Pricing in the Sharing Economy—A Hybrid Approach Leveraging Econometrics, Machine Learning, and Artificial Intelligence

Abstract

1. Introduction

2. Theoretical Background

3. Literature Review

4. Data and Design

5. Empirical Results

6. Machine Learning Analysis

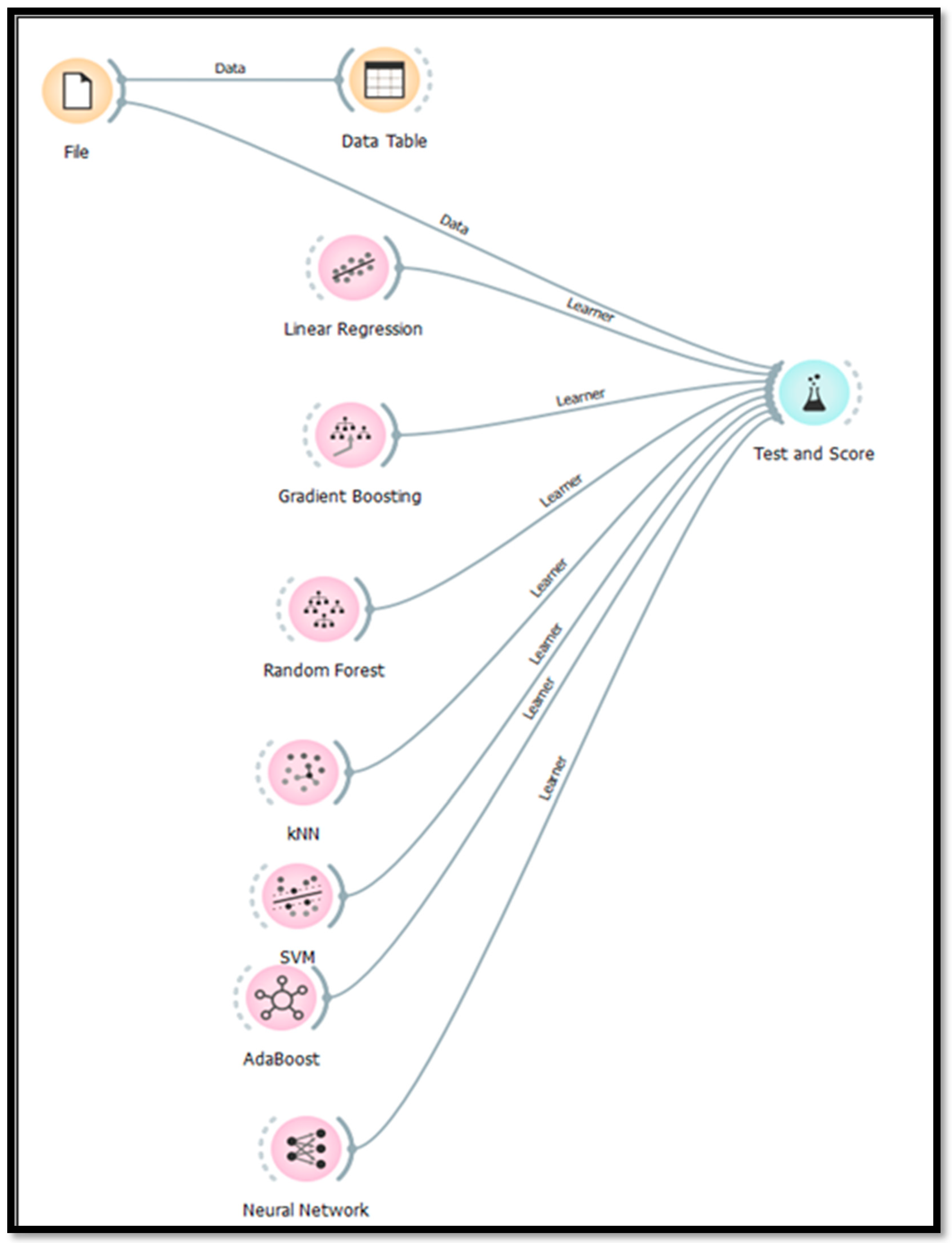

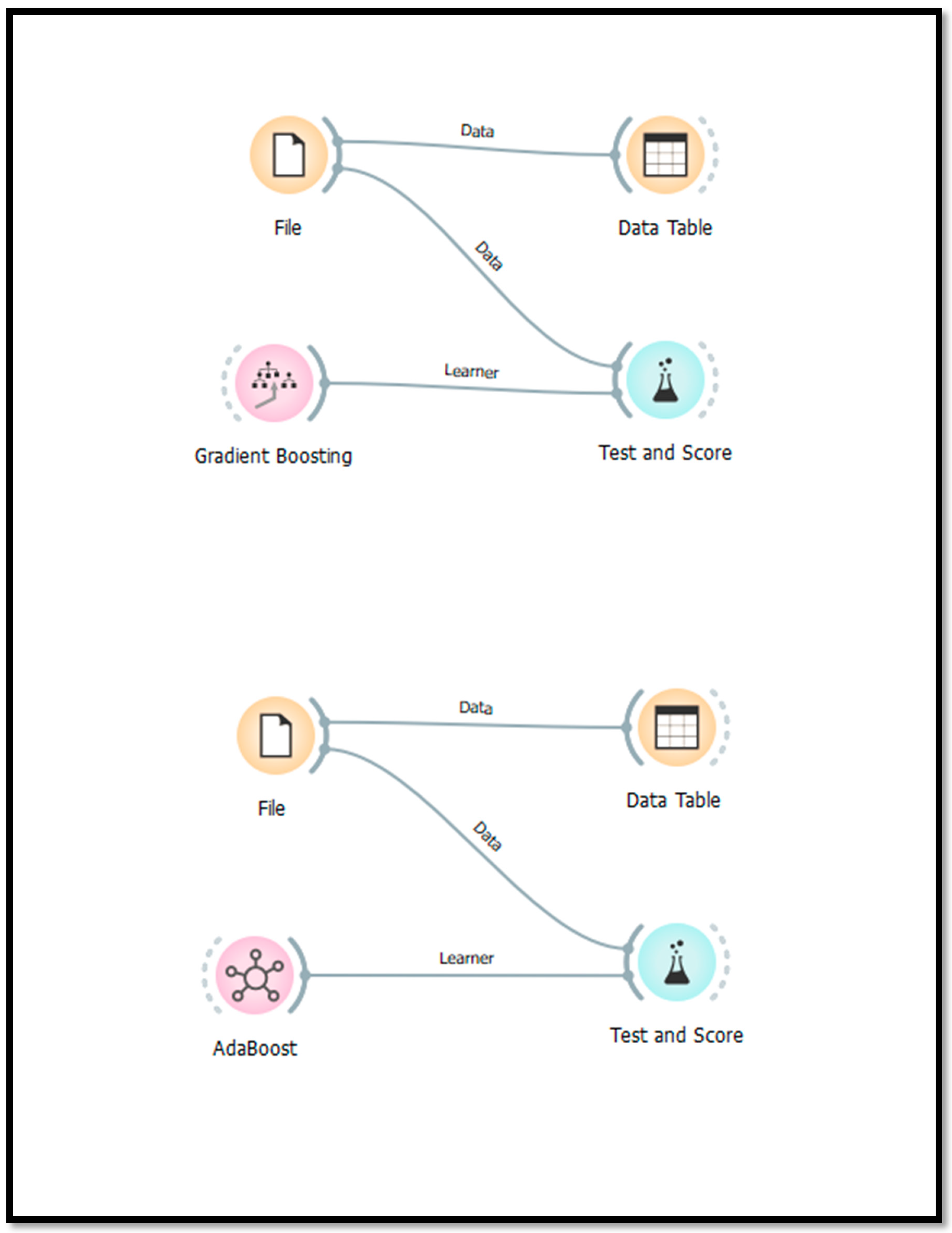

6.1. Design Process

6.2. Machine Learning Analysis Empirical Results

7. Conclusions—Discussion

Author Contributions

Funding

Institutional Review Board Statement

Data Availability Statement

Conflicts of Interest

References

- Xiao, B.; Lee, Y.; Lim, K.; Tan, C.-W. The sharing economy: Promises and challenges. Internet Res. 2019, 29, 993–995. [Google Scholar] [CrossRef]

- Görög, G. The definitions of sharing economy: A systematic literature review. Management 2018, 13, 175–189. [Google Scholar] [CrossRef]

- Guttentag, D. Progress on Airbnb: A literature review. J. Hosp. Tour. Technol. 2019, 10, 814–844. [Google Scholar] [CrossRef]

- Li, J.; Moreno, A.; Zhang, D. Agent behavior in the sharing economy: Evidence from Airbnb. SSRN Electron. J. 2015, 1298, 10–2139. [Google Scholar] [CrossRef]

- Abrate, G.; Sainaghi, R.; Mauri, A. Dynamic pricing in Airbnb: Individual versus professional hosts. J. Bus. Res. 2022, 141, 191–199. [Google Scholar] [CrossRef]

- Lutz, C.; Newlands, G. Choice and Discrimination in the Sharing Economy. SSRN Electron. J. 2018. [Google Scholar] [CrossRef]

- Lee, T.H.; Crompton, J. Measuring novelty seeking in tourism. Ann. Tour. Res. 1992, 19, 732–751. [Google Scholar] [CrossRef]

- Reinhold, S.; Dolnicar, S. Chapter 4–How Airbnb Creates Value. In Peer-to-Peer Accommodation Networks: Pushing the Boundaries; Dolnicar, S., Ed.; Goodfellow Publishers: Oxford, UK, 2017; pp. 39–53. [Google Scholar]

- Hati, S.R.; Balqiah, T.E.; Hananto, A.; Yuliati, E. A decade of systematic literature review on Airbnb: The sharing economy from a multiple stakeholder perspective. Heliyon 2021, 7, e08222. [Google Scholar] [CrossRef]

- Basuroy, S.; Kim, Y.; Proserpio, D. Sleeping with Strangers: Estimating the Impact of Airbnb on the Local Economy. In Proceedings of the AMA Educators Proceedings, San Diego, CA, USA, 14–16 February 2020. [Google Scholar]

- Yang, Y.; Nieto-Garcia, M.; Viglia, G.; Nicolau, J.L. Competitors or complements: A meta-analysis of the effect of Airbnb on hotel performance. J. Travel Res. 2021, 61, 1508–1527. [Google Scholar] [CrossRef]

- Chaudhary, A. Effects of Airbnb on the Housing Market: Evidence from London. SSRN Electron. J. 2021, 10. [Google Scholar] [CrossRef]

- Franco, S.F.; Santos, C.D.; Longo, R.S. The impact of Airbnb on residential property values and rents: Evidence from Portugal. Reg. Sci. Urban Econ. 2021, 88, 103667. [Google Scholar] [CrossRef]

- Thackway, W.; Kok, M.; Lee, C.; Shi, V.; Pettit, C. Spatial variability of the “Airbnb effect”: A spatially explicit analysis of Airbnb’s impact on housing prices in Sydney. ISPRS Int. J. Geo-Inf. 2022, 11, 65. [Google Scholar] [CrossRef]

- Garcia-López, M.; Jofre-Monseny, J.; Martínez-Mazza, R.; Segu, M. Do short-term rental platforms affect housing markets? Evidence from Airbnb in Barcelona. J. Urban Econ. 2020, 119, 103278. [Google Scholar] [CrossRef]

- Barron, K.; Kung, E.; Proserpio, D. The effect of home-sharing on house prices and rents: Evidence from Airbnb. Mark. Sci. 2021, 40, 23–47. [Google Scholar] [CrossRef]

- Ekeroma, J.E. The Airbnb phenomenon: A Qualitative Analysis of Its Consequences on Urban Housing Markets. Preprints 2023. [Google Scholar] [CrossRef]

- Svensson, S.; Thelander, Å. Governing Airbnb: A comparative analysis of regulatory strategies in European cities. Tour. Plan. Dev. 2020, 17, 417–433. [Google Scholar]

- Gubler, Z.J. The challenges of regulating Airbnb. Fordham Urban Law J. 2021, 48, 437–478. [Google Scholar]

- OECD. Regulation of Short-Term Rentals: Evidence and Considerations; OECD Publishing: Paris, France, 2022. [Google Scholar]

- Andreu, L.; Bigne, E.; Amaro, S.; Palomo, J. Airbnb research: An analysis in tourism and hospitality journals. Int. J. Cult. Tour. Hosp. Res. 2020, 14, 2–20. [Google Scholar] [CrossRef]

- Lorde, T.; Jacob, J.; Weekes, Q. Price-setting behavior in a tourism sharing economy accommodation market: A hedonic price analysis of AirBnB hosts in the caribbean. Tour. Manag. Perspect. 2019, 30, 251–261. [Google Scholar] [CrossRef]

- Tong, B.; Gunter, U. Hedonic pricing and the sharing economy: How profile characteristics affect Airbnb accommodation prices in Barcelona, Madrid, and Seville. Curr. Issues Tour. 2022, 25, 3309–3328. [Google Scholar] [CrossRef]

- Toader, V.; Negrușa, A.L.; Bode, O.R.; Rus, R.V. Analysis of price determinants in the case of Airbnb listings. Econ. Res.-Ekon. Istraživanja 2022, 35, 2493–2509. [Google Scholar] [CrossRef]

- Visser, G.; Erasmus, I.; Miller, M. Airbnb: The emergence of a new accommodation type in Cape Town, South Africa. Tour. Rev. Int. 2017, 21, 151–168. [Google Scholar] [CrossRef]

- Perez-Sanchez, V.R.; Serrano-Estrada, L.; Marti, P.; Mora-Garcia, R.-T. The what, where, and why of Airbnb price determinants. Sustainability 2018, 10, 4596. [Google Scholar] [CrossRef]

- Phua, V.C. Perceiving Airbnb as sharing economy: The issue of trust in using Airbnb. Curr. Issues Tour. 2018, 22, 2051–2055. [Google Scholar] [CrossRef]

- Mao, Z.; Wei, W. Sleeping in a stranger’s home: A trust formation model for Airbnb. J. Hosp. Tour. Manag. 2019, 42, 67–76. [Google Scholar] [CrossRef]

- Farmaki, A.; Kaniadakis, A. Power dynamics in peer-to-peer accommodation: Insights from Airbnb hosts. Int. J. Hosp. Manag. 2020, 89, 102571. [Google Scholar] [CrossRef] [PubMed]

- Chen, Y.; Xie, K.L. Consumer valuation of Airbnb listings: A hedonic pricing approach. Int. J. Contemp. Hosp. Manag. 2017, 29, 2405–2424. [Google Scholar] [CrossRef]

- Wang, D.; Nicolau, J.L. Price determinants of sharing economy-based accommodation rental: A study of listings from 33 cities on Airbnb.com. Int. J. Hosp. Manag. 2017, 62, 120–131. [Google Scholar] [CrossRef]

- Ert, E.; Fleischer, A.; Magen, N. Trust and reputation in the sharing economy: The role of personal photos on Airbnb. Tour. Manag. 2016, 55, 62–73. [Google Scholar] [CrossRef]

- Gunter, U.; Önder, I. Determinants of Airbnb demand in Vienna and their implications for the traditional accommodation industry. Tour. Econ. 2018, 24, 270–293. [Google Scholar] [CrossRef]

- Liang, S.; Schuckert, M.; Law, R.; Chen, C. Be a “Superhost”: The importance of badge systems for peer-to-peer rental accommodations. Tour. Manag. 2017, 60, 454–465. [Google Scholar] [CrossRef]

- Zhang, C. Home sharing economy: Reputation badge and hosts competition. SSRN Electron. J. 2018. [Google Scholar] [CrossRef]

- Berentsen, A.; Rojas Breu, M.; Waller, C. What is the value of being a superhost? In Proceedings of the 68th Annual Meeting of the French Economic Association 2019, Orléans, France, 17–19 June 2019.

- Zhang, S.; Lee, D.; Singh, P.V.; Srinivasan, K. What makes a good image? Airbnb demand analytics leveraging interpretable image features. Manag. Sci. 2022, 68, 5644–5666. [Google Scholar] [CrossRef]

- Kisieliauskas, J. Host-related factors influencing airbnb prices in rural areas. Manag. Theory Stud. Rural Bus. Infrastruct. Dev. 2024, 45, 379–389. [Google Scholar] [CrossRef]

- Gutt, D.; Herrmann, P. Sharing Means Caring? Hosts’ Price Reaction to Rating Visibility. In Proceedings of the European Conference on Information Systems, Münster, Germany, 26–29 May 2015; Research-in-Progress Papers. p. 54. [Google Scholar]

- Zervas, G.; Proserpio, D.; Byers, J.W. The rise of the sharing economy: Estimating the impact of Airbnb on the hotel industry. J. Mark. Res. 2017, 54, 687–705. [Google Scholar] [CrossRef]

- Mulshine, K. The dynamics of rating platforms: Evidence from Yelp. J. Ind. Econ. 2015, 63, 437–469. [Google Scholar]

- Gibbs, C.; Guttentag, D.; Gretzel, U.; Morton, J.; Goodwill, A. Pricing in the sharing economy: A hedonic pricing model applied to Airbnb listings. J. Travel Tour. Mark. 2018, 35, 46–56. [Google Scholar] [CrossRef]

- Abrate, G.; Viglia, G. Personal or product reputation? Optimizing revenues in the sharing economy. J. Travel Res. 2019, 58, 136–148. [Google Scholar] [CrossRef]

- Magno, F.; Cassia, F.; Ugolini, M.M. Accommodation prices on Airbnb: Effects of host experience and market demand. TQM J. 2018, 30, 608–620. [Google Scholar] [CrossRef]

- Lawani, A.; Reed, M.R.; Mark, T.; Zheng, Y. Reviews and price on online platforms: Evidence from sentiment analysis of Airbnb reviews in Boston. Reg. Sci. Urban Econ. 2019, 75, 22–34. [Google Scholar] [CrossRef]

- Dogru, T.; Pekin, O. What Do Guests Value Most in Airbnb Accommodations? An Application of the Hedonic Pricing Approach; Boston Hospitality Review: Boston, MA, USA, 2017. [Google Scholar]

- Xie, K.; Mao, Z. The impacts of quality and quantity attributes of Airbnb hosts on listing performance. Int. J. Contemp. Hosp. Manag. 2017, 29, 2240–2260. [Google Scholar] [CrossRef]

- Zhang, Z.; Chen, R.; Han, L.; Yang, L. Key factors affecting the price of Airbnb listings: A geographically weighted approach. Sustainability 2017, 9, 1635. [Google Scholar] [CrossRef]

- He, J.; Li, B.; Shane Wang, X. Image features and demand in the sharing economy: A study of Airbnb. Int. J. Res. Mark. 2023, 40, 760–780. [Google Scholar] [CrossRef]

- Hu, M.; Lin, L.; Liu, M.; Ma, S. Images’ features and Airbnb listing price: The mediation effect of visual aesthetic perception. Tour. Rev. 2023, 79, 5. [Google Scholar] [CrossRef]

- Kirkos, E. Airbnb listings’ performance: Determinants and predictive models. Eur. J. Tour. Res. 2022, 30, 3012. [Google Scholar] [CrossRef]

- Rubin, D.B. Multiple Imputation after 18+ Years. J. Am. Stat. Assoc. 1996, 91, 473–489. [Google Scholar] [CrossRef]

- Schafer, J.L. Analysis of Incomplete Multivariate Data; CRC Press: Boca Raton, FL, USA, 1997. [Google Scholar]

- Rosen, S. Hedonic Prices and Implicit Markets: Product Differentiation in Pure Competition. J. Political Econ. 1974, 82, 34–55. [Google Scholar] [CrossRef]

- Li, H.; Simchi-Levi, D.; Wu, M.X.; Zhu, W. Estimating and exploiting the impact of photo layout: A structural approach. Manag. Sci. 2022, 69, 5209–5233. [Google Scholar] [CrossRef]

- Babii, A.; Ghysels, E.; Striaukas, J. Econometrics of Machine Learning Methods in Economic Forecasting. arXiv 2023, arXiv:2308.10993. [Google Scholar] [CrossRef]

- Athey, S. The impact of machine learning on economics. In The Economics of Artificial Intelligence: An Agenda; University of Chicago Press: Chicago, IL, USA, 2018; pp. 1–32. [Google Scholar]

- Zapata, H.O.; Mukhopadhyay, S. A Bibliometric Analysis of Machine Learning Econometrics in Asset Pricing. J. Risk Financ. Manag. 2022, 15, 535. [Google Scholar] [CrossRef]

| Variable | Representation | Min | Mean | Max | Std. Dev. | Description |

|---|---|---|---|---|---|---|

| Natural logarithm of listing’s daily price | LNPRICE | 0.130 | 4.193 | 8.996 | 0.6170 | Continuous variable |

| Days since host registered | DAYS | 6.000 | 2198.808 | 4932.000 | 977.3948 | Continuous variable |

| Host’s response | R_1_H | 0.000 | 0.863 | 1.000 | 0.3445 | Dummy variable = 1 if host responds within 1 h |

| Host’s acceptance rate (%) | ACC_R | 0.000 | 0.947 | 1.000 | 0.1600 | Continuous variable |

| Superhost status | SUPER | 0.000 | 0.496 | 1.000 | 0.5001 | Dummy variable = 1 if host is Superhost |

| Number of listings from the same host | LIST | 1.000 | 13.584 | 329.000 | 32.1200 | Continuous variable |

| Listing’s location | DOWNTOWN | 0.000 | 0.812 | 1.000 | 0.3912 | Dummy variable = 1 for listings in downtown Thessaloniki |

| Listing type | ENTIRE | 0.000 | 0.958 | 1.000 | 0.2018 | Dummy variable = 1 for entire homes |

| Maximum capacity of the listing | ACCOM | 1.000 | 3. | 16.00 | 1.9364 | Continuous variable |

| Minimum number of night stay for the listing | NIGHTS | 1.000 | 2.283 | 59.000 | 3.0357 | Continuous variable |

| Whether the guest can automatically book the listing without the host requiring accepting their booking request | INSTANT | 0.000 | 0.571 | 1.000 | 0.4951 | Dummy variable = 1 if the listing is instantly bookable |

| Total number of reviews of the listing | REVIEWS | 0.000 | 79.888 | 741.000 | 102.9775 | Continuous variable |

| Review score | REVIEW_SCORE | 0.000 | 4.704 | 5.000 | 0.6322 | Continuous variable |

| AI main photo score | AI_SCORE | 0.120 | 0.387 | 0.870 | 0.1445 | Continuous variable |

| Natural logarithm of main photo file size | FILE_SIZE | 9.612 | 12.232 | 14.705 | 0.9646 | Continuous variable |

| Variables | ACC_R | ACCOM | DAYS | ENTIRE | AI_SCORE | FILE_SIZE | INSTANT | LIST | NIGHTS | LNPRICE | R_1_H | REVIEWS | REVIEW_ SCORE | DOWNTOWN | SUPER |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ACC_R | 1.0000 | ||||||||||||||

| ACCOM | 0.0032 | 1.0000 | |||||||||||||

| DAYS | −0.0749 | 0.0535 | 1.0000 | ||||||||||||

| ENTIRE | 0.1446 | 0.1934 | 0.0747 | 1.0000 | |||||||||||

| AI_SCORE | 0.1186 | 0.0215 | −0.0259 | 0.0938 | 1.0000 | ||||||||||

| FILE_SIZE | 0.0986 | −0.0128 | −0.1850 | −0.0912 | 0.1075 | 1.0000 | |||||||||

| INSTANT | 0.3015 | −0.0062 | −0.0718 | 0.0676 | 0.1486 | 0.0605 | 1.0000 | ||||||||

| LIST | 0.0659 | −0.0036 | 0.0450 | 0.0230 | 0.1434 | −0.0446 | 0.2249 | 1.0000 | |||||||

| NIGHTS | −0.0323 | −0.0507 | 0.1267 | −0.0147 | −0.0738 | −0.0211 | −0.1286 | −0.0666 | 1.0000 | ||||||

| LNPRICE | 0.0576 | 0.4733 | 0.0145 | 0.2455 | 0.1331 | 0.0332 | 0.1008 | 0.1331 | −0.0710 | 1.0000 | |||||

| R_1_H | 0.3193 | 0.0018 | 0.0300 | 0.1246 | 0.1069 | −0.0526 | 0.2490 | 0.1239 | −0.1154 | 0.0209 | 1.0000 | ||||

| REVIEWS | 0.1414 | 0.0266 | 0.2934 | 0.0946 | 0.0084 | −0.1675 | 0.0798 | −0.0432 | −0.1010 | −0.0852 | 0.1645 | 1.0000 | |||

| REVIEW_SCORE | 0.1144 | 0.0311 | 0.1311 | 0.0441 | 0.0286 | 0.0234 | −0.0751 | −0.1823 | 0.0052 | 0.0093 | 0.0215 | 0.1325 | 1.0000 | ||

| DOWNTOWN | 0.0230 | 0.0016 | 0.0746 | 0.0696 | 0.0673 | −0.0918 | 0.0854 | 0.0845 | −0.0760 | 0.1975 | 0.0414 | 0.1641 | −0.0002 | 1.0000 | |

| SUPER | 0.1950 | 0.0734 | 0.1133 | 0.1297 | 0.0622 | −0.0345 | −0.0302 | −0.0748 | −0.0093 | 0.0919 | 0.1609 | 0.2337 | 0.2370 | 0.0716 | 1.0000 |

| Variable | Coefficient | Std. Error |

|---|---|---|

| CONS | 2.501 *** | 0.216 |

| DAYS | 0.00 | 0.00 |

| R_1_H | −0.056 | 0.042 |

| ACC_R | 0.052 | 0.079 |

| SUPER | 0.084 *** | 0.023 |

| LIST | 0.002 *** | 0.001 |

| DOWNTOWN | 0.301 *** | 0.028 |

| ENTIRE | 0.439 *** | 0.089 |

| ACCOM | 0.141 *** | 0.006 |

| NIGHTS | −0.007 | 0.008 |

| INSTANT | 0.076 *** | 0.026 |

| REVIEWS | −0.001 *** | 0.000 |

| REVIEW_SCORE | 0.010 | 0.000 |

| AI_SCORE | 0.289 *** | 0.078 |

| FILE_SIZE | 0.025 ** | 0.013 |

| Model | Mean Squared Error (MSE) | Root Mean Squared Error (RMSE) | Mean Absolute Error (MAE) | Mean Absolute Percentage Error (MAPE) | R-Squared (R2) |

|---|---|---|---|---|---|

| Linear Regression | 0.242 | 0.491 | 0.355 | 0.092 | 0.305 |

| Gradient Boosting | 0.220 | 0.469 | 0.336 | 0.088 | 0.368 |

| Random Forest | 0.240 | 0.490 | 0.355 | 0.093 | 0.309 |

| kNN | 0.365 | 0.604 | 0.448 | 0.117 | −0.050 |

| SVM | 0.321 | 0.566 | 0.421 | 0.107 | 0.077 |

| AdaBoost | 0.217 | 0.466 | 0.324 | 0.084 | 0.374 |

| Neural Network | 0.238 | 0.488 | 0.352 | 0.091 | 0.315 |

| Model | Mean Squared Error (MSE) | Root Mean Squared Error (RMSE) | Mean Absolute Error (MAE) | Mean Absolute Percentage Error (MAPE) | R-Squared (R2) |

|---|---|---|---|---|---|

| Linear Regression | 0.242 | 0.491 | 0.355 | 0.092 | 0.305 |

| Gradient Boosting | 0.216 | 0.464 | 0.330 | 0.086 | 0.379 |

| Random Forest | 0.240 | 0.490 | 0.355 | 0.093 | 0.309 |

| kNN | 0.365 | 0.604 | 0.448 | 0.117 | −0.050 |

| SVM | 0.321 | 0.566 | 0.421 | 0.107 | 0.077 |

| AdaBoost | 0.212 | 0.460 | 0.320 | 0.083 | 0.391 |

| Neural Network | 0.238 | 0.488 | 0.352 | 0.091 | 0.315 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Vezyroglou, K.; Siokis, F. Pricing in the Sharing Economy—A Hybrid Approach Leveraging Econometrics, Machine Learning, and Artificial Intelligence. Information 2025, 16, 450. https://doi.org/10.3390/info16060450

Vezyroglou K, Siokis F. Pricing in the Sharing Economy—A Hybrid Approach Leveraging Econometrics, Machine Learning, and Artificial Intelligence. Information. 2025; 16(6):450. https://doi.org/10.3390/info16060450

Chicago/Turabian StyleVezyroglou, Kornilios, and Fotios Siokis. 2025. "Pricing in the Sharing Economy—A Hybrid Approach Leveraging Econometrics, Machine Learning, and Artificial Intelligence" Information 16, no. 6: 450. https://doi.org/10.3390/info16060450

APA StyleVezyroglou, K., & Siokis, F. (2025). Pricing in the Sharing Economy—A Hybrid Approach Leveraging Econometrics, Machine Learning, and Artificial Intelligence. Information, 16(6), 450. https://doi.org/10.3390/info16060450