Climate Services for Renewable Energy in the Nordic Electricity Market

Abstract

1. Introduction

- (I).

- The framing of the current use of CS information on the Nordic power market, including the way that historical data and forecasts are used by different stakeholders, including hydropower producers, transmission system operators and traders;

- (II).

- Identify short- and long-term potential benefits of CSs and assess these in relation to the CS needs of key stakeholders and decision makers in the renewable energy sector and in electricity markets, and with the information provided today by key CS providers, and finally;

- (III).

- Discuss how CSs could support the introduction of higher shares of wind, solar and hydropower in the Nordic electricity market and in turn facilitate that electricity markets are managed more efficiently in the short term, and that future investments, in particular into renewables, take climate change and variability into consideration. The integration of large shares of fluctuating renewable energy in the power systems could be supported by increasing the scale of electricity trade, and this again implies that CSs have the potential to become a key information source for power utilities and market traders. The assessment of the increased share of renewables employs recent and relevant per-country projections from the European Commission of future energy system compositions.

2. Materials and Methods

2.1. Stakeholder Mapping and User Needs

2.2. Current and Projected Trends in Renewables and the Potential of Climate Services

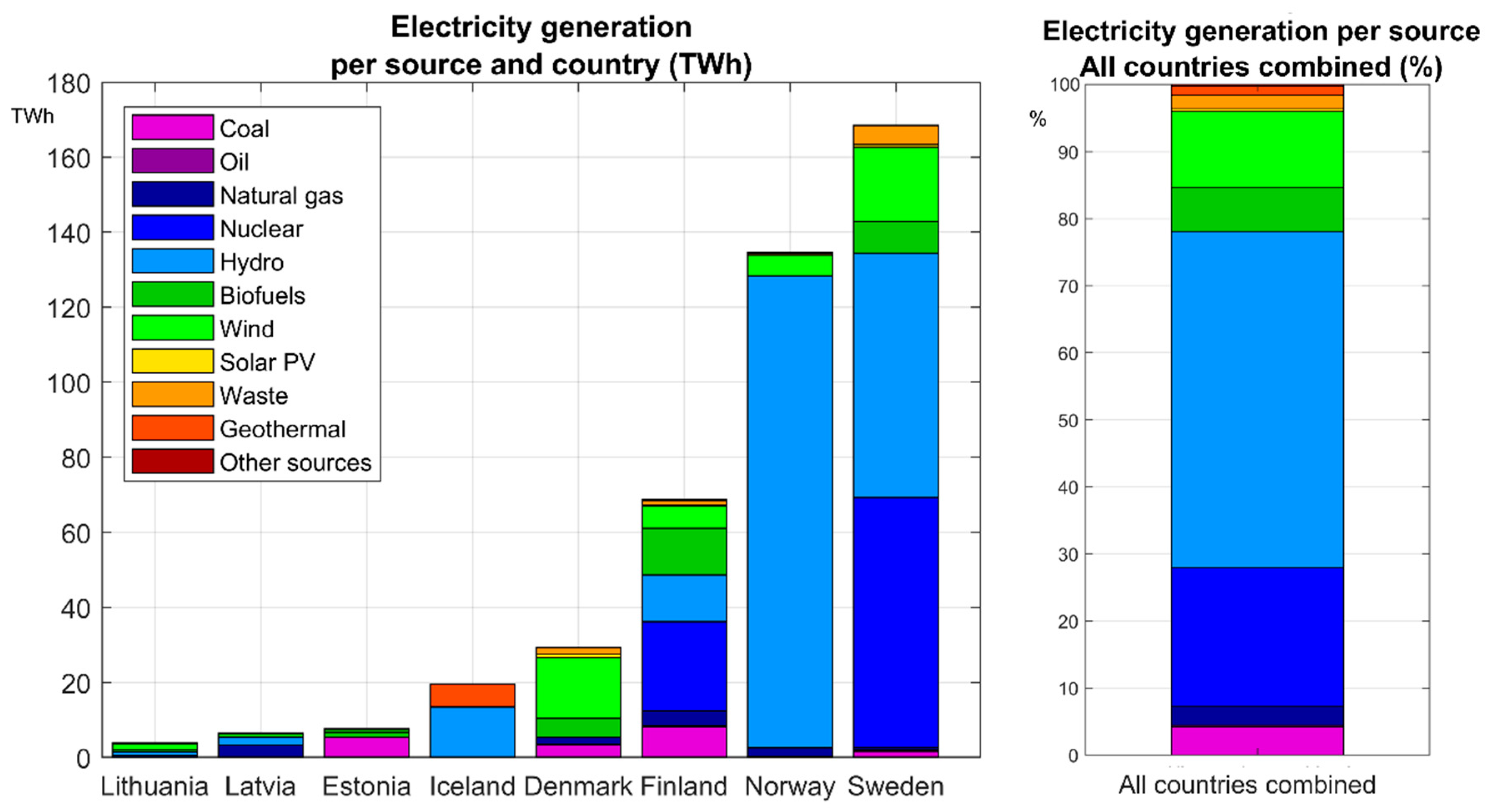

- The current (2019) composition of energy sources in the Nordic and Baltic countries [24].

- Historical trends in the observed long-term monthly and yearly inflow to the Norwegian hydro-reservoir system (in TWh, 1958–2019). Norway, by far, constitutes the largest producer of hydropower in the Nordics. Historical data for production planning are provided by the Norwegian Water Resources and Energy Directorate (NVE). Daily data on the inflow to the Norwegian hydropower system from 82 representative measurement stations were extracted from [28] and subsequently processed, converted into energy units and aggregated.

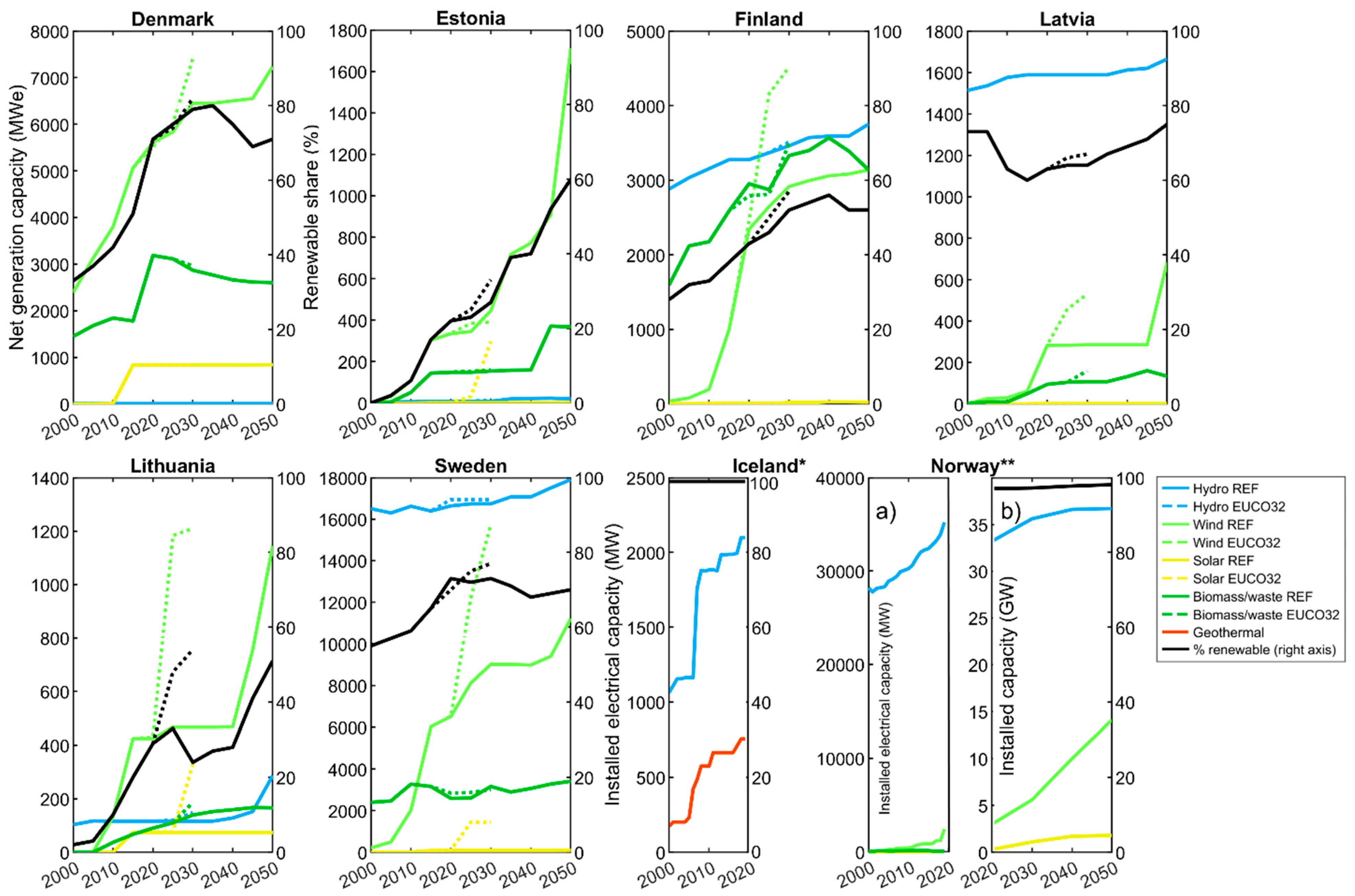

- The projected future composition of renewables, and their share of the total electricity generation level, in the Nordic and Baltic countries until 2050. These projections were based on the scenarios developed by the European Commission to assess energy, transport and climate mitigation targets. Specifically, the “Reference” [29] and “EUCO3232.5” [30] scenarios were employed representing, respectively, a reference/benchmark scenario to test the effect of new policies against and a scenario with greenhouse gas emission reductions amounting to a 32.5% energy efficiency target and 32% renewables by 2030.

3. Results

3.1. The Nordic Energy Market

3.2. Renewable Energy in the Market

3.3. Stakeholders

3.3.1. Electricity Producers

3.3.2. Transmission System Operators

3.3.3. Market Traders

3.4. Climate Services for the Electricity Market

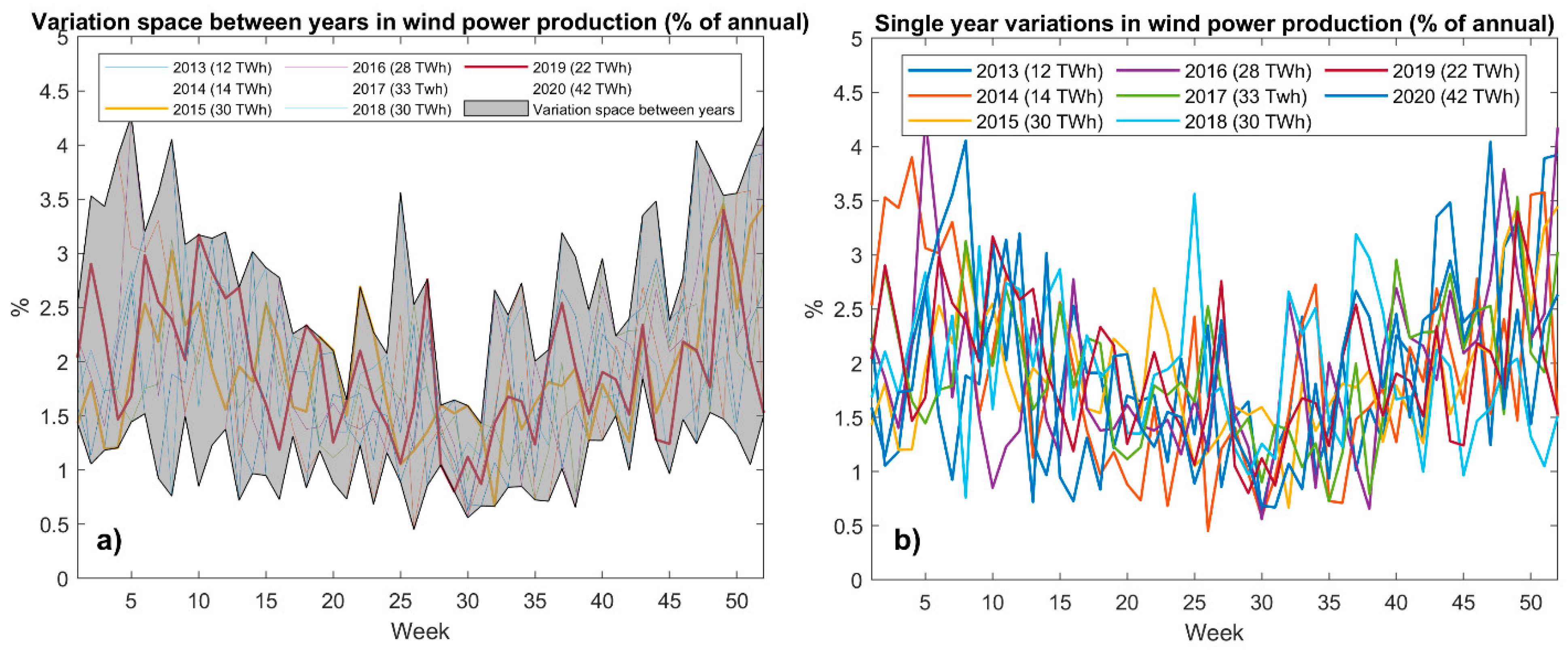

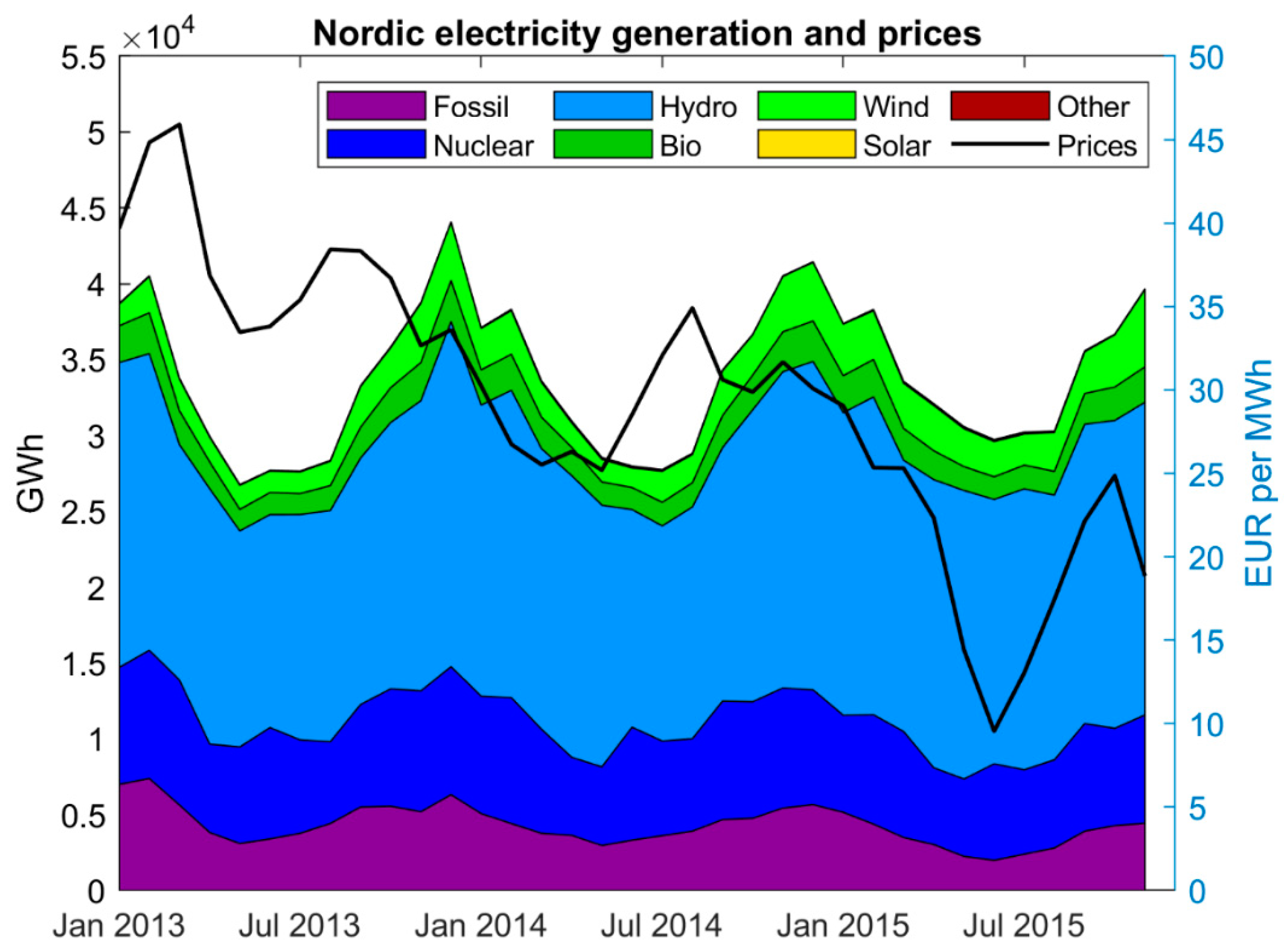

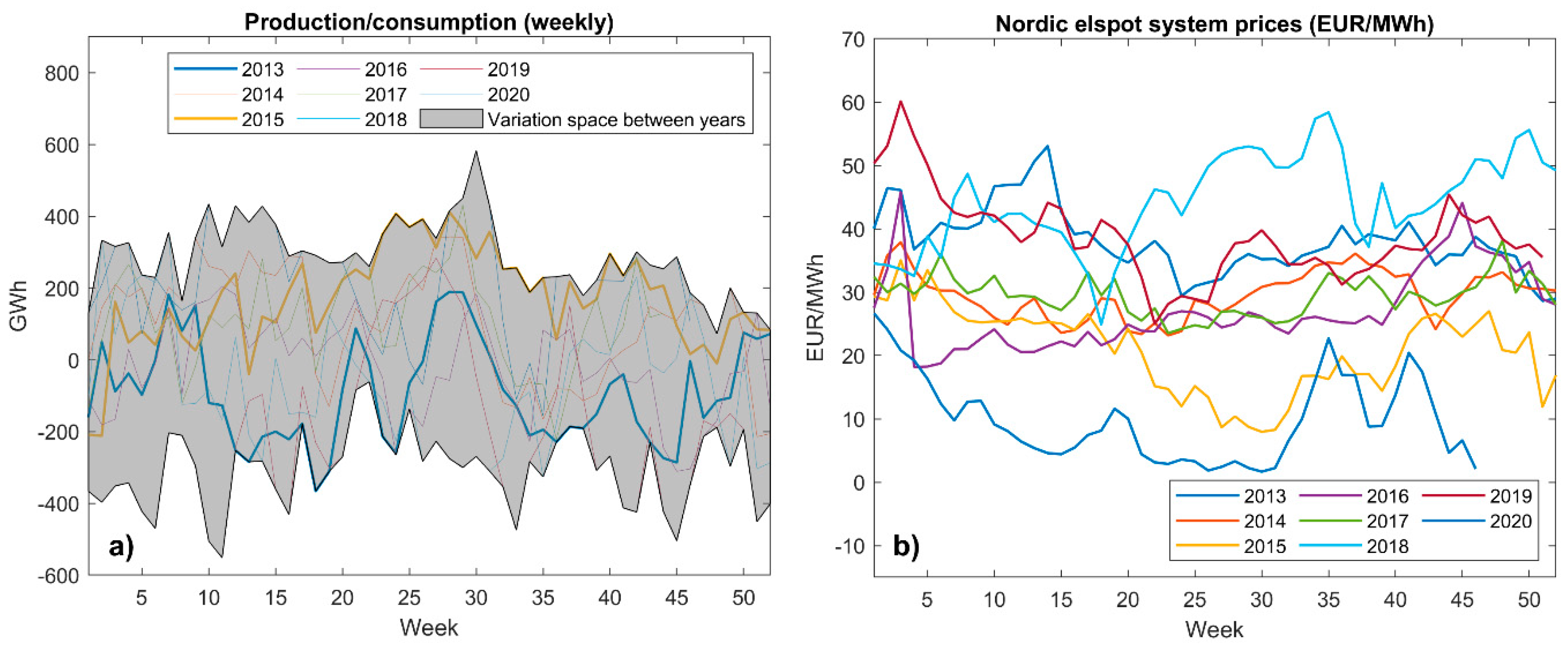

3.4.1. Observed Variations in Supply and Demand

3.4.2. Current Climate Service Suppliers

3.4.3. Longer-Term Perspectives for Renewables and Climate Service Integration

4. Discussion

4.1. Implications of Inaccurate Production Forecasts

4.2. What Is Needed for a Greater Use of Climate Services?

- Documentation and knowledge transfer of the potential economic benefits and losses by utilities and traders when considering climate predictions. Similarly, investment decisions on climate risks of renewable electricity production should be able to benefit from research and other knowledge generation.

- Development of tailor-made products, which can help stakeholders to integrate CSs in their decisions—also beyond the ranks of energy producers.

- Trust and quality assurance procedures need to be established in relation to CSs for the sector. CSs are, e.g., in relation to investment projects typically integrated into feasibility studies as part of larger consultancy services, which do not include specific expertise on climate change issues.

- Climate service data should be available for a short- to medium time frame, and at a very detailed geographical level reflecting the location of power production plants. As a side note, today’s data on offshore sites for wind parks are very uncertain.

- Creation of operational online interfaces, where users of wind, hydropower, and other stakeholders, can explore probabilistic predictions and experts provide training.

- Interactions between the renewable energy community and the climate science community to enhance the outcome and evaluate the performance of past predictions.

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- United Nations. Paris Agreement; United Nations: New York, NY, USA, 2016; Volume 55. [Google Scholar]

- Klima og Energiministeriet. National Action Plan for Renewable Energy in Denmark; Klima og Energiministeriet: Copenhagen, Denmark, 2010.

- Regeringskansliet. The Swedish National Action Plan for the Promotion of the Use of Renewable Energy; Regeringskansliet: Stockholm, Sweden, 2010.

- Ministry of Employment and the Economy Energy Department. Finland’s National Action Plan for Promoting Energy from Renewable Sources Pursuant to Directive 2009/28/EC; Ministry of Employment and the Economy Energy Department: Helsinki, Finland, 2010; Volume 9.

- Ministry of Petroleum and Energy. National Renewable Energy Action Plan under Directive 2009/28/EC Norway; Ministry of Petroleum and Energy: Oslo, Norway, 2013.

- Halsnæs, K.; Bay, L.; Dømgaard, M.L.; Kaspersen, P.S.; Larsen, M.A.D. Accelerating Climate Service Development for Renewable Energy, Finance and Cities. Sustainability 2020, 12, 7540. [Google Scholar] [CrossRef]

- Perrels, A.; Le, T.T.; Cortekar, J.; Hoa, E.; Stegmaier, P. How much unnoticed merit is there in climate services? Clim. Serv. 2020, 17, 100153. [Google Scholar] [CrossRef]

- Goodess, C.M.; Troccoli, A.; Acton, C.; Añel, J.A.; Bett, P.E.; Brayshaw, D.J.; De Felice, M.; Dorling, S.R.; Dubus, L.; Penny, L.; et al. Advancing climate services for the European renewable energy sector through capacity building and user engagement. Clim. Serv. 2019, 16, 100139. [Google Scholar] [CrossRef]

- Larsen, M.A.D.; Petrovic, S.; Engström, R.E.; Drews, M.; Liersch, S.; Karlsson, K.B.; Howells, M. Challenges of data availability: Analysing the water-energy nexus in electricity generation. Energy Strategy Rev. 2019, 26, 100426. [Google Scholar] [CrossRef]

- Kilpeläinen, S. Developing nordic cooperation in renewable electricity policy: Exploring views from Finland and Sweden. Soc. Incl. 2020, 8, 44–52. [Google Scholar] [CrossRef]

- Sovacool, B.K. Contestation, contingency, and justice in the Nordic low-carbon energy transition. Energy Policy 2017, 102, 569–582. [Google Scholar] [CrossRef]

- OECD. Energy Statistics of OECD Countries 2015; Energy Statistics of OECD Countries; OECD: Paris, France, 2015. [Google Scholar]

- Chernet, H.H.; Alfredsen, K.; Killingtveit, Å. The impacts of climate change on a Norwegian high-head hydropower system. J. Water Clim. Chang. 2013, 4, 17–37. [Google Scholar] [CrossRef]

- Gimbergson, L. Hydropower in a Future Climate; Copernicus Symposium on Climate Services for the Energy Sector: Barcelona, Spain, 2017. [Google Scholar]

- Thorsteinsson, T.; Björnsson, H. Climate Change and Energy Systems—Impacts, Risks and Adaptation in the Nordic and Baltic Countries; Nordic Council of Ministers: Copenhagen, Denmark, 2012. [Google Scholar]

- Orlowsky, B.; Seneviratne, S.I.; Orlowsky, B.; Seneviratne, S.I. Global changes in extreme events: Regional and seasonal dimension. Clim. Chang. 2012, 110, 669–696. [Google Scholar] [CrossRef]

- IPCC. Climate Change 2014: Mitigation of Climate Change; Cambridge University Press: Cambridge, UK; New York, NY, USA, 2014; ISBN 9781107654815. [Google Scholar]

- Füss, R.; Mahringer, S.; Prokopczuk, M. Electricity derivatives pricing with forward-looking information. J. Econ. Dyn. Control 2015, 58, 34–57. [Google Scholar] [CrossRef]

- Troccoli, A. Weather and Climate Services for the Energy Industry; Springer International Publishing: Berlin/Heidelberg, Germany, 2018; ISBN 9783319684185. [Google Scholar]

- Larsen, M.A.D.; Karamitilios, G.; Halsnæs, K.; She, J.; Madsen, K.S. Advancing future multi-sectorial climate services by mapping current usage and demand. Clim. Risk Manag. in review.

- Buontempo, C.; Hanlon, H.M.; Bruno Soares, M.; Christel, I.; Soubeyroux, J.M.; Viel, C.; Calmanti, S.; Bosi, L.; Falloon, P.; Palin, E.J.; et al. What have we learnt from EUPORIAS climate service prototypes? Clim. Serv. 2018, 9, 21–32. [Google Scholar] [CrossRef]

- Dessai, S.; Bruno Soares, M. Report Summarising Users’ Needs for S2D Predictions. EUPORIAS (European Provision of Regional Impact Assessment Ona Seasonal-To-Decadal Timescale) Deliverable D12.3. EUPORIAS Project Report. 2015. Available online: https://www.researchgate.net/profile/Marta-Bruno-Soares/publication/281776420_Final_report_summarising_the_users%27_needs_for_seasonal_to_decadal_climate_predictions_in_Europe/links/55f7f53608aeba1d9f008090/Final-report-summarising-the-users-needs-for-seasonal-to-decadal-climate-predictions-in-Europe.pdf (accessed on 22 September 2020).

- MARCO. MARCO—MArket Research for a Climate Services Observatory. Available online: http://marco-h2020.eu/ (accessed on 25 January 2021).

- IEA Statistics. Available online: https://www.iea.org/statistics/ (accessed on 15 October 2019).

- Nord Pool Hydro Reservoir Data|Nord Pool. Available online: https://www.nordpoolgroup.com/Market-data1/Power-system-data/hydro-reservoir1/ALL/Hourly/?view=table (accessed on 27 November 2020).

- Nord Pool Production Data|Nord Pool. Available online: https://www.nordpoolgroup.com/Market-data1/Power-system-data/Production1/Production1/ALL1/Hourly1/?view=table (accessed on 27 November 2020).

- Nord Pool Consumption Data|Nord Pool. Available online: https://www.nordpoolgroup.com/Market-data1/Power-system-data/Consumption1/Consumption/ALL/Hourly1/?view=table (accessed on 27 November 2020).

- Norges Vassdrags- og Energidirektorat. Utvalg av Tilsigsserier til Samkjøringsmodellen; Erik Holmqvist og Inger Karin Engen: Oslo, Norway, 2008. [Google Scholar]

- European Commission. EU Reference Scenario 2016; European Commission: Brussels, Belgium, 2016; ISBN 978-92-79-52373-1. [Google Scholar]

- European Commission. Technical Note Results of the EUCO3232.5 Scenario; Commission: Brussels, Belgium, 2018. [Google Scholar]

- Larsen, M.A.D.; Drews, M. Water use in electricity generation for water-energy nexus analyses: The European case. Sci. Total Environ. 2019, 651, 2044–2058. [Google Scholar] [CrossRef]

- Hadian, S.; Madani, K. A system of systems approach to energy sustainability assessment: Are all renewables really green? Ecol. Indic. 2015, 52, 194–206. [Google Scholar] [CrossRef]

- Drews, M.; Larsen, M.A.D.; Peña Balderrama, J.G. Projected water usage and land-use-change emissions from biomass production (2015–2050). Energy Strategy Rev. 2020, 29, 100487. [Google Scholar] [CrossRef]

- Nord Pool Organisation|Nord Pool. Available online: https://www.nordpoolgroup.com/About-us/organisation/ (accessed on 27 November 2020).

- Stattnet Elering, Litgrid Become Nord Pool Spot Shareholders|News|ERR. Available online: https://news.err.ee/110434/elering-litgrid-become-nord-pool-spot-shareholders (accessed on 27 November 2020).

- Energitilsynet. Overvågning Af Det Danske Engrosmarked for Elektricitet; Energitilsynet: Frederiksværk, Denmark, 2017. [Google Scholar]

- NordREG. Nordic Market Report 2014—Development in the Nordic Electricity Market Nordic Market Report; NordREG: Eskilstuna, Sweden, 2014. [Google Scholar]

- Deng, S.J.; Oren, S.S. Electricity derivatives and risk management. Energy 2006, 31, 940–953. [Google Scholar] [CrossRef]

- IEA Data & Statistics—IEA. Available online: https://www.iea.org/data-and-statistics (accessed on 11 December 2019).

- Webber, M.E. Water for Electricity Generation in the United States. In Competition for Water Resources: Experiences and Management Approaches in the US and Europe; Elsevier Inc.: Amsterdam, The Netherlands, 2017; pp. 212–232. ISBN 9780128032381. [Google Scholar]

- Bruno Soares, M.; Daly, M.; Dessai, S. Assessing the value of seasonal climate forecasts for decision-making. Wiley Interdiscip. Rev. Clim. Chang. 2018, 9, e523. [Google Scholar] [CrossRef]

- EUPORIAS Project. Report Summarising Users’ Needs for S2D Predictions. EUPORIAS Project Report. 2015. Available online: https://www.researchgate.net/profile/Marta-Bruno-Soares/publication/281776420_Final_report_summarising_the_users%27_needs_for_seasonal_to_decadal_climate_predictions_in_Europe/links/55f7f53608aeba1d9f008090/Final-report-summarising-the-users-needs-for-seasonal-to-decadal-climate-predictions-in-Europe.pdf (accessed on 22 September 2020).

- Bay, L.; Halsnæs, K. Report on Forecast Approaches, Robustness and Uncertainties Associated with Short and Long Term Forecast. H2020 MARCO Project D6.3; MARCO Project Report. 2018. Available online: http://marco-h2020.eu/wp-content/uploads/2020/01/MARCO_D6_3_Report_on_Forecast_Approaches_Robustness_and_Uncertainties_Associated_With_Short_and_Long_Term_Forecast.pdf (accessed on 22 September 2020).

- Lamich, K. MARCO—Demand-Supply Gap Analysis Report. MARCO Project Report. 2018. Available online: http://marco-h2020.eu/wp-content/uploads/2020/01/MARCO_D2_5_Demand_Supply_Gap_Analysis_Report.pdf (accessed on 22 September 2020).

- Danish Commodities. Challenge Compete Repeat; Danish Commodities: Aarhus, Denmark, 2016. [Google Scholar]

- Orlov, A.; Sillmann, J.; Vigo, I. Better seasonal forecasts for the renewable energy industry. Nat. Energy 2020, 5, 108–110. [Google Scholar] [CrossRef]

- Golombek, R.; Kittelsen, S.A.C.; Haddeland, I. Climate change: Impacts on electricity markets in Western Europe. Clim. Chang. 2012, 113, 357–370. [Google Scholar] [CrossRef]

- Larsen, M.A.D.; Petrovic, S.; Radoszynski, A.M.; McKenna, R.; Balyk, O. Climate change impacts on trends and extremes in future heating and cooling demands over Europe. Energy Build. 2020. [Google Scholar] [CrossRef]

- Lemaître, O. Meteorology, Climate and Energy. In Management of Weather and Climate Risk in the Energy Industry; Springer: Berlin/Heidelberg, Germany, 2010; pp. 51–65. [Google Scholar]

- Tart, S.; Bay, L.; Kristensen, F.B.; Nielsen, L.L.; Rycerz, A.L.; Seipold, P. Segmented Qualitative Analysis of Market Demand & Users Needs. MARCO Project Report. 2018. Available online: http://marco-h2020.eu/wp-content/uploads/2020/01/MARCO_D4_6__Segmented_qualitative_analysis_of_market_demand_users_needs.pdf (accessed on 22 September 2020).

- ENTSO-E Statistical Database. Available online: https://www.entsoe.eu/data/data-portal/Pages/default.aspx (accessed on 17 May 2018).

- Olsson, J.; Uvo, C.B.; Foster, K.; Yang, W. Technical Note: Initial assessment of a multi-method approach to spring-flood forecasting in Sweden. Hydrol. Earth Syst. Sci. 2016, 20, 659–667. [Google Scholar] [CrossRef]

- Matte, D.; Larsen, M.A.D.; Christensen, O.B.; Christensen, J.H. Robustness and scalability of regional climate projections over Europe. Front. Environ. Sci. 2019, 6, 163. [Google Scholar] [CrossRef]

- Christensen, J.H.; Larsen, M.A.D.; Christensen, O.B.; Drews, M.; Stendel, M. Robustness of European climate projections from dynamical downscaling. Clim. Dyn. 2019. [Google Scholar] [CrossRef]

- Copernicus Homepage|Copernicus. Available online: https://climate.copernicus.eu/ (accessed on 22 September 2020).

- Larsen, C.T.; Doorman, G.; Mo, B. Joint Modelling of Wind Power and Hydro Inflow for Power System Scheduling. In Energy Procedia; Elsevier Ltd.: Amsterdam, The Netherlands, 2016; Volume 87, pp. 189–196. [Google Scholar]

- Jensen, J.D.; Bolkesjø, T.F.; Sønju-Moltzau, B. Joint Use of Hydrological Modeling and Large-scale Stochastic Optimization Techniques Applied to the Nordic Power System. In Energy Procedia; Elsevier Ltd.: Amsterdam, The Netherlands, 2016; Volume 87, pp. 19–27. [Google Scholar]

- Nordic Energy Research. Summaries of Nordic Energy Commission Reports; Nordic Energy Research: Oslo, Norway, 2017; Volume 2014. [Google Scholar]

- IRENA IRENA—The International Renewable Energy Agency. Available online: http://www.irena.org/home/index.aspx?PriMenuID=12&mnu=Pri (accessed on 17 May 2018).

- Norsk Industri. Energy Transition—Norway 2050; Norsk Industri: Oslo, Norway, 2020. [Google Scholar]

- Bonjean Stanton, M.C.; Dessai, S.; Paavola, J. A systematic review of the impacts of climate variability and change on electricity systems in Europe. Energy 2016, 109, 1148–1159. [Google Scholar] [CrossRef]

- Pinson, P. Wind energy: Forecasting challenges for its operational management. Stat. Sci. 2013, 28, 564–585. [Google Scholar] [CrossRef]

- Liu, H.; Chen, C. Data processing strategies in wind energy forecasting models and applications: A comprehensive review. Appl. Energy 2019, 249, 392–408. [Google Scholar] [CrossRef]

- Okumus, I.; Dinler, A. Current status of wind energy forecasting and a hybrid method for hourly predictions. Energy Convers. Manag. 2016, 123, 362–371. [Google Scholar] [CrossRef]

- Hall, M.; Dohler, S. Vattenfall Full Year Results 2016. In Vattenfall Press Conference 7 February 2017; Vattenfall: Solna Municipality, Sweden, 2017. [Google Scholar]

- Torralba, V.; Doblas-Reyes, F.J.; MacLeod, D.; Christel, I.; Davis, M. Seasonal climate prediction: A new source of information for the management of wind energy resources. J. Appl. Meteorol. Climatol. 2017, 56, 1231–1247. [Google Scholar] [CrossRef]

| Decision-Making/ Management/Operations | Input to Forecasting Models | CS Components | |

|---|---|---|---|

| Producers of electricity | Production planning (hourly/daily/seasonal) | Production capacity (time scales and geographically specific) | Temperatures |

| Management of storage/reservoir capacity | |||

| Trade electricity short term | |||

| Trade/hedge long term (inter-annual) | Reservoir capacity Daily/hourly production from hydro/wind/solar/etc. both local/national and cross-border | Precipitation (what type (snow/rain)) | |

| Investment decisions on new production capacity | |||

| Assessment of risk from extreme events (destruction of production equipment | |||

| Adaptation to climate change | Daily/hourly consumption | Precipitation (quantity) | |

| Transmission System Operators | Balancing daily/hourly demand and supply | ||

| Grid investments | Seasonal variations in consumption (daily/hourly and geographically specific) Climate projections | Snow melt (timing) | |

| Risk assessment of grid operation | |||

| Adaptation to climate change | Grid capacities national and cross-border | Wind | |

| Financial market traders | Buy/sell decisions (futures contracts/forward contracts/other financial products) | Electricity spot prices | Solar radiation |

| Extreme weather events |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Halsnæs, K.; Bay, L.; Kaspersen, P.S.; Drews, M.; Larsen, M.A.D. Climate Services for Renewable Energy in the Nordic Electricity Market. Climate 2021, 9, 46. https://doi.org/10.3390/cli9030046

Halsnæs K, Bay L, Kaspersen PS, Drews M, Larsen MAD. Climate Services for Renewable Energy in the Nordic Electricity Market. Climate. 2021; 9(3):46. https://doi.org/10.3390/cli9030046

Chicago/Turabian StyleHalsnæs, Kirsten, Lisa Bay, Per Skougaard Kaspersen, Martin Drews, and Morten Andreas Dahl Larsen. 2021. "Climate Services for Renewable Energy in the Nordic Electricity Market" Climate 9, no. 3: 46. https://doi.org/10.3390/cli9030046

APA StyleHalsnæs, K., Bay, L., Kaspersen, P. S., Drews, M., & Larsen, M. A. D. (2021). Climate Services for Renewable Energy in the Nordic Electricity Market. Climate, 9(3), 46. https://doi.org/10.3390/cli9030046