectancies, Values, and Capability. Education Sciences. 2022; 12(7):463. https://doi.org/10.3390/educsci12070463

Chicago/Turabian StyleRanta, Mette, Milla Kruskopf, Marilla Kortesalmi, Panu Kalmi, and Kirsti Lonka. 2022. "Entrepreneurship as a Neglected Pitfall in Future Finnish Teachers’ Readiness to Teach 21st Century Competencies and Financial Literacy: Expectancies, Values, and Capability" Education Sciences 12, no. 7: 463. https://doi.org/10.3390/educsci12070463

APA StyleRanta, M., Kruskopf, M., Kortesalmi, M., Kalmi, P., & Lonka, K. (2022). Entrepreneurship as a Neglected Pitfall in Future Finnish Teachers’ Readiness to Teach 21st Century Competencies and Financial Literacy: Expectancies, Values, and Capability. Education Sciences, 12(7), 463. https://doi.org/10.3390/educsci12070463