The Impact of El Niño-Southern Oscillation Events on Price Volatility: The Case of South African Maize

Abstract

1. Introduction

2. Literature Review

- Macroeconomic conditions, such as economic policy uncertainty, credit risks in financial markets, investor sentiment, and global political tension, influence market expectations and risk perceptions [31]. These factors amplify price fluctuations across commodities.

- Commodity derivative markets, including forwards, futures, and option contracts, serve as a tool for price discovery and price risk management. However, these markets can also transmit volatility due to the influence of climate variability, such as ENSO events, and economic and financial linkages across markets [7,12].

3. Materials and Methods

4. Results

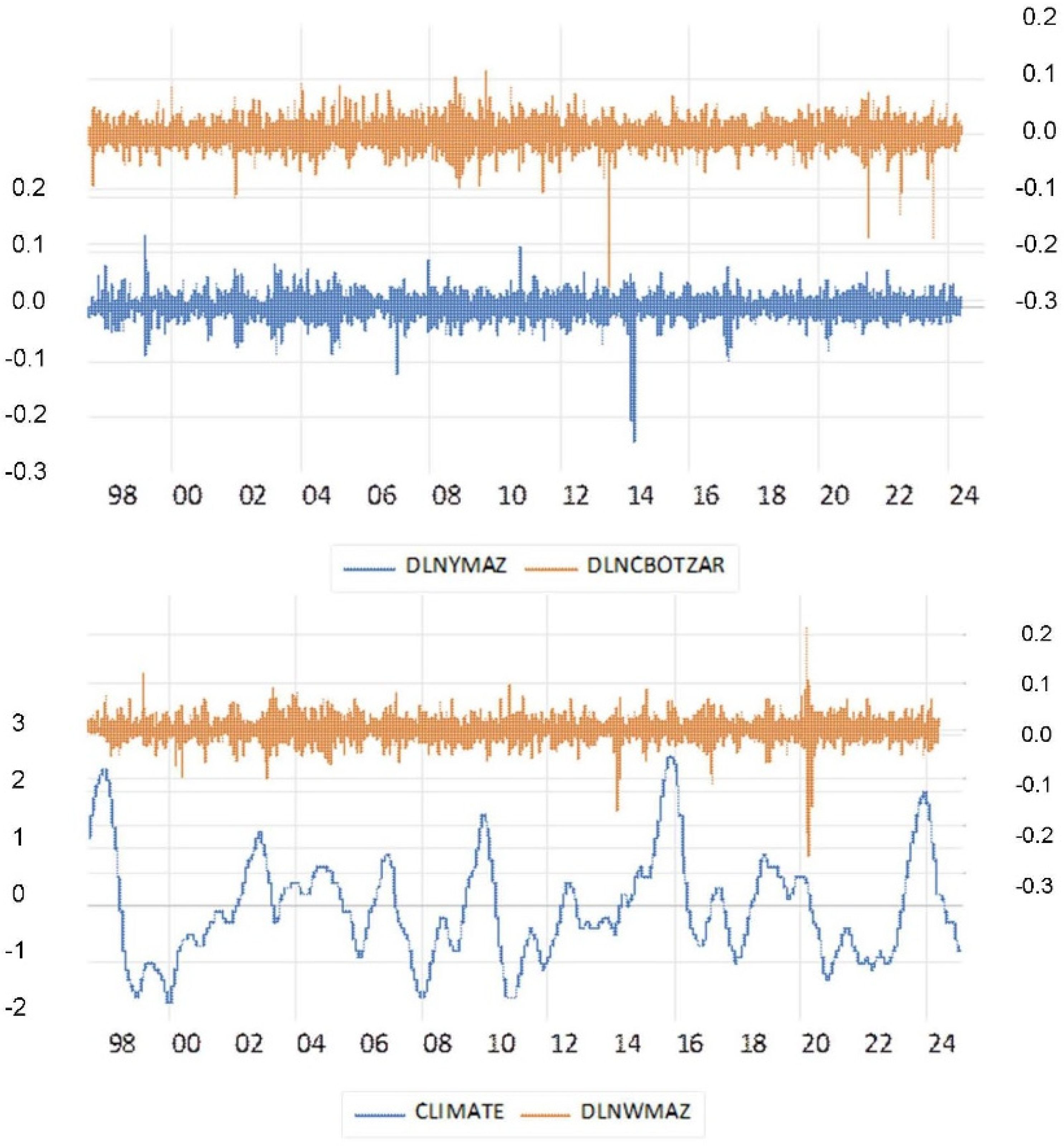

4.1. Descriptive Statistics

4.2. Regression Analysis

5. Conclusions and Discussion

- The lagged US corn price is statistically significant at 1% in the mean equations for white and yellow maize prices. This confirms the significant impact of US corn prices on South African maize prices. None of the climate variables are statistically significant in the mean equations, although there is some indication, with probabilities between 8% and 11%, that South African maize prices are higher during El Niño and La Niña periods compared to neutral ENSO periods.

- During certain El Niño and La Niña periods, the ARCH variable in the variance equation loses its significance. This points towards more persistent levels of volatility and less influence of more recent risks. While volatility patterns differ, this study did not attempt to identify factors associated with it. This may be due to factors like stock levels, the severity of the ENSO period, etc. However, it is highly unlikely that it is caused by price volatility transmission from US corn prices.

- The significance of the SOI indicator in the variance equations of both white and yellow maize underlines the significant effect of climate variability on South African maize prices.

Author Contributions

Funding

Institutional Review Board Statement

Data Availability Statement

Conflicts of Interest

Abbreviations

| CME | Chicago Mercantile Exchange |

| ENSO | El Niño–Southern Oscillation |

| JSE | Johannesburg Stock Exchange |

| US | United States |

References

- McPhaden, M.; Santoso, A.; Cai, W. Introduction to El Niño Southern Oscillation in a Changing Climate. 2020. Available online: http://handle.unsw.edu.au/1959.4/unsworks_73151 (accessed on 26 October 2025).

- Iizumi, T.; Luo, J.-J.; Challinor, A.J.; Sakurai, G.; Yokozawa, M.; Sakuma, H.; Brown, M.E.; Yamagata, T. Impacts of El Niño Southern Oscillation on the global yields of major crops. Nat. Commun. 2014, 5, 3712. [Google Scholar] [CrossRef]

- Ubilava, D.; Abdolrahimi, M. The El Niño impact on maize yields is amplified in lower income teleconnected countries. Environ. Res. Lett. 2019, 14, 054008. [Google Scholar] [CrossRef]

- Sazib, N.; Mladenova, l.E.; Bolten, J.D. Assessing the Impact of ENSO on Agriculture Over Africa Using Earth Observation Data. Front. Sustain. Food Syst. 2020, 4, 509914. [Google Scholar] [CrossRef]

- Department of Agriculture, Land Reform and Rural Development, Pretoria. Trends in the Agricultural Sector 2023. Available online: https://www.nda.gov.za/images/Branches/Economica%20Development%20Trade%20and%20Marketing/Statistc%20and%20%20Economic%20Analysis/statistical-information/trends-in-the-agricultural-sector-2023.pdf (accessed on 8 March 2025).

- Swanson, K.; National Corn Growers Association. A Study of the Economic Contribution of Corn Farming in the United States for 2023. 2024. Available online: https://dt176nijwh14e.cloudfront.net/file/700/Economic%20Contribution%20Study.pdf (accessed on 8 March 2025).

- Peri, M. Climate variability and the volatility of global maize and soybean prices. Food Secur. 2017, 9, 673–683. [Google Scholar] [CrossRef]

- Dube, B.; Khulu, N.; Mokoena, L. Assessing the impact of climatic factors on the trade performance of South African maize commodity. J. Infrastruct. Policy Dev. 2025, 9, 9471. [Google Scholar] [CrossRef]

- Chen, B.; Villoria, N.B. Climate shocks, food price stability and international trade: Evidence from 76 maize markets in 27 net-importing countries. Environ. Res. Lett. 2019, 14, 014007. [Google Scholar] [CrossRef]

- Khalfaoui, R.; Goodell, J.W.; Mefteh-Wali, S.; Chishti, M.Z.; Gozgor, G. Impact of climate risk shocks on global food and agricultural markets: A multiscale and tail connectedness analysis. Int. Rev. Financ. Anal. 2024, 93, 103206. [Google Scholar] [CrossRef]

- Auret, C.; Sayed, A. Volatility transmission in maize futures markets of major exporters. Invest. Anal. J. 2019, 48, 173–187. [Google Scholar] [CrossRef]

- Sayed, A.; Auret, C. Volatility transmission in the South African white maize futures market. Eurasian Econ. Rev. 2020, 10, 71–88. [Google Scholar] [CrossRef]

- Trenberth, K.E. The definition of el nino. Bull. Am. Meteorol. Soc. 1997, 78, 2771–2778. [Google Scholar] [CrossRef]

- Climate Prediction Center, National Oceanic and Atmospheric Administration. ENSO: Recent Evolution, Current Status and Predictions. 2025. Available online: https://www.cpc.ncep.noaa.gov/products/analysis_monitoring/lanina/enso_evolution-status-fcsts-web.pdf (accessed on 29 May 2025).

- Callahan, C.W.; Mankin, J.S. Persistent effect of El Niño on global economic growth. Science 2023, 380, 1064–1069. [Google Scholar] [CrossRef]

- Huang, Y.; Shi, M.; Fu, Z. A Dynamical Systems Perspective to Characterize the El Niño Diversity in Spatiotemporal Patterns. Front. Phys. 2022, 10, 919951. [Google Scholar] [CrossRef]

- Zenda, M. A systematic literature review on the impact of climate change on the livelihoods of smallholder farmers in South Africa. Heliyon 2024, 10, e38162. [Google Scholar] [CrossRef]

- Simanjuntak, C.; Gaiser, T.; Ahrends, H.E.; Ceglar, A.; Singh, M.; Ewert, F.; Srivastava, A.K. Impact of climate extreme events and their causality on maize yield in South Africa. Sci. Rep. 2023, 13, 12462. [Google Scholar] [CrossRef]

- Nhamo, L.; Matchaya, G.; Mabhaudhi, T.; Nhlengethwa, S.; Nhemachena, C.; Mpandeli, S. Cereal Production Trends under Climate Change: Impacts and Adaptation Strategies in Southern Africa. Agriculture 2019, 9, 30. [Google Scholar] [CrossRef]

- Mourtzinis, S.; Ortiz, B.V.; Damianidis, D. Climate change and ENSO effects on Southeastern US climate patterns and maize yield. Sci. Rep. 2016, 6, 29777. [Google Scholar] [CrossRef]

- Cai, W.; McPhaden, M.J.; Grimm, A.M.; Rodrigues, R.R.; Taschetto, A.S.; Garreaud, R.D.; Dewitte, B.; Poveda, G.; Ham, Y.-G.; Santoso, A. Climate impacts of the El Niño–southern oscillation on South America. Nat. Rev. Earth Environ. 2020, 1, 215–231. [Google Scholar] [CrossRef]

- Cai, X.; Sakemoto, R. El Niño and commodity prices: New findings from partial wavelet coherence analysis. Front. Environ. Sci. 2022, 10, 893879. [Google Scholar] [CrossRef]

- Muza, O. El Nino-Southern Oscillation influences on food security. J. Sustain. Dev. 2017, 10, 268–279. [Google Scholar] [CrossRef]

- Owusu, K.; Emmanuel, A.K.; Musah-Surugu, I.J.; Yankson, P.W.K. The effects of 2015 El Nino on smallholder maize production in the transitional ecological zone of Ghana. Int. J. Clim. Change Strateg. Manag. 2019, 11, 609–621. [Google Scholar] [CrossRef]

- Ubilava, D. The role of El Nino Southern Oscillation in commodity price movement and predictability. Am. J. Agric. Econ. 2018, 100, 239–263. [Google Scholar] [CrossRef]

- Adhikari, S. Estimating the Effects of Rising International Corn Production and Trade on the US and Global Corn Market. Master’s Thesis, University of Idaho, Idaho, ID, USA, 2023. [Google Scholar]

- Wang, X.; Pu, M.; Sun, S.; Zhong, Y. Study of Volatility Spillover from Crude Oil Futures to Grain Futures Across Multiple Cycles Based on the EEMD-BEKK-GARCH Model. Agriculture 2024, 15, 67. [Google Scholar] [CrossRef]

- Rapsomanikis, G.; Hallam, D.; Conforti, P. Market Integration and Price Transmission in Selected Food and Cash Crop Markets of Developing Countries: Review and Applications. Available online: https://www.fao.org/4/y5117e/y5117e06.htm (accessed on 17 May 2025).

- Martin, L.; Adam, C.; Gollin, D. Transport Frictions and the Pass-Through of Global Price Shocks in a Spatial Model of Low-Income Countries; (IMF Working Paper No. 25/039); International Monetary Fund: Washington, DC, USA, 2025. [Google Scholar] [CrossRef]

- Xue, H.; Du, Y.; Gao, Y.; Su, W.-H. Spatial price transmission and dynamic volatility spillovers in the global grain markets: A TVP-VAR-Connectedness approach. Foods 2024, 13, 3317. [Google Scholar] [CrossRef]

- Hu, M.; Zhang, D.; Ji, Q.; Wei, L. Macro factors and the realized volatility of commodities: A dynamic network analysis. Resour. Policy 2020, 68, 101813. [Google Scholar] [CrossRef]

- Erenstein, O.; Jaleta, M.; Sonder, K.; Mottaleb, K.; Prasanna, B.M. Global maize production, consumption and trade: Trends and R&D implications. Food Secur. 2022, 14, 1295–1319. [Google Scholar] [CrossRef]

- Borrallo, F.; Cuadro-Sáez, L.; Ghirelli, C.; Pérez, J.J. “El Niño” and “La Niña”: Revisiting the impact on food commodity prices and euro area consumer prices. SSRN 2024, 75, 63. [Google Scholar] [CrossRef]

- Yahyaei, H.; Kitsios, V.; De Mello, L. Risk transference between climate variability and financial derivatives: Implications for global food security. J. Clim. Financ. 2024, 7, 100038. [Google Scholar] [CrossRef]

- Ceballos, F.; Hernandez, M.A.; Minot, N.; Robles, M. Transmission of Food Price Volatility from International to Domestic Markets: Evidence from Africa, Latin America, and South Asia. In Food Price Volatility and Its Implications for Food Security and Policy; Kalkuhl, M., von Braun, J., Torero, M., Eds.; Springer International Publishing: Cham, Switzerland, 2016; pp. 303–328. [Google Scholar]

- Van Wyk, G.J. Measuring the Volatility Spill–over Effects Between Chicago Board of Trade and the South African Maize Market. Ph.D. Thesis, North-West University, Potchefstroomm, South Africa, 2012. [Google Scholar]

- Mutale, B.; Dai, S.; Chen, Z.; Maulu, S. Enhancing food security amid climate change: Assessing impacts and developing adaptive strategies. Cogent Food Agric. 2025, 11, 2519800. [Google Scholar] [CrossRef]

- Chiduwa, M.S.; Omondi, J.O.; Masikati, P.; Ngoma, H.; Nyagumbo, I. Empowering Farmers with Digital El Niño Advisories: Insights from Malawi and Zambia. CIMMYT. 2025. Available online: https://hdl.handle.net/10883/35637 (accessed on 29 May 2025).

- Ajayi, O.O.; Toromade, A.S.; Ayeni, O. Climate-Smart Agricultural Finance (CSAF): A model for sustainable investments in agriculture. World J. Adv. Res. Rev. 2024, 24, 001–011. [Google Scholar] [CrossRef]

- Cooper, H.; Sjögersten, S.; Lark, R.; Mooney, S. To till or not to till in a temperate ecosystem? Implications for climate change mitigation. Environ. Res. Lett. 2021, 16, 054022. [Google Scholar] [CrossRef]

- De Necker, J.; Geyser, J.; Pretorius, A. Weather derivatives as a risk management tool for maize farmers in South Africa. Afr. Rev. Econ. Financ. 2024, 16, 101–121. [Google Scholar]

- Hernandez, M.A.; Ibarra, R.; Trupkin, D.R. How far do shocks move across borders? Examining volatility transmission in major agricultural futures markets. Eur. Rev. Agric. Econ. 2014, 41, 301–325. [Google Scholar] [CrossRef]

- Engle, R.F.; Bollerslev, T. Modelling the persistence of conditional variances. Econom. Rev. 1986, 5, 1–50. [Google Scholar] [CrossRef]

- Geyser, M.; Pretorius, A. Climate’s Currency: How ENSO Events Shape Maize Pricing Structures Between the United States and South Africa. J. Risk Financ. Manag. 2025, 18, 181. [Google Scholar] [CrossRef]

| Abbreviation | Description |

|---|---|

| DLNWMAZ | log first difference in South African white maize price—sourced from the JSE (in South African Rand per ton) |

| DLNYMAZ | log first difference in South African yellow maize price—sourced from the JSE (in South African Rand per ton) |

| DLNCBOTZAR | log first difference in US corn price; original format of US cent per bushel—sourced from the CME, converted to price in South African Rand per ton |

| DLNRUSD | log first difference in exchange rate (South African Rand per US dollar)—sourced from the South African Reserve Bank |

| DUMELN | El Niño dummy generated = 1 if sea temperature at least 0.5 °C > average |

| DUMLAN | La Niña dummy generated = 1 if sea temperature at least 0.5 °C < average |

| TAHITI − DARWIN | Difference in daily recorded air pressure at Tahiti and Darwin |

| DLNCBOTZAR | DLNWMAZ | DLNYMAZ | |

|---|---|---|---|

| Whole sample period (7038 obs) | |||

| Mean | 0.000275 | 0.000311 | 0.000277 |

| Max | 0.117220 | 0.704863 | 2.307918 |

| Min | −0.279928 | −0.694829 | −2.297223 |

| Std dev | 0.019435 | 0.022945 | 0.045760 |

| El Niño (913 obs) | |||

| Mean | 0.0000730 | 0.001556 | 0.000747 |

| Max | 0.071269 | 0.704863 | 0.078332 |

| Min | −0.186497 | −0.694829 | −0.054808 |

| Std dev | 0.017928 | 0.037047 | 0.014510 |

| La Niña (2009 obs) | |||

| Mean | 0.001251 | 0.000808 | 0.000846 |

| Max | 0.086650 | 0.120714 | 2.307918 |

| Min | −0.146286 | −0.101218 | −2.297223 |

| Std dev | 0.018802 | 0.016839 | 0.081169 |

| Basic GARCH | With Dummies | |||

|---|---|---|---|---|

| White | Yellow | White | Yellow | |

| Mean equation | Mean equation | |||

| C | ** 0.000363 (0.0391) | ** 0.000348 (0.0163) | 0.000148 (0.5345) | 0.000094 (0.6304) |

| DLNCBOTZAR(−1) | *** 0.273962 (0.0000) | *** 0.276835 (0.0000) | *** 0.273143 (0.0000) | *** 0.276535 (0.0000) |

| DLNRUSD | *** 0.163407 (0.0000) | *** 0.163156 (0.0.0000) | *** 0.163705 (0.0000) | *** 0.162888 (0.0000) |

| DUMELN | * 0.000901 (0.0912) | 0.000644 (0.1366) | ||

| DUMLAN | 0.000308 (0.4305) | 0.000522 (0.1160) | ||

| Variance equation | Variance equation | |||

| C | *** 0.00000946 (0.0000) | *** 0.00000811 (0.0000) | *** 0.0000091 (0.0000) | *** 0.00000842 (0.0000) |

| RESID(−1)2 | *** 0.121122 (0.0000) | *** 0.123510 (0.0000) | *** 0.120950 (0.0000) | *** 0.124523 (0.0000) |

| GARCH(−1) | *** 0.855719 (0.0000) | *** 0.850682 (0.0000) | *** 0.856305 (0.0000) | *** 0.849374 (0.0000) |

| DUMELN | 0.00000034 (0.7397) | −0.00000013 (0.8469) | ||

| DUMLAN | 0.00000055 (0.4208) | −0.00000067 (0.3235) | ||

| Obs | 7037 | 7037 | 7037 | 7037 |

| White Maize | Yellow Maize | |

|---|---|---|

| El Niño: 1 May 2023 to 22 April 2024 | ||

| C | 0.0000259 (0.1490) | 0.0000418 (0.3229) |

| RESID(−1)2 | * 0.076589 (0.0771) | 0.054713 (0.3351) |

| GARCH(−1) | *** 0.831314 (0.0000) | ** 0.694696 (0.0183) |

| Obs | 256 | 256 |

| La Niña: 1 August 2011 to 23 April 2012 | ||

| C | 0.00000862 (0.2641) | 0.00000138 (0.3565) |

| RESID(−1)2 | * 0.140622 (0.0817) | ** −0.051845 (0.0463) |

| GARCH(−1) | *** 0.833422 (0.0000) | *** 1.060675 (0.0000) |

| Obs | 191 | 191 |

| La Niña: 3 August 2020 to 24 May 2021 | ||

| C | * 0.0000540 (0.0976) | 0.00000497 (0.1411) |

| RESID(−1)2 | ** 0.196709 (0.0460) | ** 0.201300 (0.0437) |

| GARCH(−1) | *** 0.594452 (0.0004) | ** 0.530369 (0.0276) |

| Obs | 211 | 211 |

| White Maize | Yellow Maize | |

|---|---|---|

| Mean equation | ||

| C | * 0.000427 (0.0784) | ** 0.000420 (0.0350) |

| DLNCBOTZAR(−1) | *** 0.283359 (0.0000) | *** 0.286355 (0.0000) |

| DLNRUSD | *** 0.167892 (0.0000) | *** 0.167755 (0.0000) |

| (TAHITI − DARWIN) | −0.0000257 (0.6659) | −0.0000305 (0.5551) |

| Variance equation | ||

| C | *** 0.000008 (0.0000) | *** 0.00000602 (0.0000) |

| RESID(−1)2 | *** 0.124825 (0.0000) | *** 0.119117 (0.0000) |

| GARCH(−1) | *** 0.853702 (0.0000) | *** 0.858020 (0.0000) |

| (TAHITI − DARWIN) | ** 0.00000045 (0.0134) | *** 0.000000475 (0.0019) |

| Obs | 6626 | 6626 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Pretorius, A.; Geyser, M. The Impact of El Niño-Southern Oscillation Events on Price Volatility: The Case of South African Maize. Agriculture 2025, 15, 2361. https://doi.org/10.3390/agriculture15222361

Pretorius A, Geyser M. The Impact of El Niño-Southern Oscillation Events on Price Volatility: The Case of South African Maize. Agriculture. 2025; 15(22):2361. https://doi.org/10.3390/agriculture15222361

Chicago/Turabian StylePretorius, Anmar, and Mariette Geyser. 2025. "The Impact of El Niño-Southern Oscillation Events on Price Volatility: The Case of South African Maize" Agriculture 15, no. 22: 2361. https://doi.org/10.3390/agriculture15222361

APA StylePretorius, A., & Geyser, M. (2025). The Impact of El Niño-Southern Oscillation Events on Price Volatility: The Case of South African Maize. Agriculture, 15(22), 2361. https://doi.org/10.3390/agriculture15222361