1. Introduction

According to Mital et al. [

1], growing competition requires the industry to expand its concentration on core competencies and reduce manufacturing verticalization, leading to a new dimension of cooperation of numerous companies in the form of supply chains. However, since these industries depend on different levels of suppliers, processes, warehouses, and distribution channels, they consequently increase the complexity of their activities, mainly due to issues related to reductions in stock levels, delivery time, product and geographic dispersion [

2,

3]. Christopher and Lee [

4] also note that supply chains are not a simple series of processes, but complex networks [

5,

6], where disruptions can occur at any time and harm everyone involved [

7].

When the dependence between companies increases, they are more exposed to risks [

3,

8]. This is because supply chains are increasingly connected and, consequently, increasingly subjected to interruptions [

9]. As an example, Thun and Hoenig [

10] cite a loss of millions of dollars that occurred with the German component supplier Robert Bosch (Tier 1), which delivered defective high-pressure pumps for diesel injection systems to its customers in early 2005. This error was caused by a Bosch sub-supplier (Tier 2), thus compromising the entire supply chain. Similarly, in 1996, an 18-day strike at a brake supplier factory disrupted operations, leading to idled workers at 26 General Motors plants. This strike resulted in an impact of USD 900 million [

11].

In these examples, where raw materials or components represent between 50 and 70% of the added value of a supply chain, supplier performance significantly impacts many product dimensions such as cost, quality, and on-time delivery [

12]. In monetary terms, Kern et al. [

13] estimates that interruptions in the automotive production chain have the potential to generate daily losses of around USD 100,000,000.00.

Although the automobile companies Toyota, Honda, Nissan, Chrysler, Ford, and General Motors have implemented several risk management programs in their production chains over the years, [

14,

15] note that the existing literature provides little in terms of operational frameworks for its realization. To fill this gap, De Oliveira et al. [

16] found twenty-seven models of risk management in the supply chain in the literature, reaching the conclusion that there was no consensus among researchers about the best model for practical application in the daily operation of companies. Just as an example, with regard to the steps for its realization, authors such as Juttner et al. [

17] define the existence of four stages, Harland et al. [

18] establish five steps, and Ritchie and Brindley [

19], in turn, defend performing the SCRM in seven stages. As for De Oliveira et al. [

16], the standard established by the ISO 31000:2009 standard [

20] is the one that best presents itself as a systematic procedure for performing the SCRM.

Despite the relatively recent identification of the twenty-seven models and the finding that ISO 31000 could be used as a systematic procedure for carrying out the SCRM, part of the findings of Matook et al. [

15] still persevere, that is, there is still a lack of empirical research on “how to do” SCRM in practice [

21,

22]. Seeking to fill part of this gap, [

21,

22,

23] developed empirical research looking for tools that could be used to implement SCRM in industry while De Oliveira et al. [

24] researched the development of SCRM in services. The recent efforts of these empirical studies align with the recommendations of Sodhi et al. [

25], who, more than a decade ago, pointed to the need to develop research based on practical applications in the industry through case studies.

If, in general, research on the practical implementation of SCRM is scarce, this gap is even greater when this topic is delimited into direct and indirect suppliers. Dias et al. [

21], for example, found that in the period from 2009 to 2020, only one practical application work was published focusing on suppliers in the automotive industry. Seeking to fill this gap, the present research aims to select and rank the most appropriate tools for use in SCRM in suppliers of the automotive industry. As a second objective, the research seeks to identify the most relevant stage of risk management (identification, analysis, or assessment) for the implementation of SCRM. This aspect is crucial since the difficulty in selecting appropriate tools for risk management in suppliers can be minimized by knowing the most critical phase of the process. In this way, it becomes possible to prioritize tools that are strongly applicable to this stage, optimizing the effectiveness of risk management in the supply chain. As a starting point, following the example of recent research [

21,

22,

26,

27,

28], the present research will use the ISO 31010 standard [

29] to identify the most appropriate tools since this standard provides guidance on the selection and application of more than thirty systematic techniques for risk management. For this purpose, a multinational company in the automotive sector located in Rio de Janeiro (Brazil) and twenty of its main suppliers were selected in order to rank, according to the professional knowledge of the research participants, which tools would be the most appropriate for the supply chain risk management for this business segment.

It is noteworthy that the present research does not intend to completely solve the gap that has been presented so far (lack of empirical research on how to develop the SCRM). But a starting point is sought, which will begin with choosing the most appropriate tools for SCRM in suppliers. It is understood that only in future research (perhaps to continue this and, perhaps, through the development of action-type research) will we be able to bring more robust results on a practical application of the tools that will be selected now. The delimitation of the present study focuses on this point. In other words, efforts will be made to select and prioritize the most suitable tools for SCRM in suppliers of the automotive industry.

The relevance of the topic is linked, not exclusively, but mainly, to the following aspects: (i) comprehensively understanding what the risk is, where the risk exists and how to mitigate the risk, and whether the risks presents itself as a challenge for additional research in supply chain management [

30]; (ii) supply chain risk management is positively related to supply chain resilience [

31,

32]; (iii) ensuring continuity of supply is one of the most critical objectives of the supply chain [

15,

33]; (iv) when suppliers proactively initiate risk management actions, the buyer is more likely to achieve resilience [

7,

34]; (v) with regard to “hands on” risk management processes, there is a gap caused by a lack of empirical research [

25]; (vi) since there is a relationship between sustainability and the level of resilience [

35,

36], a good risk management process improves the sustainability of the supply chain [

37,

38].

The next sections will present the research, segmented as follows:

Section 2 will address a review of the literature on the subject, bringing up concepts about SCRM, SCRM with a focus on suppliers, ISO 31000 and 31010 standards, and sustainability and SCRM;

Section 3 will address the methodological aspects used in the research, approaching the steps that were followed in the unfolding of the empirical study;

Section 4 and

Section 5 will organize and discuss the results and, finally, the last section will conclude the research, bringing the main considerations and analyzing whether the objectives that were initially aimed by the research were achieved.

3. Materials and Methods

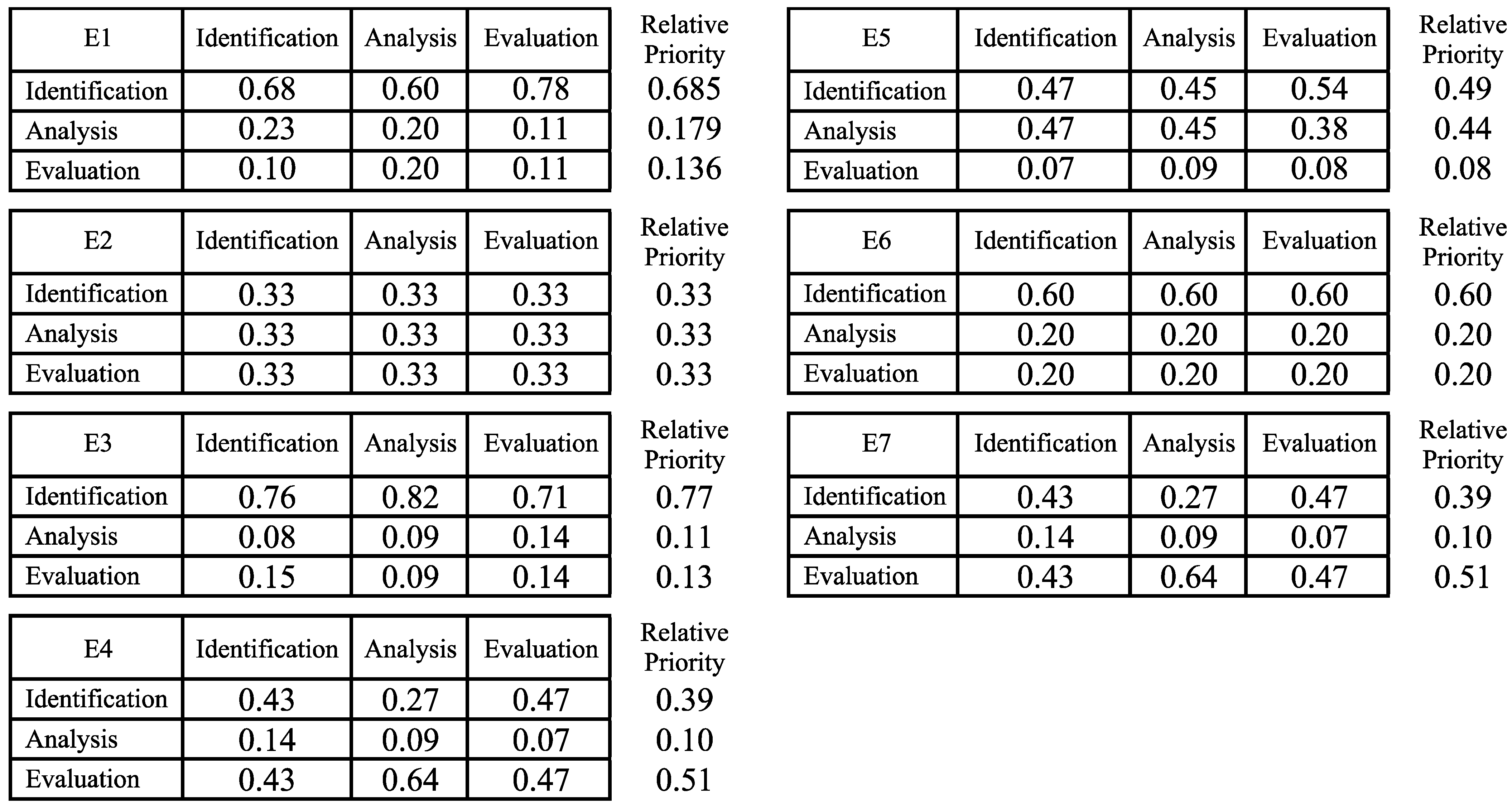

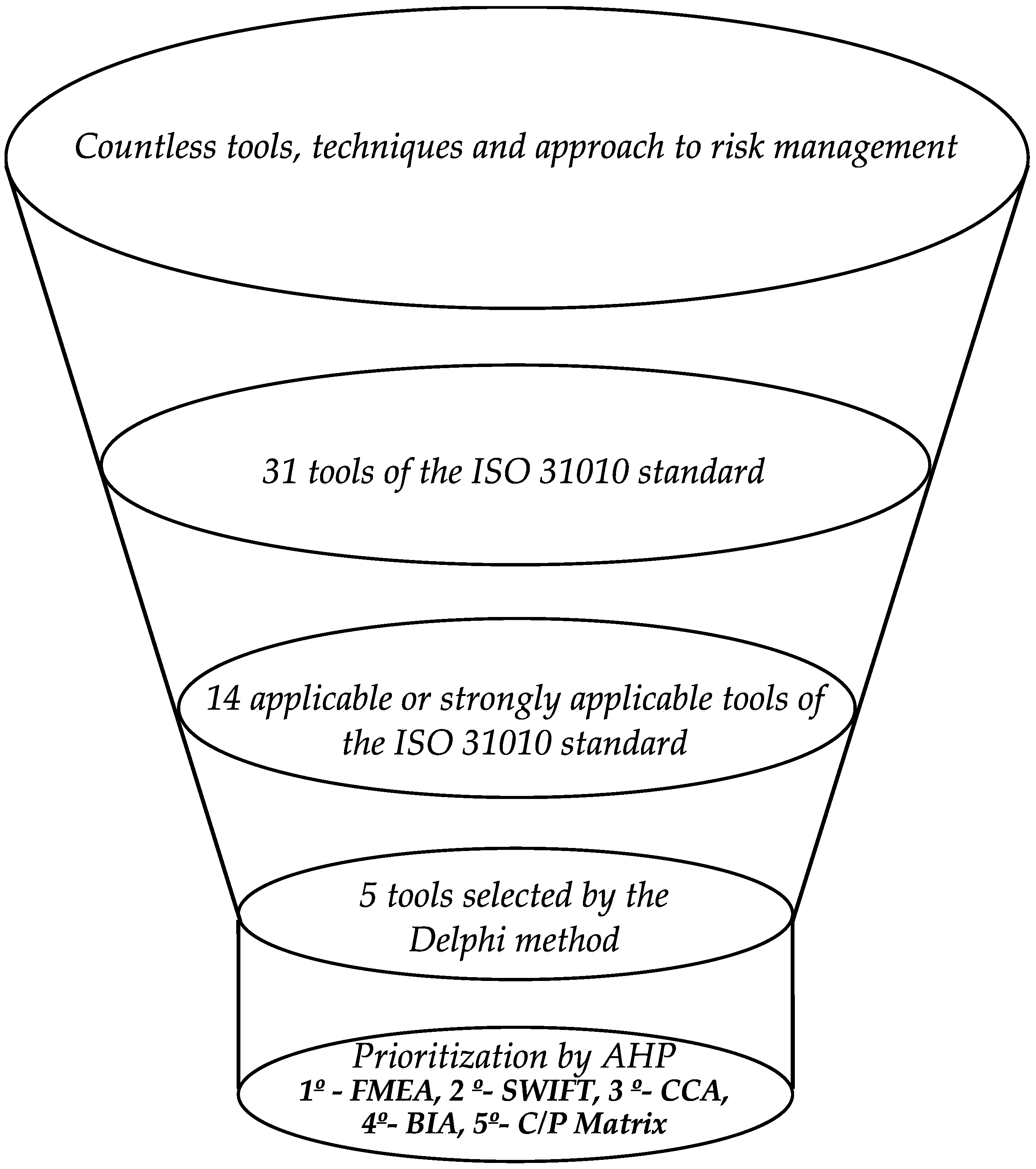

The ISO 31010:2009 standard presents 31 risk management tools, of which 14 were classified by ISO itself as applicable or highly applicable to the stages of risk identification, analysis, and assessment. This classification, established by one of the main international standardization bodies, served as a starting point for this research, lending rigor and credibility to the study. Since ISO 31010 adopts a generalist approach, applicable to different types of organizations, and since this research focuses on suppliers to the automotive industry, the investigation was conducted in two stages to identify which of these fourteen tools are the most appropriate for this context. In the first stage, the Delphi method was used with experts from Tier 2 suppliers in order to select, evaluate, and validate the most appropriate tools for risk management in the supply chain of these suppliers.

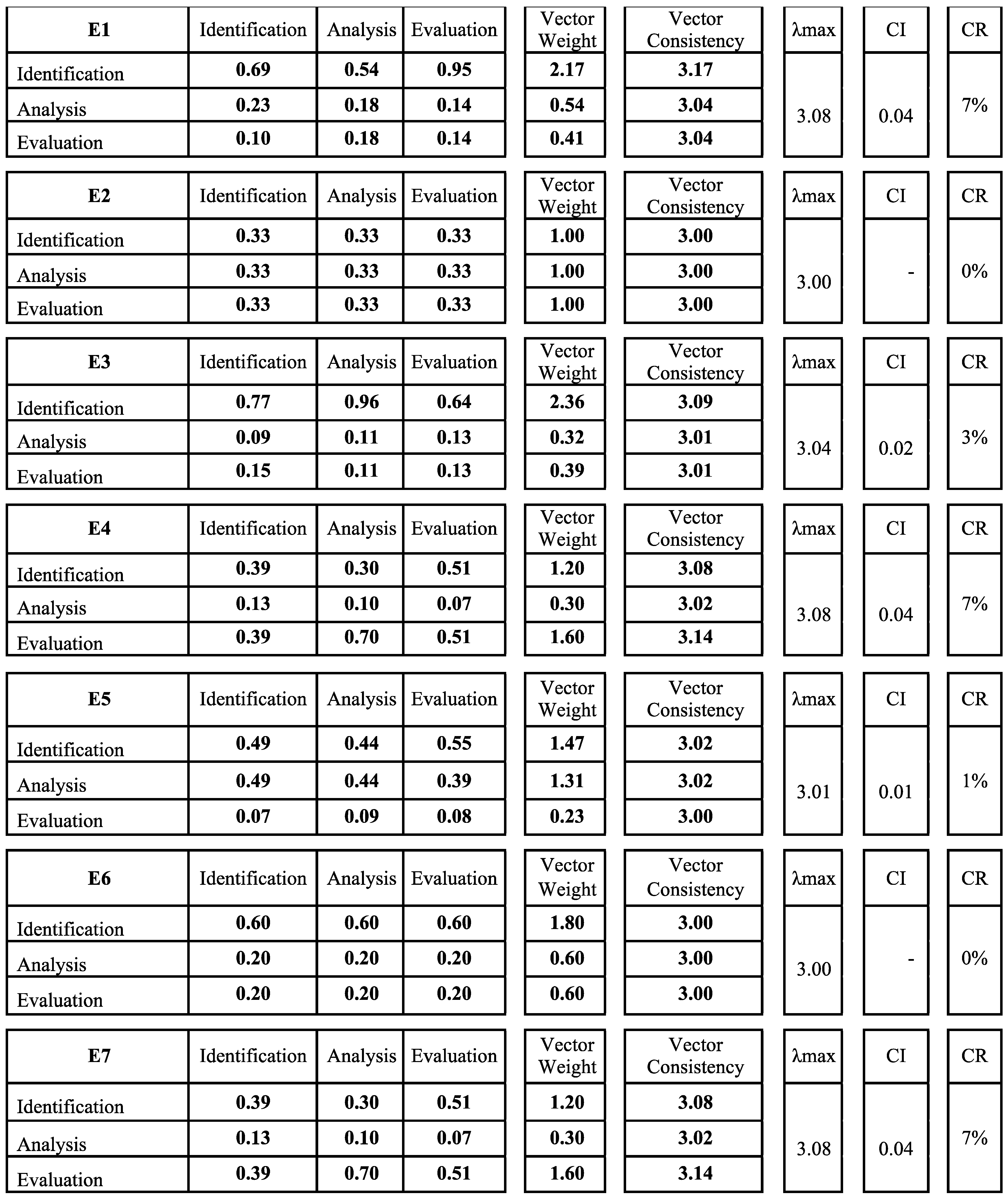

The second stage complemented this analysis using the AHP method, allowing the selected tools to be ranked. The use of AHP made the results more robust, enabling the detection and correction of inconsistencies in the experts’ responses. While the Delphi was conducted remotely via Google Forms, this phase took place in person with seven experts from a Tier 1 auto parts supplier, which allowed for immediate review of any inconsistencies. In addition, the participation of experts from a Tier 1 supplier broadened the research perspective, ensuring a more comprehensive view of the supply chain.

The combination of Delphi and AHP methods was essential to structure decision-making in a context with multiple perspectives and uncertainties. Delphi consolidated the specialized knowledge of Tier 2 suppliers, identifying a consensual set of tools, but without establishing a systematic prioritization. To fill this gap, AHP allowed pairwise comparisons and measurement of the consistency of responses, ensuring an additional level of rigor. In this way, the complementarity between the methods ensured not only the capture of specialized knowledge of the automotive supply chain, but also its structured and hierarchical organization, resulting in a robust and replicable classification of the most appropriate tools for risk management in the sector.

3.1. The Delphi Method for Selecting Supplier Risk Management Tools

The first stage of the research aimed to select the most appropriate tools for risk management in Tier 2 suppliers. To this end, twenty experts were selected (one from each Tier 2 supplier), following an intentional non-probabilistic sampling criterion in order to include only professionals with solid knowledge and relevant experience in the area. This approach aimed to ensure that participants had the potential to contribute significantly to the research. In addition, when determining the number of experts the recommendation in the literature were considered, which suggests between 15 and 20 participants in Delphi studies [

79] in order to ensure the diversity and quality of the ideas generated.

Table 2 presents the main characteristics of the respondents in this stage.

Since the Delphi Method seeks consensus among experts, it took three rounds of questionnaires to arrive at a list of tools that everyone agreed is the most appropriate. According to Douglas et al. [

80], the Delphi method is a group method that is administered by a researcher or a research team and that brings together a panel of experts, asks questions, makes feedback syntheses, and guides the group towards its goal and a consensus. Brill et al. [

81] describe Delphi as a particularly good research method for reaching consensus among a group of individuals with expertise in a specific topic, where the information sought is subjective and where the participants are separated by physical distance.

In the first round of Delphi, a questionnaire was prepared in Google Forms where information was presented on tools considered by the ISO 31010 standard as highly applicable to identify and/or analyze and/or assess risks. Based on the tools presented, participants should indicate those that, according to their judgment, would be the most appropriate for risk management in their production chain.

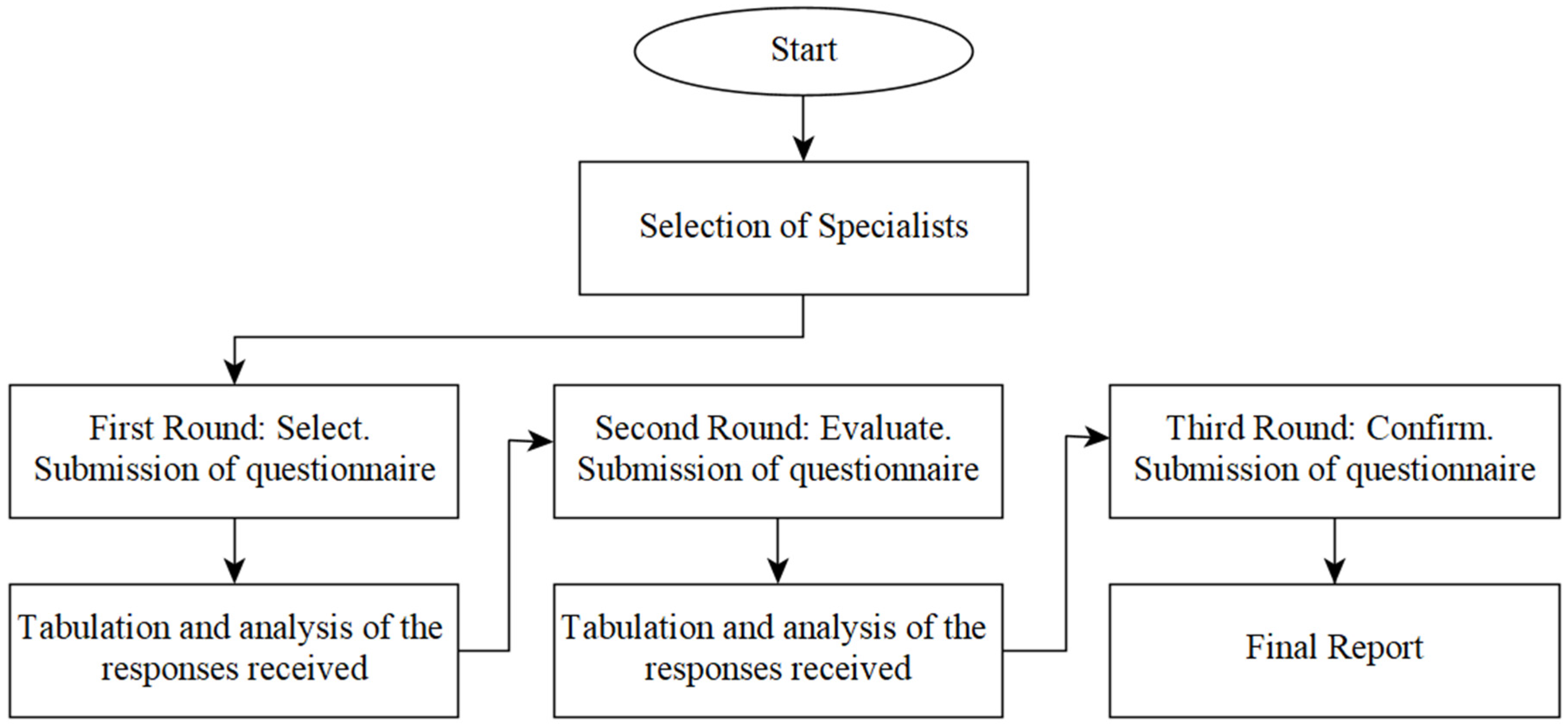

After analyzing and tabulating the data, the experts were invited to participate in a second round of Delphi (also through Google Forms), where, using a Likert-type scale, they assigned a score from 1 (not applicable) to 5 (strongly applicable) for each tool suggested in the previous round. Finally, the third round included the sending of a report with the results of the second round, so that the specialists could answer, in a justified way, whether or not they agreed with the scores given to each tool in the previous step. The sequence of execution of the Delphi method followed the one recommended by the flowchart of

Figure 1.

3.2. The AHP Method for Hierarchizing the Tools Selected in the Delphi Method

The AHP method was chosen because it allows pairwise comparisons, exploring the ability of individuals to hierarchically structure their perceptions when comparing two similar alternatives, with reference to a specific criterion and assigning degrees of importance [

82,

83,

84]. In addition to enabling hierarchization, this approach gave greater robustness to the results, as it allows the identification and correction of inconsistencies in the respondents’ choices [

85]. Roy [

86], for example, highlights the use of the AHP as an appropriate method to classify factors according to the order of preference or priority of the interviewees.

To ensure the reliability of the results, we selected seven experts from an auto parts supplier (Tier 1), adopting the same intentional non-probabilistic sampling criterion as in the first stage. The objective was to ensure the participation of professionals with consolidated knowledge of the automotive industry supply chain. The chosen experts have extensive experience in the sector, having worked for several years in strategic roles directly related to risk management. Thus, the analyses were based not only on technical knowledge but also on the participants’ practical experience.

Furthermore, the definition of the number of experts sought to balance the diversity of perspectives and the consistency of the assessments, ensuring the applicability of the AHP. The literature does not establish a fixed number for this method [

87], but indicates that small groups can generate reliable results when composed of highly qualified professionals familiar with the context analyzed [

23].

Table 3 presents the main characteristics of the respondents in this stage.

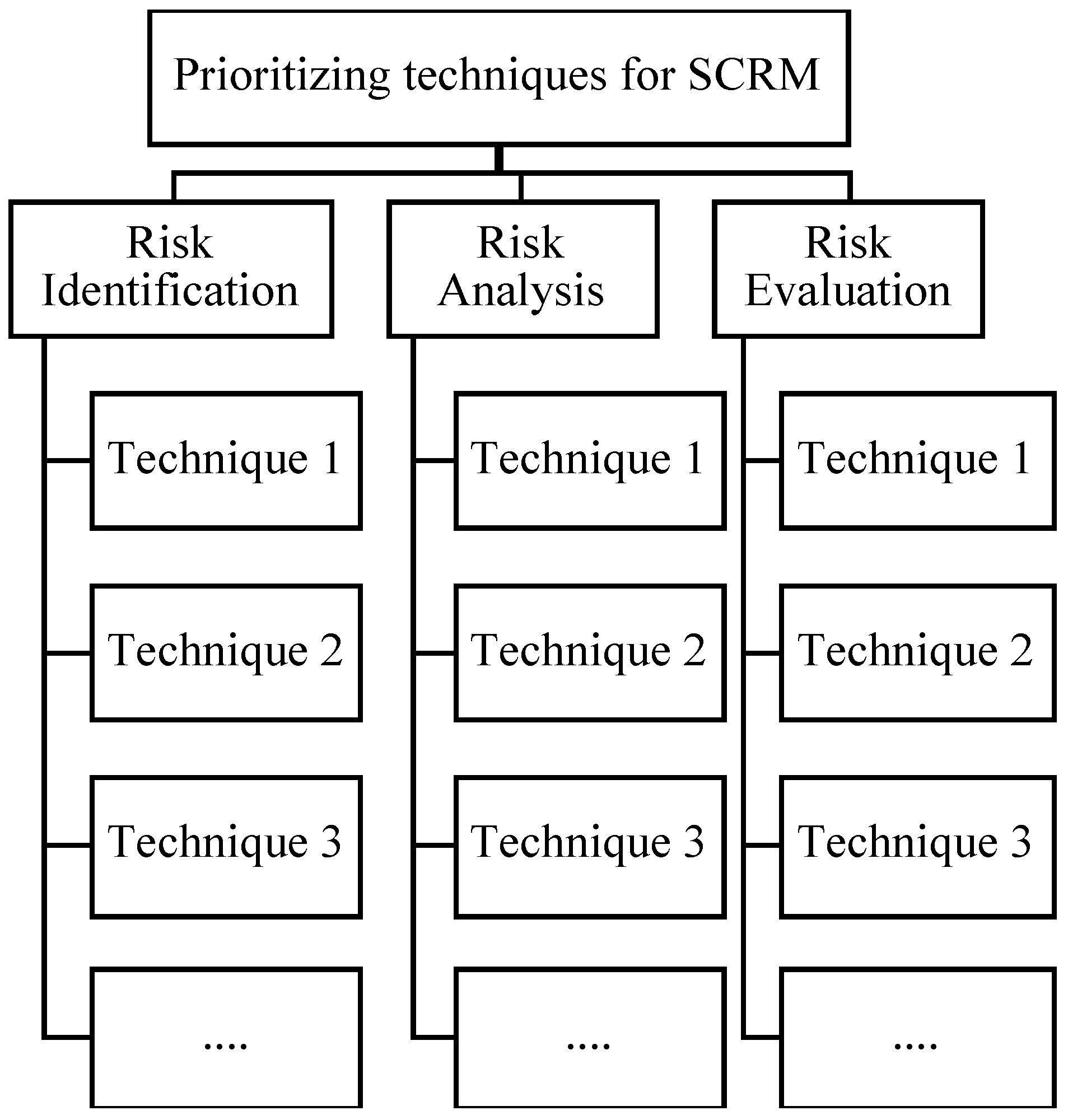

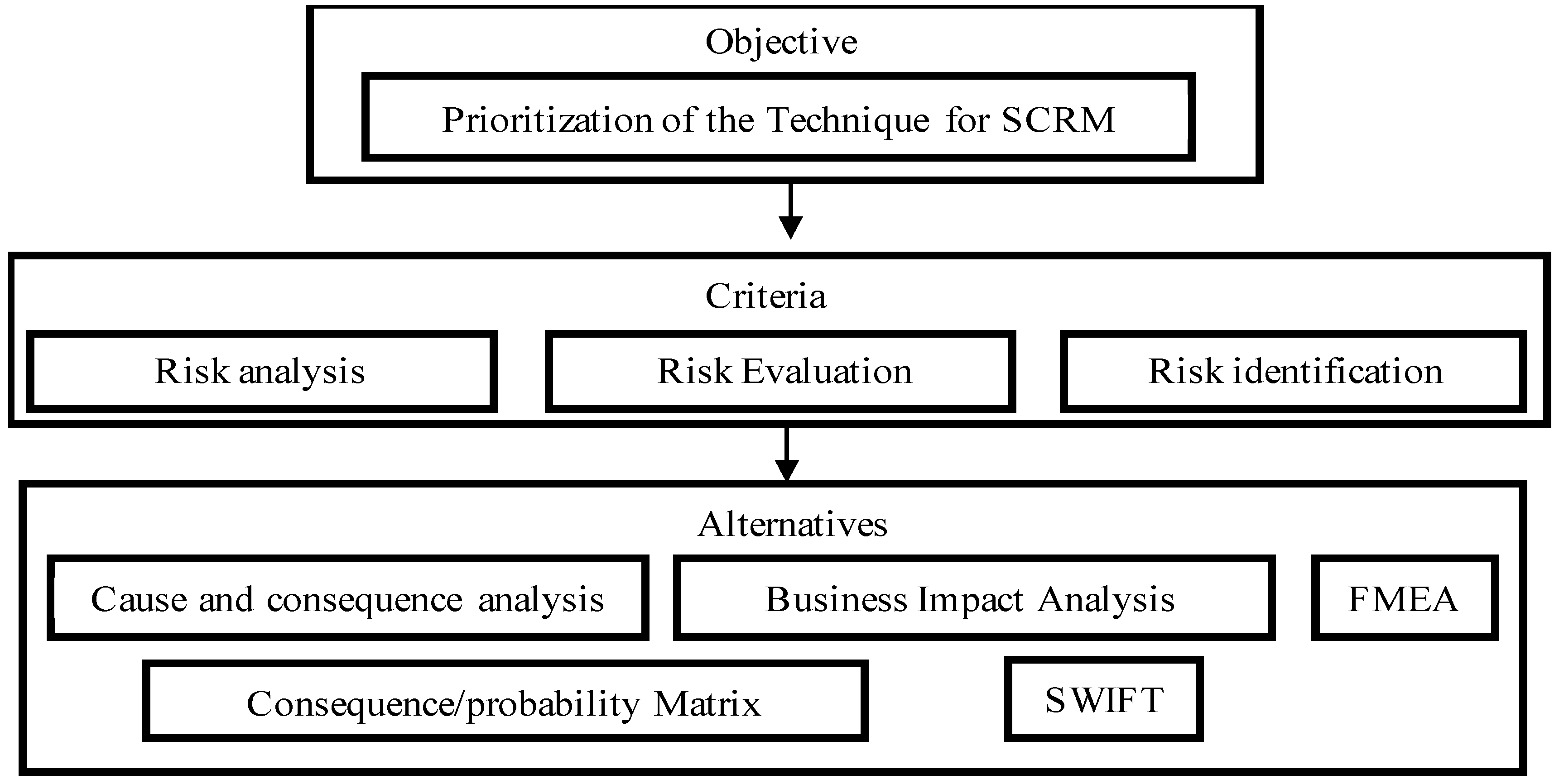

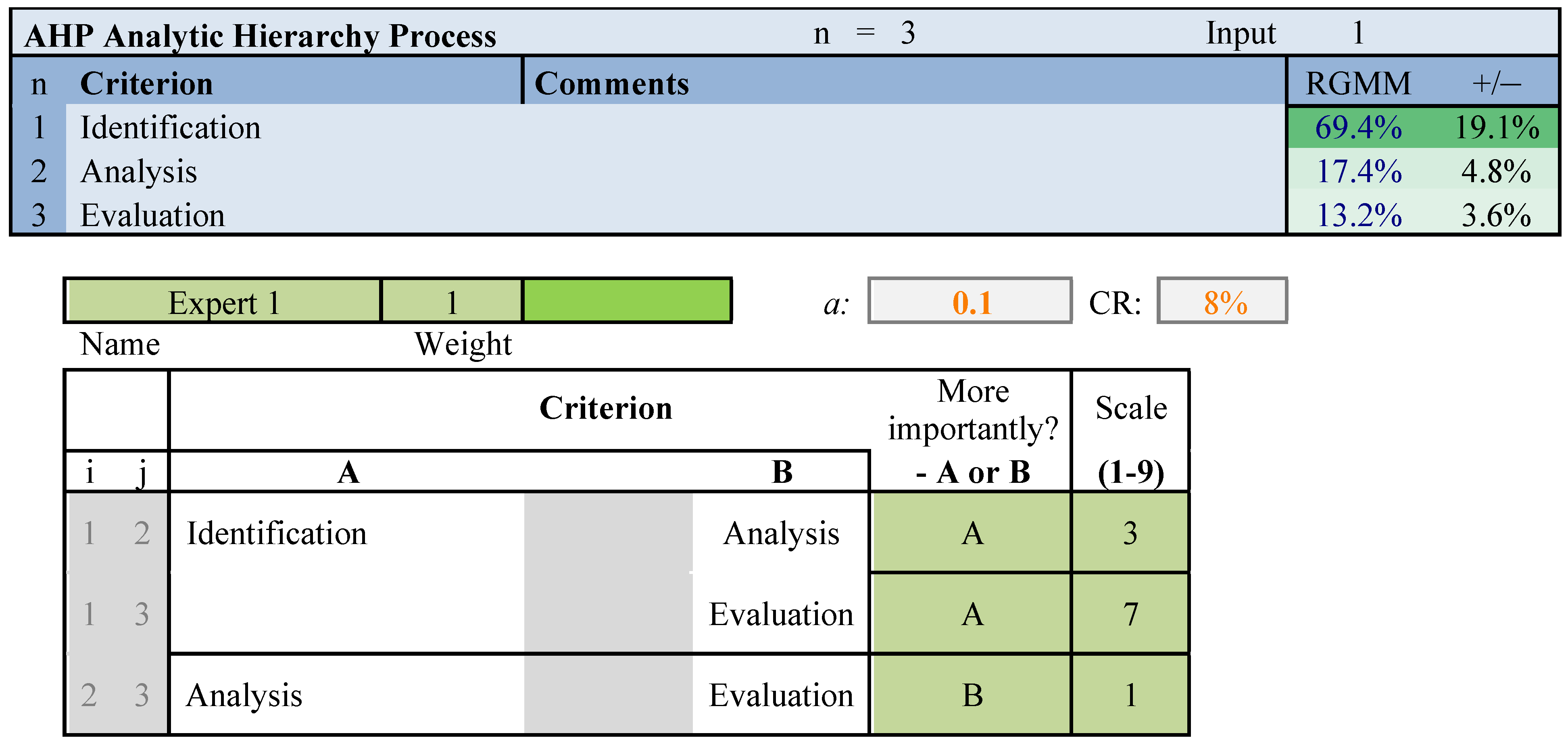

After the selection of experts, the AHP method was performed according to the following steps: (1) Hierarchy representation: Development of the decision hierarchy linked to the different related levels; (2) Prioritization of criteria for the objective: Comparison of pairs and method for self-value and eigenvector, as well as evaluation of the consistency of the comparison by pairs of criteria. At the end of this phase, individual priorities were aggregated; (3) Prioritization of alternatives for each criterion: identify, analyze, and evaluate.

Figure 2 shows the mentioned steps, addressing the hierarchical level with objective, criterion, and alternatives used in AHP application.

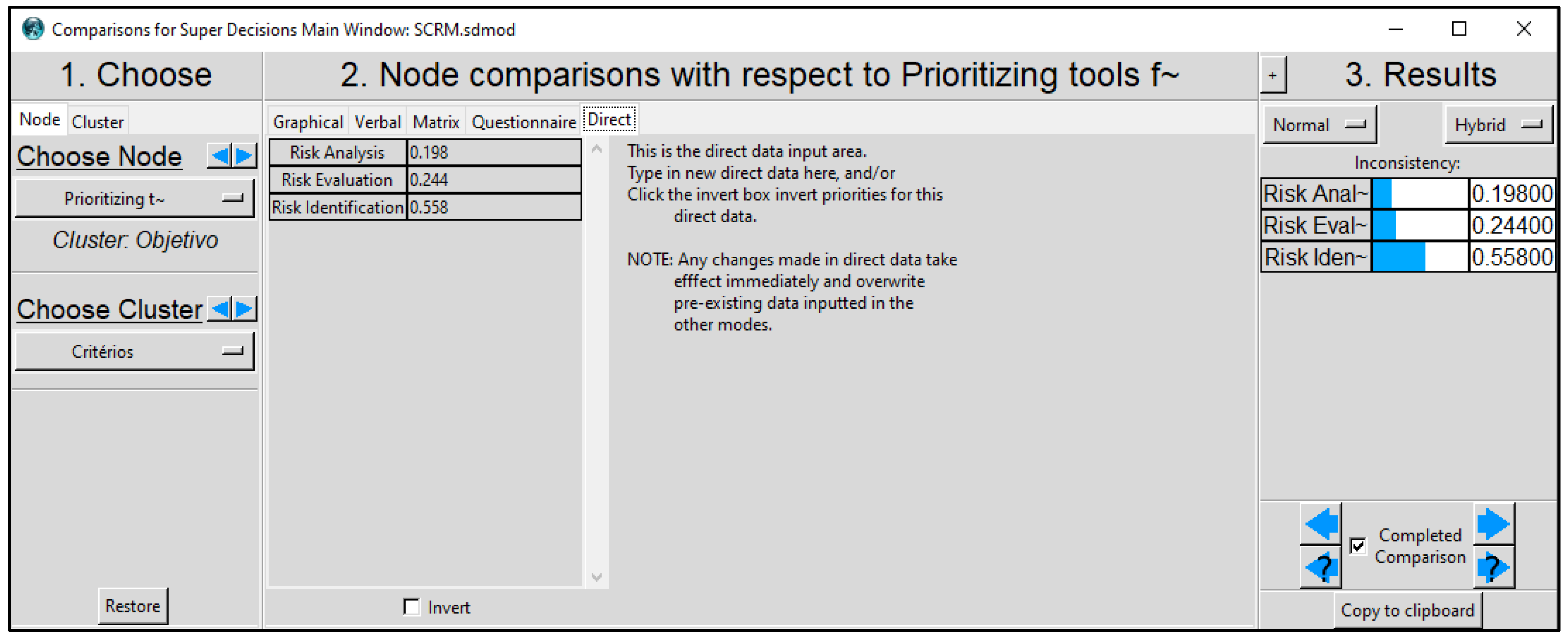

Finally, it is important to highlight that the two macro steps mentioned earlier (Delphi and AHP) were carried out in an automotive supply chain, which includes a multinational parts supplier (Tier 1) and twenty of its main suppliers (Tier 2). The companies served by Tier 1 include four major vehicle manufacturers. To perform the analyses, we used the Super Decisions® software (version 3.2) to simplify the calculations resulting from the AHP method.

5. Discussion

The results of the present paper show a higher concern from actors in the supply chain to adopt proactive methods to properly and in a timely manner identify risks within their chain, allowing them to evaluate, analyze, and mitigate risks with a reduced impact on the operational performance of the supply chain. In addition, it is relevant to highlight that the prioritization of SCRM stages and strategies proposed in this study supports better decision-making and the development of a sustainable SCRM process. This can have a positive impact in terms of reduction in the frequencies and levels of disruption, leading to increased competitiveness in the supplier market, reduction in economic damage, better image and service continuity— essential elements for the sustainability of a firm.

Although we have not conducted an empirical study on the impacts of risk management on supply chain sustainability, such as the work developed by Elmsalmi et al. [

90], which classified and prioritized sustainable practices based on their impact on SCRM, the literature [

37,

91] indicates a growing trend of integrating supply chain risk management with sustainable practices. These studies demonstrate that companies investing in supply chain risk management reap benefits in economic, social, and environmental aspects, while the absence of such investment can result in negative impacts on corporate sustainability.

Regarding the methods used (Delphi and AHP), they complemented each other, since Delphi raised the main risk management tools and the AHP method ranked them. In addition, the decision to delimit the tools based on ISO 31010 proved to be the right one, since this standard classifies the tools as not applicable, applicable, or strongly applicable [

29], which allowed us to have a starting point within hundreds of existing tools, methods, and approaches. Thus, we were able to focus the attention and efforts of specialists on the analysis of tools that were, at the very least, applicable for each of the stages of the risk management process (identification, analysis, and assessment). Subsequently, the Delphi method was essential, mainly to reduce the list of tools to be ranked, since comparing 14 tools, pair by pair, would increase the degree of complexity of the AHP method and, in the worst case, could compromise the results of the research, since, according to Saaty [

82], a high number of comparisons has the potential to generate inconsistency in the experts’ judgments.

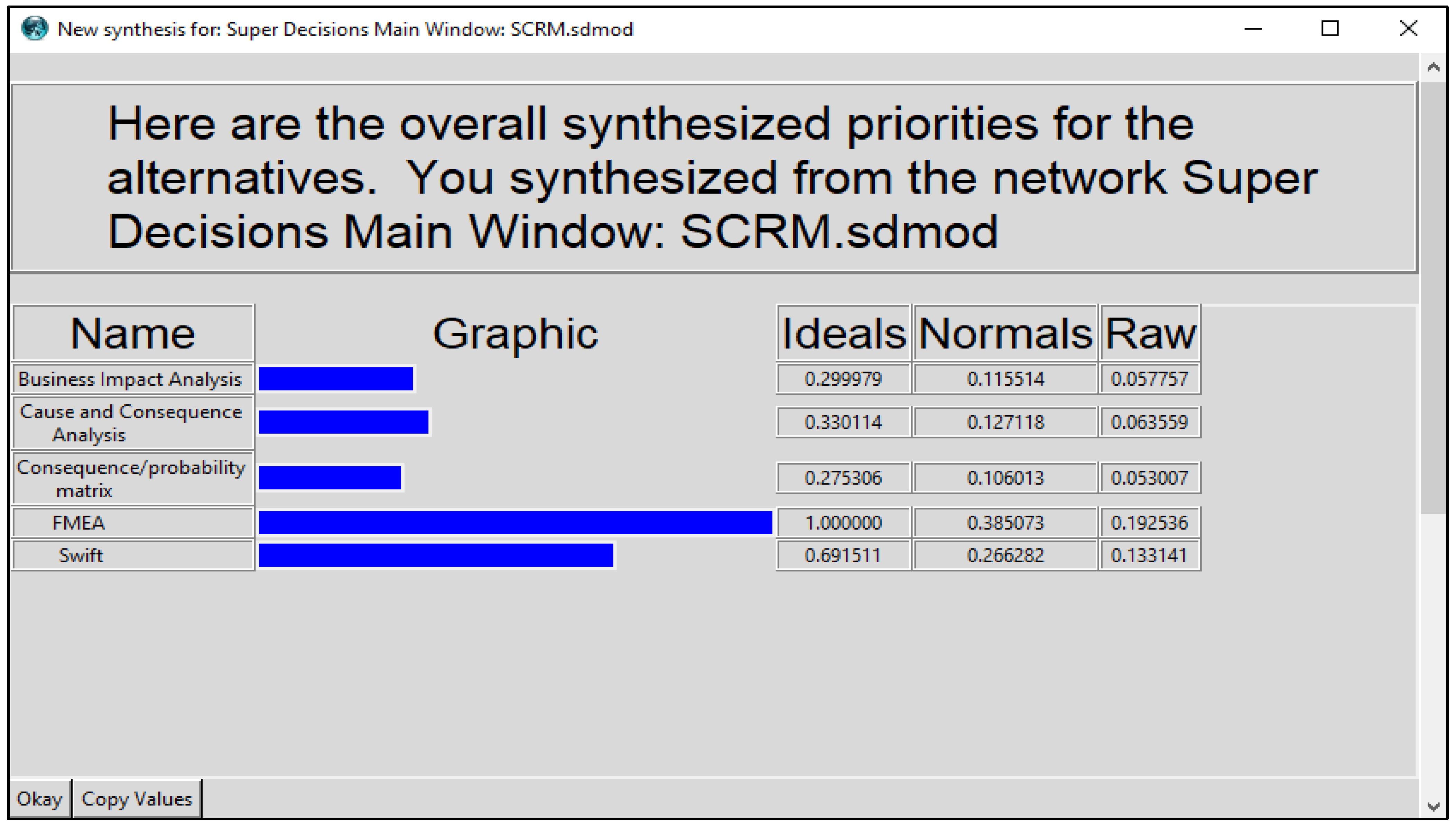

Figure 10 illustrates the paths taken by the method and their respective results.

The results of this study reinforce the relevance of the risk identification phase, especially from the perspective of suppliers, who play a central role in supply chains. One of the main challenges faced by these companies is the difficulty in identifying risks related to the lack of communication between chain members, deficient management training, and low operational flexibility—factors frequently mentioned in the literature as threats to supply chain stability [

63,

66,

67,

71].

This perception is confirmed by the survey data, which indicate that 56% of respondents consider risk identification to be the most critical step, compared to analysis (20%) and assessment (24%). This finding is in line with previous research, such as that of Hallikas et al. [

8], which highlights identification as an essential phase of risk management, since risks can be difficult to perceive in complex networks. By prioritizing effective strategies for addressing these challenges, suppliers can strengthen their resilience and contribute to a safer and more efficient supply chain.

In practical terms, companies can use these findings to improve their risk management strategies, especially in the identification phase, which was the most relevant for respondents. The prioritization model presented in this study can guide decision-makers in efficiently allocating resources to SCRM initiatives, ensuring that the most appropriate tools are applied at each stage of the process.

From a theoretical perspective, this study contributes to the literature by structuring the prioritization of risk management tools in the supply chain, with an emphasis on suppliers. The combination of Delphi and AHP methods enabled a systematic selection process, allowing the choice of tools to be based on technical criteria and not only on the individual perception of experts.

Despite these contributions, this study presents some limitations that should be addressed. The main one is the lack of empirical validation of the proposed prioritization model. Although the Delphi and AHP methods provided a structured approach for the analysis and ranking of risk management tools, future studies could carry out case studies or simulations to evaluate the practical effectiveness of the selected tools in real supply chains. In addition, the focus on the automotive industry may restrict the generalization of the findings to other sectors with different risk profiles and operational dynamics.

Finally, in the experts’ view, it appears that FMEA is the most suitable tool for performing SCRM in automotive industry suppliers. This result is not surprising, as FMEA has been applied by researchers and professionals in risk management in several areas [

92]. It is a tool widely used in the industry and its main purpose is to provide information for decision making in risk management [

93], working to identify critical components whose failures can cause physical and financial damage, thus making production systems safer and more reliable [

94].

6. Conclusions

According to the literature, current business trends and the increasing complexity of the supply chains increase vulnerability of organizations, resulting in a greater need to manage the risks of a company’s chain, especially those linked to its suppliers. The ISO 31000 and ISO 31010 standards were essential for our study, since we considered the main risk management steps listed in ISO 31000 (identify, analyze, and evaluate), as well as the 31 risk management techniques listed in ISO 31010.

We selected seven experts in SCRM from a large multinational company that produces parts for the carmakers PSA Peugeot Citroën, Nissan, Volkswagen, and Fiat to participate in our study. These seven experts prioritized five risk management techniques using the AHP method. These techniques were pre-selected by 20 experts from their supply companies using the Delphi method.

During the application of the first round of the Delphi method, all the experts interviewed selected the techniques “FMEA” and “business impact analysis” as the most suitable for supplier risk management. The techniques “reliability-centered maintenance” and “human reliability analysis” were not selected by any of the experts. The Delphi method served as an initial filter of the 31 ISO 31010 techniques, since it determined the following risk management techniques as the most applicable in processes involving suppliers: structured what if technique (SWIFT), failure mode and effect analysis (FMEA), consequence/probability matrix, cause and consequence analysis, and business impact analysis.

The AHP method, in turn, was executed to prioritize the most appropriate techniques, considering the five techniques previously selected by Delphi and the three main phases of risk management of ISO 31000: identify, analyze, and evaluate. The identification phase was considered by the experts as having twice the priority compared with the other phases.

Figure 9 shows a relevant result: FMEA as the most relevant technique for SCRM in suppliers of companies linked to the automotive industry. Because it is a qualitative tool associated with a study of the analysis of probability of failures, FMEA transforms the information into quantitative data, used in preventive actions with suppliers and thus mitigating possible risks in the supply chain. In the opinion of the experts in this study, FMEA was the best analytical technique, because it establishes the relationships between the causes and effects of failures, as well as indicates ways to seek, resolve, and make the best decisions regarding the application of appropriate measures in suppliers in the automotive supply chain. Thus, we achieved our objective, since we identified and prioritized the most appropriate techniques for SCRM of the suppliers chosen for analysis. We also observed that the secondary objective was achieved, since we found that the risk identification step is the most relevant within the risk management process.

We recommend the following procedures for future studies: (i) to reproduce our study in other automotive companies and involving different suppliers; (ii) to further study the five techniques selected in our study, applying them to risk management of suppliers in the automotive sector and comparing their effectiveness (action research, for example); and (iii) to apply the concepts of our study in other industrial segments.