Characteristics of Economic and Environmental Benefits of Shore Power Use by Container-Ship Size

Abstract

:1. Introduction

2. Literature Review

2.1. Environmental Benefit

2.2. Economic Benefit

3. Materials and Methods

3.1. Vessel Information

3.2. Port Information

3.3. Benefit Evaluation

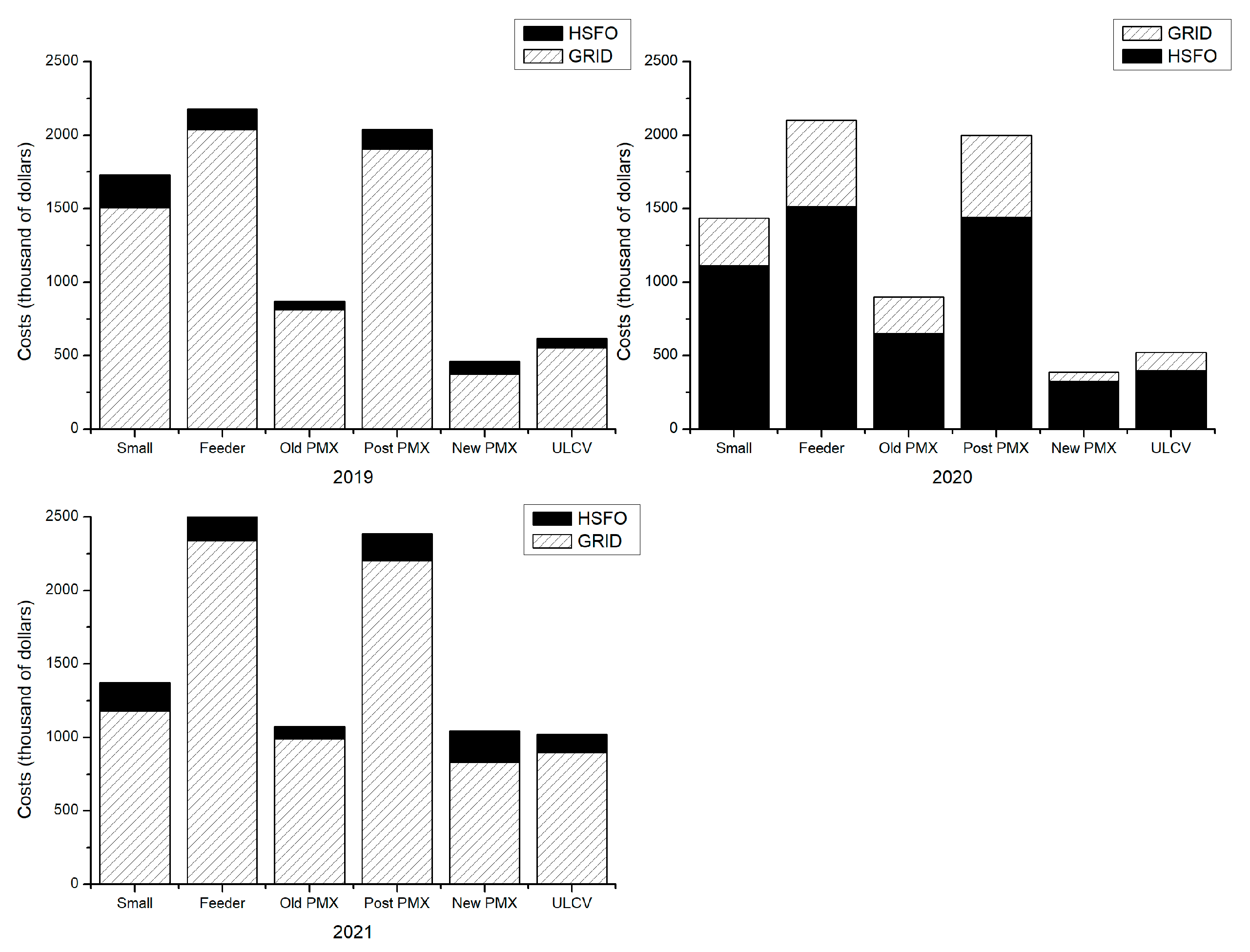

3.4. Cost Evaluation

3.5. Economic Analysis

- Scenario I: when ship operators acquire benefits from differences in fuel oil prices and electricity costs;

- Scenario II: when ship operators acquire benefits from trading carbon credits through carbon emission reduction, including the benefit in scenario I;

- Scenario III: when ship operators acquire benefits from a tax incentive, including the benefit in scenario II.

4. Results

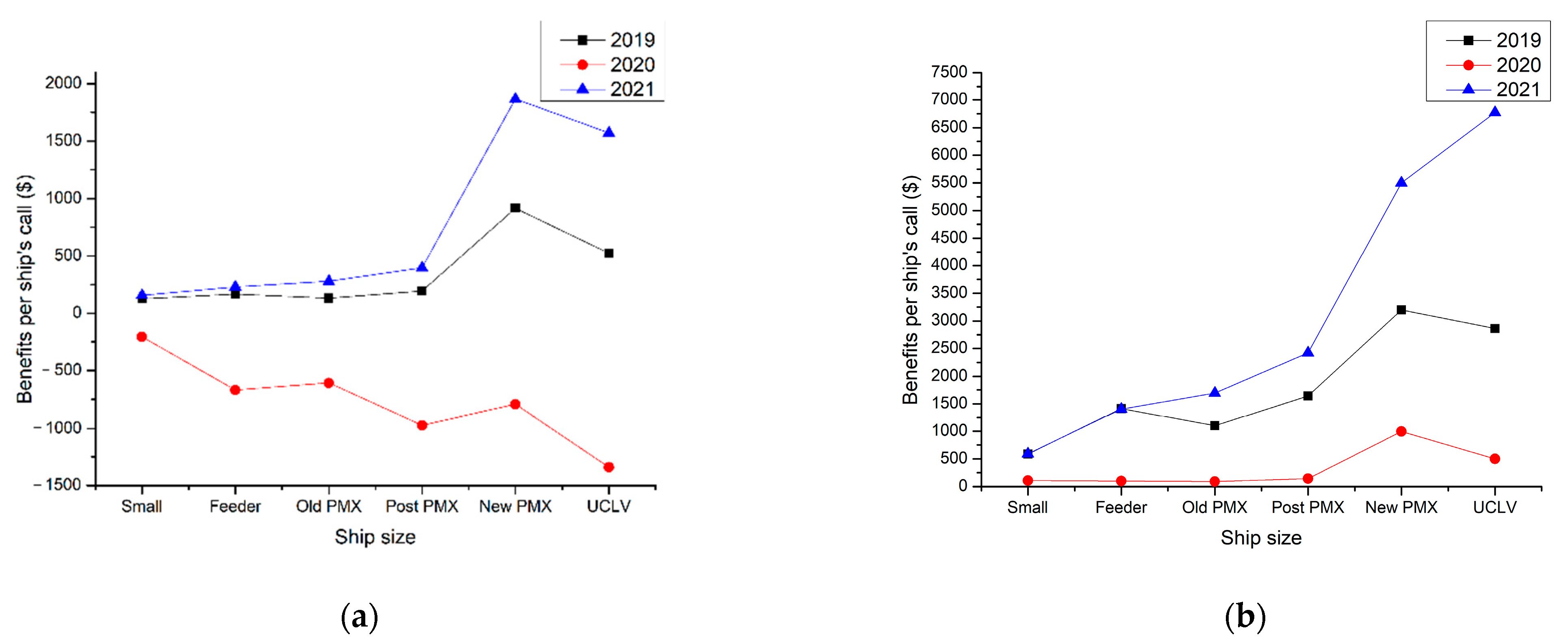

4.1. Economic Benefits from Differences in Fuel Oil and Electricity Prices

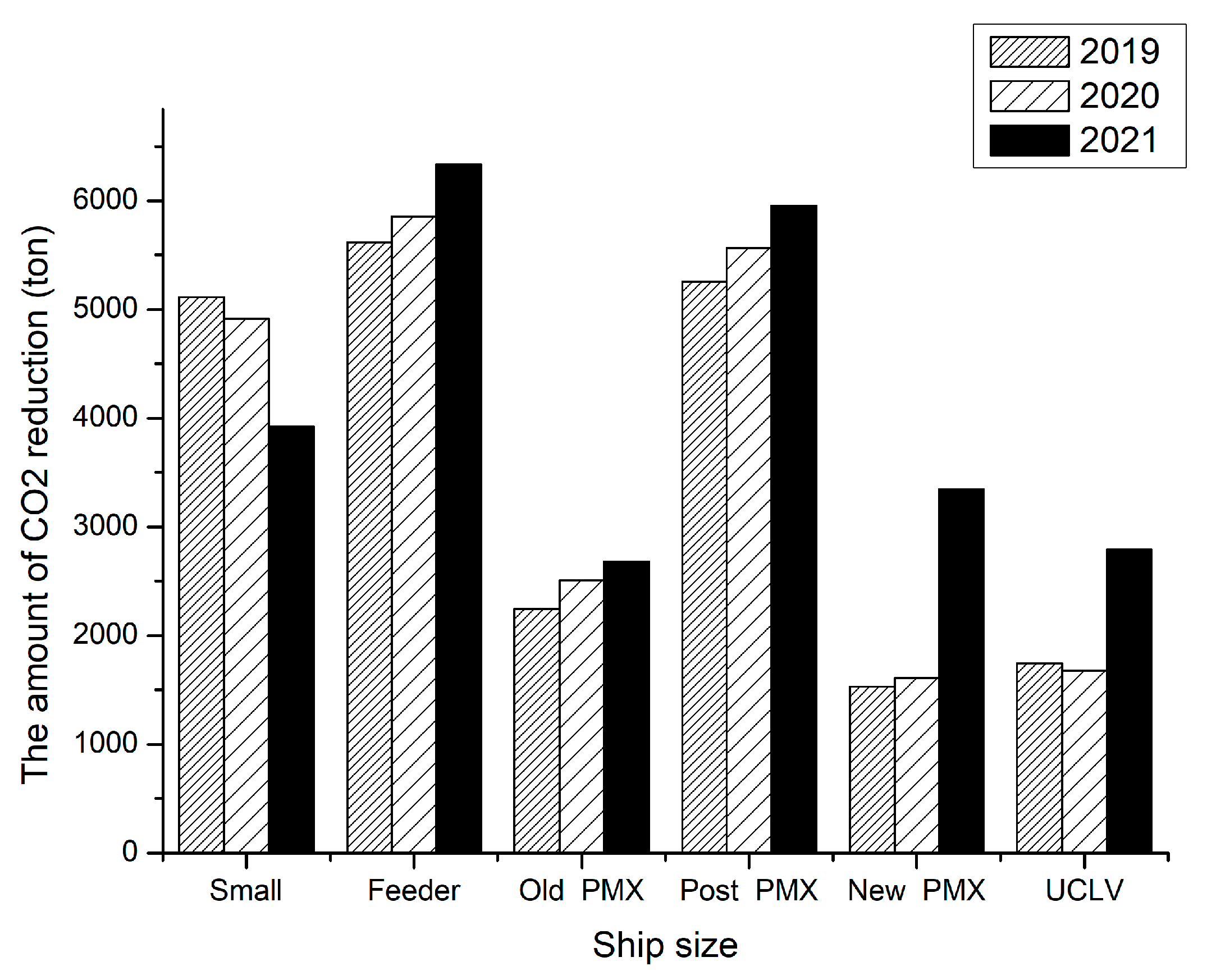

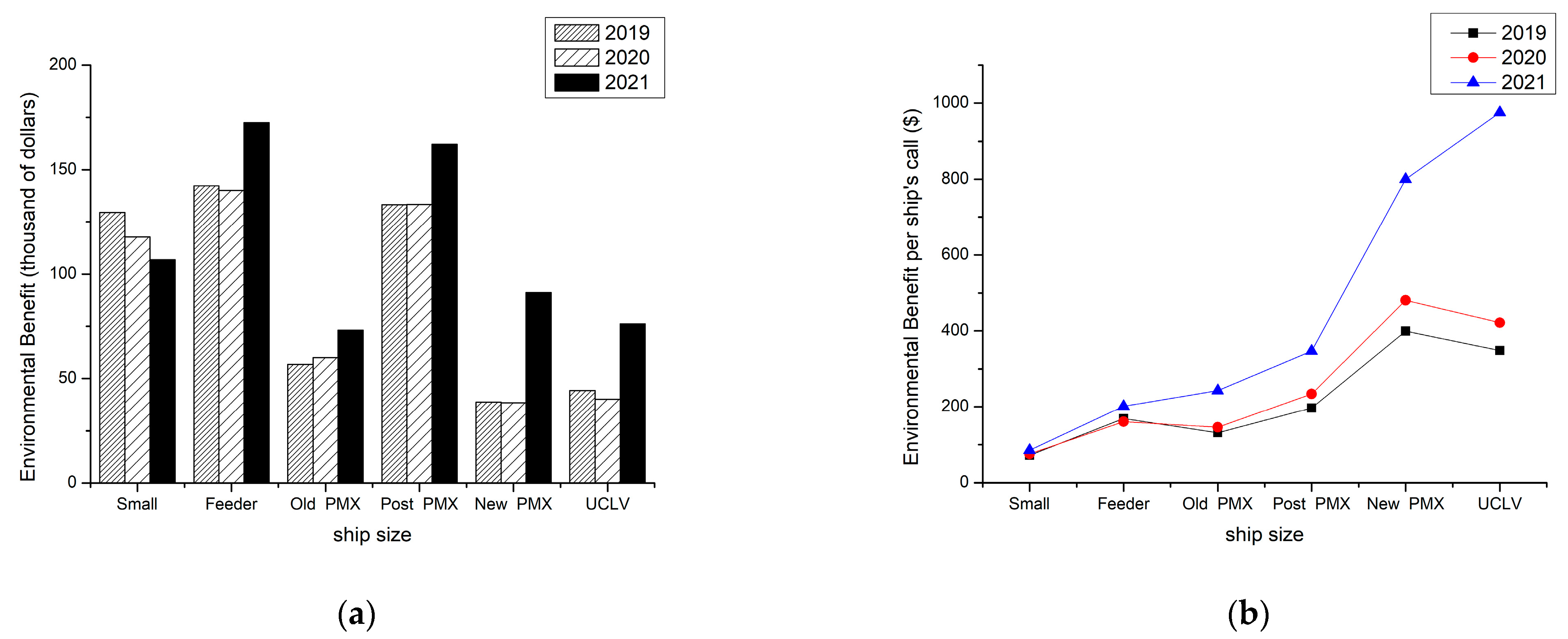

4.2. The Quantity of Carbon Dioxide Reduction and Its Economic Valuation

4.3. Economic Analysis by Container Size and Fuel Type

5. Discussion

6. Conclusions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- IPCC Climate Change 2014: Synthesis Report. Contribution of Working Groups I, II and III to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change, 2014th ed.; Pachauri, R., Meyer, L., Eds.; IPCC: Geneva, Switzerland, 2015; ISBN 978-92-9169-143-2. [Google Scholar]

- IMO Fourth IMO GHG Study 2020—Full Report. Available online: https://www.imo.org/en/OurWork/Environment/Pages/Fourth-IMO-Greenhouse-Gas-Study-2020.aspx (accessed on 10 March 2022).

- Yuan, J.; Ng, S.H.; Sou, W.S. Uncertainty Quantification of CO2 Emission Reduction for Maritime Shipping. Energy Policy 2016, 88, 113–130. [Google Scholar] [CrossRef]

- IMO MEPC.1/Circ.794; On-Shore Power Supply. IMO: London, UK, 2012.

- Hall, W.J. Assessment of CO2 and Priority Pollutant Reduction by Installation of Shoreside Power. Resour. Conserv. Recycl. 2010, 54, 462–467. [Google Scholar] [CrossRef]

- Vaishnav, P.; Fischbeck, P.S.; Morgan, M.G.; Corbett, J.J. Shore Power for Vessels Calling at U.S. Ports: Benefits and Costs. Environ. Sci. Technol. 2016, 50, 1102–1110. [Google Scholar] [CrossRef] [PubMed]

- Winkel, R.; Weddige, U.; Johnsen, D.; Hoen, V.; Papaefthimiou, S. Shore Side Electricity in Europe: Potential and Environmental Benefits. Energy Policy 2016, 88, 584–593. [Google Scholar] [CrossRef]

- IMO Resolution MEPC.323(74); Invitation to Member States to Encourage Voluntary Cooperation between the Port and Shipping Sectors to Contribute to Reducing GHG Emissions from Ships. IMO: London, UK, 2019.

- Lähteenmäki-Uutela, A.; Repka, S.; Haukioja, T.; Pohjola, T. How to Recognize and Measure the Economic Impacts of Environmental Regulation: The Sulphur Emission Control Area Case. J. Clean. Prod. 2017, 154, 553–565. [Google Scholar] [CrossRef]

- Sheng, D.; Meng, Q.; Li, Z.C. Optimal Vessel Speed and Fleet Size for Industrial Shipping Services under the Emission Control Area Regulation. Transp. Res. Part C Emerg. Technol. 2019, 105, 37–53. [Google Scholar] [CrossRef]

- Kontovas, C.A. Integration of Air Quality and Climate Change Policies in Shipping: The Case of Sulphur Emissions Regulation. Mar. Policy 2020, 113, 103815. [Google Scholar] [CrossRef]

- Ren, J.; Lützen, M. Fuzzy Multi-Criteria Decision-Making Method for Technology Selection for Emissions Reduction from Shipping under Uncertainties. Transp. Res. Part D Transp. Environ. 2015, 40, 43–60. [Google Scholar] [CrossRef]

- Daniel, H.; Trovão, J.P.F.; Williams, D. Shore Power as a First Step toward Shipping Decarbonization and Related Policy Impact on a Dry Bulk Cargo Carrier. eTransportation 2022, 11, 100150. [Google Scholar] [CrossRef]

- Zis, T.; North, R.J.; Angeloudis, P.; Ochieng, W.Y.; Bell, M.G.H. Evaluation of Cold Ironing and Speed Reduction Policies to Reduce Ship Emissions near and at Ports. Marit. Econ. Logist. 2014, 16, 371–398. [Google Scholar] [CrossRef]

- Nguyen, D.-H.; Lin, C.; Cheruiyot, N.K.; Hsu, J.-Y.; Cho, M.-Y.; Hsu, S.-H.; Yeh, C.-K. Reduction of NOx and SO2 Emissions by Shore Power Adoption. Aerosol Air Qual. Res. 2021, 21, 210100. [Google Scholar] [CrossRef]

- Yu, J.; Voß, S.; Tang, G. Strategy Development for Retrofitting Ships for Implementing Shore Side Electricity. Transp. Res. Part D Transp. Environ. 2019, 74, 201–213. [Google Scholar] [CrossRef]

- Jieling, C.; Haibo, L. Analysis of Environmental Benefits of Shore Power for Preventing and Controlling Air Pollution Caused by Vessels at Berth. E3S Web Conf. 2018, 53, 04036. [Google Scholar] [CrossRef]

- Dai, L.; Hu, H.; Wang, Z. Is Shore Side Electricity Greener? An Environmental Analysis and Policy Implications. Energy Policy 2020, 137, 111144. [Google Scholar] [CrossRef]

- Stolz, B.; Held, M.; Georges, G.; Boulouchos, K. The CO2 Reduction Potential of Shore-Side Electricity in Europe. Appl. Energy 2021, 285, 116425. [Google Scholar] [CrossRef]

- Wang, H.; Mao, X.; Rutherford, D. Costs and Benefits of Shore Power at the Port of Shenzen; ICCT: Washington DC, USA, 2015. [Google Scholar]

- Bouman, E.A.; Lindstad, E.; Rialland, A.I.; Strømman, A.H. State-of-the-Art Technologies, Measures, and Potential for Reducing GHG Emissions from Shipping – A Review. Transp. Res. Part D Transp. Environ. 2017, 52, 408–421. [Google Scholar] [CrossRef]

- Kim, J.; Rahimi, M.; Newell, J. Life-Cycle Emissions from Port Electrification: A Case Study of Cargo Handling Tractors at the Port of Los Angeles. Int. J. Sustain. Transp. 2012, 6, 321–337. [Google Scholar] [CrossRef]

- Silaksanti, D.; Sudarmo, S.T. Cost and Environmental Benefit in the Use of Shore Connection in Bjti Port. Adv. Transp. Logist. Res. 2020, 3, 38–45. [Google Scholar] [CrossRef]

- IMO Resolution MEPC.328(76); Amendments to the Annex of the Protocol of 1997 to Amend the International Convention for the Prevention of Pollution from Ships, 1973, As Modified by the Protocol of 1978 Relating Thereto. IMO: London, UK, 2021.

- Peng, Y.; Li, X.; Wang, W.; Wei, Z.; Bing, X.; Song, X. A Method for Determining the Allocation Strategy of On-Shore Power Supply from a Green Container Terminal Perspective. Ocean Coast. Manag. 2019, 167, 158–175. [Google Scholar] [CrossRef]

- Zis, T.P.V. Prospects of Cold Ironing as an Emissions Reduction Option. Transp. Res. Part A Policy Pract. 2019, 119, 82–95. [Google Scholar] [CrossRef] [Green Version]

- Jiao, Y.; Wang, C. Shore Power vs. Low Sulfur Fuel Oil: Pricing Strategies of Carriers and Port in a Transport Chain. Int. J. Low-Carbon Technol. 2021, 16, 715–724. [Google Scholar] [CrossRef]

- Cao, D.; Ma, Z.; Zheng, W.; Xu, K.; Ma, Z.; Song, C. Research on Energy Efficiency Economy and Environmental Benefit Evaluation Method of Ship Shore Electricity Technology. In Proceedings of the 2017 4th International Conference on Information Science and Control Engineering (ICISCE); IEEE: Changsha, China, 2017; pp. 1636–1640. [Google Scholar]

- Tseng, P.H.; Pilcher, N. A Study of the Potential of Shore Power for the Port of Kaohsiung, Taiwan: To Introduce or Not to Introduce? Res. Transp. Bus. Manag. 2015, 17, 83–91. [Google Scholar] [CrossRef] [Green Version]

- Chang, C.C.; Huang, P.C.; Hsieh, C.C. Carbon Allowance Allocation in the Shipping Industry under Different Economic Activities. Procedia Manuf. 2019, 30, 112–119. [Google Scholar] [CrossRef]

- Chang, C.C.; Huang, P.C. Carbon Allowance Allocation in the Shipping Industry under EEDI and Non-EEDI. Sci. Total Environ. 2019, 678, 341–350. [Google Scholar] [CrossRef]

- Schwartz, H.; Gustafsson, M.; Spohr, J. Emission Abatement in Shipping – Is It Possible to Reduce Carbon Dioxide Emissions Profitably? J. Clean. Prod. 2020, 254, 120069. [Google Scholar] [CrossRef]

- Dai, L.; Hu, H.; Wang, Z.; Shi, Y.; Ding, W. An Environmental and Techno-Economic Analysis of Shore Side Electricity. Transp. Res. Part D Transp. Environ. 2019, 75, 223–235. [Google Scholar] [CrossRef]

- Kumar, J.; Kumpulainen, L.; Kauhaniemi, K. Technical Design Aspects of Harbour Area Grid for Shore to Ship Power: State of the Art and Future Solutions. Int. J. Electr. Power Energy Syst. 2019, 104, 840–852. [Google Scholar] [CrossRef]

- Lam, J.S.L.; Notteboom, T. The Greening of Ports: A Comparison of Port Management Tools Used by Leading Ports in Asia and Europe. Transp. Rev. 2014, 34, 169–189. [Google Scholar] [CrossRef]

- Jensen, S.; Lützen, M.; Mikkelsen, L.L.; Rasmussen, H.B.; Pedersen, P.V.; Schamby, P. Energy-Efficient Operational Training in a Ship Bridge Simulator. J. Clean. Prod. 2018, 171, 175–183. [Google Scholar] [CrossRef] [Green Version]

- Wan, Z.; el Makhloufi, A.; Chen, Y.; Tang, J. Decarbonizing the International Shipping Industry: Solutions and Policy Recommendations. Mar. Pollut. Bull. 2018, 126, 428–435. [Google Scholar] [CrossRef] [Green Version]

- Lee, H.; Park, D.; Choo, S.; Pham, H.T. Estimation of the Non-Greenhouse Gas Emissions Inventory from Ships in the Port of Incheon. Sustainability 2020, 12, 8231. [Google Scholar] [CrossRef]

- Cloquell Ballester, V.; Lo-Iacono-Ferreira, V.G.; Artacho-Ramírez, M.Á.; Capuz-Rizo, S.F. The Carbon Footprint of Valencia Port: A Case Study of the Port Authority of Valencia (Spain). Int. J. Environ. Res. Public Health 2020, 17, 8157. [Google Scholar] [CrossRef] [PubMed]

- Minstry of Ocean and Fisheries Port-MIS. Available online: https://new.portmis.go.kr/ (accessed on 3 February 2022).

- MAN Energy Solution Propulsion Trends in Container Vessels. Available online: https://www.man-es.com/docs/default-source/marine/tools/propulsion-trends-in-container-vessels.pdf?sfvrsn=c48bba16_12 (accessed on 19 March 2022).

- Abramowski, T.; Cepowski, T.; Zvolenský, P. Determination of Regression Formulas for Key Design Characteristics of Container Ships at Preliminary Design Stage. New Trends Prod. Eng. 2018, 1, 247–257. [Google Scholar] [CrossRef] [Green Version]

- Lloyd’s List One Hundred Ports 2021. Available online: https://lloydslist.maritimeintelligence.informa.com/-/media/lloyds-list/images/top-100-ports-2021/top-100-ports-2021-digital-edition.pdf (accessed on 18 March 2022).

- Ministry of Environment Greenhouse Gas Invetory and Research Center National GHG Inventory Report(1990–2019). Available online: https://www.gir.go.kr/home/board/read.do;jsessionid=jAmEAKEqQGqXTjaGXI2KkLLuHLcnEeifwYbVe9bnr698GlTU7BrH9jVuFkCk0as1.og_was1_servlet_engine1?pagerOffset=0&maxPageItems=10&maxIndexPages=10&searchKey=&searchValue=&menuId=36&boardId=54&boardMasterId=2&boardC (accessed on 13 March 2022).

- Busan Port Authority Container Statistics. Available online: https://www.busanpa.com/kor/Contents.do?mCode=MN1004 (accessed on 13 March 2022).

- Clarkson Research Shipping Intelligence Network. Available online: https://sin.clarksons.net/ (accessed on 17 March 2022).

- EPA Shore Power Technology Assessment at U.S. Ports. Available online: https://www.epa.gov/sites/default/files/2017-05/documents/420r17004-2017-update.pdf (accessed on 9 March 2022).

- IMO Resolution MEPC.304(72); Initial IMO Strategy On Reduction of GHG Emissions From Ships. IMO: London, UK, 2018.

- Statistics Korea KOSIS. Available online: https://kosis.kr/statHtml/statHtml.do?orgId=310&tblId=DT_31002N_A001&vw_cd=MT_ZTITLE&list_id=U_15&scrId=&seqNo=&lang_mode=ko&obj_var_id=&itm_id=&conn_path=MT_ZTITLE&path=%252FstatisticsList%252FstatisticsListIndex.do (accessed on 13 March 2022).

- Greenhouse Gas Inventory and Research Center 2019 Korean Emissions Trading System Report. Available online: https://ors.gir.go.kr/home/board/read.do?menuId=2&boardMasterId=4&boardId=46 (accessed on 17 March 2022).

- KRX ETS Market Information Platform. Available online: https://ets.krx.co.kr/ (accessed on 1 March 2022).

- GloMEEP Shore Power. Available online: https://glomeep.imo.org/technology/shore-power/ (accessed on 10 March 2022).

| Year | Ship Size | No. of Port Calls | Average Quantity (TEU) | Average GT (t) | Average Hoteling Time (Hrs) |

|---|---|---|---|---|---|

| 2019 | Small | 1802 | 828.7 | 8044.7 | 19.6 |

| Feeder | 841 | 1511.1 | 15,598.7 | 20.9 | |

| Old Panamax | 431 | 3241.3 | 34,715.2 | 19.0 | |

| Post Panamax | 675 | 7276.3 | 79,298.0 | 18.9 | |

| New Panamax | 97 | 13,214.6 | 144,911.0 | 19.9 | |

| UCLV | 127 | 16,485.7 | 181,053.1 | 19.2 | |

| 2020 | Small | 1561 | 855.0 | 8325.8 | 21.7 |

| Feeder | 872 | 1499.8 | 15,473.5 | 21.0 | |

| Old Panamax | 411 | 3206.9 | 34,335.5 | 22.3 | |

| Post Panamax | 570 | 7219.4 | 78,670.2 | 23.8 | |

| New Panamax | 80 | 13,169.0 | 144,407.4 | 25.3 | |

| UCLV | 95 | 17,316.8 | 190,236.2 | 24.6 | |

| 2021 | Small | 1253 | 877.8 | 8597.1 | 21.6 |

| Feeder | 857 | 1525.3 | 15,755.2 | 23.1 | |

| Old Panamax | 301 | 3049.4 | 32,595.1 | 32.5 | |

| Post Panamax | 467 | 7332.2 | 79,915.9 | 31.0 | |

| New Panamax | 114 | 13,200.0 | 144,749.0 | 37.1 | |

| UCLV | 78 | 18,243.4 | 200,473.7 | 50.1 |

| Rank | Port | Country | Region | 2020 Annual Throughput (teu) |

|---|---|---|---|---|

| 1 | Shanghai | China | Asia | 43,503,400 |

| 2 | Singapore | Singapore | Asia | 36,870,900 |

| 3 | Ningbo-Zhoushan | China | Asia | 28,720,000 |

| 4 | Shenzhen | China | Asia | 26,550,000 |

| 5 | Guangzhou | China | Asia | 23,505,300 |

| 6 | Qingdao | China | Asia | 22,010,000 |

| 7 | Busan | South Korea | Asia | 21,824,400 |

| 8 | Tianjin | China | Asia | 18,353,100 |

| 9 | Hong Kong | China | Asia | 17,953,000 |

| 10 | Rotterdam | The Netherlands | Northern Europe | 14,349,446 |

| Year | CO2eq. Emissions (kg/kWh) |

|---|---|

| 2010 | 504.12 |

| 2011 | 495.26 |

| 2012 | 489.58 |

| 2013 | 495.29 |

| 2014 | 463.08 |

| 2015 | 458.50 |

| 2016 | 448.68 |

| 2017 | 454.14 |

| 2018 | 470.27 |

| 2019 | 441.79 |

| 2015 | 2016 | 2017 | 2018 | 2019 | |

|---|---|---|---|---|---|

| Volume (millions of tons) | 5.7 | 12.0 | 26.6 | 47.3 | 38.0 |

| Average price (in dollars) | 9.73 | 14.70 | 18.55 | 20.11 | 20.96 |

| Trading value (in millions of dollars) | 55.1 | 176.0 | 487.2 | 952.2 | 928.9 |

| Small | Feeder | Old PMX | Post PMX | New PMX | UCLV | ||

|---|---|---|---|---|---|---|---|

| HSFO | Scenario I | −35,400 | −90,684 | −328,962 | −245,114 | −301,864 | −305,950 |

| Scenario II | 5450 | −18,826 | −280,750 | −204,908 | −239,233 | −223,683 | |

| Scenario III | 31,889 | 18,123 | −232,366 | −137,088 | −149,581 | −68,712 | |

| MGO | Scenario I | 26,717 | 34,393 | −245,114 | −245,114 | −217,037 | −175,238 |

| Scenario II | 67,567 | 106,250 | −196,902 | −204,908 | −154,406 | −92,972 | |

| Scenario III | 94,006 | 143,200 | −148,519 | −137,088 | −64,754 | 61,999 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kim, K. Characteristics of Economic and Environmental Benefits of Shore Power Use by Container-Ship Size. J. Mar. Sci. Eng. 2022, 10, 622. https://doi.org/10.3390/jmse10050622

Kim K. Characteristics of Economic and Environmental Benefits of Shore Power Use by Container-Ship Size. Journal of Marine Science and Engineering. 2022; 10(5):622. https://doi.org/10.3390/jmse10050622

Chicago/Turabian StyleKim, Kyunghwan. 2022. "Characteristics of Economic and Environmental Benefits of Shore Power Use by Container-Ship Size" Journal of Marine Science and Engineering 10, no. 5: 622. https://doi.org/10.3390/jmse10050622

APA StyleKim, K. (2022). Characteristics of Economic and Environmental Benefits of Shore Power Use by Container-Ship Size. Journal of Marine Science and Engineering, 10(5), 622. https://doi.org/10.3390/jmse10050622