Abstract

Everything as a Service (XaaS) is commonly understood as the general tendency to replace sales contracts with service contracts. Most research in this area agrees that XaaS is a trend, but it points to many drivers. It could be strategies improving customers’ expense model, servitization strategies, customer feedback, mass customisation, and machine learning. However, we do not find contributions considering the relationship between XaaS and economies of scale. When sales contracts are replaced by service contracts, ownership is elevated from the customer to the provider. Thus, possible benefits from economies of scale linked to the ownership of products are then also elevated from the customer to the provider. In this article, we consider the claim that economies of scale may be an underlying driver of the XaaS trend. A review of 140 firms shows that the products with the greatest potential for economies of scale are the ones most frequently provided as a service. This suggests that economies of scale linked to ownership are an underlying driver of XaaS. Thus, ownership-related economies of scale may be a predictor of XaaS.

1. Introduction

Everything as a service (XaaS) refers to cases where contracts for the sale of products are substituted by service contracts. Suppliers retain ownership when products are rented, leased, or licensed to customers1. This trend originated in the software industry in three variants at the start of the century. The introduction of broadband and cloud computing led to the emergence of “Software as a Service” (SaaS) in 1999 [1] Then, “Infrastructure as a Service” (IaaS) and “Platforms as a Service” (PaaS) appeared around 2010 [2,3]2. According to Fortune Business Insights [6], the global XaaS market will experience a CAGR of 24.4% between 2022 (market size: USD 560 bill) and 2030 (market size: USD 3200 bill). Similar growth rates are estimated by The Business Research Company [7].

The literature on XaaS refers to several drivers of this growth. However, no contribution is found considering economies of scale as a driver of XaaS. Economies of scale appear when the cost of producing an additional unit of output of a product decreases as the volume of output increases. (e.g., [8]). We will consider whether economies of scale may be involved in the transition from an owner economy to XaaS. This refers to a change where the ownership of a product is elevated from the customer level to the provider. Ownership advantages linked to economies of scale at the customer level may be multiplied when suppliers retain ownership, given the hierarchical structure of most supply chains.

XaaS is distinguished from the Product Service-Systems (PSSs) where suppliers “incorporate additional services” [9] or “generate new value streams to gain closer contact with customers not reachable by mere hardware improvements” [10] (p. 289). In PSS, this change is not limited to adding services or “servitization”; it includes an integration of the value streams generated by the product and services supporting the product [11]. However, PSS does not necessarily involve the transfer of ownership as in the case of XaaS.

When the transformation from buying products to renting products started to be observed outside of the domain of the software industry, it was referred to as “selling performance” versus “selling goods” [12,13,14]. It was also referred to as “Product as a Service” [15] or as “Everything as a Service” (XaaS) [16,17,18,19]. Transactions are increasingly about a right to dispose of within an agreed, or open-ended, period3. Examples of tangible products affected by XaaS are copy machines (e.g., [20]), entrance mats (e.g., [21]), drink dispensers at the workplace (e.g., [22]), tyres for automobiles (e.g., [23]), jet engines for aeroplanes (e.g., [24]), and antibiotics (e.g., [25,26]). Lately, we even see manufacturers offering “preinstalled functionality as a service”. Functionality which is already present in the product is unlocked when customers pay subscription fees. This is described in a case study of BMW [27].

This article starts by considering the general advantages linked to XaaS in the literature. Then, we take a closer look at the possible role of economies of scale as a driver of XaaS and possible reasons for omitting economies of scale as a driver in the literature. A review of 140 firms within the NACE codes that appeared most frequent in the literature review, support thesis that economies of scale linked to ownership is an underlying driver of XaaS. Finally, implications from this finding is considered.

2. The Literature on Xaas

2.1. Advantages of Xaas

For more than 40 years, consultants and researchers of business strategy have argued that suppliers in the software sector should offer their products as a service [12,13,16,17,28]. This trend has spread to material products being offered as a service as well4. The academic literature points to at least nine advantages of offering products as a service (the XaaS trend) (see Table 1).

Table 1.

Nine advantages of XaaS mentioned in the literature.

cAn immediate effect of providing a product as a service that was formerly sold is that it may improve the expense model. No major investment is required for the customer. The initial costs are equivalent to the running costs linked to maintenance, training, and upgrading (e.g., [12,30,31,32]. The XaaS trend is often associated with the deployment of sensors allowing suppliers to monitor the usage and status of products they offer to customers (e.g., [57,58]). This is an advantage for both the provider and the customer because it reduces risks and allows the provider to predict the need for services.

We see studies showing that servitization boosts sales and XaaS is a boost for servitization. A number of studies show that servitization benefit the suppliers’ interactions with customers and thereby increase revenues of product suppliers (e.g., [19,28,33,34,35,36]).

Offering a product as a service makes it easier to put in place a system for customer and product feedback, allowing companies to learn from customers and retain their loyalty over time. This may benefit innovation because some of the feedback will point to improvements or the need for new products or services (e.g., [37,38]).

We also see that authors for decades have pointed to mass customisation as one of the advantages when products are transformed from items sold, to items offered as a service (e.g., [39,40,41]).

To implement machine learning and AI, one needs feedback from large volumes of information linked to the experiences of both machines (sensors) and humans over time. This is easier to accomplish when products are offered as a service (e.g., [43,44,45,46]).

We see that XaaS is associated with increasing cost flexibility for users. XaaS allows users to tailor their demand for services because the costs of upscaling or downscaling are relatively low when capital expenditures are not involved (e.g., [13,47,48,49]).

When products are offered as a service, suppliers have an incentive to produce higher-quality products that last longer. Suppliers’ business models benefit from increased usage time of the product (e.g., [16,17,28,50]).

Products offered as a service allow for a more time-efficient use when the costs of the end-user are linked to usage time. This reduces the consumption of resources and stands in contrast to the one-time investment linked to ownership of products (e.g., [51,52,53]).

We also see that offering products as services includes incentives for prolonging the life-cycle of products. There is a marginal cost linked to usage time, maintenance, and repair work compared to the present value calculation used when purchasers invest in new products and dispose of their products (e.g., [51,53,54,55,56]).

There are also disadvantages linked to the XaaS. One frequently mentioned in the literature is that contract regulations for services are typically more complicated than contract regulations for sales contracts. More uncertainty related to the contracts’ rights and obligations is associated with increasing transaction costs [59].

2.2. Economies of Scale Linked to Ownership

Among the nine advantages of XaaS identified in the literature (Figure 1), the seven first concern potential synergies between the provider and the customer. There are commercial gains to be obtained for both parties from a new expense model, servitization, customer feedback, mass customisation, machine learning, AI, and from risk reduction. The last two advantages (8–9 in Table 1) are predominantly in the interest of the provider. Thus, the literature has identified many advantages of XaaS, but no peer-reviewed article has been found that points to ownership-related economies of scale as a driver of the XaaS trend. This finding is also based on searches in SCOPUS. No matches were found of articles linking “economies of scale“ to XaaS on SCOPUS5.

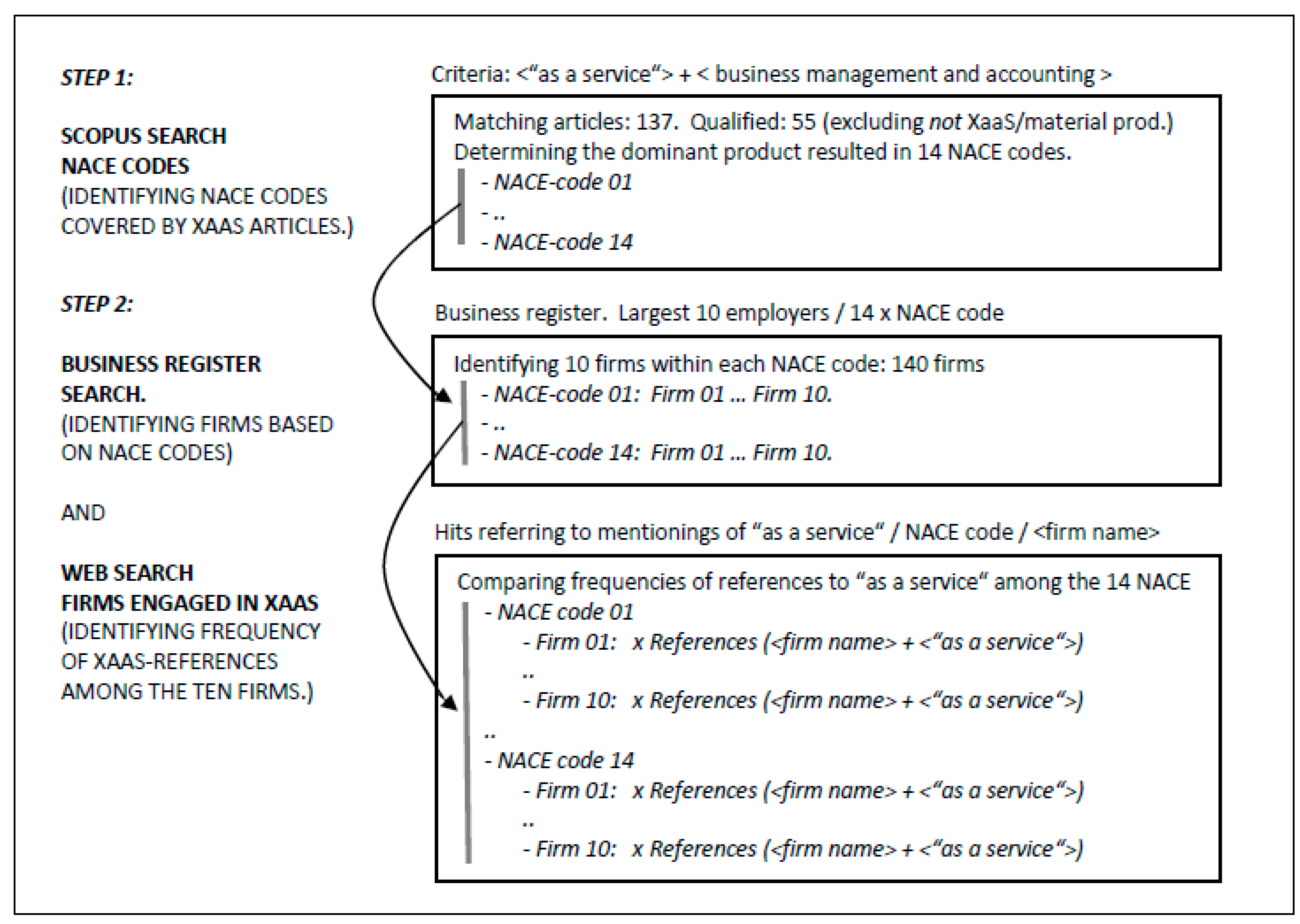

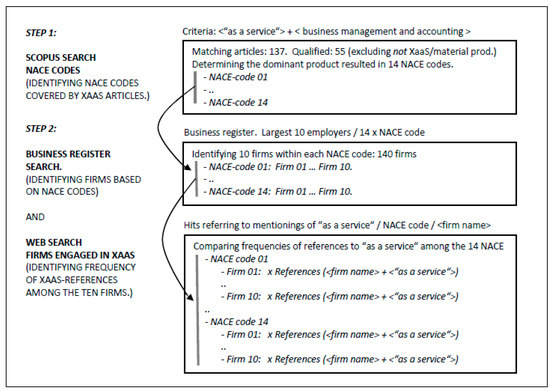

Figure 1.

Illustration of the design of the empirical study in steps 1 and 2.

What are the elements associated with “economies of scale”? A typical textbook reference is that economies of scale occur when, all other things being equal, an increase in outputs leads to a less than proportional increase in overall costs [60].

According to Stigler [61], one of the purposes of the analysis of economies of scale is to determine the optimal size of businesses. These analyses could be either related to studies of the cost profile, to the return on investment, or to businesses’ survival in competitive markets. Silberston [62] pointed out that if we take price changes into account, economies of scale are best expressed as the net present value divided by the assumed output capacity, and the degree of vertical and horizontal integration also affects economies of scale. This calls for a distinction between internal economies of scale, typically linked to business size, and external economies of scale, also referred to as positive externalities, typically linked to industry concentration and knowledge spillovers [63]. Celli [60] lists eight business characteristics favouring large businesses and covering both internal and external economies of scale. These characteristics are all referred to as economies of scale of “mass production” by Büchi et al. [64]. Büchi et al. then add economies of scale of “mass customization” and “mass personalization”, realised by technologies like additive manufacturing and smart technology in the “Industry 4.0” setting.

This article focuses mostly on internal economies of scale, as the aim is to consider the competitive advantages of firms that offer their products as a service.

The net present value (NPV) of five elements, defining “total value of ownership” presented in Azcarate-Aguerre et al. [65], covers ownership related internal economies of scale.

These five elements are similar to the elements included in the LCC literature and the PSS literature (e.g., [10,66]). The five value elements (Table 2) are relevant for durable goods with a life span of at least three years [67,68,69], not for disposable goods or consumer goods with shorter life-times [13,14,15,16,17,18,19,20,21,22,23,24,25,26,27,28,29,30,31,32,33,34,35,36,37,38,39,40,41,42,43,44,45,46,47,48,49,50,51,52,53,54,55,56,57,58,59,60,61,62,63,64,65,66,67,68,69,70].

Table 2.

The five elements of Total Value of Ownership (TVO) based on Azcárate-Aguerre et al. [65].

There are limits to economies of scale in all organisations. The classic contributions of Coase [71] and Baumol [72], describe how institutional developments and size can harm businesses as there is a trade-off between maximising profits by exploiting lower fixed costs per produced unit, and the disadvantage of becoming too large triggering diseconomies of scale [73,74]. The diseconomies of scale may be linked to both internal and external costs. Canbäck et al. [74] refer to four internal cost elements related to large organisations. First, employees have a hard time understanding the purpose of corporate activities. Second, managers may be less accountable to the lower ranks of the organisation. Third, the impact of management incentives may be weaker. Fourth, due to the cognitive limitations of managers, we see the need to compensate by developing internal hierarchies. However, diseconomies of scale may also trigger dilemmas related to the external environment of the firm. Capturing economies of scale can, in many cases involve investments with disproportionate transaction costs, or they can lead to negative externalities damaging the firm’s reputation and brand value.

When products for sale are transformed into rental services the ownership role moves one step up in the supply chain. This is what we refer to as the “XaaS trend”. Accordingly, whatever potential of economies of scale we see linked to ownership for a given product, is then elevated and multiplied to the level of the provider, given the hierarchical structure of most supply chains.

The advantages in these cases are typically less related to the scalability of the production process than to advantages related to “repeatable processes”, as we find in the definition of economies of scale in Rao [75]:

Economies of scale are the advantages that can result when repeatable processes are used to deliver large volumes of identical products or service instances.

According to Rao [75], the textbook definition of economies of scale, which focuses to falling unit costs, is really only the effect of successfully achieving economies of scale by applying repeatable processes.

The advantages of the XaaS trend, may then also be explained by “repeatable processes”. It could be by handling similar categories of transactions, similar service propositions, or similar TVO calculations. The advantages (1–7) in Table 1 are conditioned by economies of scale. Mass customisation, machine learning, and other advantages of XaaS can be introduced without realising significant economies of scale. This suggests that ownership related economies of scale may be an underlying driver of XaaS.

The XaaS trend relies on the ubiquitous broadband connectivity that allow suppliers to monitor the status of products at a low cost [19,29,76]. Before we look into empirical evidence of economies of scale driving XaaS, we shall therefore consider how digital technology influences economies of scale in general.

Many scholars indicate that digitalization and emerging business models are reducing the significance of economies of scale in various industries and business processes. According to recent literature covering additive manufacturing and cyber-physical production, economies of scale will play a lesser role due to the demand for customised products and the capacity of artificial intelligence to help businesses adapt to particular contexts within a given set of criteria (e.g., [46,77,78,79,80,81]). According to Taneja and Maney [79], the economies of scale are eroded by two complementary market forces: the emergence of platform models and the technologies that allow products to be rented whenever needed. Taneja and Maney focus on how the XaaS affects the customer, but do not take into account how the transfer of ownership affects the provider of products. They refer to this as “the economics of unscaling”. However, the prospects of AI-robots delivering customer services point in the opposite direction, according to Kunz and Wirtz [46]. They claim that AI in customer service enables “enormous economies of scale”. But none of the above-mentioned uthors consider how XaaS is affected by economies of scale at different levels of the supply chain.

Today, scalability is no longer achieved purely through the accumulation of labour and corporate resources [82]; it is achieved by exploiting market power [83], or by the ability to handle a great number of interdependent relationships in a complicated ecosystem, referred to as “network effects” [78]. Several authors believe the network effect is behind the market success of the platform model [84,85]. Choudary [78] focuses on the new network structures and the decreasing transaction costs, allowing small-value transactions triggered by smart technology. But these authors do not consider the economies of scale linked to the shift of ownership as a possible driver of XaaS.

Some scholars argue that digital technologies boost economies of scale for larger companies by utilising big data analytics, while they may reduce economies of scale for microfactories because digital technologies lead them to customise products in ways previously reserved for large companies [86]. Similar claims of a split between advantages and disadvantages of economies of scale are found with reference to additive manufacturing [87] and Industry 4.0 [64].

In summary, we observe that much of the recent literature is commenting on how digital technologies seem to reduce the importance of scale and highlighting how networks are becoming more prominent. We find no contribution arguing that economies of scale may be the driver of XaaS. A possible explanation may be that the origin of XaaS was Software as a Service (SaaS). In the software industry, products are immaterial. According to a survey of 600 IT managers in the US, the advantages of XaaS are linked to the improved operability and functionality for both customers and providers [76], and there are minimal costs linked to ownership of software. This is true both when the software is purchased and when it is licensed by the customer. But for material products, someone must bear the costs related to delivery, maintenance, training, upgrading, and the disposal of the product. Thus, there may be economies of scale linked to ownership for the provider of material products that are unattainable for owners of immaterial products.

3. Methodology

To consider the drivers of the XaaS trend empirically, we follow two research steps, illustrated in Figure 1.

Research step 1

The aim in step 1 is to analyse a sufficient number of articles to identify the typical industries and products affected by the XaaS trend. The search engine Scopus was applied to conduct a systematic literature review for articles published in 2020 or after, that were offering products as a service. The search string6 included the subject area “Business Management and Accounting”, the quote “as a service”, and the exclusion of articles mentioning “cloud” and “software”. Articles registered under the subject area “Computer Science” were also excluded. This resulted in 137 articles. When articles not covering XaaS and/or not covering material products were excluded, there were 55 matching articles. For each article, the dominant product category (NACE code) in the article was determined7. Fourteen NACE codes were found to cover the dominant product in the articles (see Figure 1).

Research step 2

Step two includes a search for Norwegian firms fulfilling two criteria (see Figure 1). These are firms situated in a relatively homogeneous legal and cultural environment. Two requirements were established. They should be active in at least one of the 14 NACE codes identified in step “1”, and they should be mentioned in texts together with the phrase “as a service” (This phrase is common in Norway and has no exact equivalent in Norwegian.). The main business of the matching firms should be to rent out products.

- -

- The first criterion is examined by using the search engine “proff.no”. This search engine is linked to the Norwegian government’s official company register, where NACE codes are included as search criteria8. Here, we identify the ten largest employers9 among the limited liability companies registered within each of the 14 NACE codes identified in research step 1 (140 firms in total).

- -

- The second criterion is included by conducting a Google search on any text mentioning <name of firm> and the text <“as a service”>. We count how many qualified matches there are per product category (NACE code). In this article, Google is not used to assess research findings or evaluate specific claims but rather to compare the relative frequency of matches in searches for “as a service” alongside particular firm names. If there is a bias in the data or weights that Google relies on, we would not assume that this would create a systematic bias among the NACE codes in our sample.

Larger firms have more references on the web (receive more matches in Google searches) than small firms. This is mitigated by only including the ten largest employers within each of the fourteen NACE codes. This ensures that firms that are offering products as a service are well known and mentioned by third parties on the web. We also see that firms with more matches in Table 3 are not distinguished by having more employees on average than the firms with fewer matches (This is shown in the data file, including the results from the search on proff.no. (See link in the Appendix B.)). Thus, the Google search is considered a reliable source for comparing firms with “as a service” hits among firms covered by the 14 NACE codes identified at Research step 1.

Table 3.

The 14 NACE codes covered by the sample of 55 peer-reviewed articles, the corresponding XaaS categories and products, the Norwegian firms, and the hits for <firm name> and “as a service”.

The Validity of This Design

To be able to analyse the variation in XaaS practices involves samples with different properties. The validity of this design relies on the assumption that the frequency of the expression “as a service” mentioned on websites that also have a reference to the name of a Norwegian employer within 14 NACE codes, found to be the dominant industry codes in international peer-reviewed articles covering XaaS. These matches may be seen as a proxy for “the degree of reliance on XaaS”. Having the search limited to only employers in one country with one national regulation and business culture reduces the chances of a systematic bias in the samples. The English expression “as a service” is used regularly among Norwegian businesses and by those representing, advising, and regulating them. The expression does not have any other meaning than as a reference to business practices where goods are offered as a service. When we exclude non-material goods, we should be left with occurrences where firms are involved in XaaS.

The selection of NACE codes representing the business areas where XaaS is most relevant, is based on a global (SCOPUS) search for peer review articles. It is assumed that these NACE codes are valid representations of the most XaaS-relevant NACE codes in Norway. Though the global NACE distribution of XaaS practices will not be equivalent to the distribution in Norway, there is no reason to believe that the difference will be significant, particularly not among the large employers selected, which typically have international trading partners and sales markets.

4. Results

An overview of all the matches for articles and firms is included in Appendix A. The 55 peer-reviewed articles in the sample cover 14 product groups (NACE codes). The NACE code of the most dominant product in each article was then recorded (Table 3, columns 1 and 2), and the “as a service”—category and a descriptor were registered (Table 3, columns 3 and 4). Thereafter, a search on proff.no was conducted to find the ten largest firms (by number of employees) registered on each of these NACE codes (Table 3, column 5). Finally, a general web search for <firm name> and the string “as a service” was conducted. Matches for each firm varied from 0 to 162, with a median of 18 (Table 3, column 6).

The NACE code with the most frequent mentioning of “as a service” was “IOT as a service”. The 14 XaaS-categories cover both business-to-business transactions and business-to-customer transactions. The categories also cover products provided by both the public and the private sector.

The data supports the assumption that the XaaS trend is mostly affecting durable goods. More than 95 percent of the articles in our systematic literature review cover products with a typical life span exceeding three years (Table 3). Only three articles referred to products other than durable goods. These articles concerned the following:

- -

- energy as a service/Sale of energy as a commodity;

- -

- equipment as a service/Wholesale of machinery, equipment, and supplies;

- -

- tourist guide robots as a service/Sale of maps and brochures.

It is not surprising that XaaS primarily concerns durable goods, as it involves renting products over extended periods. We now consider the drivers of the XaaS trend for durable goods.

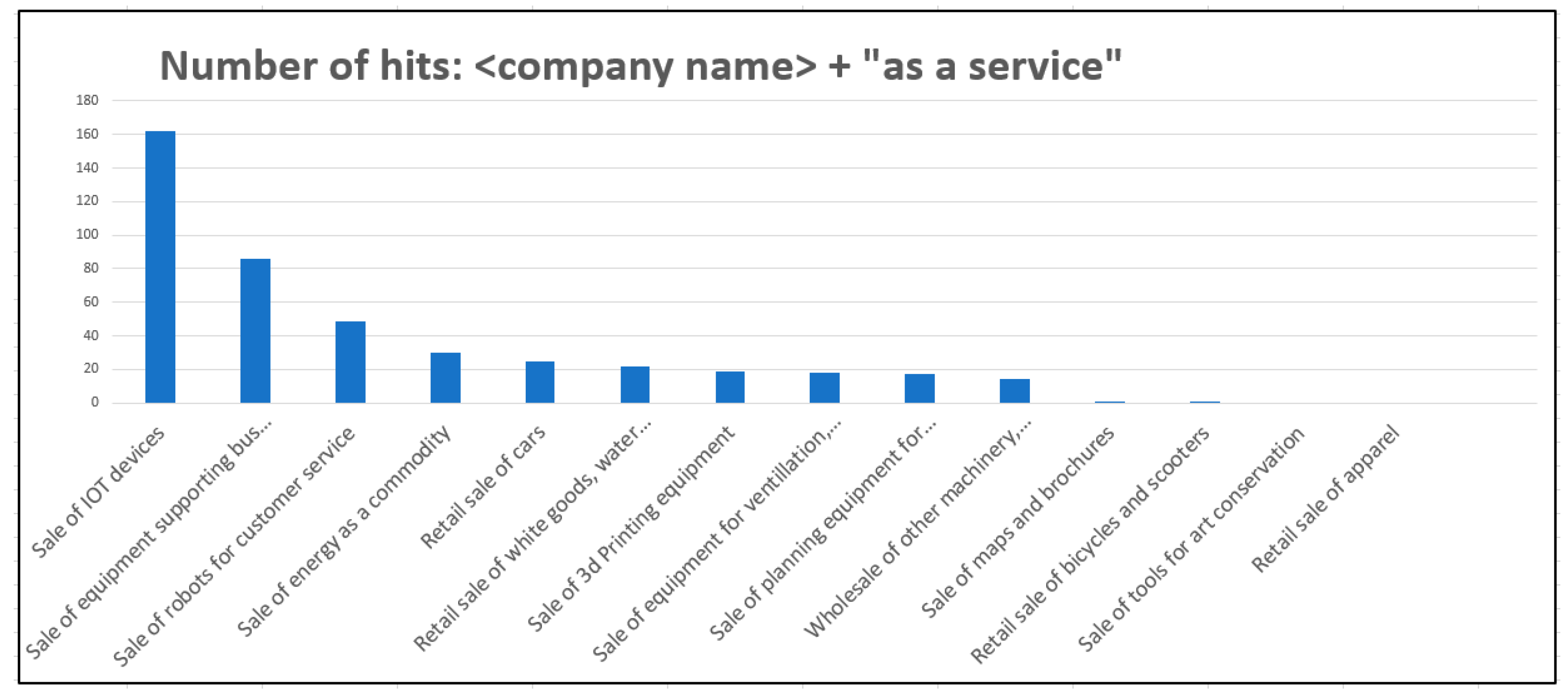

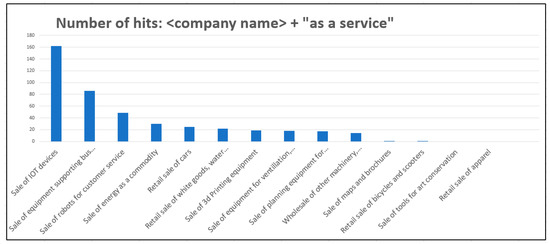

Figure 2 shows that the products with the highest number of hits “as a service” are as follows:

Figure 2.

Based on Table 3. Ranking number of hits for (<company name> + “as a service”).

- high-value products, demanding maintenance;

- allowing real-time monitoring.

The products with the lowest number of mentions of “as a service“ are products are the following:

- low-value products;

- moderate or no maintenance demand;

- products where real-time monitoring is difficult.

The maintenance costs and monitoring capabilities for the products on the left side of Figure 2 are very much influenced by economies of scale. TVO (see Table 2) includes the maintenance costs and monitoring capabilities that allow the provider to design an optimal hiring model, which in turn optimise capital expenditures. Only the products on the left side of Figure 2 have the potential to minimise these ownership costs. Thus, the products most frequently associated with the XaaS trend (the left side) have the most evident scalability advantages. This supports the thesis that economies of scale linked to ownership may be an underlying driver of the XaaS trend.

5. Discussion

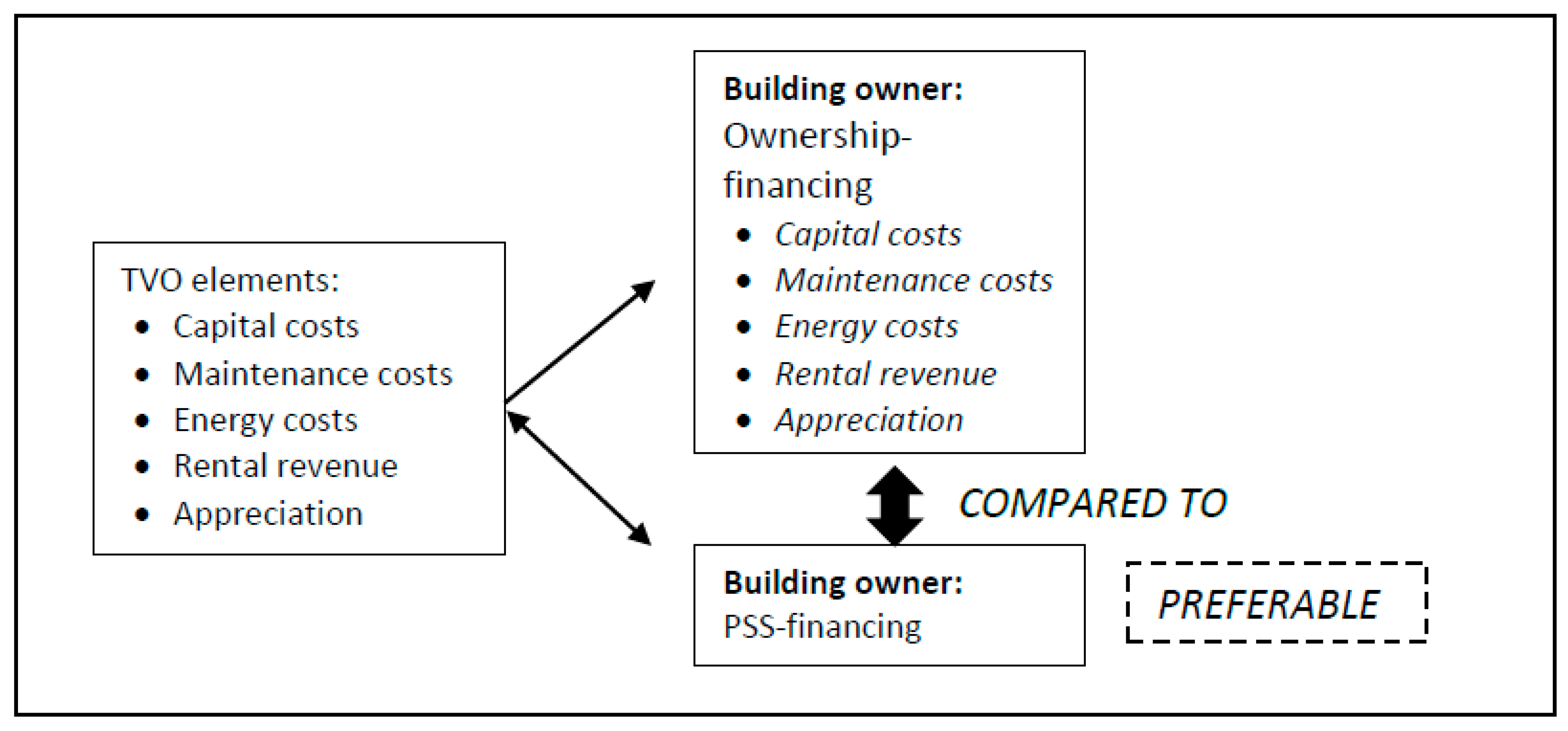

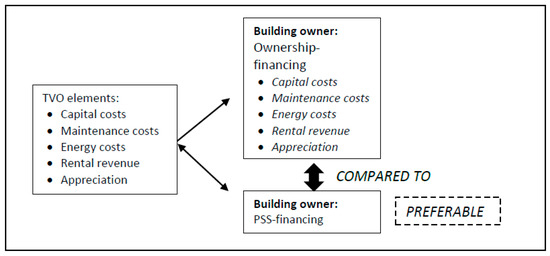

We find further empirical evidence pointing towards economies of scale as a driver of XaaS when we consider the “total value of ownership”. This is illustrated by Azcarate-Aguerre et al. [65], which compares two different financing models related to the energy renovation of buildings. The PSS model is compared with a model based on traditional contracts, where building owners purchase the products they need. The comparison showed that when tangible products like heating systems and windows, as well as soft value elements such as “comfort” and “risk perception” were included, PSS-financing was more favourable than ownership-based financing for the building owners (see Figure 3).

Figure 3.

Simplified illustration of the comparison in Azcarate-Aguerre of ownership-financing and Product–Service Systems (PSSs)-financing based on the five elements of Total Value of Ownership (TVO), based on Azcarate-Aguerre et al. [65].

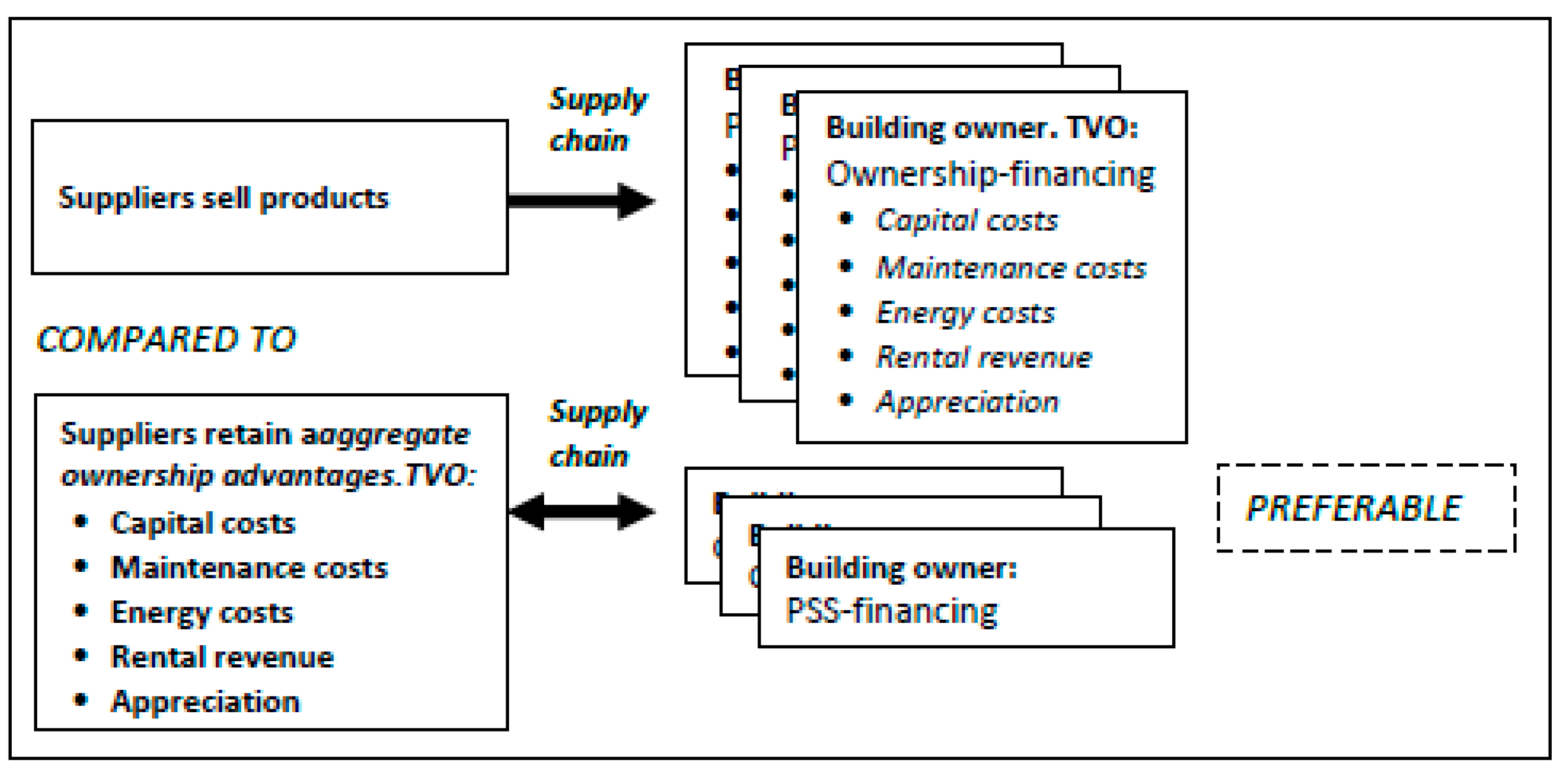

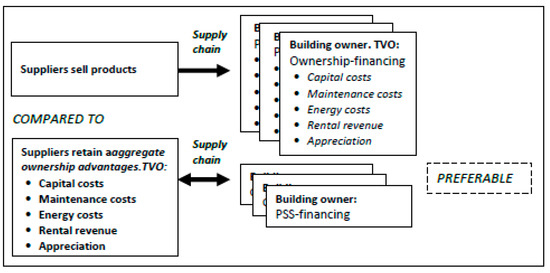

Azcarate-Aguerre et al. [65] show that building owners most often would benefit from PSS financing, but did not highlight how PSS affects suppliers. The ownership financing model is based on suppliers selling products and services, while the PSS-financing model is based on suppliers providing products and services while retaining ownership, and is illustrated in Figure 4.

Figure 4.

Ownership-financing (above) and Product–Service Systems (PSSs)-financing (below) compared along the supply chain. Selling to multiple customers and renting out to multiple customers. Based on Azcarate-Aguerro et al. [65].

When a supplier of products chooses to retain the ownership of products, the ownership costs and revenues that would otherwise be carried by customers are carried by the supplier. The supplier will exploit the potential for economies of scale in these areas.

The NPV calculations by Azcarate-Aguerre et al. [65] show that the PSS-financing model is preferable to the ownership-financing model for building owners. However, if the advantages (1–7) of XaaS outlined in Table 1 truly represent synergies, as argued above, the PSS-financing model should be most advantageous for both building owners and suppliers. Given that the advantages for the suppliers are accumulated TVO elements otherwise accrued to customers, they must be scalable. Thus, the results in Azcarate-Aguerre et al. [65] not only provide building owners with a rationale for choosing a PSS-model, the rationale also includes suppliers as well and suggests that they are valid in other industries. This further supports the thesis that ownership-related economies of scale may be an underlying driver of the XaaS trend.

6. Conclusions

This article examines the drivers of Everything as a service (XaaS) where sale contracts for durable products are substituted by service contracts. We see strong growth in rental markets, and many studies are referring to the advantages driving the transition from sales contracts to rental contracts. In this transition, product ownership is elevated from the customer level to the provider. Whatever advantages related to the economies of scale should then be strengthened at the aggregate level of the supplier, given the hierarchical structure of supply chains. Thus, economies of scale may be a driver of XaaS. However, no peer-reviewed articles have been found linking economies of scale to XaaS. The claim here is that the seven advantages referred to in the literature listed in Table 1 are conditioned on the presence of economies of scale. It is true for the reduction in customer costs, for attaching services, for exploiting customer feedback, for customization of the design, scale, and quality, and for exploiting machine learning.

Our study of 140 firms indicates that economies of scale, through repeatable processes leading to reduced unit costs, is the underlying driver of the XaaS trend. This suggests that ownership-related economies of scale may be a predictor of XaaS. Thus, we should expect XaaS among durable goods where there is a significant potential for economies of scale.

Identifying operational indicators to quantify the XaaS trend was beyond the scope of this article. Two perspectives would be of particular interest in this area. At the firm level, we may identify products and markets with a strong potential for ownership-related economies of scale linked to the transition from sales contracts to service contracts. At the macro level, we may focus on generic features of markets and products associated with economies of scale in different sectors and industries. Such studies would enhance our understanding of the XaaS trend. In light of the findings in this article, it would also be interesting to consider how government policies and regulations influence the XaaS trend.

Funding

This research received no external funding.

Data Availability Statement

Appendix B supplements the data presented in this article.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

The XaaS categories included in the scopus search result of peer reviewed

Articles mentioning “as a service” after 1 January 2021.

Table A1.

The Scopus research result for peer-reviewed articles on XaaS and the corresponding article numbers. (55 articles cover 25 NACE codes. When considering articles with multiple codes, we have 14 unique NACE codes.)

Table A1.

The Scopus research result for peer-reviewed articles on XaaS and the corresponding article numbers. (55 articles cover 25 NACE codes. When considering articles with multiple codes, we have 14 unique NACE codes.)

| Article Numbers | Category XaaS |

|---|---|

| 124 | Additive manufacturing as a service (1) |

| 102 | Agriculture as a service (1) |

| 064, 067 | Autonomous vehicle as a service (2) |

| 047 | Bicycle as a service (1) |

| 068 | Building energy retrofit as a service (1) |

| 014 | Cas as a service (1) |

| 036 | Community as a service (1) |

| 011 | Cultural heritage as a service (1) |

| 133 | Customer service as a service (1) |

| 025 | Data as a service (1) |

| 057 | Electronic product development as a service (1) |

| 005, 111 | Energy as a service (2) |

| 088, 100 | Equipment as a service (2) |

| 015 | IoT as a service (1) |

| 001, 007, 012, 017, 018, 019, 021, 028, 038, 040, 048, 050, 051, 052, 053, 063, 065, 070, 073, 075, 076, 090, 092, 098, 099, 108, 110, 117, 130 | Mobility as a service (29) |

| 030 | Office space as a service (1) |

| 058 | Public transport as a service (1) |

| 054 | Recruitment in construction as a service (1) |

| 129 | Resale as a service (1) |

| 016 | Retail as a service (1) |

| 066 | Tourist guide robots as a service (1) |

| 083 | Under used assets as a service (1) |

| 089 | Water dispenser as a service (1) |

| 062 | White goods as a service (1) |

Appendix B

The following three appendix supplements the data in this article:

- A full reference to the 137 articles (the 55 articles including the 82 excluded articles) from the Scopus search is available here. Link to the full list of articles: https://docs.google.com/document/d/1LoDBgJZGDo_i3Gwo4nKGY6TmtLpR3oHV/edit, accessed on 5 March 2025.

- Table 3, including a column with the URLs to all the proff.no searches for firms matching the NACE codes here. Link to Table A1, including the column with the URLS to all the proff.no searches: https://docs.google.com/spreadsheets/d/125B68hproDz92adcImJ2Va5j5QQQRvxU/edit?usp=sharing&ouid=116449081030483560202&rtpof=true&sd=true, accessed on 5 March 2025.

- A full reference to the search for <company name> + “as a service” is available here. Link to the overview of all Google searches for firms and “as a service”: https://docs.google.com/spreadsheets/d/1OKjmja3iG385C8RBM5q25zXdp7ciF3Ps/edit?usp=sharing&ouid=116449081030483560202&rtpof=true&sd=true, accessed on 5 March 2025.

Notes

| 1 | Based on the description of the concepts in Merriam Webster dictionary and Wikipedia, we may distinguish between three service models: To ”rent” something refers to a customer possessing a good in return for a periodic payment. To “lease” something may cover a rent agreement but is typically used when there are additional conditions to be fulfilled and/or when the customer has an option to purchase the good after a given period. To “license” something is to receive a formal permission—often granted by a public authority—to utilise or control a good for a given period. |

| 2 | In SaaS, vendors manage all tasks linked to the customer’s access and upgrading of software. In IaaS, vendors provide and operate the hardware their customers need. In “platforms as a service”, vendors provide the hardware and the operating system used by the customer’s developer (e.g., [4,5]). |

| 3 | The reference; “Right of disposal“ is here understood in the meaning of Merriam Webster; “authority to make use of as one chooses”. |

| 4 | Business services are also being included a part of the XaaS economy in some texts. Goldman and Sachs describe companies that facilitate outsourcing as “service companies“ [29]. |

| 5 | The SCOPUS search used the following search string; “(TITLE-ABS-KEY (“economies of scale”) OR TITLE-ABS-KEY (“economy of scale”)) AND (TITLE-ABS-KEY (“everything as a service”) OR TITLE-ABS-KEY (“XaaS”) OR TITLE-ABS-KEY (“servitization”) OR TITLE-ABS-KEY (“product service-system”))”. |

| 6 | The search string used in Scopus: TITLE-ABS-KEY (“as a service”) AND PUBYEAR > 2020 AND DOCTYPE (ar) AND SUBJAREA (busi) AND NOT TITLE-ABS-KEY (“cloud”) AND NOT TITLE-ABS-KEY (“software”) AND NOT SUBJAREA (comp)). |

| 7 | The coding of the most dominant NACE code was performed and checked, and confirmed to prevent any mistakes or misunderstandings. Finally, the researcher determined the dominant NACE code/product in each article. |

| 8 | ”Proff” is a brand for the Norwegian market owned by the Finnish company Enento. Proff relies on several public databases in Norway: https://www.proff.no/info/kilder/ URL (accessed on 5 March 2025)”. |

| 9 | The number of employees was chosen as a criterion because alternatives such as turnover, or market value, could be linked to funds or accumulated turnover in holding companies with firm names that are not relevant for the debate on management strategies and contract models. |

References

- Fryer, V. The History of SaaS: From Emerging Technology to Ubiquity. Blog Article Posted on bigcommerce.com. 2020. Available online: https://www.bigcommerce.com/blog/history-of-saas/ (accessed on 5 March 2025).

- Verma, P.; Kumar, K. Foundation for XaaS; Book published by the authors who are IT specialist from India. 2016. [Google Scholar]

- Ipacs, D. The History of Cloud Computing: Tracing Its Evolution and Impact. Text Posted on the Website of bluebirdinternational.com. 2023. Available online: https://bluebirdinternational.com/history-of-cloud-computing/ (accessed on 5 March 2025).

- Waters, B. Software as a service: A look at the customer benefits. J. Digit. Asset Manag. 2005, 1, 32–39. [Google Scholar] [CrossRef]

- Chai, W. Software as a Service (SaaS). Text on TechTarget.com. Available online: https://www.techtarget.com/searchcloudcomputing/definition/Software-as-a-Service?vgnextfmt=print (accessed on 10 February 2025).

- Fortune Business Insights. Everything As a Service Market Size. 2023. Available online: https://www.fortunebusinessinsights.com/everything-as-a-service-xaas-market-102096 (accessed on 7 March 2025).

- The Business Research Company. Everything as a Service Market Set to Reach $1660.21 Billion by 2029 with 21% Yearly Growth. Statistics Published on openpr.com. 2025. Available online: https://www.openpr.com/news/3888699/everything-as-a-service-market-set-to-reach-1660-21-billion (accessed on 4 March 2025).

- Linux Information Project (linfo.org). Economies of Scale Definition. Available online: http://www.linfo.org/economies_of_scale.html (accessed on 10 February 2025).

- Baines, T.S.; Lightfoot, H.W.; Evans, S.; Neely, A.; Greenough, R.; Peppard, J.; Roy, R.; Shehab, E.; Braganza, A.; Tiwari, A.; et al. State-of-the-art in product-service systems. Proc. Inst. Mech. Eng. Part B J. Eng. Manuf. 2007, 221, 1543–1552. [Google Scholar] [CrossRef]

- Bertoni, M.; Rondini, A.; Pezzotta, G. A systematic review of value metrics for PSS design. Procedia CIRP 2017, 64, 289–294. [Google Scholar] [CrossRef]

- Van Ostaeyen, J.; Van Horenbeek, A.; Pintelon, L.; Duflou, J.R. A refined typology of product–service systems based on functional hierarchy modeling. J. Clean. Prod. 2013, 51, 261–276. [Google Scholar] [CrossRef]

- Stahel, W.R. The product life factor. In An Inquiry into the Nature of Sustainable Societies: The Role of the Private Sector; Mitchell Prize Papers; Houston Area Research Centre: Houston, TX, USA, 1982. [Google Scholar]

- Stahel, W.R. The Performance Economy, 2nd ed.; Palgrave Macmillan: London, UK, 2010. [Google Scholar]

- Svensson, N.; Funck, E.K. Management control in circular economy. Exploring and theorising the adaptation of management control to circular business models. J. Clean. Prod. 2019, 233, 390–398. [Google Scholar] [CrossRef]

- Generes; Tasker, O. Get Ready for The Product-As-AService Revolution. 2020. Article in Forbes 15 October 2020. Available online: https://www.forbes.com/sites/servicenow/2020/10/15/get-ready-for-the-product-as-a-service-revolution/ (accessed on 10 February 2025).

- Banerjee, P.; Friedrich, R.; Bash, C.; Goldsack, P.; Huberman, B.; Manley, J.; Patel, C.; Ranganathan, P.; Veitch, A. Everything as a service: Powering the new information economy. Computer 2011, 44, 36–43. [Google Scholar] [CrossRef]

- Deloitte. Everything-As-a-Service. Modernising the Core Through a Service Lens; Deloitte University Press: Westlake, TX, USA, 2017; Available online: https://www2.deloitte.com/us/en/insights/focus/tech-trends/2017/everything-as-a-service.html (accessed on 10 February 2025).

- Ryan, S. EaaS, Everything as a Service. Article Published in Medium.com. 2019. Available online: https://medium.com/swlh/eaas-everything-as-a-service-5c12484b0b4e (accessed on 12 February 2025).

- Systemiq. Everything as a service. Report published by Systemiq on behalf of Sun Institute. 2021. Available online: https://www.systemiq.earth/wp-content/uploads/2021/11/XaaS-MainReport.pdf (accessed on 10 February 2025).

- London Printer Rentals. Article on their website: Photocopier Leasing & Photocopier Rental. 2023. Available online: https://www.londonprinterrentals.com/printer-rental-photocopier-leasing/photocopier-leasing-photocopier-rental/ (accessed on 7 March 2025).

- Moore, J. Article on Corporate Website. The Steps of Installing An Entrance Mat. Available online: https://www.thehouseidreamof.com/the-steps-of-installing-an-entrance-mat/ (accessed on 7 December 2024).

- Ong, O. Corporate newsletter. The Top 10 Bottleless Water Cooler Manufacturers In The USA.2021. Available online: https://www.sourcifychina.com/top-water-cooler-manufacturing-compare/ (accessed on 7 March 2025).

- Vries, T. Text Published on Linkedin. Why Tires-as-a-Service will Become More Important (TaaS). 2020. Available online: https://www.linkedin.com/pulse/why-tires-as-a-service-become-more-important-taas-theo-de-vries-1c/ (accessed on 11 March 2025).

- Hunt, K. Text published on Linkedin. Rolls-Royce & Jet Propulsion-As-a-Service. 2015. Available online: https://www.linkedin.com/pulse/rolls-royce-jet-propulsion-as-a-service-kristofer-hunt (accessed on 11 March 2025).

- Jaczynska, E.; Outterson, K.; Mestre-Ferrandiz, J. Business Model Options for Antibiotics: Learning from Other Industries; Public Law Research Paper No. 15-05; Boston University School of Law: Boston, MA, USA, 2015. [Google Scholar]

- Moon, S.; Vieira, M.; Ruiz, A.A.; Navarro, D. New Business Models for Pharmaceutical Research and Development as a Global Public Good: Considerations for the WHO European Region. Oslo Medicines Initiative Technical Report. WHO Regional Office for Europe: Copenhagen, Denmark, 2022. Licence: CC BY-NC-SA 3.0 IGO. Available online: https://repository.graduateinstitute.ch/record/300339?v=pdf (accessed on 4 March 2025).

- Dhebar, A. Preinstalled functionality as a service. Bus. Horiz. 2023, 66, 643–653. [Google Scholar] [CrossRef]

- Forbes Insights. The Big Promise of Everything-As-A-Service: Ongoing Revenue, Smarter Services. 2018. AI Issue 2, Published 21 September 2018. Available online: https://www.forbes.com/sites/insights-intelai/2018/09/21/the-big-promise-of-everything-as-a-service-ongoing-revenue-smarter-services/ (accessed on 5 February 2025).

- Goldman Sachs. The Everything-as-a-Service Economy. Report (92 pages) Published by The Goldman Sachs Group, Inc. 2018. Available online: https://knowen-production.s3.amazonaws.com/uploads/attachment/file/5276/Global%2BMarkets%2BInstitute_%2BThe%2BEverything-as-a-Service%2BEconomy%2B.pdf (accessed on 3 October 2024).

- Lin, G.; Fu, D.; Zhu, J.; Dasmalchi, G. Cloud computing: IT as a service. IT Prof. 2009, 11, 10–13. [Google Scholar]

- Benlian, A.; Hess, T. Opportunities and Risks of Software-as-a-Service: Findings from a Survey of IT Executives. Decis. Support Syst. 2011, 52, 232–246. [Google Scholar] [CrossRef]

- Janssen, M.; Joha, A. Challenges for Adopting Cloud-Based Software as a Service (saas) in the Public Sector. ECIS 2011 Proceedings. 80. 2011. Available online: https://aisel.aisnet.org/ecis2011/80/ (accessed on 5 March 2025).

- Vandermerwe, S.; Rada, J. Servitization of business: Adding value by adding services. Eur. Manag. J. 1988, 6, 314–324. [Google Scholar] [CrossRef]

- Neely, A.; Benedettini, O.; Visnjic, I. The servitisation of manufacturing: Further evidence. In Proceedings of the 18th European Operations Management Association Conference, Cambridge UK, July 2011; Volume 1. [Google Scholar]

- Raddats, C.; Kowalkowski, C.; Benedettini, O.; Burton, J.; Gebauer, H. Servitisation: A contemporary thematic review of four major research streams. Ind. Mark. Manag. 2019, 83, 207–223. [Google Scholar] [CrossRef]

- Han, J.; Heshmati, A.; Rashidghalam, M. Circular economy business models with a focus on servitisation. Sustainability 2020, 12, 8799. [Google Scholar] [CrossRef]

- Rabetino, R.; Kohtamäki, M.; Gebauer, H. Strategy map of servitisation. Int. J. Prod. Econ. 2017, 192, 144–156. [Google Scholar] [CrossRef]

- Krancher, O.; Luther, P.; Jost, M. Key affordances of platform-as-a-service: Self-organisation and continuous feedback. J. Manag. Inf. Syst. 2018, 35, 776–812. [Google Scholar] [CrossRef]

- Goldhar, J.D.; Jelinek, M. Plan for economies of scope. Harv. Bus. Rev. 1983, 61, 141–148. [Google Scholar]

- Pine, B.J., II. Mass Customisation: The New Frontier in Business Competition. Harvard Business School Press: Boston, MA, USA, 1993. [Google Scholar]

- Pine, B.J.; Victor, B.; Boynton, A.C. Making mass customisation work. Harv. Bus. Rev. 1993, 71, 108–111. [Google Scholar]

- Chui, M.; Manyika, J.; Miremadi, M. Where machines could replace humans-and where they can’t (yet). McKinsey Q. July 2016. [Google Scholar]

- Cognite, A.S. The Digital Twin: The Evolution of a Key Concept of Industry 4.0. Blog Article. Available online: https://www.cognite.com/en/blog/digital-twin-evolution-1 (accessed on 5 February 2025).

- Halleberg, D.; Martinac, I. Indoor Climate as a Service: A digitalised approach to building performance management. In IOP Conference Series: Earth and Environmental Science; IOP Publishing: Bristol, UK, 2020; Volume 588, p. 032013. [Google Scholar]

- Sousa, B.; Arieiro, M.; Pereira, V.; Correia, J.; Lourenço, N.; Cruz, T. ELEGANT: Security of Critical Infrastructures with Digital Twins. IEEE Access 2021, 9, 107574–107588. [Google Scholar] [CrossRef]

- Kunz, W.H.; Wirtz, J. AI in Customer Service—A Service Revolution in the Making. In Artificial Intelligence in Customer Service: Next Frontier for the Global World; Sheth, J., Jain, V., Mogaji, E., Ambika, A., Eds.; McMillan: Basingstoke, UK, 2023. [Google Scholar]

- Ardagna, C.A.; Damiani, E.; Frati, F.; Rebeccani, D.; Ughetti, M. Scalability patterns for platform-as-a-service. In Proceedings of the 2012 IEEE Fifth International Conference on Cloud Computing, Honolulu, HI, USA, 24–29 June 2012; pp. 718–725. [Google Scholar]

- Manvi, S.S.; Shyam, G.K. Resource management for Infrastructure as a Service (IaaS) in cloud computing: A survey. J. Netw. Comput. Appl. 2014, 41, 424–440. [Google Scholar] [CrossRef]

- Tsai, W.; Bai, X.; Huang, Y. Software-as-a-service (SaaS): Perspectives and challenges. Sci. China Inf. Sci. 2014, 57, 1–15. [Google Scholar] [CrossRef]

- Migliorato, L. Beyond the Asset: The Future of the Product as a Service. Article Published by LeasingLife.com. 2018. Available online: https://www.dllgroup.com/us/en-us/-/media/Project/Dll/United-States/Images/New-Blogs/Product-as-a-service-new-normal-for-equipment-manufacturers/2018LeasingLifeAprilEditionProductasaService.pdf (accessed on 5 February 2025).

- Ellen Macarthur Foundation 2013. Towards the Circular Economy. Report. Available online: https://www.ellenmacarthurfoundation.org/assets/downloads/publications/Ellen-MacArthur-Foundation-Towards-the-Circular-Economy-vol.1.pdf (accessed on 5 February 2025).

- Schulze, G. Growth Within: A Circular Economy Vision for a Competitive Europe. Published in Ellen MacArthur. Foundation and the McKinsey Center for Business and Environment, 1–22. 2016. Available online: https://www.ellenmacarthurfoundation.org/assets/downloads/publications/EllenMacArthurFoundation_Growth-Within_July15.pdf (accessed on 9 February 2025).

- Aboulamer, A. Adopting a circular business model improves market equity value. Thunderbird Int. Bus. Rev. 2017, 60, 765–769. [Google Scholar] [CrossRef]

- Baumgartner, R.J.; Rauter, R. Strategic perspectives of corporate sustainability management to develop a sustainable organisation. J. Clean. Prod. 2017, 140, 81–92. [Google Scholar] [CrossRef]

- Lacy, P.; Rutqvist, J. Waste to Wealth: The Circular Economy Advantage; Palgrave Macmillan: London, UK, 2015; Volume 91. [Google Scholar]

- Vermunt, D.A.; Negro, S.O.; Verweij, P.A.; Kuppens, D.V.; Hekkert, M.P. Exploring barriers to implementing different circular business models. J. Clean. Prod. 2019, 222, 891–902. [Google Scholar] [CrossRef]

- Chen, S.L.; Chen, Y.Y.; Hsu, C. A new approach to integrate internet-of-things and software-as-a-service model for logistic systems: A case study. Sensors 2014, 14, 6144–6164. [Google Scholar] [CrossRef] [PubMed]

- Iqbal, R.; Butt, T.A. Safe farming as a service of blockchain-based supply chain management for improved transparency. Clust. Comput. 2020, 23, 2139–2150. [Google Scholar] [CrossRef]

- Perzanowski, A.; Schultz, J. The end of Ownership: Personal Property in the Digital Economy; MIT Press: Cambridge, MA, USA, 2016. [Google Scholar]

- Celli, M. Determinants of Economies of Scale in Large Businesses—A Survey on UE Listed Firms. Am. J. Ind. Bus. Manag. 2013, 3, 255–261. [Google Scholar] [CrossRef][Green Version]

- Stigler, G.J. The economies of scale. J. Law Econ. 1958, 1, 54–71. [Google Scholar] [CrossRef]

- Silberston, A. Economies of scale in theory and practice. Econ. J. 1972, 82, 369–391. [Google Scholar] [CrossRef]

- Junius, K. Economies of Scale: A Survey of the Empirical Literature; Kiel Working Paper No. 813; Nova Science Publishers Inc.: Hauppauge, NY, USA, 1997. [Google Scholar]

- Büchi, G.; Cugno, M.; Castagnoli, R. Economies of Scale and Network Economies in Industry 4.0. Symphonya Emerg. Issues Manag. 2018, 2, 66–76. [Google Scholar] [CrossRef]

- Azcarate-Aguerre, J.F.; Conci, M.; Zils, M.; Hopkinson, P.; Klein, T. Building energy retrofit-as-a-service: A Total Value of Ownership assessment methodology to support whole life-cycle building circularity and decarbonisation. Constr. Manag. Econ. 2022, 40, 676–689. [Google Scholar] [CrossRef]

- Davis, M.; Coony, R.; Gould, S.; Daly, A. Guidelines for Life Cycle Cost Analysis; Stanford University: Stanford, CA, USA, 2005. [Google Scholar]

- Cooper, T. The durability of consumer durables. Bus. Strategy Environ. 1994, 3, 23–30. [Google Scholar] [CrossRef]

- Waldman, M. Durable goods theory for real world markets. J. Econ. Perspect. 2003, 17, 131–154. [Google Scholar] [CrossRef]

- Ingham, Sean. “Public Good”. Encyclopedia Britannica. 2018. Available online: https://www.britannica.com/topic/public-good-economics (accessed on 5 February 2025).

- McCollough, J. The effect of income growth on the mix of purchases between disposable goods and reusable goods. Int. J. Consum. Stud. 2007, 31, 213–219. [Google Scholar] [CrossRef]

- C8oase, R.H. The Nature of the Firm/Coase Ronald H. Economics 1937, 4, 386–405. [Google Scholar]

- Baumol, W.J. On taxation and the control of externalities. Am. Econ. Rev. 1972, 62, 307–322. [Google Scholar]

- Williamson, O.E. The Economic Institutions of Capitalism; The Free Press: New York, NY, USA, 1985. [Google Scholar]

- Canback, S.; Samouel, P.; Price, D. Do diseconomies of scale impact firm size and performance? A theoretical and empirical overview. ICFAI J. Manag. Econ. 2006, 4, 27–70. [Google Scholar]

- Rao, V. Economies of Scale, Economies of Scope. Published on Ribbonfarm.com. 2012. Available online: https://www.ribbonfarm.com/2012/10/15/economies-of-scale-economies-of-scope/ (accessed on 5 February 2025).

- Deloitte Insights. Enterprise IT: Thriving in Disruptive Times with Cloud and As-a-Service. Deloitte Everything as a Service Study, 2021 ed. Available online: https://www2.deloitte.com/us/en/insights/industry/technology/enterprise-it-as-a-service.html (accessed on 5 February 2025).

- Fogliatto, F.S.; Da Silveira, G.J.; Borenstein, D. The mass scustomisation decade: An updated review of the literature. Int. J. Prod. Econ. 2012, 138, 14–25. [Google Scholar] [CrossRef]

- Choudary, S.P. An introduction to interaction-first businesses. In Platform Scale: How an Emerging Business Model Helps Startups Build Large Empires with Minimum Investment; Chourday, S.P., Ed.; Platform Thinking Labs: Singapore, 2015. [Google Scholar]

- Taneja, H. & Maney, K; The end of scale. MIT Sloan Manag. Rev. 2018, 59, 67–72. [Google Scholar]

- Beltrametti, L.; Gasparre, A. Industrial 3D printing in Italy. Int. J. Manuf. Technol. Manag. 2018, 32, 43–64. [Google Scholar] [CrossRef]

- Manavalan, E.; Jayakrishna, K. A review of Internet of Things (IoT) embedded sustainable supply chain for industry 4.0 requirements. Comput. Ind. Eng. 2019, 127, 925–953. [Google Scholar] [CrossRef]

- Haldi, J.; Whitcomb, D. Economies of scale in industrial plants. J. Political Econ. 1967, 75 Pt 1, 373–385. [Google Scholar] [CrossRef]

- Chandler, A.D. The visible hand. The Managerial Revolution in American Business; The Belknap Press of Harvard University Press: Cambridge, MA, USA, 1977. [Google Scholar]

- Van Alstyne, M.W.; Parker, G.G.; Choudary, S.P. Pipelines, platforms, and the new rules of strategy. Harv. Bus. Rev. 2016, 94, 54–62. [Google Scholar]

- Srnicek, N. Platform Capitalism; Polity Press: Cambridge, UK, 2017. [Google Scholar]

- Montes, J.O.; Olleros, F.X. Microfactories and the new economies of scale and scope. J. Manuf. Technol. Manag. 2019, 31, 72–90. [Google Scholar] [CrossRef]

- Baumers, M.; Dickens, P.; Tuck, C.; Hague, R. The cost of additive manufacturing: Machine productivity, economies of scale and technology-push. Technol. Forecast. Soc. Change 2016, 102, 193–201. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).