Abstract

The fruit and vegetable industry is an important segment of the U.S. agriculture. The 2017 U.S. Agriculture Census shows that the industry had total sales of USD 48 billion from over 10 million acres of land. However, over the last two decades, production of major fruit and vegetable crops in the United States has been declining while imports have grown significantly. The rapidly growing imports have posed challenges to the sustainability of the U.S. domestic industry. This study provides a systematic industry review of fresh fruit and vegetable production and trade between the United States and Mexico, by far the largest source of U.S. imports, highlighting the structural shift in the market over the last two decades and the caveats for industry sustainability. The analysis shows that Florida, Georgia, and California are among the states that face the strongest competition from Mexico. Among the 10 crops reviewed, berry, tomato, pepper, and cucumber production has been affected the most. The study further discusses the factors driving the rapid growth of imports and shows the importance of innovation and policy reform to the sustainability of the U.S. fruit and vegetable industry.

1. Introduction

The fruit and vegetable industry is an important segment of U.S. agriculture and provides a large share of agricultural employment. According to the most recent USDA Agricultural Census report, in 2017, fruit and vegetable production was valued at USD 48.2 billion, accounting for 12.4% of total agricultural output and 25% of crop production [1]. To put it in perspective, the market value of fruit and vegetables was larger than soybean (USD 40.3 billion), hogs and pigs (USD 26.3 billion), and milk from cows (USD 36.7 billion) and slightly smaller than poultry and eggs combined (USD 49.2 billion) [1]. Fruit and vegetables play an increasingly important role in human diet, especially among the households with underaged children [2]. Across the United States, approximately 10 million acres of farmland were used by 184 thousand farms to produce fruit and vegetables [3].

Due to warm temperature and sufficient sunlight and rainfall, the U.S. fruit and vegetable industry is mainly clustered in the Sunbelt states. The Sunbelt is a region in the southern tier of the continental United States, of which Arizona, California, Florida, Georgia, New Mexico, North Carolina, and Texas combined supplied nearly 70% of the total U.S. fruit and vegetable production [3]. Over half of the fruit and vegetable acres were located in the two major producing states, California and Florida [3].

For a perishable commodity that cannot be stored for an extended period of time and requires constant supply, a sustainable and resilient production and supply system is of vital importance. However, the U.S. fruit and vegetable industry has been facing major challenges in production and import competition. In recent years, growers of fruit and vegetables, which are labor-intensive crops, have reported challenges in hiring sufficient farm labor, especially in the peak harvesting months [4,5,6,7]. Moreover, rising labor costs have been trimming down growers’ profit margins over the years [8]. In contrast, producers in developing countries enjoy ample labor supply and lower labor costs [9,10], which constitutes a major competitive advantage for the labor-intensive industry. As a result, foreign competition becomes a major challenge facing U.S. growers.

In the U.S. fresh produce market, Mexico is by far the largest competitor for American growers. Like the Sunbelt states, Mexico has favorable growing conditions for fruit and vegetables (e.g., warm temperature and sufficient rainfall). The USDA data shows that agricultural imports from Mexico grew from USD 2.7 billion in 1990 to USD 33 billion in 2020, and over half of the imports were fruit and vegetables [11]. This rapid growth coincided with the implementation of the North American Free Trade Agreement (NAFTA) which took effect in 1994. The United States had an agricultural trade deficit of USD 15 billion with Mexico in 2020. The large deficit was primarily due to the fast-growing fruit and vegetable imports from Mexico. Several recent studies investigated the impacts of Mexican competition and trade on the U.S. fruit and vegetable industry including avocados [12], berries [13,14,15], citrus [16], tomatoes [17,18,19], cucumbers [20], squash [21], and peppers [22], raising concerns on the sustainability of the domestic industry and the resilience of food supply systems in the case of supply chain disruptions or other shocks.

This study provides a comprehensive review of the fresh fruit and vegetable production and trade between the United States and Mexico. The paper is organized as follows. Section 2 presents an overview of major U.S. trade partners in fresh fruit and vegetables, highlighting the dominant position of Mexico in the U.S. produce market. Section 3 analyzes U.S. production and imports of major fruit and vegetable crops. The fruits reviewed in this study include avocados, berries (raspberry, strawberry, and blueberry), citrus, and watermelons; vegetables covered include tomatoes, peppers, cucumbers, and squash. For each crop, we compare the domestic harvesting schedules across regions to identify the states that face direct competition from Mexico. The complete harvesting calendars can be found in Appendix A (Table A1 and Table A2) at the end of the document. Section 4 analyzes the underlying factors driving the growth of fresh produce imports from Mexico, including technology, macroeconomic factors, and trade policy. The last section concludes the study with a summary and a discussion on the pathway to a competitive and sustainable industry.

2. Major U.S. Produce Trade Partners

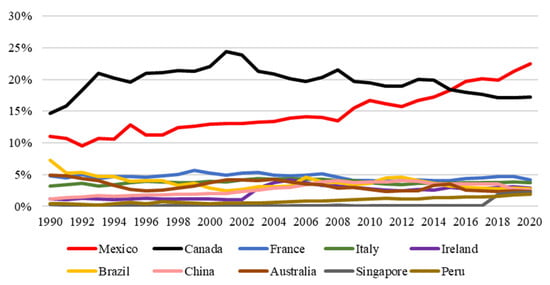

The United States has been the largest exporter of agricultural products and one of the major origins of agricultural products for countries around the world due to its competitive advantages in agricultural productivity [23,24]. In terms of import, Mexico and Canada have been the two largest suppliers in the U.S. market due to the geographic proximities of the three countries [25]. Figure 1 shows that the market share of imports from Mexico more than doubled from 11% in 1990 to 23% in 2020 while the market share of imports from Canada only increased slightly, from 15% to 17%, within the same period. Mexico surpassed Canada in 2016 to become the largest supplier of U.S. agricultural imports. Other major origins of U.S. imports among the top 10 include China, France, Italy, Ireland, Brazil, Australia, Singapore, and Peru. Each of these countries accounted for 5% or less of the import market share most of the time.

Figure 1.

Shares of the top 10 agricultural product import origins of the U.S. from 1990 to 2020. Source: USDA FAS [11].

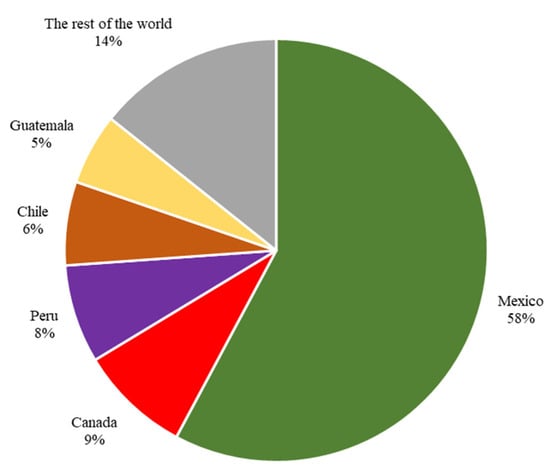

Figure 2 presents the top five import origins of fresh fruit and vegetables. Fresh fruit in this article is defined as the products listed under one of the following four product categories in the USDA FAS Global Agricultural Trade System (GATS): (1) Fresh Fruit Citrus; (2) Fresh Fruits “Decidi” (including grapes, peaches, apples, and plums); (3) Fresh Fruits Melons; and (4) Fresh Fruit Other. Fresh vegetables refer to the products listed under the Fresh Vegetable Exclude Potato. Mexico is by far the largest supplier of U.S. imports of fresh fruit and vegetables [11,26]. In 2020, 58% of U.S. imports of fresh fruit and vegetables were from Mexico, higher than the amount from the rest of the world combined. Other major suppliers, Canada, Peru, Chile, and Guatemala accounted for 9%, 8%, 6%, and 5%, respectively (Figure 2). Given the dominant position of Mexico in the U.S. import market, the fresh produce trade discussion is mainly focused on the imports from Mexico.

Figure 2.

Top 5 U.S. fresh fruit and vegetables import origins in 2020. Source: USDA FAS [11].

Fruit imports from Mexico on average accounted for 20% of U.S. total fresh fruit imports in 2000. In 2020, the percentage reached 49%. For fresh vegetables, imports from Mexico on average accounted for 68% of the total U.S. imports in 2000; it increased to 72% in 2020 [11]. These statistics show that Mexican products have been dominating the U.S. fruit and vegetable market compared to other U.S. trade partners.

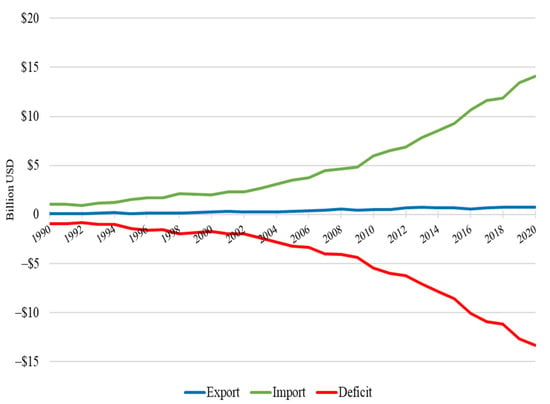

Figure 3 shows that the value of annual fresh fruit and vegetable import from Mexico increased from USD 1 billion in 1990 to over USD 14 billion in 2020. During the same period, the value of U.S. fresh fruit and vegetable exports to Mexico remained low, growing from USD 49 million to USD 72 million. As a result, the U.S. fresh fruit and vegetable trade deficit with Mexico expanded from USD 1 billion in the early 1990s to over USD 13 billion in 2020. To put it in perspective, the total U.S. agricultural trade deficit with Mexico in 2020 was USD 15 billion.

Figure 3.

U.S. fresh fruit and vegetables trade with Mexico from 1990 to 2020. Source: USDA FAS [11].

Large import volume from Mexico has further affected market prices and U.S. domestic growers’ profit margins [13] and market shares [14]. Due to overlapping harvesting windows, the challenges are greater for southeastern states. This rapid growth coincided with the implementation of the NAFTA. Before NAFTA took effect in 1994, there were tariff and quota in place for trade between the United States and Mexico. The tariff and quota were reduced or eliminated after the implementation of the agreement [26,27], boosting the competitiveness of Mexican fresh produce in the U.S. market [18]. The overall trend of the fast growing imports have been observed for all major fruit and vegetable crops, raising industry sustainability concerns among stakeholders and policymakers [17], prompting a series of trade disputes between the United States and Mexico on many crops, including tomatoes, strawberries, blueberries, raspberries, peppers, cucumbers, and squash [20,21,28,29,30,31,32,33].

3. U.S. Production and Imports from Mexico

This section analyzes U.S. production and imports from Mexico and compares the harvesting schedules of major fruit and vegetable crops in the United States and Mexico to highlight the groups of growers that are in direct competition in the U.S. market.

3.1. Growth of Imports from Mexico

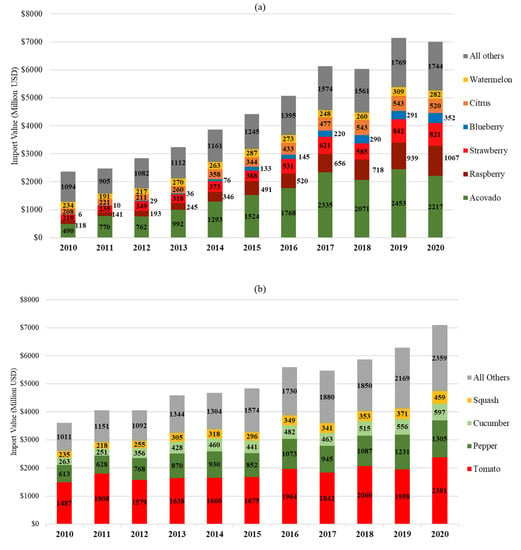

The total import value of fresh fruit and vegetables increased sevenfold from USD 2 billion in 2000 to USD 14 billion in 2020. Figure 4 presents a picture of major crops over 2010–2020 for an in-depth analysis.

Figure 4.

(a) Upper panel: value of major fresh fruit imports from Mexico from 2010 to 2020; (b) lower panel: value of major fresh vegetable imports from Mexico from 2010 to 2020. Source: USDA FAS [11].

In 2020, the top fruit imports from Mexico were avocados and berries (raspberry, strawberry, blueberry), each accounting for nearly one-third (32%) of the total value of fruit import from the country, followed by citrus (7%) and watermelon (4%) [11]. Figure 4 panel (a) shows that avocados have been the top fresh fruit imported from Mexico, and its annual import value grew four-fold from USD 490 million in 2010 to USD 2.2 billion in 2020. The blueberry import has been growing at the fastest pace among all major crops, up from USD 6 million to USD 352 million during the same period. Raspberry, strawberry, and citrus imports from Mexico all have been growing rapidly. The watermelon imports increased only slightly, from USD 234 million in 2010 to USD 282 million in 2020. Overall, the total value of fruit import from Mexico increased from USD 2.4 billion in 2010 to USD 7 billion in 2020, nearly tripled in a period of 10 years.

Tomatoes have been the largest vegetable import with a total value of USD 2.4 billion in 2020, followed by peppers, cucumbers, and squash. Tomatoes, peppers, cucumbers, and squash accounted for 34%, 18%, 8%, and 7%, respectively, of the total value of fresh vegetable imports from Mexico in 2020. Overall, these four crops accounted for two-thirds of the total value of vegetable imports from Mexico. The total value of vegetable imports from Mexico nearly doubled from USD 3.6 billion in 2010 to USD 7.1 billion in 2020.

3.2. Fresh Fruit Production and Imports

3.2.1. Avocado

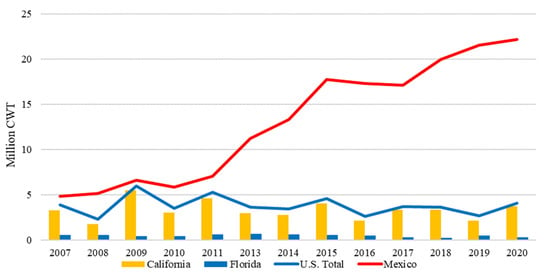

Avocados are the single largest fresh fruit imported from Mexico. In the United States, avocado consumption more than quadrupled in the last two decades, from two pounds per capita in 2001 to eight pounds per capita in 2018 [34]. The growing demand has been driving the rapid growth of imports from Mexico. In 2020, avocados accounted for 32% of the total value of fresh fruit imports from Mexico [11]. The import volume of Mexican avocados grew more than fourfold from 5 million CWT in 2008 (CWT, Hundredweight, equals 100 pounds) to over 22 million CWT in 2020 while U.S. avocado production remained below 5 million CWT (Figure 5). Mexican avocados have an absolute dominant market position. Imports from Mexico accounted for 90% of the total volume of U.S. avocado imports and 91% of the total value in 2020 [11]. California and Florida produce nearly 100% of U.S. avocados. Florida avocados are harvested from June to February and California and Mexico avocados are harvested throughout the year [35,36], competing in the same market window. Increasing imports from Mexico and other countries with lower labor costs have been a challenge to U.S. avocado growers, especially small firms which are generally more constrained on cost reduction [12].

Figure 5.

U.S. production and Mexican imports: fresh avocado. Notes: (1) The 2012 state and national production are unavailable. (2) The fresh avocado production of California from 2017 to 2020 and Florida from 2016 to 2020 are undisclosed and calculated based on the percentages of fresh avocados from available data; on average, 99.8% of California and 100% of Florida total production were sold to the fresh market. Sources: USDA FAS [11]; USDA NASS [37].

3.2.2. Berries: Raspberry, Strawberry, and Blueberry

In the family of berries, the top two imports from Mexico are raspberries and strawberries [11]. Blueberries are another major produce with rapidly growing demand. In 2020, the three berries combined accounted for nearly one-third of the total value of fresh fruit imports from Mexico.

Surpassing strawberries in 2015, raspberries are is the largest fresh berry import from Mexico. The import value of fresh raspberries grew almost ten-fold from USD 118 million in 2010 to USD 1067 million in 2020 [11], while the volume increased from 0.3 million CWT to over 2 million CWT during the same period. Imports from Mexico accounted for 99% of the total volume of U.S. fresh raspberry imports in 2020 [11].

In the United States, California is the top raspberry producer. Over the period of 2014–2020, 94% of the U.S. fresh raspberry production was from California, averaging over 1.2 million CWT per year [37]. The other two major raspberry producing states are Oregon and Washington, accounting for 0.5% and 2.7%, respectively, of the total U.S. production in 2017 (most recent production data disclosed for the two states). Outside the United States., Mexico is the largest fresh raspberry supplier for the U.S. market. In 2017, the imports from Mexico surpassed U.S. total production (Figure 6). The gap continued to widen in the following years. In 2020, the imports from Mexico reached 2 million CWT while California production remained below 1.3 million CWT. California has a 5-month harvesting window from June to October while Mexico harvests from October through June of the next year [35,38]. About half of the California season overlaps with that of Mexico. As a result, the increasing supply from Mexico has taken up more market share from the Californian industry.

Figure 6.

U.S. production and Mexican imports: fresh raspberry. Notes: The 2007 to 2013 U.S. production data are undisclosed and calculated from the available data. On average (2014–2020), 94% of the U.S. total production was from California, so 106% (calculated by 1 divided by 0.94) of the California production was used to represent the U.S. total production in the undisclosed years. Sources: USDA FAS [11]; USDA NASS [37].

Strawberries are the second largest fresh berry imports from Mexico, accounting for 12% of the total value of fresh fruit imports from Mexico in 2020. Imports from Mexico accounted for 99% of the total volume of U.S. fresh strawberry imports in 2020 [11]. Its volume grew seven-fold from less than 0.6 million CWT in 1998 to over 4.3 million CWT in 2020 [11]. Whitin the same period, U.S. fresh strawberry production grew from 11 million CWT in 1998 to 25 million CWT in 2013, and then slowly declined to below 19 million CWT in 2020. The top two producers, California and Florida, supply over 97% of the U.S. domestic production [37]. In Figure 7, the production trends of both states follow a reversed U-shape trend similar to that of U.S. production. From 1998 to 2020, California production increased by 82% while Florida production increased by only 10% due to competition from Mexico. California strawberries are harvested between March and September while the Florida season is from November to April of the next year [35], highly overlapping with the Mexican season which is from November through March [39]. As a result, Mexican competition poses stronger challenges to the Florida strawberry industry [40]. In 1998, Florida production was 1.6 million CWT, approximately three times higher than imports from Mexico; in 2020, it was 1.78 million CWT, less than one-half of the Mexican imports (4.3 million CWT).

Figure 7.

U.S. production and Mexican imports: fresh strawberry. Notes: The fresh strawberry production data of California from 2019 and 2020 and Florida from 2017 to 2020 are undisclosed and calculated based on the percentages of fresh strawberries from available data; on average, 77% of California and 100% of Florida total production were sold to the fresh market. Sources: USDA FAS [11]; USDA NASS [37].

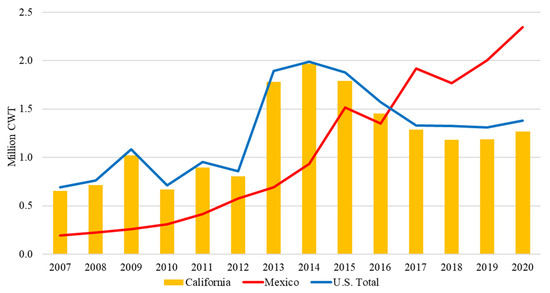

The popularity of blueberries has been growing globally due to its high antioxidant content and other health benefits [41]. Blueberries also became one of the major fresh fruit imports from Mexico. Imports from Mexico accounted for 23% of the total volume of U.S. fresh blueberry imports in 2020 [11] and are expected to continue to grow. Prior to 2012, fresh blueberries accounted for less than 1% of the total value of fresh fruit imports from Mexico, but it increased to 6% in 2020 [11]. Imports grew exponentially from less than three thousand CWT in 2008 to over 1 million CWT in 2020 (Figure 8). The total U.S. production of blueberries has been growing at a much slower rate, increasing from about 2 million CWT in 2008 to 3.5 million CWT in 2020 (Figure 8). Blueberries are produced across the United States. Major producers include California, Oregon, Washington, Florida, Georgia, North Carolina, and Michigan [37]. Among these states, only the Sunbelt states’ harvesting windows (California, Florida, Georgia, and North Carolina) overlap with the peak season of Mexico. The harvesting windows of the Sunbelt states are from April to June while those of the northern states are July and August [35]. In Mexico, blueberry harvesting begins in September and continues through June of the next year, peaking from February to May [15]. Due to the overlapping harvesting windows, California, Florida, Georgia, and North Carolina blueberries face greater competition from Mexico. Florida, with a short, two-month harvesting window falling entirely within the peak harvesting months of Mexican blueberries, faces the strongest competition, which is expected to further intensify in coming years as Mexico quickly expands its production capacity [15]. Besides Mexico, Peru and Chile are the other two major exporters of fresh blueberries to the U.S. market. The two countries respectively accounted for 38% and 24% of U.S. fresh market blueberry import volume in 2020 [11].

Figure 8.

U.S. production and Mexican imports: fresh blueberry. Notes: The fresh blueberry production data of California from 2013 to 2017, Florida from 2016 to 2020, and North Carolina from 2018 to 2020 are undisclosed and calculated based on the percentages of fresh blueberries from available data; on average, 92% of California, 95% of Florida, and 75% of North Carolina total production were sold to the fresh market. Sources: USDA FAS [11]; USDA NASS [37].

3.2.3. Citrus

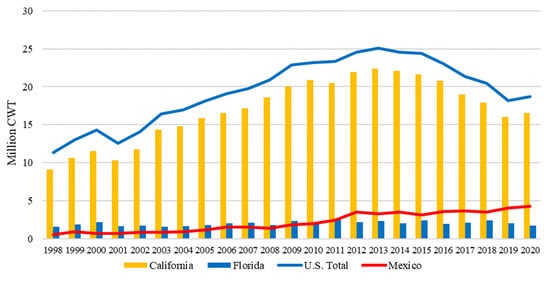

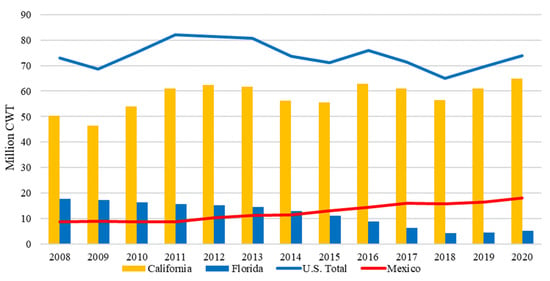

The citrus family includes limes, lemons, oranges, grapefruit, tangelos, and tangerines [35]. Despite the fall in orange juice consumption due to health concerns, fresh citrus consumption remained stable in the last two decades in the United States [16]. California and Florida are the two major producers of fresh citrus, accounting for over 93% of U.S. fresh citrus production in the past decade [37]. However, production in the two states shows different industry trajectories. The annual production of California fluctuated between 55 and 65 million CWT in the past decade while the production in Florida dropped 66% from 15.7 million CWT in 2011 to 5.3 million CWT in 2020 (Figure 9). In Figure 9, the trends show that Florida fresh citrus production shrank while imports from Mexico doubled from 8.7 million CWT in 2008 to 18 million CWT in 2020. Imports from Mexico accounted for 56% of the total volume of U.S. fresh citrus imports in 2020 [11]. Chile and Peru are the other two major exporters of fresh citrus to the U.S. market. The two countries respectively accounted for 21% and 7% of U.S. fresh citrus import volume in 2020 [11]. California produces limes, lemons, and oranges year round and grapefruits and tangerines over half of the year. In Florida, oranges and grapefruits are harvested every month except August and September and tangerines harvested from October to April of the next year [35]. In Mexico, limes and lemons are harvested all year long; oranges are harvested from November to May of the next year; grapefruits are harvested from June to November [42]. For almost every month, there are overlaps in harvesting windows between Mexico and the two states in at least one citrus variety. The only exception is August when Florida does not harvest any citrus variety. Competition from Mexico is expected to continue to grow, which will pose further challenges to an industry that is being ravaged by citrus greening [43].

Figure 9.

U.S. production and Mexican imports: fresh citrus. Sources: USDA FAS [11]; USDA NASS [37].

3.2.4. Watermelon

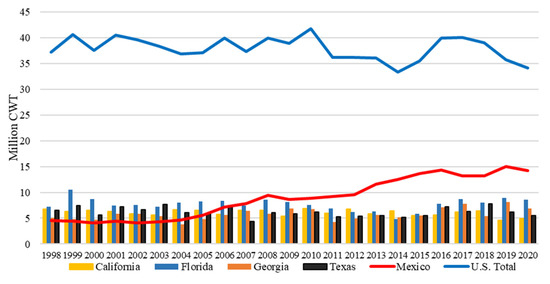

Fresh watermelon imports from Mexico have grown three-fold from 4.5 million CWT in 1998 to over 14 million CWT in 2020 (Figure 10). Imports from Mexico accounted for 85% of the total volume of U.S. watermelon imports in 2020 [11]. Guatemala and Honduras were the other two major exporters of watermelon to the U.S. market. The two countries respectively accounted for 8% and 5% of U.S. watermelon import volume in 2020 [11]. The value of U.S. imports of watermelons from Mexico accounted for 10% of the total value of fruit imports from Mexico in 2010, but the percentage declined to 4% in 2020 [11]. Rapid increases in imports of other higher value fresh fruits such as strawberries and blueberries may explain the simultaneous increase in volume and decrease in the share of import value. Four states (Florida, 25%; Georgia, 20%; Texas, 16%; California 14%) in the Sunbelt accounted for more than three-quarters of the total U.S. production [37]. The trends in Figure 10 show that the U.S. annual production fluctuated between 33 million CWT and 42 million CWT in the last two decades. Watermelons are usually harvested from April to October in the United States [35] and from December to May of the next year in Mexico [44]. The watermelon harvesting window in Mexico fills the production gap in the United States, suggesting Mexican and U.S. watermelons are not competing directly in most of the months. The nonconcurrent harvesting windows may explain why U.S. production did not plunge when the volume of Mexican imports increased more than three-fold over the last two decades.

Figure 10.

U.S. production and Mexican imports: fresh watermelon. Sources: USDA FAS [11]; USDA NASS [37].

3.3. Fresh Vegetable Production and Imports

3.3.1. Tomato

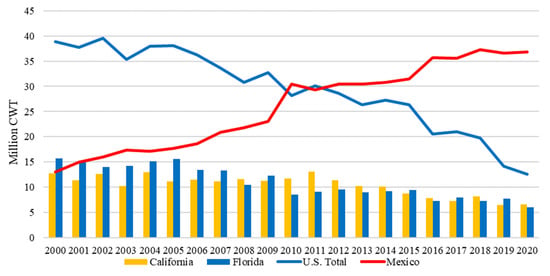

Tomatoes are the largest fresh vegetable import from Mexico. In 2020, it accounted for approximately one-third of the total value of fresh vegetable imports from Mexico [11]. Imports from Mexico accounted for 91% of the total volume of U.S. fresh tomato imports in 2020 [11]. Canada was the distant second, accounting for 8% of the U.S. imports. The volume of imports from Mexico increased approximately three-fold from 13 million CWT in 2000 to 37 million CWT in 2020, but total U.S. production plunged 67% from 39 million CWT to 13 million CWT within the same timeframe (Figure 11). The U.S. production in 2020 in Figure 11 represents the open-field production that was utilized; there is a small percentage of unsold production that is not included. The market positions of the U.S. and Mexican tomatoes completely reversed in the last two decades. The imports from Mexico were three times higher than the total U.S. production in 2020. In the United States, California and Florida are the top two fresh tomato producers. The production of the two states combined accounted for nearly three quarters of the U.S. total production in the last two decades [37]. Fresh tomatoes are harvested from May to January of the next year in California, and from October to June in Florida (with a one-month gap in March) [45]. In Mexico, tomatoes are harvested all year round [39]. Due to the overlapping harvesting windows, both states face direct competition from Mexico all season long. Growing competition from Mexico has been a constant source of friction between the two countries. Led by grower organizations in Florida, the U.S. tomato industry filed an antidumping investigation case against the Mexican tomato industry in 1996. The two sides eventually agreed to suspend the investigation, but Mexican tomatoes must sell above a “reference price”, a floor price imposed to prevent undercutting of prices. The “suspension agreement” is renegotiated every five years [18]. Despite the introduction of floor prices, imports from Mexico continued to rise over the years [17,18].

Figure 11.

U.S. production and Mexican imports: fresh tomatoes. Notes: The fresh tomato production data of Florida in 2018 is undisclosed and calculated based on the percentages of fresh tomatoes from available data; on average, 96% of Florida total production were sold to the fresh market. Sources: USDA FAS [11]; USDA NASS [37].

3.3.2. Peppers

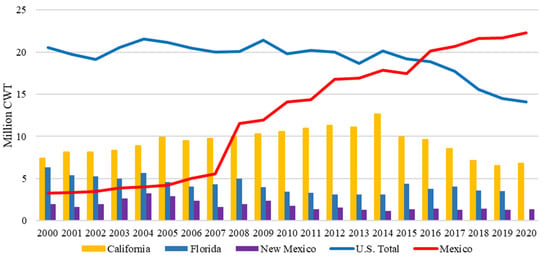

Peppers, including bell and chili peppers, accounted for 18% of the value of all fresh vegetable imports from Mexico in 2020 [11]. Imports from Mexico accounted for 84% of the total volume of U.S. pepper imports in 2020 [11]. Canada was the second largest supplier, accounting for 12% of the U.S. imports. The imports from Mexico grew seven-fold from 3 million CWT in 2000 to over 22 million CWT in 2020, while U.S. production decreased by 6 million CWT (29%) over the same period (Figure 12). In the United States, the three major pepper producing states are California, Florida, and New Mexico, which accounted for about 80% of U.S. total production in the past two decades [37]. In California, the largest producer, production reached its peak in 2014 and dropped continually since then. Its production in 2020 was below the level in 2000. Florida, the second largest producer of peppers in the country, lost approximately half of its pepper production during the same period. In Mexico, bell peppers are harvested from November to April while chili peppers are harvested all year round [39,46]. The bell pepper harvesting window overlaps with that of Florida, and the chili pepper harvesting window with those of California and New Mexico. U.S. growers in the southeastern states reported that the import prices of Mexican peppers fell below the breakeven price of domestic peppers in spring 2020 and that the imports were devastating the industry [47]. The challenge is especially severe for the Florida bell pepper growers [22].

Figure 12.

U.S. production and Mexican imports: peppers. Notes: The 2020 Florida production data is unavailable and not presented. Sources: USDA FAS [11]; USDA NASS [37].

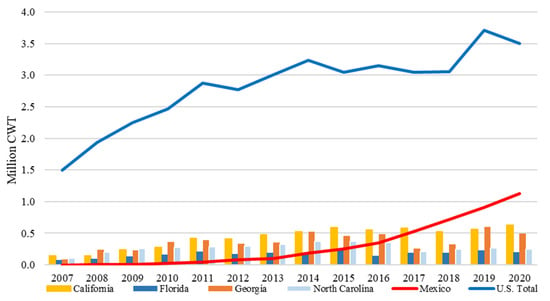

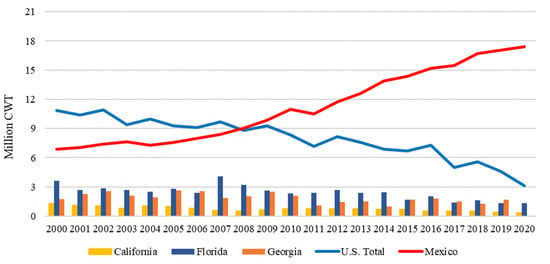

3.3.3. Cucumber

In 2020, fresh market cucumbers accounted for about 8% of the import value of all fresh vegetables imported from Mexico. Imports from Mexico accounted for 79% of the total volume of U.S. cucumber imports in 2020 [11]. Canada was the distant second, accounting for 16% of the U.S. imports. Mexican imports doubled from 7 million CWT in 2000 to 14 million CWT in 2015 and further increased to over 17 million CWT in 2020 [11]. In contrast, U.S. cucumber production follows a completely opposite trajectory, dropping 70% from 10 million CWT in the early 2000s to 3 million CWT in 2020 (Figure 13). As shown in Figure 13, the U.S. production and Mexican imports curves crossed over in 2008 and the gap continued to grow. In 2020, the volume of fresh market cucumbers imported from Mexico was approximately six times higher than that of domestic production. In the United States, cucumbers are grown in both the Sunbelt and northern states. Mexican cucumbers are normally harvested from December to June of the next year [39], and the harvesting window overlaps with those of major Sunbelt producing states including California, Florida, and Georgia. As a result, production from these states declined significantly over the years. The production of California and Florida plunged 71% and 64%, respectively, over the period of 2000–2020, and the production of Georgia also dropped 36% from its peak of 2.6 million CWT in 2005 to 1.7 million CWT in 2019 (Figure 13). Cucumber growers in Florida reported that the imports from Mexico had greatly affected their market share, crop volume, and revenues [47].

Figure 13.

U.S. production and Mexican imports: fresh market cucumbers. Notes: (1) The fresh cucumber production data of California in 2016 and 2017, Florida in 2018 and 2019, and Georgia from 2017 to 2019 are undisclosed and calculated based on the percentages of fresh cucumbers from available data; on average, 36% of California, 39% of Florida, and 93% of Georgia were sold to the fresh market. (2) The 2020 Georgia data are not presented in the figure because neither the fresh market nor total production data of Georgia in 2020 is available. Sources: USDA FAS [11]; USDA NASS [37].

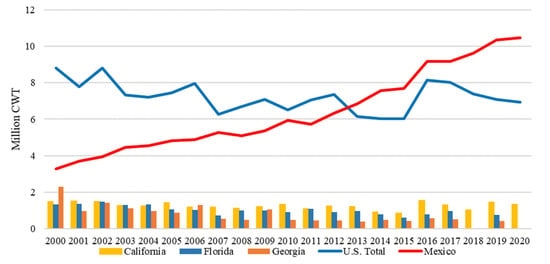

3.3.4. Squash

Squash accounted for 6% of the value of all fresh vegetable imports from Mexico in 2020 [11]. Imports from Mexico accounted for 96% of the total volume of U.S. squash imports in 2020 [11]. The volume of squash import from Mexico grew over three-fold from 3 million CWT in 2000 to over 10 million CWT in 2020 while the U.S. squash production declined from 9 million CWT to 7 million CWT, down 22%, during the same period (Figure 14). The three major squash producing states in the Sunbelt are California, Florida, and Georgia, which accounted for 38% of U.S. total production in 2019 [37]. In Florida, squash can be harvested as early as October and harvesting continues through June of the next year [45]. In California and Georgia, harvesting seasons start from late Spring to mid-Summer [45]. For each of the three Sunbelt producing states, at least half of the harvesting window overlaps with that of Mexico, which spans the period from November to June of the next year. From 2000 to 2019, squash production in California, Florida, and Georgia dropped 2%, 43%, and 81%, respectively (Figure 14). The competition from Mexico has posed major challenges to the Florida and Georgia’s squash industry [47].

Figure 14.

U.S. production and Mexican imports: squash. Notes: The data of Florida and Georgia in 2018 and 2020 are unavailable and not presented. Sources: USDA FAS [11]; USDA NASS [37].

Michigan and Oregon are also major producers of squash in the United States, which supplied about 40% of total U.S. production in 2019 [37]. Squash harvesting in Michigan and Oregon starts in July, one month after the harvesting season of Mexico ends, and the harvesting finishes in October which is one month prior to the start of the next harvesting season of Mexico [45]. Therefore, Mexican competition poses less challenges to growers in these states. The decline of the total U.S. production was mainly due to the rapid declines in the southeastern states such as Florida and Georgia.

3.4. Trade Performance of Mexican Fruit and Vegetable Imports

The U.S. fruit and vegetable market is increasingly dependent on Mexican imports. Imports from Mexico hold an increasing share of the total U.S. imports. Table 1 presents Mexican imports as a percentage of the total U.S. fresh fruit and vegetable imports in terms of both volume (the first number) and value (number in parentheses).

Table 1.

Share of imports (%) of Mexican fruit and vegetable from 2000 to 2020.

From 2000 to 2020, the shares of the Mexican imports over the total U.S. imports from the world have been growing rapidly: (1) avocados from 17% (19%) to 90% (91%); (2) raspberries from 25% (65%) to 99% (100%); (3) blueberries from 0% (0%) to 23% (28%); and (4) fresh market tomatoes from 81% (64%) to 91% (85%). However, the Mexican shares for the following crops have slightly declined within the same period: (1) fresh market cucumbers from 90% (85%) to 79% (66%); (2) peppers from 100% (100%) to 84% (73%); (3) watermelons from 93% (94%) to 85% (83%). This is due to more diversified U.S. import sources. But the amounts of total imports of these crops from Mexico still increased over the period.

Table 1 shows that Mexican imports are dominating the U.S. import markets of major fresh produce commodities. In 2020, for nine out of the 10 fruits and vegetables analyzed in the study, Mexico was the top exporter to the U.S. market. The only exception was blueberry which Mexico still accounted for about a quarter of the total U.S. imports from the world. For avocados, raspberries, strawberries, tomatoes, and squash, Mexican imports accounted for 90% (85%) or more of the total U.S. imports in terms of volume (value). The dominating market position of the Mexican imports has not only suppressed other U.S. trade partners’ market shares but also squeezed the market shares of the U.S. domestic suppliers, especially those in the Sunbelt states where crops share the similar market windows with Mexico.

4. Factors Driving the Surge of Imports from Mexico

As imports from Mexico surge over the last two decades, major Sunbelt producing states California, Florida, and Georgia face the greatest challenges from Mexico. The impact on Florida and Georgia in the southeast has been particularly large due to the overlapping market windows. Major factors driving the growth of imports include the implementation of the North American Free Trade Agreement (NAFTA), Mexican peso depreciation, Mexico’s labor advantages and government support.

NAFTA, the agreement signed between the United States, Canada, and Mexico and implemented in 1994, has greatly facilitated free movement of commodities and market integration between the three north American countries [30]. Zahniser, et al. [48] indicated that the total value of intraregional agricultural trade (exports and imports) among the three NAFTA partners increased by 233% from 1993 to 2013. Before NAFTA became effective, there were tariff and quota in place for fruit and vegetable trade between the United States and Mexico. For example, Mexican strawberries had a tariff of USD 0.18 or USD 0.77 per CWT depending on the season [27]. The elimination of these tariff and quota under NAFTA has enhanced the competitiveness of Mexican fresh produce in the U.S. market [18,26].

Exchange rates also play an important role in international trade. Depreciation of the currency of a country boosts export by making exported goods cheaper in the international market. The Mexican peso depreciated over 50% within two years after NAFTA took effect in 1994, from USD 0.3 in July 1994 to USD 0.13 by the end of 1995. It continued to lose value over the years, reaching USD 0.05 in 2021, dropping 83% from the 1994 rate [49]. In the last 10 years (2011–2021), the Mexican peso lost approximately 40% of its value. The depreciation of a Mexican peso makes its exports more competitive, boosting the growth of imports from Mexico to the United States.

Fruit and vegetable production is labor intensive. Significant amount of labor is needed for operations from planting to harvesting. The shrinking domestic labor pool and rising labor costs have been major challenges for the U.S. fruit and vegetable industry [4,50,51,52]. The strenuous physical work in the field and lower wages make farm jobs unattractive to American citizens [53]. Growers are increasingly relying on foreign guest workers admitted under the H-2A visa program [54,55]. However, many employers still hesitate to adopt the H-2A program due to the complexity of the process and the costs associated with H-2A hires [56,57,58,59,60]. In recent years, improved economy and employment opportunities in the central and south American countries have also enticed more workers to stay in their home countries [10], which, along with stricter enforcement of immigration policy in the United States, has led to a dwindling pool of migrant workers (many undocumented), causing severe labor shortages in U.S. agriculture. Furthermore, large gaps of labor costs between the United States and Mexico also pose a major challenge to American growers. A survey conducted by Wu, et al. [61] showed that the total labor cost of strawberry production in central Mexico was about 45% of the Florida labor cost in the 2014/2015 season. In 2020, the U.S. average wage for non-supervisory farm jobs was USD 14.62 per hour [62], whereas the average wage of farm workers in Mexico was about USD 1.7 per hour (calculated based on exchange rate of 20.9 pesos per dollar) [63].

Favorable government policy in Mexico is another major factor driving the fast growth of its agricultural export to the United States. To boost the productivity and competitiveness of the Mexican agriculture industry, the Secretariat of Agriculture and Rural Development (SADER) of Mexico has been subsidizing the industry through the National Development Plan, covering production, post-harvest management, marketing, and other activities along the supply chain [64,65]. One of the most successful cases is the promotion of the protected-culture system which utilizes protection structures such as greenhouses and shade houses to improve growth condition, increase productivity, and extend growing seasons [66]. In the case of tomatoes, year-round tomato yields under shade houses can reach 250 to 300 tons per hectare while the yields in open-field production are only around 40 tons per hectare [67]. However, large capital investment is needed to build the protected-culture systems. To overcome producers’ capital constraints and reduce the cost of production, the Mexican government has been providing generous support since 2001, subsidizing up to 50% of the investment [65]. The “strategic project” has accelerated the adoption of the technology. The protected production area in Mexico increased from 300 hectares in 2000 to 54,088 hectares in 2019 [68]. The widespread adoption of the protected-culture technology has not only boosted productivity, but also expanded the market of its products due to its ability to provide reliable, year-round supply. In the United States, the greenhouse systems are also adopted by some growers of high-value or organic crops. However, the adoption rate is low due to high capital investment requirement. According to the USDA 2017 Census of Agriculture, the total greenhouse vegetable and fruit production of the United State is approximately 2853 acres (1155 hectares) which is less than 3% of 2016 protected production area in Mexico [1]. The top five greenhouse vegetable production states, California, Texas, New York, Ohio, and Pennsylvania, account for 808 (326), 172 (69), 124 (50), 114 (46), and 94 (38) acres (hectares), respectively; and the top five greenhouse fruit production states, California, Florida, Oregon, Michigan, and New York, account for 146 (59), 42 (17), 16 (6), 7 (3), and 4 (2) acres (hectares), respectively [1].

The growth in imports and structural changes in the U.S. fresh produce market have caused tremendous pressure on the U.S. domestic growers. The cost subsidies given to Mexican producers were a particularly controversial issue, prompting industry campaigns in the United States to seek trade remedies during NAFTA renegotiation and in the post-NAFTA era. In July 2020, the USMCA (United States-Mexico-Canada Agreement) replaced the NAFTA. Several significant commitments were made to reduce agricultural trade distortion and improve transparency. The three participating countries agreed to not use export subsidies or WTO agricultural safeguards for exports within the three countries, ensure transparency of domestic support programs, and adopt support measures that have minimal trade distorting or production effects [69]. However, the tension between the United States and Mexico regarding the fruit and vegetable trade and domestic support programs continued to rise after the USMCA became effective. There have been a series of trade disputes between the two countries on the trade of fresh produce, including disputes on berries, tomatoes, peppers, cucumber, and squash [20,21,28,29,30,31,32,33]. The Office of U.S. Trade Representative (USTR), the U.S. Department of Commerce (USDC), and the U.S. International Trade Commission (USITC) have held multiple hearings and conducted investigations or market monitoring on major produce commodities [20,21,28,32,33].

5. Conclusions

This study provides a comprehensive review and analysis of the fresh fruit and vegetable production, harvesting windows, and trade between the United States and Mexico. The analysis shows that the U.S. domestic production of fruit and vegetables has been declining in the last two decades while imports from Mexico have been growing rapidly. Fresh produce from major Sunbelt states including California, Florida, and Georgia face the strongest competition from Mexico. Florida, the largest domestic producer of fruit and vegetables in wintertime, is particularly vulnerable because of overlapping harvesting windows. Based on the production and import data, the U.S. domestic production of berries, tomatoes, peppers, and cucumbers face the greatest pressure from Mexican imports. Citrus imports from Mexico have also accelerated in recent years and could be the next major challenge for American growers. The study shows that Mexican products are dominating the U.S. import market for many fruit and vegetable crops.

Major factors driving the rapid growth of imports from Mexico include U.S.–Mexico commodity market integration under NAFTA, Mexican currency depreciation and government support, as well as gaps in labor costs between the two countries. To address labor challenges facing American growers, including labor shortage and rising labor costs, farm labor immigration reform has been on the top agendas of industry stakeholders and policymakers. Immigration reform that addresses issues in the foreign guest worker program (H-2A visa program) and those associated with the undocumented workers inside the country could boost farm labor availability and address urgent labor needs. However, it would not make the U.S. produce industry more competitive because of large gaps in labor costs between the two competitors. In the long run, mechanization or automation could provide a more fundamental solution and is believed to be the future of the industry. Hence, accelerating technology development and deployment is critical to the survival and sustainability of the U.S. fresh produce industry and a resilient domestic food supply system.

Author Contributions

Conceptualization, K.-M.H. and Z.G.; methodology, K.-M.H. and Z.G.; software, K.-M.H.; validation, K.-M.H. and Z.G.; formal analysis, K.-M.H.; investigation, K.-M.H. and Z.G.; resources, Z.G.; data curation, K.-M.H.; writing—original draft preparation, K.-M.H.; writing—review and editing, K.-M.H. and Z.G.; visualization, K.-M.H. and A.H.; supervision, Z.G.; project administration, Z.G.; funding acquisition, Z.G. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the USDA Specialty Crop Block Grant Program, FDACS contracts #026695 and #027436.

Institutional Review Board Statement

Not applicable.

Data Availability Statement

Production and import data reviewed and analyzed in this study are publicly available on USDA NASS: https://quickstats.nass.usda.gov/ and USDA FAS: https://apps.fas.usda.gov/gats/default.aspx. Authors accessed the datasets on 12 May 2022.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Table A1.

Fruit harvesting calendars of major U.S. producing states and Mexico.

Table A1.

Fruit harvesting calendars of major U.S. producing states and Mexico.

| (a) Avocado | ||||||||||||

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| Mexico | X | X | X | X | X | X | X | X | X | X | X | X |

| California | X | X | X | X | X | X | X | X | X | X | X | X |

| Florida | X | X | X | X | X | X | X | X | X | |||

| (b) Raspberry | ||||||||||||

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| Mexico | X | X | X | X | X | X | X | X | X | |||

| California | X | X | X | X | X | |||||||

| (c) Strawberry | ||||||||||||

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| Mexico | X | X | X | X | X | X | X | |||||

| California | X | X | X | X | X | X | X | |||||

| Florida | X | X | X | X | X | X | ||||||

| (d) Blueberry | ||||||||||||

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| Mexico | X | X | X | X | X | X | X | X | X | X | ||

| California | X | X | ||||||||||

| Florida | X | X | ||||||||||

| Georgia | X | X | X | X | X | X | ||||||

| N. Carolina | X | X | X | X | ||||||||

| Michigan | X | X | X | X | ||||||||

| Oregon | X | X | X | X | ||||||||

| Washington | X | X | X | X | X | |||||||

| (e) Citrus | ||||||||||||

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| Mexico | LO | LO | LO | LO | LO | GL | GL | GL | GL | GL | GLO | LO |

| California | LOT | LOT | GLOT | GLOT | GLO | GLO | GLO | GLO | GLO | GLOT | LOT | LOT |

| Florida | GOT | GOT | GOT | GOT | GO | GO | GO | G | GOT | GOT | GOT | |

| (f) Watermelon | ||||||||||||

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| Mexico | X | X | X | X | X | X | ||||||

| California | X | X | X | X | X | X | ||||||

| Florida | X | X | X | X | ||||||||

| Georgia | X | X | ||||||||||

| Texas | X | X | X | X | ||||||||

Notes: In panel (c), G denotes grapefruit; O denotes oranges; L denotes lime and lemon; T denotes tangelo and tangerine. Sources: Wu and Guan [15]; USDA NASS [35]; Osuna-Garcia et al. [36]; GAO [39]; González-Ramírez, Santoyo-Cortés, Arana-Coronado and Muñoz-Rodríguez [38]; Osoyo and Elms [42]; Espinoza-Arellano [44].

Table A2.

Vegetables harvesting calendars of major U.S. producing states and Mexico.

Table A2.

Vegetables harvesting calendars of major U.S. producing states and Mexico.

| (a) Tomato | ||||||||||||

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| Mexico | X | X | X | X | X | X | X | X | X | X | X | |

| California | X | X | X | X | X | X | X | X | X | |||

| Florida | X | X | X | X | X | X | X | X | ||||

| (b) Peppers (Bell and Chili) | ||||||||||||

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| Mexico | BC | BC | BC | BC | C | C | C | C | C | C | BC | BC |

| California | C | C | C | C | BC | BC | BC | BC | ||||

| Florida | B | B | B | B | B | B | B | B | B | |||

| N. Mexico | C | C | C | C | C | C | C | |||||

| (c) Cucumber | ||||||||||||

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| Mexico | X | X | X | X | X | X | X | |||||

| California | X | X | X | X | X | X | X | X | ||||

| Florida | X | X | X | X | X | X | X | X | ||||

| Georgia | X | X | X | X | X | |||||||

| N. Carolina | X | X | X | X | X | |||||||

| Michigan | X | X | X | X | ||||||||

| (d) Squash | ||||||||||||

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| Mexico | X | X | X | X | X | X | X | X | ||||

| California | X | X | X | X | ||||||||

| Florida | X | X | X | X | X | X | X | X | X | |||

| Georgia | X | X | X | X | X | X | X | |||||

| Michigan | X | X | X | X | ||||||||

| Oregon | X | X | X | |||||||||

Notes: In panel (b), B denotes bell pepper and C denotes Chile pepper. Sources: GAO [39]; USDA NASS [45]; Blue Book Services [46].

References

- USDA National Agricultural Statistics Service (USDA NASS). 2017 Census of Agriculture: United States Summary and State Data. Census Agric. 2019, 1, 6–10; 611–614. [Google Scholar]

- Huang, K.-M.; Sant’Anna, A.C.; Etienne, X. How did COVID-19 impact US household foods? an analysis six months in. PLoS ONE 2021, 16, e0256921. [Google Scholar] [CrossRef] [PubMed]

- USDA National Agricultural Statistics Service (USDA NASS). 2017 Census of Agriculture:Specialty Crops. Census Agric. 2019, 2, 1–15. [Google Scholar]

- Guan, Z.; Wu, F.; Roka, F.; Whidden, A. Agricultural Labor and Immigration Reform. Choices 2015, 30, 1–9. [Google Scholar] [CrossRef]

- Biswas, T.; Wu, F.; Guan, Z. Labor Shortages in the Florida Strawberry Industry. EDIS 2018, FE1041, 1–3. [Google Scholar]

- Charlton, D.; Taylor, J.E.; Vougioukas, S.; Rutledge, Z. Can Wages Rise Quickly Enough to Keep Workers in the Fields? Choices 2019, 34, 1–7. [Google Scholar] [CrossRef]

- Beal Cohen, A.A.; Judge, J.; Muneepeerakul, R.; Rangarajan, A.; Guan, Z. A model of crop diversification under labor shocks. PLoS ONE 2020, 15, e0229774. [Google Scholar] [CrossRef]

- Guan, Z.; Wu, F.; Whidden, A. Florida strawberry production costs and trends. EDIS 2020, FE1013, 1–4. [Google Scholar] [CrossRef]

- Canales, E.; Andrango, G.; Williams, A. Mexico’s Agricultural Sector: Production Potential and Implications for Trade. Choices 2019, 34, 1–12. [Google Scholar] [CrossRef]

- Zahniser, S.; Taylor, J.E.; Hertz, T.; Charlton, D. Farm Labor Markets in the United States and Mexico Pose Challenges for US Agriculture. USDA Econ. Res. Serv. Econ. Inf. Bull. 2018, 201, 1–40. [Google Scholar]

- USDA Foreign Agricultural Service (USDA FAS). Global Agricultural Trade System Online. Available online: https://apps.fas.usda.gov/GATS/default.aspx (accessed on 12 May 2022).

- USDA Animal and Plant Health Inspection Service (USDA APHIS). Mexican Hass Avocado Import Program. Fed. Regist. Rules Regul. 2016, 81, 33581–33588. [Google Scholar]

- Suh, D.H.; Guan, Z.; Khachatryan, H. The impact of Mexican competition on the US strawberry industry. Int. Food Agribus. Manag. Rev. 2017, 20, 591–604. [Google Scholar] [CrossRef]

- Guan, Z.; Wu, F.; Whidden, A.J. Top challenges facing the Florida strawberry industry: Insights from a comprehensive industry survey. EDIS 2015, FE972, 1–3. [Google Scholar]

- Wu, F.; Guan, Z. An Overview of the Mexican Blueberry Industry. EDIS 2021, FE1106. [Google Scholar] [CrossRef]

- Luckstead, J.; Devadoss, S. Trends and Issues Facing the US Citrus Industry. Choices 2021, 36, 1–10. [Google Scholar] [CrossRef]

- Li, S.; Wu, F.; Guan, Z.; Luo, T. How trade affects the US produce industry: The case of fresh tomatoes. Int. Food Agribus. Manag. Rev. 2021, 25, 121–133. [Google Scholar] [CrossRef]

- Wu, F.; Guan, Z.; Suh, D.H. The Effects of Tomato Suspension Agreements on Market Price Dynamics and Farm Revenue. Appl. Econ. Perspect. Policy 2018, 40, 316–332. [Google Scholar] [CrossRef]

- Guan, Z.; Suh, D.H.; Wu, F. Tomato Suspension Agreements and the Effects on Market Prices and Farm Revenue. EDIS 2018, FE1025, 1–4. [Google Scholar] [CrossRef]

- United States International Trade Commission (USITC). Cucumbers: Effect of Imports on U.S. Seasonal Markets, with a Focus on the U.S. Southeast. USITC Investig. Rep. 2021, 5268, 17–173. [Google Scholar]

- United States International Trade Commission (USITC). Squash: Effect of Imports on U.S. Seasonal Markets, with a Focus on the U.S. Southeast. USITC Investig. Rep. 2021, 5269, 17–127. [Google Scholar]

- Biswas, T.; Guan, Z.; Wu, F. An overview of the US bell pepper industry. EDIS 2018, FE1028, 1–4. [Google Scholar]

- Pawlak, K.; Smutka, L.; Kotyza, P. Agricultural Potential of the EU Countries: How Far Are They from the USA? Agriculture 2021, 11, 282. [Google Scholar] [CrossRef]

- Pawlak, K. Competitiveness of the EU Agri-Food Sector on the US Market: Worth Reviving Transatlantic Trade? Agriculture 2022, 12, 23. [Google Scholar] [CrossRef]

- Congressional Research Service. Agricultural Provisions of the U.S.-Mexico-Canada Agreement. Congr. Res. Serv. Rep. 2020, R45661, 1–19. [Google Scholar]

- Zahniser, S. United States-Mexico-Canada Agreement (USMCA) Approaches the Starting Block, Offers Growth Opportunities for Agriculture. USDA Econ. Res. Serv. Amber Waves 2020, 2020, 1. [Google Scholar]

- Lee, Y.; Kennedy, P.L. Trade creation and diversion under NAFTA: The North American strawberry market. In Proceedings of the Agricultural and Applied Economics Association (AAEA) Conferences, 2016 Annual Meeting, Boston, MA, USA, 31 July –2 August 2016; pp. 1–32. [Google Scholar] [CrossRef]

- United States International Trade Commission (USITC). Fresh Tomatoes from Mexico. USITC Investig. Rep. 2019, 5003, 1–41. [Google Scholar]

- Congressional Research Service. Seasonal Fruit and Vegetable Competition in U.S.-Mexico Trade. Congr. Res. Serv. Rep. 2020, IF11701, 1–3. [Google Scholar]

- Congressional Research Service. U.S.-Mexico Economic Relations: Trends, Issues, and Implications. Congr. Res. Serv. Rep. 2020, RL32934, 1–26. [Google Scholar]

- Congressional Research Service. U.S. Food and Agricultural Imports: Safeguards and Selected Issues. Congr. Res. Serv. Rep. 2020, R46440, 1–38. [Google Scholar]

- United States International Trade Commission (USITC). Fresh, Chilled, or Frozen Blueberries. USITC Investig. Rep. 2021, 5164, 1. [Google Scholar]

- United States International Trade Commission (USITC). Raspberries for Processing: Conditions of Competition between U.S. and Foreign Suppliers, with a Focus on Washington State. USITC Investig. Rep. 2021, 5194, 151–168. [Google Scholar]

- USDA Economic Research Service Webpage. U.S. Avocado Demand Is Climbing Steadily. Available online: https://www.ers.usda.gov/data-products/chart-gallery/gallery/chart-detail/?chartId=98071 (accessed on 1 July 2022).

- USDA National Agriculutral Statistics Service (USDA NASS). Fruits and Tree Nuts: Blooming, Harvesting, and Marketing Dates. Agric. Handb. 2006, 729, 62–84. [Google Scholar]

- Osuna-García, J.A.; Doyon, G.; Salazar-García, S.; Goenaga, R.; González-Durán, I.J. Effect of harvest date and ripening degree on quality and shelf life of Hass avocado in Mexico. Fruits 2010, 65, 367–375. [Google Scholar] [CrossRef]

- USDA National Agricultural Statistics Service (USDA NASS). Quick Stats. Available online: https://quickstats.nass.usda.gov/ (accessed on 12 May 2022).

- González-Ramírez, M.G.; Santoyo-Cortés, V.H.; Arana-Coronado, J.J.; Muñoz-Rodríguez, M. The insertion of Mexico into the global value chain of berries. World Dev. Perspect. 2020, 20, 100240. [Google Scholar] [CrossRef]

- U.S. General Accounting Office (GAO). U.S.-Mexico Trade: Extent to Which Mexican Horticultural Exports Complement U.S. Production. GAO Brief. Rep. Chairm. Comm. Agric. House Represent. 1991, NSIAD-91-94BR, 10–30. [Google Scholar]

- Wu, F.; Guan, Z.; Whidden, A. An Overview of the US and Mexico Strawberry Industries. EDIS 2018, FE971, 1–4. [Google Scholar]

- Evans, E.A.; Ballen, F.H. An Overview of US Blueberry Production, Trade, and Consumption, with Special Reference to Florida. EDIS 2019, FE952, 1–8. [Google Scholar] [CrossRef]

- Osoyo, A.; Elms, R. Citrus Annual: Mexico. USDA Foreign Agric. Serv. Rep. 2020, MX2020-0075, 1–14. [Google Scholar]

- Li, S.; Wu, F.; Duan, Y.; Singerman, A.; Guan, Z. Citrus greening: Management strategies and their economic impact. HortScience 2020, 55, 604–612. [Google Scholar] [CrossRef]

- Espinoza-Arellano, J.d.J.; Fuller, S.; Malaga, J. Analysis of forces affecting competitive position of Mexico in supplying US winter melon market. Int. Food Agribus. Manag. Rev. 1998, 1, 495–507. [Google Scholar] [CrossRef]

- USDA National Agriculutral Statistics Service (USDA NASS). Vegetables Usual Planting and Harvesting Dates. Agric. Handb. 2007, 507, 42–86. [Google Scholar]

- Blue Book Services. Know Your Commodity Guide: Chile Peppers. Available online: https://www.producebluebook.com/know-your-commodity/chile-peppers/ (accessed on 1 July 2022).

- Lighthizer, R.E.; Ross, W.L., Jr.; Perdue, S. Report on Seasonal and Perishable Products in U.S. Commerce. Off. United States Trade Represent. Rep. 2020, 2020, 1–27. [Google Scholar]

- Zahniser, S.; Angadjivand, S.; Hertz, T.; Kuberka, L.; Santos, A. NAFTA at 20: North America’s free trade area and its impact on agriculture. A Rep. USDA Econ. Res. Serv. 2015, WRS-15-01, 1–7. [Google Scholar]

- Organisation for Economic Co-operation and Development (OECD). Exchange Rates: National Currency Units/US Dollars. Available online: https://data.oecd.org/conversion/exchange-rates.htm (accessed on 1 March 2022).

- Escalante, C.L.; Luo, T. Sustaining a healthy farm labor force: Issues for policy consideration. Choices 2017, 32, 1–9. [Google Scholar]

- Richards, T.J. Immigration reform and farm labor markets. Am. J. Agric. Econ. 2018, 100, 1050–1071. [Google Scholar] [CrossRef]

- Roka, F.M.; Guan, Z. Farm labor management trends in Florida, USA-challenges and opportunities. Int. J. Agric. Manag. 2018, 7, 79–87. [Google Scholar] [CrossRef]

- Wei, X.; Önel, G.; Guan, Z.; Roka, F. Substitution between immigrant and native farmworkers in the United States: Does legal status matter? IZA J. Dev. Migr. 2019, 10, 1–27. [Google Scholar] [CrossRef]

- Qushim, B.; Guan, Z.; Roka, F. The H-2A Program and Immigration Reform in the United States. EDIS 2018, FE1029, 1–5. [Google Scholar] [CrossRef]

- U.S. Department of Labor Office of Foreign Labor Certification (DOL OFLC). OFLC Programs and Disclosures. Available online: https://www.dol.gov/agencies/eta/foreign-labor/performance (accessed on 1 September 2022).

- Roka, F.M.; Simnitt, S.; Farnsworth, D. Pre-employment costs associated with H-2A agricultural workers and the effects of the ‘60-minute rule’. Int. Food Agribus. Manag. Rev. 2017, 20, 335–346. [Google Scholar] [CrossRef]

- Luckstead, J.; Devadoss, S. The Importance of H-2A Guest Workers in Agriculture. Choices 2019, 34, 1–8. [Google Scholar] [CrossRef]

- Bier, D. H-2A Visas for Agriculture: The Complex Process for Farmers to Hire Agricultural Guest Workers. Cato Inst. Immigr. Res. Policy Brief 2020, 17, 1–36. [Google Scholar]

- Charlton, D.; Castillo, M. Potential Impacts of a Pandemic on the US Farm Labor Market. Appl. Econ. Perspect. Policy 2020, 43, 39–57. [Google Scholar] [CrossRef]

- Farnsworth, D.U.S. COVID-19 Policy Affecting Agricultural Labor. Choices 2020, 35, 1–6. [Google Scholar] [CrossRef]

- Wu, F.; Guan, Z.; Garcia-Nazariega, M. Comparison of Labor Costs between Florida and Mexican Strawberry Industries. EDIS 2017, FE1023, 1–5. [Google Scholar] [CrossRef]

- USDA National Agricultural Statistics Service (NASS). Farm Labor (March 2022). Available online: https://www.ers.usda.gov/topics/farm-economy/farm-labor/ (accessed on 3 October 2022).

- Data México. Workers in Farming Activities. Available online: https://datamexico.org/en/profile/occupation/trabajadores-en-actividades-agricolas-y-ganaderas?growthSalary=salaryOption&quarters5=20204&quarters6=20204 (accessed on 1 July 2022).

- Wu, F.; Soto-Caro, A.; Guan, Z. Government Support in Mexican Agriculture: The Agri-Food Productivity and Competitiveness Program. EDIS 2021, FE1107, 1–7. [Google Scholar] [CrossRef]

- Wu, F.; Qushim, B.; Calle, M.; Guan, Z. Government Support in Mexican Agriculture. Choices 2018, 33, 1–11. [Google Scholar] [CrossRef]

- Guan, Z.; Biswas, T.; Wu, F. The US Tomato Industry: An Overview of Production and Trade. EDIS 2018, FE1027, 1–4. [Google Scholar]

- Pratt, L.; Ortega, J.M. Protected agriculture in Mexico: Building the methodology for the first certified agricultural green bond. Inter-Ameriacn Dev. Bank Tech. Note 2019, IDB-TN-1668, 13–25. [Google Scholar] [CrossRef]

- Servicio de Información Agroalimentaria y Pesquera (SIAP). Anuario Estadístico de la Producción Agrícola (Statistical Yearbook of Agricultural Production). Available online: https://nube.siap.gob.mx/cierreagricola/ (accessed on 10 October 2022).

- Office of the United States Trade Representative (USTR). United States-Mexico-Canada Trade Fact Sheet. Available online: https://ustr.gov/trade-agreements/free-trade-agreements/united-states-mexico-canada-agreement/fact-sheets/strengthening (accessed on 10 October 2022).

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).