The Capacity Decision-Making of Omnichannel Catering Firms Based on Queueing System Considering Customer Reference Behavior

Abstract

1. Introduction

2. Literature Review

3. Channel Information Is Unavailable

3.1. Optimal Decision

3.2. Sensitivity Analysis

- (1)

- and . Then the omnichannel catering firm’s profit increases with the increase in and .

- (2)

- and . The firm’s profit increases with the increase in , but decreases with the increase in .

- (3)

- , and . The firm’s profit decreases with the increase in , but increases with the increase in in .

- (4)

- and . The firm’s profit will not only decrease with the increase in , but also increase with the increase in .

4. Channel Information Is Available

4.1. Optimal Decision

4.2. Sensitivity Analysis

4.3. Comparison of Different Situations

5. Numerical Analysis

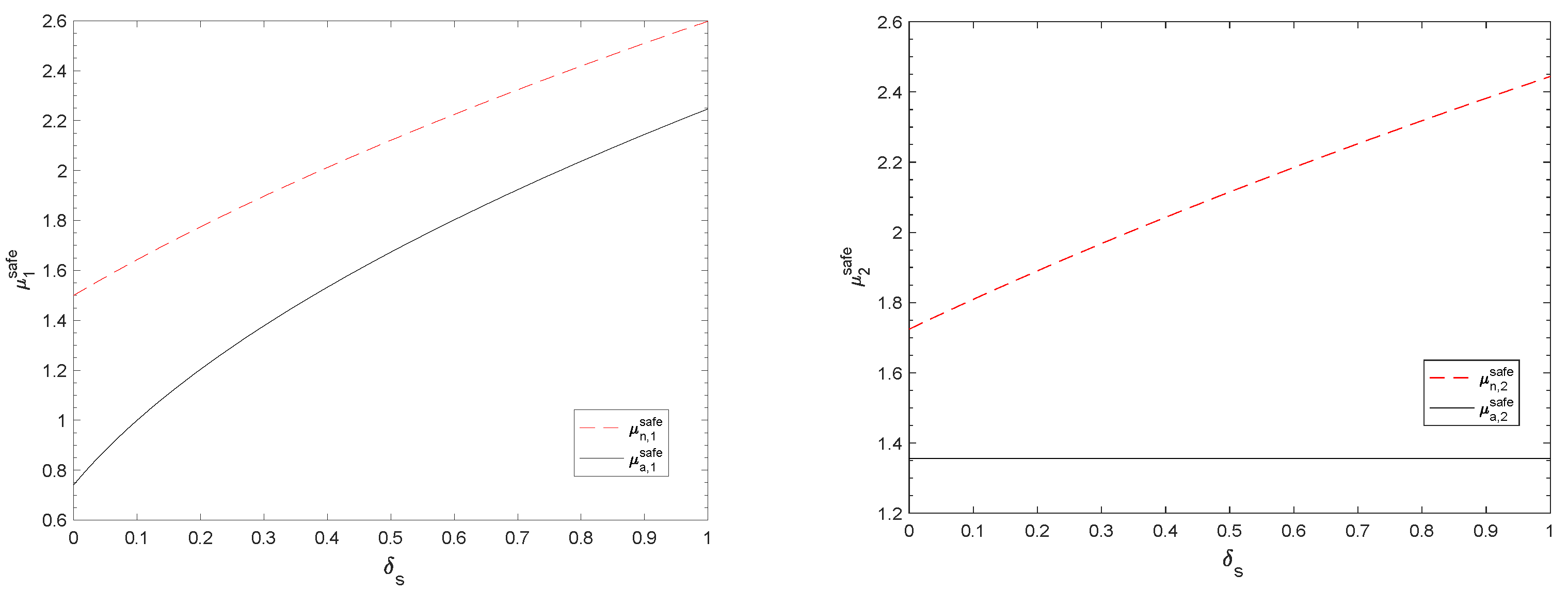

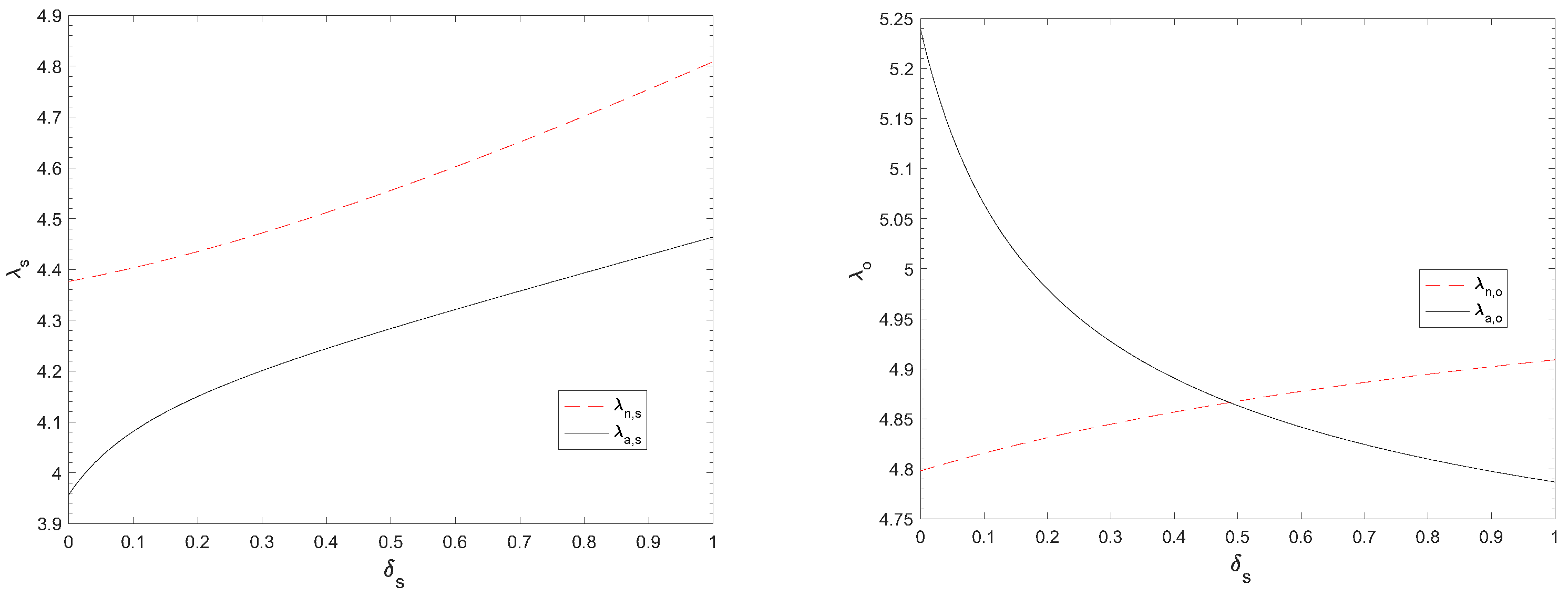

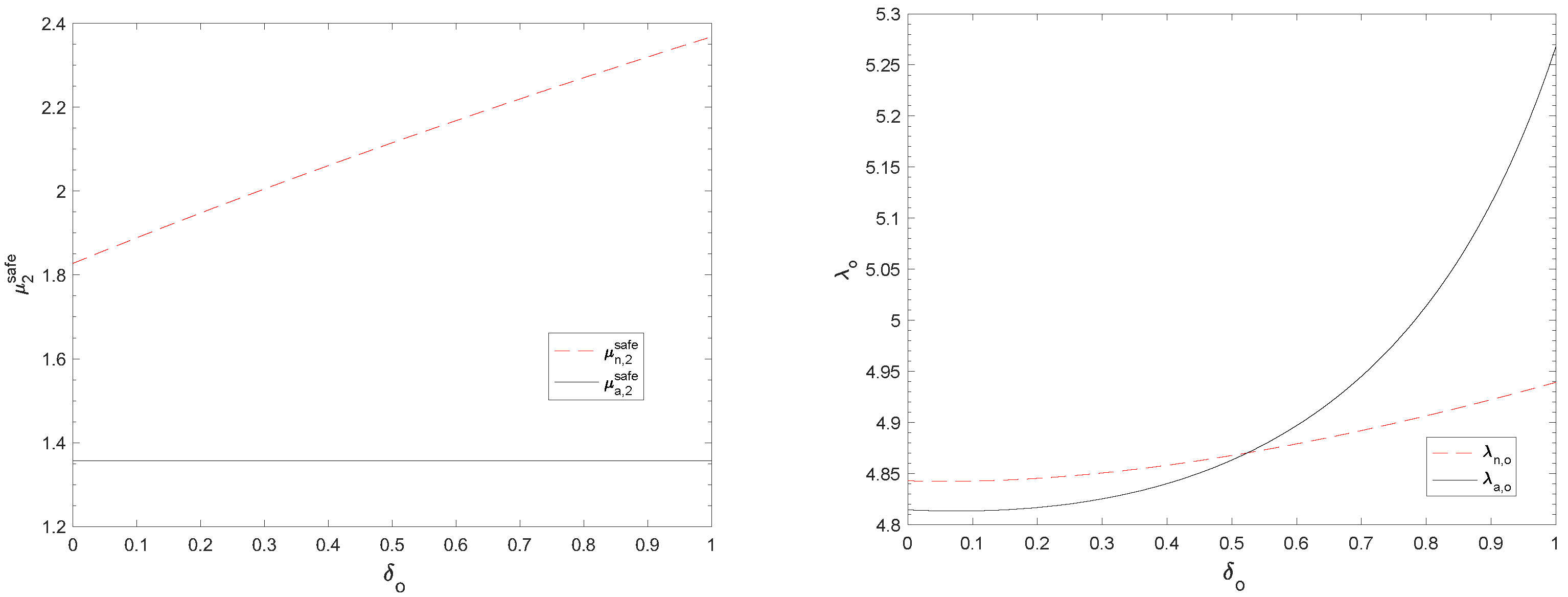

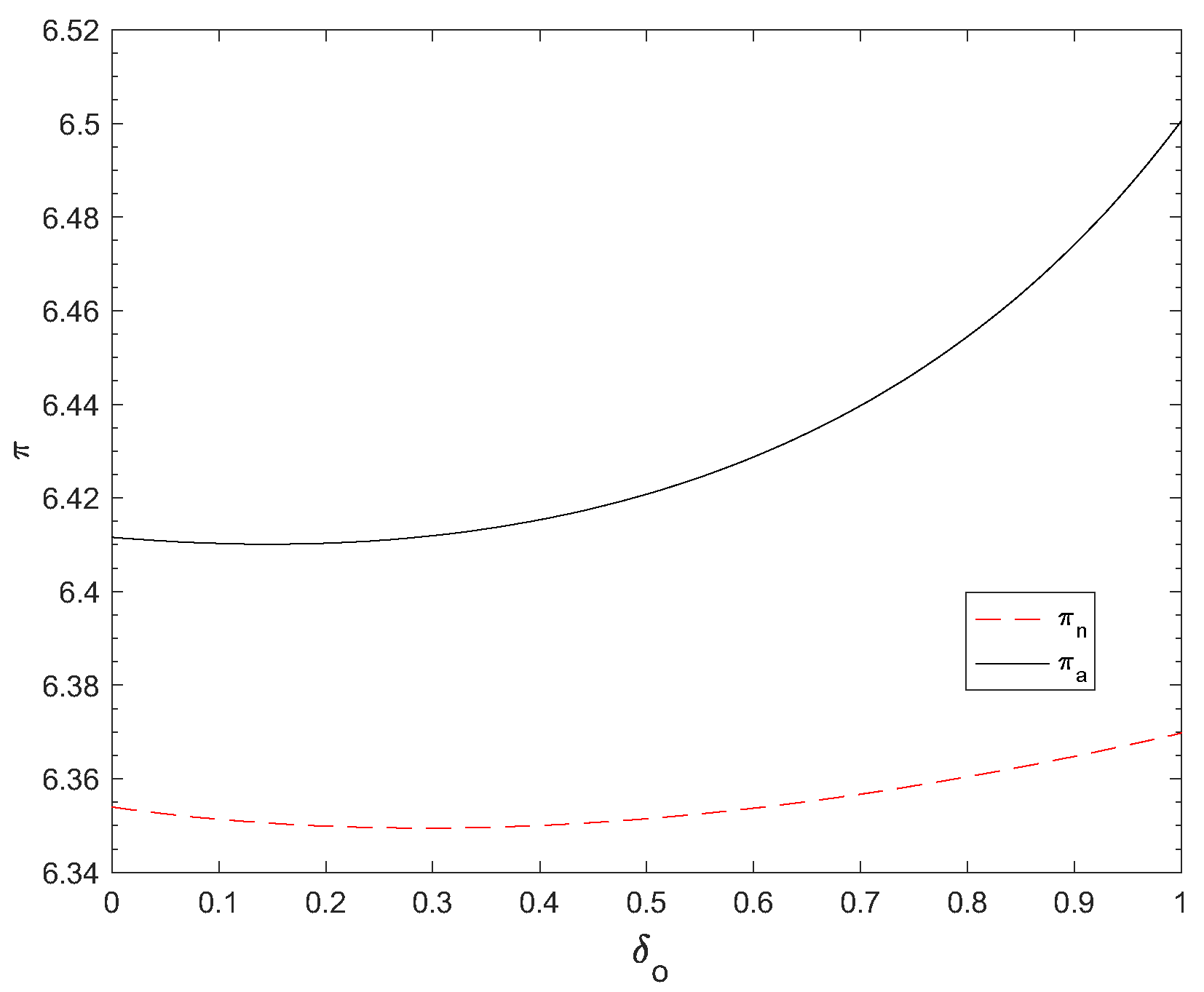

5.1. Analysis of Offline Customers

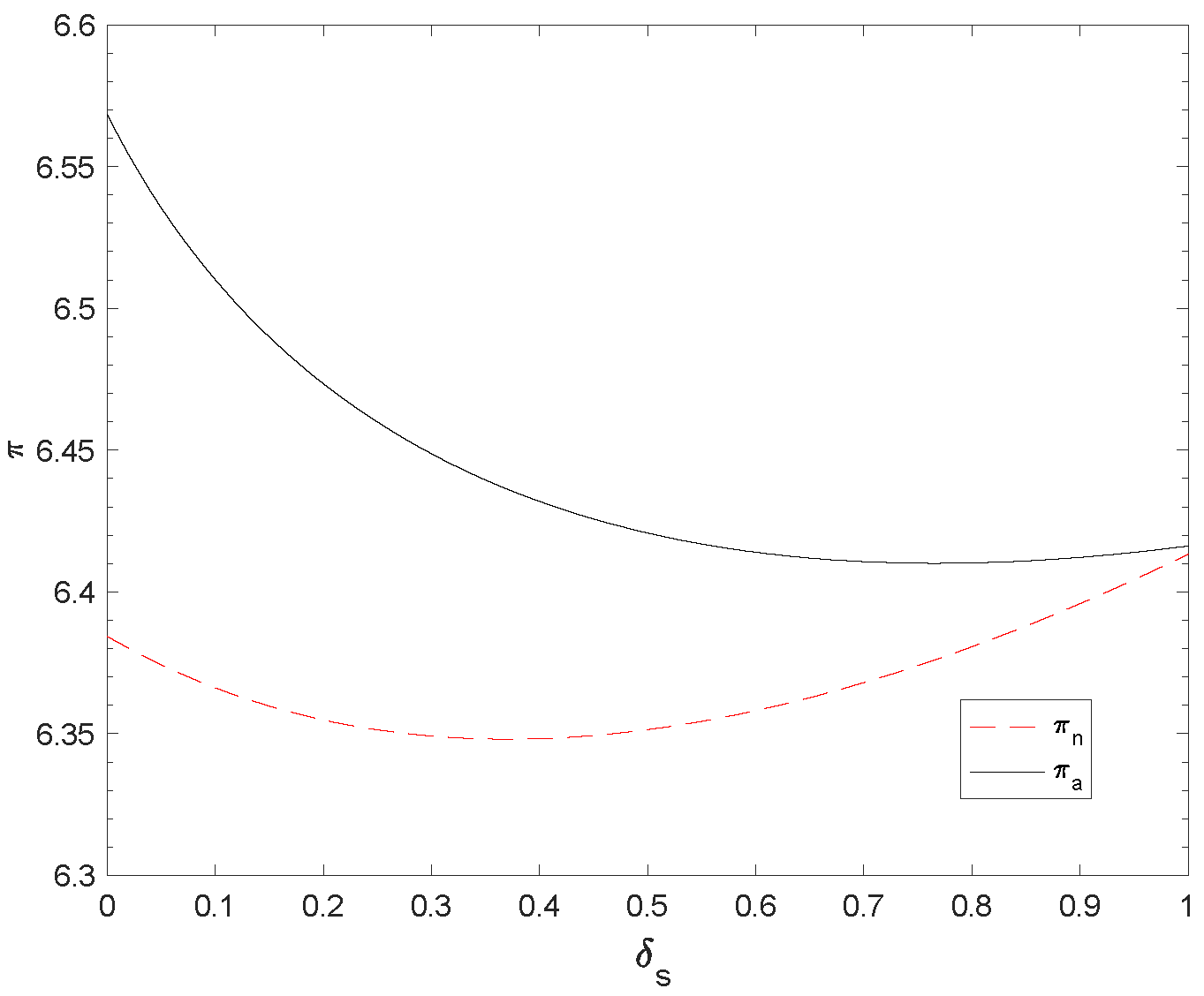

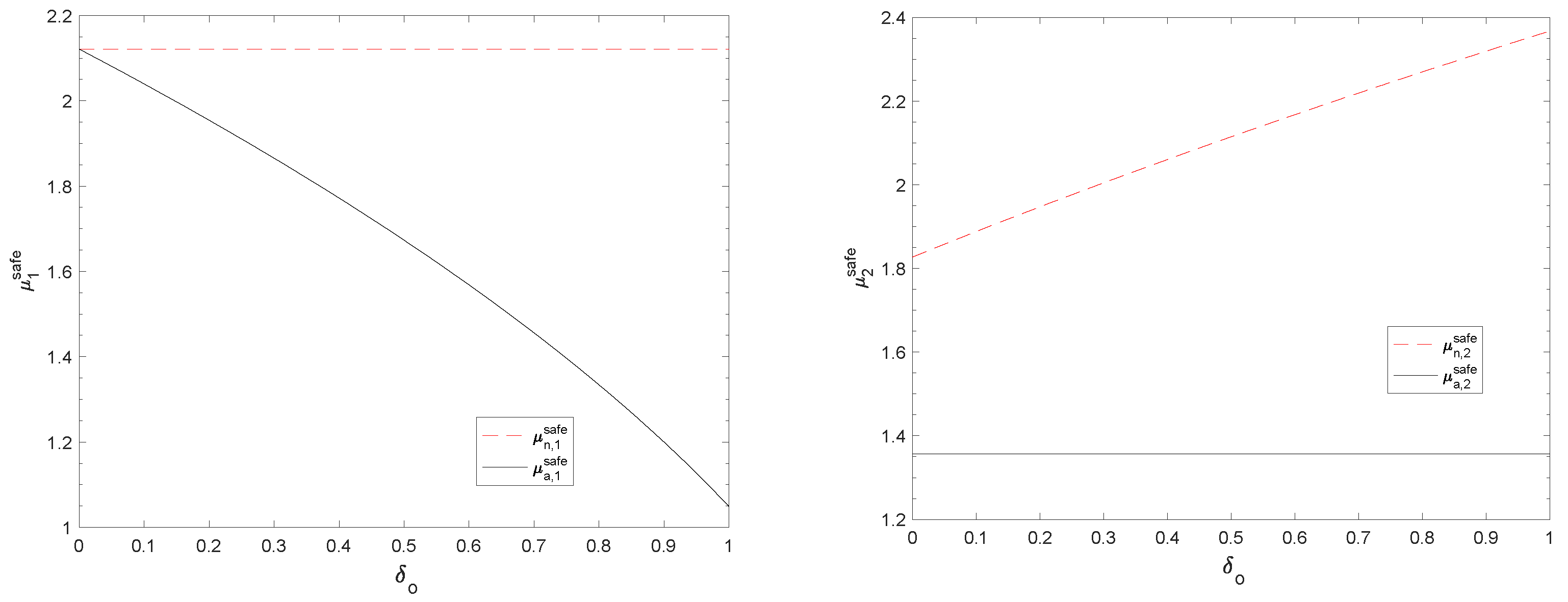

5.2. Analysis of Online Customers

6. Conclusions

- (1)

- If channel information is unavailable, customers take their expectations of waiting time as the reference point. With the improvement of the reference point sensitivity of customers, the omnichannel catering firm should enhance the safety capacity of the ordering and production stages to meet the needs of customers. At the same time, the improvement of the reference point sensitivity of customers also contributes to the increase in the firm’s profit under the higher customer expected waiting time.

- (2)

- Once channel information is available, customers take the waiting time of customers in other channels as the reference point. In this case, the change of customer sensitivity does not affect the safety capacity in the production stage. At this time, the sensitivity of online customers and the sensitivity of offline customers have exactly opposite effects on the safety capacity in the ordering stage. Moreover, the impact of customer sensitivity on the firm’s profit is also different between the different channels.

- (3)

- We also found that when channel information is available, the firm can set lower safety capacities to reduce costs, and can obtain higher profit when customers’ expected waiting time is small than when information is unavailable. In fact, this provides theoretical support for the choice of the channel information disclosure strategy of firms, and is of great significance for the operation and development of catering enterprises.

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Notations | Definitions |

|---|---|

| Capacity in stage | |

| Base capacity in stage | |

| Safety capacity in stage | |

| Unit capacity cost in stage | |

| Waiting time in stage | |

| The revenue per customer | |

| The proportion of offline customers in the market | |

| or | The actual shopping rate of offline or online customers |

| Total market demand | |

| or | The expected waiting times (reference point) of offline or online customers |

| The delivery time to online customers | |

| or | The sensitivity of offline or online customers to reference points |

| Customer sensitivity to waiting time | |

| The proportion of anxiety cost in waiting cost per unit time | |

| The base shopping rate of online and offline customers (determined by food quality) | |

| The firm’s profits |

References

- Anand, K.S.; Paç, M.F.; Veeraraghavan, S. Quality–Speed Conundrum: Trade-offs in Customer-Intensive Services. Manag. Sci. 2011, 57, 40–56. [Google Scholar] [CrossRef]

- Zhan, W.; Jiang, M.; Li, C. The service strategy of customer-intensive services under advertising effects. Kybernetes 2020, 50, 2453–2470. [Google Scholar] [CrossRef]

- Yuan, X.; Dai, T.; Chen, L.G.; Gavirneni, S. Co-Opetition in Service Clusters with Waiting-Area Entertainment. Manuf. Serv. Oper. Manag. 2021, 23, 106–122. [Google Scholar] [CrossRef]

- Gao, F.; Su, X. Omnichannel Service Operations with Online and Offline Self-Order Technologies. Manag. Sci. 2018, 64, 3595–3608. [Google Scholar] [CrossRef]

- Zhan, W.; Jiang, M.; Wang, X. Optimal Capacity Decision-Making of Omnichannel Catering Merchants Considering the Service Environment Based on Queuing Theory. Systems 2022, 10, 144. [Google Scholar] [CrossRef]

- Bell, D.R.; Gallino, S.; Moreno, A. Offline showrooms in omni- channel retail: Demand and operational benefits. Manag. Sci. 2018, 64, 1629–1651. [Google Scholar] [CrossRef]

- Kopalle, P.K.; Winer, R.S. A dynamic model of reference price and expected quality. Mark. Lett. 1996, 7, 41–52. [Google Scholar] [CrossRef]

- Popescu, I.; Wu, Y. Dynamic Pricing Strategies with Reference Effects. Oper. Res. 2007, 55, 413–429. [Google Scholar] [CrossRef]

- Nasiry, J.; Popescu, I. Dynamic Pricing with Loss-Averse Consumers and Peak-End Anchoring. Oper. Res. 2011, 59, 1361–1368. [Google Scholar] [CrossRef]

- Roels, G.; Su, X. Optimal Design of Social Comparison Effects: Setting Reference Groups and Reference Points. Manag. Sci. 2014, 60, 606–627. [Google Scholar] [CrossRef]

- Yang, L.; Guo, P.; Wang, Y. Service Pricing with Loss-Averse Customers. Oper. Res. 2018, 66, 761–777. [Google Scholar] [CrossRef]

- Wang, Z.G.; Yang, Y.X.; Liu, H.; Lin, M.Y. Analysis of Consumers’ cognition level, reference behavior and benefit degree of ag-ricultural product certification labeling: Based on the questionnaire survey of 20 provinces and autonomous regions in China. J. Agric. Econ. Manag. 2013, 59, 38–44. [Google Scholar]

- Fehr, E.; Schmidt, K.M. A Theory of Fairness, Competition, and Cooperation. Q. J. Econ. 1999, 114, 817–868. [Google Scholar] [CrossRef]

- Kahneman, D.; Tversky, A. Prospect Theory: An Analysis of Decision under Risk. Econometrica 1979, 47, 263. [Google Scholar] [CrossRef]

- Blettner, D.P.; Gollisch, S. The role of reference points and organizational identity in strategic adaptation to performance feed-back. Manag. Res. Rev. 2022, 45, 1205–1228. [Google Scholar] [CrossRef]

- Wang, Y.; Liu, P.; Yao, Y. BMW-TOPSIS: A generalized TOPSIS model based on three-way decision. Inf. Sci. 2022, 607, 799–818. [Google Scholar] [CrossRef]

- Qiu, R.; Yu, Y.; Sun, M. Joint pricing and stocking decisions for a newsvendor problem with loss aversion and reference point effect. Manag. Decis. Econ. 2020, 42, 275–288. [Google Scholar] [CrossRef]

- Long, X.; Nasiry, J. Prospect Theory Explains Newsvendor Behavior: The Role of Reference Points. Manag. Sci. 2015, 61, 3009–3012. [Google Scholar] [CrossRef]

- Kirshner, S.N.; Ovchinnikov, A. Heterogeneity of reference points in the competitive newsvendor problem. Manuf. Serv. Oper. Manag. 2018, 21, 571–581. [Google Scholar] [CrossRef]

- Zong, J.C. Comparison trap under stereotype: Experimental research on product bundling strategy. Nankai Manag. Rev. 2018, 21, 210–218. [Google Scholar]

- Verhoef, P.C.; Kannan, P.; Inman, J.J. From Multi-Channel Retailing to Omni-Channel Retailing. J. Retail. 2015, 91, 174–181. [Google Scholar] [CrossRef]

- Narang, U.; Shankar, V. Mobile App Introduction and Online and Offline Purchases and Product Returns. Mark. Sci. 2019, 38, 756–772. [Google Scholar] [CrossRef]

- Gallino, S.; Moreno, A. Integration of Online and Offline Channels in Retail: The Impact of Sharing Reliable Inventory Availability Information. Manag. Sci. 2014, 60, 1434–1451. [Google Scholar] [CrossRef]

- Bell, D.; Gallino, S.; Moreno, A. Showrooms and Information Provision in Omni-channel Retail. Prod. Oper. Manag. 2014, 24, 360–362. [Google Scholar] [CrossRef]

- Chopra, S. How omnichannel can be the future of retailing. Decision 2016, 43, 135–144. [Google Scholar] [CrossRef]

- Yan, L.; Guo, B.; Chao, C.; He, D.; Yu, Z.; Zhang, D. Foodnet: Toward an optimized food delivery network based on spatial crowdsourcing. IEEE Trans. Mob. Comput. 2018, 6, 1288–1301. [Google Scholar]

- Pei, Y.; Li, D.; Xue, W. The evaluation of customer experience using BP neural network-taking catering O2O takeout. Concurr. Comput. Pract. Exp. 2019, 32, e5515. [Google Scholar] [CrossRef]

- Zhao, D.Z.; Yang, J. Research on Decision-making Model of Estimated Delivery Time in O2O Food Delivery. Ind. Engi-Neering Management. 2018, 23, 8–15. [Google Scholar]

- Chen, M.; Hu, M.; Wang, J. Food Delivery Service and Restaurant: Friend or Foe? Manag. Sci. 2022. [Google Scholar] [CrossRef]

- Bensoussan, A.; Guo, P. Technical Note—Managing Nonperishable Inventories with Learning About Demand Arrival Rate Through Stockout Times. Oper. Res. 2015, 63, 602–609. [Google Scholar] [CrossRef]

- Gao, F.; Su, X. Online and Offline Information for Omnichannel Retailing. Manuf. Serv. Oper. Manag. 2017, 19, 84–98. [Google Scholar] [CrossRef]

- Li, W.; Jiang, M.; Zhan, W. Research on the Pricing Decisions of a Video Platform Based on Interaction. Systems 2022, 10, 192. [Google Scholar] [CrossRef]

- Kostecki, M. Waiting lines as a marketing issue. Eur. Manag. J. 1996, 14, 295–303. [Google Scholar] [CrossRef]

- Bassamboo, A.; Randhawa, R.S.; Zeevi, A. Capacity Sizing Under Parameter Uncertainty: Safety Staffing Principles Revisited. Manag. Sci. 2010, 56, 1668–1686. [Google Scholar] [CrossRef]

- Guo, W.; Chen, X.-R.; Liu, H.-C. Decision-Making under Uncertainty: How Easterners and Westerners Think Differently. Behav. Sci. 2022, 12, 92. [Google Scholar] [CrossRef] [PubMed]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhan, W.-T.; Wang, X.-P.; Jiang, M.-H.; Jiang, H.; Huo, D.; Liu, Y.-T. The Capacity Decision-Making of Omnichannel Catering Firms Based on Queueing System Considering Customer Reference Behavior. Systems 2022, 10, 229. https://doi.org/10.3390/systems10060229

Zhan W-T, Wang X-P, Jiang M-H, Jiang H, Huo D, Liu Y-T. The Capacity Decision-Making of Omnichannel Catering Firms Based on Queueing System Considering Customer Reference Behavior. Systems. 2022; 10(6):229. https://doi.org/10.3390/systems10060229

Chicago/Turabian StyleZhan, Wen-Tao, Xue-Ping Wang, Ming-Hui Jiang, Han Jiang, Da Huo, and Yun-Tao Liu. 2022. "The Capacity Decision-Making of Omnichannel Catering Firms Based on Queueing System Considering Customer Reference Behavior" Systems 10, no. 6: 229. https://doi.org/10.3390/systems10060229

APA StyleZhan, W.-T., Wang, X.-P., Jiang, M.-H., Jiang, H., Huo, D., & Liu, Y.-T. (2022). The Capacity Decision-Making of Omnichannel Catering Firms Based on Queueing System Considering Customer Reference Behavior. Systems, 10(6), 229. https://doi.org/10.3390/systems10060229