Abstract

In the context of the globalization process, the interplay between geopolitical dynamics and international trade fluctuations has had significant effects on global economic and business stability. Recent crises, such as the US–China trade war, the invasion of Ukraine, and the COVID-19 pandemic, have highlighted how changes in the structure of international trade can amplify the risks of business failure and reshape global competitiveness. This study aims to analyze in depth the transmission of business failure risk within the global trade network by assessing the sensitivity of industrial sectors in different countries to disruptive/critical/significant events. Through the integration of data from sources such as the World Trade Organization, national customs, and international relations research centers, a quantitative, exploratory, and descriptive approach based on graph theory, random forest, multivariate regression models, and neural networks is developed. This quantitative system makes it possible to identify patterns of risk propagation and to evaluate the degree of vulnerability of each country according to its commercial and financial structure. The mechanisms that relate geopolitical factors, such as trade sanctions and international conflicts, with the oscillations in the global market are analyzed. This study not only contributes to our understanding of how the macroeconomic environment influences business survival, but also provides analytical tools for strategic decision making. By providing an empirical and theoretical framework for early risk identification, it brings a novel perspective to academia and business, facilitating better adaptation to an increasingly volatile and uncertain business environment.

1. Introduction

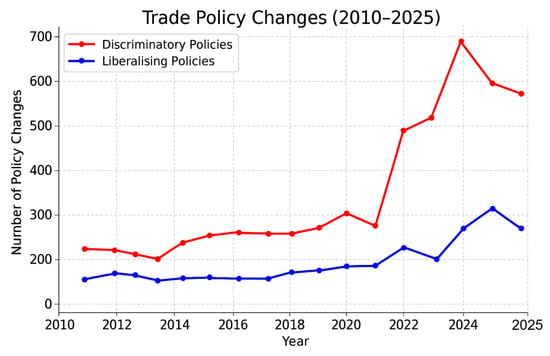

In recent decades, the world economy has moved from a phase of high trade integration to a clear trend toward deglobalization, a process in which, after a stage of global interaction and interdependence, the economy once again becomes more local or regional. At the end of the 20th century and the beginning of the 21st century, globalization boosted trade growth, reaching its maximum point in 2008. After the global financial crisis, the share of trade in global GDP stagnated. This stagnation is not only the result of cyclical economic factors but is also structurally reinforced by a sharp increase in discriminatory trade policies (Figure 1). As protectionism spread, many countries experienced a decline in the annual growth of their trade flows (Figure 2), with some economies facing even negative trade growth. This combination of rising trade barriers and sluggish trade performance helps explain why trade has failed to regain its pre-crisis momentum as a driver of global economic expansion. In recent years, protectionism and regionalism have slowed global trade, with nearly 3.000 restrictive measures in 2023, five times more than in 2015 [1].

Figure 1.

Trade policy changes. Source: author’s visualization based on data from Global Trade Alert, University of St. Gallen (accessed on 20 February 2025).(www.globaltradealert.org).

Events such as the US–China trade war, the COVID-19 pandemic, and the Russia–Ukraine war have transformed international trade. For a discussion of concrete effects in specific commercial areas, see [2,3,4,5]. In particular, the US–China trade war marked, since 2018, a turning point for both economies, with the imposition of tariffs and a process of economic “decoupling”. Although they sought to protect their domestic industries, these measures affected the global value chain, reducing the GDP of China and the US by −1.41 % and −1.35 %, respectively, and causing a generalized fall in import and production sectors in both countries [6]. In addition, the increase in political risk since 2018 has increased China’s business exit rate by 34% [7].

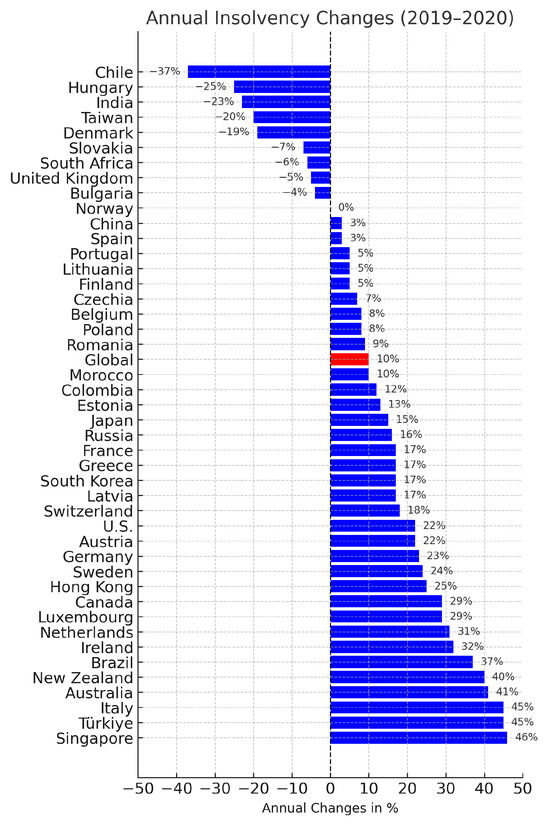

Figure 2.

Business insolvencies in 2024, annual changes in %. Source: Global Insolvency Outlook [8], author’s adaptation.

On the other hand, corporate bankruptcies have increased in recent years on a global scale. Allianz Trade’s Global Insolvency Report [8] forecasts that business bankruptcies will continue to rise in the coming years, with 10% growth in 2024, followed by 6% in 2025 and 3% in 2026, accumulating five consecutive years of increases. In 2024, four out of five countries will record an increase in bankruptcies, exceeding the 2016–2019 average by 12% [8]. North America and Asia lead this trend, while Western Europe, albeit with a slowdown in growth compared to its usual trend of previous years, remains a key contributor, with two-thirds of its industrial sectors registering increases in bankruptcies and almost half exceeding pre-pandemic levels [5]. In this paper, as we will explain in detail later, we are interested in investigating the relationship between changes in international trade and the risk of business bank disruptions across countries.

This would enable a better understanding of the dynamics affecting specific groups of countries. For instance, within the global trade environment, developing countries tend to be more vulnerable to economic crises, as their companies simultaneously face rising costs and declining demand due to the reduction in purchasing power among the population. Studies highlight two main aspects of how these crises affect businesses in such contexts. First, industries reliant on raw materials, such as those in the food, fertilizer, and transportation sectors, are severely impacted by increasing costs and shortages of inputs. Second, limited access to financial support leads to widespread business closures. In contrast to developed countries, which are often able to mitigate the effects of price increases through subsidies, developing countries face fiscal constraints that leave businesses without sufficient support, thereby increasing the risk of systemic corporate failure and economic and social instability [9].

In this context, the rise in aggressive U.S. tariff policies after Donald Trump’s election as president created a situation of major global uncertainty. Our work seeks to provide tools to measure how international conflicts can affect the health of companies, whether these conflicts come from wars or other situations that disrupt global economic exchanges. Understanding these effects is key to anticipating risks, designing better public policies, and helping businesses adapt to a changing global environment.

From a methodological point of view, we will analyze this relationship using a network analysis derived from graph theoretical modeling. We will characterize the graph defined by a set of countries, weighted by parameters related to various economic indicators (such as centrality metrics, AI-based procedures, etc.). This approach will not only facilitate the interpretation of the relationships but also provide a robust methodology for forecasting the rate of corporate bankruptcies in response to global crises, including drastic changes in international trade regulations, such as those currently taking place under the new U.S. policy, as well as identifying the countries most likely to be affected by these events.

Thus, in summary, this study aims to contribute to a better understanding of the impact of international trade disruptions on business failure rates by quantifying the relationship between international trade network structure and the risk of business failure using a unique combination of graph theoretical indicators and machine learning models. The novelty lies in incorporating geopolitical shocks into a dynamic trade network framework and applying hybrid modeling techniques (random forest, neural networks, and regression) to assess systemic vulnerability. Unlike existing works focusing only on macroeconomic or firm-level predictors, this study leverages country-level trade connectivity as a structural predictor of insolvency risk.

1.1. Structural Characteristics of the Global Economic Network, Transmission of Dependencies, and Mechanisms of Bankruptcy Propagation

Many studies show that the global trade network is not random but exhibits a “small-world” structure and scale-free network properties [10]. High connectivity (intensity and extent of trade connections between countries) and “short paths” (direct and fast trade routes) facilitate rapid and efficient trade, but also allow for the accelerated propagation of economic impacts between countries. Moreover, the distribution of connections follows a power law, with a few countries acting as central nodes of high trade volume [11]. This stable hierarchy reinforces structural inequality and the vulnerability of less developed peripheral economies [10].

Trade network topology has a dual impact on economic stability. On the one hand, the scale-free structure increases resilience to random shocks, as the disruption of trade in smaller economies has a limited effect [10]. On the other hand, the concentration of trade in a few nodes makes the network extremely vulnerable to crises in key countries, the effects of which can quickly spread to the global network. Research shows that large economies such as the US can generate crises with global impact, but also countries with lower GDP but high connectivity, such as Belgium, can trigger systemic effects [10].

The interconnection of business and supply networks makes corporate failure a systemic phenomenon. The insolvency of one company can trigger a “domino effect” in the supply chain, affecting suppliers and customers. A study of more than 5000 supplier–customer relationships in Japan revealed that the bankruptcy of a large company significantly increases the probability of bankruptcies in linked smaller companies, with 40% of secondary insolvencies occurring within one month and 85% within one year [12]. The asymmetry in the size of companies (large to small) is a key factor in the transmission of risk.

In the financial system, corporate failure also has a contagious effect. Research on the spread of risk through payment delays indicates that, although bankruptcy itself is a low probability event, financial distress can alter transaction patterns and increase the risk of default in the supply chain. Retailers and wholesalers have been found to be the main initiators of payment defaults (43%), while wholesalers bear 80% of the risk [13]. In liquidity-constrained supply chains, even with stable orders, payment variability can spill over to suppliers, amplifying the risk of ecosystem failure [13].

These findings underscore the systemic nature of bankruptcy risk: individual insolvencies can amplify across commercial and financial networks, generating macroeconomic impacts. However, the network structure also offers opportunities to mitigate these risks through diversification and resilience mechanisms.

1.2. Business Network and Corporate Bankruptcies

Trade network analysis makes it possible to identify the most influential countries and industries within global trade. The PageRank indicator is widely used to evaluate the global centrality of a node since it not only considers the volume of direct trade but also the indirect dependencies along multiple trade steps. Studies have compared direct trade networks with adjusted networks, showing that the latter has a greater explanatory capacity on the propagation of economic events, as indicated by its correlation with countries GDP [14].

The study of the structure of global trade has identified key economic communities, such as those centered on the U.S. and Japan (whose leadership has declined in recent years), China (on the rise), and the Germany–Netherlands bloc within Europe. These communities reflect geoeconomic and sectoral alignments, such as the East Asian manufacturing circle, the American free trade area, and the European single market [15]. Identifying these nodes and communities makes it possible to determine the economic actors with the greatest impact on the global market, who not only act as logistics hubs but also lead economic activity in their respective regions.

Centrality in the trade network is closely related to business risk. Countries with high centrality have extensive trade networks and diversified supply chains, which increase their exposure to global shocks, but also give them more options for adaptation, rapid recovery, and access to other key international markets [16]. During global recessions, core countries tend to experience synchronized downturns and increased corporate bankruptcy pressures [17]. However, redundancy within the network can also act as a buffer: if a central firm can be replaced by others, its exit will not lead to a widespread collapse. Thus, the impact of country centrality on business stability is not one-dimensional.

Crises can expose vulnerabilities in the global trade network, revealing bottlenecks in supply chains. Notable examples include the disruption of the supply of critical hard disk drive components during the floods in Thailand in 2011 and the disruption of automotive parts following the Fukushima earthquake [18]. These events demonstrated that certain hubs or core countries play a crucial role in the stability of the global trade network. Companies that depend on a single supplier or import market may face significant downtime or bankruptcy risks if that node collapses and no viable alternatives are available in the short term.

International trade also reflects countries’ macroeconomic strategies and foreign policies. Changes in the structure of the trade network can offer clues about adjustments in economic policies or diplomatic tensions. Recent research suggests that variation in a country’s betweenness within the trade network can serve as a leading indicator of geopolitical tensions [17]. A sharp rise or fall in a country’s intermediation often precedes changes in its global economic role, indicating possible political adjustments or emerging conflicts. In this sense, a trade network analysis not only allows us to understand the present, but also to anticipate future trends in the global economy.

For example, the conflict between Russia and Ukraine, which began in 2014, has had a profound and lasting impact on Ukraine’s economy. One of the most striking early consequences was an 18% decline in GDP during the first quarter of 2015 compared to the same period in 2014, a drop largely attributed to the collapse of heavy industry in the Donbas region and the sharp contraction of trade with Russia [2]. Although Western support helped cushion the blow, the risk of economic collapse remained a serious concern. By March 2022, nearly 79% of Ukrainian businesses were either shut down or facing imminent bankruptcy. This figure improved over the year, decreasing to 32% by December [19]. In Russia, the economic disruption was also significant, particularly in the agribusiness sector, which accounted for roughly a quarter of all bankruptcy cases [20]. Beyond the immediate region, the conflict has triggered broader global repercussions. The war has contributed to rising energy and raw material prices, with Europe being especially affected. In 2021, 40% of the countries for which data is available reported higher bankruptcy rates, double the share from 2020. Notable increases were observed in Slovakia, Spain, and the Czech Republic [21].

The remainder of this paper is organized as follows. Section 2 defines the research objective and scope of this study. Section 3 presents the theoretical framework, linking international trade structure, institutional quality, and systemic insolvency risk. Section 4 details the methodology, including the research design, data sources, data preprocessing, and the analytical techniques employed. This section introduces the construction of the global trade network, the use of graph theory and community detection via the Louvain algorithm, and the modeling of the relationship between trade connectivity and corporate insolvency using machine learning and spatial econometric methods. Section 5 reports the empirical results. It begins with a temporal analysis of the evolution of the global trade network from 2015 to 2023, highlighting events such as Brexit, the COVID-19 pandemic, and the Russia–Ukraine war. It then analyzes country-level centrality measures, trade network structures, community characteristics, and associated bankruptcy resolution patterns. This section also compares the performance of different predictive models, including random forest and neural networks, and presents the results of global spatial autocorrelation (Moran’s I). Section 6 concludes this paper by summarizing the main findings, discussing policy implications, and suggesting directions for future research.

2. Objective

The main objective of this study is to analyze the transmission of business failure risk in the context of global trade, taking into account the impact of economic crises and geopolitical conflicts on the stability of trade networks. Using different methodologies, such as graph theory, multivariate regression models and neural networks, and crisis propagation modeling, we seek to understand how relationships between firms and countries can amplify or diminish the effects of these crises.

This paper examines how the dynamics of international trade and the structure of economic and trade networks in each country influence the vulnerability of firms to disruptive events such as trade wars, financial crises, and international conflicts. Thus, the aim is to provide an analytical framework to help identify risk patterns and possible strategies to strengthen business resilience in an increasingly volatile global environment. To achieve this general objective, a series of specific objectives were defined, which are as follows.

The first one is to analyze how a country’s position within the international trade network influences its exposure to the risk of corporate bankruptcy and its degree of vulnerability to economic crises. We also examine the risk transmission mechanism and the domino effect within the trade and financial network, studying how corporate failures can propagate along supply chains and between interconnected sectors, generating systemic impacts at different levels of the global economy.

Second, this study aims to determine the impact that key large-scale events have on the structure of the business network, investigating how economic and geopolitical crises, such as the Russia–Ukraine war, the US–China geopolitical war, or the COVID-19 pandemic, modify the connectivity between countries, alter the stability of global markets and affect the resilience of firms in the face of these changes.

These ideas are intended to provide new data to interpret the effect that the current geopolitical situation we are experiencing, in which the US is applying tariffs deliberately interrupting the global flow of economic exchange, may have on industrial and commercial activity.

3. Theoretical Framework

The theoretical framework of this research is based on the mathematical analysis of the diffusion of risk and economic crises, the economic impact of conflicts and global crises, and the models and procedures used to evaluate these phenomena. In recent decades, the world trade network has been the subject of increasing attention in the economic literature. A network analysis applied to international trade makes it possible to study trade volumes as well as the structure and resilience of linkages between countries [10,15].

Using these tools, it has been shown that geopolitical and economic shocks can propagate through the nodes and links of the network, affecting the countries directly involved and their trading partners [14,17]. As noted earlier, extreme events such as the U.S.–China trade conflict [6,22], with relevant consequences on the network [15,16], as well as the Ukraine war [9,11,19] and the COVID-19 crisis [3,4] have been extensively studied from this point of view [21].

These events modify bilateral relations and reconfigure the centrality and structural power of countries in the global trade network [16]. China, for example, has strengthened its role as a central node, especially after episodes of trade isolation with the United States [15]. Likewise, as we already explained, recent armed conflicts have had a profound impact on the global economy, affecting commodity prices, supply chains, and overall geopolitical risk [9,11,19]; the COVID-19 crisis has also caused an unprecedented disruption in global value chains and international transportation [3,4]. This situation also revived discussions on the need to diversify suppliers and strengthen the resilience of [21] networks.

From a more microeconomic perspective, research on risk propagation in business networks and interfirms shows how financial or logistical shocks can be transmitted between firms through their business relationships [12,13]. This is especially relevant in environments where firms rely heavily on stable cash flows and robust supply chains. In this context, the study of global trade network resilience to external shocks has become a priority. Authors such as the ones of [18] propose to assess the fragility of trade networks based on simulations of localized shocks, highlighting the critical role of certain "hubs" in global stability. On the other hand, reports from agencies such as the OECD and the IMF have warned about the stagnation of global trade due to the rise of protectionism, economic nationalism, and geoeconomic fragmentation [1,23].

Finally, recent studies also point to the specific impact of regional events such as Brexit on labor and trade networks [24], as well as the importance of emerging logistics hubs such as Poland in reshaping intra-European trade [25].

4. Methodology

In this section, we explain the analytical method we used for the study of the problem we fixed in the previous sections. Starting from the explanation of the reference, we provide a step-by-step description of our method.

4.1. Research Design

This study adopts a quantitative, exploratory, and descriptive approach, focusing on the analysis of the structure of the international trade network and its relationship with business failure at a global level. The main objective is to identify how the topology of the trade network (particularly its small-world and scale-free characteristics) influences the emergence and spread of business bankruptcies in different countries, considering the period between 2015 and 2023.

The approach of this research also explores how large-scale economic events (such as trade wars, pandemics, or geopolitical conflicts) can alter the structure of the network, transforming patterns of bankruptcies that are generally independent into highly correlated events. It is hypothesized that under normal circumstances, business bankruptcies behave as isolated events within the network, but under significant external shocks, risk transmission mechanisms are activated that connect previously disconnected countries, in a similar way to how electrical circuits suddenly activate, forming connected paths.

In addition, it is considered that geographical proximity and participation in regional trade agreements may influence the spatial correlation of business failures. For example, countries belonging to economic blocs or sharing regional supply chains (such as RCEP, EU, or USMCA) may experience similar patterns of bankruptcies when one of the members faces a significant shock.

To this end, a longitudinal approach is employed in order to observe the structural evolution of the network and how these changes are correlated with business failure indicators. The methodology relies on complex network analysis techniques, neural network algorithms, and multivariate prediction models. Furthermore, a geographic centrality analysis and the influence of trade agreements are incorporated, exploring how the impact of critical events propagates within specific trade communities and how this affects business resilience in different regions of the world.

4.2. Data Sources and Variables

Table 1 shows the data used in this research, which come from reliable international sources. Data selection was carried out rigorously to ensure the representativeness and precision of the results.

Table 1.

Description of international trade and business bankruptcy data.

Following common practice in international trade research, we rely on exporter-reported trade flows to construct the trade network. Export data are generally considered more accurate and consistent than importer-reported data, due to the exporter’s stronger institutional incentives for customs compliance and valuation accuracy. This preference is also reflected in major datasets such as UN Comtrade, NBER-UN, and CEPII-BACI, all of which prioritize exporter data when both records are available [26,27].

The international trade data, obtained from Trademap [28], provide a clear view of exports between countries, allowing the construction of a trade network based on concrete economic relationships. On the other hand, the business bankruptcy data collected from Trading Economics [29] and complemented with information from Statista [30] for China ensures representative coverage of the main economic players globally.

Although there are other databases such as the IMF [23] or the World Bank [31], the aforementioned sources were prioritized due to their specialization in trade and bankruptcies, respectively, which ensures a more direct and coherent approach with the objectives of this research. The collected data will be used to construct a directed and weighted trade network, where nodes represent countries and directed edges indicate export volume. Subsequently, centrality metrics (such as PageRank and betweenness centrality) and community algorithms (Louvain) will be applied to identify structural patterns.

The business bankruptcy data will be cross-referenced with the network metrics to identify correlations between position in the trade network and the risk of business failure. Additionally, it will be explored how disruptive events (such as economic crises or geopolitical conflicts) can transform these patterns of independence into correlated and propagative events.

4.3. Descriptive Analysis

4.3.1. Descriptive Analysis of Export Data

This section summarizes the statistical properties of the bilateral export dataset from 2001 to 2023. As discussed, the dataset consists of directed export flows between countries, recorded in U.S. dollars, based on exporter-reported data (mirror statistics). Each year’s data is used to construct a weighted directed trade network, with edges representing observed export relationships between pairs of countries.

Table 2 presents descriptive statistics for each year, including the number of valid country pairs, average and median export values, dispersion, and extremal values. The data show substantial sparsity in the early 2000s (e.g., only 274 valid pairs in 2001), followed by rapid improvements in coverage and completeness. From 2008 onward, the dataset consistently includes over 30,000 exporter–importer observations annually, making this period ideal for network-based analysis.

Table 2.

Descriptive statistics of export values (2001–2023).

Export values are heavily right-skewed in all years, with mean values often far exceeding the median. For instance, in 2020, the mean export value reached approximately 1.06 million USD, while the median remained below 700 USD. This long-tail distribution is further confirmed by the high standard deviations and extreme maxima observed in each year.

A notable observation is the resurgence of missing values in the years following 2020, despite the total number of records remaining high. This pattern is attributed to the COVID-19 pandemic, which not only disrupted international trade flows but also hampered the ability of many national statistical agencies to collect and publish timely trade data. The effect is particularly noticeable in low-income and developing economies.

Nevertheless, the post-2020 trade networks remain sufficiently dense to support robust structural analysis. Specifically, even in 2023, the dataset contains over 23,000 valid trade relationships, covering more than 150 exporting countries and nearly all major economies. The network’s giant component—the largest connected subgraph—remains intact, and key structural properties (such as average degree, density, and clustering) remain stable over time. Moreover, the countries with the most missing values tend to be peripheral in the global trade system, contributing minimally to centrality-based metrics such as PageRank or betweenness. This ensures that core network features remain reliable despite incomplete reporting at the margins.

Therefore, while we acknowledge the presence of increased data gaps after 2020, our approach of constructing annual trade networks based on available data remains methodologically sound. It preserves empirical accuracy and avoids speculative imputation that could distort global trade topology.

4.3.2. Descriptive Analysis of Bankruptcies

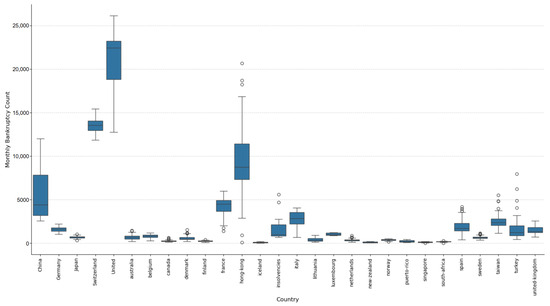

Figure 3 presents a boxplot of monthly corporate bankruptcy filings across the 27 countries and regions included in the dataset. The distributions reveal substantial cross-country heterogeneity in both magnitude and variability.

Figure 3.

Monthly bankruptcies by country.

The United Kingdom consistently exhibits the highest number of monthly bankruptcies, with a median exceeding 22,000 filings and an upper range surpassing 26,000. The interquartile range (IQR) is relatively tight, indicating a stable yet high level of insolvency. Switzerland and Hong Kong follow, each with median monthly filings above 8000, though with wider IQRs and notable outliers in the case of Hong Kong, indicating episodes of rapid fluctuation. In contrast, countries such as Japan, Finland, Ireland, and several Nordic countries exhibit much lower bankruptcy levels, often with median values below 500 filings per month. The boxplots for these countries are narrow, with minimal whisker length and few outliers, suggesting relatively stable corporate environments and consistent reporting practices.

The presence of extreme outliers in some countries (e.g., France, China, and Italy) signals short-term spikes that may be associated with economic shocks, legal reforms, or reporting changes. These variations underscore the need to account for country-specific institutional and macroeconomic contexts when comparing bankruptcy trends. Overall, the boxplot confirms that the global distribution of corporate bankruptcies is strongly right-skewed, with a handful of large economies accounting for the vast majority of cases.

4.3.3. Descriptive Analysis of Insolvency Resolution Time

This dataset reports the time to resolve insolvency, defined as the average duration (in years) required to complete a corporate bankruptcy process through the formal judicial system of a country. The data are sourced from the World Bank Doing Business indicators [31], covering the period from 2003 to 2019, with annual records available for over 100 countries.

Across the dataset, the global average resolution time is approximately 2.6 years, with values ranging from under 0.3 years in the fastest systems to over 6 years in the most delayed jurisdictions. While some countries report minimal within-country variation over the years (e.g., Albania and Algeria), others (particularly those undergoing legal reform or affected by external shocks) exhibit moderate fluctuations.

Since the Doing Business project was discontinued after 2020, data beyond 2019 are not available. However, given the institutional inertia typically observed in judicial and insolvency systems, resolution times are widely regarded as stable over medium-to-long horizons. Unless there is a major insolvency law reform or governance crisis, the average time to resolve bankruptcy tends to remain consistent within each country.

Therefore, for the purposes of this study, the resolution time series is treated as structurally persistent, and the most recent available value (i.e., 2019) is used as a representative proxy for each country in modeling and cross-sectional comparisons post-2020. This approach is consistent with the prior literature in international finance and economic institutions, where insolvency indicators are treated as structural constraints rather than volatile market variables [32,33].

4.4. Data Processing

Since the data come from various sources and present differences in format and temporal coverage, the cleaning and normalization process is essential to ensure consistency in the analysis. We will take into account the following properties.

- Missing data removal. First, records with incomplete or null data were removed, thus ensuring the integrity of the dataset. A manual verification was subsequently performed to identify errors or inconsistencies in the values.

- Standardization of country names. To ensure consistency in handling international data, country names were normalized using the ISO-3 code, thereby avoiding duplications or discrepancies due to spelling variations or alternative names.

- Temporal organization of the data. The data from each set were organized chronologically, ensuring that the information for the selected years (2013–2024 for trade and 2015–2023 for bankruptcies) was correctly temporally aligned. This structuring is essential for conducting an accurate longitudinal analysis.

4.5. Models and Techniques for the Integration of Trade and Financial Data

Let us explain in this section how the characteristic graph parameters, when used on a specific network constructed with the countries considered in the model, are able to explain the properties of the trade relations among countries. We will explain the whole process in what follows, explaining the construction of the model step by step.

4.5.1. Network Establishment

With the data obtained as explained, we have created a new network structure that will be the basis of our further analysis. In particular, a directed and weighted trade network is constructed in which

- Nodes represent individual countries.

- Directed edges indicate export relationships between countries.

- The weight of each edge reflects the annual export volume.

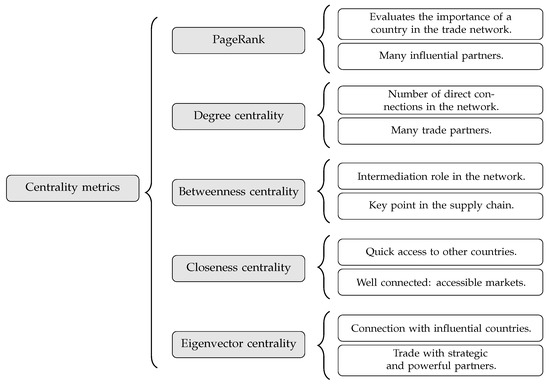

Each year is modeled as an independent network to capture the dynamic evolution of trade relationships. For each annual network, as shown in Figure 4, the fundamental centrality metrics are calculated: PageRank, degree centrality, betweenness centrality, closeness centrality, and eigenvector centrality. These metrics provide complementary perspectives on the role and influence of each country within the global trade system. PageRank captures the importance of a country based on the significance of its trade partners; degree centrality measures the number of direct trade connections; betweenness centrality quantifies a country’s role as a bridge or intermediary in trade flows; closeness centrality reflects how easily a country can reach others in the network; and eigenvector centrality accounts for both the quantity and quality of a country’s connections. Together, these indicators allow for a multidimensional analysis of countries’ positions in the trade network over time.

Figure 4.

Visualization of centrality metrics in trade networks.

4.5.2. Topological Analysis

To characterize the structure of the commercial network, we analyze two of its key topological properties. First, we study the small-world property. Recall that the small-world property means that countries are well connected, both to their neighbors and to distant countries, making trade faster and easier. So, we first assess whether the network combines a high clustering coefficient with a short average length of paths between nodes. These characteristics are typical of many real-world networks, including international trading systems, where countries tend to form dense local clusters but are also connected through a few intermediaries to distant markets. Testing for the presence of the small-world effect allows us to understand the efficiency with which goods and information can circulate in the global trading system.

Second, we examine the scale-free property, which refers to the degree distribution of the network following a power law. In such networks, a small number of nodes—countries in this case—are highly connected, while the majority have relatively few connections. The detection of a scale-free structure suggests that trade is concentrated around a few key economies, making the network robust to random failures but vulnerable to selective shocks affecting those core countries. Understanding this property is crucial for assessing the resilience and vulnerabilities of the global trade network.

4.5.3. Community Detection: Louvain Algorithm

To identify natural groupings within the network, the Louvain algorithm is used, which allows maximizing modularity and determining trade communities. Subsequently, a comparison is made between the detected communities and the average time to resolve bankruptcies in each country.

4.5.4. Community Analysis and Bankruptcy Resolution Times

Although the World Bank’s Doing Business dataset provides insolvency resolution time (IC.ISV.DURS) as a panel across years (2003–2018), we observe that for the majority of countries, the reported values remain constant or exhibit only minimal variation over the full period. This reflects the structural nature of legal procedures and institutional frameworks governing bankruptcy processes, which tend to change slowly over time.

Accordingly, we calculate and use the country-level mean value across the available years as a proxy for institutional efficiency in insolvency resolution. This average is interpreted as a quasi-structural attribute, capturing the long-run procedural burden associated with resolving corporate distress and reflecting structural national-level institutional characteristics. The purpose of this stage is to examine whether the communities identified through the Louvain algorithm reflect common characteristics in terms of trade policy, economic agreements, or geographical proximity. Additionally, these data are cross-referenced with the average bankruptcy resolution time to explore whether countries within the same community exhibit similar patterns of efficiency in insolvency proceedings.

This comparison allows for the evaluation of whether certain trade communities are associated with similar legal regimes or economic structures, which could imply greater resilience or vulnerability to financial disruptions.

4.5.5. Modeling the Trade–Insolvency Relationship

To assess whether countries’ positions in the trade network are predictive of corporate bankruptcy risk, we adopt two machine learning methods: random forest regression (RFR) and a feedforward neural network (FNN). Random forest is a robust decision-tree-based ensemble method that offers good interpretability when working with structured data, while neural networks are especially useful for detecting hidden nonlinear patterns within the data. Both models are designed to capture the potentially nonlinear relationship between network centrality indicators and the number of corporate bankruptcies.

The response variable is the annual number of bankruptcies for each of the 27 countries over the period 2015–2023. The input features include five centrality measures computed yearly from the trade network: PageRank, Degree, betweenness, closeness, and eigenvector centrality.

To build the dataset, we first filtered the trade data to include only bilateral export flows among the 27 countries with available bankruptcy data. For each year, we constructed a directed weighted trade network, using export values as edge weights. Each country’s network centrality values were computed per year and paired with its corresponding annual bankruptcy count, resulting in a panel of 243 observations (27 countries × 9 years).

The resulting dataset was cleaned for missing or infinite values and then split into training and testing sets (80/20 split). For the neural network, features and target variables were standardized using z-score normalization to improve convergence. The neural network was implemented in PyTorch 2.0.1 with two hidden layers and LeakyReLU activation functions, trained for 500 epochs using the Adam optimizer and MSE loss. Feature importance was approximated by averaging the absolute values of the first-layer weights. For random forest, we used 100 estimators and the default depth. Feature importance was derived directly from the trained model.

To asses bankruptcy, a subnetwork is built comprising the 27 countries for which bankruptcy data is available. Centrality metrics are then considered as independent variables, and the average number of annual bankruptcies as the dependent variable.

Then, to evaluate the influence of trade structure on business bankruptcies, the following statistical and AI methods are used:

- OLS regression: used to explore linear relationships between centrality indicators and the number of bankruptcies.

- Nonlinear models: Since trade influence may not be strictly linear, advanced methods are employed:

- -

- Random forest: captures complex interactions and nonlinear relationships.

- -

- Artificial neural networks (ANNs): models intricate patterns that may emerge from the interaction of multiple centrality metrics.

Finally, to detect whether business bankruptcies show spatial clustering, we apply Moran’s index, a measure that quantifies the degree to which similar values (such as high or low bankruptcy rates) are geographically grouped rather than randomly distributed. This index is given by

where

- denotes the value of the economic variable of interest (such as the number of business bankruptcies) for country i;

- is the mean of the variable across all countries;

- are spatial weights representing the degree of geographical or economic connection between countries i and j (e.g., neighborhood relationships or trade intensity);

- n is the total number of countries included in the analysis.

We will use two different instances of this statistic, the Global Moran’s I and the Local Moran’s I.

5. Results

5.1. The Evolution of the Global Trade Network (2015–2023)

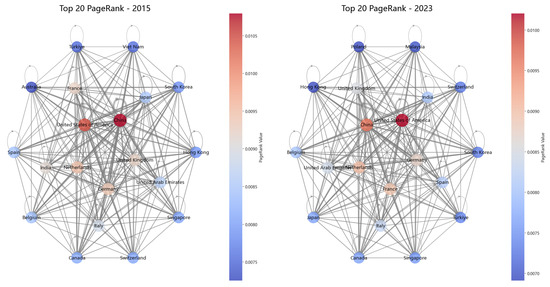

The period from 2015 to 2023 marks a clear structural transformation in the global trade network (Figure 5). While core economies such as China and the United States (Table 3) have retained their dominant positions in terms of PageRank centrality, the overall composition of the top 20 countries has evolved significantly—reflecting the rise in new emerging economies.

Figure 5.

Comparison of the trade network between 2015 and 2023.

Table 3.

PageRank changes for top 20 countries (2015–2023).

In 2015, the top 20 countries were predominantly traditional economic powers from Western Europe, North America, and East Asia. However, by 2023, several emerging economies had entered the top 20 list, replacing older incumbents. Notably, Poland and Malaysia—absent in 2015—made it into the top rankings by 2023. Among them, Poland exhibited the most prominent growth, with its PageRank value increasing by 6.8%, indicating a tangible rise in its trade centrality and network influence.

Other newly included countries such as Vietnam (2015) and Malaysia (2023) represent Southeast Asia’s increasing integration into global value chains, likely driven by manufacturing shifts and regional trade agreements (e.g., RCEP). Additionally, countries like India, the United Arab Emirates, and Singapore, while already part of the network, have either maintained or slightly improved their positions, underscoring the growing role of strategic trade hubs and populous emerging markets.

Although the color gradient in the network diagrams may appear visually similar—especially among countries with lower PageRank values—the actual network restructuring is evident in the entry of new nodes into the top 20 and the relative PageRank gains of select emerging economies. This shift is not merely cosmetic but reflects deeper structural changes in global trade flows, such as supply chain diversification, digital trade participation, and regional integration.

The Evolution of the Trade Position Between China and the United States

In 2015, China held a slightly higher position than the United States in terms of PageRank value within the global trade network. This was mainly due to China’s massive export volume, which reached 2.28 trillion dollars, consolidating its role as the “world’s factory” and establishing strong supply chains with multiple countries.

However, in 2018, the trade war between China and the United States had a significant impact on their bilateral trade relations. In response to the increased tariffs imposed by both powers, the United States strengthened its ties with other trade partners, such as Vietnam and Mexico, allowing it to partially offset the decline in trade with China and maintain its central position in the global network [22].

Although China’s total trade volume did not decrease significantly, its trade dependence on the United States was reduced, resulting in a slight decline in its centrality within the network. This dynamic illustrates how trade conflicts can influence the redistribution of connections in the international network.

5.2. The Manifestation of the “Deglobalization” Trend in the Trade Network

During the period 2015–2023, several significant geopolitical and economic events affected the structure of the global trade network. These events, including Brexit, the COVID-19 pandemic, and the war between Russia and Ukraine, triggered structural changes in international trade and tested the resilience of the trade network. The specific impacts of these events are analyzed in the following.

5.2.1. Brexit: A Setback in European Integration

Brexit represented a drastic change in the structure of European trade, as it entailed a partial reversal of the regional integration achieved within the European Union. Following the 2016 referendum and the formal process in 2020, the United Kingdom ceased to be part of the EU single market and customs union, increasing trade frictions with EU member countries.

Since 2021, data show a significant decline in both exports and imports between the UK and the EU. Exports of the UK to the EU decreased by 11% compared to 2019, while imports from the EU dropped by 32% by 2023 [24]. This decline reflects the direct impact of new tariffs, border controls, and customs procedures introduced after the UK exit from the customs union.

In terms of the trade network, Brexit weakened the connections between the UK and several key European nodes. This led to an even greater concentration of trade within the European core, particularly between countries such as Germany, France, and the Netherlands. As a result, the internal cohesion of the European trading community increased after the UK’s departure, strengthening intra-European relations as the UK sought new trade partners outside the European bloc.

5.2.2. The COVID-19 Pandemic: A Temporary but Symmetric Disruption

The COVID-19 pandemic represented an unprecedented external shock that simultaneously affected all economies in the world. In 2020, the implementation of widespread lockdowns and mobility restrictions resulted in the drastic disruption of supply chains and a temporary collapse of international transport. This led to a slight decline of 5% in global trade in goods [4].

From a network point of view, connections between many countries weakened significantly, especially in sectors dependent on air and maritime logistics. However, this disruption was essentially temporary and symmetric: all nations faced similar challenges, which prevented a permanent breakdown of key trade links. As the global economy began recovering in 2021, trade networks also quickly rebounded, indicating that the pandemic acted more as a disruptive factor than a driver of true deglobalization.

5.2.3. The War Between Russia and Ukraine: Reconfiguration of the Trade Network

The conflict between Russia and Ukraine, which began in 2022, had a profound impact on both European and global trade networks.

The imposition of economic sanctions on Russia by Western countries led to a sharp breakdown in trade ties between Russia and Europe, especially affecting energy trade. According to reports, trade between Russia and the EU decreased by 75% after multiple rounds of sanctions [34]. This sharp decline led to a clear segmentation in the trade network, where Russia ceased to be a relevant node for many European economies.

In response to these restrictions, Russia redirected its exports to Asia, particularly China and India. In 2022, trade between Russia and China grew by 34%, reaching 190 billion dollars, which represented 3% of China’s total trade [35]. Additionally, India significantly increased its imports of Russian oil, establishing a new Eurasian trade axis. This reorganization of the trade network reflects Russia’s transition from a European to an Asian node, strengthening its ties with economies not aligned with Western sanctions. While Russia’s global centrality decreased, its role within the Asian subnetwork strengthened. This suggests that, even amid significant geopolitical conflicts, the global trade network shows adaptability by redirecting trade flows toward regions less affected by sanctions.

5.3. Analysis of Country Centrality in the Global Trade Network (2023)

A centrality analysis allows for the identification of each country’s role within the global trade network, evaluating its influence and connectivity based on different metrics. The following Table 4 presents the results for the most representative countries in 2023.

Table 4.

Analysis of country centrality in global trade.

The centrality analysis reflects the distribution of power and commercial influence among the centrality levels of countries in 2023, that is, those selected for our study due to their leading role in global trade activity.

To characterize the structural roles of major economies within the global trade network, we performed a centrality-based classification using five indicators: PageRank, degree, betweenness, closeness, and eigenvector centrality. For each metric, we selected the top 20 countries based on their centrality values computed from a network of over 200 countries (2023 data). Countries that appeared repeatedly across multiple centrality top 20 lists were considered structurally representative and were retained for further descriptive analysis. For each such country, we then classified their centrality levels (high, medium–high, medium, and low) based on the relative value of their centrality scores within the top 20 group, using the following percentile-based rule: high: top 20%; medium–high: 20–50%; medium: 50–80%; and low: bottom 20%.

China and the United States stand out as the two main centers of global trade, with high values in all centrality metrics, especially in PageRank and degree. This reflects their ability to establish numerous trade connections and maintain strong influence in the global network, solidifying their positions as central nodes in the international supply chain. The combination of high closeness centrality and high PageRank indicates that these countries not only have many direct trade partners but are also strategically positioned to maximize trade flow across the network.

Germany and the Netherlands also occupy prominent positions in the European network. Germany shows a high betweenness centrality, underscoring its role as an interconnecting node in intra-European trade. Meanwhile, the Netherlands maintains a high degree of centrality due to its logistical role in Europe, primarily driven by the Port of Rotterdam, making it an essential trade bridge between Europe and the rest of the world.

Iceland, although of a lower degree compared to the commercial giants, exhibits very high betweenness centrality. This suggests that the country acts as an important nexus in specific trade routes, especially in sectors such as energy and fishing, where it plays a strategic role despite its small size. Singapore and the United Arab Emirates stand out as high-connectivity nodes in Asia and the Middle East, respectively. Singapore, as a trade and logistics hub in Southeast Asia, shows high eigenvector centrality values, indicating strong connectivity with other relevant economies. On the other hand, the United Arab Emirates reflects its position as a link in energy trade, with high eigenvector centrality and constant connection with global economies.

Together, the analysis reveals that the global trade structure remains highly centralized around major economic powers (China and the United States), while other nations such as Germany, the Netherlands, Singapore, and the United Arab Emirates perform specialized roles in logistics and regional connectivity. Smaller but strategic countries like Iceland act as bridges in specific industries, reflecting the structural diversity within the global trade network in 2023.

The data presented in Section 5.2.1, Section 5.2.2 and Section 5.2.3 are closely related to the quantitative results presented in Section 5 and provide a historical and contextual interpretation of the observed changes in network indicators. Specifically, the identified economic events (such as the 2008 financial crisis and the COVID-19 pandemic) coincide with notable fluctuations in key network measures such as average path length, the clustering coefficient, and centrality distributions. These changes in network structure reflect the modification and reconfiguration of trade relations between countries during major shocks. Thus, the empirical results justify our hypotheses on the relationship between, on the one hand, traumatic events that change international trade situations and, on the other hand, the risk of corporate insolvency, illustrating how systemic economic shocks manifest themselves in the topology of the international trade network.

These findings highlight the value of combining quantitative network analysis with empirical analysis based on real situations, as it allows for a more comprehensive understanding of how global disruptions propagate through trade structures and ultimately impact business stability. By linking structural shifts in the trade network to concrete economic crises, this procedure provides a suitable framework for anticipating future vulnerabilities.

5.4. Structural Properties of the Global Trade Network in 2023

After analyzing the structure of the global trade network in 2023, a series of indicators were obtained to characterize its structural properties and assess its efficiency and connectivity. Below is a summary of the results presented in Table 5.

Table 5.

Results of the structural analysis of the global trade network in 2023.

The results shown in Table 5 reflect the complex and structurally efficient nature of the global trade network in 2023.

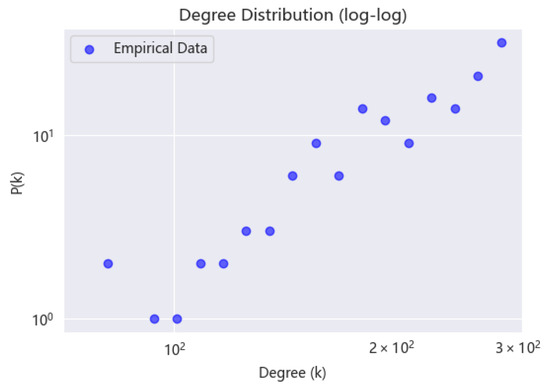

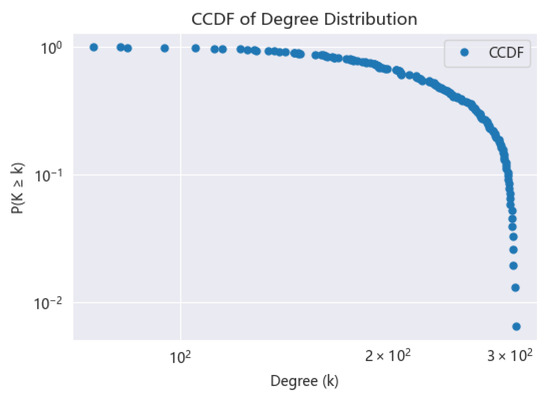

A network is considered scale free when its degree distribution follows a power law of the form . The power law index () with a value of 1.94 suggests that the degree distribution (and its Complementary Cumulative Distribution Function (CCDF), see Figure 6 and Figure 7 in logarithmic scale) follows a power law, which is typical in scale-free networks where a few nodes (countries) have high connectivity while the majority have limited connections. Clauset et al. (2009) suggest that power law behavior with is a strong indicator of a scale-free structure [36]. In our analysis, the exponent falls slightly below this typical range, suggesting an even more skewed degree distribution with dominant hubs. This supports the hypothesis that the trade network is scale free.

Figure 6.

Degree distribution (log–log).

Figure 7.

CCDF of the degree distribution.

To evaluate whether the power law distribution provides a better fit than an alternative such as the exponential distribution, we employed the Kolmogorov–Smirnov (K–S) statistic and log-likelihood comparisons. A large negative D-statistic (–65.396) and the null p-value in the comparison between power law and exponential confirm that the power law fits significantly better [36], providing strong statistical evidence that the network’s degree distribution is not only heavy tailed but specifically scale free.

The assortativity coefficient r quantifies the preference for nodes in a network to attach to others with similar degrees. A positive r indicates assortative mixing, where high-degree nodes tend to connect with other high-degree nodes, whereas a negative r reflects disassortative mixing—where high-degree nodes are more likely to connect with low-degree ones. Newman systematically examined mixing patterns [37] in various network types and concluded that most social networks tend to be assortative (), driven by homophily and group formation mechanisms, while technological, biological, and economic networks are generally disassortative () due to functional constraints and hierarchical organization [37]. Subsequent studies have consistently supported this view. Litvak and van der Hofstad showed that many large-scale self-organized systems, including the Internet and Web graphs, exhibit strong disassortative mixing [38]. In the economic context, So et al. observed that financial networks exhibit localized disassortative centers, which are closely tied to systemic vulnerability [39]. Empirical analyses of international trade networks also point in the same direction. For example, Fagiolo et al. found that the World Trade Web shows negative assortativity, with high-degree (large economy) countries tending to form connections with low-degree (peripheral) countries [40]. In our analysis, the computed assortativity coefficient for the 2023 trade network is , which aligns with this established pattern. The negative value suggests that high-degree countries (typically major trading hubs), preferentially connect with low-degree, less-connected countries. This supports the interpretation of the global trade network as a disassortative, hierarchical, and structurally heterogeneous system.

Together, these indicators reflect that the global trade network in 2023 follows a scale-free network pattern, characterized by its high efficiency and cohesion but also by its vulnerability to disruptions in central nodes. This suggests that while the global economic system shows a robust structure, it remains susceptible to systemic risks if key countries are affected.

5.5. Identification of Commercial Communities

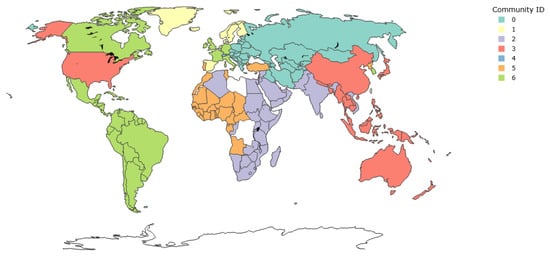

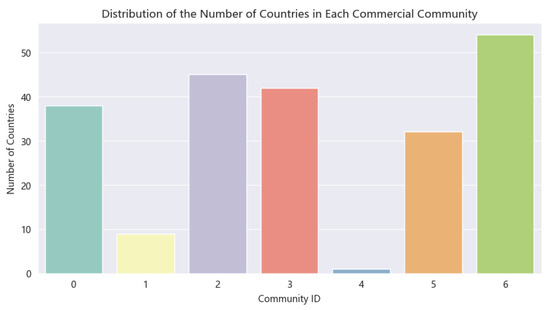

In this study, based on the structural characteristics of the global trade network, seven main trade communities were identified using community detection techniques (Figure 8). They contain a different number of countries (Figure 9). These communities exhibit a certain regional concentration from a geographical point of view and share similar economic and institutional traits. For example, some communities group countries from Central and Eastern Europe, others include high-income economies such as the Nordic countries and North America, while others are formed by emerging economies in Latin America, Africa, or South Asia.

Figure 8.

Map of global commercial communities.

Figure 9.

Distribution of the number of countries in each commercial community.

Despite the differences in the geographical and economic composition of these communities, their efficiency levels in insolvency resolution show systematic patterns. These patterns show the inequalities in economic development levels between global trade communities and suggest a possible relationship between the structural position of countries within the network and their financial resilience.

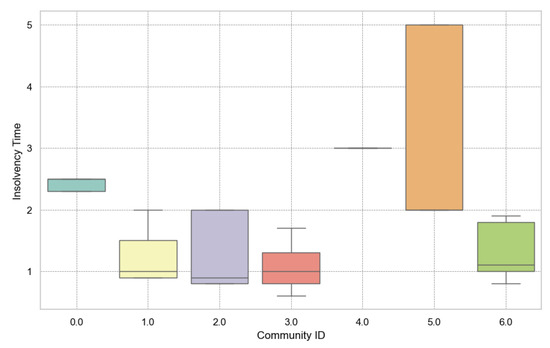

In the following sections, the characteristics of each community (Table 6) will be analyzed in more depth, as well as the economic and geopolitical factors that could influence their institutional performance in terms of insolvencies (Figure 10). Recall that the insolvency time refers to the number of years required to resolve a corporate insolvency case, measured from the moment of court filing until the distressed assets are fully recovered or liquidated. This indicator, provided by the World Bank, reflects the efficiency of a country’s legal and institutional framework in handling insolvency proceedings. Given that annual fluctuations are minimal, a multi-year average (2003–2018) is used to represent each country’s structural characteristics. It is expressed in units of years and serves as a quasi-static institutional indicator for comparative analysis across jurisdictions. This analysis aims to provide a more comprehensive understanding of the interaction mechanisms between the institutional environment and the structure of the international trade network.

Table 6.

Global trade communities and their characteristics.

Figure 10.

Distribution of insolvency time by community.

In what follows, we describe the characteristics of each group identified through our graph analysis, addressing them one by one.

5.5.1. Communities in Transition: Hybrid Institutions and Limited Efficiency (Community 0—Post-Socialist and Transitional States)

This group primarily comprises countries from Eastern Europe and former Soviet republics, including Russia, Belarus, Ukraine, and Armenia, among others. These states share a common historical background marked by centrally planned economies and are currently at different stages in their transition toward market-oriented systems.

Their institutional and legal frameworks tend to be characterized by ongoing reforms and persistent compliance challenges. Average insolvency resolution times are generally high, although with notable internal variation. In many cases, these countries exhibit partial institutional alignment with external powers such as the European Union or Russia, creating a gray zone between market-based regulation and state intervention. Moreover, bureaucratic inertia and fragmented legal structures continue to undermine the effectiveness and efficiency of insolvency proceedings. As a result, this group can be regarded as a hybrid institutional zone, where the incomplete nature of economic and legal transitions significantly hampers the capacity to manage business crises effectively.

5.5.2. Moderate Efficiency but Internal Heterogeneity (Community 2—India, Southern Africa, Some Arab Countries)

The countries in this community exhibit a moderate median resolution time of around two years; however, the range of values is extremely wide, indicating substantial internal variation. This internal institutional heterogeneity is notable, as it brings together countries like India and South Africa with others that have weaker or more fragmented systems. The group is marked by extreme diversity in institutional quality and high statistical dispersion, as reflected in the wide whiskers of the boxplot. These patterns suggest ongoing processes of institutional convergence, where some members are beginning to align with international standards, while others still face significant inefficiencies. This community embodies the tensions between progress and stagnation, underscoring the need for differentiated policy approaches within regional integration frameworks.

5.5.3. Systemically Low Efficiency: Fragile or Dysfunctional Institutions (Community 5—West Africa, Central Africa, North Korea, etc.)

This group shows a markedly low performance in insolvency resolution, with both average and maximum values frequently exceeding four years. This outcome reflects a combination of structural institutional weakness, the presence of internal conflicts, political instability, or failed governance, as well as collapsed or highly restricted judicial systems. In addition, these countries tend to be disconnected from the global trade network in terms of both legal and financial integration. As such, this community represents some of the greatest challenges to global economic integration and underscores the limitations of the trade network as an effective risk buffer in the absence of a solid institutional framework.

5.5.4. Atypical Case of High Institutional Quality but Low Relative Efficiency (Community 4—Switzerland)

Switzerland presents a unique case. Despite being one of the countries with the highest institutional quality in the world, its average insolvency resolution time is approximately three years, significantly longer than that of its counterparts in Western Europe or North America. This apparent anomaly can be explained by a more detailed and protective procedural design aimed at safeguarding creditors, a legal logic geared to maximizing long-term value rather than speed, and a legal culture that may favor out-of-court settlements or lengthy reorganization processes. This case illustrates that the efficiency of insolvency proceedings is not always directly correlated with overall institutional quality, highlighting the need for more qualitative research on legal design and cultural practices.

5.5.5. High Efficiency and Institutional Stability (Communities 1, 3, and 6—Developed and Advanced Emerging Countries)

These three communities, although geographically diverse, share a common characteristic: a high degree of institutionalism and efficiency in insolvency resolution. Community 1 includes countries in Northern and Western Europe as well as North America; Community 3 is composed of Southeast Asian states, developed countries in the Middle East, and some island nations with advanced legal systems; and Community 6 brings together strong emerging economies such as Mexico and Brazil with developed countries such as South Korea and Australia, resulting in consistently strong average results. In these communities, the average time to resolve insolvency ranges between 1.5 and 2 years, with low statistical dispersion, indicating procedural homogeneity. They are characterized by well-established insolvency frameworks, adequate technical and human resources, and a high capacity for regulatory adaptation and effective governance. Together, these groups represent a benchmark of institutional efficiency, providing a comparative standard for evaluating other communities.

As shown, the graph analysis enables a precise classification of countries based on patterns of business disruption and international trade. This facilitates a deeper understanding of how these processes affect countries with different structural and institutional profiles. This insight represents one of the key outcomes of our analysis, as it provides valuable information to predict, prevent, or at least better understand why severe financial problems emerge in specific national contexts.

5.6. Statistical Models

Let us explain in this section the results of the application of the usual statistical models. The variables used in this section are the five annual network centrality metrics (PageRank, degree, betweenness, closeness, and eigenvector centrality), calculated for 27 countries based on export data, and the corresponding annual number of corporate bankruptcies per country during 2015–2023. In order to assess whether the structural position of countries in the global trade network affects their economic performance in terms of business insolvencies, a network of international trade limited to 27 selected countries was reconstructed. From this network, five key centrality indicators were recalculated: PageRank, degree, betweenness, closeness, and eigenvector. We employ several techniques that provide complementary insights, contributing to a more comprehensive understanding of both the methodology and the results obtained. To ensure a clearer presentation of the findings, the results are explained in the following subsections separately.

5.6.1. Linear Regression Analysis

A linear regression was then performed to explore the relationship between these measures and the average annual number of bankruptcies between 2015 and 2023. The variance inflation factors of these indicators are shown in Table 7.

Table 7.

Variance inflation factors (VIFs) of the centrality indicators.

The multicollinearity analysis through VIF shows acceptable values (all under five), indicating that the variables are not highly correlated with each other. However, in general, the results of the model are not interesting due to the bad rates obtained for the control parameters.

The OLS regression (Ordinary least Squares) on the logarithmic transformation of bankruptcy counts (Table 8) reveals several notable relationships between network centrality measures and the intensity of corporate failures. Among the five predictors, eigenvector centrality exhibits the strongest positive association with the number of bankruptcies, with a statistically significant coefficient of 0.822 (p < 0.001). This suggests that countries more embedded in influential trade positions (as captured by their connectivity to other central nodes) tend to experience higher levels of bankruptcy.

Table 8.

OLS regression on log(1 + bankruptcies).

Conversely, both PageRank and degree centrality display significant negative coefficients (–0.280 and –0.682, respectively), indicating that more influential or better-connected countries in terms of trade flow may actually face fewer bankruptcies once we control for other network characteristics. This apparent contradiction with eigenvector centrality may reflect the fact that not all forms of centrality contribute equally to systemic risk: while degree and PageRank emphasize quantity and recursive importance, eigenvector centrality may also capture exposure to vulnerable partners.

Other variables such as betweenness and closeness centrality are not statistically significant, suggesting a limited role in explaining bankruptcy variation in this context. The adjusted value of 0.152, though modest, confirms that network structure does offer meaningful explanatory power over corporate failure patterns, especially when nonlinear distortions are addressed via logarithmic transformation.

The results obtained from the OLS model, which incorporates all standardized centrality measures as predictors, are not particularly conclusive. The coefficient of determination () is only 0.048, meaning that just 4.8% of the variance in the average bankruptcy rate is explained by the model. This low value reflects a weak global relationship between trade network centrality and insolvency rates.

Among the individual variables, only degree centrality shows a statistically significant relationship, with a negative coefficient of –0.2993 and a p-value of 0.008. This suggests that countries with more direct trade connections tend to experience lower bankruptcy rates, possibly due to greater resilience or better diversification of economic risks. However, the other variables (PageRank, betweenness, closeness, and eigenvector centrality) do not reach statistical significance at the 5% level. Some of these show potentially interesting tendencies; for example, closeness centrality has a positive coefficient, which might imply that countries with more direct access to others in the network are more vulnerable to contagion or external shocks. Nonetheless, these patterns are speculative, as the lack of statistical significance prevents drawing firm conclusions.

Overall, the model’s limited explanatory power and the absence of consistent effects across most variables indicate that it is not possible to extract robust or generalizable conclusions from these results. While degree centrality offers a modest insight, the broader relationship between trade network position and insolvency risk appears to be more complex and likely influenced by nonlinear or unobserved factors not captured in this linear model.

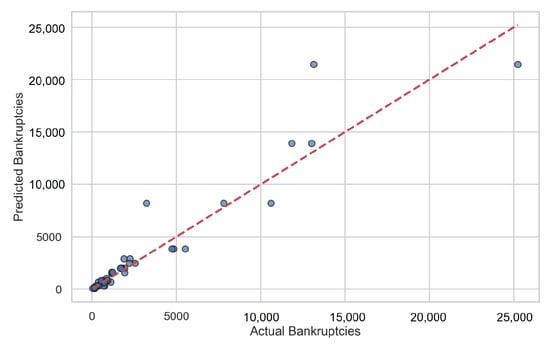

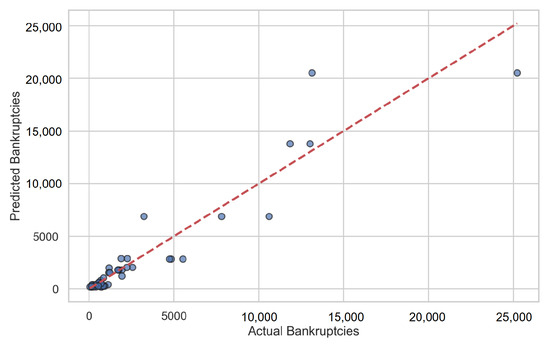

5.6.2. Model Comparison: Random Forest vs. Neural Network

The next step in our analysis consists of comparing two well-known AI techniques. The first is random forest, a decision-tree-based ensemble method known for its robustness and interpretability when dealing with structured data. The second is a neural network, which is widely recognized for its ability to capture complex nonlinear relationships and is particularly effective at detecting subtle patterns within the data. Through the comparative study between the traditional random forest model and the neural network model, it has been found that both models exhibit good convergence. Compared to the neural network, the random forest model has a slight edge in terms of overall performance (see Table 9 and Figure 11 and Figure 12).

Table 9.

Performance and feature importance comparison.

Figure 11.

Actual vs. predicted bankruptcies (random forest).

Figure 12.

Actual vs. predicted bankruptcies (neural network).

The MAE (Mean Absolute Error) and MSE (Mean Squared Error) are common evaluation metrics in regression problems. The smaller these values, the less the discrepancy between the model’s predictions and the actual values, implying a better predictive performance of the model. In this case, smaller MAE and MSE values usually indicate that the model fits the data better. As for the index (the coefficient of determination), both models show a similar performance. The of the random forest model is and that of the neural network is This suggests that, although random forest has a slight advantage in terms of precision, both models achieve a very high prediction rate, considering only the network connections as explanatory variables. In the comparison of feature importance, both random forest and the neural network identify “PageRank” and “Eigenvector” as the most important features, although the importance of these features is slightly lower in the neural network. Furthermore, it is interesting to observe that the feature “Betweenness” has almost no influence in the random forest model, whereas in the neural network model, it shows some importance . This could indicate the existence of complex nonlinear relationships that the neural network is better able to capture.

5.6.3. Moran’s Index

To explore the geographical patterns and clustering of corporate bankruptcies, we conducted a spatial autocorrelation analysis using both the indices Global Moran’s I and Local Moran’s I. The analysis covered the period from 2015 to 2023, based on annual bankruptcy data across 27 countries and regions.

To define spatial relationships, we used two types of spatial weight matrices. For the global analysis, we used a k-nearest neighbors (KNNs) approach with , which provides a robust structure particularly suited for datasets with geographical outliers or non-contiguous regions. For comparison, we also constructed a weights matrix using the queen contiguity criterion, where countries are considered neighbors if they share at least one vertex or edge. The spatial polygons used for this purpose were obtained from the Natural Earth Admin 0—Countries shapefile at 1:110 m resolution, a widely used and standardized source for global geopolitical boundaries [41]. All spatial weight matrices were row standardized before applying spatial statistics.

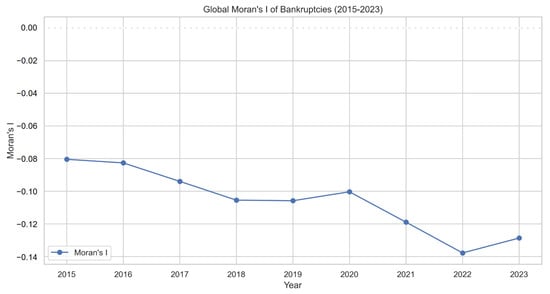

Global Moran’s I Analysis

We computed the Global Moran’s I for each year. A positive Global Moran’s I indicates spatial clustering, while a negative value suggests spatial dispersion. The results associated with this analysis are presented in Figure 13 and Table A1, which summarize the yearly evolution of global spatial autocorrelation in corporate bankruptcy rates.

Figure 13.

Global Moran’s I of bankruptcies (2015–2023).

During the period 2015–2023, the values of the Global Moran’s I were predominantly negative, indicating a general trend of spatial heterogeneity in bankruptcy distribution. This suggests that, under normal conditions, bankruptcy patterns tend to be spatially independent, with limited diffusion of insolvency risk between neighboring countries. In 2022 and 2023, the p-values dropped below 0.05 and the z-statistics were notably high, confirming that the observed negative spatial correlation was statistically significant. The temporal evolution of Moran’s I shows a sharp decline from 2020 to 2022, with a modest recovery in 2023—likely reflecting the effects of global disruptions such as the COVID-19 pandemic, supply chain issues, and geopolitical shifts.

While in stable periods, bankruptcies are mainly driven by national factors, during crises, differences between countries intensify due to structural divergences in policy, industry, and institutions. This leads to greater spatial dispersion and a more negative Moran’s I, emphasizing the growing heterogeneity of financial vulnerability internationally.

Local Moran’s I Analysis

To better capture the nuanced spatial structure of corporate bankruptcies across countries, we calculate the Local Moran’s I rather than rely solely on its global counterpart. In small country samples, global measures may miss local clustering and cross-border risk transmission. The Local Moran’s I captures these patterns, making it suitable for analyzing regional vulnerabilities shaped by trade and policy ties.

Three countries (Hong Kong, Singapore, and Iceland) were excluded from the Local Moran’s I computation due to their absence in the shapefile used. Their exclusion resulted from missing polygon data or naming mismatches that prevented integration into the spatial weight matrix. These compact and economically distinctive nations warrant separate treatment in future studies using higher-resolution data or network-based proximity measures. At the national level, Local Moran’s I values from 2015 to 2023 reveal a coexistence of spatial clustering and heterogeneity. Countries like Australia, Finland, and Belgium consistently show positive autocorrelation, forming high–high or low–low clusters. Others (such as Japan, Denmark, and the Netherlands) show values near zero, indicating low spatial dependence. In contrast, China, the United States, and Switzerland exhibit persistently negative values, diverging from their neighbors’ trends. These outliers likely reflect unique institutional settings, economic structures, or distinct exposure to global shocks.