Resource Conservation as the Main Factor in Increasing the Resource Efficiency of Russian Gas Companies

Abstract

1. Introduction

2. Materials and Methods

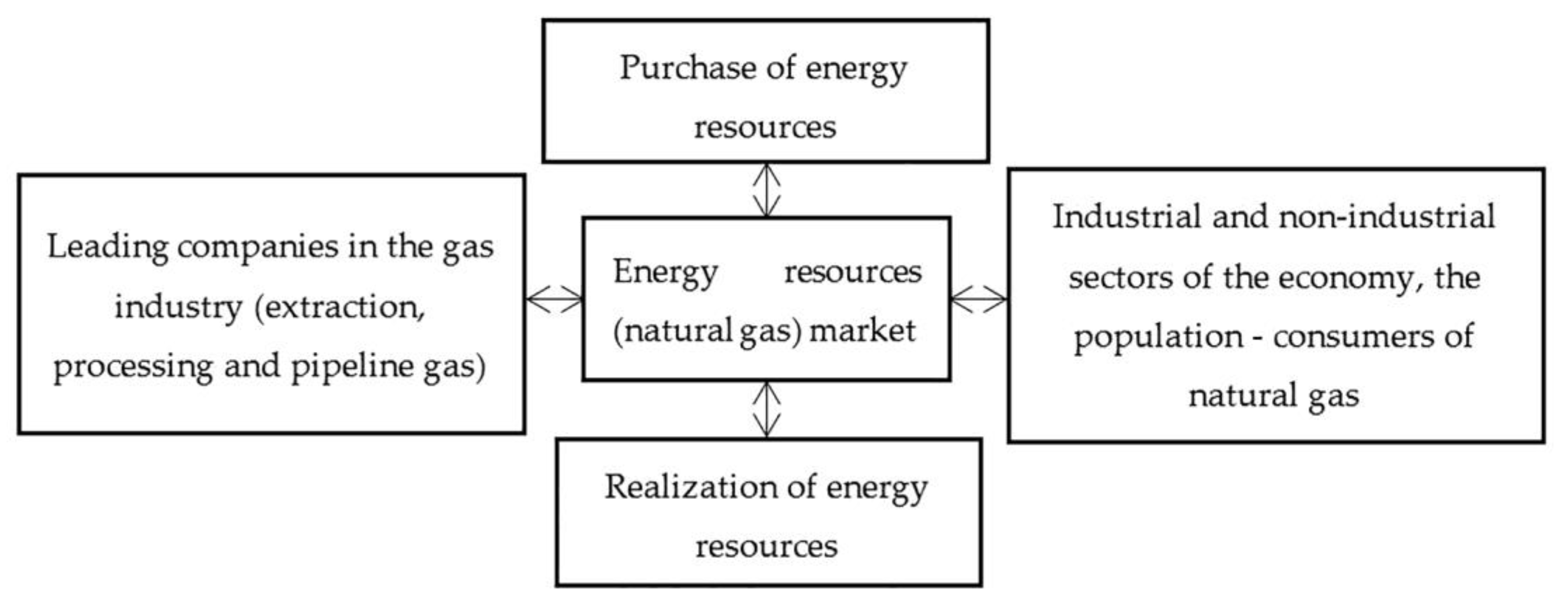

- (1)

- Flow of products produced by companies (production, processing and transport):

- (2)

- Flow of input production resources:

- (3)

- Flow of funds from the sale of company products (production, processing and transport):

- (4)

- Outflow of funds for the supply of products and production resources:

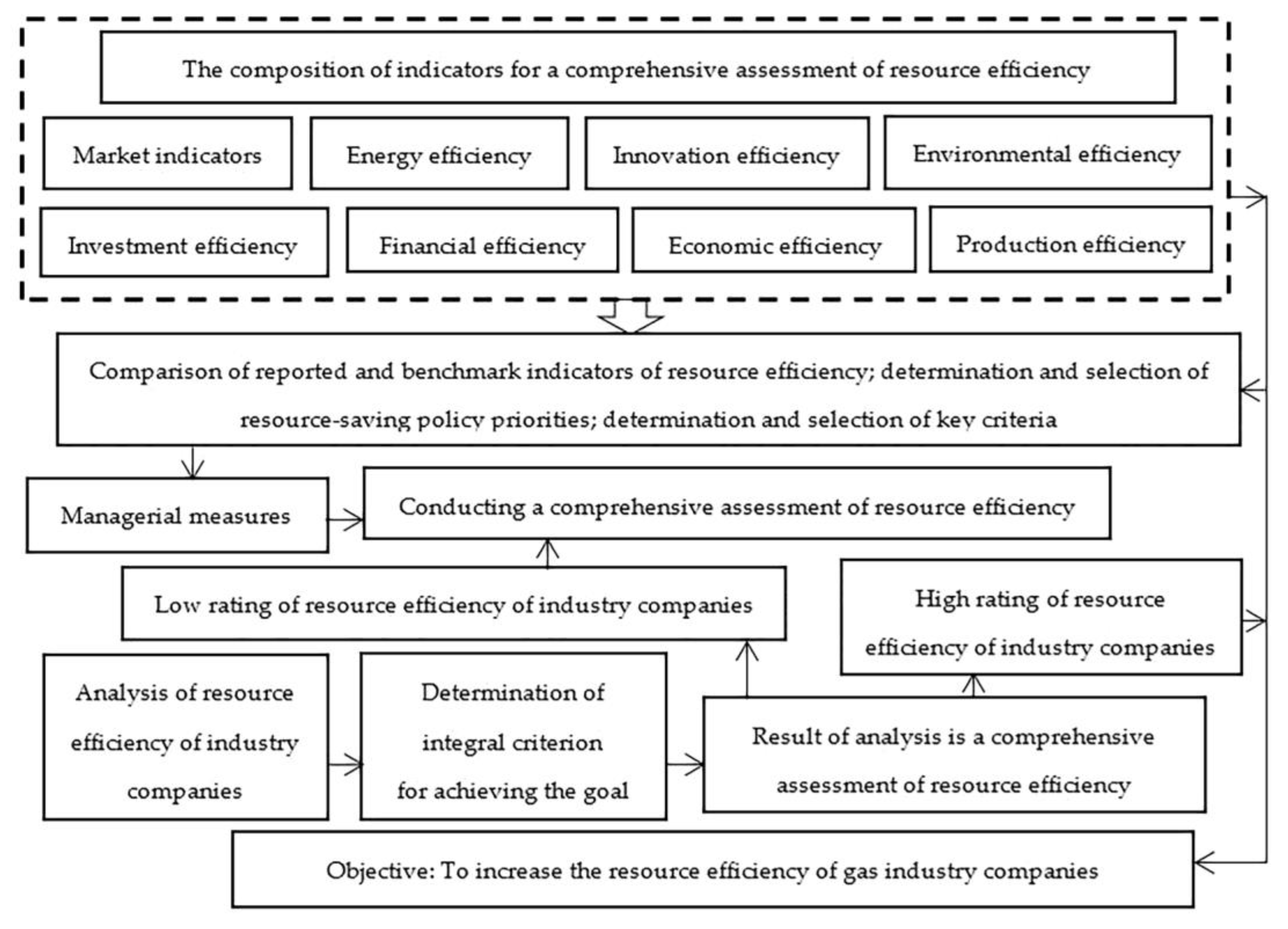

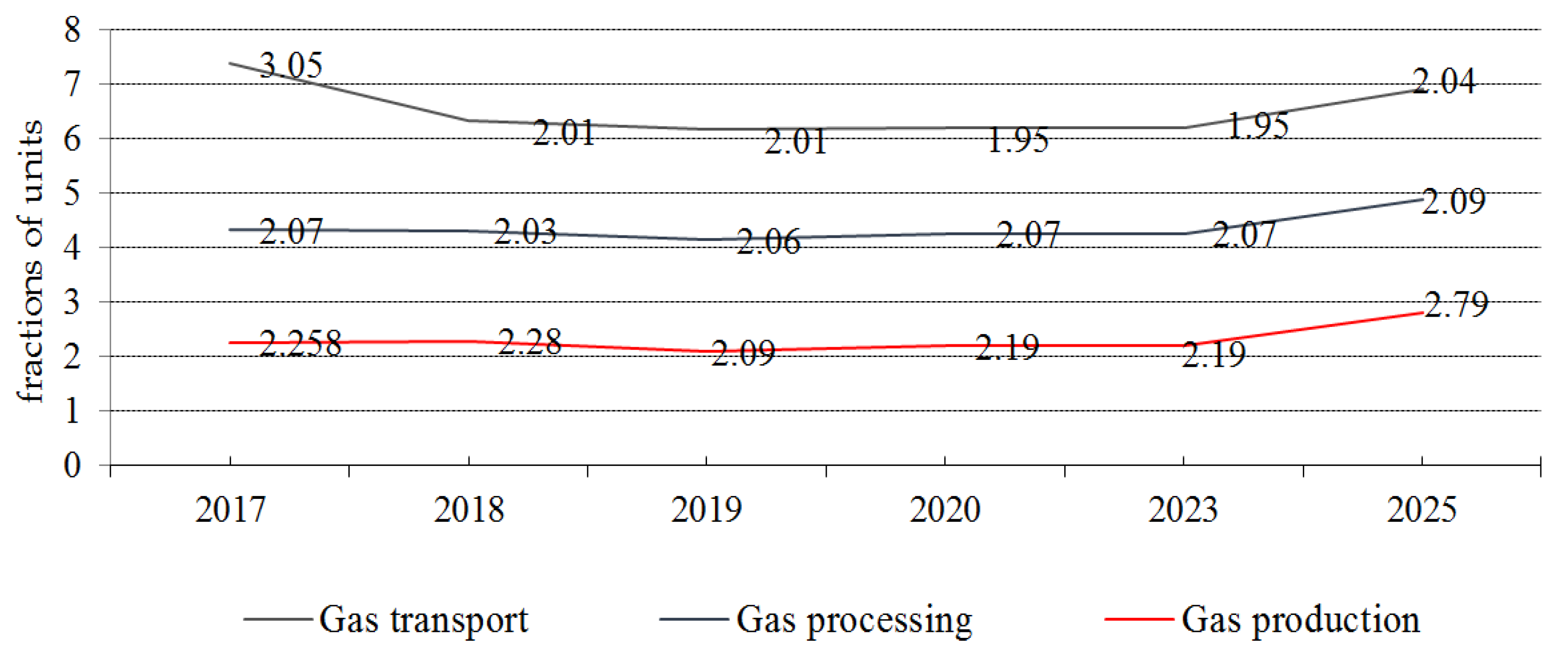

3. Results and Discussion

4. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Kheirkhah, Z.; Boozarjomehry, R.; Babaei, F. A unified benchmark for security and reliability assessment of the integrated chemical plant, natural gas and power transmission networks. J. Nat. Gas Sci. Eng. 2021, 96, 104293. [Google Scholar] [CrossRef]

- Khan, M.; Wood, D.; Qyyum, M.; Ansari, K.; Ali, W. Graphical approach for estimating and minimizing boil-off gas and compression energy consumption in LNG regasification terminals. J. Nat. Gas Sci. Eng. 2022, 101, 104539. [Google Scholar] [CrossRef]

- Lutzenhiser, L. Through the energy efficiency looking glass. Energy Res. Soc. Sci. 2014, 1, 141–151. [Google Scholar] [CrossRef]

- Li, W.; Chien, F.; Hsu, C.C.; Zhang, Y.Q. Nexus between energy poverty and energy efficiency: Estimating the long-run dynamics. Resour. Policy 2021, 72, 102063. [Google Scholar] [CrossRef]

- Jarboui, S.; Ghorbel, A.; Jeribi, A. Efficiency of U.S. Oil and Gas Companies toward Energy Policies. Gases 2022, 2, 61–73. [Google Scholar] [CrossRef]

- Nykänen, R. Emergence of an Energy Saving Market: The rise of Energy Service Companies. Ph.D. Thesis, University of Oulu, Oulu, Finland, 2016; p. 233. [Google Scholar]

- Teng, S.Y. Intelligent Energy-Savings and Process Improvement Strategies in Energy-Intensive Industries. Ph.D. Thesis, Fakulta strojního inženýrství, Vysoké učení technické v Brně, Brno-střed, Czech Republic, 2020. [Google Scholar]

- Triquenaux, N. Energy Characterization and Savings in Single and Multiprocessor Systems: Understanding How Much Can Be Saved and How to Achieve It in Modern Systems. Ph.D. Thesis, Versailles-St Quentin en Yvelines, Paris, France, 2015. [Google Scholar]

- Wiatr, P. Energy Saving vs. Performance: Trade-offs in Optical Networks. Ph.D. Thesis, DiVA Archive at Upsalla University, Uppsala, Sweden, 2016. [Google Scholar]

- Nickless, E.; Yakovleva, N. Resourcing Future Generations Requires a New Approach to Material Stewardship. Resources 2022, 11, 78. [Google Scholar] [CrossRef]

- Marinina, O.; Tsvetkova, A.; Vasilev, Y.; Komendantova, N.; Parfenova, A. Evaluating the Downstream Development Strategy of Oil Companies: The Case of Rosneft. Resources 2022, 11, 4. [Google Scholar] [CrossRef]

- Samylovskaya, E.; Makhovikov, A.; Lutonin, A.; Medvedev, D.; Kudryavtseva, R.-E. Digital Technologies in Arctic Oil and Gas Resources Extraction: Global Trends and Russian Experience. Resources 2022, 11, 29. [Google Scholar] [CrossRef]

- Shove, E. What is wrong with energy efficiency? Build. Res. Inf. 2018, 46, 779–789. [Google Scholar] [CrossRef]

- Timmons, D.; Khalil, E.; Ming, L. Energy efficiency and conservation values in a variable renewable electricity system. Energy Strategy Rev. 2022, 43, 100935. [Google Scholar] [CrossRef]

- Adams, P.D.; Parmenter, B.R. Computable general equilibrium modeling of environmental issues in Australia: Economic impacts of an emission trading scheme. In Handbook of Computable General Equilibrium Modeling; Elsevier: Amsterdam, The Netherlands, 2013; pp. 553–657. [Google Scholar] [CrossRef]

- Farajzadeh, Z.; Bakhshoodeh, M. Economic and environmental analyses of Iranian energy subsidy reform using Computable General Equilibrium (CGE) model. Energy Sustain. Dev. 2015, 27, 147–154. [Google Scholar] [CrossRef]

- Parmenter, D. Key Performance Indicators (KPI); John Wiley and Sons: Hoboken, NJ, USA, 2010; p. 320. [Google Scholar]

- UNEP Guide for Energy Efficiency and Renewable Energy Laws. In United Nations Environment Programme; Pace University Law School Energy and Climate Center: White Plains, NY, USA, 2016; p. 388.

- International Energy Agency. Energy Efficiency Indicators: Fundamentals on Statistics; IEA: Paris, France, 2014; p. 387. [Google Scholar]

- Naveiro, M.; Gómez, M.R.; Fernández, I.A.; Insua, B. Energy efficiency and environmental measures for Floating Storage Regasification Units. J. Nat. Gas Sci. Eng. 2021, 96, 104271. [Google Scholar] [CrossRef]

- Hsieh, J.-C. Study of energy strategy by evaluating energy–environmental Efficiency. Department of Business Administration, Taipei City University of Science and Technology. Energy Rep. 2022, 8, 1397–1409. [Google Scholar] [CrossRef]

- Bhagaloo, K.; Baboolal, A.; Ali, R.; Razac, Z.; Lutchmansingh, A. Resource efficiency as a guide to clean and affordable energy: A case study on Trinidad and Tobago. Chem. Eng. Res. Des. 2021, 178, 405–420. [Google Scholar] [CrossRef]

- Karaeva, A.; Magaril, E.; Rada, E.C. Improving the approach to efficiency assessment of investment projects in the energy sector. WIT Trans. Ecol. Environ. 2020, 246, 113–123. [Google Scholar] [CrossRef]

- Karaeva, A.; Magaril, E.; Al-Kayiem, H.; Torretta, V.; Rada, E.C. Approaches to the assessment of ecological and economic efficiency of investment projects: Brief review and recommendations for improvements. WIT Trans. Ecol. Environ. 2021, 253, 515–525. [Google Scholar] [CrossRef]

- Karaeva, A.; Magaril, E.; Al-Kayiem, H.H. Regulations for efficiency assessment of investment projects in the energy sector: Brief overview and comparative analysis. WIT Trans. Ecol. Environ. 2022, 255, 35–47. [Google Scholar] [CrossRef]

- Koondhar, M.A.; Qiu, L.; Li, H.; Liu, W.; He, G. A nexus between air pollution, energy consumption and growth of economy: A comparative study between the USA and China-based on the ARDL bound testing approach. Agric. Econ. 2018, 64, 265–276. [Google Scholar] [CrossRef]

- Rosén, T. Efficiency of Heat and Work in a Regional Energy System. Licentiate Thesi. Linköpings Universitet. 2019. Available online: http://liu.diva-portal.org/smash/record.jsf?pid=diva2%3A1377104&dswid=9694 (accessed on 10 August 2022).

- Forster, H.A. Saving Money or Saving Energy? Decision Architecture and Decision Modes to Encourage Energy Saving Behaviors. Ph.D. Thesis, Columbia University, New York, NY, USA, 2016. [Google Scholar] [CrossRef]

- Paramati, S.R.; Shahzad, U.; Dogan, B. The role of environmental technology for energy demand and energy efficiency: Evidence from OECD countries. Renew. Sustain. Energy Rev. 2022, 153, 111735. [Google Scholar] [CrossRef]

- Thalassinos, E.; Kadłubek, M.; Thong, L.; Hiep, T.; Ugurlu, E. Risk-Based Methodology for Determining Priority Directions for Improving Occupational Safety in the Mining Industry of the Arctic Zone. Resources 2022, 11, 42. [Google Scholar] [CrossRef]

- Bouacida, I.; Wachsmuth, J.; Eichhammer, W. Impacts of greenhouse gas neutrality strategies on gas infrastructure and costs: Implications from case studies based on French and German GHG-neutral scenarios. Energy Strategy Rev. 2022, 44, 100908. [Google Scholar] [CrossRef]

- Song, W.; Xianfeng, H. A bilateral decomposition analysis of the impacts of environmental regulation on energy efficiency in China from 2006 to 2018. Energy Strategy Rev. 2022, 43, 100931. [Google Scholar] [CrossRef]

- Sarpong, F.; Wang, J.; Cobbinah, B.; Makwetta, J.; Chen, J. The drivers of energy efficiency improvement among nine selected West African countries: A two-stage DEA methodology. Energy Strategy Rev. 2022, 43, 100910. [Google Scholar] [CrossRef]

- Koirala, B.P. Integrated Community Energy Systems. Ph.D. Thesis, DiVA Archive at Upsalla University, Upsalla, Sweden, 2017. [Google Scholar]

- Labanca, N. Complex Systems and Social Practices in Energy Transitions. In Framing Energy Sustainability in the Time of Renewables; Springer: Berlin/Heidelberg, Germany, 2017; p. 337. [Google Scholar]

- Yang, C.; Gao, F.; Dong, M. Energy efficiency modeling of integrated energy system in coastal areas. Global Topics and New Trends in Coastal Research: Port. J. Coast. Res. 2020, 103 (Suppl. 1), 995–1001. [Google Scholar] [CrossRef]

- DeCarolis, J.; Daly, H.; Dodds, P.; Keppo, I. Formalizing best practice for energy system optimization modeling. Appl. Energy 2017, 194, 184–198. [Google Scholar] [CrossRef]

- Mahler, R. The Potential of Solar Energy to Meet Renewable Energy Needs in Idaho, USA. Int. J. Energy Prod. Manag. 2022, 7, 140–150. [Google Scholar] [CrossRef]

- Zhang, J.; Liu, L.; Xie, Y.; Zhang, Y.; Guo, H. An integrated optimization and multi-scale input–output model for interaction mechanism analysis of energy–economic–environmental policy in a typical fossil-energy-dependent. Energy Strategy Rev. 2022, 44, 100947. [Google Scholar] [CrossRef]

- Debnath, K.; Mourshed, M. Forecasting methods in energy planning models. Renew. Sustain. Energy Rev. 2018, 88, 297–325. [Google Scholar] [CrossRef]

- Herbst, A.; Toro, F.; Reitze, F.; Jochem, E. Introduction to Energy Systems Modelling. Swiss J. Econ. Stat. 2012, 148, 111–135. [Google Scholar] [CrossRef]

- Moret, S.; Codina, G.; Bierlaire, M.; Maréchal, F. Characterization of input uncertainties in strategic energy planning models. Appl. Energy 2017, 202, 597–617. [Google Scholar] [CrossRef]

- Sherwin, E.; Henrion, M.; Azevedo, I. Estimation of the year-on-year volatility and the unpredictability of the United States energy system. Nat. Energy 2018, 3, 341–346. [Google Scholar] [CrossRef]

- Granado, C.; Nieuwkoop, R.; Kardakos, E.; Schaffner, C. Modelling the energy transition: A nexus of energy system and economic models. Energy Strategy Rev. 2018, 20, 229–235. [Google Scholar] [CrossRef]

- Dixon, P.B.; Koopman, R.B.; Rimmer, M.T. The MONASH Style of Computable General Equilibrium Modeling: A Framework for Practical Policy Analysis. In Handbook of Computable General Equilibrium Modeling; Elsevier: Amsterdam, The Netherlands, 2013; pp. 22–103. [Google Scholar] [CrossRef]

- Jebaraj, S.; Iniyan, S. A review of energy models. Renew. Sustain. Energy Rev. 2006, 10, 281–311. [Google Scholar] [CrossRef]

- Psarras, J.; Capros, P.; Samouilidis, J. Multiobjective programming. Energy 1990, 15, 583–605. [Google Scholar] [CrossRef]

- Sebhatu, S. Corporate Social Responsibility for Sustainable Service Dominant Logic. Int. Rev. Public Nonprofit Mark. 2010, 9, 195–196. [Google Scholar] [CrossRef]

- Lee, H.; Kim, H.; Choi, D.; Koo, Y. The impact of technology learning and spillovers between emission-intensive industries on climate policy performance based on an industrial energy system model. Energy Strategy Rev. 2022, 43, 100898. [Google Scholar] [CrossRef]

- Cao, W.; Chen, S.; Huang, Z. Does Foreign Direct Investment Impact Energy Intensity? Evidence from Developing Countries. Math. Probl. Eng. 2020, 2020, 1–11. [Google Scholar] [CrossRef]

- Greening, L.; Bernow, S. Design of coordinated energy and environmental policies: Use of multi-criteria decision-making. Economics. Energy Policy 2004, 32, 721–735. [Google Scholar] [CrossRef]

- Vagenina, L. Project Management of Strategy for Energy Efficiency and Energy Conservation in the Gas Sector of the Economy. Stud. Russ. Econ. Dev. 2015, 26, 37–46. [Google Scholar] [CrossRef]

- Tsybatov, V.; Vazhenina, L. Methodical Approaches to Analysis and Forecasting of Development Fuel and Energy Complex and Gas Industry in the Region. Ekon. Reg. 2014, 4, 188–199. [Google Scholar] [CrossRef]

- Russian Classification of Economic Activities. Available online: https://www.consultant.ru/document/cons_doc_LAW_163320/ (accessed on 20 August 2022).

| Group | Authors | Research Content | Disadvantages |

|---|---|---|---|

| I | [1,2,3,4,5,6,7,8,9,10,11,12,13,14,15,16,17] | Includes studies aimed at the balanced provision of energy resources for production processes and reduced consumption. | The studies consider only the production task of providing resources and consuming them. The resources include only electric energy and natural gas. Material, investment, innovation and other resources of the company are not taken into account at all when identifying reserves for improving energy efficiency. |

| II | [18,19,20,21,22,23,24,25,26,27,28,29,30,31,32,33] | Considers the tasks involved in increasing energy and resource efficiency by reducing the load on the environment and assessing energy efficiency. | The authors narrowly try to solve the problem of increasing energy efficiency from an environmental point of view and do not consider the problem in the complex mix of economic, investment, innovation and other areas of the company’s activities. |

| III | [34,35,36,37,38,39,40,41,42,43,44,45,46,47] | Devoted to identifying reserves for resource conservation and resource efficiency growth. The authors consider the process of modeling efficient energy systems at the regional and national levels. | The studies are relevant, but their aggregation reduces their applicability to production systems and individual companies, and they also have regional and national specificities. |

| IV | [42,43,44,45] | Examines the impacts of innovations on improving resource efficiency. | Studies assessing the impacts of innovations on improving resource efficiency do not sufficiently take into account the specifics of production systems; therefore, their application is not possible. |

| Efficiency Indicators | Gas Production | Gas Processing | Gas Transport |

|---|---|---|---|

| 1. Changes in market conditions | |||

| Output, bcm | 109 | ||

| Throughput, bcm | 37.8 | ||

| Volume of transported products, bcm | 866.3 | ||

| Growth rate of output, % | 110 | 110 | 110 |

| Growth rate of proceeds from product sales, % | 113 | 112 | 113 |

| Growth rate of production costs, % | 109 | 106.8 | 107 |

| Investment growth rate, % | 108.2 | 117 | 118.4 |

| Growth rate of natural gas consumption, % | 107.8 | - | 100 |

| Growth rate of electricity consumption, % | 107.5 | 108 | 96.6 |

| Growth rate of heat energy consumption, % | 107.3 | 105 | 103.5 |

| Growth rate of pollutant emissions, % | 89.9 | 89.9 | 98.1 |

| Growth rate of environmental protection costs, % | 175 | 178 | 116 |

| 2. Increase in production efficiency | |||

| Fixed assets turnover ratio, thous.cm/rub | 0.18 | 26.6 | 216.5 |

| Labor efficiency, mmcm/person | 8.2 | 9.84 | 104.5 |

| Working capital turnover, times | 2.8 | 1.42 | 0.297 |

| Material productivity, thous.cm/rub | 3040 | 204.3 | 41.1 |

| Material productivity, rub/rub | 27.4 | 4.42 | 0.013 |

| Materials-output ratio, rub/rub | 0.037 | 0.23 | 76.9 |

| 3. Increase in economic efficiency | |||

| Product profitability, % | 38.1 | 68 | 24 |

| Margin on sales, % | 32.1 | 47.3 | 28.6 |

| EBITDA margin, % | 47.8 | 48.5 | 60.7 |

| Return on assets, % | 89.5 | 69.2 | 28.9 |

| Return on equity, % | 17 | 24.8 | 13.1 |

| Return on investments, % | 14.8 | 17.3 | 12.4 |

| 4. Increase in financial efficiency | |||

| Debt ratio | 53.2 | 1.93 | 28.6 |

| Leverage ratio | 0.02 | 1.05 | 0.036 |

| Equity ratio | 1.1 | 0.5 | 1.2 |

| Coverage ratio | 1.9 | 1.23 | 12.4 |

| 5. Increase in investment efficiency | |||

| Simple rate of return (SRR), rub/rub | 0.56 | 0.56 | 1.09 |

| Payback period (PBP), years | 1.79 | 1.79 | 0.92 |

| Benefit-cost ratio (BCR), rub/rub | 0.37 | 0.46 | 0.235 |

| Profitability index (PI), rub/rub | 0.34 | 0.55 | 0.1 |

| 6. Increase in energy efficiency | |||

| Specific natural gas consumption, thous.cm/thous.rub | 4.8 | - | 255.1 |

| Specific electricity consumption, kWh/thous.rub | 0.002 | - | 53.6 |

| Specific electricity consumption, kWh/rub | - | 0.03 | - |

| Specific heat energy consumption, Gcal/thous.rub | 0.001 | 0.06 | 0.023 |

| Gascapacity, thous. cm/thous.cm | 31.9 | - | 62.3 |

| Electric capacity, kWh/thous.cm | 13.3 | 386 | 13.0 |

| Heat capacity, Gcal/thous.cm | 6.6 | 0.79 | 0.006 |

| 7. Increase in environmental efficiency | |||

| Environmental impact index (EII), t/mmcm | 0.82 | 2.79 | 2.33 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Vazhenina, L.; Magaril, E.; Mayburov, I. Resource Conservation as the Main Factor in Increasing the Resource Efficiency of Russian Gas Companies. Resources 2022, 11, 112. https://doi.org/10.3390/resources11120112

Vazhenina L, Magaril E, Mayburov I. Resource Conservation as the Main Factor in Increasing the Resource Efficiency of Russian Gas Companies. Resources. 2022; 11(12):112. https://doi.org/10.3390/resources11120112

Chicago/Turabian StyleVazhenina, Larisa, Elena Magaril, and Igor Mayburov. 2022. "Resource Conservation as the Main Factor in Increasing the Resource Efficiency of Russian Gas Companies" Resources 11, no. 12: 112. https://doi.org/10.3390/resources11120112

APA StyleVazhenina, L., Magaril, E., & Mayburov, I. (2022). Resource Conservation as the Main Factor in Increasing the Resource Efficiency of Russian Gas Companies. Resources, 11(12), 112. https://doi.org/10.3390/resources11120112