Consumers’ Perspective on Full-Scale Adoption of Smart Meters: A Case Study in Västerås, Sweden

Abstract

:1. Introduction

1.1. Variable Electricity Tariffs

1.2. Information and Feedback

2. Survey Description

3. Results and Discussion

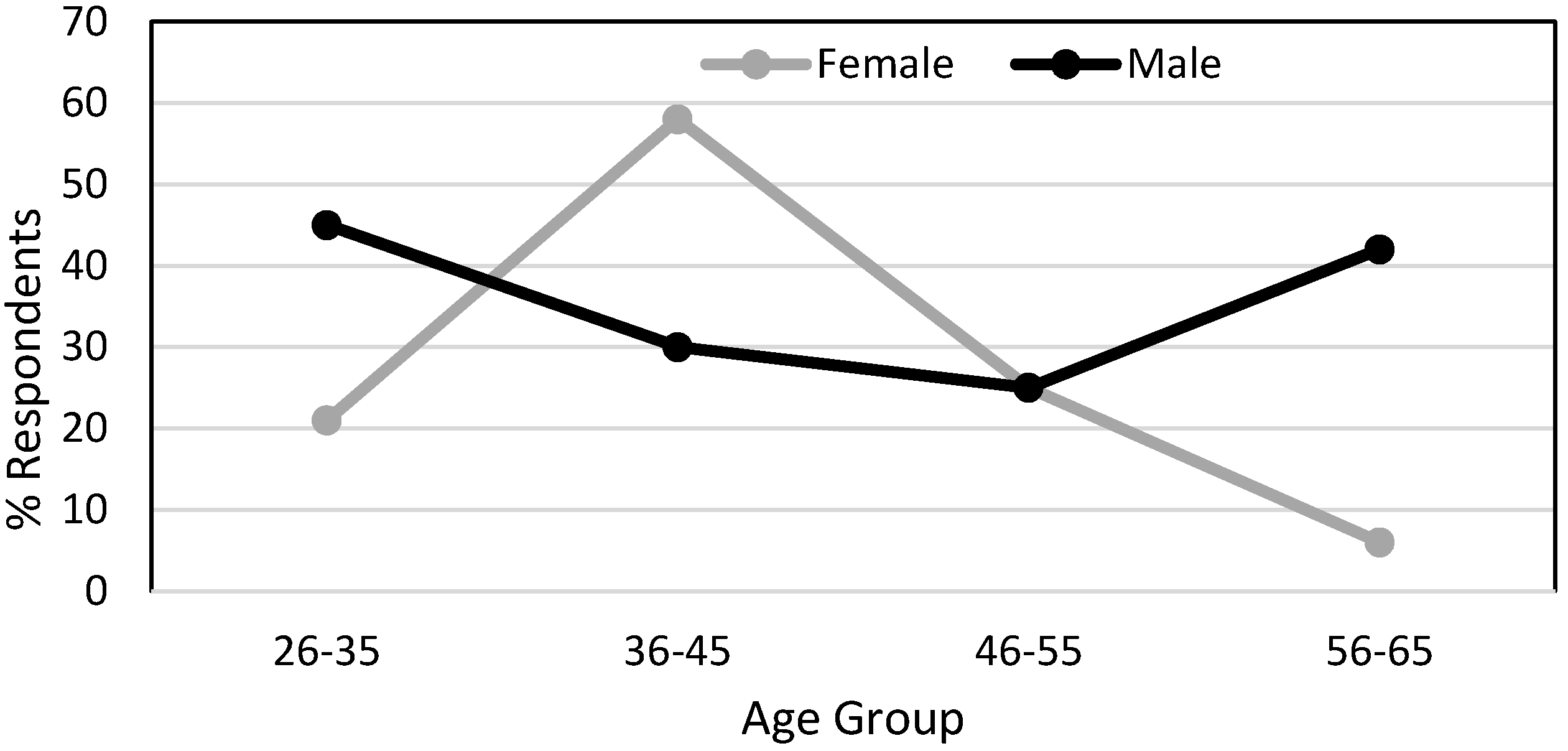

3.1. Respondents and Dwelling Characteristics

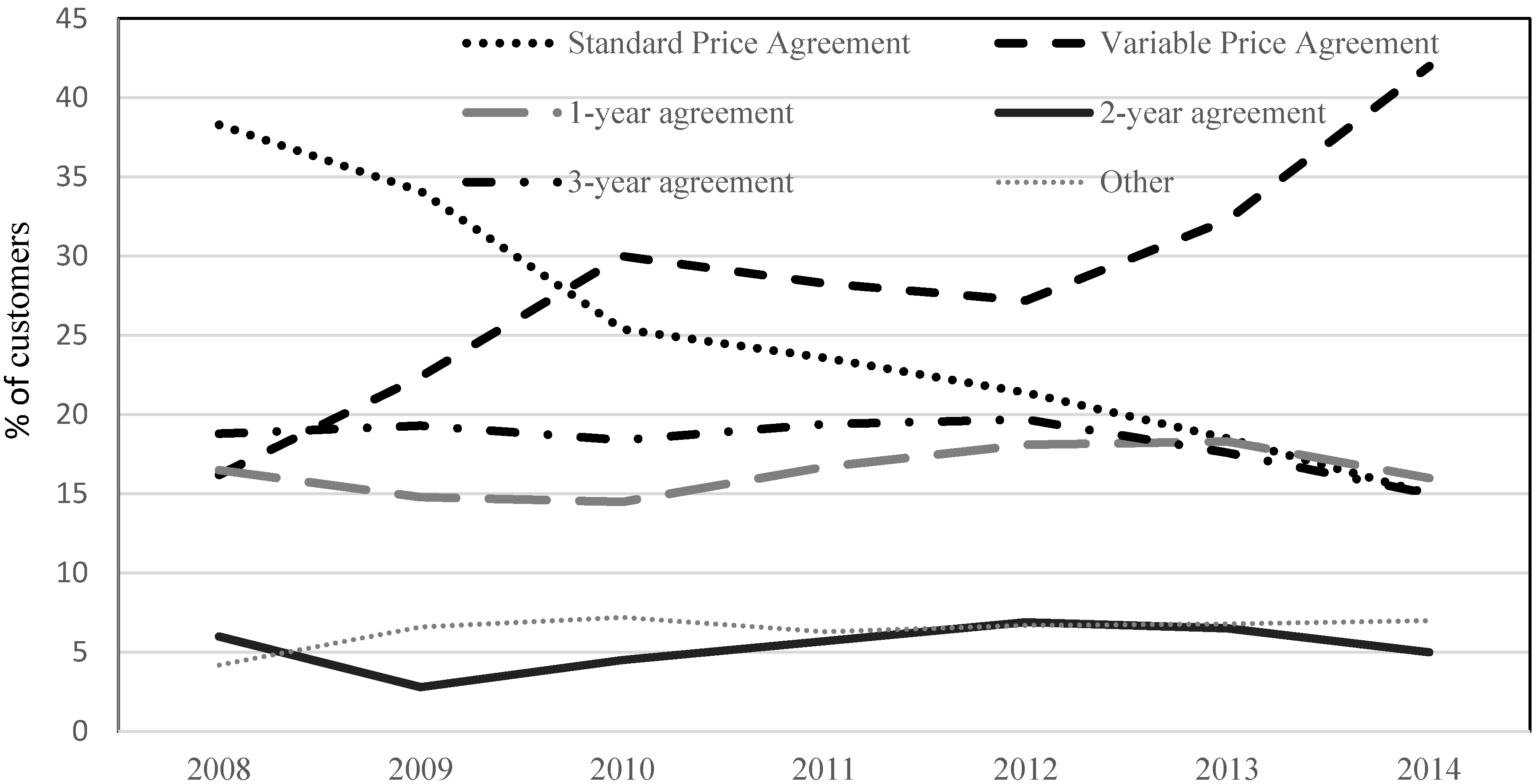

3.2. Variable Price

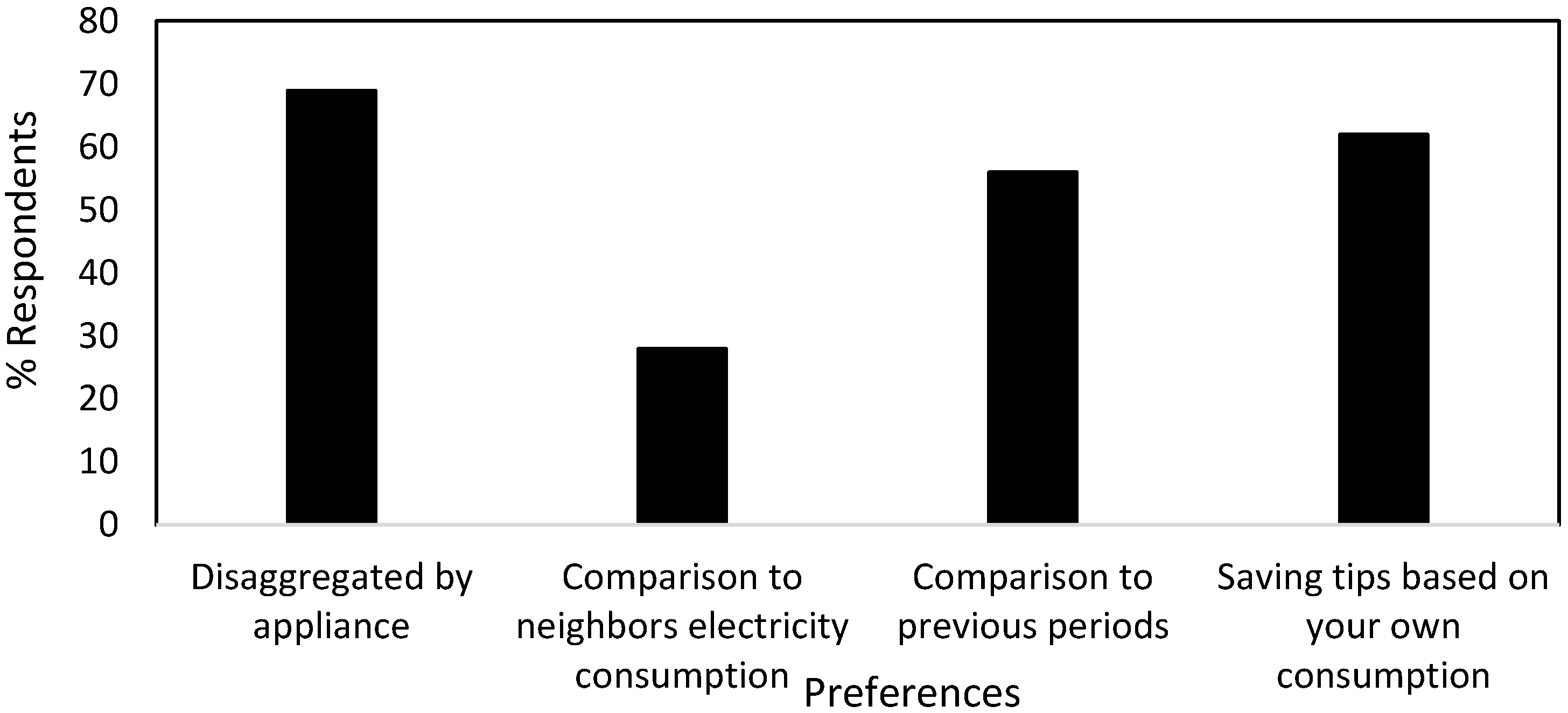

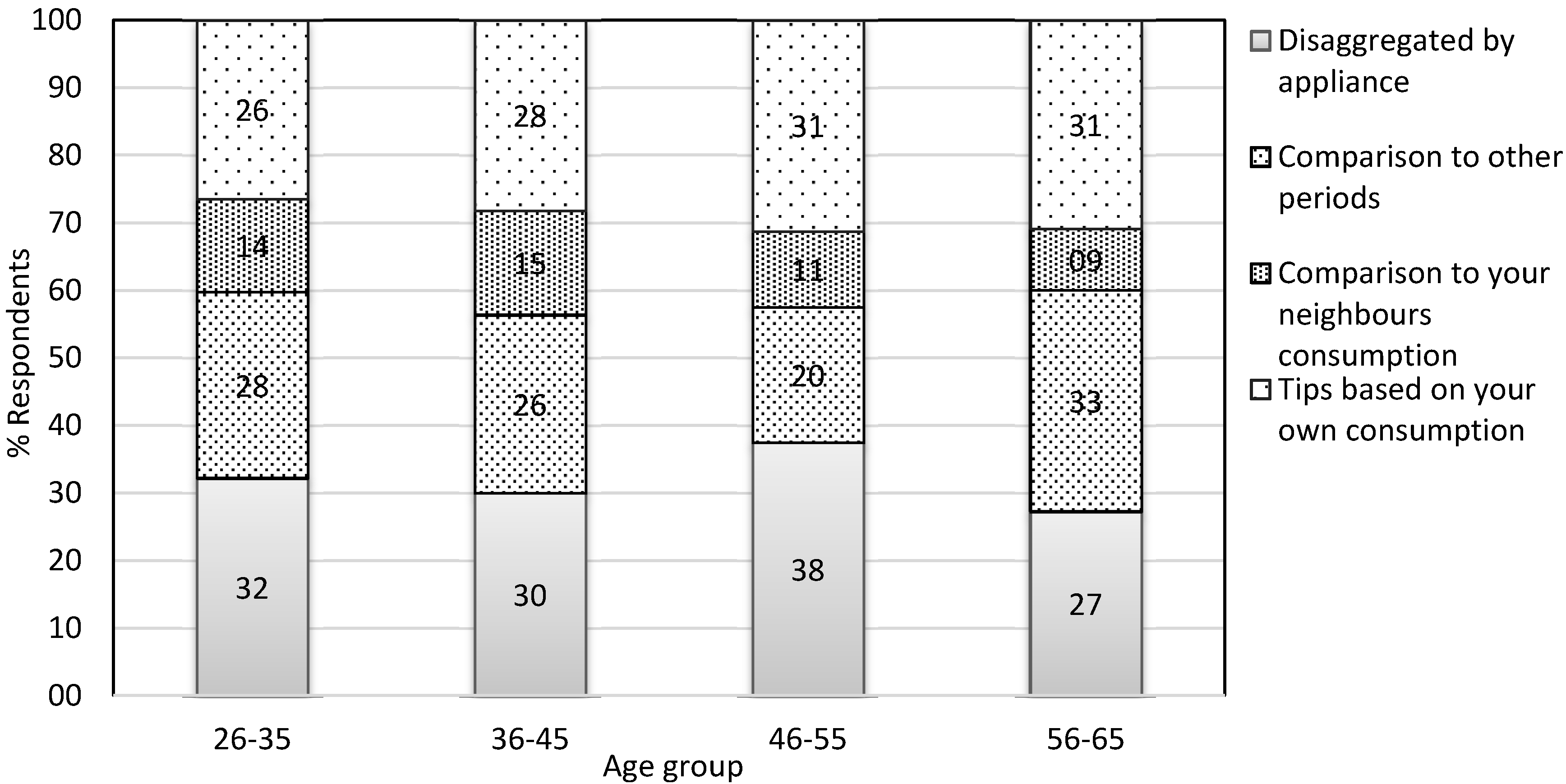

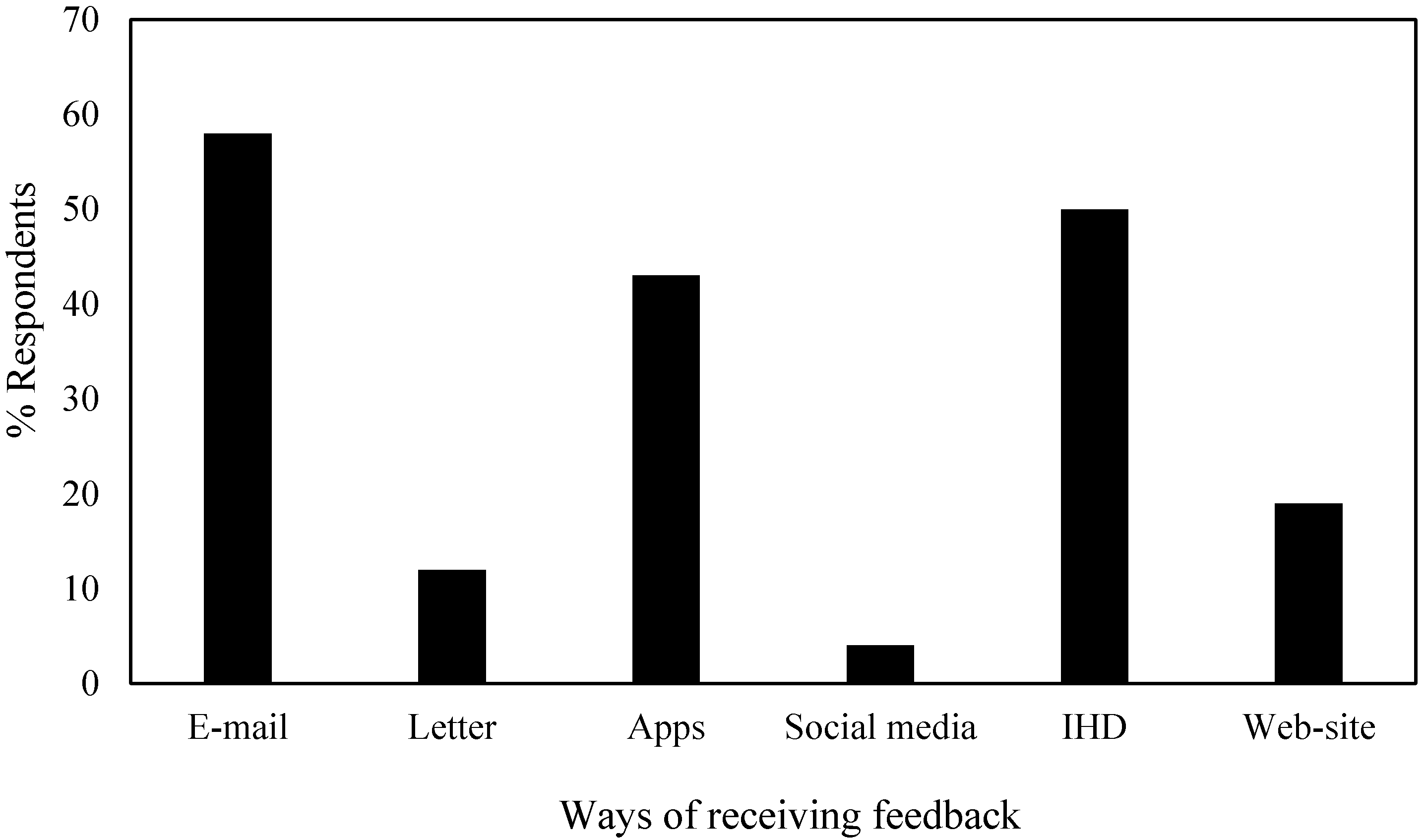

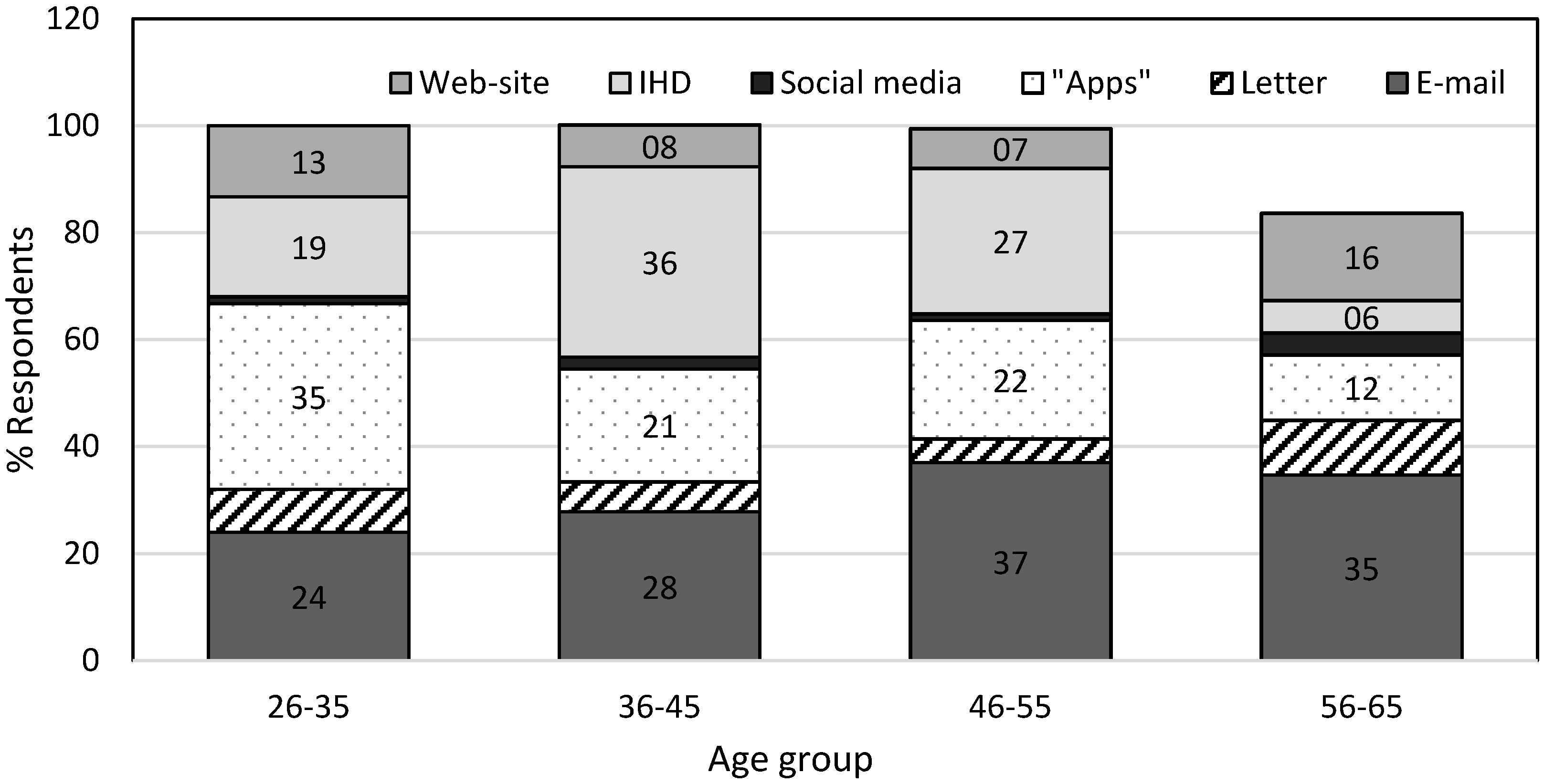

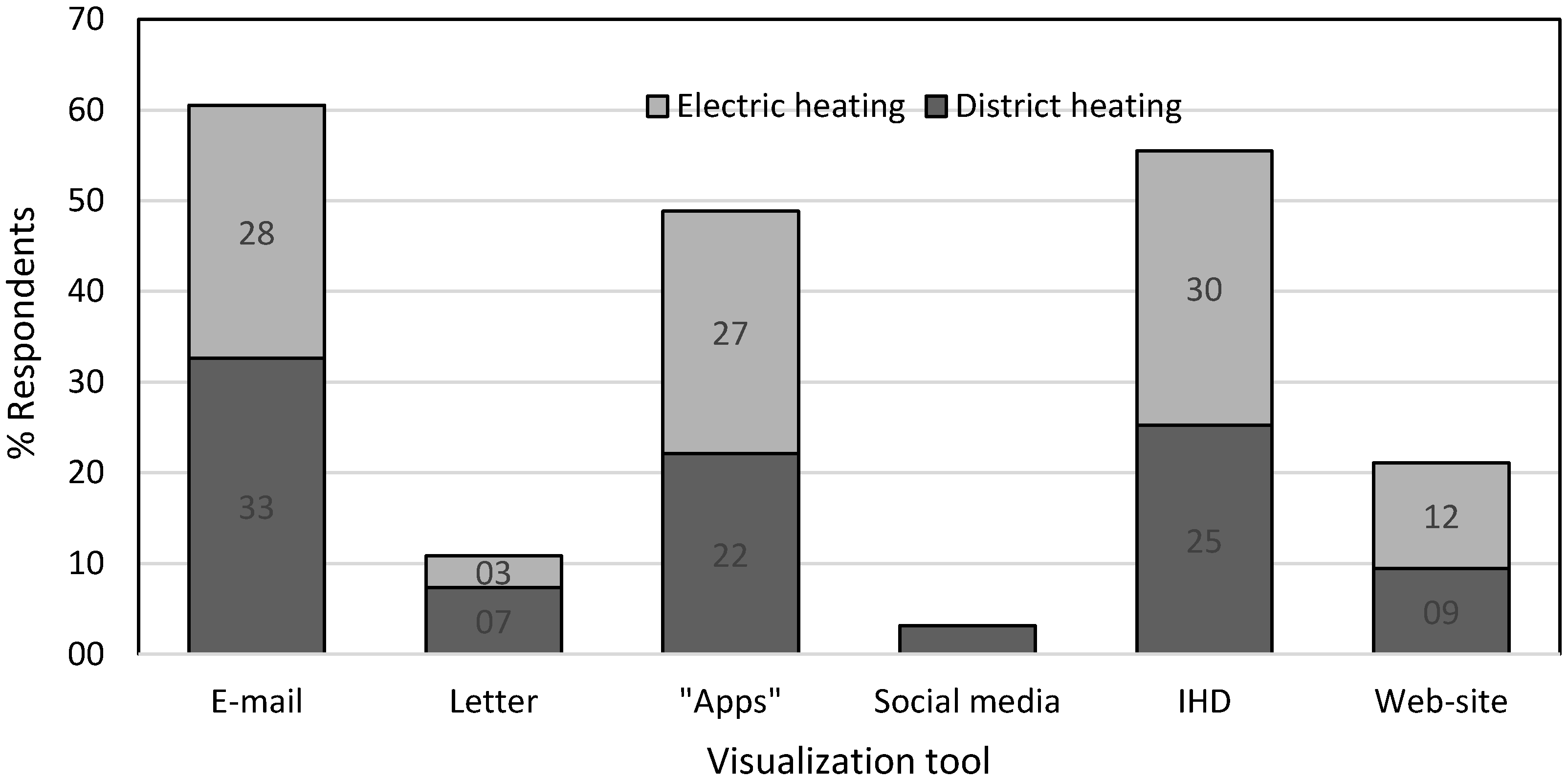

3.3. Consumption Information and Feedback

4. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Energy in Sweden. 2013. Available online: https://energimyndigheten.a-w2m.se/Home.mvc?ResourceId=2785 (accessed on 4 May 2014).

- Berkhout, P.H.G.; Muskens, J.C.; Velthuijsen, J.W. Defining the rebound effect. Energy Policy 2000, 28, 425–432. [Google Scholar] [CrossRef]

- European Commission. A New Directive for Energy Efficiency—Challenges Addressed and Solutions Proposed. Available online: http://ec.europa.eu/energy/efficiency/eed/doc/2011_directive/20110622_energy_efficiency_directive_slides_presentation_en.pdf (accessed on 5 May 2014).

- European Commission. Energy Efficiency Directive. Available online: http://ec.europa.eu/energy/efficiency/eed/eed_en.htm (accessed on 30 August 2014).

- Smart Meters. Smart Electric Meters, Advanced Metering Infrastructure, and Meter Communications: Global Market Analysis and Forecasts; Navigant Consulting, Inc.: Boulder, CO, USA, 2013; p. 69. [Google Scholar]

- Delivering Successful Smart Metering Projects in Europe. Available online: http://www.ey.com/Publication/vwLUAssets/EY-delivering-successful-smart-metering-projects-in-Europe/$FILE/EY-delivering-successful-smart-metering-projects-in-Europe.pdf (accessed on 2 December 2015).

- Gerpott, T.J.; Paukert, M. Determinants of willingness to pay for smart meters: An empirical analysis of household customers in Germany. Energy Policy 2013, 61, 483–495. [Google Scholar] [CrossRef]

- Faruqui, A.; Sergici, S.; Sharif, A. The impact of informational feedback on energy consumption—A survey of the experimental evidence. Energy 2010, 35, 1598–1608. [Google Scholar] [CrossRef]

- Darby, S. Smart metering: What potential for householder engagement? Build. Res. Inf. 2010, 38, 442–457. [Google Scholar] [CrossRef]

- Pyrko, J.; Darby, S. Conditions of Behavioural Changes Towards Efficient Energy Use—A Comparative Study Between Sweden and the United Kingdom. Available online: http://www.lth.se/fileadmin/ees/Publikationer/2009/8200_Pyrko.pdf (accessed on 31 August 2014).

- Council of European Energy Regulators. Status Review of Regulatory Aspects of Smart Metering. Available online: http://www.energy-regulators.eu/portal/page/portal/EER_HOME/EER_PUBLICATIONS/CEER_PAPERS/Customers/2013/7-1_C13-RMF-54-05-Status_Review_of_Regulatory_Aspects_of_Smart_Metering_FOR_PUBLICATION.pdf (accessed on 20 March 2015).

- Swedish Energy Markets Inspectorate. Available online: http://erranet.org/Events/ERRA/2012/Licensing_Gdansk_February (accessed on 1 December 2015).

- Kerstin Sernhed. Energy Services in Sweden. Customers Relations Towards Increased Sustainability. 2008. Available online: http://www.ees.energy.lth.se/fileadmin/ees/Publikationer/2008/K_Sernhed_DoctoralThesis2008.pdf (accessed on 1 December 2015).

- Armel, C.K.; Gupta, A.; Shrimali, G.; Albert, A. Is disaggregation the holy grail of energy efficiency? The case of electricity. Energy Policy 2013, 52, 213–234. [Google Scholar] [CrossRef]

- European Commission. The Commission’s New Energy Efficiency Directive. Available online: http://europa.eu/rapid/pressReleasesAction.do?reference=MEMO/11/440&format=HTML&aged=0&language=en&guiLanguage=en (accessed on 5 May 2014).

- Figueiredo, M.; de Almeida, A.; Ribeiro, B. Home electrical signal disaggregation for non-intrusive load monitoring (NILM) systems. Neurocomputing 2012, 9, 66–73. [Google Scholar] [CrossRef]

- Benyoucef, D.; Klein, P.; Bier, T. Smart Meter with non-intrusive load monitoring for use in Smart Homes. In Proceeding of the 2010 IEEE International Energy Conference, Manama, Bahrain, 18–22 December 2010; pp. 96–101.

- Zoha, A.; Ali, I.M.; Rajasegarar, S. Non-intrusive load monitoring approaches for disaggregated energy sensing: A survey. Sensors 2012, 12, 16838–16866. [Google Scholar] [CrossRef] [PubMed]

- McKenna, E.; Richardson, I.; Thomson, M. Smart meter data: Balancing consumer privacy concerns with legitimate applications. Energy Policy 2012, 41, 807–814. [Google Scholar] [CrossRef]

- Dütschke, E.; Paetz, A.-G. Dynamic electricity pricing-which programs do consumers prefer? Energy Policy 2013, 59, 226–234. [Google Scholar] [CrossRef]

- Dupont, B.; de Jonghe, C.; Olmos, L.; Belmans, R. Demand response with locational dynamic pricing to support the integration of renewables. Energy Policy 2014, 67, 344–354. [Google Scholar] [CrossRef]

- Swedish Energy Market Inspectorate. Available online: https://www.ei.se/Documents/Publikationer/rapporter_och_pm/Rapporter%202015/Rapport_An_electricity_market_in_transition_Umea_universitet.pdf (accessed on 29 November 2015).

- Federal Energy Regulatory Commission (FERC). Assessment of Demand Response and Advanced Metering; Staff Report; Federal Energy Regulatory Commission (FERC): Washington, DC, USA, 2012. Available online: https://www.ferc.gov/legal/staff-reports/12-20-12-demand-response.pdf (accessed on 18 December 2015).

- Campillo, J.; Wallin, F.; Vassileva, I.; Dahlquist, E. Economic impact of dynamic electricity pricing mechanisms adoption for households in Sweden. In Proceeding of the World Renewable Energy Congress, Murdoch University Australia, Murdoch, Australia, 14–18 July 2103.

- Hu, Z.; Kim, J.-H.; Wang, J.; Byrne, J. Review of dynamic pricing programs in the U.S. and Europe: Status quo and policy recommendations. Renew. Sustain. Energy Rev. 2015, 42, 743–751. [Google Scholar] [CrossRef]

- Darby, S.J.; McKeena, E. Social implications of residential demand response in cool temperate climates. Energy Policy 2012, 49, 759–769. [Google Scholar] [CrossRef]

- Peters, J.S.; Moezzi, M.; Lutzenhiser, S.; Woods, J.; Dethman, L.; Kunkle, R. Power Choice Residential Customer Response to TOU Rates, For California Energy Commission; Report CEC-5000–2009-XXX; Research into Action, Inc.: Berkeley, CA, USA, 2009. [Google Scholar]

- Statistics Sweden (SCB). Negotiation and Changes of Electricity Contracts. 2014. Available online: http://www.scb.se/Statistik/EN/EN0304/2014K04/EN0304_2014K04_SM_EN24SM1501.pdf (accessed on 1 December 2015).

- Heiskanen, E.; Matschoss, K. Exploring emerging customer needs for smart grid applications. In Proceeding of the 2nd IEEE PES International Conference and Exhibition on Innovative Smart Grid Technologies (ISGT Europe), Manchester, UK, 5–7 Decemebr 2011.

- Broman Toft, M.; Schuitema, G.; Thøgersen, J. Responsible technology acceptance: model development and application to consumer acceptance of smart grid technology. Appl. Energy 2014, 134, 392–400. [Google Scholar] [CrossRef]

- Throne-Holst, H.; Strandbakken, P.; Stø, E. Identification of households’ barriers to energy saving solutions. Manag. Environ. Qual. Int. J. 2008, 19, 55–66. [Google Scholar] [CrossRef]

- Energy in Sweden. Available online: https://www.energimyndigheten.se/contentassets/50a0c7046ce54aa88e0151796950ba0a/energilaget-2015_webb.pdf (accessed on 30 Decemebr 2015).

- Hargreaves, T.; Nye, M.; Burgess, J. Making energy visible: A qualitative field study of how householders interact with feedback from smart energy monitors. Energy Policy 2010, 39, 6111–6119. [Google Scholar] [CrossRef]

- Fischer, C. Feedback on household electricity consumption: A tool for saving energy? Energy Effic. 2008, 1, 79–104. [Google Scholar] [CrossRef]

- Darby, S. The Effectiveness of Feedback on Energy Consumption: A review for DEFRA of the Literature on Metering, Billing and Direct Displays; Environmental Change Institute, University of Oxford: Oxford, UK, 2006. [Google Scholar]

- Vassileva, I.; Odlare, M.; Wallin, F.; Dahlquist, E. The impact of consumers’ feedback preferences on domestic electricity consumption. Appl. Energy 2012, 93, 575–582. [Google Scholar] [CrossRef]

- Faruqui, A.; Harris, D.; Hledik, R. Unlocking the 53 billion savings from smart meters in the EU: How increasing the adoption of dynamic tariffs could make or break the EU’s smart grid investment. Energy Policy 2010, 38, 6222–6231. [Google Scholar] [CrossRef]

- Grønhøj, A.; Thøgersen, J. Feedback on household electricity consumption: Learning and social influence processes. Int. J. Consum. Stud. 2011, 35, 138–145. [Google Scholar] [CrossRef]

- Göransson, A. Indicators for Electricity Consumption and End-Use. Elforsk Report 06:54. October 2006. Available online: http://www.elforsk.se/Rapporter/?rid=06_54_ (accessed on 29 November 2015).

- Vaasaett. Assessing the Use and Value of Energy Monitors in Great Britain. Available online: http://www.vaasaett.com/wp-content/uploads/2014/04/assessing_the_use_and_value_of_energy_monitors_in_great_britain-2.pdf (accessed on 10 December 2014).

- Chiang, T.; Natarajan, S.; Walker, I. A laboratory test of the efficacy of energy display interface design. Energy Build. 2012, 55, 471–480. [Google Scholar] [CrossRef]

- Bonino, D.; Corno, F.; de Russis, L. Home energy consumption feedback: A user survey. Energy Build. 2012, 47, 383–393. [Google Scholar] [CrossRef]

- Vassileva, I.; Wallin, F.; Dahlquist, E. Understanding energy consumption behavior for future demand response strategy development. Energy 2012, 46, 94–100. [Google Scholar] [CrossRef]

- Crouch, M.; McKenzie, H. The logic of small samples in interview-based qualitative research. Soc. Sci. Inf. 2006, 45, 483–499. [Google Scholar] [CrossRef]

- Flyvberg, B. Five misunderstandings about case-study research. Qual. Inq. 2004, 12, 219–245. [Google Scholar] [CrossRef]

- Braunsberger, K.; Whybenga, H.; Gates, R.A. Comparison of reliability between telephone and web-based surveys. J. Bus. Res. 2007, 60, 758–764. [Google Scholar] [CrossRef]

- Fleming, C.H.M.; Bowden, M. Web-based surveys as an alternative to traditional mail methods. J. Environ. Manag. 2009, 90, 284–292. [Google Scholar] [CrossRef] [PubMed]

- Vasteras City. Available online: http://www.vasteras.se/omvasteras/statistikochfakta/statistikafteramne/Sidor/befolkning.aspx (accessed on 27 August 2014).

- Survey System. Available online: http://www.surveysystem.com/sscalc.htm (accessed on 27 August 2014).

- Ueno, T.; Inada, R.; Saeki, O.; Truji, K. Effectiveness of an energy-consumption information system for residential buildings. Appl. Energy 2006, 83, 868–883. [Google Scholar] [CrossRef]

- Eurostat. Available online: http://ec.europa.eu/eurostat/statistics-explained/index.php/Household_composition_statistics (accessed on 26 November 2015).

- Statistics Sweden. Available online: http://www.scb.se/en_/Finding-statistics/Statistics-by-subject-area/Housing-construction-and-building/Housing-construction-and-conversion/Dwelling-stock/Aktuell-Pong/87476/Behallare-for-Press/388316/ (accessed on 25 November 2015).

- NordREG. Nordic Market Report 2011: Development in the Nordic Electricity Market; NordREG: København V, Danmark, 2011. [Google Scholar]

- Karjalainen, S. Should it be automatic or manual—The occupant’s perspective on the design of domestic control systems. Energy Build. 2013, 65, 119–126. [Google Scholar] [CrossRef]

- Peschiera, G.; Taylor, J.E. The impact of peer network position on electricity consumption in building occupant networks utilizing energy feedback systems. Energy Build. 2012, 49, 584–590. [Google Scholar] [CrossRef]

- Löfström, E. Smart meters and people using the grid: Exploring the potential benefits of AMR-technology. Energy Proced. 2014, 58, 65–72. [Google Scholar] [CrossRef]

- Naus, J.; van Vliet, B.J.M.; Hendriksen, A. Householders as change agents in a Dutch smart energy transition: on power, privacy and participation. Energy Res. Soc. Sci. 2015, 9, 125–136. [Google Scholar] [CrossRef]

- Chen, V.L.; Delmas, M.A.; Kaiser, W.J.; Locke, S.L. What can we learn from high frequency appliance-level energy metering? Results from a field experiment. Energy Policy 2015, 77, 164–175. [Google Scholar] [CrossRef]

- Vassileva, I.; Wallin, F.; Ding, Y.; Beigl, M.; Dahlquist, E. Household Indicators for Developing Innovative Feedback Technologies. In Proceedings of 2011 2nd IEE PES International Conference and Exhibition on Innovative Smart Grid Technologies (ISGT Europe), Manchester, UK, 5–7 December 2011.

- Ivanov, C.; Getachew, L.; Fenrick, S.A.; Vittetoe, B. Enabling technologies and energy savings: The case of EnergyWise Smart Meter Pilot of Connexus Energy. Util. Policy 2013, 26, 76–84. [Google Scholar] [CrossRef]

- Hargreaves, T.; Nye, M.; Burgess, J. Keeping energy visible? Exploring how householders interact with feedback from smart energy monitors in the longer term. Energy Policy 2013, 52, 126–134. [Google Scholar]

© 2016 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons by Attribution (CC-BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Vassileva, I.; Campillo, J. Consumers’ Perspective on Full-Scale Adoption of Smart Meters: A Case Study in Västerås, Sweden. Resources 2016, 5, 3. https://doi.org/10.3390/resources5010003

Vassileva I, Campillo J. Consumers’ Perspective on Full-Scale Adoption of Smart Meters: A Case Study in Västerås, Sweden. Resources. 2016; 5(1):3. https://doi.org/10.3390/resources5010003

Chicago/Turabian StyleVassileva, Iana, and Javier Campillo. 2016. "Consumers’ Perspective on Full-Scale Adoption of Smart Meters: A Case Study in Västerås, Sweden" Resources 5, no. 1: 3. https://doi.org/10.3390/resources5010003

APA StyleVassileva, I., & Campillo, J. (2016). Consumers’ Perspective on Full-Scale Adoption of Smart Meters: A Case Study in Västerås, Sweden. Resources, 5(1), 3. https://doi.org/10.3390/resources5010003