Surplus Cost Potential as a Life Cycle Impact Indicator for Metal Extraction

Abstract

:1. Introduction

2. Methods and Data

2.1. Cause-Effect Pathway

2.2. Cumulative Cost-Tonnage Relationships

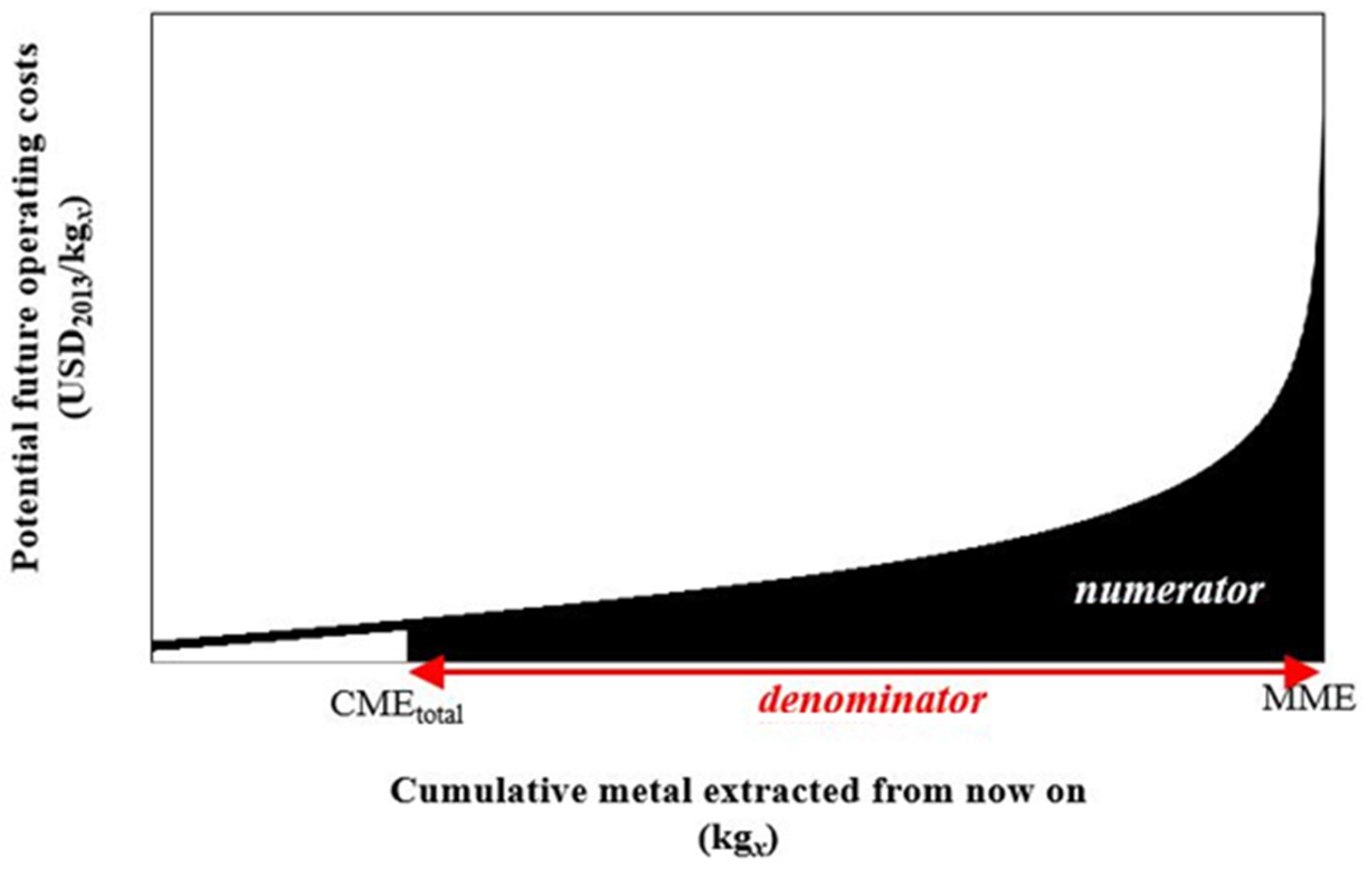

2.3. Characterization Factors

2.4. Sensitivity Analysis

2.5. Data Selection and Fitting

| Metal | Cumulative Metal Extracted | Maximum Metal Extracted | |

|---|---|---|---|

| CMEtotal (kgx) | MMER (kgx) | MMEURR (kgx) | |

| Copper | 5.92 × 1011 | 1.28 × 1012 | 5.22 × 1012 |

| Iron | 3.41 × 1013 | 1.15 × 1014 | 6.49 × 1015 |

| Lead | 2.35 × 1011 | 3.24 × 1011 | 3.04 × 1012 |

| Manganese | 5.80 × 1011 | 1.15 × 1012 | 1.28 × 1014 |

| Molybdenum | 6.62 × 109 | 1.76 × 1010 | 1.89 × 1011 |

| Nickel | 5.53 × 1010 | 1.29 × 1011 | 7.82 × 1012 |

| Palladium | 5.15 × 106 | 2.83 × 107 | 8.25 × 107 |

| Platinum | 6.97 × 106 | 3.82 × 107 | 1.12 × 108 |

| Rhodium | 7.36 × 105 | 4.04 × 106 | 1.18 × 107 |

| Silver | 1.13 × 109 | 1.65 × 109 | 2.11 × 1010 |

| Uranium | 2.71 × 109 | 5.23 × 109 | 4.33 × 1011 |

| Zinc | 4.58 × 1011 | 7.08 × 1011 | 1.16 × 1013 |

| Platinum-Group Metals | 1.47 × 107 | 8.07 × 107 | 2.36 × 108 |

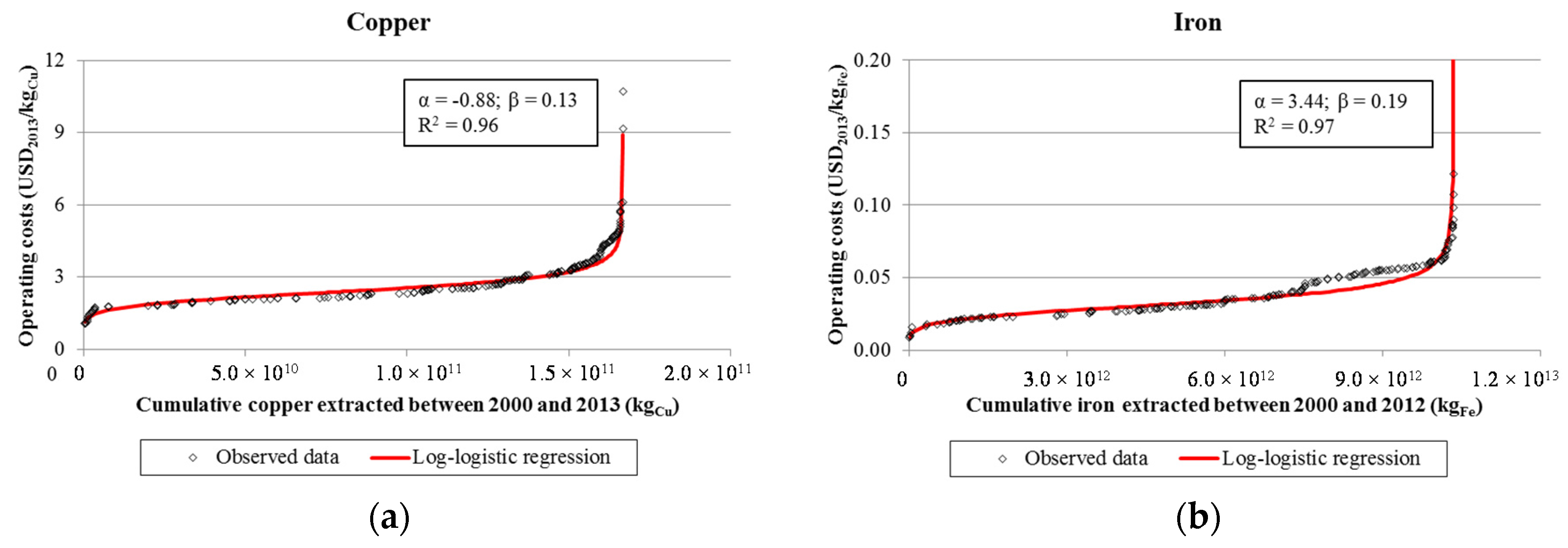

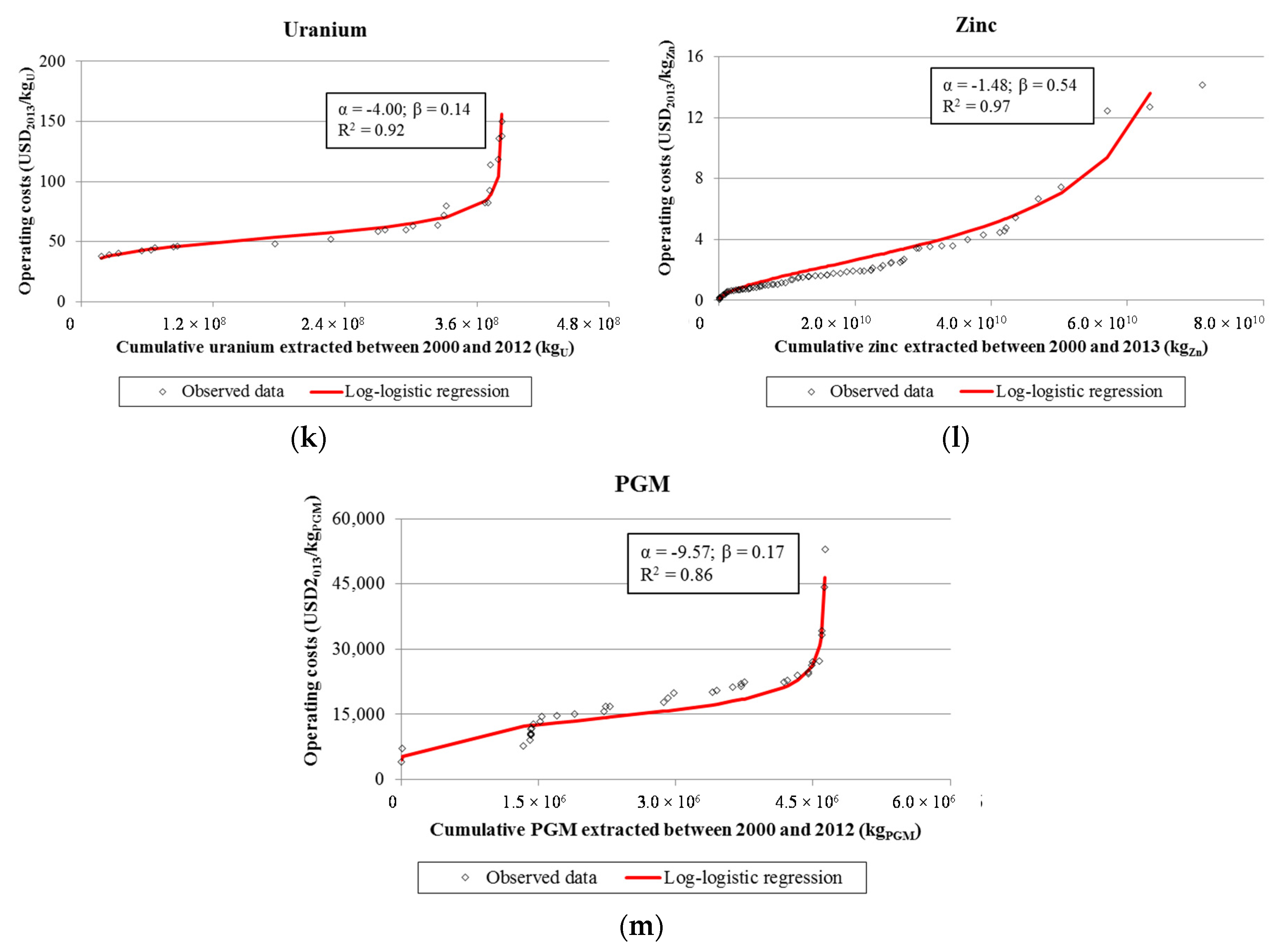

2.5.1. Cumulative Cost-Tonnage Relationships

- -

- Typically, deposits contain various metals but there is often a main metal that justifies the operation of a mine exploring that deposit. As such, the operating costs of a mine are to be shared by all outputs with a market value. In the World Mine Cost Data Exchange [33], the costs were allocated across all mine products in proportion to their production (monetary) value to the mine operator.

- -

- Each table includes data in U.S. dollars valued in the year it represents, e.g., the costs for 2004 are expressed in constant USD valued in 2004. The CPI Inflation Calculator [34] was used to convert all costs into U.S. dollars for 2013 (USD2013).

- -

- For each mine, the weighted average costs per amount of metal produced, calculated on basis of the operating costs per metal in that mine each year and the production tonnages for the same years, and the total metal extracted in the period covered for that mine were calculated.

- -

- The mines were then ranked in increasing order of costs per amount of metal extracted and the cumulative metal extracted for each mine was calculated by adding the metal extracted of that mine to that of all previous mines with lower operating costs.

- -

- A log-logistic fit was applied to the inverted costs for every mine with the software R for statistical computing [35] to derive the scale parameter α and the shape parameter β, including their 95% confidence interval (95% CI). The R square (R2) of the log-logistic fit was also determined. For the derivation of α and β, the total tonnage of metal extracted Ax was set equal to the total metal extracted as reported in the WMCDE database between 2000 and 2012 or 2013, depending on the metal [33].

2.5.2. Characterization Factors

3. Results

3.1. Cumulative Cost-Tonnage Relationships

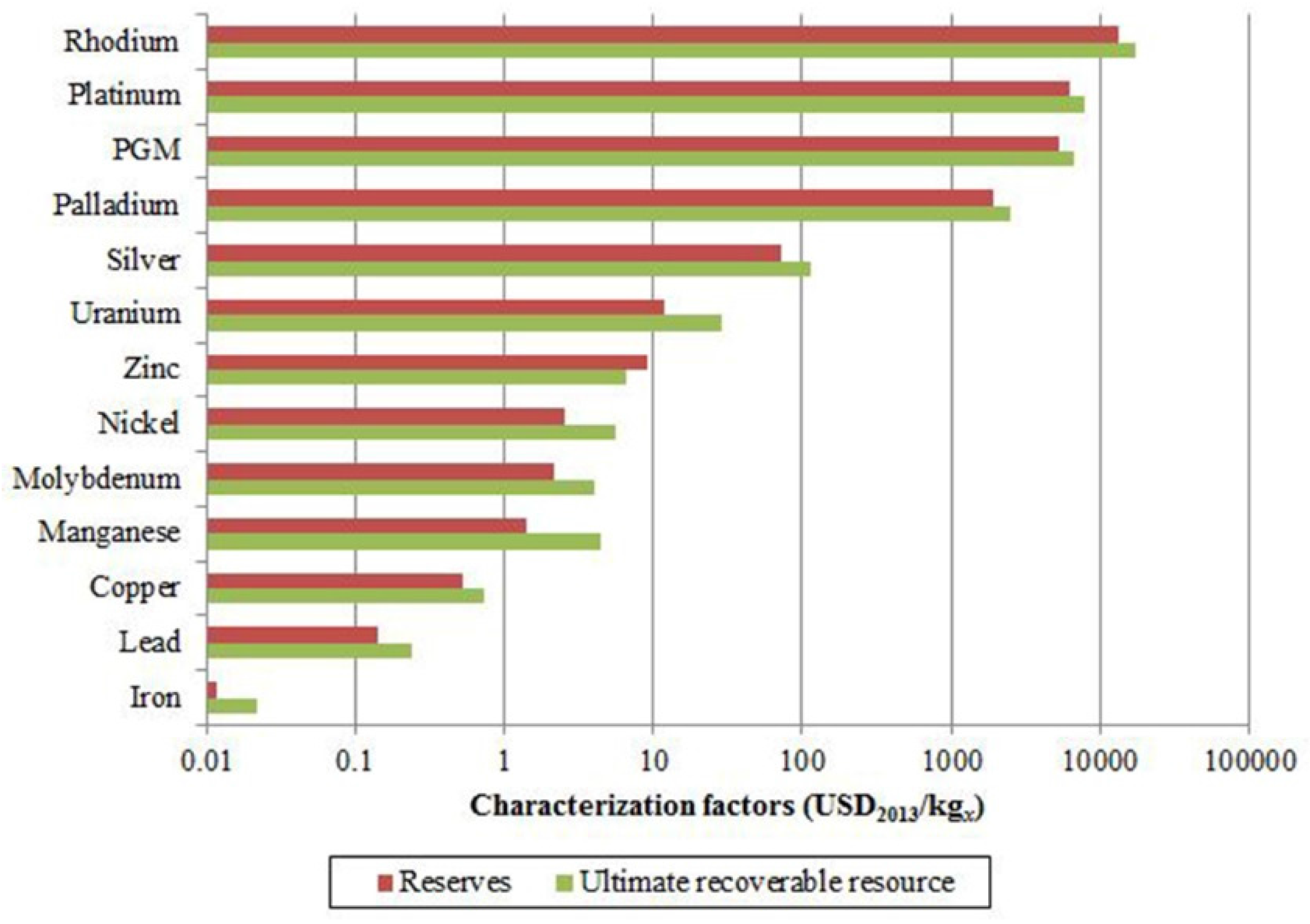

3.2. Characterization Factors

4. Discussion

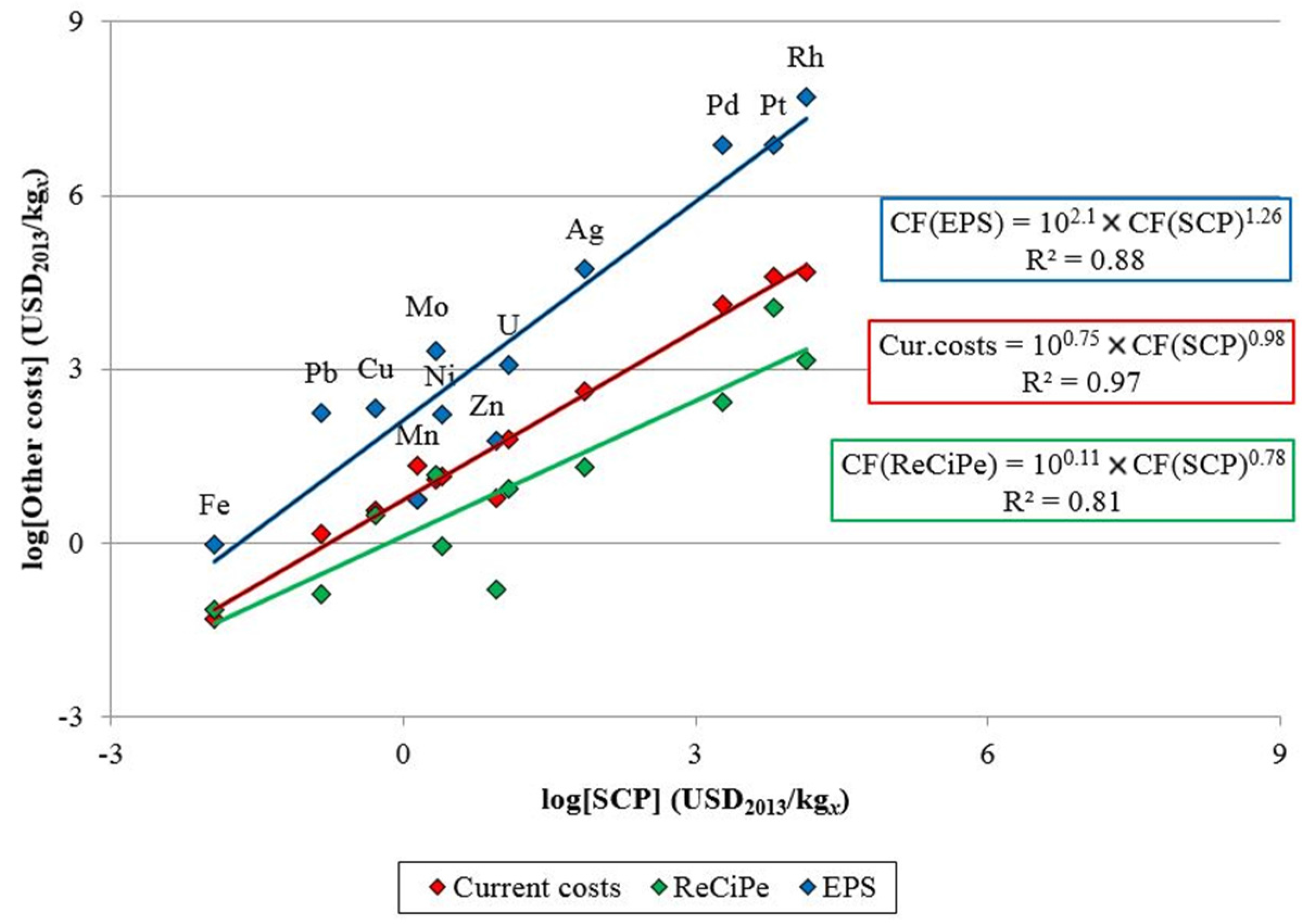

4.1. Comparison with other Indicators

4.2. Limitations

5. Conclusions

Supplementary Files

Supplementary File 1Acknowledgments

Author Contributions

Conflicts of Interest

References

- Kleijn, R. Materials and Energy: A Story of Linkages. Ph.D. Thesis, Leiden University, Leiden, The Netherlands, 5 September 2012. [Google Scholar]

- Kleijn, R.; van der Voet, E.; Kramer, G.J.; van Oers, L.; van der Giesen, C. Metal requirements of low-carbon power generation. Energy 2011, 36, 5640–5648. [Google Scholar] [CrossRef]

- Guinée, J.B.; Gorrée, M.; Heijungs, R.; Huppes, G.; Kleijn, R.; de Koning, A.; van Oers, L.; Wegener Sleeswijk, A.; Suh, S.; Udo de Haes, H.A.; et al. Handbook on Life Cycle Assessment. Operational Guide to the ISO Standards. I: LCA in Perspective. IIa: Guide. IIb: Operational annex. III: Scientific Background; Kluwer Academic Publishers: Dordrecht, The Netherlands, 2002. [Google Scholar]

- Steen, B. Abiotic resource depletion: Different perceptions of the problem with mineral deposits. Int. J. Life Cycle Assess. 2006, 11, 49–54. [Google Scholar] [CrossRef]

- European Commission-Joint Research Centre-Institute for Environment and Sustainability. International Reference Life Cycle Data System (ILCD) Handbook—Recommendations for Life Cycle Impact Assessment in the European Context, 1st ed.; Publications Office of the European Union: Luxemburg, 2011. [Google Scholar]

- Klinglmair, M.; Sala, S.; Brandão, M. Assessing resource depletion in LCA: A review of methods and methodological issues. Int. J. Life Cycle Assess. 2014, 19, 580–592. [Google Scholar] [CrossRef]

- Tilton, J.E. Exhaustible resources and sustainable development: Two different paradigms. Resour. Policy 1996, 22, 91–97. [Google Scholar] [CrossRef]

- Sonnemann, G.; Gemechu, E.D.; Adibi, N.; de Bruille, V.; Bulle, C. From a critical review to a conceptual framework for integrating the criticality of resources into Life Cycle Sustainability Assessment. J. Clean Prod. 2015, 94, 20–34. [Google Scholar] [CrossRef]

- Tilton, J.E. Depletion and the long-run availability of mineral commodities. In International Institute for Environment and Development, Prepared for Workshop on the Long-Run Availability of Mineral Commodities Sponsored by the Mining, Minerals and Sustainable Development Project and Resources for the Future. Washington, DC, USA, 22–23 April 2001; Available online: http://pubs.iied.org/pdfs/G01035.pdf (accessed on 8 July 2013).

- Tilton, J.E. On borrowed time? In Assessing the Threat of Mineral Depletion; Resources for the Future: Washington, DC, USA, 2002. [Google Scholar]

- Vieira, M.D.M.; Storm, P.; Goedkoop, M.J. Stakeholder Consultation: What do decision makers in public policy and industry want to know regarding abiotic resource use? In Towards Life Cycle Sustainability Management; Finkbeiner, M., Ed.; Springer: Berlin, Germany, 2011; pp. 27–34. [Google Scholar]

- Drielsma, J.A.; Russel-Vaccari, A.J.; Drnek, T.; Brady, T.; Weihed, P.; Mistry, M.; Perez Simbor, L. Mineral resources in life cycle impact assessment—Defining the path forward. Int. J. Life Cycle Assess. 2016, 21, 85–105. [Google Scholar] [CrossRef]

- Backman, C.-M. Global Supply and Demand of Metals in the Future. J. Toxicol. Environ. Health A 2008, 71, 1244–1253. [Google Scholar] [CrossRef] [PubMed]

- Giurco, D.; Evans, G.; Cooper, C.; Mason, L.; Franks, D. Mineral Futures Discussion Paper: Sustainability Issues, Challenges and Opportunities. 2009. Available online: http://www.csiro.au/Organisation-Structure/Flagships/Minerals-Down-Under-Flagship/mineral-futures/mineral-futures-collaboration-cluster/minerals-futures-discussion-paper.aspx (accessed on 22 August 2012).

- International Energy Agency. World Energy Outlook. International Energy Agency, 2011. Available online: http://www.iea.org/publications/freepublications/publication/WEO2011_WEB.pdf (accessed on 22 November 2013).

- Meadows, D.; Randers, J.; Meadows, D. Limits to Growth—The 30 Year Update; Earthscan: London, UK, 2005. [Google Scholar]

- Tilton, J.E.; Lagos, G. Assessing the long-run availability of copper. Resour. Policy 2007, 32, 19–23. [Google Scholar] [CrossRef]

- Schneider, L.; Berger, M.; Schüler-Hainsch, E.; Knöfel, S.; Ruhland, K.; Mosig, J.; Bach, V.; Finkbeiner, M. The economic resource scarcity potential (ESP) for evaluating resource use based on life cycle assessment. Int. J. Life Cycle Assess. 2014, 19, 601–610. [Google Scholar] [CrossRef]

- Ponsioen, T.C.; Vieira, M.D.M.; Goedkoop, M.J. Surplus cost as a life cycle impact indicator for fossil resource scarcity. Int. J. Life Cycle Assess. 2014, 19, 872–881. [Google Scholar] [CrossRef]

- Goedkoop, M.; de Schryver, A. Mineral Resource Depletion. In ReCiPe 2008: A life cycle impact assessment method which comprises harmonised category indicators at the midpoint and the endpoint level. In Report I: Characterisation Factors, 1st ed.; Goedkoop, M., Heijungs, R., Huijbregts, M.A.J., de Schryver, A., Struijs, J., van Zelm, R., Eds.; Ministerie van Volkhuisvesting, Ruimtelijke Ordening en Milieubeheer: Den Haag, The Netherlands, 2009; pp. 108–117. [Google Scholar]

- Dahlman, C.J. The problem of externality. J. Law Econ. 1979, 22, 141–162. [Google Scholar] [CrossRef]

- Weidema, B.P. Using the budget constraint to monetarise impact assessment results. Ecol. Econ. 2009, 68, 1591–1598. [Google Scholar] [CrossRef]

- Hunkeler, D.; Lichtenvort, K.; Rebitzer, G. (Eds.) Environmental Life Cycle Costing; Society of Environmental Toxicology and Chemistry (SETAC): New York, NY, USA, 2008.

- Hochschorner, E.; Noring, M. Practitioners’ use of life cycle costing with environmental costs—A Swedish study. Int. J. Life Cycle Assess. 2011, 16, 897–902. [Google Scholar] [CrossRef]

- Vieira, M.D.M.; Goedkoop, M.J.; Storm, P.; Huijbregts, M.A.J. Ore Grade Decrease As Life Cycle Impact Indicator for Metal Scarcity: The Case of Copper. Environ. Sci. Technol. 2012, 46, 12772–12778. [Google Scholar] [CrossRef] [PubMed]

- U.S. Geological Survey. Mineral Commodity Summaries 2014; U.S. Geological Survey: Reston, VA, USA, 2014. Available online: http://minerals.usgs.gov/minerals/pubs/mcs/2014/mcs2014.pdf (accessed on 3 October 2014).

- UNEP. Estimating Long-Run Geological Stocks of Metals; UNEP International Panel on Sustainable Resource Management, Working Group on Geological Stocks of Metal: Paris, France, 2011; Available online: http://www.unep.org/resourcepanel/Portals/24102/PDFs/GeolResourcesWorkingpaperfinal040711.pdf (accessed on 24 December 2015).

- Kelly, T.D.; Matos, G.R. Historical Statistics for Mineral and Material Commodities in the United States (2014 Version). U.S. Geological Survey Data Series 140; Available online: http://minerals.usgs.gov/minerals/pubs/historical-statistics/ (accessed on 12 November 2014).

- Nuclear Energy Agency and International Atomic Energy Agency (NEA-IAEA). Uranium 2014: Resources, Production and Demand. NEA No. 7209. Available online: http://www.oecd-nea.org/ndd/pubs/2014/7209-uranium-2014.pdf (accessed on 12 November 2014).

- Hall, S.; Coleman, M. Critical Analysis of World Uranium Resources; U.S. Scientific Investigations Report 2012–5239; U.S. Geological Survey: Reston, VA, USA, 2012. [Google Scholar]

- Pincock, Allen and Holt. The Processing of Platinum Group Metals (PGM)—Part 1. Pincock Perspectives 89, March 2008. Available online: http://www.pincock.com/perspectives/Issue89-PGM-Processing-Part1.pdf (accessed on 5 November 2012).

- Schneider, L.; Berger, M.; Finkbeiner, M. Abiotic resource depletion in LCA—Background and update of the anthropogenic stock extended abiotic depletion potential (AADP) model. Int. J. Life Cycle Assess. 2015, 20, 709–721. [Google Scholar] [CrossRef]

- World Mine Cost Data Exchange. Cost Curves. Available online: http://www.minecost.com/curves.htm (accessed on 2 July 2014).

- Bureau of Labor Statistics. CPI Inflation Calculator. Available online: http://www.bls.gov/data/inflation_calculator.htm (accessed on 9 July 2014).

- R Development Core Team. R: A Language and Environment for Statistical Computing, Version 3.0.1 (2013–05–16). R Foundation for Statistical Computing: Vienna, Austria, 2013. Available online: http://www.R-project.org (accessed on 1 November 2013).

- Coulas, M. Copper. In Canadian Minerals Yearbook 2008; Birchfield, G., Trelawny, P., Eds.; Natural Resources Canada: Vancouver, Canada, 2008; Available online: http://www.nrcan.gc.ca/mining-materials/markets/canadian-minerals-yearbook/2008/commodity-reviews/8522?destination=node/3012 (accessed on 3 September 2014).

- Philips, W.G.B.; Edwards, D.P. Metal prices as a function of ore grade. Resour. Policy 1976, 2, 167–178. [Google Scholar] [CrossRef]

- Steen, B. A Systematic Approach to Environmental Priority Strategies in Product Development (EPS). Version 2000—Models and Data of the Default Method; Chalmers University of Technology: Göteburg, Sweden, 1999. [Google Scholar]

- Crowson, P. Mine size and the structure of costs. Resour. Policy 2003, 29, 15–36. [Google Scholar] [CrossRef]

- Rudenno, V. The Mining Valuation Handbook: Mining and Energy Valuation for Investors and Management, 4th ed.; John Wiley & Sons Australia: Brisbane, Australia, 2012. [Google Scholar]

- Swart, P.; Dewulf, J. Quantifying the impacts of primary metal resource use in life cycle assessment based on recent mining data. Resour. Conserv. Recycl. 2013, 73, 180–187. [Google Scholar] [CrossRef]

- Gerst, M.D. Linking Material Flow Analysis and Resource Policy via Future Scenarios of In-Use Stock: An Example for Copper. Environ. Sci. Technol. 2009, 43, 6320–6325. [Google Scholar] [CrossRef] [PubMed]

- Gerst, M.D. Revisiting the cumulative grade-tonnage relationship for major copper ore types. Econ. Geol. 2008, 103, 615–628. [Google Scholar] [CrossRef]

- Reynolds, D.B. The mineral economy: How prices and costs can falsely signal decreasing scarcity. Ecol. Econ. 1999, 31, 155–166. [Google Scholar] [CrossRef]

- Mudd, G. An analysis of historic production trends in Australian basic metal mining. Ore Geol. Rev. 2007, 32, 227–261. [Google Scholar] [CrossRef]

© 2016 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons by Attribution (CC-BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Vieira, M.D.M.; Ponsioen, T.C.; Goedkoop, M.J.; Huijbregts, M.A.J. Surplus Cost Potential as a Life Cycle Impact Indicator for Metal Extraction. Resources 2016, 5, 2. https://doi.org/10.3390/resources5010002

Vieira MDM, Ponsioen TC, Goedkoop MJ, Huijbregts MAJ. Surplus Cost Potential as a Life Cycle Impact Indicator for Metal Extraction. Resources. 2016; 5(1):2. https://doi.org/10.3390/resources5010002

Chicago/Turabian StyleVieira, Marisa D.M., Thomas C. Ponsioen, Mark J. Goedkoop, and Mark A.J. Huijbregts. 2016. "Surplus Cost Potential as a Life Cycle Impact Indicator for Metal Extraction" Resources 5, no. 1: 2. https://doi.org/10.3390/resources5010002

APA StyleVieira, M. D. M., Ponsioen, T. C., Goedkoop, M. J., & Huijbregts, M. A. J. (2016). Surplus Cost Potential as a Life Cycle Impact Indicator for Metal Extraction. Resources, 5(1), 2. https://doi.org/10.3390/resources5010002