LSTM-Based Time Series Forecasting of User-Derived Quality Signals in Mobile Banking Systems

Abstract

1. Introduction

2. Related Work

2.1. User Reviews and Service Quality

2.2. Rating Dynamics and Release Effects

2.3. LSTM-Based Forecasting of User-Derived Quality Signals

3. Materials and Methods

3.1. Dataset and Preprocessing

3.2. Benchmark Model: Seasonal Naïve (SNaive)

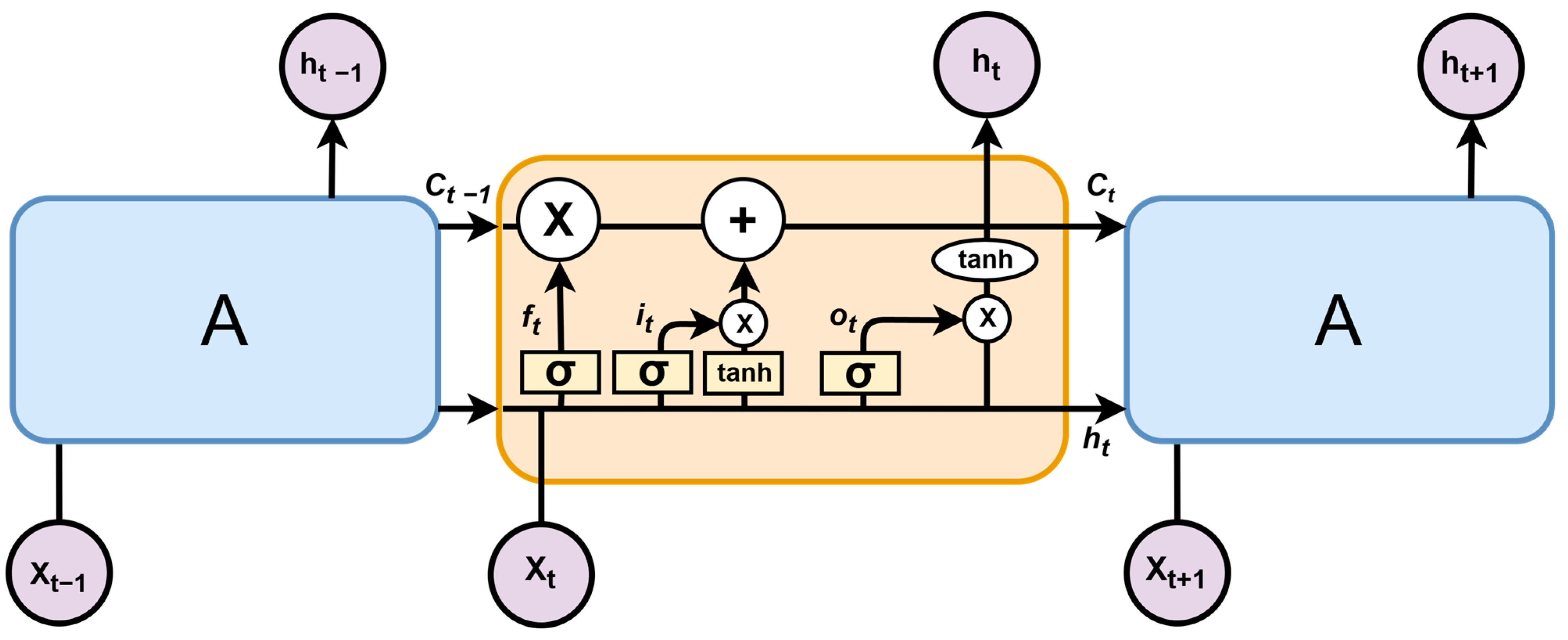

3.3. LSTM Model Development

3.4. Hyperparameter Optimization

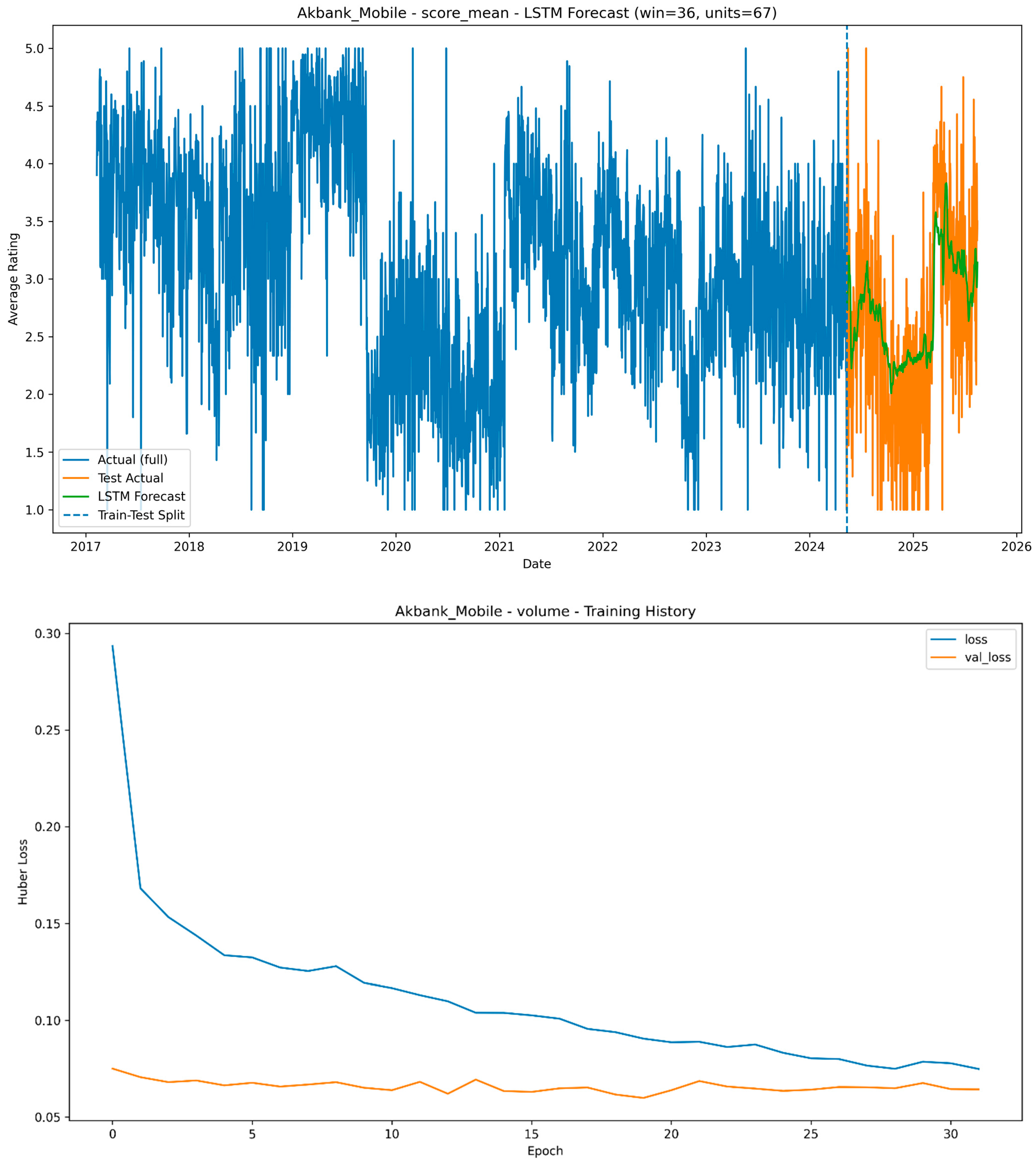

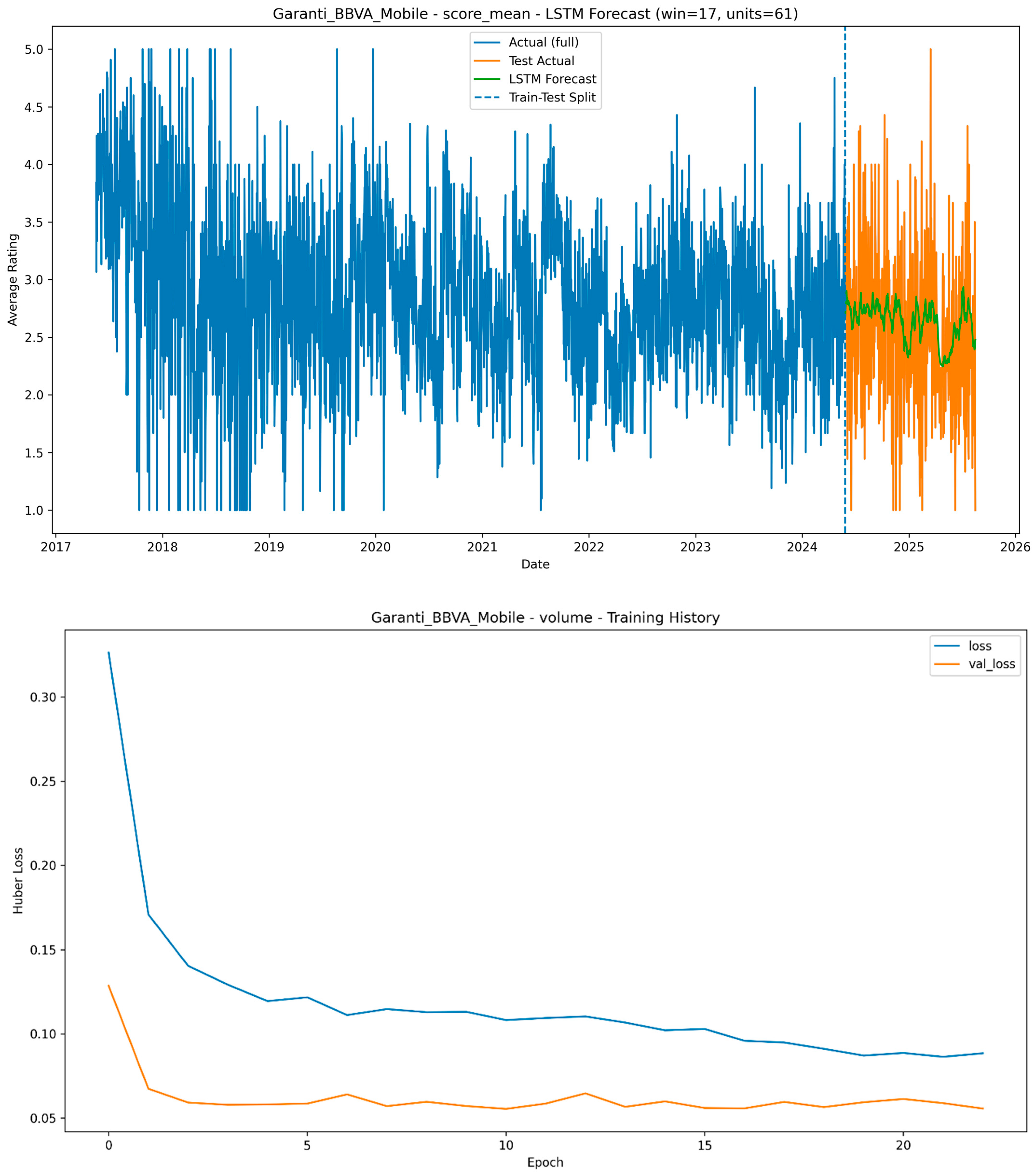

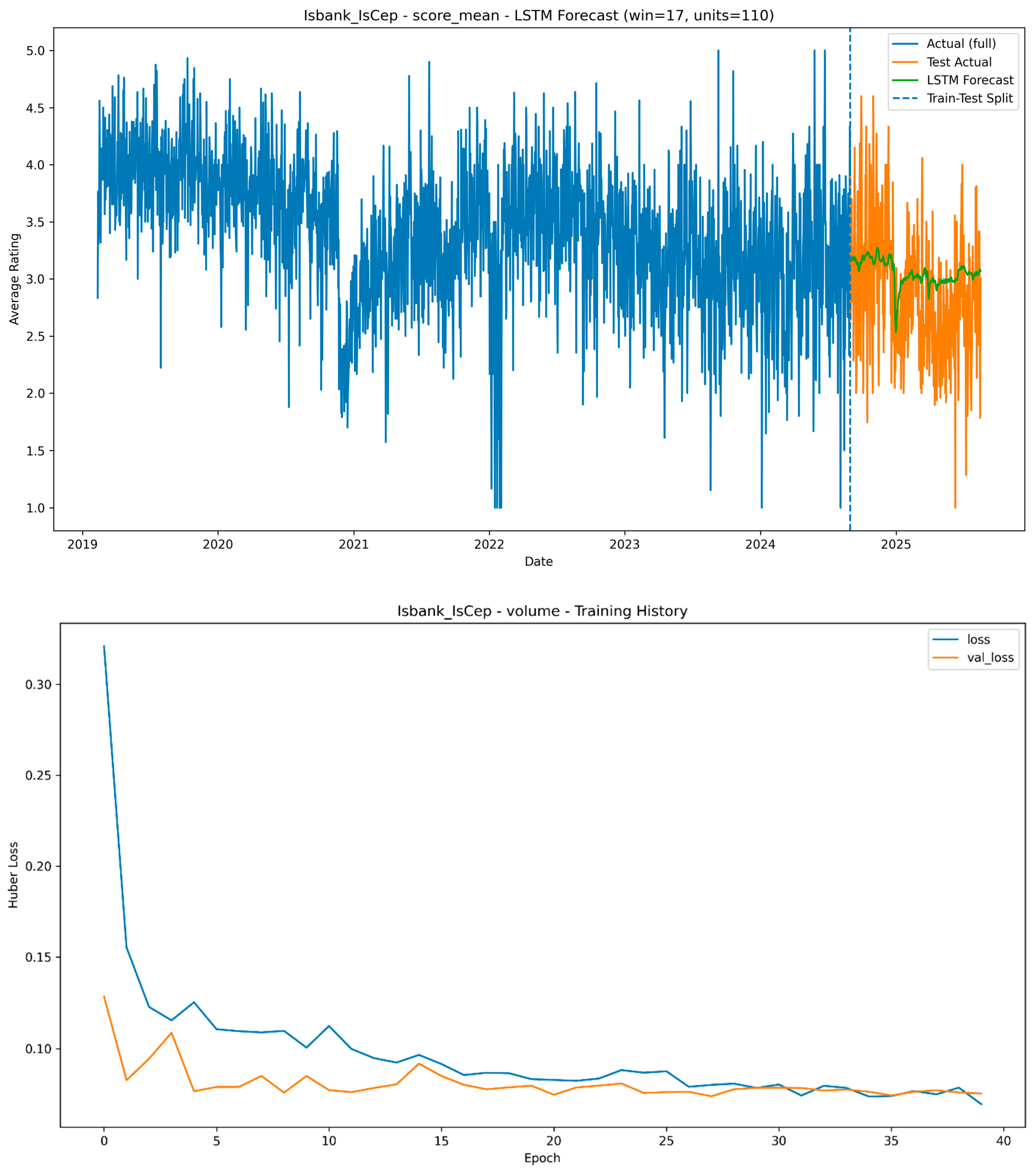

4. Results

5. Discussion

5.1. Theoretical Implications

5.2. Model Performance and Comparative Effectiveness

5.3. Heterogeneity of User Behavior Across Banks

5.4. Implications for Practical Applications and Future Research

6. Limitations

7. Conclusions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Metric | İşbank | Yapı Kredi | Garanti | Akbank | Ziraat |

|---|---|---|---|---|---|

| n_train | 1,998,000 | 1,483,000 | 2,536,000 | 2,620,000 | 3,442,000 |

| n_test | 352,000 | 261,000 | 447,000 | 462,000 | 607,000 |

| Window size | 17 | 20 | 17 | 36 | 44 |

| Units | 110 | 111 | 61 | 67 | 140 |

| Batch size | 83 | 46 | 103 | 48 | 75 |

| Learning rate | 0.003 | 0.004 | 0.004 | 0.003 | 0.005 |

| Dropout | 0.29 | 0.40 | 0.39 | 0.39 | 0.20 |

| Epochs | 109 | 152 | 141 | 144 | 114 |

| MAE | 0.47 | 0.49 | 0.50 | 0.55 | 0.72 |

| RMSE | 0.58 | 0.63 | 0.65 | 0.70 | 0.95 |

| MAPE (%) | 18.59 | 16.59 | 23.03 | 28.47 | 39.59 |

| sMAPE (%) | 16.54 | 15.74 | 19.98 | 23.16 | 32.16 |

| MedAE | 0.43 | 0.41 | 0.39 | 0.46 | 0.55 |

| R2 | −0.01 | 0.32 | 0.00 | 0.36 | −0.06 |

| MASE (m = 7) | 0.90 | 0.65 | 0.75 | 0.86 | 0.84 |

| Mean bias | 0.20 | −0.07 | 0.08 | 0.14 | 0.06 |

| MSE (LSTM) | 0.34 | 0.39 | 0.42 | 0.48 | 0.91 |

| MSE (SNaive) | 0.54 | 1.04 | 0.77 | 0.89 | 1.75 |

| Metric | Akbank | Garanti | Ziraat | İşbank | Yapı Kredi |

|---|---|---|---|---|---|

| n_train | 2,620,000 | 2,536,000 | 3,442,000 | 1,998,000 | 1,483,000 |

| n_test | 462,000 | 447,000 | 607,000 | 352,000 | 261,000 |

| Window size | 28 | 23 | 18 | 17 | 25 |

| Units | 55 | 179 | 133 | 128 | 103 |

| Batch size | 32 | 76 | 79 | 57 | 54 |

| Learning rate | 0.004 | 0.005 | 0.004 | 0.004 | 0.005 |

| Dropout | 0.29 | 0.31 | 0.36 | 0.34 | 0.31 |

| Epochs | 83 | 101 | 80 | 154 | 104 |

| MAE | 3.63 | 4.15 | 3.58 | 5.11 | 6.83 |

| RMSE | 6.35 | 6.72 | 6.99 | 8.15 | 10.89 |

| MAPE (%) | 45.25 | 37.92 | 58.41 | 35.11 | 36.56 |

| sMAPE (%) | 37.57 | 31.90 | 49.18 | 30.84 | 37.63 |

| MedAE | 2.70 | 2.96 | 2.04 | 3.66 | 3.91 |

| R2 | 0.27 | 0.32 | 0.43 | 0.39 | 0.39 |

| MASE (m = 7) | 7.92 | 9.18 | 6.76 | 14.07 | 9.22 |

| Mean bias | −0.63 | −0.74 | −1.32 | −1.31 | −4.16 |

| MSE (LSTM) | 40.28 | 45.09 | 48.88 | 66.41 | 118.59 |

| MSE (SNaive) | 97.48 | 90.08 | 110.87 | 170.88 | 355.91 |

References

- Alt, R.; Fridgen, G.; Chang, Y. The Future of Fintech—Towards Ubiquitous Financial Services. Electron. Mark. 2024, 34, 3. [Google Scholar] [CrossRef]

- Rahman, M.; Yee, H.P.; Masud, M.A.K.; Uzir, M.U.H. Examining the Dynamics of Mobile Banking App. Adoption during the COVID-19 Pandemic: A Digital Shift in the Crisis. Digit. Bus. 2024, 4, 100088. [Google Scholar] [CrossRef]

- Karjaluoto, H.; Glavee-Geo, R.; Ramdhony, D.; Shaikh, A.A.; Hurpaul, A. Consumption Values and Mobile Banking Services: Understanding the Urban–Rural Dichotomy in a Developing Economy. Int. J. Bank Mark. 2021, 39, 272–293. [Google Scholar] [CrossRef]

- Papathomas, A.; Konteos, G. Financial Institutions Digital Transformation: The Stages of the Journey and Business Metrics to Follow. J. Financ. Serv. Mark. 2023, 29, 590–606. [Google Scholar] [CrossRef]

- Adiningtyas, H.; Auliani, A.S. Sentiment Analysis for Mobile Banking Service Quality Measurement. Procedia Comput. Sci. 2024, 234, 40–50. [Google Scholar] [CrossRef]

- Kim, L.; Jindabot, T.; Yeo, S.F. Understanding Customer Loyalty in Banking Industry: A Systematic Review and Meta Analysis. Heliyon 2024, 10, e36619. [Google Scholar] [CrossRef]

- Shaikh, A.A.; Karjaluoto, H. Mobile Banking Adoption: A Literature Review. Telemat. Inform. 2015, 32, 129–142. [Google Scholar] [CrossRef]

- Sharma, N. A Digital Cohort Analysis of Consumers’ Mobile Banking App Experience. Int. J. Consum. Stud. 2024, 48, e12989. [Google Scholar] [CrossRef]

- Dąbrowski, J.; Letier, E.; Perini, A.; Susi, A. Analysing App Reviews for Software Engineering: A Systematic Literature Review. Empir. Softw. Eng. 2022, 27, 43. [Google Scholar] [CrossRef]

- Genc-Nayebi, N.; Abran, A. A Systematic Literature Review: Opinion Mining Studies from Mobile App Store User Reviews. J. Syst. Softw. 2017, 125, 207–219. [Google Scholar] [CrossRef]

- Alismail, M.A.; Albesher, A.S. Evaluating Developer Responses to App Reviews: The Case of Mobile Banking Apps in Saudi Arabia and the United States. Sustainability 2023, 15, 6701. [Google Scholar] [CrossRef]

- Oliver, R.L. A Cognitive Model of the Antecedents and Consequences of Satisfaction Decisions. J. Mark. Res. 1980, 17, 460–469. [Google Scholar] [CrossRef]

- Bhattacherjee, A. Understanding Information Systems Continuance: An Expectation-Confirmation Model. MIS Q. 2001, 25, 351–370. [Google Scholar] [CrossRef]

- DeLone, W.H.; McLean, E.R. Information Systems Success: The Quest for the Dependent Variable. Inf. Syst. Res. 1992, 3, 60–95. [Google Scholar] [CrossRef]

- DeLone, W.H.; McLean, E.R. The DeLone and McLean Model of Information Systems Success: A Ten-Year Update. J. Manag. Inf. Syst. 2003, 19, 9–30. [Google Scholar] [CrossRef]

- Larsen, M.E.; Nicholas, J.; Christensen, H. Quantifying App Store Dynamics: Longitudinal Tracking of Mental Health Apps. JMIR Mhealth Uhealth 2016, 4, e96. [Google Scholar] [CrossRef]

- Martin, W.; Sarro, F.; Harman, M. Causal Impact Analysis for App Releases in Google Play. In Proceedings of the 2016 24th ACM SIGSOFT International Symposium on Foundations of Software Engineering, Seattle, WA, USA, 13–16 November 2016; Association for Computing Machinery: New York, NY, USA, 2016; pp. 435–446. [Google Scholar]

- Mroua, M.; Lamine, A. Financial Time Series Prediction under Covid-19 Pandemic Crisis with Long Short-Term Memory (LSTM) Network. Humanit. Soc. Sci. Commun. 2023, 10, 530. [Google Scholar] [CrossRef]

- Tuhin, K.H.; Nobi, A.; Rakib, M.H.; Lee, J.W. Long Short-Term Memory Autoencoder Based Network of Financial Indices. Humanit. Soc. Sci. Commun. 2025, 12, 100. [Google Scholar] [CrossRef]

- Ricchiuti, F.; Sperlí, G. An Advisor Neural Network Framework Using LSTM-Based Informative Stock Analysis. Expert Syst. Appl. 2025, 259, 125299. [Google Scholar] [CrossRef]

- Amirkhalili, Y.; Wong, H.Y. Banking on Feedback: Text Analysis of Mobile Banking iOS and Google App Reviews. arXiv 2025, arXiv:2503.11861. [Google Scholar]

- Pınarbaşı, F. Mapping the Online Reviews Sentiment Landscape: An Exploration of Emotion Spectrum in User Reviews of Mobile Apps. Nevşehir Hacı Bektaş Veli Üniversitesi SBE Dergisi 2024, 14, 1598–1619. [Google Scholar] [CrossRef]

- Sun, P. Customers’ Emotional Impact on Star Rating and Thumbs-up Behavior Towards Food Delivery Service Apps. 2024. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4912648 (accessed on 23 August 2025).

- Motger, Q.; Oriol, M.; Tiessler, M.; Franch, X.; Marco, J. What About Emotions? Guiding Fine-Grained Emotion Extraction from Mobile App Reviews. In Proceedings of the 2025 IEEE 33rd International Requirements Engineering Conference (RE), Valencia, Spain, 1–5 September 2025. [Google Scholar]

- Aydin Gokgoz, Z.; Ataman, M.B.; van Bruggen, G.H. If It Ain’t Broke, Should You Still Fix It? Effects of Incorporating User Feedback in Product Development on Mobile Application Ratings. Int. J. Res. Mark. 2025, 42, 467–486. [Google Scholar] [CrossRef]

- Gong, X.; Razzaq, A.; Wang, W. More Haste, Less Speed: How Update Frequency of Mobile Apps Influences Consumer Interest. J. Theor. Appl. Electron. Commer. Res. 2021, 16, 2922–2942. [Google Scholar] [CrossRef]

- Hazarika, B.; Shrivastava, U.; Hiele, T.M.; Pham, C. The Impact of Technology Frustration and Consumer Passion on Consumer Evaluation Shift in Case of Mobile Apps. Acta Psychol. 2025, 256, 105006. [Google Scholar] [CrossRef]

- Oh, Y.K.; Kim, J.-M. What Improves Customer Satisfaction in Mobile Banking Apps? An Application of Text Mining Analysis. Asia Mark. J. 2022, 23, 3. [Google Scholar] [CrossRef]

- Sällberg, H.; Wang, S.; Numminen, E. The Combinatory Role of Online Ratings and Reviews in Mobile App Downloads: An Empirical Investigation of Gaming and Productivity Apps from Their Initial App Store Launch. J. Mark. Anal. 2022, 11, 426–442. [Google Scholar] [CrossRef]

- Su, Q.; Namin, A.; Ketron, S. The Effect of Online Company Responses on App Review Quality. J. Consum. Mark. 2024, 41, 110–125. [Google Scholar] [CrossRef]

- Kapoor, A.P.; Vij, M. How to Boost Your App Store Rating? An Empirical Assessment of Ratings for Mobile Banking Apps. J. Theor. Appl. Electron. Commer. Res. 2020, 15, 99–115. [Google Scholar] [CrossRef]

- Wang, C.; Liu, T.; Liang, P.; Daneva, M.; van Sinderen, M. The Role of User Reviews in App Updates: A Preliminary Investigation on App Release Notes. In Proceedings of the 2021 28th Asia-Pacific Software Engineering Conference (APSEC), Taipei, Taiwan, 6–9 December 2021; pp. 520–525. [Google Scholar]

- Siami-Namini, S.; Namin, A.S. Forecasting Economics and Financial Time Series: ARIMA vs. LSTM. arXiv 2018, arXiv:1803.06386. [Google Scholar] [CrossRef]

- Lara-Benítez, P.; Carranza-García, M.; Riquelme, J.C. An Experimental Review on Deep Learning Architectures for Time Series Forecasting. Int. J. Neural Syst. 2021, 31, 2130001. [Google Scholar] [CrossRef]

- Cheng, J.; Zhuo, Y.; Yao, Z.; Deng, J. Mobile Application Usage Forecast Based on LSTM. In Proceedings of the 2023 International Conference on Frontiers of Artificial Intelligence and Machine Learning, Beijing China, 14–16 April 2023; Association for Computing Machinery: New York, NY, USA, 2024; pp. 92–97. [Google Scholar]

- Gheewala, S.; Xu, S.; Yeom, S. In-Depth Survey: Deep Learning in Recommender Systems—Exploring Prediction and Ranking Models, Datasets, Feature Analysis, and Emerging Trends. Neural Comput. Appl. 2025, 37, 10875–10947. [Google Scholar] [CrossRef]

- Li, P.; Noah, S.A.M.; Sarim, H.M. A Survey on Deep Neural Networks in Collaborative Filtering Recommendation Systems. arXiv 2024, arXiv:2412.01378. [Google Scholar] [CrossRef]

- Zhou, H.; Xiong, F.; Chen, H. A Comprehensive Survey of Recommender Systems Based on Deep Learning. Appl. Sci. 2023, 13, 11378. [Google Scholar] [CrossRef]

- Noh, S.-H. Analysis of Gradient Vanishing of RNNs and Performance Comparison. Information 2021, 12, 442. [Google Scholar] [CrossRef]

- Bougteb, Y.; Ouhbi, B.; Frikh, B.; Zemmouri, E.M. A Multi-Criteria Attention-LSTM Approach for Enhancing Privacy and Accuracy in Recommender Systems. Soc. Netw. Anal. Min. 2025, 15, 38. [Google Scholar] [CrossRef]

- Zhang, J.; Zeng, Y.; Starly, B. Recurrent Neural Networks with Long Term Temporal Dependencies in Machine Tool Wear Diagnosis and Prognosis. SN Appl. Sci. 2021, 3, 442. [Google Scholar] [CrossRef]

- Wen, X.; Li, W. Time Series Prediction Based on LSTM-Attention-LSTM Model. IEEE Access 2023, 11, 48322–48331. [Google Scholar] [CrossRef]

- Mahmoudi, A. Investigating LSTM-Based Time Series Prediction Using Dynamic Systems Measures. Evol. Syst. 2025, 16, 71. [Google Scholar] [CrossRef]

- Waqas, M.; Humphries, U.W. A Critical Review of RNN and LSTM Variants in Hydrological Time Series Predictions. MethodsX 2024, 13, 102946. [Google Scholar] [CrossRef] [PubMed]

- Ibrahim, I.A.; Hossain, M.J. Short-Term Multivariate Time Series Load Data Forecasting at Low-Voltage Level Using Optimised Deep-Ensemble Learning-Based Models. Energy Convers. Manag. 2023, 296, 117663. [Google Scholar] [CrossRef]

- Banks Union of Türkiye. Digital, Internet and Mobile Banking Statistics; Banks Union of Türkiye: Istanbul, Turkey, 2025. [Google Scholar]

- Similarweb. Top Finance Apps Ranking—Most Popular Finance Apps in Turkey. Available online: https://www.similarweb.com/top-apps/google/turkey/finance/ (accessed on 25 August 2025).

- Appfigures. Top Finance Apps for Android on Google Play in Turkey. Available online: https://appfigures.com/top-apps/google-play/turkey/finance (accessed on 25 August 2025).

- Hewamalage, H.; Ackermann, K.; Bergmeir, C. Forecast Evaluation for Data Scientists: Common Pitfalls and Best Practices. Data Min. Knowl. Discov. 2022, 37, 788–832. [Google Scholar] [CrossRef] [PubMed]

- de Camargo, A.A.R.; de Oliveira, M.A. Analysis of the Application of Different Forecasting Methods for Time Series in the Context of the Aeronautical Industry. Eng. Proc. 2023, 39, 74. [Google Scholar] [CrossRef]

- Beck, N.; Dovern, J.; Vogl, S. Mind the Naive Forecast! A Rigorous Evaluation of Forecasting Models for Time Series with Low Predictability. Appl. Intell. 2025, 55, 395. [Google Scholar] [CrossRef]

- Oliveira, J.M.; Ramos, P. Evaluating the Effectiveness of Time Series Transformers for Demand Forecasting in Retail. Mathematics 2024, 12, 2728. [Google Scholar] [CrossRef]

- Unterberger, V.; Lichtenegger, K.; Kaisermayer, V.; Gölles, M.; Horn, M. An Adaptive Short-Term Forecasting Method for the Energy Yield of Flat-Plate Solar Collector Systems. Appl. Energy 2021, 293, 116891. [Google Scholar] [CrossRef]

- Kreuzer, D.; Munz, M.; Schlüter, S. Short-Term Temperature Forecasts Using a Convolutional Neural Network—An Application to Different Weather Stations in Germany. Mach. Learn. Appl. 2020, 2, 100007. [Google Scholar] [CrossRef]

- Kılınç, M.; Aydın, C.; Tarhan, Ç. Kitle Fonlamasındaki Proje Metin İçeriklerinin LSTM ile Analizi. J. Res. Bus. 2022, 7, 48–59. [Google Scholar] [CrossRef]

- Om, K.; Boukoros, S.; Nugaliyadde, A.; McGill, T.; Dixon, M.; Koutsakis, P.; Wong, K.W. Modelling Email Traffic Workloads with RNN and LSTM Models. Hum.-Centric Comput. Inf. Sci. 2020, 10, 39. [Google Scholar] [CrossRef]

- Yu, Y.; Si, X.; Hu, C.; Zhang, J. A Review of Recurrent Neural Networks: LSTM Cells and Network Architectures. Neural Comput. 2019, 31, 1235–1270. [Google Scholar] [CrossRef]

- Ozyegen, O.; Ilic, I.; Cevik, M. Evaluation of Interpretability Methods for Multivariate Time Series Forecasting. Appl. Intell. 2021, 52, 4727–4743. [Google Scholar] [CrossRef]

- Dip Das, J.; Thulasiram, R.K.; Henry, C.; Thavaneswaran, A. Encoder–Decoder Based LSTM and GRU Architectures for Stocks and Cryptocurrency Prediction. J. Risk Financ. Manag. 2024, 17, 200. [Google Scholar] [CrossRef]

- Chung, J.; Gulcehre, C.; Cho, K.; Bengio, Y. Empirical Evaluation of Gated Recurrent Neural Networks on Sequence Modeling. arXiv 2014, arXiv:1412.3555. [Google Scholar] [CrossRef]

- Gefen, D.; Karahanna, E.; Straub, D.W. Trust and TAM in Online Shopping: An Integrated Model. MIS Q. 2003, 27, 51–90. [Google Scholar] [CrossRef]

- Venkatesh, V.; Morris, M.G.; Davis, G.B.; Davis, F.D. User Acceptance of Information Technology: Toward a Unified View. MIS Q. 2003, 27, 425–478. [Google Scholar] [CrossRef]

- Lim, B.; Zohren, S. Time-Series Forecasting with Deep Learning: A Survey. Philos. Trans. R. Soc. A Math. Phys. Eng. Sci. 2021, 379, 20200209. [Google Scholar] [CrossRef] [PubMed]

- Xu, X. What Are Customers Commenting on, and How Is Their Satisfaction Affected? Examining Online Reviews in the on-Demand Food Service Context. Decis. Support Syst. 2021, 142, 113467. [Google Scholar] [CrossRef]

- Markiewicz, M.; Wyłomańska, A. Time Series Forecasting: Problem of Heavy-Tailed Distributed Noise. Int. J. Adv. Eng. Sci. Appl. Math. 2021, 13, 248–256. [Google Scholar] [CrossRef]

- Zhang, Y.; Zhou, X.; Zhang, Y.; Li, S.; Liu, S. Improving Time Series Forecasting in Frequency Domain Using a Multi Resolution Dual Branch Mixer with Noise Insensitive ArcTanLoss. Sci. Rep. 2025, 15, 12557. [Google Scholar] [CrossRef]

- Hyndman, R.J.; Koehler, A.B. Another Look at Measures of Forecast Accuracy. Int. J. Forecast. 2006, 22, 679–688. [Google Scholar] [CrossRef]

- Zachariadis, M.; Ozcan, P. The API Economy and Digital Transformation in Financial Services: The Case of Open Banking. 2017. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2975199 (accessed on 27 August 2025).

- Armstrong, J.S. Findings from Evidence-Based Forecasting: Methods for Reducing Forecast Error. Int. J. Forecast. 2007, 22, 583–598. [Google Scholar] [CrossRef]

- Ng, K.W.; Horawalavithana, S.; Iamnitchi, A. Social Media Activity Forecasting with Exogenous and Endogenous Signals. Soc. Netw. Anal. Min. 2022, 12, 102. [Google Scholar] [CrossRef]

- Motiwalla, L.F.; Albashrawi, M.; Kartal, H.B. Uncovering Unobserved Heterogeneity Bias: Measuring Mobile Banking System Success. Int. J. Inf. Manag. 2019, 49, 439–451. [Google Scholar] [CrossRef]

- Yu, Z.; Liu, J. The Digital Revolution in Banking: Unpacking Risk Management in the Age of Transformation. Int. Rev. Econ. Financ. 2025, 103, 104444. [Google Scholar] [CrossRef]

- Zhao, J.; Wang, C.; Ibrahim, H.; Chen, Y. The Impact of Digital Financial Inclusion on Bank Performance: An Exploration of Mechanisms of Action and Heterogeneity. PLoS ONE 2024, 19, e0309099. [Google Scholar] [CrossRef]

- Barjaktarovic Rakocevic, S.; Rakic, N.; Rakocevic, R. An Interplay Between Digital Banking Services, Perceived Risks, Customers’ Expectations, and Customers’ Satisfaction. Risks 2025, 13, 39. [Google Scholar] [CrossRef]

| Research | Context | Data Source | Method | Key Findings | Contribution/Limitation |

|---|---|---|---|---|---|

| [9] | Use of app reviews in software engineering | App store reviews (general) | Systematic literature review | Reviews useful for requirements and bug reporting, but short/fragmented texts pose challenges | Comprehensive mapping for SE, not banking-specific |

| [11] | Developer responses in banking apps | App store reviews (KSA & USA) | Content analysis | Response tone/style strongly influence user satisfaction | Highlights developer–user communication, limited scope |

| [21] | Canadian mobile banking app reviews | iOS & Google Play reviews | LSTM-based sentiment analysis, topic modeling | 82% accuracy; positives: usability/reliability, negatives: login issues & bugs | Strong methodological focus, single-country limitation |

| [25] | User feedback and release effects | Mobile app reviews | Regression analysis | Feedback significantly impacts subsequent ratings | Causal link shown, not app-specific |

| [27] | Technological frustration in updates | Mobile apps (general) | Survey & data analysis | Frustration and passion drive post-update dissatisfaction | Emphasizes psychological factors |

| [28] | Determinants of satisfaction in banking apps | Korean mobile banking apps | Text mining | Security and ease of use strongly improve ratings | Banking-specific, limited to one region |

| [33] | Financial time series forecasting | Financial indices | LSTM vs. ARIMA | LSTM achieved 80%+ lower error | Baseline methodological reference |

| [34] | Deep learning architectures in time series | Multidomain datasets | LSTM, CNN, RNN comparison | LSTM outperforms in overall accuracy | General methodological benchmark |

| Feature Name | Data Type | Description |

|---|---|---|

| package_name | object | Unique identifier of the mobile banking app (e.g., com.pozitron.iscep). |

| review_id | object | Unique ID for each user review. |

| content | object | Text content of the user review. |

| score | int64 | Star rating provided by the user (1–5). |

| thumbs_up_count | int64 | Number of likes/upvotes a review received. |

| review_created_version | object | App version at the time the review was written. |

| at_utc | object | Review timestamp in UTC. |

| scrape_lang | object | Language of the review text (e.g., tr). |

| scrape_country | object | Country of origin of the review (e.g., tr). |

| scraped_at_utc | object | Time when the review was scraped in UTC. |

| at_ist | object | Review timestamp converted to Istanbul local time. |

| scraped_at_ist | object | Scraping timestamp in Istanbul local time. |

| bank_name | object | Name of the bank associated with the application. |

| Hyperparameter | Range/Values | Type | Description |

|---|---|---|---|

| window | 10–45 | Integer | Input window length (in days) |

| units | 48–192 | Integer | Number of neurons in the LSTM layer |

| dropout | 0.10–0.40 | Float | Dropout rate to reduce overfitting |

| batch_size | 32–128 | Integer | Number of samples per training batch |

| lr | 0.0005–0.005 | Float | Learning rate of the Adam optimizer |

| epochs | 80–160 | Integer | Maximum number of training epochs |

| Setting | Value | Notes |

|---|---|---|

| Loss | Huber(delta = 1.0) | Robust to outliers |

| Optimizer | Adam | lr taken from the search space |

| EarlyStopping | patience = 12, restore_best_weights | Monitors val_loss |

| ReduceLROnPlateau | factor = 0.5, patience = 6, min_lr = 1 × 10−5 | Monitors val_loss |

| Validation split | Time ordered, about 20% | Falls back to validation_split = 0.2 if needed |

| Random seed | 42 | Reproducibility |

| Output activation (rating) | sigmoid | Target scaled to [0, 1] with MinMax |

| Output activation (volume) | linear | Target uses log1p, inverse applied for metrics |

| Test share | about 15% | Time ordered split |

| Seasonality | m = 7 | For SNaive baseline comparison |

| Forecast horizon | 1 day | Output dimension |

| Feature scaling | RobustScaler | Fit on train only to prevent leakage |

| Fallback grid (HPO off) | window {14, 30}, units {64, 128}, epochs 120, batch 64, lr 0.002, dropout 0.2 | Used when HPO is disabled |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kilinc, M. LSTM-Based Time Series Forecasting of User-Derived Quality Signals in Mobile Banking Systems. Systems 2025, 13, 949. https://doi.org/10.3390/systems13110949

Kilinc M. LSTM-Based Time Series Forecasting of User-Derived Quality Signals in Mobile Banking Systems. Systems. 2025; 13(11):949. https://doi.org/10.3390/systems13110949

Chicago/Turabian StyleKilinc, Murat. 2025. "LSTM-Based Time Series Forecasting of User-Derived Quality Signals in Mobile Banking Systems" Systems 13, no. 11: 949. https://doi.org/10.3390/systems13110949

APA StyleKilinc, M. (2025). LSTM-Based Time Series Forecasting of User-Derived Quality Signals in Mobile Banking Systems. Systems, 13(11), 949. https://doi.org/10.3390/systems13110949