Being (Not) Successful in Internationalisation After Receiving Export Support: Which Predictors Are Able to Forecast It and How Accurately?

Abstract

1. Introduction

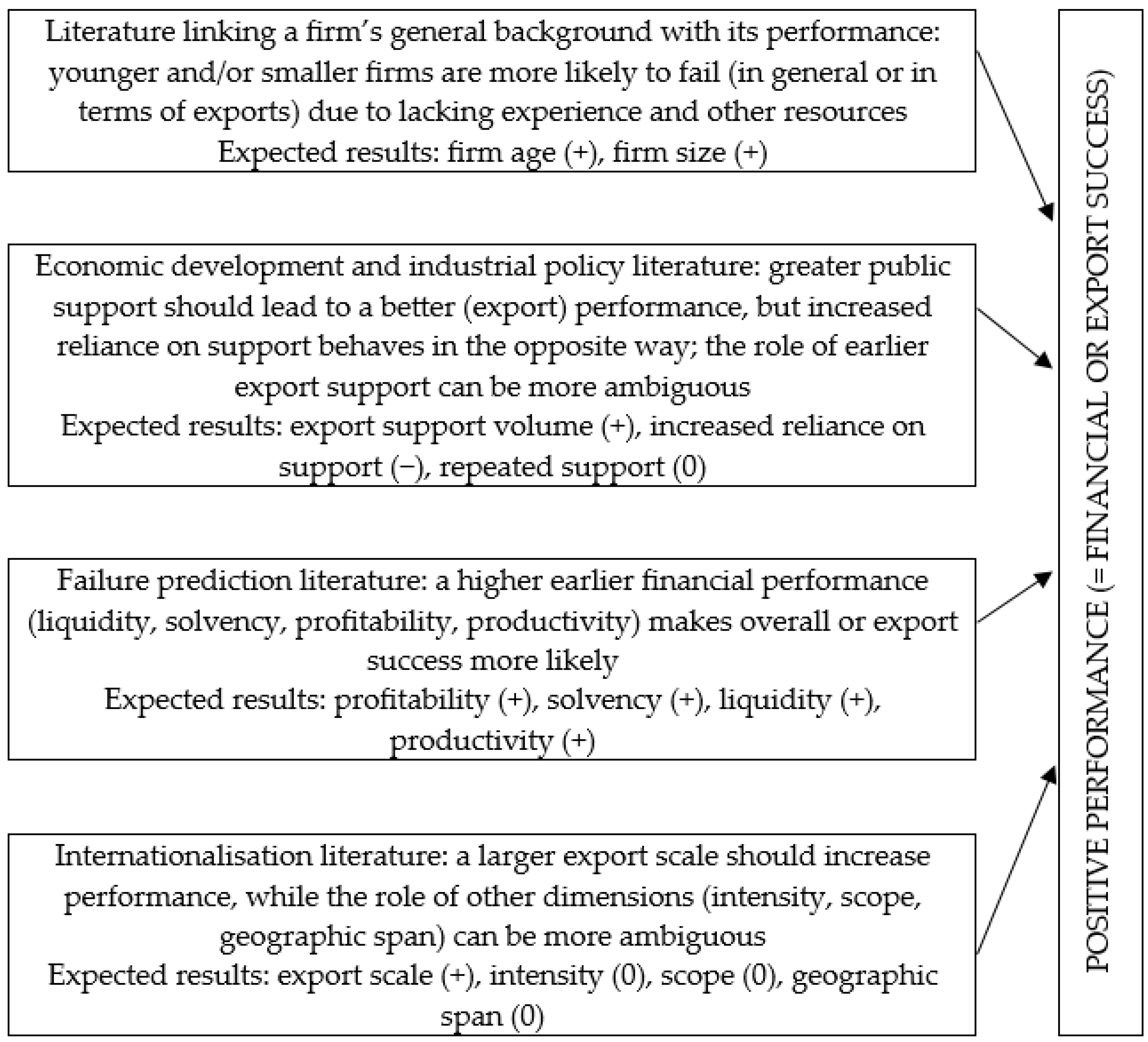

2. Theoretical Background

3. Study Design

4. Results and Discussion

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Freixanet, J. Export promotion programs: A system-based systematic review and agenda for future research. J. World Bus. 2022, 57, 101344. [Google Scholar] [CrossRef]

- Heriqbaldi, U.; Esquivias, M.A.; Samudro, B.R.; Widodo, W. Do national export promotion programs in Indonesia support export competitiveness? Heliyon 2023, 9, e16918. [Google Scholar] [CrossRef] [PubMed]

- Kahiya, E.T. A problematization review of export assistance: Debates and future directions. Int. Bus. Rev. 2024, 33, 102202. [Google Scholar] [CrossRef]

- Heriqbaldi, U.; Esquivias, M.A.; Lau, W.; Cesilia, A.F. Export promotion programs and firm performance: Linking knowledge, commitment, and market strategy to enhance competitiveness. J. Open Innov. Technol. Mark. Complex. 2025, 11, 100479. [Google Scholar] [CrossRef]

- Jalali, H.S. Trade policy revisited: How government support initiatives affect international performance in SMEs? Rev. Int. Bus. Strategy 2024, 34, 692–712. [Google Scholar] [CrossRef]

- Jalali, H.S. Reframing government support for SMEs’ performance in international market: The critical role of institutional context. Asia-Pac. J. Bus. Adm. 2025, in press. [Google Scholar] [CrossRef]

- Coudounaris, D.N. Export promotion programmes for assisting SMEs. Rev. Int. Bus. Strategy 2018, 28, 77–109. [Google Scholar] [CrossRef]

- Demena, B.A. Does export promotion enhance firm-level intensive margin of exports? Evidence from a meta-regression analysis. J. Asian Bus. Econ. Stud. 2024, 31, 250–262. [Google Scholar] [CrossRef]

- Amankwah-Amoah, J. An integrative process model of organisational failure. J. Bus. Res. 2016, 69, 3388–3397. [Google Scholar] [CrossRef]

- Honjo, Y. Business failure of new firms: An empirical analysis using a multiplicative hazards model. Int. J. Ind. Organ. 2000, 18, 557–574. [Google Scholar] [CrossRef]

- Thornhill, S.; Amit, R. Learning about failure: Bankruptcy, firm age, and the resource-based view. Organ. Sci. 2003, 14, 497–509. [Google Scholar] [CrossRef]

- Aghazadeh, H.; Zandi, F. A typology of internationalisation patterns for SMEs in developing countries. J. Res. Mark. Entrep. 2022, 24, 337–364. [Google Scholar] [CrossRef]

- Vissak, T.; Masso, J. Export patterns: Typology development and application to Estonian data. Int. Bus. Rev. 2015, 24, 652–664. [Google Scholar] [CrossRef]

- Beck, T.; Demirgüç-Kunt, A.; Maksimovic, V. Financial and legal constraints to growth: Does firm size matter? J. Financ. 2005, 60, 137–177. [Google Scholar] [CrossRef]

- Esteve-Pérez, S.; Mañez-Castillejo, J.A. The resource-based theory of the firm and firm survival. Small Bus. Econ. 2008, 30, 231–249. [Google Scholar] [CrossRef]

- Vissak, T. A literature review on CEE firms’ outward internationalization failures: Definitions, processes, causes and consequences. Rev. Int. Bus. Strategy 2024, 34, 632–658. [Google Scholar] [CrossRef]

- Barroso, C.; Villegas, M.M.; Pérez-Calero, L. Board influence on a firm’s internationalization. Corp. Gov. Int. Rev. 2011, 19, 351–367. [Google Scholar] [CrossRef]

- Jiménez-Asenjo, N.; Filipescu, D.; Curran, L. Unpacking stimuli and barriers to internationalization across export stages: The case of Spanish wine firms in China. Thunderbird Int. Bus. Rev. 2024, 66, 429–446. [Google Scholar] [CrossRef]

- Flögel, F.; Letonja, M.; Meyer, K.; Rabadjieva, M.; Vilman, Z.; Zhekova, R.; Zlateva, M.; Butzin, A. Beyond start-up formation: Effects of entrepreneurial ecosystem support activities for developing lagging regions. Local Econ. 2024, 39, 127–146. [Google Scholar] [CrossRef]

- Pack, H.; Saggi, K. Is there a case for industrial policy? A critical survey. World Bank Res. Obs. 2006, 21, 267–297. [Google Scholar] [CrossRef]

- Zaman, M.; Tanewski, G. R&D investment, innovation, and export performance: An analysis of SME and large firms. J. Small Bus. Manag. 2024, 62, 3053–3086. [Google Scholar] [CrossRef]

- Chaney, T. Liquidity constrained exporters. J. Econ. Dyn. Control 2016, 72, 141–154. [Google Scholar] [CrossRef]

- Evans, P.C.; Oye, K.A. International competition: Conflict and cooperation in government export financing. In The Ex-Im Bank in the 21st Century: A New Approach? Hufbauer, G.C., Rodriguez, R.M., Eds.; Columbia University Press: New York, NY, USA, 2001; pp. 113–158. [Google Scholar]

- Nurmi, S.; Vanhala, J.; Virén, M. Are zombies for real? Evidence from zombie dynamics. Int. J. Ind. Organ. 2022, 85, 102888. [Google Scholar] [CrossRef]

- Wu, L.; Wei, Y.; Wang, C.; McDonald, F.; Han, X. The importance of institutional and financial resources for export performance associated with technological innovation. Technol. Forecast. Soc. Change 2022, 185, 122040. [Google Scholar] [CrossRef]

- Sui, S.; Baum, M. 2014. Internationalization strategy, firm resources and the survival of SMEs in the export market. J. Int. Bus. Stud. 2014, 45, 821–841. [Google Scholar] [CrossRef]

- Altman, E.I. Financial ratios, discriminant analysis and the prediction of corporate bankruptcy. J. Financ. 1968, 23, 589–609. [Google Scholar] [CrossRef]

- Bellovary, J.L.; Giacomino, D.E.; Akers, M.D. A review of bankruptcy prediction studies: 1930 to present. J. Financ. Educ. 2007, 33, 1–42. [Google Scholar]

- Lukason, O.; Vissak, T. Exporters’ failure predictors and processes: A multi-country analysis based on the theoretical concept of firms’ financial crisis types. Cogent Econ. Financ. 2024, 12, 2399957. [Google Scholar] [CrossRef]

- Askenazy, P.; Caldera, A.; Gaulier, G.; Irac, D. Financial constraints and foreign market entries or exits: Firm-level evidence from France. Rev. World Econ. 2015, 151, 231–253. [Google Scholar] [CrossRef]

- Görg, H.; Spaliara, M.-E. Financial health, exports and firm survival: Evidence from UK and French firms. Economica 2014, 81, 419–444. [Google Scholar] [CrossRef]

- Vissak, T. A literature review on CEE firms’ internationalization: Success measurement, achievement and outcomes. Rev. Int. Bus. Strategy 2023, 33, 740–762. [Google Scholar] [CrossRef]

- Fernandes, A.M.; Freund, C.; Pierola, M.D. Exporter behavior, country size and stage of development: Evidence from the exporter dynamics database. J. Dev. Econ. 2016, 119, 121–137. [Google Scholar] [CrossRef]

- Schueffel, P.; Baldegger, R.; Amann, W. Behavioral patterns in born-again global firms: Towards a conceptual framework of the internationalization activities of mature SMEs. Multinatl. Bus. Rev. 2014, 22, 418–441. [Google Scholar] [CrossRef]

- Freeman, S.; Vissak, T.; Nummela, N.; Trudgen, R. Do technology-focused fast internationalizers’ performance measures change as they mature? Int. Bus. Rev. 2023, 32, 102168. [Google Scholar] [CrossRef]

- Békés, G.; Muraközy, B. Temporary trade and heterogeneous firms. J. Int. Econ. 2012, 87, 232–246. [Google Scholar] [CrossRef]

- Cheraghali, H.; Molnár, P. SME default prediction: A systematic methodology-focused review. J. Small Bus. Manag. 2024, 62, 2847–2905. [Google Scholar] [CrossRef]

- Hosmer, D.W.; Lemeshow, S. Applied Logistic Regression, 2nd ed.; John Wiley & Sons Inc.: New York, NY, USA, 2004; 392p. [Google Scholar]

| Variable Code | Variable Content | No. of Unsuccessful Firms (Value 0) | No. of Successful Firms (Value 1) |

|---|---|---|---|

| EXIT4 | No sales revenue in the 4th year (=0) | 27 | 173 |

| EXIT7 | No sales revenue in the 7th year (=0) | 33 | 167 |

| EXPEXIT4 | No export sales in the 4th year (=0) | 35 | 165 |

| EXPEXIT7 | No export sales in the 7th year (=0) | 40 | 160 |

| SC0 | Not achieving earlier export scale in the 0th year (=0) | 59 | 141 |

| SC1 | Not achieving earlier export scale in the 1st year (=0) | 64 | 136 |

| SC4 | Not achieving earlier export scale in the 4th year (=0) | 77 | 123 |

| SC7 | Not achieving earlier export scale in the 7th year (=0) | 79 | 121 |

| INT0 | Not achieving earlier export intensity in the 0th year (=0) | 94 | 106 |

| INT1 | Not achieving earlier export intensity in the 1st year (=0) | 86 | 114 |

| INT4 | Not achieving earlier export intensity in the 4th year (=0) | 105 | 95 |

| INT7 | Not achieving earlier export intensity in the 7th year (=0) | 107 | 93 |

| SP0 | Not achieving earlier export scope in the 0th year (=0) | 55 | 145 |

| SP1 | Not achieving earlier export scope in the 1st year (=0) | 54 | 146 |

| SP4 | Not achieving earlier export scope in the 4th year (=0) | 78 | 122 |

| SP7 | Not achieving earlier export scope in the 7th year (=0) | 89 | 111 |

| C0 | Not achieving SC, INT, and SP together in the 0th year (=0) | 122 | 78 |

| C1 | Not achieving SC, INT, and SP together in the 1st year (=0) | 120 | 80 |

| C4 | Not achieving SC, INT, and SP together in the 4th year (=0) | 132 | 68 |

| C7 | Not achieving SC, INT, and SP together in the 7th year (=0) | 136 | 64 |

| SCALL | Not achieving SC for the 0th, 1st, 4th, and 7th year (=0) | 113 | 87 |

| INTALL | Not achieving INT for the 0th, 1st, 4th, and 7th year (=0) | 150 | 50 |

| SPALL | Not achieving SP for the 0th, 1st, 4th, and 7th year (=0) | 110 | 90 |

| CALL | Not achieving SC, INT and SP for the 0th, 1st, 4th, and 7th year (=0) | 169 | 31 |

| Variable Code | Variable Content (Expected Sign in Brackets) | Mean | S.D. | Median | Min. | Max. |

|---|---|---|---|---|---|---|

| General characteristics | ||||||

| AGE | Firm age in years (“+”) | 10.0 | 4.9 | 10.9 | 0.8 | 17.1 |

| SIZE1 | LN of total assets (“+”) | 14.1 | 1.7 | 14.2 | 7.9 | 18.3 |

| SIZE2 | LN of sales revenue (“+”) | 14.2 | 2.6 | 14.5 | 0.0 | 18.8 |

| SIZE3 | LN of number of employees (“+”) | 3.2 | 1.5 | 3.2 | 0.0 | 7.2 |

| Earlier export performance | ||||||

| SCALE | LN of export sales revenue (“+”) | 12.6 | 4.3 | 13.9 | 0.0 | 18.3 |

| INT | Export share from sales (“0”) | 0.6 | 0.4 | 0.6 | 0.0 | 1.0 |

| SCOPE | Number of foreign markets (“0”) | 5.7 | 6.2 | 4.0 | 0.0 | 45.0 |

| OUTEUR | At least one market outside Europe (=1) (“0”) | 0.2 | 0.4 | 0.0 | 0.0 | 1.0 |

| Export support characteristics | ||||||

| SUP | LN of export support (“+”) | 9.9 | 1.1 | 10.2 | 6.2 | 12.0 |

| SUPSHA | Ratio of export support and current assets (“−”) | 0.1 | 0.2 | 0.0 | 0.0 | 1.0 |

| PREVSUP | Obtained export support before (=1) (“0”) | 0.4 | 0.5 | 0.0 | 0.0 | 1.0 |

| Earlier financial performance | ||||||

| NITA | Ratio of net income and total assets (“+”) | 0.1 | 0.2 | 0.1 | −1.0 | 0.9 |

| TETA | Ratio of total equity and total assets (“+”) | 0.5 | 0.3 | 0.5 | −0.3 | 1.0 |

| WCTA | Ratio of net working capital to total assets (“+”) | 0.2 | 0.3 | 0.2 | −0.9 | 1.0 |

| STA | Ratio of sales to total assets (“+”) | 1.7 | 1.2 | 1.5 | 0.0 | 5.0 |

| Dependent (Row) and Independent (Column) Variable | AGE | SIZE1 | SIZE2 | SIZE3 | SCALE | INT | SCOPE | OUTEUR | SUP | SUPSHA | PREVSUP | NITA | TETA | WCTA | STA | # of “+” Sign | # of “−” Sign |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| EXIT4 | +2 | +3 | +1 | +6 | +4 | +11 | −5 | +12 | +9 | +8 | 9 | 1 | |||||

| EXIT7 | +3 | +2 | +1 | +7 | +4 | +10 | −8 | +12 | +6 | +9 | 9 | 1 | |||||

| EXPEXIT4 | +3 | +5 | +1 | +6 | +2 | +12 | −7 | +8 | +9 | 8 | 1 | ||||||

| EXPEXIT7 | +3 | +4 | +1 | +6 | +2 | +10 | +11 | −7 | +12 | +8 | +9 | 10 | 1 | ||||

| SC0 | +1 | 1 | 0 | ||||||||||||||

| SC1 | +2 | 1 | 0 | ||||||||||||||

| SC4 | +2 | +4 | +1 | +3 | 4 | 0 | |||||||||||

| SC7 | +6 | +4 | +3 | +2 | +5 | +1 | −9 | 6 | 1 | ||||||||

| INT0 | +1 | 1 | 0 | ||||||||||||||

| INT1 | −1 | 0 | 1 | ||||||||||||||

| INT4 | +6 | +4 | +3 | +1 | −2 | +5 | 5 | 1 | |||||||||

| INT7 | +7 | +4 | +1 | −2 | −6 | 3 | 2 | ||||||||||

| SP0 | +5 | +3 | +8 | +1 | +2 | +4 | +6 | 7 | 0 | ||||||||

| SP1 | +3 | +1 | +4 | +2 | 4 | 0 | |||||||||||

| SP4 | +1 | +3 | 2 | 0 | |||||||||||||

| SP7 | +6 | +5 | +1 | +4 | +3 | 5 | 0 | ||||||||||

| C0 | −1 | −2 | 0 | 2 | |||||||||||||

| C1 | −3 | −1 | −2 | 0 | 3 | ||||||||||||

| C4 | −1 | −2 | −3 | 0 | 3 | ||||||||||||

| C7 | −1 | −2 | 0 | 2 | |||||||||||||

| SCALL | +3 | +4 | +2 | +1 | 4 | 0 | |||||||||||

| INTALL | −1 | −3 | +2 | 1 | 2 | ||||||||||||

| SPALL | +5 | +2 | +4 | +1 | +6 | +3 | −11 | +7 | +8 | 8 | 1 | ||||||

| CALL | −2 | −1 | 0 | 2 | |||||||||||||

| # of “+” sign | 9 | 11 | 13 | 13 | 8 | 3 | 0 | 0 | 16 | 0 | 2 | 3 | 4 | 4 | 2 | ||

| # of “−” sign | 0 | 0 | 0 | 0 | 2 | 9 | 3 | 4 | 0 | 6 | 0 | 0 | 0 | 0 | 0 |

| Dependent (Row) and Predictor Domain (Column) | General Characteristics | Earlier Export Performance | Export Support Characteristics | Earlier Financial Performance | ||||

|---|---|---|---|---|---|---|---|---|

| AUC | Rank | AUC | Rank | AUC | Rank | AUC | Rank | |

| EXIT4 | 0.81 | 1 s | 0.74 | 2 s | 0.73 | 3 s | 0.70 | 4 s |

| EXIT7 | 0.77 | 1 s | 0.70 | 4 s | 0.70 | 3 s | 0.71 | 2 s |

| EXPEXIT4 | 0.78 | 1 s | 0.77 | 2 s | 0.68 | 3 s | 0.65 | 4 |

| EXPEXIT7 | 0.77 | 1 s | 0.75 | 2 s | 0.69 | 3 s | 0.68 | 4 s |

| SC0 | 0.58 | 4 | 0.58 | 3 | 0.62 | 1 | 0.59 | 2 |

| SC1 | 0.57 | 4 | 0.60 | 2 | 0.59 | 3 | 0.64 | 1 |

| SC4 | 0.58 | 3 | 0.65 | 1 s | 0.58 | 2 | 0.50 | 4 |

| SC7 | 0.62 | 3 | 0.63 | 2 | 0.66 | 1 s | 0.54 | 4 |

| INT0 | 0.56 | 4 | 0.60 | 2 | 0.60 | 1 | 0.60 | 3 |

| INT1 | 0.57 | 4 | 0.65 | 1 s | 0.59 | 2 | 0.57 | 3 |

| INT4 | 0.60 | 2 | 0.63 | 1 s | 0.57 | 3 | 0.52 | 4 |

| INT7 | 0.62 | 2 | 0.68 | 1 s | 0.58 | 3 | 0.55 | 4 |

| SP0 | 0.64 | 2 s | 0.69 | 1 s | 0.64 | 3 s | 0.61 | 4 |

| SP1 | 0.66 | 1 | 0.66 | 2 | 0.61 | 4 | 0.63 | 3 s |

| SP4 | 0.58 | 2 | 0.62 | 1 | 0.58 | 3 | 0.57 | 4 |

| SP7 | 0.60 | 3 | 0.61 | 2 | 0.61 | 1 s | 0.56 | 4 |

| C0 | 0.55 | 4 | 0.61 | 1 | 0.57 | 3 | 0.58 | 2 |

| C1 | 0.52 | 4 | 0.67 | 1 s | 0.55 | 3 | 0.57 | 2 |

| C4 | 0.54 | 3 | 0.63 | 1 s | 0.54 | 4 | 0.55 | 2 |

| C7 | 0.55 | 4 | 0.66 | 1 s | 0.57 | 3 | 0.59 | 2 |

| SCALL | 0.57 | 3 | 0.63 | 2 | 0.63 | 1 s | 0.53 | 4 |

| INTALL | 0.55 | 3 | 0.69 | 1 s | 0.62 | 2 | 0.54 | 4 |

| SPALL | 0.63 | 3 | 0.67 | 1 | 0.64 | 2 s | 0.57 | 4 |

| CALL | 0.56 | 2 | 0.68 | 1 s | 0.55 | 3 | 0.52 | 4 |

| Type of Dependent | Main Results |

|---|---|

| Exiting export markets or ceasing all activities by the firm after receiving export support | Firms’ larger size and age, larger earlier export volume, better financial performance, more slack resources, and larger export support size increase success chances. The benefit of variable domains for prediction, in most cases, reduces in the following order: general characteristics, earlier export performance, export support characteristics, and earlier financial performance. |

| Not achieving an earlier export scale, intensity, or scope for certain periods after receiving export support | Firms’ larger size and age increase success chances, especially for later periods concerning the scale and intensity, while more universally for scope. Larger export support size increases success chances, while variables representing earlier export and financial performance are more irrelevant. In contrast to the latter, the earlier export performance variable domain inclusive of four predictors is often the most useful. |

| Not achieving all three export performance indicators simultaneously for certain periods after receiving export support | Only earlier export performance variables are useful, while with an inverse relationship, their larger size reducing success chances. Linking to the previous finding, the earlier export performance variable domain inclusive of four predictors is the most useful. Only for this type of dependent, the earlier financial performance domain inclusive of four variables systematically obtains the second position. |

| Longitudinally not achieving single or all export performance indicators after receiving export support | Likewise with the previous simultaneous achievement dependent variables, an earlier export performance is mainly in an inverse relationship, but with much fewer significant relationships. Firms’ larger size and age, but also larger export support size, increase success chances. The domain of earlier export performance variables, followed by export support characteristics, emerge as the best predictor pools. |

| AUC and Independent (Column) and Dependent (Row) Variables | AUC | AGE | SIZE1 | SIZE2 | SIZE3 | SCALE | INT | SCOPE | OUTEUR | SUP | SUPSHA | PREVSUP | NITA | TETA | WCTA | STA | NoIm > 75 Frequency |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| EXIT4 | 0.963 | 33 | 72 | 100 | 33 | 49 | 23 | 53 | 30 | 49 | 41 | 16 | 40 | 43 | 55 | 44 | 1 |

| EXIT7 | 0.962 | 37 | 75 | 100 | 41 | 35 | 25 | 47 | 14 | 48 | 11 | 25 | 29 | 54 | 58 | 39 | 1 |

| EXPEXIT4 | 0.959 | 52 | 66 | 100 | 51 | 79 | 32 | 80 | 31 | 63 | 24 | 16 | 62 | 57 | 50 | 38 | 3 |

| EXPEXIT7 | 0.954 | 54 | 77 | 94 | 44 | 46 | 36 | 100 | 35 | 55 | 44 | 39 | 96 | 100 | 91 | 59 | 6 |

| SC0 | 0.892 | 31 | 100 | 78 | 62 | 72 | 29 | 63 | 24 | 63 | 31 | 31 | 70 | 47 | 75 | 70 | 2 |

| SC1 | 0.864 | 38 | 69 | 77 | 61 | 51 | 63 | 33 | 30 | 72 | 32 | 22 | 100 | 46 | 64 | 34 | 2 |

| SC4 | 0.740 | 46 | 100 | 68 | 40 | 68 | 78 | 82 | 24 | 68 | 32 | 29 | 99 | 37 | 68 | 20 | 4 |

| SC7 | 0.729 | 45 | 37 | 46 | 49 | 44 | 17 | 67 | 34 | 100 | 20 | 23 | 53 | 20 | 70 | 27 | 1 |

| INT0 | 0.742 | 54 | 33 | 44 | 14 | 45 | 44 | 70 | 16 | 59 | 56 | 15 | 100 | 61 | 45 | 22 | 1 |

| INT1 | 0.705 | 21 | 72 | 45 | 44 | 65 | 88 | 17 | 9 | 100 | 25 | 6 | 48 | 11 | 14 | 4 | 2 |

| INT4 | 0.783 | 31 | 30 | 41 | 96 | 33 | 40 | 26 | 39 | 39 | 24 | 16 | 100 | 20 | 38 | 17 | 2 |

| INT7 | 0.734 | 18 | 50 | 26 | 100 | 51 | 63 | 84 | 52 | 43 | 52 | 10 | 35 | 28 | 27 | 23 | 2 |

| SP0 | 0.870 | 46 | 100 | 91 | 76 | 47 | 34 | 90 | 32 | 85 | 37 | 9 | 50 | 30 | 68 | 37 | 5 |

| SP1 | 0.902 | 21 | 45 | 100 | 54 | 43 | 41 | 87 | 27 | 33 | 62 | 18 | 54 | 42 | 36 | 70 | 2 |

| SP4 | 0.687 | 42 | 87 | 100 | 42 | 55 | 18 | 99 | 24 | 34 | 35 | 33 | 60 | 42 | 74 | 24 | 3 |

| SP7 | 0.717 | 20 | 33 | 71 | 51 | 32 | 31 | 100 | 40 | 70 | 11 | 25 | 99 | 89 | 55 | 19 | 3 |

| C0 | 0.747 | 24 | 49 | 36 | 25 | 71 | 36 | 100 | 17 | 100 | 27 | 23 | 60 | 13 | 35 | 19 | 2 |

| C1 | 0.788 | 31 | 79 | 45 | 100 | 44 | 83 | 74 | 55 | 53 | 57 | 22 | 59 | 39 | 64 | 29 | 3 |

| C4 | 0.788 | 12 | 43 | 62 | 99 | 100 | 37 | 51 | 16 | 48 | 34 | 14 | 38 | 31 | 38 | 61 | 2 |

| C7 | 0.888 | 52 | 72 | 84 | 100 | 31 | 72 | 59 | 68 | 74 | 66 | 34 | 66 | 50 | 49 | 52 | 2 |

| SCALL | 0.794 | 36 | 61 | 49 | 75 | 59 | 53 | 27 | 20 | 100 | 23 | 20 | 56 | 58 | 61 | 20 | 1 |

| INTALL | 0.911 | 41 | 81 | 97 | 100 | 76 | 78 | 63 | 57 | 91 | 46 | 38 | 74 | 66 | 81 | 17 | 7 |

| SPALL | 0.801 | 38 | 37 | 74 | 36 | 25 | 57 | 100 | 22 | 41 | 26 | 18 | 98 | 25 | 26 | 17 | 2 |

| CALL | 0.989 | 39 | 100 | 40 | 65 | 47 | 81 | 71 | 46 | 82 | 56 | 38 | 71 | 65 | 83 | 59 | 4 |

| NoIm > 75 frequency | 0 | 8 | 11 | 7 | 3 | 5 | 10 | 0 | 7 | 0 | 0 | 7 | 2 | 3 | 0 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lukason, O.; Vissak, T. Being (Not) Successful in Internationalisation After Receiving Export Support: Which Predictors Are Able to Forecast It and How Accurately? Information 2025, 16, 544. https://doi.org/10.3390/info16070544

Lukason O, Vissak T. Being (Not) Successful in Internationalisation After Receiving Export Support: Which Predictors Are Able to Forecast It and How Accurately? Information. 2025; 16(7):544. https://doi.org/10.3390/info16070544

Chicago/Turabian StyleLukason, Oliver, and Tiia Vissak. 2025. "Being (Not) Successful in Internationalisation After Receiving Export Support: Which Predictors Are Able to Forecast It and How Accurately?" Information 16, no. 7: 544. https://doi.org/10.3390/info16070544

APA StyleLukason, O., & Vissak, T. (2025). Being (Not) Successful in Internationalisation After Receiving Export Support: Which Predictors Are Able to Forecast It and How Accurately? Information, 16(7), 544. https://doi.org/10.3390/info16070544