1. Introduction

Coffee is the backbone of the Ethiopian economy and represents its highest source of foreign exchange earnings [

1]. According to the United States Department of Agriculture (USDA) Foreign Agricultural Service Coffee Annual Report for 2021 [

2], Ethiopia’s coffee exports for the 2019/2020 fiscal year amounted to 821.14 million USD. This amount represents approximately 31% of the total value of the country’s exports and 42% of the value of agricultural exports for the same fiscal year. Ethiopia produces, on average, 400,000 metric tons of coffee annually and exports more than 60% of its annual production (Note 1). Historically, the Government of Ethiopia kept a tight grip on the coffee sector. Until 2008, coffee had to be traded through an auction system that had many deficiencies.

The Ethiopian Commodity Exchange (ECX) was championed by academics and practitioners who argued that Ethiopia, a country prone to food crises, could tackle this issue with a market-oriented solution for grain allocation using a commodity exchange [

3]. Ethiopia received broad support from multinational development agencies to establish the ECX. The ECX was initially conceived primarily as a marketplace for grain trading, although it was planned that export products such as coffee might be included at a later stage. A few months after the opening of the ECX, the government passed a law mandating that all coffee trade, with a few exceptions, would have to be conducted through the ECX. Coffee began to be traded on the exchange. In December 2008, coffee became one of the ECX’s main traded commodities.

Despite its flaws, the pre-2008 auction system had the advantage of preserving coffee traceability. At the auction centers, coffees from different growing origins were kept apart in order to preserve the specific cup-tasting characteristic of the coffee from each region, thereby making it possible for overseas buyers to trace the origin of the coffee they acquired. Its cup taste and spatial or grower origin are important and sought-after features for a product such as coffee. International buyers are particularly interested in traceable coffee and are willing to pay higher prices.

Unfortunately, by requiring coffee to be traded through the ECX, the attribute of traceability was eliminated for 80% of the coffee exported from Ethiopia. Traceability was maintained for 20% of coffee exports that were still conducted by cooperatives and a few large private estate farmers and state farms. State farms and private estates were granted the right to export their coffee directly and do not have to pass through the commodity exchange. Cooperatives, meanwhile, only have to have their coffee inspected and graded at the ECX, after which they can export it themselves, thereby preserving the traceability of their coffee. The focus of this paper is to use the information gained from this natural experiment to evaluate foreign buyers’ willingness to pay for the attribute of traceability of Ethiopian coffee and to see how traceability has affected buyers’ trust in the grades given by the ECX for the coffee it grades.

1.1. Economic Value of Traceability

Traceability is a term used to designate the ability to track every aspect of a good’s production, growing, processing, and distribution from “farm to fork.” Traceability was first defined in 1987 in ISO 8402 standard as “the ability to retrieve history, use or location of an entity by means of recorded identifications.” The entity may designate an activity, a process, a product, an organization, or a person.

Traceability has an economic value because it increases the certainty of the product’s origin, enabling consumers to be able to make a better judgement on the quality of the produce they are buying. For products where quality is a function of the location of its production, customers will bid up the price of the items from the more desirable locations. For example, [

4] conducted an experimental study to evaluate the willingness of US consumers to pay for the traceability of red meat. Their results suggest that the average consumer had a willingness to pay an extra amount of 16.7% of the price of meat when the attribute of traceability was present. In a similar experiment conducted in Canada, [

5] found that consumers were willing to pay 7% more for meat on average when the location of its source was traceable.

The market value of coffee is determined in the same manner as that of wine: its geographic place of origin strongly influences its price [

6]. A country such as Ethiopia is known for coffee brands that are grown in specific regions. The traceability of coffee allows farmers to acquire a reputation and claim recognition. Traceability is important as overseas buyers are usually willing to pay a premium price for coffee beans that can be traced all the way back to specific cooperatives, production areas, and even individual farms. Buyers know the geographic areas and/or farms that produce specific types of coffee, their likely grade, and their particular taste. Traceability allows them to confirm the type and quality of the product they acquire. A system in which traceability is nonexistent hurts both buyers and sellers. Suppliers lose out on potential higher revenues, and from the buyers’ point of view, the grades of coffee are uncertain. Buyers fear that they may end up with a product that is below par in terms of quality.

1.2. Evolution of the Institutions Regulating the Sale and Export of Coffee from Ethiopia

Before 2008, small-scale coffee farmers would sell their harvest to locally licensed collectors (or “sebsabies” in Ethiopian parlance). Collectors would then proceed to sell the coffee to licensed warehousing suppliers (“akrabies”). Suppliers would have to physically bring the coffee they bought to one of the two auction centers—in the capital, Addis Ababa, or in Dire Dawa—where it would be graded by the Coffee Liquoring Unit (CLU) before being ultimately sold to exporters. Suppliers could not export their coffee directly, and exporters could only buy coffee from the auction. The grading standards were determined based on the number of defects and the processing method [

1].

This auction system had many deficiencies. One recurrent complaint was that price manipulations occurred that undervalued the officially reported coffee sales prices. Given that exporters had to go through the auction, some traders would try to avoid declaring their true receipts and reported foreign exchange earnings by placing low bids on their own coffee. Other buyers would be informed of the situation and would not bid on these specific batches of coffee. Lastly, the old auction system was also characterized by high transaction costs as well as low enforcement of contracts and delays in payments [

7].

Soon after its inception, the ECX was faced with many challenges; there was a reluctance on the part of prominent grain traders to trade through the exchange as they perceived it as a threat to their business model. The lackluster performance of the ECX at the beginning meant its viability was threatened. To boost the volume of trading through the ECX, the Government of Ethiopia decided that all coffee trade from then on would have to be conducted through the ECX. The only exceptions were cooperatives and large estates who, after having their coffee graded by the ECX, could directly export their coffee without having to go through an ECX auction Prior to requiring coffee to be processed through the ECX, cooperatives and a number of large producers had well-established relationships with foreign companies buying coffee. Most cooperatives and large producers were focused on the certified (fairtrade or organic) coffee niche market. Traceability is a must for these certification schemes. The Government of Ethiopia decided to grant them an exemption as a means to allow them to continue selling certified coffee and strengthen their position in the market [

1].

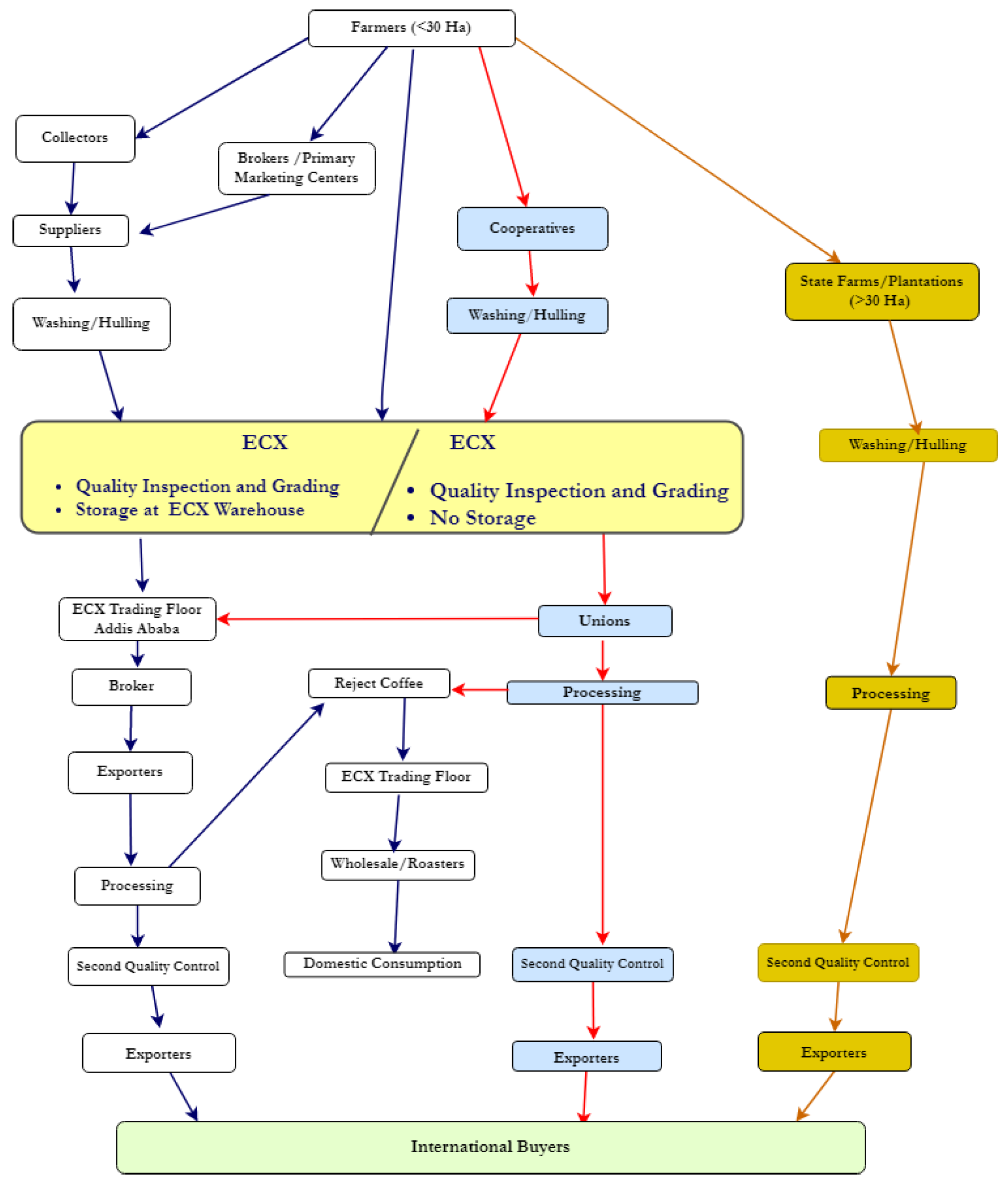

Figure 1 illustrates the coffee value chain flow in Ethiopia from 2008 to 2017.

The ECX was touted as an organized trading platform where traders could meet and engage in trading transactions with full confidence that they would receive timely payment and delivery. Furthermore, both the quantity and the quality of the commodity bought would match their requirements. The ECX is credited with correcting many of the major deficiencies that plagued the pre-ECX auction system, such as weak contract enforcement, delayed or defaulted payments, the lack of access to up-to-date pricing information on the part of farmers, and collusion between buyers and sellers to reduce reported revenues from coffee sales [

8].

The problem of lack of information for farmers concerning the grade of their coffee was addressed by setting up a series of regional ECX warehouses where the coffee is initially graded. In this way, it was hoped that the frequency with which buyers cheated farmers would be reduced. The coffee was then graded again by the ECX prior to being auctioned.

Despite its positive impacts, the ECX led to homogenization in the trading of commodities. The ECX required that suppliers bring their coffee to ECX-controlled warehouses. After inspection and grading, coffee was then pooled into standard lots and stockpiled into compartments at the warehouses, with no distinction in terms of regional or grower origin. This overlooked the subtle differences in cup taste within a grade category and the specific spatial and grower origin. The ECX’s first-in-first-out delivery policy completely homogenized the coffee, as buyers would receive a coffee blend from various anonymized sources.

This anonymity brought some efficiencies in the Ethiopian coffee market by improving the level of transparency when suppliers and exporters engaged in transactions [

9]. However, this improvement was achieved at the cost of overlooking the subtle distinction in cup taste that existed within the grade categories and specific spatial and grower origins. Exporters and international buyers were deprived of the ability to buy their coffee from specific washing stations or farmers [

10].

For some commodities, such as cereals, commoditization is advantageous, but for coffee, it is detrimental since the quality of coffee is gauged and confirmed through knowledge about the place of growing and cup tasting [

11]. Ethiopian coffee varieties are often identified by agroecological and local conditions, shape, acidity, body, flavor, aroma, and processing method, and they are generally auctioned by their corresponding origin of production. Ethiopian coffee is traded in the world market based on its origin of production, for example, Sidamo, Yirgacheffe, Harar, Jimma, Lekemt, Teppi, Limmu, or Bebeka [

12].

From the start of coffee trading through the ECX, an aggressive lobbying effort was undertaken by the participants in the coffee market to reform the system so that the traceability of coffee would be retained, even if grading was conducted via the ECX system [

10]. The international buyers of Ethiopia’s high-quality, niche market, or “specialty” coffee, were among the most vocal opponents of the ECX [

1]. For example, the Specialty Coffee Association of America (SCAA) opposed the ECX [

13]. The introduction of the ECX in the coffee market also occurred at a time when the importance of specialized coffees and traceability was increasing in the international coffee market. Over time, the Government of Ethiopia increasingly felt intense pressure from exporters, overseas buyers, and development agencies to loosen its rules and allow for greater flexibility in the coffee sector. Specialty coffee buyers and exporters were campaigning for the greater traceability of coffee in the ECX and to bypass the ECX and trade coffee directly [

14].

Due to the increased certainty that traceability provides as to the type and grade of the coffee available, international sellers of coffee find it worthwhile to increase their efforts to market their coffee to the niche markets that are willing to pay for specialized coffee that is location specific.

Consequently, in 2017, the rules of the ECX were adjusted to allow a high degree of traceability and flexibility, while at the same time, the ECX retained the key functions of washing (to improve the grade of coffee) and grading coffee. The practice of blending coffee lots at ECX warehouses, which resulted in the loss of traceability, was abolished. Coffee sold at the ECX can now be traced all the way back to the initial washing station where it was first processed. Several restrictions pertaining to the value chains were lifted. For instance, farmers gained the right to hold an export license, and individual exporters can now own washing stations. Furthermore, exporters can sell directly to overseas buyers, bypassing the ECX, but on the condition that they do so within three days of the coffee reaching the warehouses in Addis Ababa [

10].

With respect to traceability, the steps in the value chain for Ethiopian coffee have gone full circle, from the original situation where there was full traceability to a situation where only about 20% of the coffee sold was traceable to the current situation where all coffee is potentially traceable. In this process of institutional evolution, a natural experiment was created where the market prices of traceable and nontraceable coffee of identical types and quality were traded on the market simultaneously. This allows one to estimate the willingness to pay for the attribute of traceability in the case of Ethiopian coffees.

2. Literature Review

There have been many articles written that study the impact that the creation of the ECX had on the Ethiopian coffee sector. However, only a few have tried to quantify the impacts of the ECX on traceable and nontraceable coffee prices.

Minten et al. [

15] studied the structure and the performance of the Ethiopian coffee export industry from 2003 to 2013. Using a hedonic regression model, they found that the geographic origin of the coffee has a strong positive effect on export prices. The various geographic origins of coffee lead to different prices. Furthermore, certifications such as fairtrade and organic yield premium prices of about 9%. Moreover, coffee exported via cooperatives and private commercial farms achieves higher prices: cooperatives have achieved export premium prices of 16%, compared with private farms, whose export premium prices are just 5%. Washed coffee is another characteristic that attracts premiums, these being about 20% on average. These findings corroborate the assertion that overseas buyers (on average) are willing to offer higher prices for high-quality, traceable coffee.

Hernandez et al. [

12] investigated the extent to which the ECX has altered price dynamics between international and domestic markets and across different regional markets in Ethiopia. Their analysis covered the period from 1992 to 2013 and used time series data on farm gate prices, auction prices, and international coffee prices. Their results indicated that the level of interdependence between the ECX and international markets is greater than that between international markets and farm gate markets. However, the degree of correlation between farm gate prices and international markets has remained very low, even after the establishment of the ECX, suggesting that the ECX had only a limited influence on price dynamics in the coffee value chain, and only a very small proportion of the increase in international prices trickles down to local farmers.

Handino et al. [

16] set out to determine whether farmers who sell their coffee through cooperatives receive higher prices than those who sell via the ECX. Their results showed that those who sold their coffee via cooperatives achieved higher prices on average.

Andersson et al. [

17] examined the impact that the creation of the ECX and a decentralized warehouse system has had on the market efficiency in Ethiopia. While the focus of their research was highly relevant to understanding the impacts of the ECX on improving the efficiency of the value chain for coffee up to the point of export, it did not address the question of the willingness to pay for traceability, which is the primary focus of the current article.

In the same vein, Gelaw et al. [

18] examined the impact that the introduction of the ECX had on the coffee market efficiency in Ethiopia. They postulated that the ECX would lead to an improvement in terms of speed and symmetry of the price signal transmission along different levels of the coffee value chains, resulting in better integration between world prices and export prices as well as between ECX prices and producers’ prices. Their results revealed, however, that the ECX has not led to a substantial enhancement of the price transmission between export prices in Ethiopia and world market coffee prices.

Table 1 presents a synopsis of the main articles that are relevant to our research.

3. Estimating the Willingness to Pay for Traceability

This investigation estimates the impact that the ECX system and the loss of traceability had on coffee prices. It is worth remembering that from 2008 to 2017, exported coffee could only reach overseas buyers via two primary pathways. We refer to them here as producer coffee and trader coffee.

In 2009, to assuage buyers’ misgivings about the ECX, the Government of Ethiopia decided to grant permission to licensed cooperatives, state farms, and a few large producers for the direct trade of traceable and certified smallholder coffee [

19]. This meant that cooperatives could bypass the ECX, except for the grading of the coffee and export directly to foreign buyers. The smallholder coffee sold via the cooperatives is classified as producer coffee in our dataset, and the attribute of traceability is preserved.

Producer coffee was allowed to go from state farms or plantations of over 30 hectares to the port without passing through the ECX; alternatively, it could go from individual farmers to the ECX via cooperatives. The ECX’s role here was limited to quality inspection and grading. Coffee was essentially exported directly by the cooperatives. This coffee was fully traceable since the coffee was not sold on the ECX trading floor in both cases.

Trader coffee is a product that was exported via brokers. In this case, coffee ineluctably had to go through the ECX warehouse before being traded on the ECX floor. This resulted in the coffee becoming untraceable. In the warehousing phase, coffees of similar origin were bagged together, creating anonymity and disregarding cup taste differences.

4. Methodology

4.1. Data Sources

For our analysis, we used a dataset from the Ministry of Trade of Ethiopia. It contains entries of reported export sales transactions providing such information as the free on board (FOB) value of the exported coffee in US dollars, the volume of coffee exported in kilograms, the coffee variety, the grade assigned by the CLUs at the time of export, and the country of destination. In total, the dataset contains about 12,000 observations covering the period of 2007–2012. Between 2007 and 2012, there were nearly 270 coffee exporters in Ethiopia. In-depth research was conducted to determine whether domestic exporters grew their coffee themselves, in which case the shipment was labeled as producer coffee, and otherwise, the shipment was classified as trader coffee. After the classification was completed, the reported price/kg of the coffee was calculated by dividing the total export value FOB (USD) of the shipment by its volume (kg). The grade and type of coffee information available in this dataset were determined by the CLUs in Addis Ababa or Dire Dawa before being ultimately exported from Ethiopia. Grading was repeated at this stage to ensure that only export-quality coffee was being shipped abroad. This information is recorded on the export document that is the source of the data used in this study. The descriptive statistics for the dataset are presented in

Table 2.

A total of 10,673 observations were categorized as trader coffee and 1634 observations as producer coffee. Over the entire period, the average price of producer coffee was 1.23 USD/kg, or 33% higher than the export price of trader coffee.

For the set of trader coffee shipments, there were a total of seven types of coffee sold with seven reported grades of coffee. Sidamo, Jimma, and Lekempti made up more than 75% of the types of trader coffee, while Grades 2, 4, and 5 covered more than 85% of the trader coffee exported. Producer coffee was dominated by Sidamo, Jimma, Yirgarcheffe, and Limmu, which together made up over 80% of exported producer coffee. In terms of the grades of producer coffee exported, it was primarily of Grades 2, 4, and 5, with over 60% being Grade 2.

4.2. The Model

To investigate the important determinant factors affecting the export prices of trader and producer coffee, two sets of regressions were used, one each for trader and producer coffee, as shown in Equations (1) and (2).

where the dependent variables PT and PP represent the FOB price per kg for trader coffee and producer coffee, respectively. Both dependent variables are expressed in USD. The export price of either producer or trader coffee is defined for a specific coffee variety and grade that was exported during a given month of a given year. Outlier values of PT and PP were excluded.

The independent variable PNY is the monthly average coffee price quoted at the New York Mercantile Exchange, published by the International Coffee Organization (ICO), PNY was inserted as a proxy for the general world price of coffee. As the world price of coffee rises and falls, it is expected that the general export price of Ethiopian coffee will move in a similar fashion.

A key explanatory variable in this study is the dummy variable ECX used to indicate whether the export date was after Ethiopian coffee began to be traded on the ECX in December 2008. For transactions prior to December 2008, the value of this variable is zero. The coefficient of this dummy variable will measure the impact of the ECX on the prices of both trader and producer coffee sold after the imposition of the ECX on the coffee market in Ethiopia.

Dummy variables were used to evaluate the effect of the coffee types and grades on the prices. Ethiopian coffee brands have a geographical name indicating the region where they are cultivated. Those regions are each characterized by distinct variations in landscape and altitudes that determine the quality of the coffee grown. Unfortunately, this Ministry of Trade dataset did not provide full information on whether the export coffee was certified as fairtrade or organic. This constraint precluded us from using certification as a control variable in our analysis. In international coffee markets as well as locally, Ethiopian coffee is differentiated by region, altitude, and cupping score, rather than by variety. In our dataset there are nine types of coffee and seven grades. Coffees with a grade of 1 or 2 are considered “specialty.” Coffees with Grade 3 through 8 are classified as “commercial.” Grades are assigned after visual inspection for defects and depend on cup quality. In the estimated regressions, a dummy variable of 1 was used for each type of coffee. To have a benchmark or reference type, Jimma coffee was omitted from the estimated equations. In the case of grades, to have a benchmark for comparison, Grade 2 coffee was omitted. Hence, the coefficients of the other types and grades measured the impact on the price per kg of coffee relative to that for Jimma coffee and Grade 2 coffee sold.

5. Results

The results of the empirical analysis using an OLS regression are presented in

Table 3, covering the whole period from 2007 to 2012 and for the totality of our dataset. These results show that trading coffee through the ECX led to an increase in the price for both types of coffee. Nonetheless, we observed a major difference between the two sets of coffees. In the case of producer coffee, the prices per kg of exported coffee increased much more than in the case of trader coffees.

We can see that the regression coefficients of the ECX variable are 0.80 for producer coffee and 0.14 for trader coffee, and they are highly significant. This implies that after the ECX took over the processing of trader coffee, the price gap between producer and trader coffee widened by a further 0.66 USD/kg. The difference in the price increase between the two types of coffee measures the value of the premium that the international market placed on the traceability of coffee for the period of 2008–2012.

The reason for this increase in price can be attributed to the fact that the ECX eliminated the traceability attribute for some of the trader coffee that was previously traceable. After the ECX took over the grading and auctioning of trader coffee, approximately 80% of the coffee sold from Ethiopia became nontraceable. The shortage of traceable coffee from Ethiopia meant that the remaining coffee that could be traced was now able to command a substantial price premium. As we investigated subsequently, the price effect may also be partially attributed to the improved alignment of the prices of the exported producer coffees with their types and grades. These empirical results and the political reaction to the ECX indicate that traceability is a source of value for coffee sold in the international market.

During the period of 2007 to 2012, we were not aware of any other significant changes exogenous in Ethiopia, other than the imposition of the ECX into the coffee value chain, that would affect coffee prices. However, at the same time, several shifts in the international supply and demand for coffee outside Ethiopia did affect the international price of coffee. It was for this reason we included the New York price of coffee (PNY) as an explanatory variable to capture the impacts of the exogenous variable over which Ethiopia had no control.

The regression coefficient on PNY reflects the impact of the world price of coffee on the sale price of coffee from Ethiopia. The coefficients of about 0.7 for both producer coffee and trader coffee indicate that the average export price of Ethiopian coffee was approximately 70% of the average price of coffee delivered in New York. This reflects on the trade margins between these two points of the supply chain. For both trader and producer coffee, when considering the entire period from 2007 to mid-2012, the coefficient of the average monthly New York Mercantile price of coffee is highly significant.

The results in

Table 3 show that for the total dataset for producer coffee, including both before and after the introduction of the ECX, a total of five out of the seven types of producer coffee have

p values that are highly significant (

p value lower than 0.1%). This means that the coffee type attribute does indeed significantly help to explain the export price/kg (relative to the Jimma type) for the export sale of producer coffee.

For trader coffee, on the other hand, only Yirgacheffe and Harar have p values that are significant at the 0.1% level, while the coefficients of the coffee types Ghimbi and Limmu are significant at the 5% level. In the case of Yirgacheffe and Harar coffee, the size of the positive coefficient is much smaller than for these same coffee types if they were classified as producer coffee.

Regarding the impact of the grade of coffee on the price of coffee, for producer coffee, five out of the six grades of coffee are significant at the 0.1% level. They all reflect a lower price than for Grade 2, which is the reference grade in these regressions. In the case of trader coffee, only the coefficient of Grade 5 coffee is significant at the 5% level, but it has the wrong sign (positive).

These results raise two further questions. First, did the Ethiopian export price of coffee track the world price of coffee as closely before the sale of coffee was required to be conducted via the ECX as after the introduction of the ECX in the coffee market? Second, did the types and grades of coffee play different roles in determining the price before and after trader coffee was sold through the ECX?

To address these two questions, the data series for both trader and producer coffee were divided between the observations that occurred prior to December 1, 2008 and those that occurred after that date. For trader coffee, there were 3371 observations prior and 7302 after 1 December, 2008. For producer coffee, there were 352 observations prior and 1282 observations after December 1, 2008. The analysis of the impacts of the same set of explanatory variables on these two separate sets of data is presented in

Table 4.

5.1. Reported Export Prices and World Prices

The results in

Table 4 seem to suggest that, prior to the ECX, Ethiopian export prices were not very transparent (those are self-reported prices). An important point to observe is that the regression coefficients of the variable PNY are very different for the regressions “before the ECX” and “after the ECX”. PNY is a measure of the world price of coffee. We would expect that this variable would always strongly impact on the price of Ethiopian coffee.

Prior to coffee being traded through the ECX, the coefficient of this variable was not significant in the case of either trader or producer coffee. This is a surprising result, given that coffee is an internationally traded commodity, and Ethiopia accounts for a considerable share of the world’s coffee production. However, after the introduction of the ECX, the coefficients of the PNY variable were highly significant for both trader and producer coffee with a value of approximately 0.7.

It is certain that the cooperatives and large producers would be very aware of the world prices of coffee both before and after December 2008; however, there is a dramatic change in the relationship between the prices they report to the authorities at the point of export and the world price of coffee after the date. For trader coffee, the ECX auctions reduced the scope for collusion on the sales prices they reported to the authorities. The higher degree of transparency with respect to trader coffee seems to have also carried over to the reported export sale prices of producer coffee after the introduction of the ECX.

5.2. Impact of Coffee Types and Grades on Reported Export Prices before and after the ECX

Before coffee was traded through the ECX, there was no significant statistical relationship between the types and grades of coffee and the reported export prices of the trader coffee (

Table 4, col. 1). In the trader regression case for after the ECX (

Table 4, col. 2), the coffee types Harar, Yirgacheffe, and Ghimbi had an impact on the reported export price with a significance level of at least 5%. When it comes to grades, we observed that after trader coffee was sold via the ECX, only Grade 6, a low-quality type, exhibited a significant (negative) impact on the reported export price. As previously mentioned, the old auction system was fraught with deficiencies. It is to be expected that in such a context, the market would not particularly trust the results of its grading and inspection. After 2008, trader coffee was auctioned after the coffee was graded by the ECX. However, the impact of grades on prices for trader coffee did not change much, even with the grading being conducted by the ECX and auctioned in a transparent manner. The mixing of the coffee from different growers and the elimination of traceability to the original growers seems to have reduced the information value of the ECX grading of trader coffee.

The problem of the lack of traceability of trader coffee existed to a considerable degree prior to the channeling of all trader coffee through the ECX. For some suppliers of trader coffee, the value chain might be quite long from the original grower through the various collectors to the ultimate licensed warehouse suppliers who would then sell the coffee to the international buyers. At the point of export, much of the trader coffee would probably not be traceable. This lack of traceability, however, was exacerbated by the requirement that all coffee be graded and sold via the ECX.

The situation changed greatly for producer coffee before and after 2008 (

Table 4, col. 3). For export sales of producer coffee before 2008, the coefficients of four of the seven types of coffee were statistically significant in explaining the reported export prices. However, prior to 2008, the final grades of the coffee were in general not significant, except for Grade 7. This is a very low grade of coffee for which the sign of the coefficient was negative, as expected.

After 2008, the situation was quite different. The ECX was required to grade all producer coffee before it was sold, but the final sale could be made directly by producers to exporters. Out of the seven coffee types, a total of six had a significant impact on the export price of the consignment. The coefficients of all the grades of coffee were significant at the 5% level. When coffee is fully traceable and there are fewer intermediaries in the value chain, the market appears to agree that grades and coffee types should have a greater impact on export prices. Traceability is not only a valuable feature in and of itself, but it also enables the export prices to reflect more accurately the type and quality of the coffee.

Although trader coffee is graded twice by the ECX before it is sold, it often lacks the information that would allow the buyer to trace it to where it was grown. The export buyers do not trust the grading conducted by the ECX when traceability is not present. This problem does not seem to be as prevalent with producer coffee, where all the coefficients on grades and types were of the expected sign and had a high degree of statistical significance. Although the ECX also graded the producer coffee, the traceable nature of the coffee allowed the exporters to better assess the true type and grade of the coffee they were buying.

Combining the attributes of specialty coffee and traceability led to higher prices for producer coffee given that that the ECX caused traceability to disappear altogether in the case of trader coffee. In a sense, the ECX made producer coffee more valuable in the eyes of foreign buyers by reducing the supply of this attribute. Traceability is a feature that gives more incentives to cooperatives and the few large producers to make sure that their shipment of coffee meets the quality specification of their oversea customers. In the case of trader coffee, there are many different participants in the value chain, and hence, trust in the reported grade and type may not exist.

6. Conclusions

Ethiopia is a country that is constantly beset by drought, which has triggered mass famine in the past. A leading cause of food scarcity in Ethiopia has been the highly localized nature of its markets, which have hampered the availability and the free movement of goods across the country. The Government of Ethiopia sought to tackle this recurring problem with a market-oriented solution by setting up a commodity exchange. The ECX was established primarily to provide systems to ease the trade and movement of foodstuffs such as grains and sesame. However, in December 2008, a few months after the launch of the ECX, coffee began to be traded on the exchange floor and soon became its most traded commodity. In the case of coffee, the ECX replaced the old auction system that had been operating since the 1980s. Despite its longevity, the old auction system had several deficiencies. The ECX was touted as a mechanism to iron out those inefficiencies, with the hope that the approximately 5 million Ethiopian coffee farmers would receive higher prices for their products. However, after coffee was introduced to the ECX, a new issue emerged, namely the loss of traceability of the coffee for a substantial share of the market.

The value of coffee is inextricably linked to its place of origin, cup taste, mode of cultivation, and processing. Commoditization made it impossible for international buyers to both trace ECX-sourced coffee and distinguish it using cup taste. The introduction of the ECX into the coffee market divided the sales of coffee so that, for a large part of the market, it was impossible to trace it to where it was produced. At the same time, for a smaller share of the market, traceability was maintained and even enhanced.

These circumstances created a natural experiment to study the impact that traceability along with the introduction of the ECX had on the export prices of coffee. Using export data from 2007 to 2012, we found that after coffee was forced to be traded via the ECX, traceable coffee export prices increased on average by 0.66 USD/kg more than the increase in the reported price of nontraceable coffee. This substantial difference in the pricing of these two types of coffee indicates that traceability is a very valuable attribute for coffee and increases its export value. Furthermore, the attribute of traceability along with the accurate and honest grading of coffee allows the export market to align the export sales prices of the coffee more closely to the types and grade attributes of the coffee. We also found that, after the introduction of the ECX, the reported export prices of coffee were also much more closely aligned to the movements in the international prices of coffee than they were prior to the formation of the ECX and its use for the marketing of Ethiopian coffee exports.

The dataset used in this study covers the period up to 2012. It would be interesting to study the impact on Ethiopian coffee prices from 2017 to present as, in this period, the ECX has reintroduced the traceability of the coffee sold. This data is being collected by the Ministry of Trade in Ethiopia. An extension of this dataset would allow for an analysis that includes both the elimination of the traceability of a large part of the coffee sold from Ethiopia from 2008 to 2017 and then the reintroduction of traceability in 2017. Such an analysis would provide a very robust estimation of the value of the attribute of traceability in the coffee value chain of Ethiopia.

Notes: Coffee exports: 2018/2019: 250.4 (000 MT) out of a production of 442.6 (000 MT).