Abstract

Through the interaction terms of business condition expectations and structural shocks, the non-linear effects of business condition expectations on expected stock market returns were studied. We found that the recession expectation enlarges the positive effects of a permanent shock on the expected stock market return, and also increases the negative impacts of the temporary shock. Over the long-horizon forecast, these effects increase over time. Moreover, the impacts under the recession expectation are greater than those under the expansion expectation. The results are robust and have economic significance. We also provide evidence for the existence of a negative relationship between business condition expectations and expected stock market returns.

1. Introduction

The impacts of business conditions on stock market returns are essentially attributed to the predictability of stock returns. Cochrane [1] pointed out that stock returns are predictable. This predictability is closely related to fluctuations in the business cycle. On the one hand, a large amount of research found that changes in the real economy have an opposite relationship with expected stock market returns (Fama and French [2], Black, Fraser [3], Black [4], Marathe and Shawky [5], Andreou, DeSiano [6], Kim and Lee [7], Lochstoer [8], McQueen and Roley [9], Jarvinen [10], Flannery and Protopapadakis [11], Loflund and Nummelin [12]). On the other hand, expectation plays an important role in economic analysis. The two most common models of expectation formation are adaptive expectation and rational expectation (Mlambo [13]). Adaptive expectation assume that people form an expectation of one variable only depending on its past values. However, rational expectation assume that an expectation about one variable is formed using all of the relevant information. Expectations are mostly studied through survey data (Dokko and Edelstein [14],Hafer and Resler [15],Croushore [16]) and experiments (Mirdamadi and Petersen [17], Colasante, Palestrini [18]). Among the works mentioned above, some support adaptive expectation (Colasante, Palestrini [18], and Dokko and Edelstein [14]), while others provide evidence for rational expectation (Hafer and Resler [15], Mirdamadi and Petersen [17]). We can also see that the impacts of business condition expectations on stock market returns have aroused widespread interest among scholars, such as Chen [19]; Liu, Tao [20]; Conrad and Loch [21]; Campbell and Diebold [22]; Chava, Gallmeyer [23]; Colacito, Ghysels [24]; Kadilli [25]; and Silva [26]. Among these works, some form business condition expectations according to economic models (Chen [19]; Liu, Tao [20]; and Conrad and Loch [21]), while others focus on expectations from survey data (Campbell and Diebold [22], Chava, Gallmeyer [23]) or professional forecasters (Kadilli [25], Silva [26]). They all found that business condition expectations can affect the expected stock market return. Regarding adaptive or rational expectation, there is a great deal of debate about which one of them is better. The business condition expectations used in this paper belong to rational expectation.1 However, proving the superiority of rational expectation over adaptive expectation is not our focus.

Changes in the real economy and business condition expectations both reflect the fluctuations of the business cycle. Previous studies have separately explored their impacts on expected stock market returns. When investors make decisions, they usually consider both. Kadilli [25] used both of them as independent variables in linear regression and found that they both have significant predictive power.

When we consider the joint influences of a change in the real economy and business condition expectations, their linear combination may be inappropriate. Mlambo [13] has pointed out that expectations are thoughts and they involve a process of estimating the future rather than a process of influencing the future. When investors make investment decisions, they are under the influence of their expectations. It is the decisions influenced by the expectations that determine the stock price, rather than the expectations themselves. Therefore, the joint influences of the changes in the real economy and business condition expectations should be modeled in a non-linear manner.

When we combine the business condition expectation with the changes in the real economy in a non-linear manner, what happens to the predictive power of the latter? Under different business condition expectations—for example, expansion or recession—does the predictive power change accordingly? Which one of the business condition expectations has the greater impact?

We used Blanchard and Quah [27] structural shocks to represent changes in the real economy and the composite leading indicators (CLI) published by the Organization for Economic Cooperation and Development (OECD) to represent business condition expectations. By constructing the interaction terms between structural shocks and composite leading indicators, we studied the impacts of structural shocks on expected stock market returns under different business condition expectations. Our model structure is similar to that of Velázquez and Smith [28]; the difference is that they use ex-post information [29] to classify business conditions in Britain and there is a look-ahead bias. The composite leading indicators are prior information, so this problem does not exist here.

Due to concerns regarding the strong influence of COVID-19, we prepared two data sets. The first one is 1960–2019 and the second is 1960–2021. In Section 3.1, Section 3.2, Section 3.3 and Section 3.4 (the sub-sample test is not included) and Section 4.1, we only show the outcomes of 1960–2021 because the results of the two data sets are similar. In the sub-sample test of Section 3.4 and in Section 4.2, Section 4.3, Section 4.4, the outcomes of both data sets are shown because they are different. We attribute these differences to the influences of COVID-19 because, as we can see in the last two figures in Section 3.1, there is a rapid drop associated with both structural shocks in 2020, which are outliers in the data. We compared the outcomes of the two data sets and found that the data set of 1960–2019 delivered better results. The predictive power of the structural shocks and the business condition expectations is significantly damaged because of the outliers in the data set of 1960–2021.

Upon comparison, we take the outcomes of the data set of 1960–2019 to be more credible as it is exempt from the immeasurable influences of COVID-19. 2 Moreover, some credible conclusions can be obtained from the data set of 1960–2021. By combining the outcomes of the two data sets, we can make the following conclusions.

Firstly, under the influence of recession expectations, the impacts of structural shocks on the expected stock market returns increase. Secondly, the impacts under the recession expectations are greater than those under the expansion expectations. Thirdly, as is well-known, the relationship between business condition expectations and expected stock market returns is controversial. Chen [19], Campbell and Diebold [22], Conrad and Loch [21], and Kadilli [25] found that there is a negative relationship between business condition expectation and expected stock market returns but Chava, Gallmeyer [23] found that this relationship is positive. According to our findings, we also support the existence of a negative relationship.

The structure of the article is as follows. Section 2 presents the models and methods. Section 3 explains the impacts of structural shocks and business condition expectations on expected market returns. Section 4 presents the in-sample prediction, the out-of-sample forecast, and their economic significance. The last section concludes.

2. Models and Methods

2.1. Models

Before we explain the models, we report the descriptions of notations in Table 1.

Table 1.

Descriptions of notations.

First, we needed to build a model that reflects the impacts of the changes in the real economy on the stock market return. We extracted the structural shocks from the series of real gross domestic product (RGDP) and the implied GDP price deflator. The long-term restrictions of the structural shocks are consistent with the macroeconomic analysis framework of changes in aggregate supply and aggregate demand (AS/AD). Specifically, the aggregate supply shock causes the output to permanently rise and the price to fall. Aggregate demand shock causes the output to temporarily rise, and prices rise accordingly and have no long-term effects on the output. Keating and Nye [30] improved the structural impact of Blanchard and Quah [27]. We used their method to construct a VAR system through the growth rate of RGDP () and the implied GDP price deflator () to extract the structural shocks and . represents the permanent shock and represents the temporary shock. They can also be understood as aggregate supply and aggregate demand shocks, respectively. They can represent the changes in the real economy. Then, the influences of the permanent shock and temporary shock on could be analyzed through Model (1).

It is worth noting that the structural shocks were calculated using the whole set of data. For the stock market return at t, they contain future information. Therefore, in Model (1), there is a form of violation to basic asset pricing principles. However, for in Lettau and Ludvigson [31], a similar problem exists. They explained that the variables from which are derived are cointegrated, so the OLS estimates of cointegrating parameters are super consistent. We also found that the two variables from which the structural shocks are extracted are cointegrated (the results not shown). We hope that the readers who wish to replicate our results take note of this point.

Secondly, we built the model jointly considering the influences of the changes in the real economy and business condition expectations. We chose the interaction terms between them to describe their relationship. On the one hand, this is the simplest non-linear solution. On the other hand, we can clearly observe what happens to the impacts of the changes in the real economy when under different business condition expectations. We derived two dummy variables as the business condition expectations from CLI. The reason that we chose CLI is that they are published by the OECD and are widely known among global investors. The two dummies are the expansion () and recession expectation (). Then, we obtained the interaction terms between the business condition expectations and the structural shocks. There are four interaction terms. They are the permanent shocks under the expansion and recession expectation ( and , respectively) and the temporary shocks under the expansion and recession expectation ( and , respectively). Then, the stock market return was analyzed using the four interaction terms. This is expressed in Model (2):

Through Model (1), we can determine the impacts of the change in the real economy on the stock market return. Through Model (2), we can observe what happens to the impacts of the change in the real economy when under different business condition expectations. By comparing Models (2) and (1), we can identify the additional influence of the business condition expectations through their interaction with the change in the real economy.

2.2. Methods

Next, we introduce the methods that we use. Before this, we report the data used to estimate Models (1) and (2) and the robustness tests in Table 2.

Table 2.

Data related to the estimation of Models (1) and (2) and the robustness tests.

Table 2.

Data related to the estimation of Models (1) and (2) and the robustness tests.

| Notation | Description | Related Data | Data Interval |

|---|---|---|---|

| The excess market returns | Quarterly return on the S&P 500 index net of three-month treasury bill rate 3,4,5 | 1960–2021 1960–2019 | |

| Quarterly return on the NYSE composite index net of three-month treasury bill rate 6 | 1960–2021 1960–2019 | ||

| The structural shocks | 1960–2021 1960–2019 | ||

| The growth rate of Real Gross Domestic Product | Real Gross Domestic Product7 | 1959–2021 1959–2019 | |

| The growth rate of the implied Gross Domestic Product price deflator | The implied Gross Domestic Product price deflator8 | 1959–2021 1959–2019 | |

| Business condition expectation | Composite Leading Indicators9 | 1960–2021 1960–2019 | |

| OECD, Business Tendency Surveys for Manufacturing: Confidence Indicators10 | 1960–2021 1960–2019 |

Note: All data frequencies are quarterly.

Models (1) and (2) were estimated through ordinary least squares (OLS). The dependent variable is the excess return of the S&P 500 index. The data of the independent variables are mentioned in Section 2.1 for Models (1) and (2).

The robustness tests were performed from the following five aspects.

(a) Improved augmented regression (IARM): Stambaugh [32] pointed out that, if the independent variables have strong autocorrelation, in the case of limited samples, the OLS estimator is biased. To solve these problems, Kim [33] proposed an improved augmented regression method (IARM). This method can solve the problem of small-sample deviation and strong autocorrelation of independent variables11.

According to Kim [33], for the bivariate predictor ( and ) case order p,

The improved bias-corrected estimator can be obtained through the augmented regression of the following form:

on 1, , , , , , and ,

where and , and is estimated through Equation (9) of Kim [33].

(b) Another dependent variable: We substituted the S&P 500 index with the NYSE composite stock index.

(c) Another calculation method for stock market returns: is the seasonally adjusted stock market price index at time t. In Campbell and Shiller [34], the realized log gross return at time t is expressed as . is the dividend12. On this basis, subtracting the risk-free interest rate, we can obtain the realized excess stock market return.

(d) Another business condition indicator: We chose the confidence indicator of the Business Tendency Surveys for Manufacturing published by OECD to test Model (2).

(e) Sub-sample test: The sample was divided into two periods from the year 1990 and the models were separately tested. We chose the year 1990 because it equally divides the time interval from 1960 to 2021.

3. Empirical Results of Models (1) and (2)

3.1. Extraction of the Structural Shocks

We extracted the structural shocks from the VAR system of the growth rate of RGDP and the implied GDP price deflator ( and ). It can be seen in Table 3 that these two variables are both stationary.

Table 3.

Statistic descriptions of and .

Since the extraction of the structural shocks is a standardized process, it is not shown13. The characteristic values of the VAR system are 0.9363, 0.3671, 0.3358, and 0.2222, respectively. It can be seen that these values are all less than 1 and the null hypothesis that the VAR system is stationary cannot be rejected.

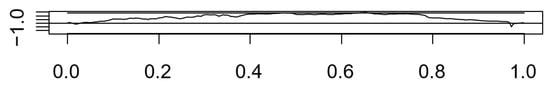

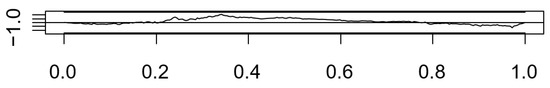

The stationarity test of the regression relationship of the VAR system can be found in Figure 1 and Figure 214. The stationarity test of the ordinary least squares cumulative sum (OLS−CUSUM) detects whether the regression relationship of the VAR system is stable by calculating whether the recursive residual process of the VAR system conforms to Brownian motion. If it was stable, the process curve would not exceed the boundary on both sides. It can be seen in Figure 1 and Figure 2 that the regression relationship is stable.

Figure 1.

OLS−CUSUM of output change.

Figure 2.

OLS−CUSUM of price change.

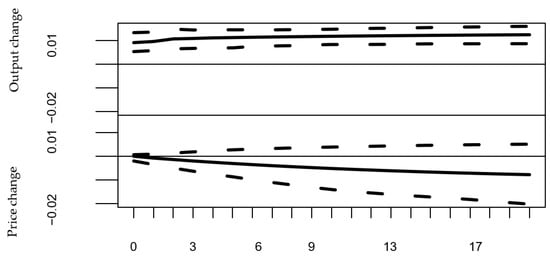

Figure 3.

Impulse response diagram of permanent shock .

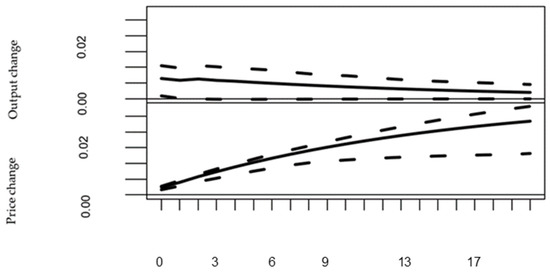

Figure 4.

Impulse response diagram of temporary shock .

It can be seen in Figure 3 that, under one positive standard deviation of the permanent shock, the output rises and price levels fall. It can be seen in Figure 4 that, under one positive standard deviation of the temporary shock, the output rises at the beginning but, over time, the resulting change falls to zero and the price level rises. Figure 3 and Figure 4 conform to the assumptions of Blanchard and Quah [27].

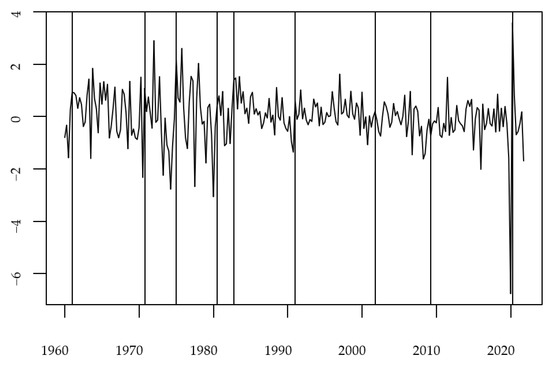

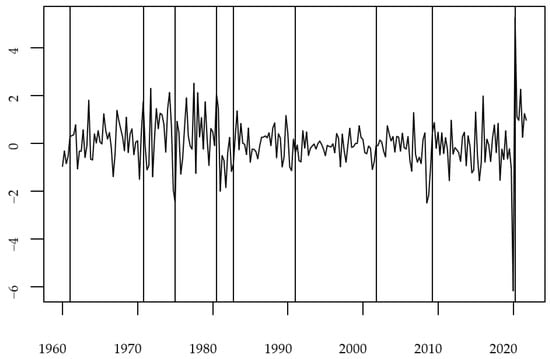

Figure 5 shows the permanent shock and Figure 6 shows the temporary shock. The trough dates of the turning point of the NBER business cycle are marked in both figures15.

Figure 5.

Permanent shock and the trough date of the NBER business cycle.

Figure 6.

Temporary shock and the trough date of the NBER business cycle.

It can be found in Figure 5 that the permanent shock presents counter-cyclical fluctuations, which are relatively high during the economic recession and relatively low during economic expansion. In Figure 6, although the relationship between the temporary shock and business cycle fluctuations is not as obvious as the relationship with the permanent shock, there is still a certain correlation. The relationships between the structural shocks and business cycle fluctuations imply that they should have predictive power for stock market returns. We can also find that there is a large drop in 2020, seen in both Figure 5 and Figure 6, because of the influences of COVID-19; these data can be taken as outliers. In the next sections, the influences of the outliers on the predictive powers of the structural shocks and the business condition expectations can be observed.

3.2. The Empirical Results of Model (1)

Next, we performed the empirical test of Model (1). The dependent variable is the excess stock market return .The independent variables are the permanent shock and the temporary shock . The descriptive statistics for can be seen in Table 4. According to the result of the unit root test, this return series is stationary.

Table 4.

Descriptive statistics of .

For convenience of reading, Model (1) is shown in Equation (1).

The results of Model (1) are shown in Table 5.

Table 5.

Regression results of Model (1) (1960–2021).

It can be found in Table 5 that the permanent shock has a positive effect on the expected return of the S&P 500 index, while the temporary shock has no significant effect. Unless otherwise specified, the standard errors are Newey–West-adjusted (Newey and West [35]).

3.3. The Empirical Results of Model (2)

Next, we estimated Model (2) in Equation (2).

represents the permanent shock under the expansion expectation.

represents the permanent shock under the recession expectation.

represents the temporary shock under the expansion expectation.

represents the temporary shock under the recession expectation.

The results of Model (2) are shown in Table 6.

Table 6.

Regression results of Model (2) (1960–2021).

It can be seen in Table 6 that, in Model (2), under the influences of business condition expectations , the permanent shock has a positive impact on the expected stock market return. Compared to Table 5, the addition of the recession expectation expands the impacts of the permanent shock . The impacts under the recession expectation are larger than those under the expansion . In addition, it can be found that the adjusted R-squared of Model (2) is greater than that of Model (1).

At the same time, we also designed another two regression models to test for multicollinearity problems. The results are also listed in Table 6. It can be seen that the adjusted R-squared values of Columns 3 and 4 add up to 0.0349. The adjusted R-squared of Model (2) is 0.0351. The difference between the two R-squared values is very small. Therefore, we do not believe that Model (2) has serious multicollinearity problems.

3.4. Robustness Tests

We first show the robustness tests of another estimation method, IARM; another dependent variable, the NYSE composite stock index; another calculation method for stock market returns, presented in Campbell and Shiller [34]; and another business condition expectation index (only for Model (2)). The descriptive statistics of the excess return of the NYSE composite stock index and the excess stock market return realized in Campbell and Shiller [34] are shown in Table 7.

Table 7.

Descriptive statistics of .

It can be seen in Table 7 that the two return series are stationary.

Table 8 shows the first three types of robustness test results of Model (1).

Table 8.

Comparison of regression results of Model (1).

According to the IARM results in the last three columns of Table 8, it can be seen that the permanent shock has a positive effect on stock market returns, while the temporary shock has no effects. This result is similar to the OLS result of Model (1). It can be seen that the results of Model (1) are relatively stable regardless of the change in the regression method, the calculation method for returns and the replacement of the dependent variable.

The results of Model (2) are shown in Table 9.

Table 9.

Comparison of regression results of Model (2).

It can be seen in Table 9 that, under the recession expectation , the permanent shock has a positive effect on the stock market return. Compared to Table 8, the addition of the recession expectation expands the impacts of the permanent shock . The impacts under the recession expectation are larger than those under the expansion These results are similar to the OLS results of Model (2). It can be seen that the results of Model (2) are relatively stable regardless of the change in regression method, the calculation method of returns, and the replacement of the dependent variable and business condition expectation index. Moreover, it also can be found that, under these robustness tests, the adjusted R-squared of Model (2) is greater than that of Model (1).

Next, we show the results of the sub-sample test. The sample was divided into two periods from the year 1990 and they were separately tested.

Table 10 shows the sub-sample test of Model (1).

Table 10.

Sub-sample regression results of Model (1).

It can be seen in Table 10 that, from 1960 to 1990, the permanent shock has positive effects on the return of the S&P 500 index, while the temporary shock has no significant effects. From 1991 to 2021, has no significant effects but has positive effects. For the two regression methods of OLS and IARM, the results are similar.

We also performed the sub-sample test for the first data set of 1960–2019 (not shown) and found that the permanent shock has positive effects for the whole period, not only in the stage of 1960–1990. It seems that the addition of the two years 2020 and 2021 sharply decreases the predictive power of the permanent shock .

The results of the sub-sample test of Model (2) are shown in Table 11.

Table 11.

Sub-sample regression results of Model (2) (1960–2021).

It can be seen that, for the period of 1960–1990, under the recession expectation , the permanent shock has positive impacts on the return of the S&P 500 index. Compared to Table 10, the addition of the recession expectation expands the impacts of the permanent shock . Even with the addition of and , the temporary shock still has no significant impacts. However, for the period of 1991–2021, we can find that there is no clear rule. The addition of and increases the coefficients of and but we cannot determine which one of the business condition expectations has more influence. For example, in Column 4 of Table 11, for the temporary shock , the coefficient of is larger than that of . In Column 5, the situation is reversed. In consideration of the outliers (the two years 2020 and 2021), we introduce the sub-sample test of 1960–2019 in Table 12.

Table 12.

Sub-sample regression results of Model (2) (1960–2019).

It can be seen that, for the period of 1960–1990, under the recession expectation , the permanent shock has a positive impact on the return of the S&P 500 index. The coefficients of the permanent shock under the recession expectation are larger than those under the expansion expectation. These results are similar to the ones for 1960–1990 in Table 11. For the period of 1991–2019, we can clearly see that the impacts of the recession expectation are greater than those of the expansion expectation for both shocks. For the two regression methods of OLS and IARM, the results are similar.

It seems that the outliers (the two years 2020 and 2021) blur the predictive power of the business condition expectations. Without the outliers, we find that the impacts of the recession expectation are greater than those of the expansion expectation. However, the addition of the two years 2020 and 2021 makes this rule less clear. We speculate that COVID-19 exerted a sudden impact on the global economy, which has never been experienced before. Therefore, society did not know how to respond and what changes to expect regarding the future of the economy. This may explain why the rule was lost for the period of 1991–2021.

We take the results of 1960–2019 to be more credible; combining the results of 1960–2021, we make the following conclusions. First, the permanent shock has positive impacts on stock market returns. The addition of the recession expectation expands its impacts. The impacts of the recession expectation are greater than those of the expansion expectation. These conclusions are supported regardless of the regression method, the stock market index, the calculation of stock market returns, and the choice of business condition expectation indicator.

The difference between the sub-sample tests and the former robustness tests is that, for the period of 1991–2019 or 1991–2021, the temporary shock has significant positive impacts on stock market returns and these impacts are enlarged under the business condition expectations and . This phenomenon does not appear in the other robustness tests. There may be two reasons. On the one hand, Welch and Goyal [36] revealed that predictors have unstable predictive ability, so this phenomenon can be explained by this point. On the other hand, there may be some changes in the economic circumstances for this period that result in the change in the relationship between the temporary shock and the stock market return. This could be left to future research. In the next section, we show our further analysis of the predictive power of structural shocks and business condition expectations.

4. The Predictive Power of Models (1) and (2) and Their Economic Significance

4.1. In-Sample Prediction

In this section, we introduce the addition of control variables that have predictive power on stock market returns in Welch and Goyal [36] to test the predictive power of Models (1) and (2).

The time interval is 1960–2021. A stationarity test was carried out. According to the results of the stationarity test and the availability of data, the following variables were finally selected, as follows.

(a) The first category is related to stock characteristics.

Dividend payment ratio : the difference between the log of dividends and the log of earnings.

Stock variance : the daily return of the S&P 500 index after the square.

Net securities issuance : the total mobile net issuance for the 12 months listed on the NYSE divided by the total market value of all stocks at the end of the year.

(b) The second category is related to interest rate.

Term spread : the difference between Moody’s Aaa corporate bond yield and federal funds rate at time t16.

Default spread : the difference between the yields of Moody’s Baa and Aaa corporate bonds at time t17,18.

(c) The third category is related to macroeconomics.

Investment to capital ratio : the total investment of the entire economy divided by the total capital.

is found in Lettau and Ludvigson [31]19.

The descriptive statistics of the control variables are shown in Table 13.

Table 13.

Descriptive statistics of control variables (1960–2021).

Table 13.

Descriptive statistics of control variables (1960–2021).

| Mean | 1.0069 | 2.0666 | −0.7530 | 0.0066 | 0.0097 | 0.0362 | 0.0001 |

| Standard Deviation | 0.4300 | 1.8745 | 0.3120 | 0.0111 | 0.0196 | 0.0032 | 0.0039 |

| ADF statistic p-value of ADF test | −4.5444 (0.0250) | −2.5885 (0.01) | −2.4799 (0.0144) | −6.7043 (0.01) | −3.3634 (0.01) | −3.5198 (0.01) | −2.3031 (0.0219) |

| Number of samples | 248 | 248 | 248 | 248 | 248 | 248 | 248 |

Note: The lag order of the ADF test is 1. For variables with a p-value less than 0.01, the true p-value is less than the p-value in parentheses. Most of the control variables were derived from Amit Goyal’s website20.

It can be seen in Table 13 that the control variables are all stationary.

There are four steps to adding control variables: The first step is to add the control variables of stock characteristics; the second step is to add interest-rate-related control variables; the third step is to add macroeconomic-related control variables; the fourth step is to add all control variables. Due to space limitations, only the results of the fourth step are shown here. The results of the first three steps are similar.

Table 14 shows the results of Model (1).

Table 14.

Regression results of Model (1) (all control variables).

It can be seen in Table 14 that the permanent shock has a significant positive impact on future stock market returns, while the temporary shock has no significant impact.

The results of Model (2) are shown in Table 15.

Table 15.

Regression results of Model (2) (all control variables).

It can be seen in Table 15 that, under the influences of recession expectations , the permanent shock has a significant positive impact on stock market returns. Compared to Table 14, it can be seen that the recession expectation has expanded the impacts of the permanent shock. The temporary shock has no effects. The impacts of the recession expectation are greater than those of the expansion expectation. It can also be found that, after adding the control variables, the adjusted R-squared of Model (2) is greater than that of Model (1).

Combining this information, regardless of the type of control variable, whether it is used alone or whether all control variables are used, structural shocks have a predictive effect on stock market returns and the addition of business condition expectations can expand this impact.

4.2. Long-Horizon Forecast

The forecast in the previous section is for period t + 1. Consider the forecast for period t + i, i = 2, 4, 6…18. It should be noted here that the long-horizon return is the accumulation of quarterly returns. If i = 2, it means that , and so on, for other . Since the long-term forecast return rate is calculated by the superposition of , there is an autocorrelation between the residual and the independent variables, which violates the assumption of the exogeneity of independent variables (Hansen and Hodrick [37]). The Hansen–Hodrick standard deviation was used to correct this problem. Regarding the question of whether the coefficients of all independent variables are 0 at the same time, the chi-squared test was used. The results of the following regression equations only show the results that passed the chi-squared test. To avoid the problem of small-sample bias, the bootstrap (1000 simulations) method was used to calculate the 95% confidence interval of the standard deviation for all of the standard deviations of the long-horizon forecast. The time interval is 1960–2021. Table 16 shows the results of Model (1).

Table 16.

Forecast of Model (1) (S&P 500 long-horizon forecast results) (1960–2021).

In Table 16, it can be seen that the temporary shock has negative impacts on future stock market returns and these influences gradually increase with time. It can also be seen that, with the exception of the intercept term, the standard deviations of all coefficients are essentially within the confidence intervals.

Table 17 shows the results of Model (2).

Table 17.

Forecast results of Model (2) (S&P 500 long-horizon forecast) (1960–2021).

In Table 17, it can be seen that, with the exception of the intercept term, the standard deviations of all coefficients are essentially within the confidence intervals. However, it must be noted that, for the 12th period, the standard deviation of the coefficient is lower than the confidence interval, so this result needs to be treated with caution.

We can find that the addition of the expansion expectation and the recession expectation increases the coefficients of both of the structural shocks. As time passes, the impacts of the structural shocks and the business condition expectations grow. All of the impacts are negative. For the permanent shock and the temporary shock , the impacts of the expansion expectations are greater than those of the recession expectation . Again, this finding conflicts with our former one, i.e., the influences of are larger than those of .

We know from the sub-sample test that the outliers damage the predictive power of the permanent shock and blur the impacts of different business condition expectations. To solve this problem, we again introduced the outcomes of 1960–2019, which are shown in Table 18.

Table 18.

Forecast of Model (1) (S&P 500 long-horizon forecast results) (1960–2019).

It can be seen in Table 18 that, with the exception of the intercept term, the standard deviations of all coefficients are essentially within the confidence intervals. It should be noted that the standard deviations of some individual coefficients are on the right side of the confidence intervals. This means that this sample may overestimate the standard deviation, which means that the significance of some coefficients is underestimated. For the 14th and 16th periods, the standard deviations of the coefficients are much higher than the confidence intervals, which can only show that the coefficients are more significant than those in Table 18, as with the standard deviation of the coefficients in the 6th period.

We can find that the permanent shock in the 4th and 6th periods has a positive impact on the future stock market return but these impacts gradually disappear over time. The temporary shock has a negative impact on the future stock market returns in the 6th, 14th, and 16th periods and these influences gradually increase with time.

Table 19 shows the results of Model (2).

Table 19.

Forecast results of Model (2) (S&P 500 long-horizon forecast) (1960–2019).

It can be seen in Table 19 that, with the exception of the intercept term, the standard deviations of all coefficients are essentially within the confidence intervals. It should be noticed that, for the 14th period, the standard deviation of the coefficient is much higher than the confidence interval, which means that its significance is underestimated.

It can also be seen that the permanent shock has a significant positive impact on stock market returns under the recession expectation . Compared to Table 18, the business condition expectation expands the impact of the permanent shock . The impacts of the recession expectations are greater than those of the expansion expectations. The predictive power of the permanent shock does not disappear over time due to the addition of the recession expectation.

Compared to the results shown in Table 18, in the 14th and 16th periods, the recession expectation expands the impacts of the temporary shock . Under the recession expectation , a temporary shock has a significant negative impact on stock market returns and this impact will extend with time. The impacts of the recession expectations are greater than those of the expansion expectations. In summary, as the time length of the long-horizon return is extended, the impacts of the permanent shock gradually disappear and the impacts of the temporary shock gradually increase.

For both shocks, the addition of business condition expectations increases their impacts. For both the permanent shock and the temporary shock, the impacts of the recession expectations are greater than those of the expansion expectations.

Furthermore, the recession expectation prolongs the impacts of the permanent shock.

4.3. Out-of-Sample Forecast

Next, the out-of-sample forecast was performed. The NYSE composite index was divided into two periods in 1991 and the S&P 500 index was divided into two periods in 1993. The root mean square error and the out-of-sample R-squared were calculated. A regression model with only constant terms was taken as a control model. The results are shown in Table 20.

Table 20.

Out-of-sample forecast results.

It can be seen in Columns 2 and 3 of Table 20 that the root mean square errors of Models (1) and (2) are both larger than those of the control model. We already know from the previous sections that the outliers have caused losses in the in-sample prediction. This may offer some explanation for the poor outcomes of the out-of-sample forecast. To overcome this problem, we again introduced the outcomes excluding the outliers in Columns 4 and 5. We found that the root mean square errors of Model (2) are smaller than those of the control model for the S&P 500 index. For the NYSE composite index, both the root mean square errors of Models (1) and (2) are smaller than those of the control model and Model (2)’s value is smaller than Model (1)’s. Although, for the S&P 500 index and the NYSE composite index, the out-of-sample R-squared of Model (1) and Model (2) is negative, we can also find that the addition of the business condition expectations can help to promote the prediction accuracy.

4.4. Economic Significance

We used the above out-of-sample forecast data to calculate the investment ratio by applying the method of Marquering and Verbeek [38]21. According to the calculated ratio, one can invest in stock market indexes or risk-free assets at t to construct an investment portfolio22. Since we performed out-of-sample forecasts for both Models (1) and (2), correspondingly, we also constructed two investment portfolios, namely Portfolio 1 and Portfolio 2.

Three control portfolios were selected. The first portfolio invests 100% in the S&P 500 index; the second portfolio invests 50% in the S&P 500 index and 50% in risk-free assets. The third portfolio is entirely invested in risk-free assets. Next, we introduce the analysis indicators of the investment portfolio.

- (a)

- Sharpe ratio: The Sharpe ratio is expressed as the ratio of the return of a portfolio to its standard deviation. The return data of Portfolio 1 and Portfolio 2 and the three control portfolios are shown in Table 21.

Table 21. Portfolio return data (1991–2021).

Table 21. Portfolio return data (1991–2021).

In Table 21, we can see that, for the S&P 500 index, the Sharpe ratio of Portfolio 1 is higher than the ratios of the other three control portfolios but, for Portfolio 2, this point does not apply. For the NYSE composite index, the Sharpe ratios of Portfolio 1 and Portfolio 2 are both higher than those of the other three control portfolios. To check the influence of the outliers, we also introduced the data from 1991 to 2019 in Table 22.

Table 22.

Portfolio return data (1991–2019).

It can be seen in Table 22 that the Sharpe ratios of Portfolio 1 and Portfolio 2 are both higher than those of the other three control portfolios for both stock market indexes.

- (b)

- Jensen’s alpha: Marquering and Verbeek [38] pointed out that the Sharpe ratio does not properly consider time-varying volatility. When measuring dynamic investment strategies, the use of only the standard deviation of the sample (such as the Sharpe ratio) can easily overestimate the risk of the strategy. Therefore, they used Jensen’s alpha to measure the portfolio.

Model (3) was built as follows:

where represents the excess return of a certain investment portfolio and represents the excess return of the market portfolio. represents Jensen’s alpha. When , it means that investing in this portfolio can generate excess returns. However, due to market timing, OLS estimates tend to underestimate the true alpha. To solve this problem, Treynor and Mazuy [39] assumed and established the following regression equation, namely Model (4). A positive and significant indicates the correct market timing.

If in Model (3) and is significant, it means that this portfolio can generate excess returns; if in Model (4) is significant, it means that the correct timing is selected. The results of Portfolio 1 and Portfolio 2 of 1991–2021 are shown in Table 23.

Table 23.

Jensen’s alpha (1991–2021).

It can be seen that and is significant for both stock indexes. This means that the two portfolios can generate excess returns. However, only Portfolio 2 of the NYSE composite index can obtain the correct timing.

The results of Portfolio 1 and Portfolio 2 for 1991–2019 are shown in Table 24.

Table 24.

Jensen’s alpha (1991–2019).

It can be seen in Table 24 that for both Portfolio 1 and Portfolio 2, and is significant and and is significant. This shows that Portfolio 1 and Portfolio 2 can generate excess returns and the correct timing was selected.

The outcomes of Table 24 are better than those of Table 23. Without the outliers of the two years 2020 and 2021, we can see that the economic significance is improved.

According to Table 21 and Table 22, we may conclude that Model (1), which only contains the permanent shock and temporary shock, is better than Model (2), in which the business condition expectations were added, because the performance of Portfolio 1 (associated with Model (1)) is better than that of Portfolio 2 (corresponding to Model (2)). However, as Marquering and Verbeek [38] pointed out, the Sharpe ratio has its drawbacks. In Table 23, we can find that only Portfolio (2) of the NYSE composite index can not only generate excess returns but also obtain the correct market timing under the strong influences of COVID-19. This is the advantage of Model (2), which not only considers the changes in the real economy but also the impacts of the business condition expectations.

5. Conclusions

A permanent shock has positive impacts on the expected stock market returns, and the recession expectation can make them larger. Over the long-horizon forecast, it gradually loses its power over time. However, the addition of the recession expectation can prolong its effects. Over the long-horizon forecast, the temporary shock has negative influences, which gradually increase over time. The recession expectation makes the effects larger.

Compared with purely structural shocks, the recession expectation enlarges the impacts of structural shocks on the expected stock market returns. This enlargement effect is valid under the robustness tests, in the in-sample prediction and long-horizon forecast.

The impacts of structural shocks under the recession expectation are greater than those under the expansion expectation. This shows that the relationship between the business condition expectation and expected stock market returns occurs in the opposite direction. This study provides additional support for the conclusions of Campbell and Diebold [22], Chen [19], Conrad and Loch [21], and Kadilli [25]. The difference is that we have reached this conclusion based on the impacts of structural shocks.

The predictive ability of structural shocks and business condition expectations is of economic significance. Under the influence of COVID-2019, the consideration of business condition expectations can help to gain excess returns and achieve the correct timing. This is strong evidence that it is better for investors to jointly use information about the changes in the real economy and business condition expectations when making investment decisions.

Author Contributions

Conceptualization, W.C.; methodology, W.C. and M.L.; software, M.L.; writing—original draft preparation, M.L.; writing—review and editing, M.L.; supervision, W.C.; project administration, W.C. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

The data that support the findings of this study are available from the corresponding author upon reasonable request. These data were derived from the following resources available in the public domain.

| Name | Description | Source | |

| Section 2 | RGDP | U.S. Bureau of Economic Analysis | |

| The implied GDP price deflator | U.S. Bureau of Economic Analysis | ||

| The turning point of the NBER business cycle | http://www.nber.org/cycles/cyclesmain.html (accessed on 11 September 2022) | ||

| S&P 500 index | Yahoo Finance | ||

| The three-month treasury bill rate | Board of Governors of the Federal Reserve System (US) | ||

| Composite Leading Indicators | OECD | ||

| Section 3 | NYSE composite index | Yahoo Finance | |

| Dividend (D12) | http://www.hec.unil.ch/agoyal/ (accessed on 11 September 2022) | ||

| Another business condition expectation index | OECD | ||

| Section 4 | Earnings (E12) | http://www.hec.unil.ch/agoyal/ (accessed on 11 September 2022) | |

| Stock variance | http://www.hec.unil.ch/agoyal/ (accessed on 11 September 2022) | ||

| Net securities issuance | http://www.hec.unil.ch/agoyal/ (accessed on 11 September 2022) | ||

| Moody’s Aaa corporate bond yield | Moody’s | ||

| Moody’s Baa corporate bond yield | Moody’s | ||

| Investment to Capital Ratio | http://www.hec.unil.ch/agoyal/ (accessed on 11 September 2022) | ||

| https://www.sydneyludvigson.com/publications (accessed on 11 September 2022) |

Conflicts of Interest

The authors declare no conflict of interest.

Notes

| 1 | According to the documents of the OECD, the composite leading indicators from which the business condition expectations in our paper are derived have several inference series and are formed by professional forecasters who try to use all relevant information. Therefore, they belong to rational expectation. The readers can refer to http://www.oecd.org/std/leading-indicators/41629509.pdf (accessed on 16 November 2022). |

| 2 | The readers should note that the outcomes from 1960–2019 were only calculated with the data from 1960 to 2019. We can also extract the structural shocks using the data set of 1960–2021 and cut the data of 1960–2019 from it but we think that this method is not suitable. |

| 3 | The adjusted S&P 500 index is from Yahoo Finance. We calculated the quarterly stock market price through the moving average of monthly prices in one quarter. |

| 4 | The raw data were seasonally adjusted through http://www.seasonal.website/ (accessed on 11 September 2022). All of the raw data that were not seasonally adjusted were adjusted through this website. |

| 5 | The three-month treasury bill rate was used as the risk-free interest rate. Board of Governors of the Federal Reserve System (US), 3-Month Treasury Bill: Secondary Market Rate [TB3MS], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/TB3MS (accessed on 11 September 2022). |

| 6 | The adjusted NYSE composite index is from Yahoo Finance. |

| 7 | U.S. Bureau of Economic Analysis, Real Gross Domestic Product [GDPC1], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/GDPC1 (accessed on 11 September 2022). |

| 8 | U.S. Bureau of Economic Analysis, Gross Domestic Product: Implicit Price Deflator [GDPDEF], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/GDPDEF (accessed on 11 September 2022). |

| 9 | OECD (2022), composite leading indicator (CLI) (indicator). https://doi.org/10.1787/4a174487-en (accessed on 13 September 2022). The raw data are monthly series. We calculated the quarterly data through the moving average of monthly indicators in one quarter. Then, the quarterly data were seasonally adjusted. |

| 10 | Organization for Economic Cooperation and Development, Business Tendency Surveys for Manufacturing: Confidence Indicators: Composite Indicators: European Commission and National Indicators for the United States [BSCICP02USQ460S], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/BSCICP02USQ460S (accessed on 13 September 2022). |

| 11 | Our independent variables are stationary. We applied the method of IARM to correct the small-sample bias. Because the whole model of IARM is sophisticated, in this paper, we only provide some simplified procedures to explain the rationale of IARM. The readers can refer to Kim [33]. The author of this paper also provides an R package of IARM. |

| 12 | The dividend data (D12) are from http://www.hec.unil.ch/agoyal/ (accessed on 11 September 2022). |

| 13 | The structural shocks were obtained through the vars package of R software. The specific steps can be found in https://rstudio-pubs-static.s3.amazonaws.com/270271_9fbb9b0f8f0c41e6b7e06b0dc2b13b62.html (accessed on 11 September 2022). |

| 14 | https://cran.r-project.org/web/packages/strucchange/vignettes/strucchange-intro.pdf (accessed on 11 September 2022). For a detailed description of the test method, see the CUSUM process on page 4. |

| 15 | The vertical lines in Figure 5 and Figure 6 represent the trough dates of the NBER business cycle turning points (http://www.nber.org/cycles/cyclesmain.html) (accessed on 11 September 2022). They include May 1954 (II), April 1958 (II), February 1961 (I), November 1970 (IV), March 1975 (I), July 1980 (III), November 1982 (IV), March 1991 (I), November 2001 (IV), June 2009 (II), and April 2020 (II). |

| 16 | Federal Reserve Bank of St. Louis, Moody’s Seasoned Aaa Corporate Bond Minus Federal Funds Rate [AAAFFM], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/AAAFFM (accessed on 14 September 2022). |

| 17 | Moody’s, Moody’s Seasoned Aaa Corporate Bond Yield [AAA], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/AAA (accessed on 13 September 2022). |

| 18 | Moody’s, Moody’s Seasoned Baa Corporate Bond Yield© [BAA], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/BAA (accessed on 13 September 2022). |

| 19 | https://www.sydneyludvigson.com/publications (accessed on 11 September 2022). |

| 20 | http://www.hec.unil.ch/agoyal/ (accessed on 11 September 2022). |

| 21 | When the ratio is less than or equal to 0, put all funds into risk-free assets; when it is between 0 and 1, put the share equal to the ratio in the stock market index; when the ratio is greater than 1, put all funds into the stock market index. Here, we use the historical variance of the risky assets (e.g., 1960–1992 for the S&P 500) to replace the conditional variance of Marquering and Verbeek [38] in Equation (4). |

| 22 | Here, the risk-free asset is the three-month treasury bill. |

References

- Cochrane, J.H. Asset Pricing (Revised Edition), 2nd ed.; Princeton University Press: Princeton, NJ, USA, 2005; pp. 391–435. [Google Scholar]

- Fama, E.F.; French, K.R. Business conditions and expected returns on stocks and bonds. J. Financ. Econ. 1989, 25, 23–49. [Google Scholar] [CrossRef]

- Black, A.; Fraser, P.; Macdonald, R. Business conditions and speculative assets. Manch. Sch. 1997, 65, 379–393. [Google Scholar] [CrossRef]

- Black, A. Expected returns and business conditions: A commentary on Fama and French. Appl. Financ. Econ. 2000, 10, 389–400. [Google Scholar] [CrossRef]

- Marathe, A.; Shawky, H.A. Predictability of Stock Returns and Real Output. Q. Rev. Econ. Financ. 1994, 34, 317–331. [Google Scholar] [CrossRef]

- Andreou, E.; DeSiano, R.; Sensier, M. The behaviour of stock returns and interest rates over the business cycle in the US and UK. Appl. Econ. Lett. 2001, 8, 233–238. [Google Scholar] [CrossRef]

- Kim, S.-W.; Lee, B.-S. Stock returns, asymmetric volatility, risk aversion, and business cycle: Some new evidence. Econ. Inq. 2008, 46, 131–148. [Google Scholar] [CrossRef]

- Lochstoer, L.A. Expected Returns and the Business Cycle: Heterogeneous Goods and Time-Varying Risk Aversion. Rev. Financ. Stud. 2009, 22, 5251–5294. [Google Scholar] [CrossRef]

- McQueen, G.; Roley, V.V. Stock prices, news, and business conditions. Rev. Financ. Stud. 1993, 6, 683–707. [Google Scholar] [CrossRef]

- Jarvinen, J. Industry portfolios, economic news and business conditions: Evidence from the Finnish stock market. Liiketal. Aikak. 2000, 49, 209–232. [Google Scholar]

- Flannery, M.J.; Protopapadakis, A.A. Macroeconomic factors do influences aggragate stock returns. Rev. Financ. Stud. 2002, 15, 751–782. [Google Scholar] [CrossRef]

- Loflund, A.; Nummelin, K. On stocks, bonds and business conditions. Appl. Financ. Econ. 1997, 7, 137–146. [Google Scholar] [CrossRef]

- Mlambo, L. Adaptive And Rational Expectations Hypotheses: Reviewing The Critiques. Int. J. Econ. Behav. 2012, 2, 3–15. [Google Scholar]

- Dokko, Y.; Edelstein, R.H. How Well Do Economists Forecast Stock Market Prices? A Study of the Livingston Surveys. Amer. Econ. Rev. 1989, 79, 865–871. [Google Scholar]

- Hafer, R.W.; Resler, D.H. On the Rationality of Inflation Forecasts: A New Look at the Livingston Data. South. Econ. J. 1982, 48, 1049–1056. [Google Scholar] [CrossRef]

- Croushore, D.D. The Livingston Survey: Still Useful After All These Years. Bus. Rev. 1997, 2, 1–12. [Google Scholar]

- Mirdamadi, M.; Petersen, L. Macroeconomic Literacy and Expectations. SSRN Electron. J. 2018, 3187131. [Google Scholar] [CrossRef]

- Colasante, A.; Palestrini, A.; Russo, A.; Gallegati, M. Adaptive expectations versus rational expectations: Evidence from the lab. Int. J. Forecast. 2017, 33, 988–1006. [Google Scholar] [CrossRef]

- Chen, M.-H. Stock returns and changes in the business cycle. APMR 2005, 10, 321–327. [Google Scholar]

- Liu, Q.; Tao, L.B.; Wu, W.X.; Yu, J.F. Short- and Long-Run Business Conditions and Expected Returns. Manag. Sci. 2017, 63, 4137–4157. [Google Scholar] [CrossRef]

- Conrad, C.; Loch, K. The variance risk premium and fundamental uncertainty. Econ. Lett. 2015, 132, 56–60. [Google Scholar] [CrossRef]

- Campbell, S.D.; Diebold, F.X. Stock returns and expected business conditions: Half a century of direct evidence. J. Bus. Econ. Stat. 2009, 27, 266–278. [Google Scholar] [CrossRef]

- Chava, S.; Gallmeyer, M.; Park, H. Credit conditions and stock return predictability. J. Monet. Econ. 2015, 74, 117–132. [Google Scholar] [CrossRef]

- Colacito, R.; Ghysels, E.; Meng, J.; Siwasarit, W. Skewness in Expected Macro Fundamentals and the Predictability of Equity Returns: Evidence and Theory. Rev. Financ. Stud. 2016, 29, 2069–2109. [Google Scholar] [CrossRef]

- Kadilli, A. Predictability of stock returns of financial companies and the role of investor sentiment: A multi-country analysis. J. Financ. Stab. 2015, 21, 26–45. [Google Scholar] [CrossRef]

- Silva, N. Equity premia predictability in the EuroZone. Span. Rev. Financ. Econ. 2015, 13, 48–56. [Google Scholar] [CrossRef]

- Blanchard, O.J.; Quah, D. The Dynamic Effects of Aggregate Demand and Supply Disturbances. Amer. Econ. Rev. 1989, 79, 655–673. [Google Scholar]

- Velázquez, A.M.; Smith, P.N. Equity Returns and the Business Cycle: The Role of Supply and Demand Shocks. Manch. Sch. 2013, 81, 100–124. [Google Scholar] [CrossRef]

- Bry, G.; Boschan, C. Cyclical Analysis of Time Series: Selected Procedures and Computer Programs; NBER: Cambridge, MA, USA, 1971. [Google Scholar]

- Keating, J.W.; Nye, J.V. Permanent and Transitory Shocks in Real Output: Estimates from Nineteenth-Century and Postwar Economies. J. Money Crédit. Bank. 1998, 30, 231–251. [Google Scholar] [CrossRef]

- Lettau, M.; Ludvigson, S. Consumption, Aggregate Wealth, and Expected Stock Returns. J. Financ. 2001, 56, 815–849. [Google Scholar] [CrossRef]

- Stambaugh, R.F. Predictive regressions. J. Finan. Econ. 1999, 54, 375–421. [Google Scholar] [CrossRef]

- Kim, J.H. Predictive regression: An improved augmented regression method. J. Empir. Financ. 2014, 26, 13–25. [Google Scholar] [CrossRef]

- Campbell, J.Y.; Shiller, R.J. The dividend-price ratio and expectations of future dividends and discount factors. Rev. Financ. Stud. 1989, 1, 195–228. [Google Scholar] [CrossRef]

- Newey, W.K.; West, K.D. A simple, positive semi-definite, heteroskedasticity and autocorrelation consistent covariance matrix. Econometrica 1987, 55, 703–708. [Google Scholar] [CrossRef]

- Welch, I.; Goyal, A. A Comprehensive Look at The Empirical Performance of Equity Premium Prediction. Rev. Financ. Stud. 2008, 21, 1455–1508. [Google Scholar] [CrossRef]

- Hansen, L.P.; Hodrick, R.J. Forward Exchange Rates as Optimal Predictors of Future Spot Rates: An Econometric Analysis. J. Political Econ. 1980, 88, 829–853. [Google Scholar] [CrossRef]

- Marquering, W.; Verbeek, M. The Economic Value of Predicting Stock Index Returns and Volatility. J. Finan. Quant. Anal. 2004, 39, 407–429. [Google Scholar] [CrossRef]

- Treynor, J.; Mazuy, K. Can Mutual Funds Outguess the Market? Harvard Bus. Rev. 1966, 44, 131–136. [Google Scholar]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).