Basic Income with High Open Innovation Dynamics: The Way to the Entrepreneurial State

Abstract

1. Introduction

1.1. Growth Limits of Capitalism

1.2. Research Question and Research Method

“How can a government enact policies to conquer the growth limits imposed on the economy by inequality or the control of big businesses?”

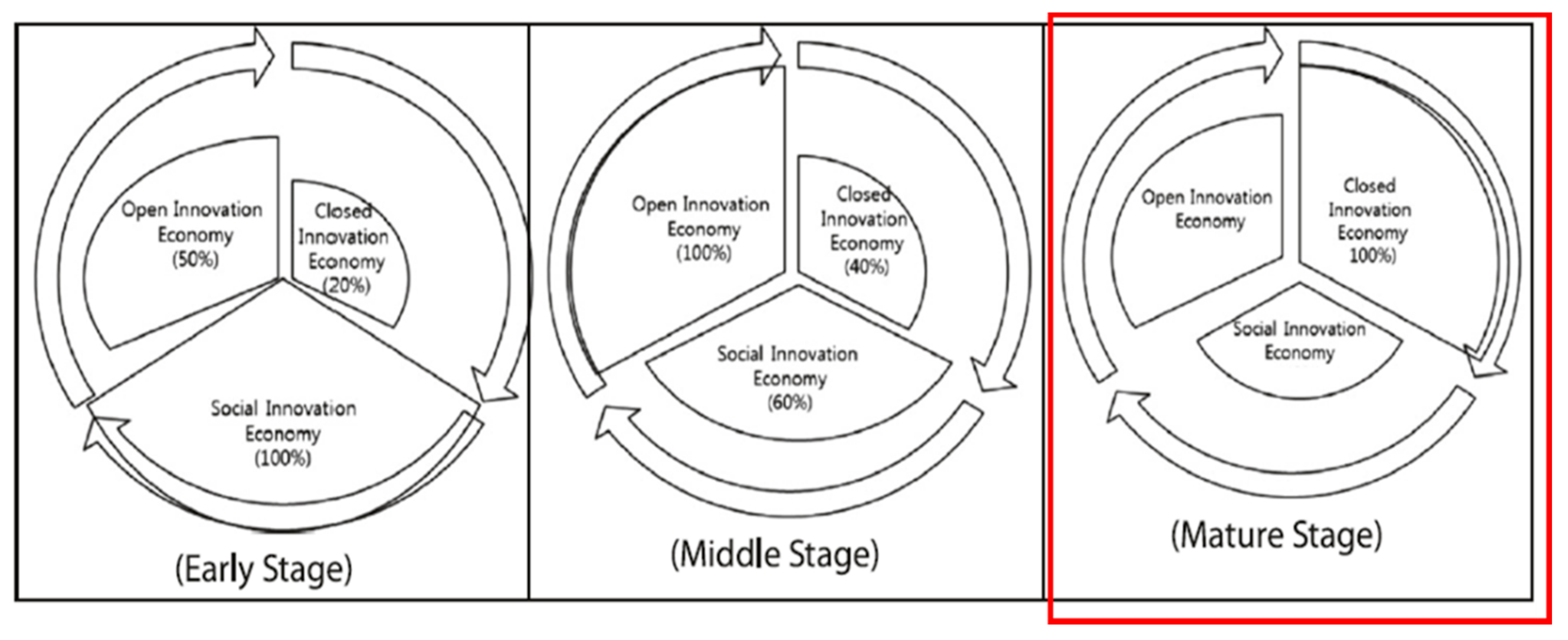

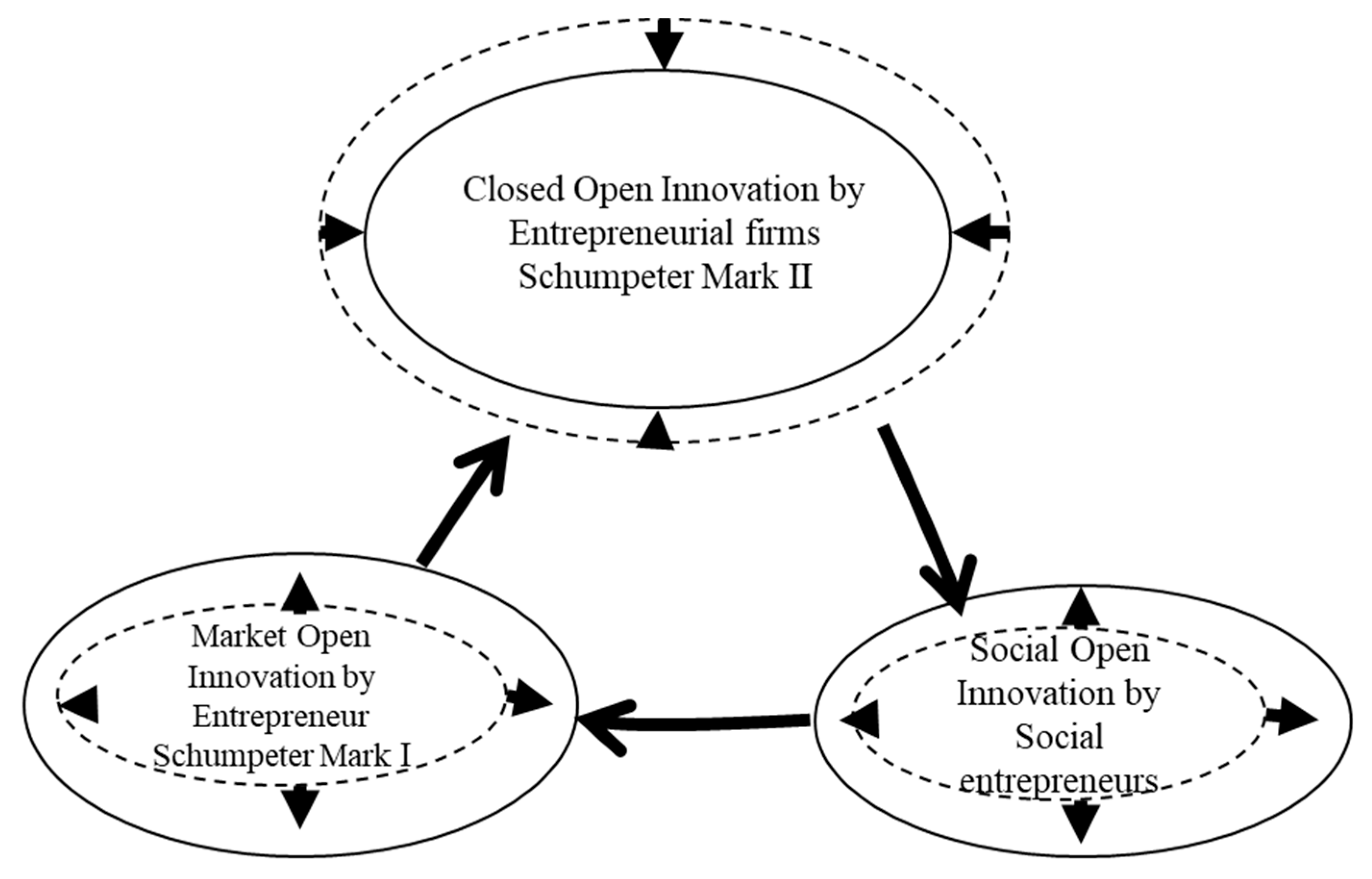

2. Basic Income as the Engine of Open Innovation Dynamics

2.1. Definition of Basic Income

2.2. Philosophical Foundation of Basic Income

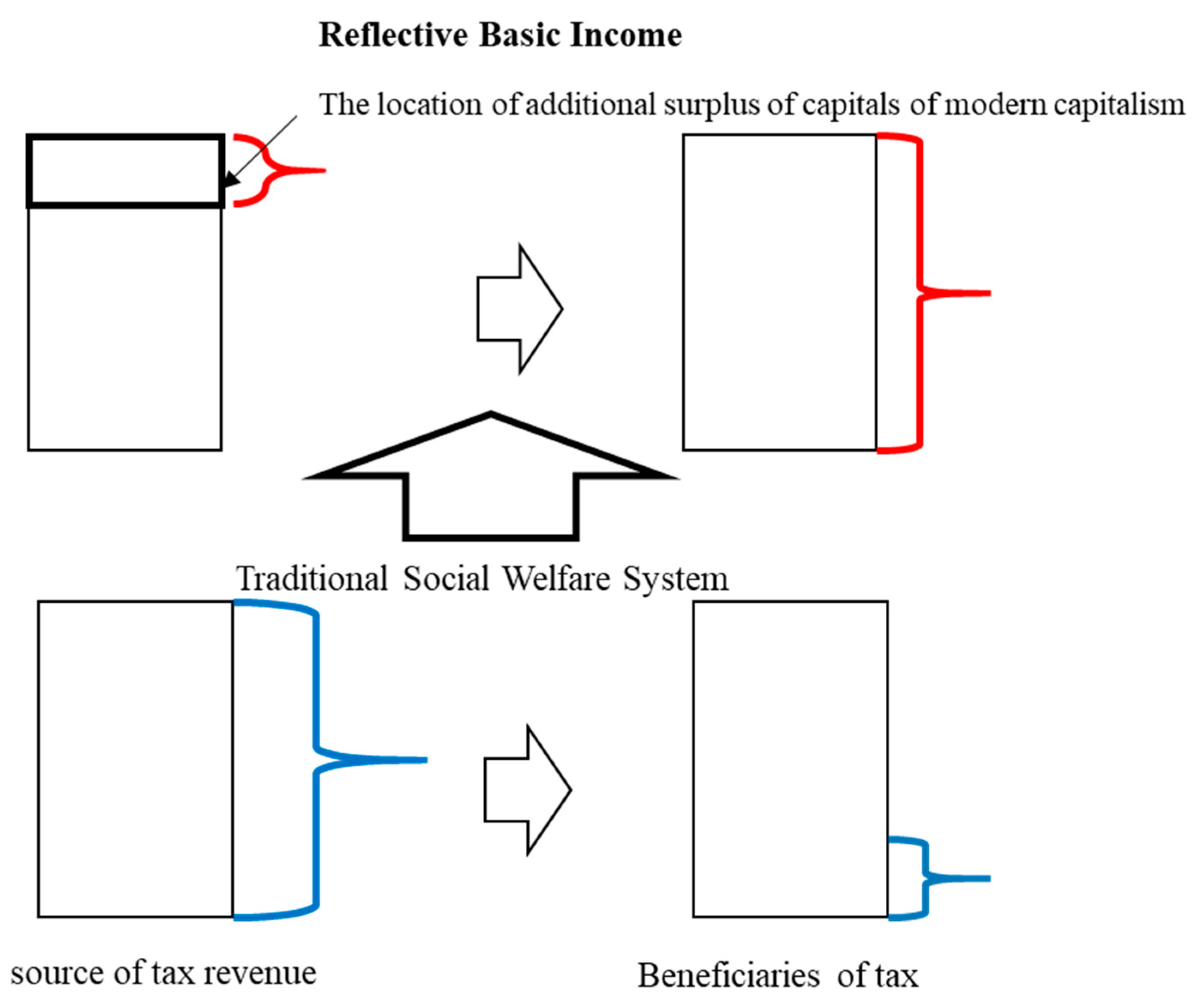

2.3. Budget for Basic Income

2.4. The Effect of Reflective Basic Income on Open Innovation Dynamics

3. Additional Conditions to Increase Open Innovation Dynamics by Reflective Basic Income

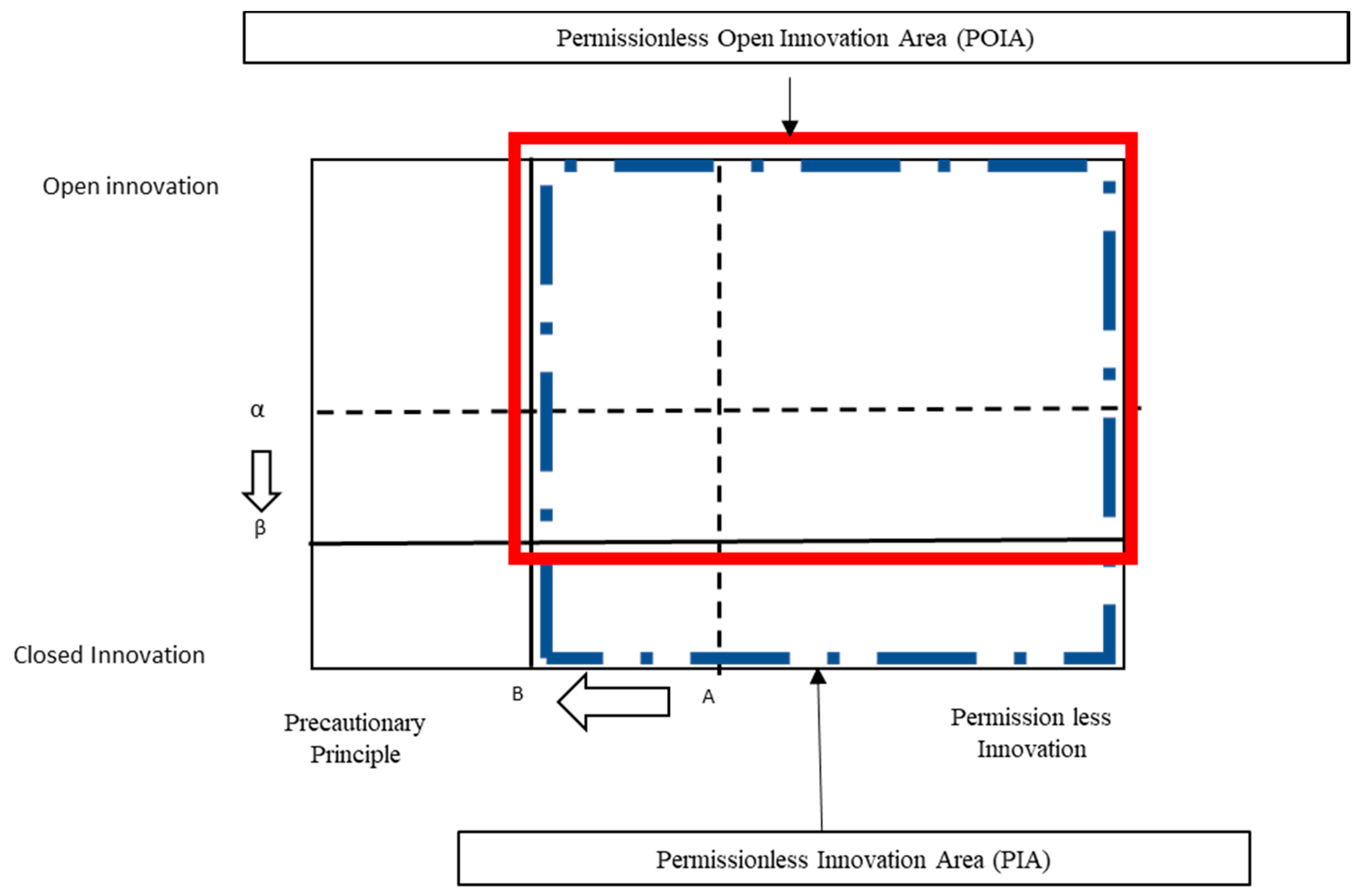

3.1. Permissionless Open Innovation

3.2. High Capital Fluidity for Motivating Not Financialization But Destructive Innovation

- Increase the amount of venture capital;

- Set up the securitization standard and restrict it at some rational level;

- Restrict the share buy-back;

- Restrict pursuing the short-term benefit maximization of firms;

- Restrict the internal reserve of firms at some rational level;

- Motivate the financial supports to increase M&A, technology licensing, spin-offs, and diverse open innovation strategies.

3.3. Moving to Sharing Economy with Platform Tax and Open Innovation Ecosystem

- Introducing a sharing platform tax which will be fully used for the budget of basic income;

- Institutionalizing the participation of peers in social sharing platforms;

- Motivating diverse social sharing platforms as a social open innovation business model ecosystem;

- Motivating permissionless open innovation of market sharing platforms.

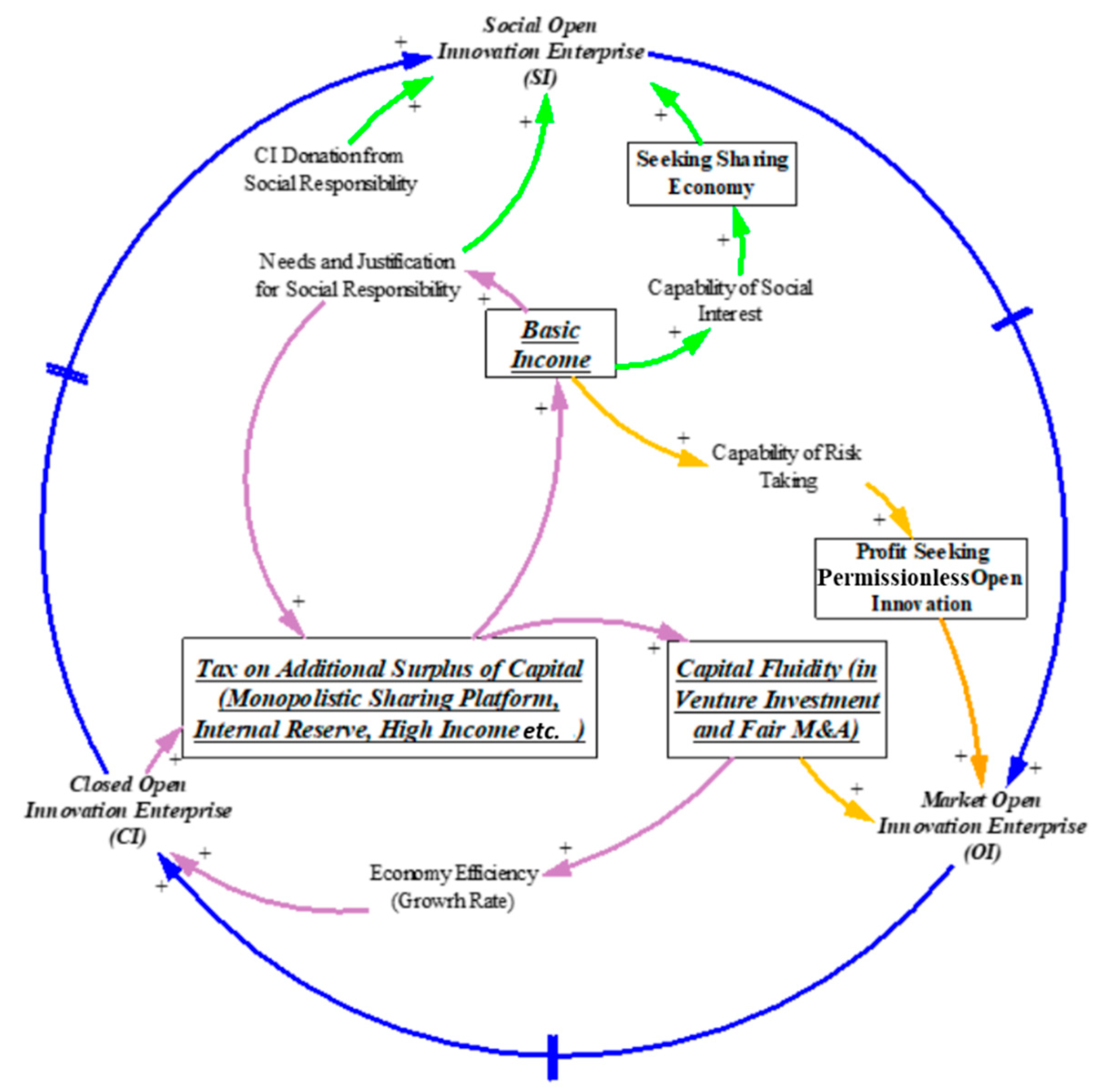

4. Discussion: Casual Loop Modeling and Meta-Analysis

4.1. Causal Loop Modeling of Open Innovation Dynamics with Reflective Basic Income

4.2. Meta-Analysis of Diverse Basic Income Policies to Confirm the Causal Loop Model

5. Conclusions

5.1. Main Finding, and the Value of This Research

5.2. Limits of This Research and Additional Research Targets

Author Contributions

Funding

Conflicts of Interest

References

- Frey, C.B.; Osborne, M.A. The future of employment: How susceptible are jobs to computerisation? Technol. Forecast. Soc. Chang. 2017, 114, 254–280. [Google Scholar] [CrossRef]

- Brynjolfsson, E.; McAfee, A. The Second Machine Age: Work, Progress, and Prosperity in a Time of Brilliant Technologies; WW Norton & Company: New York, NY, USA, 2014. [Google Scholar]

- Piketty, T. About capital in the twenty-first century. Am. Econ. Rev. 2015, 105, 48–53. [Google Scholar] [CrossRef]

- Stigiitz, J. The Price of Inequality; WW Norton & Company: New York, NY, USA, 2012. [Google Scholar]

- Mazzucato, M. The Value of Everything: Making and Taking in the Global Economy; Hachette UK: London, UK, 2018. [Google Scholar]

- Hardoon, D.; Fuentes-Nieva, R.; Ayele, S. An Economy for the 1%: How Privilege and Power in the Economy drive Extreme Inequality and How This Can be Stopped; Oxfam International: Oxford, UK, 2016. [Google Scholar]

- Chang, H.-J. Kicking Away the Ladder: Development Strategy in Historical Perspective; Anthem Press: New York, NY, USA, 2002. [Google Scholar]

- Chang, H.-J. Bad Samaritans: The Myth of Free Trade and the Secret History of Capitalism; Bloomsbury Publishing USA: New York, NY, USA, 2010. [Google Scholar]

- Chang, H.-J. How to ‘do’ a developmental state: Political, organisational and human resource requirements for the developmental state. In Constructing a Democratic Developmental State in South Africa: Potentials and Challenges; Hsrc Press: Cape Town, South Africa, 2010; pp. 82–96. [Google Scholar]

- Black, B.S.; Jang, H.; Kim, W. Predicting firms’ corporate governance choices: Evidence from Korea. J. Corp. Finance 2006, 12, 660–691. [Google Scholar] [CrossRef]

- Black, B.S.; Jang, H.; Kim, W. Does corporate governance predict firms’ market values? Evidence from Korea. J. Law Econ. Org. 2006, 22, 366–413. [Google Scholar] [CrossRef]

- Schumpeter, J.A. The Theory of Economic Development: An Inquiry into Profits, Capital, Credit, Interest, and the Business Cycle; Transaction Publishers: Piscataway, NJ, USA, 1934. [Google Scholar]

- Kirchhoff, B.A. Entrepreneurship and Dynamic Capitalism: The Economics of Business Firm Formation and Growth; ABC-CLIO: Santa Barbara, CA, USA, 1994. [Google Scholar]

- Schumpeter, J.A. Capitalism, Socialism and Democracy; Harper Perennial Modern Classics: New York, NY, USA, 1942. [Google Scholar]

- Crotty, J.R. Marx, Keynes and Minsky on the instability of the capitalist growth process and the nature of government economic policy. In Keynes and Schumpeter: A Centenary Celebration of Dissent; Citeseer; CRC Press: Boca Raton, FL, USA, 1986. [Google Scholar]

- Grossman, G.M.; Helpman, E. Innovation and Growth in the Global Economy; The MIT Press: Cambridge, MA, USA, 1991. [Google Scholar]

- Yun, J.J. How do we conquer the growth limits of capitalism? Schumpeterian Dynamics of Open Innovation. J. Open Innov. Technol. Mark. Complex. 2015, 1, 17. [Google Scholar] [CrossRef]

- Yun, J.J.; Won, D.; Park, K. Entrepreneurial cyclical dynamics of open innovation. J. Evolut. Econ. 2018, 28, 1151–1174. [Google Scholar] [CrossRef]

- Lazonick, W.; Mazzucato, M.; Tulum, Ö. Apple’s changing business model: What should the world’s richest company do with all those profits? In Accounting Forum; Taylor & Francis: Abingdon, UK, 2013. [Google Scholar]

- Mazzucato, M. The Entrepreneurial State: Debunking Public vs. Private Sector Myths; Anthem Press: London, UK, 2015; Volume 1. [Google Scholar]

- Rifkin, J. The End of Work: The Decline of the Global Labor Force and the Dawn of the Post-Market Era; ERIC: New York, NY, USA, 1995. [Google Scholar]

- Slee, T. What’s Yours is Mine: Against the Sharing Economy; Or Books: New York, NY, USA, 2017. [Google Scholar]

- Hamari, J.; Sjöklint, M.; Ukkonen, A. The sharing economy: Why people participate in collaborative consumption. J. Assoc. Inf. Sci. Technol. 2016, 67, 2047–2059. [Google Scholar] [CrossRef]

- Torraco, R.J. Writing integrative literature reviews: Guidelines and examples. Hum. Resour. Dev. Rev. 2005, 4, 356–367. [Google Scholar] [CrossRef]

- Kitchenham, B.; Brereton, O.P.; Budgen, D.; Turner, M.; Bailey, J.; Linkman, S. Systematic literature reviews in software engineering—A systematic literature review. Inf. Softw. Technol. 2009, 51, 7–15. [Google Scholar] [CrossRef]

- Sterman, J.D. System dynamics modeling: Tools for learning in a complex world. Calif. Manag. Rev. 2001, 43, 8–25. [Google Scholar] [CrossRef]

- Georgiadis, P.; Vlachos, D.; Iakovou, E. A system dynamics modeling framework for the strategic supply chain management of food chains. J. Food Eng. 2005, 70, 351–364. [Google Scholar] [CrossRef]

- Borenstein, M.; Hedges, L.V.; Higgins, J.P.; Rothstein, H.R. Introduction to Meta-Analysis; John Wiley & Sons: Hoboken, NJ, USA, 2011. [Google Scholar]

- Lipsey, M.W.; Wilson, D.B. Practical Meta-Analysis; SAGE Publications, Inc.: Thousand Oaks, CA, USA, 2001. [Google Scholar]

- Van Parijs, P. Basic income versus stakeholder grants: Some afterthoughts on how best to redesign distribution. In Redesigning Distribution; Verso: Brooklyn, NY, USA, 2006. [Google Scholar]

- Van Parijs, P. Basic income: A simple and powerful idea for the twenty-first century. Politics Soc. 2004, 32, 7–39. [Google Scholar] [CrossRef]

- De Wispelaere, J.; Stirton, L. The many faces of universal basic income. Political Q. 2004, 75, 266–274. [Google Scholar] [CrossRef]

- Standing, G. How cash transfers promote the case for basic income. Basic Income Stud. 2008, 3, 1–30. [Google Scholar] [CrossRef]

- Van der Veen, R.J.; Van Parijs, P. A capitalist road to communism. Theory Soc. 1986, 15, 635–655. [Google Scholar] [CrossRef]

- Pateman, C.J.P. Democratizing citizenship: Some advantages of a basic income. Politics Soc. 2004, 32, 89–105. [Google Scholar] [CrossRef]

- Van Parijs, P. Real Freedom for All: What (If Anything) Can Justify Capitalism? Palgrave Macmillan: London, UK, 1997. [Google Scholar]

- Anderson, E. Optional freedoms. In Basic Income. An Anthology of Contemporary Research; Wiley: Hoboken, NJ, USA, 2013; pp. 23–25. [Google Scholar]

- Van Parijs, P. Competing justifications of basic income. In Arguing for Basic Income: Ethical Foundations for a Radical Reform; Verso Books: Brooklyn, NY, USA, 1992; pp. 3–43. [Google Scholar]

- Jordan, B. Basic income and the common good. In Basic Income: An Anthology of Contemporary Research; Widerquist, K., Ed.; Wiley: Hoboken, NJ, USA, 2013; pp. 62–72. [Google Scholar]

- Van Parijs, P. Arguing for Basic Income. Ethical Foundations for a Radical Reform; Verso Books: Brooklyn, NY, USA, 1992. [Google Scholar]

- Pettit, P. A Republican Right to Basic Income? Int. J. Basic Income Res. 2007, 2. [Google Scholar] [CrossRef]

- Standing, G. Basic Income: And How We Can Make It Happen; Penguin UK: London, UK, 2017. [Google Scholar]

- White, S.J.P.S. Liberal equality, exploitation, and the case for an unconditional basic income. Political Stud. 1997, 45, 312–326. [Google Scholar] [CrossRef]

- Gordon, R.J. The Rise and Fall of American Growth: The US Standard of Living Since the Civil War; Princeton University Press: Princeton, NJ, USA, 2017; Volume 70. [Google Scholar]

- Stiglitz, J.E. Rewriting the Rules of the American Economy: An Agenda for Growth and Shared Prosperity; WW Norton & Company: New York, NY, USA, 2015. [Google Scholar]

- Stiglitz, J. The Great Divide; Penguin: London, UK, 2015. [Google Scholar]

- Kalleberg, A.L. Nonstandard employment relations: Part-time, temporary and contract work. Ann. Rev. Sociol. 2000, 26, 341–365. [Google Scholar] [CrossRef]

- Ratti, L. Online platforms and crowdwork in Europe: A two-step approach to expanding agency work provisions. Comp. Lab. Law Policy J. 2016, 38, 477–511. [Google Scholar]

- Huws, U.; Spencer, N.H.; Joyce, S. Crowd Work in Europe: Preliminary Results from a Survey in the UK, Sweden, Germany, Austria and the Netherlands. Commissioned Report, Foundation for European Progressive Studies. 2016. Available online: http://researchprofiles.herts.ac.uk/portal/files/10749125/crowd_work_in_europe_draft_report_last_version.pdf (accessed on 27 June 2019).

- Kurzweil, R. The Singularity Is Near: When Humans Transcend Biology; Penguin: London, UK, 2005. [Google Scholar]

- Lee, M.; Yun, J.; Pyka, A.; Won, D.; Kodama, F.; Schiuma, G.; Park, H.; Jeon, J.; Park, K.; Jung, K. How to respond to the Fourth Industrial Revolution, or the Second Information Technology Revolution? Dynamic new combinations between technology, market, and society through open innovation. J. Open Innov. Technol. Mark. Complex. 2018, 4, 21. [Google Scholar] [CrossRef]

- Van Parijs, P.; Vanderborght, Y. Basic Income: A Radical Proposal for a Free Society and a Sane Economy; Harvard University Press: Cambridge, MA, USA, 2017. [Google Scholar]

- Friedman, M. Capitalism and Freedom; University of Chicago Press: Chicago, IL, USA, 2009. [Google Scholar]

- Bregman, R. Utopia for Realists: And How We Can Get There; Bloomsbury Publishing: London, UK, 2017. [Google Scholar]

- Auerbach, A.J.; Hassett, K. Capital taxation in the twenty-first century. Am. Econ. Rev. 2015, 105, 38–42. [Google Scholar] [CrossRef]

- Murphy, J.B. Baby steps: Basic income and the need for incremental organizational development. Basic Income Stud. 2010, 5. [Google Scholar] [CrossRef]

- George, H. Progress and Poverty: An Inquiry into the Cause of Industrial Depressions, and of Increase of Want with Increase of Wealth, the Remedy; W. Reeves: London, UK, 1884. [Google Scholar]

- Birnbaum, S.; Widerquist, K. History of Basic Income; Basic Income Earth Network: London, UK, 2017. [Google Scholar]

- Rhodes, C. Funding Basic Income Through Data Mining. Available online: http://basicincome. org/news/2017/01/funding-basic-income-data-mining (accessed on 18 June 2017).

- Frenken, K. Political economies and environmental futures for the sharing economy. Philos. Trans. R. Soc. A Math. Phys. Eng. Sci. 2017, 375, 20160367. [Google Scholar] [CrossRef] [PubMed]

- Yang, A. The War on Normal People: The Truth about America’s Disappearing Jobs and Why Universal Basic Income Is Our Future; Hachette: London, UK, 2018. [Google Scholar]

- Nikiforos, M.; Steinbaum, M.; Zezza, G. Modeling the Macroeconomic Effects of a Universal Basic Income; Levy Institute Strategic Analysis; Levy Ec: Annandale-on-Hudson, NY, USA, 2017. [Google Scholar]

- Barnes, P. With Liberty and Dividends for All: How to Save Our Middle Class When Jobs Don’t Pay Enough; Berrett-Koehler Publishers: Oakland, CA, USA, 2014. [Google Scholar]

- Cummine, A.L. Overcoming Dividend Skepticism: Why the World’s Sovereign Wealth Funds Are Not Paying Basic Income Dividends. Basic Income Stud. 2011. [Google Scholar] [CrossRef]

- Atkinson, A.B. Public Economics in Action: The Basic Income/Flat Tax Proposal; Clarendon Press: Oxford, UK, 1996. [Google Scholar]

- Simon, H.A. UBI and the Flat Tax. What’s Wrong with a Free Lunch? Beacon Press: Boston, MA, USA, 2001; pp. 34–38. [Google Scholar]

- Moffitt, R.A. The negative income tax and the evolution of US welfare policy. J. Econ. Perspect. 2003, 17, 119–140. [Google Scholar] [CrossRef]

- Yun, J.J. Business Model Design Compass: Open Innovation Funnel to Schumpeterian New Combination Business Model Developing Circle; Springer: Berlin/Heidelberg, Germany, 2017. [Google Scholar]

- Gobble, M.M. Regulating innovation in the new economy. Res. Technol. Manag. 2015, 58, 62–67. [Google Scholar]

- Thierer, A. Permissionless Innovation: The Continuing Case for Comprehensive Technological Freedom; Mercatus Center at George Mason University: Arlington, VA, USA, 2016. [Google Scholar]

- Schaefer, M. The contours of permissionless innovation in the outer space domain. Univ. Pa. J. Int. Law 2017, 39, 103. [Google Scholar]

- Thierer, A. Embracing a Culture of Permissionless Innovation; Cato Institute: Washington, DC, USA, 2014. [Google Scholar]

- Castells, M. The Power of Identity. The Information Age: Economy, Society and Culture; Wiley: Hoboken, NJ, USA, 1997; Volume 2. [Google Scholar]

- Mergel, I.; Desouza, K.C. Implementing open innovation in the public sector: The case of Challenge.gov. Public Adm. Rev. 2013, 73, 882–890. [Google Scholar] [CrossRef]

- Seltzer, E.; Mahmoudi, D. Citizen participation, open innovation, and crowdsourcing: Challenges and opportunities for planning. J. Plan. Lit. 2013, 28, 3–18. [Google Scholar] [CrossRef]

- Chesbrough, H.; Vanhaverbeke, W.; Bakici, T.; Lopez-Vega, H. Open Innovation and Public Policy in Europe; Science|Business: London, UK, 2011. [Google Scholar]

- Aldieri, L.; Vinci, C.P. Innovation effects on employment in high-tech and low-tech industries: Evidence from large international firms within the triad. Eurasian Bus. Revi. 2018, 8, 229–243. [Google Scholar] [CrossRef]

- Griliches, Z. Issues in assessing the contribution of research and development to productivity growth. Bell J. Econ. 1979, 10, 92–116. [Google Scholar] [CrossRef]

- Orlando, M.J. Measuring spillovers from industrial R&D: On the importance of geographic and technological proximity. RAND J. Econ. 2004, 35, 777–786. [Google Scholar]

- Kaufmann, V.; Bergman, M.M.; Joye, D. Motility: Mobility as capital. Int. J. Urban Reg. Res. 2004, 28, 745–756. [Google Scholar] [CrossRef]

- Schumpeter, J.A. Business Cycles; McGraw-Hill: New York, NY, USA, 1939; Volume 1. [Google Scholar]

- Epstein, G.A. Financialization and the World Economy; Edward Elgar Publishing: Cheltenham, UK, 2005. [Google Scholar]

- Bryan, D.; Martin, R.; Rafferty, M. Financialization and Marx: Giving labor and capital a financial makeover. Rev. Radic. Political Econ. 2009, 41, 458–472. [Google Scholar] [CrossRef]

- Frenken, K.; Schor, J. Putting the sharing economy into perspective. Environ. Innov. Soc. Trans. 2017, 23, 3–10. [Google Scholar] [CrossRef]

- Sundararajan, A. The Sharing Economy: The End of Employment and the Rise of Crowd-Based Capitalism; MIT Press: Cambridge, MA, USA, 2016. [Google Scholar]

- Martin, C.J. The sharing economy: A pathway to sustainability or a nightmarish form of neoliberal capitalism? Ecol. Econ. 2016, 121, 149–159. [Google Scholar] [CrossRef]

- Schor, J. Debating the sharing economy. J. Self Gov. Manag. Econ. 2016, 4, 7–22. [Google Scholar]

- Lavinas, L. From Means-Test Schemes to Basic Income in Brazil: Exceptionality and Paradox. Int. Soc. Secur. Rev. 2006, 59, 103–125. [Google Scholar] [CrossRef]

- Haarmann, C.; Haarmann, D. Namibia: Seeing the Sun Rise—The Realities and Hopes of the Basic Income Grant Pilot Project. In Basic Income Worldwide; Springer: Berlin/Heidelberg, Germany, 2012; pp. 33–58. [Google Scholar]

- Caputo, R. Basic Income Guarantee and Politics: International Experiences and Perspectives on the Viability of Income Guarantee; Springer: Berlin/Heidelberg, Germany, 2012. [Google Scholar]

- Korpi, W.; Palme, J. The paradox of redistribution and strategies of equality: Welfare state institutions, inequality, and poverty in the Western countries. Am. Sociol. Rev. 1998, 63, 661–687. [Google Scholar] [CrossRef]

- Kang, N.H. SungNam City, Youth Basic Income Disputes and Experience; Social Welfare Academy: Seoul, Korea, 2016. [Google Scholar]

| Number Year | Name, Location (Nation) | Characteristics | Relation with Causal Loop Model |

|---|---|---|---|

| ① 1795 | Speenhamland system, UK | Giving poor classes and their family reimbursement of living cost until the minimum level. | Increased income and economy of UK rural area (20C evaluation). |

| ② 1974–77 | Mincome project, Canada | Dauphin county 1000 houses received $19,000 (four people) basic income every year. | Motivated students to study hard. Never decreased the working time of the main workers of every house (men). Marriage postponed until employment dreams of workers realized. |

| ③ 1984– | Alaska Permanent fund: AFD, USA | Giving all citizens in Alaska who were living there for more than 1 year, $331.294 in 1984, $2072 in 2015. | Alaska became the state with the lowest level of poverty in the USA. Increased the quality of life of citizens even though the basic income was insufficient. |

| ④ 1997– | Harrah’s Cherokee Casino, USA | All Cherokee Indians, near 3000, each received $500 in 1997, $6000 in 2001. The amount increases every year. | Working harder than before the basic income. Crime rate decreasing. Good relationships developed between parents and children. Increased self-development. |

| ⑤ 2003 | Bolsa Familia Program, Brazil | Gave basic income and additional basic income to poor families, and more poor families. Until 2006, 25% of the population (1.1 million families) received this. | Population with political and financial fault was not expanded at all. However, had positive implications. |

| ⑥ 2005 | Homeless Task Force at the State of Utah, USA | Gave housing to the homeless. | Homelessness decreased by 74% in the state of Utah, and people developed self-capability. Budget to tackle the homeless problem in the state of Utah decreased. |

| ⑦ 2008. 1 | Omitara and Otjivero, Namibia | Gave money to individuals over 60 as basic income grants. | Increased labor income from $267 to $308. Income increased to 200% that without basic income. |

| ⑧ 2009 | London, UK | Gave 113 homeless individuals £3000 each in one year. | All paid attention to developing self-capability. Near all prepared their own house |

| ⑨ 2016 | SungNam City, Youth dividend, Korea | Givave 24-year-old youth $250 every 4 months (total $1000);($1 = 1000 won in local currency). | Motivated the activation of young generations. The youth used the money to develop their own skills and buy books. |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yun, J.J.; Park, K.; Hahm, S.D.; Kim, D. Basic Income with High Open Innovation Dynamics: The Way to the Entrepreneurial State. J. Open Innov. Technol. Mark. Complex. 2019, 5, 41. https://doi.org/10.3390/joitmc5030041

Yun JJ, Park K, Hahm SD, Kim D. Basic Income with High Open Innovation Dynamics: The Way to the Entrepreneurial State. Journal of Open Innovation: Technology, Market, and Complexity. 2019; 5(3):41. https://doi.org/10.3390/joitmc5030041

Chicago/Turabian StyleYun, Jinhyo Joseph, KyungBae Park, Sung Duck Hahm, and Dongwook Kim. 2019. "Basic Income with High Open Innovation Dynamics: The Way to the Entrepreneurial State" Journal of Open Innovation: Technology, Market, and Complexity 5, no. 3: 41. https://doi.org/10.3390/joitmc5030041

APA StyleYun, J. J., Park, K., Hahm, S. D., & Kim, D. (2019). Basic Income with High Open Innovation Dynamics: The Way to the Entrepreneurial State. Journal of Open Innovation: Technology, Market, and Complexity, 5(3), 41. https://doi.org/10.3390/joitmc5030041