Techno-Economic Analysis of Multi-Purpose Heavy-Lift Vessels Using Methanol as Fuel

Abstract

1. Introduction

1.1. Background

1.2. Literature Review

1.3. Challenges and Research Gaps

1.4. Objectives and Innovations

2. Methodology

2.1. Technical Analysis Methods

2.2. Economic Analysis Methods

- (a)

- Annual Fuel Procurement Cost

- (b)

- Carbon allowances Under the EU ETS (Until 2027)

- (c)

- FuelEU Maritime GHG Intensity Penalties (From 2025)

- (d)

- IMO Net-Zero Framework Compliance Costs (From 2028)

- (e)

- Total Cost Calculation

2.3. Data Sources and Processing Methods

2.3.1. Data Sources

2.3.2. Data Processing Methods

3. Results and Discussion

3.1. Technical Analysis Results

3.2. Results of Economic Analysis

3.3. Limitations of This Study

3.3.1. Limitations in Technical Analysis

3.3.2. Limitations in Economic Analysis

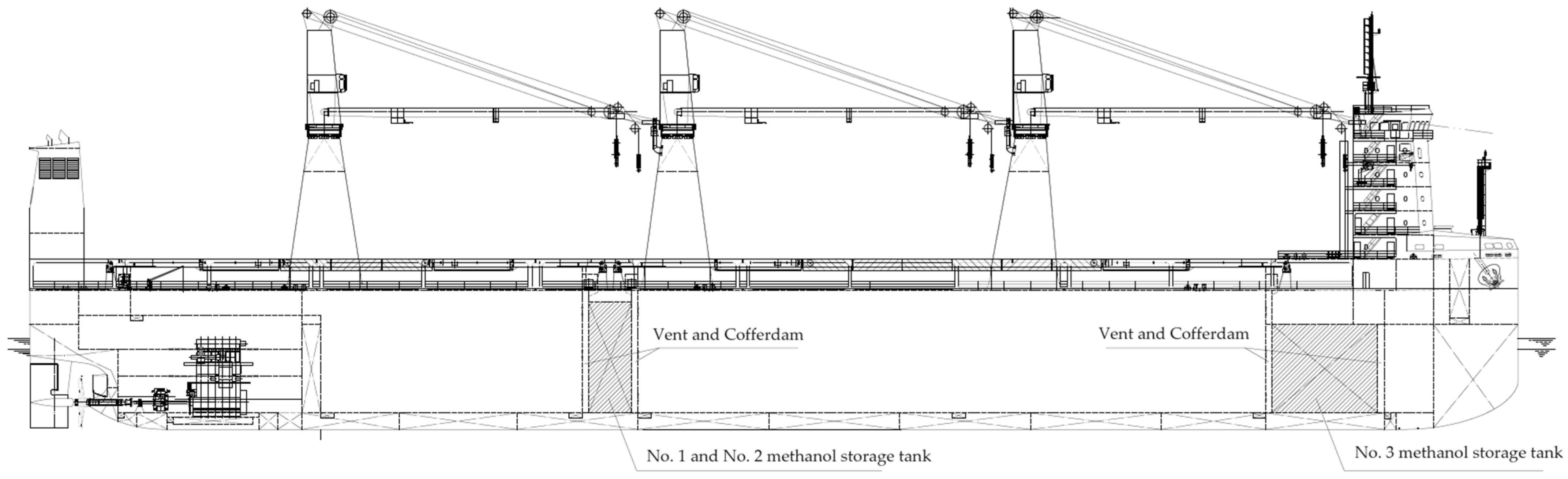

4. Case Study of a Methanol-Fueled MPHLV

4.1. Traditional Fuel Power System

4.2. Methanol-Fueled Main and Auxiliary Power Unit

4.3. Methanol Fuel Tank Design

4.4. Methanol Auxiliary System Configuration

5. Conclusions

5.1. Summary of Main Findings

5.2. Application Prospects of Methanol Fuel in MPHLVs

5.3. Research Limitations and Future Research Directions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| BCT | Base Compliance Target |

| CAPEX | Capital Expenditures |

| CF | Carbon Conversion Factor |

| CII | Carbon Intensity Indicator |

| CSIC | China Shipbuilding Industry Corporation |

| CSR | Continuous Service Rating |

| CSSC | China State Shipbuilding Corporation |

| DCT | Direct Compliance Target |

| DWT | Deadweight Tonnage |

| ECA | Emission Control Area |

| EEA | European Economic Area |

| EEDI | Energy Efficiency Design Index |

| EEOI | Energy Efficiency Operational Indicator |

| EEXI | Energy Efficiency Existing Ship Index |

| EGR | Exhaust Gas Recirculation |

| EU | European Union |

| EU ETS | European Union Emissions Trading System |

| GFI | GHG Fuel Intensity |

| GHG | Greenhouse Gas |

| GHGIE | GHG Intensity of the Energy |

| IACS | International Association of Classification Societies |

| IGF Code | International Code of Safety for Ships Using Gases or Other Low-Flashpoint Fuels |

| IMO | International Maritime Organization |

| LCV | Lower Calorific Value of Fuel |

| LFO | Low-Sulfur Fuel Oil |

| MDO | Marine Diesel Oil |

| ME | Main Engine |

| MEPC | Marine Environment Protection Committee |

| MGO | Marine Gas Oil |

| MPHLVs | Multi-Purpose Heavy-Lift Vessels |

| MRV | Monitoring, Reporting and Verification |

| OEM | Original Equipment Manufacturer |

| OPEX | Operational Expenditures |

| OPS | Onshore Power Supply |

| ROC | Records of Fuel Oil Consumption |

| SCR | Selective Catalytic Reduction |

| SEEMP | Ship Energy Efficiency Management Plan |

| SMCR | Specified Maximum Continuous Rating |

| SUs | Surplus Units |

| TEA | Techno-Economic Analysis |

| VLSFO | Very Low Sulfur Fuel Oil |

| WTW | Well-To-Wake |

References

- Sun, Z.; Xi, Y.; Shi, B.; Liu, J. Dynamic State Equations and Distributed Blockchain Control: A Differential Game Model for Optimal Emission Trajectories in Shipping Networks. Symmetry 2025, 17, 817. [Google Scholar] [CrossRef]

- Xing, H.; Spence, S.; Chen, H. A comprehensive review on countermeasures for CO2 emissions from ships. Renew. Sustain. Energy Rev. 2020, 134, 110222. [Google Scholar] [CrossRef]

- Heydari, D. Walmart’s Dirty Shipping Problem. 23 March 2022. Available online: https://www.pacificenvironment.org/walmart-dirty-shipping/ (accessed on 18 June 2025).

- Xiao, J.; Shuai, J.; Deng, W.; Liu, L.; Wang, P.; Li, L. Low-Carbon and Green Materials in Construction: Latest Advances and Prospects. Buildings 2025, 15, 1508. [Google Scholar] [CrossRef]

- Díaz-Secades, L.A. Enhancement of Maritime Sector Decarbonization through the Integration of Fishing Vessels into IMO Energy Efficiency Measures. J. Mar. Sci. Eng. 2024, 12, 663. [Google Scholar] [CrossRef]

- Zhang, J.; Zhang, Z.; Liu, D. Optimization of Carbon Emission Reduction Investment for Replacement Fuel Ships Based on the Shipowners’ Perspective. Atmosphere 2025, 16, 141. [Google Scholar] [CrossRef]

- Yu, X.; He, C. An Improved Large Neighborhood Search Algorithm for the Comprehensive Container Drayage Problem with Diverse Transport Requests. Appl. Sci. 2025, 15, 5937. [Google Scholar] [CrossRef]

- Cui, F.; Tan, Y.; Lu, B. How the Belt and Road Initiative Transforms Corporate ESG Performance: Insights from China’s Experience. Sustainability 2025, 17, 3700. [Google Scholar] [CrossRef]

- EU. Regulation (EU) 2023/957 of the European Parliament and of the Council of 10 May 2023 amending Regulation (EU) 2015/757 in order to provide for the inclusion of maritime transport activities in the EU Emissions Trading System and for the monitoring, reporting and verification of emissions of additional greenhouse gases and emissions from additional ship types. Off. J. Eur. Union 2023, L130, 105–114. Available online: https://eur-lex.europa.eu/eli/reg/2023/957/oj (accessed on 18 June 2025).

- Lynce de Faria, D. The EU Emission Trading System Tax Regime and the Issue of Unfair Maritime Competition. Sustainability 2024, 16, 9474. [Google Scholar] [CrossRef]

- Christodoulou, A.; Dalaklis, D.; Ölçer, A.I.; Ghaforian Masodzadeh, P. Inclusion of Shipping in the EU-ETS: Assessing the Direct Costs for the Maritime Sector Using the MRV Data. Energies 2021, 14, 3915. [Google Scholar] [CrossRef]

- EU. Commission Implementing Regulation (EU) 2018/2066 of 19 December 2018 on the monitoring and re-porting of greenhouse gas emissions pursuant to Directive 2003/87/EC of the European Parliament and of the Council and amending Commission Regulation (EU) No 601/2012. Off. J. Eur. Union 2018, L334, 1–93. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A32018R2066&qid=1750411962182 (accessed on 18 June 2025).

- EU. Regulation (EU) 2023/1805 of the European Parliament and of the Council of 13 September 2023 on the use of renewable and low-carbon fuels in maritime transport, and amending Directive 2009/16/EC. Off. J. Eur. Union 2023, L234, 48–100. Available online: http://data.europa.eu/eli/reg/2023/1805/oj (accessed on 18 June 2025).

- Albo-López, A.B.; Carrillo, C.; Díaz-Dorado, E. Contribution of Onshore Power Supply (OPS) and Batteries in Reducing Emissions from Ro-Ro Ships in Ports. J. Mar. Sci. Eng. 2024, 12, 1833. [Google Scholar] [CrossRef]

- Lisauskas, A.; Striūgas, N.; Jančauskas, A. Lower-Carbon Substitutes for Natural Gas for Use in Energy-Intensive Industries: Current Status and Techno-Economic Assessment in Lithuania. Energies 2025, 18, 2670. [Google Scholar] [CrossRef]

- IMO. IMO Approves Net-Zero Regulations for Global Shipping. 11 April 2025. Available online: https://www.imo.org/en/MediaCentre/PressBriefings/pages/IMO-approves-netzero-regulations.aspx (accessed on 18 June 2025).

- Pereda, P.C.; Lucchesi, A.; Oliveira, T.D.; Wolf, R.; Marques, C.H.; Assis, L.F.; Caprace, J.-D. Sustainable Shipping: Modeling Economic and Greenhouse Gas Impacts of Decarbonization Policies (Part II). Sustainability 2025, 17, 3765. [Google Scholar] [CrossRef]

- Zhao, Y.; Liu, F.; Zhang, Y.; Wang, Z.; Song, Z.; Zan, G.; Wang, Z.; Guo, H.; Zhang, H.; Zhu, J.; et al. Economic Assessment of Maritime Fuel Transformation for GHG Reduction in the International Shipping Sector. Sustainability 2024, 16, 10605. [Google Scholar] [CrossRef]

- Wu, P.-C.; Lin, C.-Y. Feasibility and Cost-Benefit Analysis of Methanol as a Sustainable Alternative Fuel for Ships. J. Mar. Sci. Eng. 2025, 13, 973. [Google Scholar] [CrossRef]

- Palomar-Torres, A.; Rey-Hernández, J.M.; Rey-Hernández, A.; Rey-Martínez, F.J. Decarbonizing Near-Zero-Energy Buildings to Zero-Emission Buildings: A Holistic Life Cycle Approach to Minimize Embodied and Operational Emissions Through Circular Economy Strategies. Appl. Sci. 2025, 15, 2670. [Google Scholar] [CrossRef]

- Schinas, O.; Butler, M. Feasibility and commercial considerations of LNG-fueled ships. Ocean Eng. 2016, 122, 84–96. [Google Scholar] [CrossRef]

- Hwang, S.; Jeong, B.; Jung, K.; Kim, M.; Zhou, P. Life Cycle Assessment of LNG Fueled Vessel in Domestic Services. J. Mar. Sci. Eng. 2019, 7, 359. [Google Scholar] [CrossRef]

- Brynolf, S.; Fridell, E.; Andersson, K. Environmental assessment of marine fuels: Liquefied natural gas, liquefied biogas, methanol and bio-methanol. J. Clean. Prod. 2014, 74, 86–95. [Google Scholar] [CrossRef]

- Wang, Y.; Iris, Ç. Transition to near-zero emission shipping fleet powered by alternative fuels under uncertainty. Transp. Res. Part D Transp. Environ. 2025, 142, 104689. [Google Scholar] [CrossRef]

- Butarbutar, R.; Gurning, R.O.S.; Semin. Prospect of LNG as Marine Fuel in Indonesia: An Economic Review for a Case Study of 600 TEU Container Vessel. Appl. Sci. 2023, 13, 2760. [Google Scholar] [CrossRef]

- Iris, Ç.; Lam, J.S.L. A review of energy efficiency in ports: Operational strategies, technologies and energy management systems. Renew. Sustain. Energy Rev. 2019, 112, 170–182. [Google Scholar] [CrossRef]

- Nunes, L.J.R. Renewable Methanol as an Agent for the Decarbonization of Maritime Logistic Systems: A Review. Future Transp. 2025, 5, 54. [Google Scholar] [CrossRef]

- Holubcik, M.; Durcansky, P.; Jandacka, J.; Najser, J.; Klacko, A. Novel Design for Rotary Burner for Low-Quality Pellets. Appl. Sci. 2023, 13, 3053. [Google Scholar] [CrossRef]

- Parsons, J.; Alotaibi, M. The Application of Transition Metal Sulfide Nanomaterials and Their Composite Nanomaterials in the Electrocatalytic Reduction of CO2: A Review. Appl. Sci. 2023, 13, 3023. [Google Scholar] [CrossRef]

- Xing, H.; Stuart, C.; Spence, S.; Chen, H. Alternative fuel options for low carbon maritime transportation: Pathways to 2050. J. Clean. Prod. 2021, 297, 126651. [Google Scholar] [CrossRef]

- Wang, K.; Wang, J.; Huang, L.; Yuan, Y.; Wu, G.; Xing, H.; Wang, Z.; Wang, Z.; Jiang, X. A comprehensive review on the prediction of ship energy consumption and pollution gas emissions. Ocean Eng. 2022, 266, 112826. [Google Scholar] [CrossRef]

- Ma, R.; Zhao, Q.; Wang, K.; Cao, J.; Yang, C.; Hu, Z.; Huang, L. Energy efficiency improvement technologies for ship in operation: A comprehensive review. Ocean Eng. 2025, 331, 121258. [Google Scholar] [CrossRef]

- Ganji, M.; Gheibi, M.; Aldaghi, A.; Dhoska, K.; Vito, S.; Atari, S.; Moezzi, R. Comprehensive Study on Hydrogen Production for Sustainable Transportation Planning: Strategic, Techno-Economic, and Environmental Impacts. Hydrogen 2025, 6, 24. [Google Scholar] [CrossRef]

- Jayalath, P.; Ananthakrishnan, K.; Jeong, S.; Shibu, R.P.; Zhang, M.; Kumar, D.; Yoo, C.G.; Shamshina, J.L.; Therasme, O. Bio-Based Polyurethane Materials: Technical, Environmental, and Economic Insights. Processes 2025, 13, 1591. [Google Scholar] [CrossRef]

- Su, Y.; Xu, G. Can Intelligent Equipment Optimization Improve the Carbon Emissions Efficiency of the Equipment-Manufacturing Industry? Processes 2025, 13, 1543. [Google Scholar] [CrossRef]

- Percic, M.; Vladimir, N.; Fan, A. Techno-economic assessment of alternative marine fuels for inland shipping in Croatia. Renew. Sustain. Energy Rev. 2021, 148, 111363. [Google Scholar] [CrossRef]

- Wang, Y.; Wright, L.A. A comparative review of alternative fuels for the maritime sector: Economic, technology, and policy challenges for clean energy implementation. World 2021, 2, 456–481. [Google Scholar] [CrossRef]

- Korberg, A.D.; Brynolf, S.; Grahn, M.; Skov, I.R. Techno-economic assessment of advanced fuels and propulsion systems in future fossil-free ships. Renew. Sustain. Energy Rev. 2021, 142, 110861. [Google Scholar] [CrossRef]

- Zhu, Y.; Li, J.; Liu, P.; Zhang, G.; Liu, H. Modeling and Optimization of an Integrated Energy Supply in the Oil and Gas Industry: A Case Study of Northeast China. Processes 2025, 13, 1512. [Google Scholar] [CrossRef]

- Wada, Y.; Yamamura, T.; Hamada, K.; Wanaka, S. Evaluation of GHG Emission Measures Based on Shipping and Shipbuilding Market Forecasting. Sustainability 2021, 13, 2760. [Google Scholar] [CrossRef]

- International Association of Classification Societies (IACS). The Term of “Heavy Load Carrier” for the Application of EEDI/EEXI and CII. Rec No. 170. May 2022. Available online: https://iacs.org.uk/resolutions/161-180/rec-170-new-2/rec-170-new-2 (accessed on 18 June 2025).

- IMO. Amendments to Part A of the International Code on Intact Stability, 2008 (2008 IS CODE). Resolution MSC.443(99). Adopted on 24 May 2018. Available online: https://wwwcdn.imo.org/localresources/en/KnowledgeCentre/IndexofIMOResolutions/MSCResolutions/MSC.413(97)%20and%20MSC.443(99)%20(1).pdf (accessed on 18 June 2025).

| Fuel Type | Carbon Reduction Potential | Technology Maturity | Storage Conditions | Volumetric Energy Density (GJ/m3) | Key Challenges |

|---|---|---|---|---|---|

| LNG | 20–30% CO2 reduction | High | Cryogenic storage at −162 °C or high-pressure tanks | 20.8–24.8 | Methane slip; fossil-based; limited long-term potential |

| Green Methanol | 83–94% CO2 reduction (WTW) | Medium | Liquid storage at ambient temperature and pressure | 15.8 | Immature supply chain; higher cost than fossil fuels |

| Ammonia | Zero Carbon (CO2-free combustion) | Low | Low-temperature storage; highly volatile | 12.6 | High toxicity; safety and regulatory issues unresolved |

| Hydrogen | Zero Carbon | Low | −253 °C cryogenic or high-pressure storage | 4.5–8.5 | Very low density; high storage volume and cost |

| Bio-fuels | Low carbon | Medium to High | Conventional liquid storage | 33–38 | Limited feedstock availability; cost and sustainability |

| Ship Parameter | 12,500 DWT | 13,000 DWT | 14,000 DWT | 22,000 DWT | 32,000 DWT | 38,000 DWT | 62,000 DWT |

|---|---|---|---|---|---|---|---|

| Year of initial order | 2014 | 2015 | 2024 | 2025 | 2022 | 2023 | 2020 |

| Overall length (m) | 147 | 149.99 | 159.75 | 165 | 179.9 | 182.0 | 199.9 |

| Molded breadth (m) | 22.8 | 25.6 | 22.8 | 25.6 | 30.0 | 30.0 | 32.26 |

| Molded depth (m) | 11.55 | 10.65 | 11.55 | 13.5 | 15.5 | 16.0 | 19.3 |

| Service speed (knots) | 15.3 | 15.3 | 15.0 | 14.0 | 14.5 | 14.5 | 14.4 |

| Crane configuration | 2 × 250 t | 2 × 450 t | 2 × 250 t | 2 × 150 t 1 × 100 t | 3 × 350 t | 2 × 400 t 1 × 200 t | 2 × 150 t 2 × 80 t |

| Cargo hold volume (m3) | 17,600 | 26,600 | 20,100 | 28,000 | 40,000 | 44,000 | 74,800 |

| Longest cargo hold length (m) | 76.5 | 105.45 | 89.25 | 79.5 | 68.4 | 52.8 | 39.36 |

| Endurance range (nm) | 10,200 | 12,000 | 11,000 | 10,000 | 18,000 | 15,000 | 18,000 |

| Fuel type | LFO | LFO | Methanol ready | Methanol ready | Methanol ready | LFO | LFO |

| Bridge location | Stern | Bow | Stern | Stern | Bow | Bow | Stern |

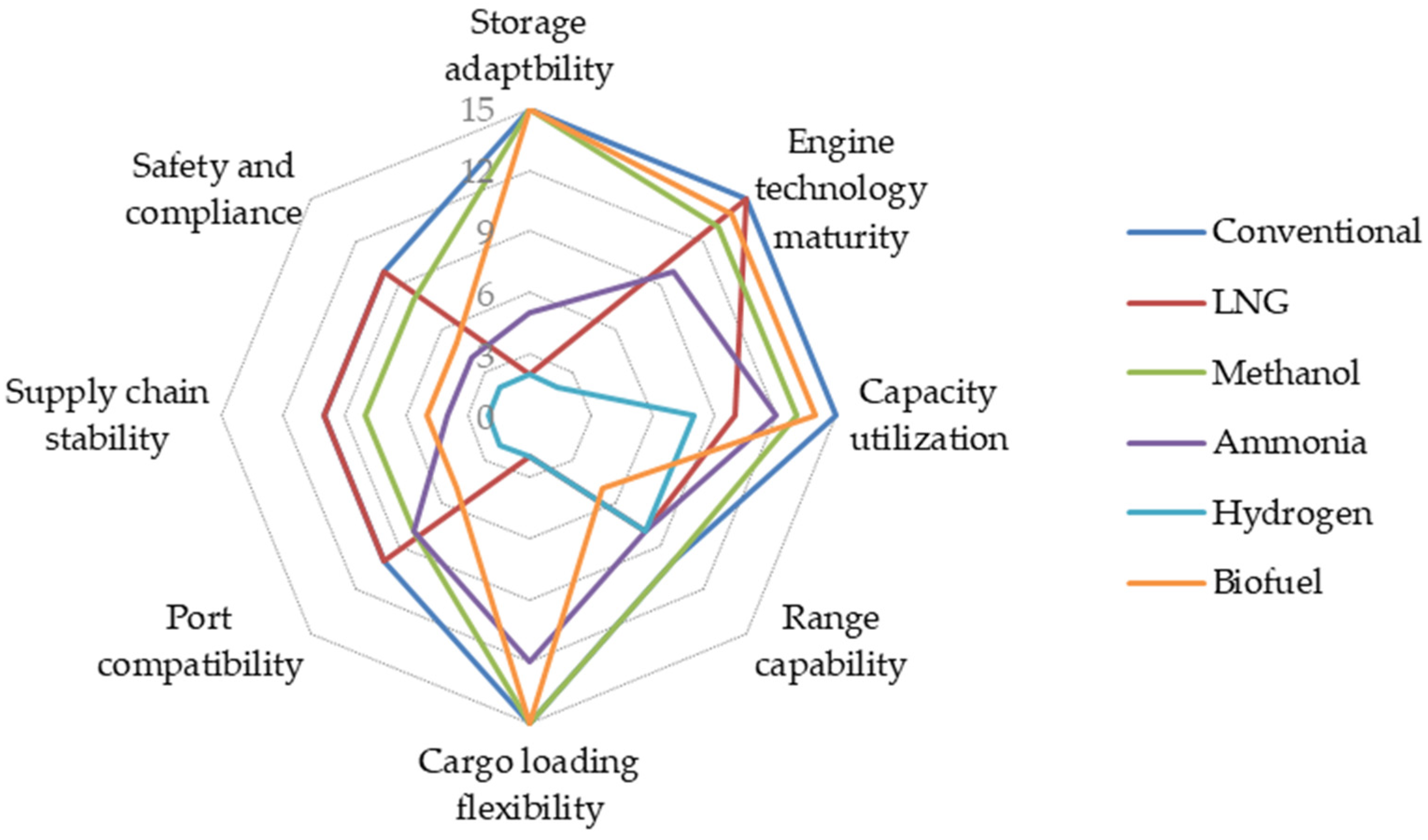

| Assessment Dimension | Indicator Description | Weight (%) | Evaluation Methodology |

|---|---|---|---|

| Storage adaptability | Fuel energy density (liquid/gas), temperature/pressure conditions, and tank arrangement flexibility | 15 | FMEA analysis; dimensional comparison with conventional tank layouts |

| Engine technology maturity | Readiness of engine systems for the target fuel and OEM support availability | 15 | Scoring based on market availability and operational case studies |

| Cargo capacity utilization | Volume loss due to fuel storage systems relative to total cargo space | 15 | Ratio analysis between tank volume and usable deck/hold volume |

| Range capability | Cruising range determined by volumetric energy content and onboard tank size | 10 | Scenario simulation based on voyage profiles and fuel properties |

| Cargo loading flexibility | Impacts of fuel system layout on cargo hold and deck loading patterns | 15 | CAD-based spatial interference and layout analysis |

| Port compatibility | Availability of bunkering infrastructure and port acceptance worldwide | 10 | Database query of bunkering ports and regional distribution analysis |

| Fuel supply chain stability | Reliability of feedstock supply and price volatility risks | 10 | Energy economics analysis; market forecast review |

| Safety and regulatory compliance | Conformity with IMO, class society, and flag state safety and regulatory standards | 10 | IGF Code compliance review and classification society documentation check |

| DWT (t) | Distance (nm) | HFO (t) | LSFO (t) | MGO (t) | Total CO2 Emission (t) | Total Fuel Consumption (t-eq) | CO2 Emission in EU (t) | Fuel Consumption in EU (t-eq) |

|---|---|---|---|---|---|---|---|---|

| 30,000 | 57,469 | 4520.07 | 150.00 | 802.38 | 17,121 | 5498 | 7987 | 2565 |

| 30,000 | 54,953 | 2857.60 | 1526.70 | 1172.07 | 17,467 | 5609 | 4217 | 1354 |

| 30,000 | 68,437 | 4321.30 | 897.28 | 629.30 | 18,301 | 5877 | 6155 | 1977 |

| 30,000 | 53,919 | 3482.87 | 1335.80 | 914.74 | 17,987 | 5776 | 6708 | 2154 |

| 30,000 | 52,782 | 3913.10 | 300.00 | 891.17 | 15,988 | 5134 | 5347 | 1717 |

| 30,000 | 79,751 | 4266.26 | 1350.51 | 640.27 | 19,593 | 6292 | 3534 | 1135 |

| 30,000 | 63,144 | 5154.65 | 0.00 | 1171.37 | 19,807 | 6361 | 8923 | 2865 |

| 32,000 | 68,658 | 4203.03 | 1175.92 | 834.97 | 19,470 | 6253 | 7324 | 2352 |

| 32,000 | 65,424 | 5884.74 | 233.40 | 1081.16 | 22,527 | 7234 | 4217 | 1354 |

| 32,000 | 66,584 | 4065.23 | 629.90 | 833.87 | 17,317 | 5561 | 7541 | 2422 |

| 32,000 | 63,717 | 5040.72 | 0.00 | 525.96 | 17,383 | 5582 | 4778 | 1534 |

| 32,000 | 72,568 | 5405.69 | 667.30 | 230.50 | 19,675 | 6318 | 5753 | 1847 |

| Average | 5958 | - | 1940 | |||||

| Assessment Dimension | Conventional Fuel | LNG | Methanol | Ammonia | Hydrogen | Biofuel |

|---|---|---|---|---|---|---|

| Storage adaptability | 15 | 2 | 15 | 5 | 2 | 15 |

| Engine technology maturity | 15 | 15 | 13 | 10 | 2 | 14 |

| Cargo capacity utilization | 15 | 10 | 13 | 12 | 8 | 14 |

| Range capability | 10 | 8 | 10 | 8 | 8 | 5 |

| Cargo loading flexibility | 15 | 2 | 15 | 12 | 2 | 15 |

| Port compatibility | 10 | 10 | 8 | 8 | 2 | 5 |

| Supply chain stability | 10 | 10 | 8 | 4 | 2 | 5 |

| Safety and regulatory compliance | 10 | 10 | 8 | 4 | 2 | 5 |

| Total Score | 100 | 67 | 90 | 63 | 28 | 78 |

| Fuel Type | LCV (kJ/kg) | CF (tCO2/tFuel) | GFI (gCO2eq/MJ) | Energy Equivalent Fuel Consumption (t) | EU Region Equivalent Fuel (t) | Average Price (USD/t) |

|---|---|---|---|---|---|---|

| LFO (baseline) | 40,200 | 3.114 | 91.25 | 5958 | 1940 | 488 |

| LNG | 48,000 | 2.750 | 76.23 | 4990 | 1625 | 682 |

| Green Methanol | 19,900 | 1.375 | 32.9 | 12,036 | 3919 | 1113 |

| Year | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 | 2035 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| FuelEU Target | 89.34 | 89.34 | 89.34 | 89.34 | 89.34 | 85.69 | 85.69 | 85.69 | 85.69 | 85.69 | 77.94 |

| IMO GFI BCT | - | - | - | 89.57 | 87.70 | 85.84 | 81.73 | 77.63 | 73.52 | 69.42 | 65.31 |

| IMO GFI DCT | - | - | - | 77.44 | 75.57 | 73.71 | 69.60 | 65.50 | 61.39 | 57.29 | 53.18 |

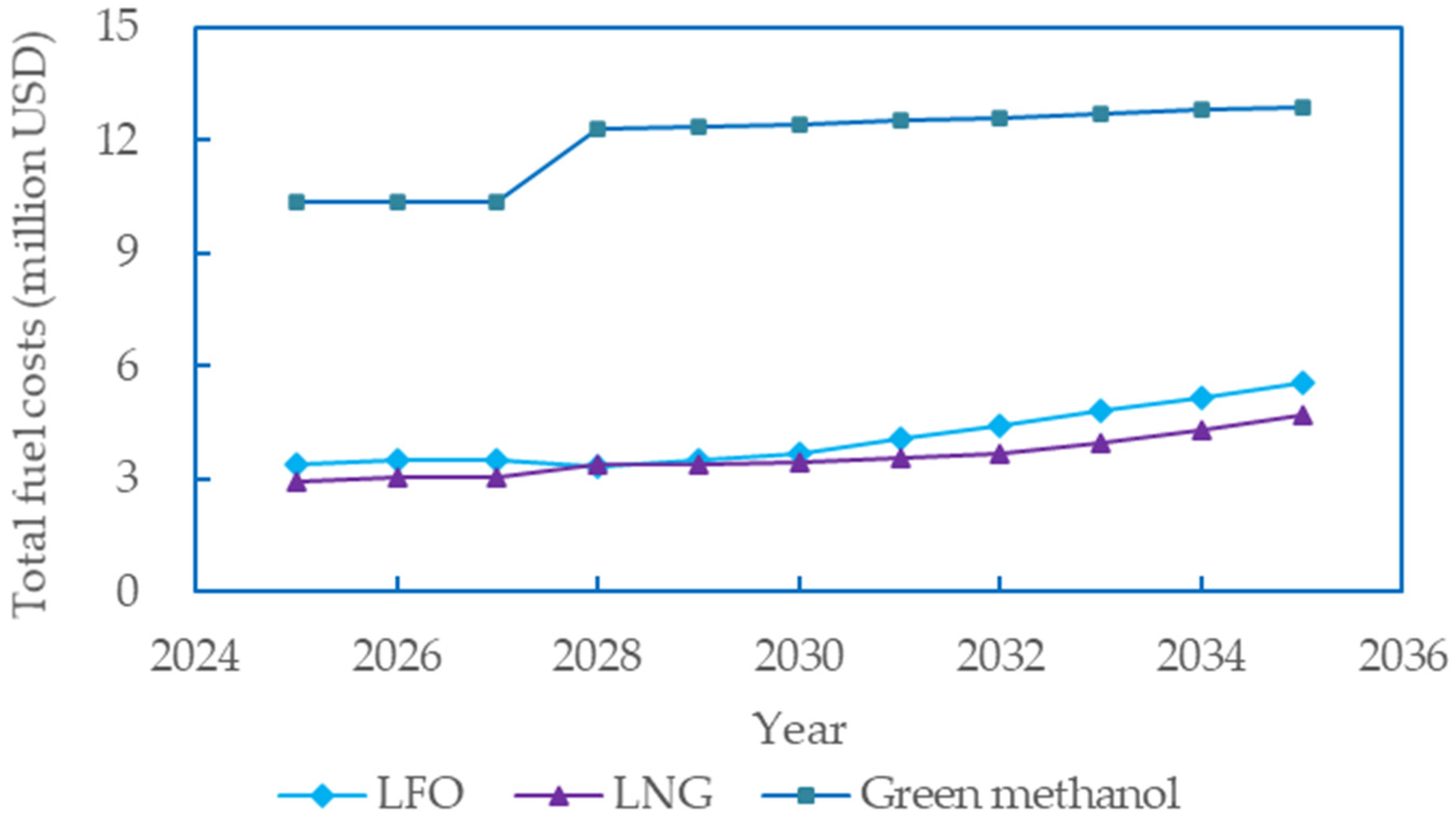

| Fuel Type | Cost | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 | 2035 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| LFO | Cfuel | 2,907,504 | 2,907,504 | 2,907,504 | 2,907,504 | 2,907,504 | 2,907,504 | 2,907,504 | 2,907,504 | 2,907,504 | 2,907,504 | 2,907,504 |

| Ccarbon allowance | 363,678 | 519,540 | 519,540 | - | - | - | - | - | - | - | - | |

| CFuelEU Penalty | 103,200 | 103,200 | 103,200 | - | - | - | - | - | - | - | - | |

| CTier 1 RUs | - | - | - | 289,795 | 289,795 | 289,795 | 289,795 | 289,795 | 289,795 | 289,795 | 289,795 | |

| CTier 2 RUs | - | - | - | 159,268 | 323,086 | 492,364 | 866,415 | 1,239,556 | 1,613,607 | 1,986,748 | 2,360,799 | |

| Ctotal | 3,374,382 | 3,530,244 | 3,530,244 | 3,356,567 | 3,520,385 | 3,689,663 | 4,063,714 | 4,436,855 | 4,810,906 | 5,184,047 | 5,558,098 | |

| LNG | Cfuel | 3,403,180 | 3,403,180 | 3,403,180 | 3,403,180 | 3,403,180 | 3,403,180 | 3,403,180 | 3,403,180 | 3,403,180 | 3,403,180 | 3,403,180 |

| Ccarbon allowance | 269,019 | 384,313 | 384,313 | - | - | - | - | - | - | - | - | |

| CFuelEU Penalty | −708,351 | −708,351 | −708,351 | - | - | - | - | - | - | - | - | |

| CTier1 RUs | - | - | - | 0 | 15,089 | 60,594 | 158,789 | 256,984 | 289,795 | 289,795 | 289,795 | |

| CTier2 RUs | - | - | - | 0 | 0 | 0 | 0 | 0 | 246,637 | 619,778 | 993,829 | |

| Ctotal | 2,963,847 | 3,079,141 | 3,079,141 | 3,403,180 | 3,418,269 | 3,463,774 | 3,561,969 | 3,660,164 | 3,939,612 | 4,312,753 | 4,686,804 | |

| Green Methanol | Cfuel | 13,396,068 | 13,396,068 | 13,396,068 | 13,396,068 | 13,396,068 | 13,396,068 | 13,396,068 | 13,396,068 | 13,396,068 | 13,396,068 | 13,396,068 |

| Ccarbon allowance | 0 | 0 | 0 | - | - | - | - | - | - | - | - | |

| CFuelEU Penalty | −3,049,531 | −3,049,531 | −3,049,531 | - | - | - | - | - | - | - | - | |

| CTier1 RUs | - | - | - | −1,065,775 | −1,022,665 | −977,160 | −878,965 | −780,770 | −682,575 | −584,380 | −486,185 | |

| CTier2 RUs | - | - | - | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| Ctotal | 10,346,537 | 10,346,537 | 10,346,537 | 12,330,293 | 12,373,403 | 12,418,908 | 12,517,103 | 12,615,298 | 12,713,493 | 12,811,688 | 12,909,883 |

| ME | WinGD 6X52-S2.0-HPSCR Tier III |

|---|---|

| SMCR | 6940 kW@92 r/min |

| CSR (85% SMCR) | 5899 kW@87.1 r/min |

| Main generator | 1000 kWe × 3 |

| Endurance | 15,000 nm |

| LFO | 1500 m3 |

| VLSFO | 500 m3 |

| MGO | 250 m3 |

| Brand | Model | Application Project |

|---|---|---|

| MAN | G95ME-C10.5-LGIM | Maersk 16,000 TEU |

| G80ME-C10.5-LGIM | / | |

| G60ME-C10.5-LGIM | / | |

| S60 ME-C10.5-LGIM | / | |

| G50ME-C9.6-LGIM | 50,000-ton chemical tanker Guangzhou Shipyard International | |

| S50ME-C9.6-LGIM | New Dayang 1170 TEU | |

| S50ME-C10.7-LGIM | ||

| G45 ME-C9.7-LGIM | / | |

| WinGD | X92DF-M-1.0 | COSCO SHIPPING 16,000 TEU |

| X82DF-M-1.0 | / | |

| X72DF-M-1.0 | / | |

| X62DF-M-1.0 | / | |

| X62DF-M-S1.0 | / | |

| X52DF-M-S1.0 | / | |

| X52DF-M-1.0 | / | |

| CSSC Power | CX40DF-M | Testing |

| Model | SMCR (kW) | Speed (r/min) | CSR (kW) | Speed (r/min) | Tier II Fuel Consumption SMCR, ISO (g/kWh) | Tier II Fuel Consumption CSR, ISO (g/kWh) | Tier II Methanol Consumption Rate SMCR, ISO (g/kWh) | Tier II Methanol Consumption Rate CSR, ISO (g/kWh) |

|---|---|---|---|---|---|---|---|---|

| WinGD 6 X52-S2.0-HPSCR Tier III | 6940 | 92 | 5899 | 87.1 | ~161.1 | ~153.8 | — | — |

| MAN 6S50ME-C 10.7-LGIM-HPSCR Tier III | 6940 | 92 | 5899 | 87.1 | ~165.1 | ~161.3 | ~324.2 | ~312.1 |

| Brand | Model | Single Cylinder Power kW/Cylinder | Application Project |

|---|---|---|---|

| MAN (Augsburg, Germany) | L21/31DF-M | 220 | / |

| Wärtsilä (Helsinki, Finland) | L32M | 580 | / |

| Hyundai (Ulsan, Republic of Korea) | H32DF-LM | 500 | Maersk 16,000 TEU |

| CSSC 711 (Shanghai, China) | CS21M3 | 200 | / |

| CSSC Power (Shanghai, China) | M320DF-M | 405 | Under development |

| Zibo Diesel Engine Factory (Zibo, China) | Z170 | 75 | / |

| Model | MCR (kW) | Speed (r/min) | Fuel Consumption MCR, ISO (g/kWh) | Methanol Consumption Rate MCR, ISO (g/kWh) | Methanol Substitution Rate (%) |

|---|---|---|---|---|---|

| 5L21/31DF-M | 1100 | 1000 | ~192 | ~380.0 | ~60 |

| 6CS21M3 | 1200 | 1000 | ~197 | ~390.0 | >90 |

| Name | System Components | Fuel Tank | Methanol Dedicated Tank | Fuel Oil/Methanol Combined Tank |

|---|---|---|---|---|

| Injection System | Filling station ESD system | × | × | |

| Fuel filling pipe | × | × | ||

| Methanol injection pipe | × | × | ||

| High level and high-high-level sensors | × | × | × | |

| Temperature Sensor | × | × | × | |

| Pressure Sensors | × | × | ||

| Breathable System | Open air pipe head | × | ||

| Controlled breather valve | × | × | ||

| Boil-off gas recovery line | × | × | ||

| Cabin pressure sensor | × | × | ||

| Supply System | Fuel supply system | × | × | |

| Methanol supply system | × | × | ||

| In-cabin methanol transfer pump | × | × | ||

| Double wall pipe | × | × | ||

| Oil supply unit steam heating system | × | × | ||

| Methanol unit ethylene glycol heat exchange system | × | × | ||

| Fire Protection System | Fixed alcohol-resistant foam fire extinguishing system for filling stations | × | × | |

| Fixed alcohol-resistant foam fire-extinguishing system for Class A machinery spaces/fuel preparation rooms | × | × | ||

| Methanol tank fixed alcohol-resistant foam fire extinguishing system (when located on open deck) | N/A | N/A | ||

| Fire water | × | × | × | |

| Water spray system (when methanol tank is located on open deck) | N/A | N/A | ||

| Portable fire extinguisher | × | × | ||

| Nitrogen System | Nitrogen generator | × | × | |

| Nitrogen tank | × | × | ||

| Oxygen detection sensor | × | × | ||

| Nitrogen injection tube | × | × | ||

| Isolate empty space with nitrogen protection or ventilation, or water injection measures | × | × | ||

| Bilge System | Tank discharge | × | × | |

| Isolate the independent bilge water in the empty tank | × | × | ||

| Gas Detection Systems | Isolation cabin | × | × | |

| Ventilation System | Double wall pipe mechanical exhaust | × | × | |

| Fire Protection Arrangement | A60 fireproof insulation | × | × | |

| Isolation cabin | × | × | × |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zheng, Q.; Sun, L.; Chang, S.; Xing, H. Techno-Economic Analysis of Multi-Purpose Heavy-Lift Vessels Using Methanol as Fuel. J. Mar. Sci. Eng. 2025, 13, 1234. https://doi.org/10.3390/jmse13071234

Zheng Q, Sun L, Chang S, Xing H. Techno-Economic Analysis of Multi-Purpose Heavy-Lift Vessels Using Methanol as Fuel. Journal of Marine Science and Engineering. 2025; 13(7):1234. https://doi.org/10.3390/jmse13071234

Chicago/Turabian StyleZheng, Qingguo, Liping Sun, Shengdai Chang, and Hui Xing. 2025. "Techno-Economic Analysis of Multi-Purpose Heavy-Lift Vessels Using Methanol as Fuel" Journal of Marine Science and Engineering 13, no. 7: 1234. https://doi.org/10.3390/jmse13071234

APA StyleZheng, Q., Sun, L., Chang, S., & Xing, H. (2025). Techno-Economic Analysis of Multi-Purpose Heavy-Lift Vessels Using Methanol as Fuel. Journal of Marine Science and Engineering, 13(7), 1234. https://doi.org/10.3390/jmse13071234